Tradesight Market Preview for 8/21/12

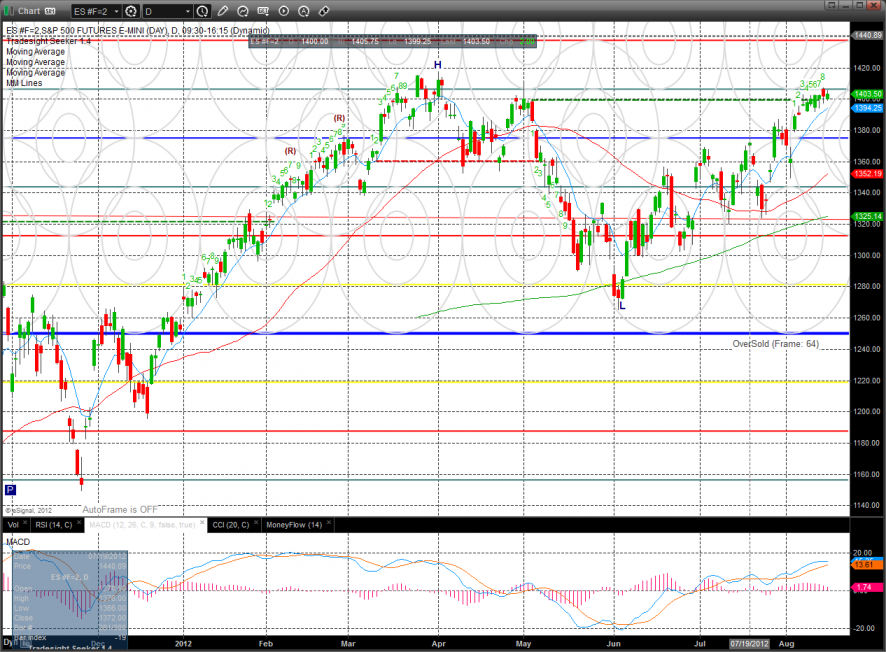

The ES was unchanged on the day after recouping an early drop. There is nothing new technically other than the CCI has totally stagnated.

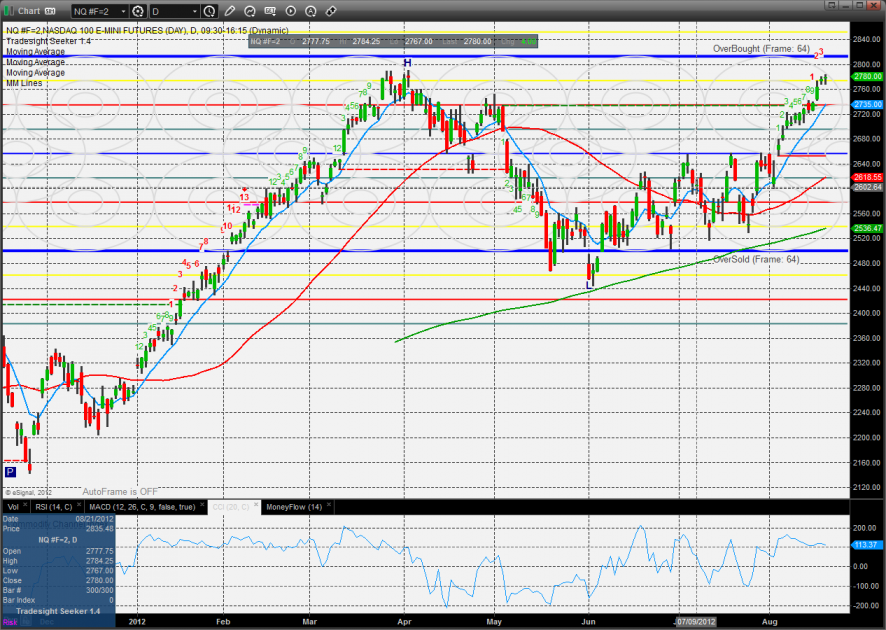

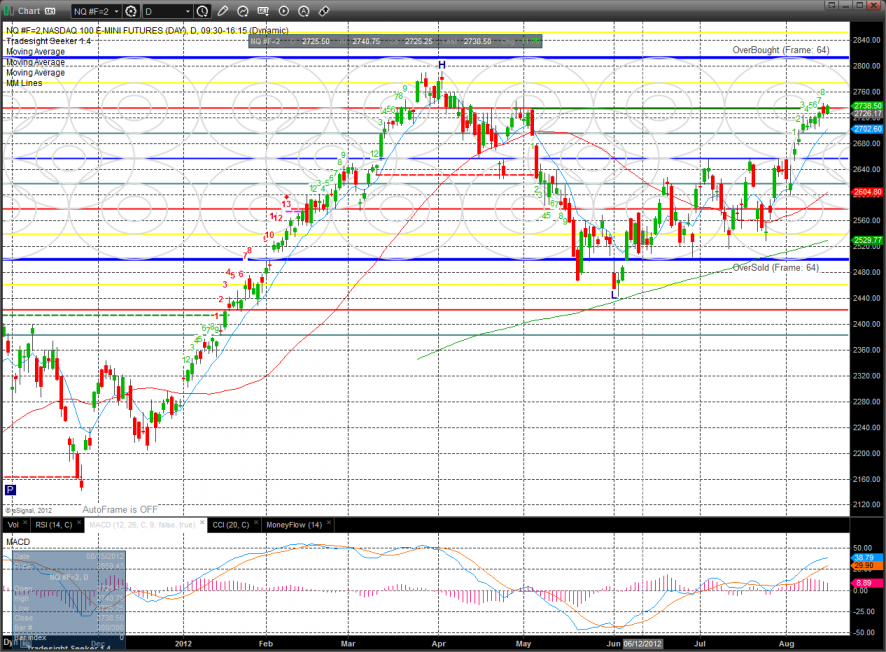

The NQ futures were higher by 4 on the day. The pattern has left price right in the area of the prior March high. Note that the Seeker countdown is still very immature and only 4 days up.

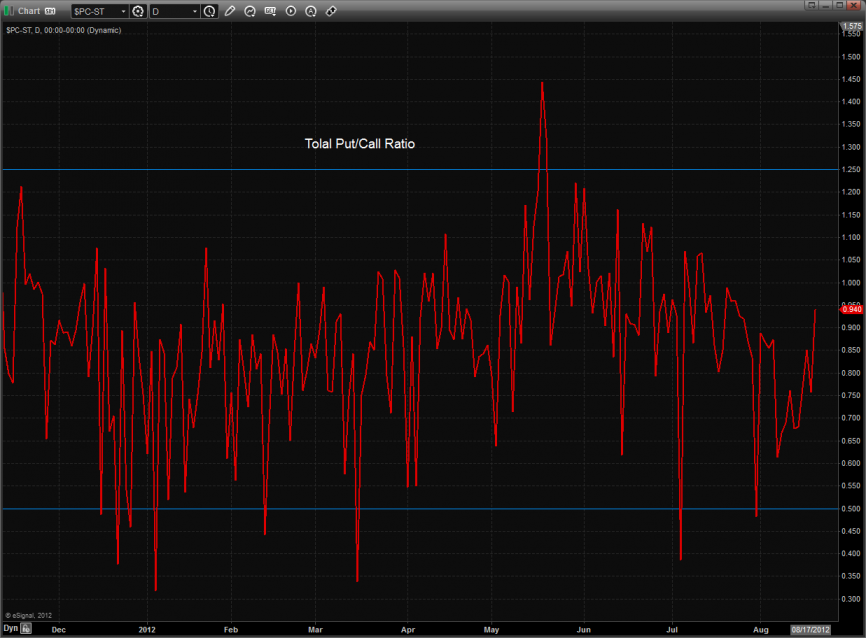

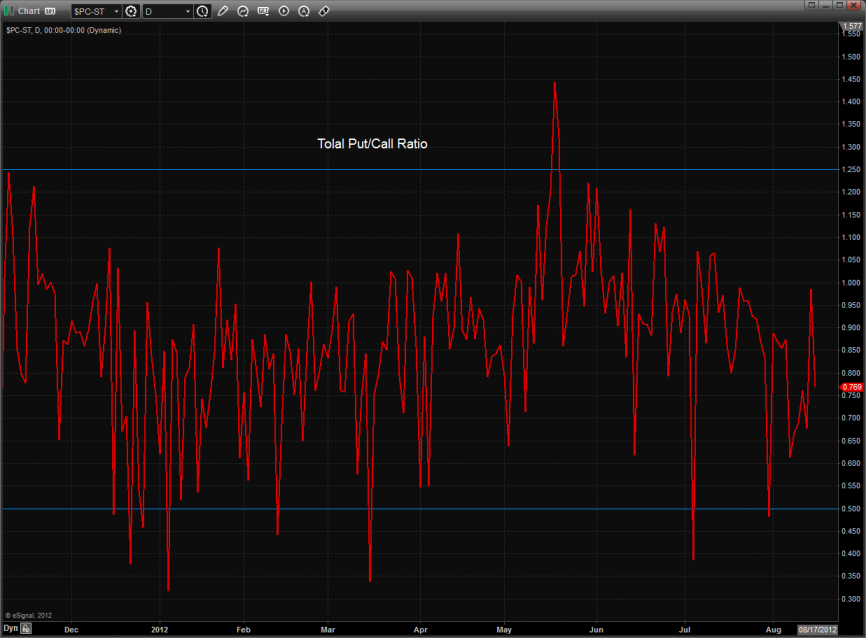

The total put/call ratio is still neutral:

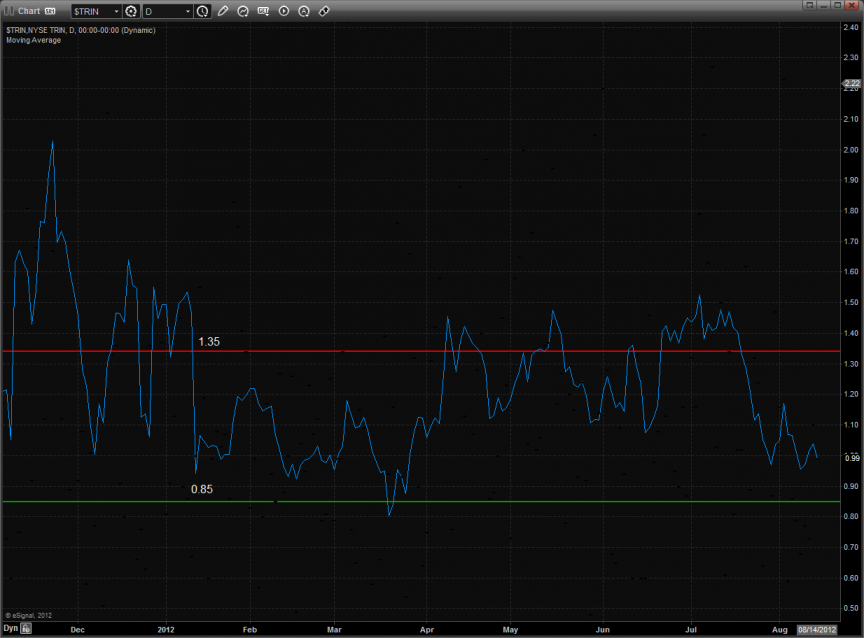

Late last week, the 10-day Trin recorded the first overbought reading since March. If the market should choose to turn down, it has sufficient energy to cover some ground and begin a decent move.

Multi sector daily chart:

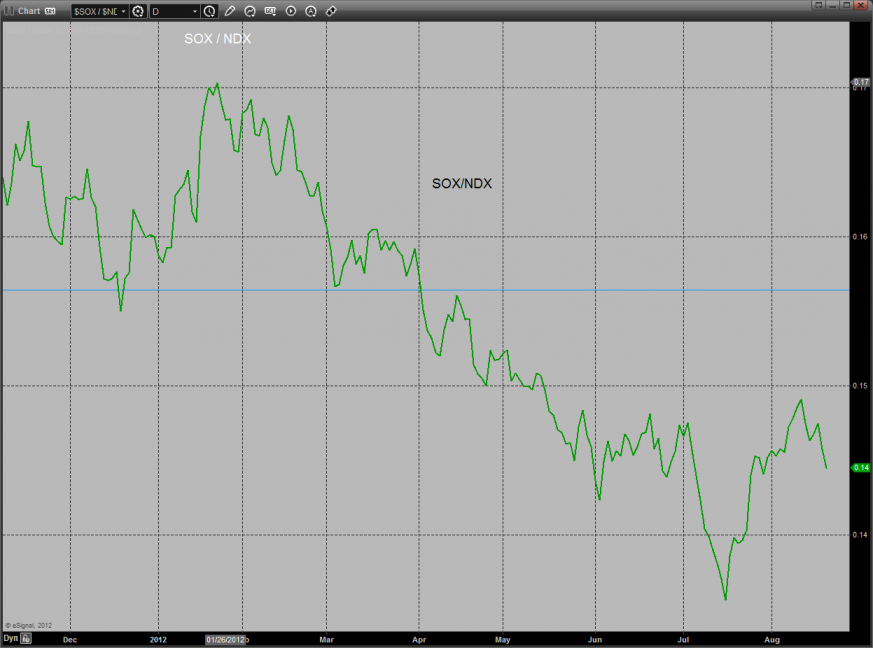

The budding reversal in the SOX/NDX cross has lost momentum and taken a bearish turn. A true failure here would be very bearish for the overall NDX.

Both the NDX and SPX are grappling with their prior highs and are double top until they breakout and qualify new highs.

The defensive XAU was the top gun on the day closing right near the static trend line.

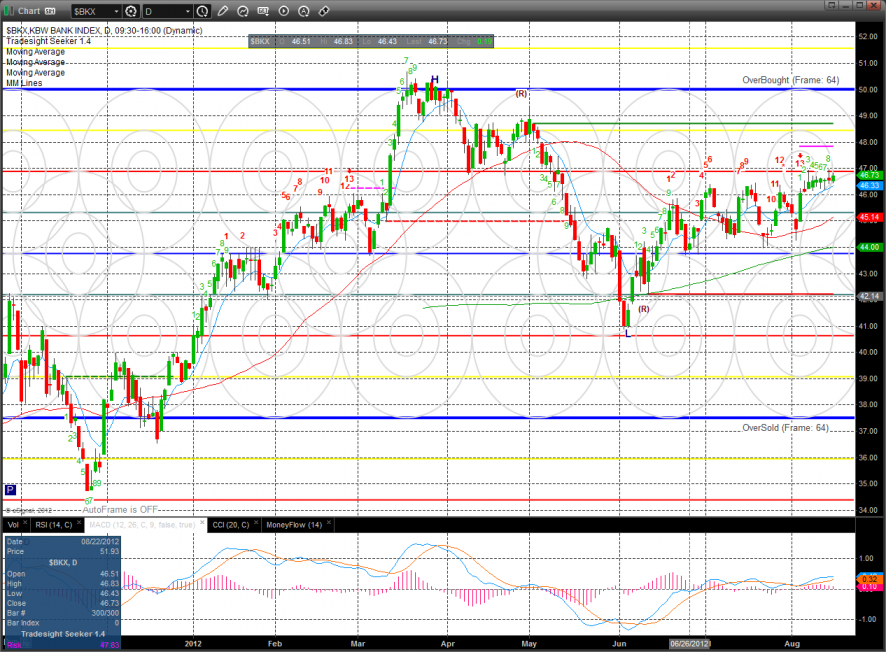

The BKX was higher on the day but still has an active Seeker sell signal in place until the risk line is broken.

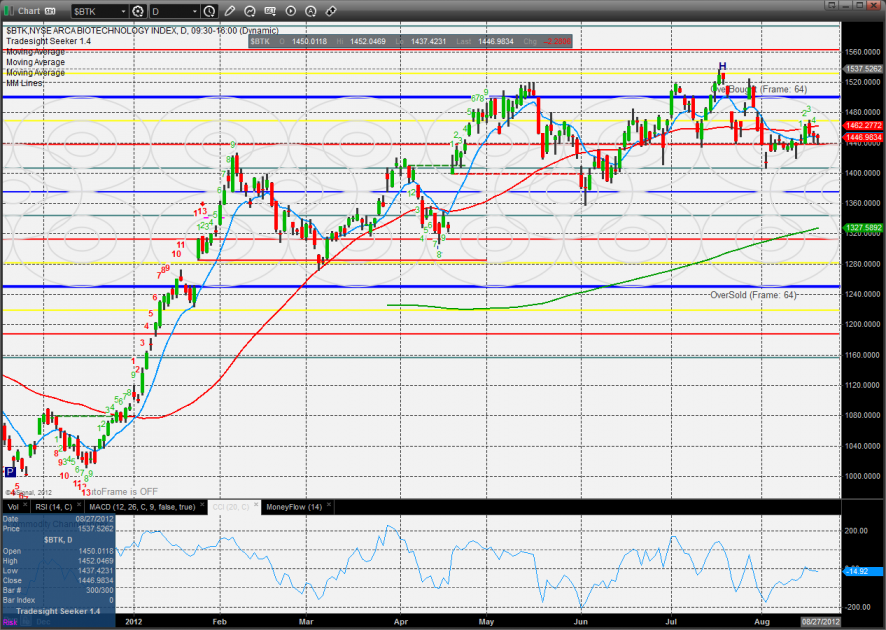

The BTK treaded water and is showing relative weakness.

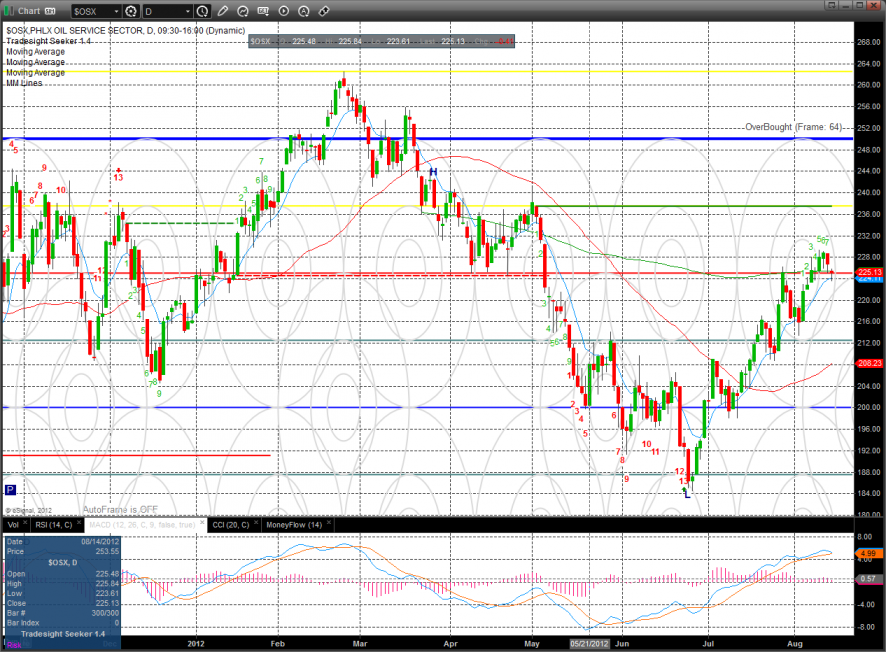

The OSX was weak all day and should be showing relative strength at this point in the “revovery”. Price remains above all the major moving averages. The next bull target will be the 7/8 Gann level which is exactly the active static trend line.

The SOX was the last laggard on the day and traded all the way down to one of the key MA’s. If the chart closes below the 10ema the pattern will turn short term negative.

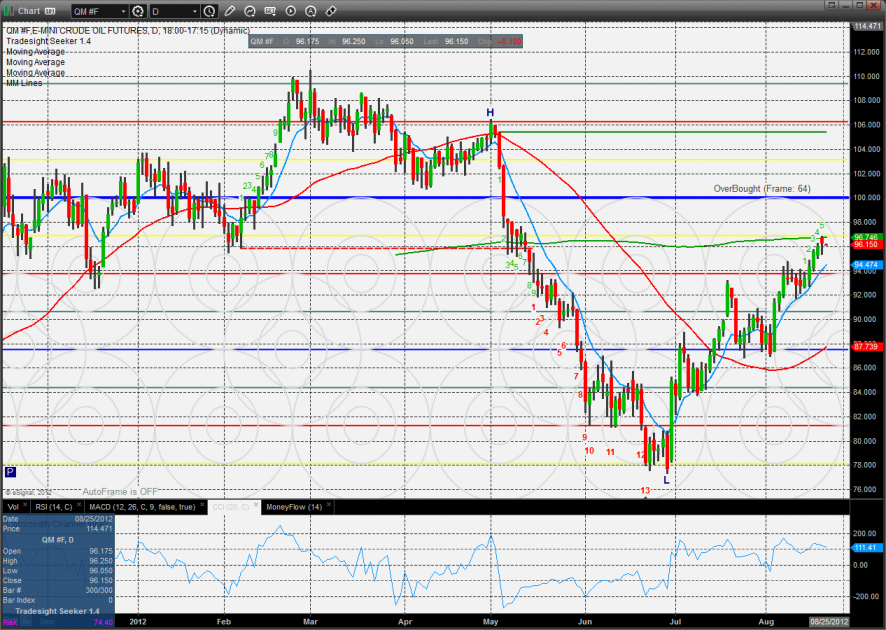

Oil:

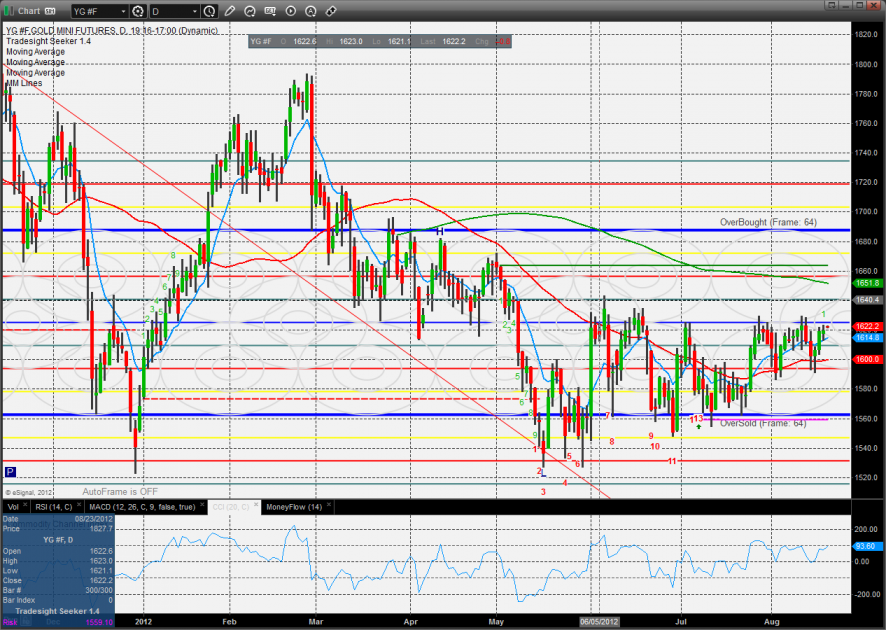

Gold:

Silver:

Stock Picks Recap for 8/20/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's VMW triggered short (with market support) and didn't work:

His AMZN triggered short (with market support) and worked:

His NFLX triggered short (with market support) and didn't work:

His GOOG triggered short (with market support) and didn't work:

His LNKD triggered long (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 1 of them worked, 4 did not. Lowest winning percentage in a while to go with the light volume.

Futures Calls Recap for 8/20/12

Another horrible volume day in the markets, with NASDAQ volume ending at only 1.3 billion shares. Barely worth trading. We had a winner in the ES and a double stop in the NQ. See both sections below.

Net ticks: -11.5 ticks.

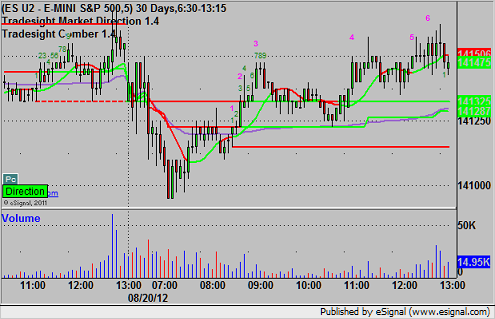

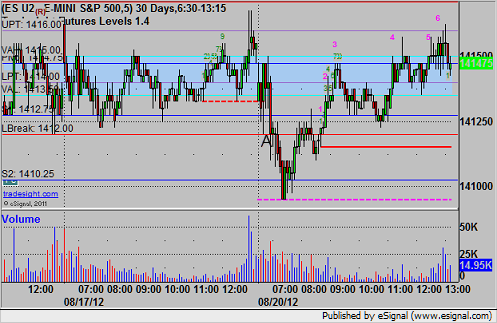

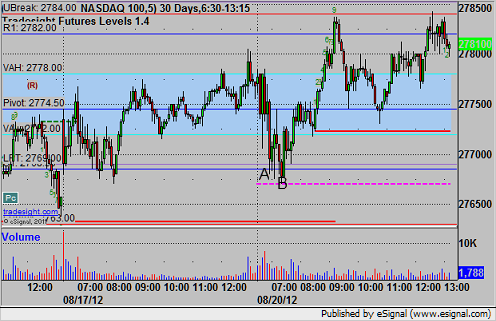

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short under LBreak after setting it perfectly at A at 1411.75, hit first target for 6 ticks, and stopped the second half over the entry:

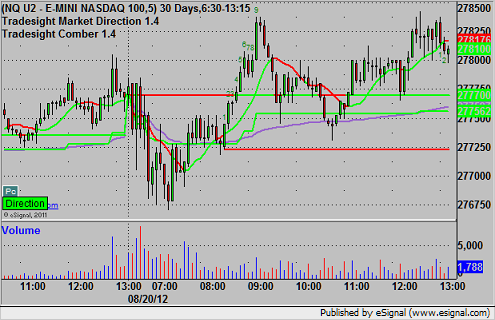

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's NQ triggered short at 2767.75 at A and stopped for 7 ticks, then again at B and the same result:

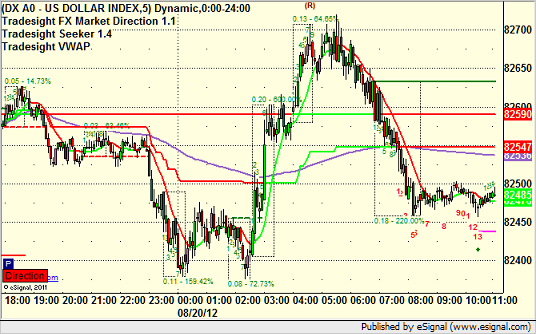

Forex Calls Recap for 8/20/12

60 pips of range on the EURUSD, so neither of our trade calls triggered for the entire session. We will definitely be sticking with half size through the end of August with ranges like this, as we do most Augusts.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

No trades triggered so no individual pairs to show.

Stock Picks Recap for 8/16/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ARRY triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's VMW triggered long (with market support) and worked:

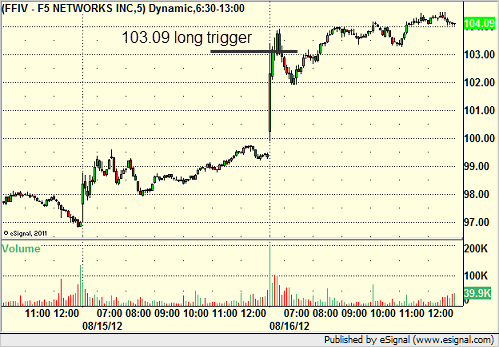

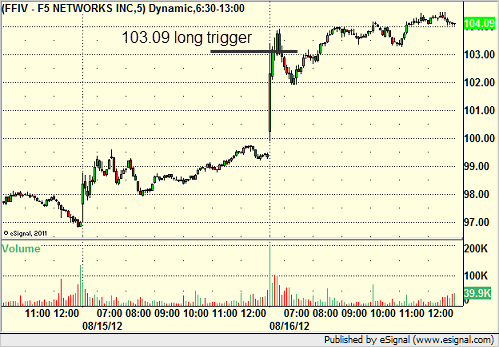

His FFIV triggered long (with market support) and didn't work:

His VXX triggered long (ETF, so no market support needed) and didn't work:

His QQQ triggered short (ETF, so no market support needed) and didn't work:

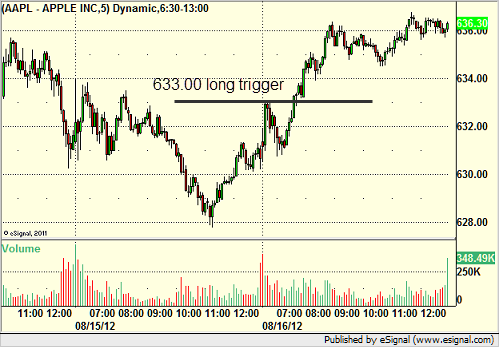

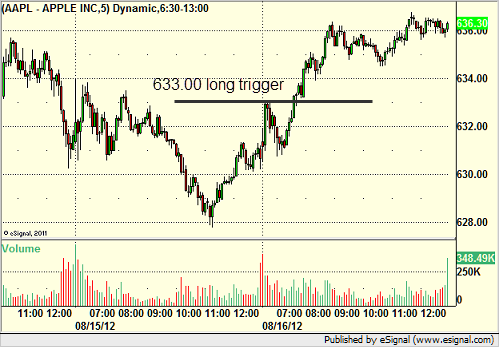

AAPL triggered long (with market support) and worked great:

Rich's SOHU triggered long (with market support) and worked:

His DECK triggered long (with market support) and worked:

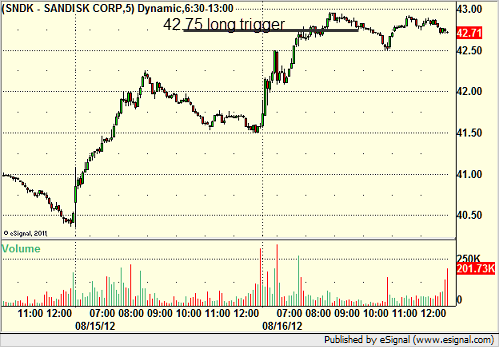

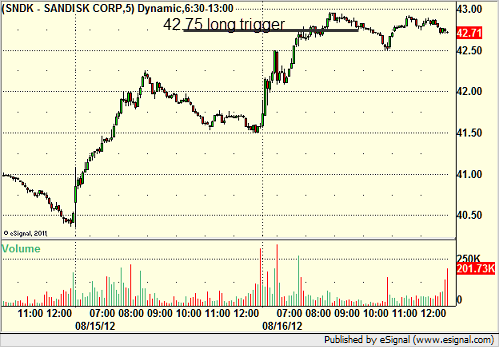

His SNDK triggered long (with market support) and worked enough for a partial:

NFLX triggered long (with market support) and worked:

Rich's AMZN triggered long (with market support) and didn't work:

His WYNN triggered long (with market support) and worked:

GOOG triggered long (with market support) and didn't work:

In total, that's 13 trades triggering with market support, 8 of them worked, 5 did not.

Stock Picks Recap for 8/16/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ARRY triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's VMW triggered long (with market support) and worked:

His FFIV triggered long (with market support) and didn't work:

His VXX triggered long (ETF, so no market support needed) and didn't work:

His QQQ triggered short (ETF, so no market support needed) and didn't work:

AAPL triggered long (with market support) and worked great:

Rich's SOHU triggered long (with market support) and worked:

His DECK triggered long (with market support) and worked:

His SNDK triggered long (with market support) and worked enough for a partial:

NFLX triggered long (with market support) and worked:

Rich's AMZN triggered long (with market support) and didn't work:

His WYNN triggered long (with market support) and worked:

GOOG triggered long (with market support) and didn't work:

In total, that's 13 trades triggering with market support, 8 of them worked, 5 did not.

Futures Calls Recap for 8/16/12

One stop out, one winner, and one trade that took too long to get going heading into lunch so we killed it.

Net ticks: +1 tick.

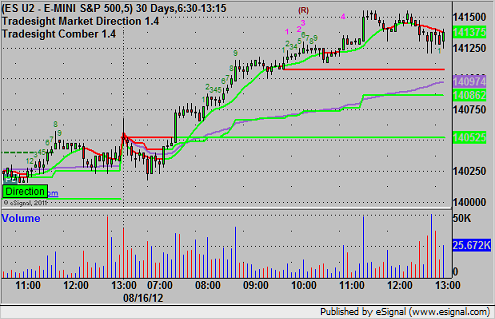

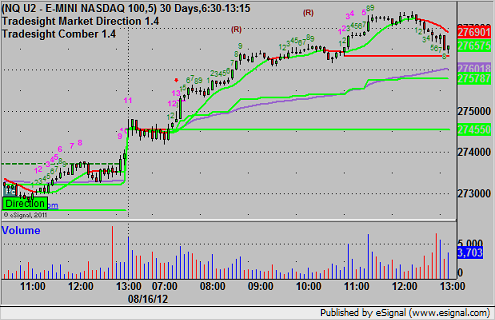

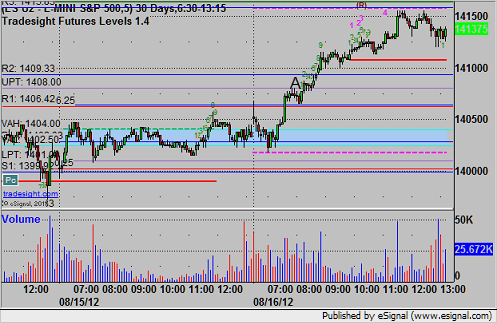

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered ong at 1408.25 at A. After 30 minutes, it hadn't move more than 2 ticks in either direction, so we closed the trade heading into lunch, although it ended up working just after that:

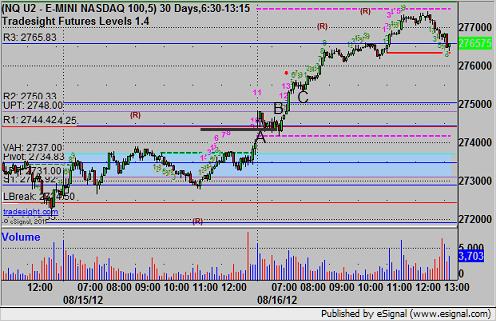

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 2743.50 and stopped. Triggered long at 2748.50 at B, hit first target for six ticks, raised stop and stopped at 2753.50 at C:

Forex Calls Recap for 8/16/12

One early half-sized trigger stopped and then we triggered EURUSD overnight and it worked great. See that section below.

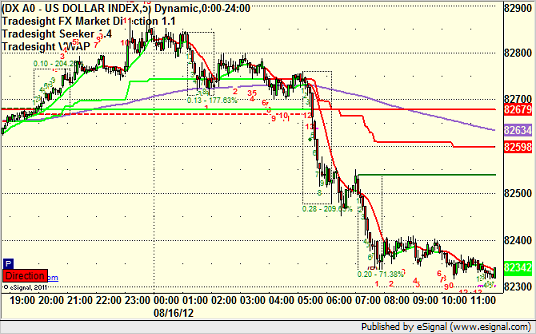

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

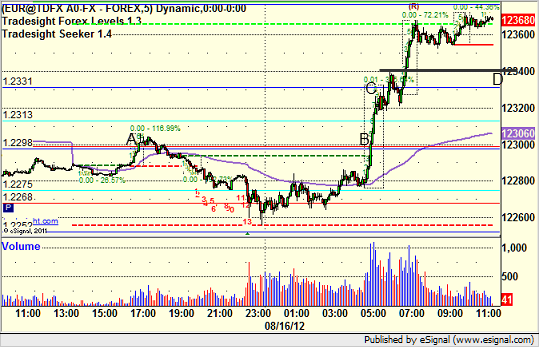

EURUSD:

Triggered long very early at A (half size if you were around to grab it) and stopped for 25 pips. Triggered long at B overnight, hit first target at C, and holding now with a stop under the black line at D:

Tradesight Market Preview for 8/16/12

The ES was higher by 2 on the day and recorded 9 bars up in the Seeker count. Price remains lackluster and markets can fall of their own weight. There are no new technical developments but keep an eye on the MACD.

The NQ futures were relatively strong vs. the SP up 13 on the day. This is a new high close on the move and also completes the minimum Seeker 9 bar setup. Note that this chart has much more extension than the SP side which leaves more room for a retracement.

10-day Trin is still neutral:

The put/call ratio is still in the comfort zone.

Multi sector daily chart:

The BTK was the top gun on the day by breaking above the recent range. The overhead open gap at 1487 is the next target then the 8/8 Murrey math level.

The SOX was strong but posted and inside day so nothing new technically.

The BKX is still frustratingly stuck in the same range. This was a new high close if your eyes are good enough to spot it. The Seeker count is now 9 days up.

The XAU is still orphaned and was unchanged on the day. The potential higher low is still in place.

The OSX is stuck at the convergence of the 10ema and the 50sma. Price very subtly and bearishly closed below yesterday’s low.

Oil closed at a new high on the move and the 200dma is the next hurdle for the bulls.

Gold:

Silver:

The BKX continues to bearishly lag the broad market.

The NDX/SPX cross remains healthy with relative strength in the Naz side.

Stock Picks Recap for 8/15/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PCYC triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered long (with market support) and worked enough for a partial:

Rich's SBUX triggered long (with market support) and didn't work:

His AAPL triggered short (with market support) and worked:

His SINA triggered short (with market support) and didn't work:

His FSLR triggered long (with market support) and worked:

His JDSU triggered long (with market support) and didn't work:

His NFLX triggered long (with market support) and worked enough for a partial:

BIDU triggered short (with market support) and didn't work:

Rich's EBAY triggered short (with market support) and didn't work:

His SLB triggered long (with market support) and didn't work:

AMZN triggered long (with market support) and worked:

In total, that's 12 trades triggering with market support, 6 of them worked, 6 did not. Several worked extremely well.