Futures Calls Recap for 5/22/12

Ended up with two trades that triggered after the market headed away from our short idea early, and both worked fine in the afternoon. See NQ and ES sections below.

Total ticks: +18 ticks.

Let's start by looking at the ES and NQ with our market directional tool, Seeker, and VWAP:

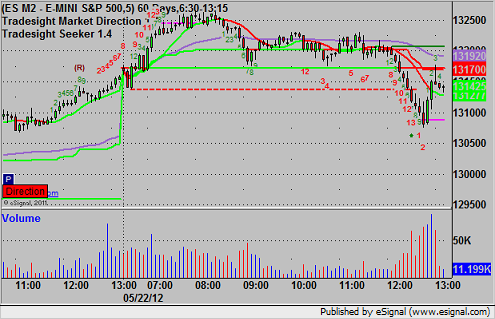

ES:

Mark's ES short triggered at A, hit first target at B for six ticks, and closed the final for 7 ticks as the session ran out of time at C:

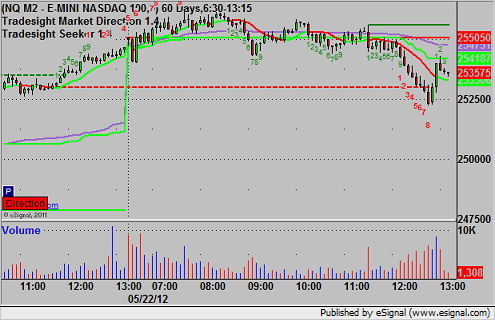

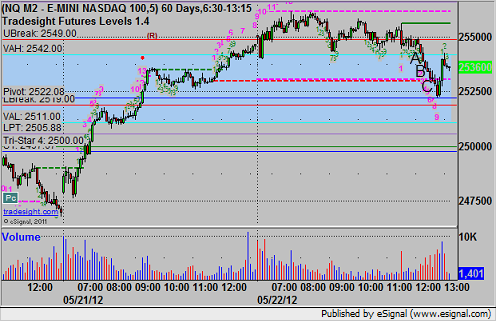

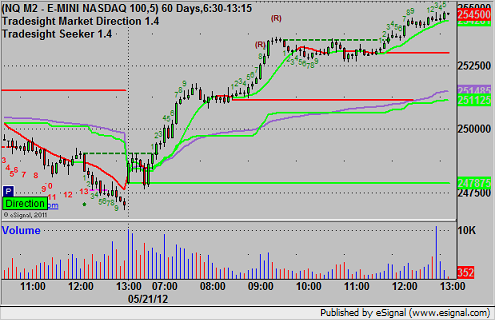

NQ:

We measure the NQ tick as half a point instead of the quarter point that the exchange uses as the half point equals $10 and makes more sense.

Triggered short under VAH at A in the afternoon, hit first target for 6 ticks at B and kept adjusting stop until we stopped out at C for about 17 ticks to that exit:

Forex Calls Recap for 5/22/12

Had a winning trade in EURUSD for the session, see that section below. Still holding the second half of the short.

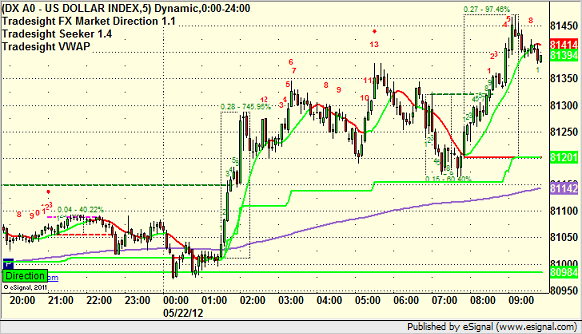

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

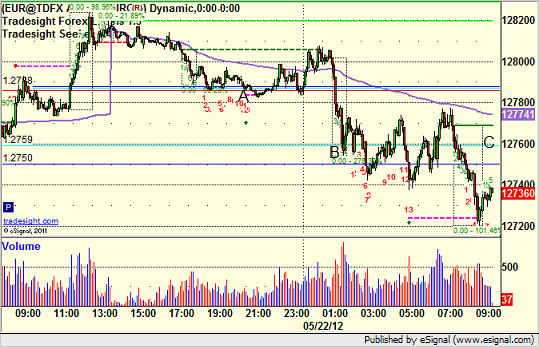

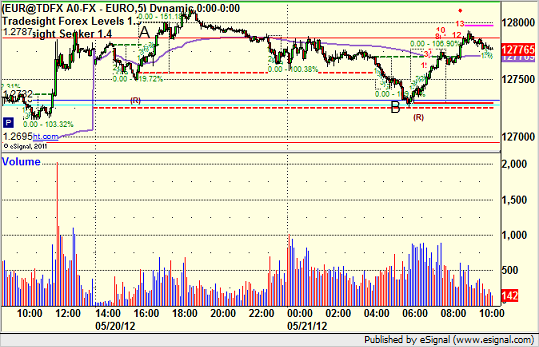

EURUSD:

Triggered short at A, never stopped, gave later chances to take the same entry, hit first target at B, currently holding second half short with a stop over VAL at C:

Tradesight Market Preview for 5/22/12

The ES took a turn for the better rallying 25 full handles on a fist day up. Note that price is still below the short term trend defining 10ema so expect a measuring day tomorrow.

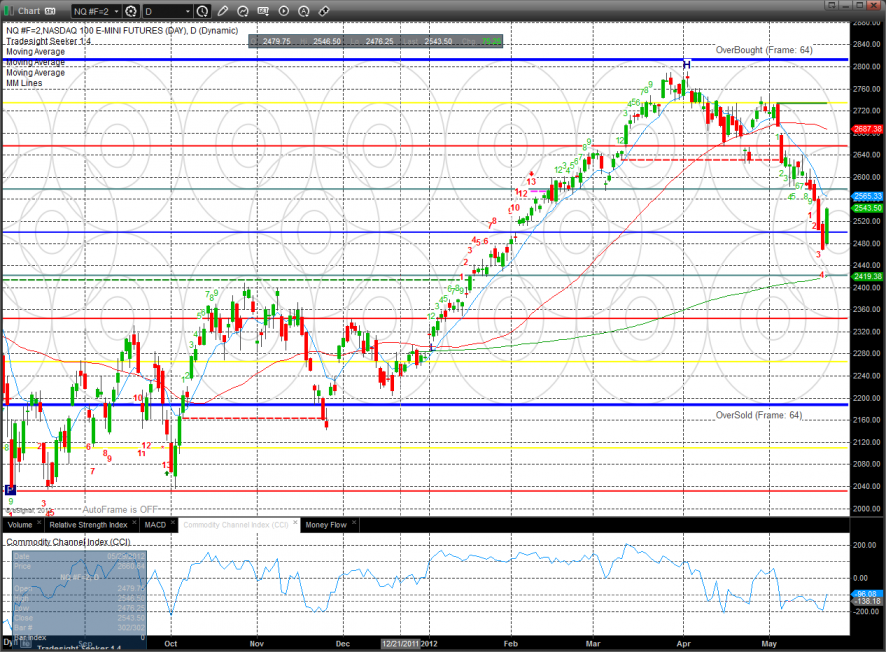

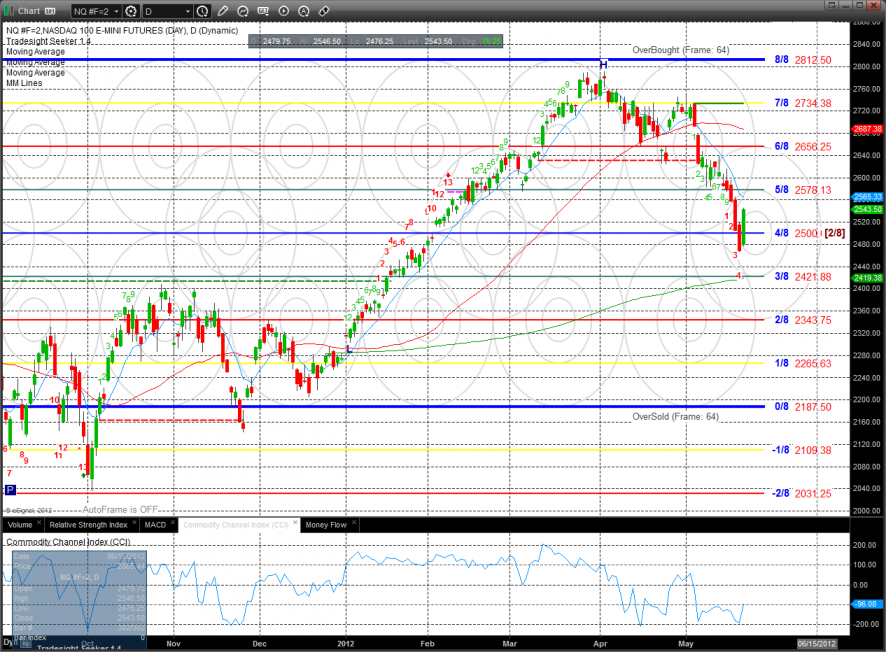

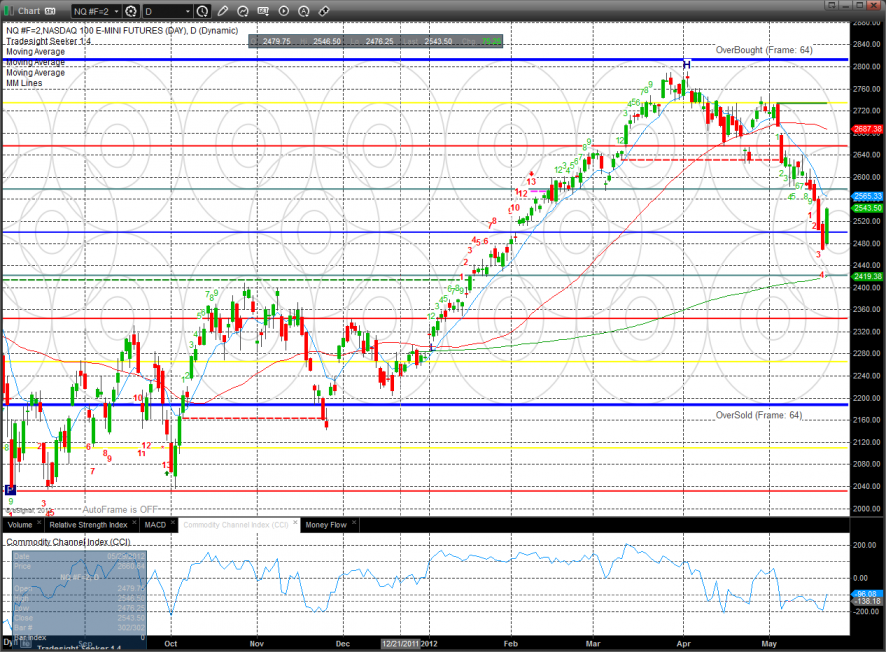

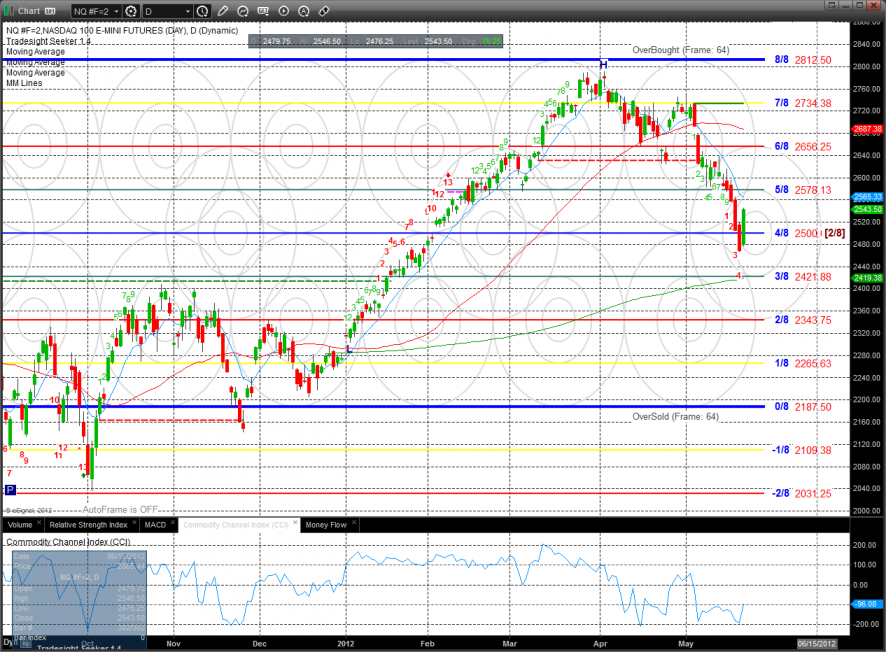

The NQ futures were higher by 75 and still have oversold energy for more upside. Target the 10ema for starters and then the 5/8 level which was the April low.

The 10-day Trin has retreated to neutral territory but still has energy loaded in it for more upside.

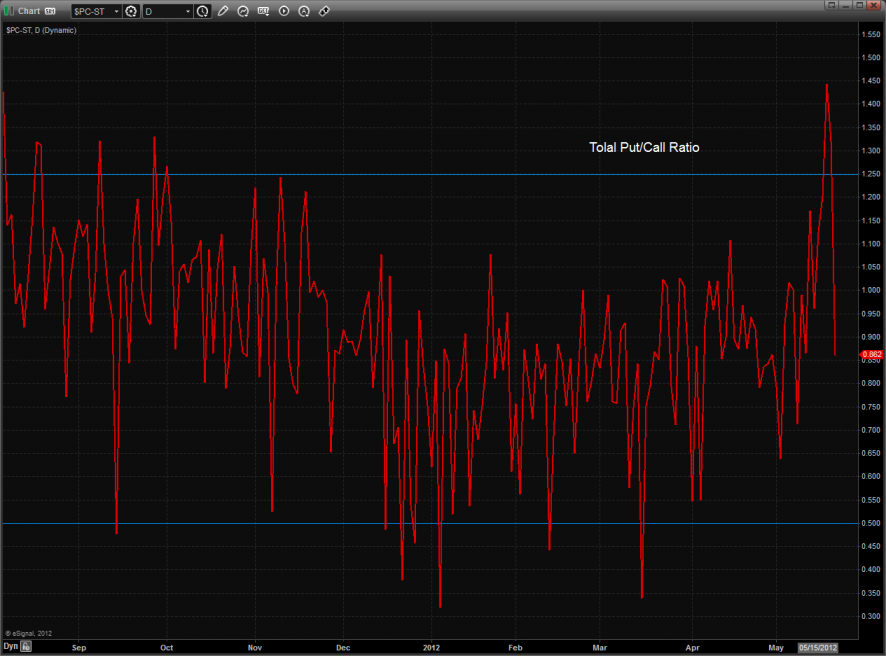

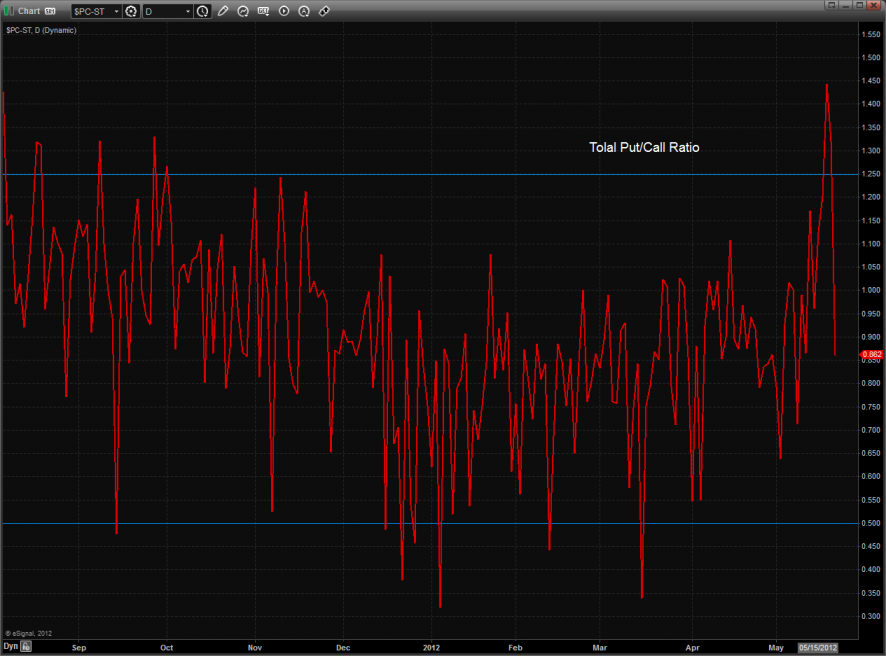

The total put/call ratio recorded a climatically bearish reading late last week which is loaded the market with reversal potential.

Multi sector daily chart:

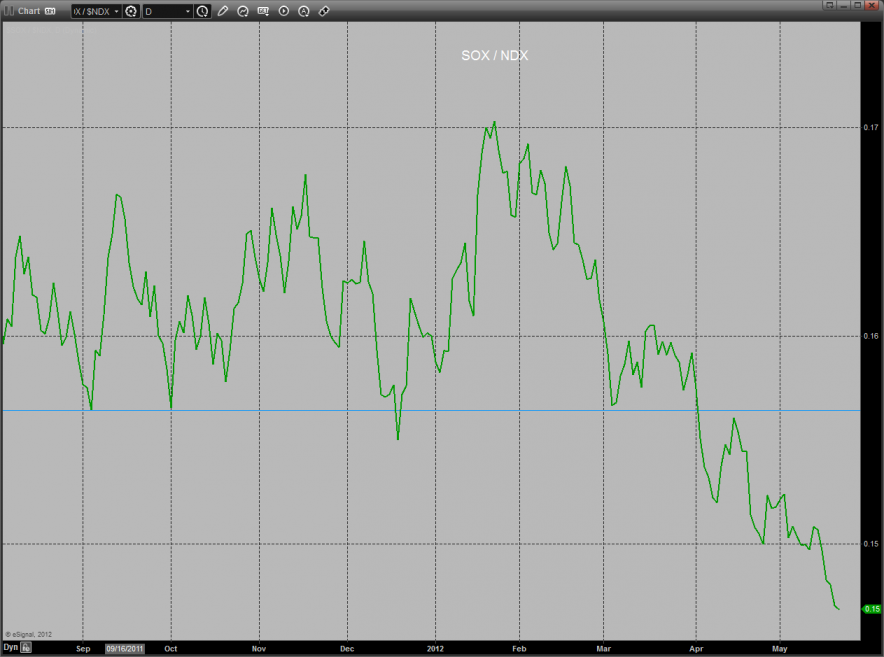

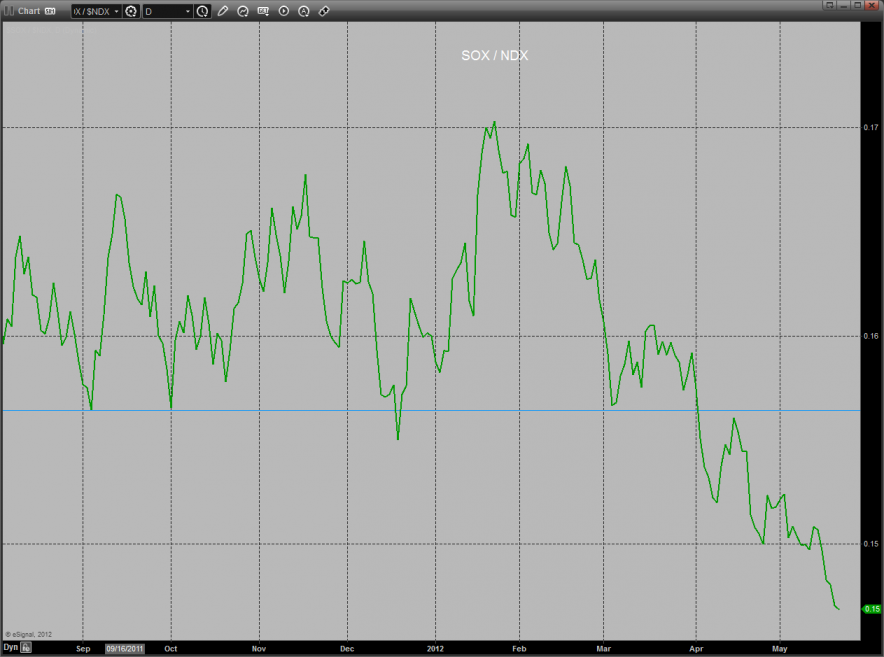

The SOX/NDX cross continues to bearishly bleed.

The OSX was the top gun on the day up almost 4% so expect a measuring day. If price continues higher after the pause then the 10ema and 4/8 level will come into play.

The XAU was also up big and since price closed back above the 10ema it is now in a short term up trend.

The BTK was stronger than the Naz but it doesn’t have the oversold energy that the other indexes have. Expect stiff resistance at the 8/8 level.

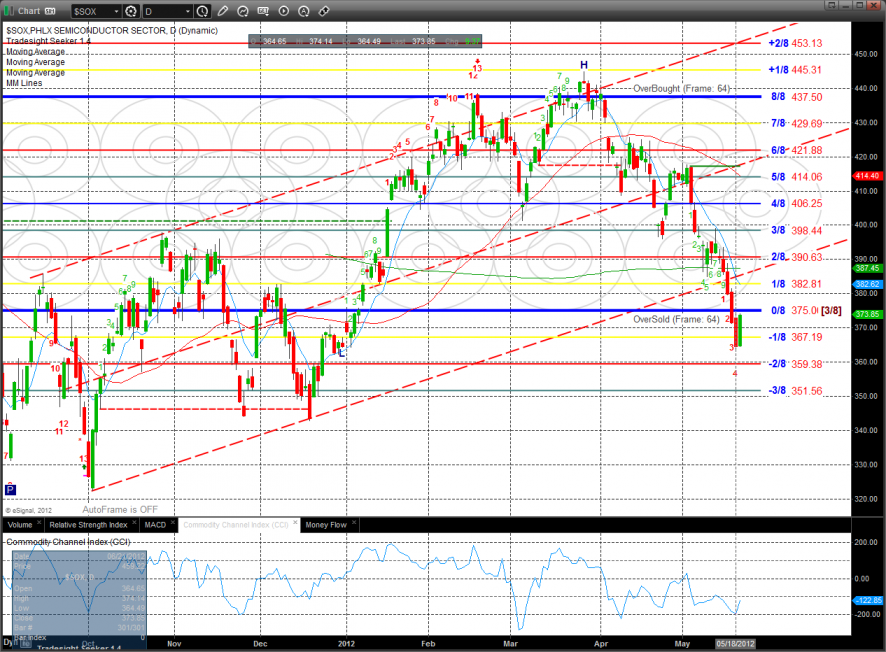

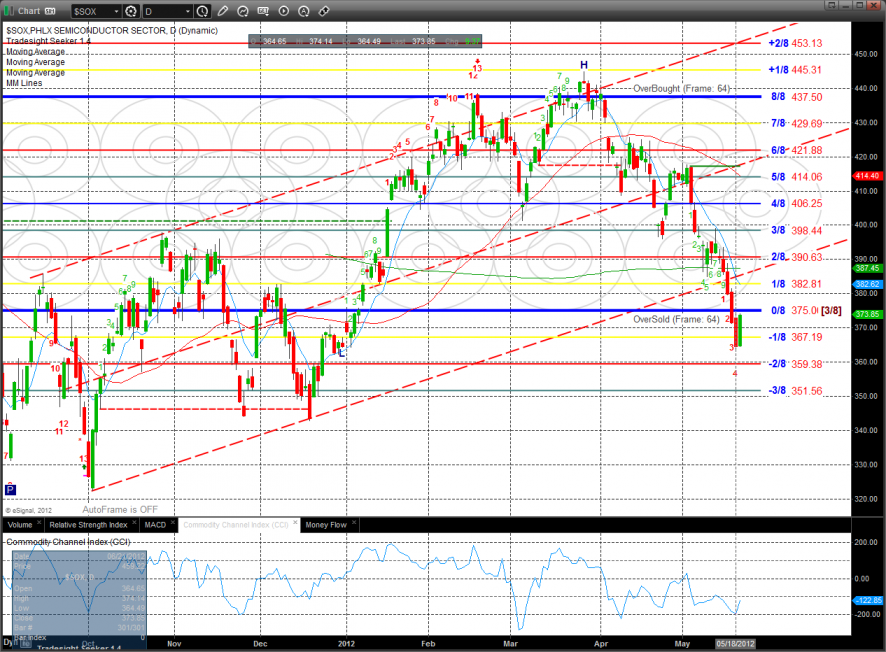

The SOX bearishly lagged the performance of the overall Naz. Expect failure at the lower trend channel.

The BKX was the last laggard and is still technically broken.

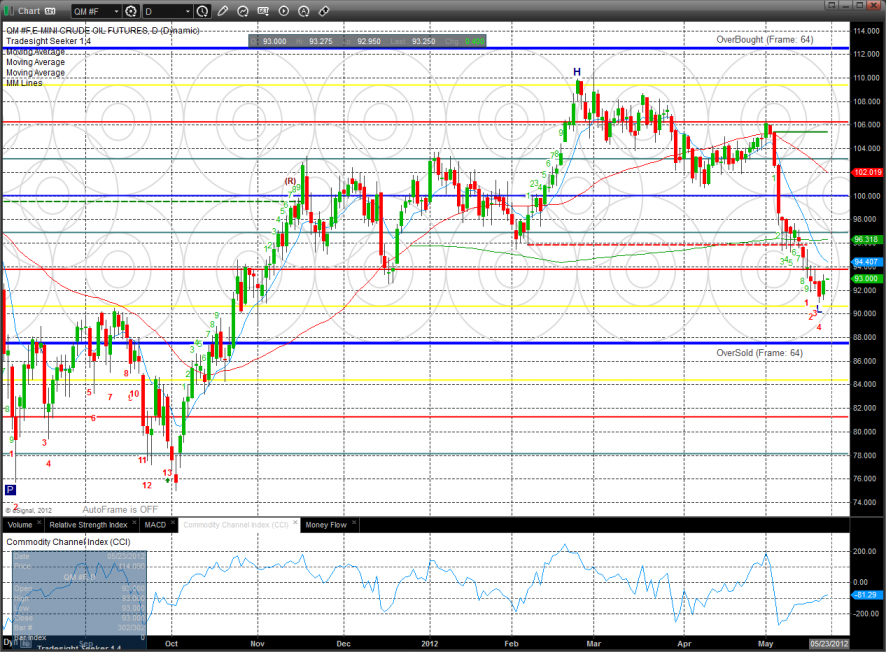

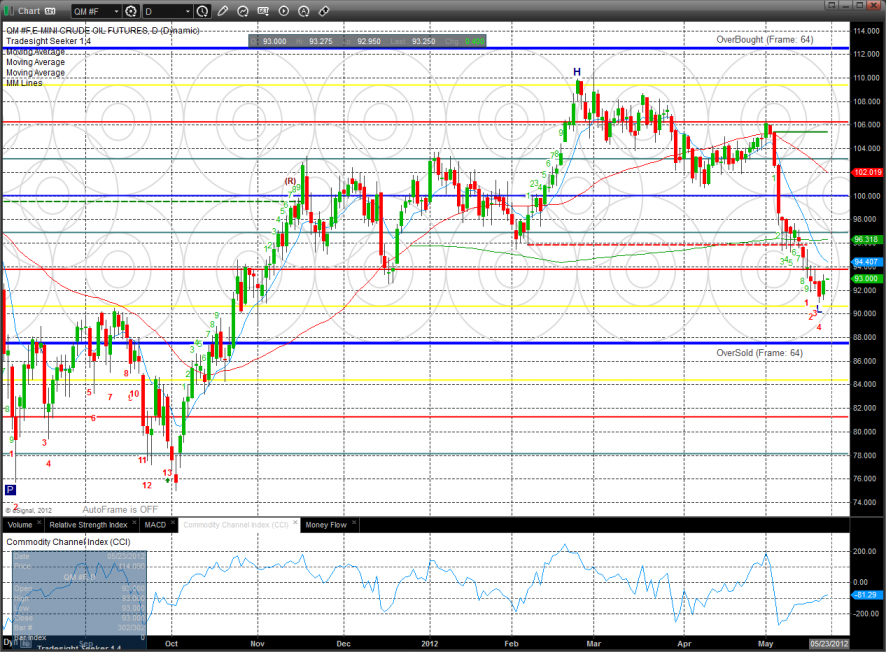

Oil:

Gold:

Silver:

Tradesight Market Preview for 5/22/12

The ES took a turn for the better rallying 25 full handles on a fist day up. Note that price is still below the short term trend defining 10ema so expect a measuring day tomorrow.

The NQ futures were higher by 75 and still have oversold energy for more upside. Target the 10ema for starters and then the 5/8 level which was the April low.

The 10-day Trin has retreated to neutral territory but still has energy loaded in it for more upside.

The total put/call ratio recorded a climatically bearish reading late last week which is loaded the market with reversal potential.

Multi sector daily chart:

The SOX/NDX cross continues to bearishly bleed.

The OSX was the top gun on the day up almost 4% so expect a measuring day. If price continues higher after the pause then the 10ema and 4/8 level will come into play.

The XAU was also up big and since price closed back above the 10ema it is now in a short term up trend.

The BTK was stronger than the Naz but it doesn’t have the oversold energy that the other indexes have. Expect stiff resistance at the 8/8 level.

The SOX bearishly lagged the performance of the overall Naz. Expect failure at the lower trend channel.

The BKX was the last laggard and is still technically broken.

Oil:

Gold:

Silver:

Stock Picks Recap for 5/21/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IACI triggered short (without market support due to opening 5 minutes) and worked:

CREE triggered short (without market support) and worked enough for a partial:

In the Messenger, Mark's MXIM triggered short (without market support) and didn't work:

His SYNA triggered short (without market support) and worked enough for a partial:

Rich's GOOG triggered long (with market support) and worked great:

AMZN triggered short (with market support for that one bar) and didn't work:

Rich's GDX triggered long (ETF, so no market support needed) and worked:

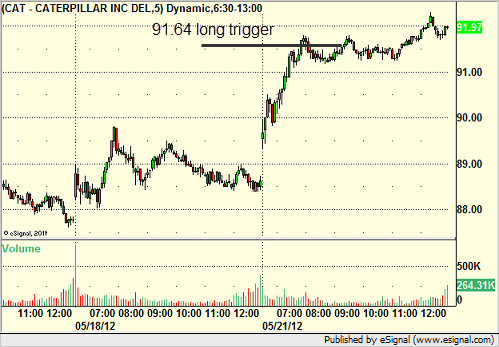

His CAT triggered long (with market support) and didn't work:

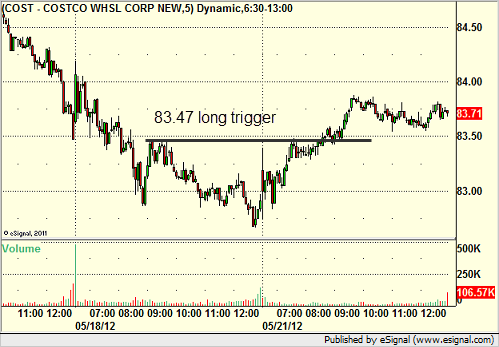

COST triggered long (with market support) and worked:

Rich's WYNN triggered long (with market support) and didn't work:

His AAPL triggered long (with market support) and worked big:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Futures Calls Recap for 5/21/12

A nice run in the futures trade with a clean trigger that ran well on the ES. See that section below for the recap.

Net ticks: +14.

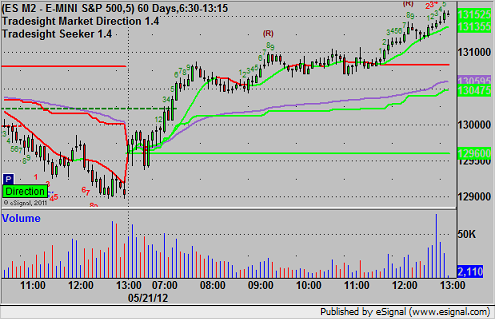

First, let's look at the ES and NQ with market directional, VWAP, and Seeker:

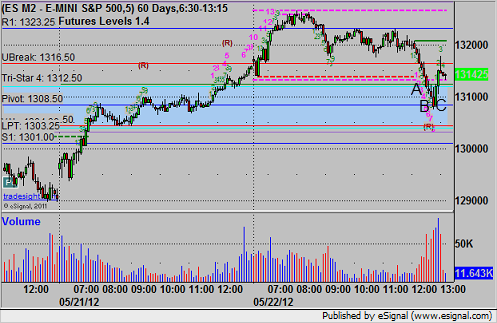

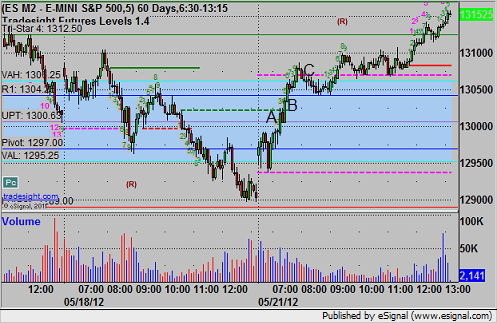

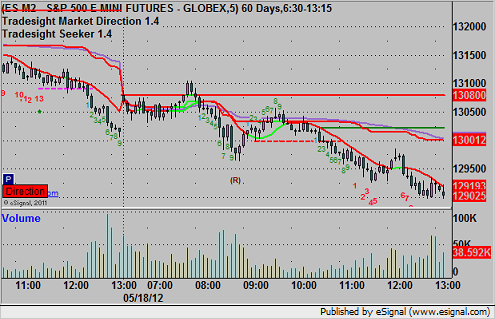

ES:

Triggered long over our UPT level at A, sold half for 6 ticks at B, raised the stop several times and stopped at C for 22 ticks on the second half:

Forex Calls Recap for 5/21/12

Two half size losing trades to start the week as the market went nowhere. See EURUSD below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long very early (half size) at A and stopped. Triggered only part of the trade short at B under our order staggering rules and stopped:

Stock Picks Recap for 5/18/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EBAY triggered short (with market support) and worked:

In the Messenger, OIH triggered short (ETF, so no market support needed) and worked enough for a partial:

Rich's ONXX triggered short (with market support) and worked enough for a partial:

Rich's LNKD triggered short (with market support) and worked:

His GOOG triggered short (with market support) and worked great:

In total, that's 5 trades triggering with market support, all 5 of them worked, GOOG huge, which is pretty nice for an options expiration Friday.

Futures Calls Recap for 5/18/12

We weren't expecting much for options expiration. Ended up with a winner in the ES and a loser in the NQ, but no continuation on the winner. See those sections below.

Net ticks: -4.5.

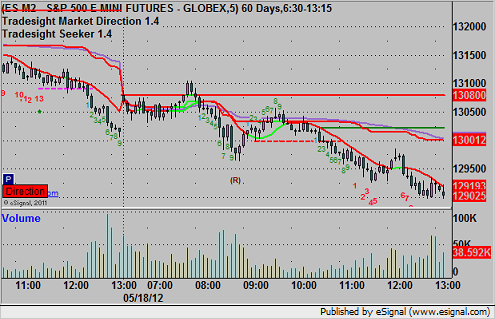

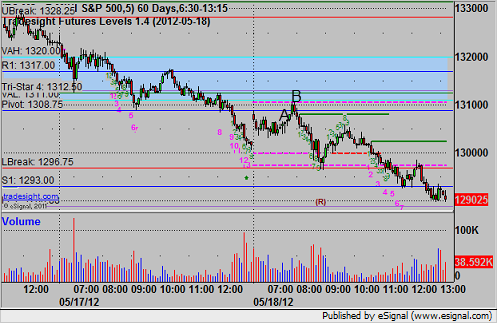

We'll start by looking at the ES and NQ with our market directional tools, Seeker, and VWAP:

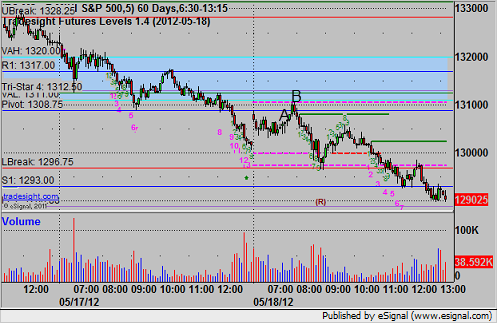

ES:

Triggered long at A, hit first target at B, raised stop under entry and stopped second half:

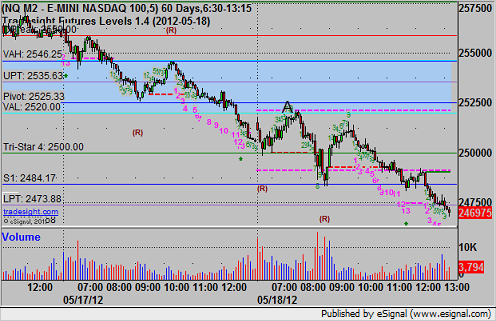

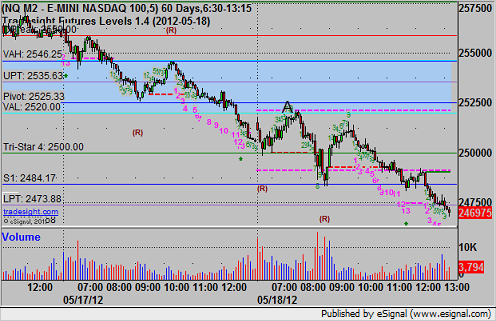

NQ:

Triggered long at A and stopped for 7 tick loss:

Futures Calls Recap for 5/18/12

We weren't expecting much for options expiration. Ended up with a winner in the ES and a loser in the NQ, but no continuation on the winner. See those sections below.

Net ticks: -4.5.

We'll start by looking at the ES and NQ with our market directional tools, Seeker, and VWAP:

ES:

Triggered long at A, hit first target at B, raised stop under entry and stopped second half:

NQ:

Triggered long at A and stopped for 7 tick loss: