Stock Picks Recap for 7/24/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WPRT and SPRD gapped over their long triggers, no plays. CSCO gapped under its short trigger. No other triggers.

In the Messenger/Twitter, Rich's VMW triggered long (without market support) and didn't work:

His AAPL triggered short (with market support) and worked:

His BIDU triggered long (without market support) and worked great:

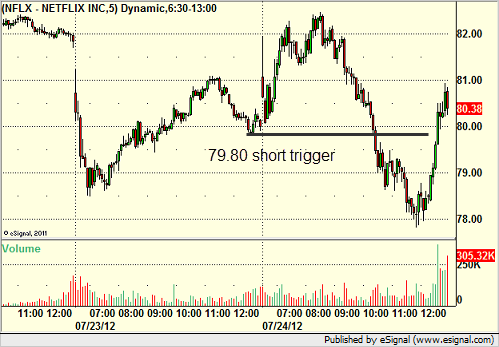

NFLX triggered short (with market support) and worked:

GOOG triggered short (with market support) and worked:

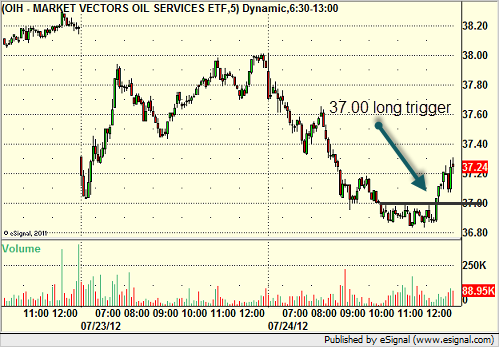

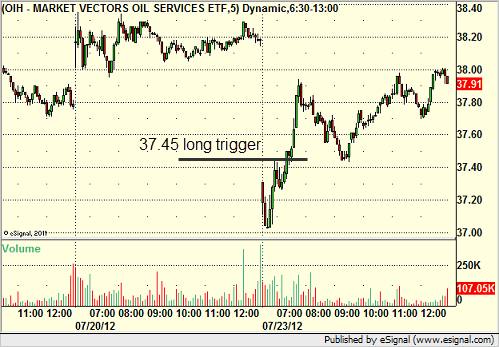

Rich's OIH triggered long (ETF, so no market support needed) and worked:

His RCII triggered long (without market support) and worked:

AAPL triggered short (with market support) and worked enough for a partial:

AMZN triggered short (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, all 6 of them worked, at least enough for a partial. Only two did much beyond that.

Futures Calls Recap for 7/24/12

We had an ES trade that worked, an NQ trade that didn't, and then an NQ trade later that worked for a couple of ticks before I closed it out for lack of action. See both sections below.

Net ticks: -2.5 ticks.

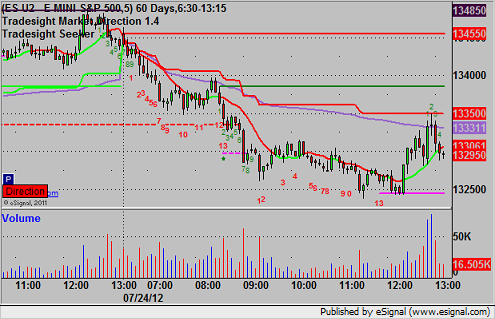

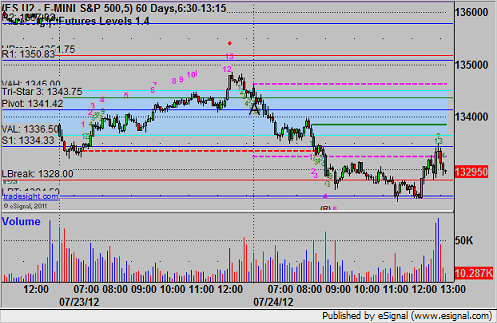

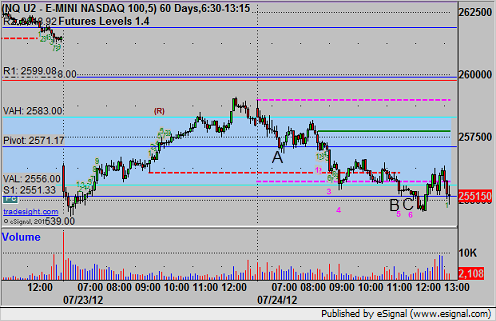

As usual, let's start out by looking at the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

Mark's trade triggered short at A at 1342.00, hit first target for 6 ticks, and then stopped the second half over the entry, just barely, before pushing lower. Just missed a bigger trade on that one:

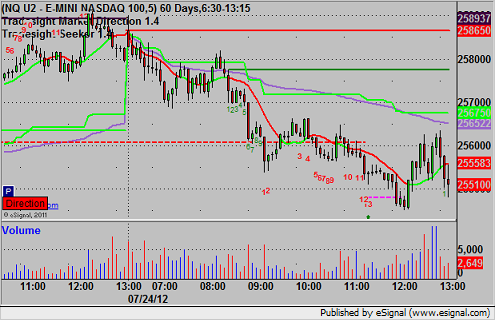

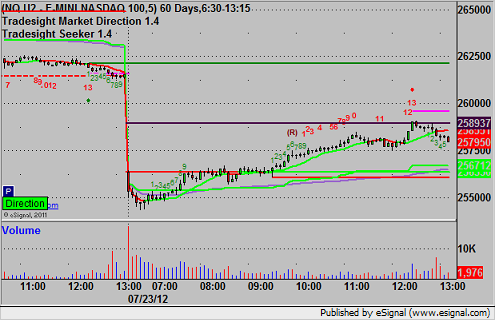

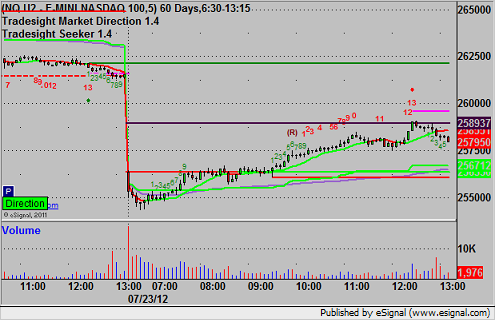

NQ:

Remember that on the NQ, we use half points as ticks.

Early triggered under the Pivot at A stopped for 7 ticks. Later, we set the S1 at B, called the short under it that triggered at C, and closed it out for 2 ticks when it took 15 minutes to do nothing (and then it proceeded to go):

Forex Calls Recap for 7/24/12

One stop out on the GBPUSD. See that section below. Fairly slow session with light range.

New calls and Chat tonight. Slow week so far.

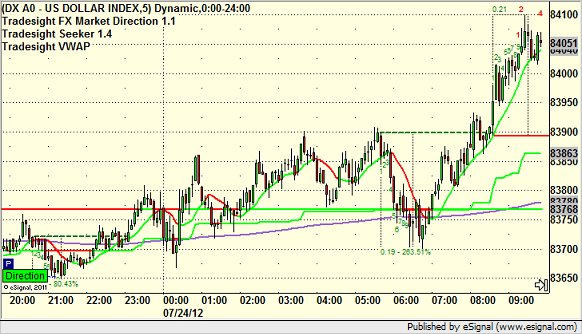

Here's the US Dollar Index intraday with our market directional lines:

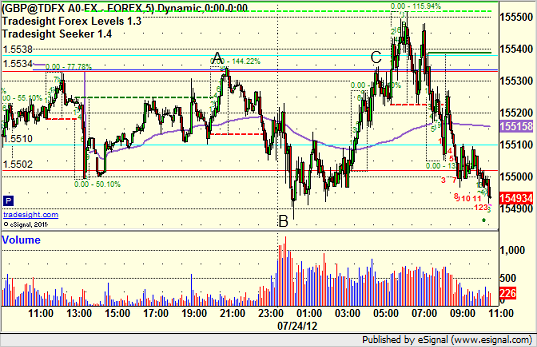

GBPUSD:

Usually, when the market addresses both our short and long entries, it breaks one or the other and we end up with a winner. You know you have the right triggers when the market comes up and tests them. In this case, the GBPUSD tested our long entry at A, then went down to test our short entry (under 1.5485) at B exactly. Unfortunately, in this case, we then triggered long at C and stopped for 25 pips:

Tradesight Market Overview for 7/24/12

The ES lost 15 on the day but managed to post a camouflage buy signal by settling above the open. Price remains in the upward regression channel. The camouflage signal implies that the ES will take out Monday’s high before the low.

The NQ was lower by 34 on the day but like the SP side settled with a camo buy signal with the same implications.

Interestingly the 10-day Trin worked lower on the day but still has oversold energy in it.

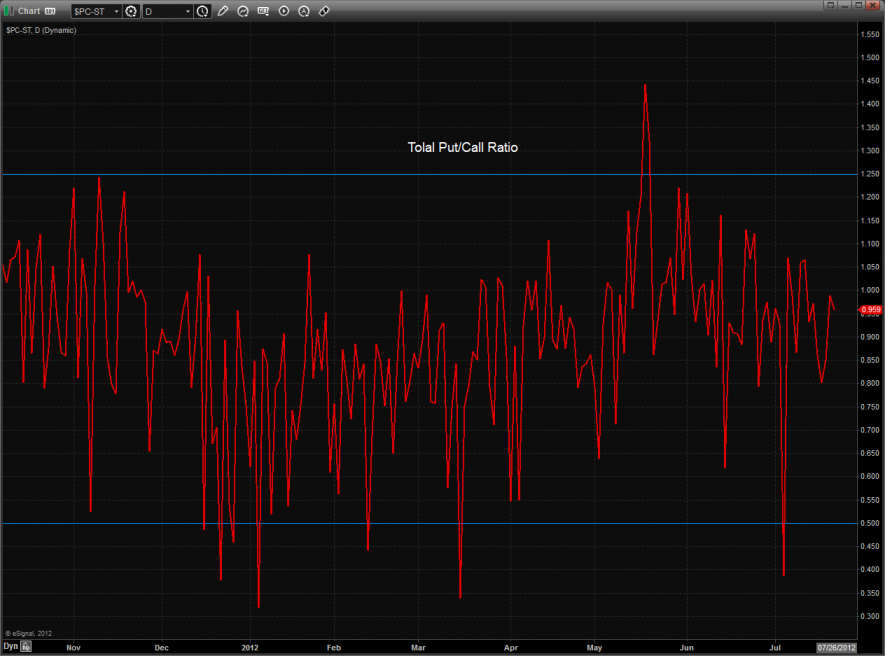

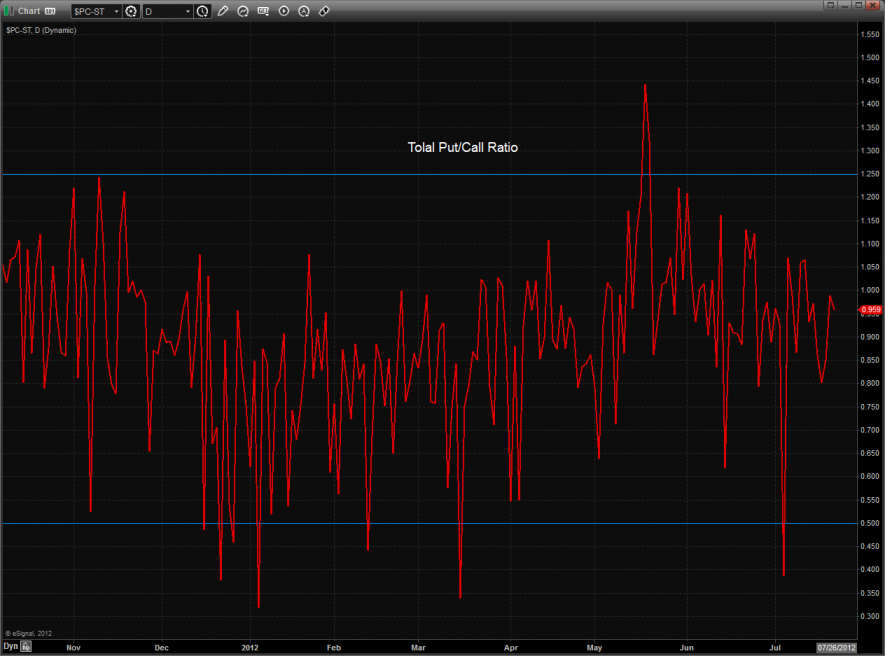

The total put/call ratio is neutral.

Multi sector daily chart:

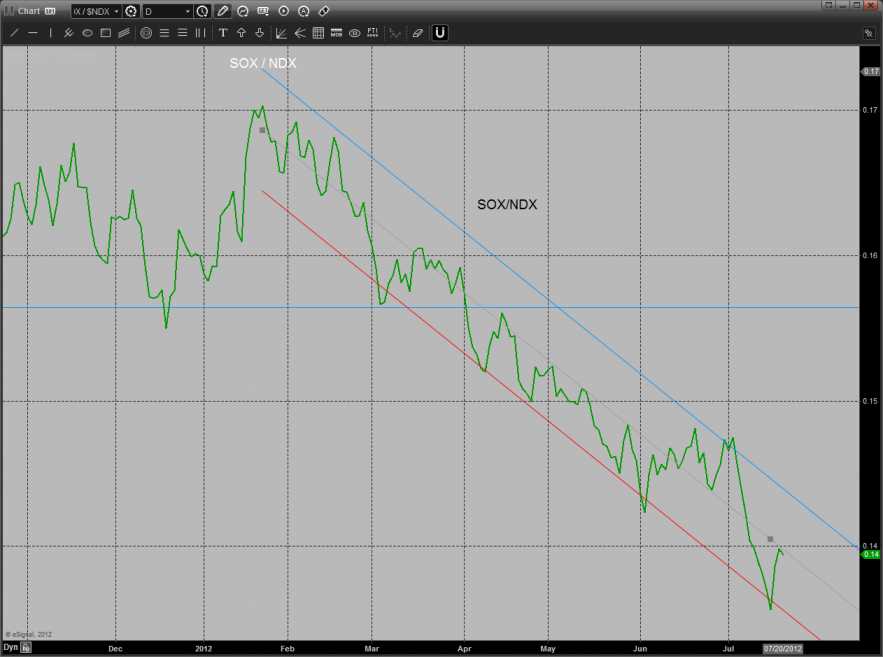

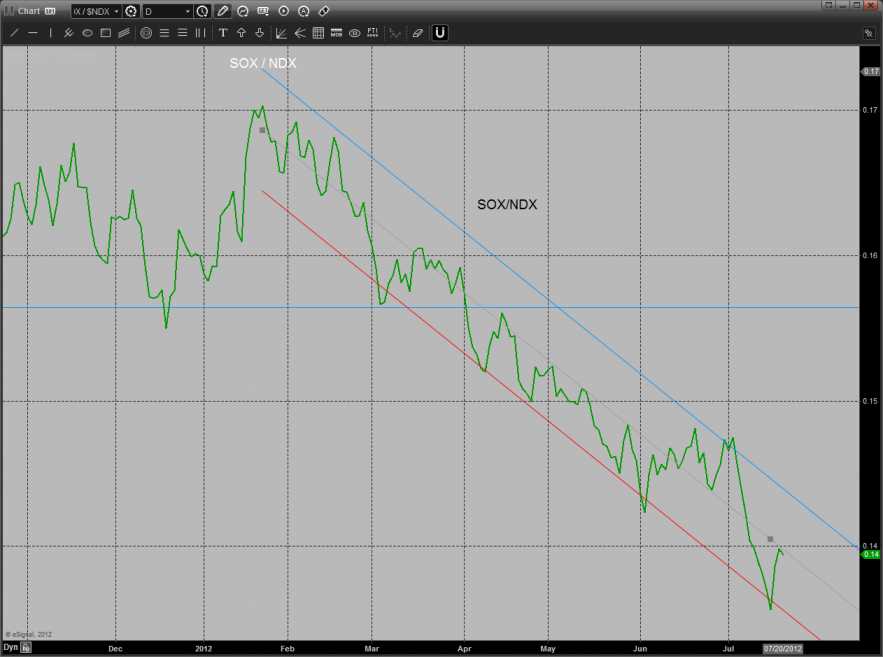

The Sox/Ndx cross has bounced off the lower regression channel and has more room to nit the top and is back to the midpoint of the range. Keep a close eye on a break back above the midpoint which would be the first step for a real reversal.

The weekly Dow/gold cross is very slowly making progress. The ultimate breakout remains the upper regression channel.

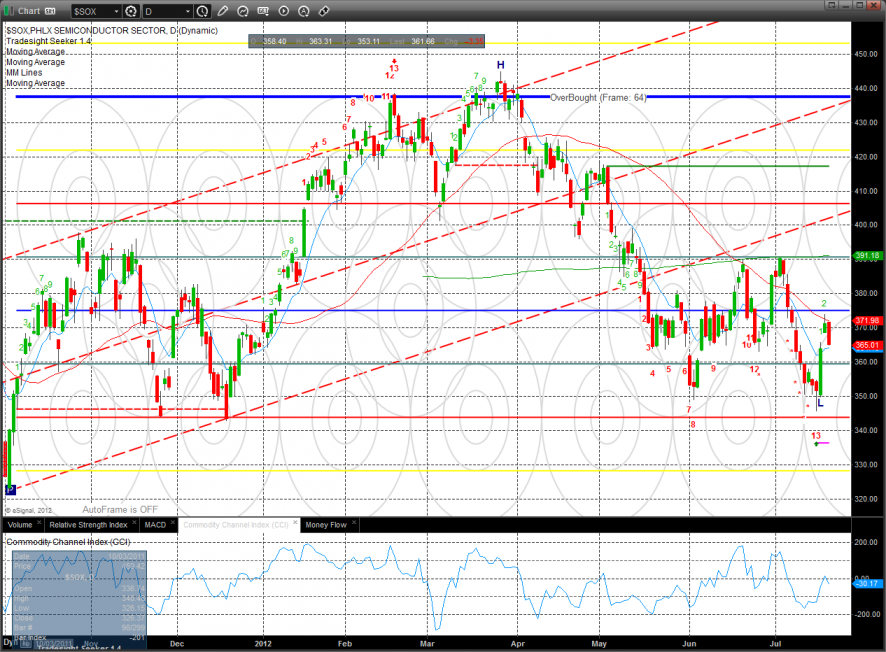

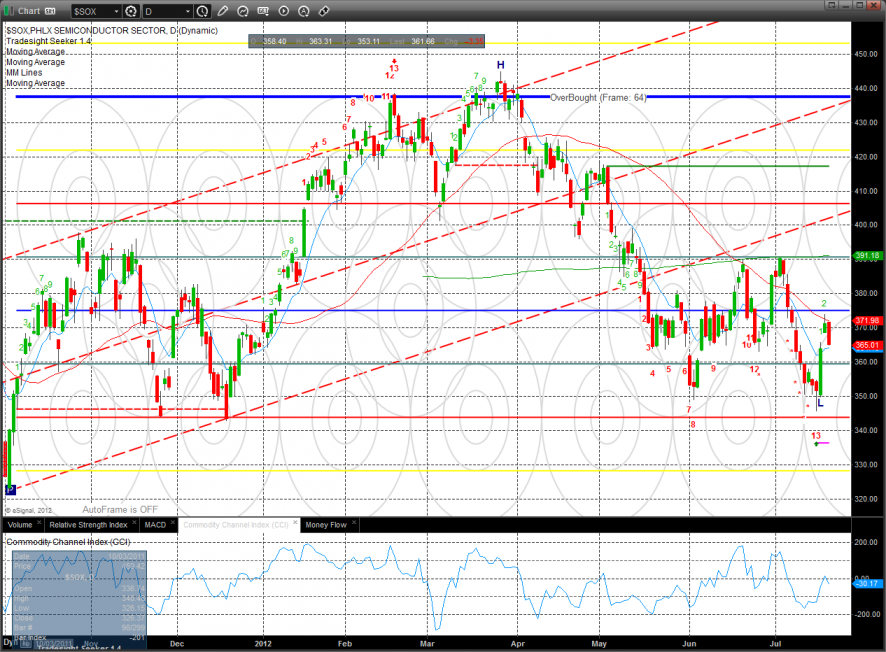

The SOX filled the dirty gap and still has an active Seeker exhaustion in place.

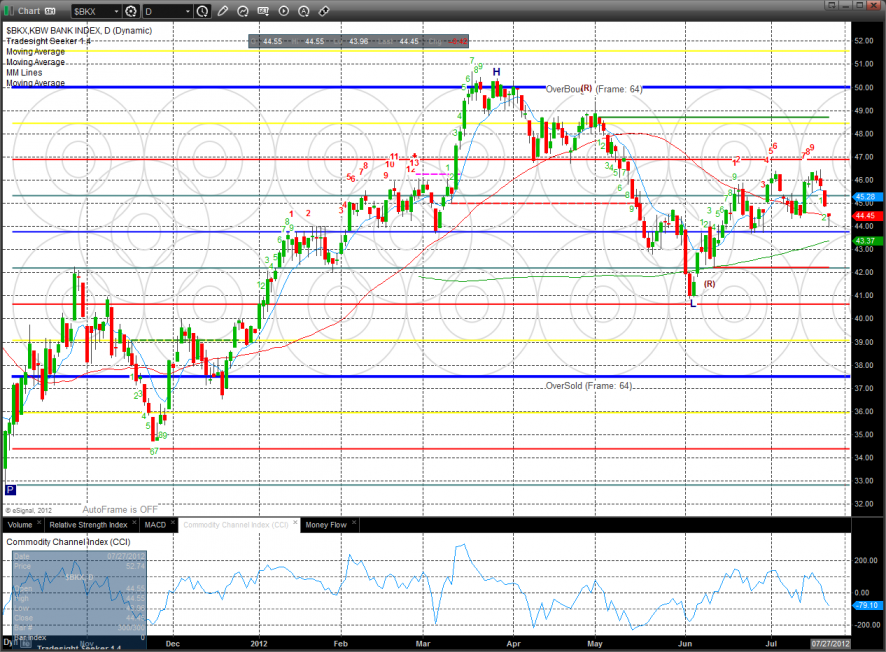

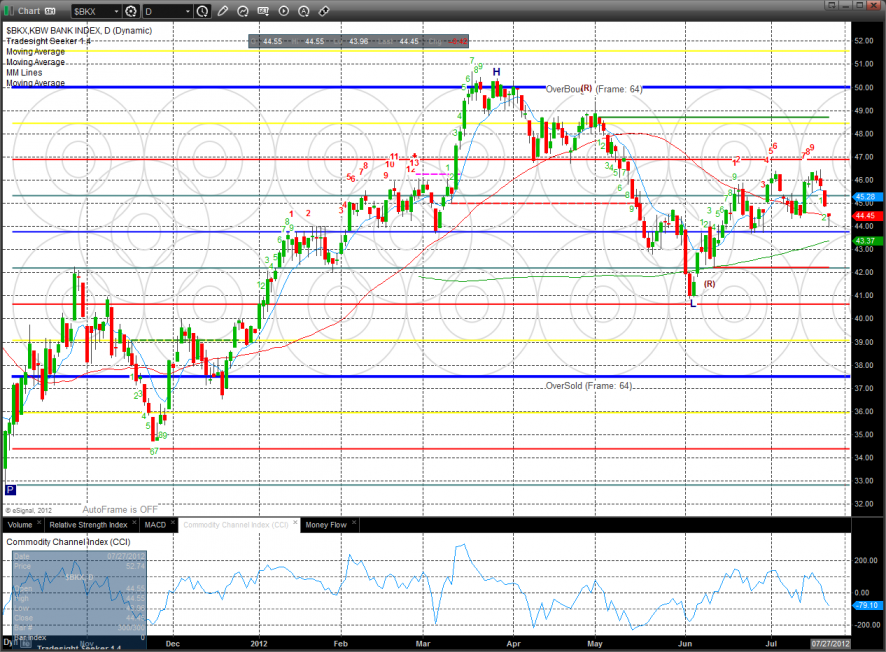

The BKX closed right at the 50dma.

The BTK is retreating the overbought 9/8 level. Expect support at the 50dma.

The XAU was the last laggard on the day but did not make a new low on the move. The CCI suggests that the reduced selling pressure could produce a double bottom. Stay tuned.

The TLT put in what could be a very important range high camouflage sell signal. Keep in mind the Seeker sell signal is still active.

Oil:

Gold:

Silver:

Tradesight Market Overview for 7/24/12

The ES lost 15 on the day but managed to post a camouflage buy signal by settling above the open. Price remains in the upward regression channel. The camouflage signal implies that the ES will take out Monday’s high before the low.

The NQ was lower by 34 on the day but like the SP side settled with a camo buy signal with the same implications.

Interestingly the 10-day Trin worked lower on the day but still has oversold energy in it.

The total put/call ratio is neutral.

Multi sector daily chart:

The Sox/Ndx cross has bounced off the lower regression channel and has more room to nit the top and is back to the midpoint of the range. Keep a close eye on a break back above the midpoint which would be the first step for a real reversal.

The weekly Dow/gold cross is very slowly making progress. The ultimate breakout remains the upper regression channel.

The SOX filled the dirty gap and still has an active Seeker exhaustion in place.

The BKX closed right at the 50dma.

The BTK is retreating the overbought 9/8 level. Expect support at the 50dma.

The XAU was the last laggard on the day but did not make a new low on the move. The CCI suggests that the reduced selling pressure could produce a double bottom. Stay tuned.

The TLT put in what could be a very important range high camouflage sell signal. Keep in mind the Seeker sell signal is still active.

Oil:

Gold:

Silver:

Stock Picks Recap for 7/23/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BPOP triggered short (with market support) and didn't work:

The other three gapped past their triggers.

In the Messenger, Rich's BIDU triggered short (with market support) and worked:

His CELG triggered long (with market support) and worked:

His OIH triggered long (ETF, so no market support needed) and worked:

His SOXX triggered long (ETF, so no market support needed) and worked:

His BIDU triggered long (with market support) and worked enough for a partial:

AMZN triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Futures Calls Recap for 7/23/12

Started out the week with an ES call that turned into a gain using our market directional tool. See that section below.

Net ticks: +8 ticks.

As usual, let's start by looking at the ES and NQ with our market directional lines, Seeker, and VWAP:

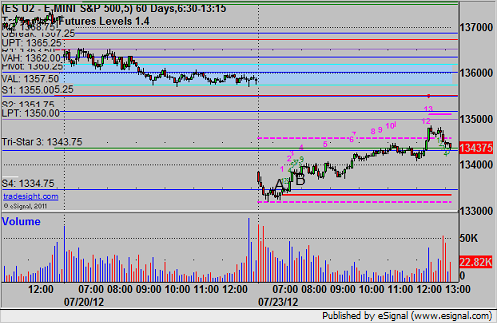

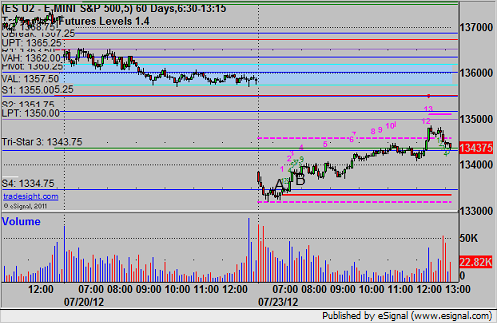

ES:

Triggered long over the early midpoint at A at 1335.50, hit first target for six ticks, raised stop and stopped at 1338.00 at B:

Futures Calls Recap for 7/23/12

Started out the week with an ES call that turned into a gain using our market directional tool. See that section below.

Net ticks: +8 ticks.

As usual, let's start by looking at the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

Triggered long over the early midpoint at A at 1335.50, hit first target for six ticks, raised stop and stopped at 1338.00 at B:

Forex Calls Recap for 7/23/12

The market gapped and I didn't like the setups that I was seeing, particularly back for weakness in the USD. Fortunately, that wasn't the direction that we headed anyway. I put in a short idea which triggered and stopped, see EURUSD below with some notes.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight. Back to normal after the gap hopefully.

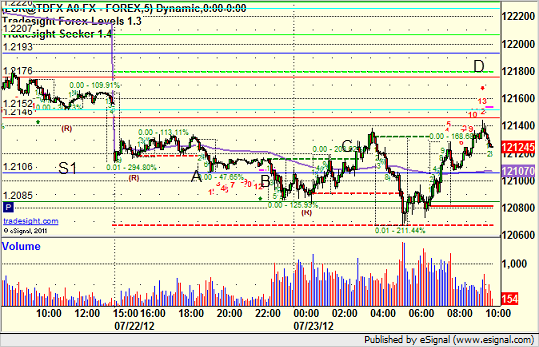

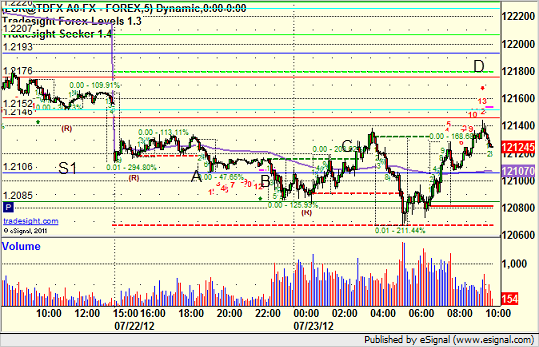

EURUSD:

Set the S1 level exactly at A, triggered short at B, stopped at C. Note that the high of the session was the Seeker 13 sell signal at D:

Forex Calls Recap for 7/23/12

The market gapped and I didn't like the setups that I was seeing, particularly back for weakness in the USD. Fortunately, that wasn't the direction that we headed anyway. I put in a short idea which triggered and stopped, see EURUSD below with some notes.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight. Back to normal after the gap hopefully.

EURUSD:

Set the S1 level exactly at A, triggered short at B, stopped at C. Note that the high of the session was the Seeker 13 sell signal at D: