Futures Calls Recap for 7/16/12

Mark put in two calls that both worked to their first targets. See ES and NQ sections below for a positive start to the week in futures.

Net ticks: +5 ticks.

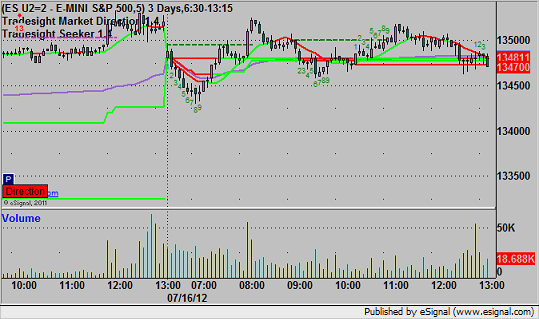

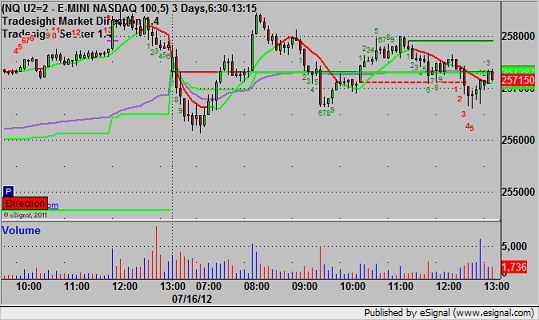

As usual, let's start with a look at the ES and NQ with our market directional lines, Seeker, and VWAP:

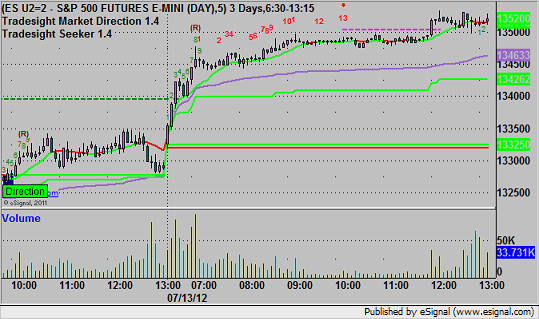

ES:

Triggered long at A at 1350.75, hit first target for 6 ticks, and moved stop under the entry and stopped about 15 minutes later:

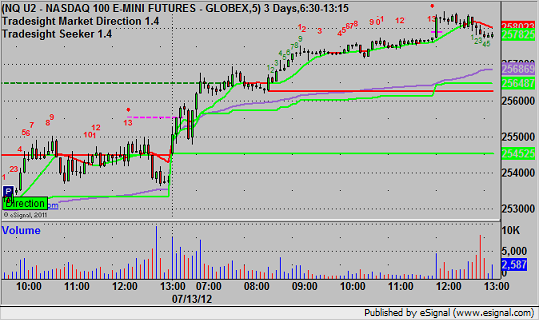

NQ:

Remember that we use half points as ticks on the NQ. Triggered short at A at 2567.00, hit first target for 6 ticks, stop was moved to just over the entry and stopped. Note that it reached down to the Value Area Low and that was it:

Forex Calls Recap for 7/16/12

One loser and one winner in the GBPUSD to start the week, and we're still carrying the second half of the long idea. See that section below.

New calls and Chat this afternoon, although they might be closer to 8 pm EST.

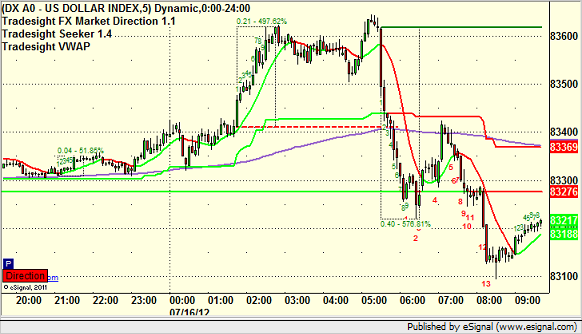

Here's the US Dollar Index intraday with our market directional lines:

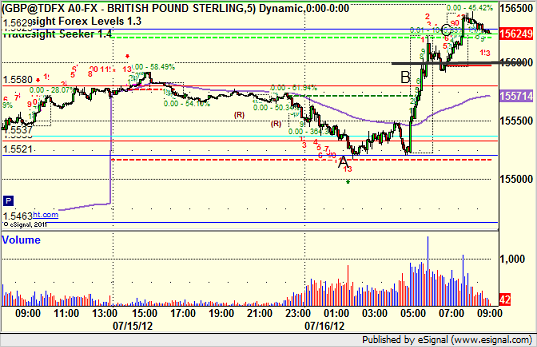

GBPUSD:

Triggered short at A (just barely, and note the Seeker 13 buy signal right there) and stopped. Triggered long at B, hit first target at C, currently holding second half with a stop under 1.5660 (the black line):

Stock Picks Recap for 7/13/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NFLX gapped over, no play.

AFFY triggered long (with market support) and worked great:

WYNN triggered short (without market support) and didn't work:

In the Messenger, Mark's VRSN triggered long (with market support) and worked:

AMGN triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 of them worked nice.

Futures Calls Recap for 7/13/12

Despite very weak volume in the market, we had a nice setup on the NQ today and played it well in the opening hour. See that section below. No other calls since the session was so light on volume.

Net ticks: +8 ticks.

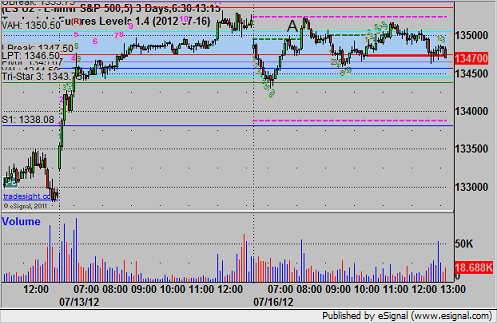

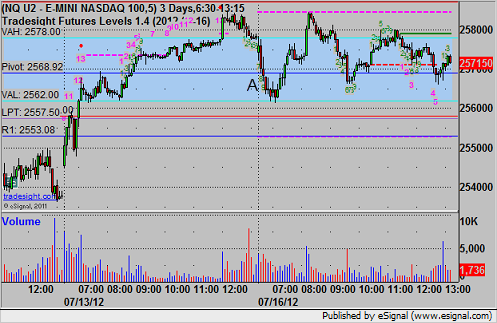

As usual, let's start with a look at the ES and NQ with our market directional lines, Seeker, and VWAP:

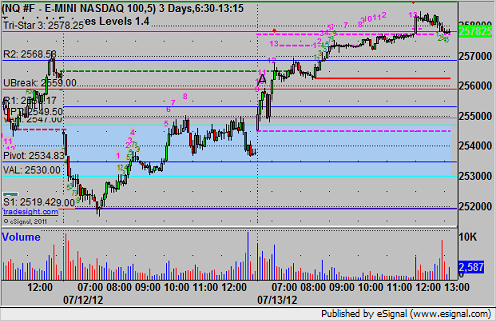

NQ:

Set the UBreak early and then Mark's call triggered long at A at 2560.00, hit first target for 6 ticks (remember that we used half points as ticks on the NQ), and closed final piece at 2565.00 on a raised stop:

Forex Calls Recap for 7/13/12

Nice GBPUSD trigger, perfect setup and test of the level and then triggered and worked for 100 pips to the final exit. See that section below.

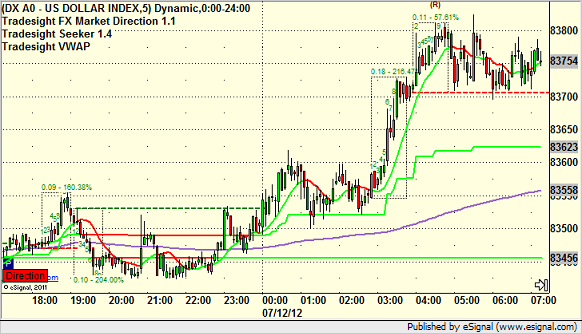

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber separately (note the GBPUSD comments there below), and then glance at the US Dollar Index.

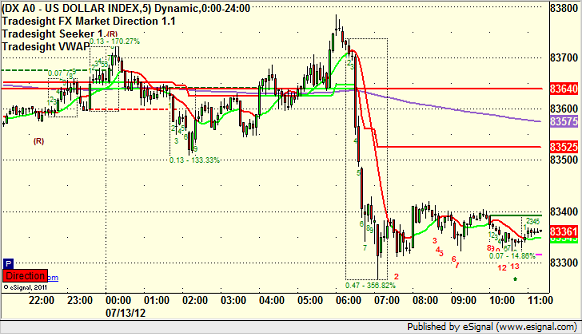

Here's the index with our market directional lines:

I will be on the road through next week. Calls and reports will still all go up, but could be a little later on any given day. I may not do Opening Comments each day from the road, depending on my schedule and location.

Levels will be posted on time each day by Mark. Have a great week.

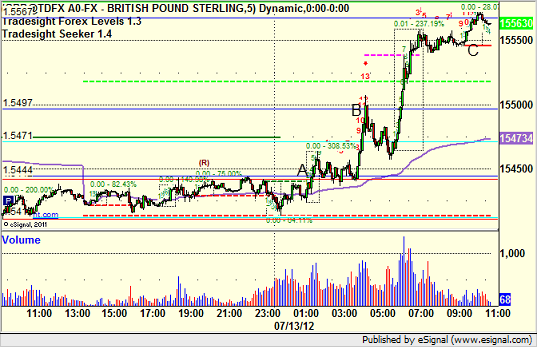

GBPUSD:

Triggered long at A perfectly, hit first target at B (note the Seeker 13 sell signal at that point), closed final piece at C for end of week:

Stock Picks Recap for 7/12/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SINA triggered short (with market support) and worked enough for a partial (before reversing hard, which is why we HAVE to manage trades):

JDSU gapped under the trigger, no play.

BRCM triggered short (without market support due to opening five minutes) and worked enough for a partial:

CY triggered short (with market support) and barely worked enough for a partial, no risk either way:

CREE triggered short (without market support due to opening five minutes) and didn't work:

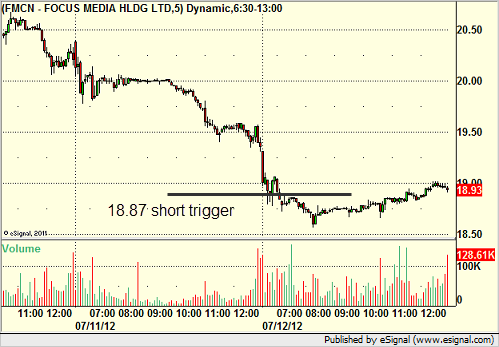

FMCN triggered short (with market support) and didn't work:

In the Messenger, AMZN triggered short (with market support) and worked:

TLT triggered short (ETF, so no market support needed) and didn't work:

BIIB triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 7/12/12

Started out good with a nice ER winner early, but then two ES stop outs erased that as market volume went lighter again (not as bad as Monday though). NASDAQ volume was 1.6 billion shares.

Net ticks: -4.5 ticks.

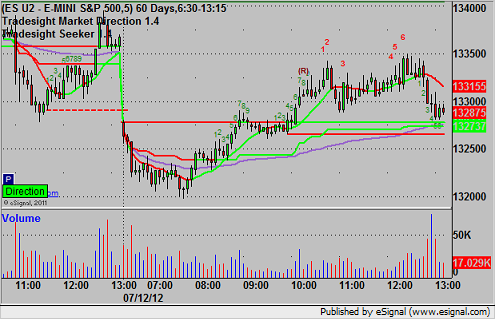

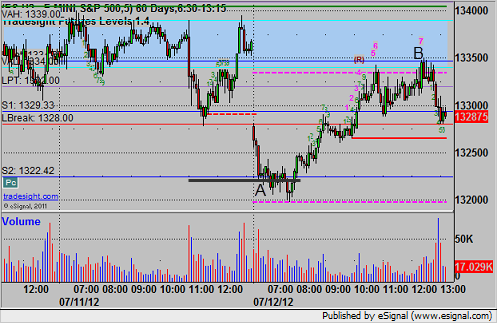

As usual, we will start with the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

Mark's short triggered at 1321.00 at A and stopped for 7 ticks. Long idea breaking into the Value Area and back above the Pivot for the gap fill triggered at B and stopped (great setup, no market action) for 7 ticks:

ER:

Triggered short under LPT at 780.20 at A, hit first target at B for 8 ticks, and lowered stop twice and stopped the final piece for 11 ticks:

Forex Calls Recap for 07/12/12

Clean trigger and winner in the GBPUSD, see that section below.

New calls and Chat tonight to close out the week. I will be on the road all of next week. Levels will go up as usual, reports might be a little late from time to time, and the calls could be late certain days, but I will notify in advance through the Messenger. There might be a couple of nights without opening comments as well.

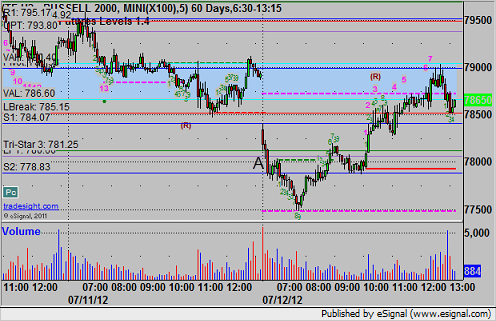

Here's the US Dollar Index intraday with our market directional lines:

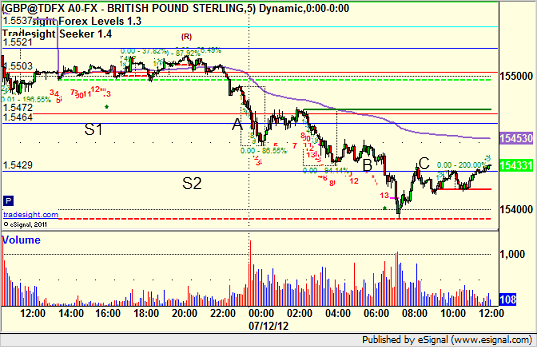

GBPUSD:

Triggered short at A, hit first target at B, moved stop over S2 and stopped at C:

Stock Picks Recap for 7/11/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

In the Messenger, AMGN triggered long (with market support) and worked:

GS triggered long (with market support over lunch) and didn't work:

AAPL triggered short (with market support) and technically stopped, although it swept and retriggered and worked the second time very nicely:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

Stock Picks Recap for 7/11/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

In the Messenger, AMGN triggered long (with market support) and worked:

GS triggered long (with market support over lunch) and didn't work:

AAPL triggered short (with market support) and technically stopped, although it swept and retriggered and worked the second time very nicely:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.