Futures Calls Recap for 8/22/12

An even lighter volume day in the market (only 1.35 NASDAQ shares traded) led to two trades that barely hit their partials and nothing more.

Net ticks: +5 ticks.

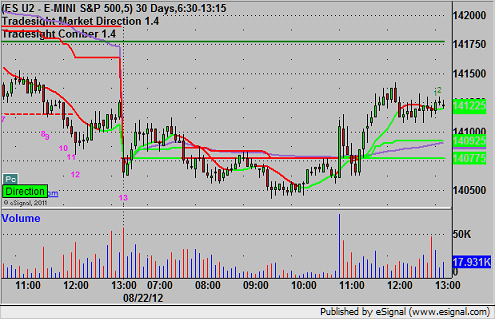

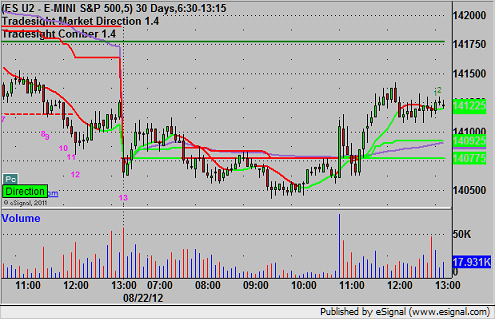

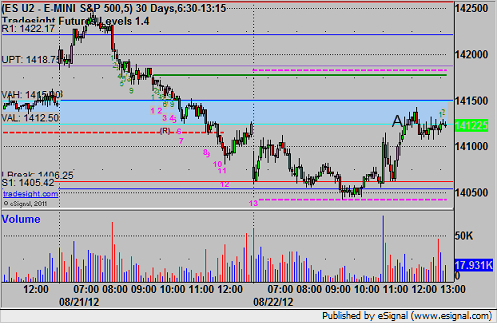

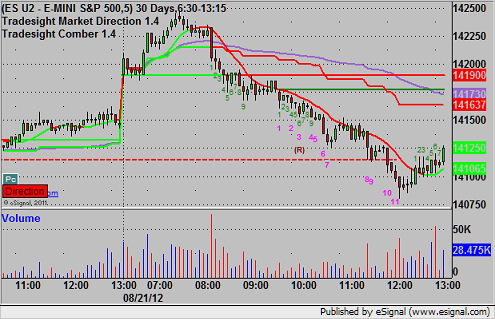

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

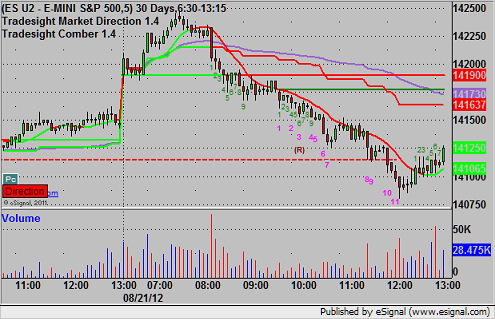

ES:

A triggered that was meant for the morning triggered long at A at 1412.75 into the Value Area, hit the first target for six ticks, and stopped the second half under the entry:

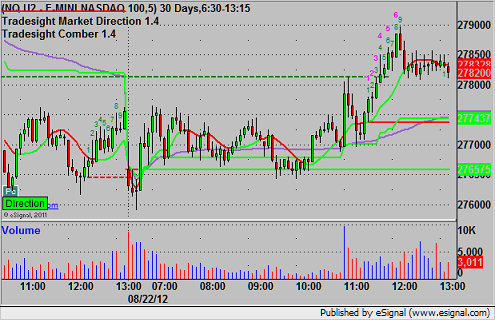

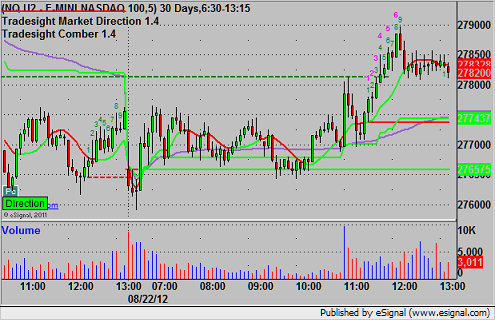

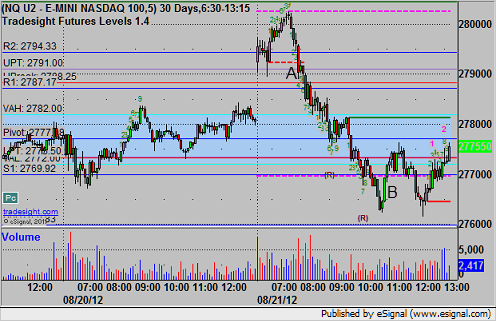

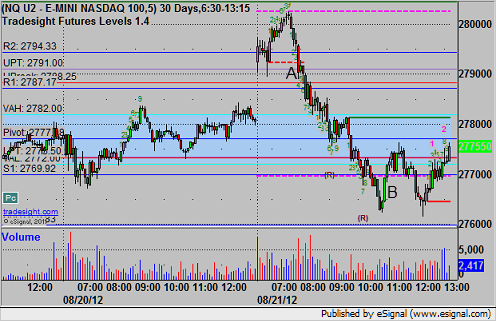

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 2762.00, hit first target for six ticks, and stopped the second half over the entry:

Futures Calls Recap for 8/22/12

An even lighter volume day in the market (only 1.35 NASDAQ shares traded) led to two trades that barely hit their partials and nothing more.

Net ticks: +5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

A triggered that was meant for the morning triggered long at A at 1412.75 into the Value Area, hit the first target for six ticks, and stopped the second half under the entry:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 2762.00, hit first target for six ticks, and stopped the second half over the entry:

Forex Calls Recap for 8/22/12

Stopped out of the prior day's trade in the money on the EURUSD, and then we had two partial sweeps of our entries, which I don't know if I've ever seen before, but it let's you know that you had the right entries. See that section below.

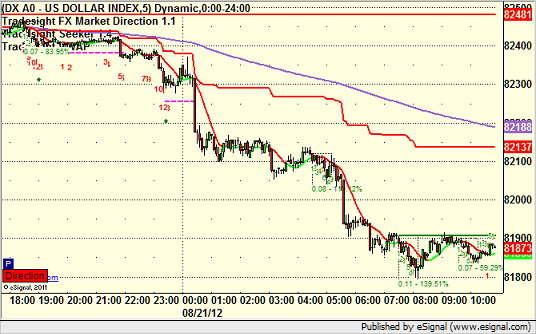

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

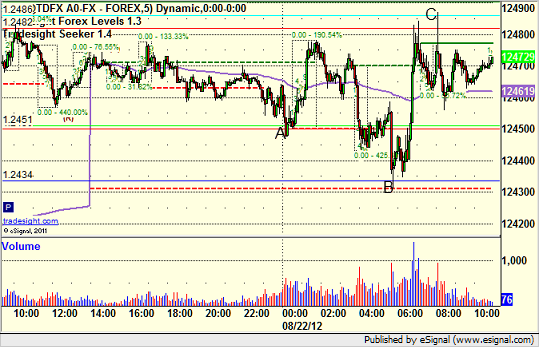

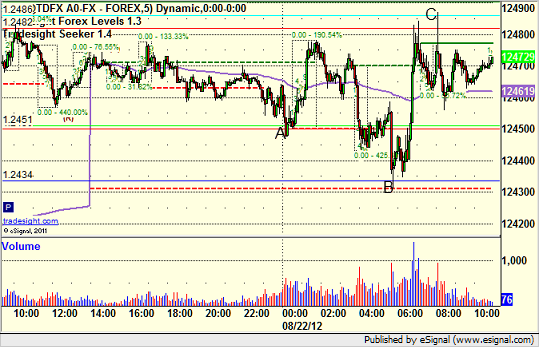

EURUSD:

Stopped out of the second half of the prior day's long under LBreak at A for 80 pips. Under our order staggering rules, triggered short for part but not all of the trade at B and stopped, and the same thing happened on the long side, triggered long and the same thing happened on the long side, triggered at C for part but not all and stopped:

Forex Calls Recap for 8/22/12

Stopped out of the prior day's trade in the money on the EURUSD, and then we had two partial sweeps of our entries, which I don't know if I've ever seen before, but it let's you know that you had the right entries. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Stopped out of the second half of the prior day's long under LBreak at A for 80 pips. Under our order staggering rules, triggered short for part but not all of the trade at B and stopped, and the same thing happened on the long side, triggered long and the same thing happened on the long side, triggered at C for part but not all and stopped:

Tradesight Market Preview for 8/22/12

The ES lost 2 on the day but there were some notable technical developments to talk about. Price made a new high but closed lower on the day. Also Tuesday’s candle engulfed the prior day’s which makes a better case for the bears. The only lacking ingredient was more volume. Note that the volume was higher than average but not decisive.

The NQ futures posted almost exactly the same day as the ES. The technicals are very similar and the rest of the week will be very important.

At key turning points it’s always useful to take a look at the DIA. This etf is a well traded basket that tracks the performance of the Dow Jones Industrials. At key turning points there is typically a surge in volume that is not always apparent in other trading vehicles. We don’t see one here.

The 10-day trin still has overbought energy:

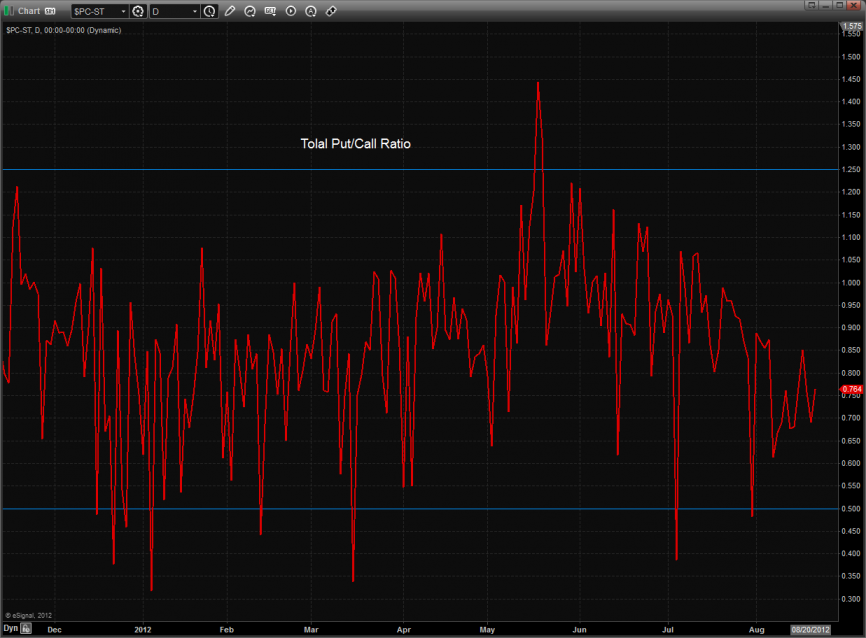

The put/call ratio still has yet to record a super-climatic reading:

Multi sector daily chart:

The double top remains in place for both the Naz and broad market:

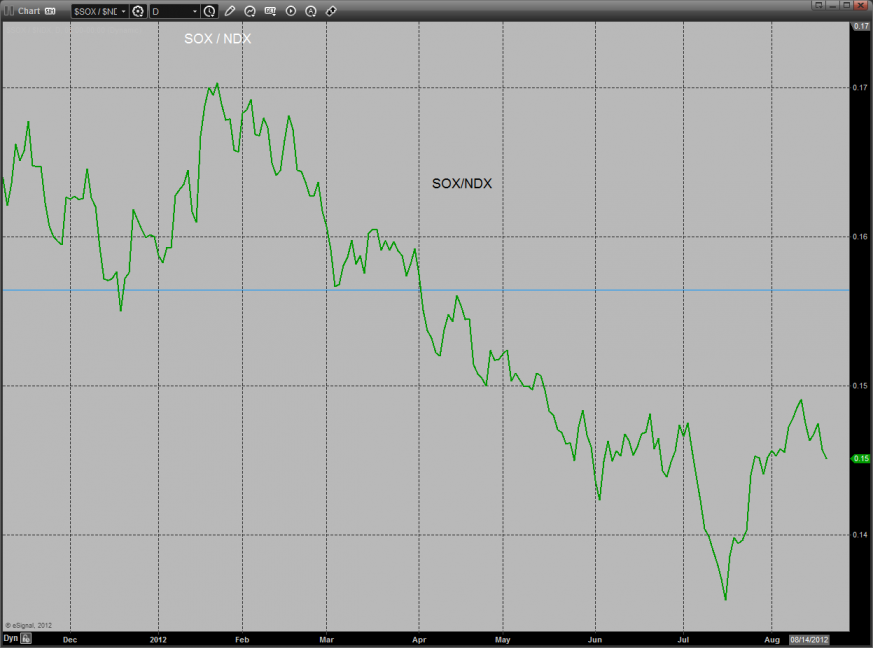

The SOX cross still has not followed through:

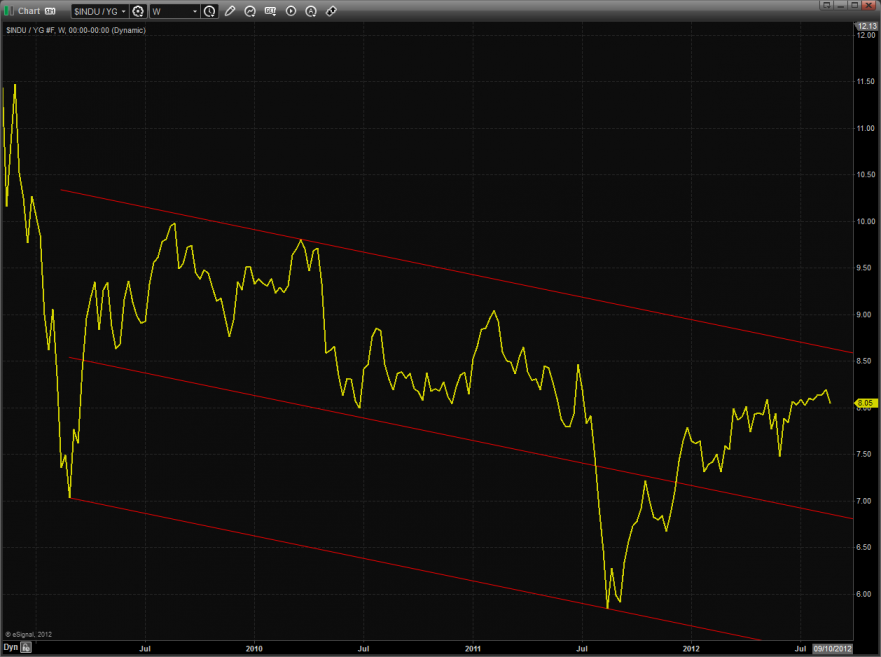

Longer-term traders always like to look at the Dow/gold cross. It has been moving in favor of stocks but hasn’t yet broken out. This will be the ULTIMATE buy confirmation.

The BKX continues to bearishly lag the SPX. There has been no higher high in the banks and it is holding back the broad market and keeping the double top in the conversation.

The bulls can point to the relative strength in the Ndx over the Spx. A higher high would be very bullish and a failure at the relative strength retest adds to the bear case.

Guess what, the defensive XAU was the top gun on the day. Surprise! Well, not rally, the XAU tracking GDX was one of our first long ideas and worked. Price closed above the active static trend line and when the June highs are taken out the 200dma and 8/8 Murrey math levels are in play.

The BKX was higher on the day but lost all of its relative strength intraday. Also intraday, the Seeker risk level was tested and it rejected the advance. The sell signal is still active and rallies should be sold until it is broken.

The SOX was exactly flat but did not break the 10ema. The 10ema is the deal breaker for the bulls.

The OSX posted a midrange outside day down:

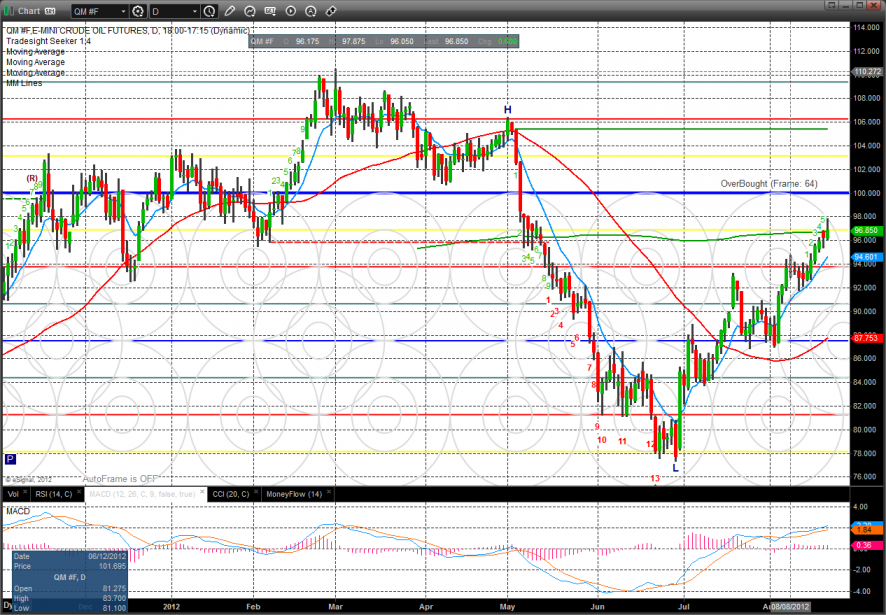

Oil got stuffed by the 200dma.

Gold:

Silver is attempting a saucer breakout:

Stock Picks Recap for 8/21/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NUAN triggered long (without market support due to opening 5 minutes) and worked:

SPPI triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's GDX triggered long (ETF, so no market support needed) and worked:

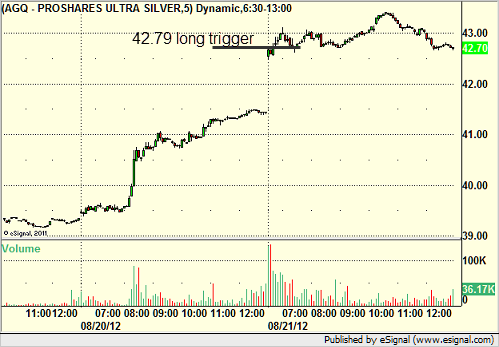

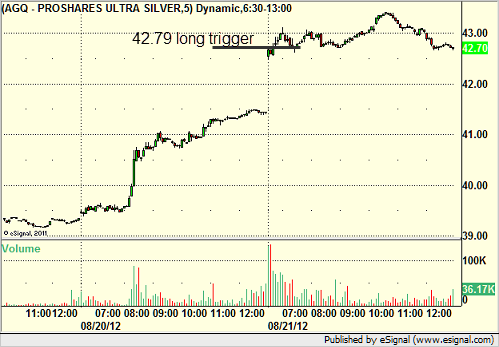

His AGQ triggered long (ETF, so no market support needed) and worked:

His BIDU triggered short (without market support) and worked great:

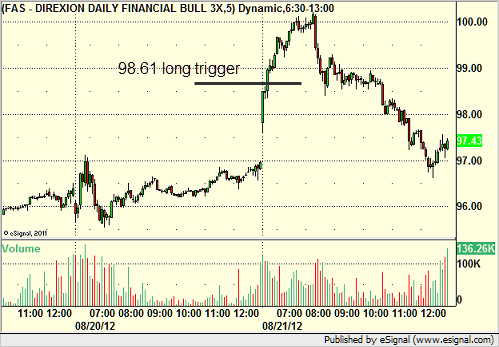

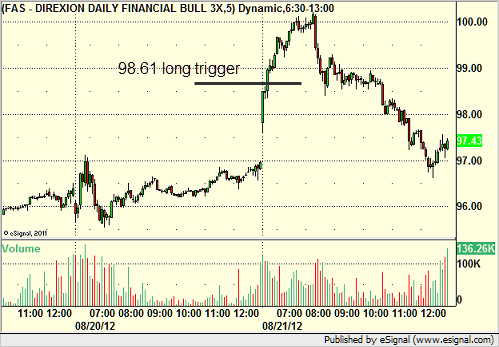

His FAS triggered long (ETF, so no market support needed) and worked:

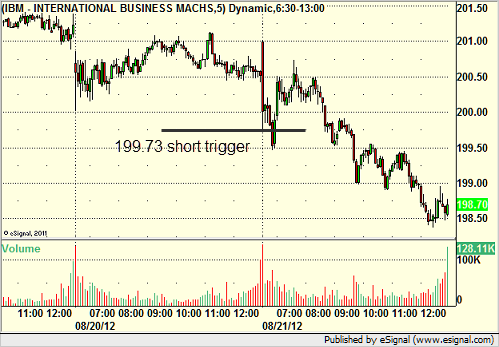

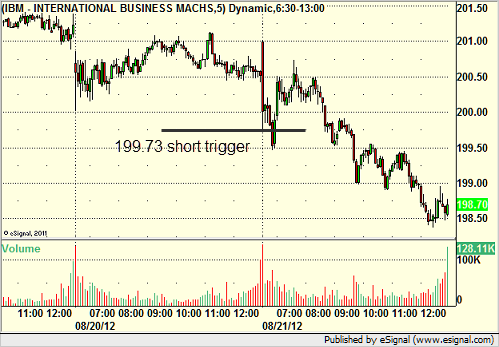

His IBM triggered short (without market support) and didn't work:

NFLX triggered long (with market support) and worked enough for a partial:

Rich's SNDK triggered long (with market support) and worked enough for a partial:

His ESRX triggered long (with market support) and worked enough for a partial:

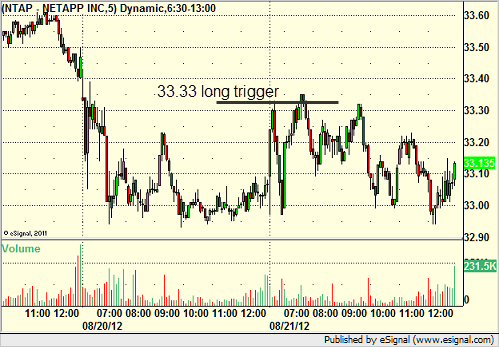

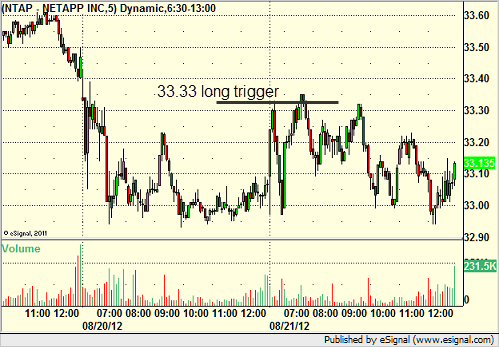

NTAP triggered long (with market support) and didn't work:

Rich's CF triggered short (with market support) and worked:

His VMW triggered short (with market support) and worked:

In total, that's 10 trades triggering with market support, 8 of them worked, 2 did not.

Stock Picks Recap for 8/21/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NUAN triggered long (without market support due to opening 5 minutes) and worked:

SPPI triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's GDX triggered long (ETF, so no market support needed) and worked:

His AGQ triggered long (ETF, so no market support needed) and worked:

His BIDU triggered short (without market support) and worked great:

His FAS triggered long (ETF, so no market support needed) and worked:

His IBM triggered short (without market support) and didn't work:

NFLX triggered long (with market support) and worked enough for a partial:

Rich's SNDK triggered long (with market support) and worked enough for a partial:

His ESRX triggered long (with market support) and worked enough for a partial:

NTAP triggered long (with market support) and didn't work:

Rich's CF triggered short (with market support) and worked:

His VMW triggered short (with market support) and worked:

In total, that's 10 trades triggering with market support, 8 of them worked, 2 did not.

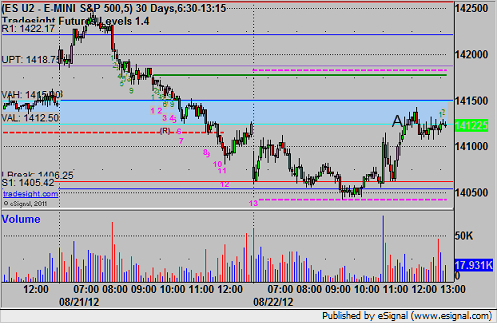

Futures Calls Recap for 8/21/12

A nice day with just one call due to light volume, but it incorporated everything we teach in our courses: Gaps, Value Areas, Pressure Thresholds, etc. (well, not everything we teach, but several key pieces). See NQ section below. The winner was 25 POINTS to final exit (50 ticks).

Net ticks: +28 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

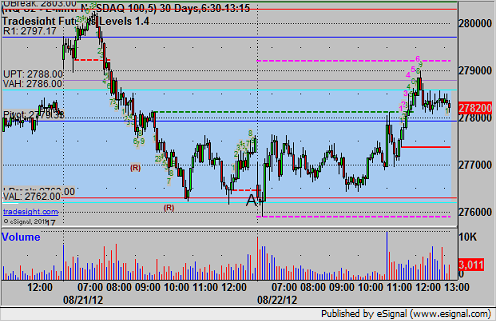

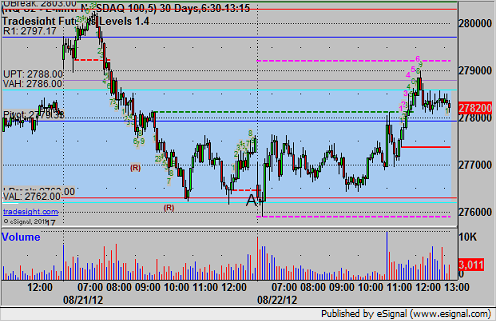

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

After the early hour of trading, I was interested in the NQ bouncing off of the UPT coming back down (it hit it exactly and bounced, then broke it, all inside the trigger bar, but the important point is that it bounced off it first). The trigger short at A was 2790.50. We hit the first target for 6 ticks at 2787.50, then proceeded to lower the stop 6 times as it filled the gap, broke into the Value Area, and went lower. Final exit was at 2765.50 at B:

Futures Calls Recap for 8/21/12

A nice day with just one call due to light volume, but it incorporated everything we teach in our courses: Gaps, Value Areas, Pressure Thresholds, etc. (well, not everything we teach, but several key pieces). See NQ section below. The winner was 25 POINTS to final exit (50 ticks).

Net ticks: +28 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

After the early hour of trading, I was interested in the NQ bouncing off of the UPT coming back down (it hit it exactly and bounced, then broke it, all inside the trigger bar, but the important point is that it bounced off it first). The trigger short at A was 2790.50. We hit the first target for 6 ticks at 2787.50, then proceeded to lower the stop 6 times as it filled the gap, broke into the Value Area, and went lower. Final exit was at 2765.50 at B:

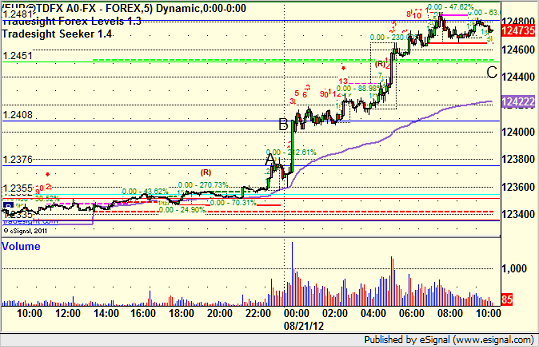

Forex Calls Recap for 8/21/12

Nice winner on the EURUSD for the session after a no-trade day the prior session. Still holding part of the long. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A, hit first target at B, adjusted stop twice in the morning and still holding with a stop under the tri-star at C up 100 pips: