Forex Calls Recap for 7/26/12

A nice winner in the GBPUSD, and we're still carrying the second half of the trade. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

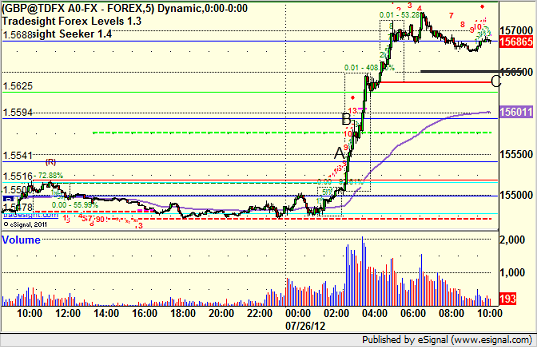

GBPUSD:

Triggered long at A, hit first target at B, kept going, and holding with a stop under line at C:

Tradesight Market Preview for 7/26/12

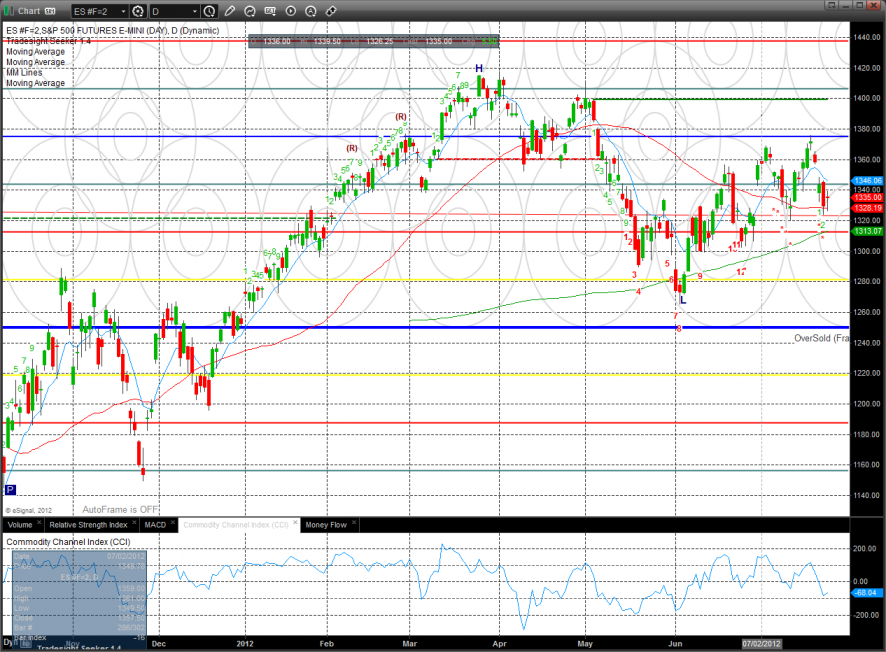

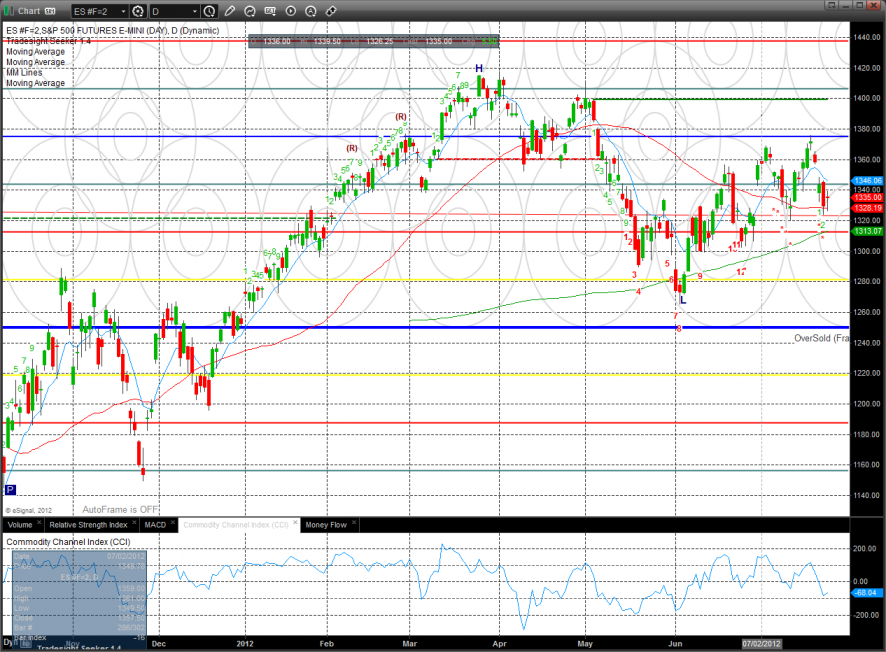

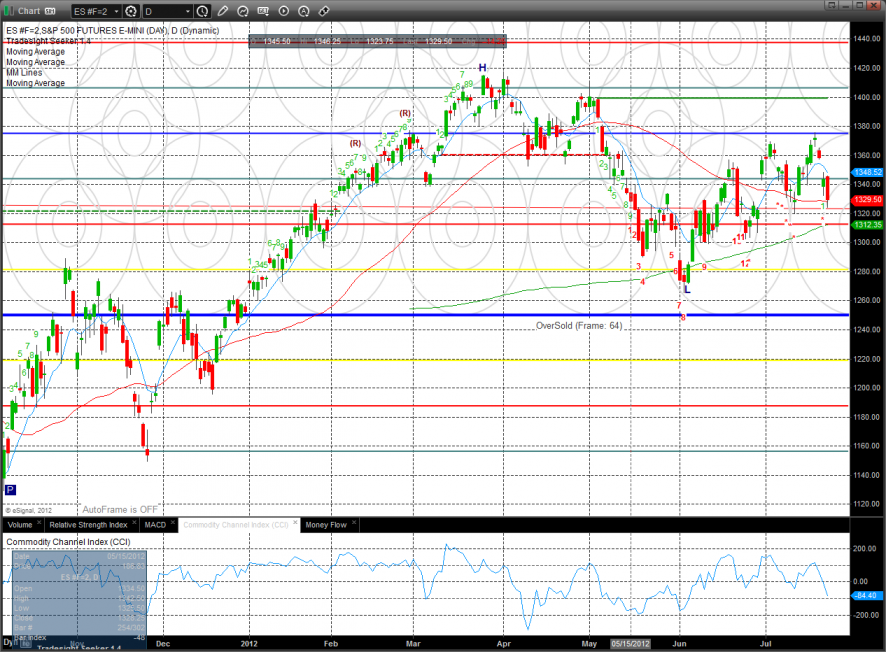

There is nothing new technically in the ES because it traded inside the prior day’s range. The futures gained 5 on the day but it means little when range bound. Options unraveling remains to be seen.

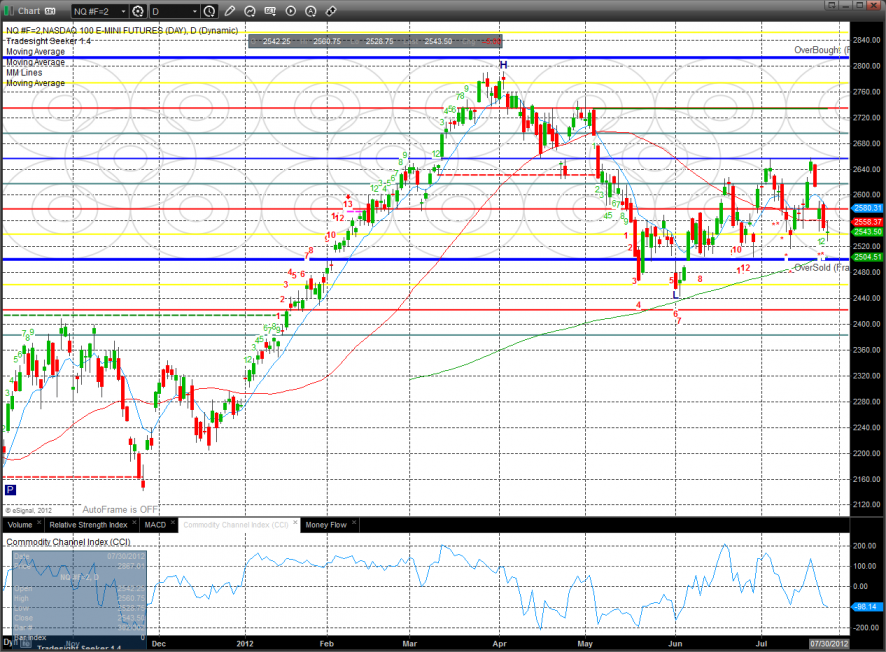

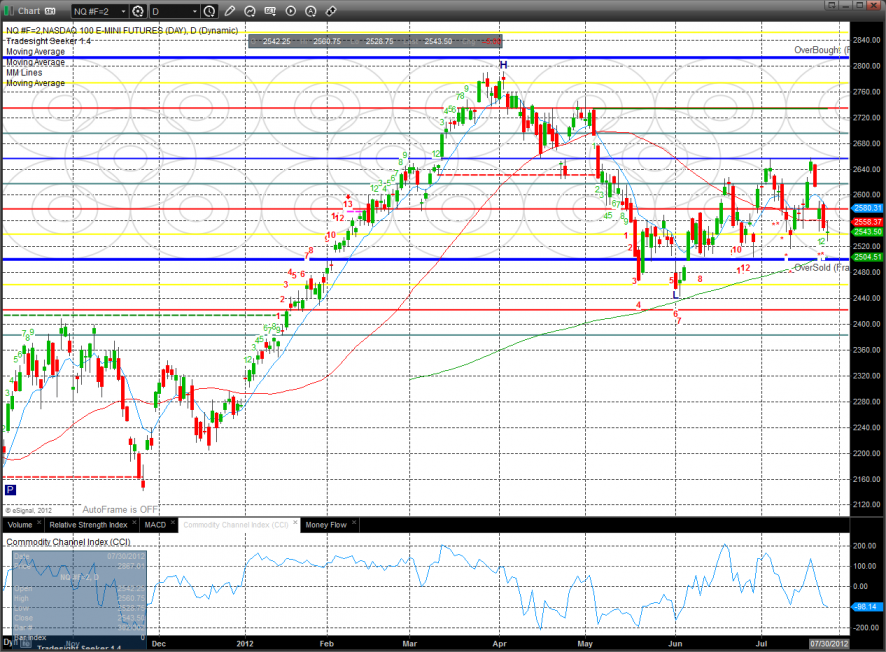

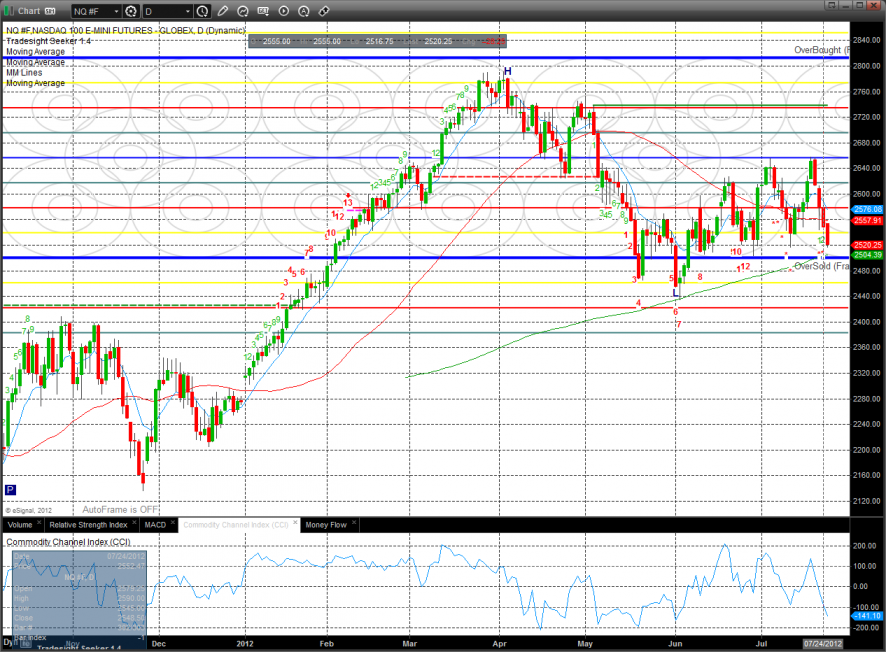

The NQ futures were lower on the day but posted a camouflage buy signal by closing above the open. The upward trend channel remains intact.

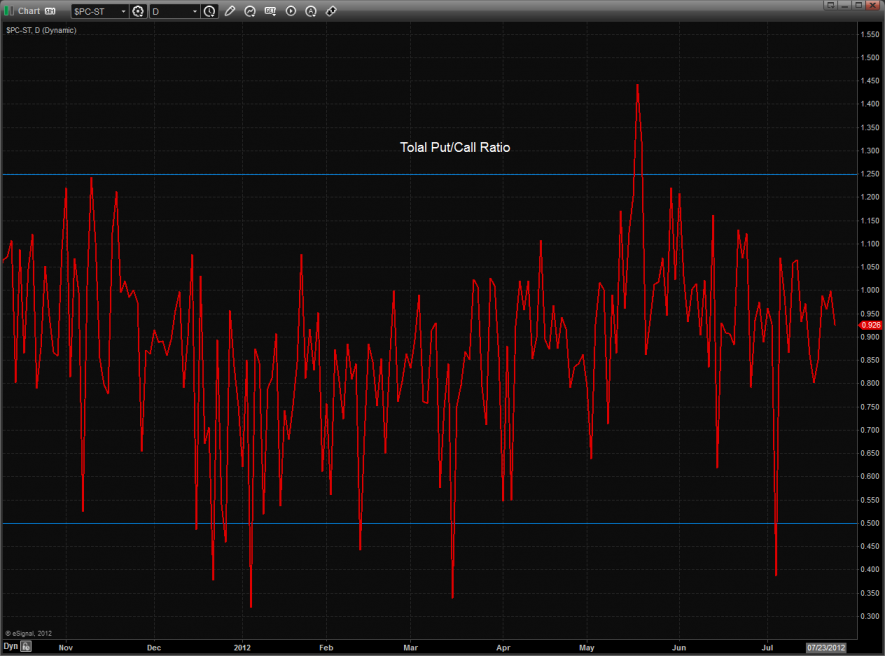

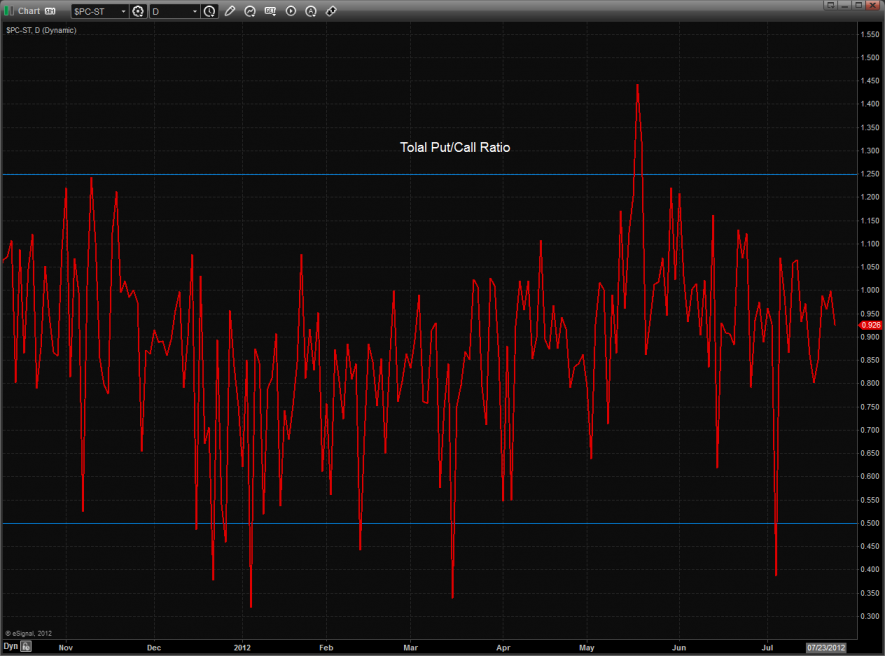

Nothing doing in the total put/call ratios as it remains neutral.

The 10-day Trin is pretty much in the neutral zone:

Multi sector daily chart:

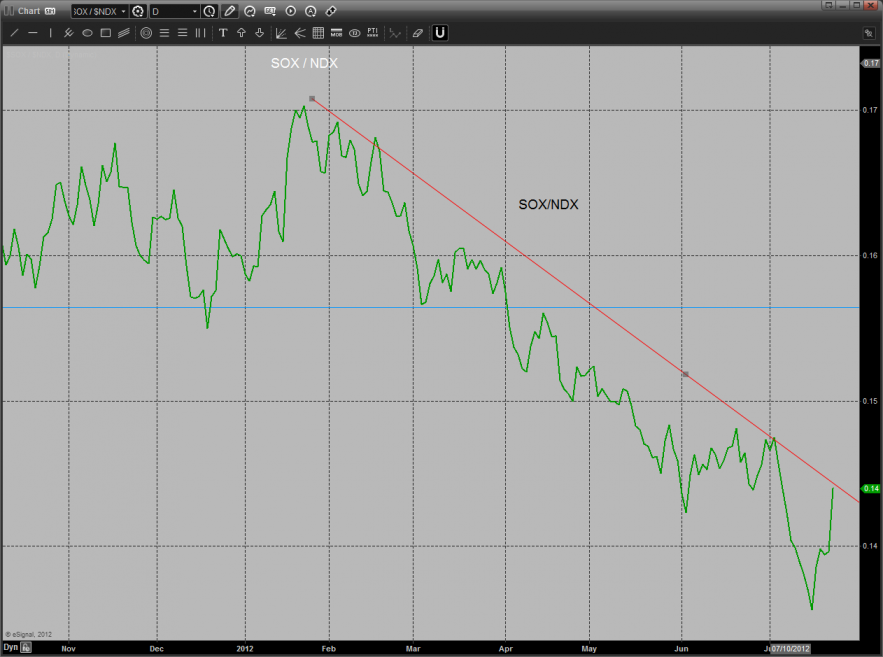

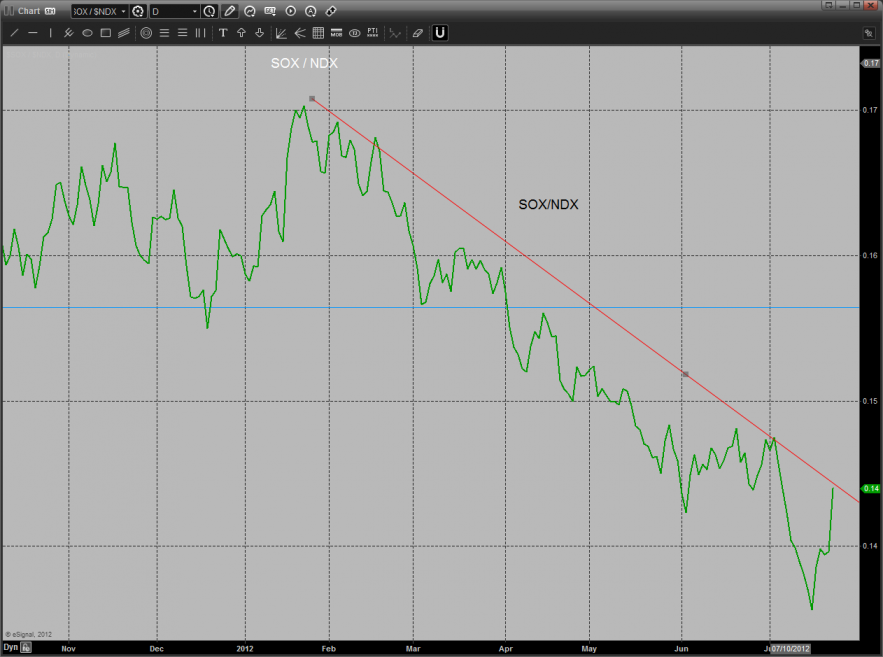

The SOX/NDX is at the door or a very bullish reversal:

The strength of gold made the Dow/gold ratio take a hit.

The defensive XAU was the top gun on the day not quite recording a key reversal day.

The SOX gapped higher and held it. Keep in mind that there is an active Seeker reversal on the chart:

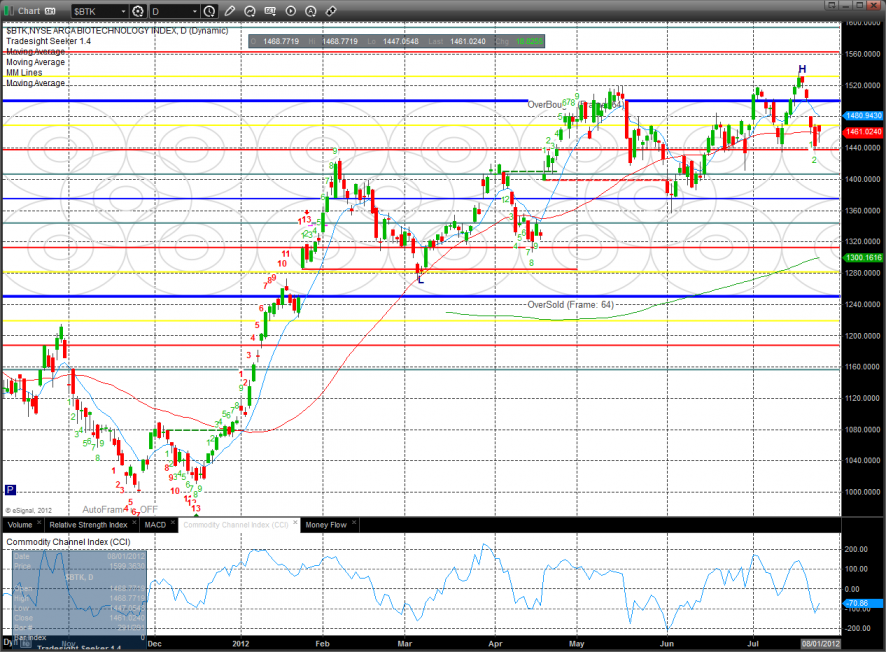

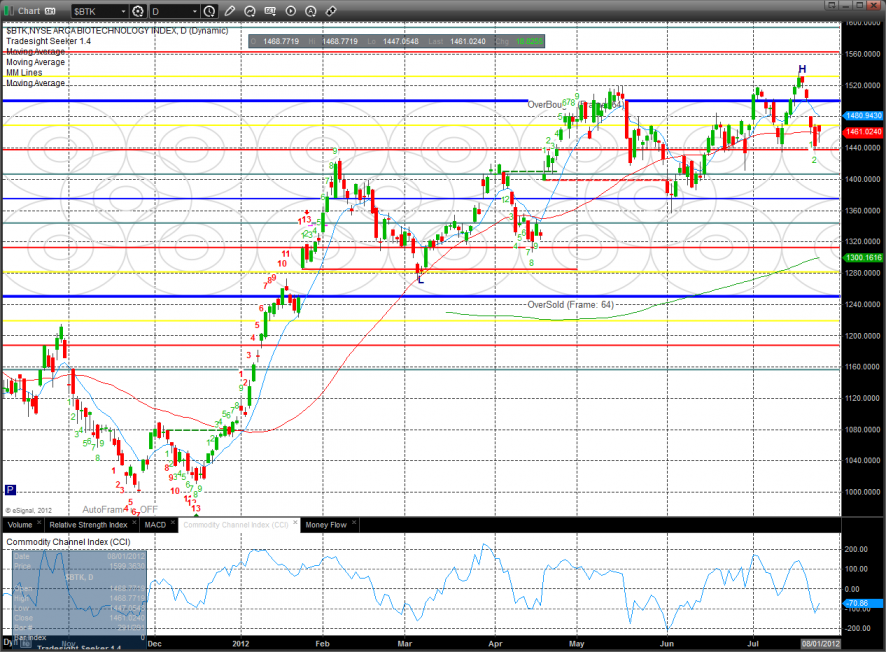

The BTK posted an inside day.

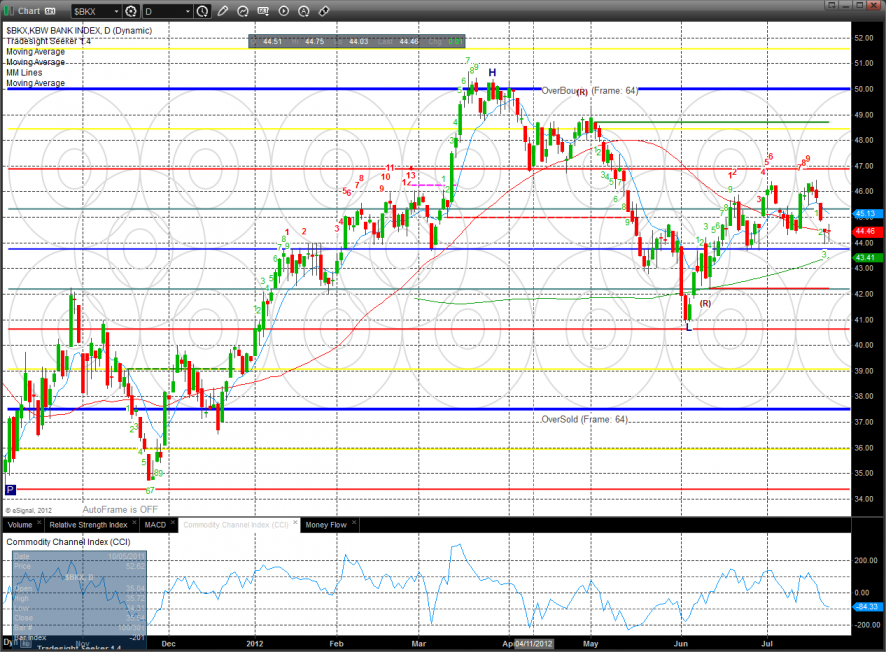

The BKX had relative strength but is still confined within the general 3 day trading range. Price is on the north side of all but the 10ma.

The OSX was the last laggard of the major indexes. Note that there is still room in the bar count for more upside.

Oil:

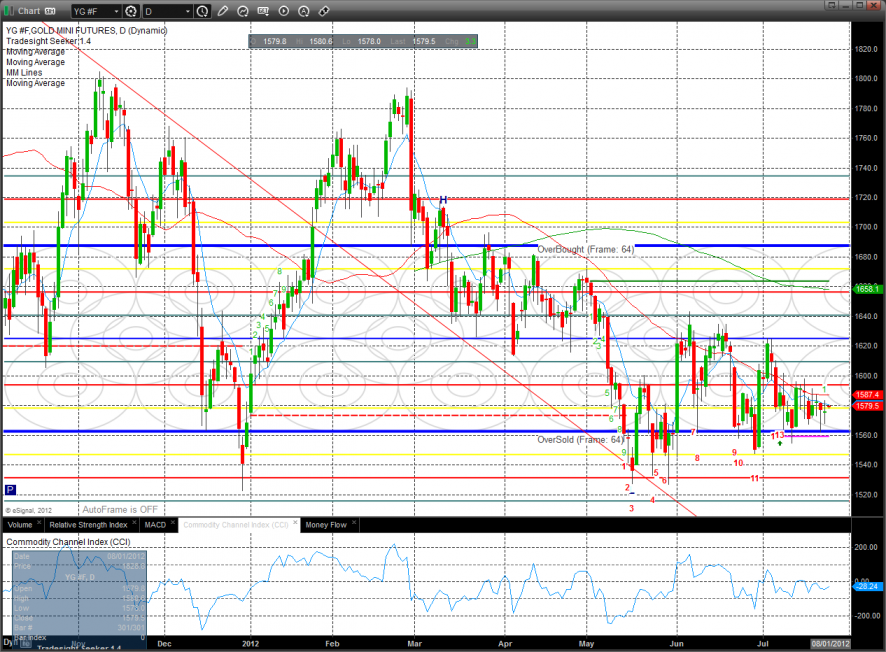

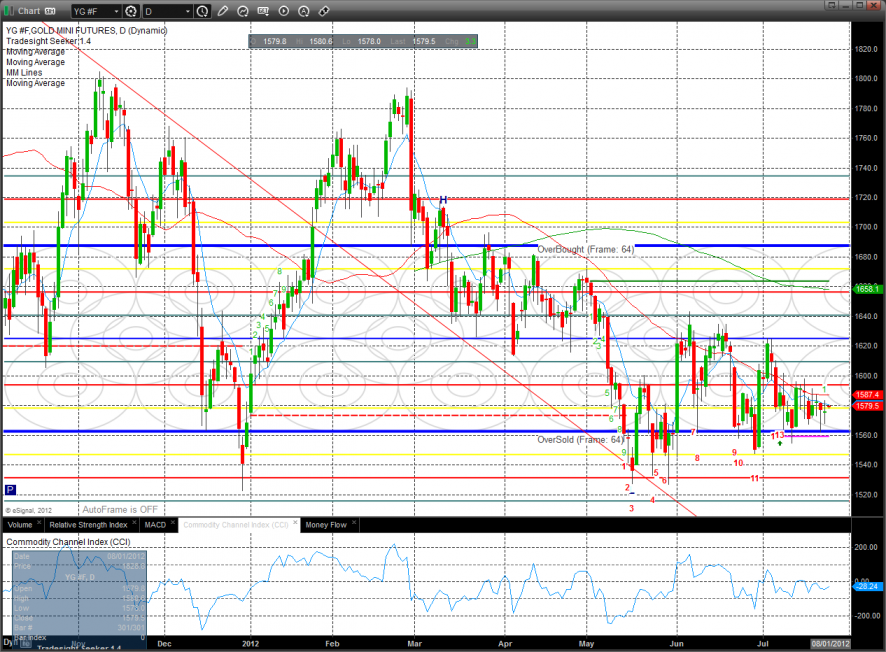

Gold:

Silver:

The TLT closed at a new high on the move and disqualified the Seeker sell signal. This instrument appears to be in the blow-off stage which can always run very, very far.

Tradesight Market Preview for 7/26/12

There is nothing new technically in the ES because it traded inside the prior day’s range. The futures gained 5 on the day but it means little when range bound. Options unraveling remains to be seen.

The NQ futures were lower on the day but posted a camouflage buy signal by closing above the open. The upward trend channel remains intact.

Nothing doing in the total put/call ratios as it remains neutral.

The 10-day Trin is pretty much in the neutral zone:

Multi sector daily chart:

The SOX/NDX is at the door or a very bullish reversal:

The strength of gold made the Dow/gold ratio take a hit.

The defensive XAU was the top gun on the day not quite recording a key reversal day.

The SOX gapped higher and held it. Keep in mind that there is an active Seeker reversal on the chart:

The BTK posted an inside day.

The BKX had relative strength but is still confined within the general 3 day trading range. Price is on the north side of all but the 10ma.

The OSX was the last laggard of the major indexes. Note that there is still room in the bar count for more upside.

Oil:

Gold:

Silver:

The TLT closed at a new high on the move and disqualified the Seeker sell signal. This instrument appears to be in the blow-off stage which can always run very, very far.

Stock Picks Recap for 7/25/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

In the Messenger, AMZN triggered short (with market support) and worked:

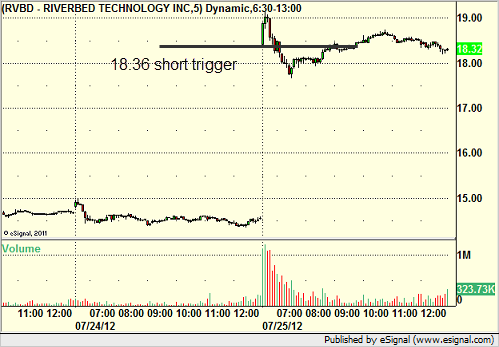

Rich's RVBD triggered short (with market support) and worked:

BIDU triggered short (with market support) and worked:

Rich's ONXX triggered long (without market support) and didn't work:

His CELG triggered long (without market support) and worked:

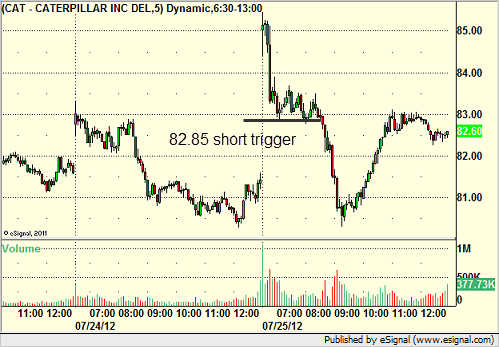

His CAT triggered short (with market support) and didn't work initially, worked later:

His FAS triggered short (ETF, so no market support needed) and worked:

Lots of other calls posted, but nothing triggered.

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

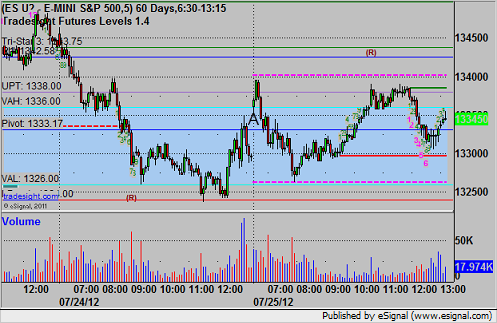

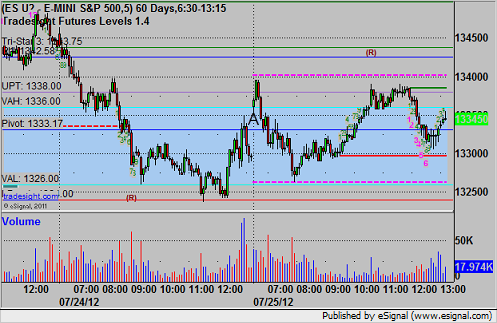

Futures Calls Recap for 7/25/12

We had a winner again the ES, and the second half stopped in the money. Another call in the afternoon that was set up beautifully didn't trigger. See ES section below.

Net ticks: +5.5 ticks.

As usual, let's start by looking at the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

Triggered short at A at 1335.75, hit 6 ticks for a first target, and stopped the second half 5 ticks in the money:

Futures Calls Recap for 7/25/12

We had a winner again the ES, and the second half stopped in the money. Another call in the afternoon that was set up beautifully didn't trigger. See ES section below.

Net ticks: +5.5 ticks.

As usual, let's start by looking at the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

Triggered short at A at 1335.75, hit 6 ticks for a first target, and stopped the second half 5 ticks in the money:

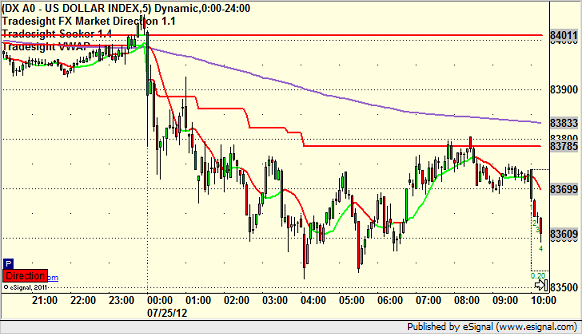

Forex Calls Recap for 7/25/12

We had a winner in the EURUSD, and stopped out of the second half of the trade well in the money. All flat again. We're getting closer to that key look at Q2 GDP on Friday, which the market is going to care about a lot.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

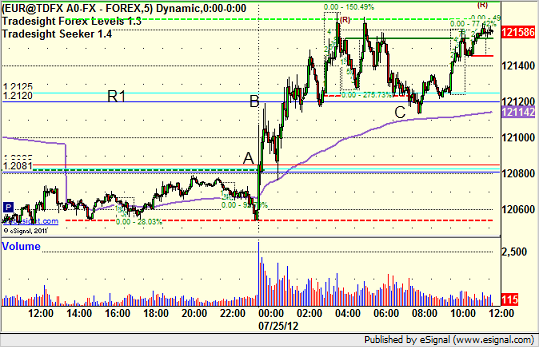

EURUSD:

Triggered long at A, hit first target at B, and stopped second half under R1 at C:

Tradesight Market Preview for 7/25/12

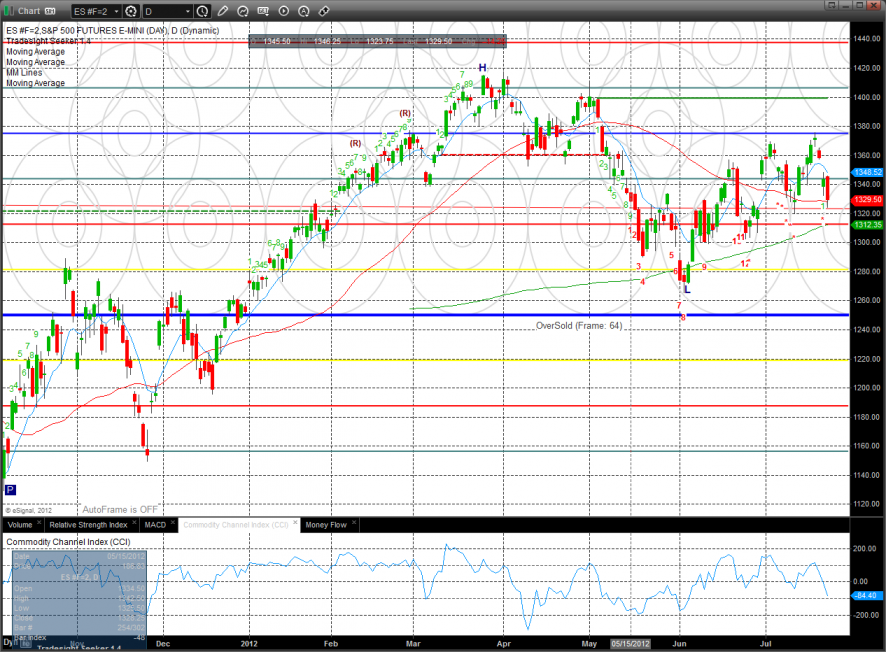

The ES lost 14 on the day which didn’t feel too bad until the prior day’s range was taken out. This left the settlement right at the 50dma with next support at the 200dma.

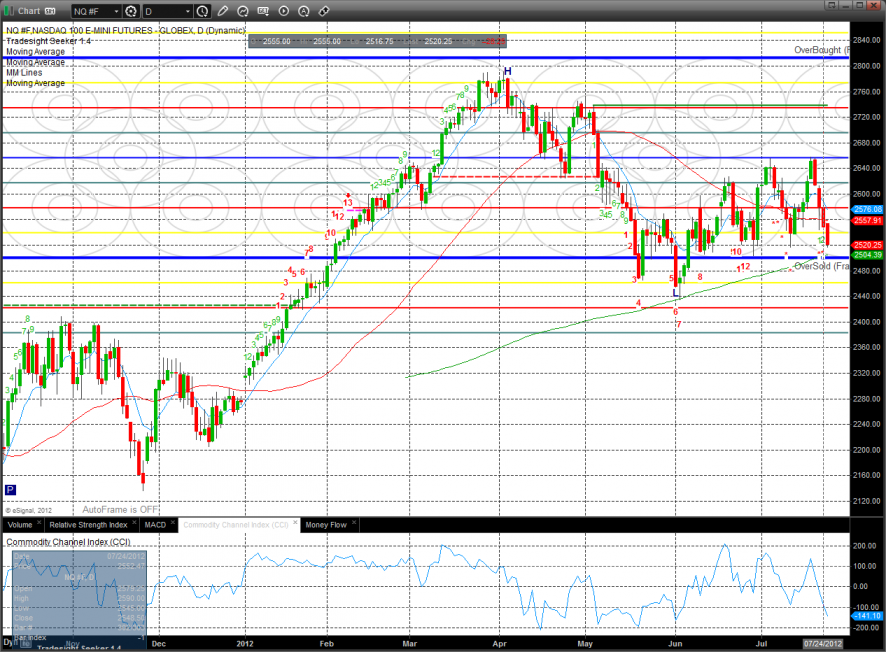

The NQ futures were lower on the day by 31 which was a parity move with the broad market. Price touched but did not break the key 0/8 support level. Keep in mind that IF the 200dma is lost then so will the 200dma. In all of the pullbacks in the current move price, both settlement and lows have been above the 200dma.

The 10-day Trin has used most of the oversold energy and has retreated to the neutral area.

The total put/call ratio remains neutral:

Multi sector daily chart:

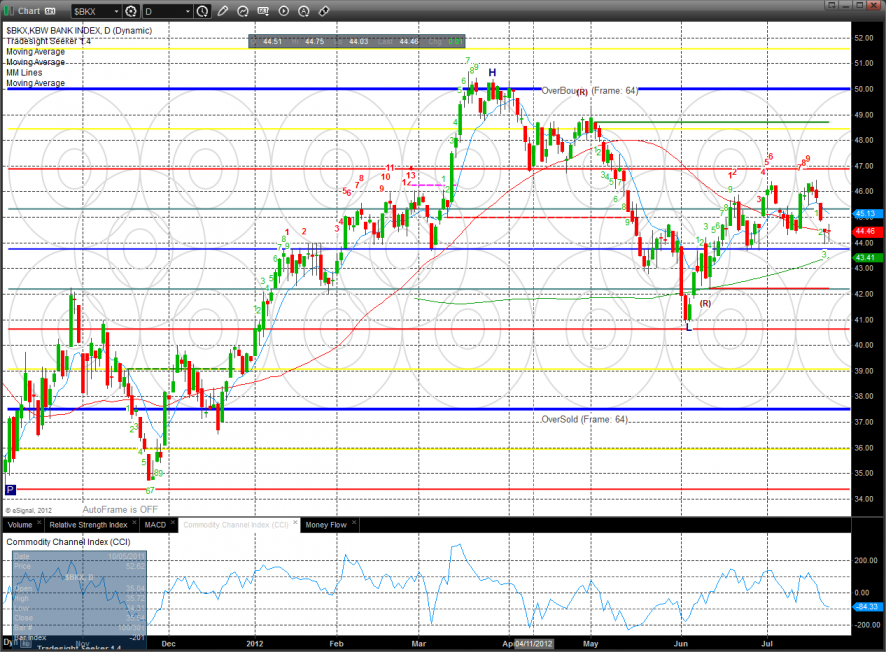

The BKX was the top gun on the day unchanged on the day and right at the 50dma.

The XAU was a good relative performer and did not produce a new low on the move.

The SOX was lower by a small amount and traded inside yesterday’s candle. A break out of the current range should have some punch.

The OSX was weak on the day but was contained within the prior candle, so yet another inside day to be resolved.

The BTK seems to be rolling over. The index was weaker than the broad market and Naz.

Oil:

Gold:

Silver:

Tradesight Market Preview for 7/25/12

The ES lost 14 on the day which didn’t feel too bad until the prior day’s range was taken out. This left the settlement right at the 50dma with next support at the 200dma.

The NQ futures were lower on the day by 31 which was a parity move with the broad market. Price touched but did not break the key 0/8 support level. Keep in mind that IF the 200dma is lost then so will the 200dma. In all of the pullbacks in the current move price, both settlement and lows have been above the 200dma.

The 10-day Trin has used most of the oversold energy and has retreated to the neutral area.

The total put/call ratio remains neutral:

Multi sector daily chart:

The BKX was the top gun on the day unchanged on the day and right at the 50dma.

The XAU was a good relative performer and did not produce a new low on the move.

The SOX was lower by a small amount and traded inside yesterday’s candle. A break out of the current range should have some punch.

The OSX was weak on the day but was contained within the prior candle, so yet another inside day to be resolved.

The BTK seems to be rolling over. The index was weaker than the broad market and Naz.

Oil:

Gold:

Silver:

Stock Picks Recap for 7/24/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WPRT and SPRD gapped over their long triggers, no plays. CSCO gapped under its short trigger. No other triggers.

In the Messenger/Twitter, Rich's VMW triggered long (without market support) and didn't work:

His AAPL triggered short (with market support) and worked:

His BIDU triggered long (without market support) and worked great:

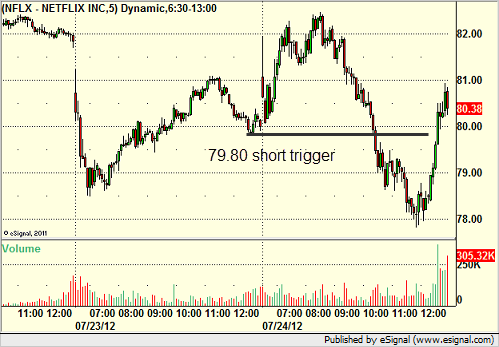

NFLX triggered short (with market support) and worked:

GOOG triggered short (with market support) and worked:

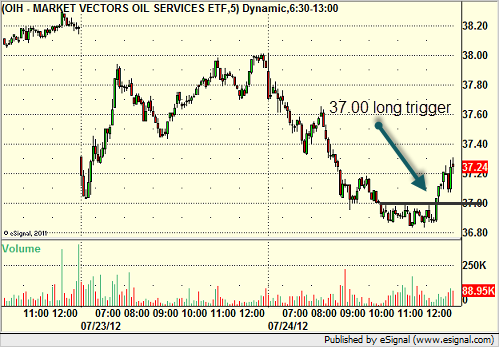

Rich's OIH triggered long (ETF, so no market support needed) and worked:

His RCII triggered long (without market support) and worked:

AAPL triggered short (with market support) and worked enough for a partial:

AMZN triggered short (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, all 6 of them worked, at least enough for a partial. Only two did much beyond that.