Austerity and Technology: Two evil words for employment

Tradesight economic reports pre-date the current website. In 2000, I predicted that the market would close lower when Bush left office than when he came in. This had never happened with a 2-term President until Bush 2, by the way, but it ended up happening. In 2004, we suggested that the real estate market was nearing a bubble top. This played out in 2005-2006. I've suggested many times in the past that the biggest issue facing America from an employment perspective is outsourcing (which we will recap here). In October 2007, when oil broke $80 a barrel the first time, we predicted an economic collapse that was unparalleled. The banking crisis hit behind that. We also pegged the bottom in late 2008/early 2009 from the VIX reading. All of these reports are available in the archive.

We are, currently, in a near-Depression that can't be rivaled since the early to mid-1930's, mostly caused by the lack of regulation in the real estate and mortgage markets of the mid-2000s, but also by a derivative bubble in the stock markets and the controlled price of oil.

But the problems aren't over, partially because of our own undoing due to a lack of education.

We have talked many times in the past about how technology affects employment. The reality is that the US, the greatest economy in the world until the last 5 years, has begun to outsource what I call support employment. Ever bought a Dell computer? Ever needed help? Ever talked to someone with a name that sounded foreign? There you have it. Now, this isn't the end of the world. I live in Arizona, a state where house cleaners and landscape maintenance folk have employed what I will generously call "cheap labor" for a long time. But there comes a time where technology and outsourcing make a difference. Been to a grocery store lately? What used to take 8 check-out clerks helping you check out and pay is now down to three plus the guy that monitors the self-checkout lines. Home Depot and Lowes offer this now. It's a norm. This is where the world is going.

We eliminated manufacturing jobs with computers. Now check-out clerks. Then sales people. It doesn't end, but it does mean trouble on the labor front. An economy will never support 4% unemployment with most employment dependent on higher-end wages. We don't even need to talk about minimum wage. Let's just face the facts. The Internet, technology, and out-sourcing have increased unemployment.

Then the rest of the world tried austerity. What is it? It's tightening the belt. It's taking the idea that we can spend less on things and do better. To be kind, it's BS. It doesn't work. Spending less on things means higher unemployment, which is the whole problem right now.

What is a Depression? It's when everyone spends less and becomes risk averse. How does it work? Simple. Most people decide to pay off debt instead of invest and spend. That's individuals. Sukanto Tanoto businesses. That's people in general. That's the government. Historically, what breaks that cycle? The only group in the equation that can spend more. Government. Businesses in this country are sitting on two TRILLION dollars in excess capital. Profits have never been higher. But they don't spend. For the first time in 30 years, individuals are paying off debts. And, tax rates are at historic lows. If low tax rates created jobs, we would have the lowest unemployment in years. But we don't. Why?

Because low taxes don't mean anything for employment. Businesses produce goods, and they do it when they see buyers. There are no buyers because unemployment is too high. The middle class gets smaller day by day. So how do we fix this? There is only one way that has worked throughout history. The government must spend.

If we need a reminder of this, look at most of the countries in Europe over the last two years. They tried to cut government spending, and unemployment rose. They tried to balance the budget by spending less, saving more, and not raising costs. It didn't work. It never has before in history. The role of government should be simple. Stay out of the way usually, but when things are good, collect taxes that pay off debts, and when they aren't good, spend. That's reality. Don't spend more in the bad times than you have to, but spend to bridge the gap until the economy is repaired. There has never, not once in history, been an economy that has fixed itself on lower taxes. In fact, countries have died on that principle.

Europe is now the example. Britain felt a depression coming and cut spending without raising taxes on the elite, and now faces higher unemployment than ever. That means a smaller middle class and no buying power to buy goods from producers.

The current US Congress was voted in with one job. Pass a Jobs Bill. Not a tax cut, which we've been trying for ten years without success, but a Jobs Bill that puts people back to work. Until you accept that this country includes people that will forever be middle class, but people that can build and fix and improve infrastructure, well, you haven't understood this country.

France and Greece and most of Europe tried austerity. It's a bad principle. Balance your books during the good times. We didn't do that in 2000 when we had a surplus. We voted to give the money back (remember the $200 check you got in 2001?) and to cut taxes on the "job creators." That was our solution. We don't try to balance the books when spending is weak. At those times, we should spend more. The only reason this is a problem is that most of the world went on a ten-year spending binge without trying to balance the books when things were good. Now we have to clean it up.

The current Congress has failed miserably at their primary job, which is to put the middle class back to work. There has been no bill passed that represents or enables those jobs. The economy is now in trouble because of this failure. The US sat through a debt downgrade not because we were unwilling to understand the issues, but because we couldn't do what has always been done to solve the problem: cut spending where we can and raise taxes to pay the bills. This was the first downgrade of US debt in history, and it wasn't because of deficit spending. It was because the S&P and groups that decide when to upgrade and downgrade realized that we were no longer serious about solving our problems.

There is now only one path out of our own misery, and that is for the government to recognize that there are bridges and roads and rails to be repaired, and that US workers are the best to make those fixes and improvements. We need to invest in our future and our infrastructure as a country as we always have in the past, raise taxes on those that benefit the most, and take strides to balance our budget. We can fix this in the next couple of years, but not if we continue to believe that taxes are a bad word, especially for those that benefit from this great country. Put people back to work and you will have a growing class of citizens who can spend to purchase goods and services, and that will break the cycle of depression. It won't happen without that, no matter what anyone does with taxes.

Technology improves and eliminates jobs. Tightening the proverbial belt of spending does the same. Combine the two and employment can never improve. It means that less people can trade, less people can invest, markets become dependent on the Fed, and volume and activity decreases, which is bad for traders. We can do better. Let's not get the next Congress wrong. For more info please visit http://www.air-compressoreng.co.uk.

Tradesight Market Preview for 6/7/12

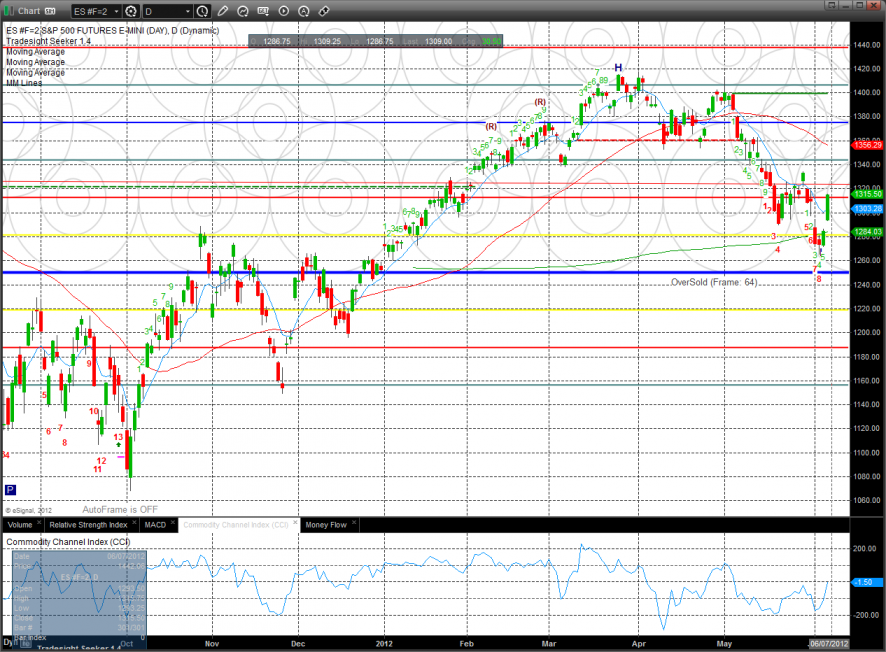

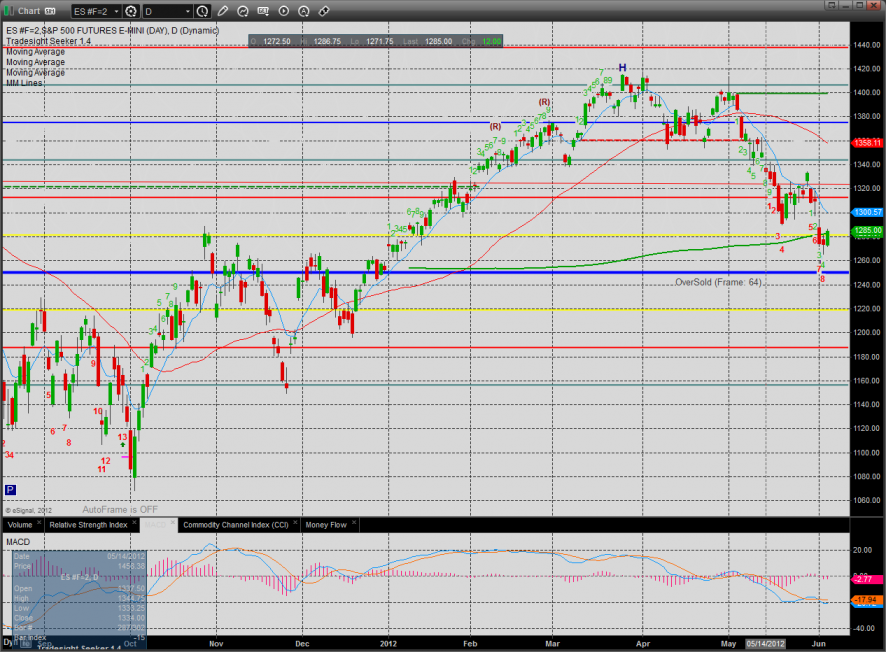

The ES was higher by a full 30 handles. Price broke decisively above the 10ema. It was a relatively easy day to trade because the ES opened just above the upper pressure threshold and never dipped below it.

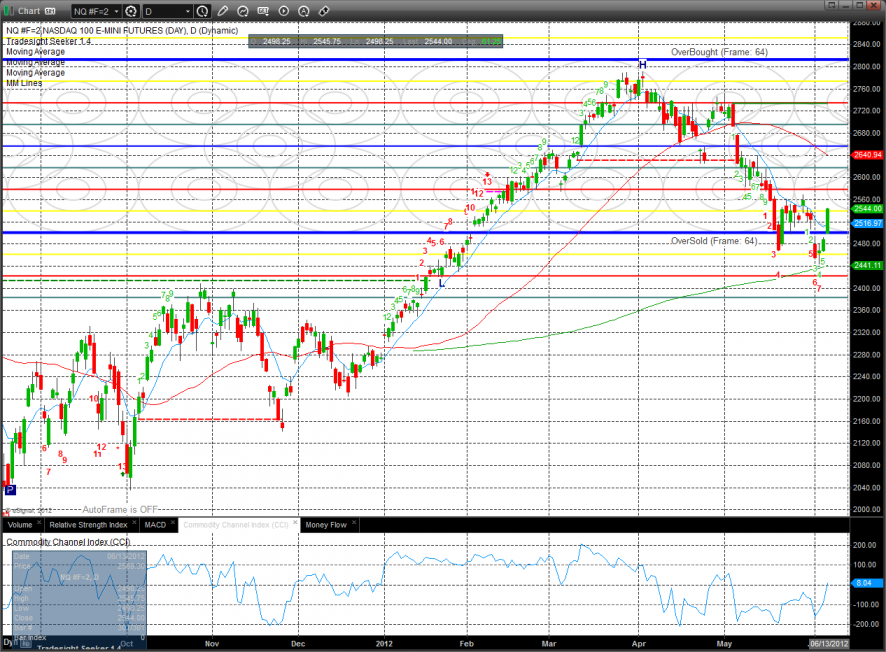

The NQ futures were higher by 61 on the day which reclaims both the 10ema and the 0/8 Murrey math level.

10-day Trin:

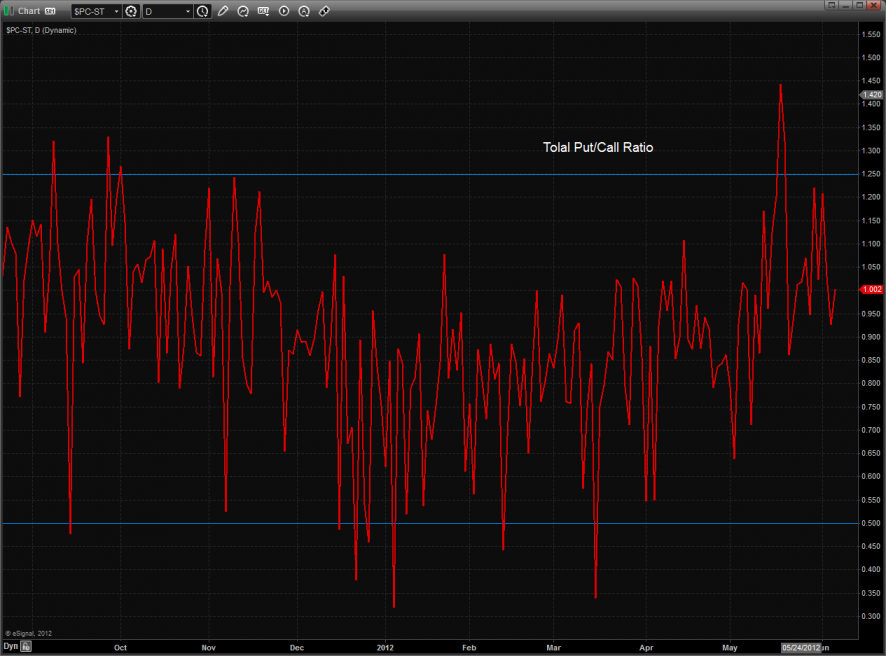

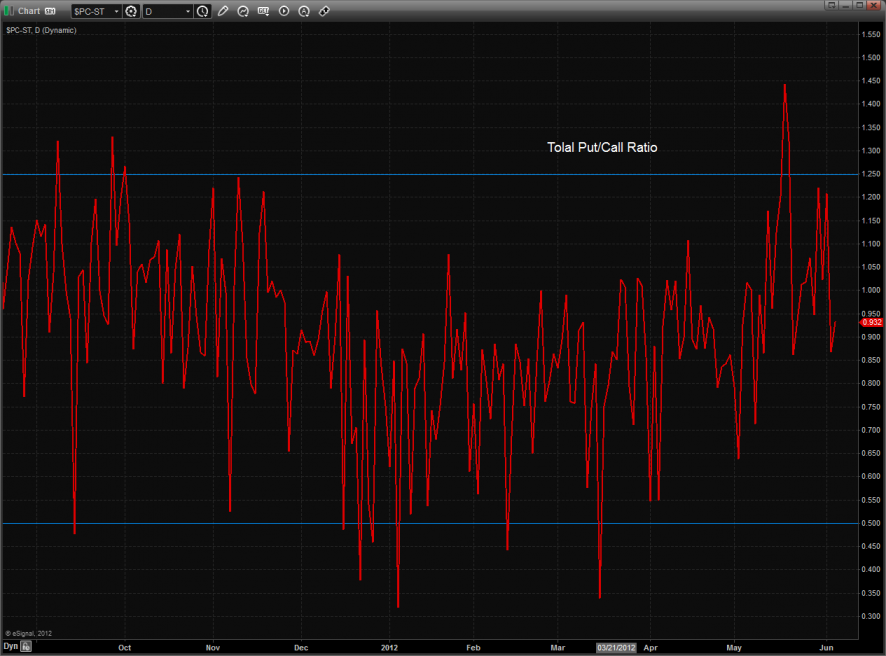

Total put/call ratio:

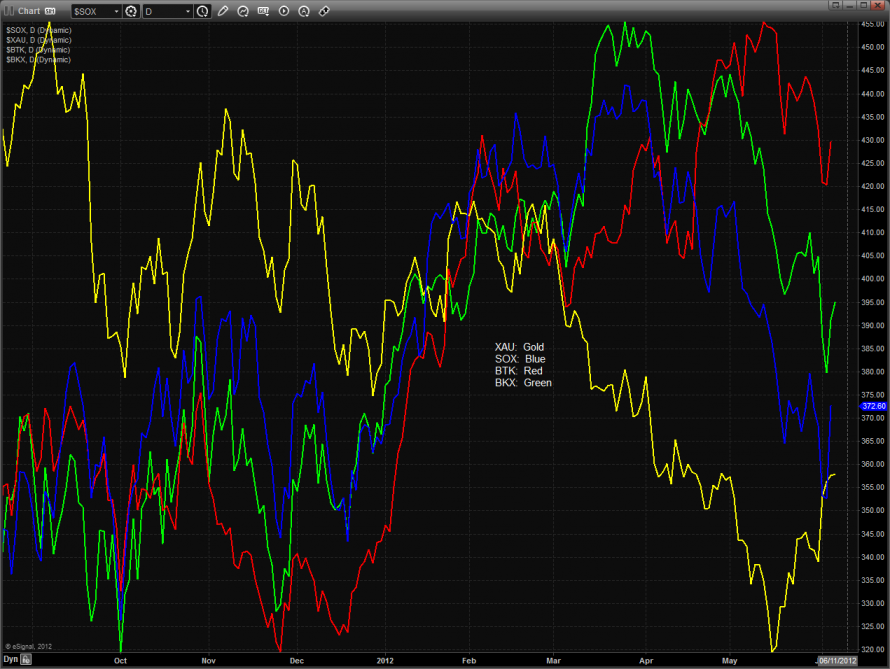

Multi sector daily chart:

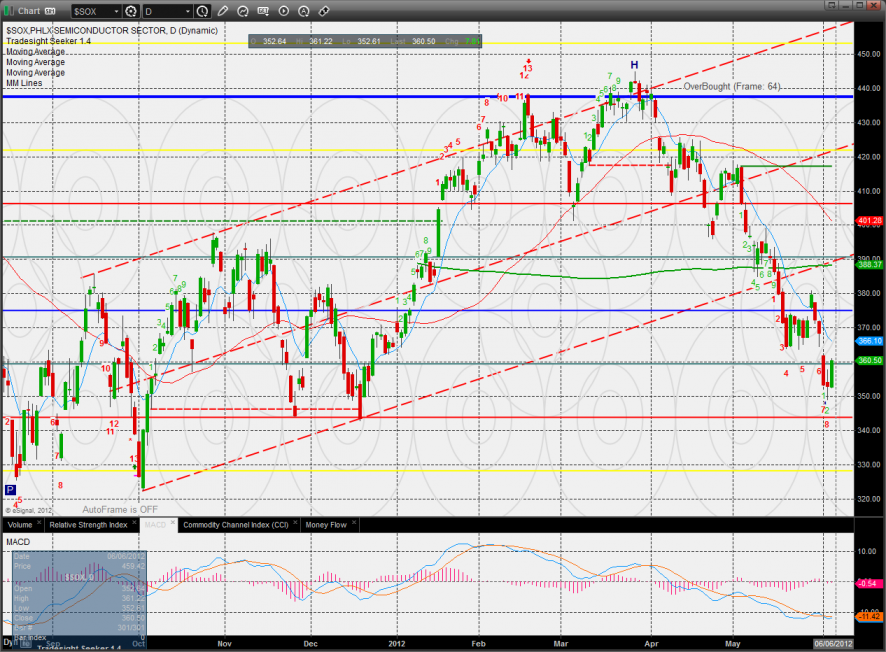

The SOX was higher by 3% making it the strongest Naz sector on the day.

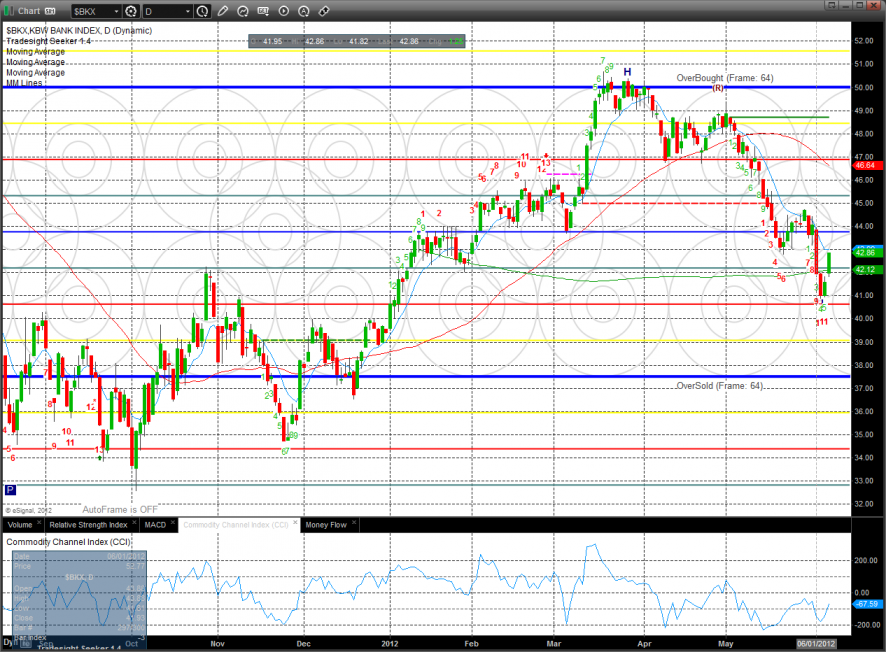

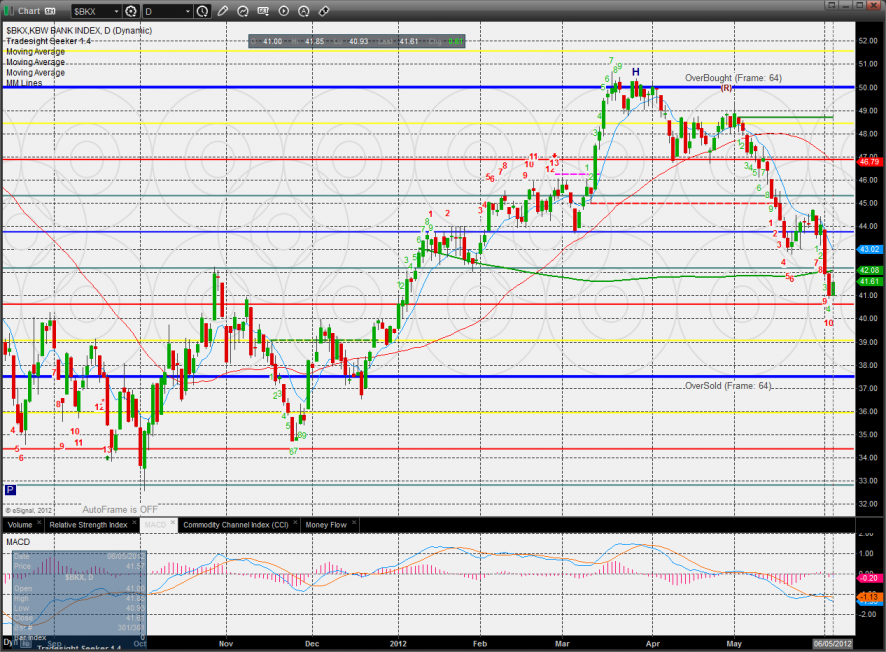

The BKX bearishly lagged the overall market:

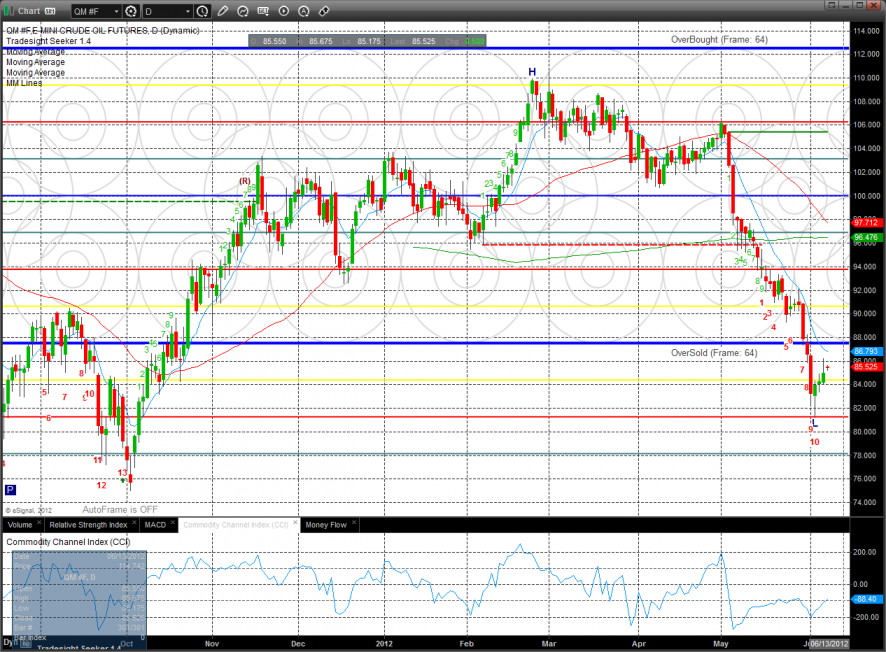

Oil:

Gold:

Silver:

Stock Picks Recap for 6/6/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

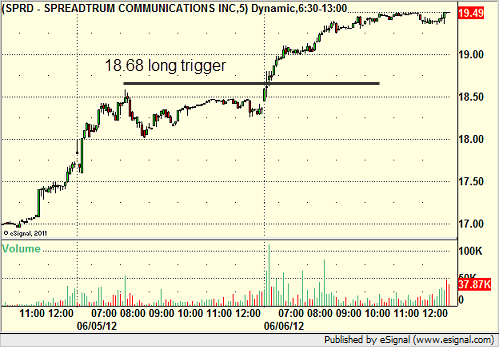

From the report, SPRD triggered long (with market support) and worked great:

Z triggered short (without market support) and didn't work:

In the Messenger, Rich's IBM triggered long (with market support) and worked great:

His VMW triggered long (with market support) and worked:

His MFRM triggered short (without market support) and didn't work initially (retraced $0.35), but then worked:

His PXD triggered long (with market support) and didn't work, worked later:

His GOLD triggered long (with market support) and worked:

RIMM triggered long (with market support), didn't go a dime in either direction so we don't count it:

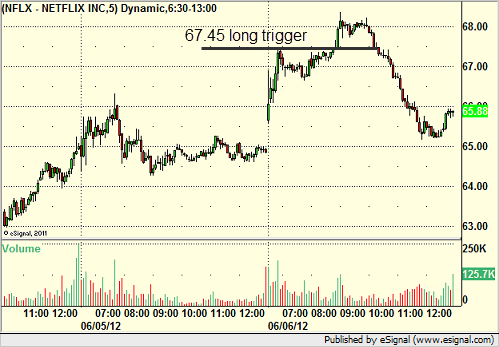

NFLX triggered long (with market support) and worked:

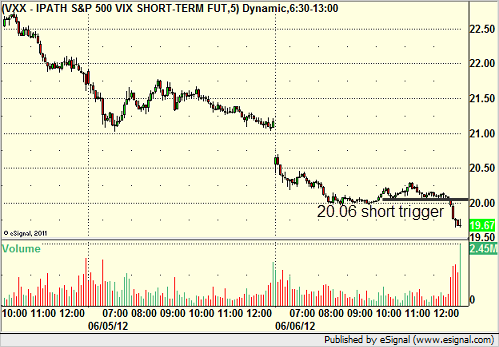

Rich's VXX triggered short (ETF, so no market support needed) and worked:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not. Some of the winners were huge.

not. Some of the winners were huge.

Futures Calls Recap for 6/6/12

Two clean trades today that triggered, hit a partial, and stopped the second half under the entry. Nothing major, but we tacked on gains. See ES and NQ sections below.

Net ticks: +5 ticks.

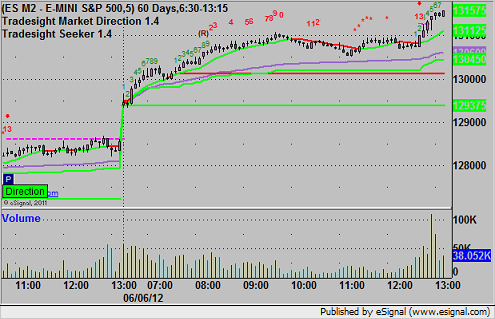

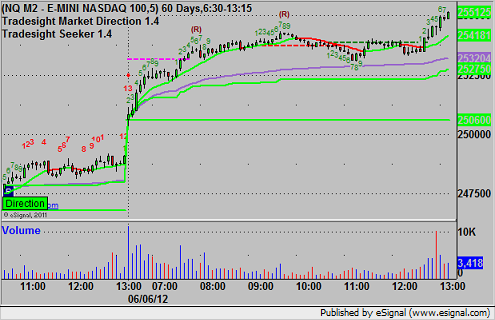

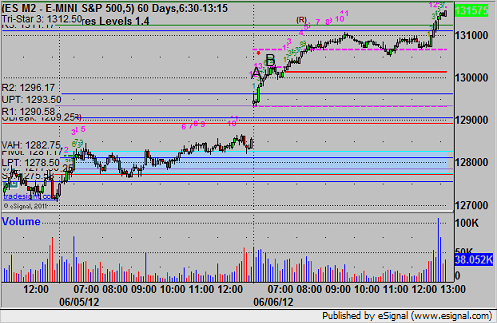

Here's the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

Triggered long at A and hit first target at B, stopped second half under entry:

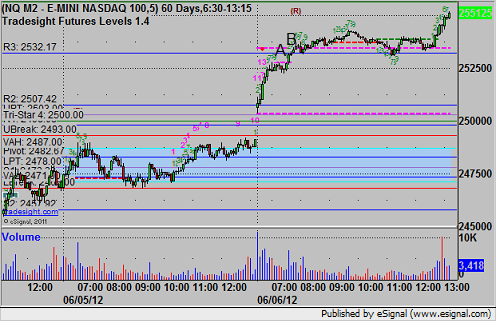

NQ:

Triggered long at A and hit first target at B, stopped second half under entry:

Forex Calls Recap for 6/6/12

Another winner (and you really should have done it twice), see EURUSD below.

New calls and Chat tonight.

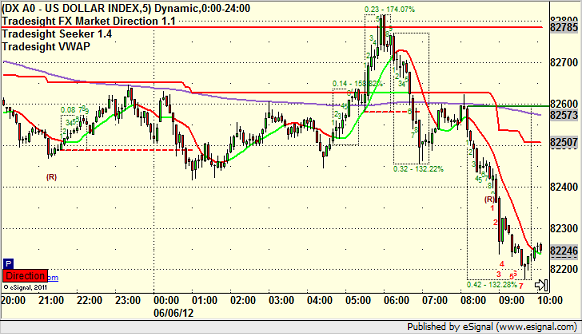

Here's the US Dollar Index intraday with our market directional tools:

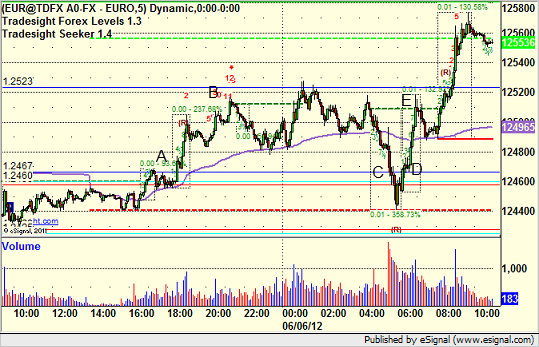

EURUSD:

Triggered long at A, hit first target at B, raised stop under entry and stopped at C in the morning, and then technically retriggered at a time that you should have retaken under our rules at D, hit first target at E. I was helping some people out with a tech issue on our end, so I missed it and didn't update it:

Tradesight Market Preview for 6/6/12

The ES was higher on the day gaining 12 handles. Price has come back to interact with the key 200dma which continues to be a draw. The next important area overhead will be the 10ema and the May lows which area approximately the same.

The NQ futures gained 20 on the day and are wedged between 2 of our moving averages. If price continues to wind up in this area it should have a powerful exit.

The SOX is tracing out reversal like action. Getting back above 365 would be the first indication that the bulls have changed the direction of the chart. The bias remains down until the 10ema is reclaimed.

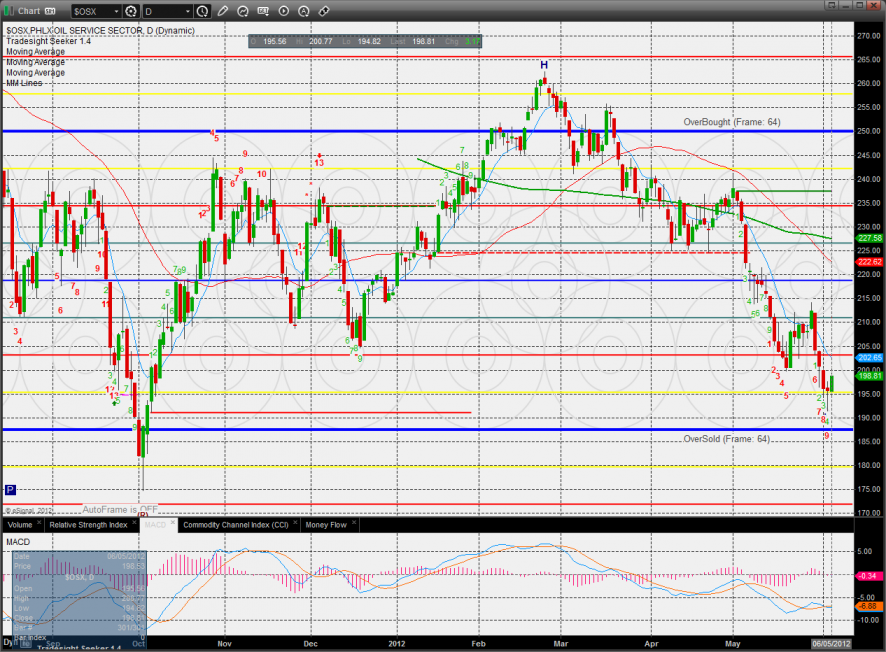

The OSX was stronger than the overall market and is still bearish but above key support at the 0/8 level.

The BKX posted an inside day down is still fairly close to a completing a Seeker buy countdown.

The BTK bounced but is still below the prior breakout level and active static trend line.

The XAU is grinding below the active static trend line and looks ready to go. Price is now back above the 10 and 50dmas. This is the one chart that looks ready to continue.

10-day Tin:

Total put/call ratio:

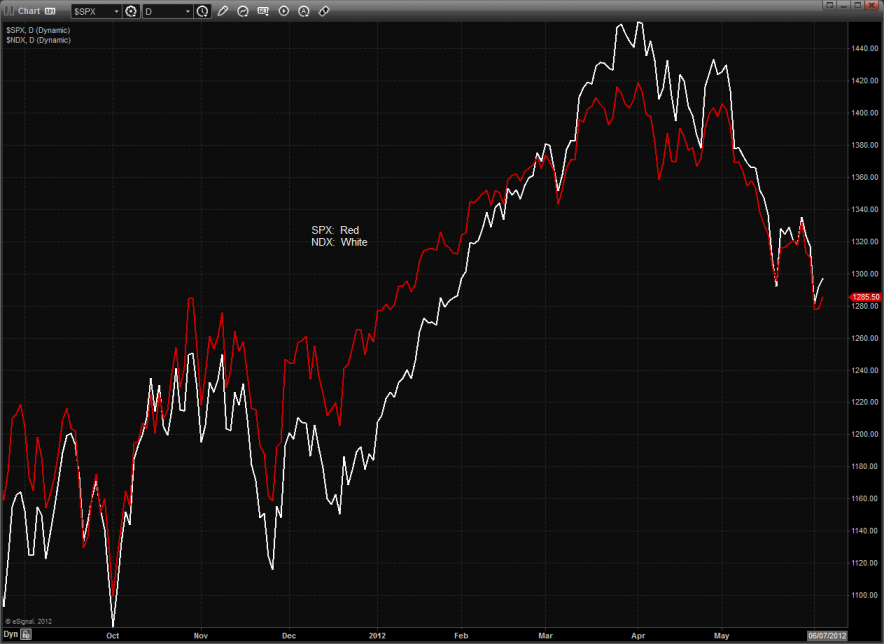

Multi sector daily chart:

The NDX continues to bullishly keep some relative strength vs. the SPX.

Oil:

Gold:

Silver:

Stock Picks Recap for 6/5/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

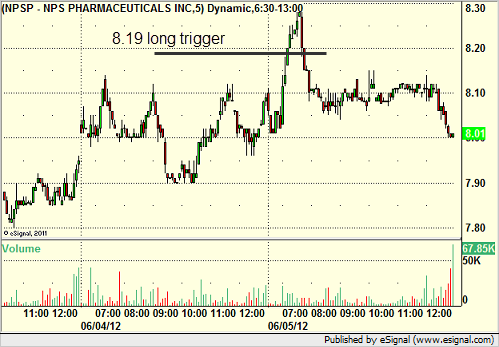

From the report, NPSP triggered long (with market support) and didn't work:

From the intraday calls, Rich's VXX triggered short (ETF, so no market support needed) and worked:

His AAPL triggered long (with market support) and didn't work:

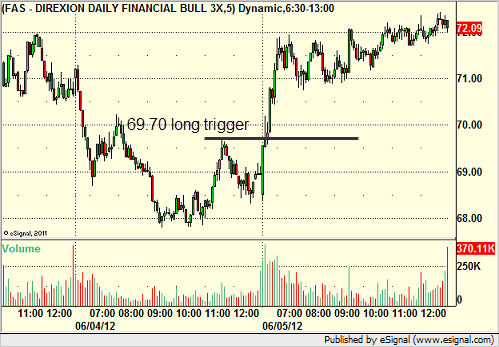

His FAS triggered long (ETF, so no market support needed) and worked great:

His FAST triggered short (without market support) and didn't work:

AMZN triggered short (with market support) and worked enough for a partial:

Rich's WPRT triggered long (with market support) and didn't work:

COST triggered long (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 3y of them worked, 4 did not. Volume drops to about as low as it can get and we win under 50%, which should be a lesson, although the winners were still good.

Futures Calls Recap for 6/5/12

A great day in our futures trading, although an afternoon trade stood little chance with no market volume. See the ES and ER sections below for reviews. We won 3 out of 5, but two of the winners worked like we like to see them.

Net ticks: +25.5 ticks.

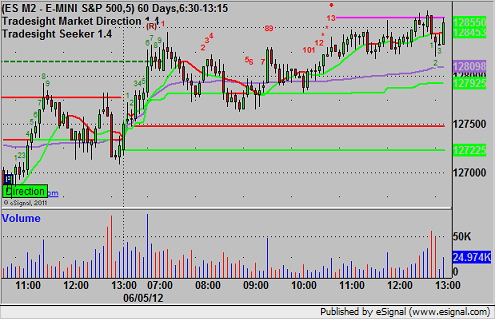

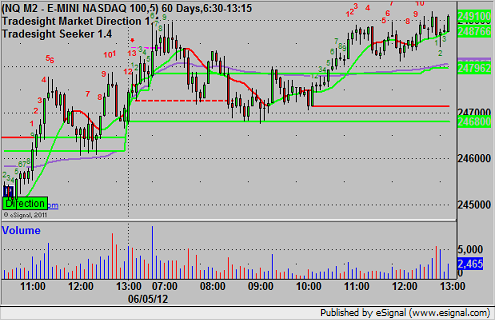

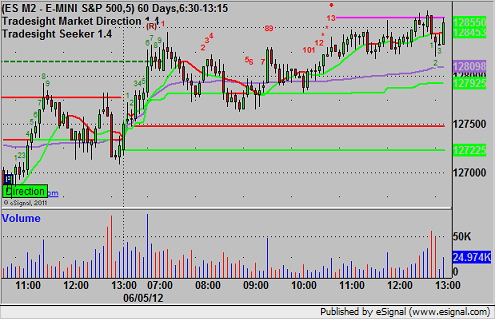

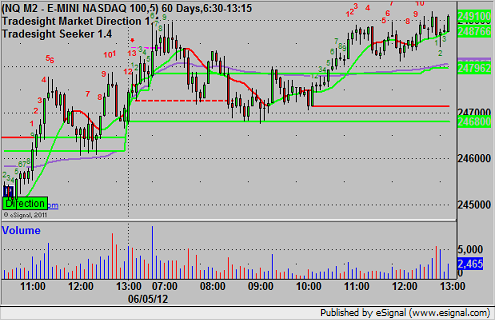

First, let's take a look at the ES and NQ with our market directional tool, Seeker, and VWAP:

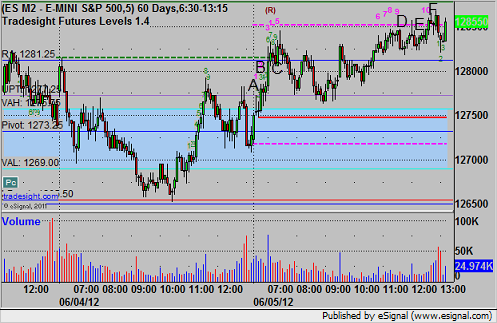

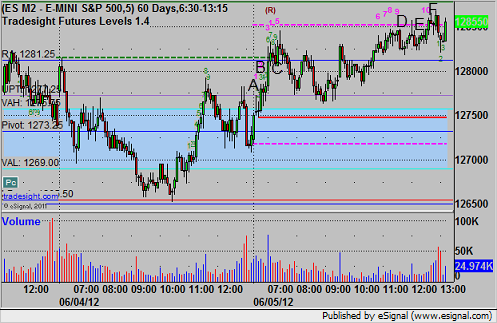

ES:

Mark's ES triggered long at A (1277.50), finally hit the first target at B for six ticks, and after two stop adjustments, stopped at C (1281.00). He had an afternoon call that triggered at 1275.00 at D and stopped for 7 ticks, and then triggered again at E and hit the first target at F, then stopped under the entry on the second half:

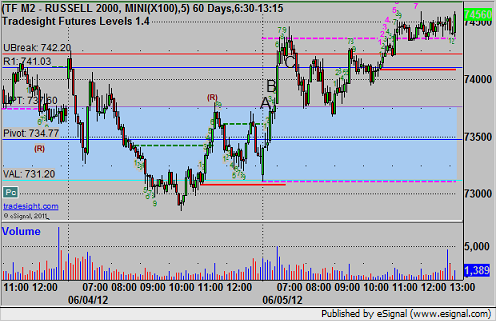

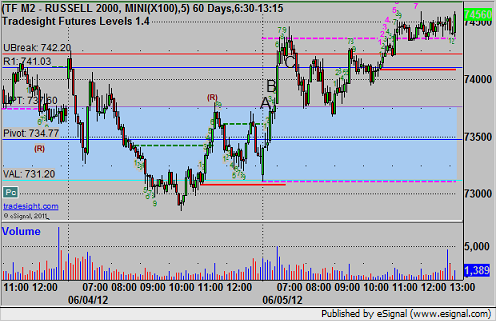

ER:

This one was a long entry at A over 737.70 that stopped quickly (ER is a jumpy contract), then triggered again in the next 5 minute bar and went, hitting the first target at B and raising the stop before finally stopping the final half at C at 742.40 for 47 ticks:

Futures Calls Recap for 6/5/12

A great day in our futures trading, although an afternoon trade stood little chance with no market volume. See the ES and ER sections below for reviews. We won 3 out of 5, but two of the winners worked like we like to see them.

Net ticks: +25.5 ticks.

First, let's take a look at the ES and NQ with our market directional tool, Seeker, and VWAP:

ES:

Mark's ES triggered long at A (1277.50), finally hit the first target at B for six ticks, and after two stop adjustments, stopped at C (1281.00). He had an afternoon call that triggered at 1275.00 at D and stopped for 7 ticks, and then triggered again at E and hit the first target at F, then stopped under the entry on the second half:

ER:

This one was a long entry at A over 737.70 that stopped quickly (ER is a jumpy contract), then triggered again in the next 5 minute bar and went, hitting the first target at B and raising the stop before finally stopping the final half at C at 742.40 for 47 ticks:

Forex Calls Recap for 6/5/12

Two more winners to start the month and we closed out the second half of the long from the prior month in the money. See EURUSD below.

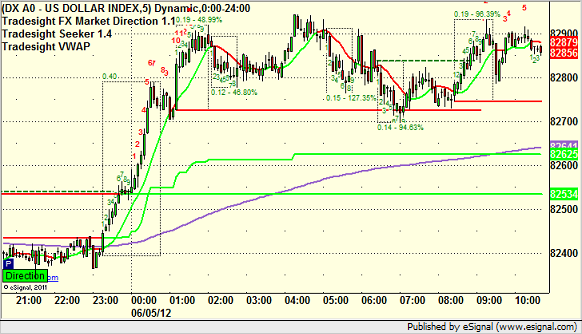

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

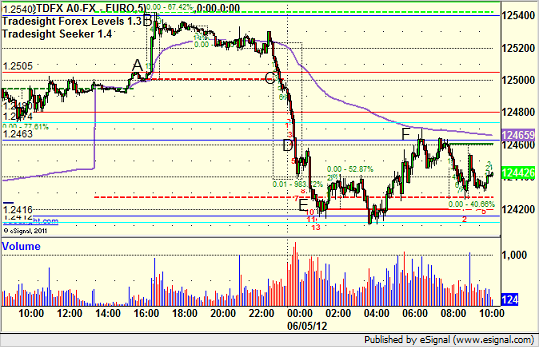

EURUSD:

New long triggered at A early (half size), hit first target at B, raised stop under the UBreak entry on that AND on the second half of the long from the prior day and stopped out at C, which was 50 pips in the money for the prior day's trade. Triggered short at D, hit first target at E, and stopped the second half over the entry at F: