Stock Picks Recap for 6/28/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SINA triggered short (with market support) and worked great:

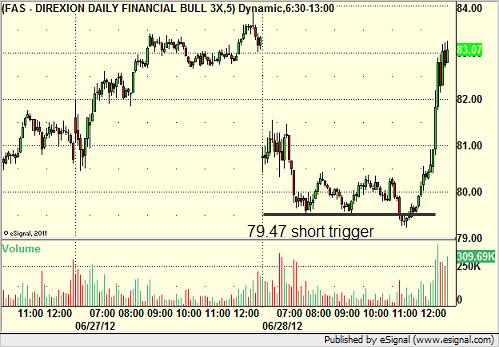

In the Messenger, Rich's FAS triggered short (ETF, so no market support needed) and worked enough for a partial:

Many other calls, but none of them triggered.

In total, that's 2 trades triggering with market support, both of them worked. Strange day.

Futures Calls Recap for 6/28/12

We got the Supreme Court ruling on the ACA, and it really didn't generate the market excitement either way that I was expecting, at least until the last 45 minutes or so. Volume closed out weak again at 1.6 billion NASDAQ shares, and we had a couple of nice setups that couldn't get going at all. See the ES section below for the recap.

Net ticks: -1.5 ticks.

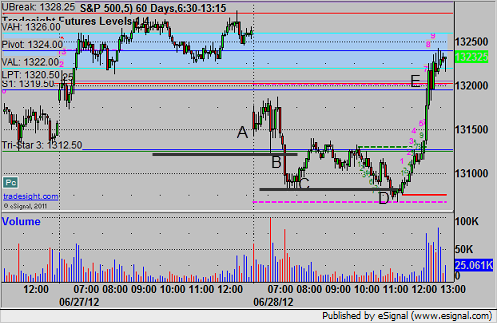

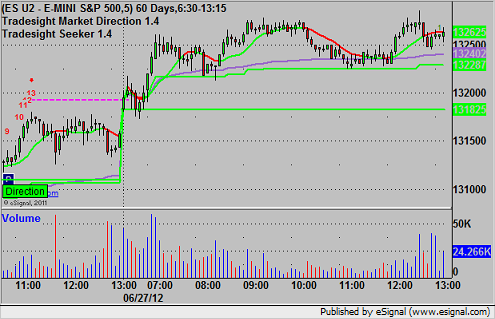

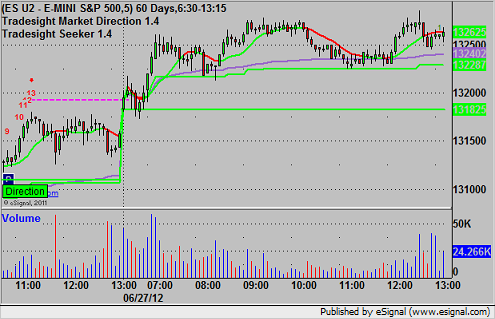

As usual, let's start with a look at the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

Mark's out-of-the-gate ES short triggered at 1315.00 at A and stopped. That trade was not valid again. The next short triggered at 1312.00 at B, hit first target for six ticks, and we closed the second half at 1308.50 for 14 ticks when the market died and volume dropped off at C. Later triggered a new trade short under 1308.00 at D which stopped. Finally, the breakout over S1, LPT, LBreak triggered long at E at 1320.75, hit first target, and stopped the second half under the entry:

Forex Calls Recap for 6/28/12

A small winner in the EURUSD (hit first target and second half stopped at original stop overnight). See that section below. Market was dead flat after that, so nothing else to do.

New calls and Chat tonight as we close out Q2 and head into the Holiday week. I WILL BE TRADING HALF SIZE FOR THE FOUR TRADING DAYS NEXT WEEK.

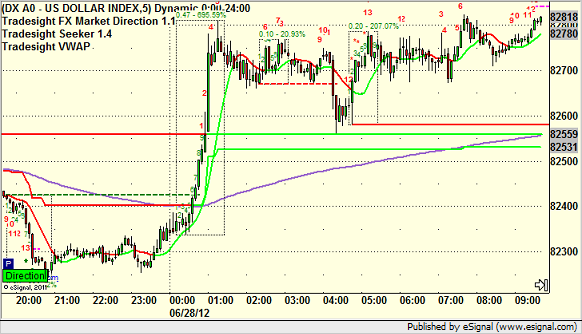

Here's the US Dollar Index intraday with our market directional lines:

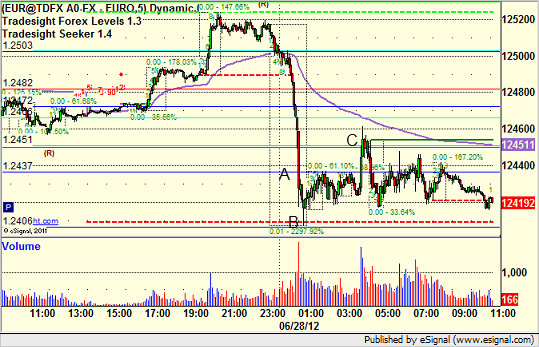

EURUSD:

Triggered short at A, hit first target at B, and basically stopped the second half at C (in theory, if you staggered your orders enough, it might not have, but we'll call it stopped):

Stock Picks Recap for 6/27/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, THLD gapped over, no play.

APOL triggered long (with market support) and didn't work:

GLUU triggered long (with market support) and worked:

RVBD triggered short (without market support) and didn't work:

From the Messenger, Rich's AZO triggered long (without market support) and worked great:

His JPM triggered short (with market support) and didn't work:

His AAPL triggered short (with market support) and didn't work:

His BIIB triggered long (with market support) and didn't work:

AMZN triggered short (without market support) and didn't work:

NFLX triggered short (without market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 1 of them worked, 4 did not. Our worst win percentage of the year on continued light volume.

Futures Calls Recap for 6/27/12

Another day of mixed results and false starts before the real move, all of it on light volume. See NQ and ES sections below.

Net ticks: -2.5 ticks.

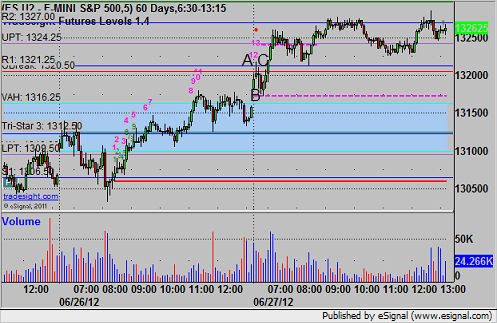

First, let's look at the ES and NQ with our market directional lines, Seeker, and VWAP:

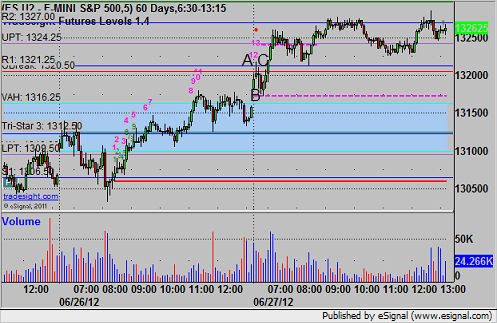

ES:

Triggered short at A and 1317.75 and stopped for 7 ticks. Triggered long at B at 1321.50 and stopped for 7 ticks. Triggered long again at C at same price, hit first target for 6 ticks, and moved stop up twice to 1324.50 for 12 ticks:

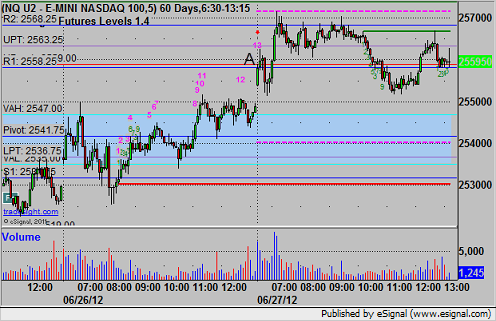

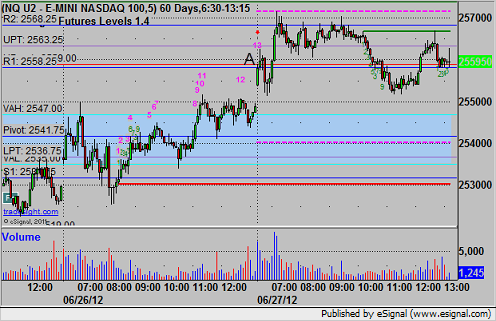

NQ:

We measure NQ ticks in 1/2 point increments, not 1/4 point. Triggered long at A at 2559.50, hit first target for 6 ticks, stopped under entry:

Futures Calls Recap for 6/27/12

Another day of mixed results and false starts before the real move, all of it on light volume. See NQ and ES sections below.

Net ticks: -2.5 ticks.

First, let's look at the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

Triggered short at A and 1317.75 and stopped for 7 ticks. Triggered long at B at 1321.50 and stopped for 7 ticks. Triggered long again at C at same price, hit first target for 6 ticks, and moved stop up twice to 1324.50 for 12 ticks:

NQ:

We measure NQ ticks in 1/2 point increments, not 1/4 point. Triggered long at A at 2559.50, hit first target for 6 ticks, stopped under entry:

Forex Calls Recap for 6/27/12

A clean winner for the session in the EURUSD on the short size, and we're still holding the second half of that play as I write this. See that section below.

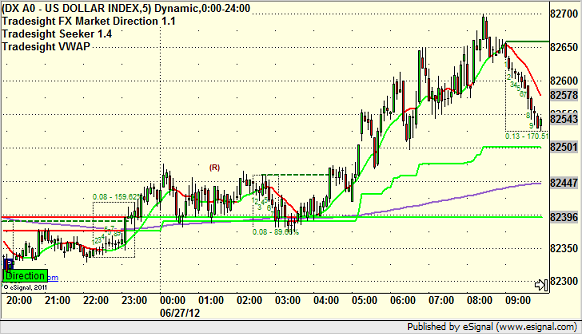

Here's the US Dollar Index intraday with our market directional tools:

New calls and Chat tonight.

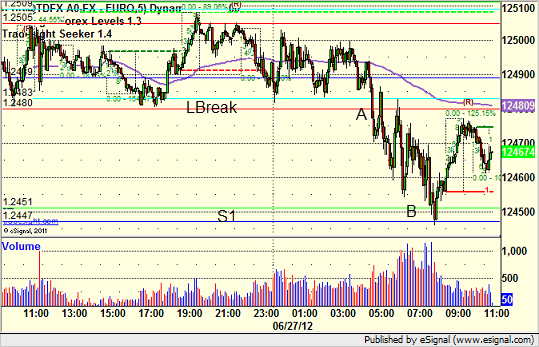

EURUSD:

Triggered short under LBreak at A, hit first target exactly at B, stop is currently over LBreak:

Tradesight Market Preview for 6/28/12

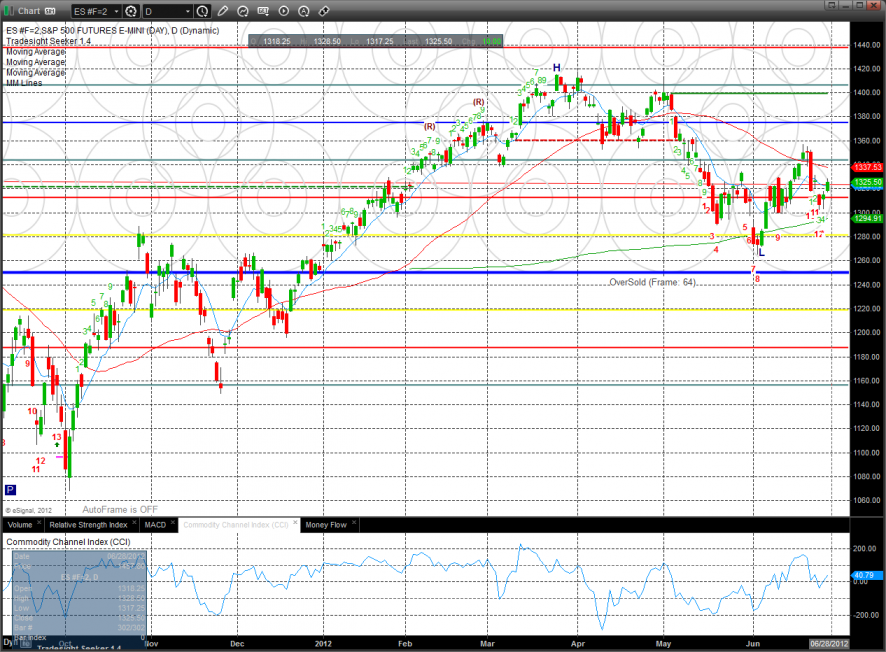

The ES was higher by 10 handles on the day after having enough oversold energy loaded into it. Price remains above the 200dma and on the north side of the 1312.50 level that has dominated the May/June trading to date.

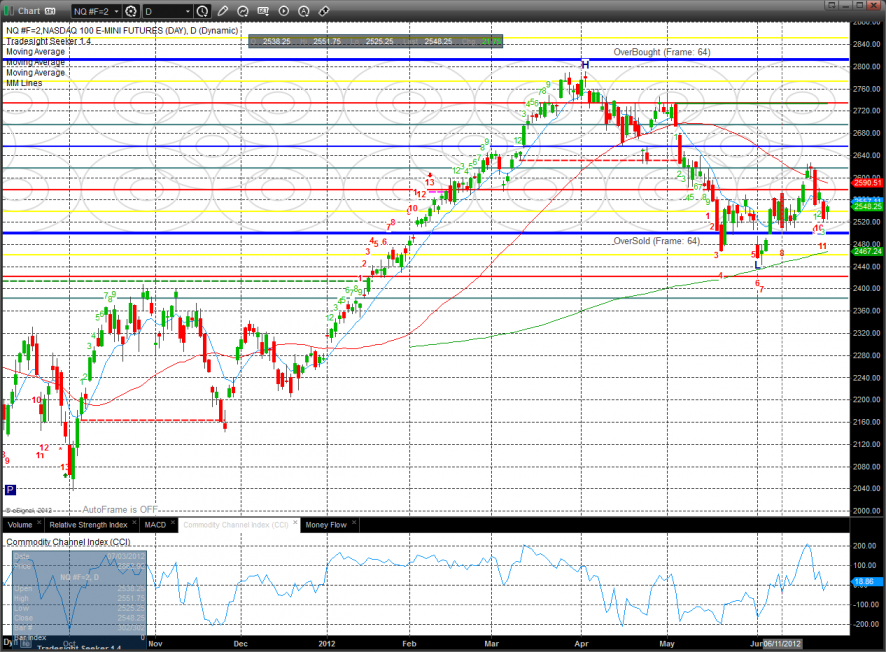

The NQ futures were higher by only 9 which made for a very bifurcated session. A little relative strength in the SP side is not a bad thing for the bulls at this point because of how badly the banks and oil service stocks have been performing in the SPX.

The 10-day Trin still has oversold energy to be released which is a very good cocktail to lift prices higher in light summer volume.

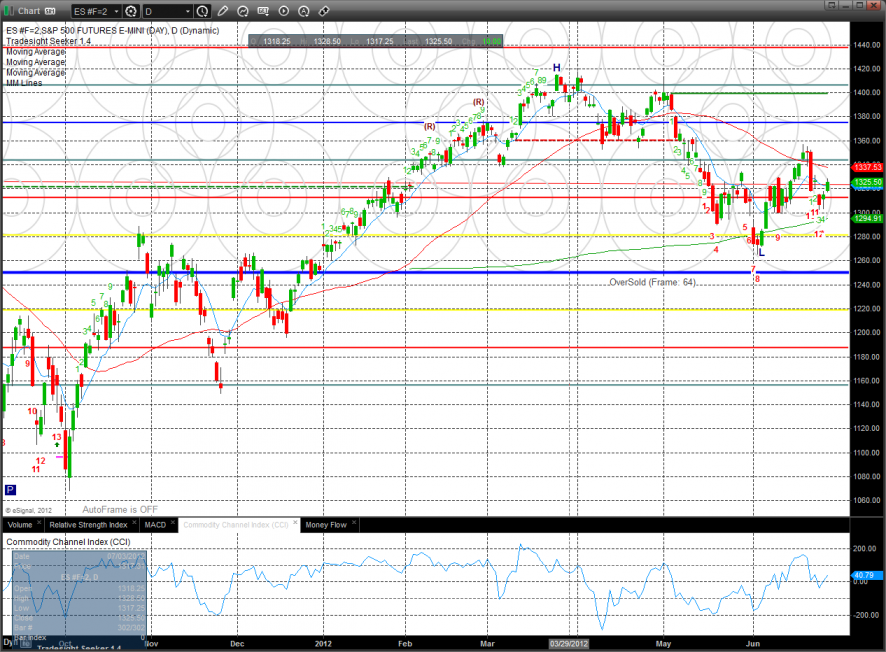

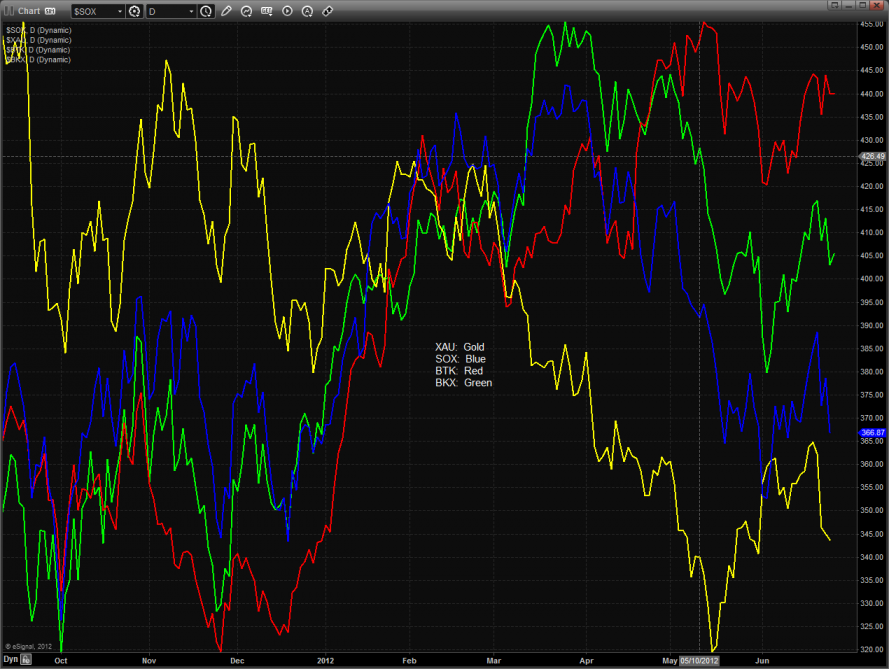

Multi sector daily chart:

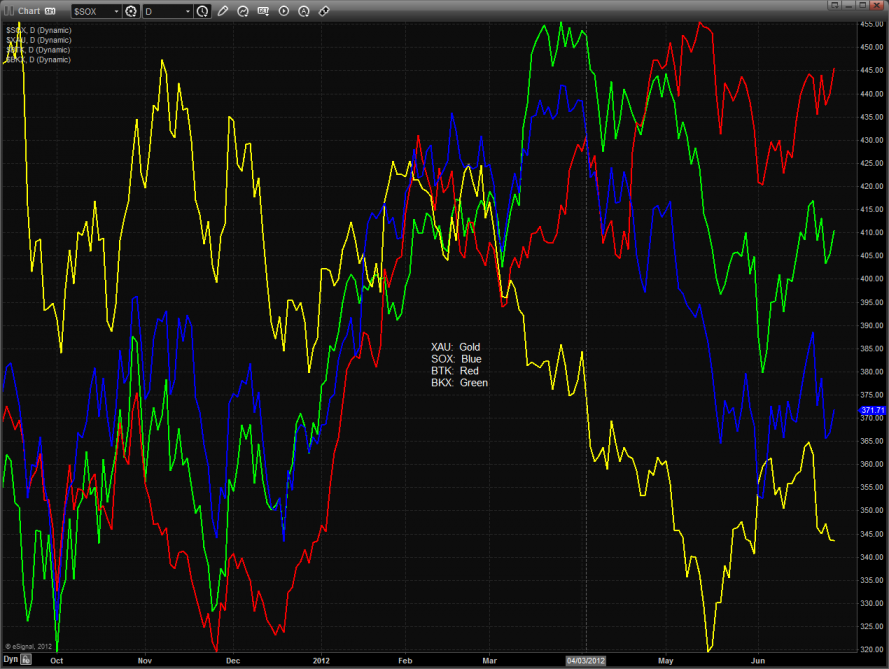

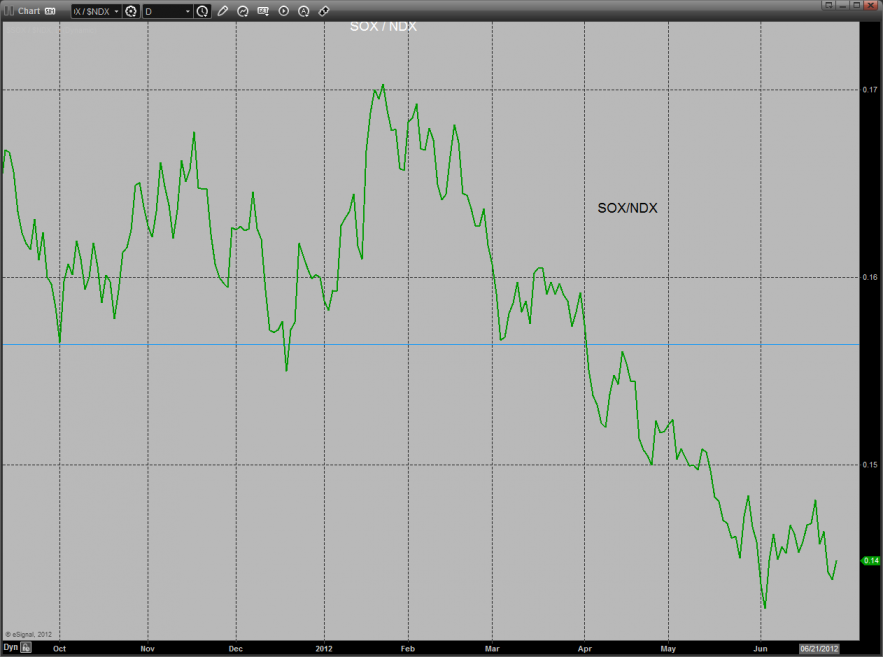

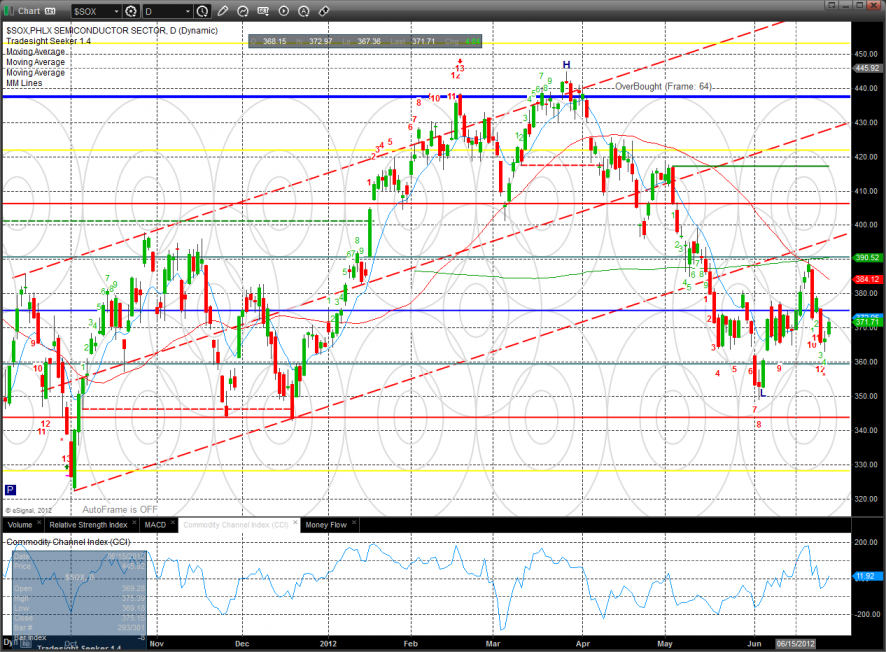

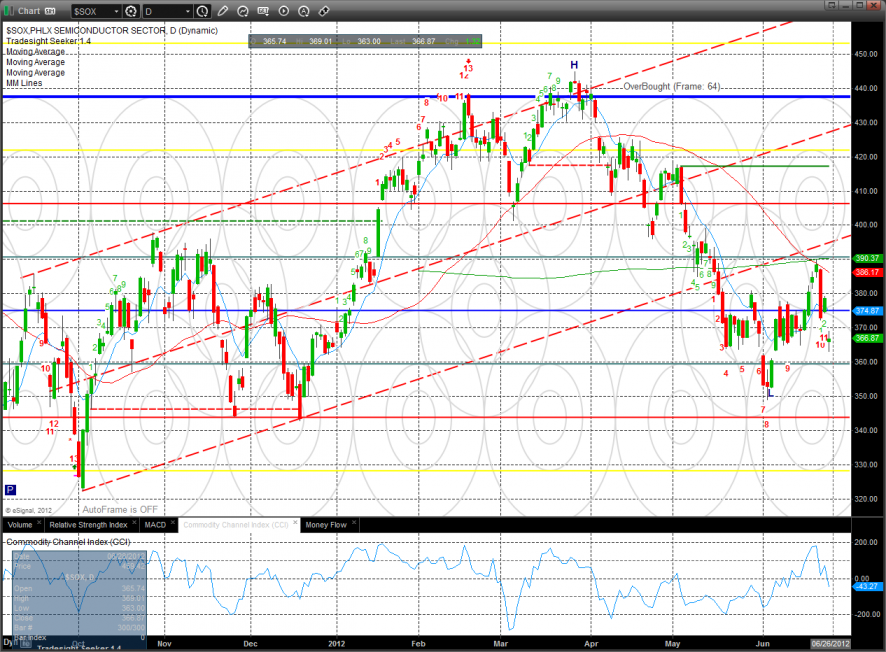

The SOX/NDX cross did not make a lower low on this move and has the potential for a higher low. A close above the June high would quality the pattern as having a legitimate higher high in place which would be positive for the NDX and then by extension the SPX.

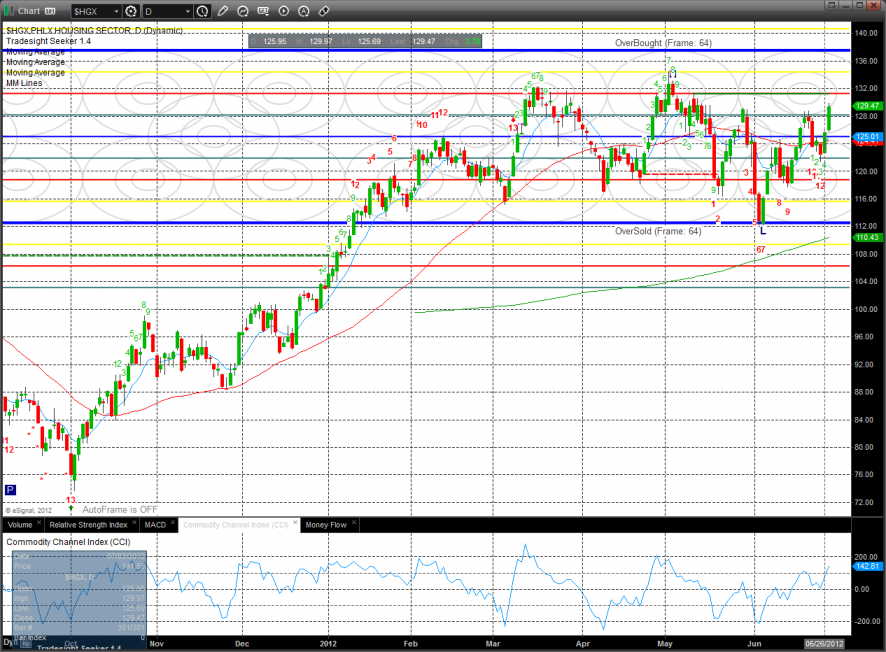

The HGX housing index is putting in some very positive chart construction. Keep a close eye on the Seeker for a high range buy signal. This would be a very notable development and could lead to a powerful breakout if the May highs are taken out.

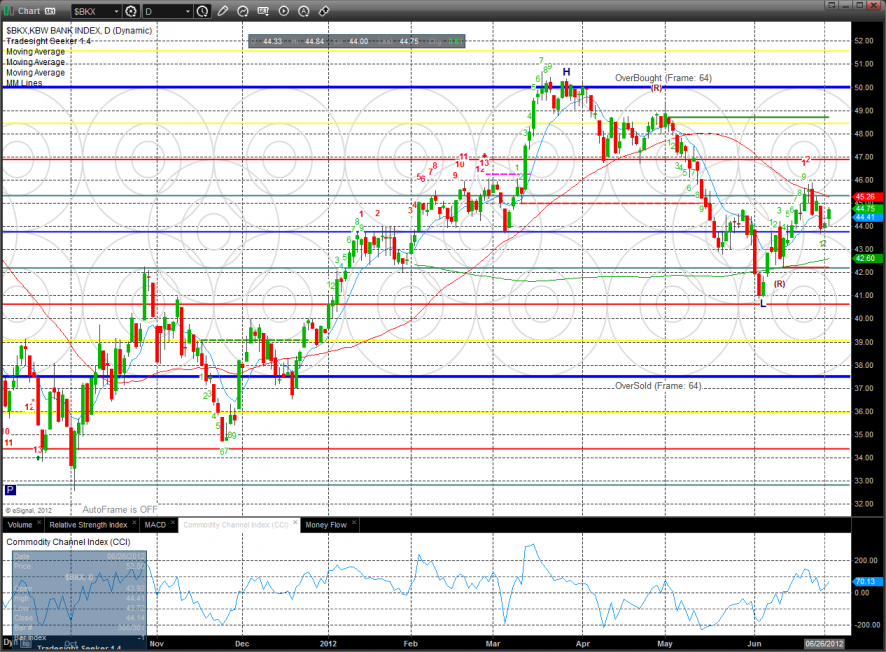

The BKX is still trapped under the 50dma and June highs. If the 10 candle of the Seeker setup is taken out the overhead static trend line from May 1 will be in play.

The SOX is very close to a Seeker buy signal. Be patient and have your buy list ready.

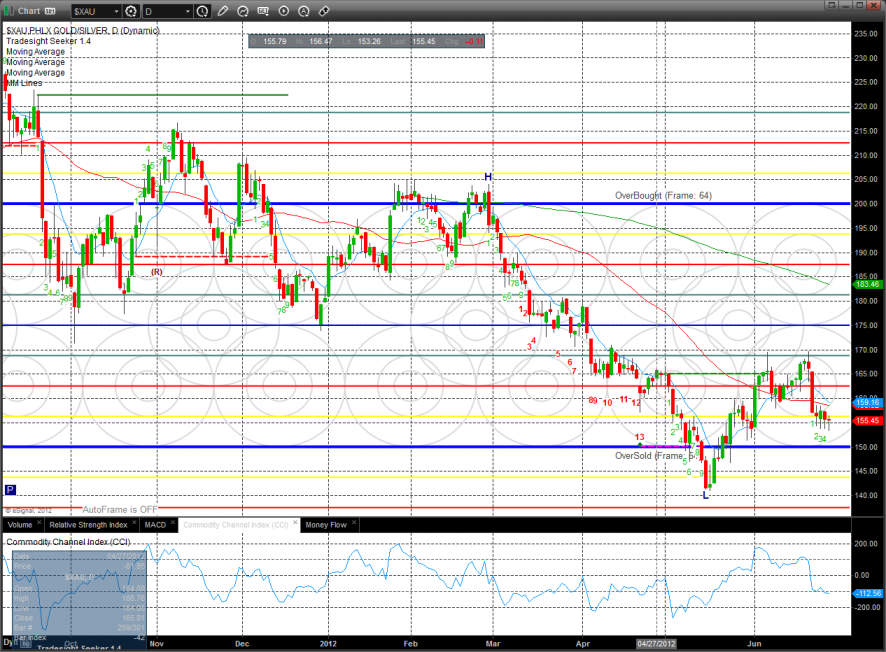

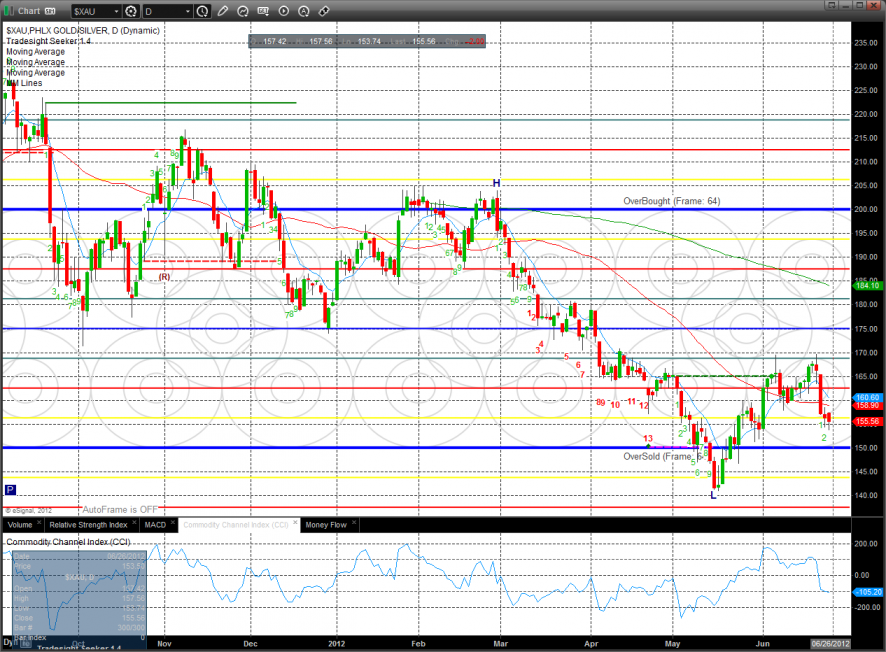

The XAU was the last laggard and a source of funds for today’s gains.

Oil has an active Seeker buy signal. A close above the 10ema will begin to turn the momentum.

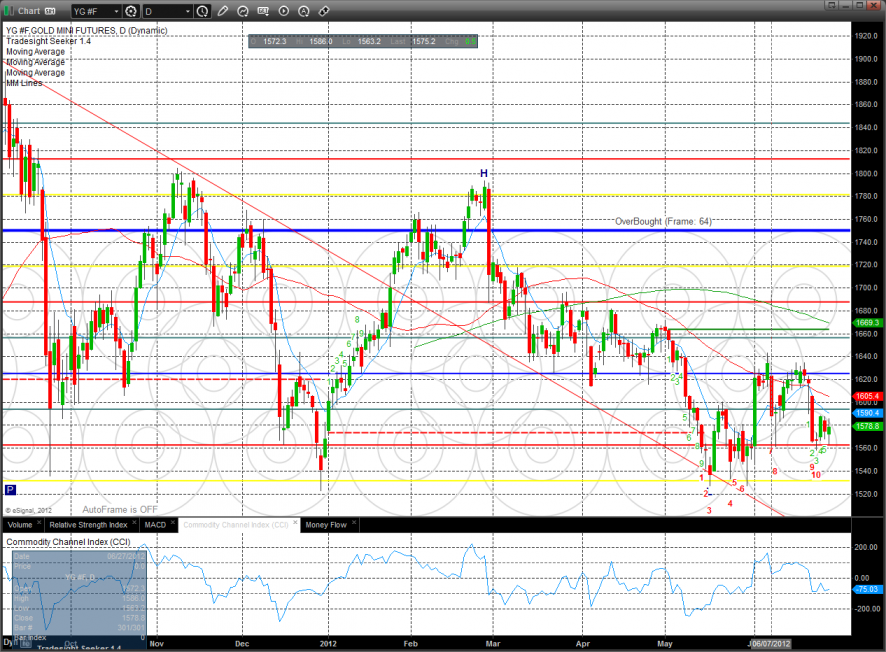

Gold:

Silver:

Stock Picks Recap for 6/26/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ALTR triggered short (with market support) and didn't work:

DISH triggered short (with market support) and worked:

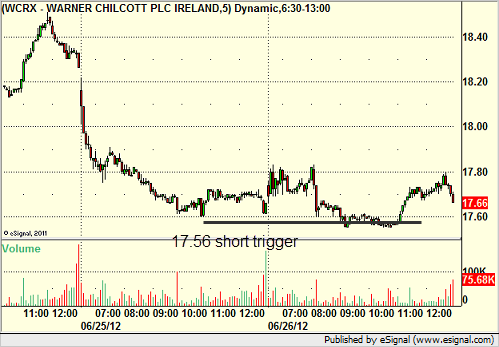

WCRX triggered short (with market support) and didn't work:

In the Messenger, Rich's AAPL triggered short (without market support due to opening five minutes) and worked enough for a partial:

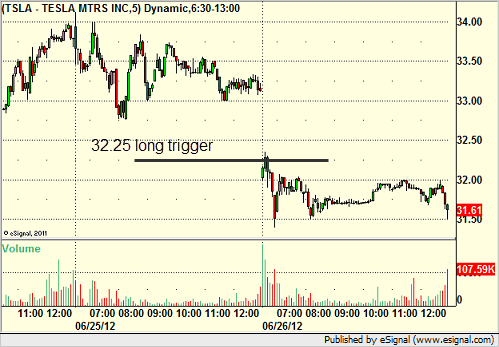

His TSLA triggered long (without market support) and didn't work:

His POT triggered long (without market support) and worked:

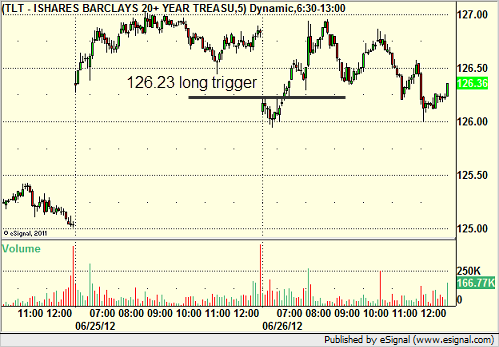

TLT triggered long (ETF, so no market support needed) and worked great:

Mark's MNST triggered long (without market support) and didn't work:

NFLX triggered short (with market support) and didn't work:

Mark's CREE triggered short (with market support) and didn't work:

Many other calls, but nothing triggered.

In total, that's 6 trades triggering with market support, 2 of them worked, 4 did not. Very choppy day.

Tradesight Market Preview for 6/27/12

The ES was higher by 9 on the day recording a Seeker 13 exhaustion buy using the most aggressive methodology. The Seeker conservative approach will defer an exhaustion buy signal until there is a close below or equal to the June low.

The NQ futures posted an inside day which means there were no new technical developments. An inside day always has some extra power loaded into it when it breaks the range so be ready.

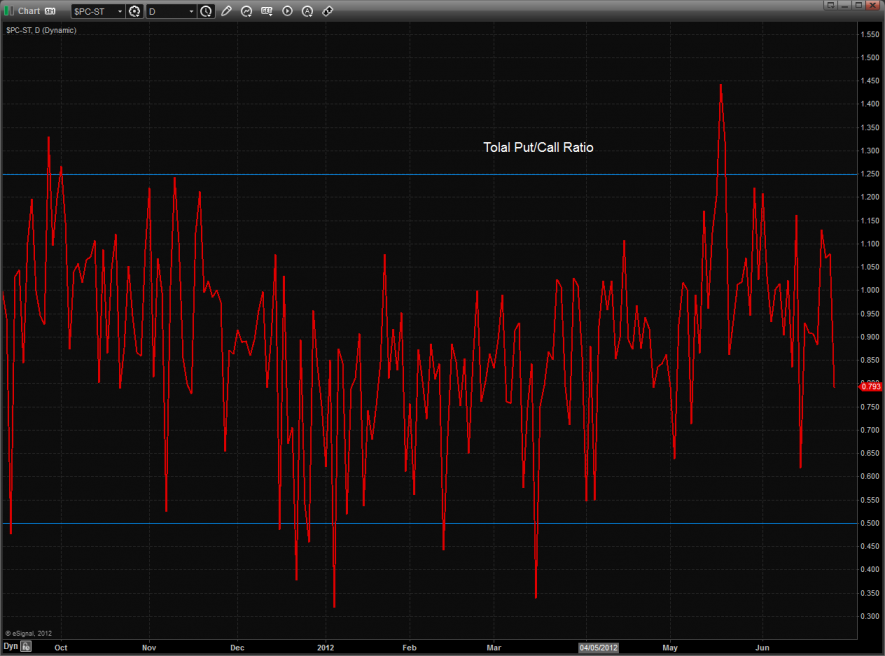

The put/call ratio has retreated back to neutral.

The 10-day Trin is back its normal trading band.

Multi sector daily chart:

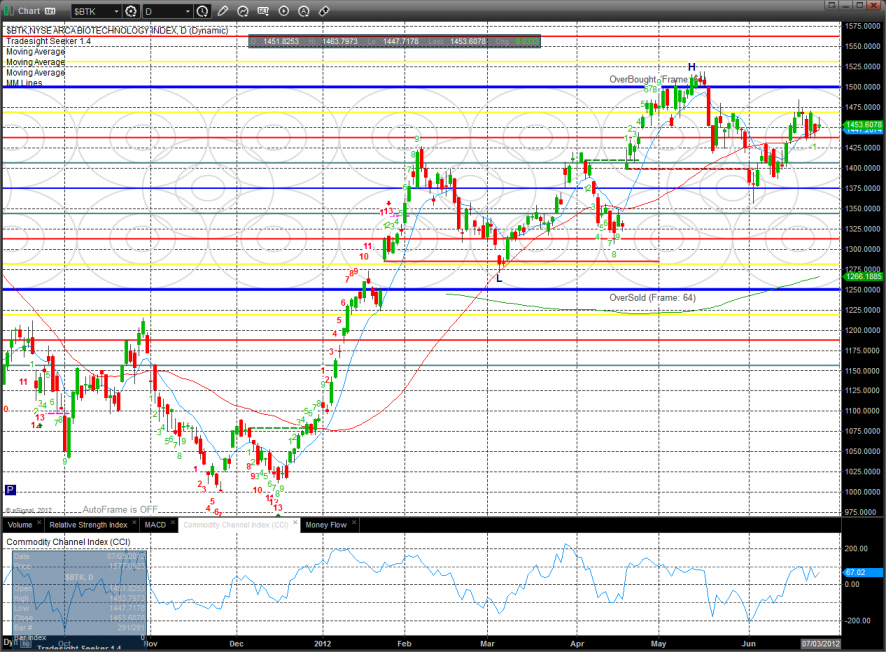

The BTK was the top gun on the day and remains boxed up.

The BKX posted an inside day and is still holding above the 4/8 level.

The OSX still has an active Seeker buy signal. Note that this is a possible double bottom.

The SOX was flat on the day.

The XAU was the loser on the day. Price remains above the 0/8 Murrey math level so this could turn into an important retest.

Oil:

Gold:

Silver: