Tradesight Market Preview for 5/24/12

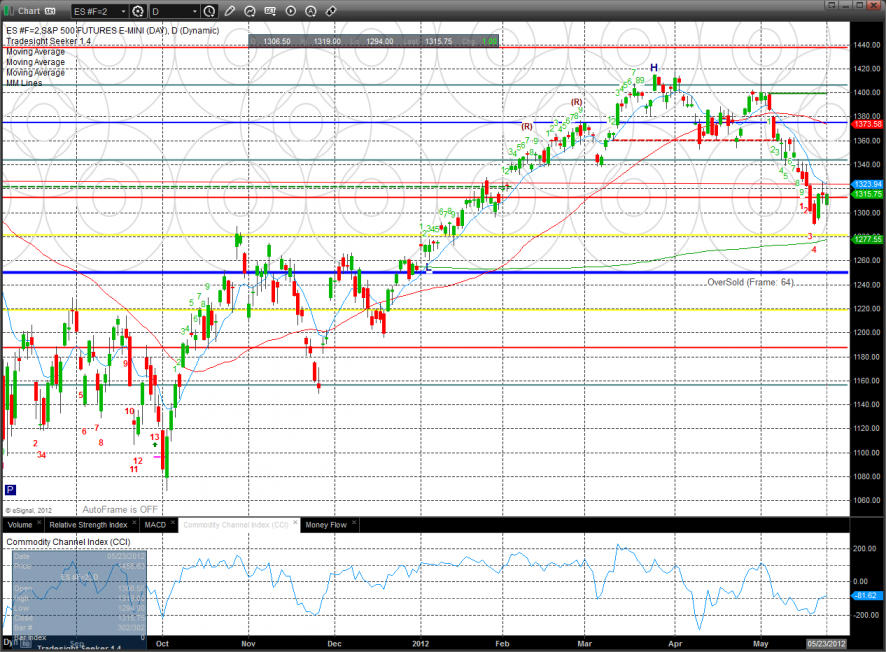

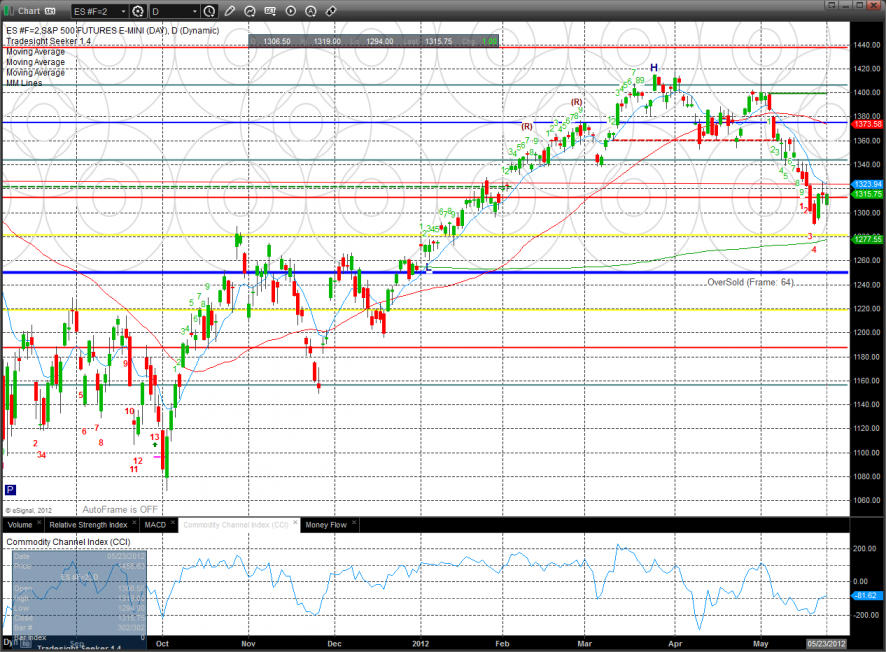

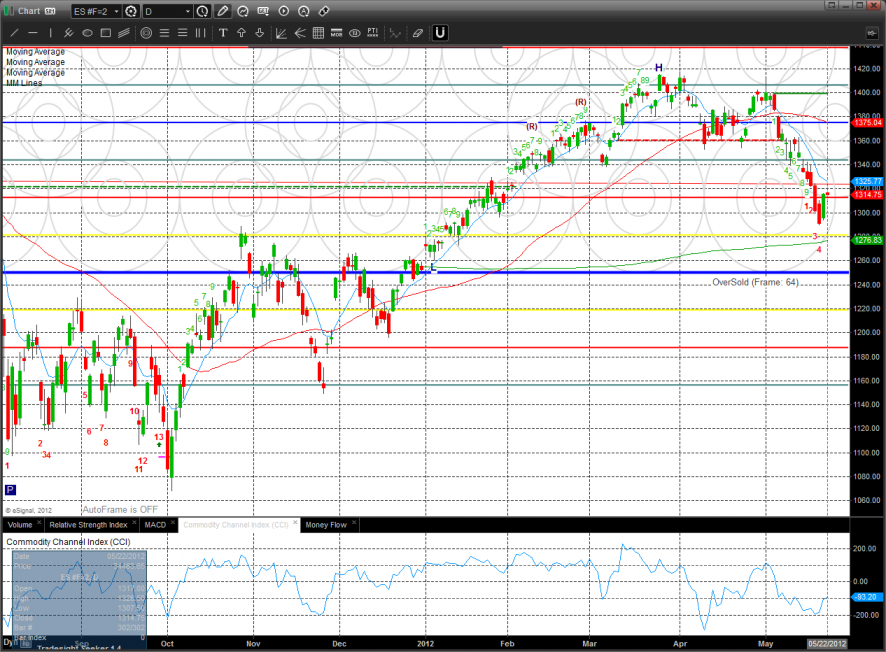

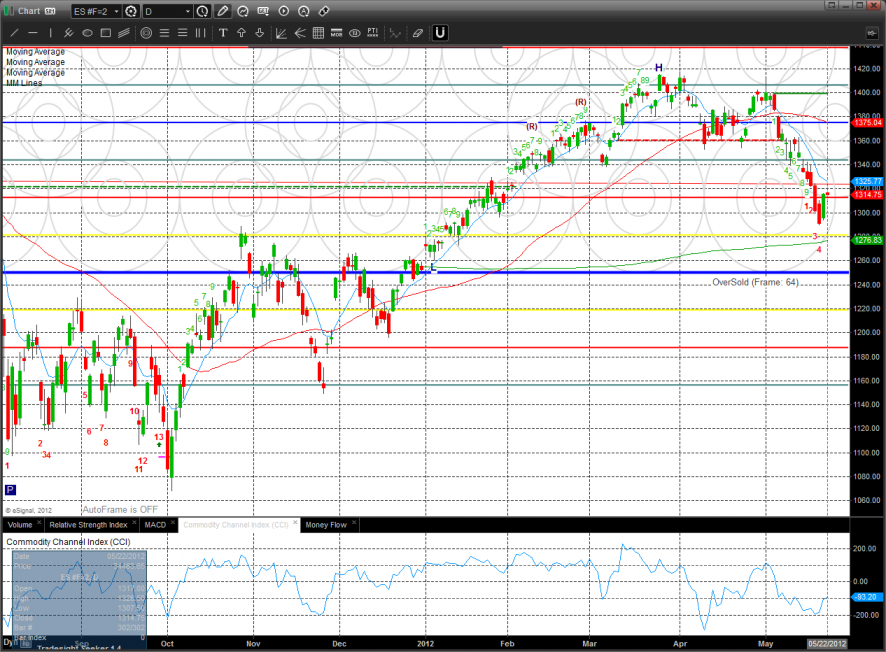

The ES is trying to make a turn but while the futures were up on the day they remain below our trend defining 10ema.

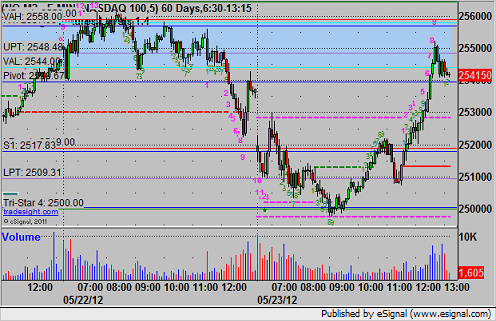

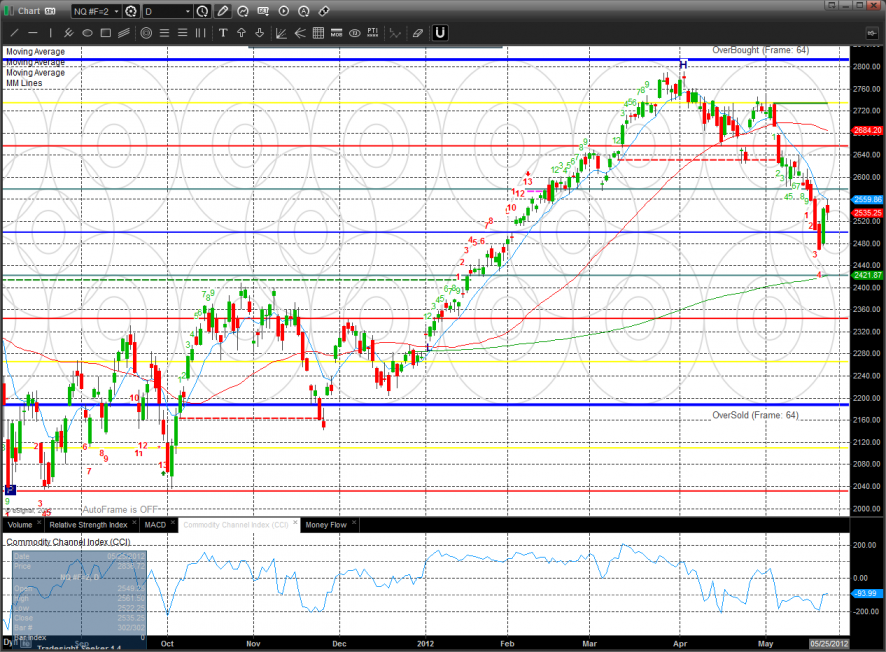

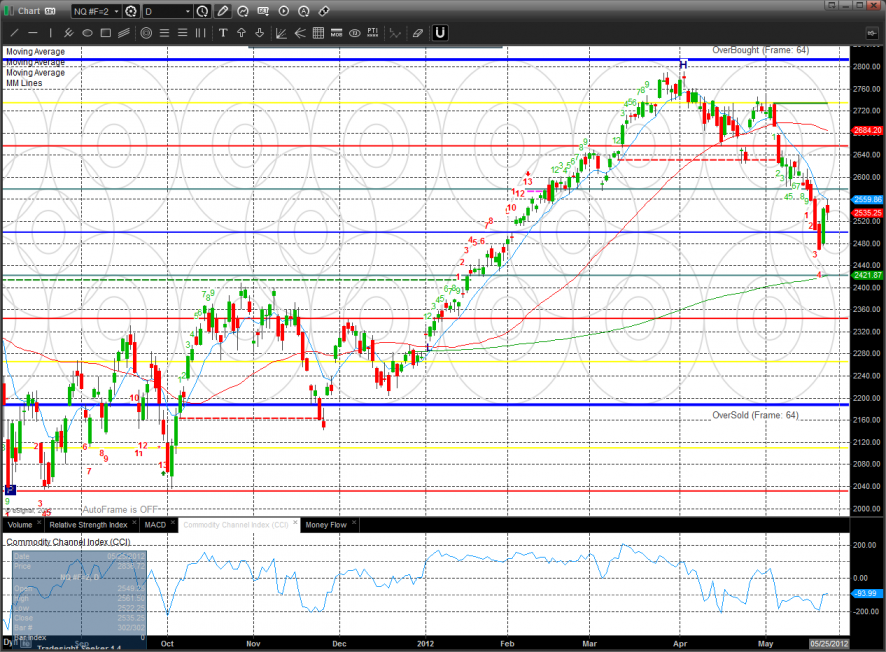

The NQ futures put in a better day closing up 5 but they still remain below the 10ema. Note that today’s low was lower than yesterday’s and today’s high was lower than the previous high.

10-day Trin:

Multi sector daily chart:

The NDX had relative strength today but the trend remains bearishly in favor of the SPX.

The XAU was the top gun by a wide margin gaining 4%. The chart is solidly above the 10ema.

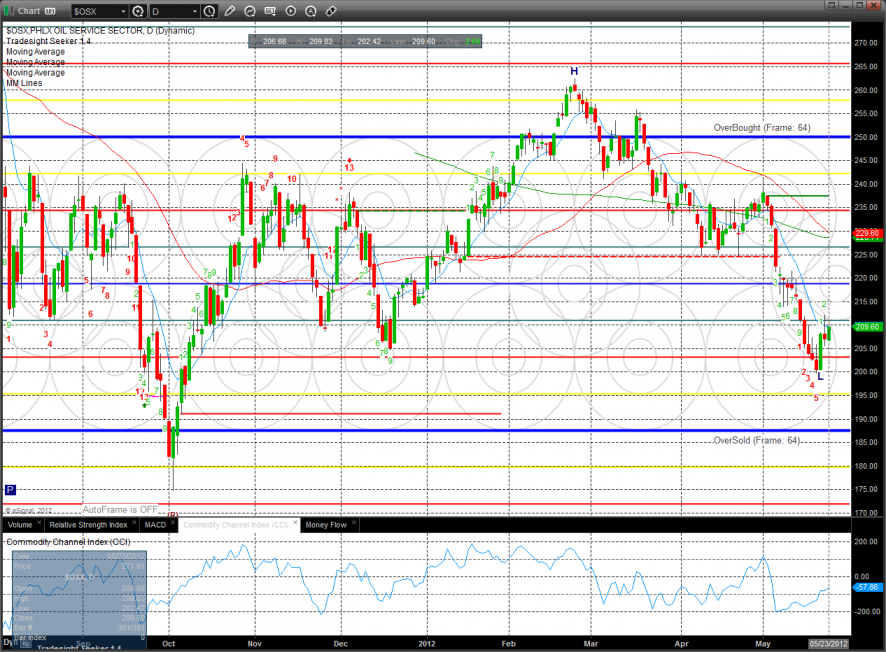

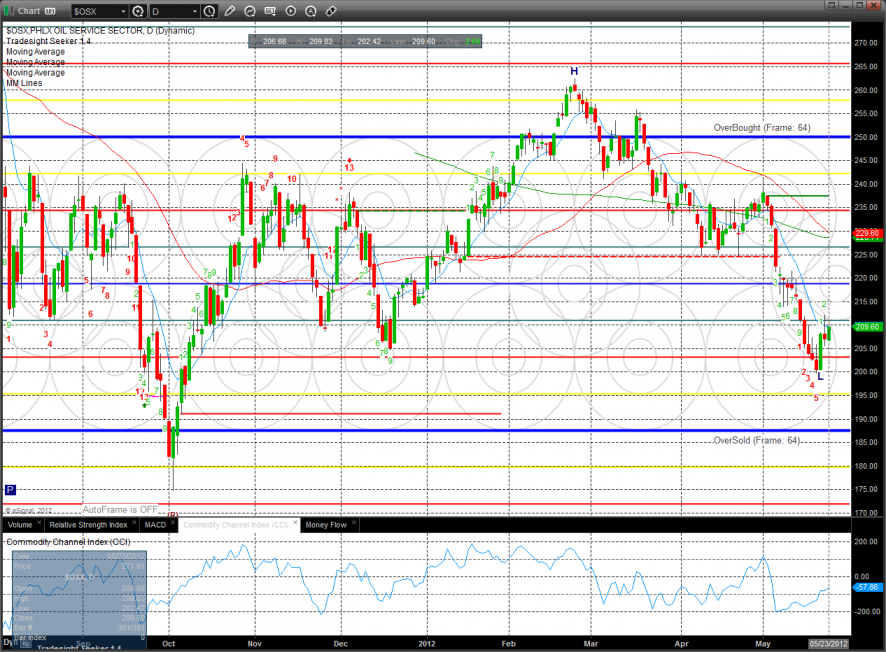

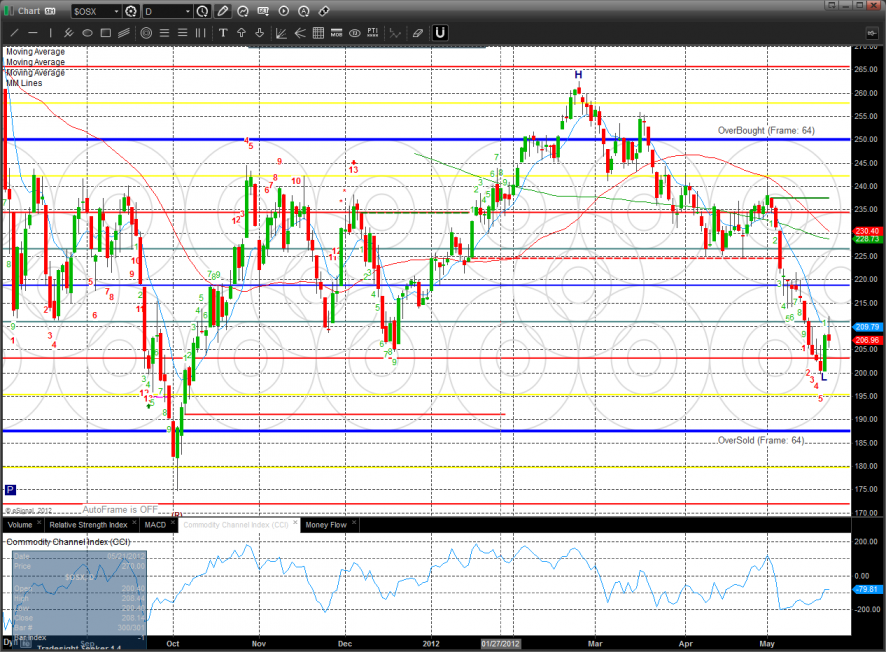

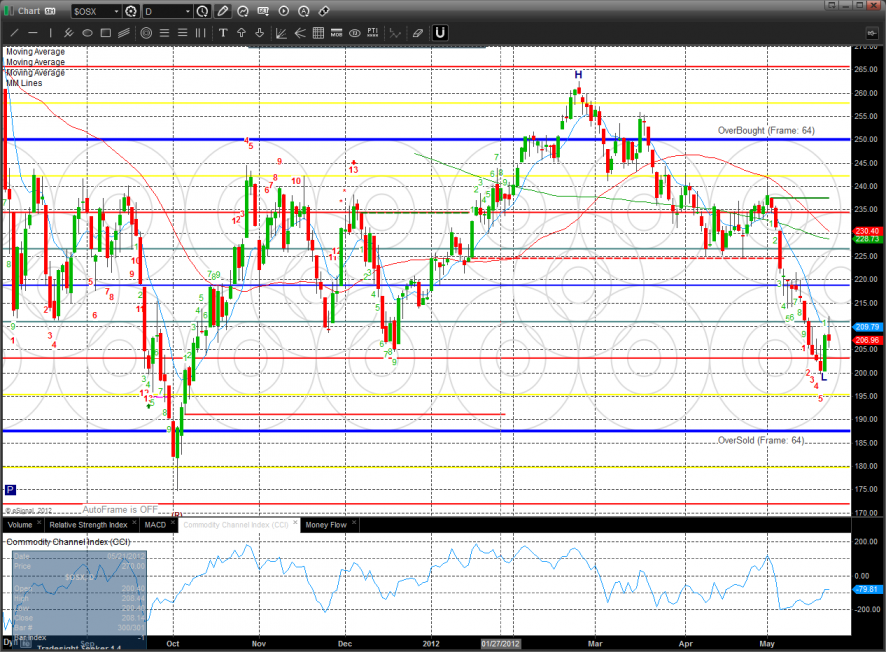

The OSX outperformed the broad market and is very close to going short-term positive.

The BKX posted and indecisive inside day.

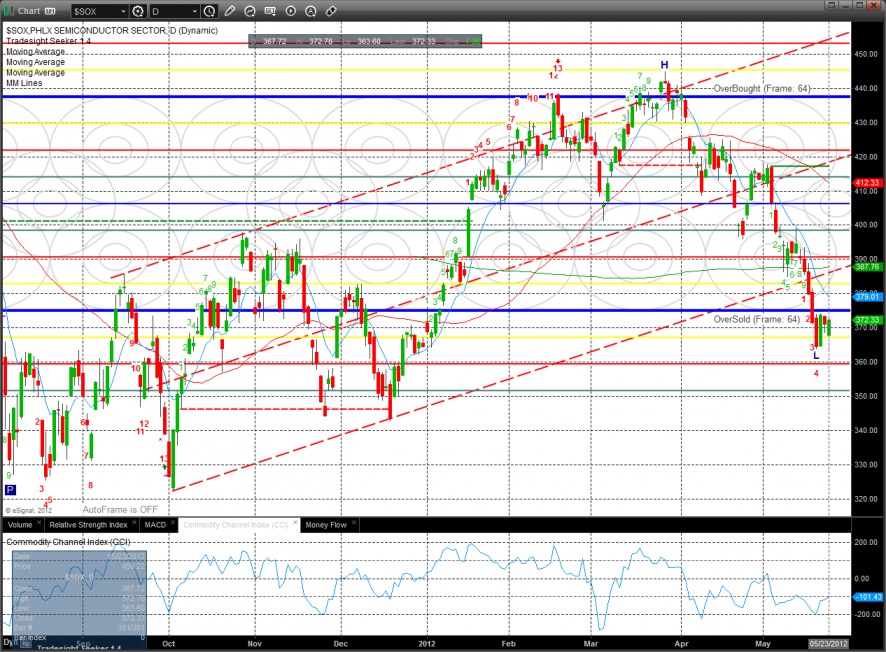

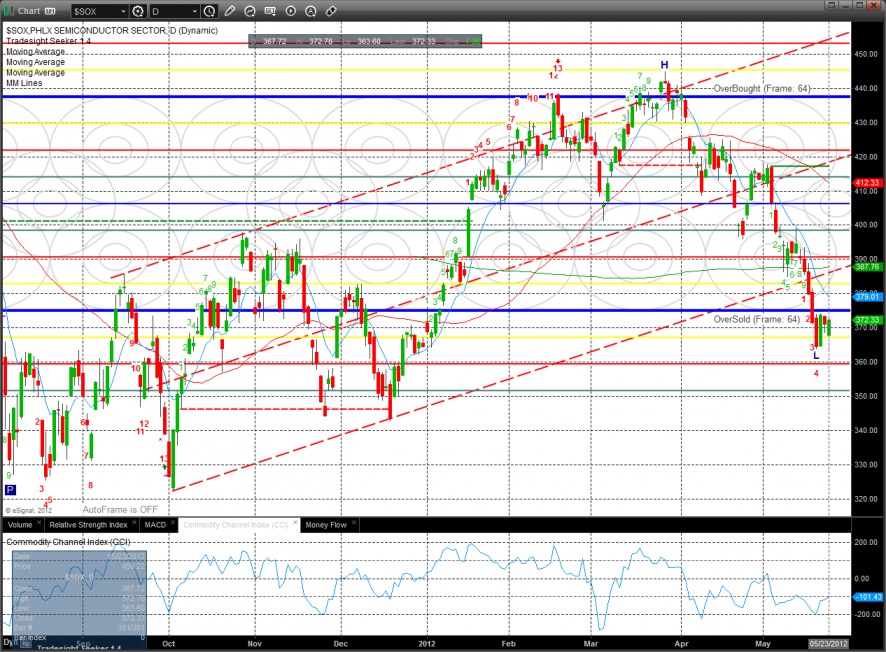

The SOX did very little after sweeping to a new low on the move.

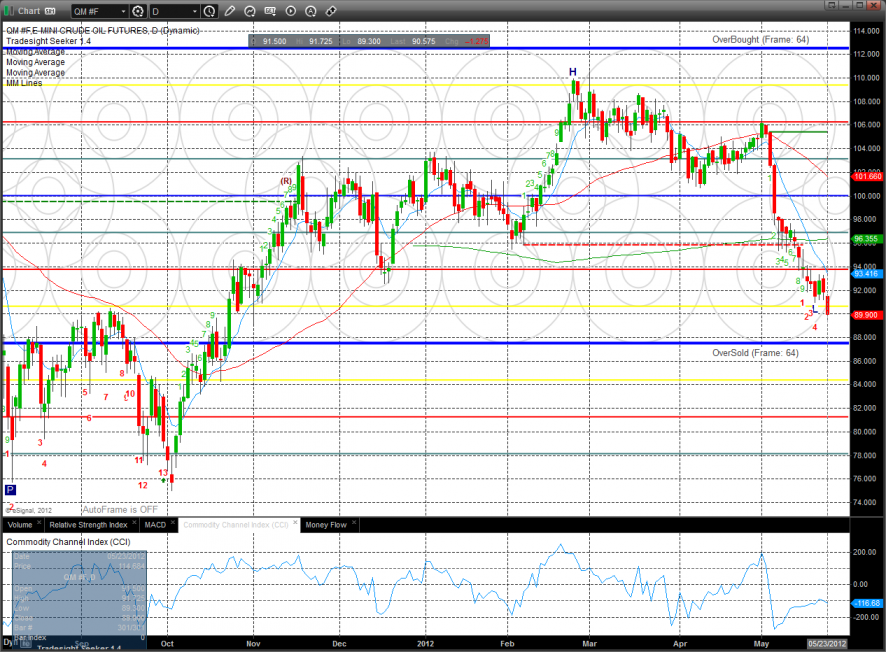

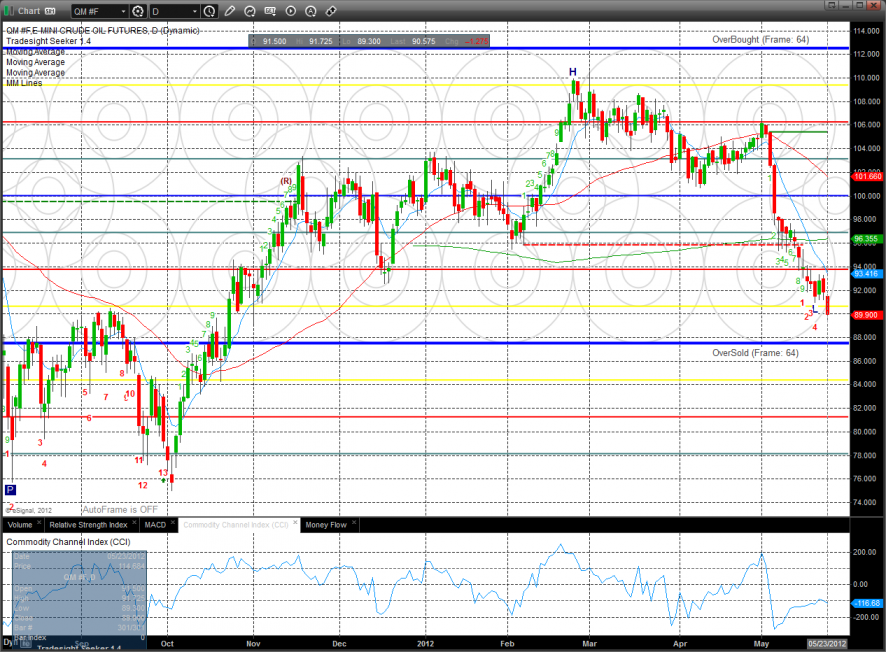

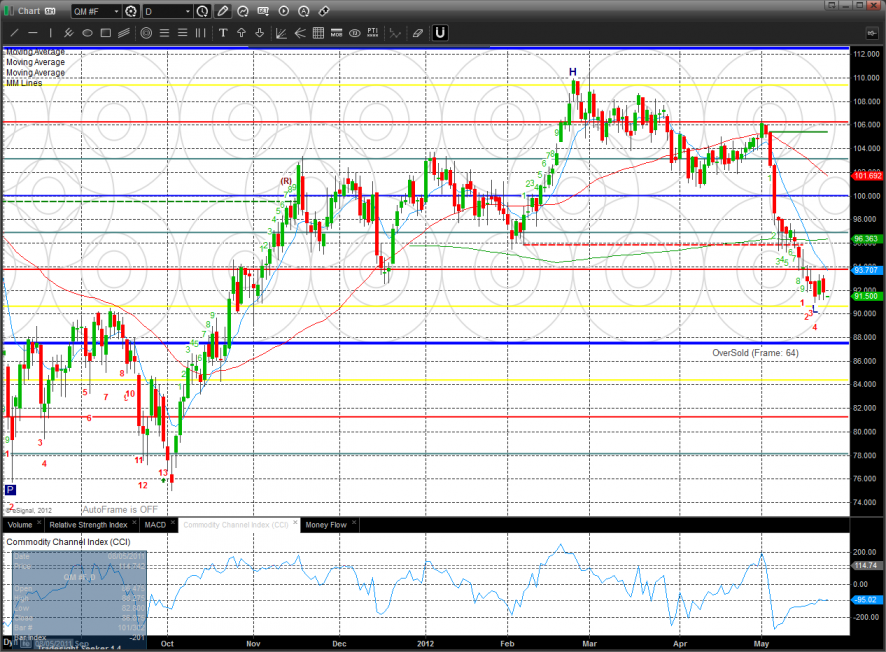

Oil:

Gold:

Silver:

Tradesight Market Preview for 5/24/12

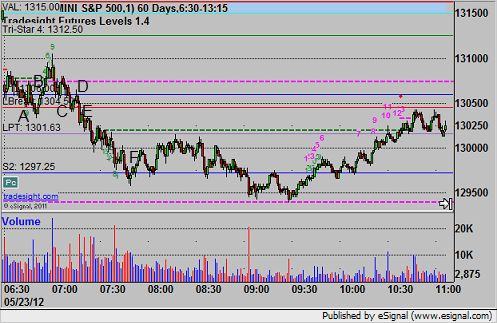

The ES is trying to make a turn but while the futures were up on the day they remain below our trend defining 10ema.

The NQ futures put in a better day closing up 5 but they still remain below the 10ema. Note that today’s low was lower than yesterday’s and today’s high was lower than the previous high.

10-day Trin:

Multi sector daily chart:

The NDX had relative strength today but the trend remains bearishly in favor of the SPX.

The XAU was the top gun by a wide margin gaining 4%. The chart is solidly above the 10ema.

The OSX outperformed the broad market and is very close to going short-term positive.

The BKX posted and indecisive inside day.

The SOX did very little after sweeping to a new low on the move.

Oil:

Gold:

Silver:

Stock Picks Recap for 5/23/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

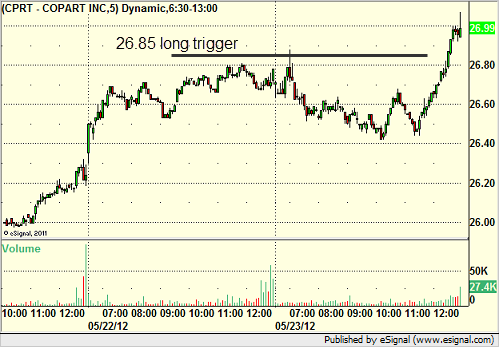

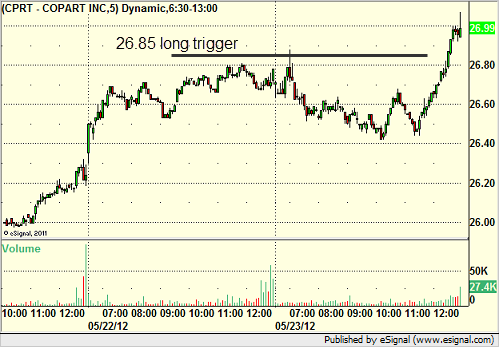

From the report, CPRT triggered long (with market support) and didn't work:

DECK triggered long (without market support) and didn't work, although it also triggered later in the day with support and worked (we don't count retriggers in the numbers):

ALKS triggered short (without market support due to opening five minutes) and didn't work:

In the Messenger, Rich's TEVA triggered short (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and didn't work:

AMZN triggered short (with market support) and worked:

SINA triggered long (with market support) and worked. It went so fast that it was through the trigger by the time that I could put the trade idea up, but it pulled back to let you take it:

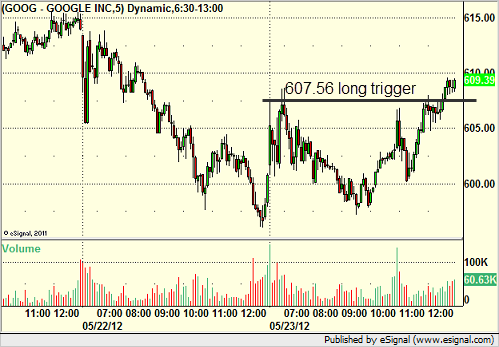

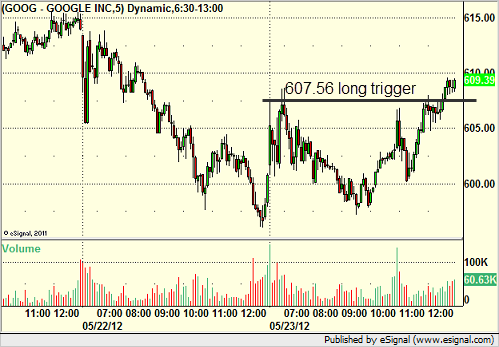

GOOG triggered long (with market support) and didn't work, although it worked later:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Stock Picks Recap for 5/23/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CPRT triggered long (with market support) and didn't work:

DECK triggered long (without market support) and didn't work, although it also triggered later in the day with support and worked (we don't count retriggers in the numbers):

ALKS triggered short (without market support due to opening five minutes) and didn't work:

In the Messenger, Rich's TEVA triggered short (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and didn't work:

AMZN triggered short (with market support) and worked:

SINA triggered long (with market support) and worked. It went so fast that it was through the trigger by the time that I could put the trade idea up, but it pulled back to let you take it:

GOOG triggered long (with market support) and didn't work, although it worked later:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Futures Calls Recap for 5/23/12

Took 6 trades to get 2 winners with both the ES and NQ short ideas sweeping twice before working. See both sections below.

Net ticks: -11 ticks.

First, let's take a look at the ES and NQ with our market directional lines, VWAP, and Seeker:

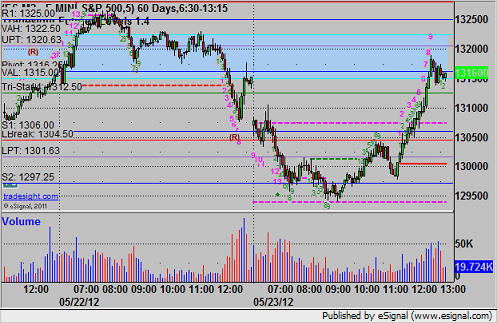

ES:

Here's the usual 5-minute chart on the ES with Levels. I will use the 1-minute chart to show today's triggers since there were a few in a row:

Triggered short under LBreak at A and stopped at B for 7 ticks. Triggered short again at C and stopped for 7 ticks again. Triggered in the next bar again, hit first target for 6 ticks, lowered stop a few times, and stopped final exit at D for 23 ticks, for an average of 14.5 ticks made on that last trade:

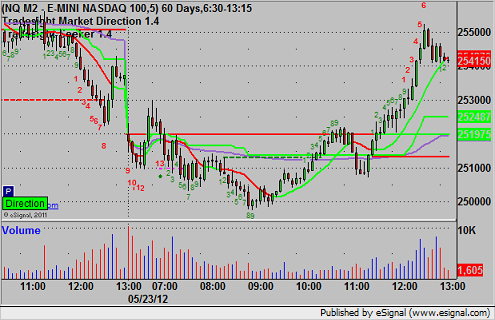

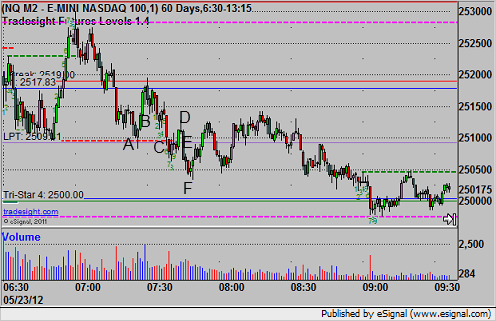

NQ:

Here's the usual 5-minute chart on the ES with Levels. I will use the 1-minute chart to show today's triggers since there were a few in a row:

Remember that on the NQ, we use half a point as a tick instead of the quarter point that the exchange uses.

Triggered short at A and stopped for 7 ticks at B. Did the same again, triggering short at C, stopping at D, and then triggered again at E, hit first target at F, stopped last over entry for 2.5 ticks on average on that play:

Forex Calls Recap for 5/23/12

Another winner, plus the EURUSD short from the prior session continues to work and is now 100 pips in the money. See EURUSD and GBPUSD sections below.

New calls and Chat tonight.

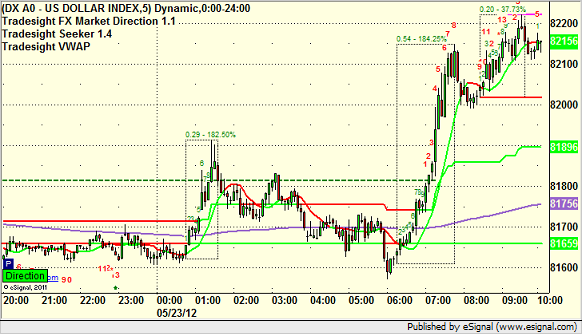

Here's the US Dollar Index intraday with our market directional lines:

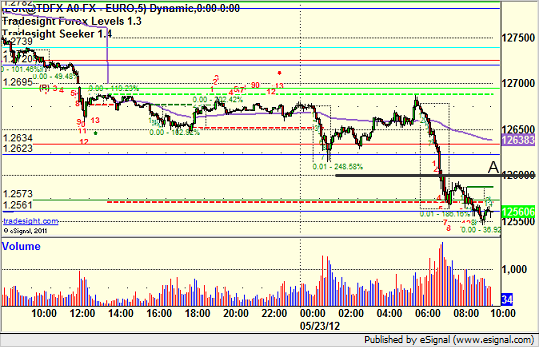

EURUSD:

Lowered stop twice during the session from the short from the prior day. Stop now over the line at A:

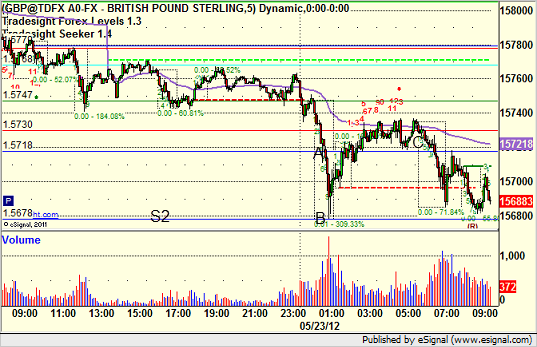

GBPUSD:

Triggered short at A overnight, hit first target at B exactly to the pip, and closed in the morning at C, as we would have lowered stop over the entry overnight if we had been there once it hit the first target:

Tradesight Market Preview for 5/23/12

The ES posted the measuring day that we were looking for. Price tested the 10ema, retreated and ultimately settled down 1 on the day. Wednesday is the important day to see if the bulls can build on Monday’s reversal candle.

The NQ futures posted exactly the same day with a slightly weaker close. The bulls will point to today’s range not breaking into the lower half of Monday’s range. The 10ema is the important level near-term.

The 10-day Trin still has over sold energy:

Multi sector daily chart:

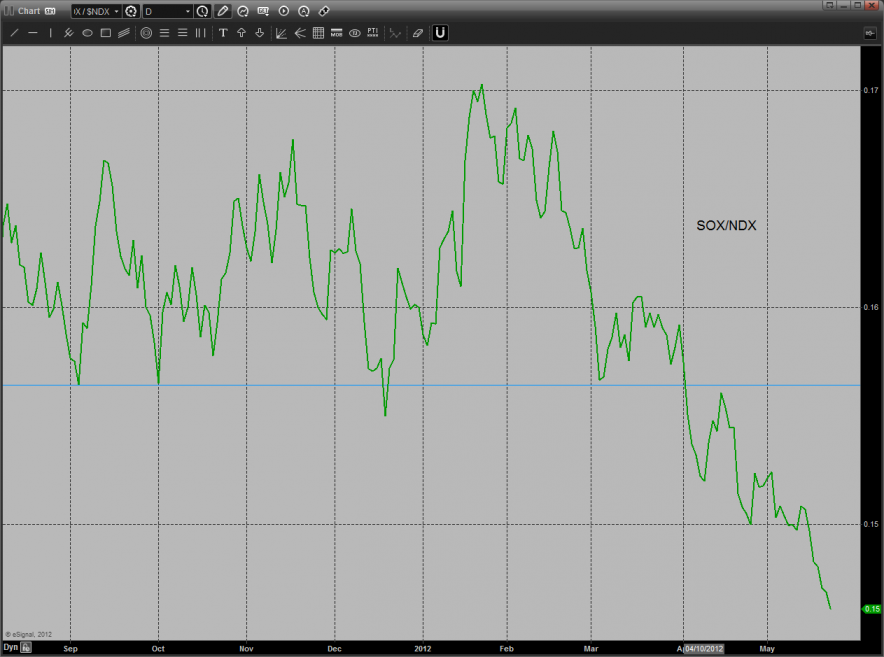

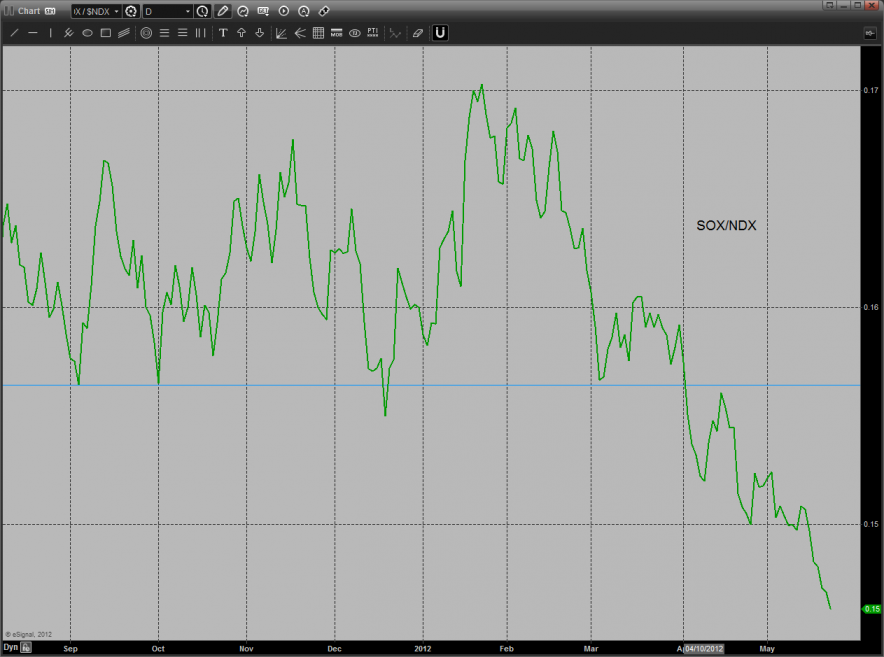

The SOX/NDX cross continues to bearishly record lower lows. This has been a problem for the overall NDX and will continue to weigh on the market perhaps until we get closer to the release of MS Windows 8.

SPX vs. NDX relative chart shows that the NDX is hanging onto a very slight margin of relative strength in the daily time frame.

The BKX was the top gun on the day closing higher by a full percent.

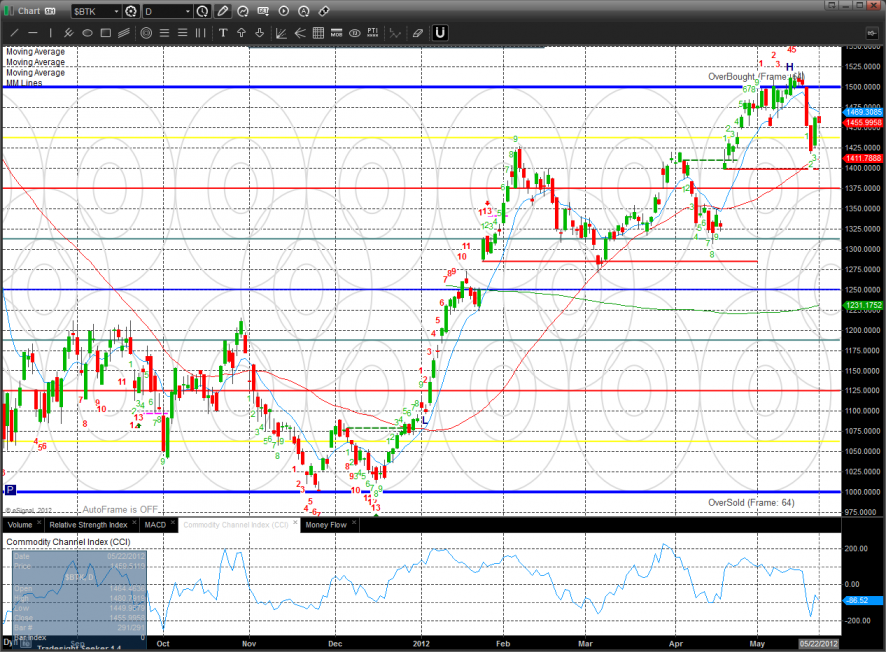

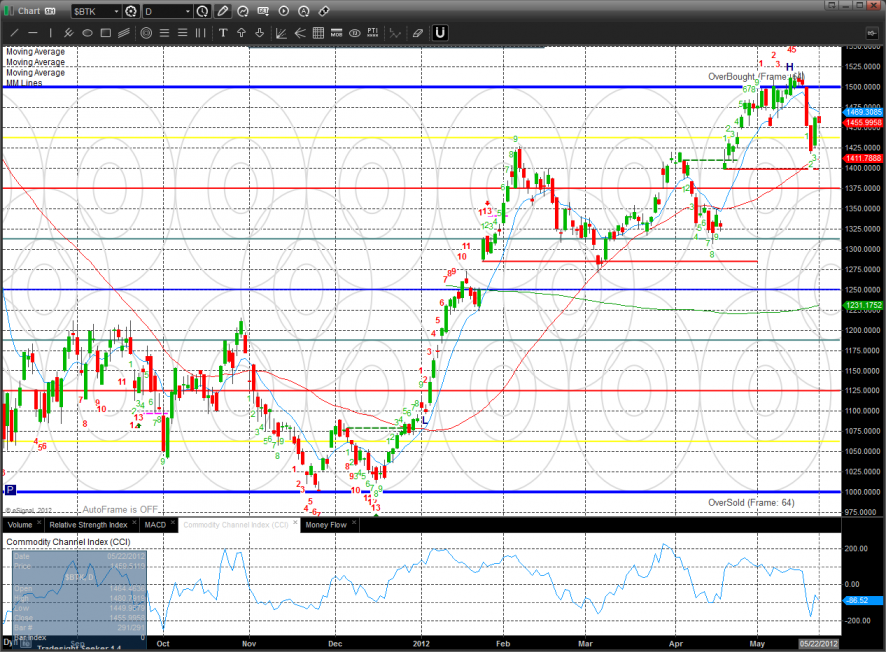

The BTK was lower on the day and should continue to find resistance at 1500.

Like the broad market the OSX hit the 10ema and failed.

The SOX was awful and the news from DELL won’t help tomorrow. Keep in mind that the chart is in the Gann oversold territory.

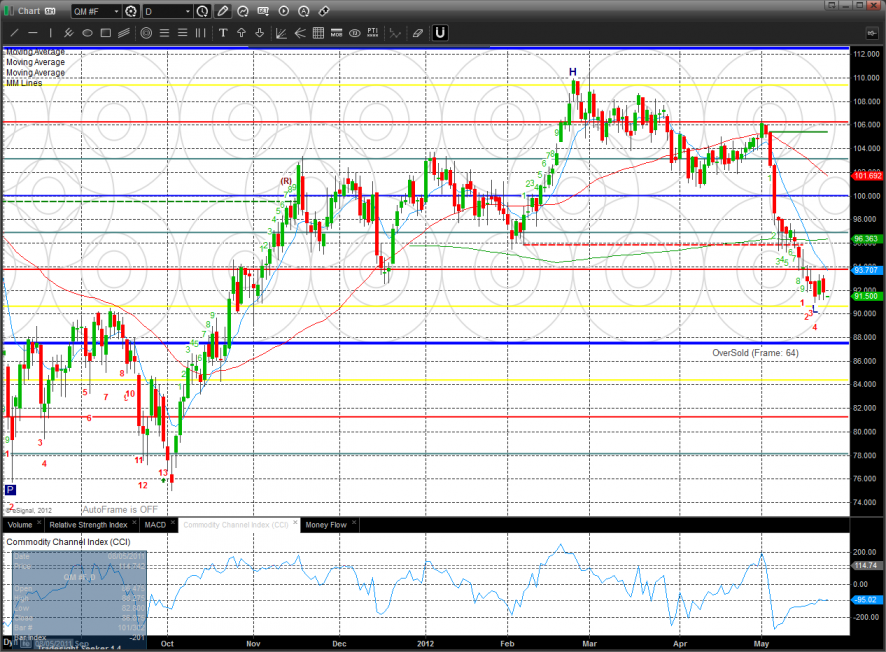

Oil:

Gold:

Silver:

Tradesight Market Preview for 5/23/12

The ES posted the measuring day that we were looking for. Price tested the 10ema, retreated and ultimately settled down 1 on the day. Wednesday is the important day to see if the bulls can build on Monday’s reversal candle.

The NQ futures posted exactly the same day with a slightly weaker close. The bulls will point to today’s range not breaking into the lower half of Monday’s range. The 10ema is the important level near-term.

The 10-day Trin still has over sold energy:

Multi sector daily chart:

The SOX/NDX cross continues to bearishly record lower lows. This has been a problem for the overall NDX and will continue to weigh on the market perhaps until we get closer to the release of MS Windows 8.

SPX vs. NDX relative chart shows that the NDX is hanging onto a very slight margin of relative strength in the daily time frame.

The BKX was the top gun on the day closing higher by a full percent.

The BTK was lower on the day and should continue to find resistance at 1500.

Like the broad market the OSX hit the 10ema and failed.

The SOX was awful and the news from DELL won’t help tomorrow. Keep in mind that the chart is in the Gann oversold territory.

Oil:

Gold:

Silver:

Stock Picks Recap for 5/22/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ANGI triggered short (without market support) and worked:

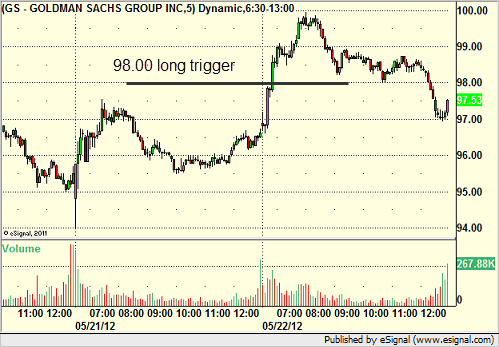

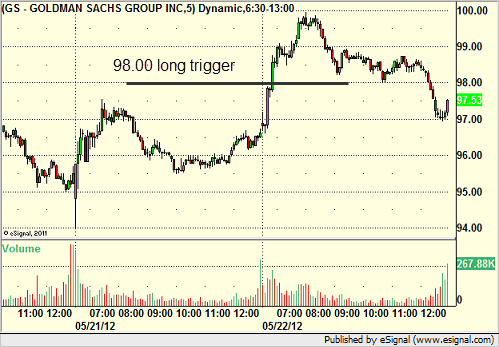

In the Messenger, Rich's GS triggered long (with market support) and worked:

His BBY triggered short (without market support) and didn't work:

His SHLD triggered long (with market support) and worked:

His VMW triggered short (with market support) and didn't work:

His CAT triggered short (without market support) and worked:

His NFLX triggered short (without market support) and worked great:

AAPL triggered short (with market support) and worked:

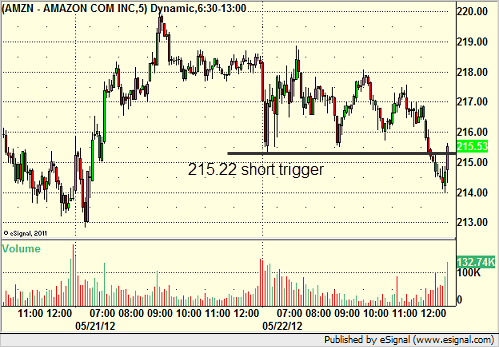

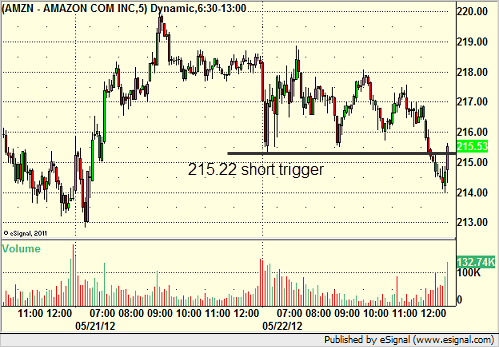

AMZN triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Stock Picks Recap for 5/22/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ANGI triggered short (without market support) and worked:

In the Messenger, Rich's GS triggered long (with market support) and worked:

His BBY triggered short (without market support) and didn't work:

His SHLD triggered long (with market support) and worked:

His VMW triggered short (with market support) and didn't work:

His CAT triggered short (without market support) and worked:

His NFLX triggered short (without market support) and worked great:

AAPL triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.