Tradesight Market Preview for 6/5/12

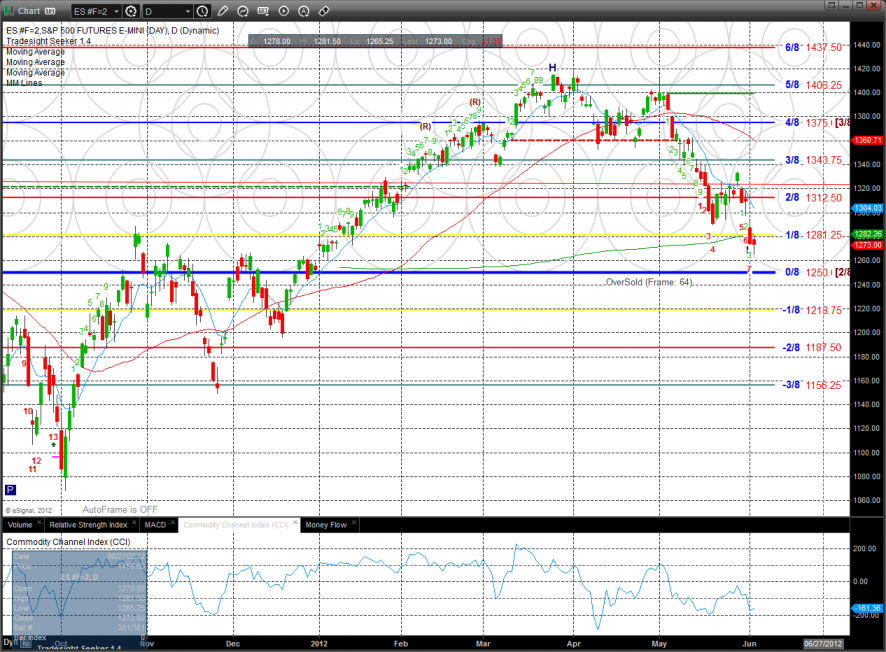

The ES wandered around on the day, expanded the range and settled lower on the day by one handle. This is the second close in a row below the 200dma. Note the important level of support just below at the 0/8 level.

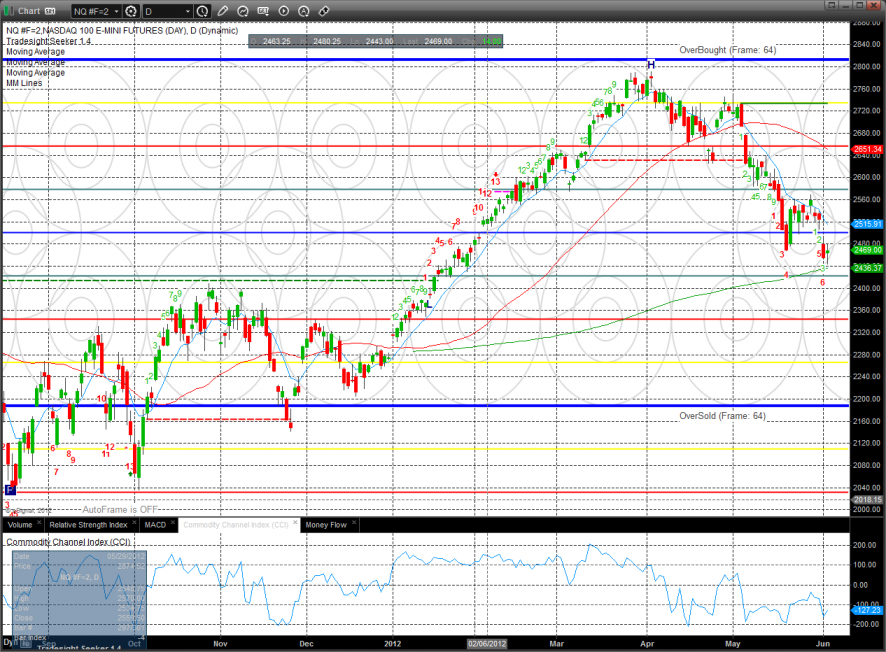

The NQ futures closed right in the middle of Friday’s real body and remain relatively strong vs. the SP side because the 200dma is still below. The 200dma is very key support and will likely be gamed once traded.

10-day Trin remains neutral but climbing.

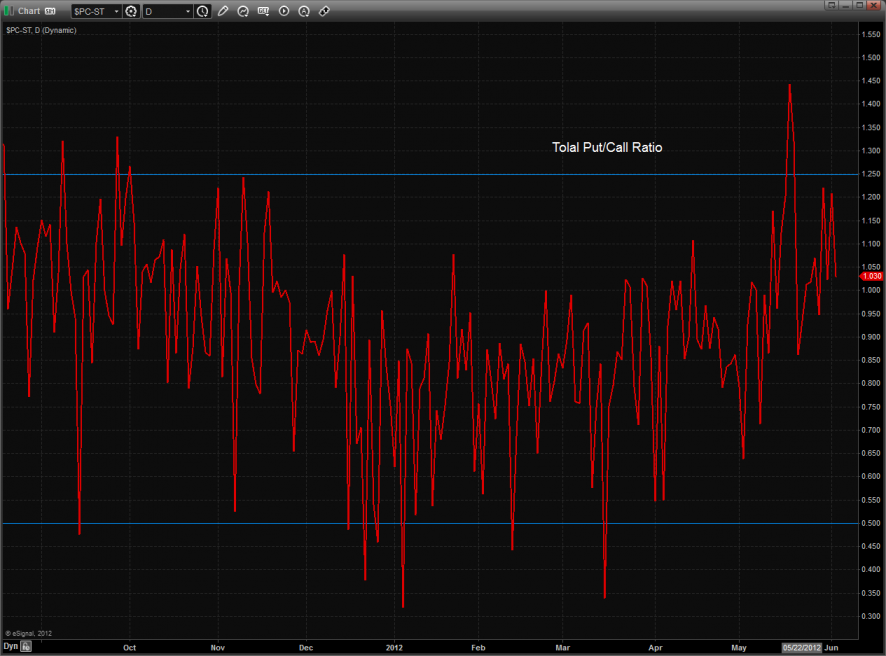

Total put/call ratio:

Multi sector daily chart:

The defensive XAU was the top gun. Note that the static trend line is a very big level and taking it will turn the chart to intermediate term positive.

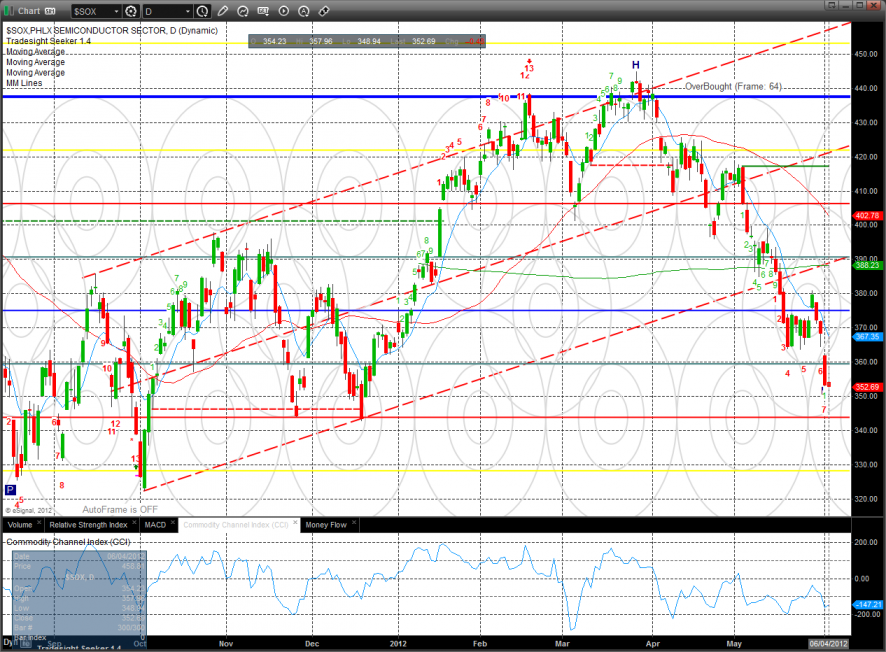

The SOX was the strongest Naz sector and is now 8 days down on the Seeker count.

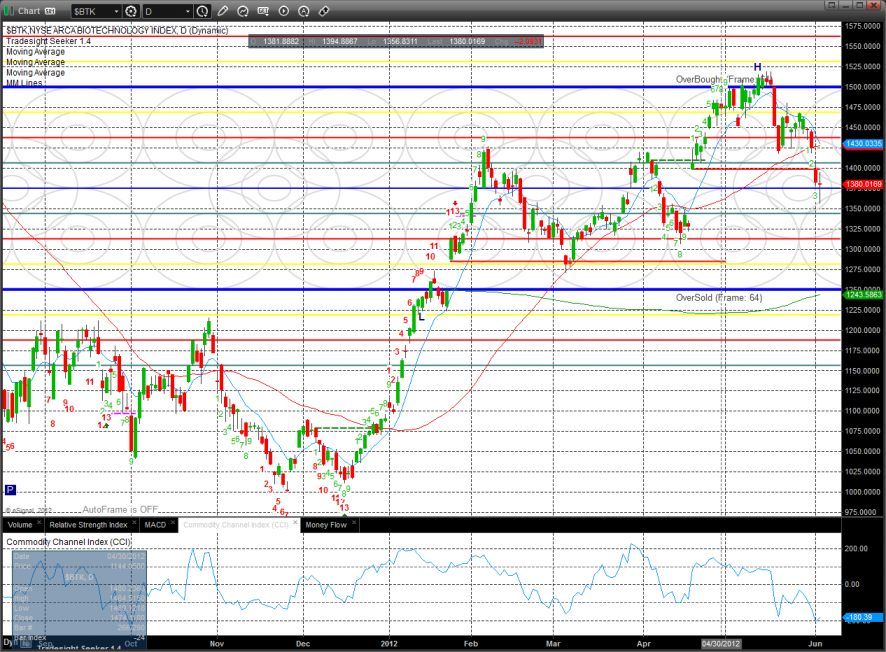

The BTK was unchanged.

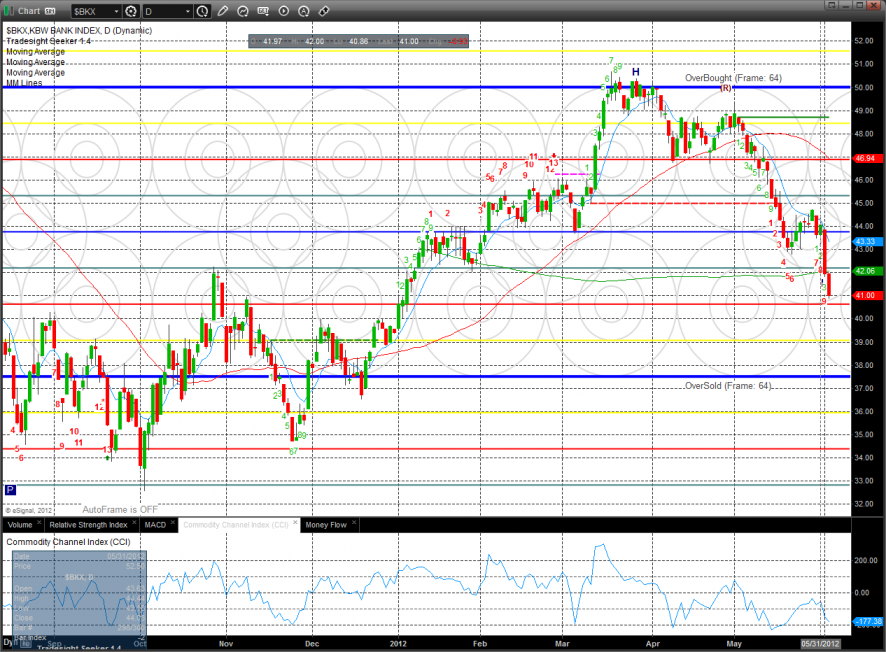

The BKX was the weakest major sector on the day and decisively broke below the 200dma. This chart looks bad but us already 10 days down in the seeker count.

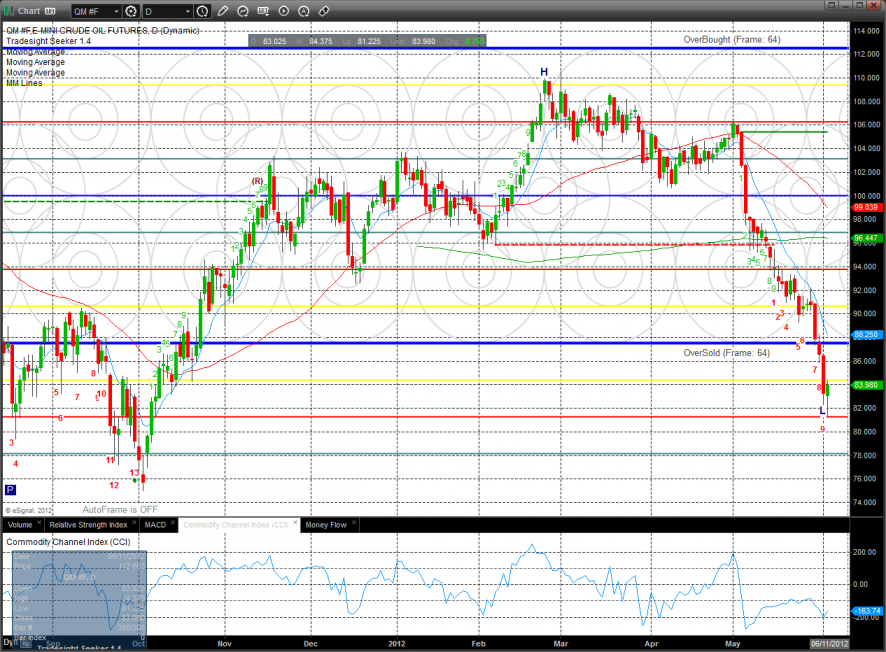

Oil

Gold:

Silver:

Stock Picks Recap for 6/4/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NWSA gapped under the trigger, no play.

DMND triggered short (with market support) and worked:

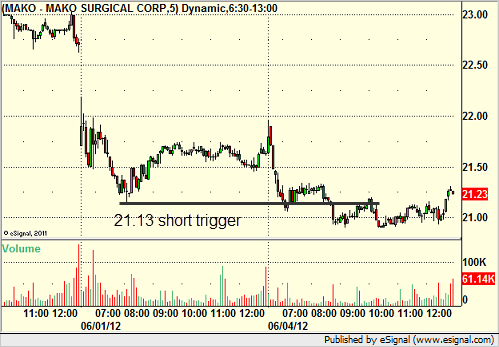

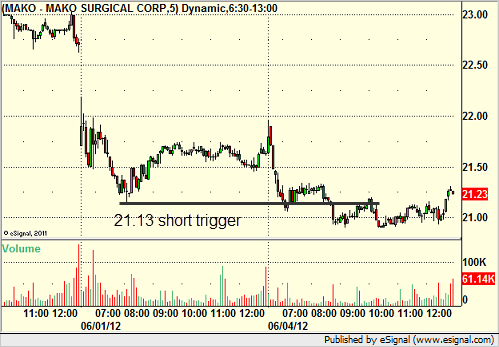

MAKO triggered short (with market support) and didn't work:

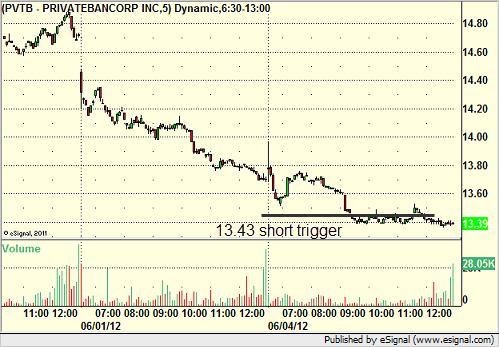

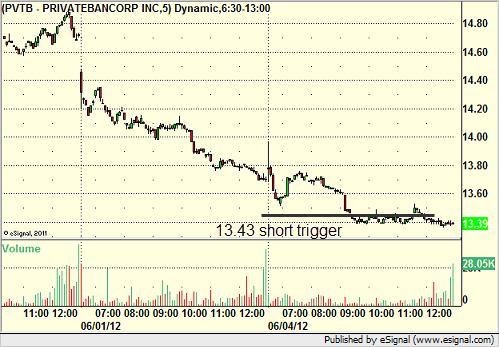

PVTB triggered short (with market support) and didn't go a dime in either direction, so we don't count it, closed just 3 cents in the money:

In the Messenger, Mark's FOSL triggered short (with market support) and worked:

His VLTR triggered short (with market support) and worked enough for a partial:

Rich's FB triggered long (with market support) and didn't work:

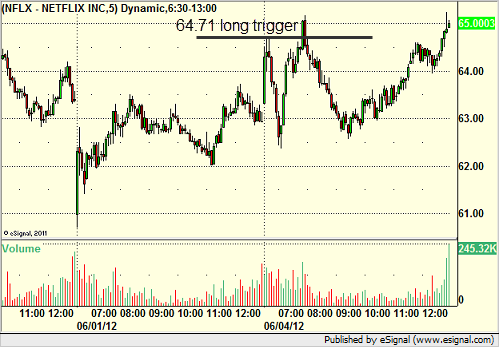

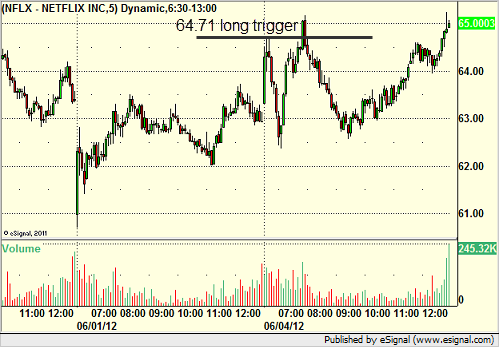

Rich's NFLX triggered long (with market support) and didn't work:

Another NFLX call later in the day triggered long (without market support) and worked enough for a partial:

Rich's PXD triggered short (with market support) and worked:

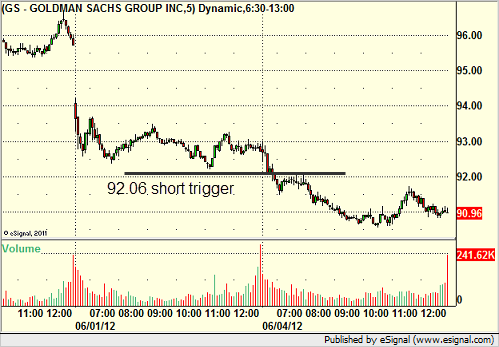

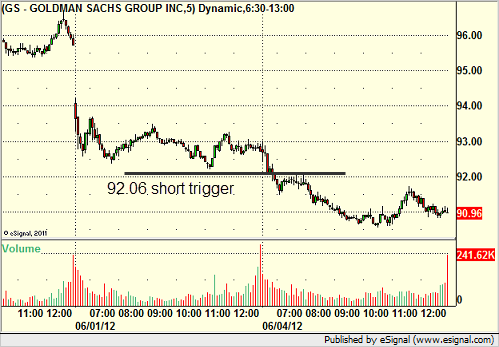

His GS triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked enough for a partial:

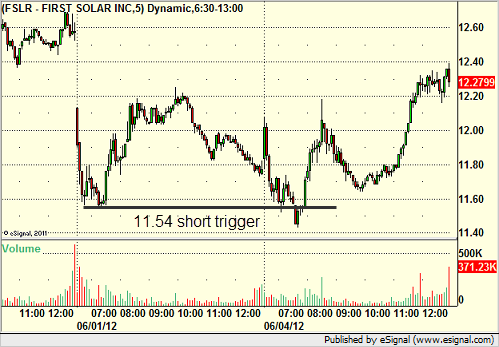

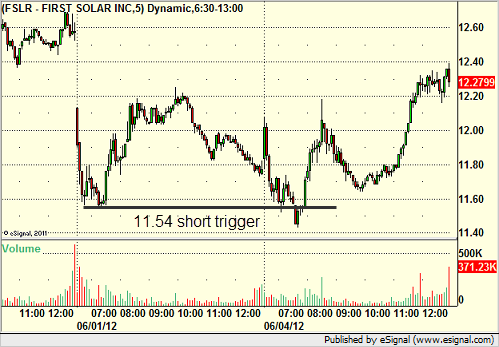

FSLR triggered short (with market support) and didn't work:

AAPL triggered long (with market support) and worked:

In total, that's 11 trades triggering with market support, 7 of them worked, 4 did not.

Stock Picks Recap for 6/4/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NWSA gapped under the trigger, no play.

DMND triggered short (with market support) and worked:

MAKO triggered short (with market support) and didn't work:

PVTB triggered short (with market support) and didn't go a dime in either direction, so we don't count it, closed just 3 cents in the money:

In the Messenger, Mark's FOSL triggered short (with market support) and worked:

His VLTR triggered short (with market support) and worked enough for a partial:

Rich's FB triggered long (with market support) and didn't work:

Rich's NFLX triggered long (with market support) and didn't work:

Another NFLX call later in the day triggered long (without market support) and worked enough for a partial:

Rich's PXD triggered short (with market support) and worked:

His GS triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked enough for a partial:

FSLR triggered short (with market support) and didn't work:

AAPL triggered long (with market support) and worked:

In total, that's 11 trades triggering with market support, 7 of them worked, 4 did not.

Futures Calls Recap for 6/4/12

ES:

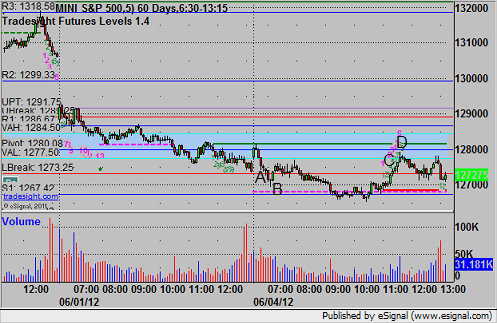

ES triggered short under LBreak at A, hit first target for 6 ticks at B, lowered stop over 1272 and stopped in the money on the second half. Mark later called a long that triggered at C, hit first target for 6 ticks at D and stopped under the entry on the last:

Forex Calls Recap for 6/4/12

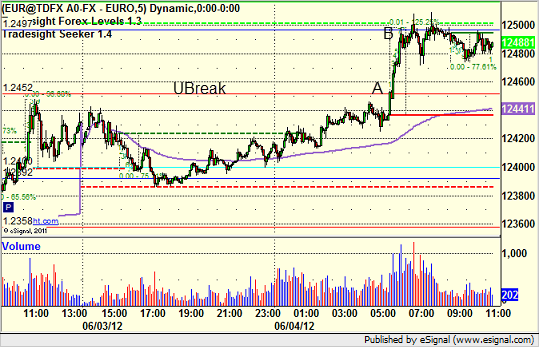

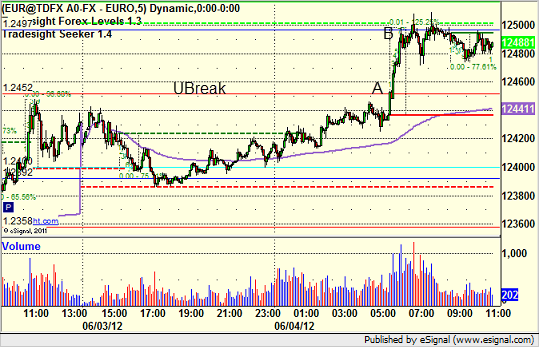

A very flat session overnight (UK was on Holiday), but we got a clean winner in the US session on the EURUSD. See that section below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, stop moved under UBreak:

Forex Calls Recap for 6/4/12

A very flat session overnight (UK was on Holiday), but we got a clean winner in the US session on the EURUSD. See that section below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, stop moved under UBreak:

Tradesight May 2012 Forex Results

Before we get to May’s numbers, here is a short reminder of the results from April. The full report from April can be found here and you can get the last several months in a row vertically by clicking here and scrolling down

Tradesight Pip Results for April 2012

Number of trades: 30

Number of losers: 16

Winning percentage: 46.7%

Worst losing streak: 6 in a row (around the 8th)

Net pips: +125

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for May 2012

Number of trades: 36

Number of losers: 23

Winning percentage: 36.1%

Worst losing streak: 6 in a row (May 20-25)

Net pips: +10

Forex continues to show us very boring ranges, despite the fact that the US Dollar Index finally broke out of a long base formation late in the month of May. With everything going on in Europe in particular, which is crushing the global economy, you would think there would be more action in Forex. We will discuss the ranges below.

In the meantime, this was our second-worst winning percentage for trade signals in two years at only 36%. 36 trades triggered and only 13 were winners. The good news is that we did end up with a couple of bigger winners that carried over a couple of days when the Dollar Index broke out, and that kept our net for the month at just around even. Trust me, this could have been the ugly negative month that we get once a year. If this is the worst that it goes, we're OK. It also continues to show that our strategy works. Despite losing a bigger percentage of trades than normal, keeping the losers tight and letting the winners ride helped us out. You don't usually expect things to pick up in the summer for Forex, but with the global situation, it is hard to say.

In terms of the ranges themselves, let's see how they did in the month on the averages. Remember that the last couple of months saw the 6 month average daily ranges drop sharply. That trend continued in May, with the EURUSD dropping its ADR from 125 to 115 and the GBPUSD going from 115 to 107. These aren't as big as the last two months, but keep in mind that even just three months ago, the EURUSD 6-month average daily range was 154. That's a whopping 25% drop in 3 months.

The turning point lies ahead. Just a matter of when. On to June...

Tradesight May 2012 Forex Results

Before we get to May’s numbers, here is a short reminder of the results from April. The full report from April can be found here and you can get the last several months in a row vertically by clicking here and scrolling down

Tradesight Pip Results for April 2012

Number of trades: 30

Number of losers: 16

Winning percentage: 46.7%

Worst losing streak: 6 in a row (around the 8th)

Net pips: +125

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for May 2012

Number of trades: 36

Number of losers: 23

Winning percentage: 36.1%

Worst losing streak: 6 in a row (May 20-25)

Net pips: +10

Forex continues to show us very boring ranges, despite the fact that the US Dollar Index finally broke out of a long base formation late in the month of May. With everything going on in Europe in particular, which is crushing the global economy, you would think there would be more action in Forex. We will discuss the ranges below.

In the meantime, this was our second-worst winning percentage for trade signals in two years at only 36%. 36 trades triggered and only 13 were winners. The good news is that we did end up with a couple of bigger winners that carried over a couple of days when the Dollar Index broke out, and that kept our net for the month at just around even. Trust me, this could have been the ugly negative month that we get once a year. If this is the worst that it goes, we're OK. It also continues to show that our strategy works. Despite losing a bigger percentage of trades than normal, keeping the losers tight and letting the winners ride helped us out. You don't usually expect things to pick up in the summer for Forex, but with the global situation, it is hard to say.

In terms of the ranges themselves, let's see how they did in the month on the averages. Remember that the last couple of months saw the 6 month average daily ranges drop sharply. That trend continued in May, with the EURUSD dropping its ADR from 125 to 115 and the GBPUSD going from 115 to 107. These aren't as big as the last two months, but keep in mind that even just three months ago, the EURUSD 6-month average daily range was 154. That's a whopping 25% drop in 3 months.

The turning point lies ahead. Just a matter of when. On to June...

Stock Picks Recap for 6/1/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, all shorts gapped under their triggers, no plays.

In the Messenger, Rich's NEM triggered long (without market support) and worked great:

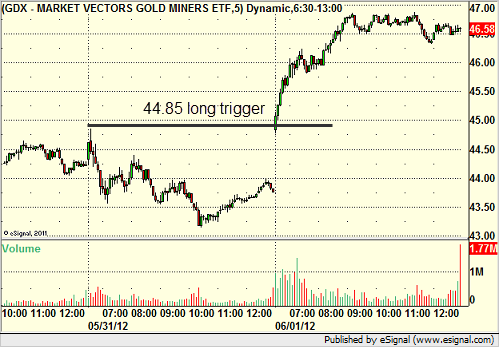

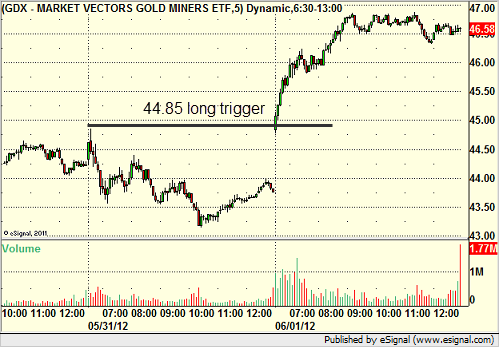

His GDX triggered long (ETF, so no market support needed) and worked:

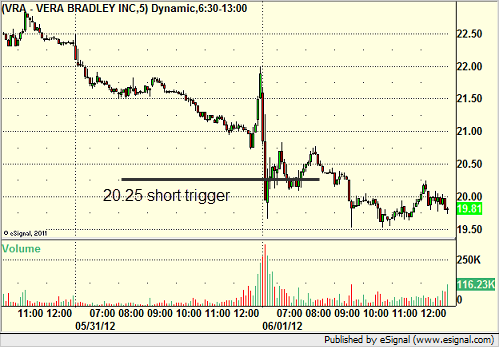

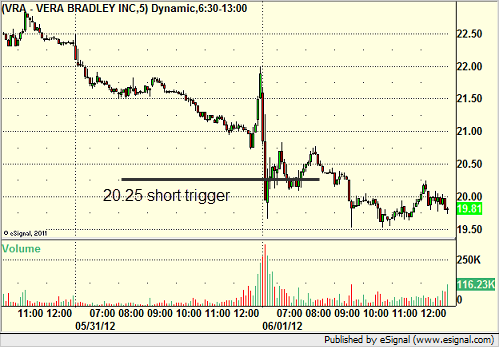

His VRA triggered short (with market support) and worked:

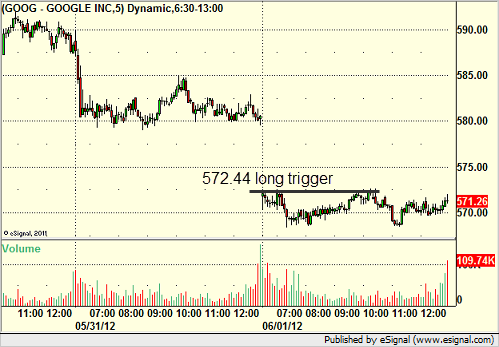

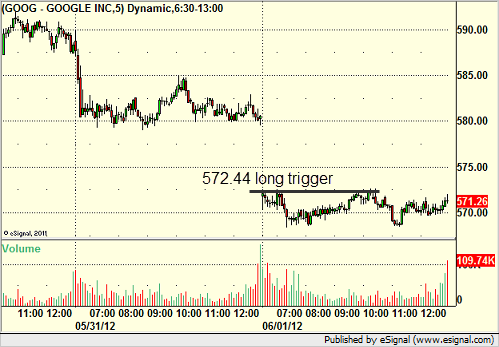

GOOG triggered long (without market support) and didn't work:

Rich's JOY triggered long (without market support) and worked:

His REGN triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Stock Picks Recap for 6/1/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, all shorts gapped under their triggers, no plays.

In the Messenger, Rich's NEM triggered long (without market support) and worked great:

His GDX triggered long (ETF, so no market support needed) and worked:

His VRA triggered short (with market support) and worked:

GOOG triggered long (without market support) and didn't work:

Rich's JOY triggered long (without market support) and worked:

His REGN triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.