Tradesight Market Preview for 7/31/12

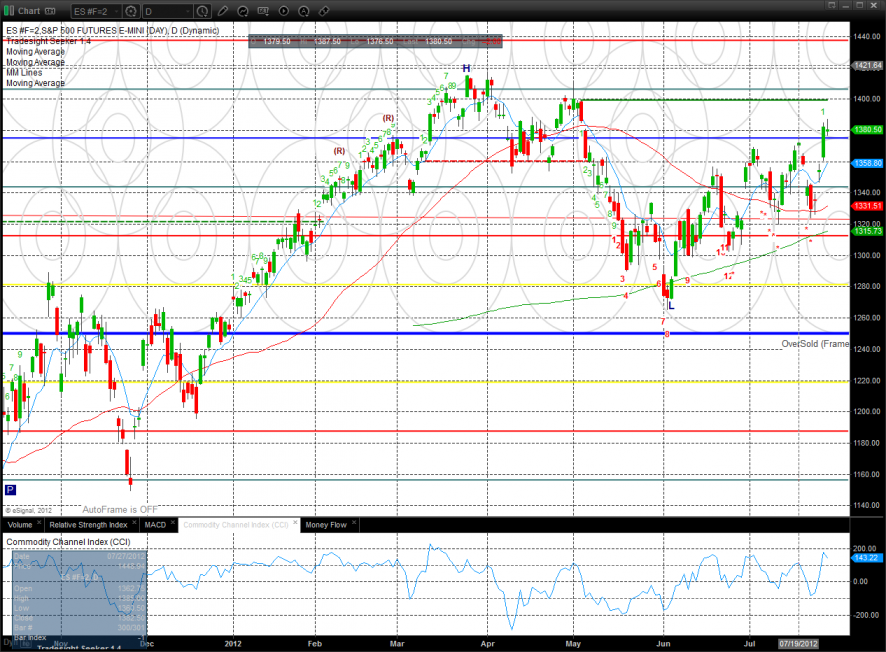

The ES lost 2 on the day posting a range high doji. Tradesight subscribers and Twitter followers got an early indication today that the VIX was signaling that there would be no net advance in the ES today. Since both the ES and the VIX were higher on the day there was a divergence between the two that never lasts a whole trading session. The VIX being more institutional in nature always wins the battle. Since the VIX was not supporting the higher prices in the futures they were doomed to fail. Tradesight subscribers benefitted from the Analysts’ short calls.

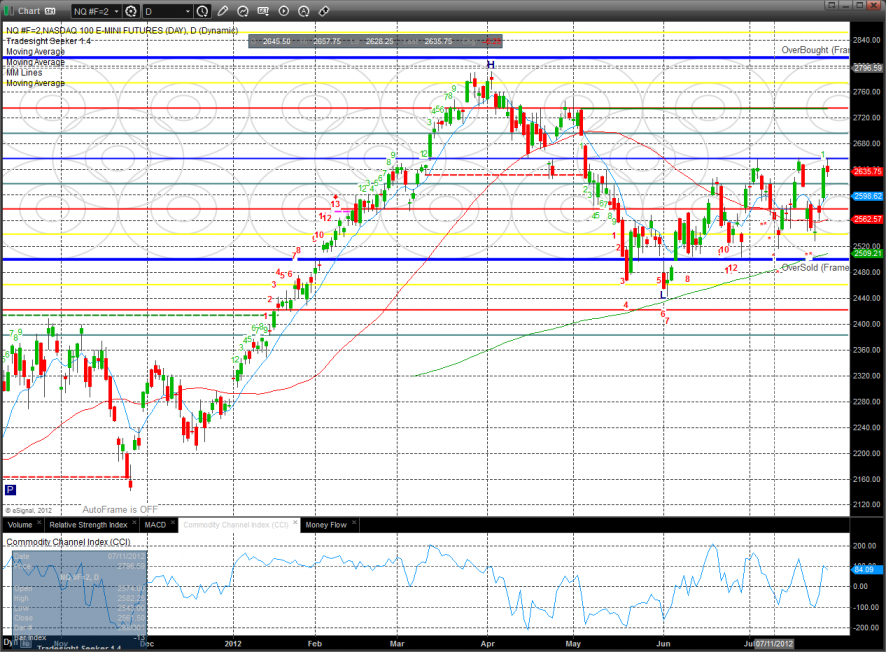

The NQ also posted a doji day and remains at the upper boundary of the positive trend channel.

The 10-day Trin is approaching the overbought level of 0.85 or lower. Close but no signal yet.

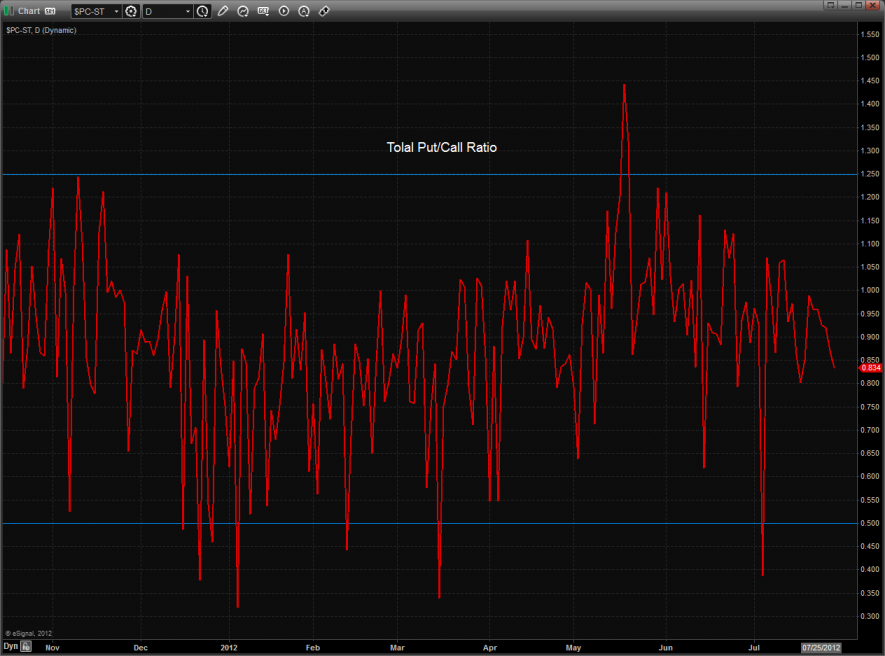

The total put/call ratio remains neutral.

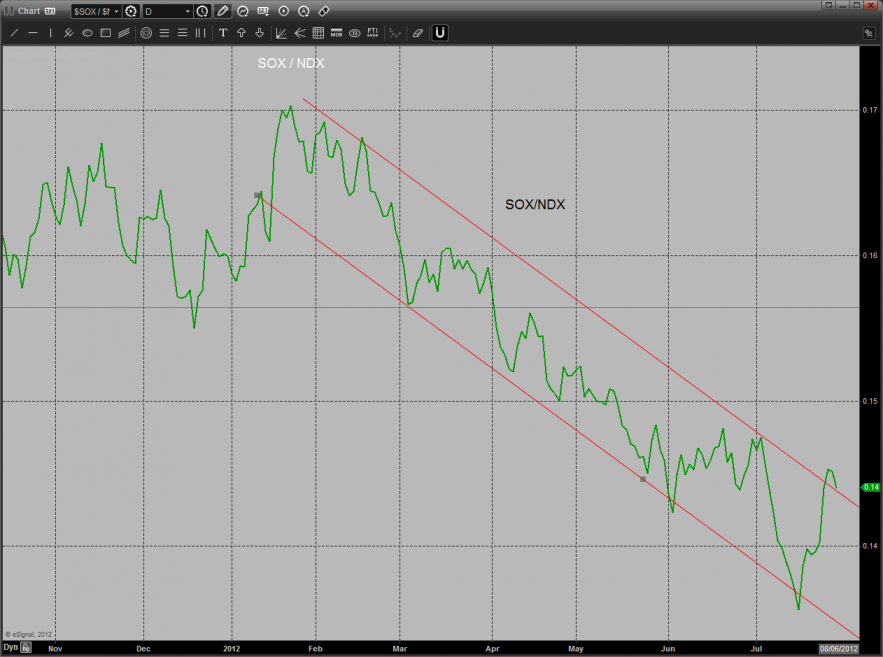

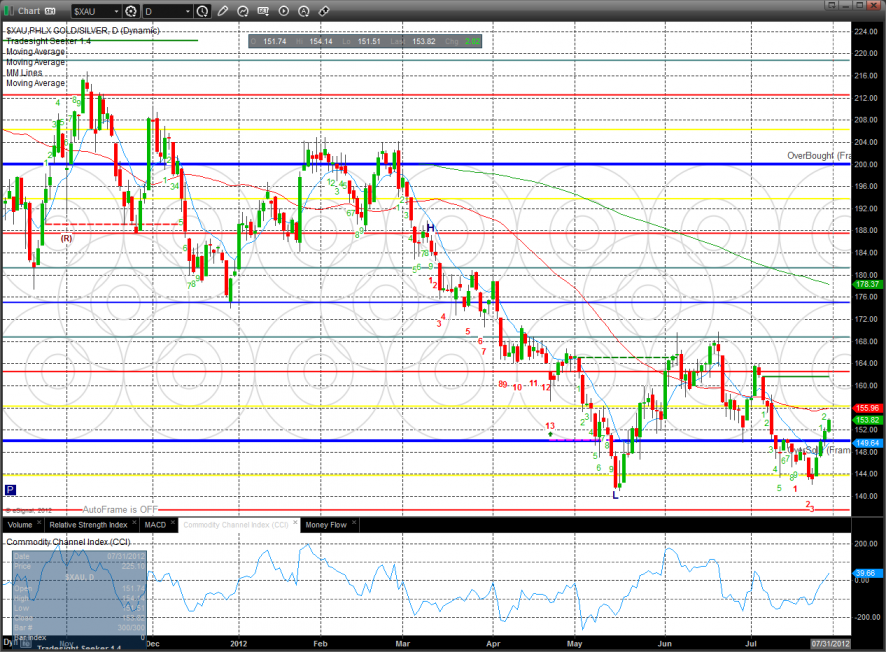

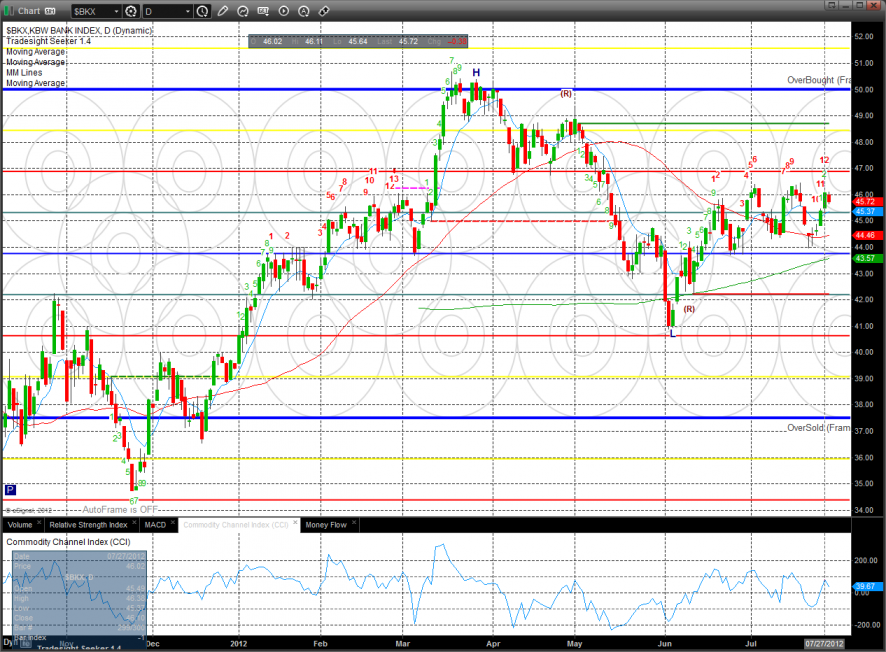

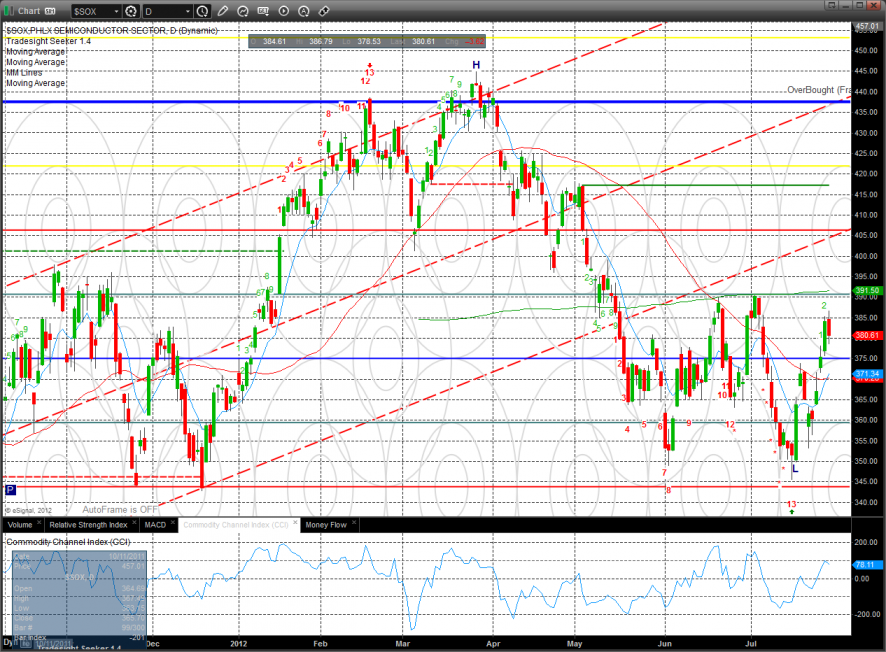

Multi sector daily chart:

The SOX/NDX ratio is close to reversing but has not yet buttered the biscut.

The defensive XAU was top gun on the day, still attempting to put in a double bottom on the daily chart.

The BKX is now 12 days up and has a Seeker sell signal on deck,

The SOX still needs to clear 390 to break out of the recent range and turn the trend positive in all time frames.

The OSX was a poor performer still not able to break above the 200dma. The next price objective will be the measured move target off the reverse H&S reversal.

Oil:

Gold:

Silver

Stock Picks Recap for 7/30/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EXEL gapped over, no play.

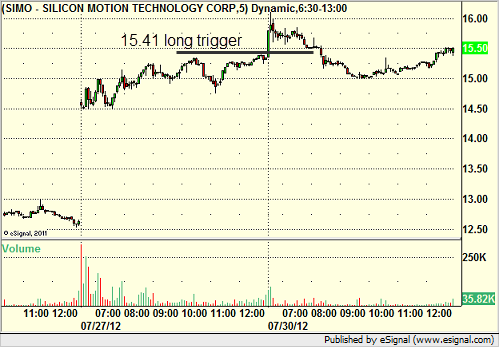

SIMO triggered long (without market support due to opening 5 minutes) and worked enough for a partial when it blasted out of the gate:

SREV triggered short (without market support) and didn't work:

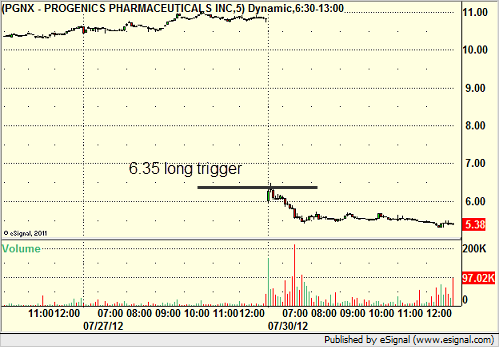

In the Messenger, Rich's PGNX triggered long (with market support) and didn't work:

His IBM triggered long (without market support) and didn't work:

NTAP triggered short (without market support) and worked:

Rich's CSTR triggered short (without market support) and worked great:

His GOOG triggered short (with market support) and worked:

His POT triggered short (with market support) and worked:

His PXD triggered short (with market support) and worked:

His GS triggered short (with market support) and didn't go enough in either direction to count:

His JPM triggered short (with market support) and didn't work:

There were a lot of other calls that didn't trigger.

A strange day with a lot of calls triggering without market support, many of them working great, but they don't count toward our totals.

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 7/30/12

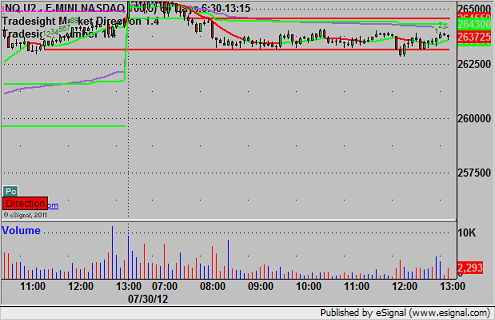

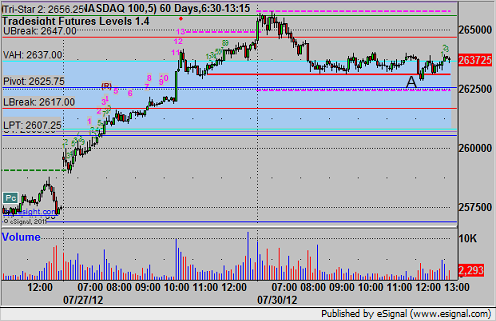

Not much of a session as volume dropped back sharply to only 1.3 billion NASDAQ shares and the market did very little for most of the session. NQ triggered short after lunch and just missed the first target by half a tick.

Tomorrow is the start of a 2-day Fed meeting, so it might not be much better.

Net ticks: -7 ticks.

As usual, let's start by looking at the ES and NQ with our Comber, market directional lines, and VWAP:

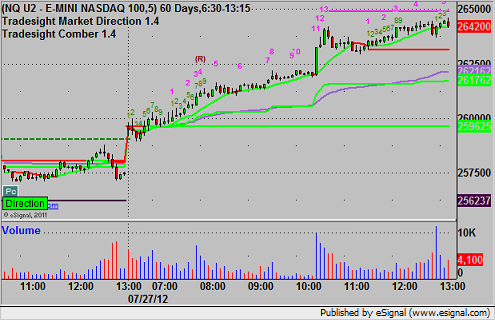

NQ:

Triggered short under the Static Trendline of the last 9-bar move up at A at 2631.00 in the afternoon on the only volume bar of the afternoon. We use half points as ticks on the NQ, and we were going for the usual 6 ticks on the partial (first target was 1628.00), and it went 5.5 ticks (low was 1628.25), then reversed and stopped:

Forex Calls Recap for 7/30/12

A non-event session as the EURUSD short triggered and didn't even get to the first target or the stop. See that section below.

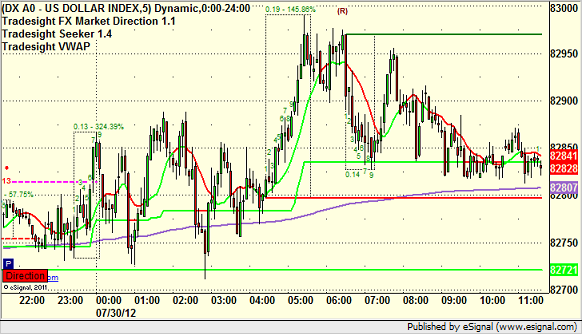

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, but we start a 2-day Fed meeting on Tuesday.

EURUSD:

Triggered short under S1 at A and didn't do anything. Finally gave up and closed it at the end of the chart:

Stock Picks Recap for 7/27/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, RIGL triggered long (with market support) and worked:

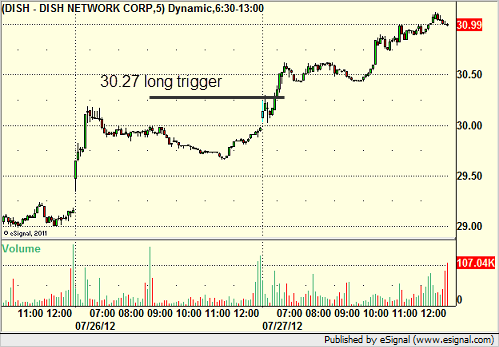

DISH triggered long (with market support) and didn't work, but although we don't count it on the official results, we took the retrigger in the room and did very well:

From the Messenger, Rich's AAPL triggered short (with market support) and worked:

His AMGN triggered long (without market support) and didn't work:

His GILD triggered long (with market support) and didn't work, worked later:

NTAP triggered long (with market support) and worked:

AAPL triggered long (with market support) and worked great:

Rich's VMW triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Futures Calls Recap for 7/27/12

A loser and a winner to close out the week. Volume was strong early, then drifted off, spiked back up on news out of Europe over lunch, and then drifted off again for the afternoon on a summer Friday.

Volume has been up and earnings and GDP are behind us, so I'm expecting better action next week with less gaps.

Net ticks: -4.5 ticks.

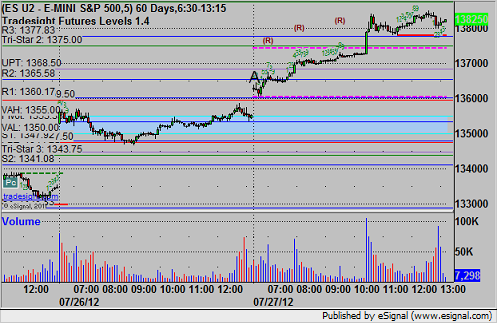

As usual, let's take a look at the ES and NQ with our market directional lines, Comber, and VWAP:

ES:

Mark's call triggered long at A at 1365.75, stopped just barely for 7 ticks, and then retriggered right after that, hit first target, raised stop under the entry and stopped at 1365.50:

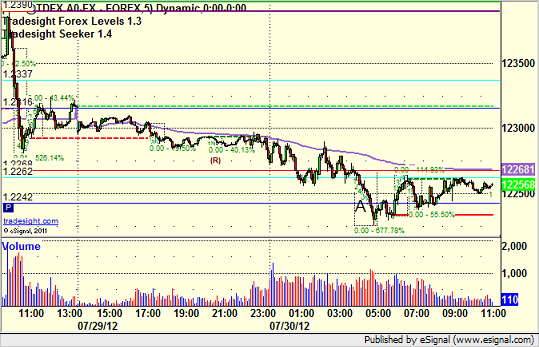

Forex Calls Recap for 7/27/12

Closed out a 170 pip winner on the GBPUSD from the prior session, but had a trigger and stop out on the EURUSD overnight. See both sections below.

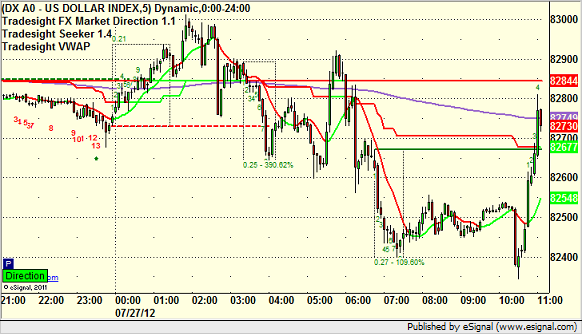

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber separately (see AUDUSD and NZDUSD in particular), and then glance at the US Dollar Index.

Here's the Index intraday with our market directional lines:

Calls resume Sunday.

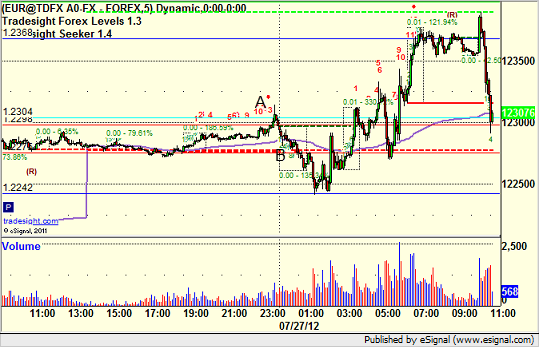

EURUSD:

Triggered long at A and stopped at B for 25 pips:

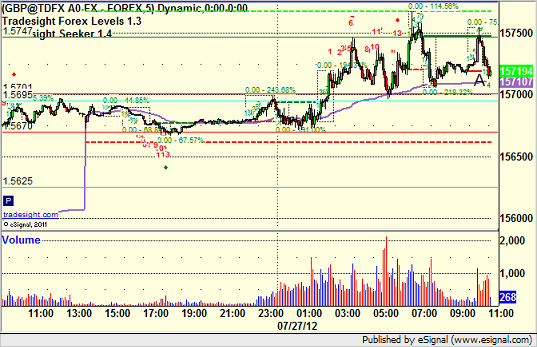

GBPUSD:

Closed second half of the trade from the prior day at A for 170 pips or so:

Stock Picks Recap for 7/26/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ADI triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

In the Messenger, Rich's FAZ triggered short (ETF, so no market support needed) and didn't work:

His AAPL triggered short (with market support) and didn't work:

AMZN triggered short (with market support) and worked enough for a partial:

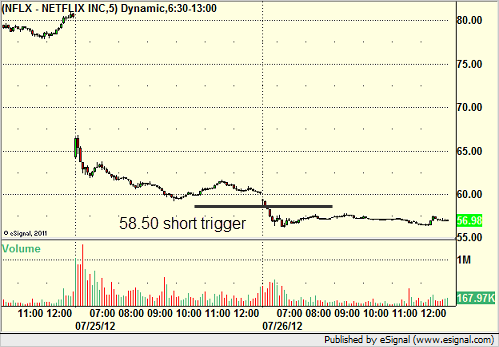

Rich's NFLX triggered short (with market support) and worked:

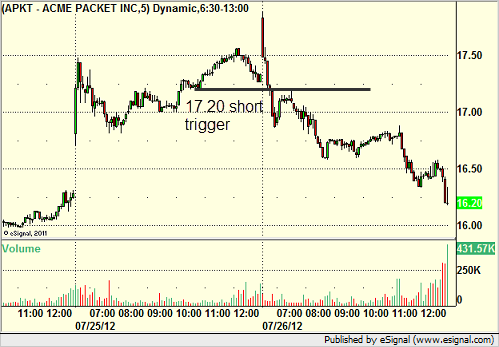

His APKT triggered short (with market support) and worked:

His CROX triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Futures Calls Recap for 7/26/12

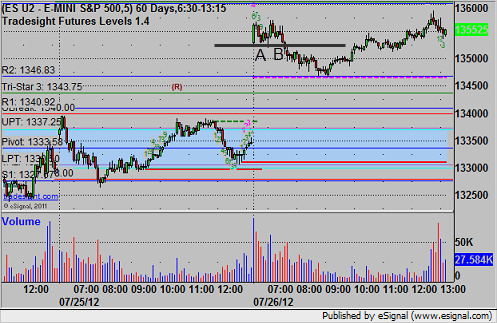

We had a big gap in the market that took us well above our key Levels, making setups for futures difficult (the ES only touch the R2, and that was the low of the session). One stop out and the retrigger worked, see ES below.

Net ticks: -1.5 ticks.

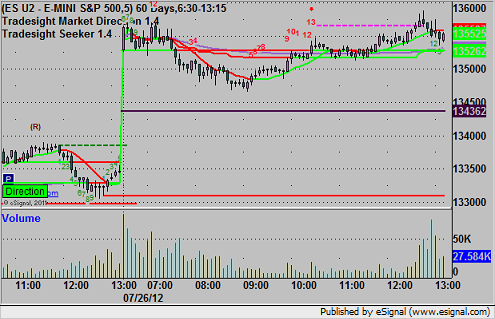

As usual, let's start with the ES and NQ with our market directional lines, Comber, and VWAP (now using Comber on these):

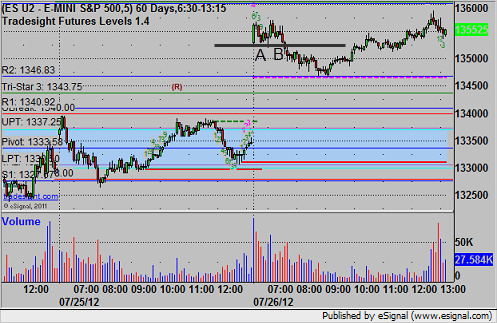

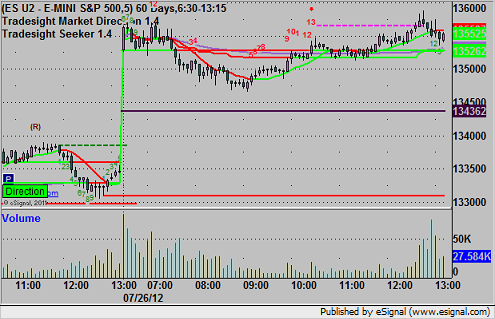

ES:

Triggered short under opening lows at 1352.50 at A, stopped for 7 ticks, then retriggered at B, hit first target for 6 ticks, and adjusted stop to final exit at 1351.25:

Futures Calls Recap for 7/26/12

We had a big gap in the market that took us well above our key Levels, making setups for futures difficult (the ES only touch the R2, and that was the low of the session). One stop out and the retrigger worked, see ES below.

Net ticks: -1.5 ticks.

As usual, let's start with the ES and NQ with our market directional lines, Comber, and VWAP (now using Comber on these):

ES:

Triggered short under opening lows at 1352.50 at A, stopped for 7 ticks, then retriggered at B, hit first target for 6 ticks, and adjusted stop to final exit at 1351.25: