Stock Picks Recap for 8/1/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

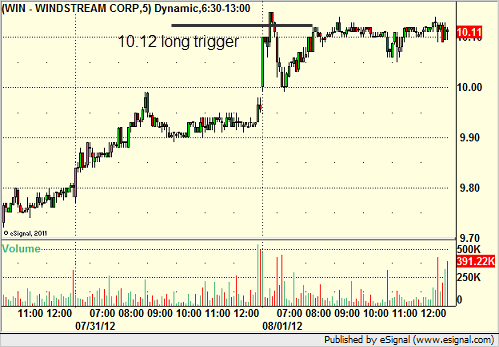

From the report, WIN triggered long (without market support) and didn't work:

MELI triggered short (with market support) and didn't work initially:

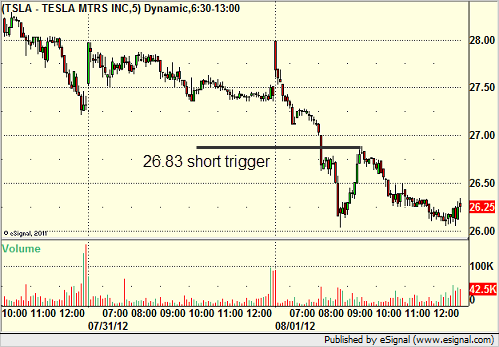

TSLA triggered short (with market support) and worked:

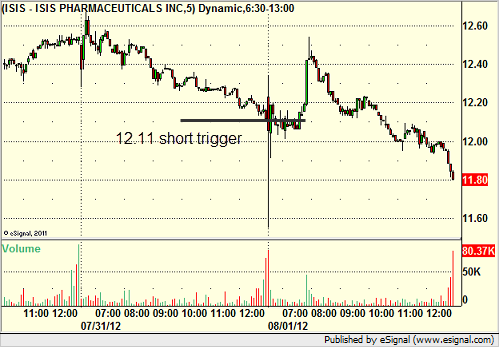

ISIS triggered short (without market support due to opening five minutes) and didn't work:

In the Messenger, NFLX triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked:

Rich's V triggered short (with market support) and didn't work initially (worked later after the early sweep):

His GDX triggered short (ETF, so no market support needed) and worked enough for a partial:

His AAPL triggered short (with market support) and worked:

His BIDU triggered long (with market support on a rare point in the afternoon that direction was green) and worked enough for a partial:

His LULU triggered short (with market support) and worked enough for a partial:

In total, that's 9 trades triggering with market support, 7 of them worked, 2 did not.

Futures Calls Recap for 8/1/12

A decent move early after a gap up, and volume was weak for the session despite the Fed announcement in the afternoon. The bulk of the session was flat between the 60-minute mark and the Fed announcement at 2:15 pm EST.

One winner and another trigger that worked, but triggered right on the Fed announcement, and we don't suggest taking trades on that level of news. See ES and NQ sections below.

Net ticks: +2.5 pips.

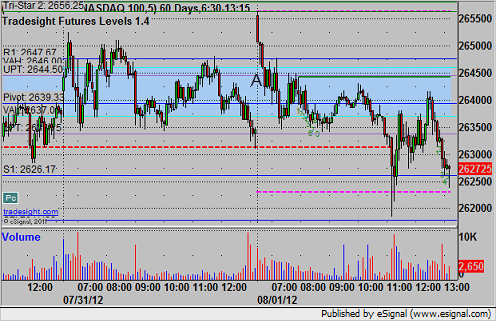

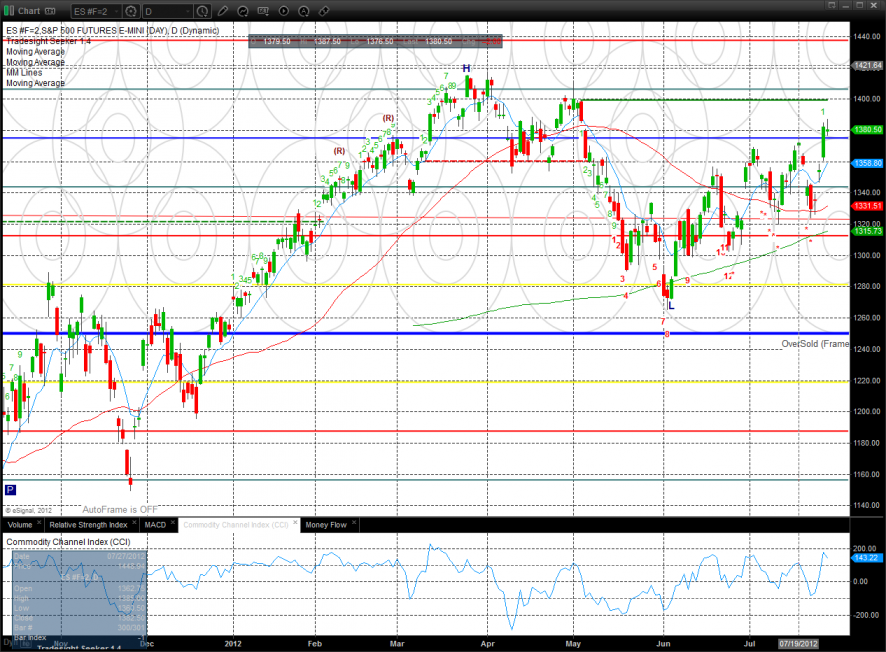

As usual, let's take a look at the ES and NQ with our market directional lines, Comber, and VWAP:

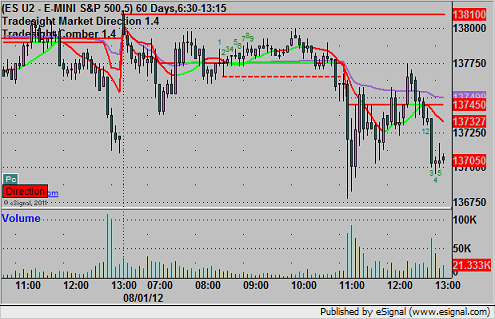

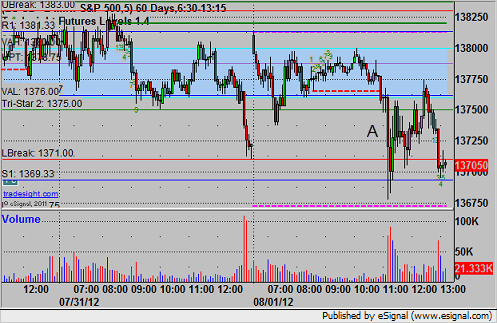

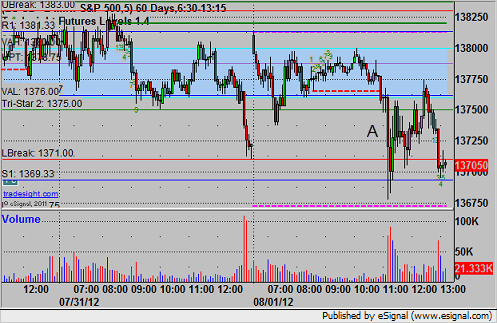

ES:

We had a short under 1373.50, which triggered at A right on the Fed news, but should not have been taken but would have worked:

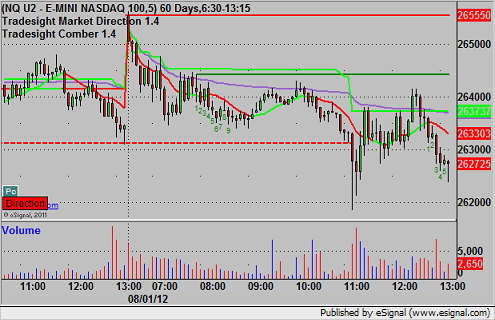

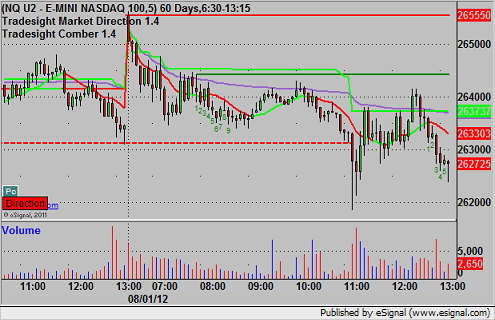

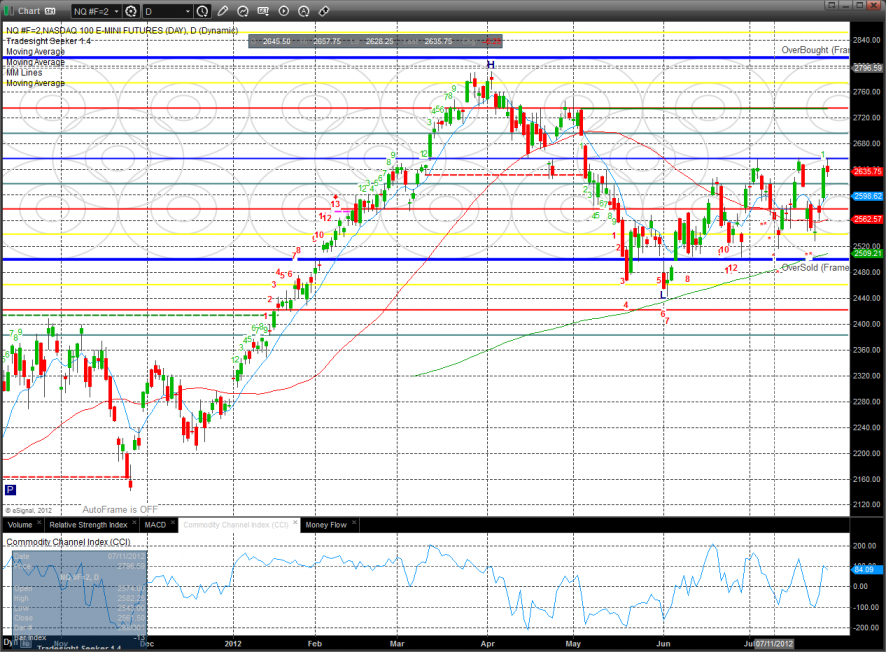

NQ:

We use half points as ticks on the NQ.

Triggered short at A at 2644.00, hit first target at 2641.00, and the second half stopped right over the entry:

Futures Calls Recap for 8/1/12

A decent move early after a gap up, and volume was weak for the session despite the Fed announcement in the afternoon. The bulk of the session was flat between the 60-minute mark and the Fed announcement at 2:15 pm EST.

One winner and another trigger that worked, but triggered right on the Fed announcement, and we don't suggest taking trades on that level of news. See ES and NQ sections below.

Net ticks: +2.5 pips.

As usual, let's take a look at the ES and NQ with our market directional lines, Comber, and VWAP:

ES:

We had a short under 1373.50, which triggered at A right on the Fed news, but should not have been taken but would have worked:

NQ:

We use half points as ticks on the NQ.

Triggered short at A at 2644.00, hit first target at 2641.00, and the second half stopped right over the entry:

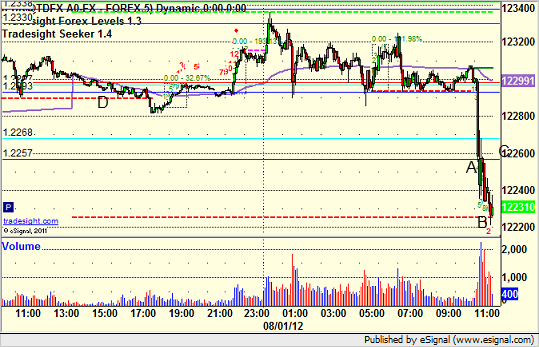

Forex Calls Recap for 8/1/12

As expected, a dead session ahead of the Fed. This is the one session where we trade later in the morning after the announcement if the trades haven't triggered. We stopped out in the money on the prior day's EURUSD trade. See that section below.

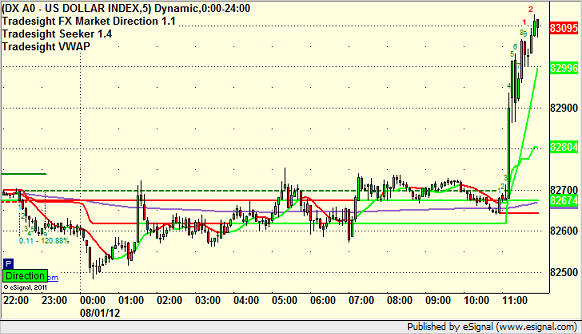

Here's the US Dollar Index intraday with our market directional lines:

Back to normal size tonight for a session (before NFP Friday), but we have rate announcements out of UK and ECB, so it is questionable what we will get.

New calls and Chat this evening a little later.

EURUSD:

Stopped out of the second half of the prior day's trade at D under Pivot for a gain. No triggers and flat action overnight, then we triggered short at A a bit after the Fed, closed half at B for 25 pips, and have a stop over the entry at C on the rest:

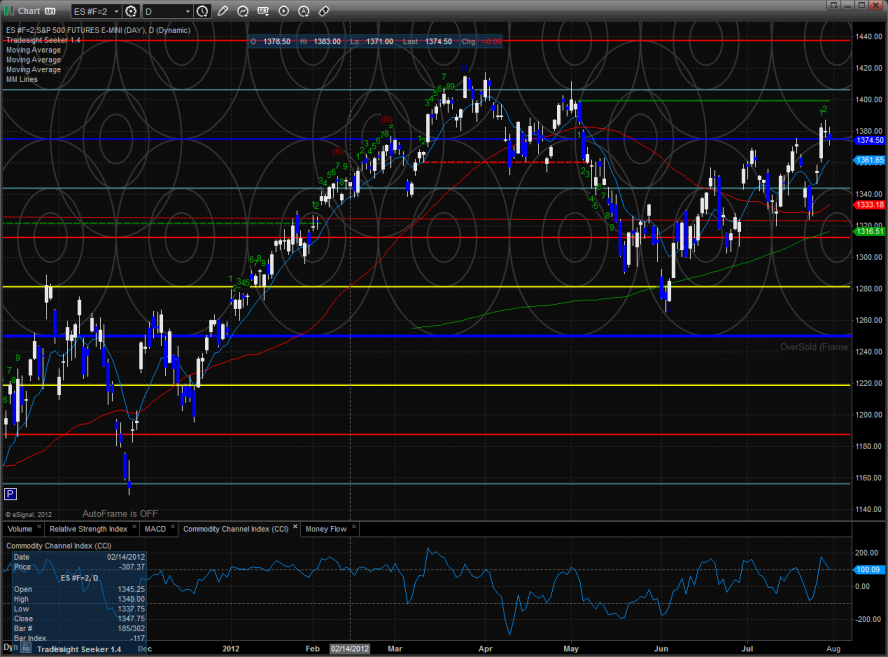

Tradesight Market Preview for 8/1/12

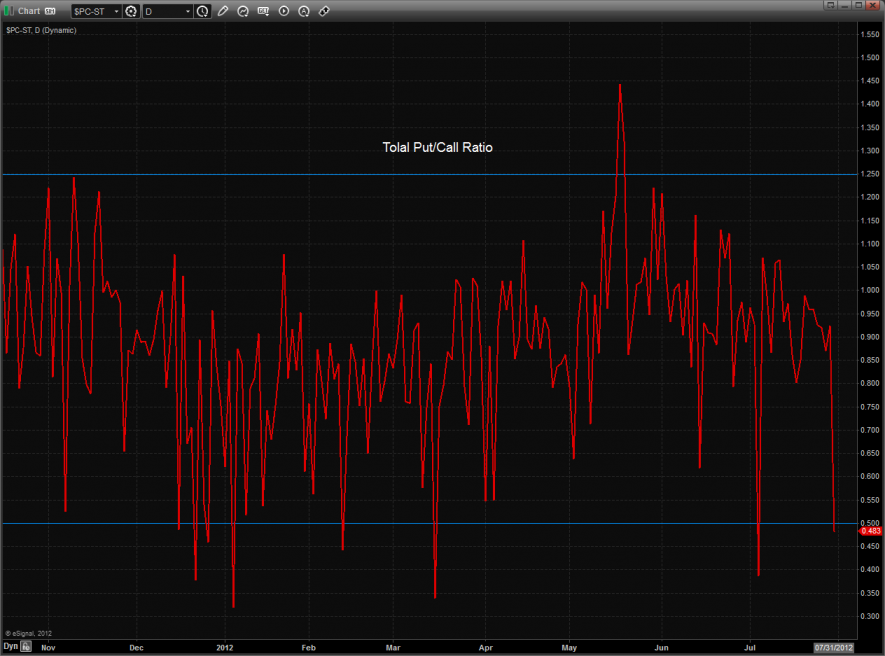

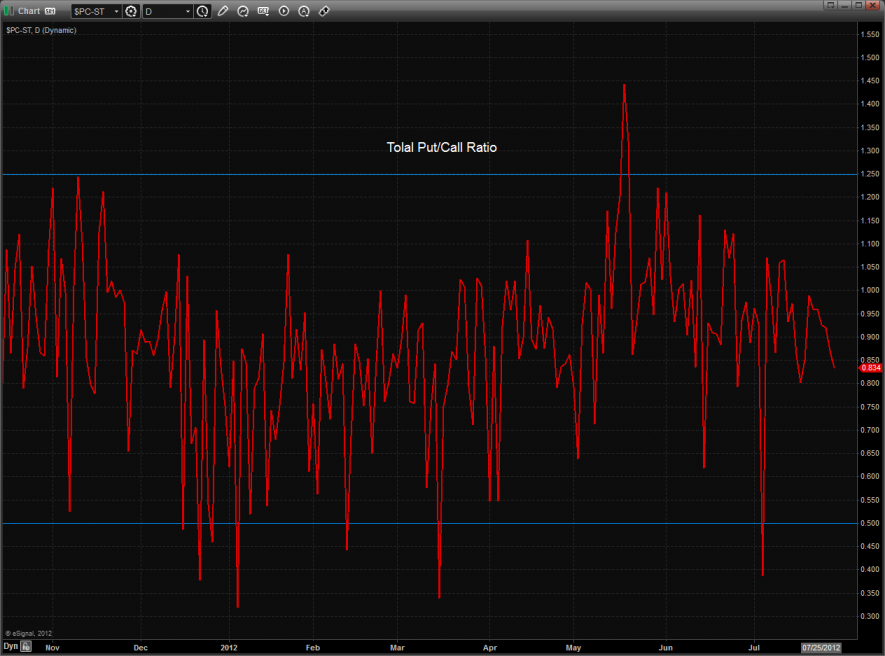

Put/call ratio alert--see below!

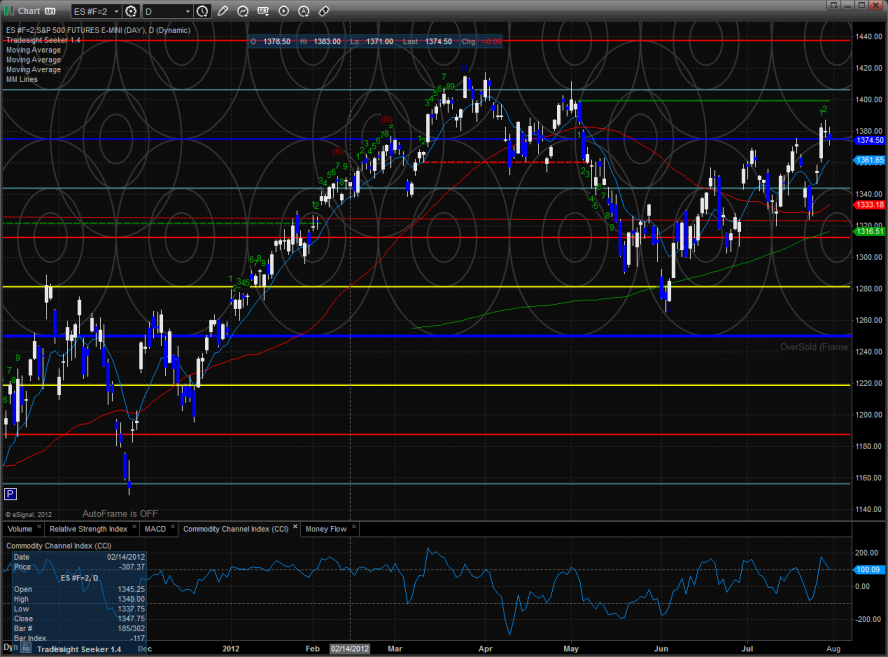

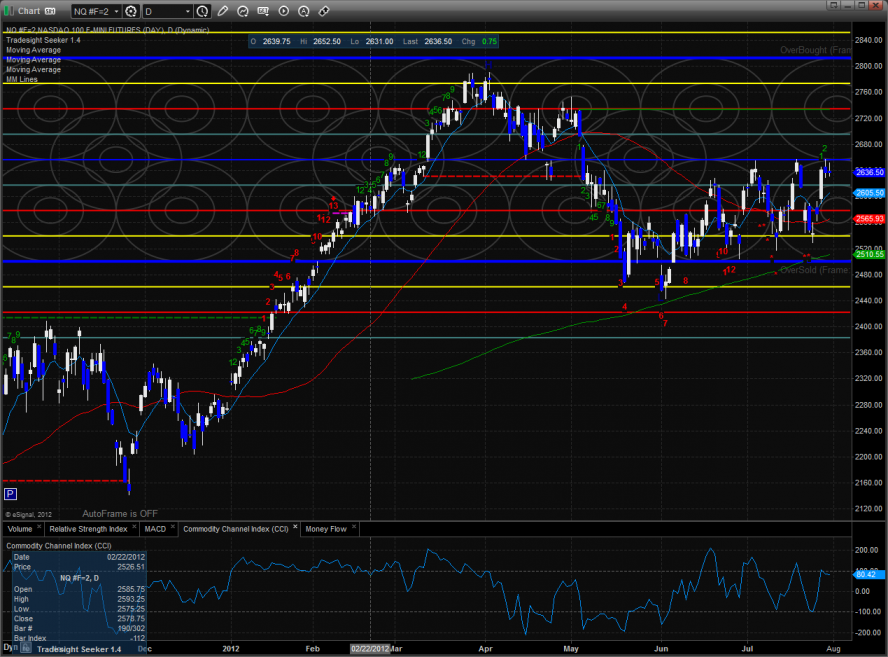

The futures are still marking time before the FOMC decision and commentary Wednesday. On the day, the ES lost 6 handles but is still short term positive. Note that the CCI has lost it’s positive bias.

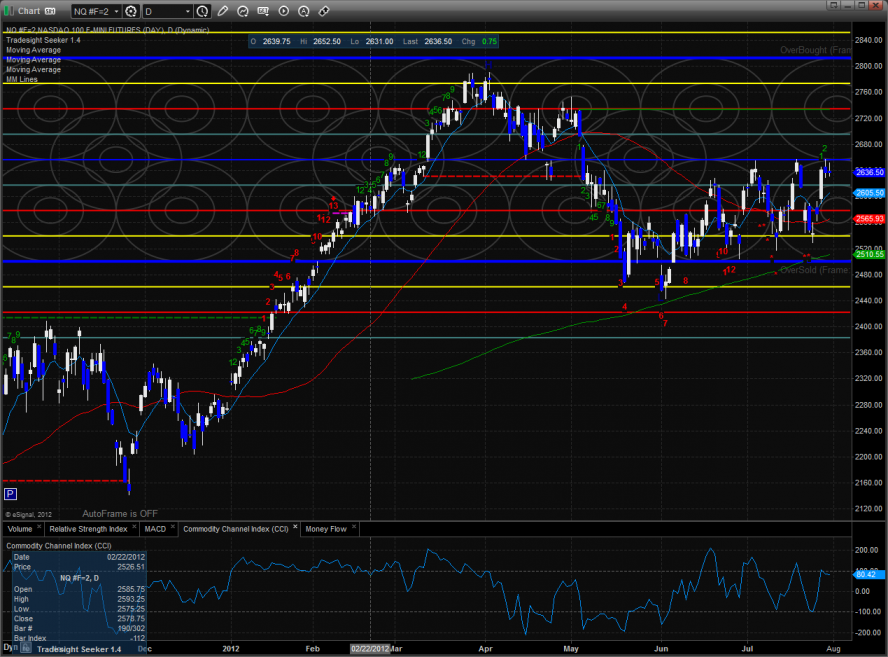

The NQ was relatively strong on the day and posted an inside candle. This will make the move out of the 2 day range better than if it wandered and swept on Tuesday

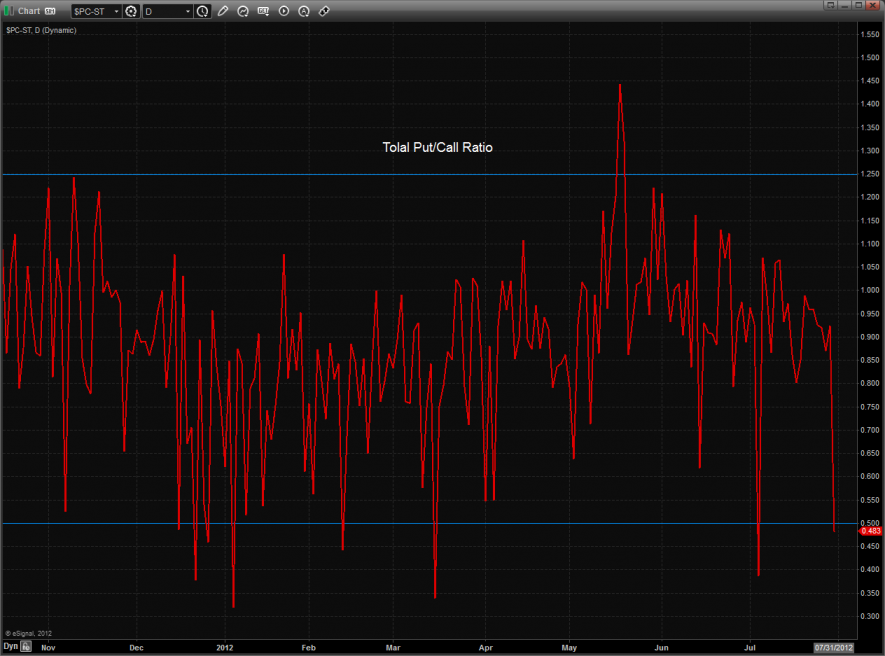

The put/call ratio recorded a climatically bullish reading. This is a contra indicator and loads the market with over enthusiasm.

Multi sector daily chart:

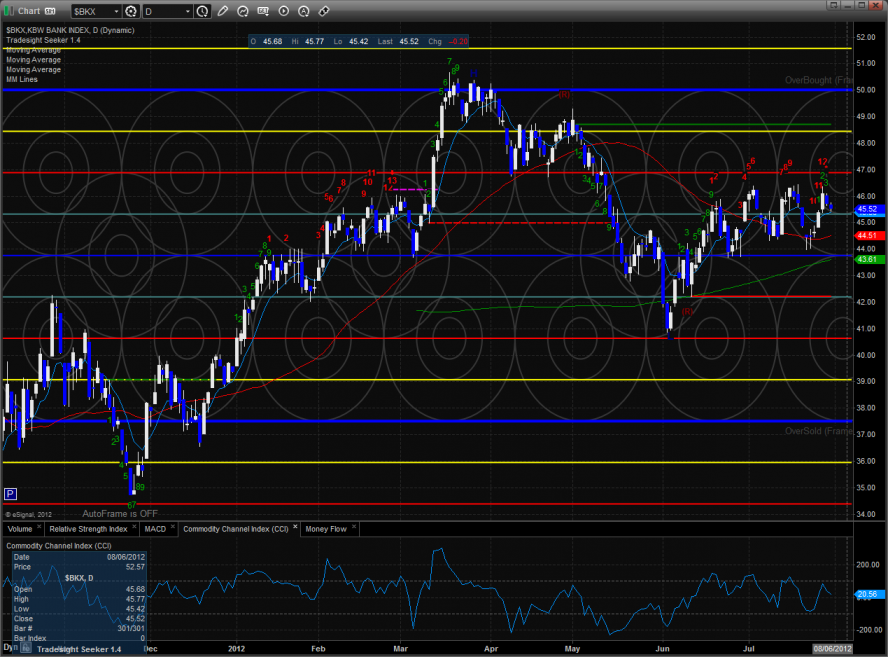

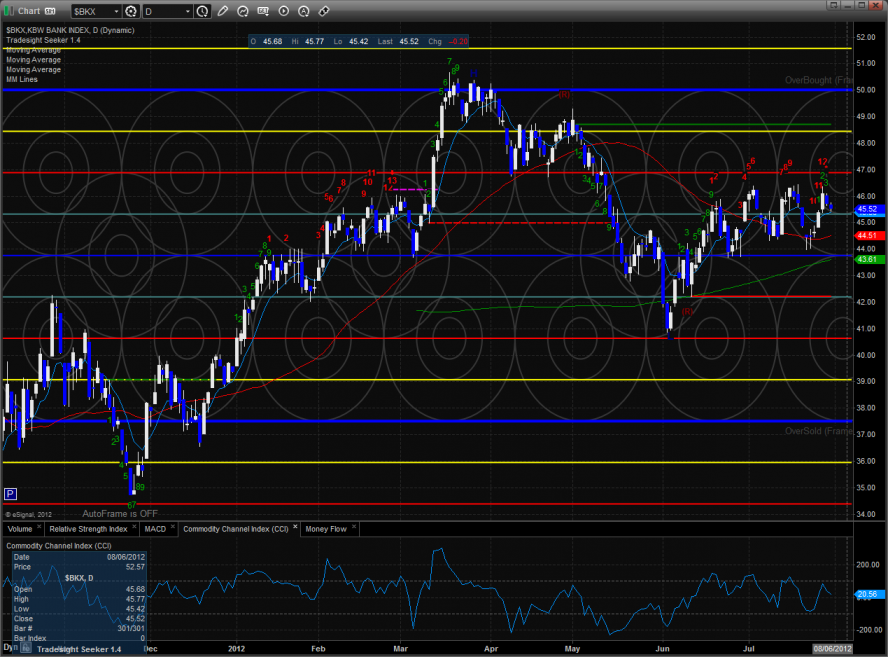

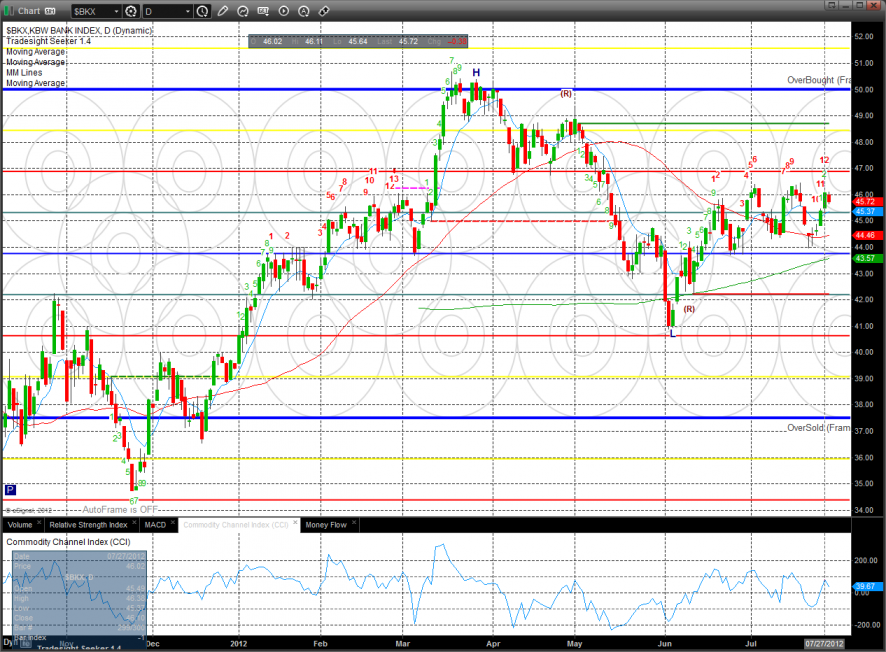

The BKX is bearishly showing relative weakness vs. the broad market tracking SPX.

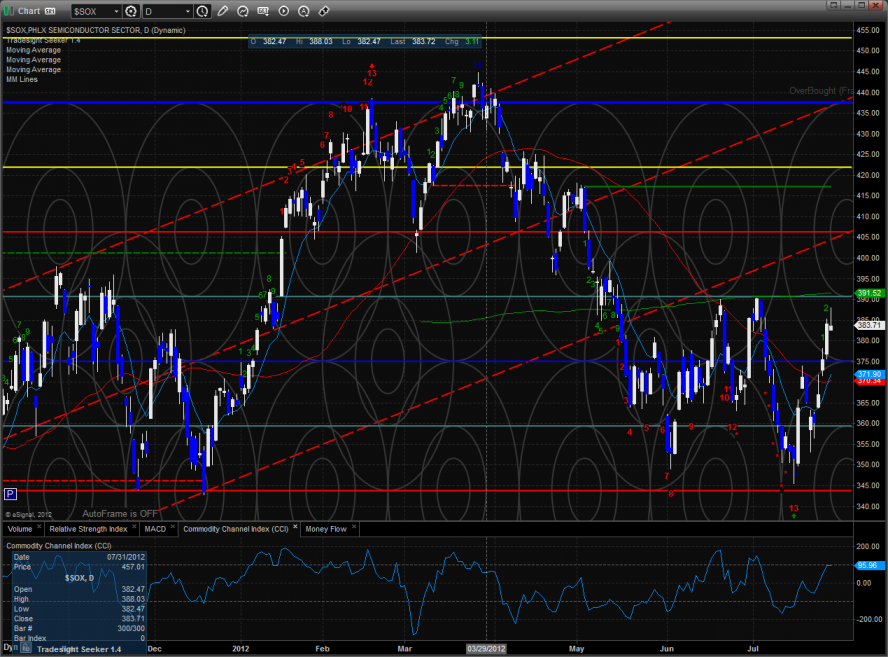

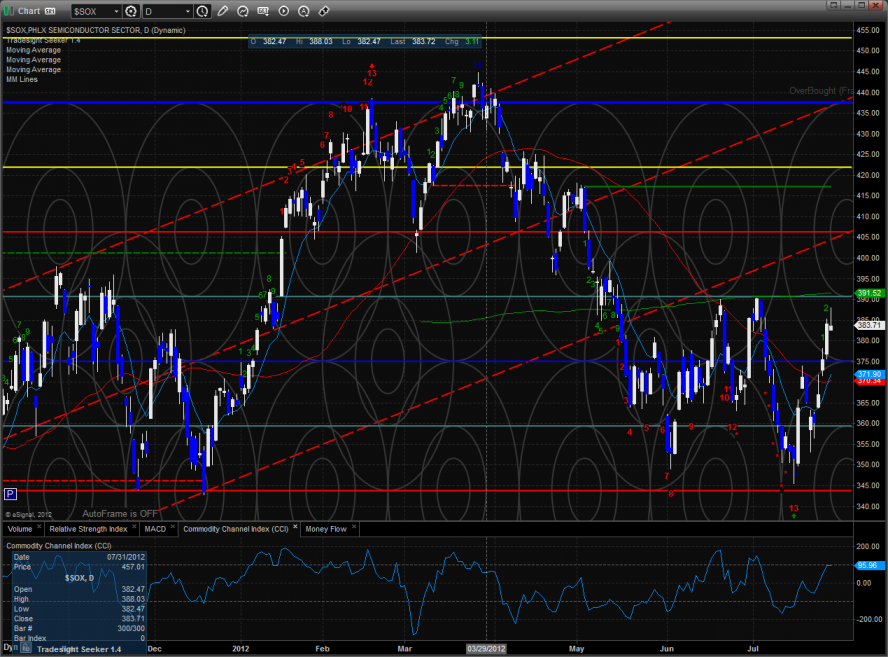

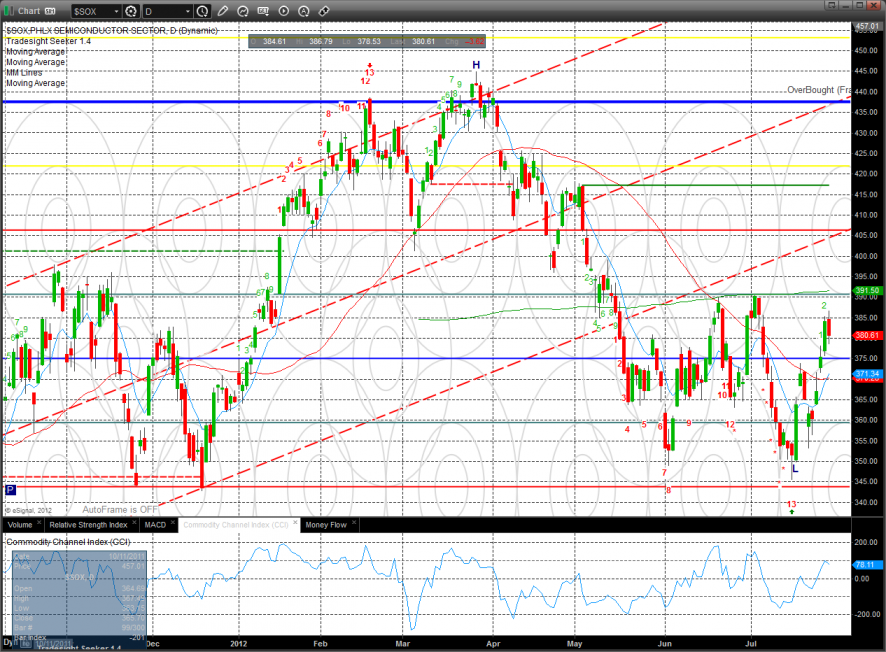

The SOX was the only major index up on the day. The index made a new high on the move but not a new closing high. The 200dma is the important level overhead.

The BKX is still one strong day away from a Seeker 13 sell signal.

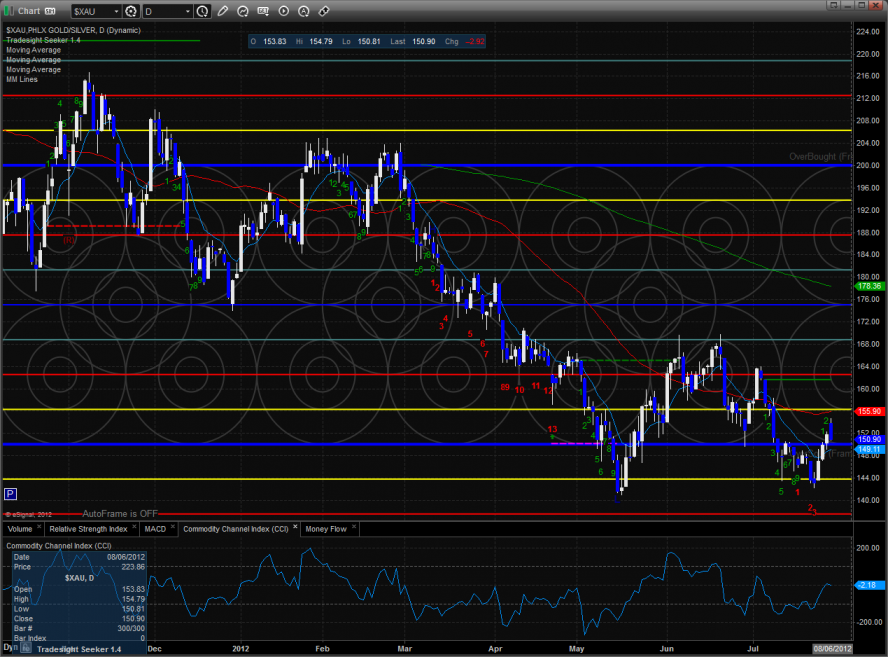

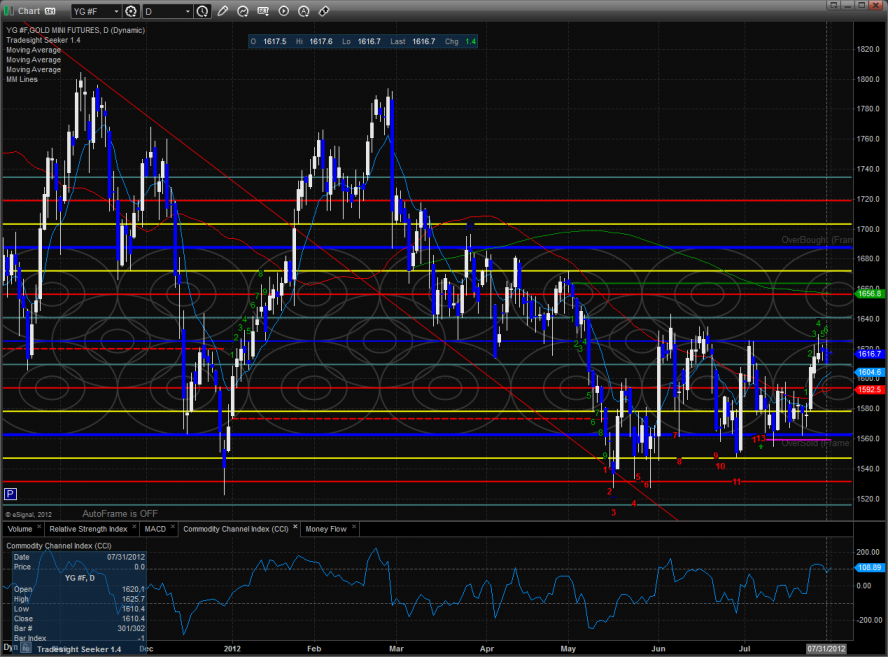

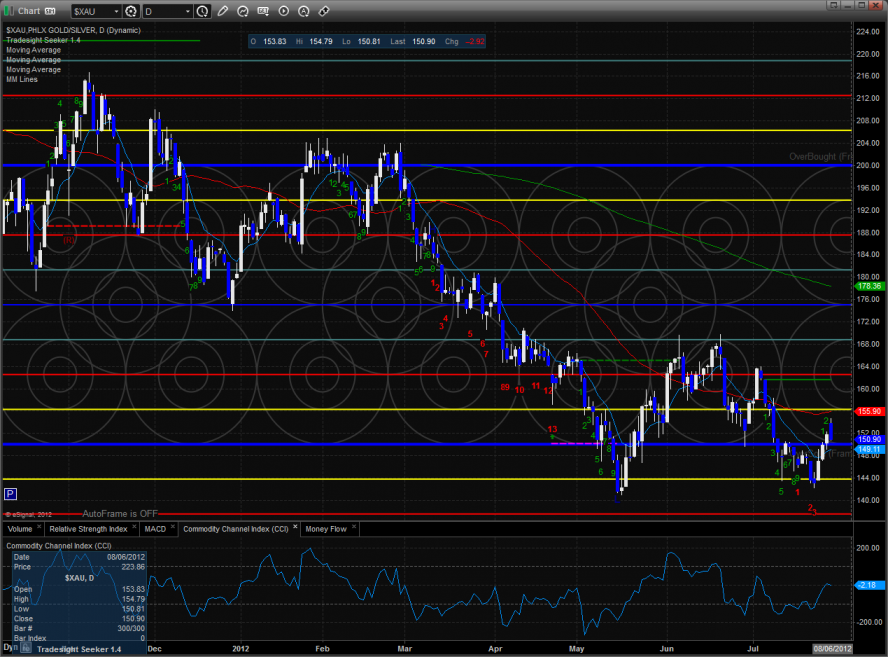

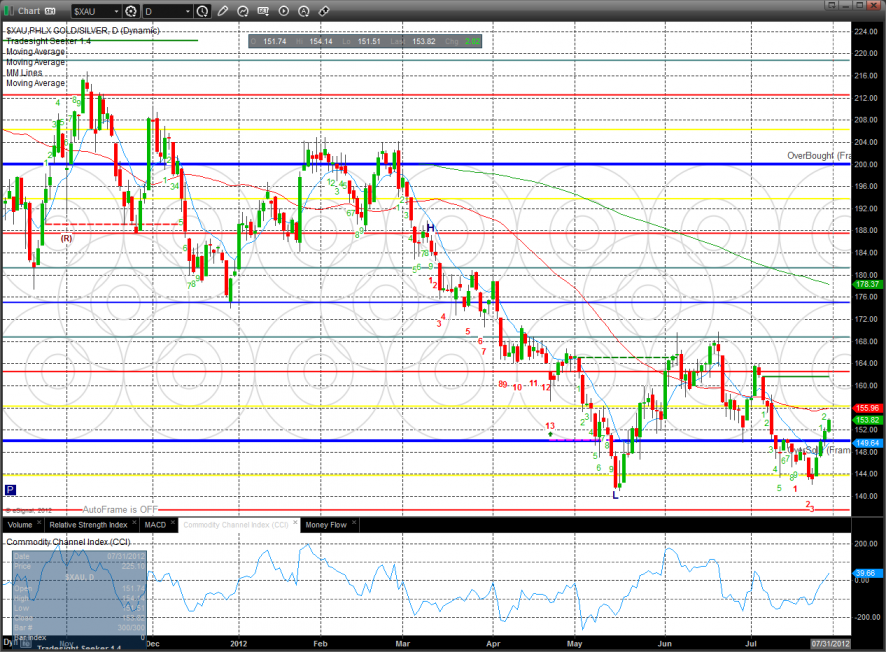

The XAU was weaker than the broad market but still has 2x bottom potential.

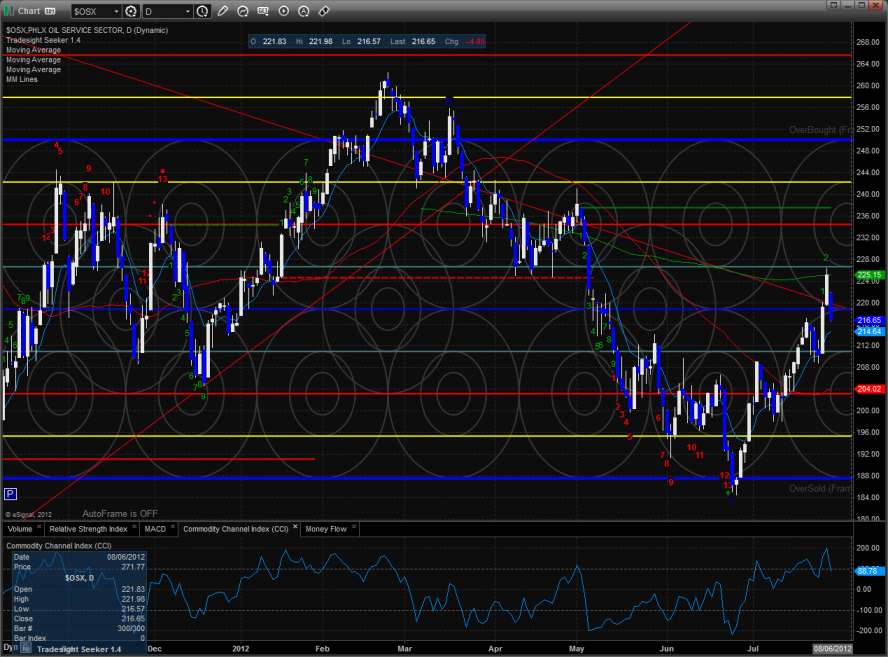

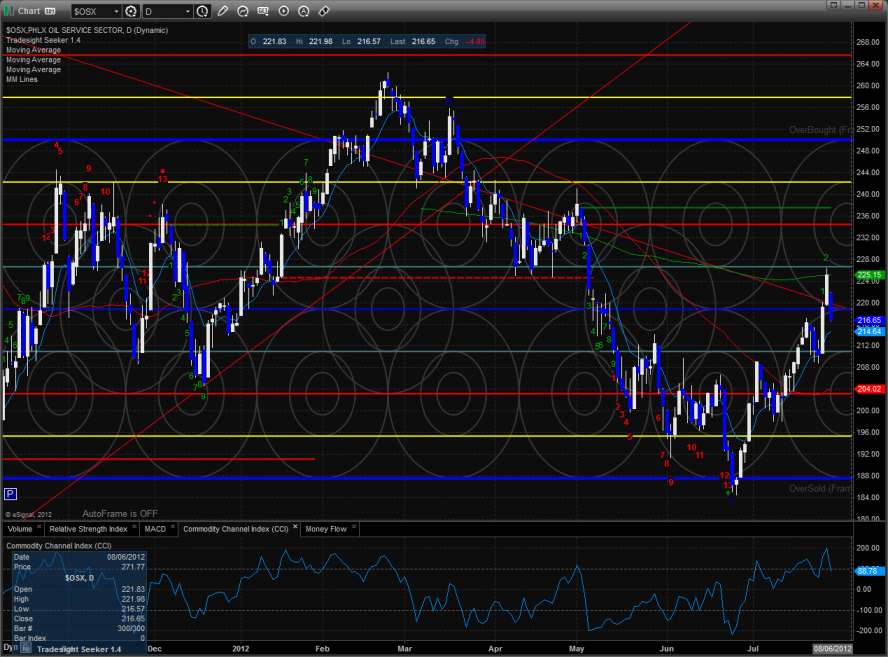

The OSX was the last laggard on the day and could be making an important pivot under the 200dma. Tomorrow is key.

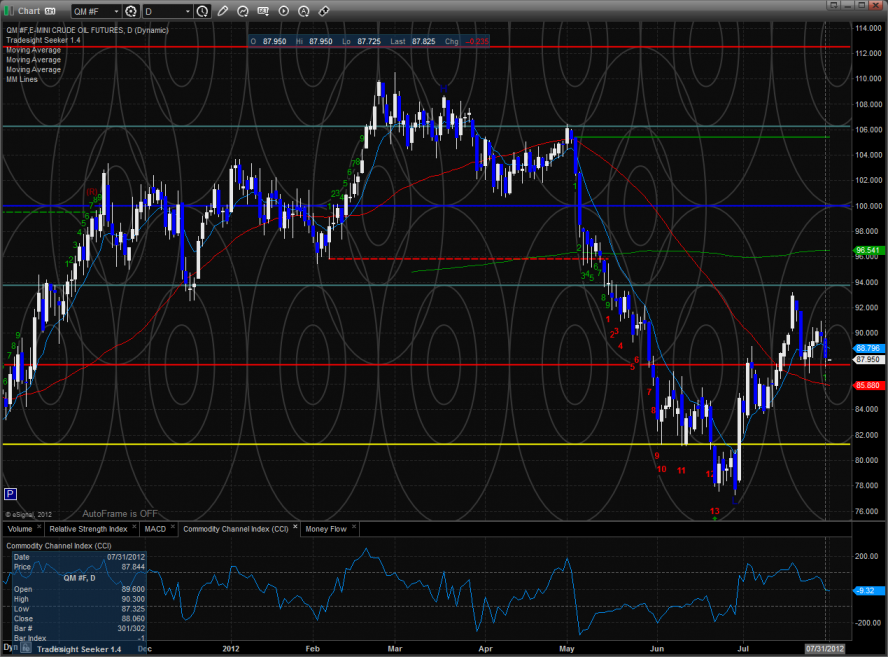

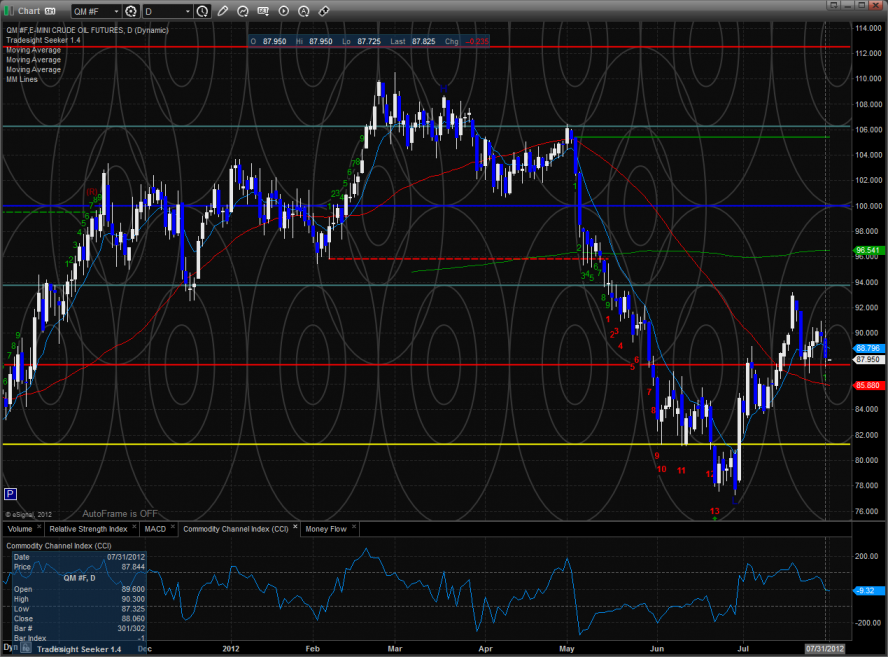

Oil:

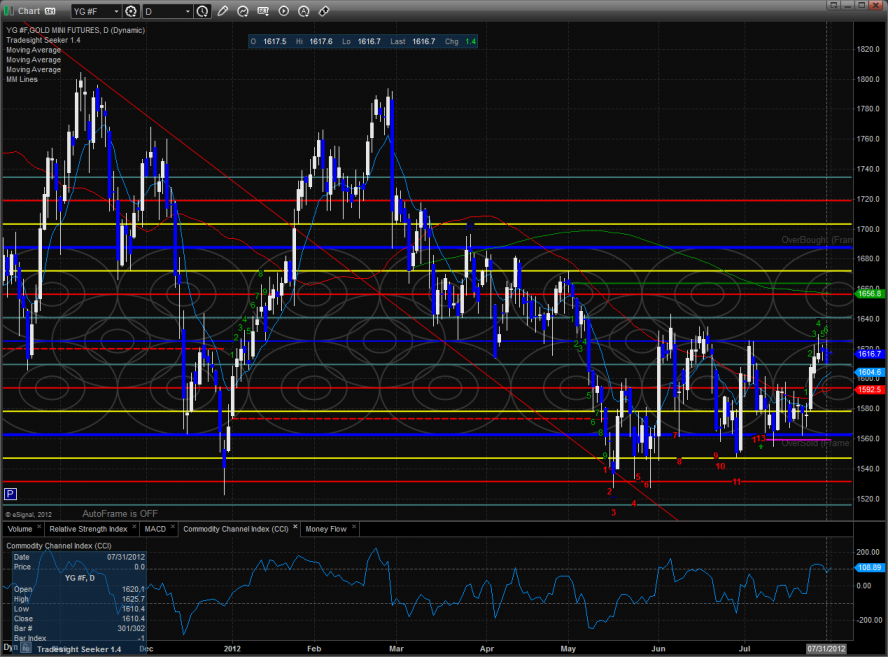

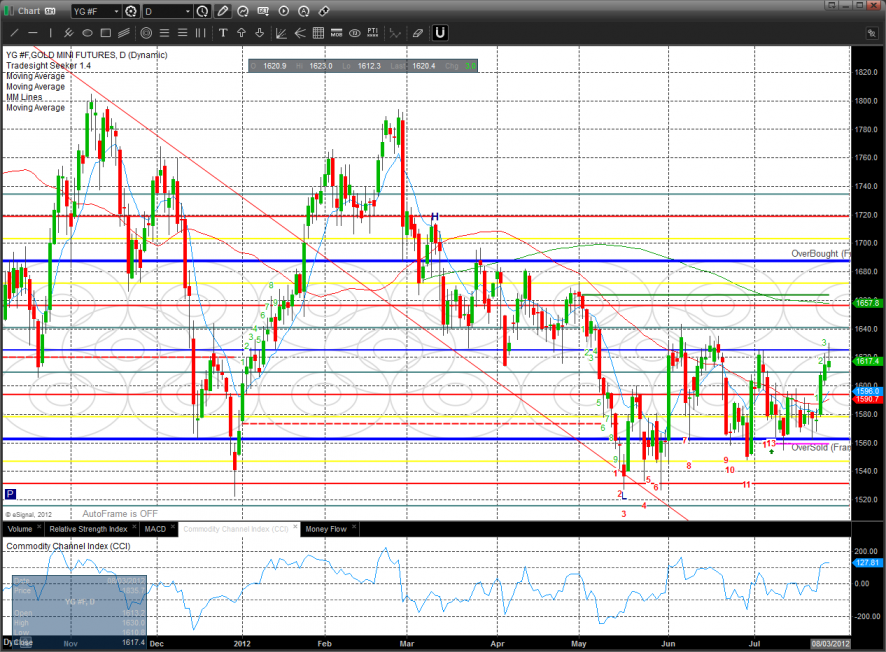

Gold:

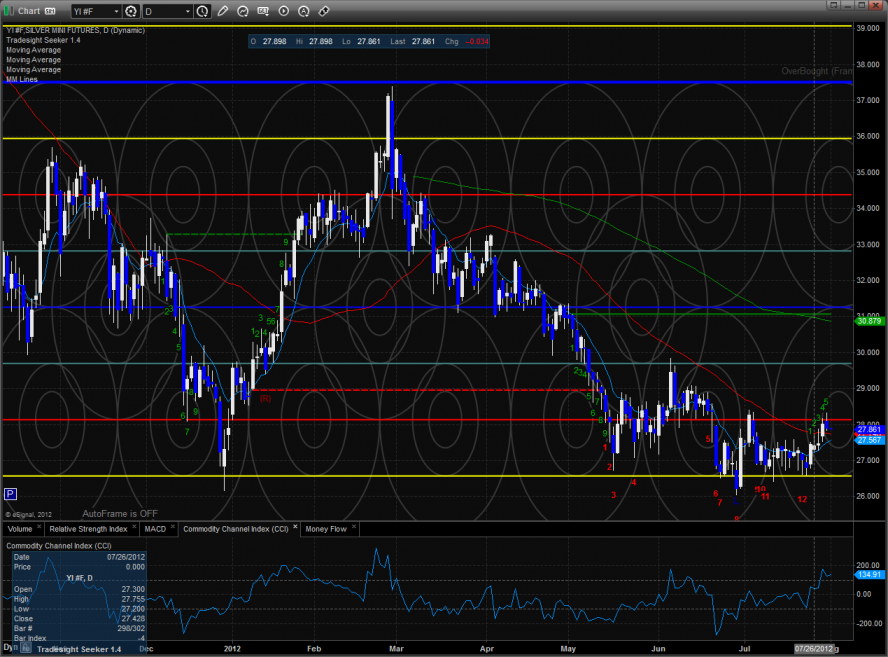

Silver:

Tradesight Market Preview for 8/1/12

Put/call ratio alert--see below!

The futures are still marking time before the FOMC decision and commentary Wednesday. On the day, the ES lost 6 handles but is still short term positive. Note that the CCI has lost it’s positive bias.

The NQ was relatively strong on the day and posted an inside candle. This will make the move out of the 2 day range better than if it wandered and swept on Tuesday

The put/call ratio recorded a climatically bullish reading. This is a contra indicator and loads the market with over enthusiasm.

Multi sector daily chart:

The BKX is bearishly showing relative weakness vs. the broad market tracking SPX.

The SOX was the only major index up on the day. The index made a new high on the move but not a new closing high. The 200dma is the important level overhead.

The BKX is still one strong day away from a Seeker 13 sell signal.

The XAU was weaker than the broad market but still has 2x bottom potential.

The OSX was the last laggard on the day and could be making an important pivot under the 200dma. Tomorrow is key.

Oil:

Gold:

Silver:

Stock Picks Recap for 7/31/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MCHP triggered long (without market support due to opening 5 minutes) and worked:

In the Messenger, Rich's GOOG triggered long (with market support) and didn't work:

His AMZN triggered short (with market support) and worked:

His VMW triggered short (with market support) and worked:

His SBUX triggered short (with market support) and worked:

His OIH triggered short (ETF, so no market support needed) and worked:

His NTGR triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 7/31/12

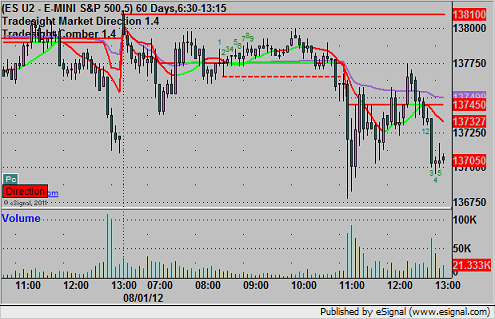

As expected, the market was extremely flat again today between the end of the month and the first day of a Fed meeting. We spent a huge piece of the day (the whole morning) inside a 4 point Value Area on the ES. Not pretty. One winner and one loser on the NQ, see that section below. No other calls as things were so flat.

Net ticks: -2.5 ticks.

As usual, we will start with the ES and NQ with our market directional lines, VWAP, and Comber:

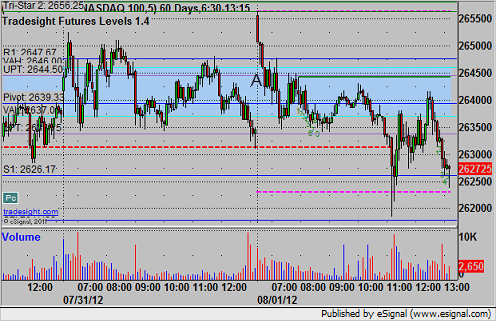

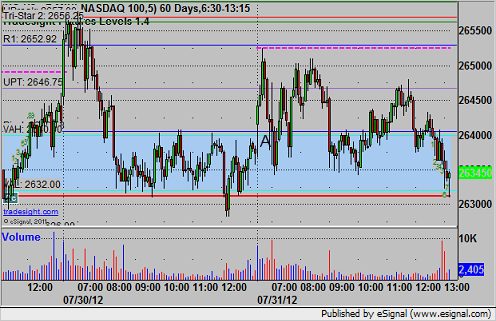

NQ:

Remember that for the NQ, we use half points as ticks instead of quarter points.

Triggered short at A at 2639.50, and that stopped. A few minutes later, it triggered again, hit the first target for 6 ticks, and we moved the stop over the entry, which stopped:

Forex Calls Recap for 7/31/12

An interesting session. We had a short idea in the GBPUSD that worked and a long idea in the EURUSD that worked. See both below, and we are still long the EURUSD.

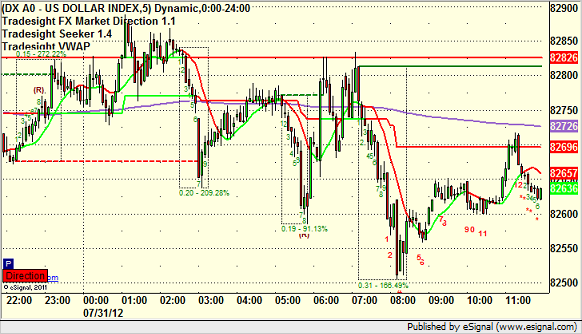

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, but we remain half size ahead of tomorrow's Fed announcement.

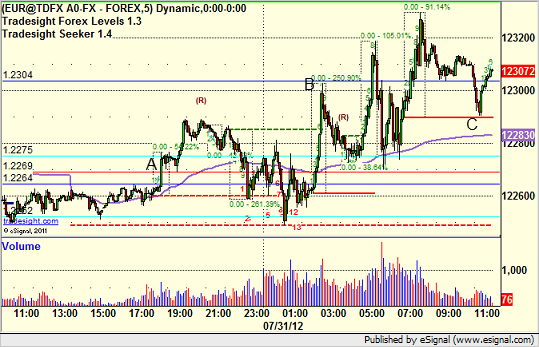

EURUSD:

Triggered long at A and gave you hour to take at that price, never went 20 pips plus spread against, hit first target at B, and holding the second half with a stop under the red line at C:

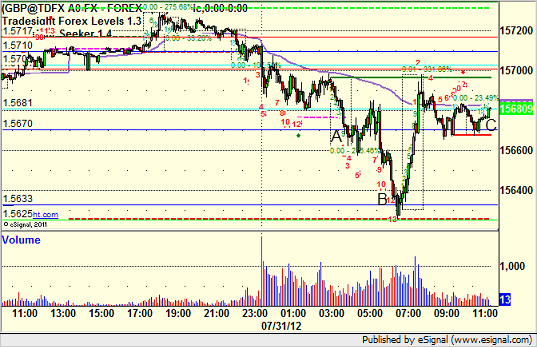

GBPUSD:

Triggered short at A, hit first target at B (and bottomed out exactly on a Seeker 13 buy signal), and closed the final piece over the entry:

Tradesight Market Preview for 7/31/12

The ES lost 2 on the day posting a range high doji. Tradesight subscribers and Twitter followers got an early indication today that the VIX was signaling that there would be no net advance in the ES today. Since both the ES and the VIX were higher on the day there was a divergence between the two that never lasts a whole trading session. The VIX being more institutional in nature always wins the battle. Since the VIX was not supporting the higher prices in the futures they were doomed to fail. Tradesight subscribers benefitted from the Analysts’ short calls.

The NQ also posted a doji day and remains at the upper boundary of the positive trend channel.

The 10-day Trin is approaching the overbought level of 0.85 or lower. Close but no signal yet.

The total put/call ratio remains neutral.

Multi sector daily chart:

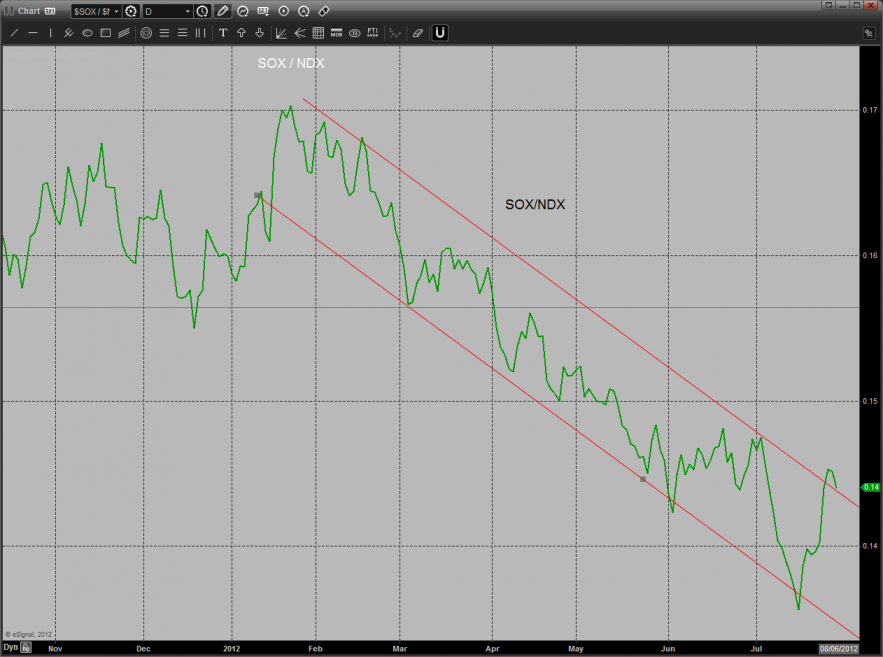

The SOX/NDX ratio is close to reversing but has not yet buttered the biscut.

The defensive XAU was top gun on the day, still attempting to put in a double bottom on the daily chart.

The BKX is now 12 days up and has a Seeker sell signal on deck,

The SOX still needs to clear 390 to break out of the recent range and turn the trend positive in all time frames.

The OSX was a poor performer still not able to break above the 200dma. The next price objective will be the measured move target off the reverse H&S reversal.

Oil:

Gold:

Silver