Futures Calls Recap for 7/11/12

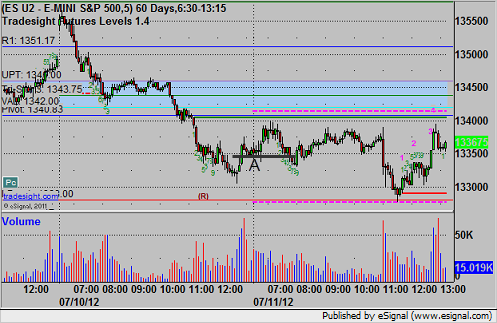

An interesting day. The ES only barely touched a single level for the whole session, finding support at LBreak. Don't think I've ever seen a day like that. Short trade triggered and stopped early, market volume was too light after that to bother. The only action in the afternoon was a spike down on the release of the Fed minutes from the last meeting. See ES section below.

Net ticks: -7 ticks.

As usual, let's start by looking at the ES and NQ intraday with our market directional lines, Seeker, and VWAP:

ES:

Triggered short at 1334.00 at A and stopped:

Forex Calls Recap for 7/11/12

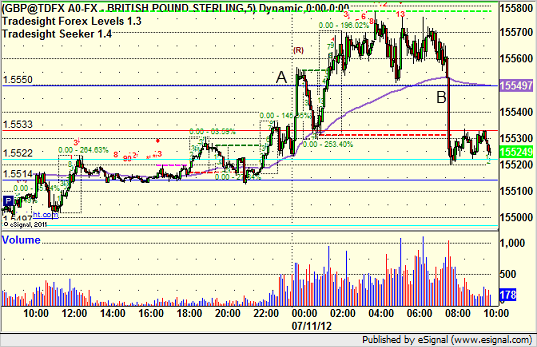

A waste of time session with just a 5-pip plus spreads loser in the GBPUSD. See that section below.

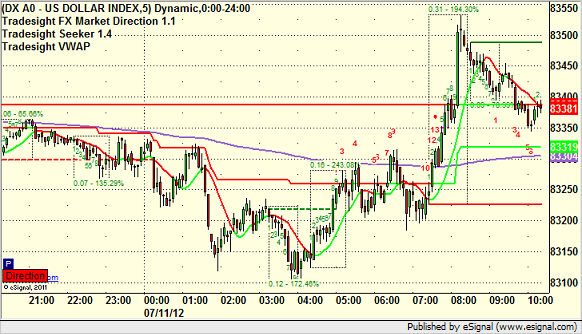

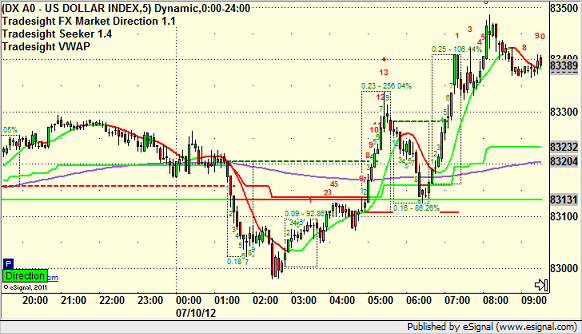

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight. Back to normal size, but this has not been exciting so far.

GBPUSD:

Triggered long at A, did not stop or hit first target overnight, raised stop to 5 pips under UBreak and stopped at B:

Stock Picks Recap for 7/10/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ALTR triggered short (with market support) and didn't work:

PAAS triggered short (with market support) and worked:

From the Messenger, TEVA triggered short (without market support) and didn't work:

KLAC triggered long (with market support) and worked:

COST triggered short (with market support) and worked:

GOOG triggered short (with market support) and worked:

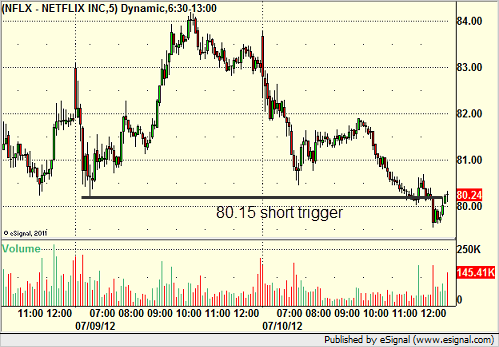

NFLX triggered short (with market support) and didn't work, worked on a retrigger but we don't count those:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

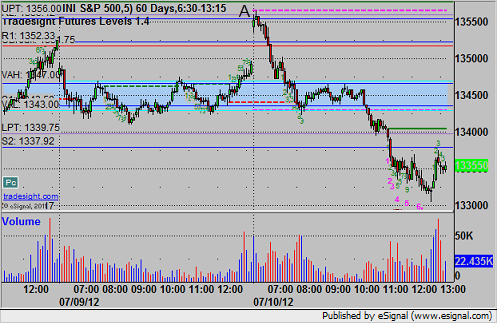

Futures Calls Recap for 7/10/12

A nice day. We had a good setup early on the ES against the UPT which triggered and stopped, but then shorts in the NQ and ER set up nicely and worked well. See those sections below.

Net ticks: +29 ticks.

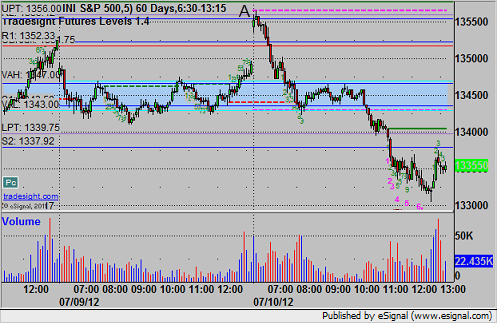

As usual, let's start by taking a look at the ES and NQ with our Seeker, VWAP, and market directional lines:

ES:

Triggered long over UPT after setting that level exactly as the high of the first 5-minute bar...a great setup, but triggered at A and stopped for 7 ticks:

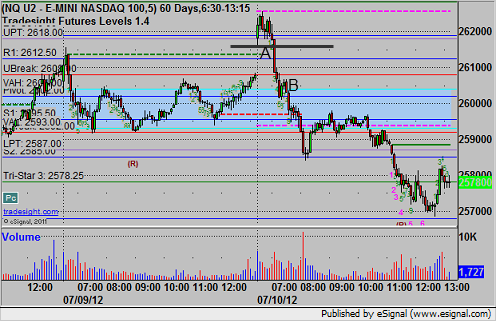

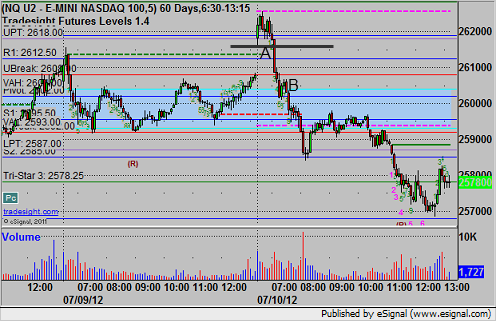

NQ:

Remember that on the NQ, we use half points as ticks, not quarter points as the market does. Mark had a short entry under the opening bar low at 2617.00, which triggered at A, hit first target for six ticks at 2614.00, and then he adjusted the stop a few times and stopped the final piece at 2606.50 for a net 13.5 (6 ticks for first half, 21 for second half, averages to 13.5):

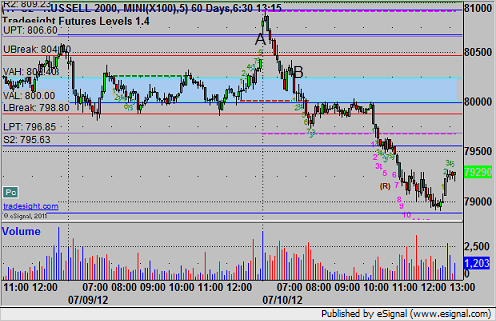

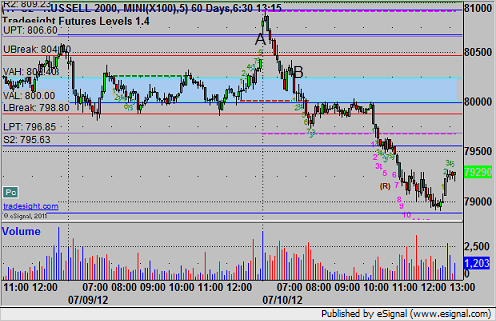

ER:

Finally, the ER (Russell 2000) gapped over the UPT and used it as the low of the first bar. When the market rolled, I added a short under that level at 806.50 at A, hit 7 ticks in this case for a first target, and lowered the stop a few times before the final exit at B at 802.70 for an average of 22.5 ticks:

Futures Calls Recap for 7/10/12

A nice day. We had a good setup early on the ES against the UPT which triggered and stopped, but then shorts in the NQ and ER set up nicely and worked well. See those sections below.

Net ticks: +29 ticks.

As usual, let's start by taking a look at the ES and NQ with our Seeker, VWAP, and market directional lines:

ES:

Triggered long over UPT after setting that level exactly as the high of the first 5-minute bar...a great setup, but triggered at A and stopped for 7 ticks:

NQ:

Remember that on the NQ, we use half points as ticks, not quarter points as the market does. Mark had a short entry under the opening bar low at 2617.00, which triggered at A, hit first target for six ticks at 2614.00, and then he adjusted the stop a few times and stopped the final piece at 2606.50 for a net 13.5 (6 ticks for first half, 21 for second half, averages to 13.5):

ER:

Finally, the ER (Russell 2000) gapped over the UPT and used it as the low of the first bar. When the market rolled, I added a short under that level at 806.50 at A, hit 7 ticks in this case for a first target, and lowered the stop a few times before the final exit at B at 802.70 for an average of 22.5 ticks:

Forex Calls Recap for 7/10/12

A loser and a winner (not quite a wash) on the EURUSD. See that section below. Trade Balance tomorrow morning, so half-size tonight ahead of that.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat this evening.

EURUSD:

tell me how to import data and install. I will probably need new templates

Tradesight Market Preview for 7/10/12

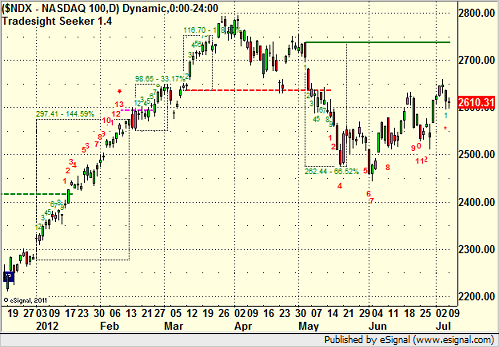

The NDX lost 2 points on 1.3 billion NASDAQ shares, a very weak volume day. Note that for those that understand the Tradesight Seeker tool, technically, the NDX had a 13 buy signal on Friday, although if you use the "8 bar qualifier," it did not meet that criteria:

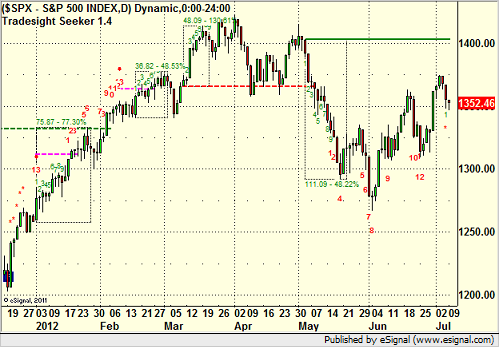

Even more interesting is that the S&P (down 2) did the same with what would have been a 13 buy signal on Friday, but the asterisk shows up in its place with the qualifier because we were not under bar 8. The reason that this is interesting on the S&P is because bar 8 is the low day back at the beginning of June, so we would have to get all the way under that bar and close one day to get the ultimate 13 buy signal, which is strange to see:

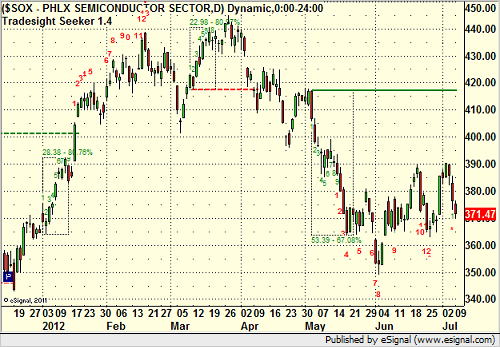

The SOX lost 5:

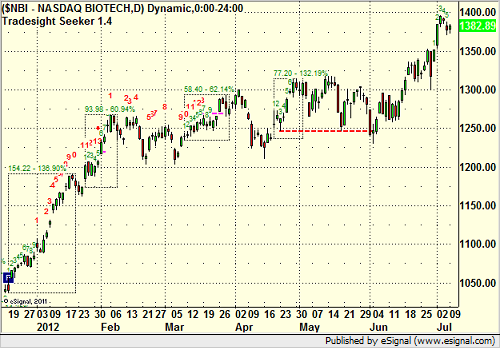

NBI gained 7:

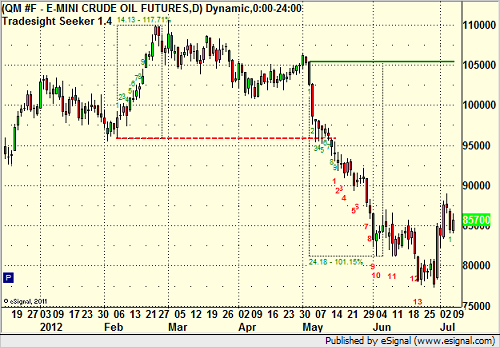

Oil closed at $85.72, and it is interesting here to see the decline since May (a strange time of year for price declines in oil, but perhaps a function of a weaker global economy). Also, note the 13 buy signal over a week ago that led to the current rally:

All of the above being said, July is usually a great trading month in terms of market volatility. We had very green trading sessions on Friday and Monday, but that was despite the weak volume in the market. Now that the Holiday is behind us, we're going to need to see that volume pick up if we want a chance to see the rest of the month play out good.

Stock Picks Recap for 7/9/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FOSL triggered short (with market support) and worked:

NTAP triggered short (with market support) and worked:

AFFY triggered short (with market support) and worked:

PMTC triggered short (with market support) and worked enough for a partial:

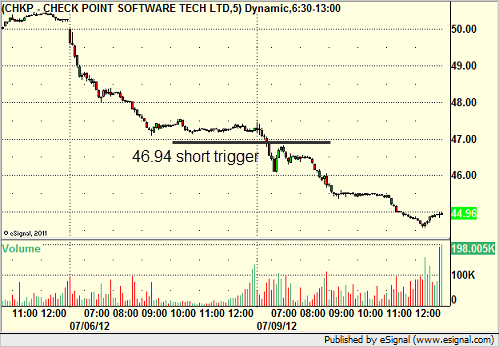

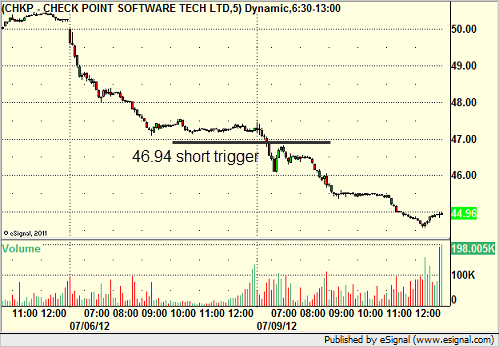

CHKP triggered short (with market support) and worked:

In the Messenger, AAPL triggered long (without market support due to opening 5 minutes) and worked for a couple of points:

AIG triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, and 7 of them worked, as did the AAPL long out of the gate. Nice day.

Stock Picks Recap for 7/9/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FOSL triggered short (with market support) and worked:

NTAP triggered short (with market support) and worked:

AFFY triggered short (with market support) and worked:

PMTC triggered short (with market support) and worked enough for a partial:

CHKP triggered short (with market support) and worked:

In the Messenger, AAPL triggered long (without market support due to opening 5 minutes) and worked for a couple of points:

AIG triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, and 7 of them worked, as did the AAPL long out of the gate. Nice day.

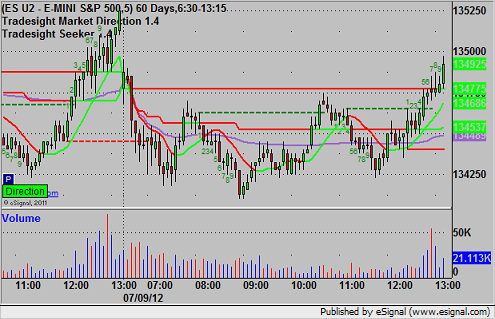

Futures Calls Recap for 7/9/12

Volume ended up being worse than last week, and although stocks moved well, the futures market was extremely dull and spent most of the session stuck in the Value Area. Although we encourage less size in a light-volume environment, our raw data totals only account for net ticks. Mark's ES short triggered twice and stopped both times (see ES below). The long idea never triggered.

Net ticks: -14 ticks.

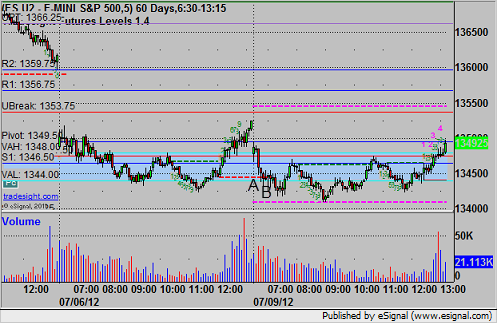

As usual, we will start with a look at the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

Trigger was short at 1342.75, which triggered at A and stopped for 7 ticks immediately, then triggered 10 minutes later at B and took about 30 minutes before it finally stopped. Trade was cancelled going forward due to the horrible market volume: