Forex Calls Recap for 7/5/12

We were half size for the Holiday week, but would have been half size anyway with the ECB and BoE rate announcements, and the BoE one stopped us out of the trade (which is why we go half size for those). See GBPUSD below.

One more day and then back to a better environment.

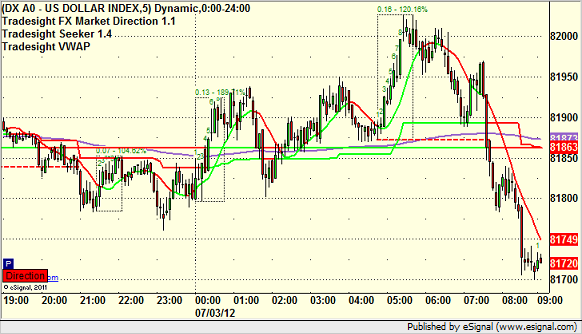

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, still half size, also have NFP/Unemployment in the morning.

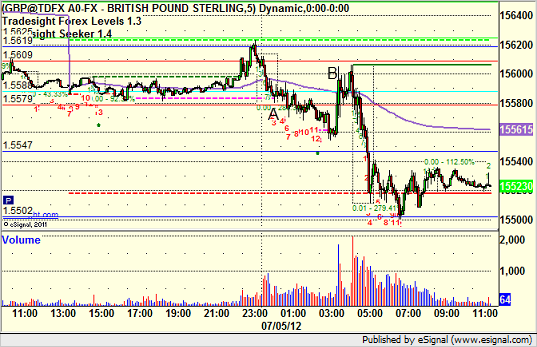

GBPUSD:

Triggered short at A, just barely stopped at B on the rate announcement news, which was unfortunate because then it worked after that:

Tradesight Market Preview for 7/5/12

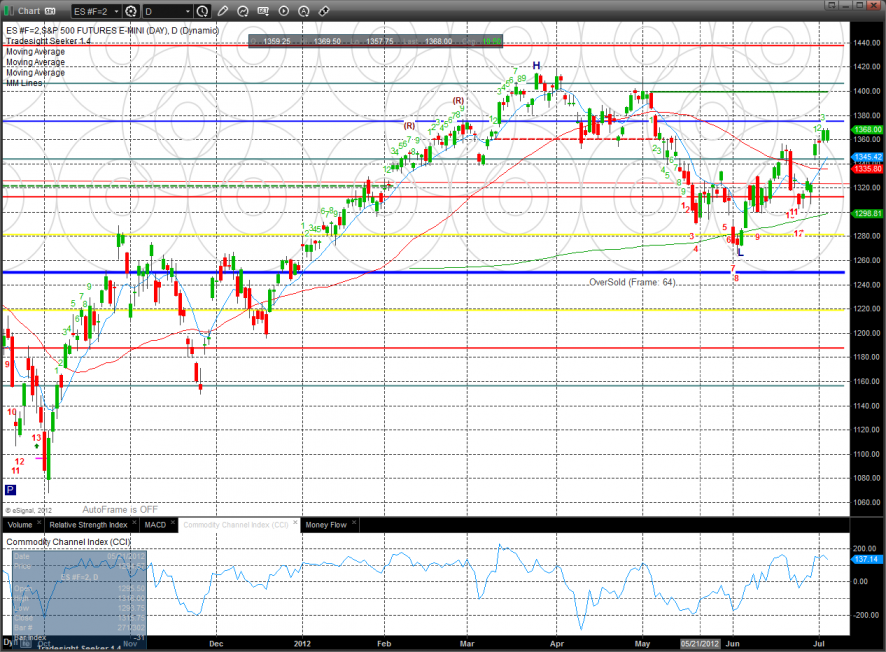

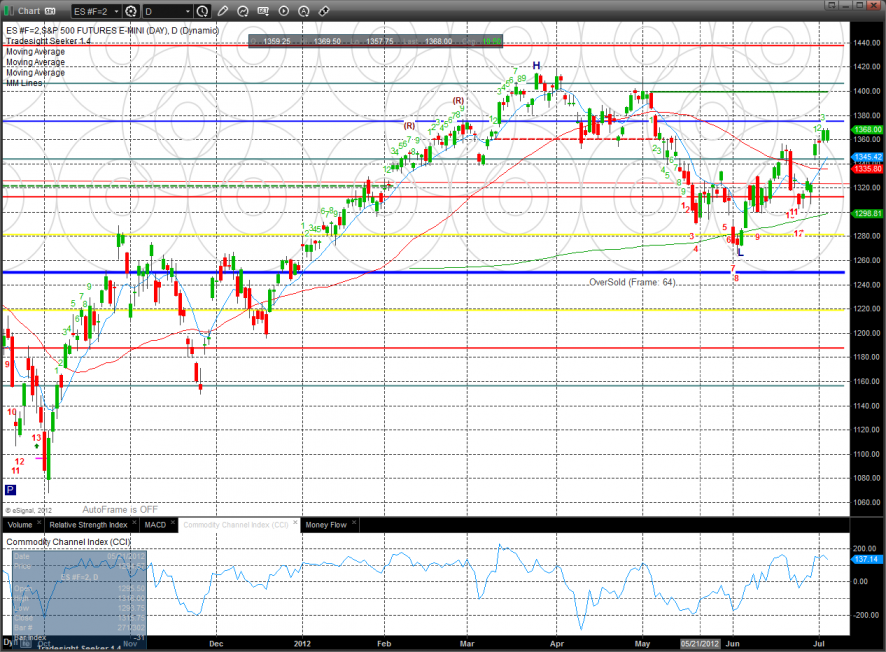

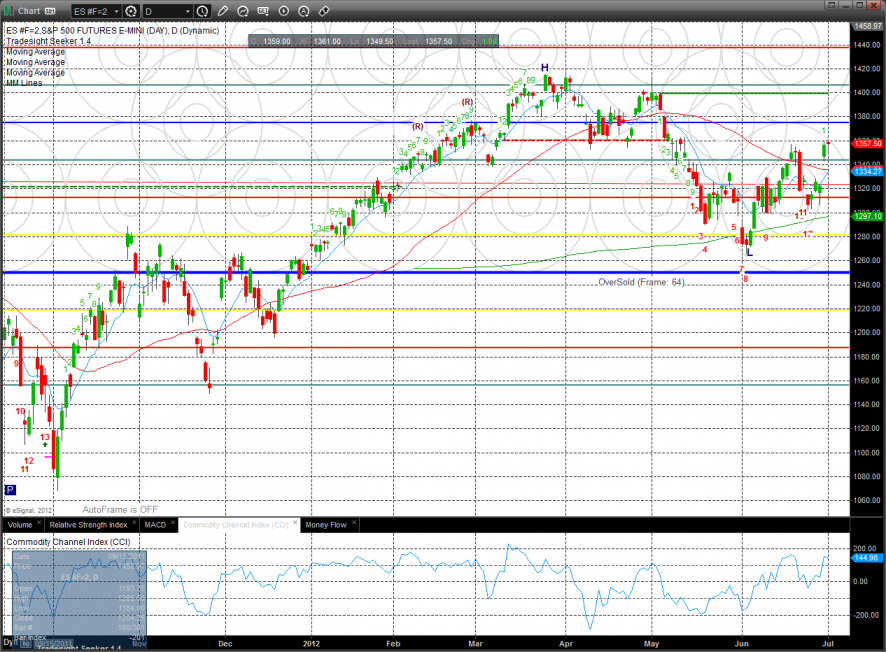

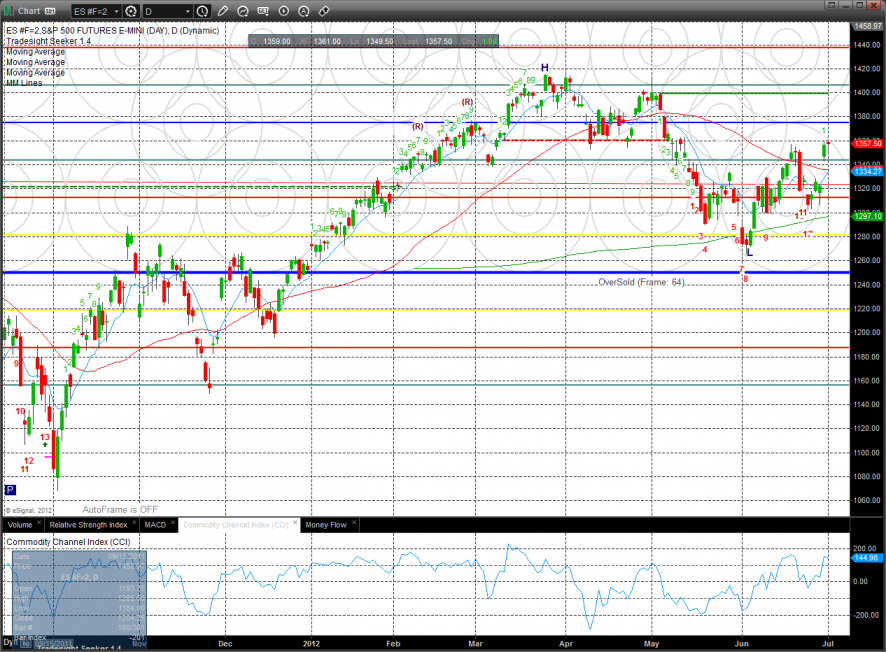

The ES posted a relatively inside day where a 10 handle gap down was recovered.

Since trade was contained within the prior day’s there is nothing new technically.

The NQ futures were higher by 27 on the day and are just below the key 4/8 midpoint of the Murrey math box.

The 10-day Trin remains loaded with oversold energy and buying power.

The NDX continues to show relative strength vs. the SPX.

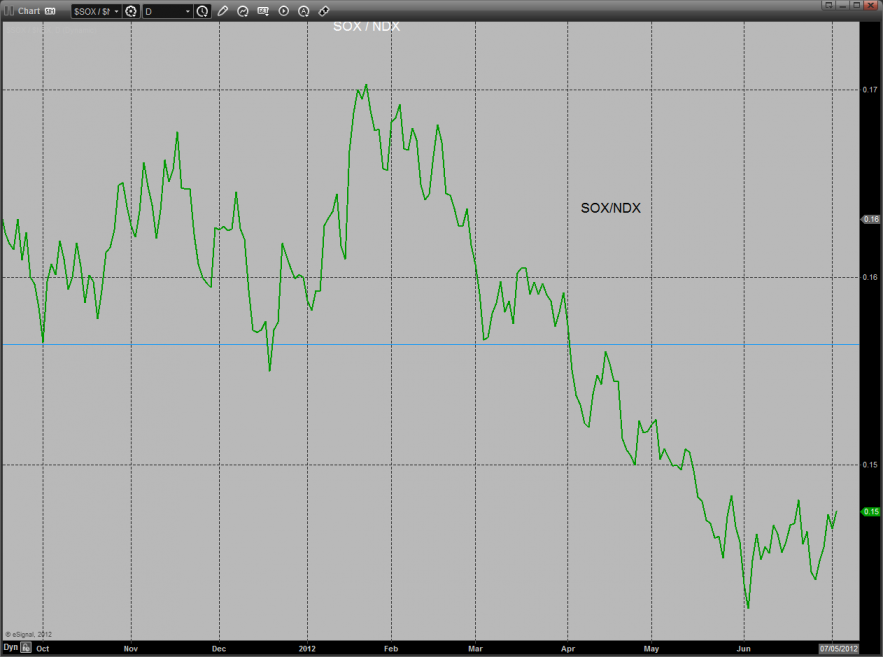

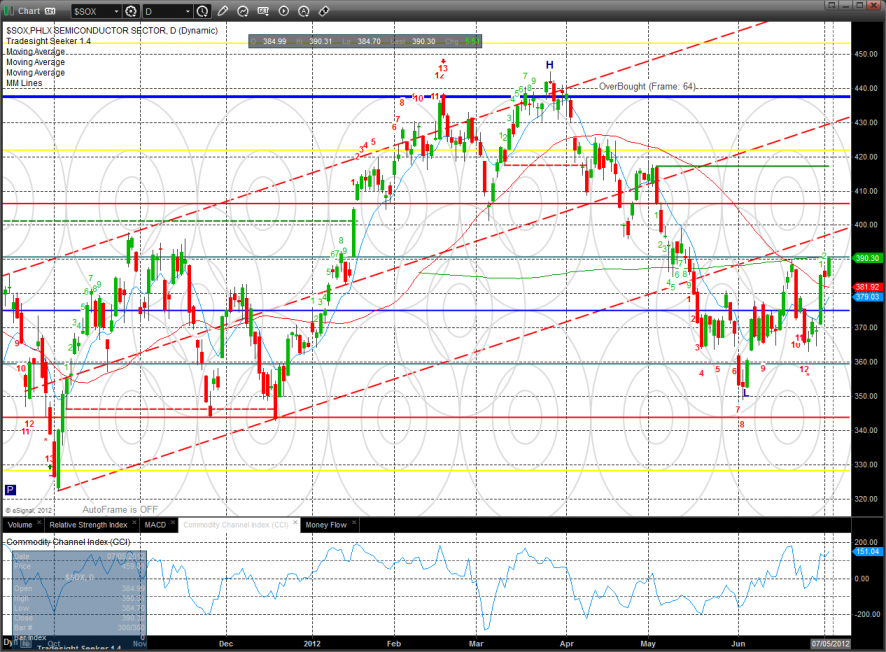

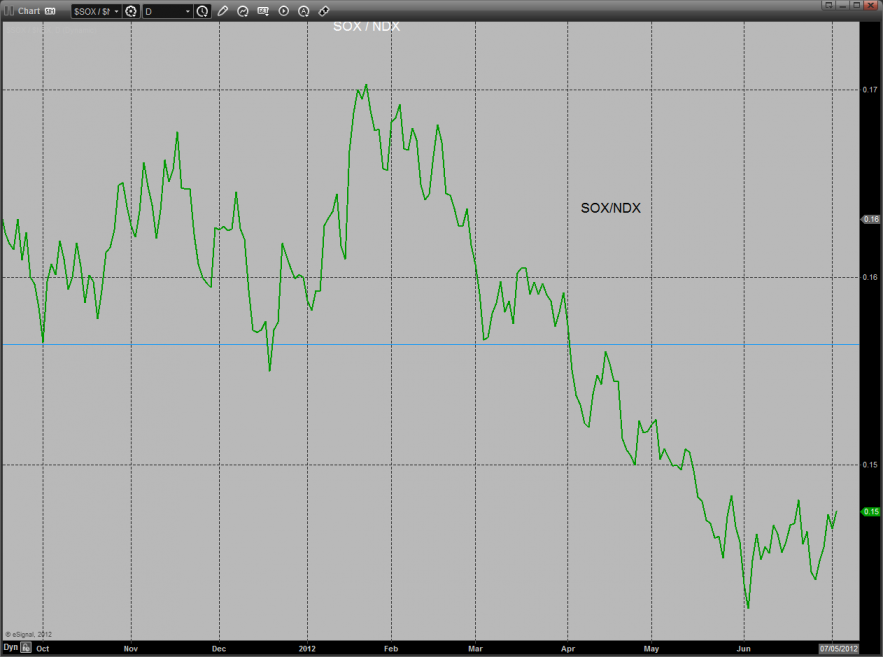

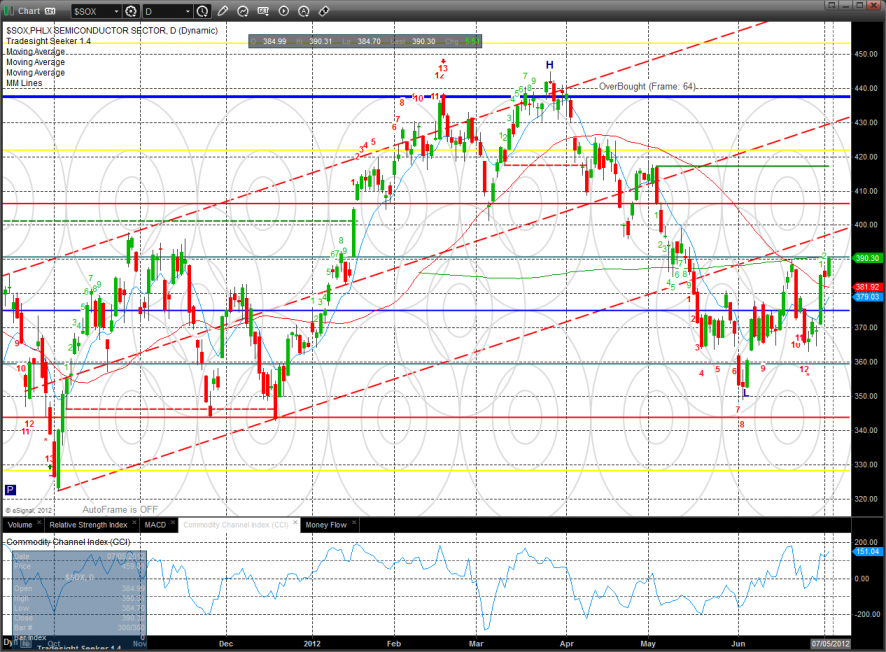

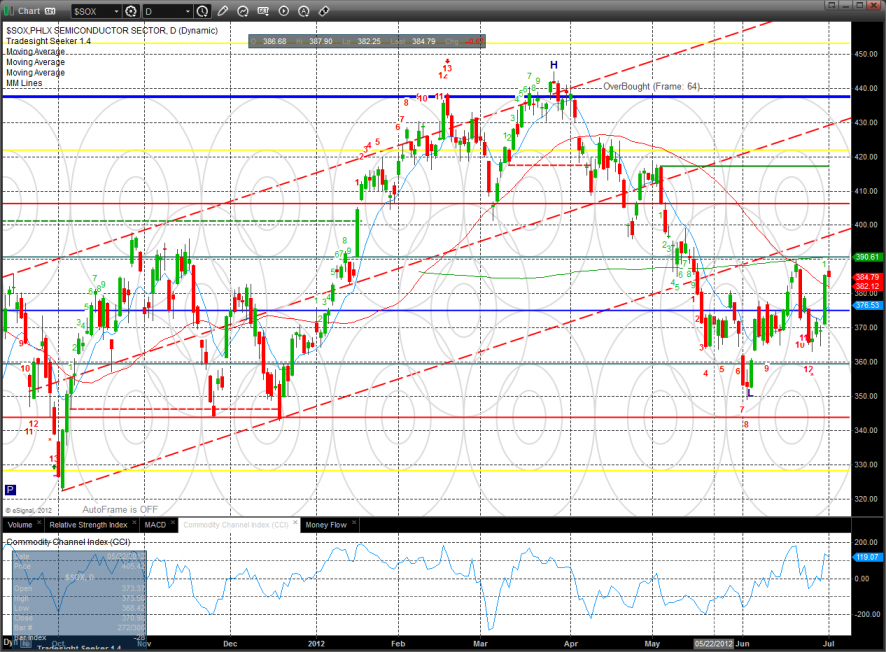

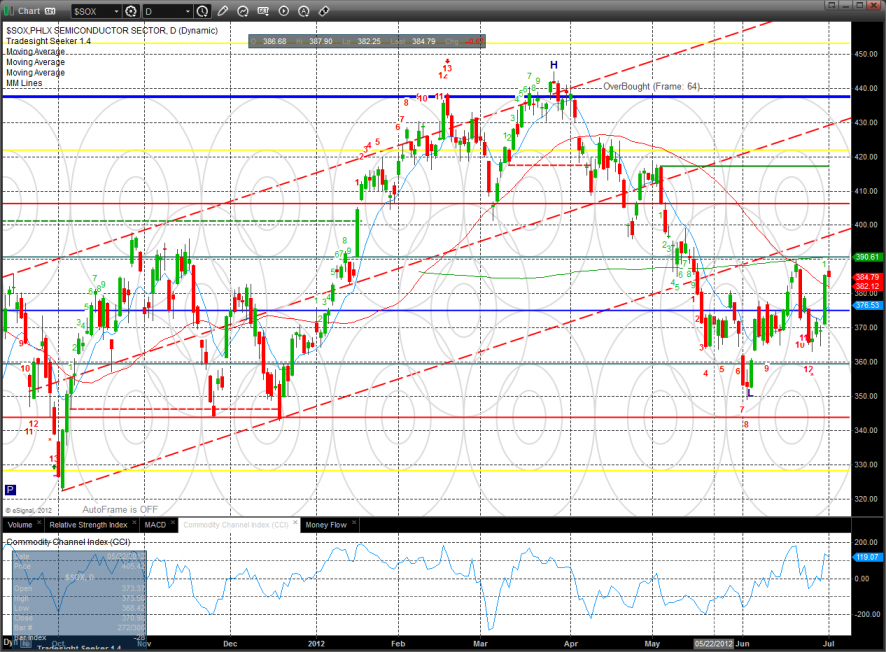

The SOX/NDX cross is getting closer to a bullish change in trend. Keep a close eye on this chart for a higher high.

The Dow/gold chart has yet to breakout which would be a huge buy signal for the long term equity bulls.

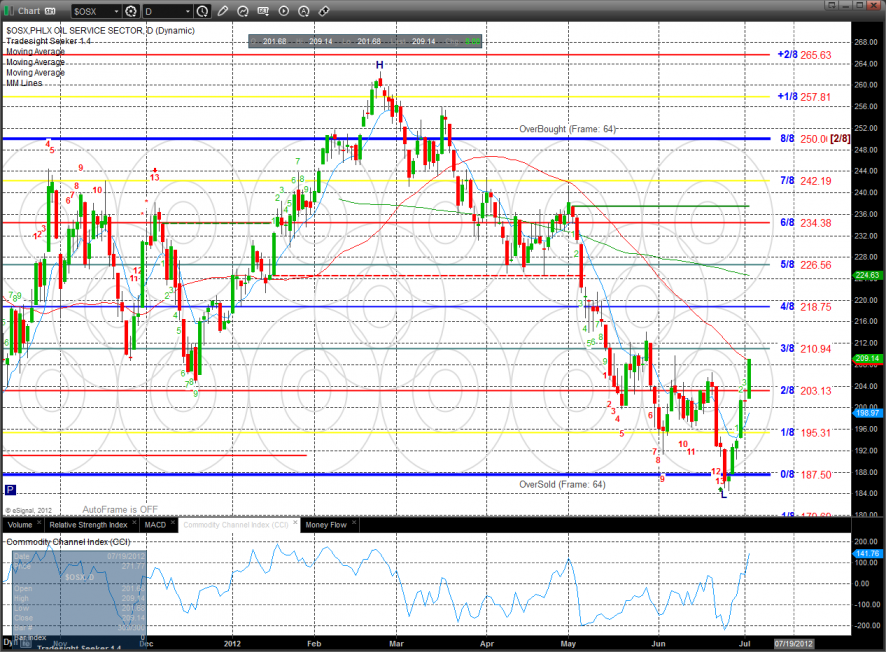

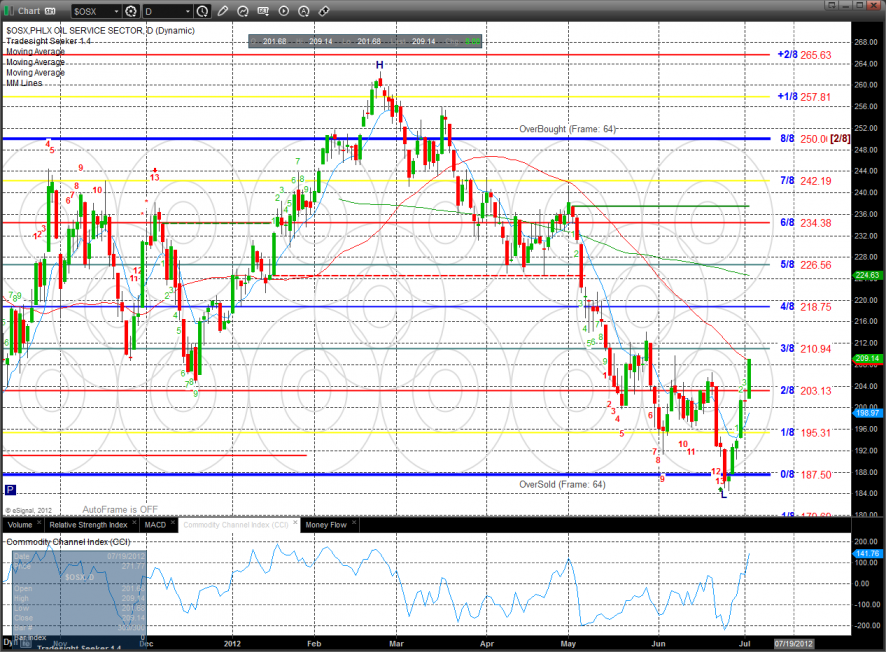

The OSX was top gun Tuesday making good on the Seeker 13 exhaustion buy signal. A close above the 50dma will get the attention of the media and many closet oil bulls. The next real challenge will be the 4/8 level up at 218.

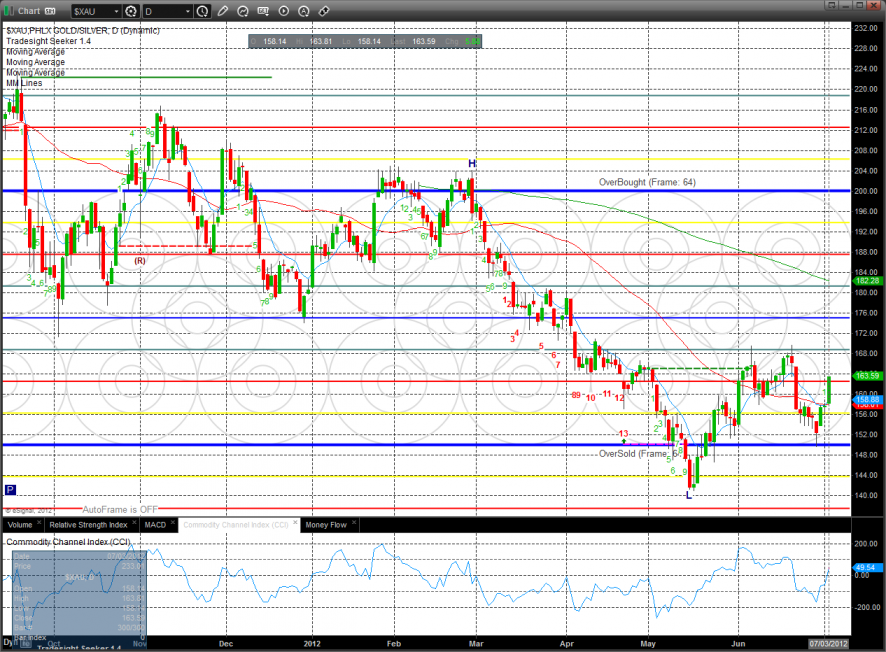

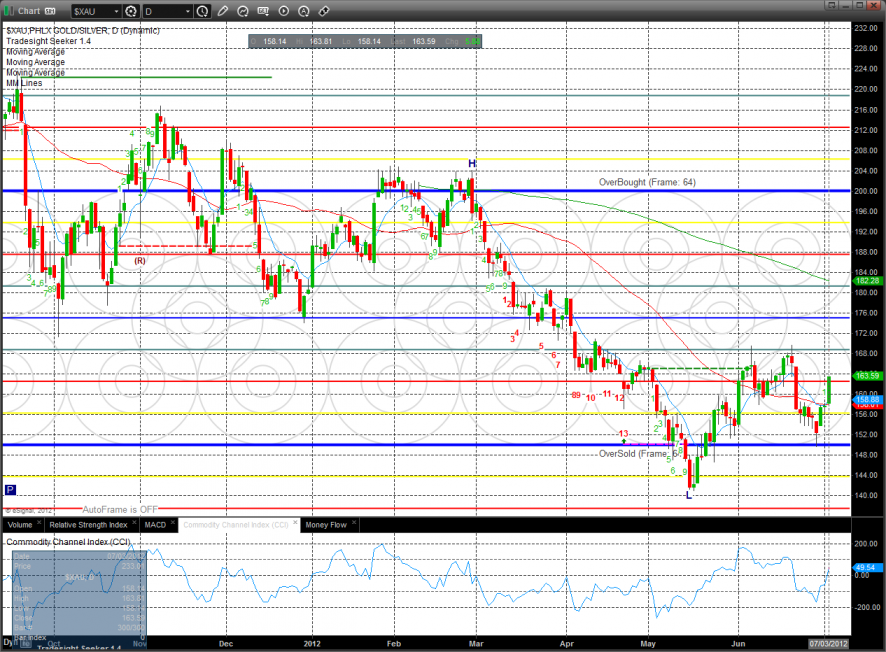

The weak sensitive XAU could be making a higher low but won’t be qualified until a close above the June high.

The SOX closed above the June high and right at the 200dma. Note that the Seeker still has not yet recorded a buy signal.

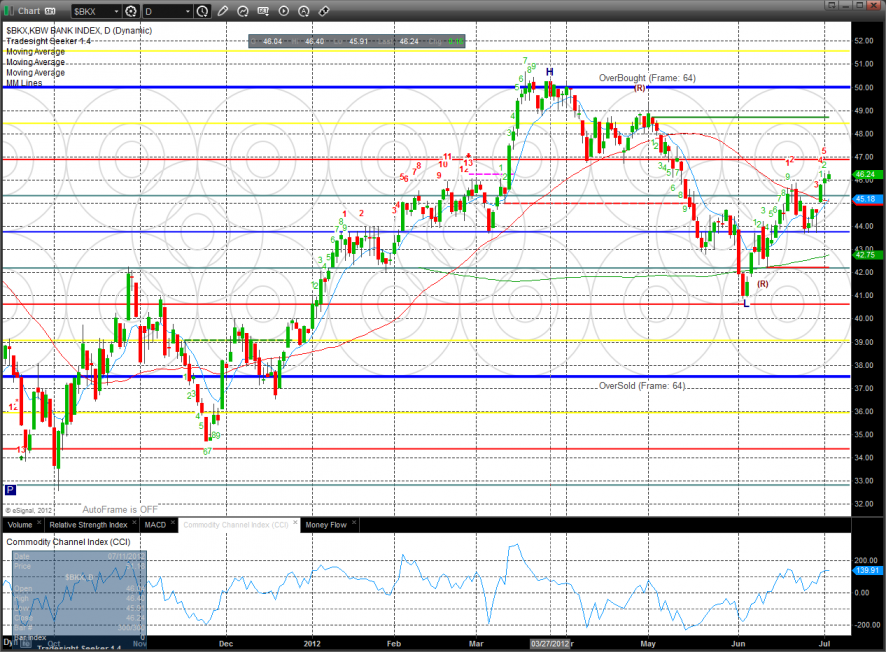

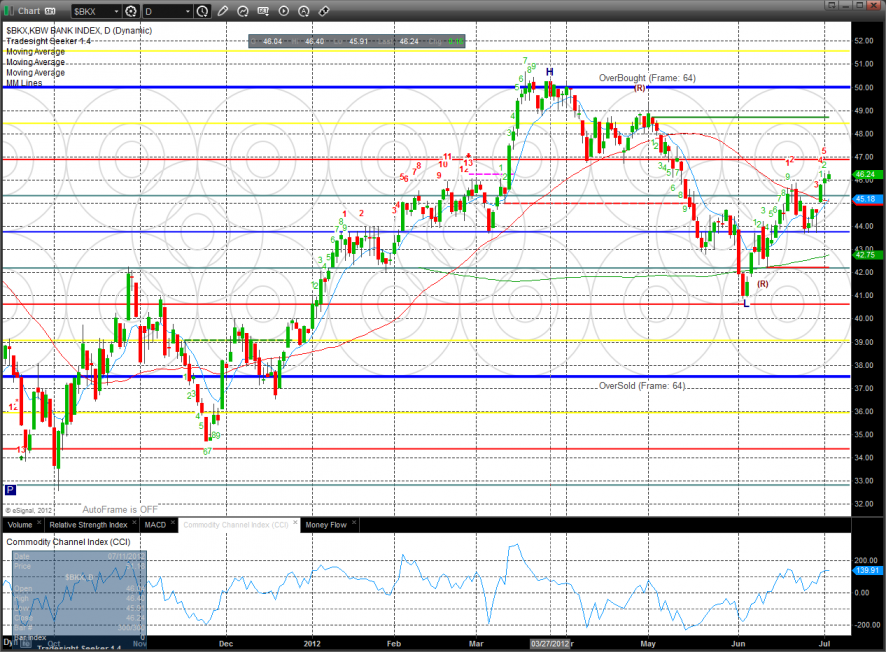

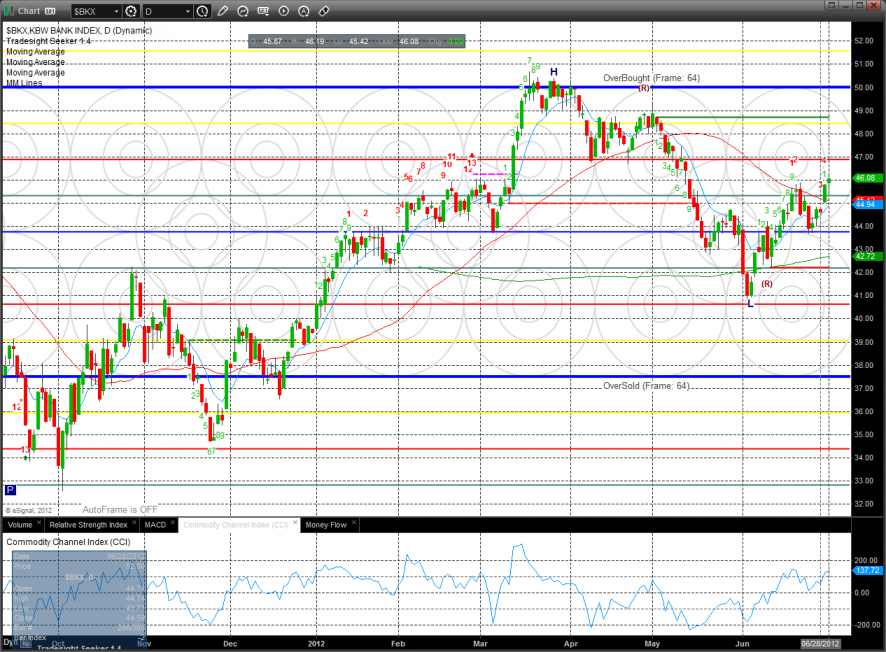

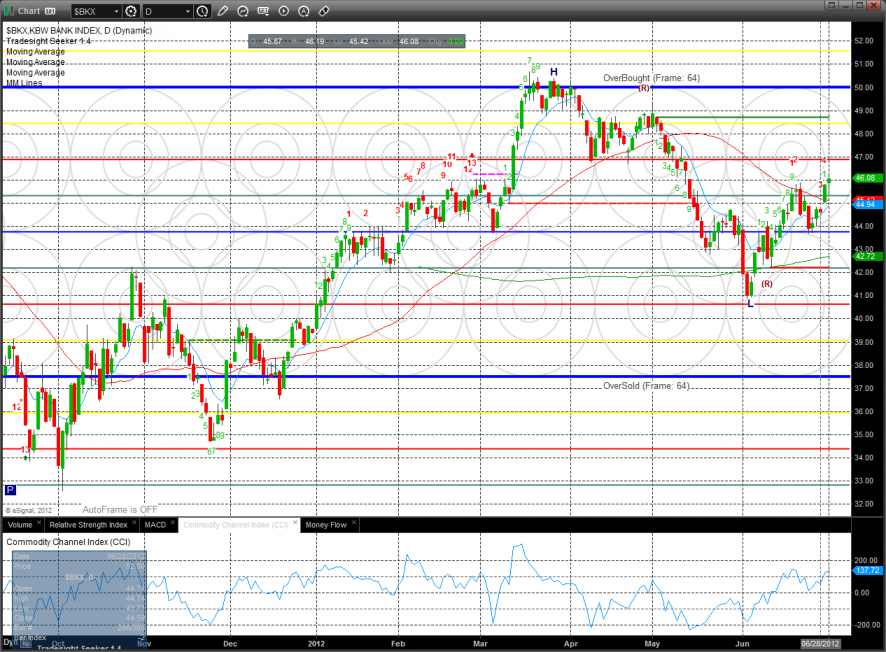

The BKX made a new high but unimpressively so. The next important level is the 47 level which is the April low and May breakdown.

Oil:

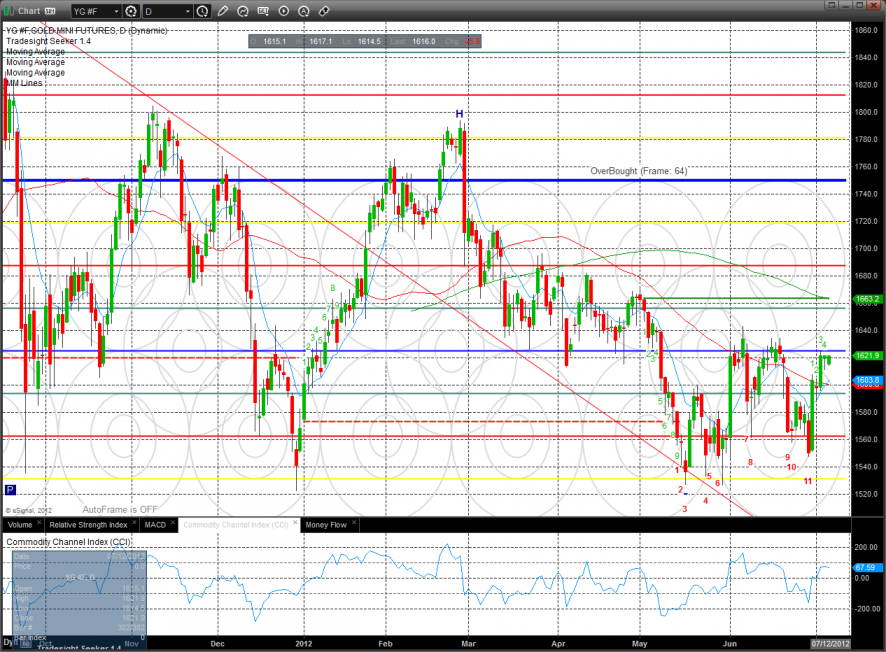

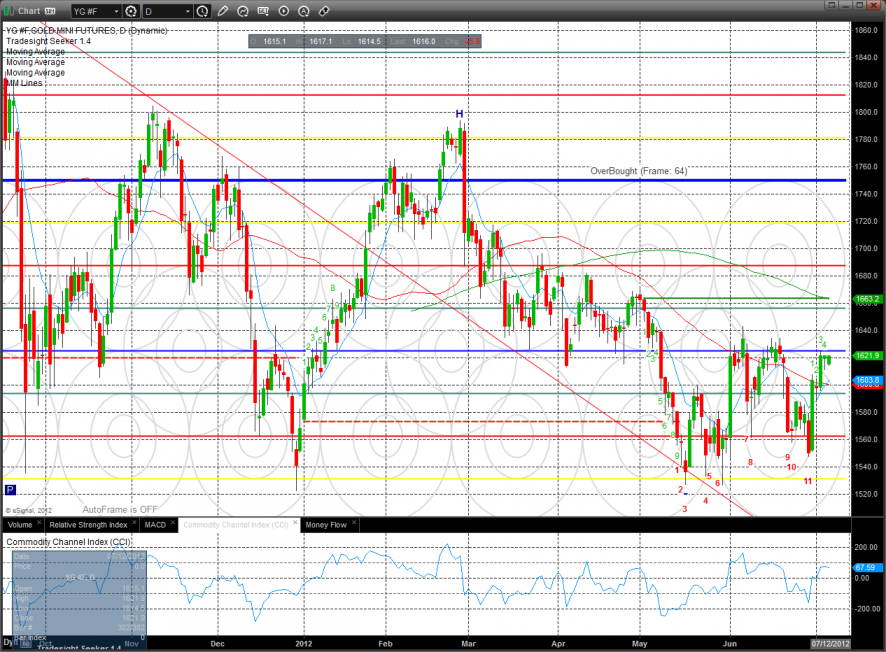

Gold:

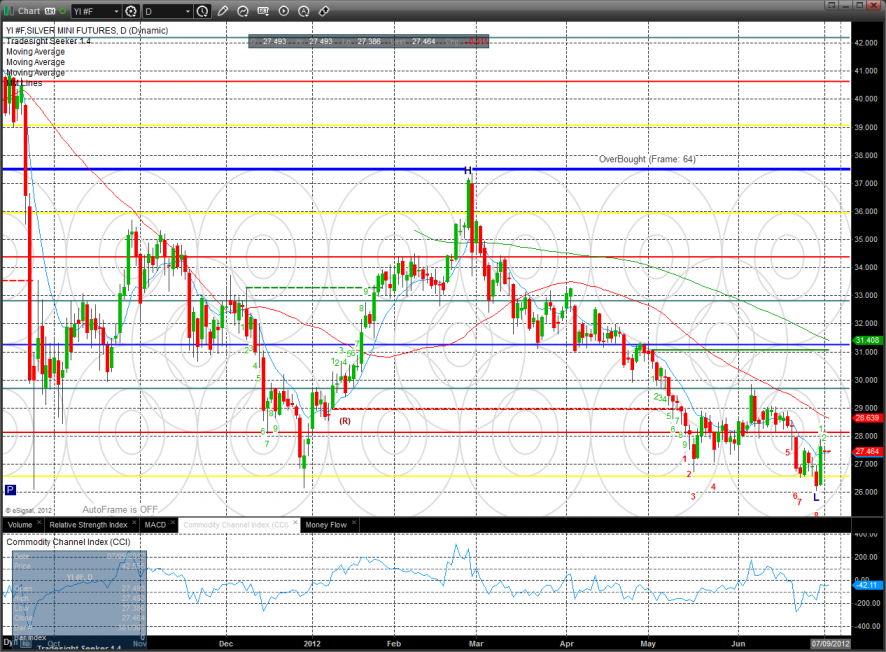

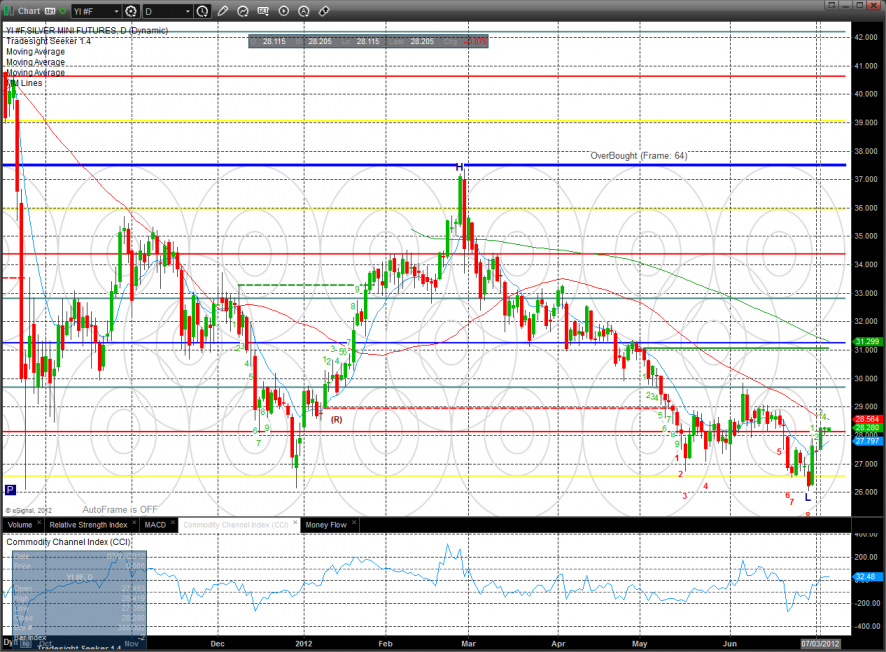

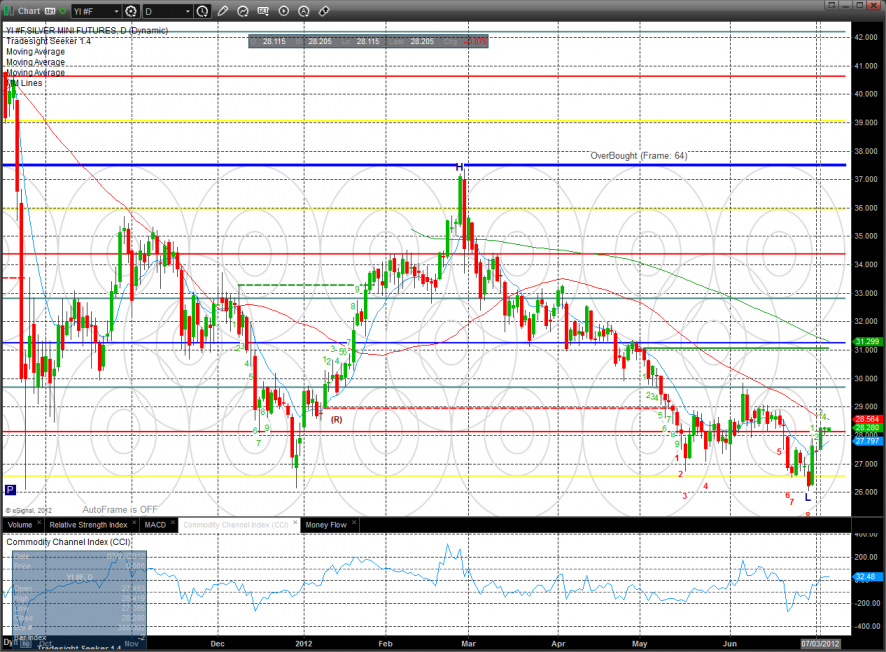

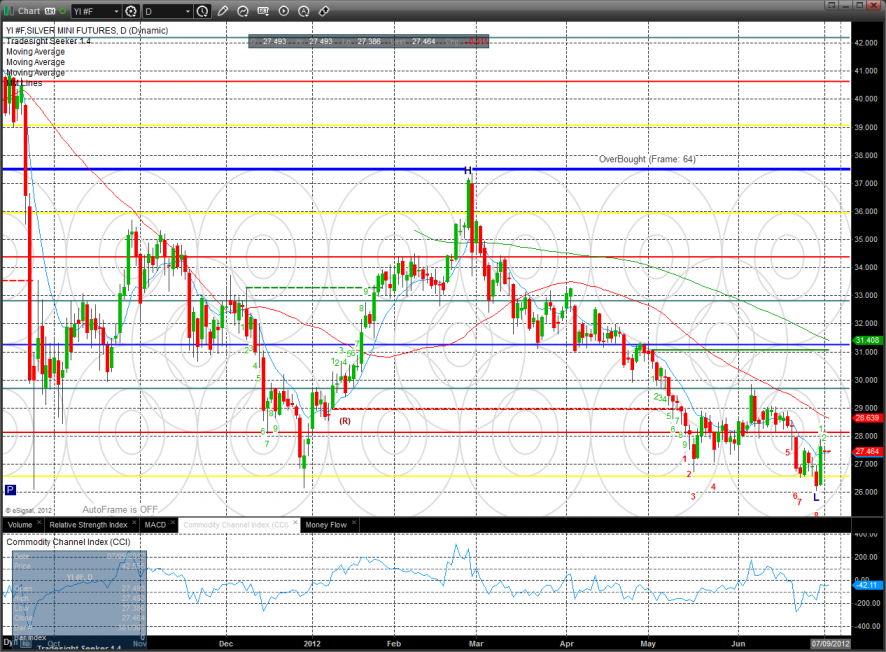

Silver:

Tradesight Market Preview for 7/5/12

The ES posted a relatively inside day where a 10 handle gap down was recovered.

Since trade was contained within the prior day’s there is nothing new technically.

The NQ futures were higher by 27 on the day and are just below the key 4/8 midpoint of the Murrey math box.

The 10-day Trin remains loaded with oversold energy and buying power.

The NDX continues to show relative strength vs. the SPX.

The SOX/NDX cross is getting closer to a bullish change in trend. Keep a close eye on this chart for a higher high.

The Dow/gold chart has yet to breakout which would be a huge buy signal for the long term equity bulls.

The OSX was top gun Tuesday making good on the Seeker 13 exhaustion buy signal. A close above the 50dma will get the attention of the media and many closet oil bulls. The next real challenge will be the 4/8 level up at 218.

The weak sensitive XAU could be making a higher low but won’t be qualified until a close above the June high.

The SOX closed above the June high and right at the 200dma. Note that the Seeker still has not yet recorded a buy signal.

The BKX made a new high but unimpressively so. The next important level is the 47 level which is the April low and May breakdown.

Oil:

Gold:

Silver:

Stock Picks Recap for 7/3/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

No calls in the report for the half day.

In the Messenger, AAPL triggered long (with market support) and worked:

In total, that's just 1 call that triggered, and it worked.

Stock Picks Recap for 7/3/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

No calls in the report for the half day.

In the Messenger, AAPL triggered long (with market support) and worked:

In total, that's just 1 call that triggered, and it worked.

Futures Calls Recap for 7/3/12

No calls for the half day. Might not be much for calls Thursday or Friday if everyone remains on vacation.

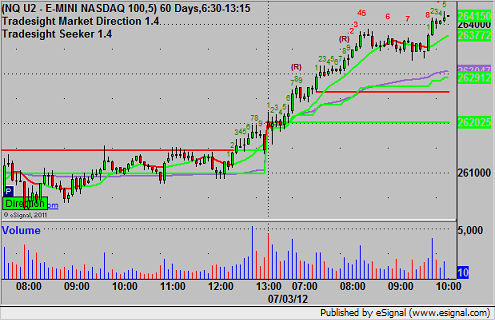

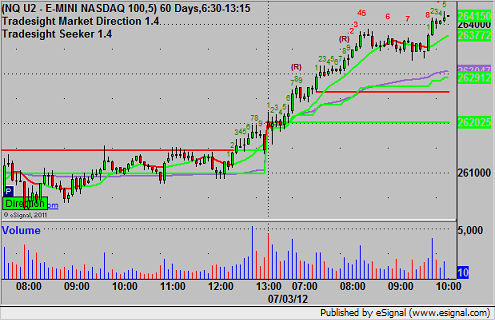

As usual, let's look at the ES and NQ with our market directional lines, Seeker, and VWAP first:

Futures Calls Recap for 7/3/12

No calls for the half day. Might not be much for calls Thursday or Friday if everyone remains on vacation.

As usual, let's look at the ES and NQ with our market directional lines, Seeker, and VWAP first:

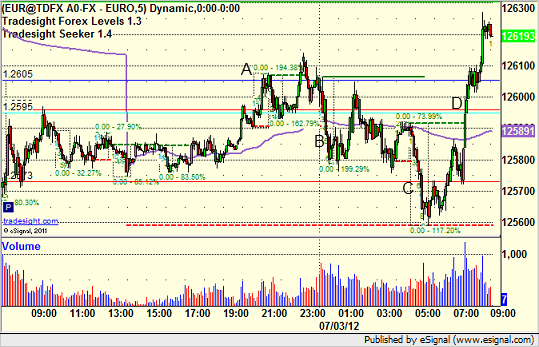

Forex Calls Recap for 7/3/12

Pretty much as expected. No range, so we stay half sized, two stop outs on EURUSD:

Levels will be posted tonight, but no calls for US Holiday. Calls resume tomorrow.

EURUSD:

Triggered long at A, stopped at B. Triggered short at C, stopped at D:

Tradesight Market Preview for 7/3/12

The ES gained one handle on the day but left a bearish range high camouflage sell signal on the chart.

Naz was higher by 4 on the day but also bearishly settled below the close.

The 10-day Trin is still in oversold territory with keeps the overall market loaded with oversold energy.

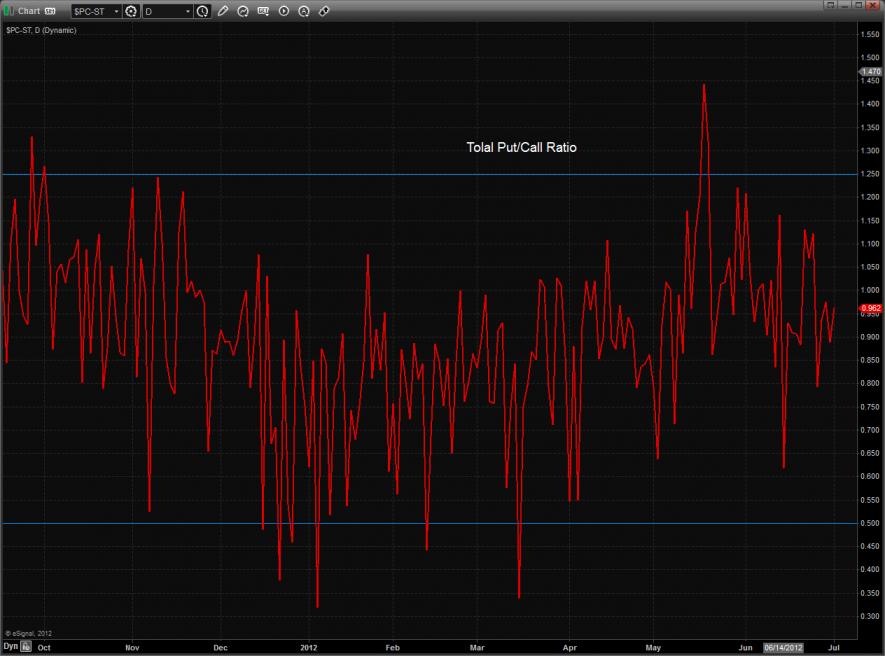

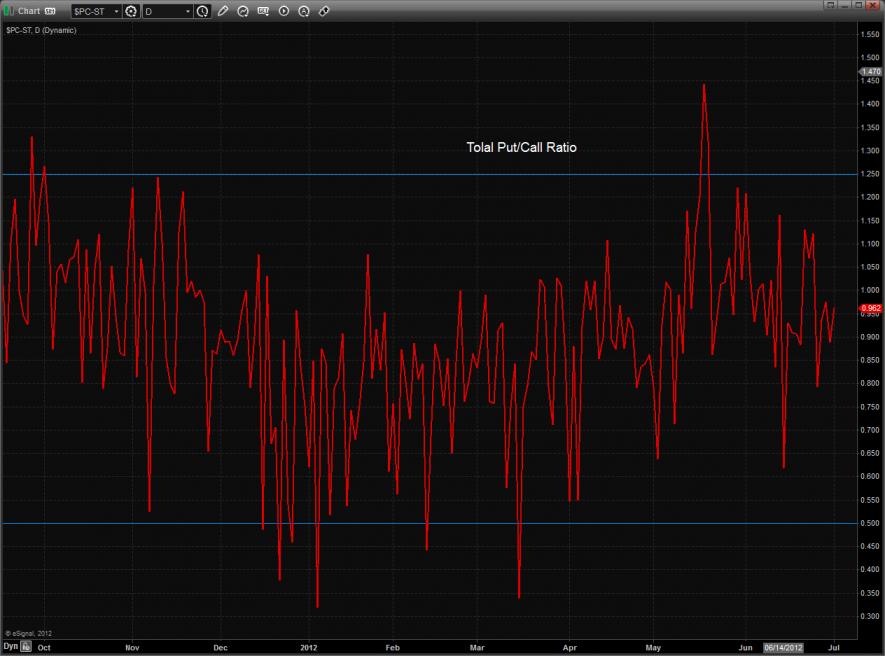

The put/call ratio is still neutral so no signal to be found here.

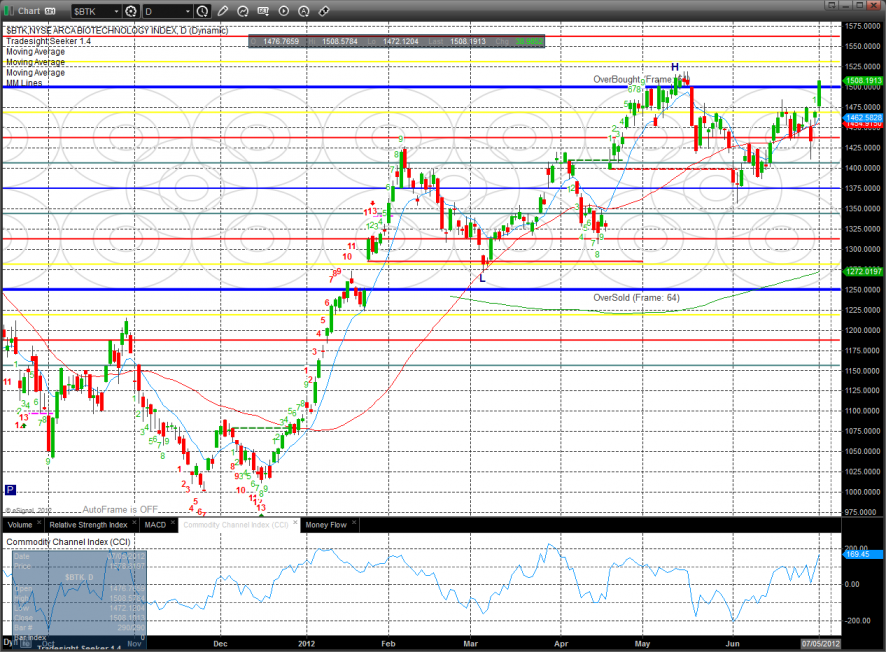

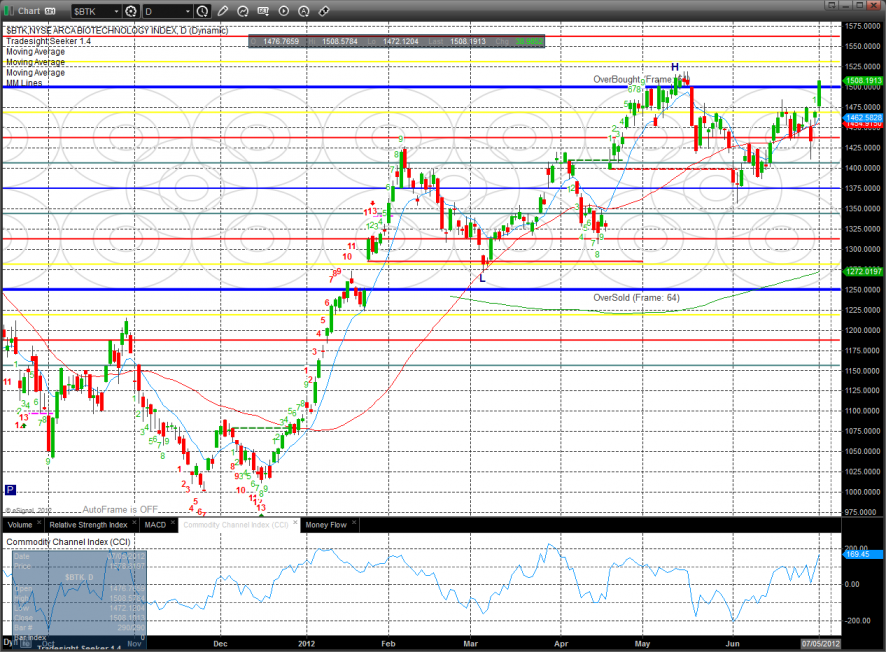

The Multi sector daily chart shows that the BTK is poised for a relative strength breakout.

The BTK was the top gun on the day, very close to the May highs and the only major sector ready for a legitimate breakout.

The BKX was higher by 0.6% on the day and good enough for a new high on the move. Note that price is now back above all of the major moving averages.

The SOX was lower on the day and still waiting for the Seeker exhaustion buy which must happen at or below the swing low close of the move.

Oil:

Gold:

Silver:

Tradesight Market Preview for 7/3/12

The ES gained one handle on the day but left a bearish range high camouflage sell signal on the chart.

Naz was higher by 4 on the day but also bearishly settled below the close.

The 10-day Trin is still in oversold territory with keeps the overall market loaded with oversold energy.

The put/call ratio is still neutral so no signal to be found here.

The Multi sector daily chart shows that the BTK is poised for a relative strength breakout.

The BTK was the top gun on the day, very close to the May highs and the only major sector ready for a legitimate breakout.

The BKX was higher by 0.6% on the day and good enough for a new high on the move. Note that price is now back above all of the major moving averages.

The SOX was lower on the day and still waiting for the Seeker exhaustion buy which must happen at or below the swing low close of the move.

Oil:

Gold:

Silver: