Stock Picks Recap for 8/15/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

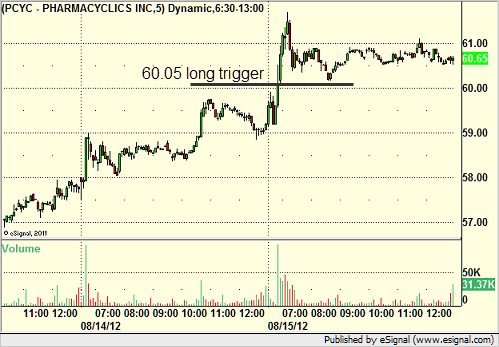

From the report, PCYC triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered long (with market support) and worked enough for a partial:

Rich's SBUX triggered long (with market support) and didn't work:

His AAPL triggered short (with market support) and worked:

His SINA triggered short (with market support) and didn't work:

His FSLR triggered long (with market support) and worked:

His JDSU triggered long (with market support) and didn't work:

His NFLX triggered long (with market support) and worked enough for a partial:

BIDU triggered short (with market support) and didn't work:

Rich's EBAY triggered short (with market support) and didn't work:

His SLB triggered long (with market support) and didn't work:

AMZN triggered long (with market support) and worked:

In total, that's 12 trades triggering with market support, 6 of them worked, 6 did not. Several worked extremely well.

Futures Calls Recap for 8/15/12

Two winners for the session (see ES and ER sections below), although they only went to their first targets in light volume early. NASDAQ volume ended at only 1.3 billion shares again, and we didn't see options unraveling.

Net ticks: +6 ticks.

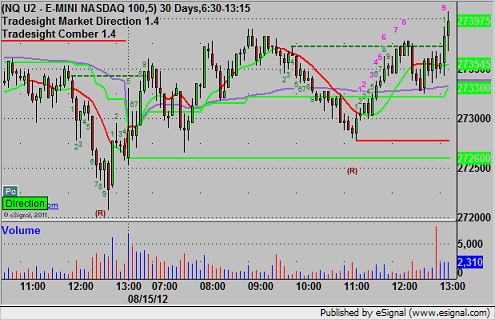

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

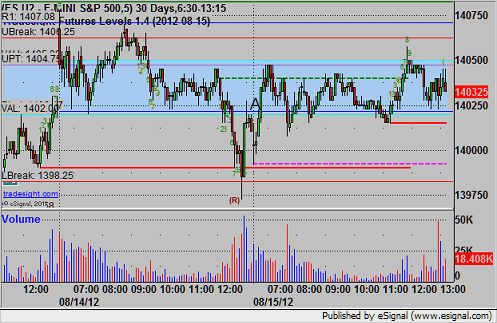

ES:

Triggered long at 1402.50 at A, hit first target for six ticks, stopped second half under the entry:

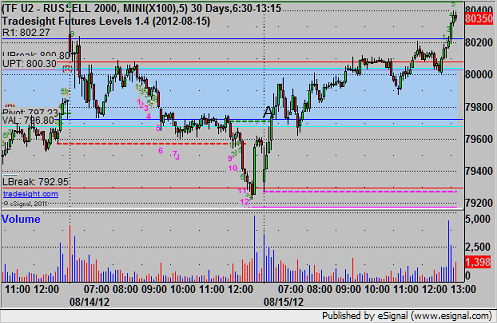

ER:

Triggered long at 797.40 at A, hit first target for 8 ticks, stopped second half under entry:

Forex Calls Recap for 8/15/12

Another slow session (GBPUSD 40 pips!), and we had to put the calls on the EURUSD beyond S2 on the short side because the Levels were so tightly bunched from the night before. See that section below. We were also half size ahead of CPI, which did nothing.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

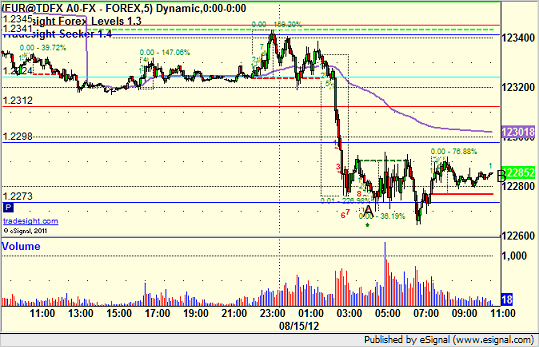

EURUSD:

Triggered short at A, didn't stop or hit first target, closed at B:

Tradesight Market Preview for 8/15/12

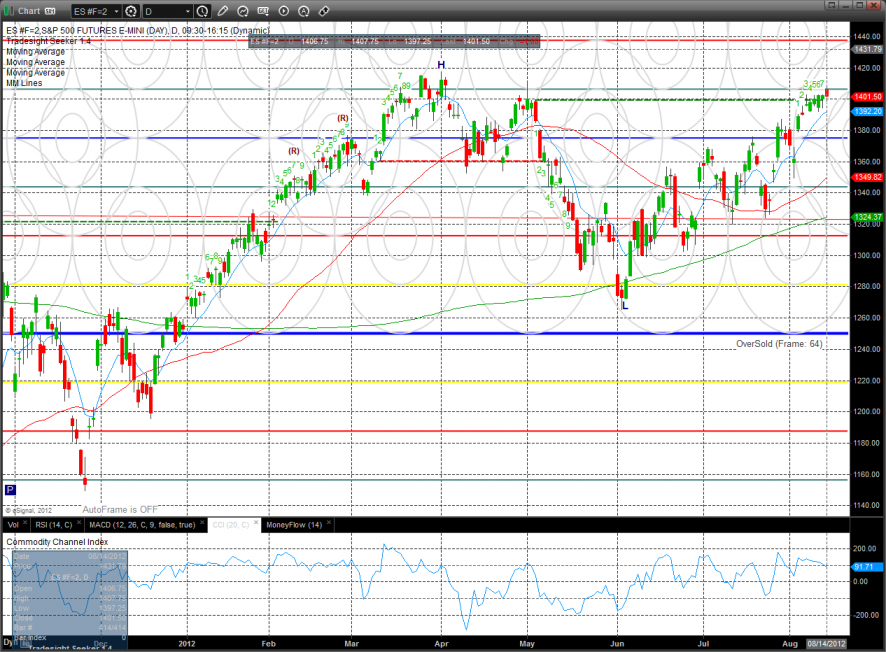

The ES was lower by one on the day but posted a range high distribution candle. This is 8 days up in the Seeker count so a disruption in trend should be expected in the next 48 hours.

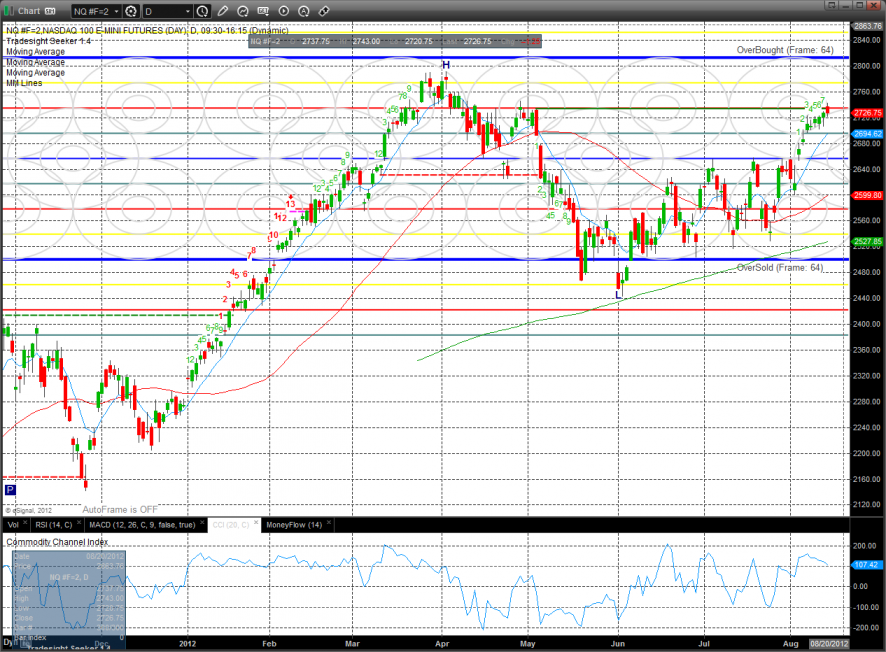

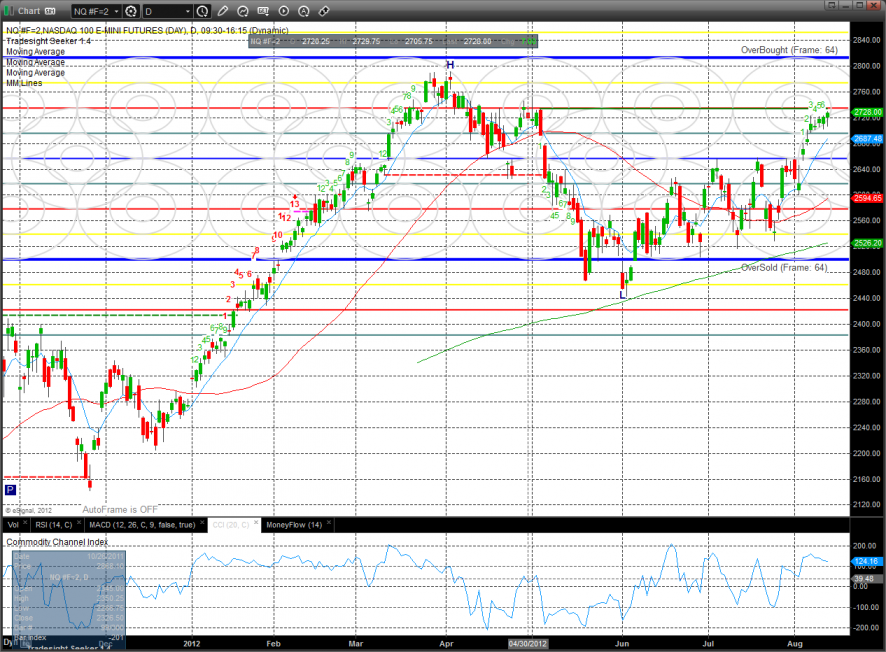

The NQ futures were stopped cold by the active static trend line and posted a bearish range high red candle. The first retracement objective will be the rising 10ema.

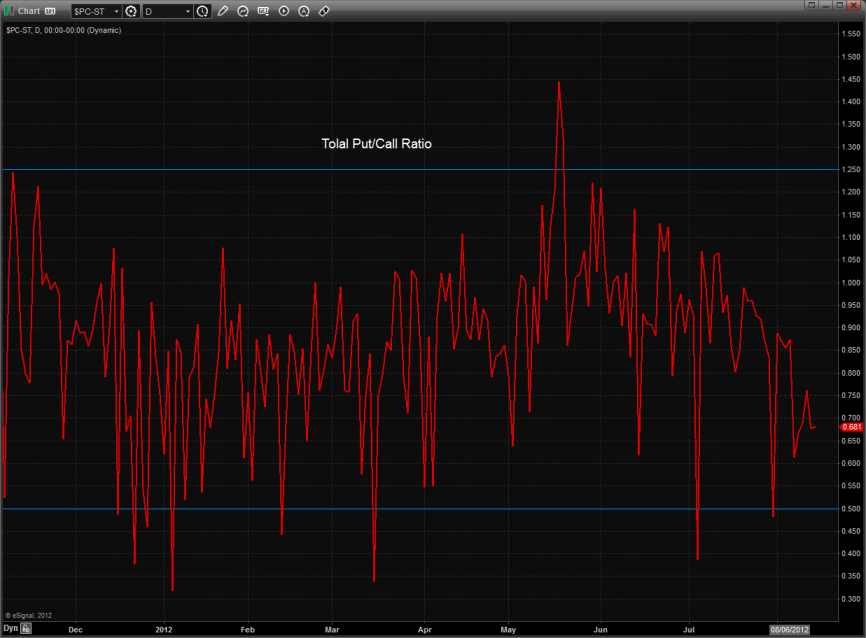

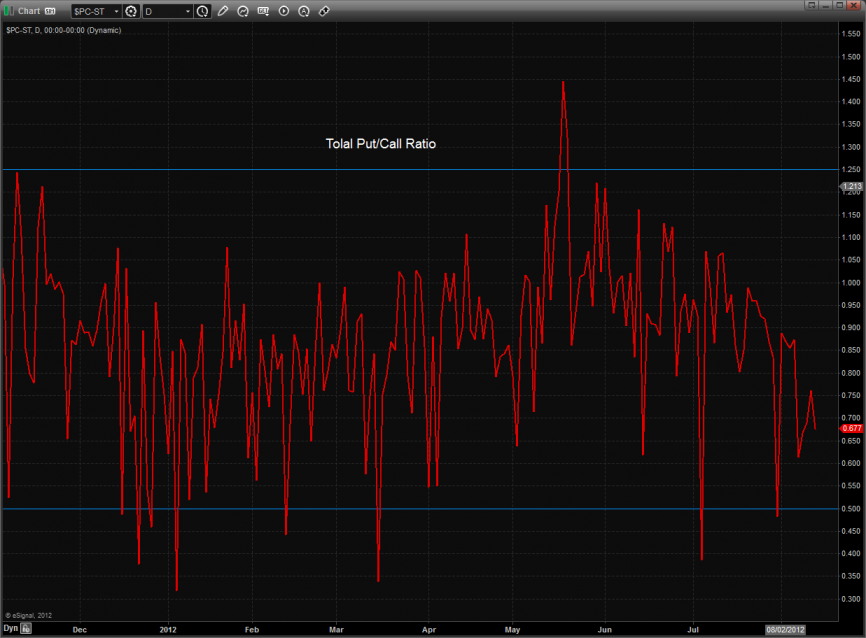

The total put/call ratio has as downward bias but hasn’t recorded a climatic reading yet.

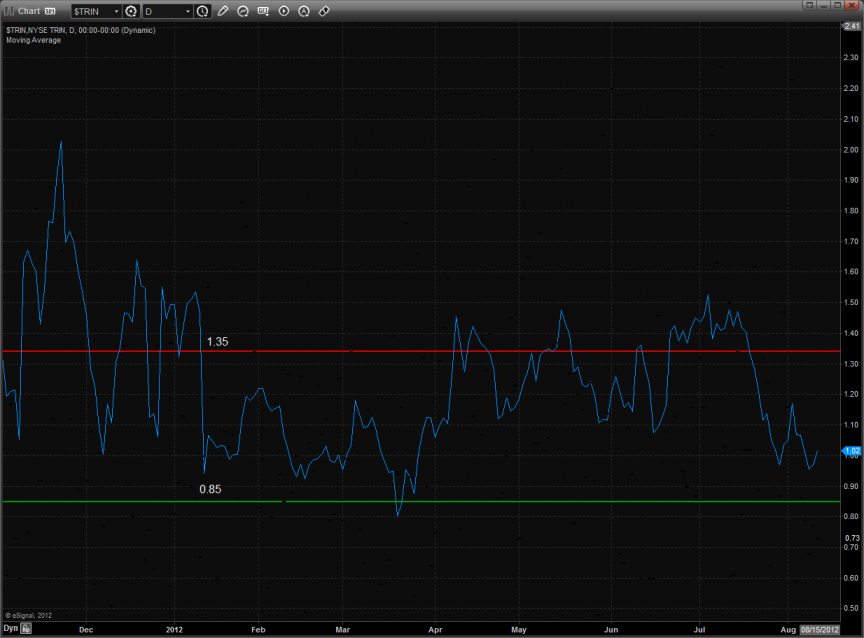

10-day Trin:

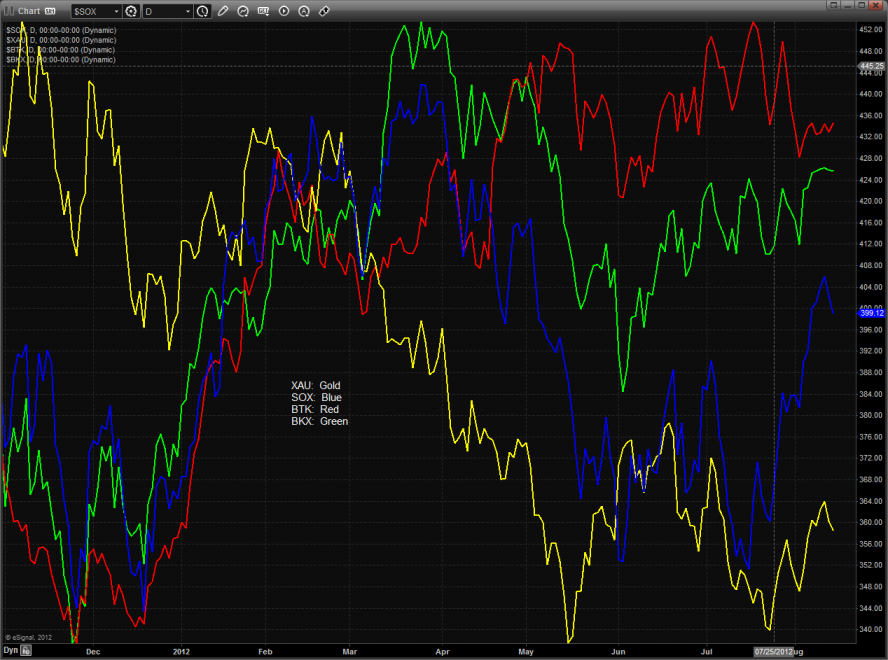

Multi sector daily chart:

The Dow/gold ratio is making slow progress but has yet to make a definitive break in favor of equities over hard the golden hard asset.

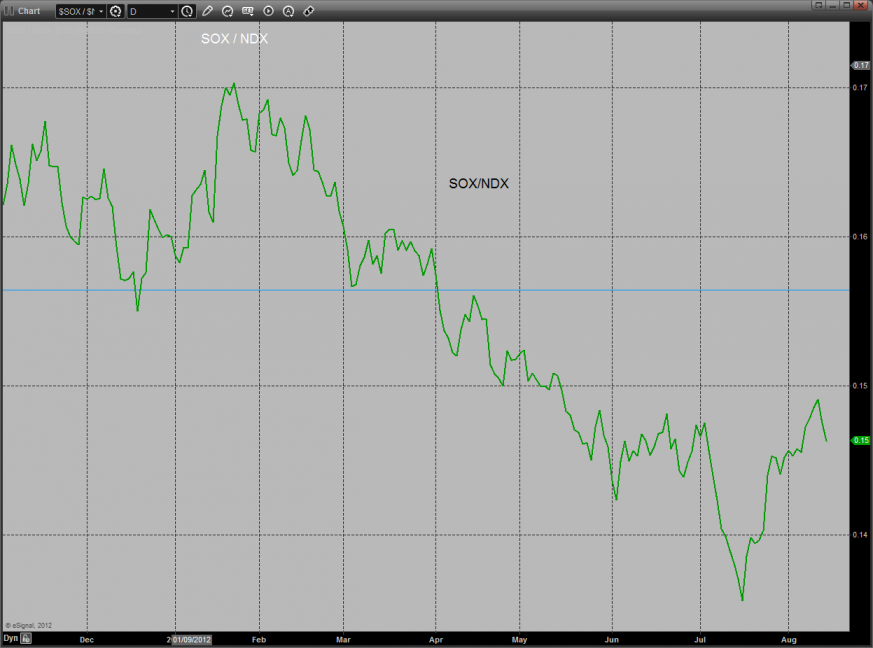

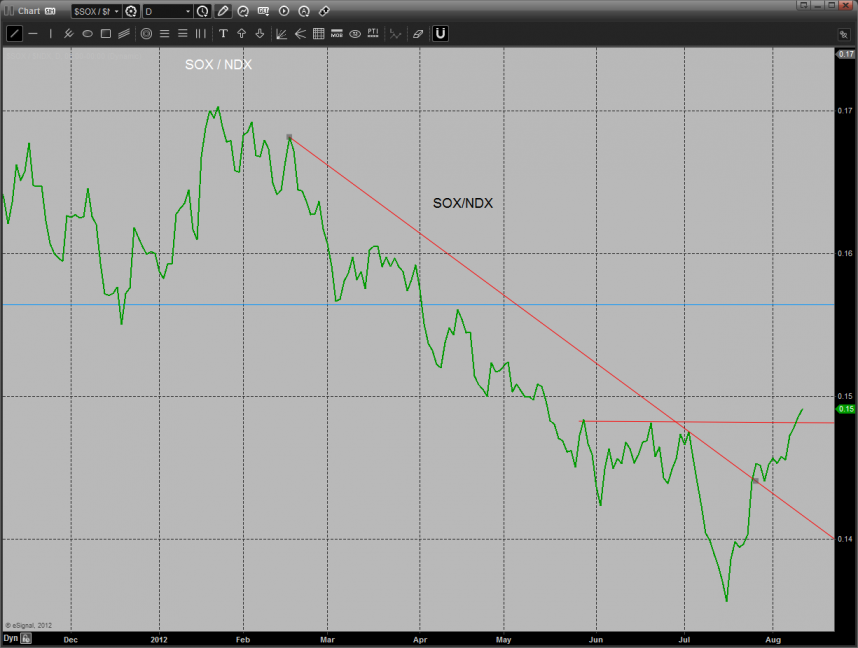

The SOX/NDX cross did not follow through on the breakout just yet.

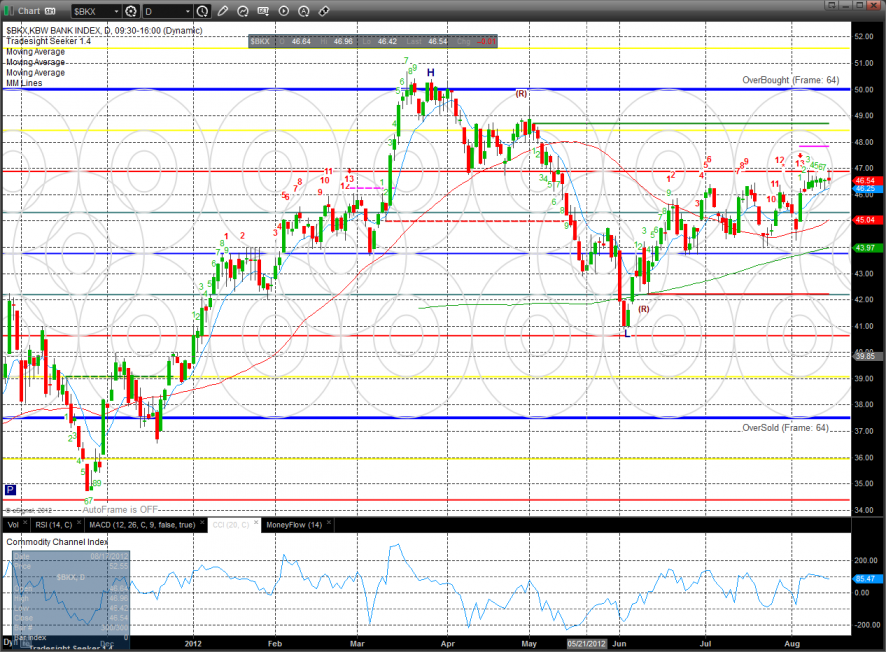

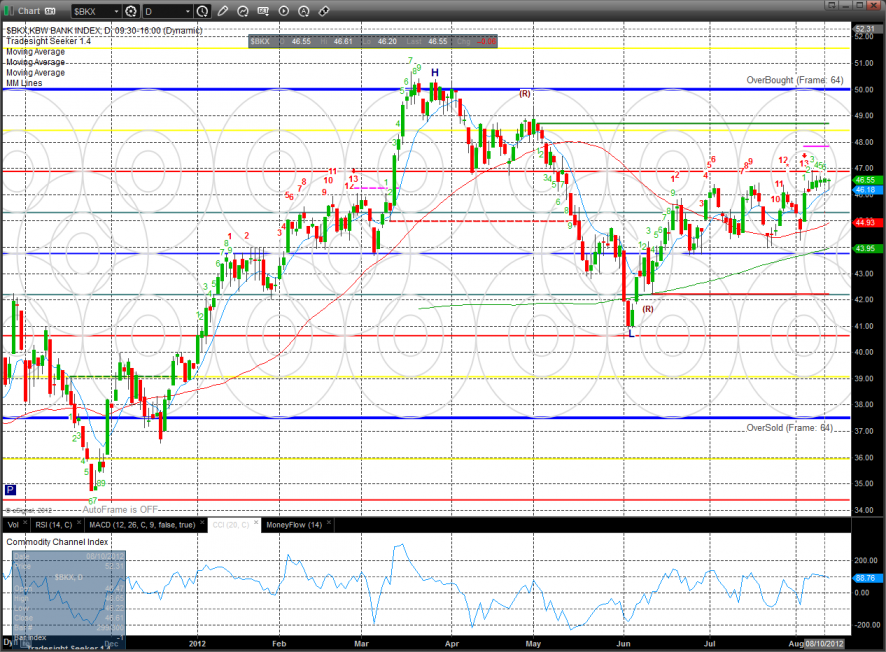

The BKX was flat on the day and hasn’t budged on a closing basis for days. When this range resolves, it should be very powerful.

The OSX was lower on the day and will turn short term negative if it loses the 10ema(blue).

The XAU is barely holding above the 10ema.

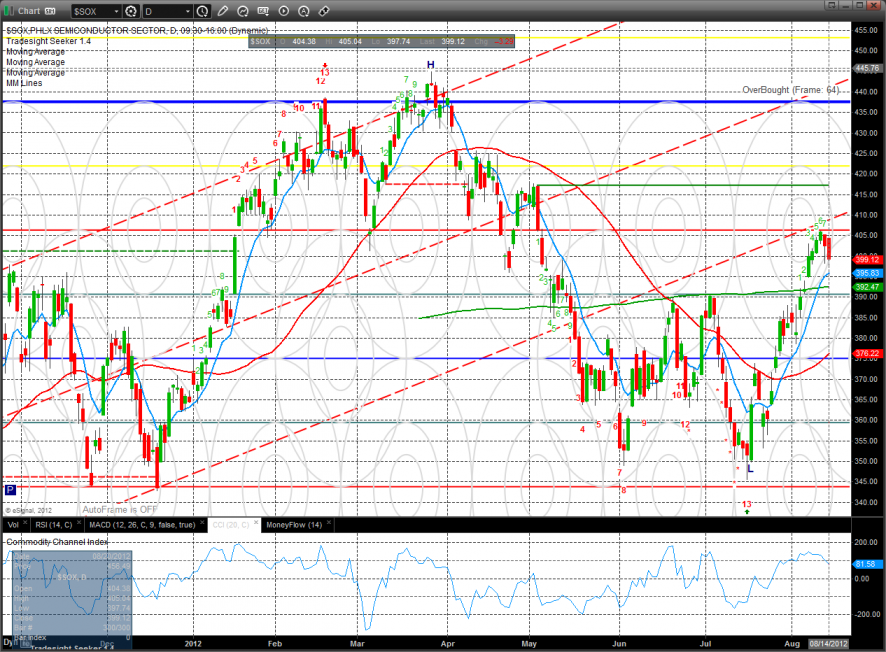

The SOX took a big hit and was much weaker than the Naz. The SOX usually leads the Naz and the Naz usually leads the SP.

Oil:

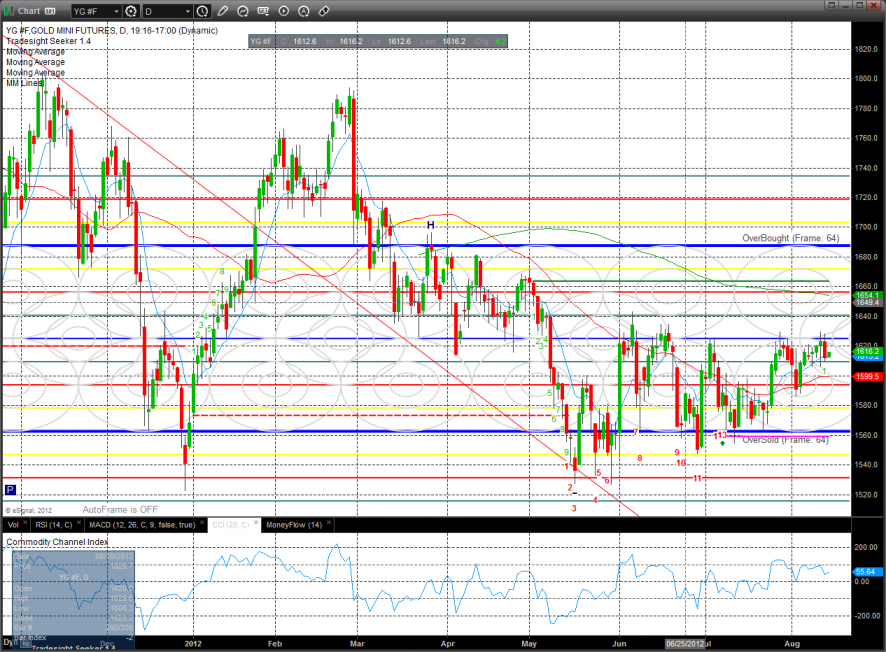

Gold:

Silver:

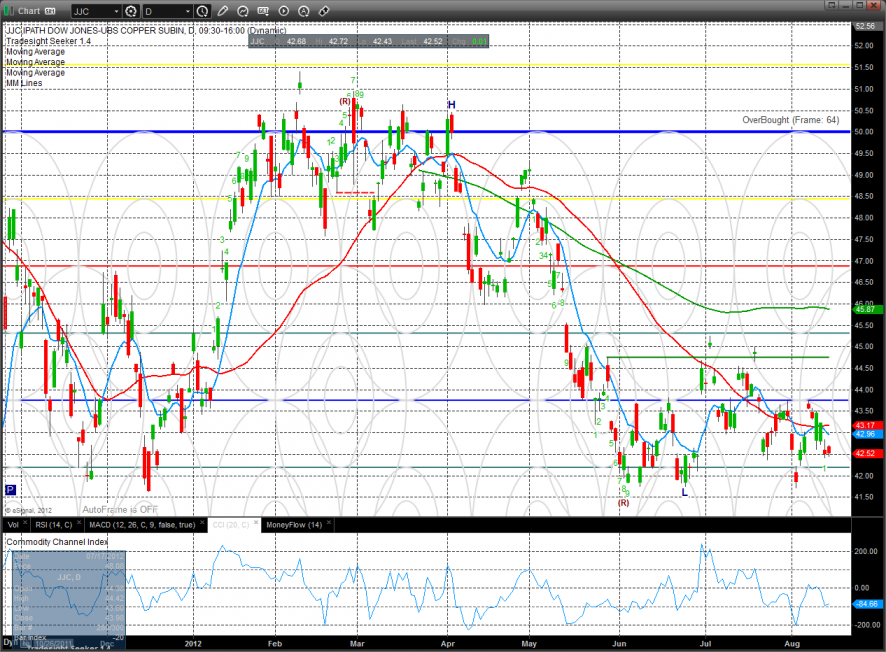

Copper:

Stock Picks Recap for 8/14/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ENTG gapped over, no play.

TRIP triggered short (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's KORS triggered long (without market support due to opening five minutes) and didn't work:

His AGU triggered short (without market support due to opening five minutes) and worked:

His SINA triggered short (with market support) and worked:

His CLF triggered short (with market support) and worked:

TLT triggered long (ETF, so no market support needed) and worked enough for a partial:

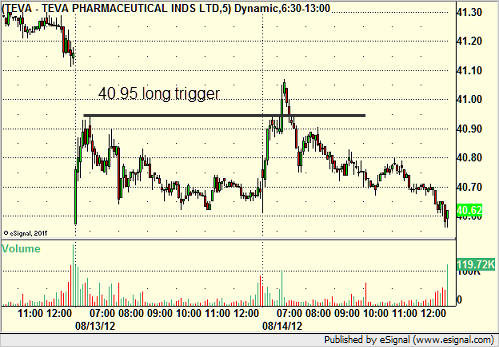

TEVA triggered long (with market support) and didn't work:

Rich's NTGR triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

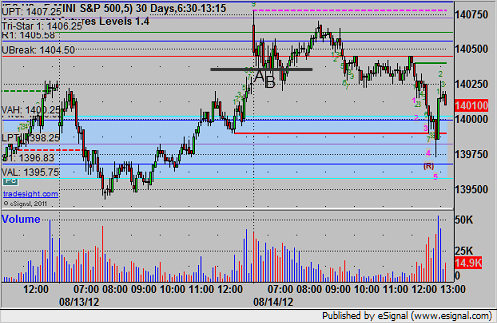

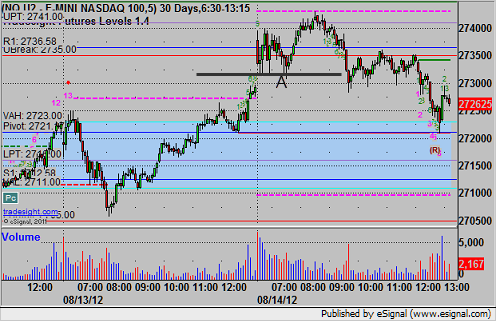

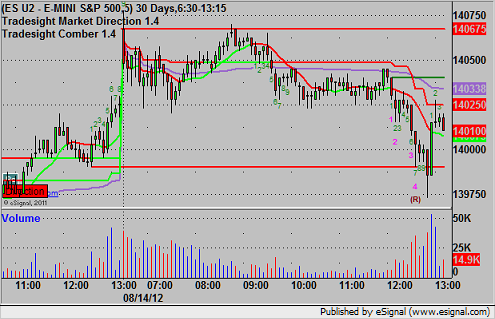

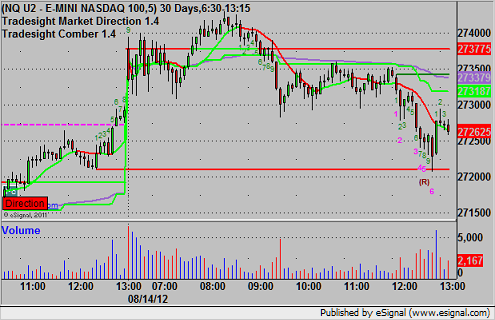

Futures Calls Recap for 8/14/12

More sweeps than I can recall seeing in a session as the ES and NQ couldn't do anything right and volume was once again weak at 1.4 billion NASDAQ shares.

Net ticks: -21 ticks.

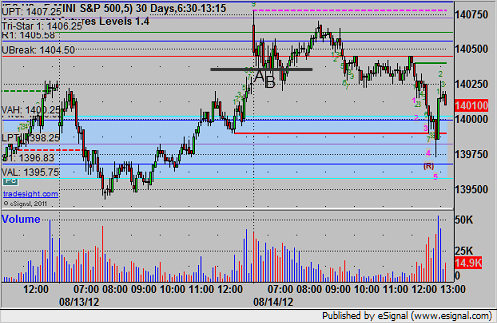

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

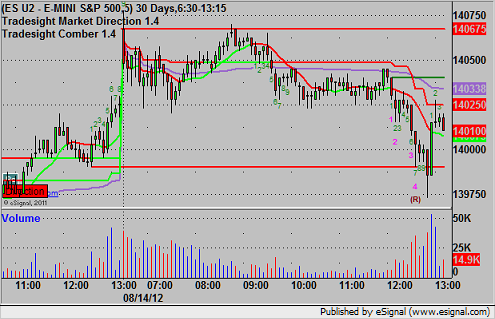

ES:

Triggered short at A at 1403.25 and stopped. Re-entered at B and stopped:

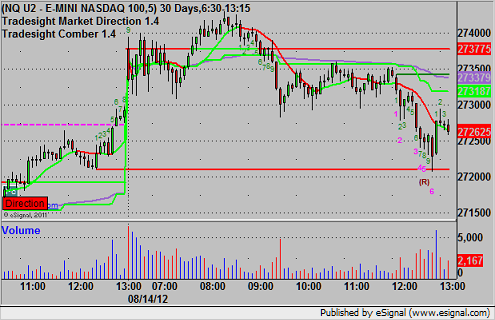

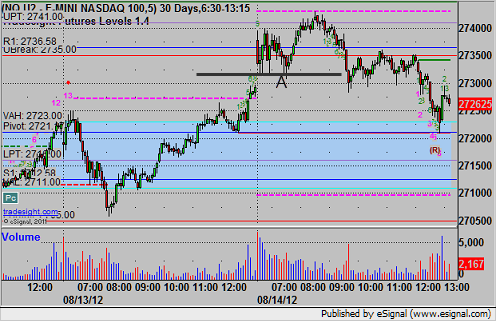

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 2731.00 and stopped:

Futures Calls Recap for 8/14/12

More sweeps than I can recall seeing in a session as the ES and NQ couldn't do anything right and volume was once again weak at 1.4 billion NASDAQ shares.

Net ticks: -21 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1403.25 and stopped. Re-entered at B and stopped:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 2731.00 and stopped:

Forex Calls Recap for 8/14/12

A winner and a loser on the EURUSD for the session. Ended up at the same price level again, and the GBPUSD barely traded 40 pips overnight (yikes!).

See EURUSD below.

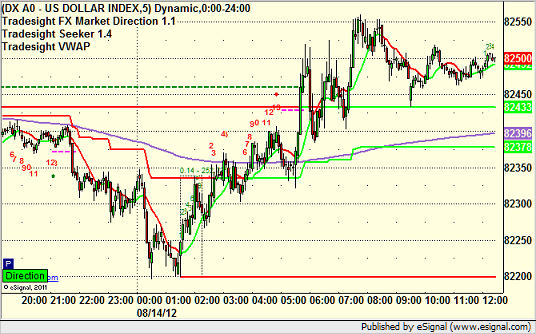

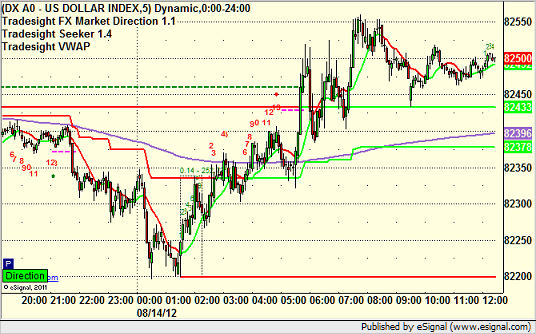

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

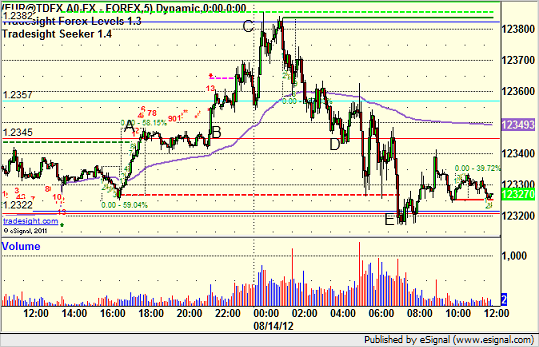

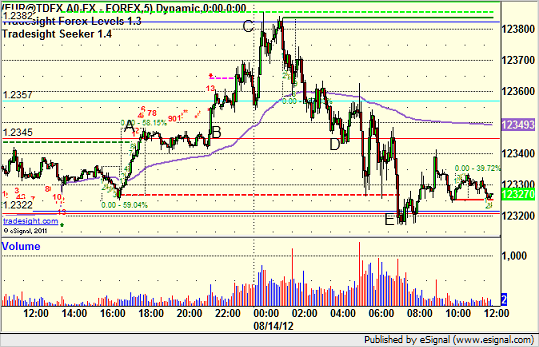

EURUSD:

Triggered long at A, gave you until B to take it, hit first target at C exactly, raised stop in the morning and stopped after D (actually the second move under UBreak there). Triggered short at E and stopped:

Forex Calls Recap for 8/14/12

A winner and a loser on the EURUSD for the session. Ended up at the same price level again, and the GBPUSD barely traded 40 pips overnight (yikes!).

See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A, gave you until B to take it, hit first target at C exactly, raised stop in the morning and stopped after D (actually the second move under UBreak there). Triggered short at E and stopped:

Tradesight Market Preview for 8/14/12

The ES did nothing on the day after recouping a mid day drop. The futures closed exactly unchanged on the day.

The NQ futures were up 7 on the day and was good enough to expand the high close of the rally. Monday, price tested the static trend line intraday but settled below it. This will be the big level on Tuesday.

The P/C ratio is showing nothing notable.

The 10-day Trin remains neutral.

The SOX is gaining relative strength on the multi sector daily chart:

The SOX has broken out in relative strength vs. the NDX and is a key reason that the tech shares have been recently outperforming the broad market. This is a fresh change in trend and had bullish implications for equities overall.

SPX vs. NDX:

The BKX was flat on the day and remains boxed up in the recent range with the Seeker sell signal keeping watch on any price advance.

The BTK is still contained below the key 50dma.

Oil:

Gold:

Silver:

TLT: