Futures Calls Recap for 8/7/12

A winner on the ER and a stop out on the NQ for the session, but volume and range were much improved, even if we got glued to the VWAP in the afternoon. See both sections below.

Net ticks: -3.5 ticks.

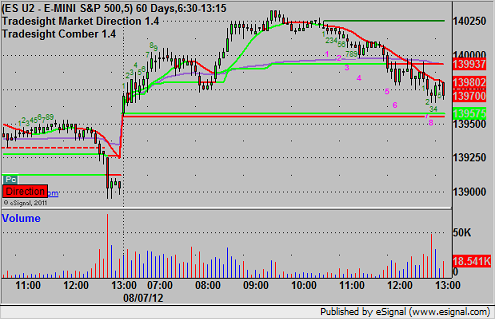

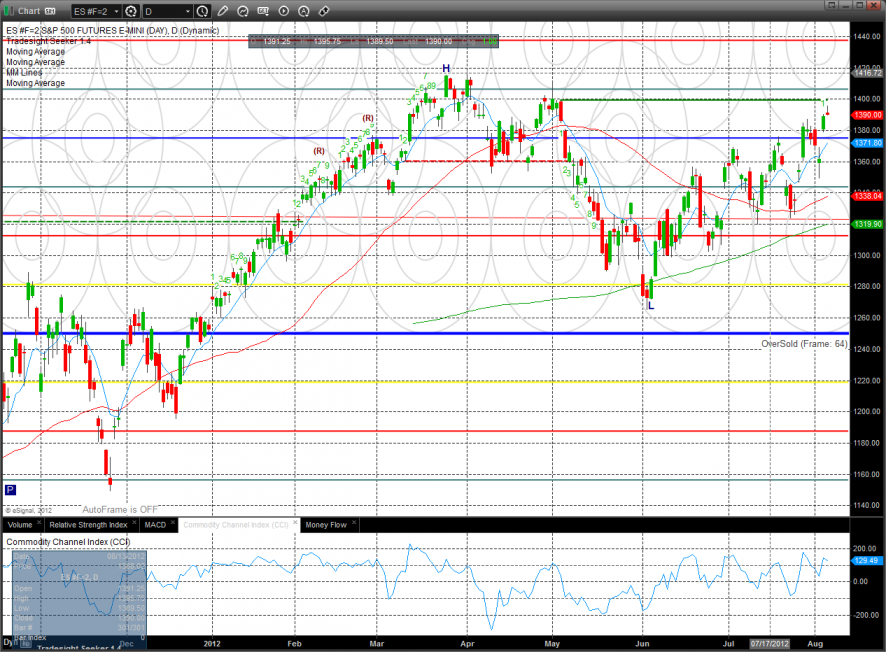

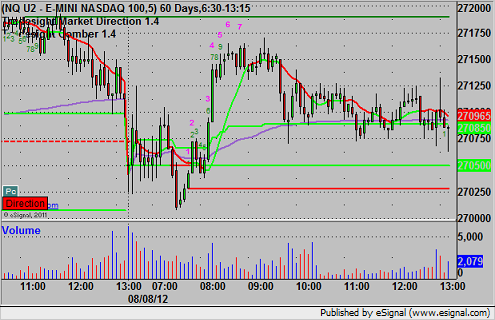

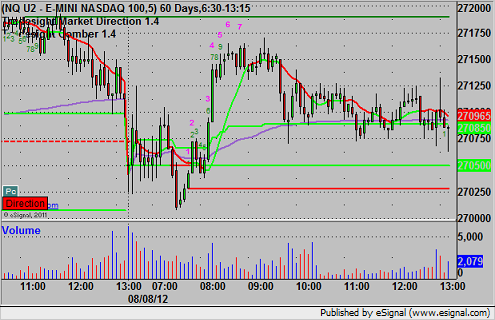

As usual, let's start by looking at the ES and NQ with our market directional lines, Comber, and VWAP:

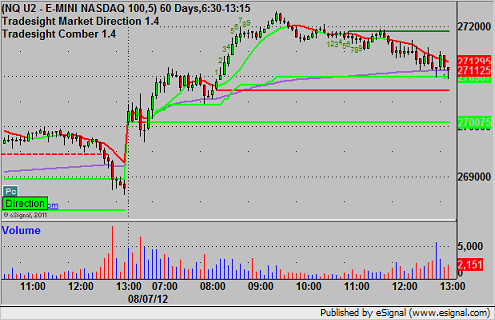

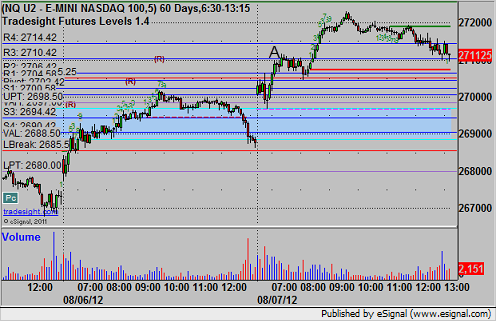

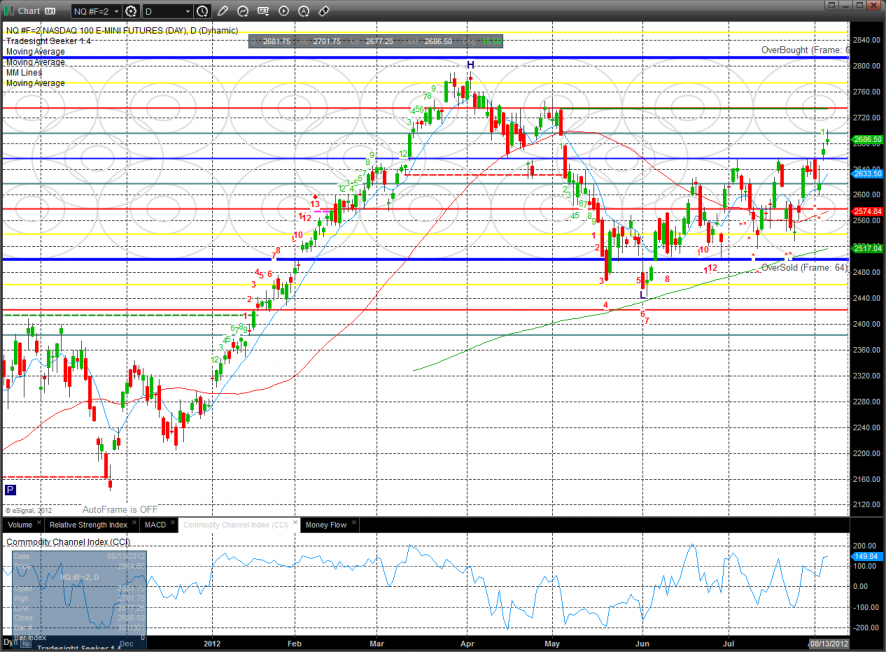

NQ:

Remember that we use half points as ticks on the NQ.

Mark's call triggered long at A at 2710.75 and stopped for 7 ticks. It ended up working later, but over lunch and not official:

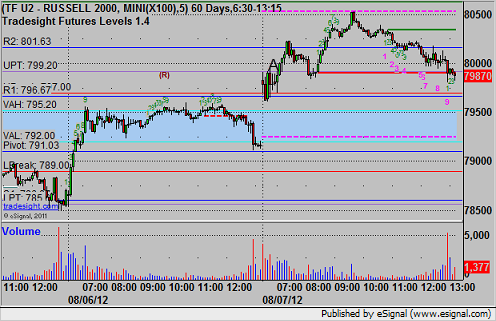

ER:

Triggered long at A at 799.60, hit first target at 800.40 for 8 ticks, stopped the second half under the entry at 799.50:

Forex Calls Recap for 8/7/12

An unusual session in that neither trade triggered on the EURUSD as the range was only 60 pips.

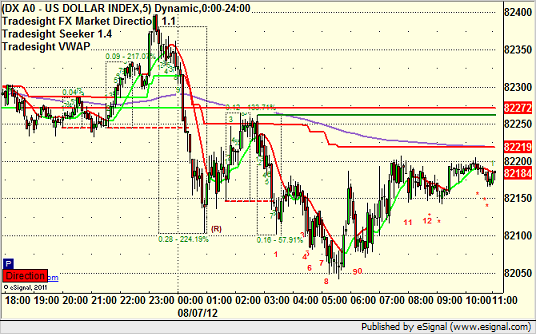

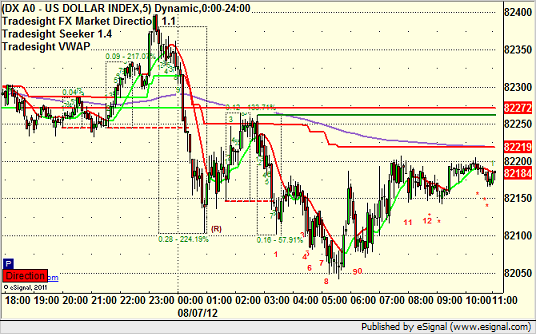

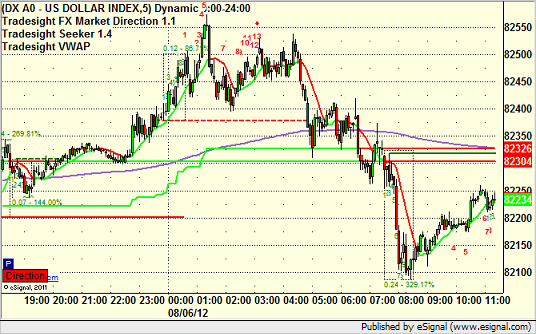

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

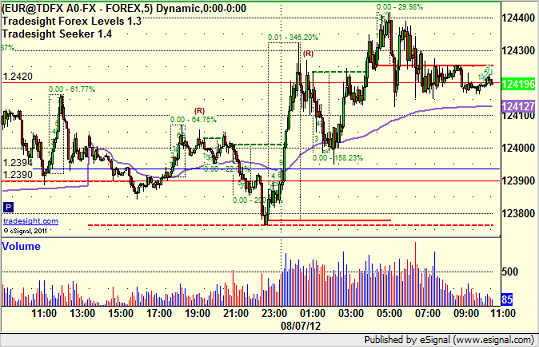

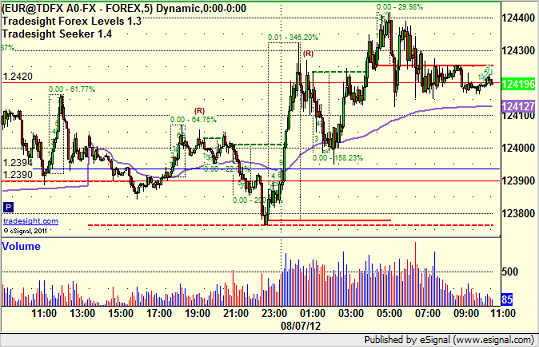

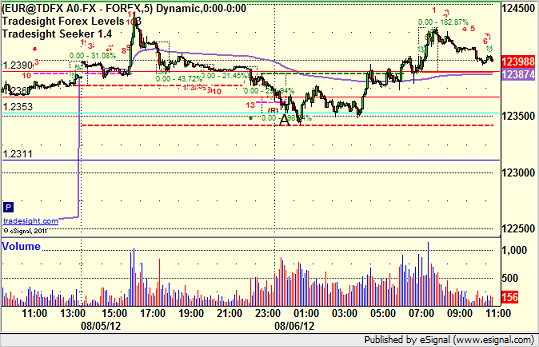

EURUSD:

Forex Calls Recap for 8/7/12

An unusual session in that neither trade triggered on the EURUSD as the range was only 60 pips.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

Tradesight Market Preview for 8/7/12

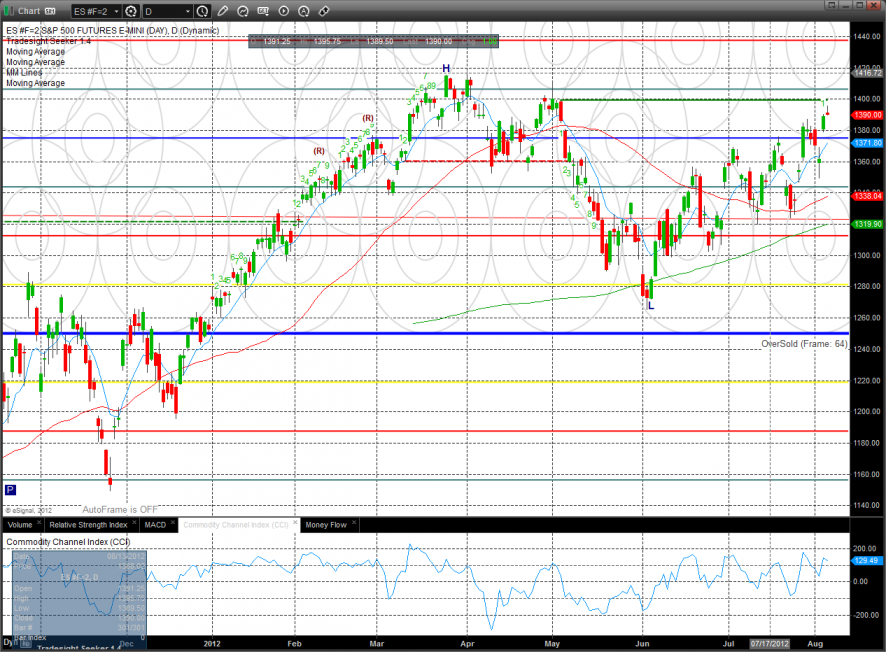

The ES gained one handle on the day but left a distribution candle at range high. At Tradesight we call this particular setup as camouflage sell signal. This happens when there are two up days followed by an up day that closes BELOW the opening price. This is a notable time for this to develop since it is at range high in the move and below the active static trend line.

There was another notable development today where while the ES was higher all day, so was the VIX. This is a divergence and a warning sign to traders. This usually develops when institutional traders are no longer strong buyers and adding protection to their portfolios.

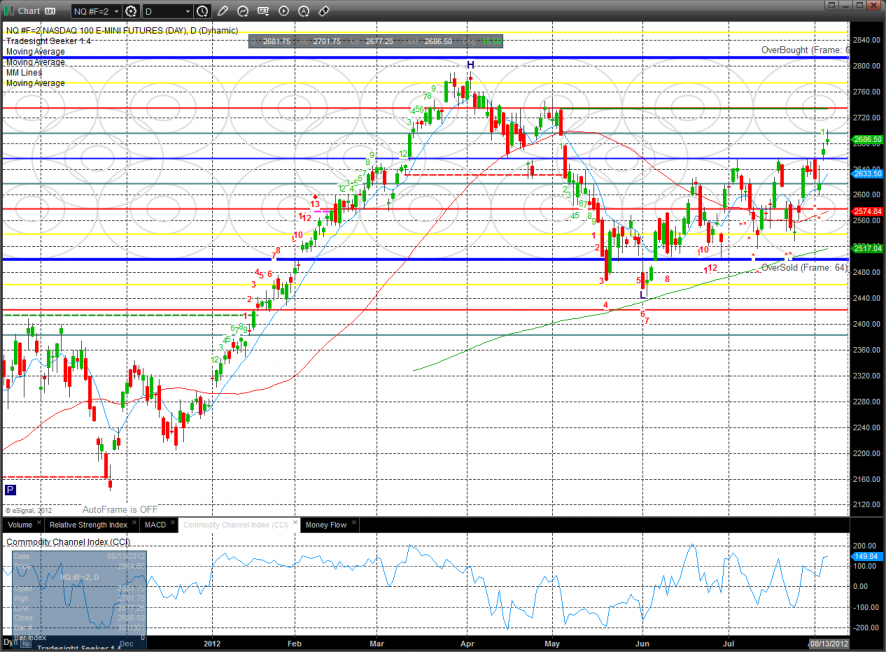

The NQ futures were higher on the day by 15 showing good relative strength vs. the ES. Note that while the ES posted a camouflage sell signal, the NQ’s did not because the close was above the day’s open. The open gap form June has been closes.

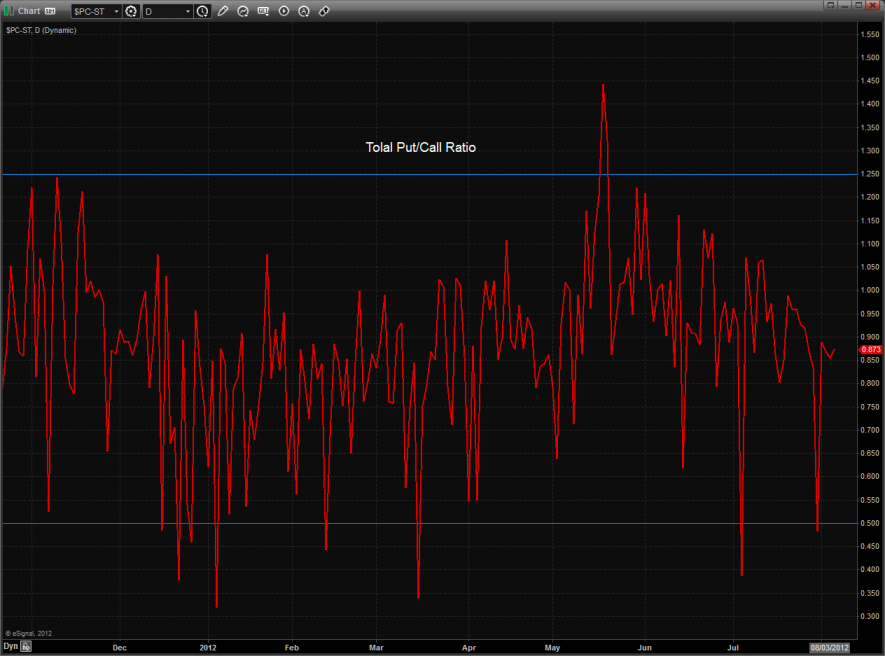

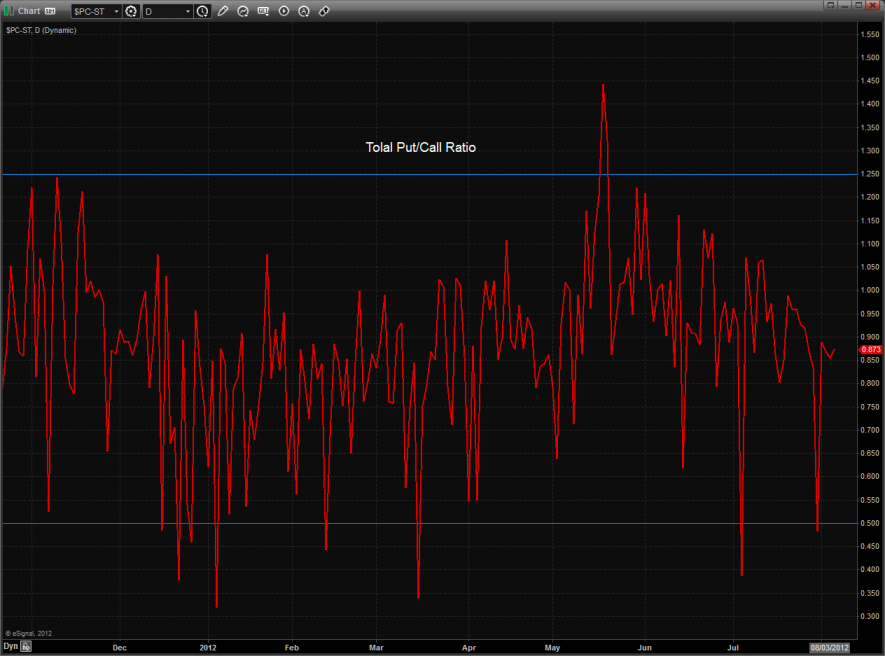

The 10-day Trin remains neutral.

Multi sector daily chart:

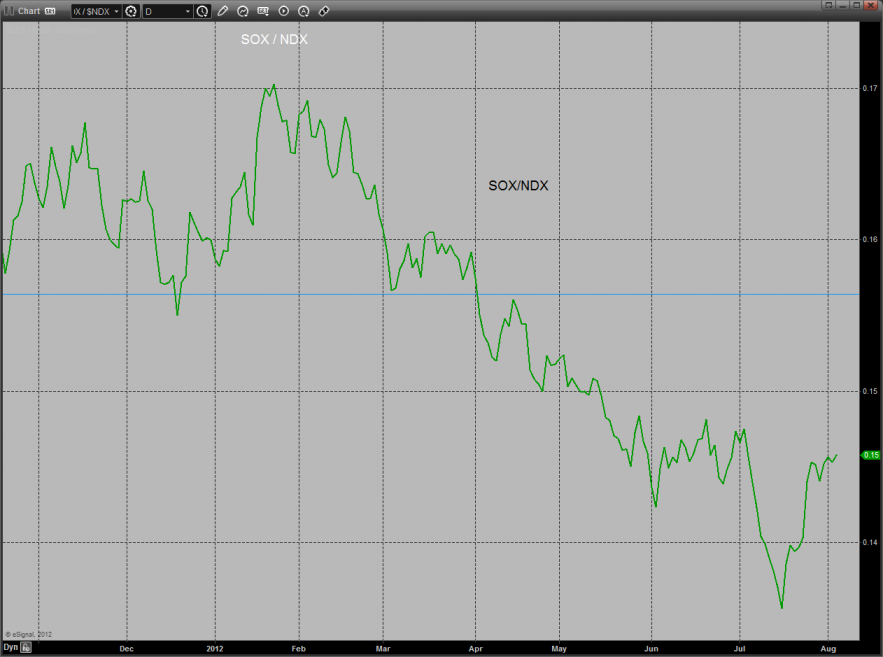

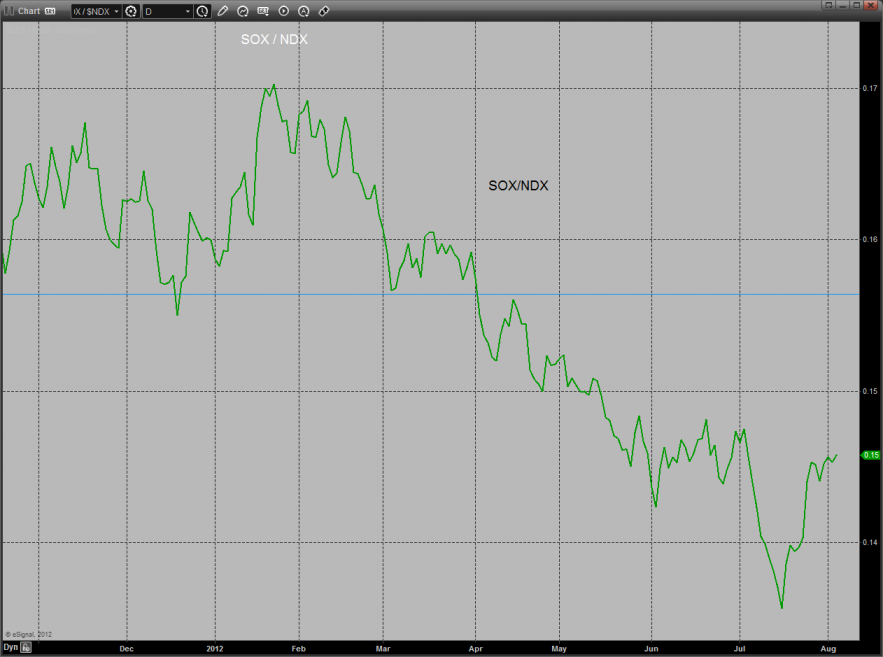

The SOX has yet to make the big turn and show relative strength vs. the Naz. The turn is on deck and would be very bullish if it materializes.

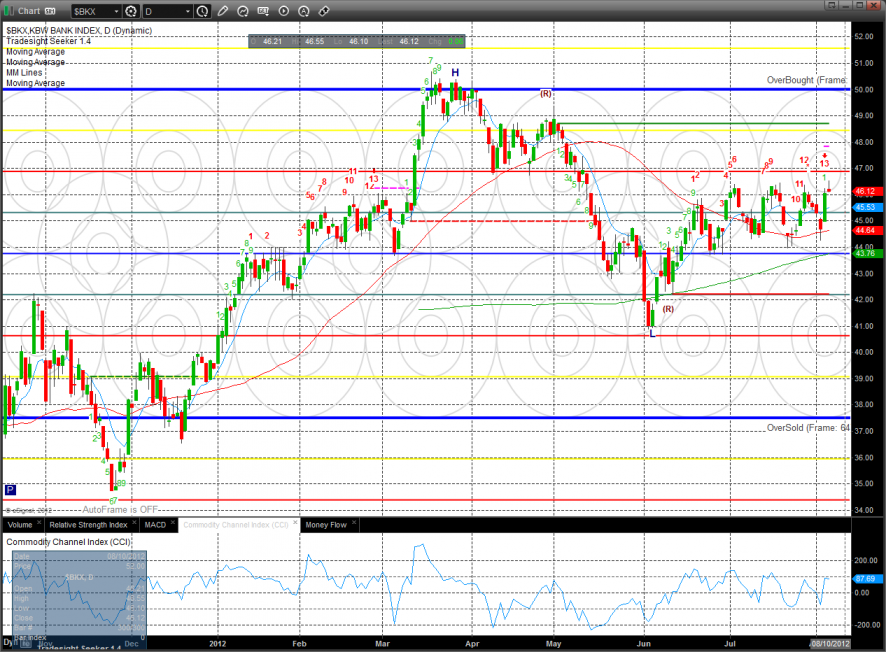

The SPX has recently been showing relative strength vs. the BKX which is a problem if it persists.

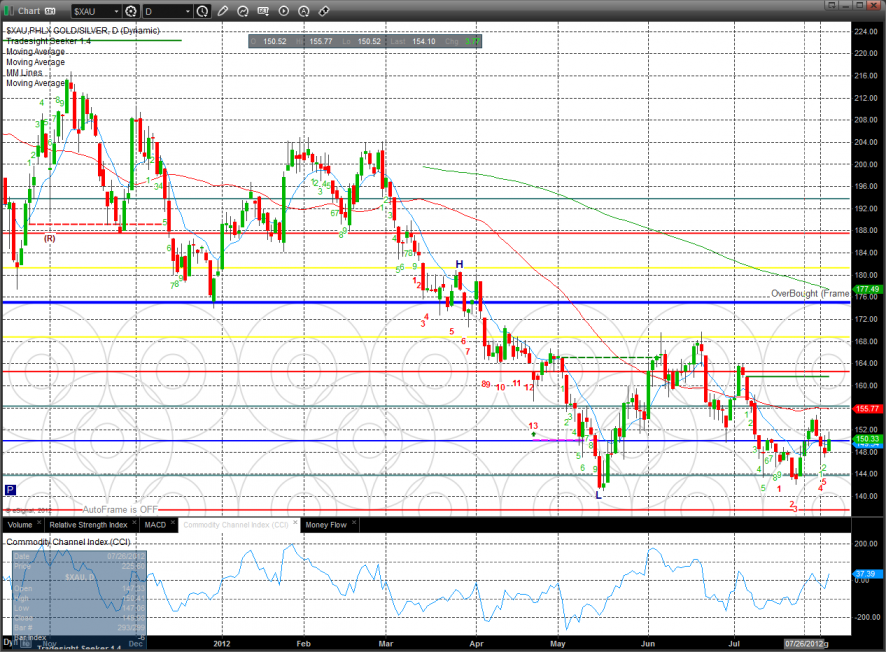

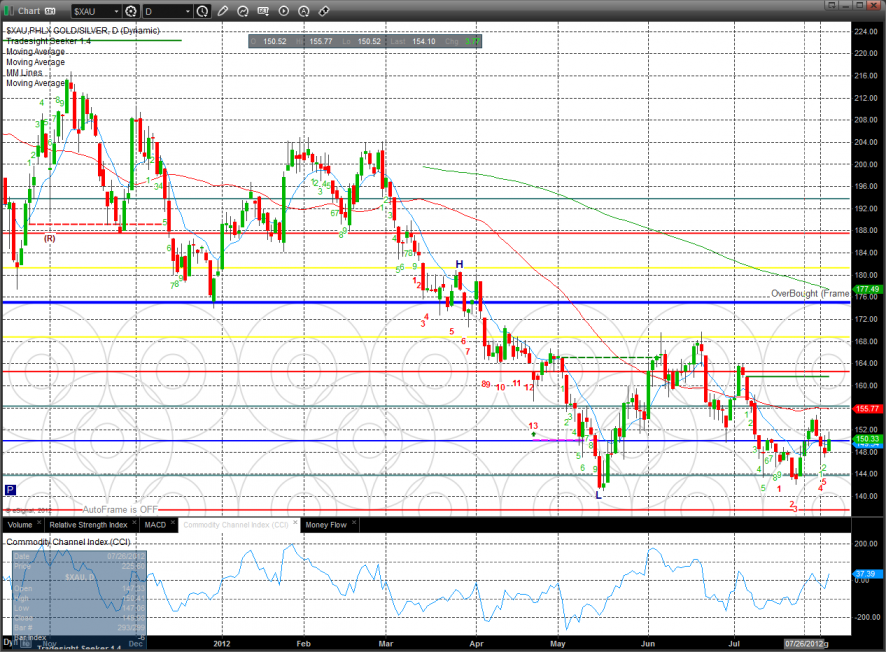

The defensive XAU was top gun on the day.

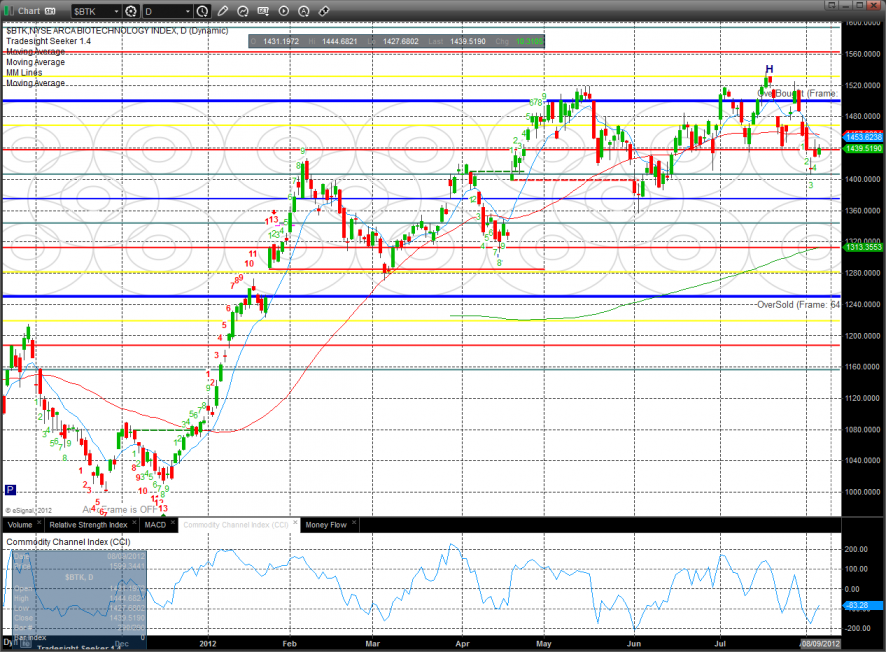

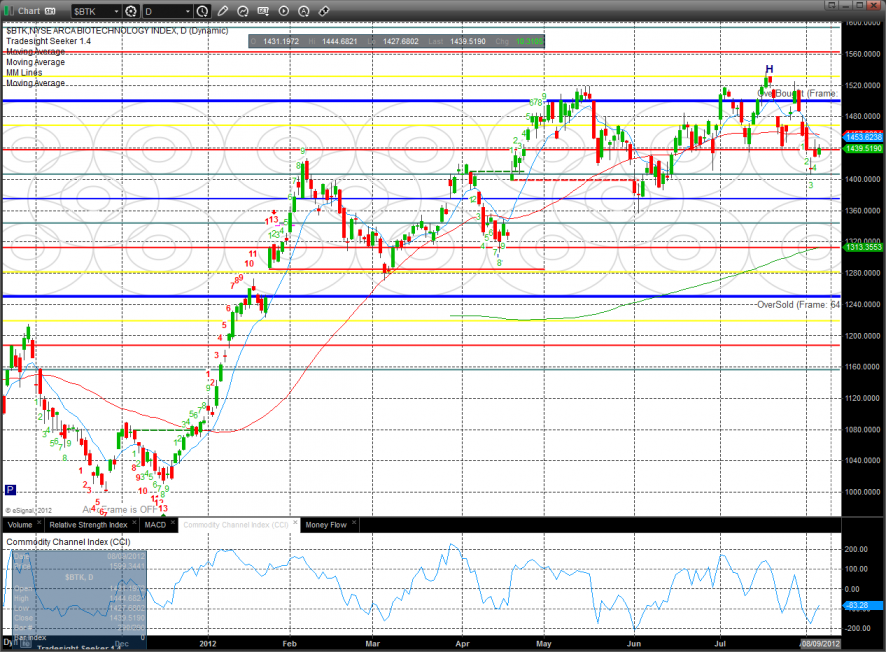

The BTK posted an indecisive inside day.

The SOX closed right at the recent high of the range and is staging right at the 200dma.

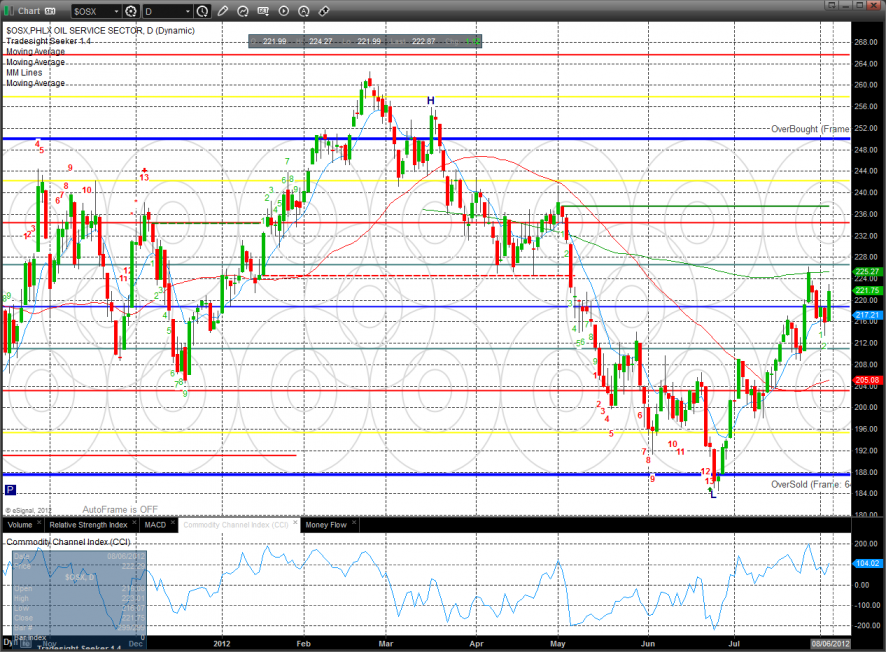

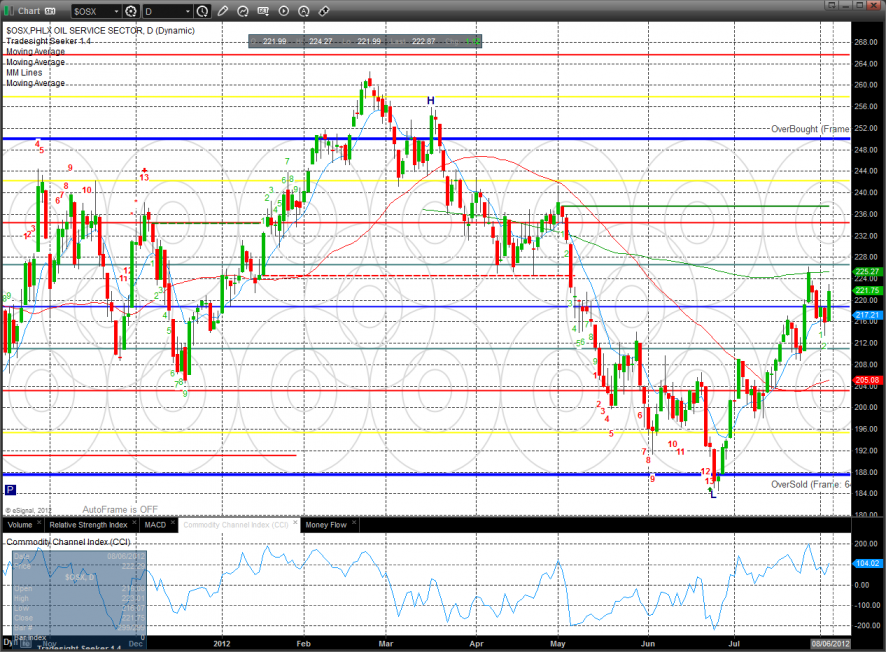

The OSX was very positive on the day and is consolidating below the recent highs. Note that there are no Seeker bar counts standing in the way of higher price.

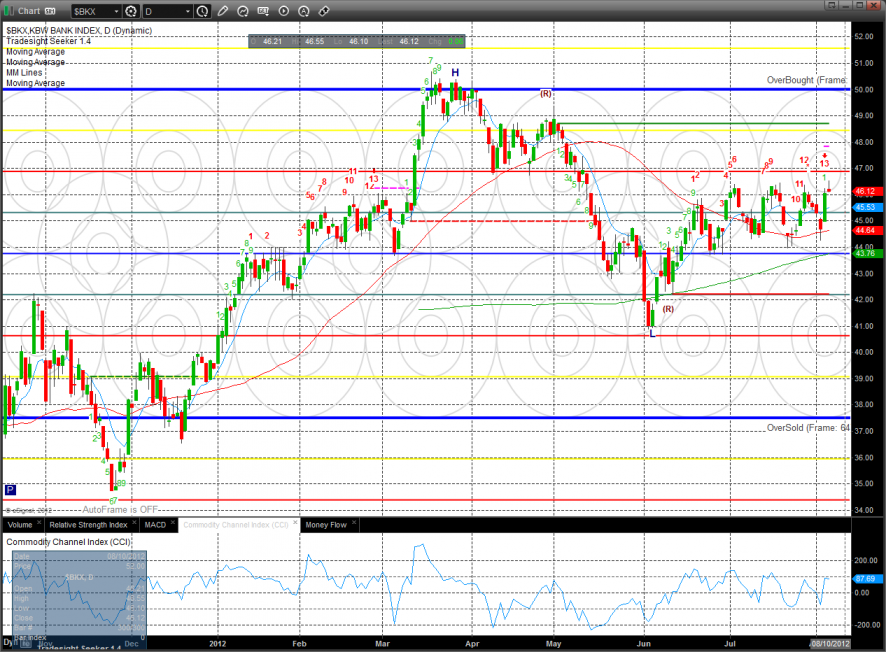

The BKX has a Seeker 13 exhaustion signal in place in a very flat pattern. How this develops will be very important for the overall helath of the broad market.

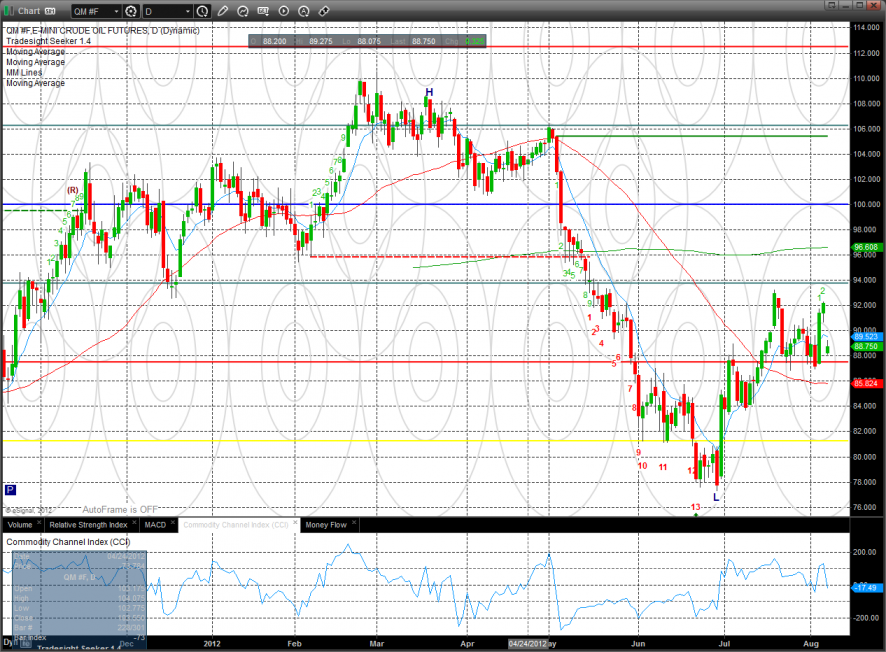

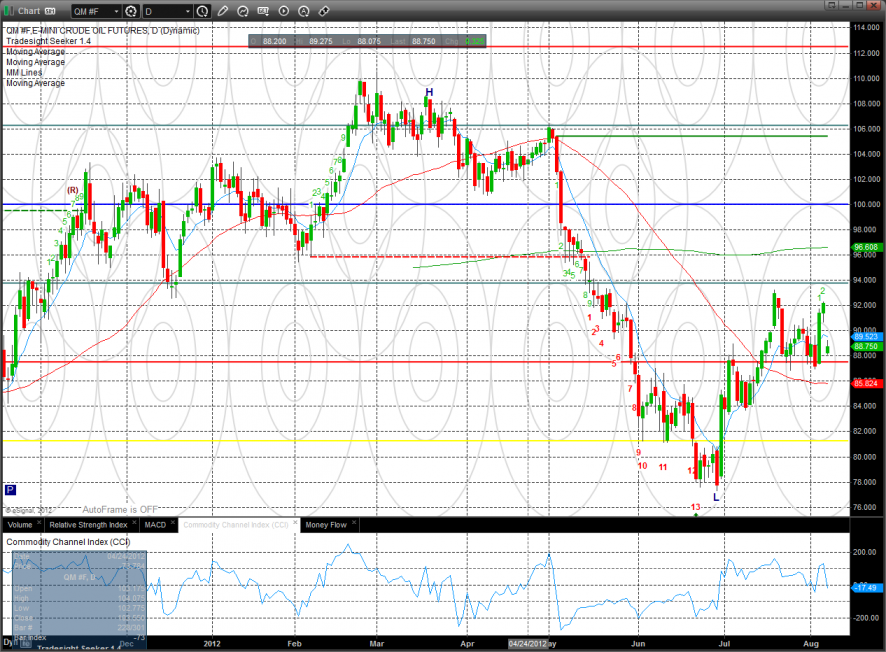

Oil:

Gold:

Silver:

TLT:

Tradesight Market Preview for 8/7/12

The ES gained one handle on the day but left a distribution candle at range high. At Tradesight we call this particular setup as camouflage sell signal. This happens when there are two up days followed by an up day that closes BELOW the opening price. This is a notable time for this to develop since it is at range high in the move and below the active static trend line.

There was another notable development today where while the ES was higher all day, so was the VIX. This is a divergence and a warning sign to traders. This usually develops when institutional traders are no longer strong buyers and adding protection to their portfolios.

The NQ futures were higher on the day by 15 showing good relative strength vs. the ES. Note that while the ES posted a camouflage sell signal, the NQ’s did not because the close was above the day’s open. The open gap form June has been closes.

The 10-day Trin remains neutral.

Multi sector daily chart:

The SOX has yet to make the big turn and show relative strength vs. the Naz. The turn is on deck and would be very bullish if it materializes.

The SPX has recently been showing relative strength vs. the BKX which is a problem if it persists.

The defensive XAU was top gun on the day.

The BTK posted an indecisive inside day.

The SOX closed right at the recent high of the range and is staging right at the 200dma.

The OSX was very positive on the day and is consolidating below the recent highs. Note that there are no Seeker bar counts standing in the way of higher price.

The BKX has a Seeker 13 exhaustion signal in place in a very flat pattern. How this develops will be very important for the overall helath of the broad market.

Oil:

Gold:

Silver:

TLT:

Stock Picks Recap for 8/6/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LIFE triggered long (without market support due to opening five minutes) and worked:

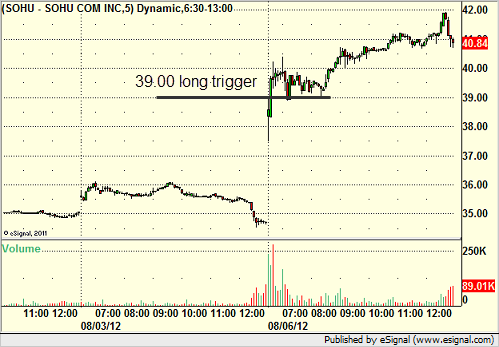

In the Messenger, Rich's SOHU triggered long (with market support) and worked:

His JPM triggered long (with market support) and worked:

His SINA triggered long (with market support) and worked:

AMZN triggered short (without market support) and didn't work:

Rich's BBY triggered short (with market support) and worked:

NTAP triggered short (with market support) late in the day and worked enough for a partial:

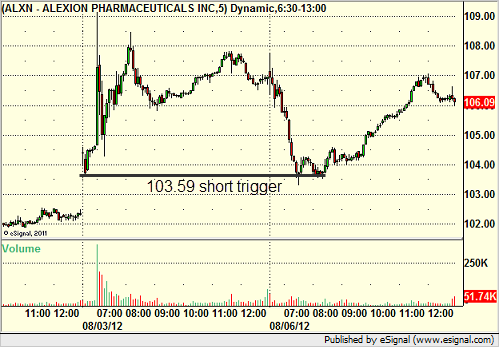

Rich's ALXN triggered short (without market support) and didn't work:

His FFIV triggered long (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, all 6 of them worked.

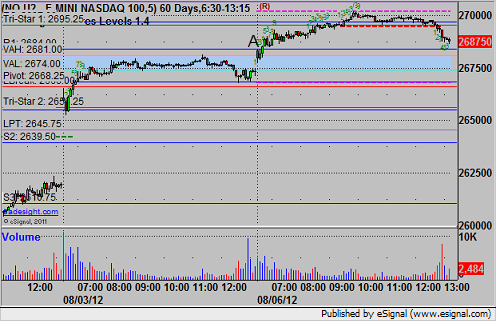

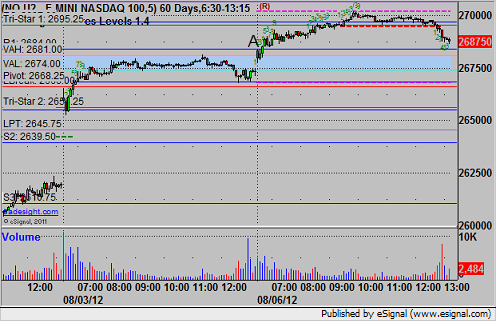

Futures Calls Recap for 8/6/12

A winning trade on the NQ in the opening 30 minutes and then the market went dead flat all day as NASDAQ volume dipped way back down to less than 1.4 billion shares. See NQ section below for the trade recap.

Net ticks: +7 ticks.

As usual, let's start by looking at the ES and NQ with our market directional lines, Comber, and VWAP:

NQ:

Remember that we use half points for ticks on the NQ.

Triggered long at 2684.50 at A, hit first target for 6 ticks, and raised the stop twice and stopped at 2688.50 before things got dull:

Futures Calls Recap for 8/6/12

A winning trade on the NQ in the opening 30 minutes and then the market went dead flat all day as NASDAQ volume dipped way back down to less than 1.4 billion shares. See NQ section below for the trade recap.

Net ticks: +7 ticks.

As usual, let's start by looking at the ES and NQ with our market directional lines, Comber, and VWAP:

NQ:

Remember that we use half points for ticks on the NQ.

Triggered long at 2684.50 at A, hit first target for 6 ticks, and raised the stop twice and stopped at 2688.50 before things got dull:

Forex Calls Recap for 8/6/12

No range and a single stop out to start the week. See EURUSD below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

Triggered short at A and stopped for 25 pips:

Tradesight July 2012 Futures Results

Before we get to July’s numbers, here is a short reminder of the results from June. The full report from June can be found here.

Tradesight Tick Results for June 2012

Number of trades: 60

Number of losers: 26

Winning percentage: 56.7%

Net ticks: +16

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don't risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for July 2012

Number of trades: 35

Number of losers: 17

Winning percentage: 51.4%

Net ticks: +11 (+27 if you ignored the Fourth of July week)

July was an unusual month for trading in general. Volume and range continue to be less than average, but there was something else here. The Fourth of July Holiday was on a Wednesday to start the month. That pretty much ruins a week, especially during the summer, and makes it like the last week of the year between Christmas and New Year’s Day. No one trades when a Holiday is Wednesday in the summer, and we warned people as such to either skip the week or go to small size. However, these results are not “sized,” they are just raw data numbers based on the calls, and we make calls each day except for Holidays (Fourth of July was a Wednesday) and half days (the day before).

July suffered from a lot of light volume days, well under the 1.5 billion share mark on NASDAQ volume. We prefer to see 1.8 billion shares daily or better, and it didn't happen often, although the second half of the month was much better than the first. We made way less calls than normal and fewer trades triggered (50% less than the prior month). August is typically one of the easier trading months of the year, although volume needs to improve a tad (volume in August is never huge, but it needs to be more than 1.5 billion a day on average on the NASDAQ).

Something should shake loose soon and get this market moving one way or the other, and we can get back to more normal trading.