Stock Picks Recap for 7/20/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

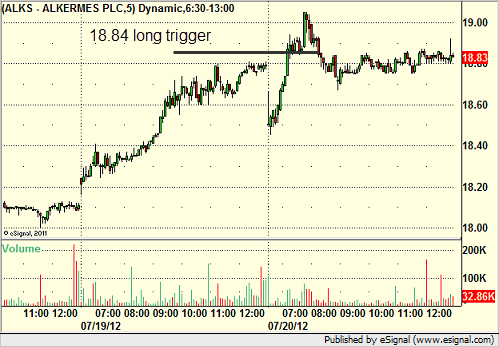

From the report, ALKS triggered long (with market support) and worked enough for a partial:

In the Messenger/Twitter, Rich's CMG triggered long (with market support) and didn't work:

His AMZN triggered long (with market support) and worked:

His GOOG triggered short (without market support) and worked:

His ISRG triggered short (with market support) and worked:

His NTAP triggered long (with market support) and worked:

His CMG triggered short (with market support) and worked (after the long didn't, this worked for a few points):

His LULU triggered short (with market support) and worked:

His GS triggered short (with market support) and didn't work:

His RGLD triggered long (without market support) and didn't work:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

Futures Calls Recap for 7/20/12

Options expiration is never an exciting day and is usually a good time to lower trading size, and this was no exception. We closed out the week with the only negative day of the week, with one ES short that triggered twice and stopped both times. See that section below.

Net ticks: -14 ticks.

As usual, we'll start with a look at the ES and NQ with our market directional lines, Seeker, and VWAP:

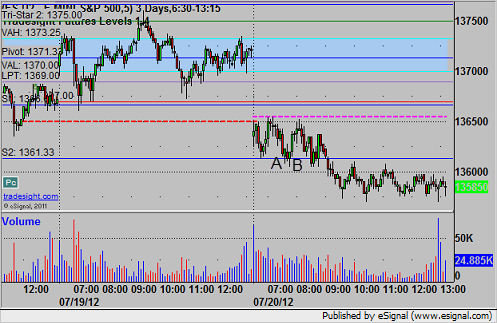

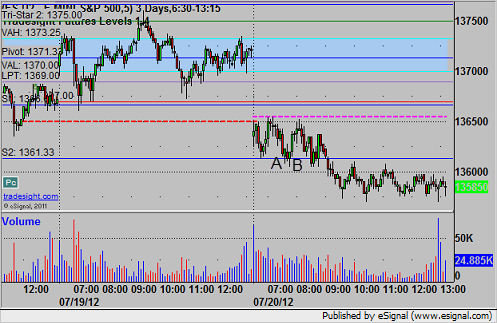

ES:

Triggered short at A at 1361.00 and stopped for 7 ticks. Retriggered again at A ten minutes later. Further triggers were cancelled:

Futures Calls Recap for 7/20/12

Options expiration is never an exciting day and is usually a good time to lower trading size, and this was no exception. We closed out the week with the only negative day of the week, with one ES short that triggered twice and stopped both times. See that section below.

Net ticks: -14 ticks.

As usual, we'll start with a look at the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

Triggered short at A at 1361.00 and stopped for 7 ticks. Retriggered again at A ten minutes later. Further triggers were cancelled:

Forex Calls Recap for 7/20/12

One final winner to close out the week. See EURUSD below.

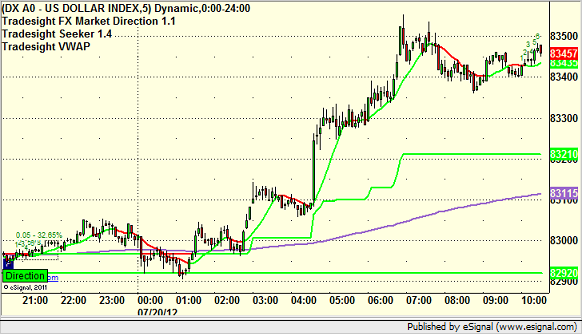

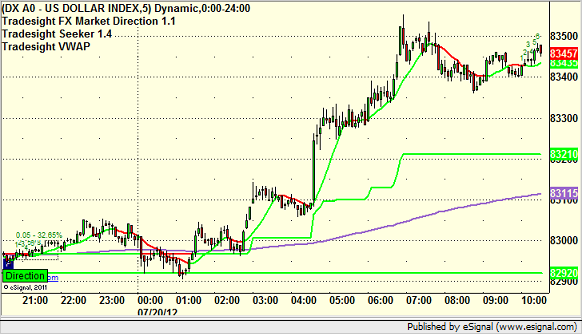

Here's the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts with the Seeker and Comber separately heading into the new week (see AUSDUSD in particular), and then glance at the US Dollar Index.

Calls resume Sunday evening, and I will be back in Phoenix.

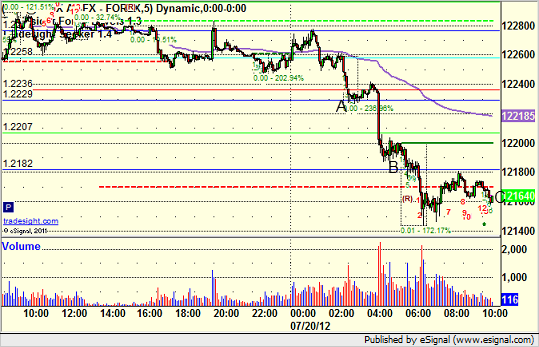

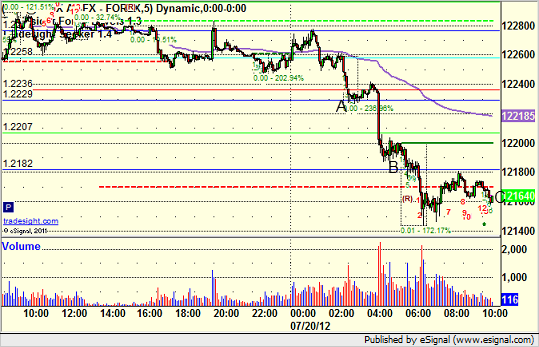

EURUSD:

Triggered short at A, hit first target at B, closed final piece at C for end of week and almost 70 pips:

Forex Calls Recap for 7/20/12

One final winner to close out the week. See EURUSD below.

Here's the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts with the Seeker and Comber separately heading into the new week (see AUSDUSD in particular), and then glance at the US Dollar Index.

Calls resume Sunday evening, and I will be back in Phoenix.

EURUSD:

Triggered short at A, hit first target at B, closed final piece at C for end of week and almost 70 pips:

Stock Picks Recap for 7/19/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SFLY gapped over the trigger, no play.

SNPS triggered long (with market support) and didn't work:

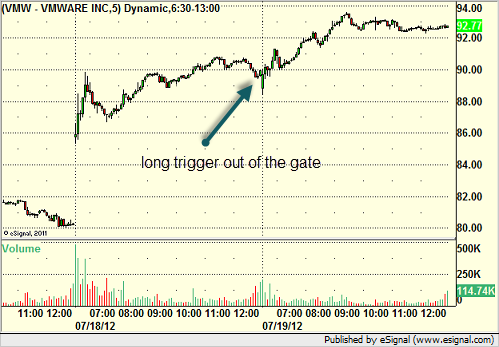

From the Messenger, Rich's VMW triggered long "for gap fill and upside continuation" (without market support due to opening five minutes) and worked great:

His GS triggered short (with market support) and worked:

His CMCSA triggered long (with market support) and worked:

His WYNN triggered short (without market support) and didn't work:

His PXD triggered long (with market support) and worked:

His SINA triggered long (with market support) and didn't work:

His PPG triggered short (with market support) and didn't work:

His TNA triggered short (ETF, so no market support needed) and worked:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Futures Calls Recap for 7/19/12

Several calls early, but it was the ES short that triggered and worked. See that section below.

Net ticks: +4.5 ticks.

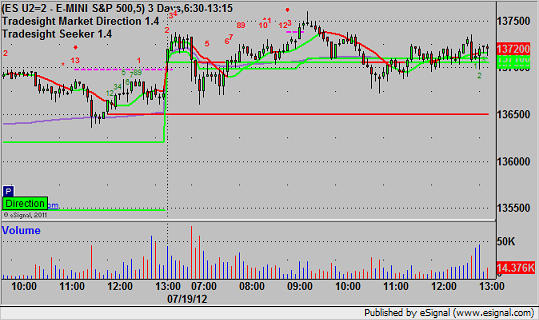

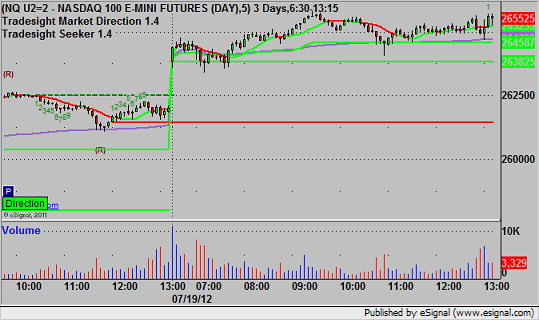

As usual, we will start with the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

Triggered short at A at 1369.25, hit first target for 6 ticks, and stopped final piece at 1368.50:

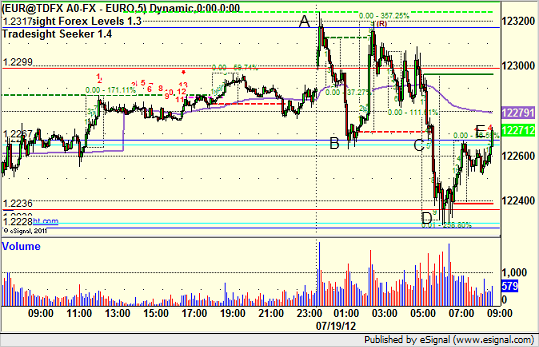

Forex Calls Recap for 7/19/12

EURUSD:

Triggered long over R1 at A and stopped. One piece of the short triggered at V and stopped, but the rest triggered at C, hit first target at D, and stop was moved over entry and stopped at E:

Stock Picks Recap for 7/18/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

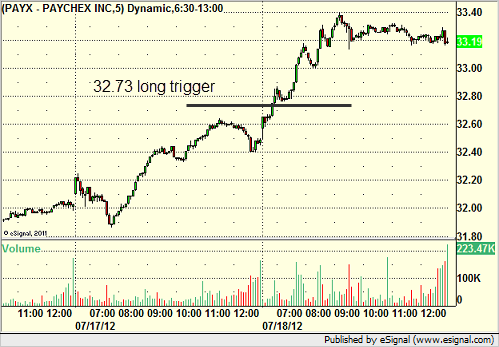

From the report, PAYX triggered long (with market support) and worked:

THOR triggered long (without market support due to opening five minutes) and worked a little:

IBKR gapped under the trigger, no play.

In the Messenger, Rich's ALTR triggered long (with market support) and worked great:

AMZN triggered long (with market support) and didn't work:

Rich's SNDK triggered long (with market support) and didn't work, although worked later:

His NTAP triggered long (with market support) and worked:

His VXX triggered short (ETF, so no market support needed) and didn't work:

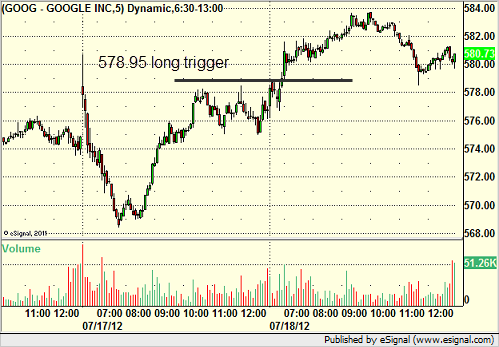

GOOG triggered long (with market support) and worked:

Rich's OIH triggered long (ETF, so no market support needed) and worked:

His VMW triggered long (with market support) and worked:

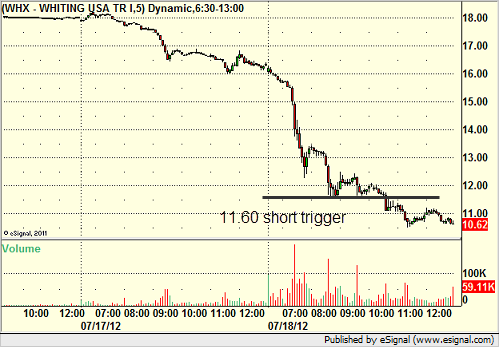

His WHX triggered short (without market support) and worked:

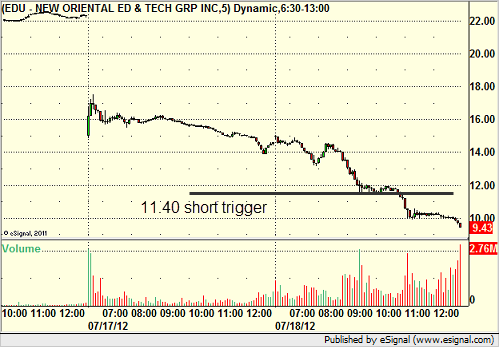

His EDU triggered short (without market support) and worked great:

In total, that's 9 trades triggering with market support, 6 of them worked, 3 did not.

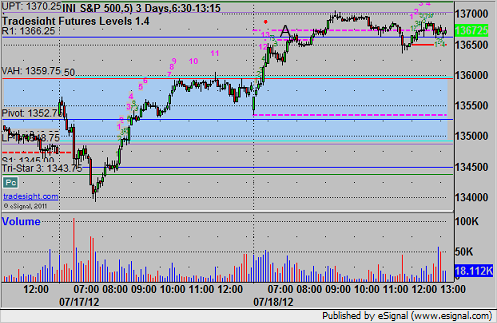

Futures Calls Recap for 7/18/12

A winner on the NQ and a loser on the ES resulted in net gains again in the session. See both sections below for their recaps.

Net ticks: +4.5 ticks.

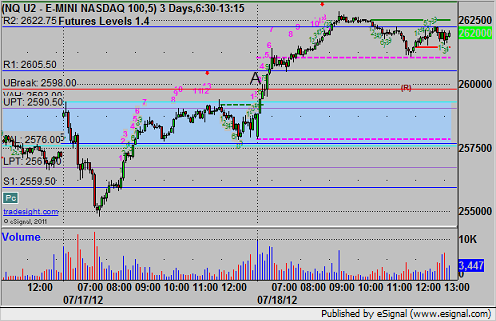

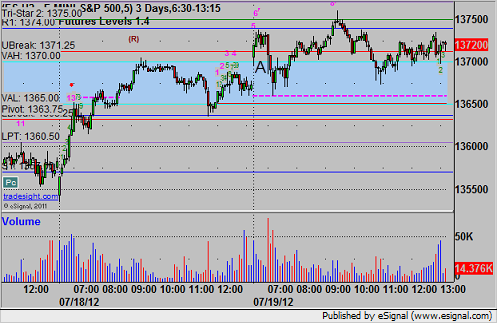

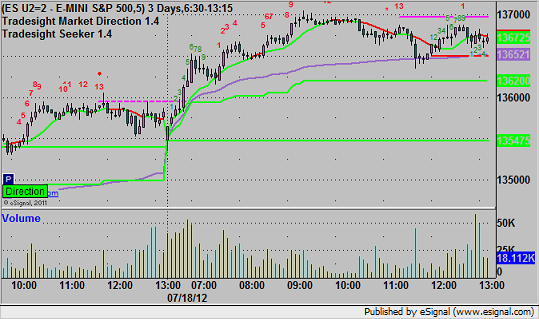

As usual, let's start by looking at the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

Triggered long at 1366.50 at A and stopped for 7 ticks:

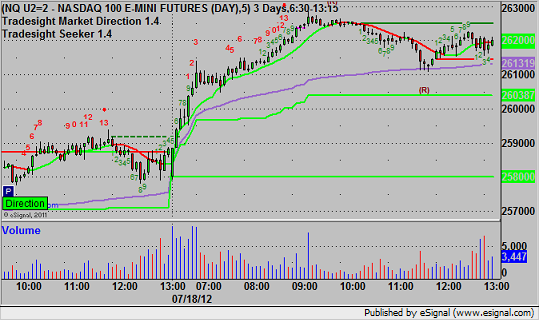

NQ:

Triggered long at 2600.00 at A and hit first target for 6 ticks. Stop was raised a couple of times and finally stopped the second half at 2608.50 for 17 ticks: