Forex Calls Recap for 6/22/12

Almost no range, no action, and no attention paid to technical levels on a drifting session. This one was of the narrowest and yet most meandering session I can recall in Forex. Watching it was painful. AUDUSD short triggered and stopped. EURUSD stopped second half of the prior day's trade in the morning for 75 pips or so.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts with the Seeker and Comber tools separately heading into the new week, and then glance at the US Dollar Index.

New calls resume Sunday evening. Remember that the FOLLOWING week is awkward because of the Fourth of July Holiday here in the US on Wednesday.

Here's a look at the US Dollar Index intraday with our market directional lines:

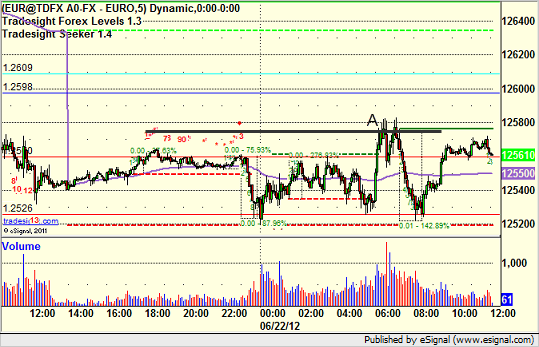

EURUSD:

Stopped out of the second half of the prior day's short at A for 75 pips:

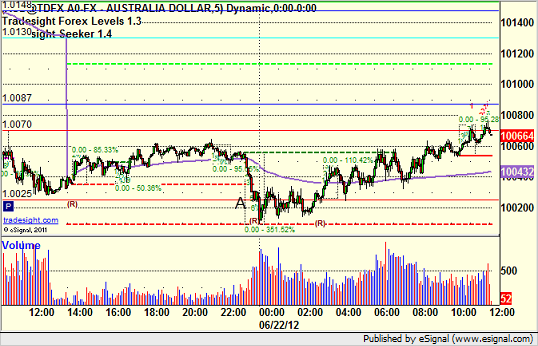

AUDUSD:

Triggered short at A and stopped:

The rest of the report, including the preview for next week, is available for subscribers and trial users only.

Stock Picks Recap for 6/21/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, JBLU triggered long (without market support) and didn't work:

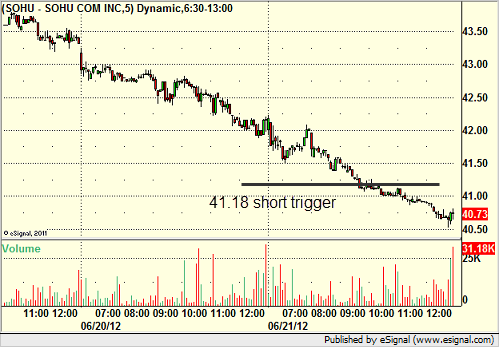

SOHU triggered short (with market support) and worked:

In the Messenger, Rich's CELG triggered long (without market support) and didn't work:

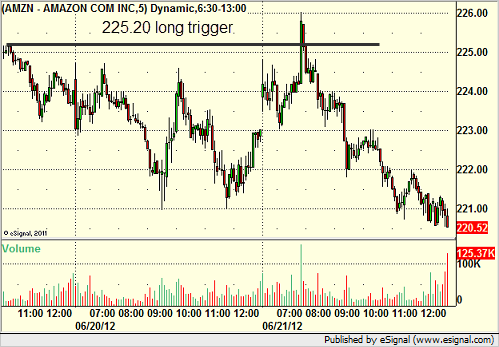

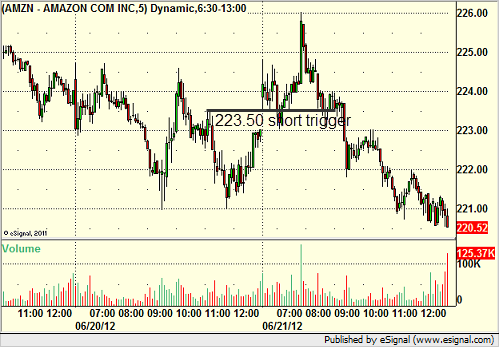

His AMZN triggered long (without market support) and didn't worked:

His CSX triggered short (with market support) and worked enough for a partial:

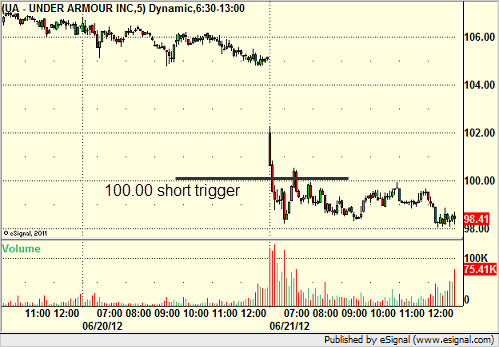

His UA triggered short (with market support) and worked:

His JPM triggered long (without market support) and worked:

His GLD triggered short (ETF, so no market support needed) and didn't work the first time (a sweep), worked the second:

His IWM triggered short (ETF, so no market support needed) and worked:

His BTU triggered short (with market support) and worked great:

AMZN triggered short (with market support) and worked enough for a partial to the gap fill:

RIMM triggered short (with market support) and worked:

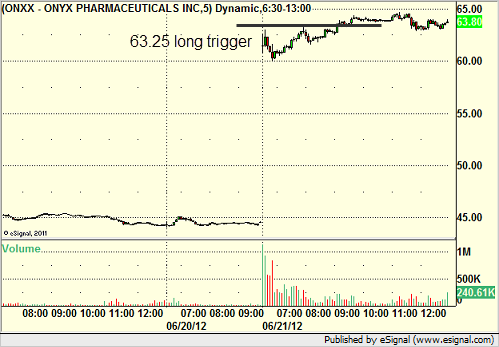

His ONXX triggered long (without market support) and worked:

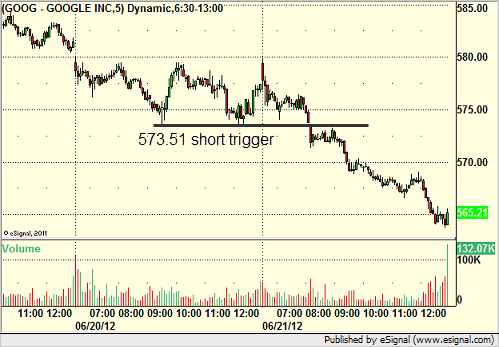

GOOG triggered short (with market support) and worked great:

Mark's DISH triggered short (with market support) and didn't work:

His GRMN triggered short (with market support) and didn't go enough in either direction to count:

Rich's PXD triggered short (with market support) and worked:

His EOG triggered short (with market support) and worked:

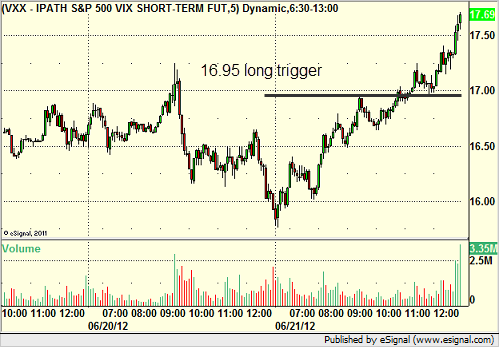

His VXX triggered long (ETF, so no market support needed) and worked:

AAPL triggered short (with market support) and didn't work the first time, worked the second (we only count the first for official results):

In total, that's 14 trades triggering with market support, 11 of them worked, 3 did not.

Futures Calls Recap for 6/21/12

Couple of nice winners early, and the ES stopped in the money by just a tick before resuming what would have been a much bigger winner. Oh well, still good. See ES and NQ sections below, and then the market got a little out of range for regular calls.

Net ticks: +15 ticks.

Let's start first by taking a look at the ES and NQ with our market directional lines, the Seeker, and the VWAP:

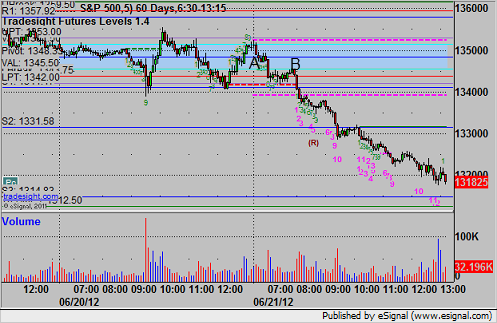

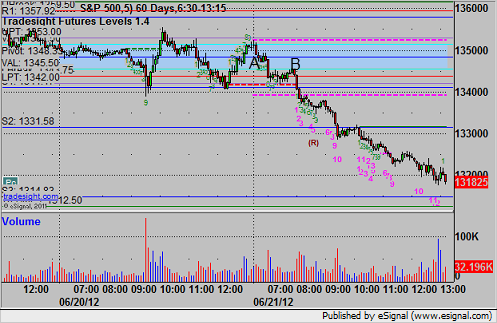

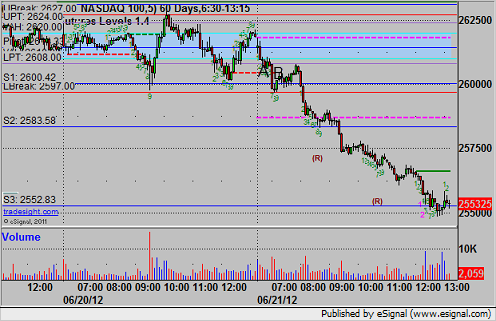

ES:

ES triggered short at A at 1348.00, hit first target for six ticks, lowered stop three times and closed the final at B at 1345.00 for 12 ticks:

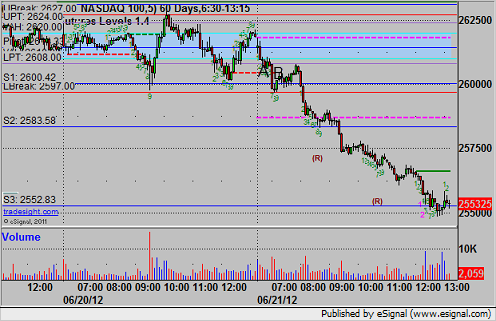

NQ:

Remember that on the NQ, we use half points as ticks and not quarter points. Triggered short at A at 2605.50, hit first target for 6 ticks, stop was lowered and stopped at the same 6 tick gain:

Futures Calls Recap for 6/21/12

Couple of nice winners early, and the ES stopped in the money by just a tick before resuming what would have been a much bigger winner. Oh well, still good. See ES and NQ sections below, and then the market got a little out of range for regular calls.

Net ticks: +15 ticks.

Let's start first by taking a look at the ES and NQ with our market directional lines, the Seeker, and the VWAP:

ES:

ES triggered short at A at 1348.00, hit first target for six ticks, lowered stop three times and closed the final at B at 1345.00 for 12 ticks:

NQ:

Remember that on the NQ, we use half points as ticks and not quarter points. Triggered short at A at 2605.50, hit first target for 6 ticks, stop was lowered and stopped at the same 6 tick gain:

Forex Calls Recap for 6/21/12

One clean full size trigger and a nice winner out of it in the EURUSD. See that section below.

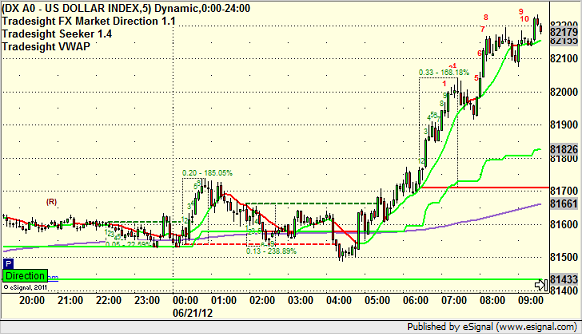

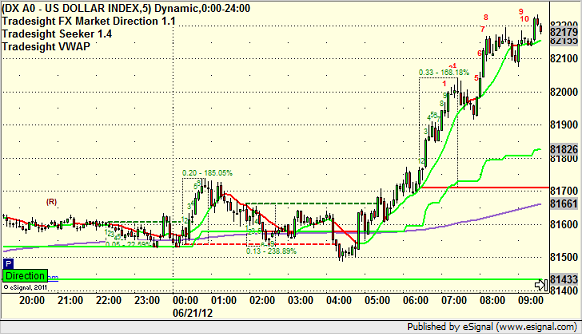

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

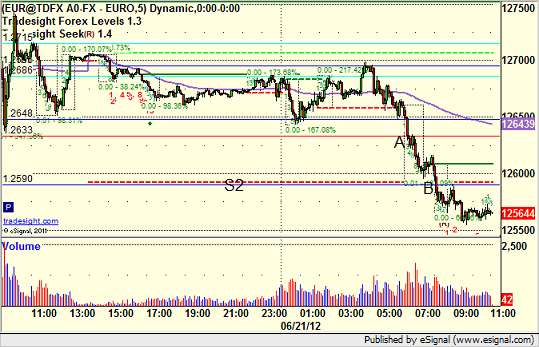

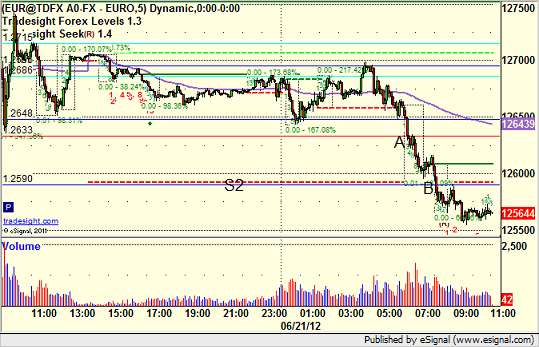

EURUSD;

Triggered short at A, hit first target at B, still holding second half with a stop over S2:

Forex Calls Recap for 6/21/12

One clean full size trigger and a nice winner out of it in the EURUSD. See that section below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD;

Triggered short at A, hit first target at B, still holding second half with a stop over S2:

Stock Picks Recap for 6/20/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

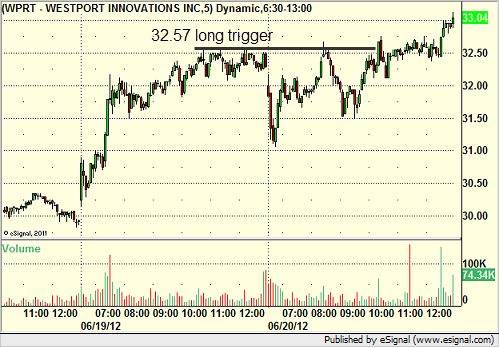

From the report, WPRT triggered long (without market support) and didn't work:

In the Messenger, AAPL triggered short (with market support) and didn't work initially:

Rich's DE triggered short (with market support) and didn't work:

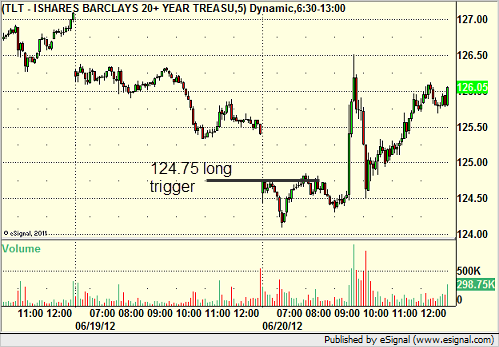

TLT triggered short (ETF, so no market support needed) and didn't work:

BIDU triggered short (with market support) and worked great:

Rich's OIH triggered short (ETF, no market support needed) and worked enough for a partial:

Rich's ADBE triggered long (with market support) and worked:

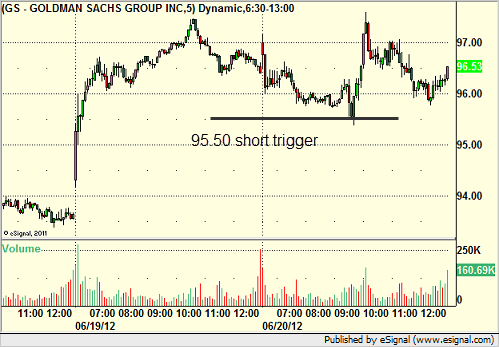

Rich's GS triggered short (with market support) and didn't work:

FSLR triggered short (with market support) and worked enough for a partial:

NFLX triggered short (with market support) and didn't work:

In total, that's 9 trades triggering with market support, 4 of them worked, 5 did not.

Tradesight Market Preview for 6/21/12

After the fed meeting and announcement the ES was unchanged on the day. This leaves an indecisive doji at range high of the move. Price remains above the 50dma and the Seeker count is only 5 days up.

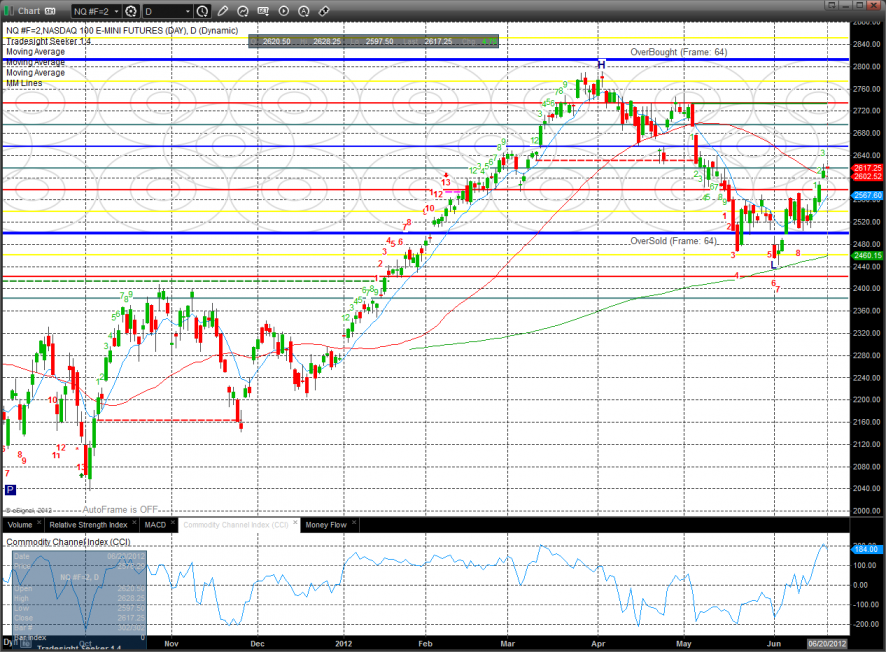

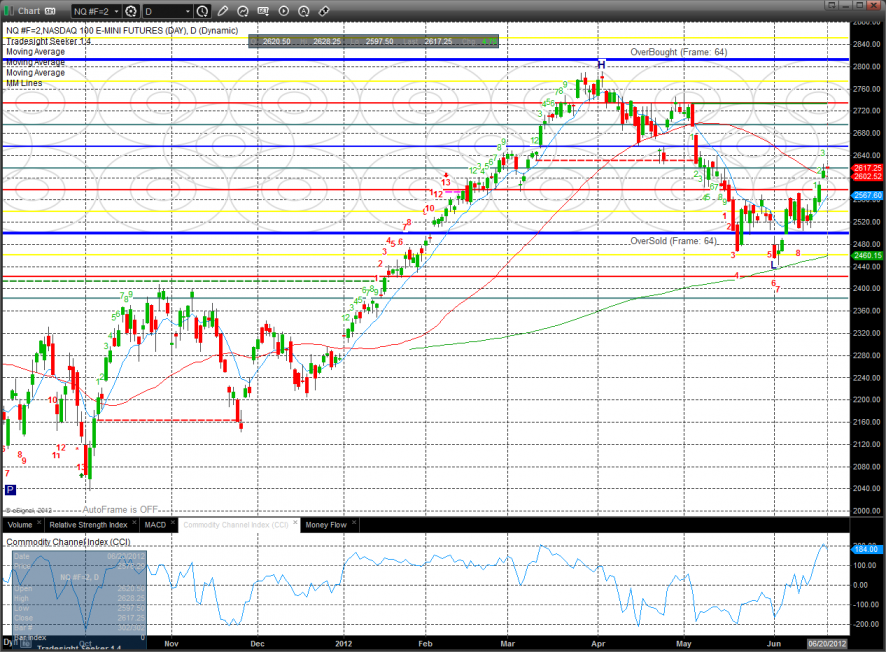

The NQ futures also doji’ed and settled up 5 handles on the day. So, both the ES and NQ futures did little on the day which leaves the door open to a nice post fed meeting move on Thursday.

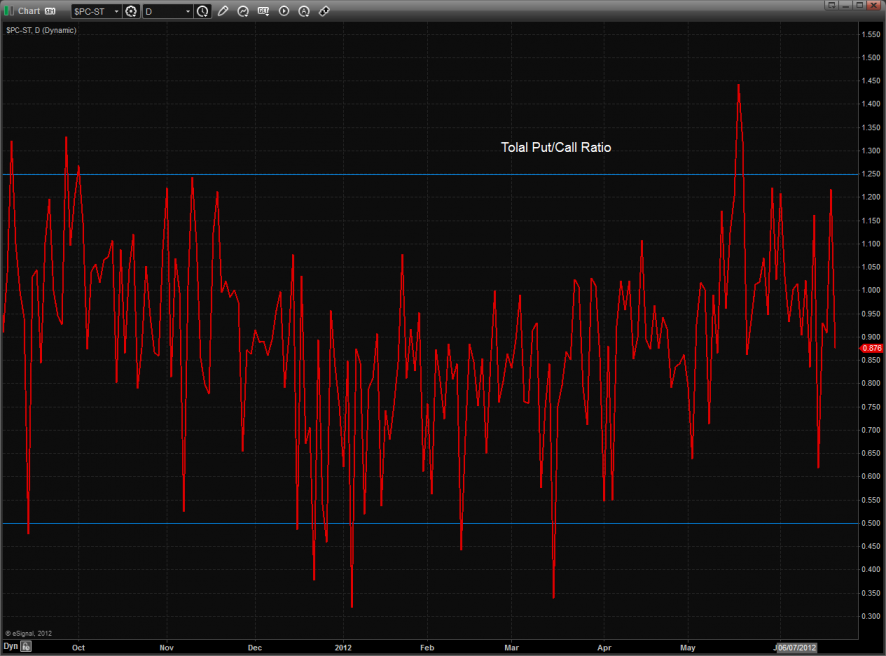

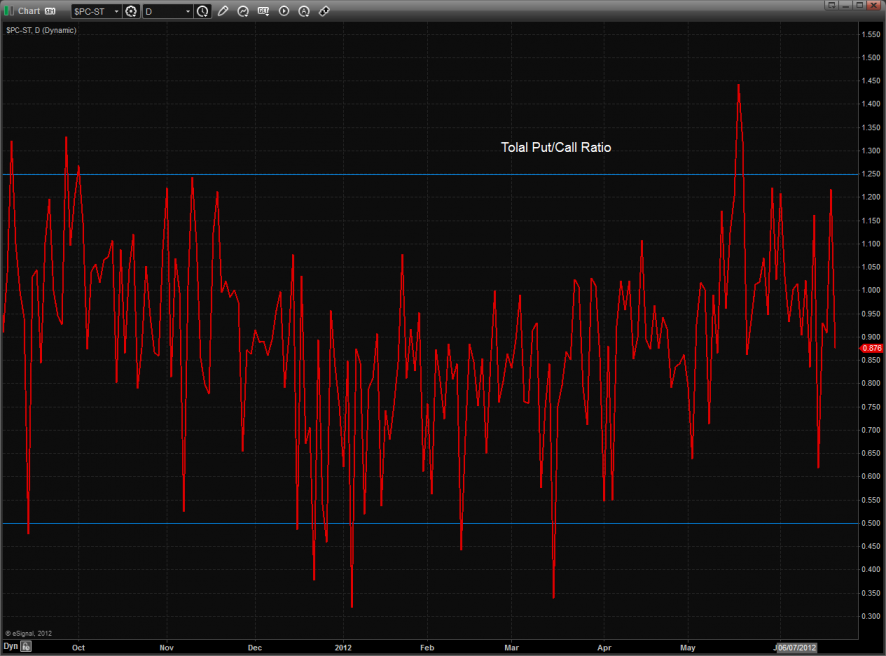

The total put/call has returned to the comfort zone.

10-day Trin remains neutral:

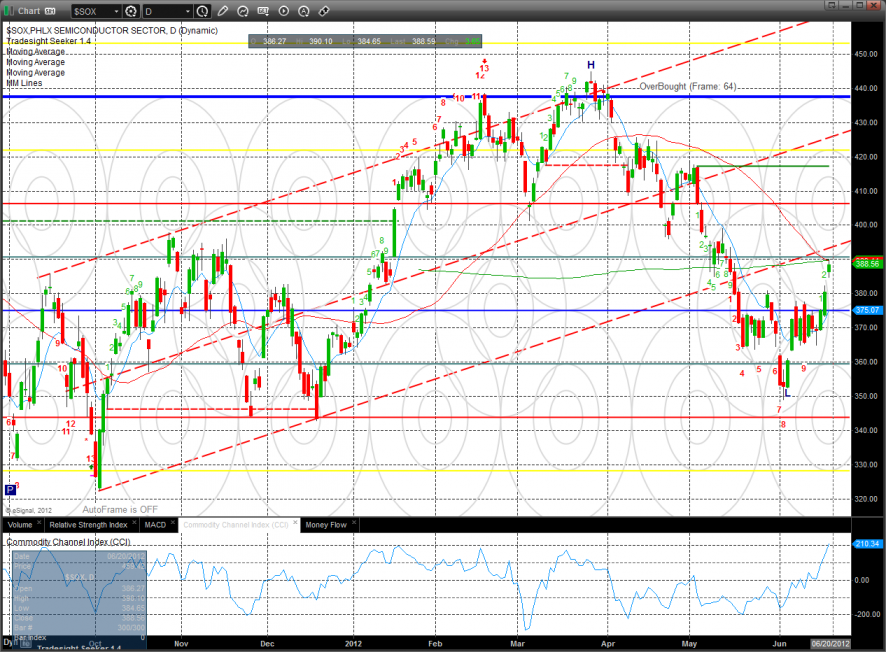

Multi sector daily chart:

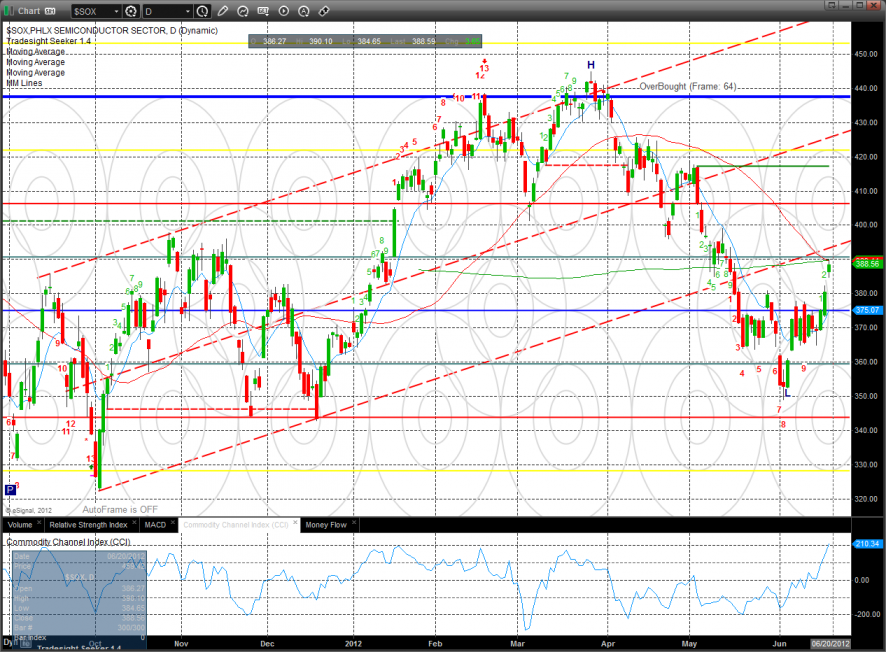

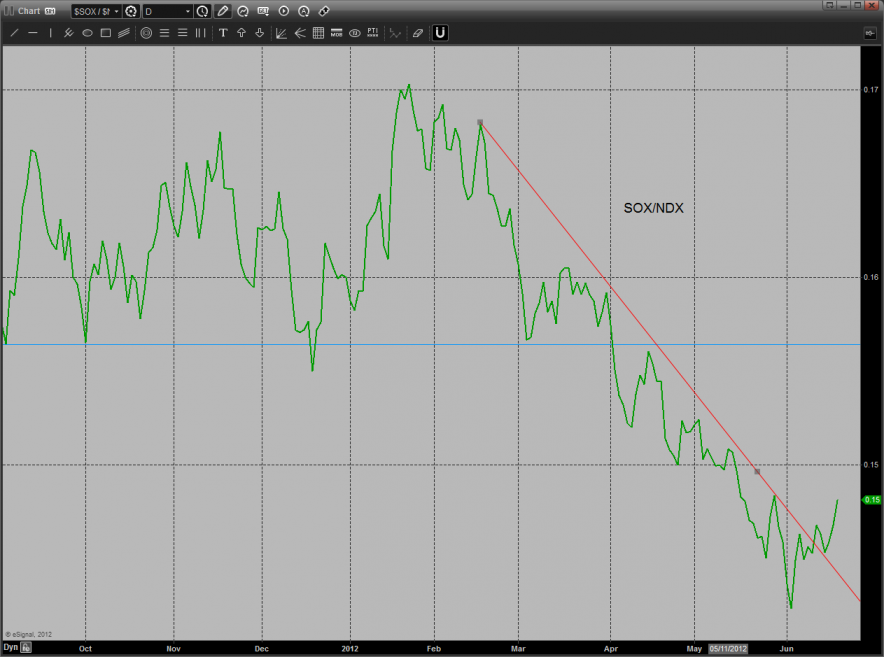

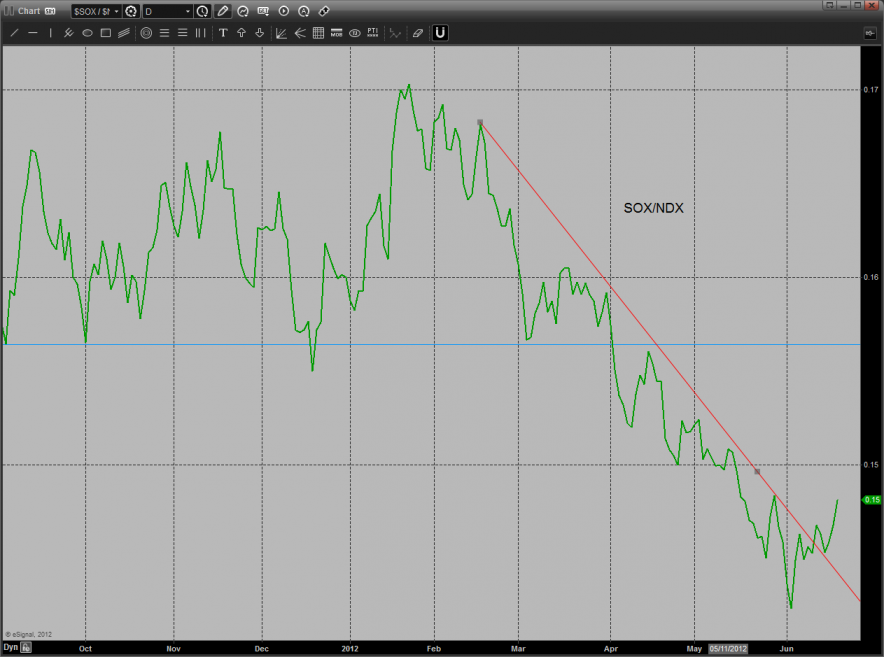

The SOX/NDX chart is possible making a bullish turn in favor of the SOX.

The SOX was the top gun on the day and has broken above the reverse H&S neckline. The next challenge for the SOX will be the 50dma.

The BKX was up marginally on the day and is hitting key resistance at the 50dma.

The OSX was the sore spot and continues to bearishly lag the overall broad market. The Seeker exhaustion is still on deck.

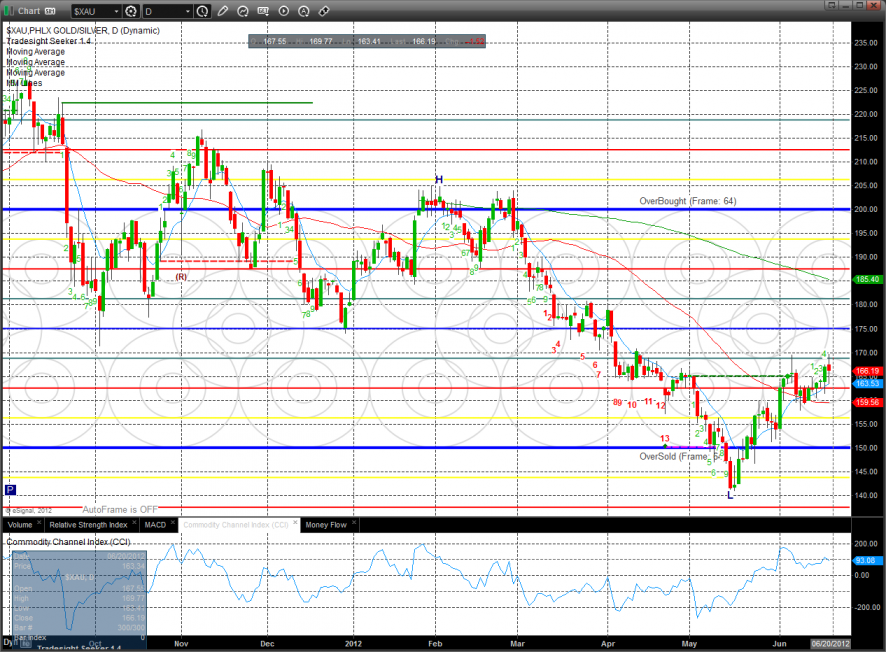

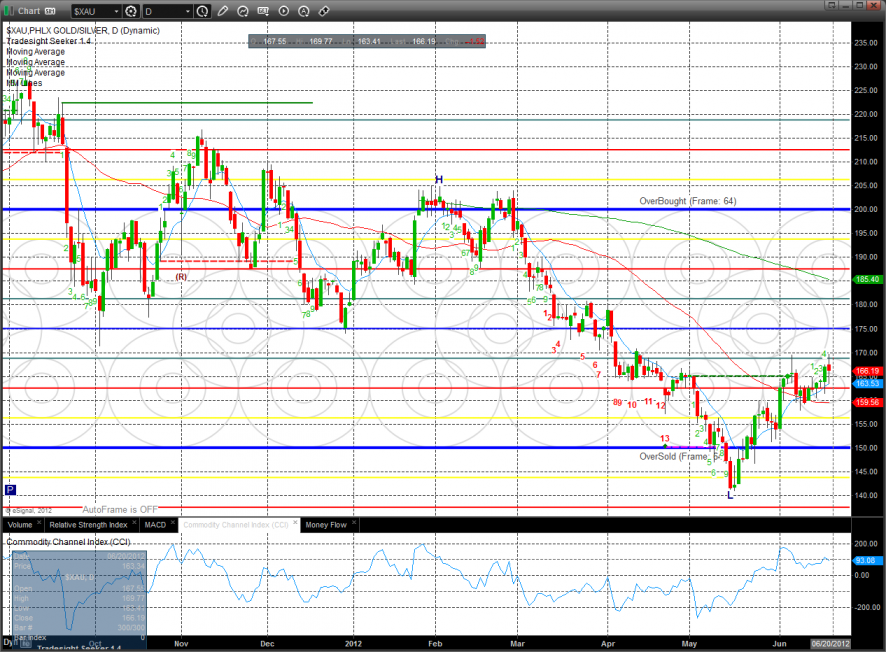

The XAU was the last laggard on the day and a source of funds. The index was lower on the day by 1%.

Oil made a new low close on the move and is 12 days down in the Seeker count and one day away from an exhaustion reversal.

Gold:

Silver:

Tradesight Market Preview for 6/21/12

After the fed meeting and announcement the ES was unchanged on the day. This leaves an indecisive doji at range high of the move. Price remains above the 50dma and the Seeker count is only 5 days up.

The NQ futures also doji’ed and settled up 5 handles on the day. So, both the ES and NQ futures did little on the day which leaves the door open to a nice post fed meeting move on Thursday.

The total put/call has returned to the comfort zone.

10-day Trin remains neutral:

Multi sector daily chart:

The SOX/NDX chart is possible making a bullish turn in favor of the SOX.

The SOX was the top gun on the day and has broken above the reverse H&S neckline. The next challenge for the SOX will be the 50dma.

The BKX was up marginally on the day and is hitting key resistance at the 50dma.

The OSX was the sore spot and continues to bearishly lag the overall broad market. The Seeker exhaustion is still on deck.

The XAU was the last laggard on the day and a source of funds. The index was lower on the day by 1%.

Oil made a new low close on the move and is 12 days down in the Seeker count and one day away from an exhaustion reversal.

Gold:

Silver:

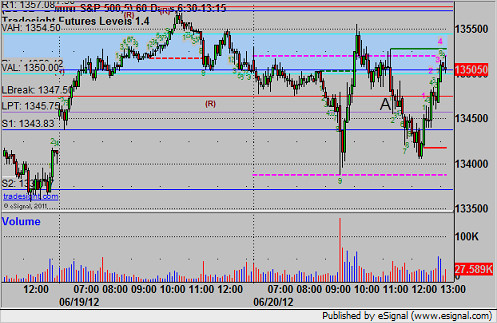

Futures Calls Recap for 6/20/12

As expected, not a very interesting day in the market with the Fed announcement. An early NQ trade went nowhere as volume was weak. After the Fed, an ES short stopped once, then worked. An ER call late stopped.

See those sections below. Very choppy action.

Net ticks: -16.5 ticks.

Here's the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

Triggered short after the Fed at 1345.50 at A and stopped, went back in and hit first target at 1344.00, stopped final half at 1344.25 in the money:

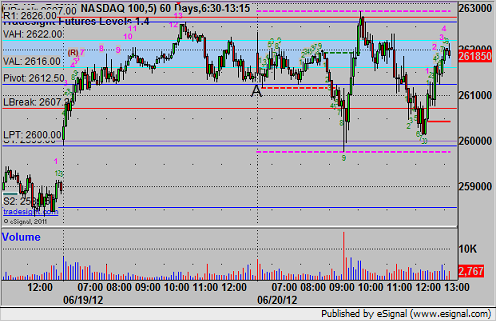

NQ:

Triggered short early on a nice setup under the Pivot at A and stopped (the retrigger of this would have worked, but we canceled ahead of the Fed):

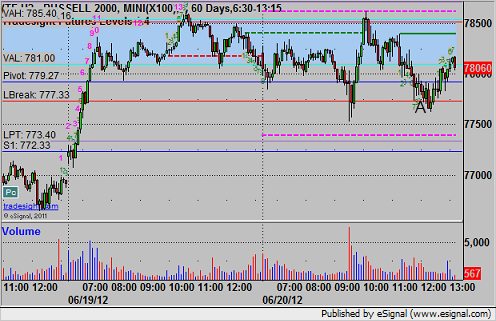

ER:

Triggered short at A at 777.00 and stopped: