Stock Picks Recap for 7/2/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CLDX triggered right at the close, so we don't count it.

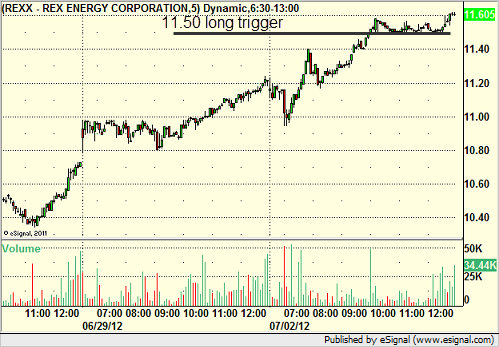

REXX triggered long (with market support) and worked a bit, but never even got twenty cents:

In the Messenger, Rich's SINA triggered short (with market support) and didn't work:

TEVA triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 7/2/12

As expected, a waste of time with no one around trading for the Holiday week. Tuesday is only a half day, so we most likely won't have any calls. The market is closed Wednesday. We resume Thursday, although I don't expect any action until Monday.

We did make one call early just to test, but there was no action.

Net ticks: -7 ticks.

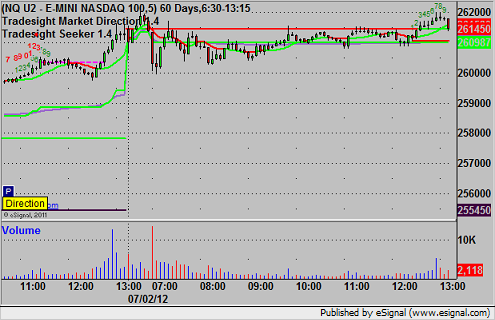

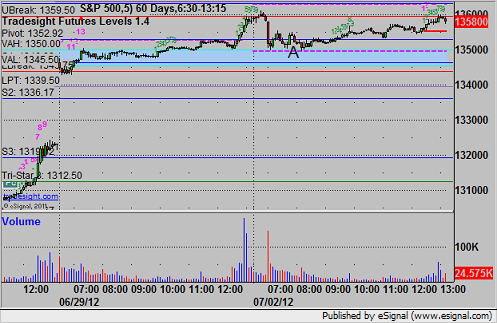

As usual, we will start by looking at the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

Triggered short at A (by a tick) heading into the Value Area and stopped:

Forex Calls Recap for 7/2/12

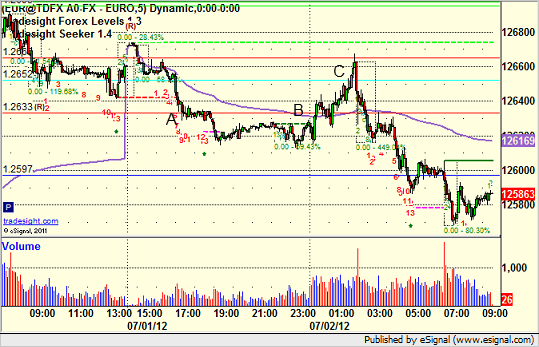

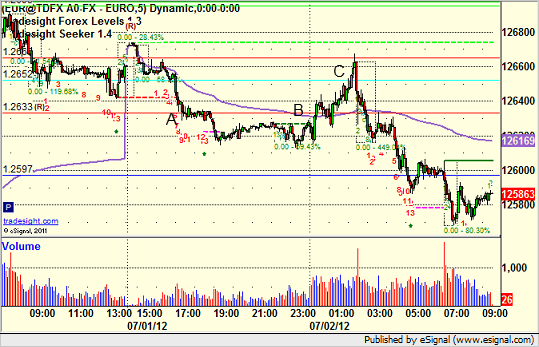

And this is why we go half-size for a week with a strange Holiday layout like this one. The market ignored virtually all technicals for the session. See EURUSD below for the trade that triggered.

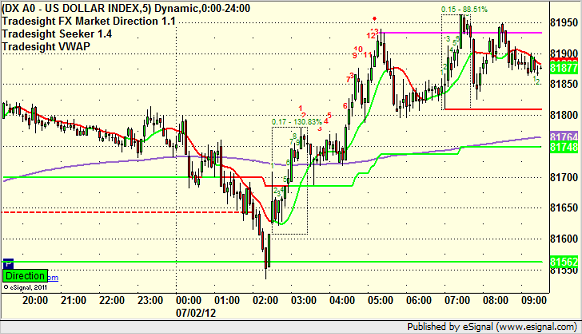

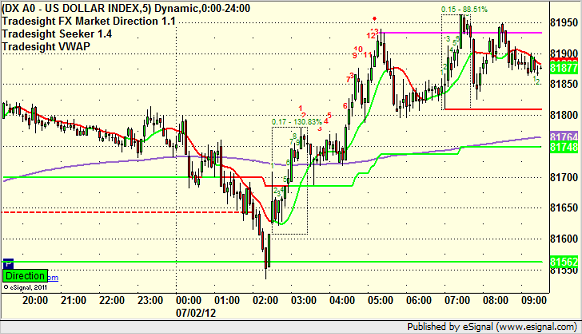

Here's a look at the US Dollar Index intraday with our market directional lines:

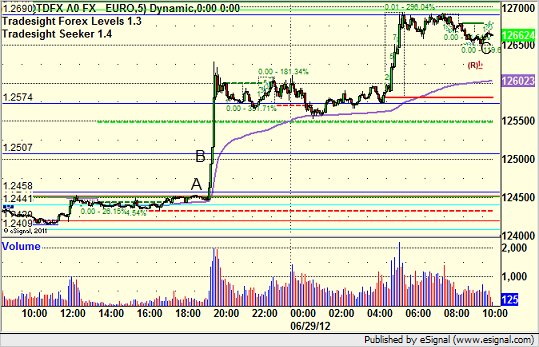

EURUSD:

Triggered short at A, gave you all the way to B to enter, stopped at C:

Forex Calls Recap for 7/2/12

And this is why we go half-size for a week with a strange Holiday layout like this one. The market ignored virtually all technicals for the session. See EURUSD below for the trade that triggered.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, gave you all the way to B to enter, stopped at C:

Tradesight June 2012 Forex Results

Finally, a much better month in Forex.

Before we get to June’s numbers, here is a short reminder of the results from May. The full report from May can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for May 2012

Number of trades: 36

Number of losers: 23

Winning percentage: 36.1%

Worst losing streak: 6 in a row (May 20-25)

Net pips: +10

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for June 2012

Number of trades: 23

Number of losers: 9

Winning percentage: 60.8%

Worst losing streak: 3 in a row (June 26)

Net pips: +275

We finished the May Results report with the line "The turning point lies ahead." Turns out, it was June 1.

For the first time in a while, Forex ranges were stable/improved for the month. Not a ton, but it does suggest a turn. We ended up with a few days where no trades triggered because the ranges were still small, so we only had 23 trades for the month, which is unusual. However, it was a really clean month. We had 3 losers in one day, and other than that, we only had 6 losing trades for the month, and many of the winners carried over a couple of days and led to bigger gains, which is what we like to see. Our system is built around small losses and letting winners play out when they do, and this definitely shows the value of that approach. Summer can be a slow time for Forex, especially June and July, but after months of a stagnant market waiting to see how Europe would dig out of its problems, the fact that the picture might be clearing up is positive for Forex trading.

The ranges didn't expand enough to add more than a couple of pips to the 6-month average daily ranges on some of the pairs, so we can't get too excited yet, but it does feel like maybe May was the turning point and end of the doldrums for now. If July stays good, then the outlook for the rest of the year is much improved from the first half.

On to July…

Tradesight June 2012 Forex Results

Finally, a much better month in Forex.

Before we get to June’s numbers, here is a short reminder of the results from May. The full report from May can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for May 2012

Number of trades: 36

Number of losers: 23

Winning percentage: 36.1%

Worst losing streak: 6 in a row (May 20-25)

Net pips: +10

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for June 2012

Number of trades: 23

Number of losers: 9

Winning percentage: 60.8%

Worst losing streak: 3 in a row (June 26)

Net pips: +275

We finished the May Results report with the line "The turning point lies ahead." Turns out, it was June 1.

For the first time in a while, Forex ranges were stable/improved for the month. Not a ton, but it does suggest a turn. We ended up with a few days where no trades triggered because the ranges were still small, so we only had 23 trades for the month, which is unusual. However, it was a really clean month. We had 3 losers in one day, and other than that, we only had 6 losing trades for the month, and many of the winners carried over a couple of days and led to bigger gains, which is what we like to see. Our system is built around small losses and letting winners play out when they do, and this definitely shows the value of that approach. Summer can be a slow time for Forex, especially June and July, but after months of a stagnant market waiting to see how Europe would dig out of its problems, the fact that the picture might be clearing up is positive for Forex trading.

The ranges didn't expand enough to add more than a couple of pips to the 6-month average daily ranges on some of the pairs, so we can't get too excited yet, but it does feel like maybe May was the turning point and end of the doldrums for now. If July stays good, then the outlook for the rest of the year is much improved from the first half.

On to July…

Tradesight June 2012 Futures Results

Tradesight officially added a Futures trade call service back in 2011, and two months ago we added a daily report for the futures service. This allows us to recap for archival purposes our results. Currently, we have 10 years of day-by-day trade results in our stock service (about 18 months worth available without a subscription in the Market Blog on the website). We have 7 years of day-by-day trade results for our Forex service (again with 18 months worth available without a subscription in the Market Blog). We have also been tabulating the monthly pip results in our Forex service for about 18 months as well. You can read those monthly results here.

Now that we have the daily Futures report, which you can scroll through here, we have an archive building of the Futures trade calls. With that, we will also be doing a monthly summary of net results.

A few words before we begin our first official monthly report. Our Futures service revolves around the Tradesight Futures Levels, which include a series of calculated support and resistance points that we teach how to use in our 10 our Futures training course. The goal of the course is to teach you how to use these levels so that you can use them all day long on the (currently) six contracts that we offer (ES, NQ, YM, ER, QM, and YG). We don't set out to teach people how to follow our calls. Our courses teach you how to trade on your own, so you would never need our calls by themselves. The calls built into the services are example calls using the material that we teach to help people see the most valid setups that we can find. Because the ES is the most liquid and commonly traded contract, the majority of our calls for the service are in the ES, but we do reach out when we see better setups in the other contracts and make calls there. Someone who has taken the course, however, should be able to apply the rules and concepts to the contracts that they prefer, so if you like trading the QM (crude oil), there is no reason that you can't. That's why we provide the data. We simply offer a handful of calls daily that focus on key setups in the active times of day, and those calls are the ones that we summarize in the futures service daily (and archive). And those are the calls that we total up here, in the end of month report, for result tracking purposes.

So, with that out of the way, let's dig into our first official month of results.

For tracking purposes, there is no adjustment for size in the results. Each trade is taken as an equal-sized trade, with an entry and stop (the stop on ES and NQ is always 6 ticks, sometimes more on something like the ER). We have a first target where we sell half and then we manage the second half of the trade to a final exit. So, these results assume the same size is taken on all trades, which in reality is not what should be done. For example, we came into the last week of June stating that between the already light market volume and the fact that the market would be focused on end of quarter window-dressing, the environment would be rougher. Our courses detail how to adjust for this in your trading size.

As always seems to be the case when launching a new product, the market wasn't extremely cooperative for our first month. Volume has been way off and got worse as the month progressed. Despite that, we had a nice month going heading into the last week, but we net lost over 30 ticks in the last week (again, somewhat predictable based on volume and end of quarter, which kept intraday movement contained most of the days until the final big gap up on the last day of the month).

We track our results in terms of win/loss ratio and net ticks gained. Here is a breakdown of the month of June:

Number of trades: 60

Number of winners: 34

Win percentage: 56.7%

Net ticks: +16

Our goal in trading over time is to win between 60-70 percent of our trades. This month fell about 3% short of that, which is fine considering the environment. The other factor is that many of the trades that worked only hit their first target and then stopped out of the second half around the entry. While our trading system keeps losses tight and searches for a 60-70% win rate, the net results are really about the trades that play out for more than just the first target. Because of the narrow, choppy activity, we only had 5 or so trades in the whole month that really played out for bigger gains, and that is not a normal situation. Early July probably won't be much better with the Holiday, but the rest of July will hopefully be improved in terms of range and hopefully market volume as well. We will analyze the trading results and compare the market environment for those results in greater detail in the future months.

Stock Picks Recap for 6/29/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NPSP gapped over the trigger just barely, so no play.

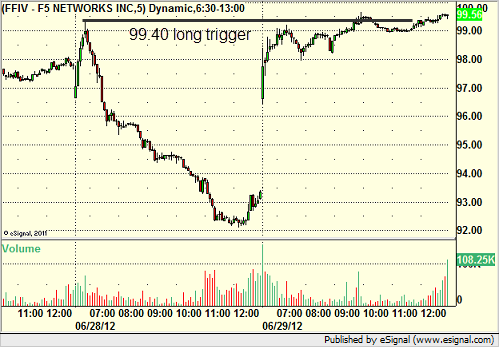

From the Messenger, Rich's FFIV triggered long (with market support) and worked enough for a partial:

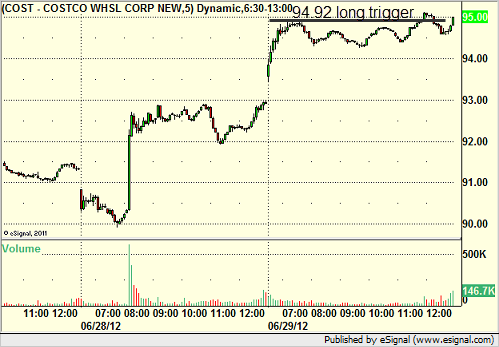

His COST triggered long (with market support) and didn't work:

His CSTR triggered long (with market support) and worked enough for a partial:

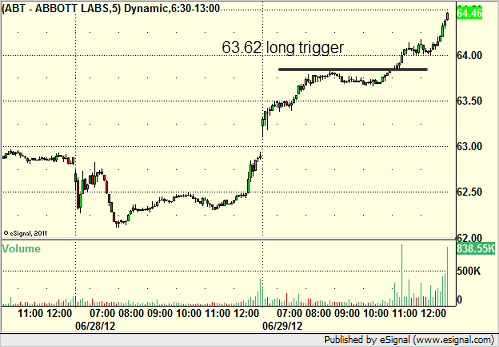

His ABT triggered long (with market support) and worked:

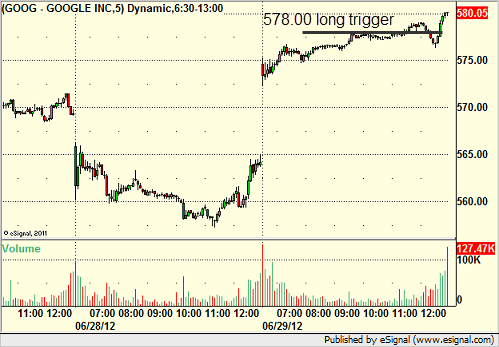

GOOG triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 6/29/12

No trades for the end of quarter after the large gap. Next week could be very light due to the Holiday. Markets are closed Wednesday. Things should pick up the week after, HOWEVER, be aware that the start of the third quarter is usually good, and with the news out of Europe and the Supreme Court ruling on ACA, the potential to get moving is here, so the Holiday is the thing in the way.

As usual, we will start with the ES and NQ with their market directional lines, Seeker, and VWAP:

Forex Calls Recap for 6/29/12

A nice 200-pip winner in the EURUSD to close out the week, month, and quarter. See that section below.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts with the Seeker and Comber separately heading into the new week (everything is mid-range with no Seeker/Comber setups or breakout points), and then look at the US Dollar Index.

Here's the Index intraday with our market directional lines:

I WILL BE HALF SIZE ALL WEEK due to the Holidays. We have Levels all five days but no calls Tuesday night ahead of the Holiday Wednesday.

EURUSD:

Triggered long at A, hit first target at B, closed final piece at C for 200 pips: