Tradesight Market Preview for 7/19/12

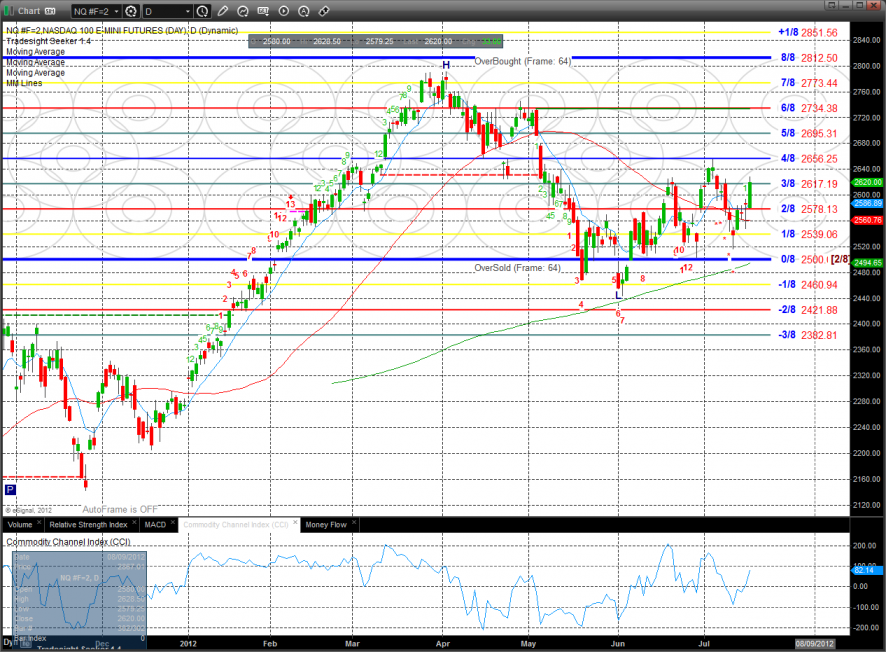

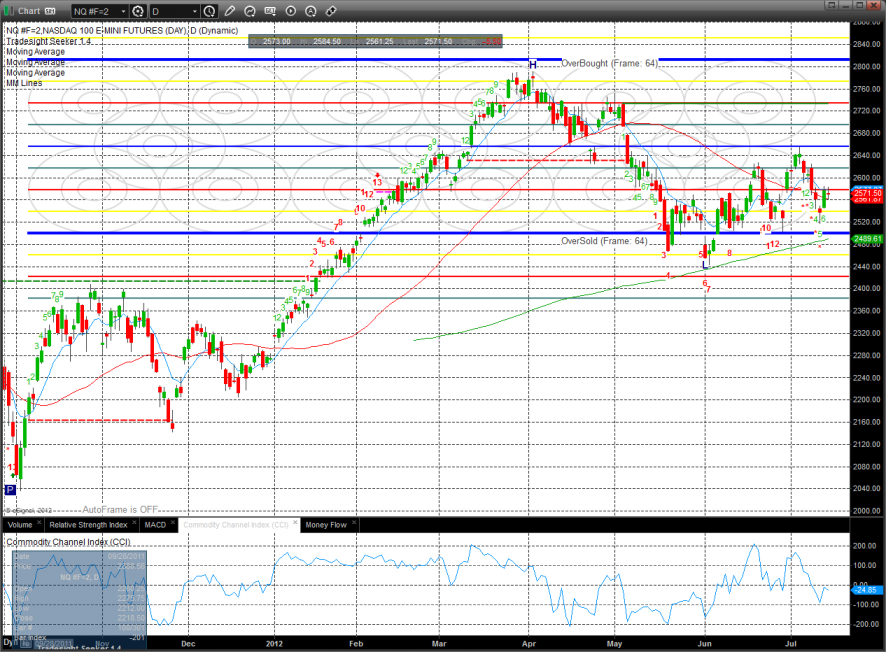

The NQ futures were higher on the day by 33 handles easily topping the relative performance from the SP side of the market. Price settled just below the prior high water mark on the move. The next critical overhead that will come into play is the 4/8 Murrey math level.

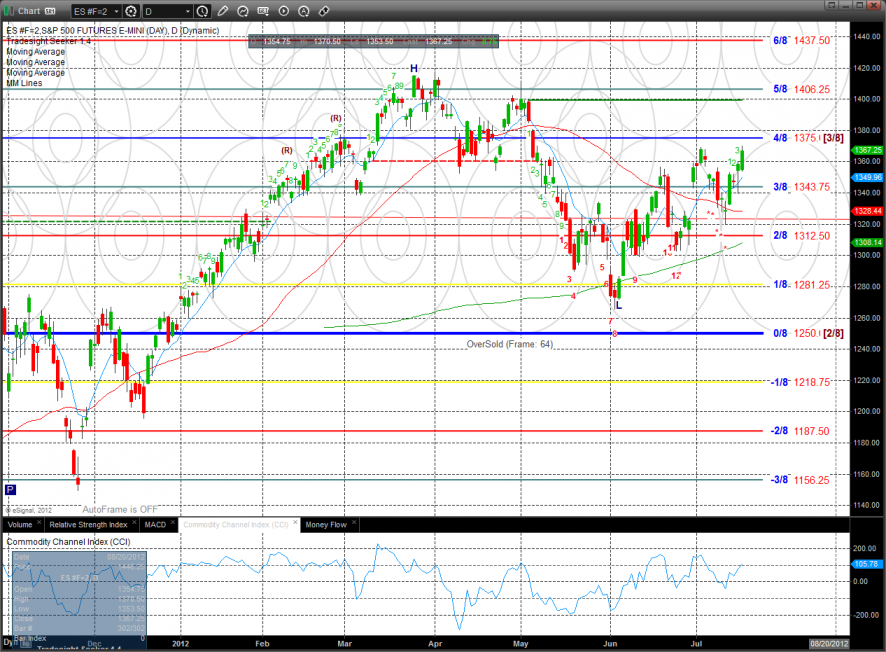

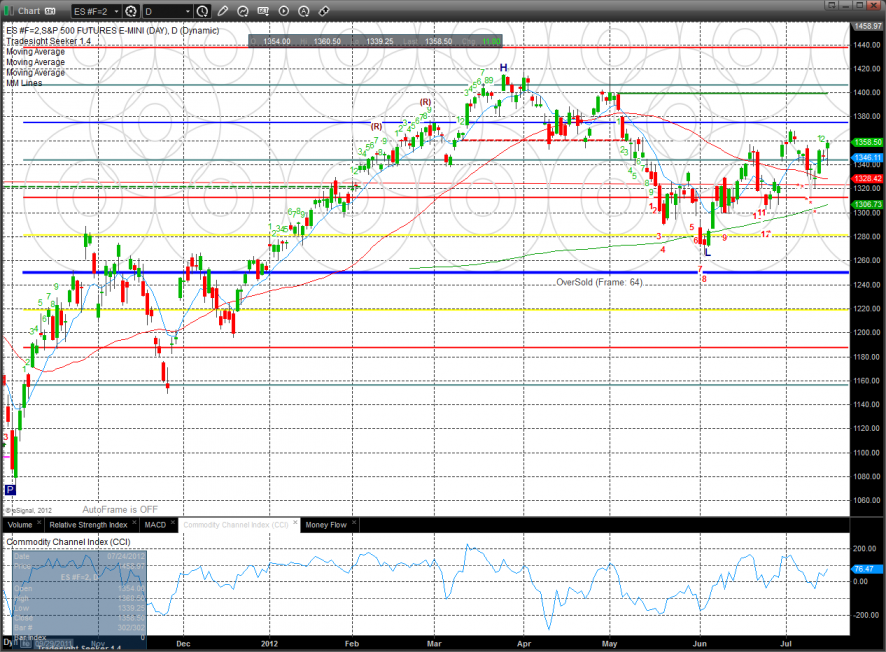

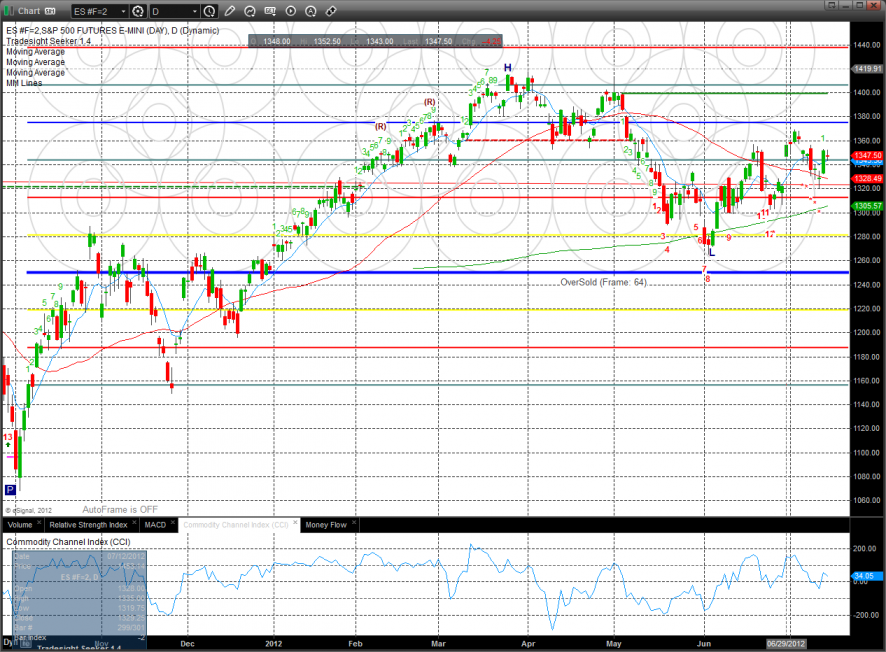

The ES was higher by 9 on the day and is in a very similar technical condition to the NQ. The Naz has been trailing the SP side so an overall bullish move in the market will need to have the Naz side get involved.

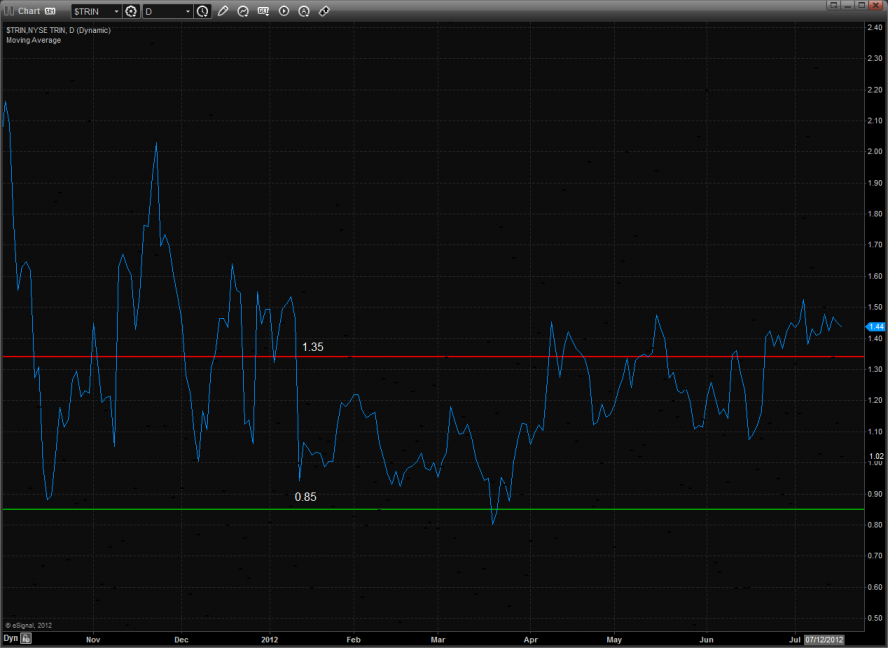

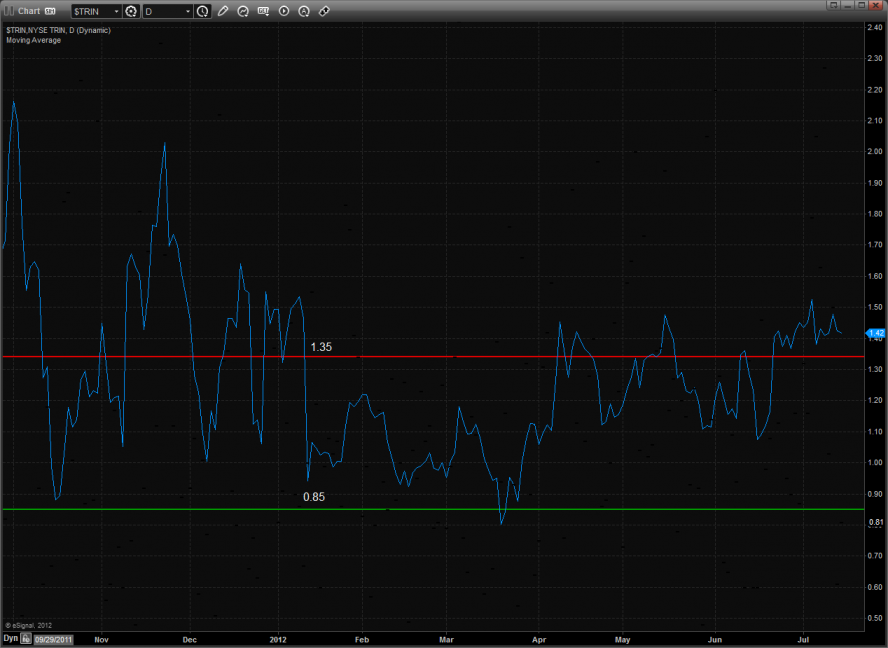

The 10-day Trin still has oversold energy:

Multi sector daily chart:

The Dow/gold ratio is on the verge of a bullish breakout. This means that investors are favoring equities over the defensive alternate asset gold.

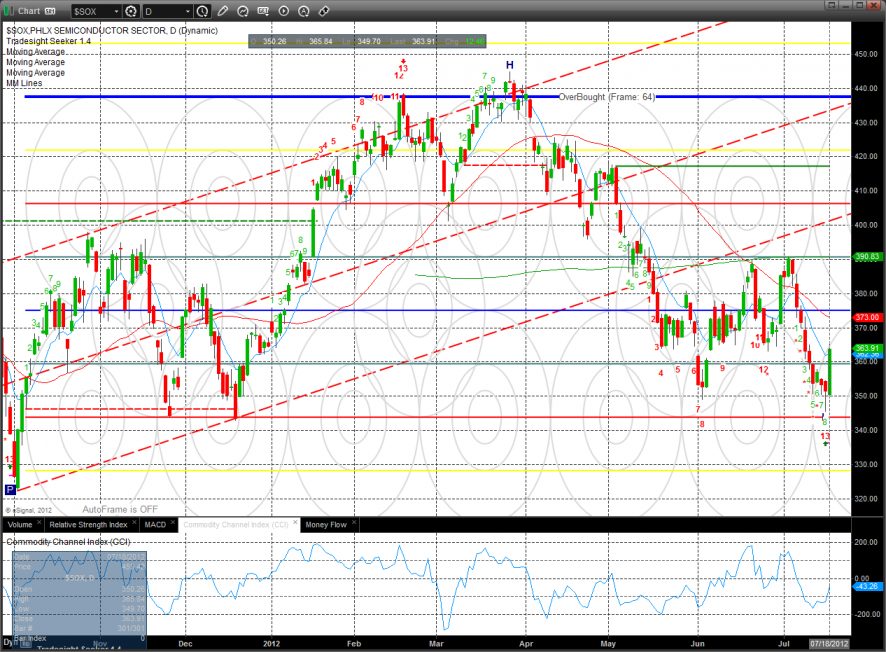

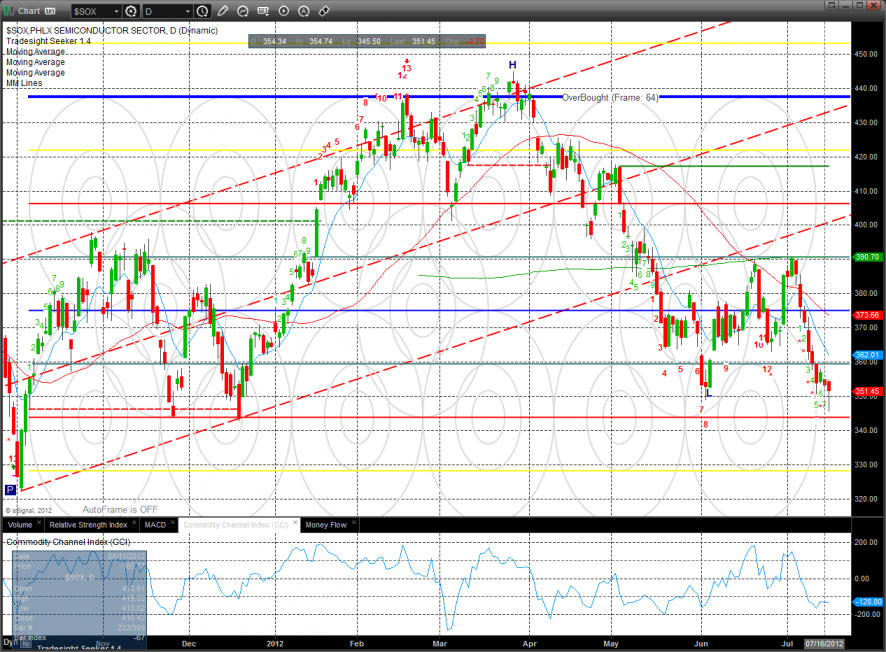

The Sox was the top gun on the day making good on the Seeker exhaustion signal put in place yesterday. Keep a list of long ideas handy and be ready to be aggressive on Friday after a measuring day Thursday.

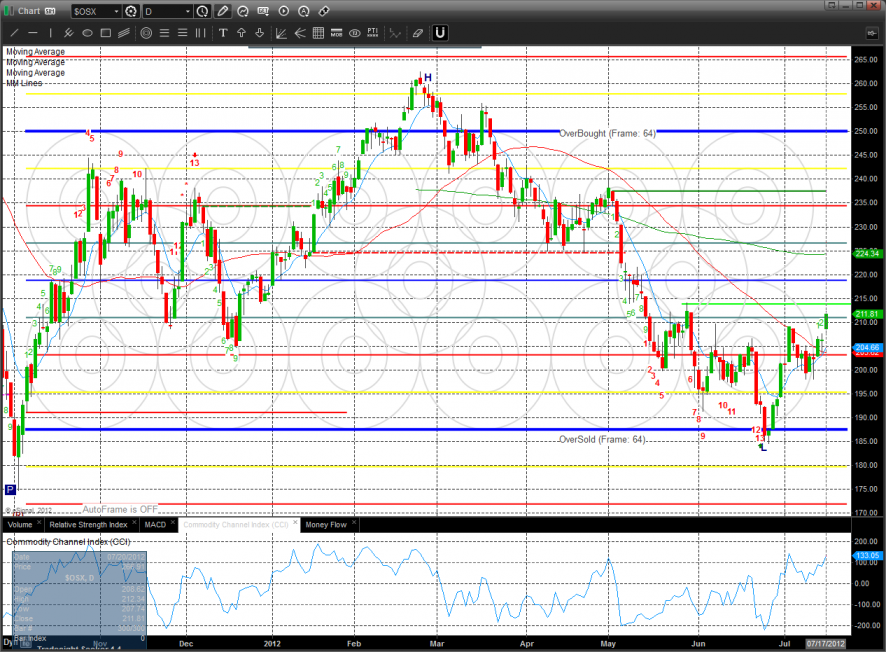

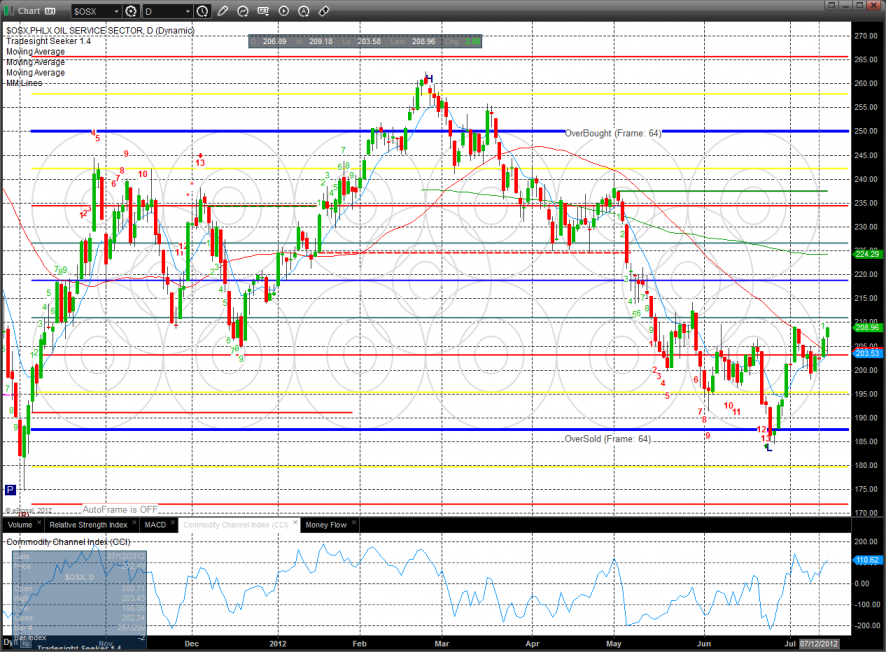

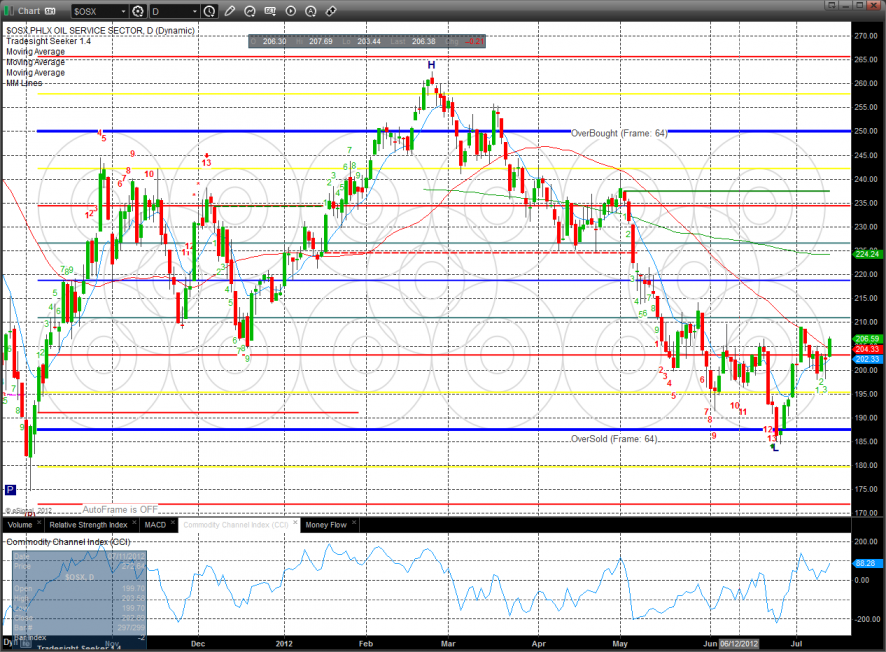

The OSX is approaching the neckline of a reverse H&S pattern. Be patient and wait for it to setup.

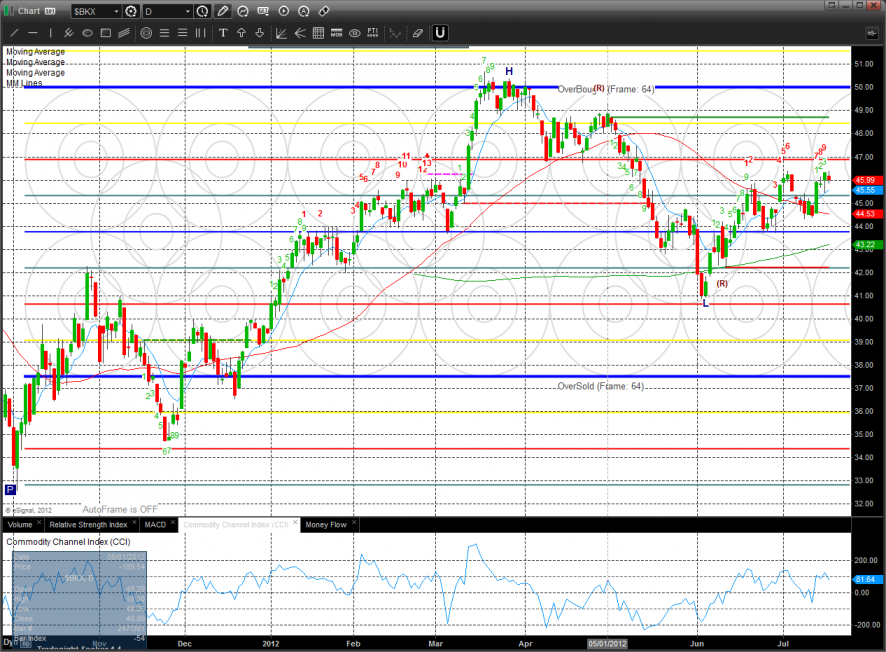

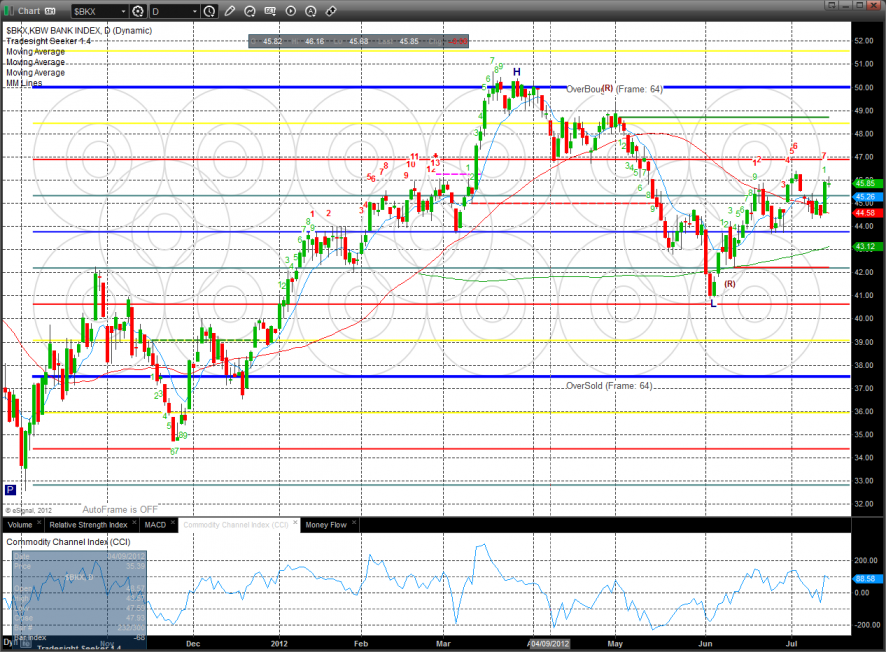

The BKX was weak all day and was the big drag on the relative performance of the SP Wednesday. The trend remains positive but note that the CCI is diverging which is a warning for the bulls.

The defensive XAU was the last laggard on the day and is now 9 bars down in the Seeker setup phase. Possible lateral consolidation or bounce in the next couple of trading days should be in the cards.

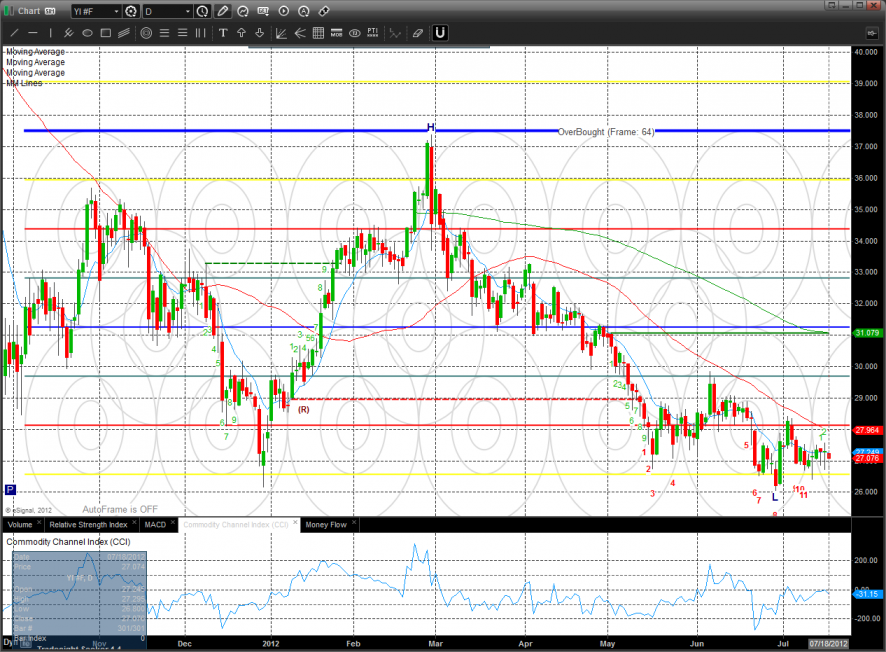

Oil:

Gold:

Silver:

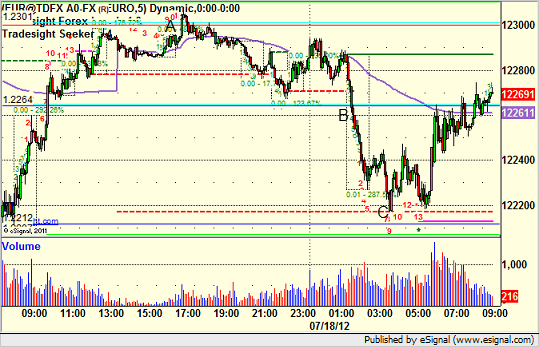

Forex Calls Recap for 7/18/12

An early half-size trigger that stopped and a normal session trigger that hit the first target, both on the EURUSD. See that section below.

New calls and Chat tonight.

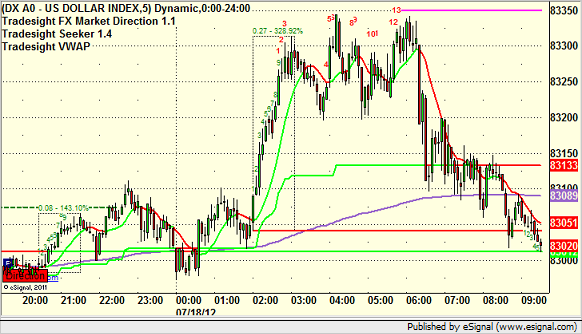

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long very early (half size) at A and stopped. Triggered short at B, hit first target at C, final piece stopped over the entry at D. Remember that when the distance between the first target and entry level is greater than 50 pips, we're only looking to stagger our exits in the 45-50 pip range per the course:

Tradesight Market Preview for 7/18/12

The ES was higher on the day by 11 which produced a settlement above the Friday and Monday high. Price has made good on a measuring day breakout and is now above all the major moving averages.

The NQ futures lagged the broad market but managed to gain 16 on the day. The one bogey on the chart is that today’s settlement was below the open which makes a camouflage sell signal.

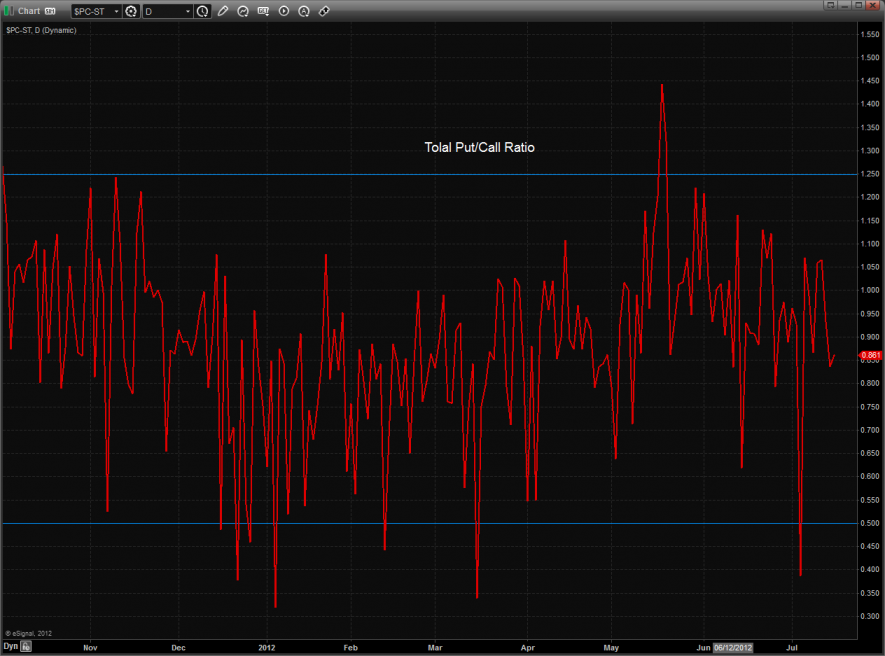

The total put/call ratio remains neutral:

The 10-day Trin still has oversold energy:

Multi sector daily chart:

The Dow/gold ratio is moving closer to upper channel boundary.

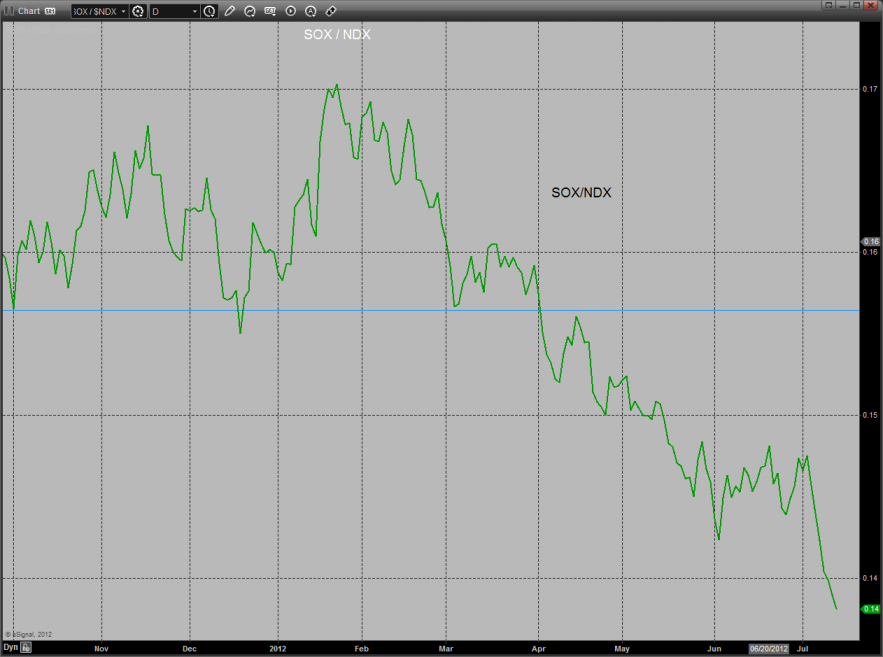

The NDX is bearishly losing its relative strength vs. the SPX. This is a chart to watch closely.

The OSX was the top gun on the day and is very close to qualifying the recent higher low. Keep in mind that there is still an active seeker buy signal.

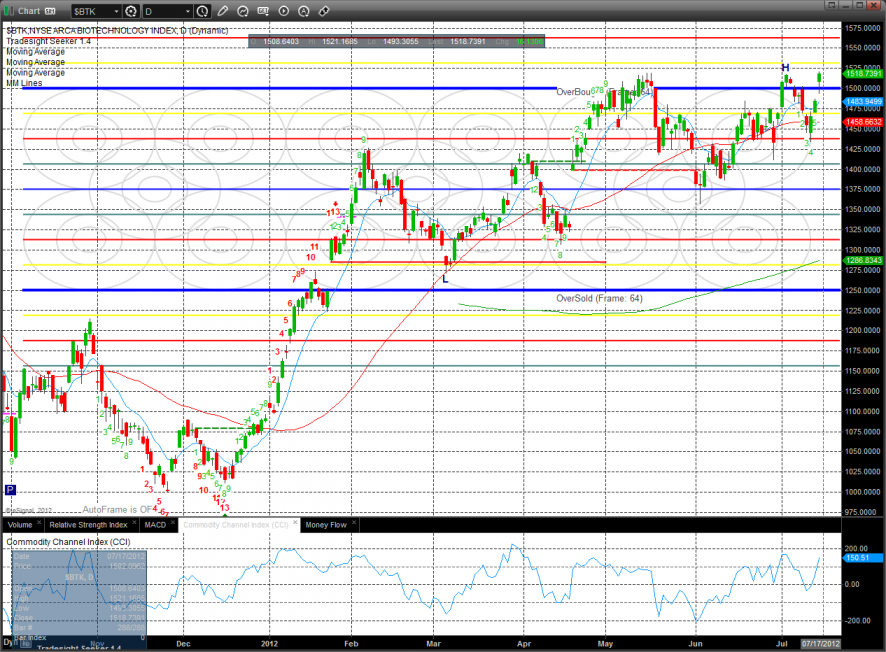

The BTK was a close second to the OSX and is very close to a 52 week breakout. Be sure to have a list of long ideas in this sector.

The SOX made a new low on the move and recorded a Seeker exhaustion buy. Have a list of reversal ideas handy for the rest of the week.

The XAU was the last laggard but did not make a new low on the move.

Oil:

Gold:

Silver:

Stock Picks Recap for 7/17/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

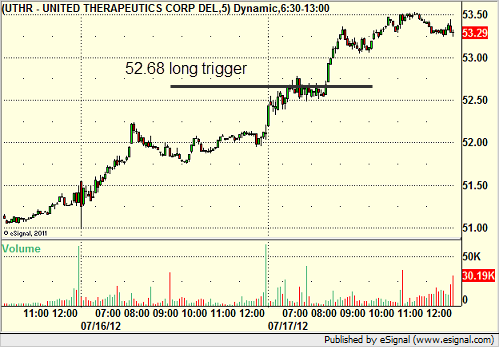

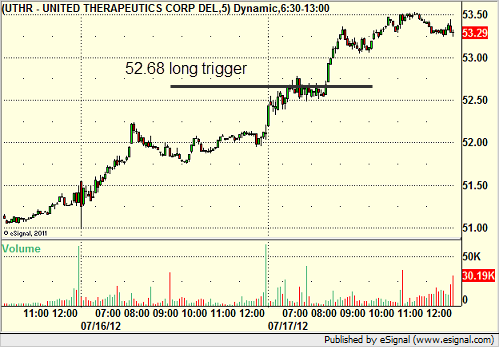

From the report, UTHR triggered long (without market support) and worked:

GILD gapped over, no play. BIDU gapped under, no play.

In the Messenger, Rich's AAPL triggered short (with market support) and worked:

His GS triggered short (with market support) and worked:

His MOS triggered long (with market support) and worked:

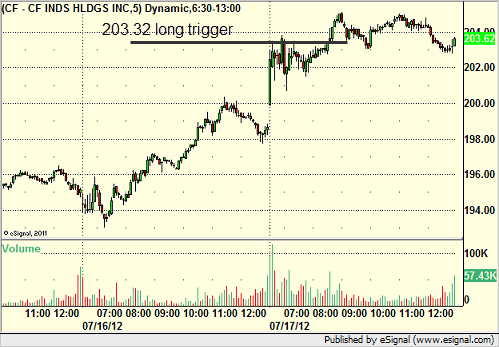

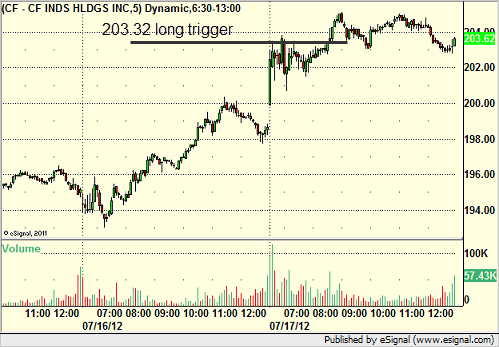

His CF triggered long (with market support) and didn't work:

His JPM triggered short (with market support) and worked:

His GOOG triggered short (with market support) and worked:

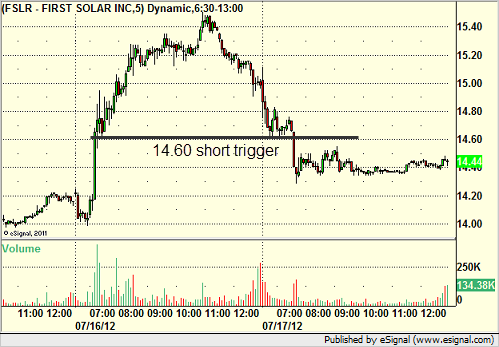

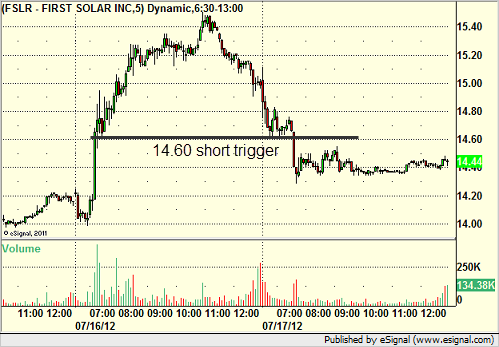

FSLR triggered short (with market support) and worked enough for a partial:

NTAP triggered short (with market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

Stock Picks Recap for 7/17/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, UTHR triggered long (without market support) and worked:

GILD gapped over, no play. BIDU gapped under, no play.

In the Messenger, Rich's AAPL triggered short (with market support) and worked:

His GS triggered short (with market support) and worked:

His MOS triggered long (with market support) and worked:

His CF triggered long (with market support) and didn't work:

His JPM triggered short (with market support) and worked:

His GOOG triggered short (with market support) and worked:

FSLR triggered short (with market support) and worked enough for a partial:

NTAP triggered short (with market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

Futures Calls Recap for 7/17/12

Nice winner in the ES on the short side after the market gapped up and broke lower to fill the gap. It was a classic Value Area play. See ES section below.

Net ticks: +12.5 ticks.

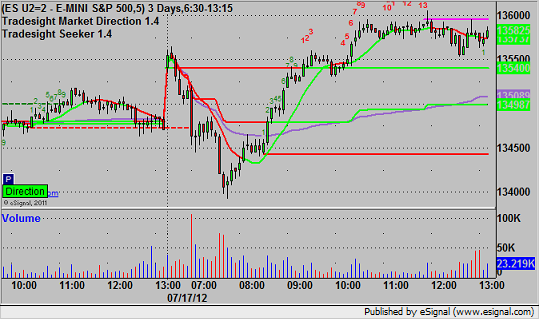

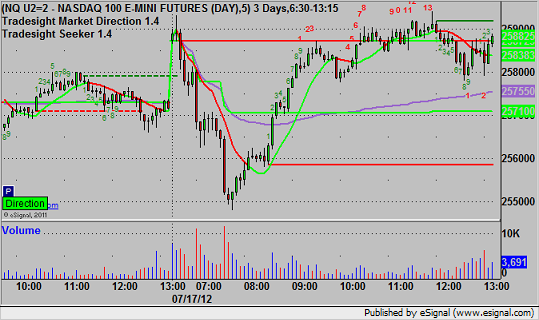

As usual, let's start out by taking a look at the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

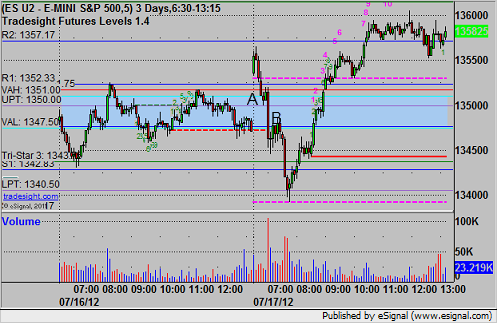

Triggered short at A at 1350.75 breaking into the Value Area, then hit the first target for 6 ticks, then lowered the stop several times and stopped at 1346 at B for 19 ticks to final exit:

Forex Calls Recap for 7/17/12

Nice session. Stopped out of the second half of the GBPUSD long from the prior session in the money and had a winner in the EURUSD. See both sections below.

New calls and Chat tonight.

Here's a look at the US Dollar Index intraday with our market direction lines:

EURUSD:

We were half size overnight ahead of CPI, but nothing triggered, and then in the morning after the CPI data (so full size), EURUSD triggered short at A, hit first target at B, and stopped second half over entry at C:

GBPUSD:

Stopped second half of long trade from the prior session under LBreak at A for 40 pips:

Tradesight Market Preview for 7/17/12

The ES lost 4 on the day settling right around where they opened today. This could have been a classic measuring day where Friday’s explosive buying need to take a breather. The key near-term level is Friday’s high and also the midpoint from the same candle.

The NQ futures put in a measuring day, losing 6 handles on the day. The same technicals as the SP futures apply.

The 10-day Trin still has oversold energy loaded.

The BTK is still the top gun on the multi sector chart:

The SOX/NDX chart continues to make new lows which is overall bearish for both the NDX and SPX.

The BTK was the top gun on the day but is still a ways away from breaking out. Keep a close eye on the individual index members that are near 52 week highs.

The OSX bullishly closed above the 50dma. This is the first close above this key benchmark since March. Note that there is an active Seeker buy signal in place.

The BKX was flat on the day doing a very nice job of measuring off Friday’s gains.

The SOX was the last laggard on the day. Keep a close eye on the Seeker count which has a buy signal on deck.

Oil:

Gold:

Silver:

Stock Picks Recap for 7/16/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

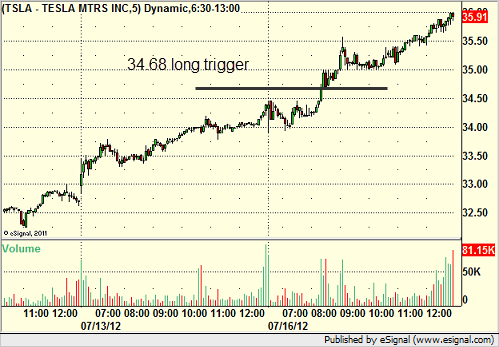

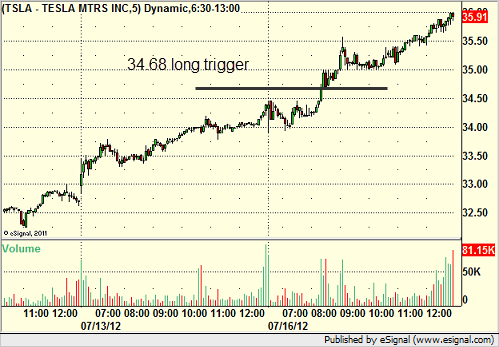

From the report, TSLA triggered long (with market support) and worked:

XRTX triggered short (with market support) and swept by only a penny:

In the Messenger, Rich's SOHU triggered short (with market support) and worked:

His AAPL triggered long (with market support) and worked:

Rich's TLT triggered short (ETF, so no market support needed) and worked great:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Stock Picks Recap for 7/16/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TSLA triggered long (with market support) and worked:

XRTX triggered short (with market support) and swept by only a penny:

In the Messenger, Rich's SOHU triggered short (with market support) and worked:

His AAPL triggered long (with market support) and worked:

Rich's TLT triggered short (ETF, so no market support needed) and worked great:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.