Futures Calls Recap for 6/20/12

As expected, not a very interesting day in the market with the Fed announcement. An early NQ trade went nowhere as volume was weak. After the Fed, an ES short stopped once, then worked. An ER call late stopped.

See those sections below. Very choppy action.

Net ticks: -16.5 ticks.

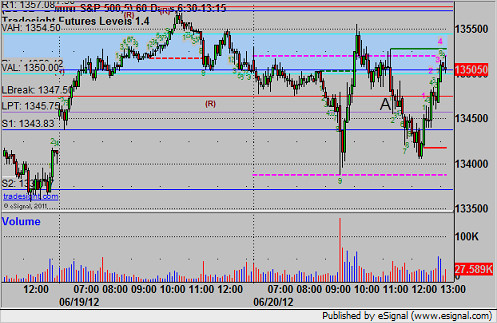

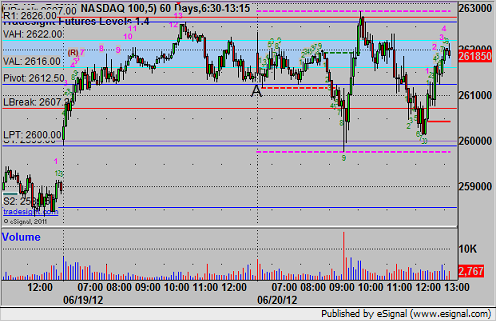

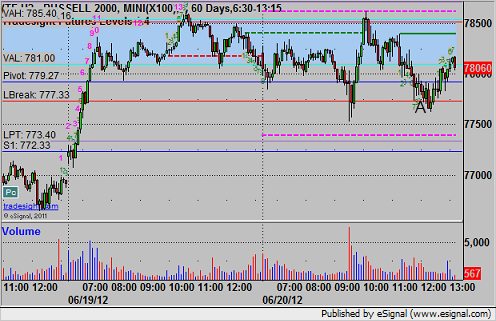

Here's the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

Triggered short after the Fed at 1345.50 at A and stopped, went back in and hit first target at 1344.00, stopped final half at 1344.25 in the money:

NQ:

Triggered short early on a nice setup under the Pivot at A and stopped (the retrigger of this would have worked, but we canceled ahead of the Fed):

ER:

Triggered short at A at 777.00 and stopped:

Forex Calls Recap for 6/20/12

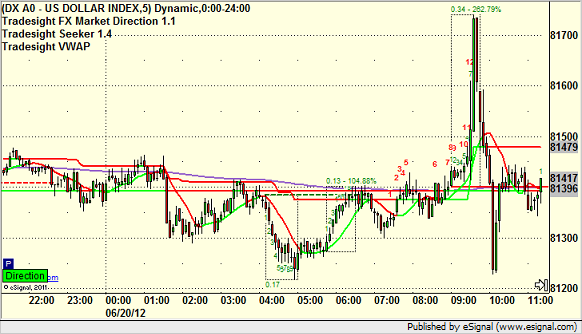

The session was a little unique in that the Forex pairs usually either do nothing after a Fed announcement or pick one direction and stick with it. In this case, the initial move was strong in favor of the Dollar, then we reversed even stronger, and then came back to par. As usual, we're half size on triggers ahead of the Fed and full size after (give it about 10 minutes to settle). We had three triggers, two half size losers and a full size winner, all in the EURUSD. We also stopped the second half of the prior day's GBPUSD long in the money.

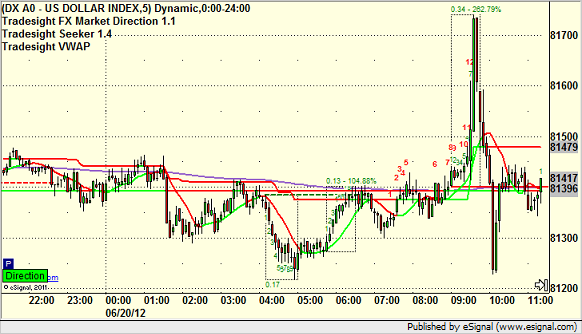

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, back to normal size. All flat at the moment.

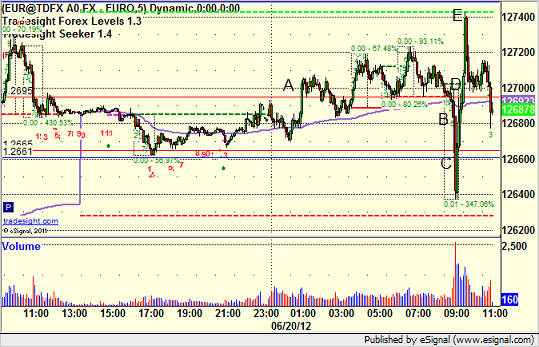

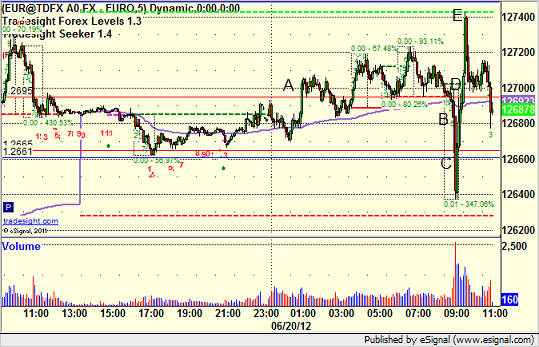

EURUSD:

Triggered long at A overnight for half size and eventually stopped at B ahead of the Fed announcement. Triggered short on the announcement at C and stopped. With that behind us, the full size trigger was the long at D, hit first target of 50 pips at E and stopped the second half under the entry:

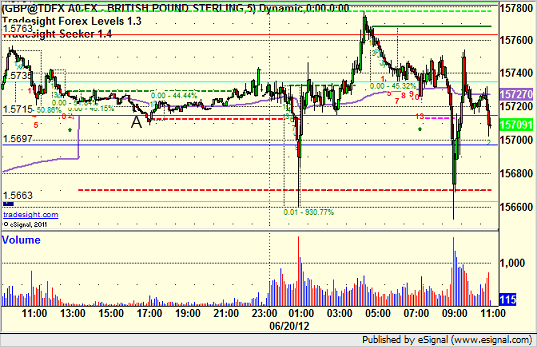

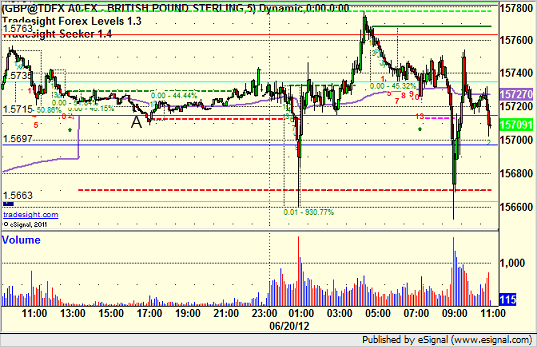

GBPUSD:

Stopped the second half of the prior day's long under LBreak at A in the money:

Forex Calls Recap for 6/20/12

The session was a little unique in that the Forex pairs usually either do nothing after a Fed announcement or pick one direction and stick with it. In this case, the initial move was strong in favor of the Dollar, then we reversed even stronger, and then came back to par. As usual, we're half size on triggers ahead of the Fed and full size after (give it about 10 minutes to settle). We had three triggers, two half size losers and a full size winner, all in the EURUSD. We also stopped the second half of the prior day's GBPUSD long in the money.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, back to normal size. All flat at the moment.

EURUSD:

Triggered long at A overnight for half size and eventually stopped at B ahead of the Fed announcement. Triggered short on the announcement at C and stopped. With that behind us, the full size trigger was the long at D, hit first target of 50 pips at E and stopped the second half under the entry:

GBPUSD:

Stopped the second half of the prior day's long under LBreak at A in the money:

Tradesight Market Preview for 6/20/12

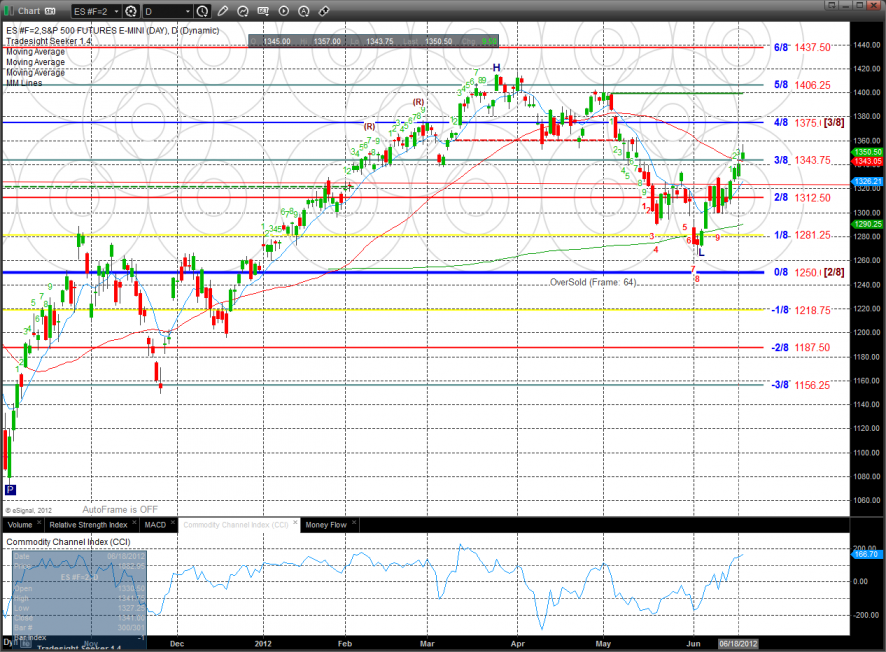

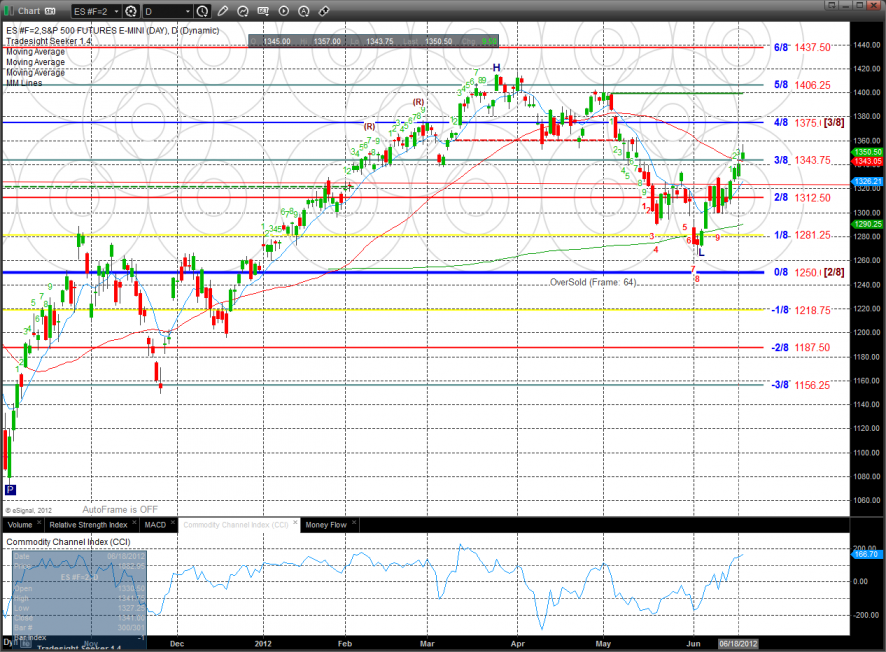

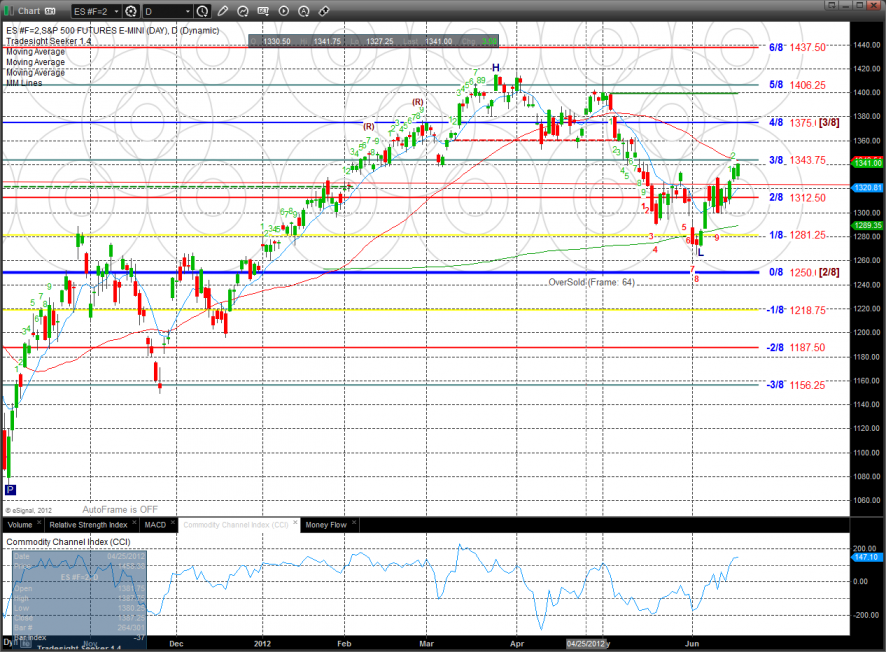

The ES settled above the 50dma for the first time since April, gaining 10 on the day. The next challenge for the up move will be 1375.

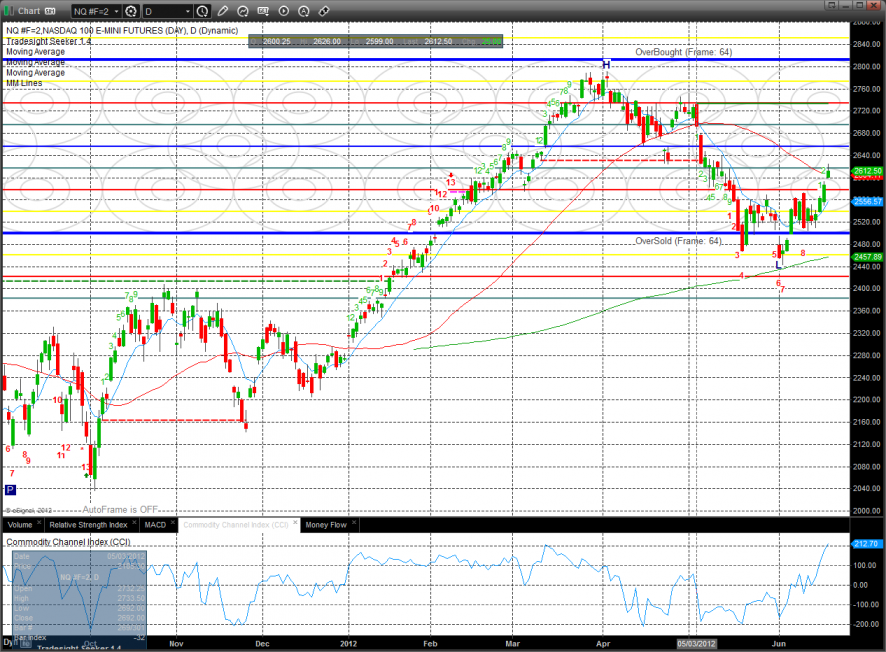

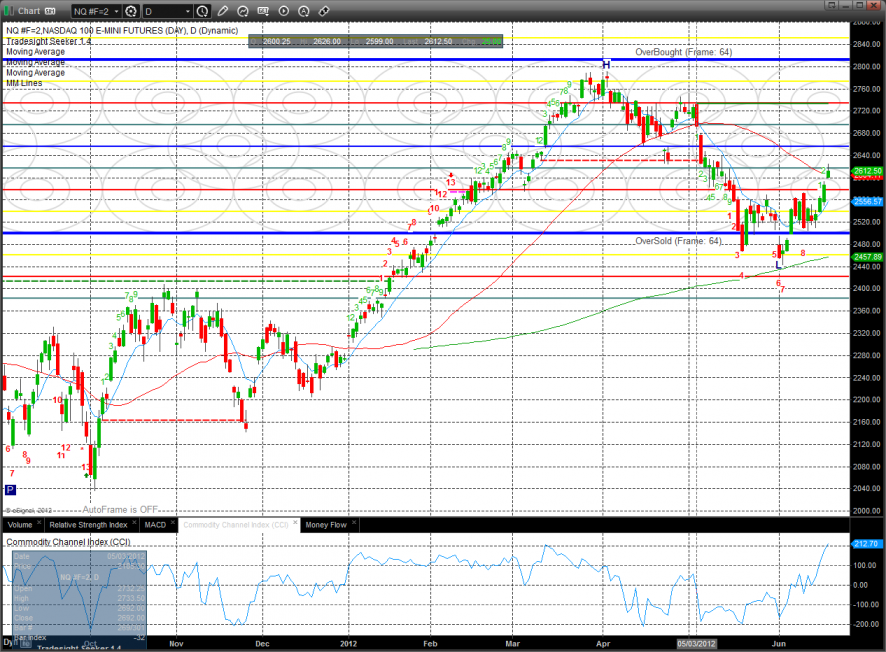

The NQ futures were higher by 25 on the day and settled above the 50dma.

The 10-day Trin has more room to go before recording an overbought reading.

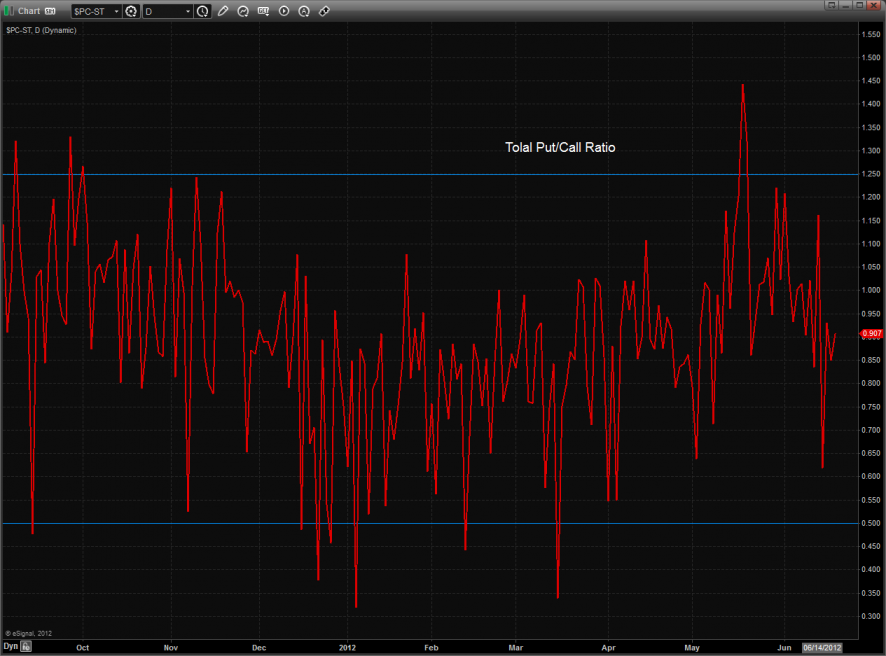

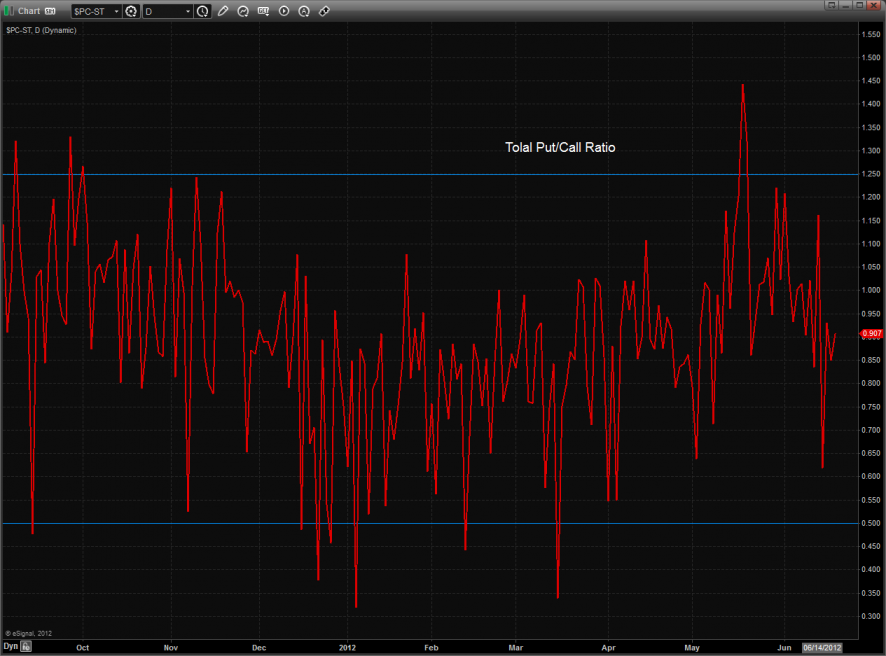

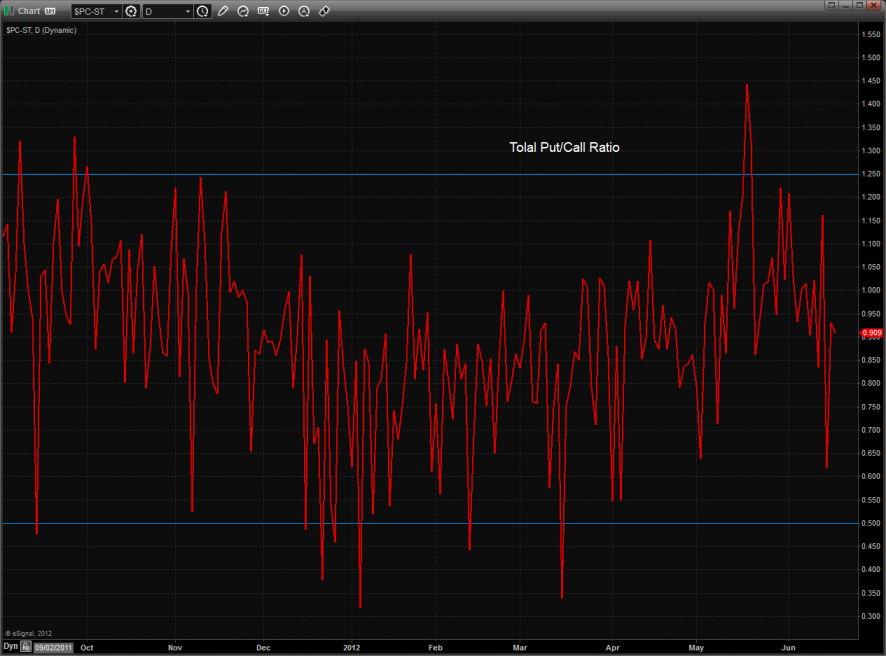

The total put/call ratio is still neutral:

Multi sector daily chart:

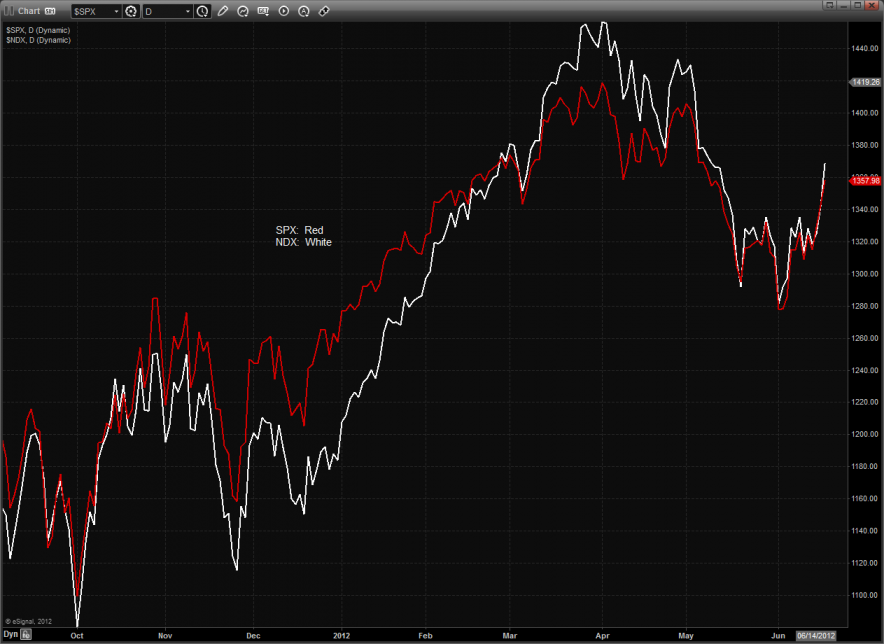

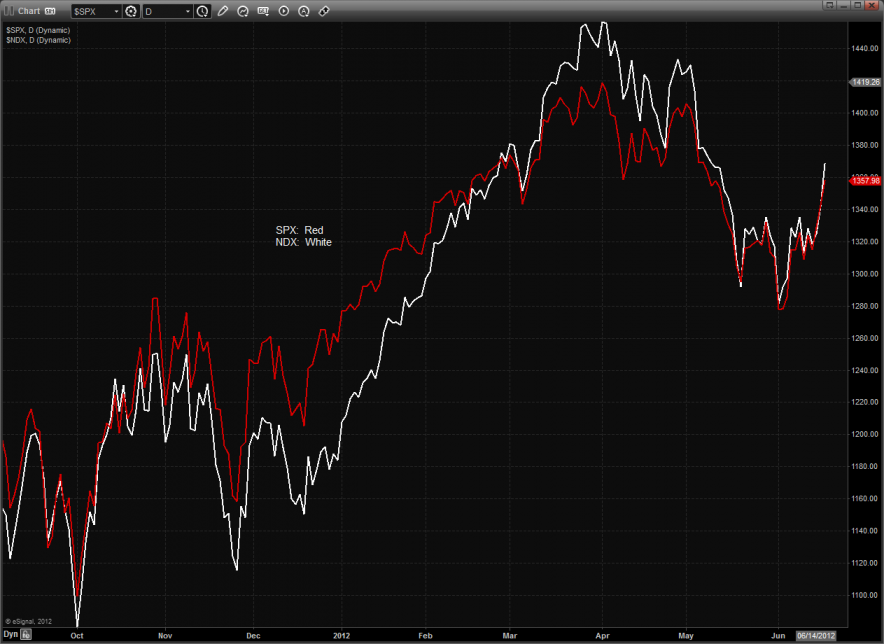

The SPX/NDX cross shows that the NDX continues to hold a bullish relative strength advantage.

The OSX cross was the top gun on the day but continues to lag the overall broad market in performance. Note that the Seeker buy countdown is still incomplete.

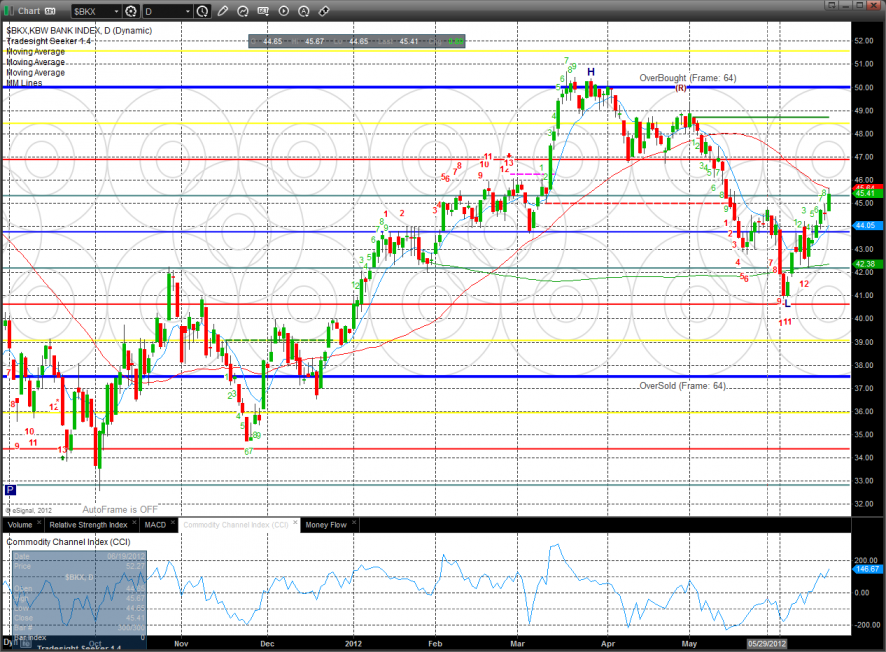

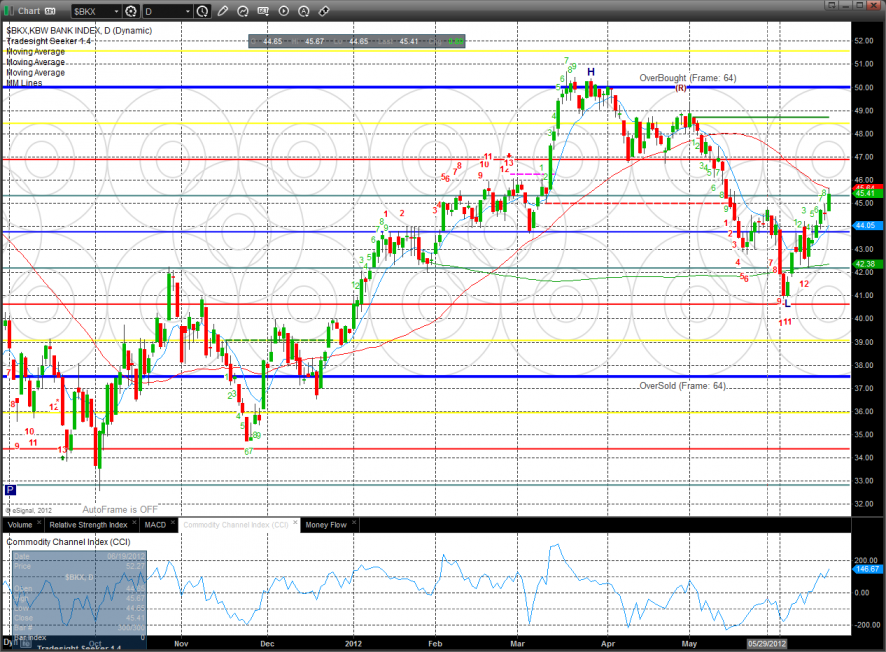

The BKX was up a full 2$ but is now 9 days up in the Seeker count and below the 50dma.

The SOX had an elusive very positive day. The pattern has nicely gapped above the reverse H&S neckline and a qualified follow through would be very positive for the overall market.

Oil:

Gold:

Silver:

Tradesight Market Preview for 6/20/12

The ES settled above the 50dma for the first time since April, gaining 10 on the day. The next challenge for the up move will be 1375.

The NQ futures were higher by 25 on the day and settled above the 50dma.

The 10-day Trin has more room to go before recording an overbought reading.

The total put/call ratio is still neutral:

Multi sector daily chart:

The SPX/NDX cross shows that the NDX continues to hold a bullish relative strength advantage.

The OSX cross was the top gun on the day but continues to lag the overall broad market in performance. Note that the Seeker buy countdown is still incomplete.

The BKX was up a full 2$ but is now 9 days up in the Seeker count and below the 50dma.

The SOX had an elusive very positive day. The pattern has nicely gapped above the reverse H&S neckline and a qualified follow through would be very positive for the overall market.

Oil:

Gold:

Silver:

Stock Picks Recap for 6/19/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INTU gapped over, no play.

SLXP triggered long (without market support due to opening 5 minutes) and worked:

IRDM triggered long (with market support) and didn't work:

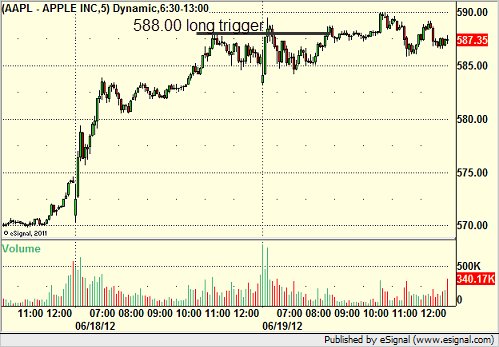

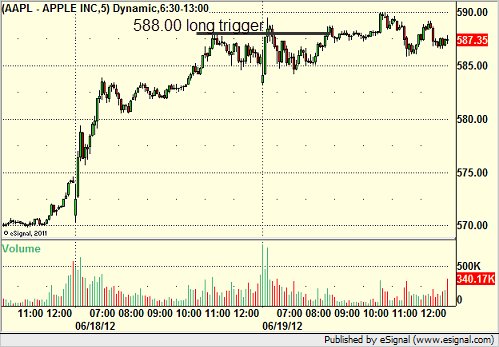

In the Messenger, Rich's AAPL triggered long (without market support) and worked enough for a partial (over a point):

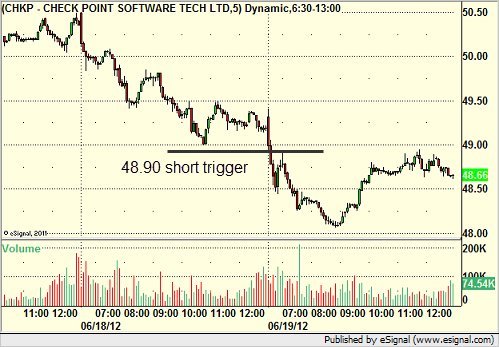

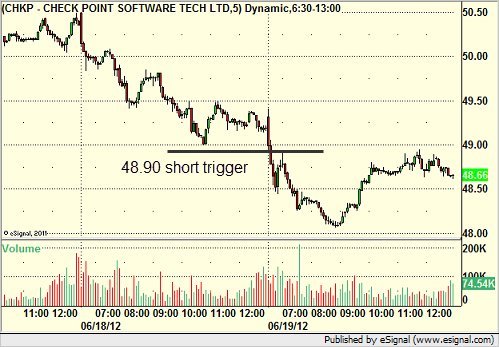

Mark's CHKP triggered short (with market support) and worked:

FSLR triggered long (with market support) and didn't work:

Rich's JPM triggered long (with market support) and worked enough for a partial:

His GS triggered long (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 2 of them worked, 3 did not.

Stock Picks Recap for 6/19/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INTU gapped over, no play.

SLXP triggered long (without market support due to opening 5 minutes) and worked:

IRDM triggered long (with market support) and didn't work:

In the Messenger, Rich's AAPL triggered long (without market support) and worked enough for a partial (over a point):

Mark's CHKP triggered short (with market support) and worked:

FSLR triggered long (with market support) and didn't work:

Rich's JPM triggered long (with market support) and worked enough for a partial:

His GS triggered long (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 2 of them worked, 3 did not.

Futures Calls Recap for 6/19/12

Two ES calls, one in the morning worked, and one in the afternoon didn't when volume fizzled once again. See that section below.

Net ticks: +1.5 ticks.

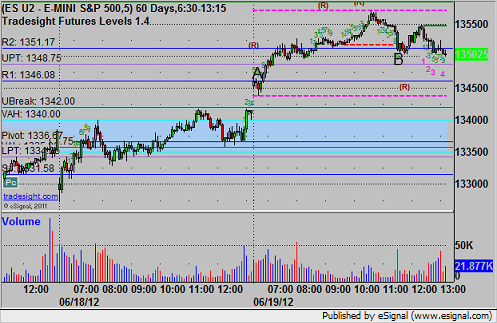

As usual, let's start by looking at the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

Triggered long at 1347.00 over early highs at A, hit 6 ticks for first target, Mark adjusted stop a few times and stopped the final piece at 1349.75, 11 ticks in the money. Later in the afternoon after we addressed the VWAP on volume, second call triggered short at 1350.25 at B and stopped:

Forex Calls Recap for 6/19/12

A loser and a winner on the GBPUSD, see that section below, and we are still long the second half of the trade.

New calls and Chat tonight, but we will be half size ahead of the Fed announcement.

Here's the US Dollar Index intraday with our market directional lines:

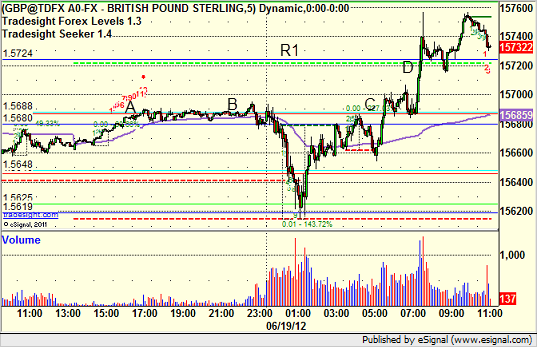

GBPUSD:

Triggered long at A and gave you all the way until B to enter, then stopped. Triggered long at C in the morning, hit first target at D, still holding second half with a stop under R1:

Tradesight Market Preview for 6/19/12

The ES was higher by 3 on the day. This is a marginal new high on the move and leaves price just below the 50dma.

The NQ futures also made a new high on the move breaking above the reverse head and shoulders neckline. The next challenge for the advance will be the 50dma and then the minor 3/8 Murrey math level.

The total put/call ratio is dead neutral:

Our 10-day Trin is also dead neutral:

Multi sector daily chart:

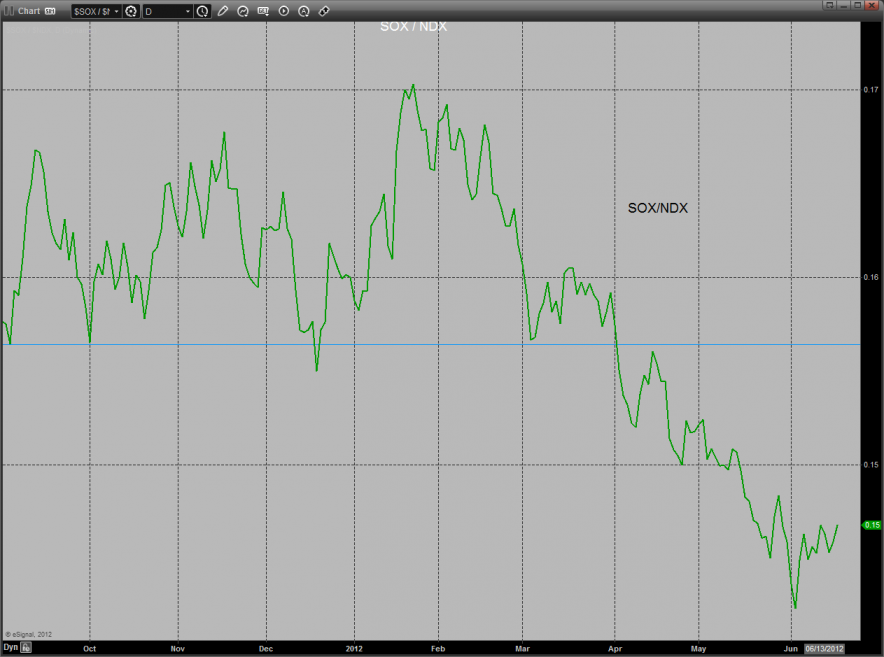

The SOX/NDX is on the verge of a positive turn which would be bullish for the overall market:

The positive turn in the Dow/gold ratio remains elusive and is still negative for the overall market.

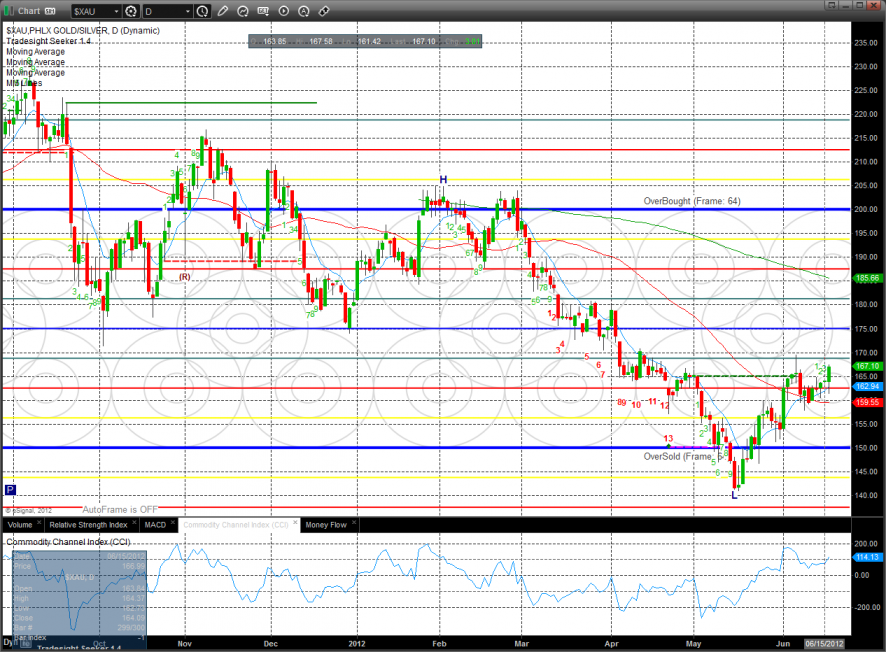

The XAU continues to build on its positive construction. This is a new high close on the move.

The SOX has rallied up to the neckline of the reverse H & S pattern.

The OSX continues to struggle and was the last laggard on the day.

Oil:

Gold:

Silver: