Forex Calls Recap for 6/15/12

Third day with no trades as the EURUSD amazingly (despite the looming vote in Greece) sat still. Definitely flat for the vote.

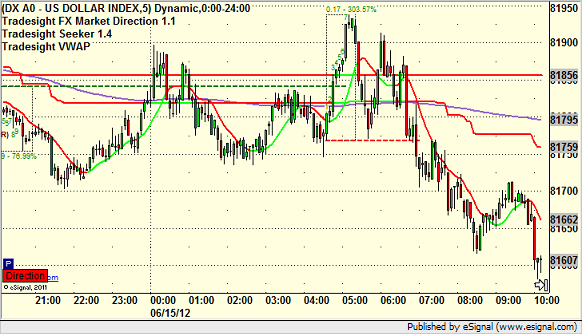

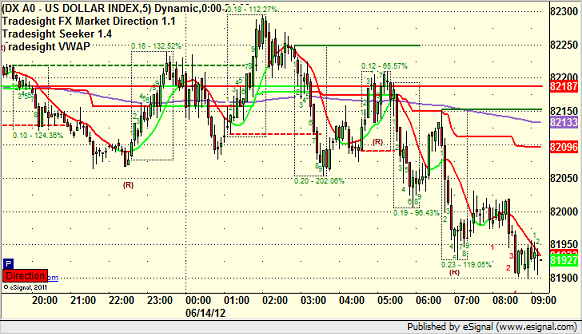

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts with the Seeker and Comber separately heading into the new week, and then look at the US Dollar Index. There's nothing in the daily charts new to see, so I have no comments in that section this weekend.

New calls Sunday, but expect a gap, so we might hold off the calls until later than usual.

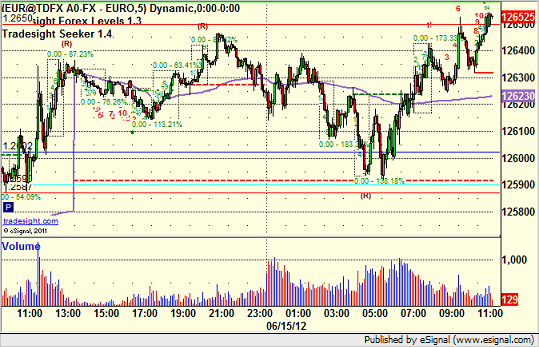

EURUSD:

Neither trade call triggered.

Stock Picks Recap for 6/15/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

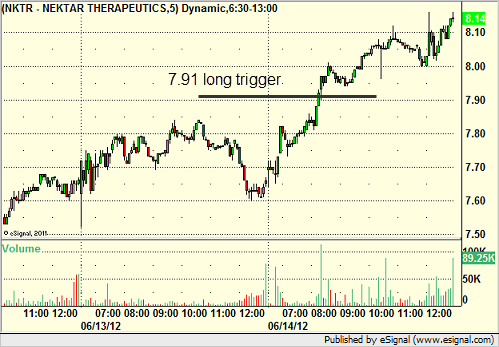

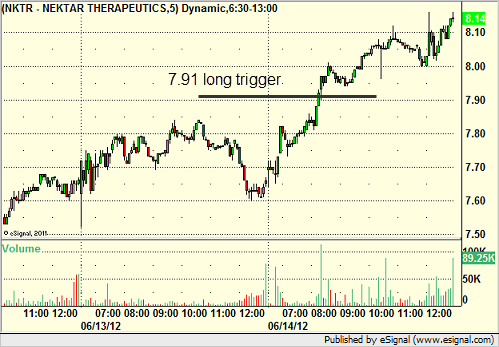

From the report, NKTR triggered long (with market support) and worked great, still carrying the second half:

FINL triggered short (without market support) and didn't work:

In the Messenger, FSLR triggered short (without market support) and didn't work:

RIMM triggered short (with market support) and worked enough for a partial:

AAPL triggered short (without market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

Stock Picks Recap for 6/15/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NKTR triggered long (with market support) and worked great, still carrying the second half:

FINL triggered short (without market support) and didn't work:

In the Messenger, FSLR triggered short (without market support) and didn't work:

RIMM triggered short (with market support) and worked enough for a partial:

AAPL triggered short (without market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 6/14/12

Another day with volume heading LOWER, and we continue to see sweeps before moves on the triggers. THe ES call triggered twice and stopped both before finally working. The NQ call worked fine the first time. Volume was only 1.4 billion NASDAQ shares, and it would have been worse except for late day news out of Europe.

Net ticks: +1.5 ticks.

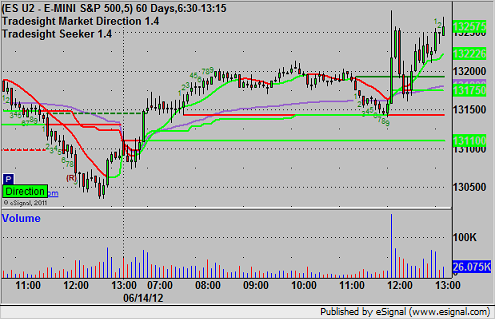

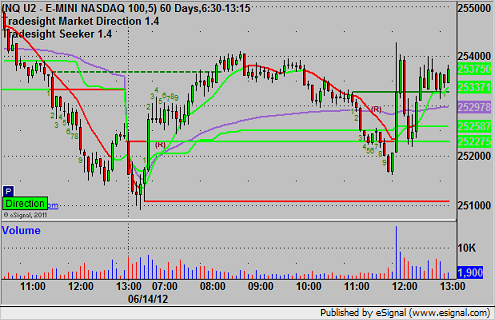

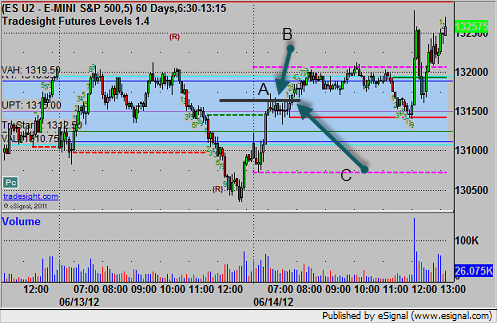

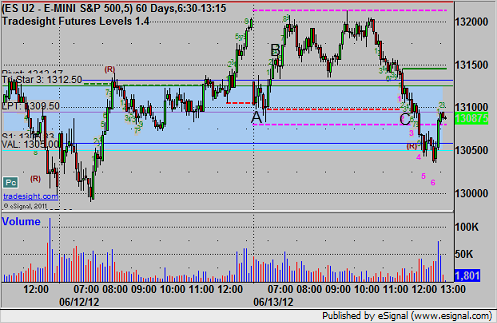

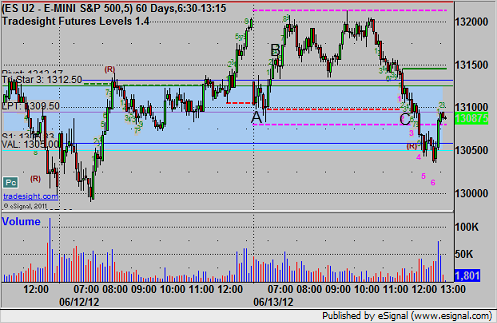

First, let's take a look at the ES and NQ with our market directional lines, Seeker, and VWAP:

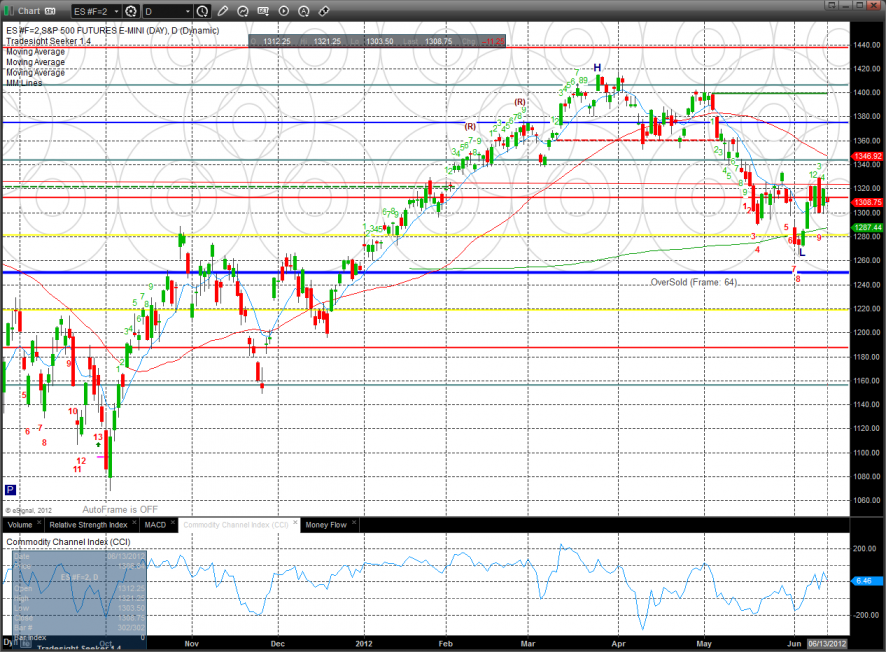

ES:

Mark's long over 1316.50 triggered at A and stopped for 7 ticks, retriggered two bars later at B and stopped again, and then triggered at C and went to the first target, and then Mark updated the stop and stopped 5 ticks in the money:

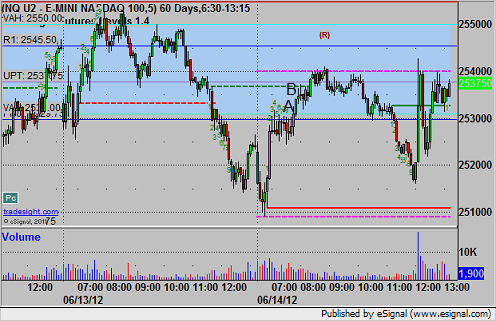

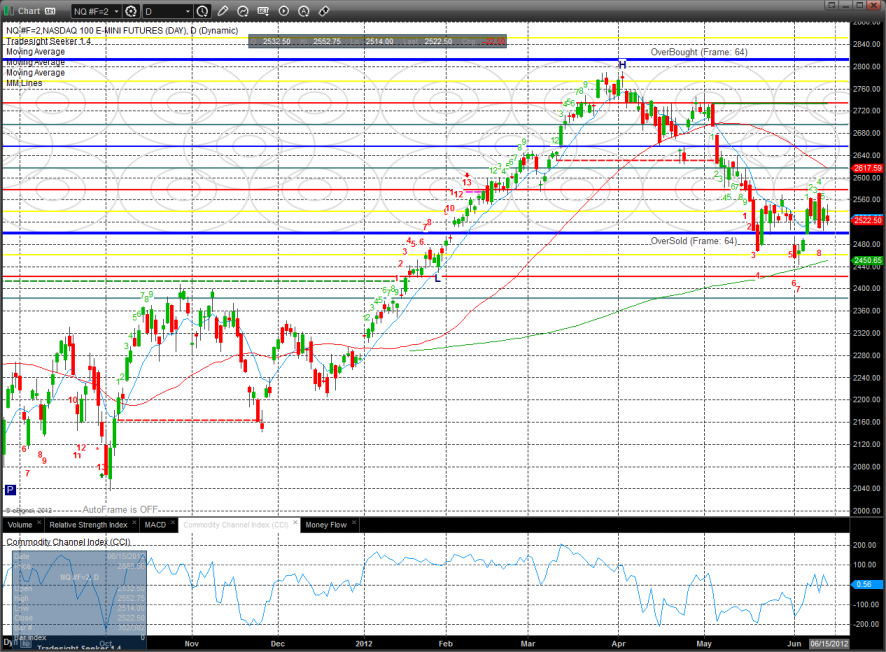

NQ:

Remember that we use half points for a tick on the NQ.

NQ triggered long at A, hit first target at B, and stopped the final piece for 10 ticks:

Forex Calls Recap for 6/14/12

A new record: Two days in a row without one of our trades triggering, although yesterday was because the EURUSD and GBPUSD went in separate directions. Today was about narrow ranges. You do, however, know that you have the right triggers when they are basically the high and low of the session. See EURUSD below, which is just as important as any day that we have trades trigger.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, but triple expiration tends to slow all markets.

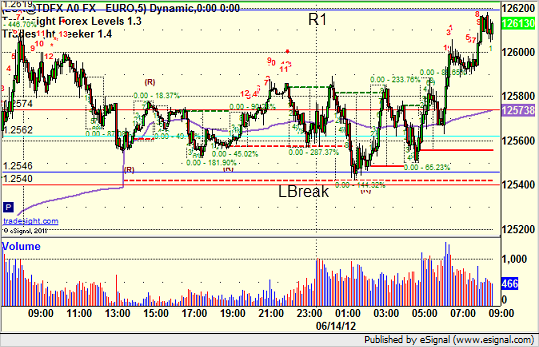

EURUSD:

We were looking to go long over R1 or short under LBreak. Looks like we had the right points as the market stuck exactly between them:

Tradesight Market Preview for 6/14/12

The ES remains boxed up and could frustratingly settle the week in the 1312.50 area that has been such a strong draw for many sessions now. The day’s candle was essentially inside the prior days so there is nothing new technically.

Like the SP, the NQ futures remain boxed up and there is nothing new technically. The NQ has a major level at 2500 which is still to the south of trading so the NQ still has relative strength vs. the broad market.

10-day Trin:

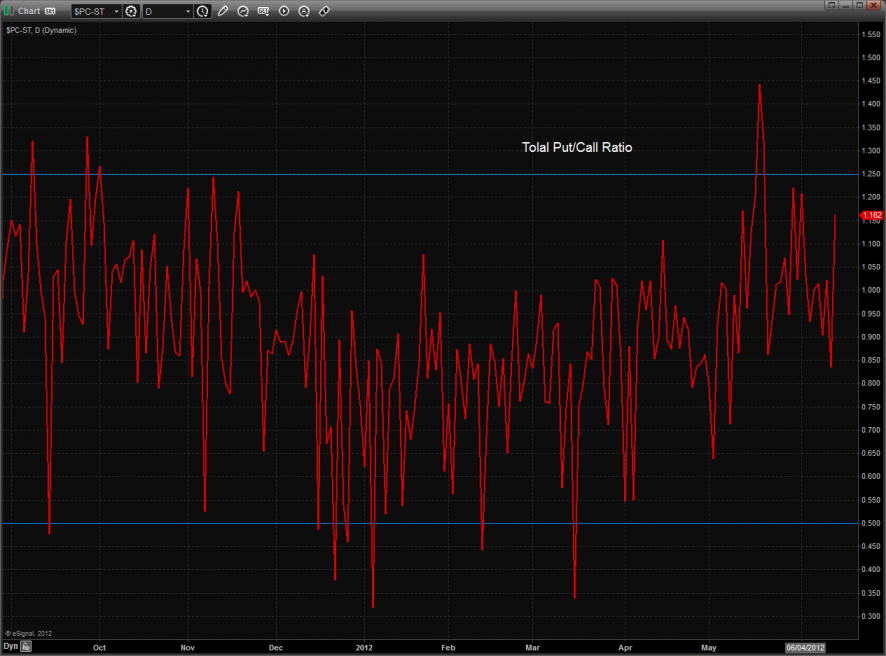

The put/call ratio is moving towards over sold but not there yet:

Multi sector daily chart:

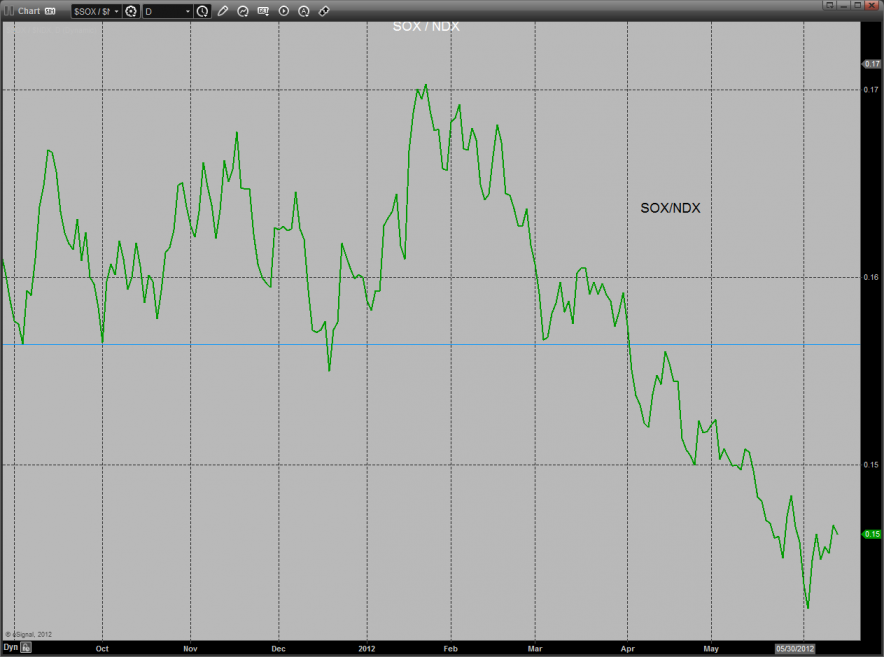

The SOX had the opportunity to change its relative weakness trend but didn’t get it done.

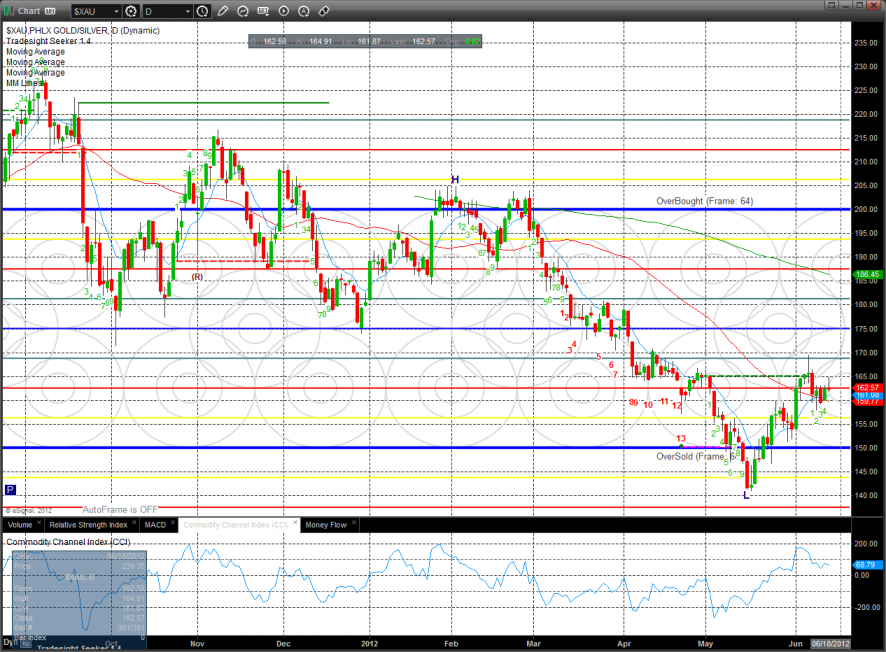

The defensive XAU was the top gun on the day with the trend remaining positive and above 2 of the 3 major moving averages.

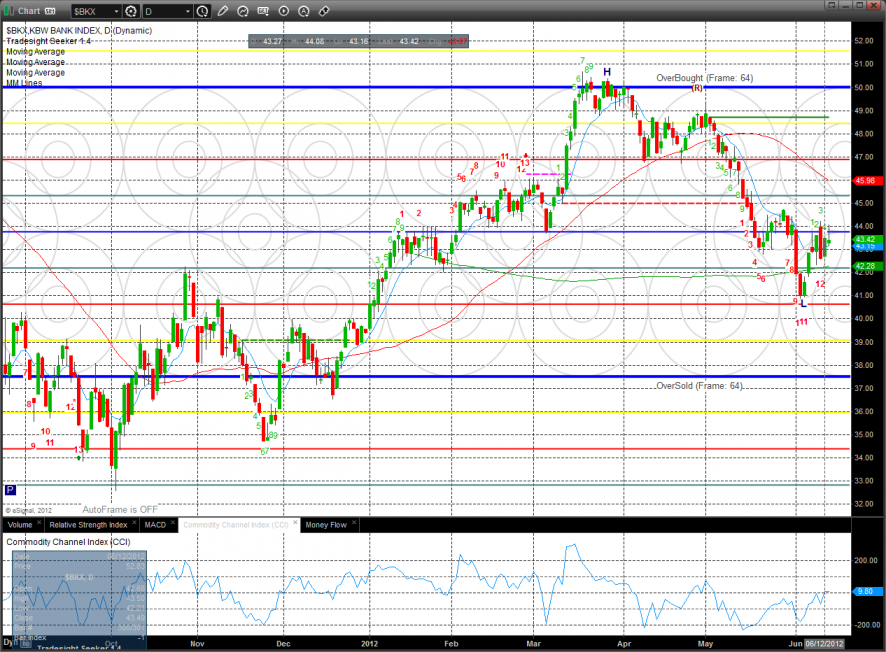

The BKX was flat on the day which is a small positive but it remains below the 4/8 midpoint.

The SOX was weaker than the Naz but after the session remains boxed up with a potential reverse head and shoulders pattern forming. Stay tuned and keep a close eye on the 380 neckline.

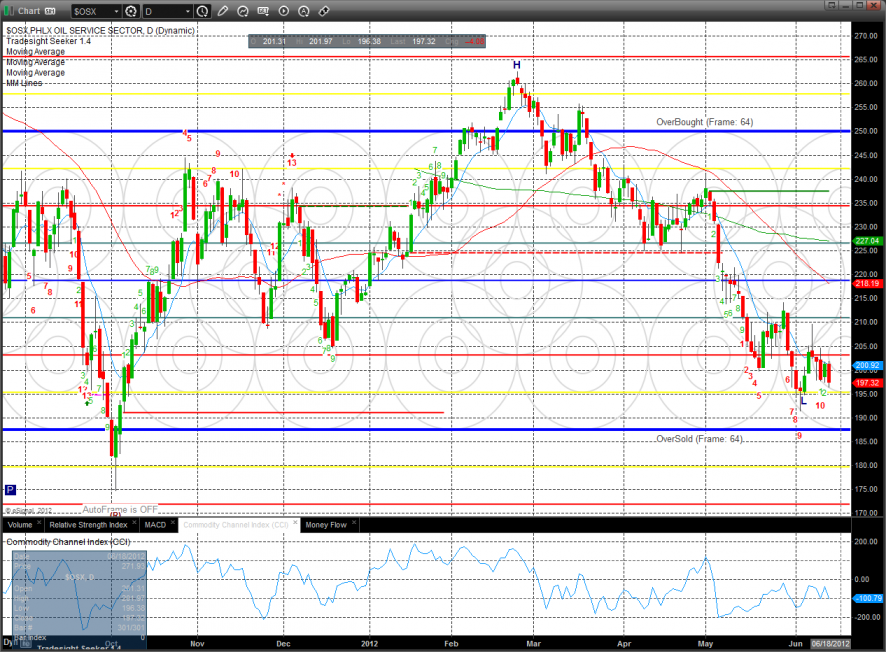

The OSX was horrible and is now 11 days down in the Seeker exhaustion countdown.

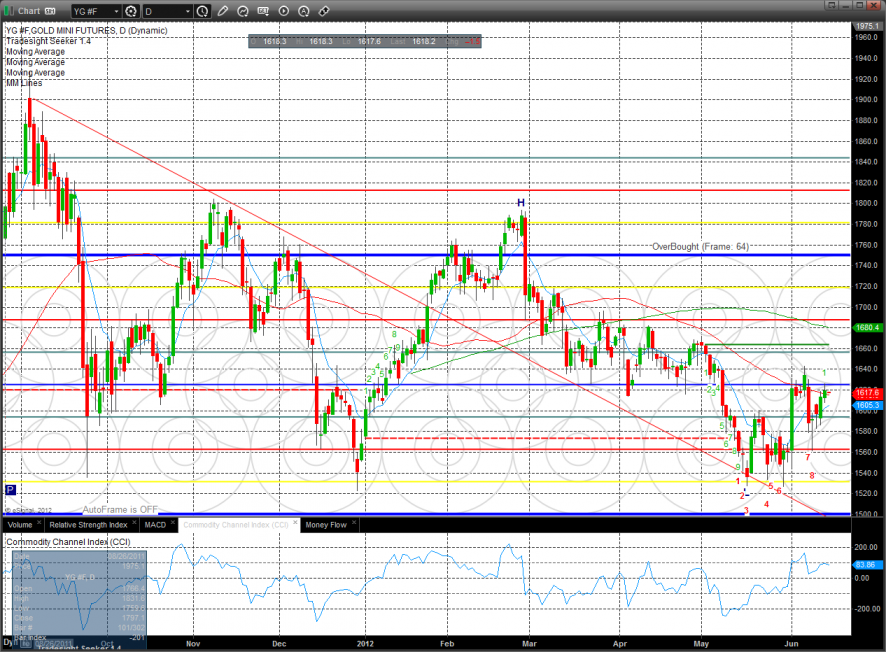

Gold appears to be on the cusp of changing trend. A break an follow through the 4/8 level would be very positive.

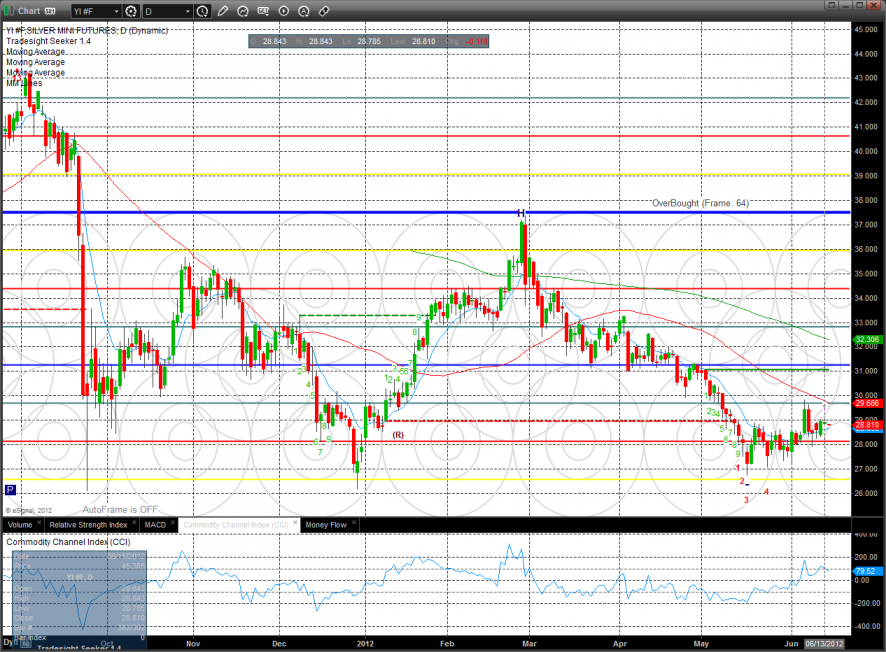

Silver:

Stock Picks Recap for 6/13/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AWAY triggered in the last ten minutes, doesn't count for time. Nothing else triggered.

In the Messenger, AAPL triggered long (with market support) and worked enough for a partial:

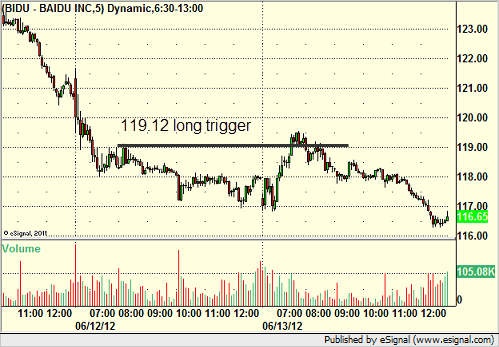

BIDU triggered long (with market support) and worked enough for a partial:

Rich's WYNN triggered long (with market support) and worked enough for a partial:

His ASML triggered long (with market support) and didn't work:

His DECK triggered long (without market support) and worked:

His CASY triggered short in the last ten minutes, doesn't count for time.

His UA triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 6/13/12

Three triggers on the ES with a loser and two winners, although we didn't get the options unraveling move that we were hoping that would have made the second trade a much bigger gain. See that section below.

Net ticks: +5.5 ticks.

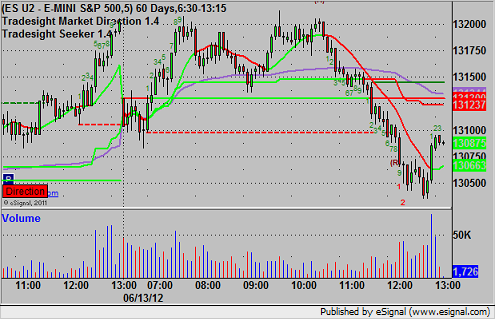

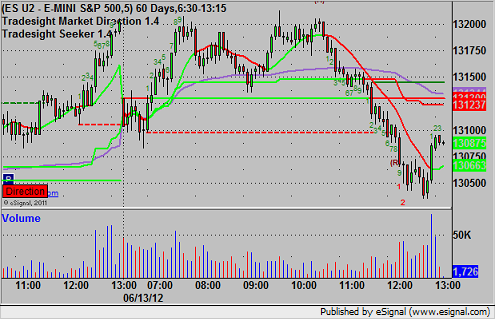

Let's start by looking at the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

Triggered short under the Lower Pressure Threshold, sweeping it at A at 1309.25 and stopping, leaving it valid for retrigger as posted in the Messenger. Triggered long at B at 1316.50, hit first target for six ticks, and stop was adjusted up and closed the final at 1317.75. Short retriggered at 1309.25 again at C, hit first target and beyond, stop adjusted and stopped at 1307.25:

Futures Calls Recap for 6/13/12

Three triggers on the ES with a loser and two winners, although we didn't get the options unraveling move that we were hoping that would have made the second trade a much bigger gain. See that section below.

Net ticks: +5.5 ticks.

Let's start by looking at the ES and NQ with our market directional lines, VWAP, and Seeker:

ES:

Triggered short under the Lower Pressure Threshold, sweeping it at A at 1309.25 and stopping, leaving it valid for retrigger as posted in the Messenger. Triggered long at B at 1316.50, hit first target for six ticks, and stop was adjusted up and closed the final at 1317.75. Short retriggered at 1309.25 again at C, hit first target and beyond, stop adjusted and stopped at 1307.25:

Forex Calls Recap for 6/13/12

No new triggers as we had a EURUSD short idea and a GBPUSD long idea and both pairs went the other way. We did stop out of the second half of our existing EURUSD short in the money. See that section below.

CPI tomorrow means half size and low expectations.

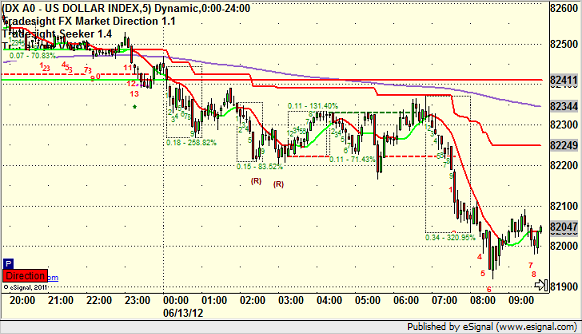

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

Stopped out of the second half of the short from two days ago at A over UBreak for about 45 pips: