Futures Calls Recap for 6/11/12

Couple of trades on another very light volume day as the NASDAQ traded only 1.3 billion shares, far below the 2.0 billion share average that we like to see. See ES and NQ sections below.

Net ticks: -9 ticks.

First, let's take a look at the ES and NQ with market directional lines, the Seeker, and our VWAP:

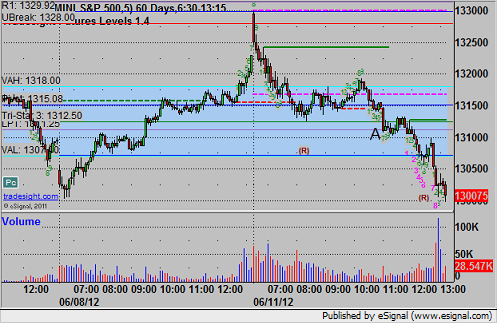

ES:

Mark's late day ES short triggered at A on a news spike and stopped:

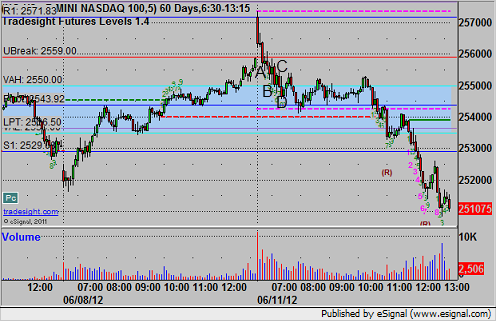

NQ:

Triggered short at A, hit first target for 6 ticks, moved stop over the entry and stopped. We then headed into the Value Area with a new call short at B which stopped at C, retriggered at D and hit the first target, second half stopped over the entry:

Forex Calls Recap for 6/11/12

We got a huge gap in the Forex pairs for the start of the week, which created a unique setup for trades. However, the gap ended up filling and we had a nice winner on the EURUSD in the process. See that section below.

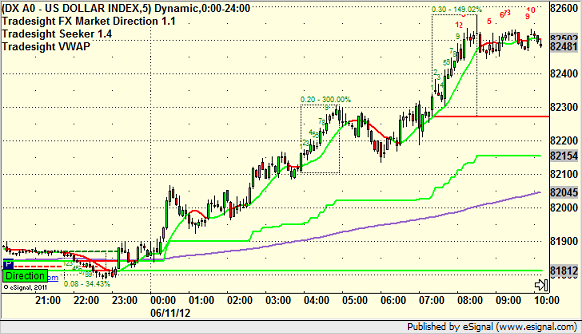

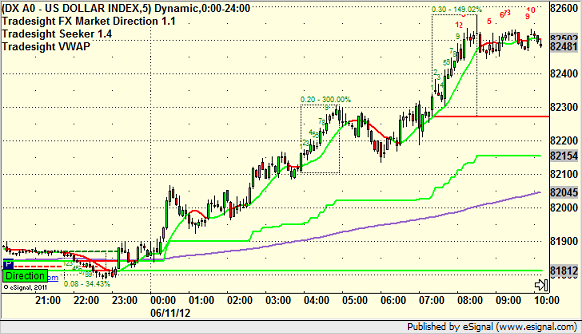

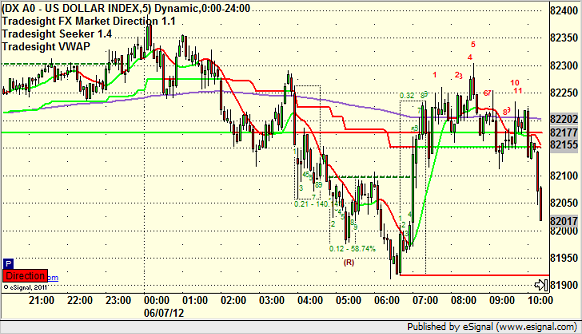

Here's the US Dollar Index intraday with our market directional lines:

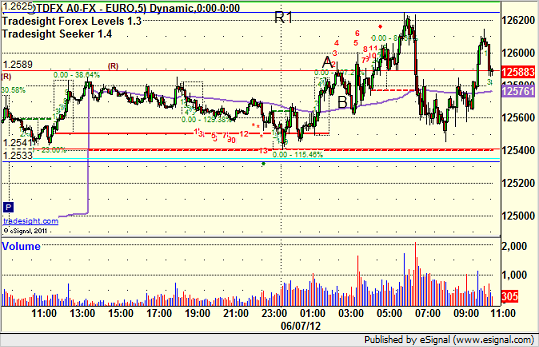

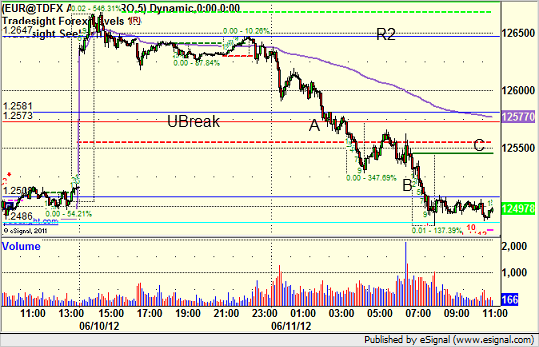

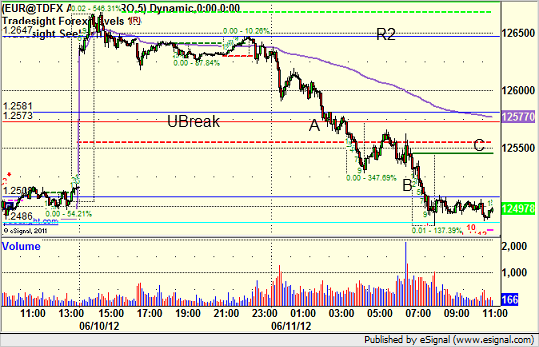

EURUSD:

Triggered short at A, hit first target at B, currently carrying the second half short with a stop in the money at C, which is above the last static trendline:

Forex Calls Recap for 6/11/12

We got a huge gap in the Forex pairs for the start of the week, which created a unique setup for trades. However, the gap ended up filling and we had a nice winner on the EURUSD in the process. See that section below.

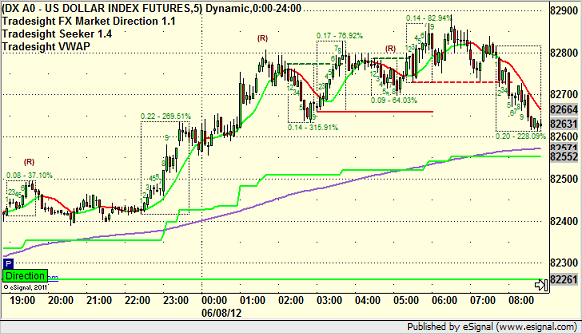

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, currently carrying the second half short with a stop in the money at C, which is above the last static trendline:

Stock Picks Recap for 6/8/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

No calls in the report.

In the Messenger, Mark's LIFE triggered short (without market support due to opening five minutes) and worked enough for a partial:

Rich's GS triggered short (without market support) and didn't work:

GOOG triggered short (with market support) and didn't work:

Rich's BNNY triggered short (without market support) and worked:

In total, that's only 1 trade triggering with market support, and it didn't work, on the lightest volume day of the year so far (non-Holiday).

Stock Picks Recap for 6/8/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

No calls in the report.

In the Messenger, Mark's LIFE triggered short (without market support due to opening five minutes) and worked enough for a partial:

Rich's GS triggered short (without market support) and didn't work:

GOOG triggered short (with market support) and didn't work:

Rich's BNNY triggered short (without market support) and worked:

In total, that's only 1 trade triggering with market support, and it didn't work, on the lightest volume day of the year so far (non-Holiday).

Futures Calls Recap for 6/8/12

Just one trade as the market was incredibly light with NASDAQ volume closing at only 1.3 billion shares, the lightest of the year. See ES below.

Net ticks: +2 ticks.

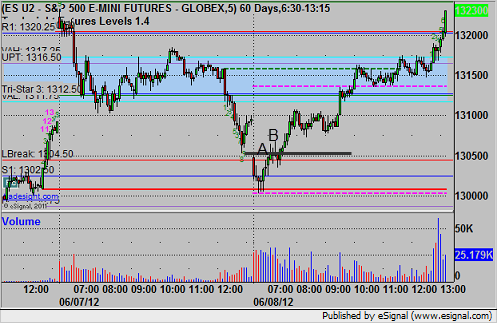

Here's the ES and NQ intraday with our market direction lines, Seeker, and VWAP:

ES:

Triggered long at A, hit first target at B, stopped second half under entry level:

Forex Calls Recap for 6/8/12

Another winner to close out the week. Five for six for the week in total. Nice stuff, and the ranges have been back up, Hopefully, this holds.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber separately, then discuss the US Dollar Index.

Here's the Index intraday from Friday with our market directional lines:

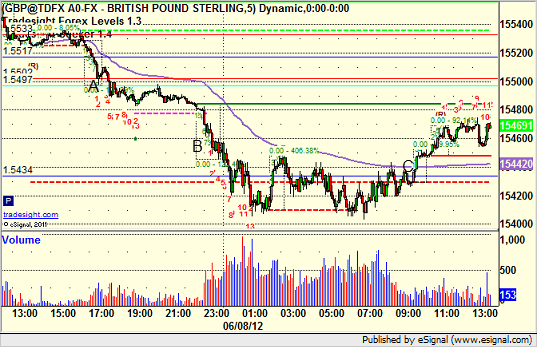

GBPUSD:

Triggered short at A (half size), hit first target at B, closed final piece at C for end of week:

Stock Picks Recap for 6/7/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SWKS triggered long (without market support) and didn't work:

CNQR gapped over the trigger, no play.

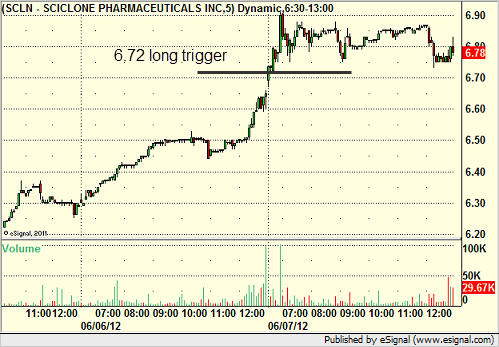

SCLN triggered long (without market support due to opening 5 minutes) and worked:

SGEN and THOR gapped over their triggers, so no play.

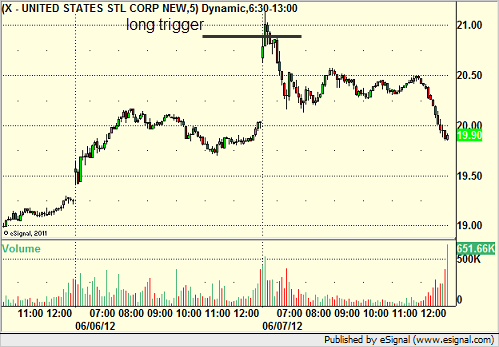

In the Messenger, Rich's X over the first 5 minute bar high triggered long (without market support) and worked enough for a partial:

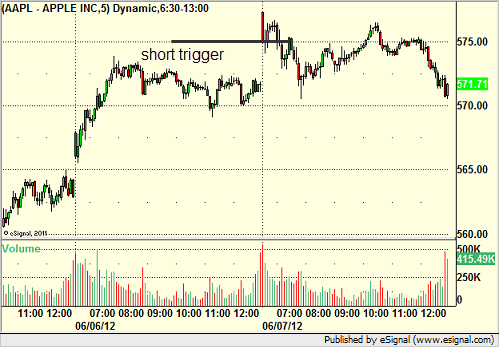

His AAPL triggered short (with market support) and worked for a point, which is a partial on AAPL:

NFLX triggered short (with market support) and worked:

My AAPL triggered short (with market support) and worked:

Rich's VXX triggered long (ETF, so no market support needed) and worked:

FSLR triggered short (with market support) and worked:

Rich's OXY triggered short (with market support) and worked:

Mark's ARUN triggered short (with market support) and didn't work:

His DISH triggered short too late in the day to go anywhere:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

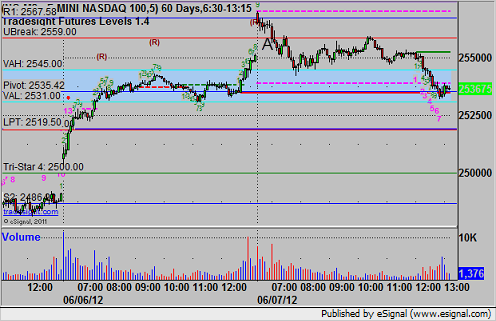

Futures Calls Recap for 6/7/12

Our first round of futures trades triggered short on the spike on Bernanke's comments to Congress and stopped, but then we had three trades that at least hit their first targets. Not much follow through though.

See ES and NQ sections below.

Net ticks: -1 tick.

First, here is a look at the ES and NQ with our market directional lines, Seeker, and VWAP:

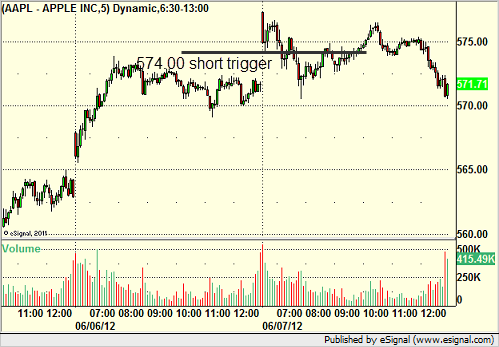

ES:

Mark had a short under R1 at 1323.00, point A on the chart, that triggered on the spike on Bernanke's comments and stopped, then triggered again a few minutes later, hit first target of 6 ticks, and he lowered his stop to 1322.00 and stopped the second half. Around the same area, I had a short under the 50% gap retracement, which was an entry of 1322.00, hit first target for 6 ticks, second half stopped over entry:

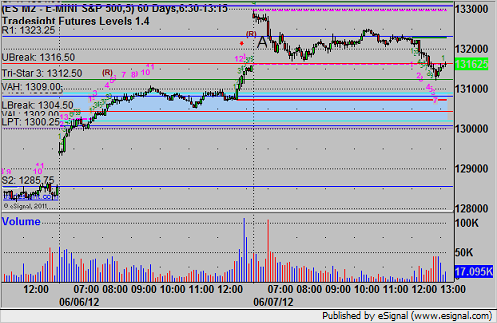

NQ:

Mark had an NQ short under UBreak at 2558.50 (point A), which did the same as the ES short, triggered and stopped on the news, then triggered, hit first target, Mark lowered stop to 2556.00 and stopped the second half:

Forex Calls Recap for 6/7/12

Finally ended up with a stop out for the week after a nice run. See EURUSD below.

New calls and Chat tonight, but half size ahead of Trade Balance in the morning.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped at B, unfortunately, as it did ultimately make the move to R1 exactly: