Tradesight Market Preview for 6/13/12

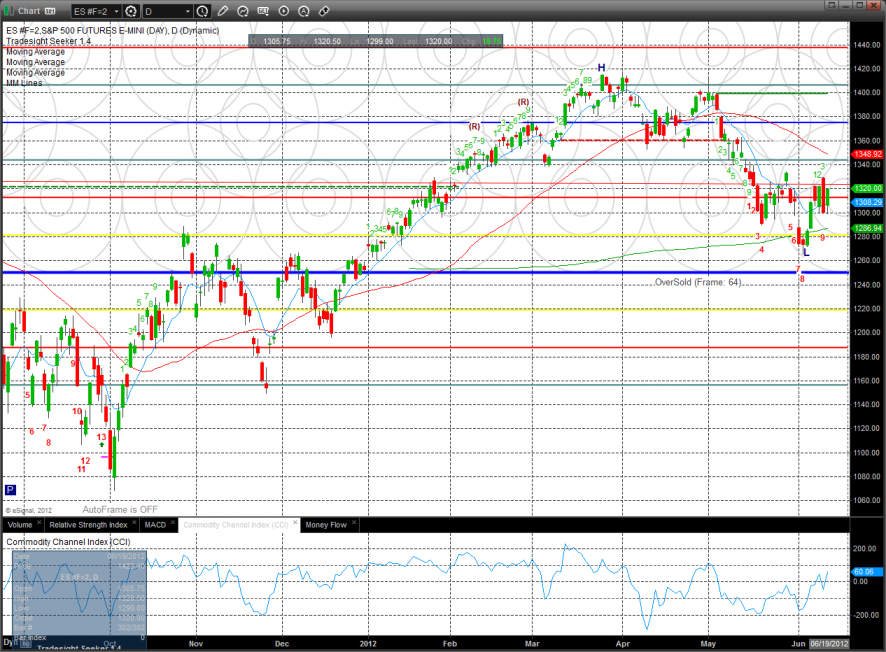

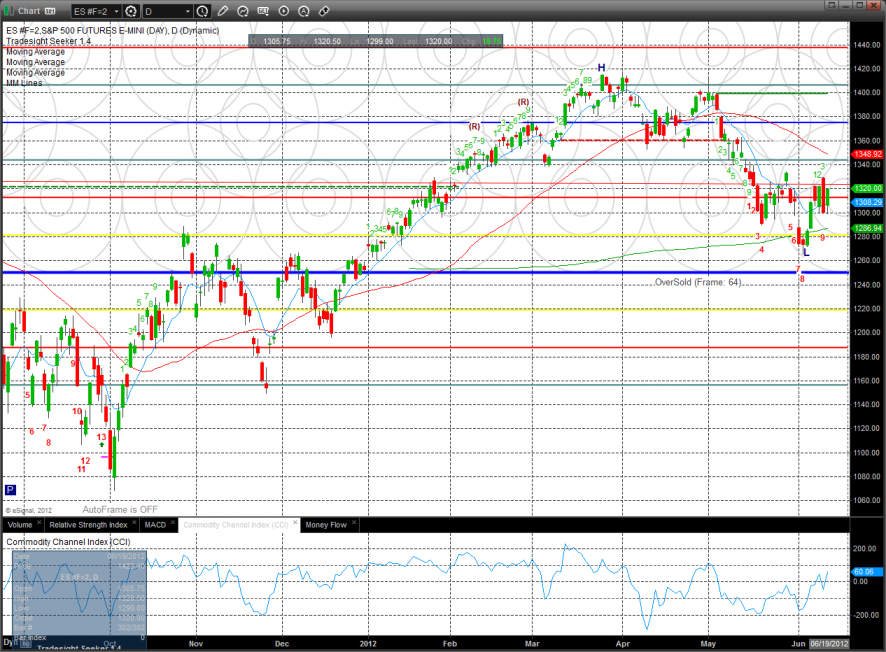

The ES was higher by 19 on the day trading inside the prior day’s large range. This means that there is nothing new technically. This marks the fourth day that price has been consolidating.

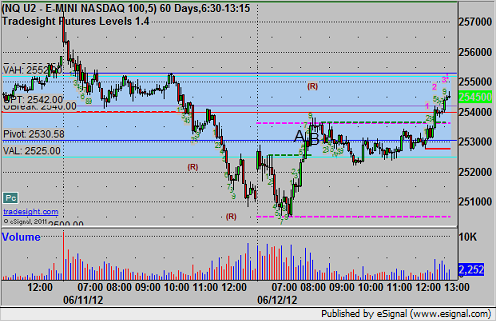

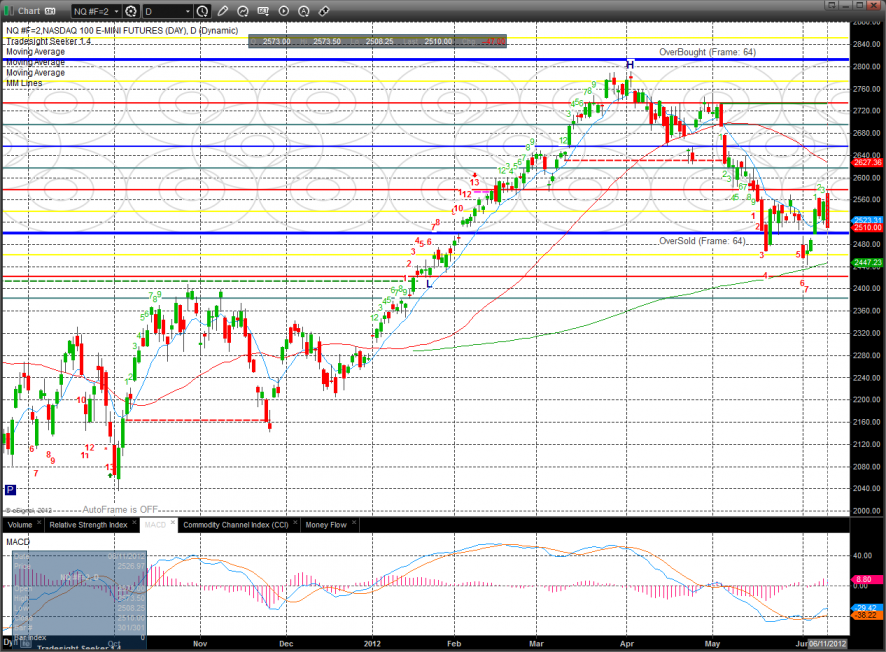

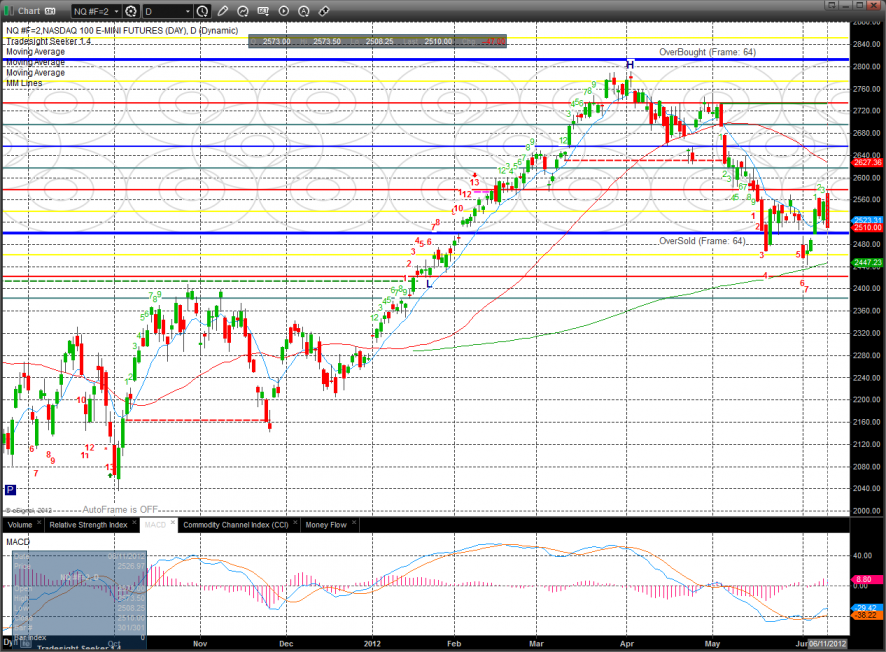

The NQ futures were higher by 35 on the cay but are still in a relative range just like the SP side. As you can see so far the futures offered below the 0/8 level has been gobbled up by the bulls.

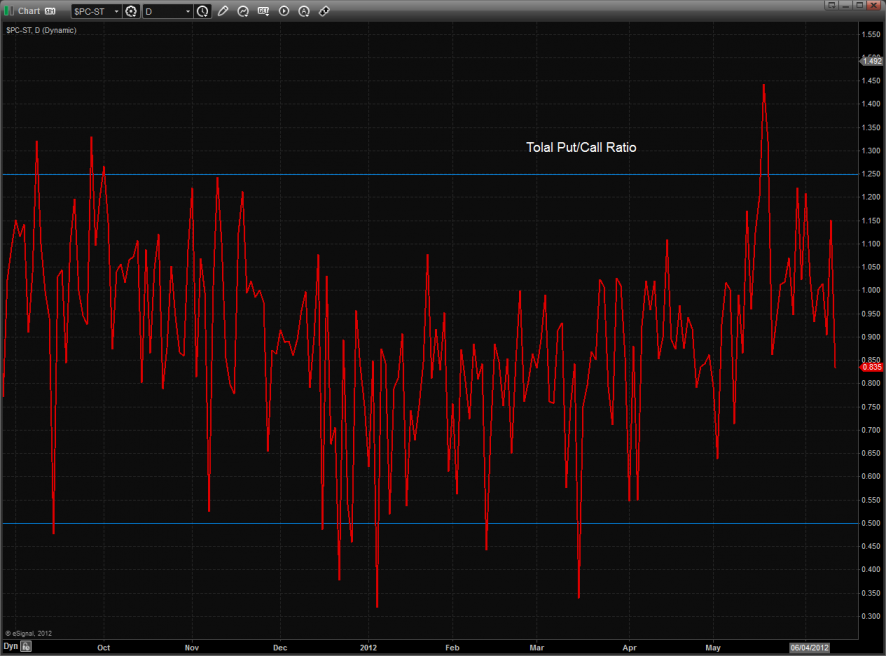

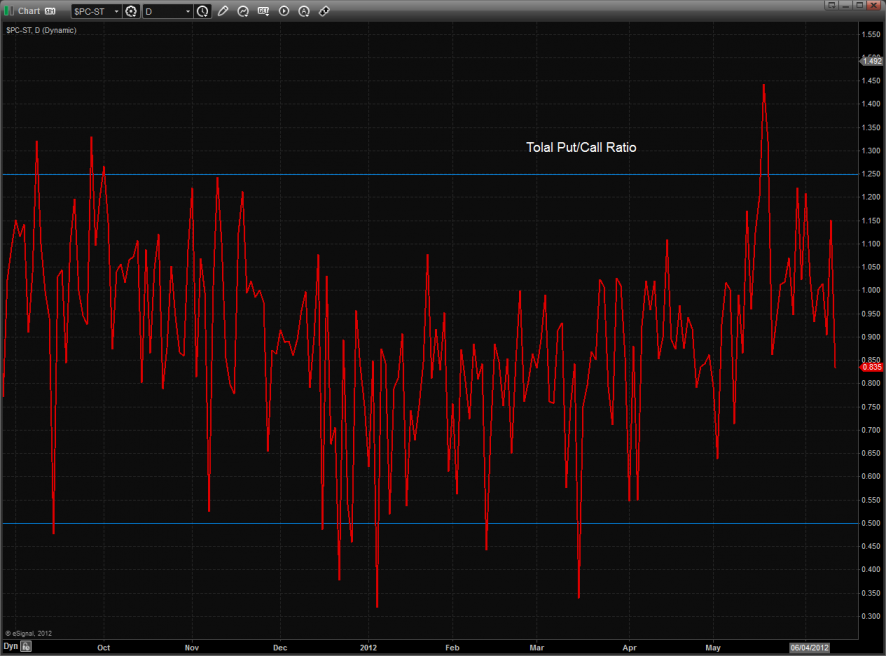

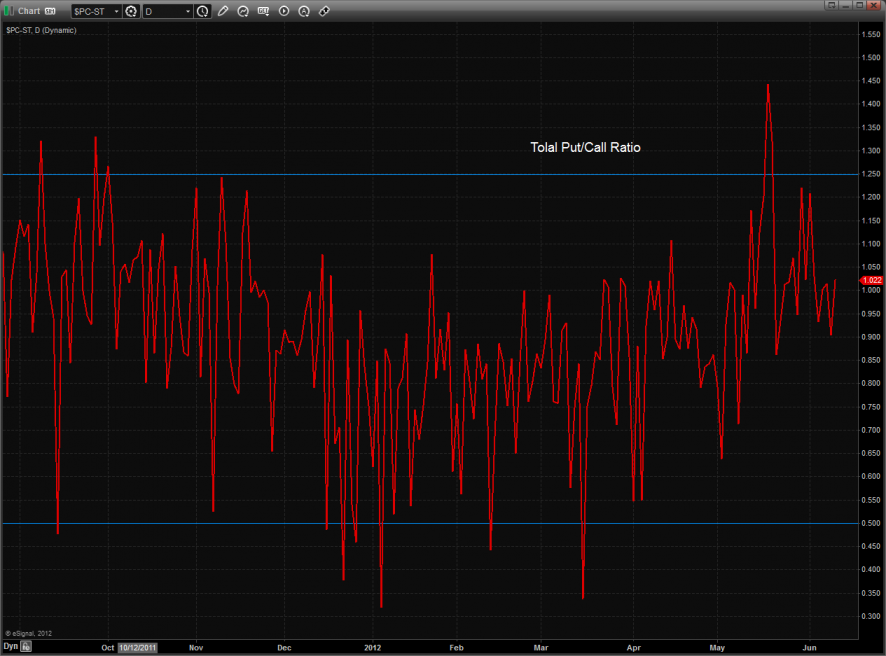

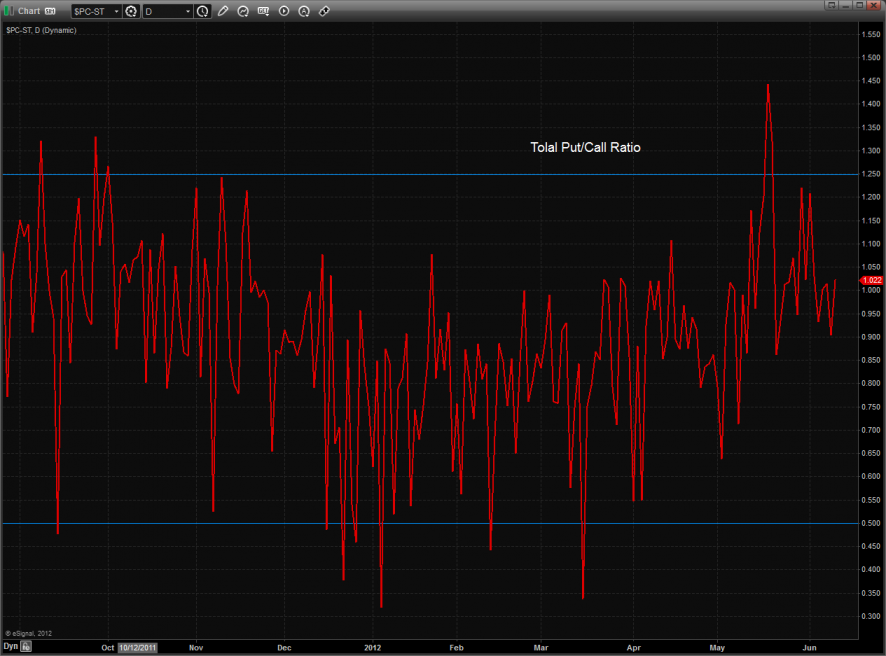

The total put/call ratio is neutral:

Multi sector daily chart:

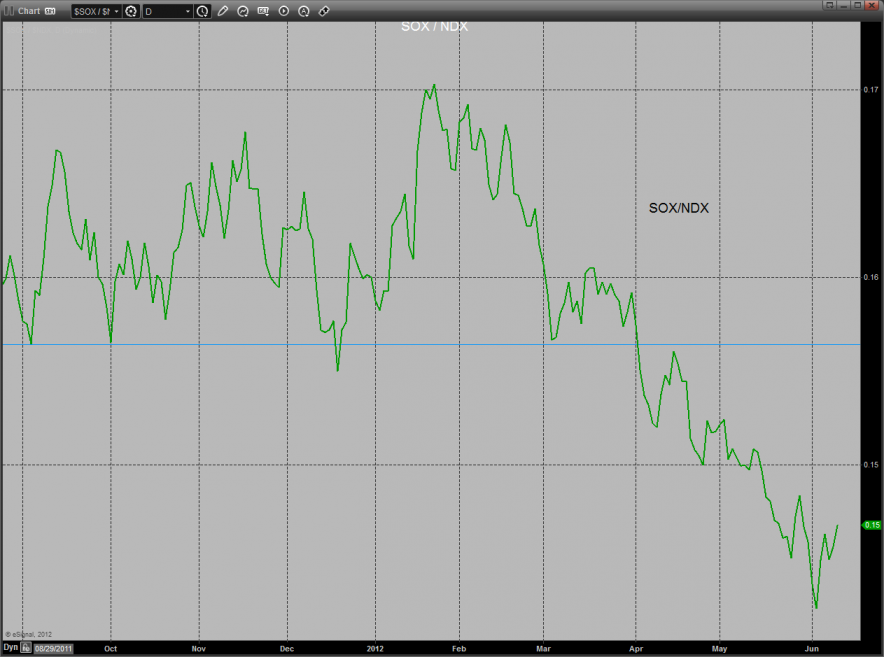

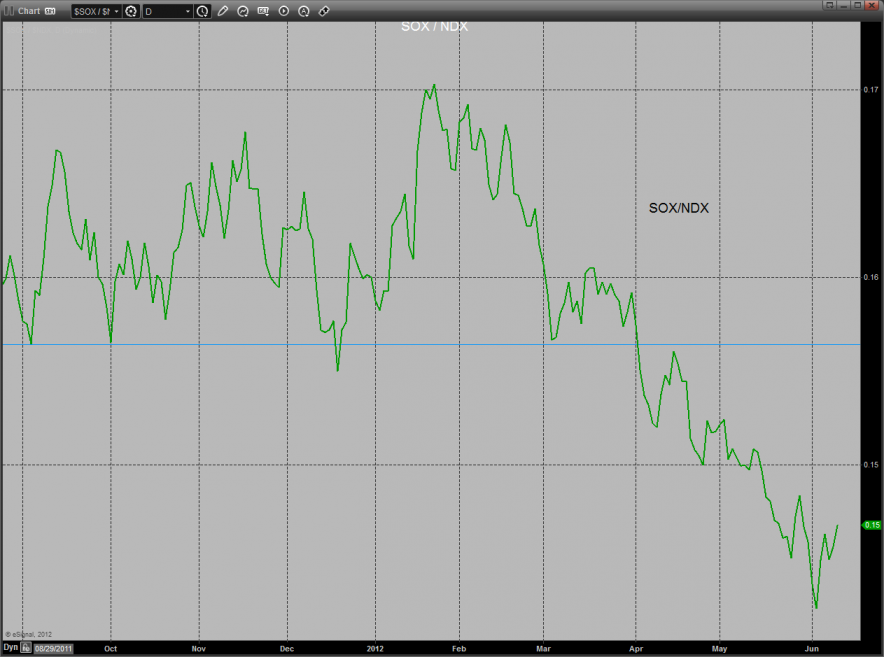

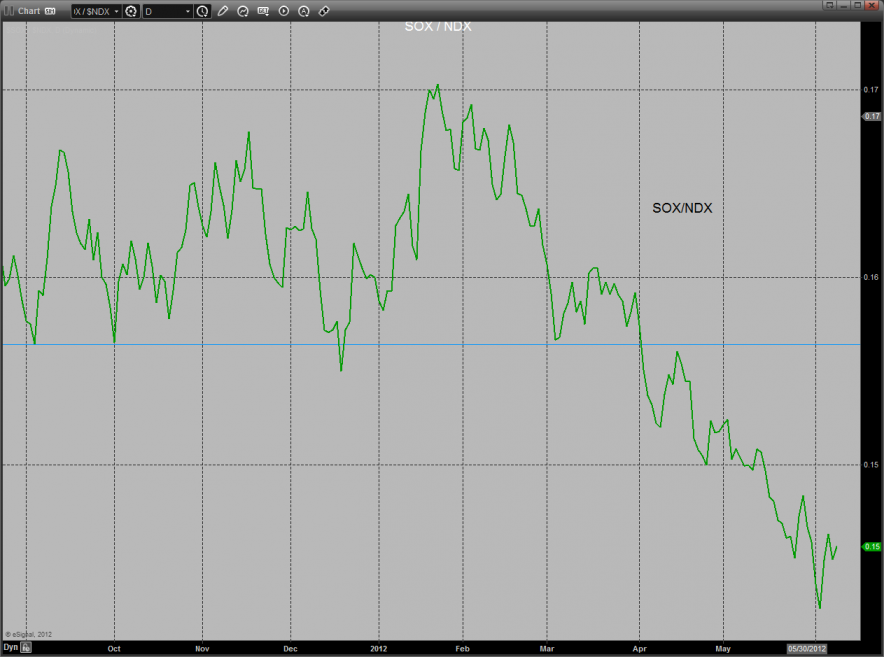

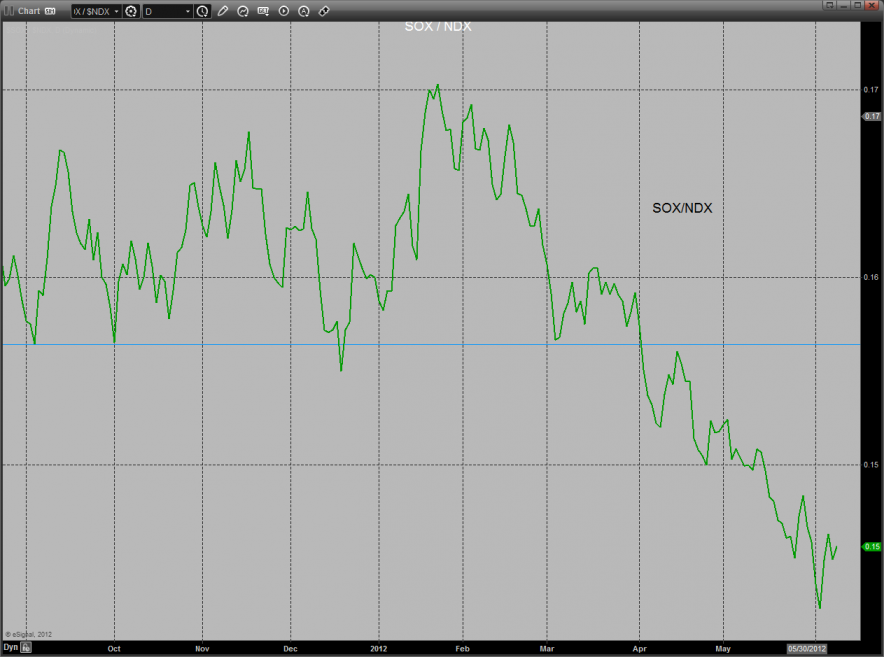

The SOX/NDX cross is setup to make a turn but needs to do some more work to turn bullish.

The Dow/gold ratio has yet to make a bullish breakout in favor of stocks over equities.

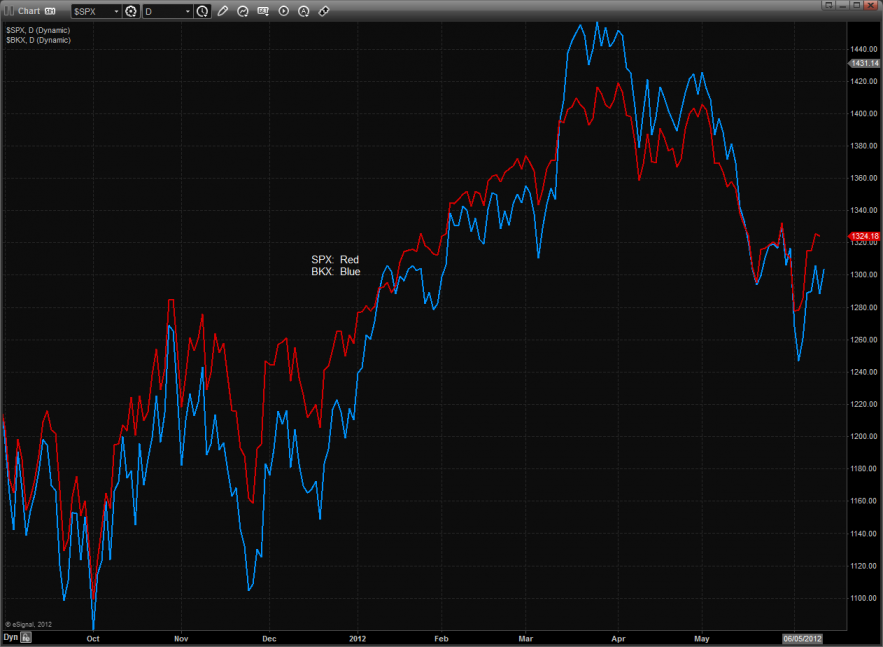

The NDX was bearishly weaker than the broader SPX:

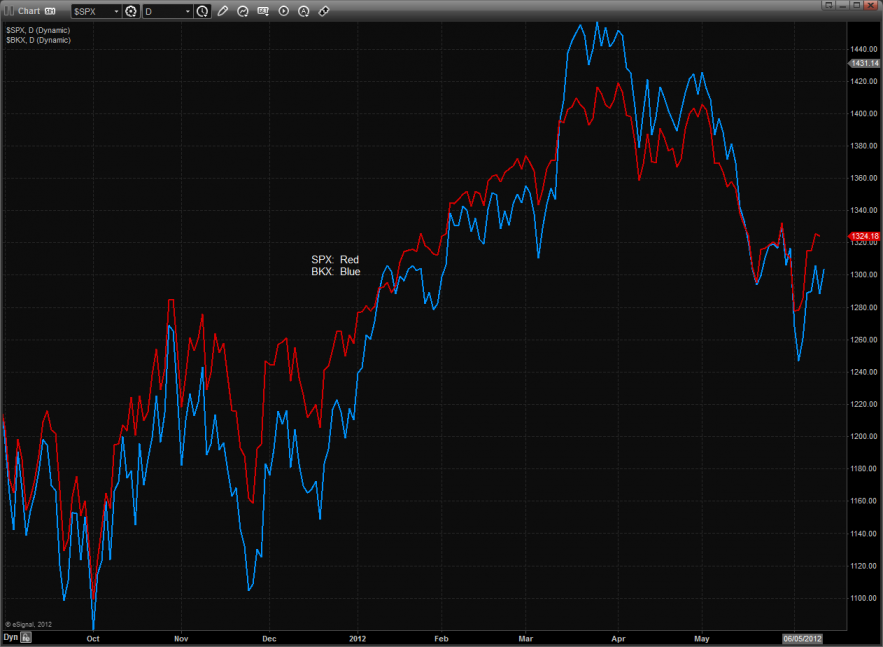

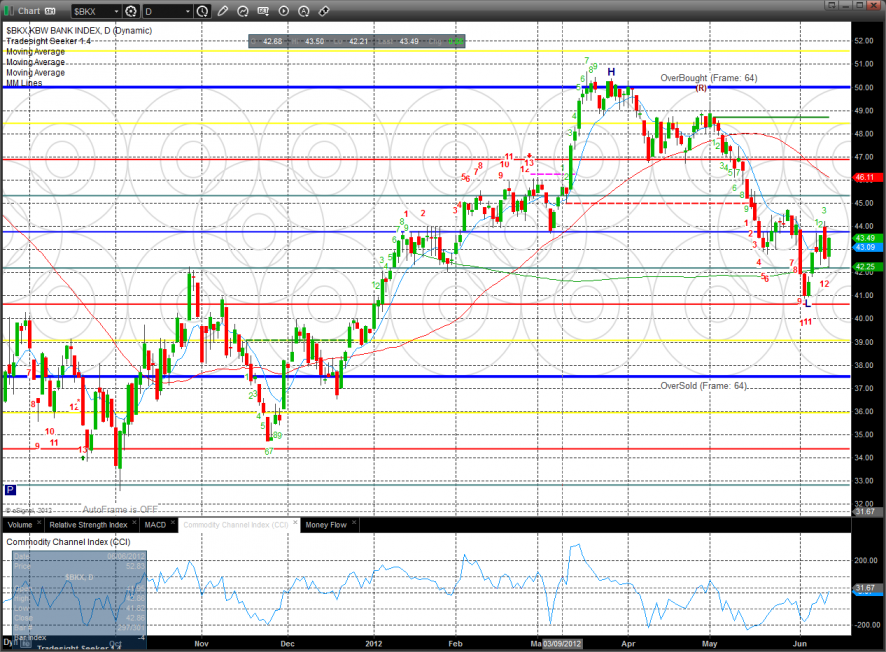

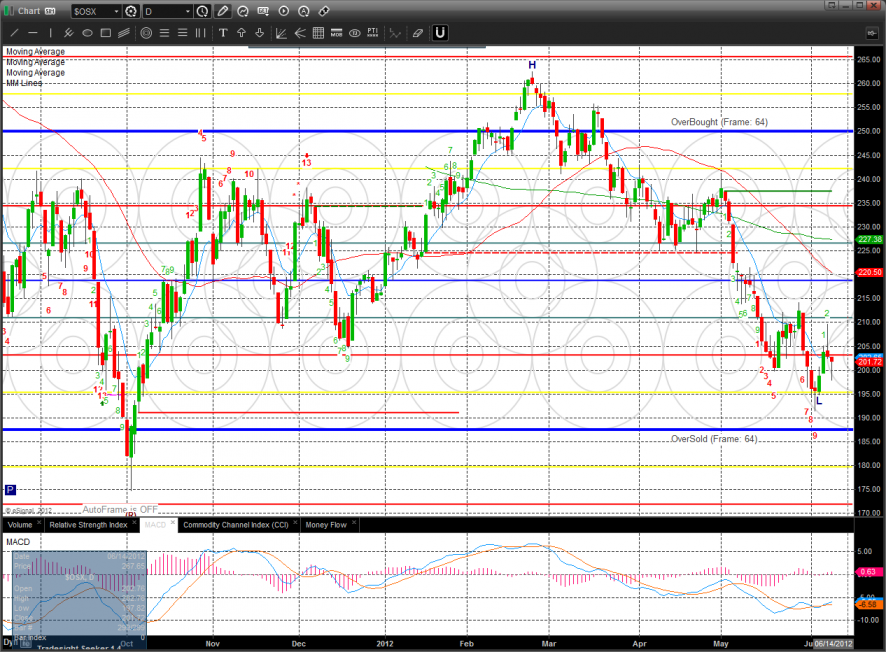

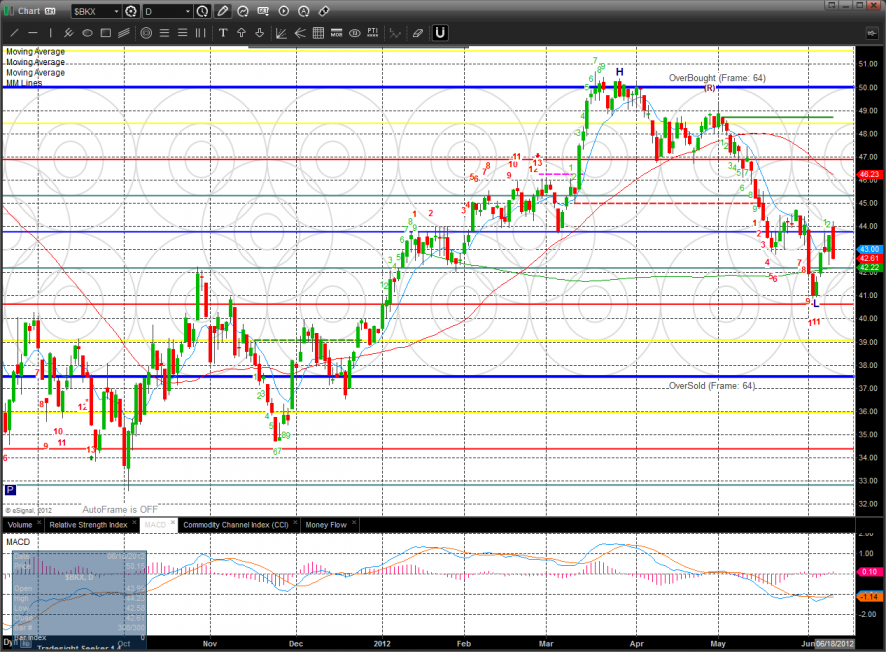

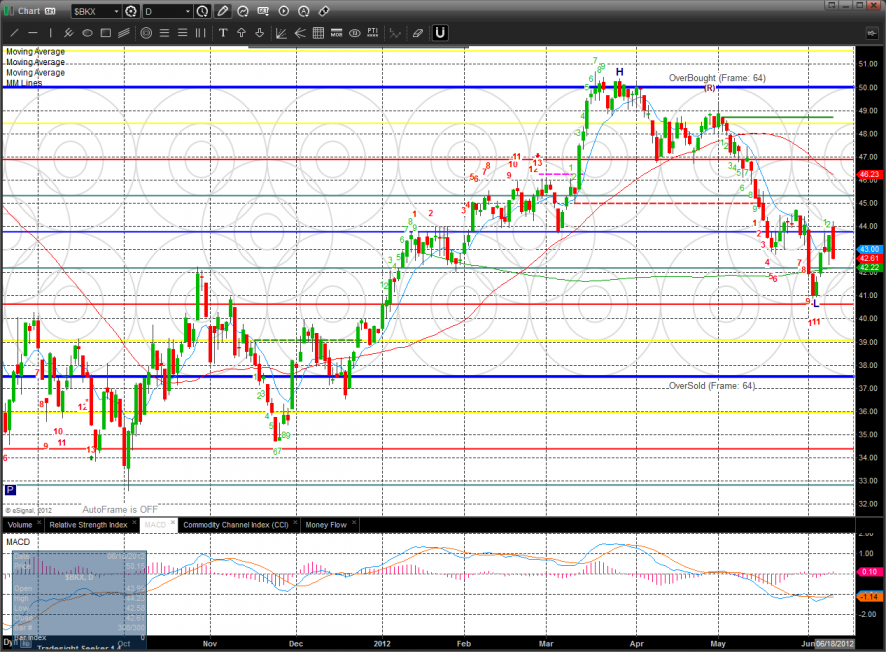

The BKX continues to bearishly lag the broad market SPX:

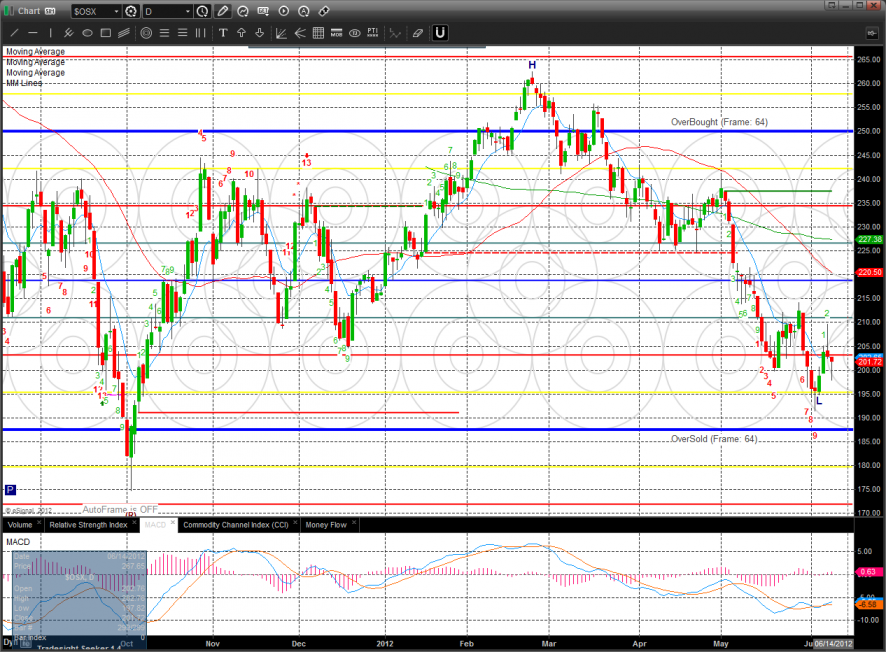

The SOX was the strongest sector on the day but remains boxed up. The near-term pattern could be tracing out a head and shoulders bottom.

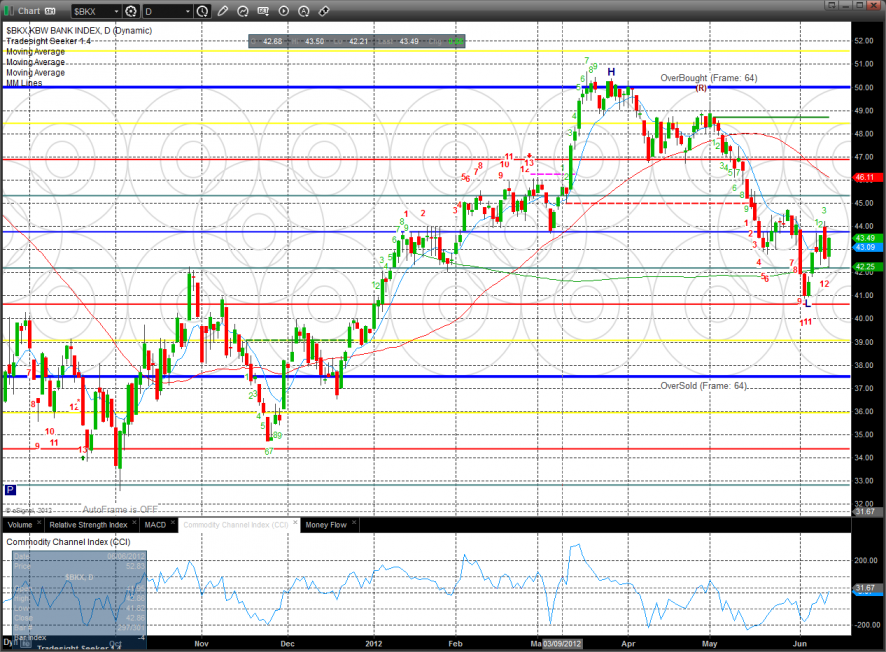

The BKX was up a full 2% but has yet to really reverse price. Note that the Seeker countdown is 12 days down.

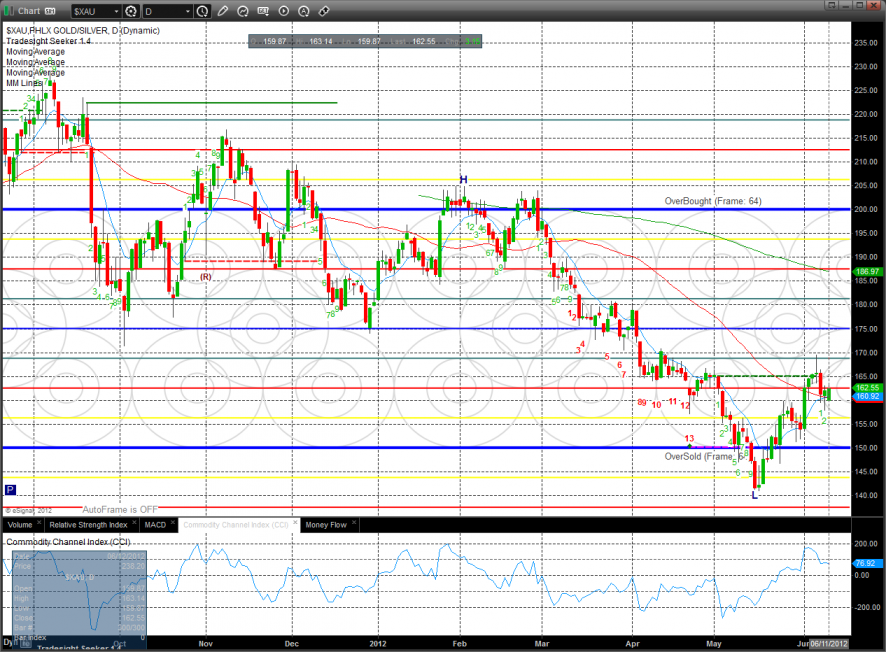

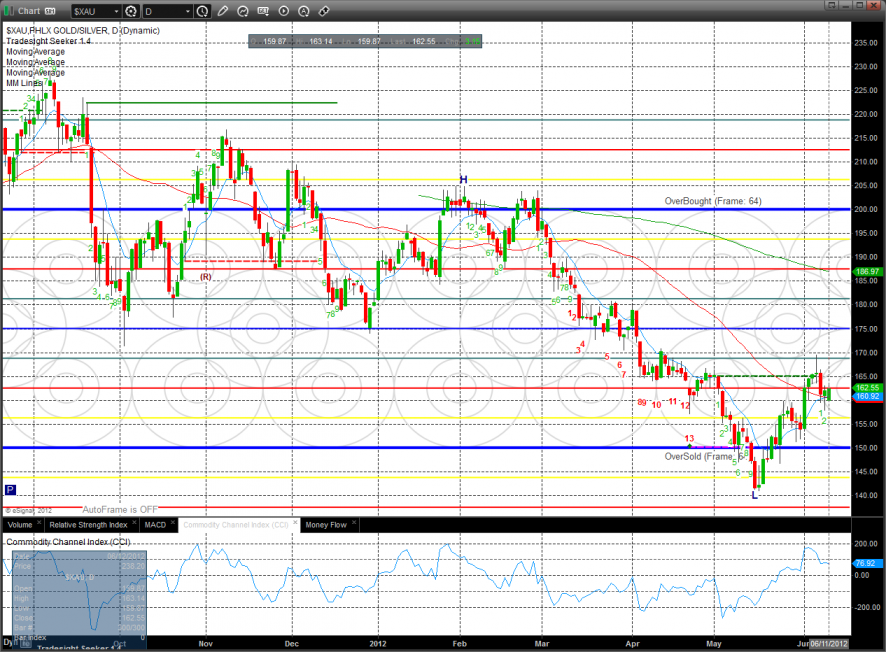

Watch the XAU for a long trade over the 2 day high.

The OSX was higher but unimpressive.

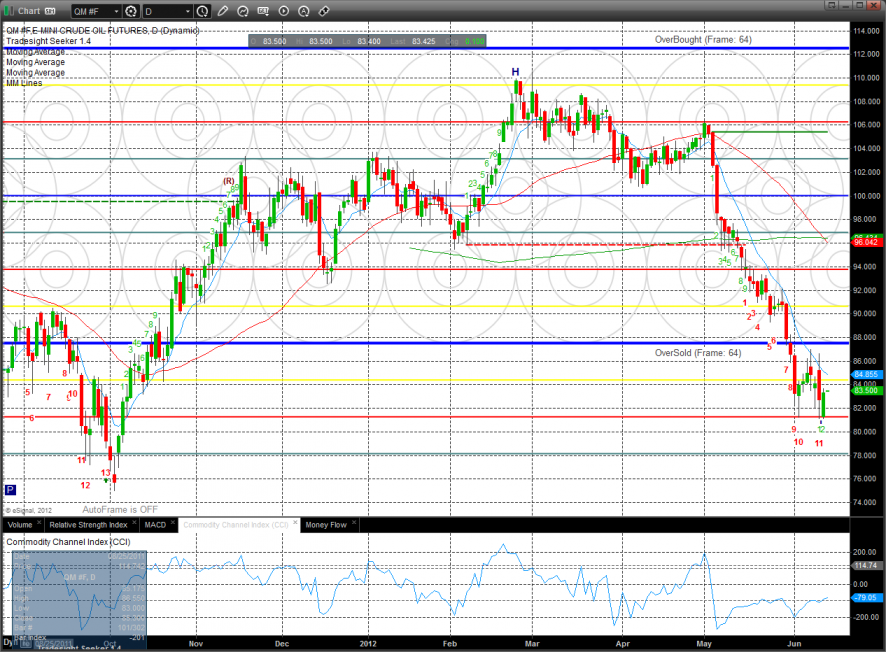

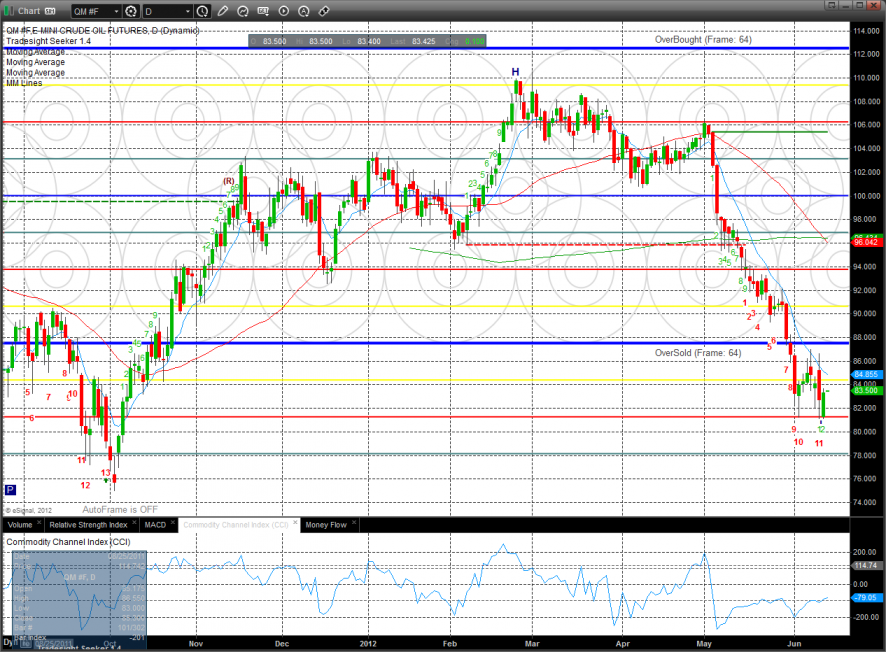

Oil used the -2/8 level for support and could reverse at any time.

Gold:

Silver:

Tradesight Market Preview for 6/13/12

The ES was higher by 19 on the day trading inside the prior day’s large range. This means that there is nothing new technically. This marks the fourth day that price has been consolidating.

The NQ futures were higher by 35 on the cay but are still in a relative range just like the SP side. As you can see so far the futures offered below the 0/8 level has been gobbled up by the bulls.

The total put/call ratio is neutral:

Multi sector daily chart:

The SOX/NDX cross is setup to make a turn but needs to do some more work to turn bullish.

The Dow/gold ratio has yet to make a bullish breakout in favor of stocks over equities.

The NDX was bearishly weaker than the broader SPX:

The BKX continues to bearishly lag the broad market SPX:

The SOX was the strongest sector on the day but remains boxed up. The near-term pattern could be tracing out a head and shoulders bottom.

The BKX was up a full 2% but has yet to really reverse price. Note that the Seeker countdown is 12 days down.

Watch the XAU for a long trade over the 2 day high.

The OSX was higher but unimpressive.

Oil used the -2/8 level for support and could reverse at any time.

Gold:

Silver:

Stock Picks Recap for 6/12/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GNTX triggered short (with market support) and didn't work:

PLCE triggered short (with market support) and worked enough for a partial:

In the Messenger, Mark's OTEX triggered short (with market support) and worked:

His CELG triggered short (with market support) and worked:

His NGLS triggered short (with market support) and worked:

Rich's GS triggered short (with market support) and didn't work:

His GMCR triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

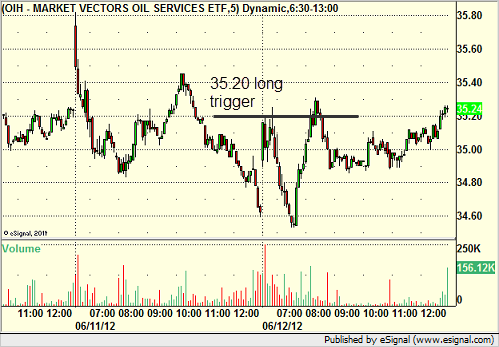

His OIH triggered long (ETF, so no market support needed) and didn't work:

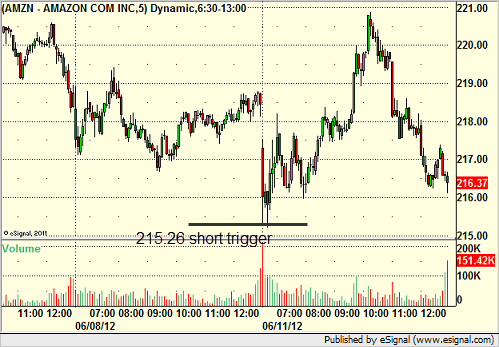

AMZN triggered short (with market support) and worked:

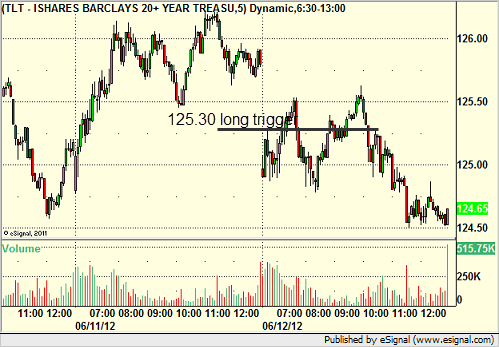

TLT triggered long (ETF, so no market support needed) and didn't work:

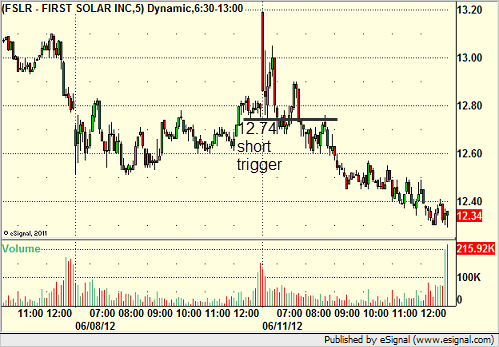

Rich's FSLR triggered long (with market support) and worked:

Rich's BA triggered long (with market support) and worked:

In total, that's 11 trades triggering with market support, 7 of them worked, 4 did not.

Futures Calls Recap for 6/12/12

Several trades triggered (6 in total between ES, NQ, and ER). Two stop outs as volume continued to be light, but we netted out gains for the day. See those sections below.

Net ticks: +5.5 ticks.

First, let's start by looking at the ES and NQ with our market direction lines, Seeker, and VWAP:

ES:

ES triggered short at A at 1303.00 and stopped. Re-entry occurred at B and hit first target for 6 ticks, then stop was moved over the entry and the second half stopped. Later, Mark's long triggered at C at 1310.25, hit first target for 6 ticks, and Mark raised stop to 1311.00 and stopped in the money on the second half:

There was another call in the Messenger to go long over the UPT at 1315.00 but I cancelled it entering the last 30 minutes for lack of time. It ended up triggering and working anyway.

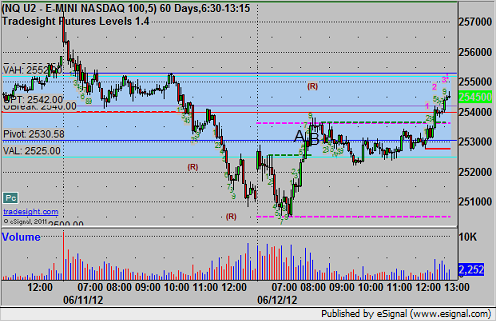

NQ:

Mark's NQ trade triggered above the Pivot at A at 2531.00 and stopped on the same bar (a sweep), which gives us an immediate re-trigger, that went two bars later at B, hit first target for 6 ticks, second half stopped under the entry:

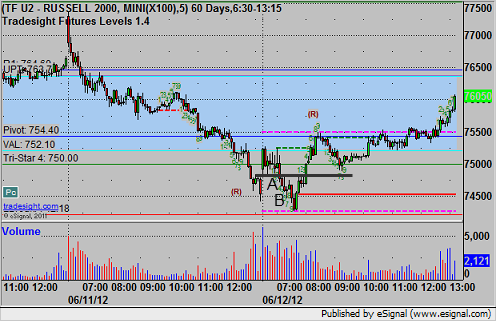

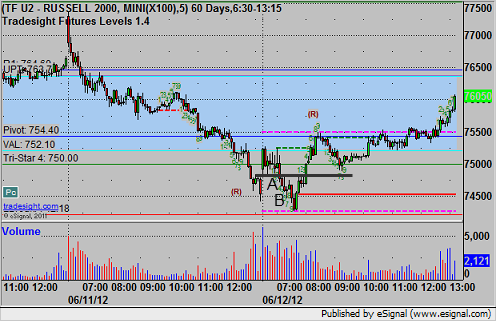

ER:

One short trade here that triggered at A at 748.20, hit first target for 8 ticks at B, and we lowered the stop and stopped for 12 ticks on the second half at 747.00:

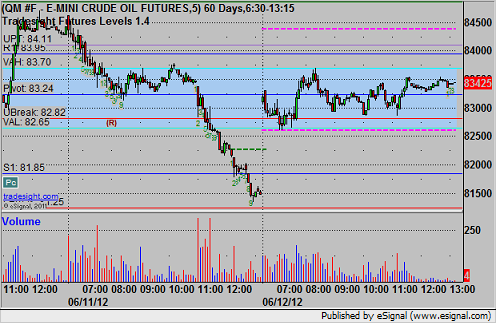

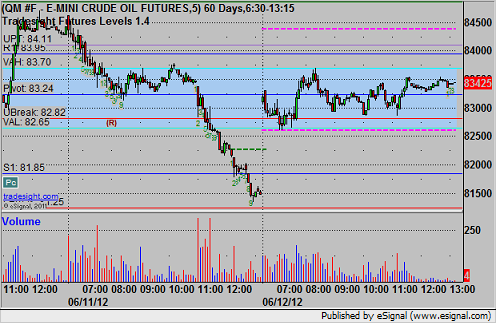

QM:

Look how the high and low of the session were the Value Area boundaries exactly:

Futures Calls Recap for 6/12/12

Several trades triggered (6 in total between ES, NQ, and ER). Two stop outs as volume continued to be light, but we netted out gains for the day. See those sections below.

Net ticks: +5.5 ticks.

First, let's start by looking at the ES and NQ with our market direction lines, Seeker, and VWAP:

ES:

ES triggered short at A at 1303.00 and stopped. Re-entry occurred at B and hit first target for 6 ticks, then stop was moved over the entry and the second half stopped. Later, Mark's long triggered at C at 1310.25, hit first target for 6 ticks, and Mark raised stop to 1311.00 and stopped in the money on the second half:

There was another call in the Messenger to go long over the UPT at 1315.00 but I cancelled it entering the last 30 minutes for lack of time. It ended up triggering and working anyway.

NQ:

Mark's NQ trade triggered above the Pivot at A at 2531.00 and stopped on the same bar (a sweep), which gives us an immediate re-trigger, that went two bars later at B, hit first target for 6 ticks, second half stopped under the entry:

ER:

One short trade here that triggered at A at 748.20, hit first target for 8 ticks at B, and we lowered the stop and stopped for 12 ticks on the second half at 747.00:

QM:

Look how the high and low of the session were the Value Area boundaries exactly:

Forex Calls Recap for 6/12/12

One loser but we continue to carry the EURUSD short from the prior session in the money. See EURUSD section below.

New calls and Chat tonight.

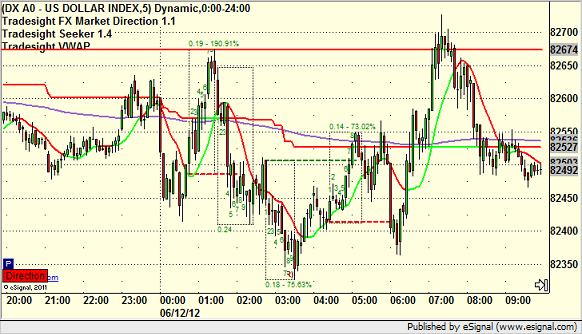

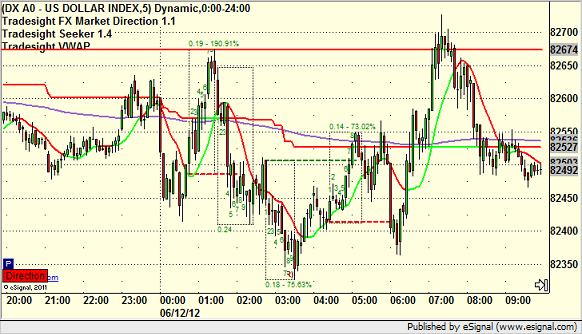

Here's the US Dollar Index intraday with our market directional lines:

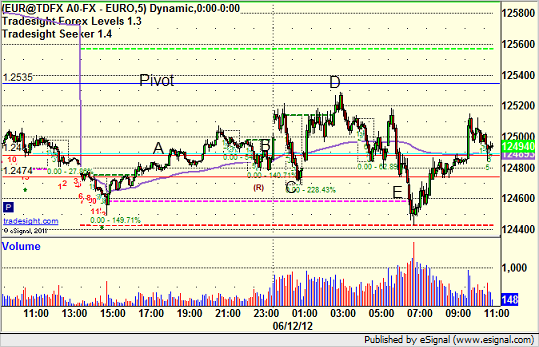

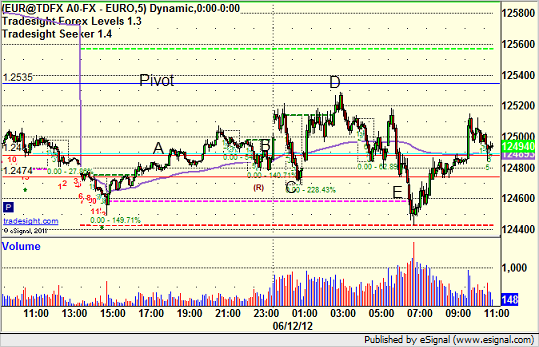

EURUSD:

We came into the session still short half of the trade from the prior day and moved our stop over the new Pivot. New trade separately triggered long at A, gave you all the way until B to enter without stopping, didn't stop at C because it didn't go 20 pips plus spread under the entry line, and just missed the first target at D (Pivot was first target) and finally stopped at E, but this still leaves us short the other trade. First time we've had to net/hedge in a while:

Forex Calls Recap for 6/12/12

One loser but we continue to carry the EURUSD short from the prior session in the money. See EURUSD section below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

We came into the session still short half of the trade from the prior day and moved our stop over the new Pivot. New trade separately triggered long at A, gave you all the way until B to enter without stopping, didn't stop at C because it didn't go 20 pips plus spread under the entry line, and just missed the first target at D (Pivot was first target) and finally stopped at E, but this still leaves us short the other trade. First time we've had to net/hedge in a while:

Tradesight Market Preview for 6/12/12

The ES gapped up big, but not over the UPT, and was sold, sold, sold. This leaves a decisive midrange outside day down on the chart. The futures lost 22 on the day with price back below the short term trend defining 10ema.

The NQ futures also had a miserable day opening at the high and closing at the low. Keep a close eye on the 0/8 level. Technically, the chart has not recorded a qualified higher high to confirm any intermediate change in trend. There has yet to be a close above the 5/29 settlement which is the key to changing the trend. The overall trend is still down.

The total put/call ratio remains neutral:

Our 10-day Trin remains neutral:

Multi sector daily chart:

The SOX vs. the NDX continues its relative strength downtrend. The market will be fighting a headwind until this changes. Keep in mind that the SOX can change direction in a hurry when it wants to.

The defensive XAU was the best of the miserable performers Monday. The static trend line is the level that needs to be claimed by the bulls. The MACD is climbing and could breakout this week.

The OSX was weak but less than the broad market. There has been no successive closes above the 10ema to change the trend.

The BKX was weaker than the broad market and is still below the 4/8 level.

Oil made a new low close on the move and has been using the -2/8 level for support. The Seeker is deep into the exhaustion countdown and should produce a buy signal soon.

Gold:

Silver:

Tradesight Market Preview for 6/12/12

The ES gapped up big, but not over the UPT, and was sold, sold, sold. This leaves a decisive midrange outside day down on the chart. The futures lost 22 on the day with price back below the short term trend defining 10ema.

The NQ futures also had a miserable day opening at the high and closing at the low. Keep a close eye on the 0/8 level. Technically, the chart has not recorded a qualified higher high to confirm any intermediate change in trend. There has yet to be a close above the 5/29 settlement which is the key to changing the trend. The overall trend is still down.

The total put/call ratio remains neutral:

Our 10-day Trin remains neutral:

Multi sector daily chart:

The SOX vs. the NDX continues its relative strength downtrend. The market will be fighting a headwind until this changes. Keep in mind that the SOX can change direction in a hurry when it wants to.

The defensive XAU was the best of the miserable performers Monday. The static trend line is the level that needs to be claimed by the bulls. The MACD is climbing and could breakout this week.

The OSX was weak but less than the broad market. There has been no successive closes above the 10ema to change the trend.

The BKX was weaker than the broad market and is still below the 4/8 level.

Oil made a new low close on the move and has been using the -2/8 level for support. The Seeker is deep into the exhaustion countdown and should produce a buy signal soon.

Gold:

Silver:

Stock Picks Recap for 6/11/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report with the gap (CRAY gapped over).

In the Messenger, Rich's AAPL triggered long (without market support) and didn't work, but wasn't really the intended trigger, he was watching it out of the gate anyway:

My AAPL short triggered (with market support) and worked:

His NFLX triggered short (with market support) and worked enough for a partial:

AMZN triggered short (with market support) and didn't work:

Rich's VXX triggered long (ETF, so no market support needed) and worked huge:

AMZN triggered long (without market support) and didn't do much:

FSLR triggered short (with market support) and worked:

AMGN triggered short (with market support) and worked:

Rich's GOOG triggered long (without market support) and didn't work:

His DNKN triggered long (without market support) and didn't work:

His CF triggered short (with market support) and worked:

Another AAPL called triggered short (with market support) and didn't work initially, sweeping the trigger and retracing over a point, before triggering and working great:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.