Stock Picks Recap for 5/25/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

No calls in the report because we knew it was going to be a light volume day heading into Memorial Day weekend.

In the Messenger, Rich's LULU triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

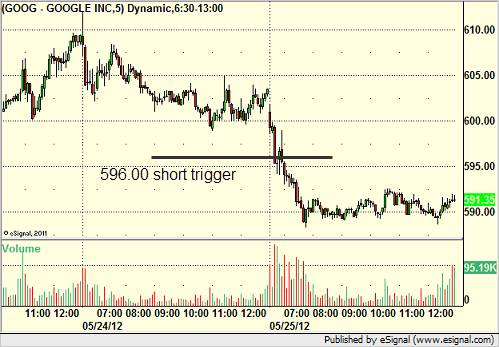

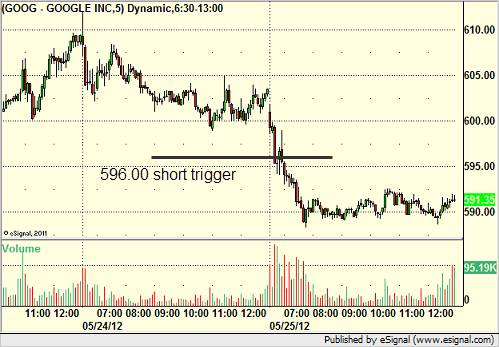

GOOG triggered short (with market support) and worked:

In total, that's 1 trade triggering with market support, and it worked.

Stock Picks Recap for 5/25/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

No calls in the report because we knew it was going to be a light volume day heading into Memorial Day weekend.

In the Messenger, Rich's LULU triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

GOOG triggered short (with market support) and worked:

In total, that's 1 trade triggering with market support, and it worked.

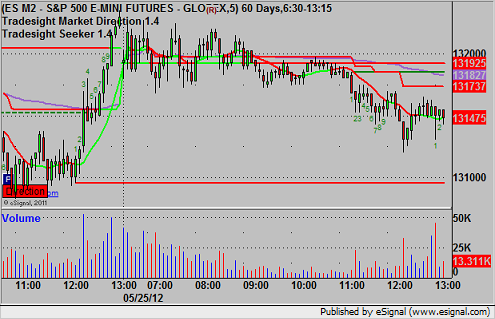

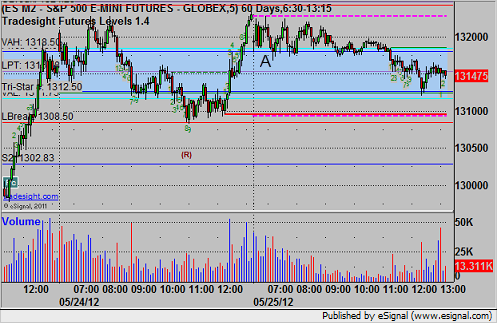

Futures Calls Recap for 5/25/12

As expected, a dead trading session for the markets as everyone headed out for the long weekend. Just to put something up, I took a stab at the ES short into the Value Area/under the Pivot, which didn't work, see that section below. Traded small size as we knew volume would be a problem.

Market is closed Monday, Levels and calls resume Tuesday.

Net ticks: -7.

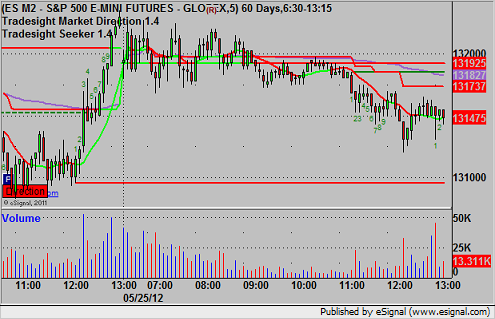

First, let's take a look at the ES and NQ with our market directional tool, VWAP, and Seeker:

ES:

Triggered short at A and stopped for 7 ticks as usual, and then we didn't bother after that:

Futures Calls Recap for 5/25/12

As expected, a dead trading session for the markets as everyone headed out for the long weekend. Just to put something up, I took a stab at the ES short into the Value Area/under the Pivot, which didn't work, see that section below. Traded small size as we knew volume would be a problem.

Market is closed Monday, Levels and calls resume Tuesday.

Net ticks: -7.

First, let's take a look at the ES and NQ with our market directional tool, VWAP, and Seeker:

ES:

Triggered short at A and stopped for 7 ticks as usual, and then we didn't bother after that:

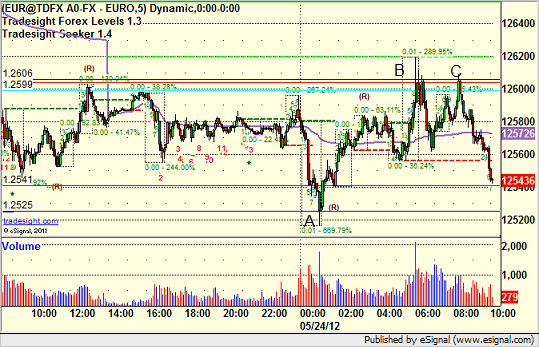

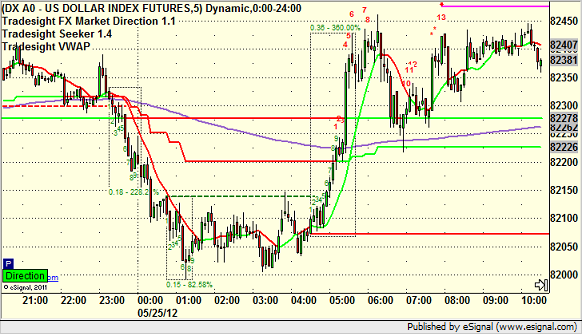

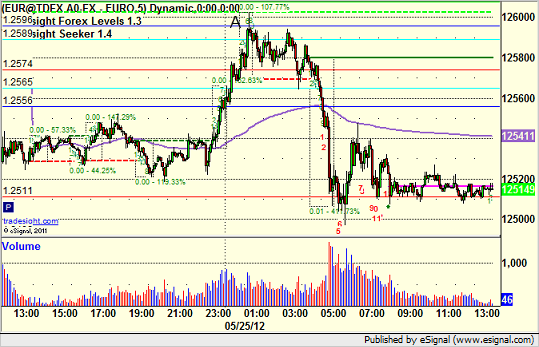

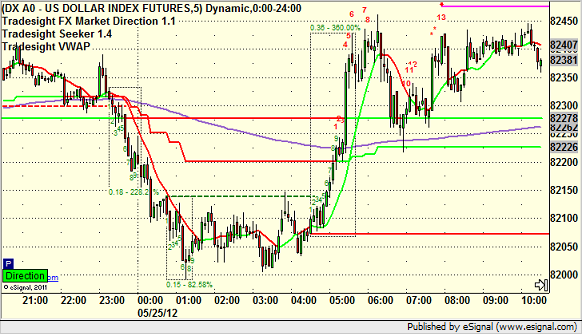

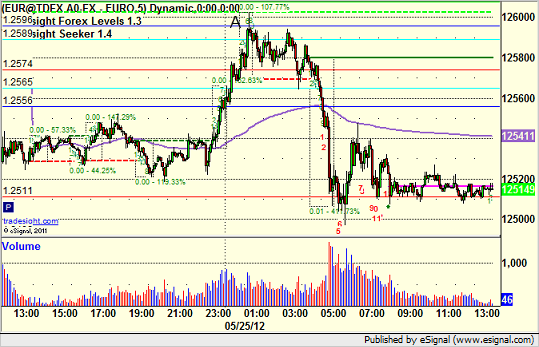

Forex Calls Recap for 5/25/12

One loser to close the week as the big players were already out the door. There wasn't even an end of week bank closeout Friday morning ahead of the long weekend. Just dead flat. See EURUSD below.

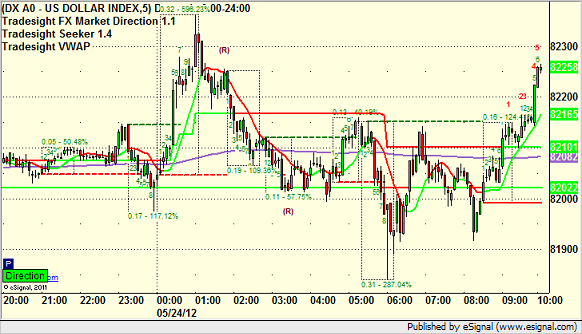

Here's the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then discuss the US Dollar Index. There are some things to discuss on the daily charts, so have a look.

EURUSD:

Triggered long at A and stopped on narrow range:

Analysis for the week ahead is for subscribers only.

Forex Calls Recap for 5/25/12

One loser to close the week as the big players were already out the door. There wasn't even an end of week bank closeout Friday morning ahead of the long weekend. Just dead flat. See EURUSD below.

Here's the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then discuss the US Dollar Index. There are some things to discuss on the daily charts, so have a look.

EURUSD:

Triggered long at A and stopped on narrow range:

Analysis for the week ahead is for subscribers only.

Stock Picks Recap for 5/24/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered from the report.

In the Messenger, Mark's FIRE triggered long (with market support) and worked:

His EBIX triggered short (with market support) and worked:

Rich's NTAP triggered long (without market support) and worked enough for a partial:

His VMW triggered short (with market support) and worked great:

His AAPL triggered short (with market support) and worked great:

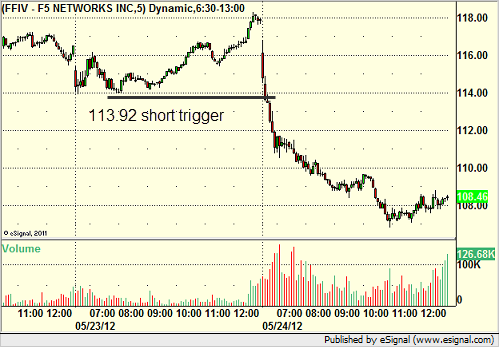

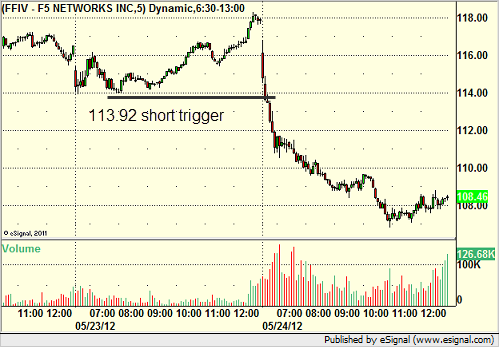

His FFIV triggered short (with market support) and worked great:

His COST triggered long (with market support) and didn't work:

NFLX triggered short (with market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Stock Picks Recap for 5/24/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered from the report.

In the Messenger, Mark's FIRE triggered long (with market support) and worked:

His EBIX triggered short (with market support) and worked:

Rich's NTAP triggered long (without market support) and worked enough for a partial:

His VMW triggered short (with market support) and worked great:

His AAPL triggered short (with market support) and worked great:

His FFIV triggered short (with market support) and worked great:

His COST triggered long (with market support) and didn't work:

NFLX triggered short (with market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

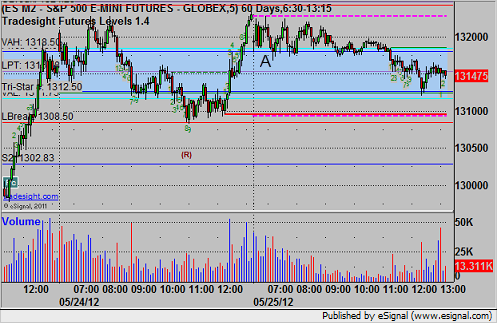

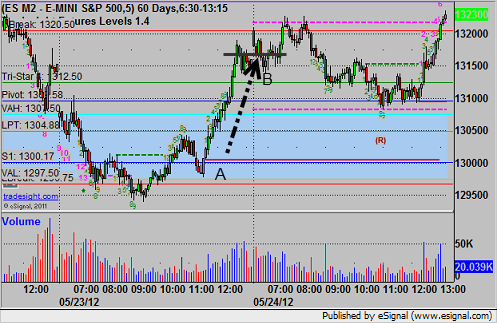

Futures Calls Recap for 5/24/12

As expected, market volume and activity are drying up as we head into the long weekend. Friday will be a slow mess, so trade at your own risk. Anything worth doing will probably be in the first hour or ninety minutes.

Winner in the ES, loser in the QM and that's it for the tame session as the ES continues to be drawn to that key 1312.50 area.

Net ticks: -4.5 ticks.

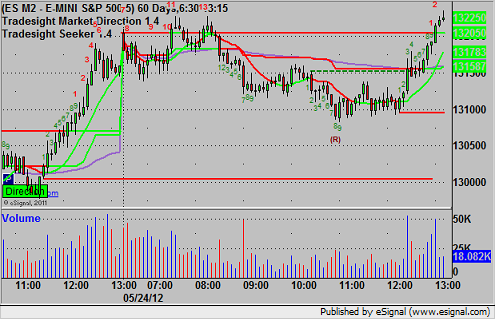

First, let's take a look at the ES and NQ with the Seeker, market directional tools, and VWAP:

ES:

Mark's call triggered short at A, hit first target at B, and second half stopped over the entry for 2.5 ticks gain on the play:

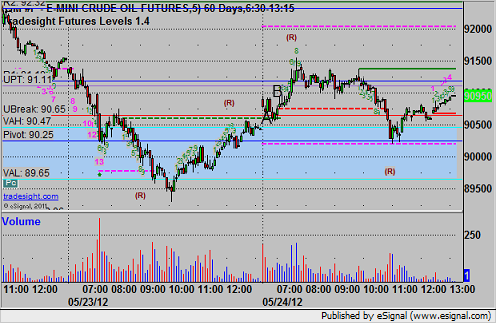

QM:

Nice setup that could have led into the Value Area but failed, triggered short at A and stopped at B for 7 ticks:

Forex Calls Recap for 5/24/12

A very flat session with the EURUSD and GBPUSD dropping to about 60 pips of range again. Here's the US Dollar Index intraday with our market directional lines:

We also closed out the EURUSD short from the prior session for about 160 pips.

New calls and Chat tonight. Hard to say how tomorrow goes leading into a long weekend.

EURUSD:

Triggered short at A and stopped. Stopped out of the final piece of the trade from the prior session at B for 160 pip gain, and also triggered our new long there, which stopped. Triggered part of the trade, but not all under our order staggering rules, at C and stopped: