Tradesight Market Preview for 8/14/12

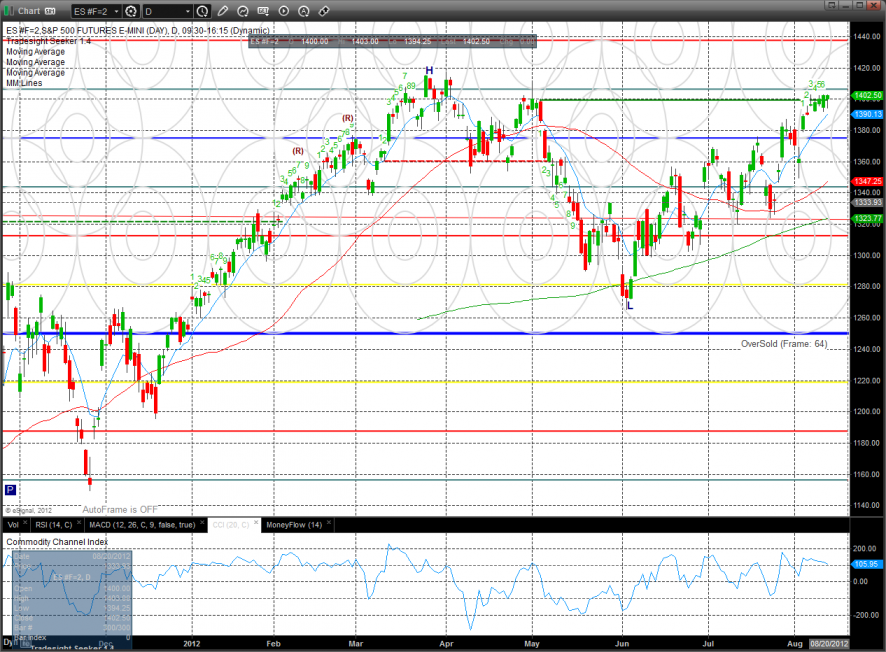

The ES did nothing on the day after recouping a mid day drop. The futures closed exactly unchanged on the day.

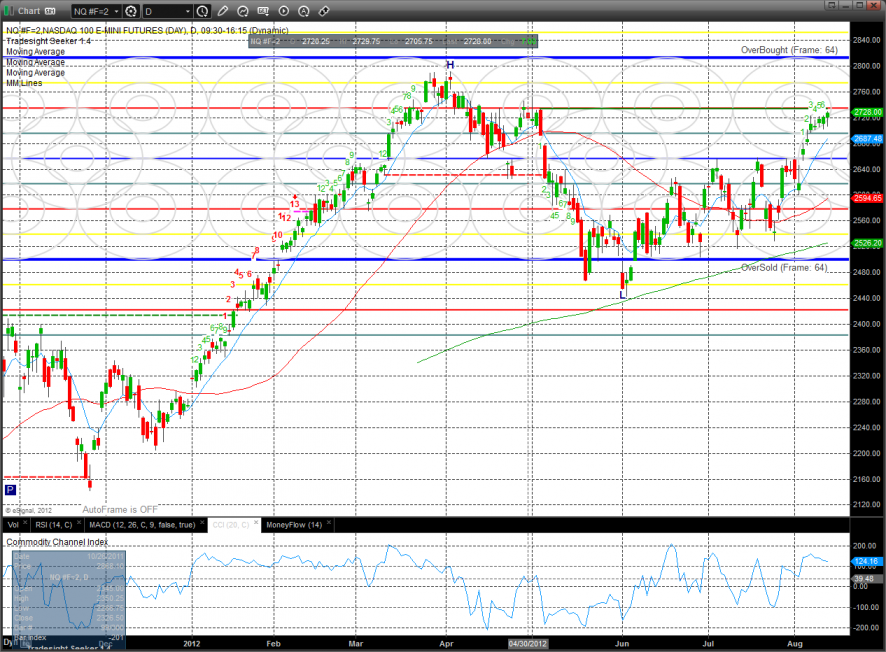

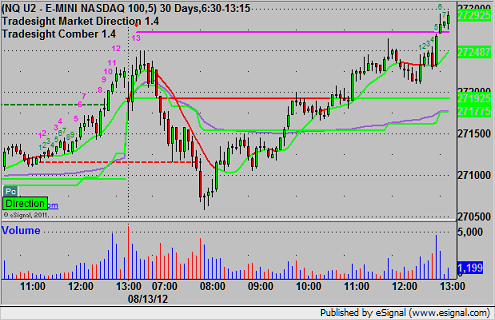

The NQ futures were up 7 on the day and was good enough to expand the high close of the rally. Monday, price tested the static trend line intraday but settled below it. This will be the big level on Tuesday.

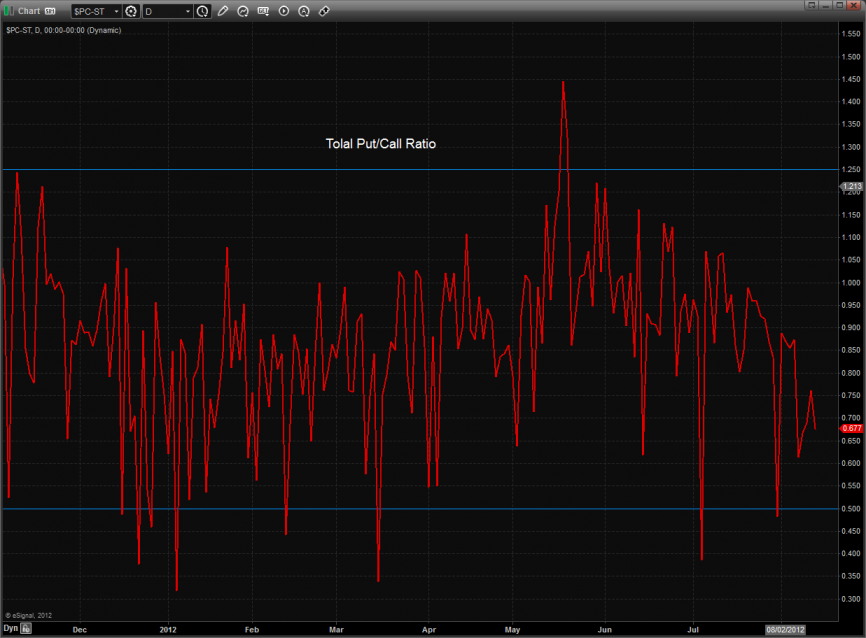

The P/C ratio is showing nothing notable.

The 10-day Trin remains neutral.

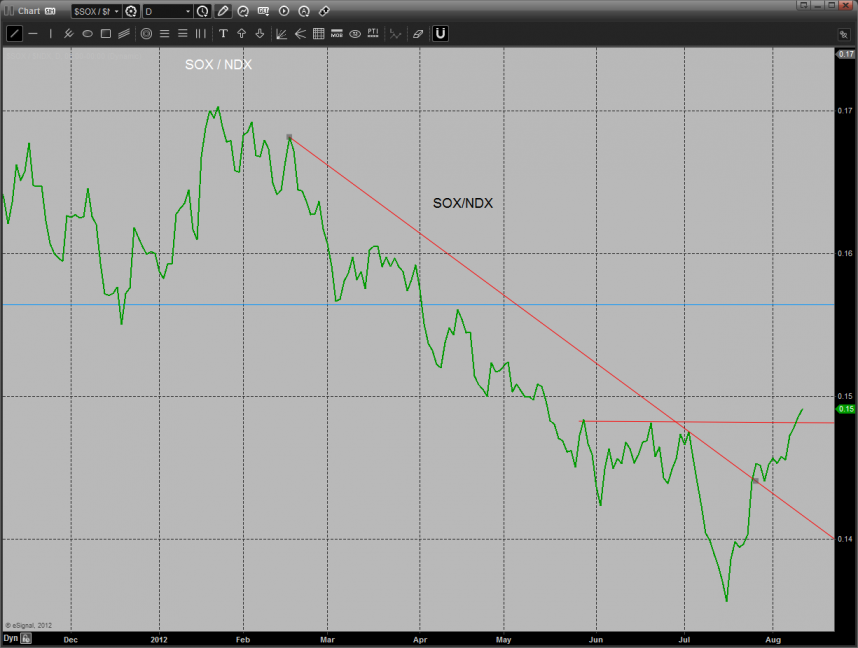

The SOX is gaining relative strength on the multi sector daily chart:

The SOX has broken out in relative strength vs. the NDX and is a key reason that the tech shares have been recently outperforming the broad market. This is a fresh change in trend and had bullish implications for equities overall.

SPX vs. NDX:

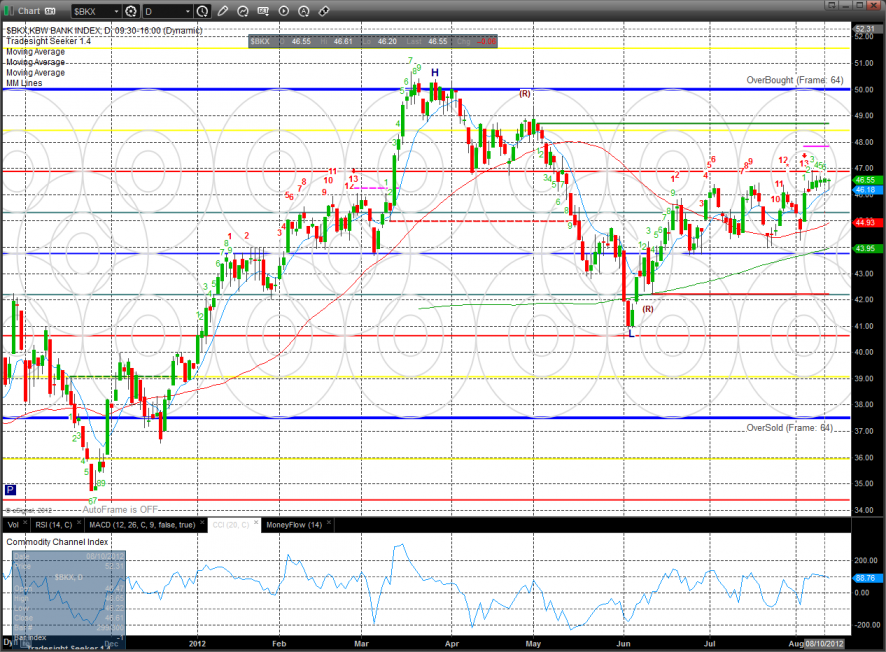

The BKX was flat on the day and remains boxed up in the recent range with the Seeker sell signal keeping watch on any price advance.

The BTK is still contained below the key 50dma.

Oil:

Gold:

Silver:

TLT:

Stock Picks Recap for 8/13/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ITRI triggered long (without market support due to opening five minutes) and didn't work:

FMCN gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's CRM triggered long over the opening 5 minute bar high (with market support) and worked:

His GOOG triggered long (with market support) and worked:

His SOHU triggered short (with market support) and worked:

His POT triggered short (with market support) and didn't work:

AMZN triggered short (with market support) and worked enough for a partial:

Rich's AAPL triggered long (with market support) and worked:

NTAP triggered long (with market support) and didn't go enough either way to count (and closed right at the trigger):

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not, but nothing really went far.

Stock Picks Recap for 8/13/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ITRI triggered long (without market support due to opening five minutes) and didn't work:

FMCN gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's CRM triggered long over the opening 5 minute bar high (with market support) and worked:

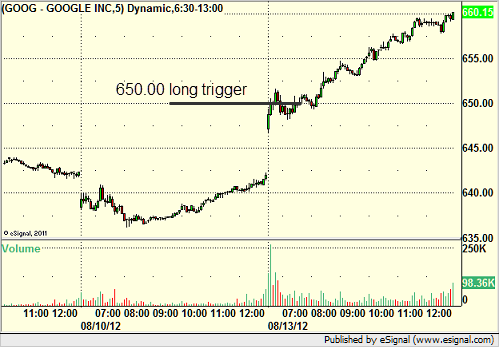

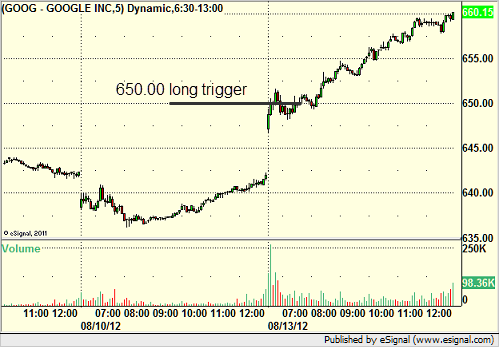

His GOOG triggered long (with market support) and worked:

His SOHU triggered short (with market support) and worked:

His POT triggered short (with market support) and didn't work:

AMZN triggered short (with market support) and worked enough for a partial:

Rich's AAPL triggered long (with market support) and worked:

NTAP triggered long (with market support) and didn't go enough either way to count (and closed right at the trigger):

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not, but nothing really went far.

Futures Calls Recap for 8/13/12

We identified that volume was extremely light very early and backed off on most calls. The NQ setup was nice but was really designed for the morning when we were playing with the UBreak level, eventually triggered long in the afternoon. See that section below.

Net ticks: -7 ticks.

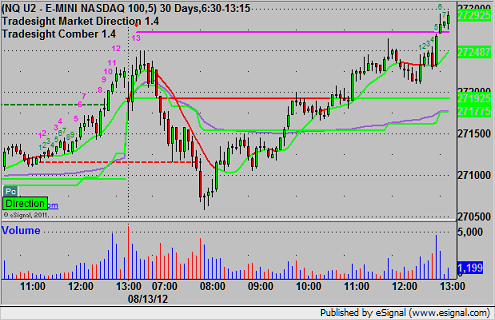

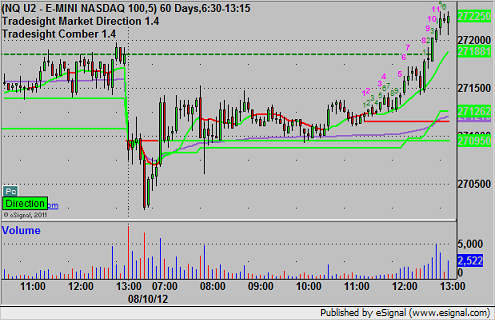

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

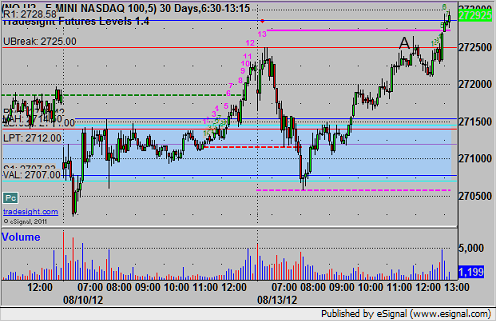

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

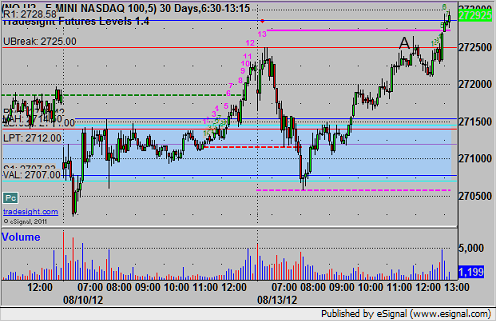

Set the UBreak early, but the trade ended up triggering in the afternoon and A and stopping:

Futures Calls Recap for 8/13/12

We identified that volume was extremely light very early and backed off on most calls. The NQ setup was nice but was really designed for the morning when we were playing with the UBreak level, eventually triggered long in the afternoon. See that section below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Set the UBreak early, but the trade ended up triggering in the afternoon and A and stopping:

Forex Calls Recap for 8/13/12

Boring session again with no movement during European or US hours. See EURUSD and GBPUSD below.

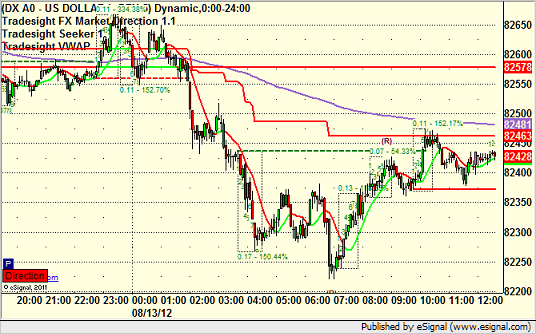

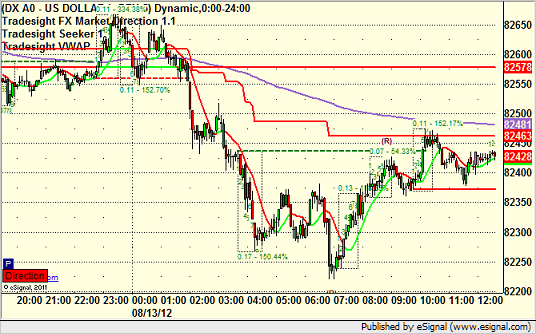

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

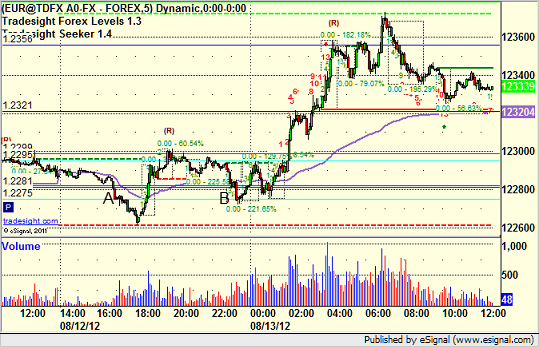

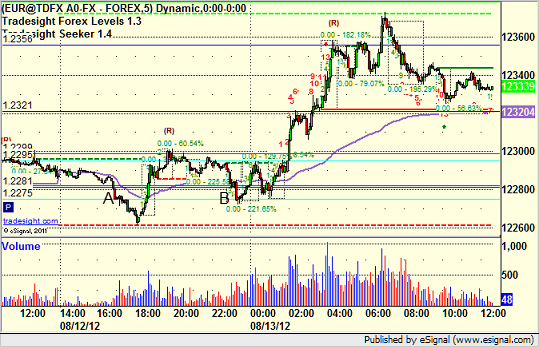

EURUSD:

Triggered short early at A and gave you all the way to B to take, then stopped:

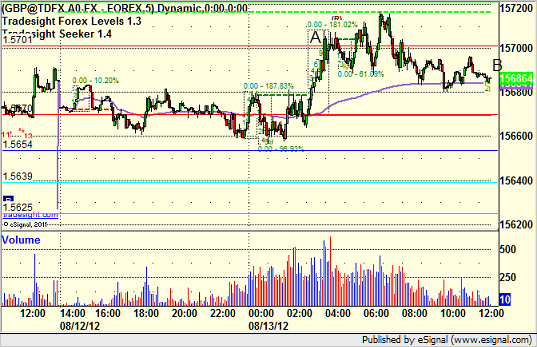

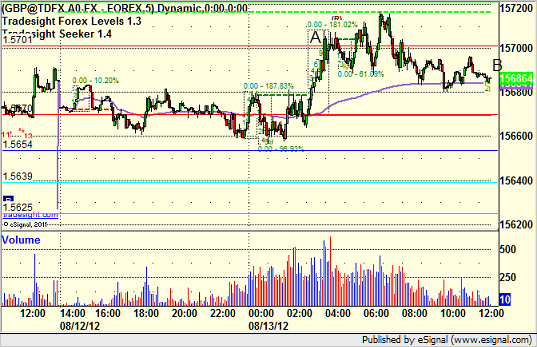

GBPUSD:

Triggered long at A, never stopped or hit first target, finally closed at B for end of session down 15 pips:

Forex Calls Recap for 8/13/12

Boring session again with no movement during European or US hours. See EURUSD and GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short early at A and gave you all the way to B to take, then stopped:

GBPUSD:

Triggered long at A, never stopped or hit first target, finally closed at B for end of session down 15 pips:

Stock Picks Recap for 8/10/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NVDA gapped over, no play.

VPHM triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TNA triggered long (ETF, so no market support needed) and worked enough for a partial:

His VMW triggered long (without market support due to opening five minutes) and worked:

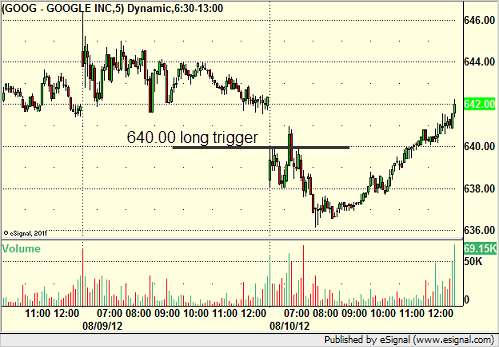

GOOG triggered long (with market support) and worked enough for a partial:

GOOG triggered short (without market support) and worked:

Rich's AMGN triggered long (with market support) and worked:

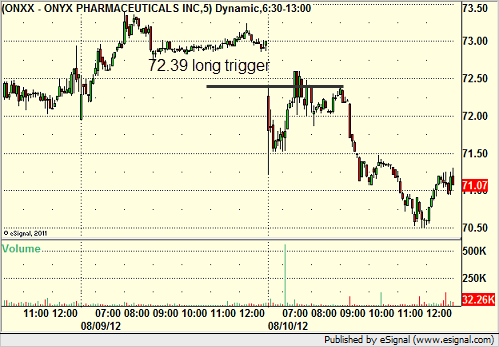

His ONXX triggered long (with market support) and didn't work:

Rich's TLT triggered short (ETF, so no market support needed) and worked:

His PCLN triggered short (without market support) and didn't work:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

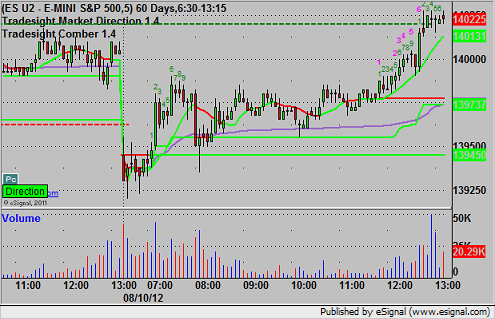

Futures Calls Recap for 8/10/12

Two stop outs (ES and NQ) and a small winner (NQ) on a narrow day in the markets. See both sections below.

Net ticks: -7.5 ticks.

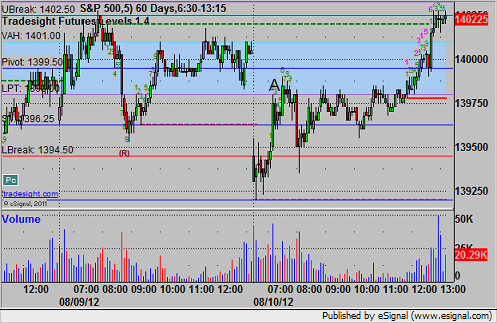

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long into the Value Area after perfectly setting the Value Area...entry was 1398.25 at A and stopped for 7 ticks, but not a re-entry candidate because it spent time above the entry:

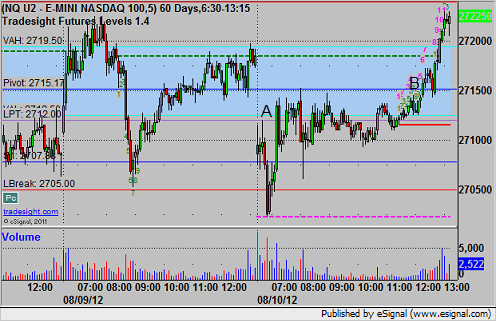

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A 2713.00 and stopped for 7 ticks, also not a re-entry candidate. Separate trade triggered long at B and hit first target for 6 ticks and closed the last piece around that level for end of session (2719.00 final exit):

Forex Calls Recap for 8/10/12

Another slow session as the ranges were poor. One trigger and stop out on the EURUSD, see that section below.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts coming into the new week (see NZDUSD for the only one that matters), and then glance at the US Dollar Index (not much to see here currently).

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered short at A and stopped for 25 pips: