Forex Calls Recap for 7/9/12

Partial entry stopped on EURUSD to start the week in a session where the range was only 60 pips on the EURUSD. See that section below.

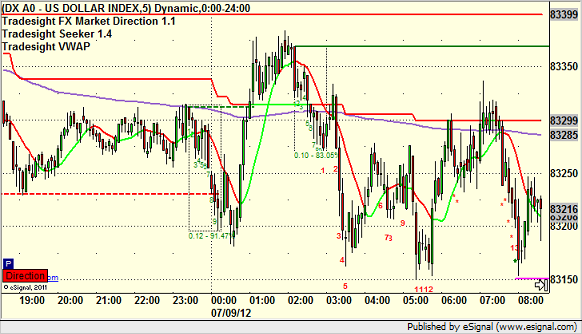

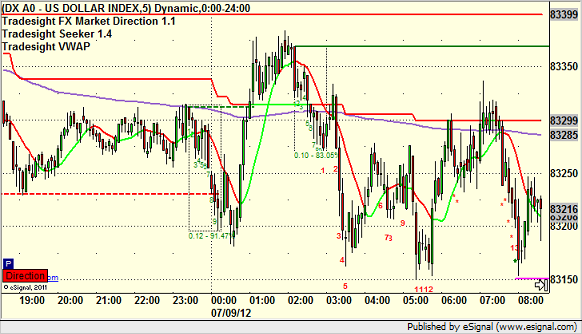

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

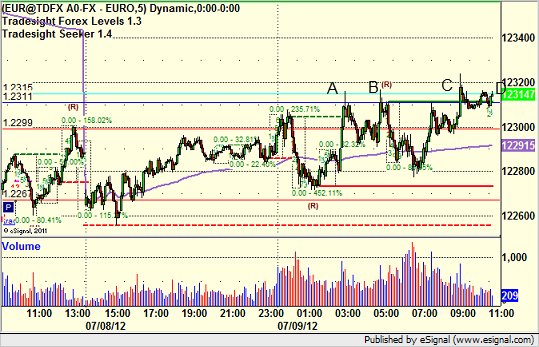

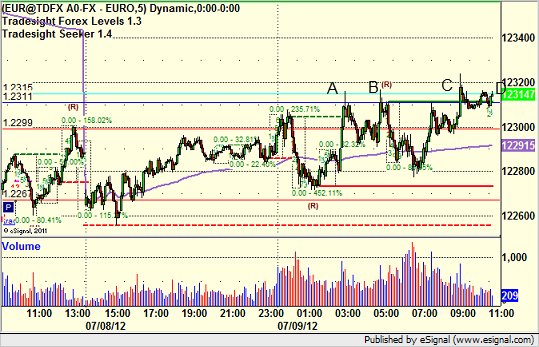

EURUSD:

The EURUSD didn't even go 2 pips past the VAL entry level at A and B, so only a piece or two of your trade should have triggered if you follow proper order staggering rules from our system. It did triggered long completely at C and closed at D at even:

Forex Calls Recap for 7/9/12

Partial entry stopped on EURUSD to start the week in a session where the range was only 60 pips on the EURUSD. See that section below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

The EURUSD didn't even go 2 pips past the VAL entry level at A and B, so only a piece or two of your trade should have triggered if you follow proper order staggering rules from our system. It did triggered long completely at C and closed at D at even:

Stock Picks Recap for 7/6/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered from the report.

In the Messenger, Rich's AAPL triggered short (with market support) and worked:

His GDX triggered short (ETF, so no market support needed) and worked:

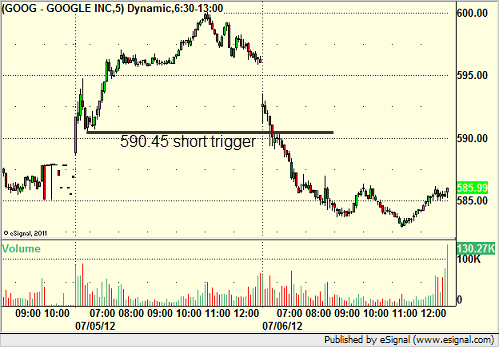

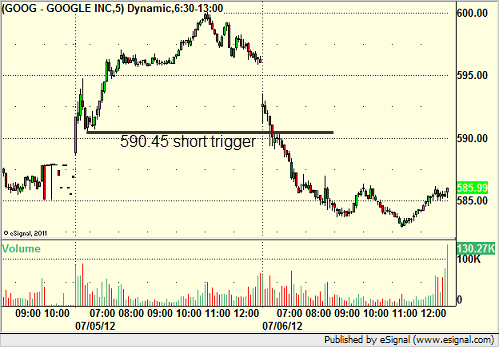

GOOG triggered short and worked great, getting me almost five points to the final exit in the Lab:

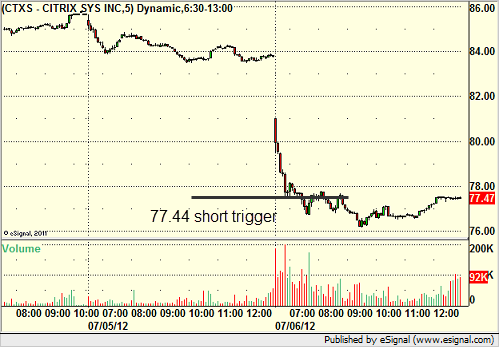

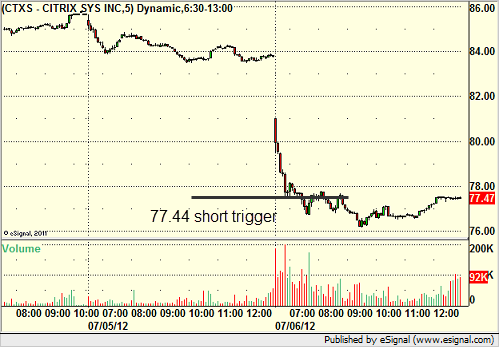

Rich's CTXS triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Stock Picks Recap for 7/6/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered from the report.

In the Messenger, Rich's AAPL triggered short (with market support) and worked:

His GDX triggered short (ETF, so no market support needed) and worked:

GOOG triggered short and worked great, getting me almost five points to the final exit in the Lab:

Rich's CTXS triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 7/6/12

Another light volume day as expected, but this time we squeaked out minor gains on just two calls. See ES and NQ sections below.

Net ticks: +3 ticks.

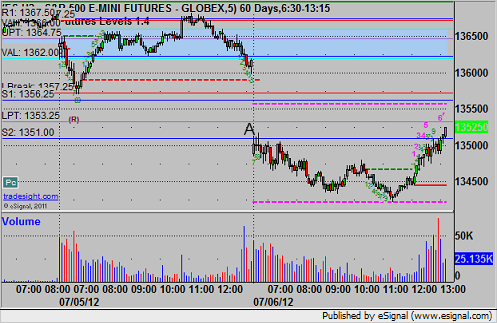

As usual, let's start by looking at the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

Triggered long at A and stopped for 7 ticks:

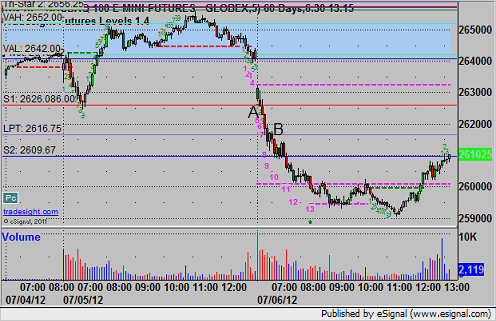

NQ:

Triggered short under LBreak at A at 2625.50, hit 6 ticks (remember, we use half points as ticks on the NQ) at 2622.50, and lowered stop and stopped the final piece at 2619.25 at B:

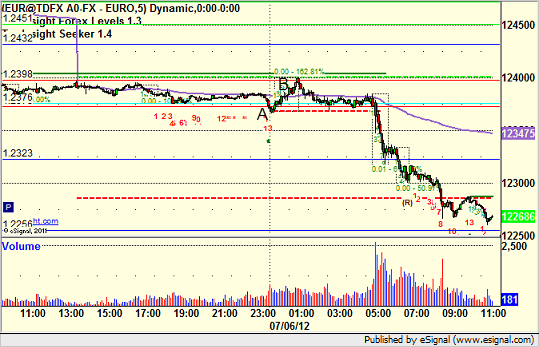

Forex Calls Recap for 7/6/12

Wrapped up what we knew would be a bad week coming in with a half-sized trade in the EURUSD ahead of NFP data. See that section below. Should be back to normal next week and I will be normal size in my trading again.

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (nothing to see), and then glance at the US Dollar Index.

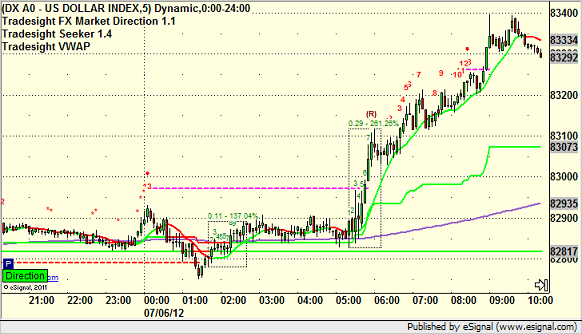

Here's the US Dollar Index intraday with our market directional lines:

New Levels and Calls Sunday afternoon.

EURUSD:

The Break levels were only 22 pips apart, but the EURUSD sat between them for most of the European session, although it did barely trigger the short at A, which stopped at B. Trade ended up working nice later:

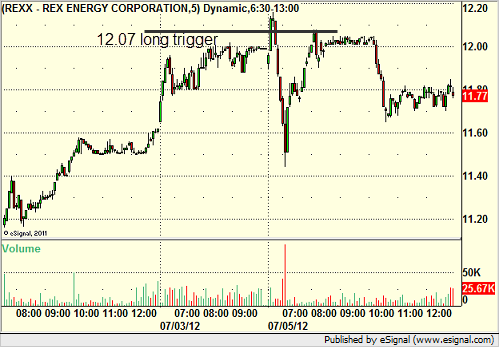

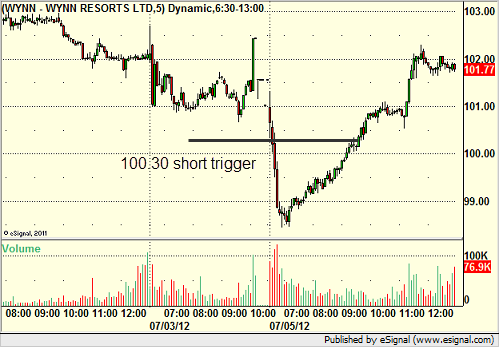

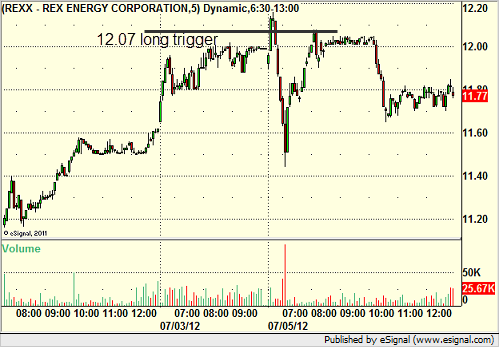

Stock Picks Recap for 7/5/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, OCZ triggered long (without market support due to opening five minutes) and didn't work:

REXX triggered long (with market support) and didn't work:

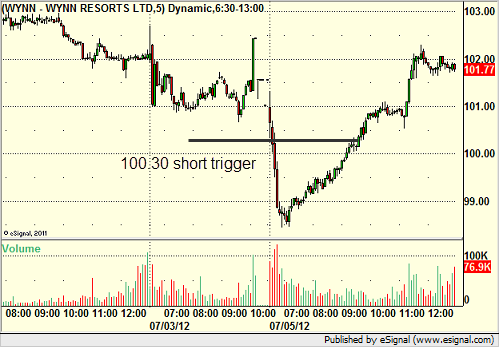

In the Messenger, Rich's WYNN triggered short (with market support) and worked:

His BIDU triggered long (without market support) and didn't work initially, worked later:

His GS triggered short (with market support) and worked nicely:

That was it. In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Stock Picks Recap for 7/5/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, OCZ triggered long (without market support due to opening five minutes) and didn't work:

REXX triggered long (with market support) and didn't work:

In the Messenger, Rich's WYNN triggered short (with market support) and worked:

His BIDU triggered long (without market support) and didn't work initially, worked later:

His GS triggered short (with market support) and worked nicely:

That was it. In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

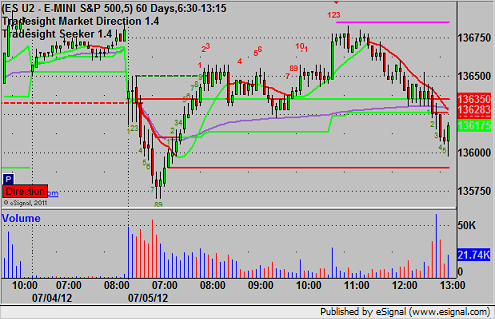

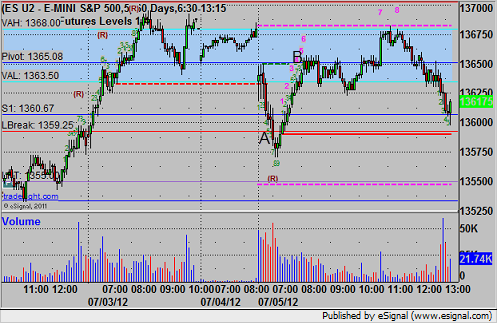

Futures Calls Recap for 7/5/12

Volume ended up being even worse today in the market than Monday. We did go ahead with two calls early despite the volume. The first one worked and the second one did not (although the second setup was terrific). See ES section below.

Net ticks: -4.5 ticks.

As usual, let's start with a look at the ES and NQ with our market directional lines, VWAP, and Seeker. Note that even in this light volume day, the Seeker gave a 13 sell signal at the high of the session (and the Value Area High):

ES:

Triggered short at A at 1359.00, hit the first target for six ticks, and stopped the second half over the entry. The market then recovered and we had a nice setup with the ES moving back into the Value Area and the Pivot being the exact high from the morning action, so we triggered long over the Pivot at B, but nothing happened for over 30 minutes and it finally stopped for 7 ticks:

Forex Calls Recap for 7/5/12

We were half size for the Holiday week, but would have been half size anyway with the ECB and BoE rate announcements, and the BoE one stopped us out of the trade (which is why we go half size for those). See GBPUSD below.

One more day and then back to a better environment.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, still half size, also have NFP/Unemployment in the morning.

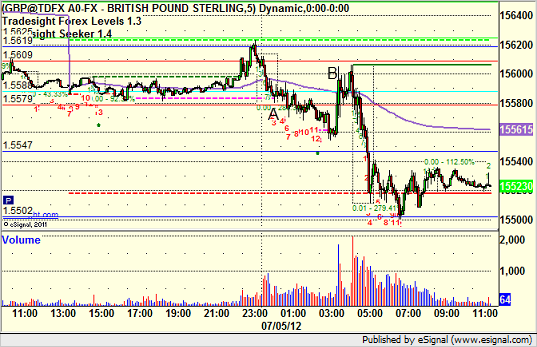

GBPUSD:

Triggered short at A, just barely stopped at B on the rate announcement news, which was unfortunate because then it worked after that: