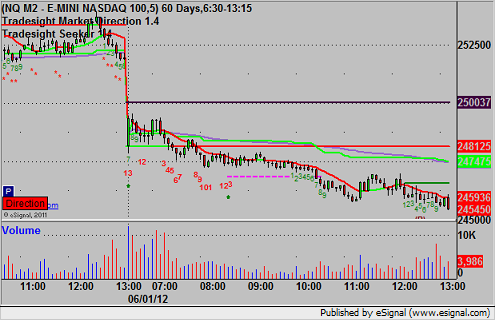

Futures Calls Recap for 6/1/12

A winner and a loser on the ES for essentially a flat session as the market gapped big again and volume flattened out after the first 60 minutes. We did get to 1.9 billion NASDAQ shares finally.

Net ticks: -1 tick.

First, let's take a look at the ES and NQ with our market directional lines, VWAP, and Seeker:

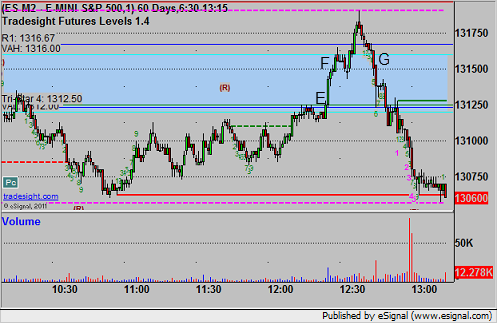

ES:

Triggered short on news at A and stopped for 7 ticks. Triggered again at B, hit first target for 6 ticks, lowered stop and stopped in the money for 5 ticks average on the trade:

Forex Calls Recap for 6/1/12

Some winners and a loser in the GBPUSD to close out the week and month of May. Glad it is over.

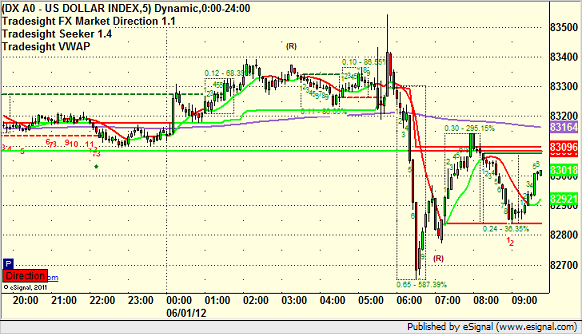

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber counts separately, and then look at the US Dollar Index.

From the perspective of the Seeker and Comber, there is a lot going on for once, all of which suggests a likely reversal to the downside of the USD and to the upside on the EUR. That might not make sense to many given the news, but the technicals are saying so. We shall see.

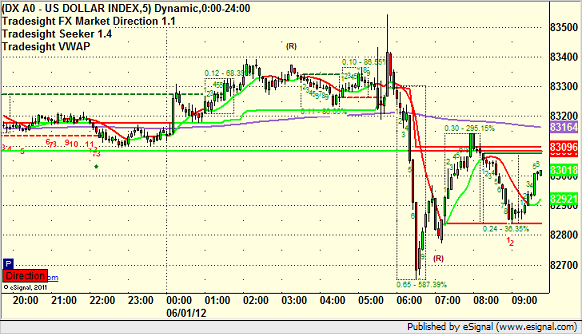

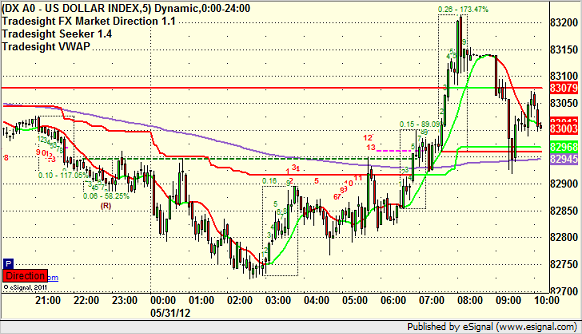

US Dollar Index intraday from Thursday/Friday with our market directional lines:

New calls and Chat Sunday afternoon.

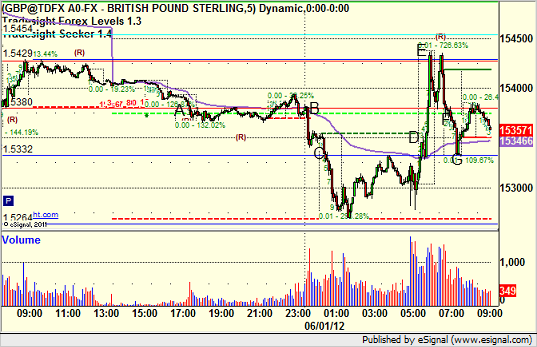

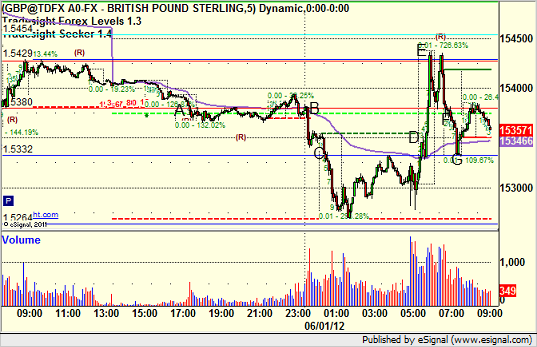

GBPUSD:

Triggered short early at A (half size night ahead of NFP), but gave you hours to enter all the way to B without stopping. Hit first target at C, lowered stop and stopped at D. Triggered the long at E and stopped. Triggered short again at F, hit first target at G, and closed out the final at the end of the chart for the end of the week:

Forex Calls Recap for 6/1/12

Some winners and a loser in the GBPUSD to close out the week and month of May. Glad it is over.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber counts separately, and then look at the US Dollar Index.

From the perspective of the Seeker and Comber, there is a lot going on for once, all of which suggests a likely reversal to the downside of the USD and to the upside on the EUR. That might not make sense to many given the news, but the technicals are saying so. We shall see.

US Dollar Index intraday from Thursday/Friday with our market directional lines:

New calls and Chat Sunday afternoon.

GBPUSD:

Triggered short early at A (half size night ahead of NFP), but gave you hours to enter all the way to B without stopping. Hit first target at C, lowered stop and stopped at D. Triggered the long at E and stopped. Triggered short again at F, hit first target at G, and closed out the final at the end of the chart for the end of the week:

Stock Picks Recap for 5/31/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QLIK triggered short (with market support) and worked:

VRSN triggered short (with market support) and worked:

SHLD triggered short (with market support) and didn't work initially (retraced $0.25), but worked later if you went again (we don't count retriggers):

In the Messenger, Mark's NTES triggered long (without market support) and didn't work:

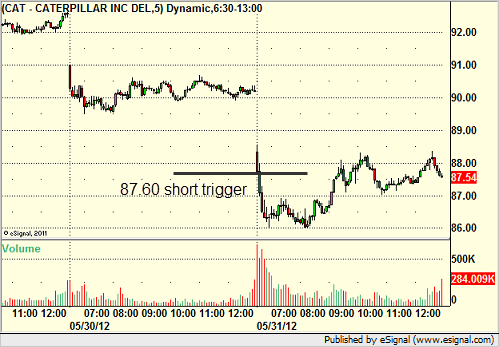

Rich's CAT triggered short (with market support) and worked great:

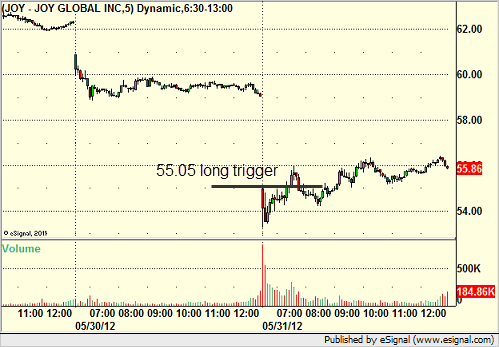

His JOY triggered long (without market support) and worked:

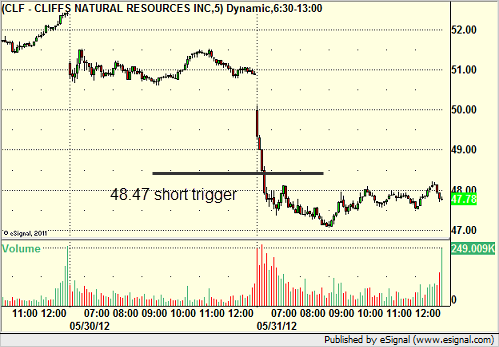

His CLF triggered short (with market support) and worked:

GOOG triggered short (with market support) and worked great:

Rich's VMW triggered short (with market support), didn't work initially, worked later:

His BIDU triggered short (with market support) and worked enough for a partial:

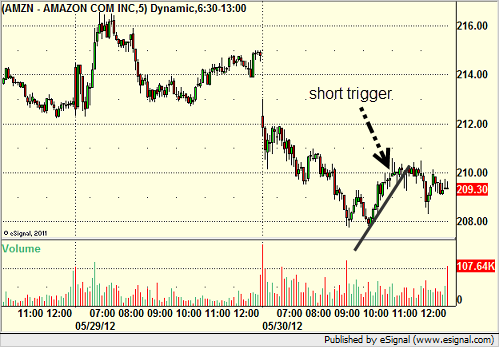

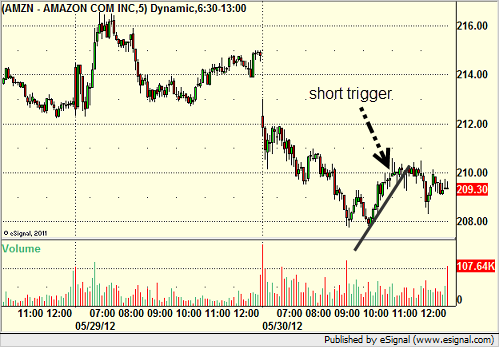

AMZN triggered short (with market support) and didn't quite work enough for a partial:

Rich's FB triggered long (with market support in the afternoon) and worked huge, our first official FB call:

In total, that's 11 trades triggering with market support, 8 of them worked, 3 did not.

Futures Calls Recap for 5/31/12

A solid day of trading the futures even though volume remains on the light side (it closed out a little better at 1.7 billion NASDAQ shares, which probably explains the afternoon opportunity). We had two winners in the ES and one in the NQ. No losers today. See those sections below.

Net ticks: +16.5 ticks.

First, we will take a look at the ES and NQ with our market directional lines, Seeker, and VWAP:

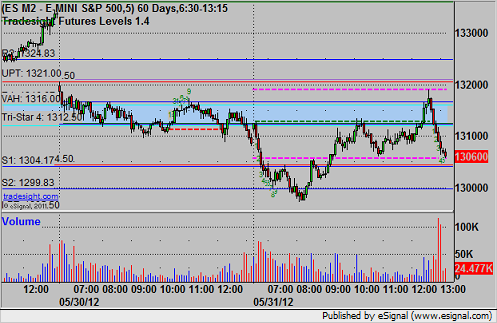

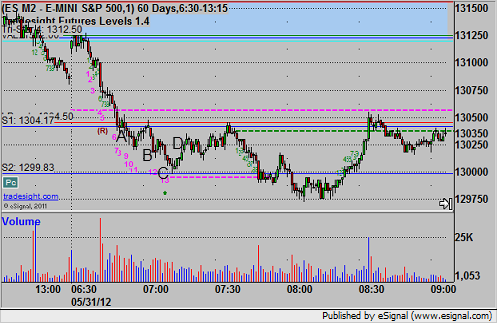

ES:

I think in some cases when the trades trigger, hit first target, and adjust quickly, I'm going to start with the 5-minute chart of the day with Levels so you can see our usual picture, but then I will do the trade recap on the 1 minute chart so it is easier to see.

5 minute chart:

Now view the 1-minute chart below. Mark's short triggered at A, finally hit first target at B, he took off another piece as it hit S2 at C and stopped the final over 1302 at D for 7 ticks net gain on the trade.

Later in the day (below), I then had a late day trigger out of the cup and handle at E, hit first target at F, stopped last piece under 1316.00 at G for 7 ticks:

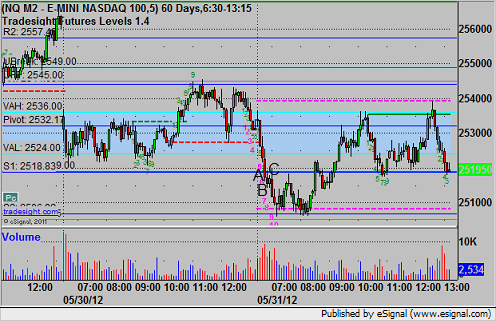

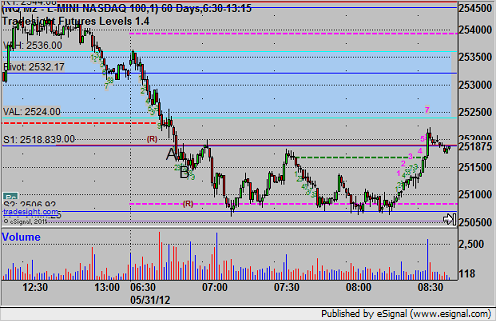

NQ:

Remember that we use half points as a tick on the NQ. 5-minute chart:

Now, on the 1-minute chart below. My trade triggered short at A, hit first target at B, lowered stop over entry and stopped second half for a tick loss:

Forex Calls Recap for 5/31/12

Another light session that tried both ways and failed on light ranges. See EURUSD below.

New calls and Chat tonight, but we will be half size ahead of the NFP data.

Here's the US Dollar Index intraday with our market directional lines:

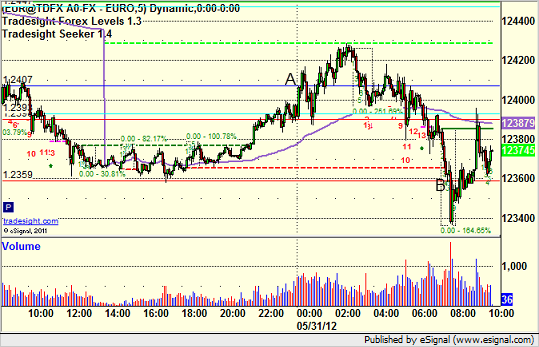

EURUSD:

Triggered long at A and stopped. Triggered short at B and stopped:

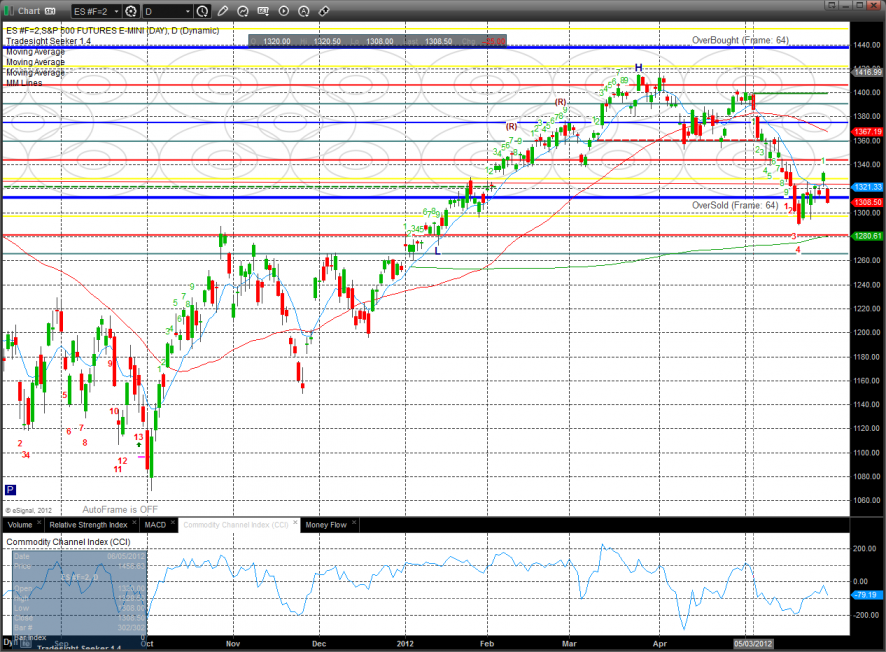

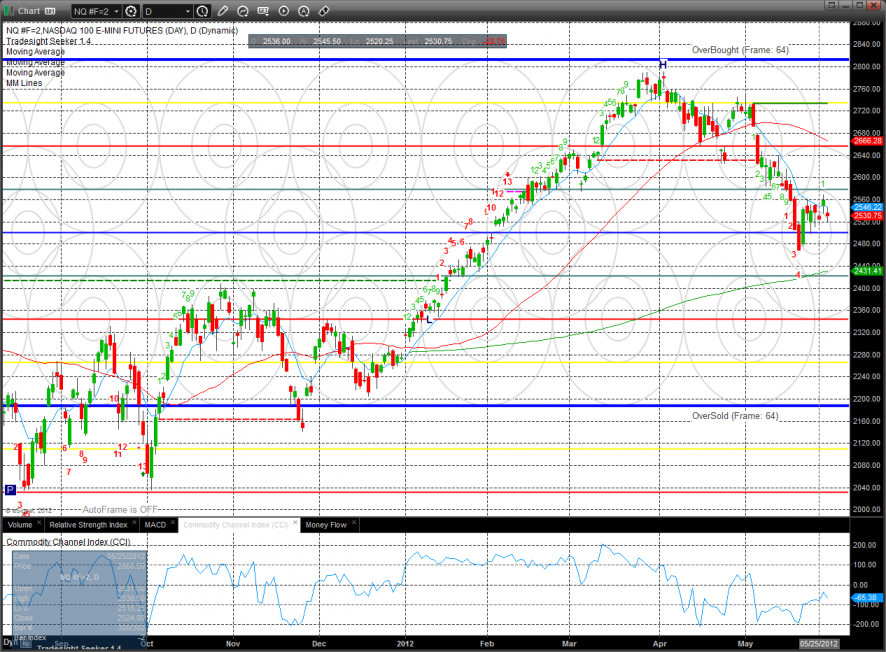

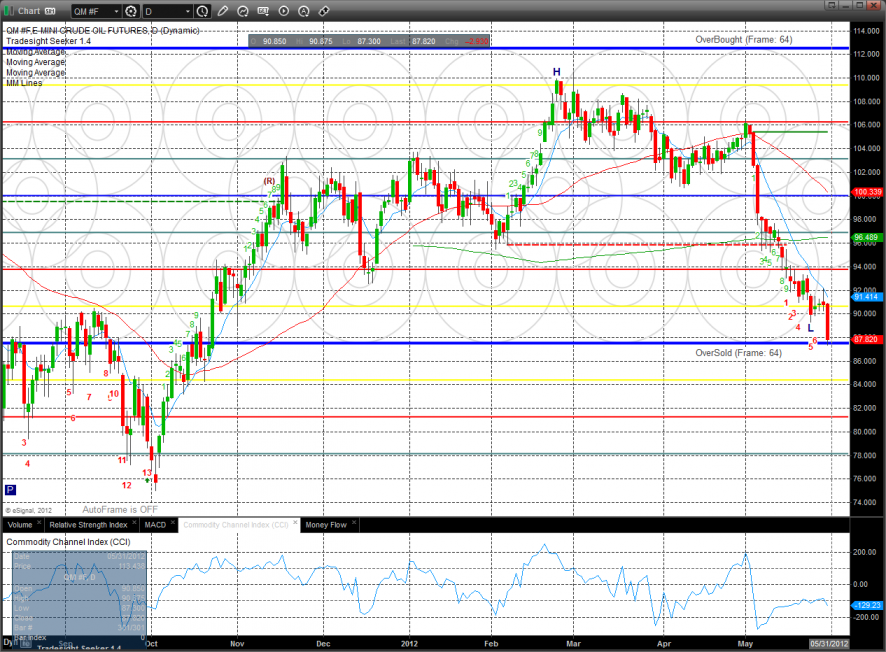

Tradesight Market Preview for 5/31/12

The ES gapped down (blow the lower pressure threshold) and closed on the low losing 25 on the day. Price is now back below the 10ema and again short-term negative.

The NQ futures were lower by 28 on the day but much stronger than the broad market because of the strength in AAPL which closed up on the day. They sold AAPL pre IPO to buy FB and now are they taking losses in FB and moving back into AAPL? The NQ pattern is tracing out a small bearish rising wedge which should be resolved by the Friday NFP number.

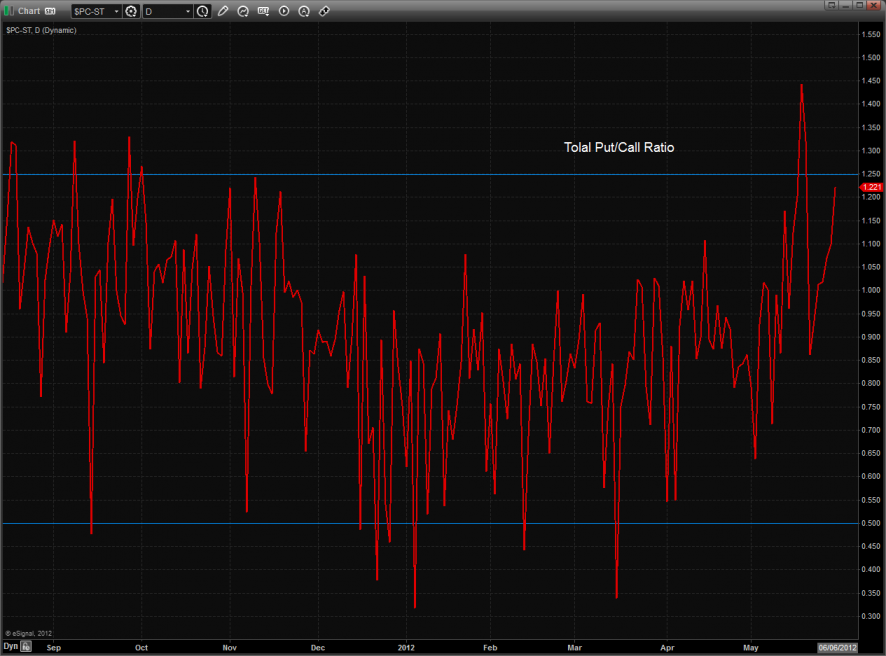

The total put/call ratio came up just short of the climatic level.

Multi sector daily chart:

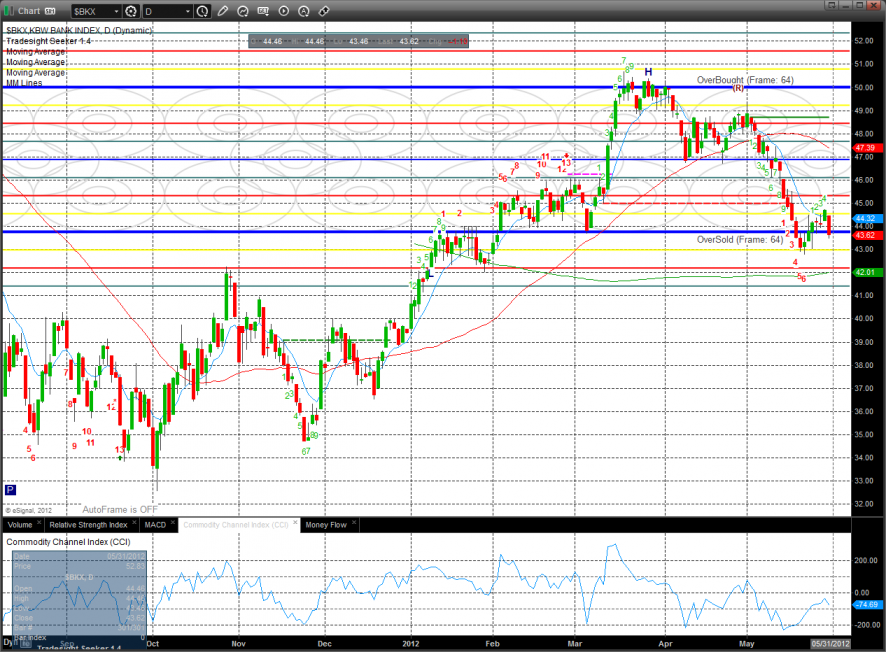

The BKX is potentially developing relative weakness vs. the SPX which would be a very bearish development if it gets traction.

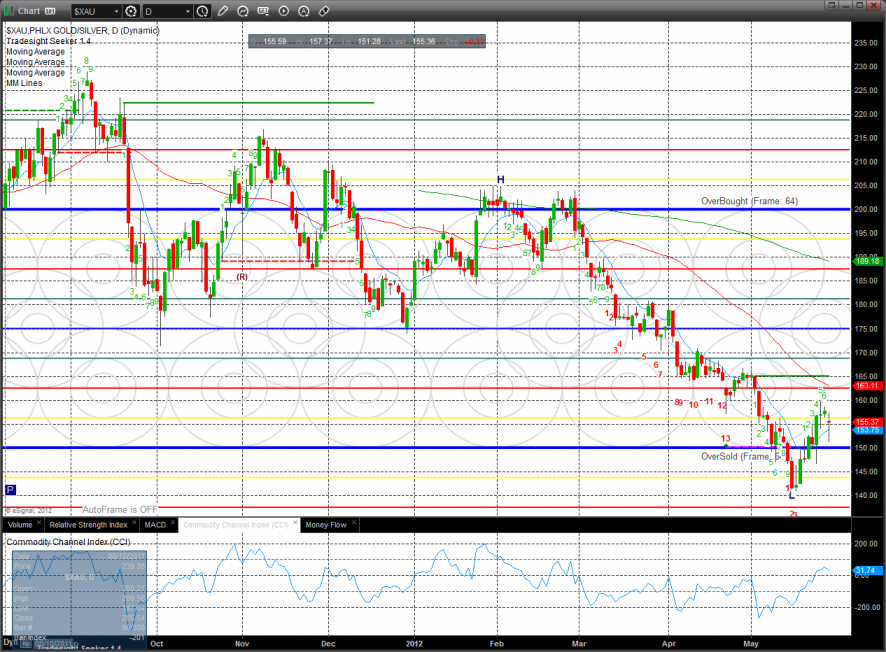

The Defensive XAU was the top gun eventhough the dollar was very strong.

The BTK was lower on the day but did nothing technically.

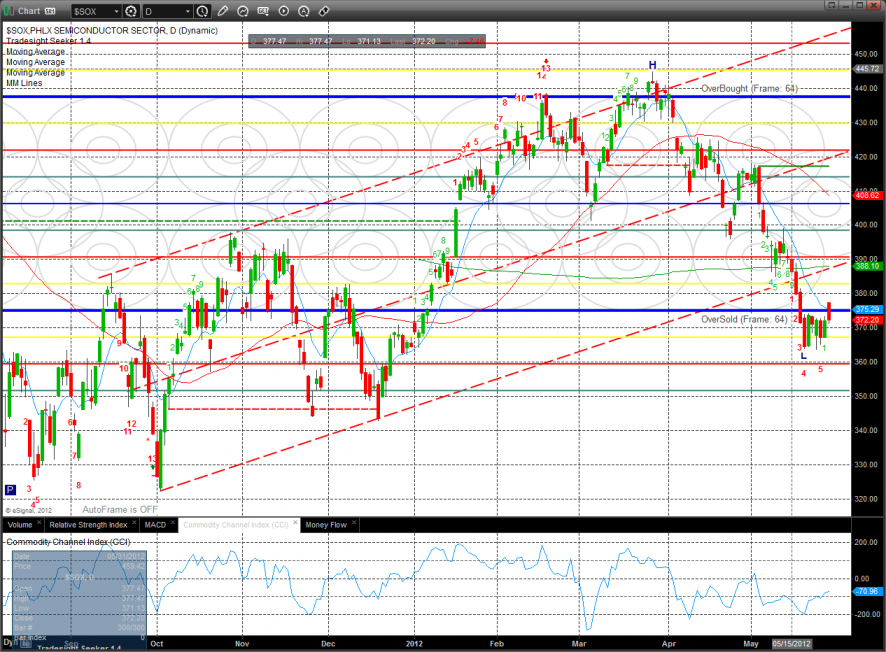

The SOX gapped up above the recent range but was rejected and settled right at the top of the range. Price remains bearishly below the 10ema.

The BKX was very weak losing 2.5% on the day and not making good on the close above the 10ema.

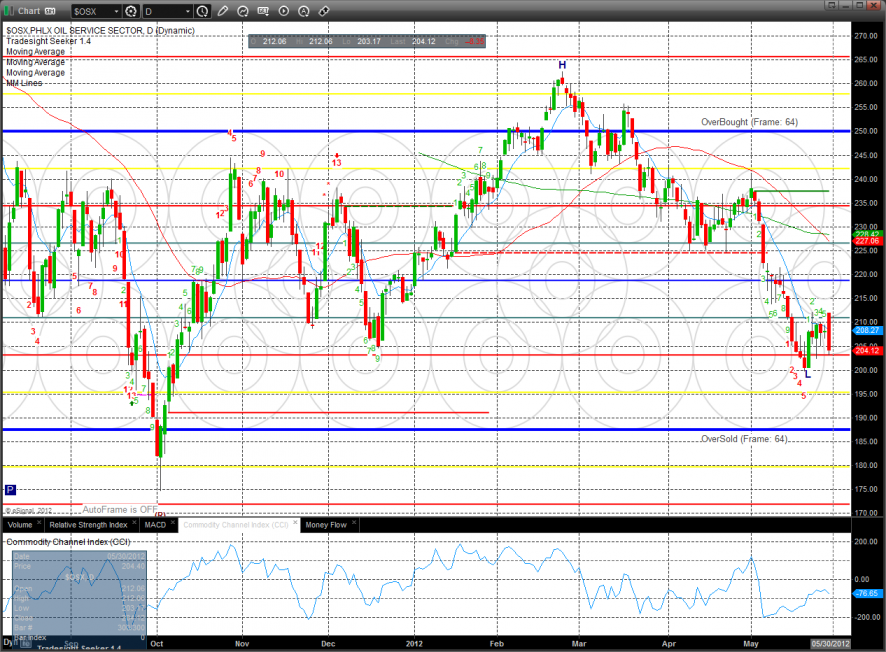

The OSX hemorrhaged 4% on the day and was obliterated by the dollar strength. Price has spent a good deal of time, too much time, below the 4/8 level and hs not been able to pivot higher which puts the 0/8 level in play sometime this summer.

Oil collapsed $3 and settled just above the key 0/8 level. Note that the seeker count offers no support right now.

Gold was higher on the day but was inside yesterday’s candle.

Silver:

Stock Picks Recap for 5/30/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

In the Messenger, Mark's NFLX triggered short (without market support due to opening 5 minutes) and worked:

His TIBX triggered short (without market support due to opening 5 minutes) and worked:

Rich's JPM triggered short (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and worked enough for a clean partial:

His SHLD triggered short (with market support) and worked:

His TSCO triggered short (with market support) and worked:

His GOOG triggered short (with market support) and worked:

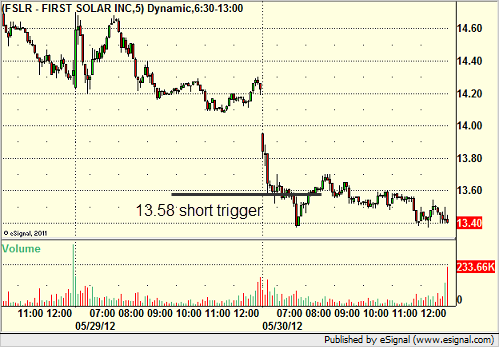

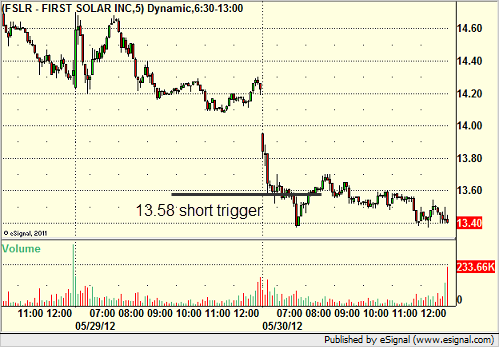

FSLR triggered short (with market support) and worked enough for a partial:

BIDU triggered short (with market support) and worked great:

AAPL triggered long (without market support from the ES, although NQ had it) and worked, doesn't count:

Rich's AMZN triggered short (without market support) and didn't work:

In total, that's 7 trades triggering with market support, all 7 of them worked, which is nice considering the volume.

Stock Picks Recap for 5/30/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

In the Messenger, Mark's NFLX triggered short (without market support due to opening 5 minutes) and worked:

His TIBX triggered short (without market support due to opening 5 minutes) and worked:

Rich's JPM triggered short (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and worked enough for a clean partial:

His SHLD triggered short (with market support) and worked:

His TSCO triggered short (with market support) and worked:

His GOOG triggered short (with market support) and worked:

FSLR triggered short (with market support) and worked enough for a partial:

BIDU triggered short (with market support) and worked great:

AAPL triggered long (without market support from the ES, although NQ had it) and worked, doesn't count:

Rich's AMZN triggered short (without market support) and didn't work:

In total, that's 7 trades triggering with market support, all 7 of them worked, which is nice considering the volume.

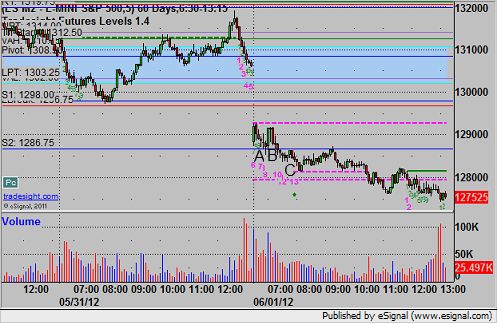

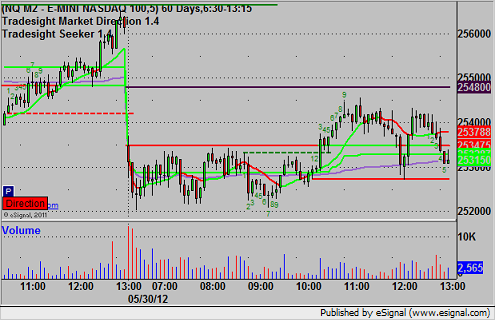

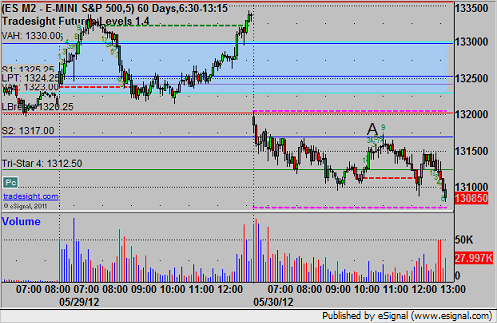

Futures Calls Recap for 5/30/12

Another slow session for futures as the market volume was horrible (NASDAQ volume only 1.5 billion at the close). One winner and two losers as the market looked setup for a nice rally late but fizzled on light volume and did nothing. See ES and NQ sections below.

Net ticks: -11.5 ticks.

First, let's take a look at the ES and NQ with our market directional tools, plus the Seeker, plus the VWAP:

ES:

Great setup against S2 for a long in the afternoon, swept the trigger to the tick at A and failed, unfortunately triggered on a 9-bar setup completion as well as the lack of volume:

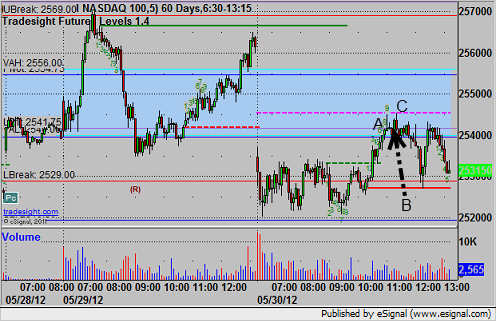

NQ:

Triggered long above the Lower Pressure Threshold heading into the Value Area at A, stopped for 7 ticks (remember that we use half points for ticks on the NQ). Re-entered at B, hit first target at C, stop goes under the entry and stopped second half, no follow through: