Stock Picks Recap for 8/9/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CPWR triggered long (with market support) and didn't go far enough in either direction to count, still holding:

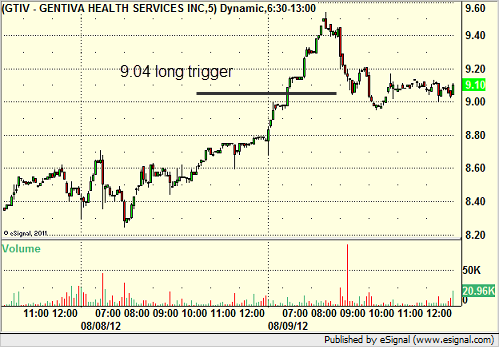

GTIV triggered long (with market support) and worked:

LIFE triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's VMW triggered long (with market support) and worked great:

His MDRX triggered long (with market support) and didn't work:

His AAPL triggered long (with market support) and worked enough for a partial:

His ARUN triggered short (without market support) and didn't work:

His DE triggered short (without market support) and didn't work:

GS triggered long (with market support) and didn't work:

Rich's CF triggered long (with market support) and worked great:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not. A couple of the winners were huge.

Futures Calls Recap for 8/9/12

A narrow ranged day in the markets (6 ES points) with only 1.6 billion NASDAQ shares. Mark's ES call stopped twice, see ES section below.

Net ticks: -14 ticks.

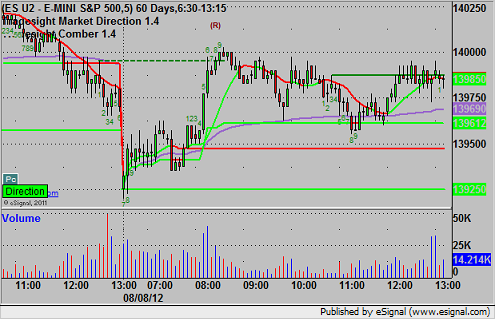

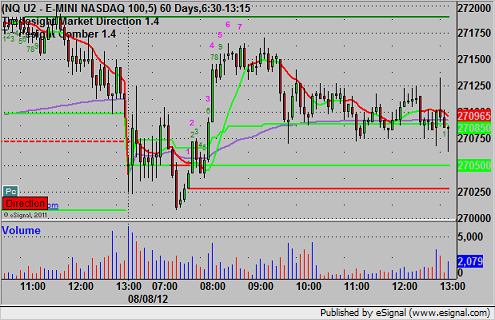

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

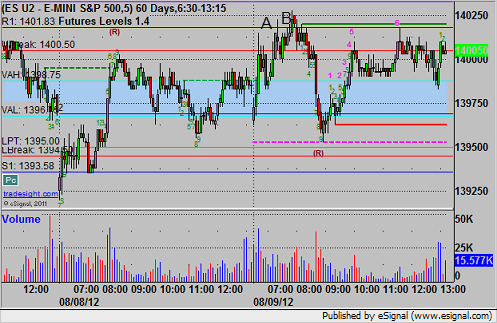

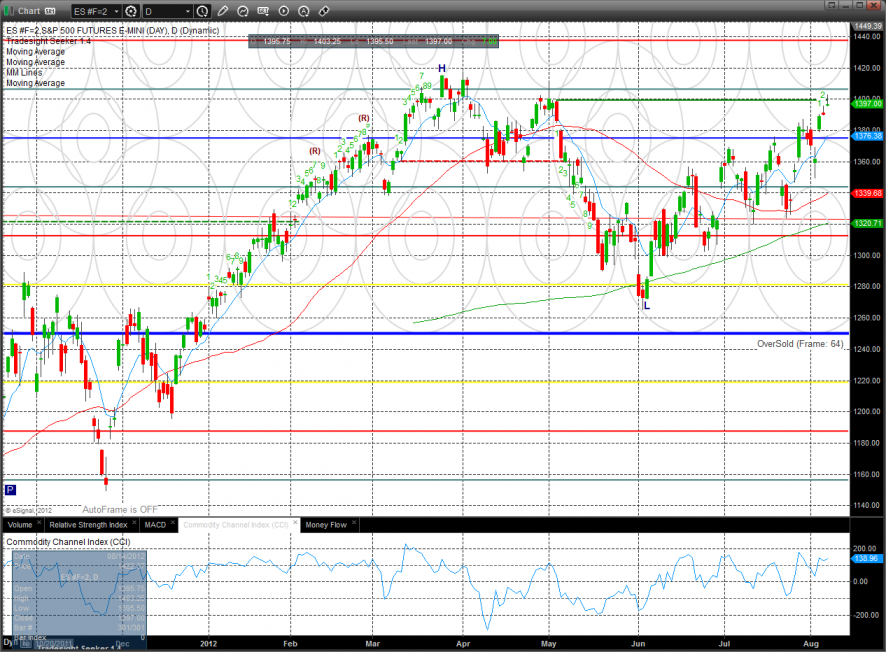

ES:

Triggered long at 1402.00 at A and stopped and at B and stopped (both times for 7 ticks):

Forex Calls Recap for 8/9/12

A winner and a loser for the session with the short GBPUSD still in play as I right this. See EURUSD and GBPUSD below.

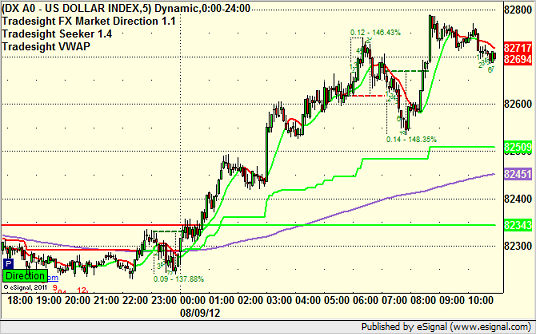

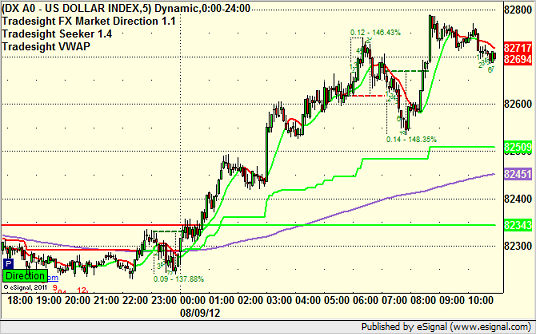

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped for 25 pips:

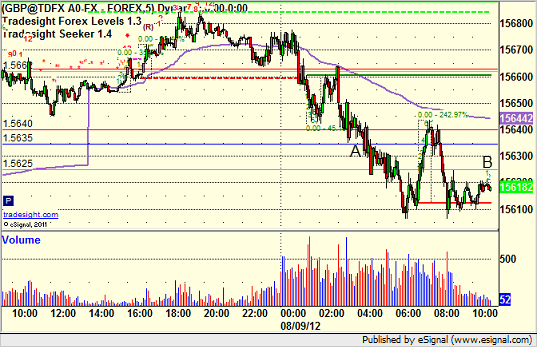

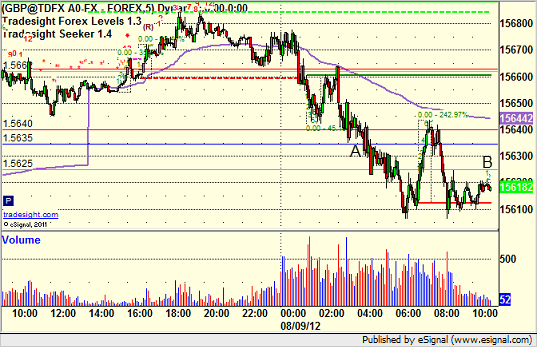

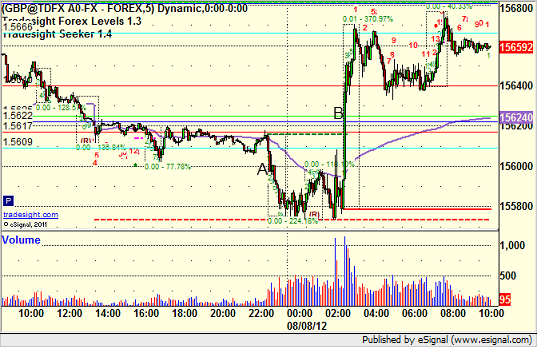

GBPUSD:

Triggered short at A, hasn't hit first target yet but we lowered stop over the tri-star level at 1.5625 (B) in the money:

Forex Calls Recap for 8/9/12

A winner and a loser for the session with the short GBPUSD still in play as I right this. See EURUSD and GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

EURUSD:

Triggered long at A and stopped for 25 pips:

GBPUSD:

Triggered short at A, hasn't hit first target yet but we lowered stop over the tri-star level at 1.5625 (B) in the money:

Tradesight Market Preview for 8/9/12

The ES continues to grind, adding only one handle to the high close of the move. Settlement was right at the static trend line and this will continue to influence price. The next level that will come into play will be the open gap at 1409.

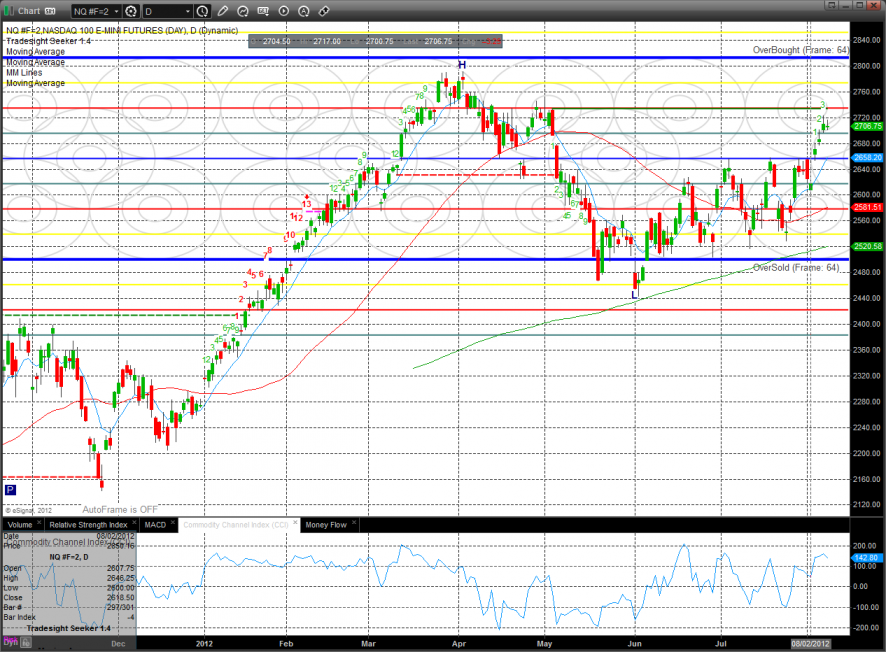

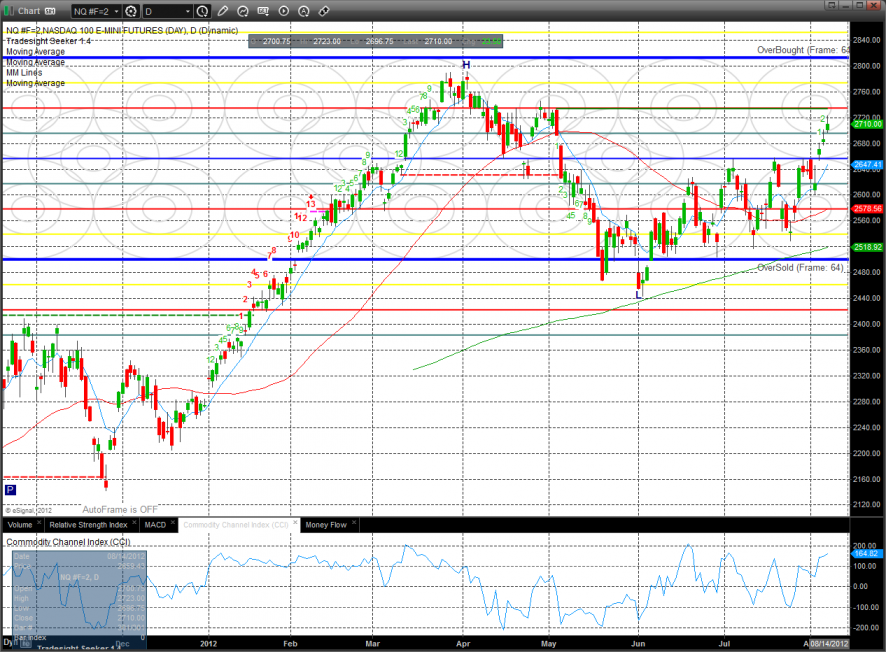

The NQ futures posted an inside day with a small loss. Price remains contained below the static trend line.

The 10-day Trin is approaching but not yet reading overbought for the market.

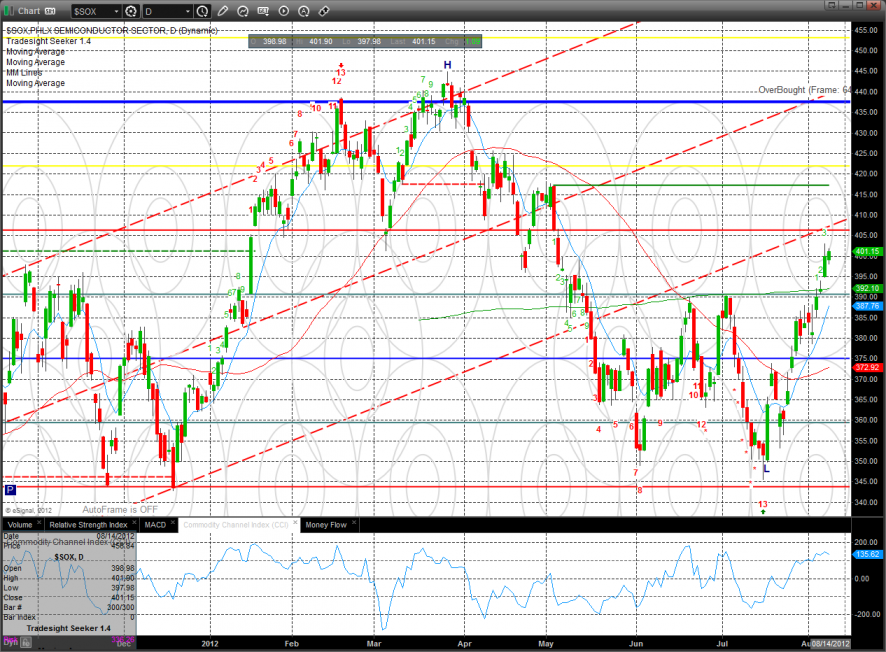

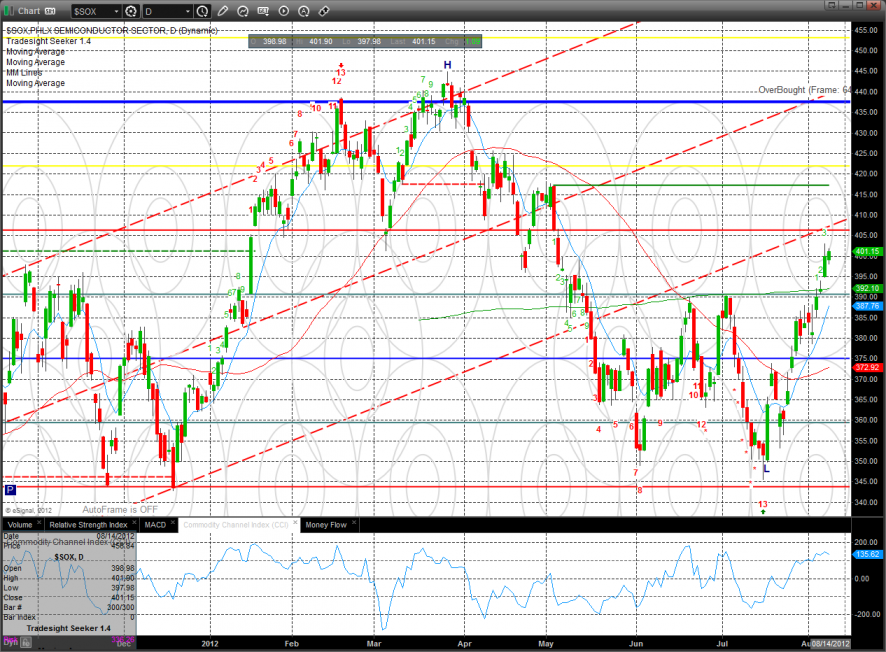

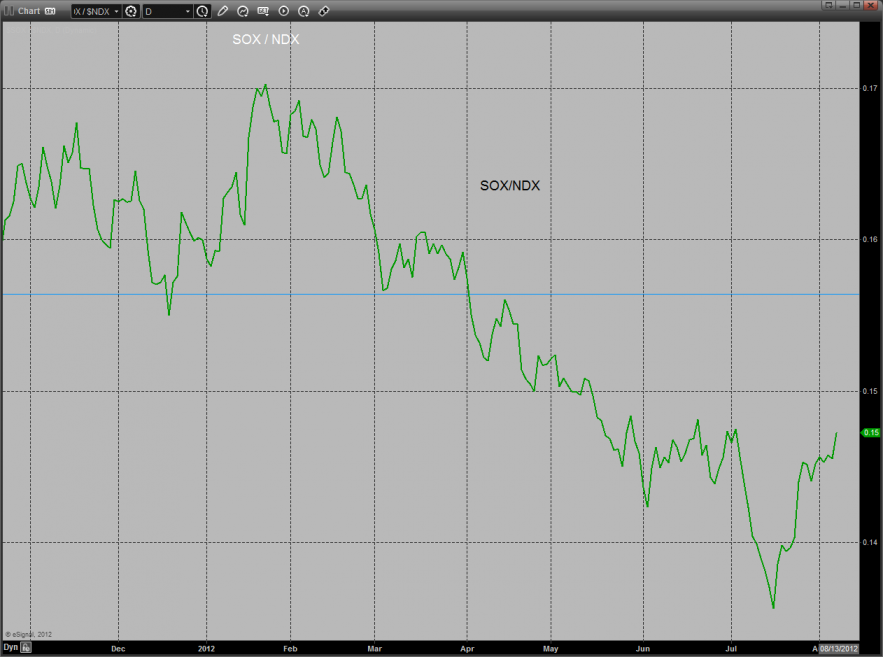

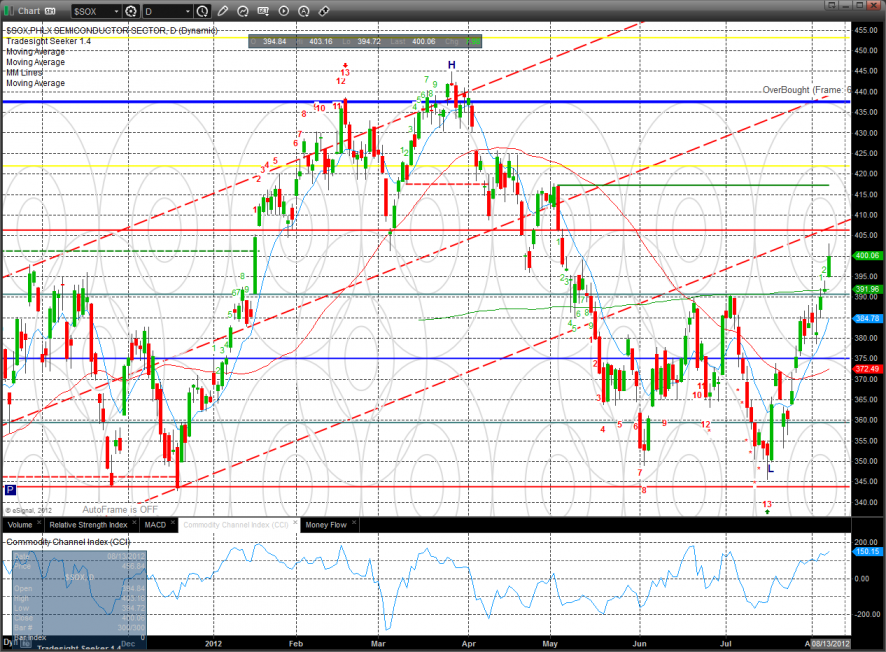

Multi sector daily chart shows the recent relative strength in the SOX.

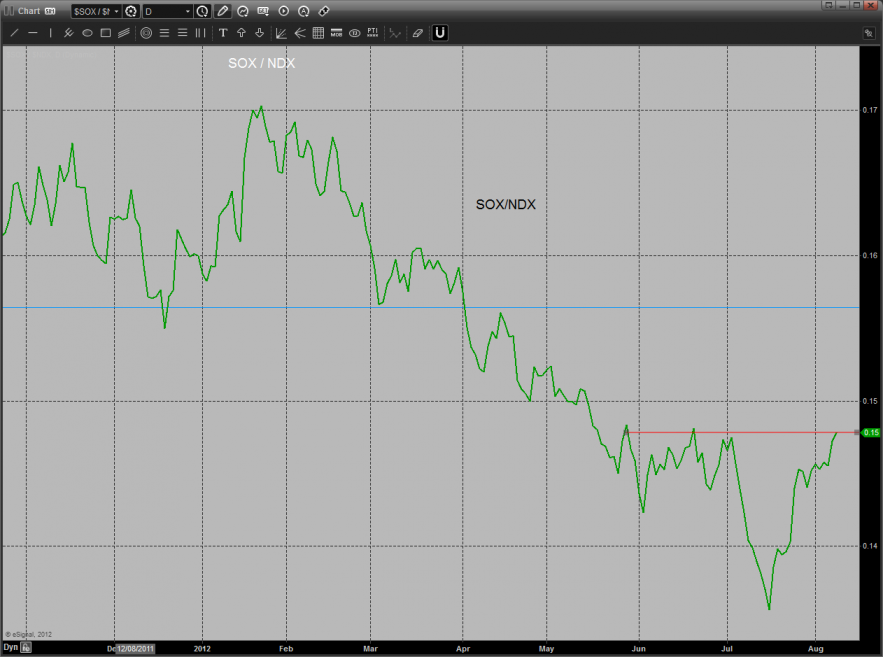

The SOX/NDX cross is very close to a key reversal, stay tuned.

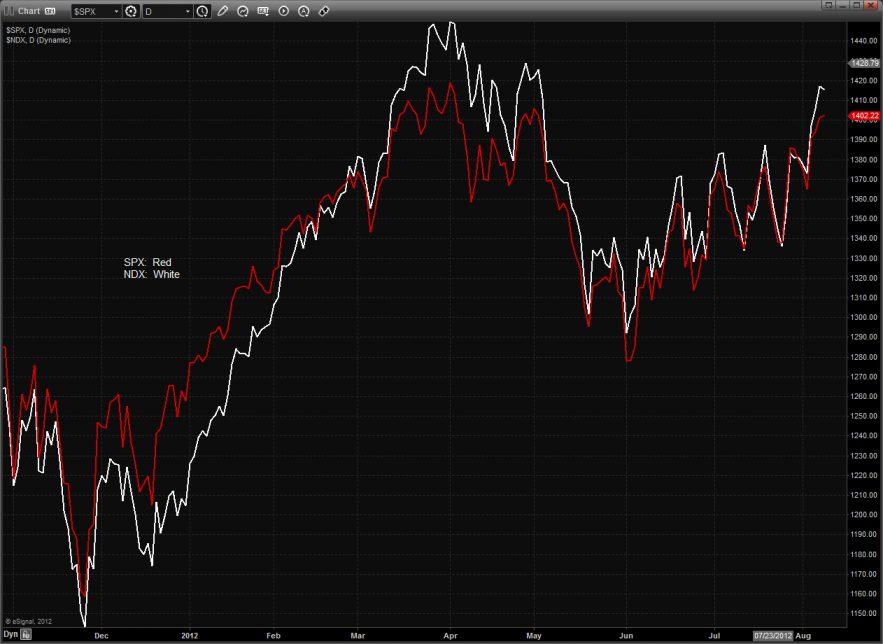

SPX/NDX still bullishly shows relative strength in the NDX.

The SOX was the top main sector on the day but was contained within the prior day’s range.

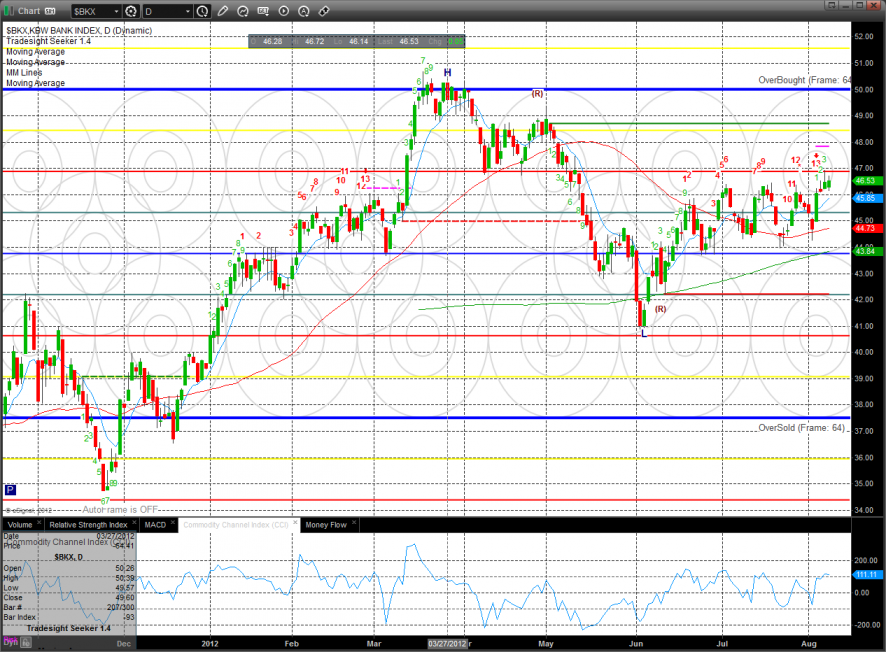

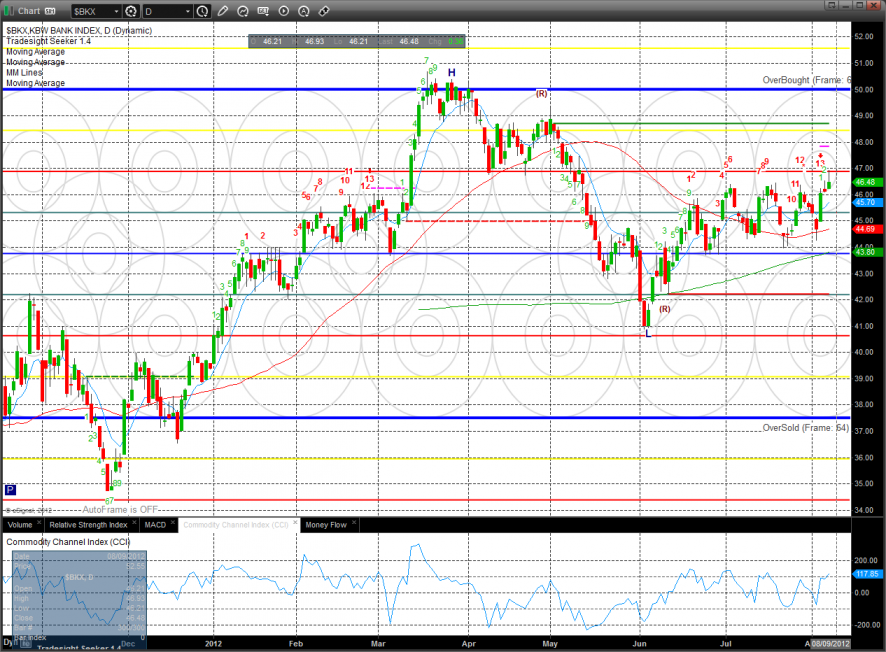

The BKX was flat on the day, basically mirroring the prior session. Keep in mind that there is still and active Seeker sell signal.

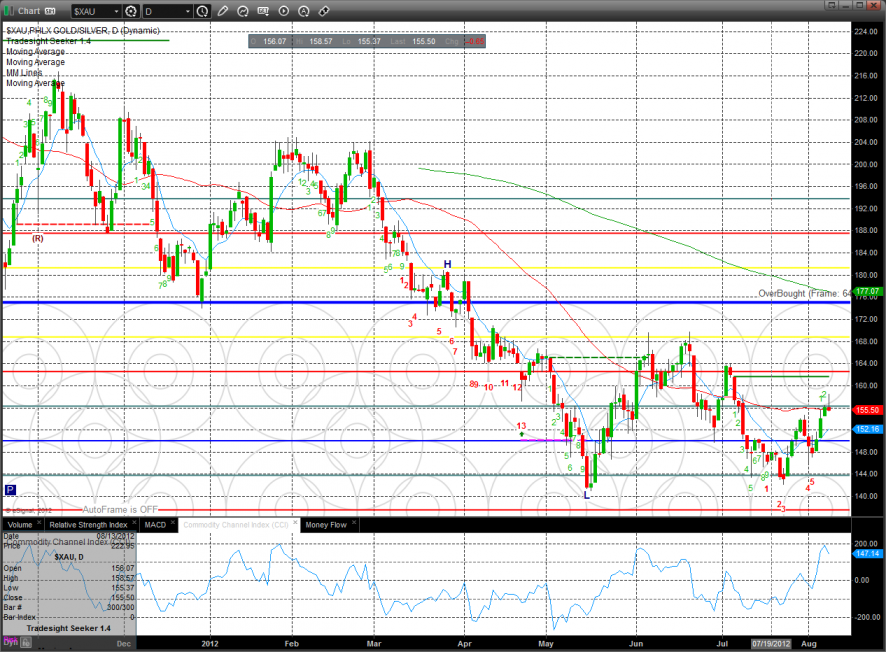

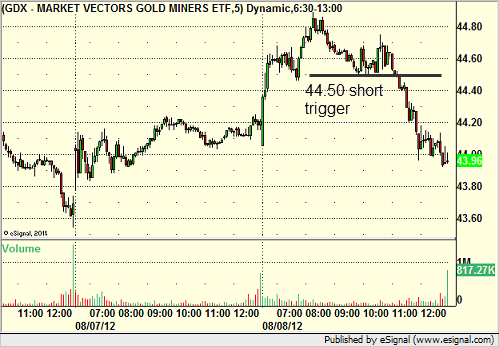

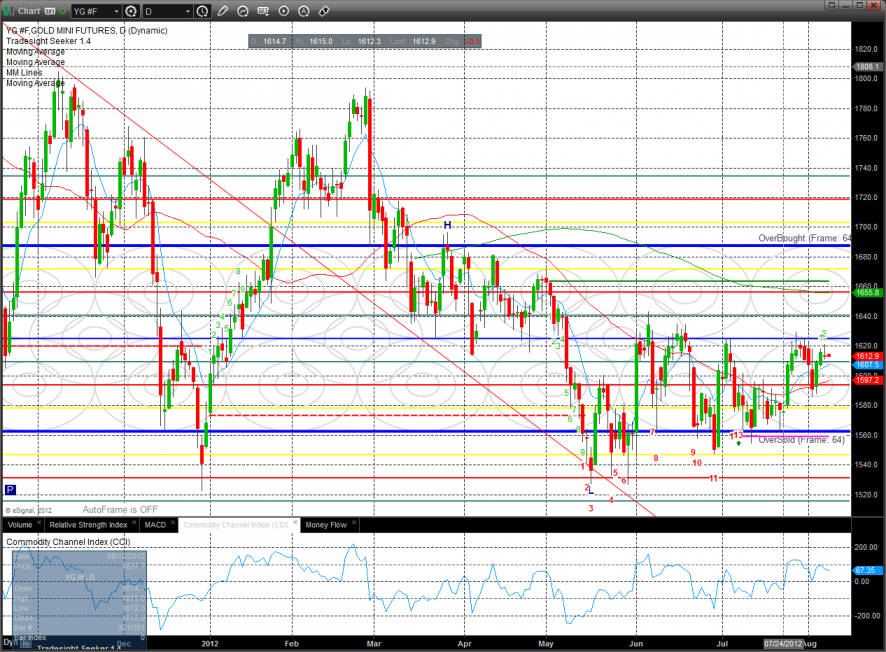

The XAU got stuffed by the 50dma and offered us a nice short trade in the GDX on Wednesday. This is a measuring day so tomorrow’s action will be important.

The BTK was the last laggard on the day and appears to be a source of funds.

Oil:

Silver:

Stock Picks Recap for 8/8/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

From the Messenger/Tradesight_st Twitter Feed, Rich's MCD triggered long (with market support) and worked:

His SODA triggered short (without market support due to opening five minutes) and worked:

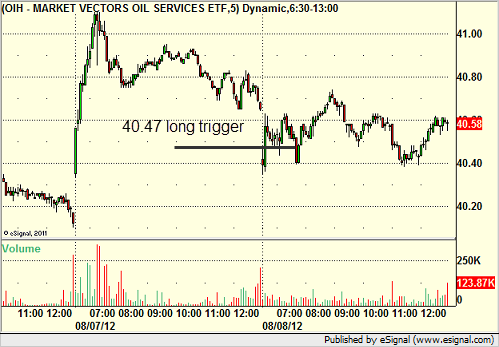

His OIH triggered long (ETF, so no market support needed) and worked enough for a partial:

His PXD triggered long (with market support) and worked great:

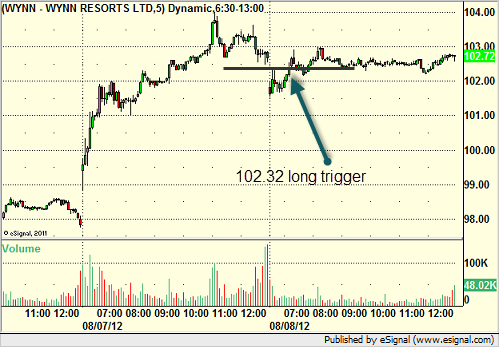

His WYNN triggered long (with market support) and worked:

BIDU triggered long (with market support) and worked:

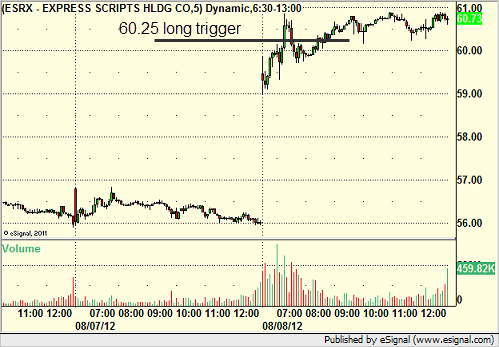

Rich's ESRX triggered long (with market support) and worked:

AMZN triggered short (without market support) and worked:

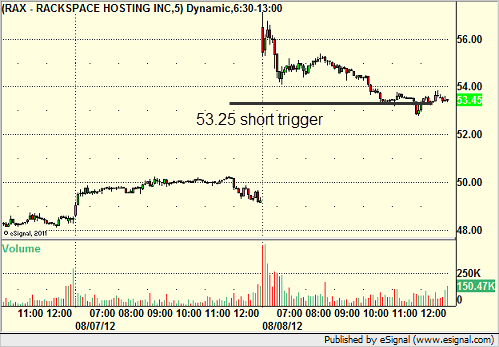

Rich's RAX triggered short (without market support) and didn't work:

His GDX triggered short (ETF, so no market support needed) and worked:

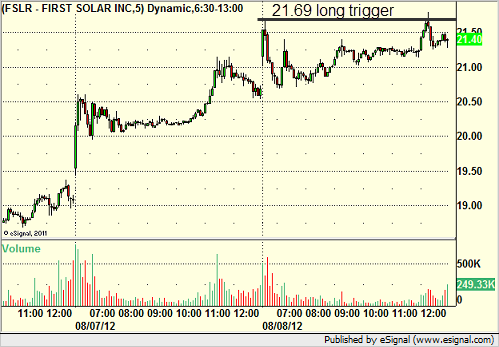

FSLR triggered long (with market support) and didn't work:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

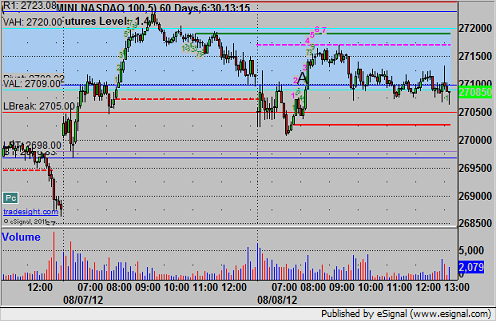

Futures Calls Recap for 8/8/12

Gains at least to the first target on the ES and NQ, see those sections below.

Net ticks: +5 ticks.

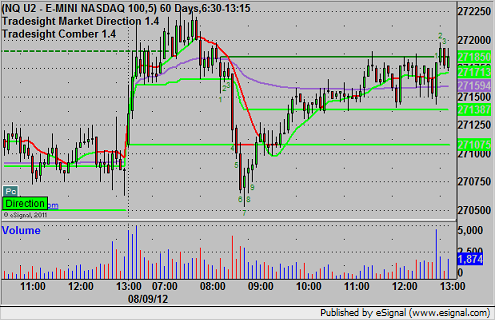

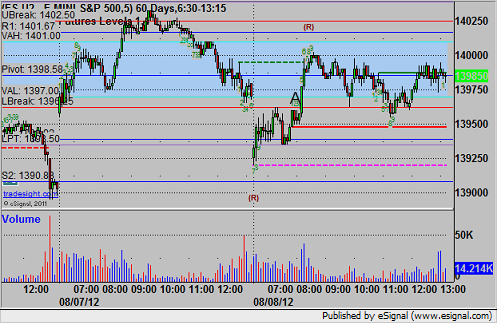

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1397.25, hit first target for 6 ticks, stopped second half under the entry:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's trade triggered long at A at 2713.00, hit the first target for 6 ticks, and stopped the second half under the entry:

Forex Calls Recap for 8/8/12

A much slower week than last week with just two stop outs and one night without a trigger. This time, the GBPUSD short stopped, see that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight after 5 pm EST when the new levels come out after global rollover.

GBPUSD:

Triggered short at A, did not quite make it to the first target, and stopped for 25 pips at B:

Tradesight Market Preview for 8/8/12

The ES made a new high on the day but is still contained below the active static trend line which was tested intraday. There is little to add here, this is the line in the sand before a retest of the highs.

The NQ futures were higher on the day by 24 and are within shooting distance of the active static trend line.

The 10-day Trin is still around the neutral area.

Multi-sector daily chart:

The SOX/NDX cross made new high on the move and is setting up for a reversal.

The SOX was the top gun on the day making a new high close on the move. Keep in mind that there is an active Seeker buy signal in place.

The XAU closed right at the 50dma and looks ready to take a run at the static trend line.

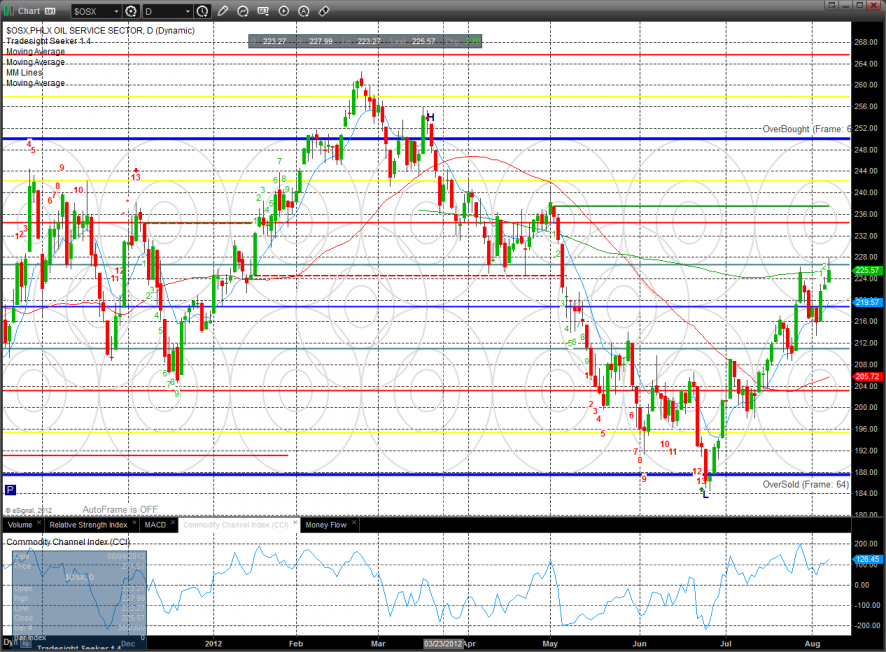

The OSX matched the high close of the recent range and is poised for a very important brealout.

The BKX also closed at a new high on the move and still has an active Seeker sell signal in place.

Oil:

Gold:

Silver:

Tlt:

Copper:

Stock Picks Recap for 8/7/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CIEN gapped over the trigger, no play.

PWER triggered long (with market support) and didn't work:

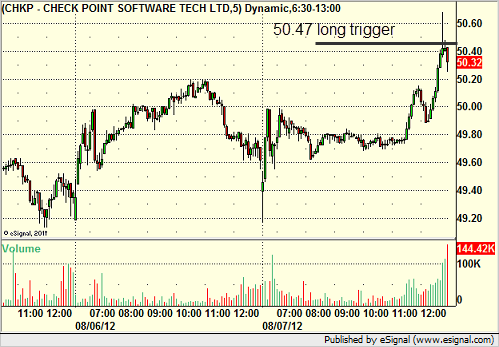

CHKP triggered long (without market support) late in the day and worked enough for a partial:

CREE triggered long (with market support) and didn't work:

In the Messenger, Rich's GOOG triggered short (without market support) and didn't work:

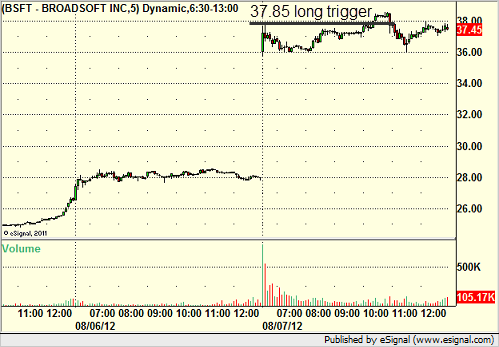

His BSFT triggered long (with market support) and didn't work:

His ALXN triggered short (without market support) and didn't work:

His AAPL triggered short (without market support) and worked:

His AMGN triggered short (without market support) and worked:

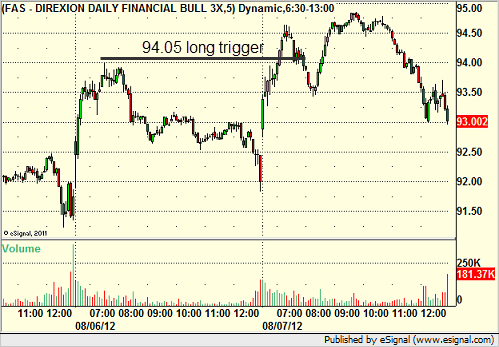

His FAS triggered long (ETF, so no market support needed) and worked:

His BRCM triggered long (with market support) and worked:

SINA triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.