Futures Calls Recap for 6/26/12

Lots of triggers on another choppy day where market direction changed eight times. Volume was again weak at 1.5 billion NASDAQ shares. See ES and NQ sections below for recaps.

Net ticks: -13 ticks.

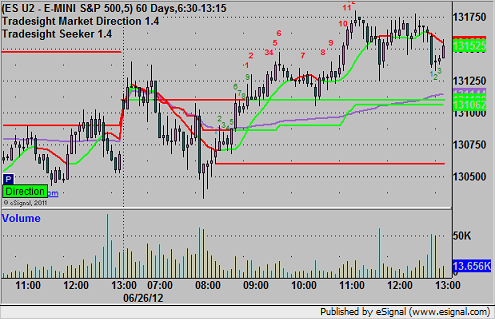

As usual, let's start by looking at the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

In the morning session, the ES triggered short at 1308.00 at A and stopped for 7 ticks, then triggered again two bars later and hit the first target for 6 ticks. Stop was adjusted over the entry and the second half stopped there. In the afternoon, triggered long at 1314.25 at B, hit first target for 6 ticks, and stop was raised to 1315.50 and stopped in the money:

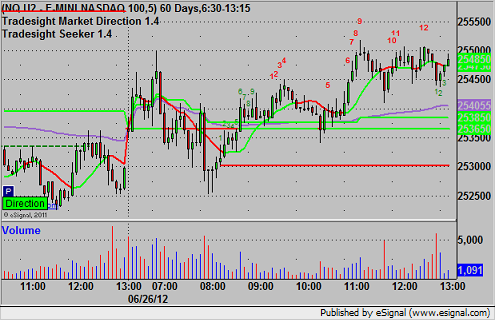

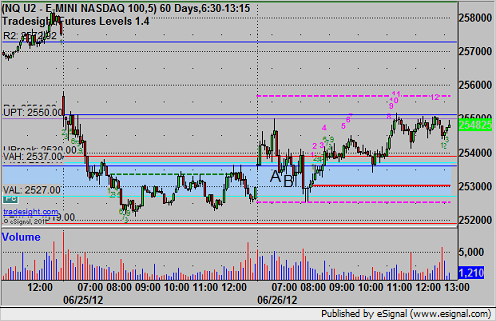

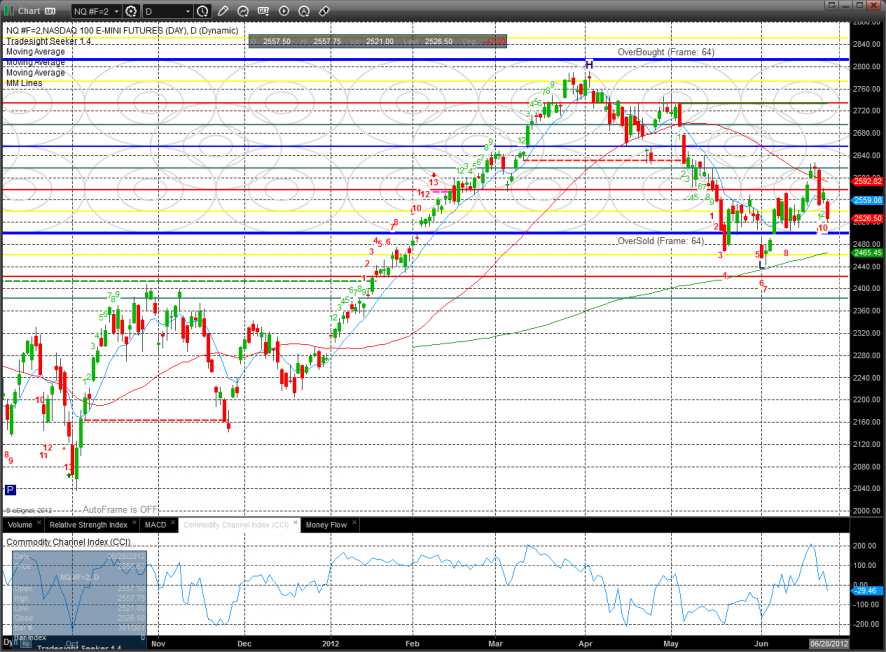

NQ:

Triggered short at 2534.50 at A and stopped. Retriggered at B and stopped. Next trigger would have worked to first target, but I canceled the re-entry after the market was so choppy:

Forex Calls Recap for 6/26/12

Not a great session once again, just choppy back and forth action in a narrow range. See EURUSD for trade call summaries.

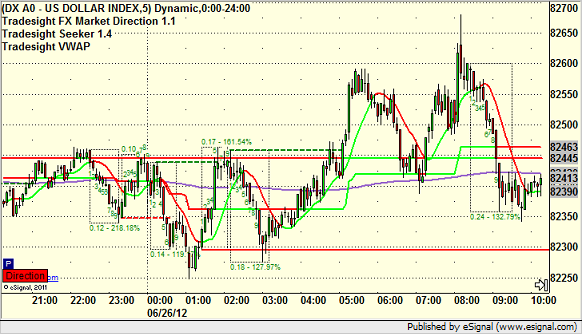

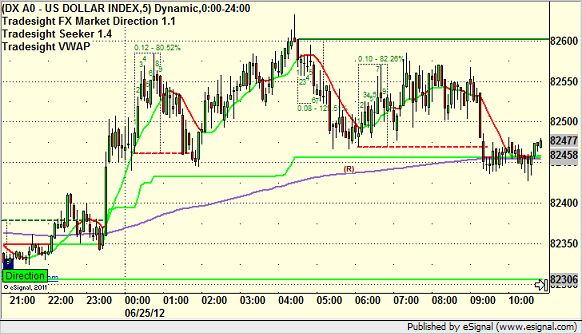

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight as we head toward the end of the quarter and next week's messy Holiday schedule.

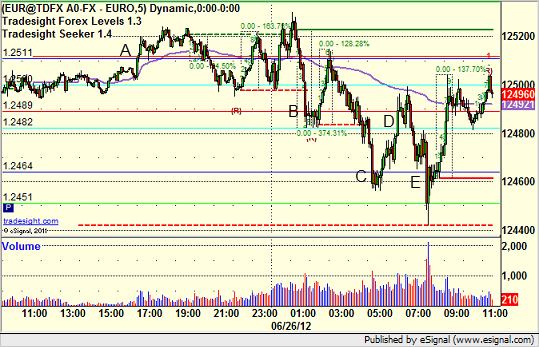

EURUSD:

Triggered long at A, gave you hours to enter, stopped overnight at B. Triggered short at C, stopped at D. Triggered short at E and stopped again. First time in a while with multiple stop outs in a session:

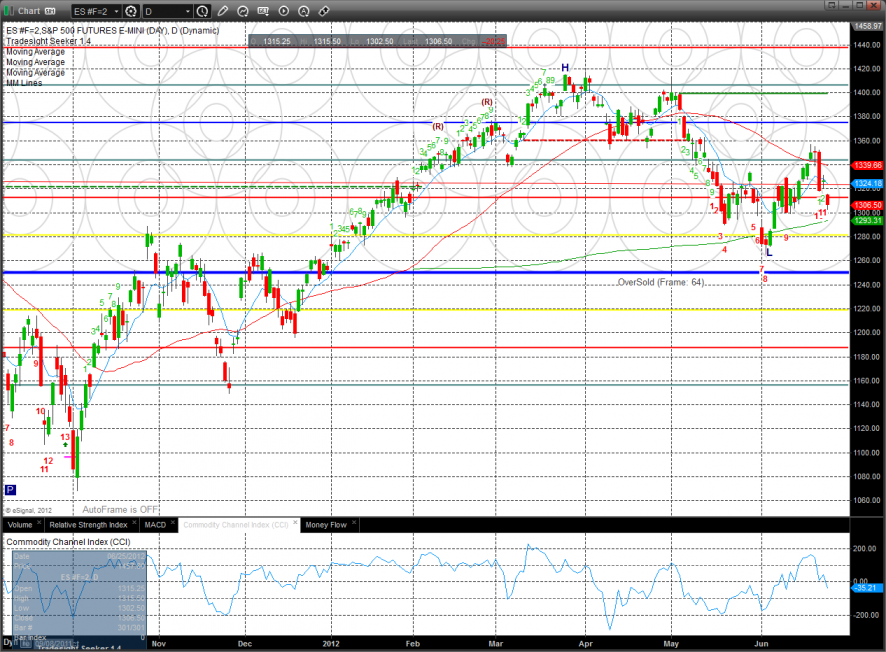

Tradesight Market Preview for 6/26/12

The ES lost 20 handles on the day putting it back to short term negative and well below the two prior highs.

The NQ futures lost 47 on the day and are again short term negative. The 0/8 Gann level is key support and then there is the 200dma below that.

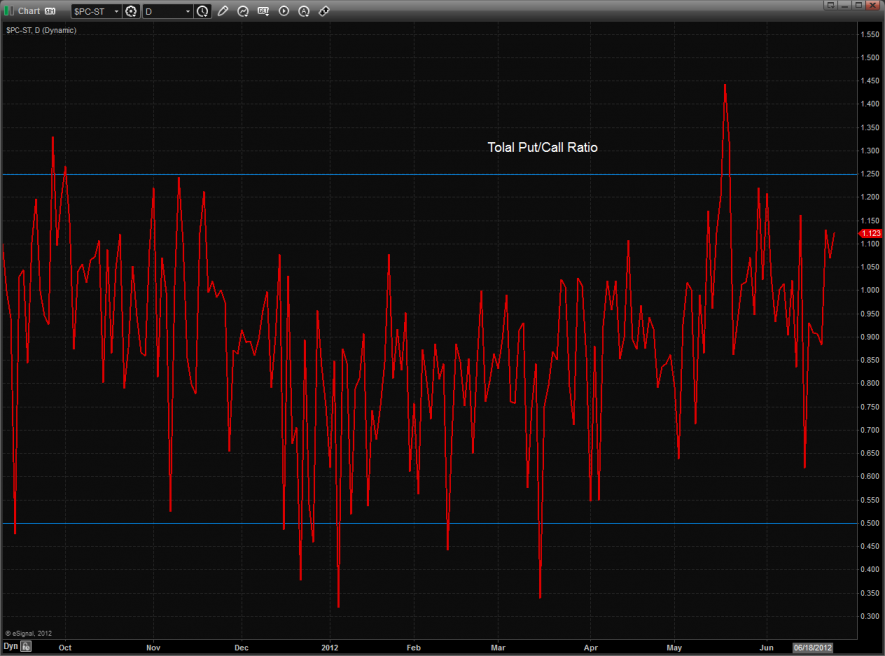

The total put/call ratio is climbing but not yet overbought.

The 10-day Trin is still over sold and loaded with potential reversal energy.

Multi sector daily chart:

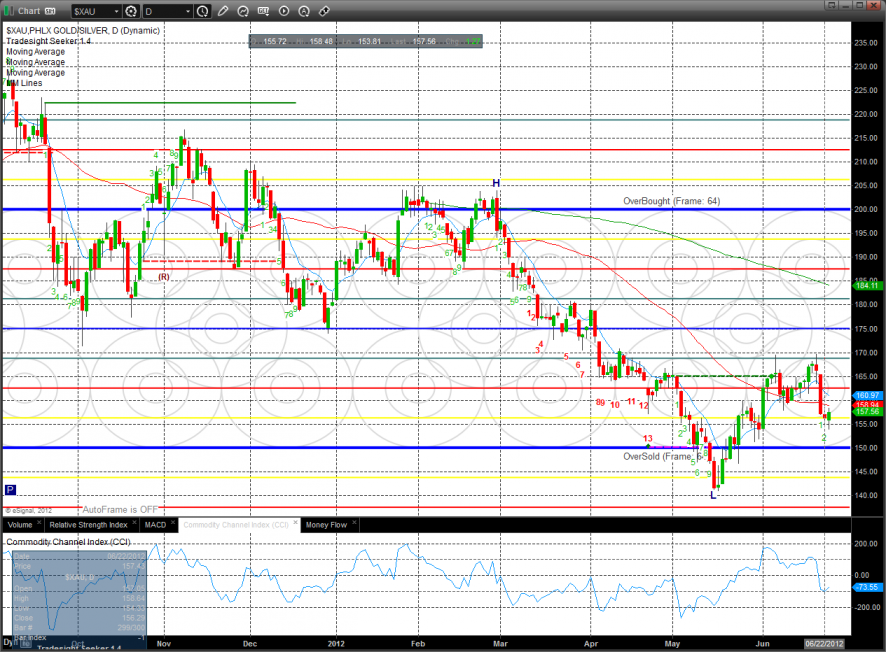

The defensive XAU was the top gun on the day and the only sector that was green.

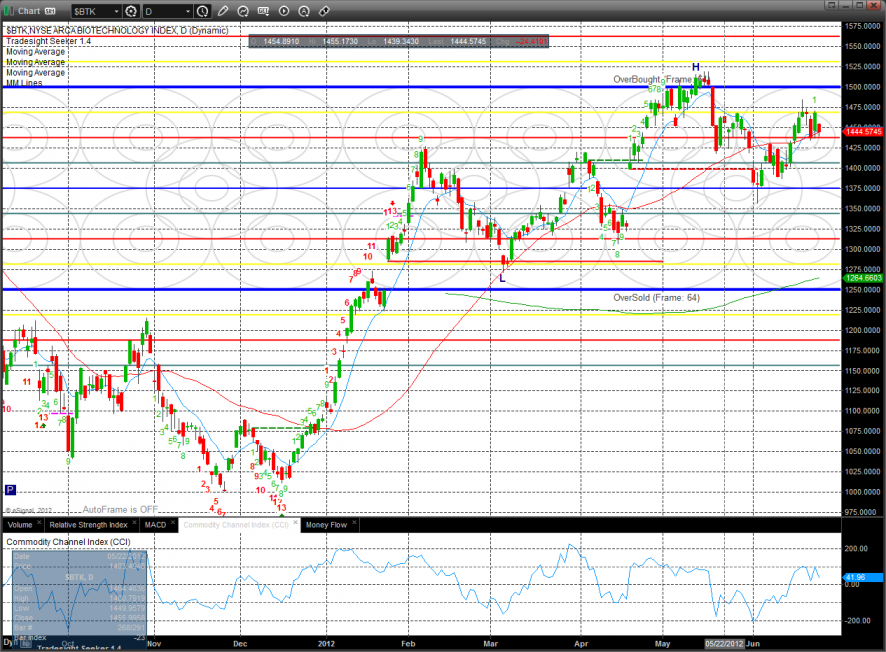

The BTK was lower but held above the important moving averages.

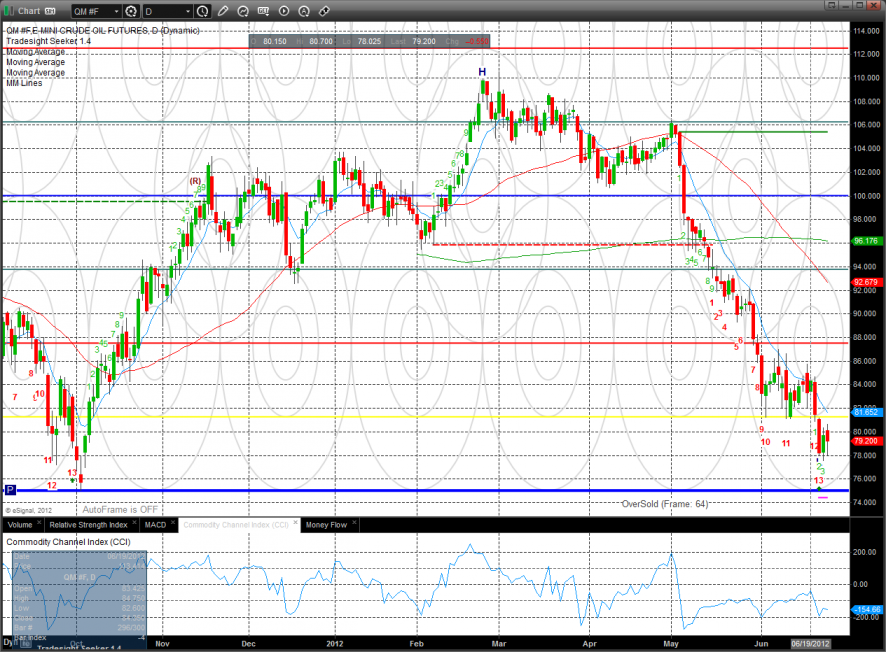

The OSX was a huge loser on the day and settled below the 0/8 Murrey math support level. Keep in mind that it’s not a break until after a follow through day has occurred.

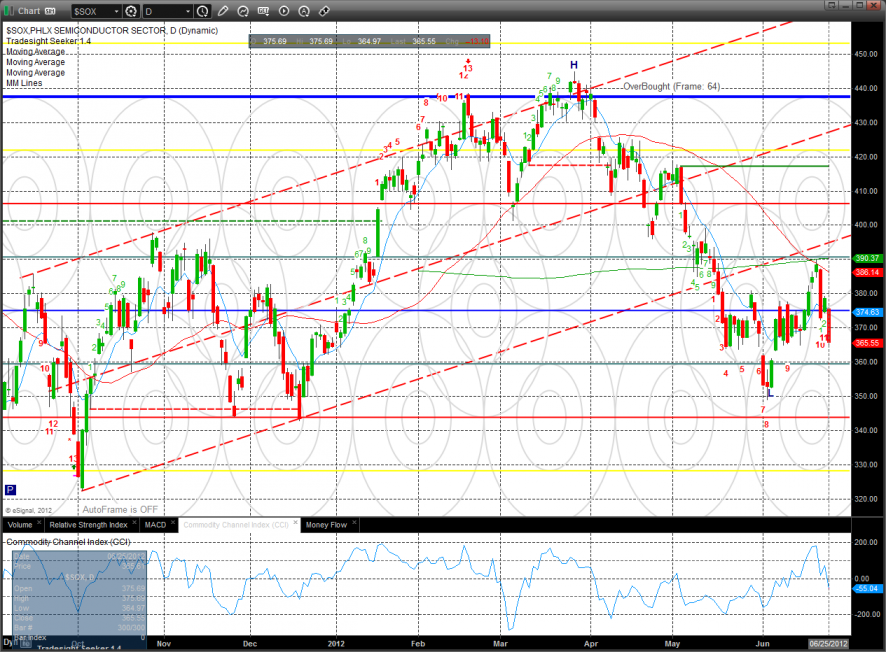

The SOX was the last laggard on the day losing 3.5%. This pattern is now 12 days down into the Seeker countdown.

Oil:

Gold:

Silver:

Stock Picks Recap for 6/25/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VCLK and FWLT gapped beyond their triggers.

CRIS triggered long (without market support) and worked a little:

SCSS triggered short (with market support) and worked:

From the Messenger, Rich's VXX triggered long (ETF, so no market support needed) and didn't work:

His GS triggered short (with market support) and worked:

His AMZN triggered short (with market support) and worked:

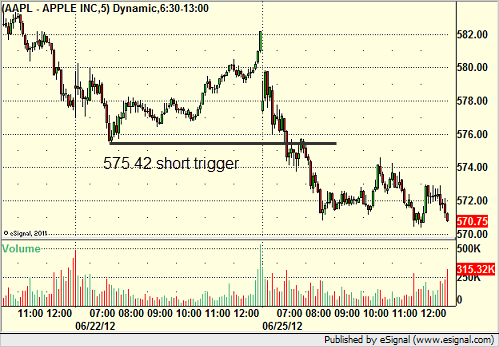

AAPL triggered short (with market support) and worked:

Rich's CAT triggered short (with market support) and worked:

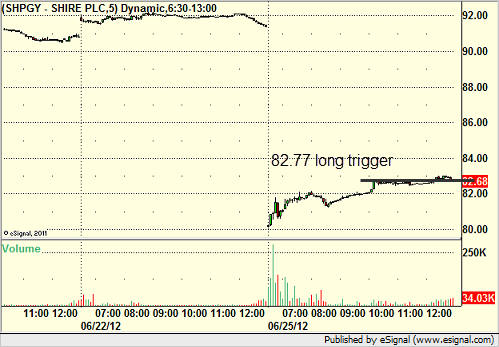

His SHPGY triggered long (without market support) and worked a little:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 6/25/12

Another very light volume day (by my count, fifth lightest of the year) with predictable results. The first move through our ES trigger stopped and the second one hit the first target. Another trade late in the day did nothing and I closed it out at even. See ES section below.

Net ticks: -4.5 ticks.

As usual, let's start by looking at the ES and NQ with our market directional lines, Seeker, and VWAP:

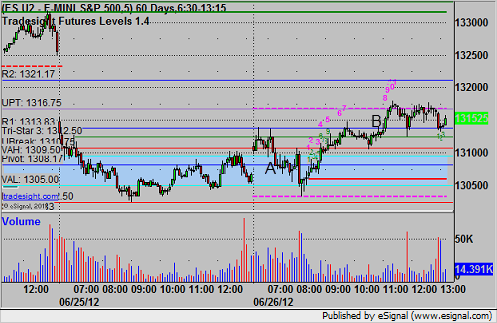

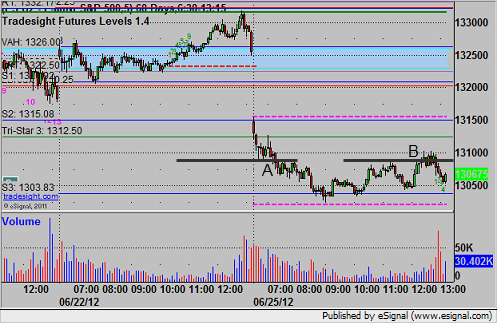

ES:

Mark's called triggered short at 1308.50 at A and stopped, then triggered again, hit the first target for 6 ticks, and stopped the second half over the entry. In the afternoon, a long idea triggered at 1309.25 at B and we closed it 15 minutes later at the entry price with time running out and nothing happening:

Forex Calls Recap for 6/25/12

A winner to start the week on the EURUSD, see that section below. We're currently still short, although the stop is near and could stop us out before new calls are made later today.

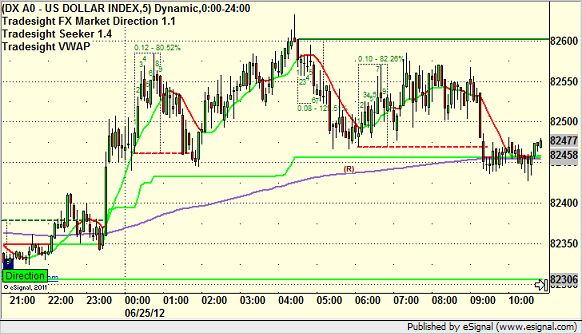

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

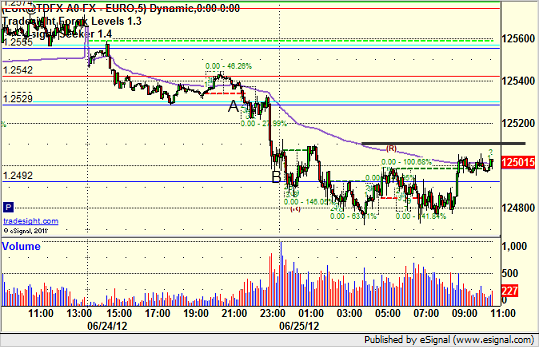

EURUSD:

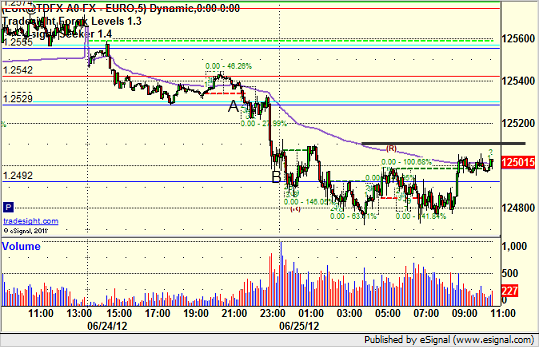

Triggered short at A, hit first target at B, currently holding with stop over 1.2510 (black line):

Forex Calls Recap for 6/25/12

A winner to start the week on the EURUSD, see that section below. We're currently still short, although the stop is near and could stop us out before new calls are made later today.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

Triggered short at A, hit first target at B, currently holding with stop over 1.2510 (black line):

Stock Picks Recap for 6/22/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MNTA triggered long (with market support) and worked:

HAIN triggered short (without market support) and worked enough for a partial:

Rich's GOOG triggered short (with market support) and worked:

Rich's UA triggered short (with market support) and worked:

His VXX triggered short (ETF, so no market support needed) and didn't work:

His TLT triggered short (ETF, so no market support needed) and didn't work:

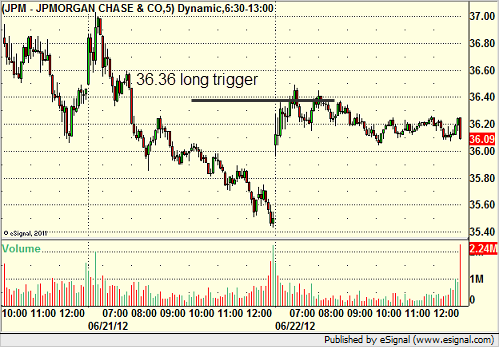

His JPM triggered long (with market support) and didn't work:

His GDX triggered short (ETF, so no market support needed) and worked:

His PXD triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not.

Stock Picks Recap for 6/22/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MNTA triggered long (with market support) and worked:

HAIN triggered short (without market support) and worked enough for a partial:

Rich's GOOG triggered short (with market support) and worked:

Rich's UA triggered short (with market support) and worked:

His VXX triggered short (ETF, so no market support needed) and didn't work:

His TLT triggered short (ETF, so no market support needed) and didn't work:

His JPM triggered long (with market support) and didn't work:

His GDX triggered short (ETF, so no market support needed) and worked:

His PXD triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not.

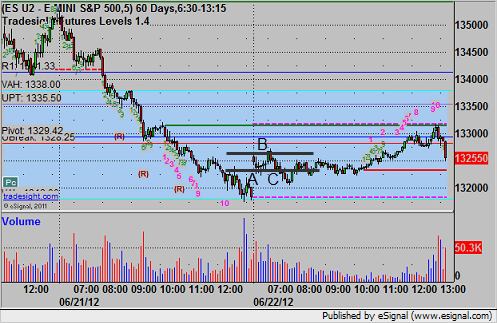

Futures Calls Recap for 6/22/12

Triggered short at 1322.50 at A and stopped. Triggered long at 1327.00 at B and stopped. Short retriggered at C, hit first target for six ticks, and moved stop over the entry and stopped. Couldn't even fill the gap. There was a nice cup and handle in the afternoon that we discussed in the Lab, but we didn't call it because volume was so bad: