Forex Calls Recap for 5/18/12

Loser and a winner to close out the week in the EURUSD. See that section below. New calls and Chat Sunday for the new week.

As usual on the Sunday report, we will look at the action on Thursday night/Friday, then look at the daily charts with the Seeker and Comber separately (some Comber 13 signals getting close), and then look at the US Dollar Index.

Here's the index intraday with our market directional lines:

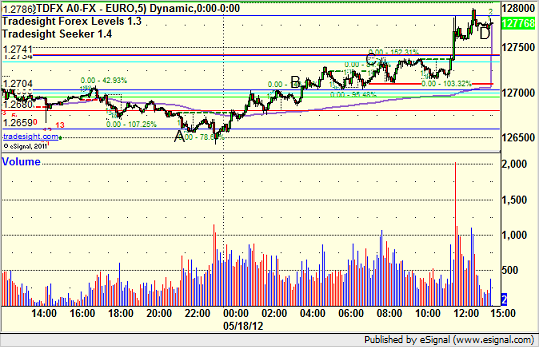

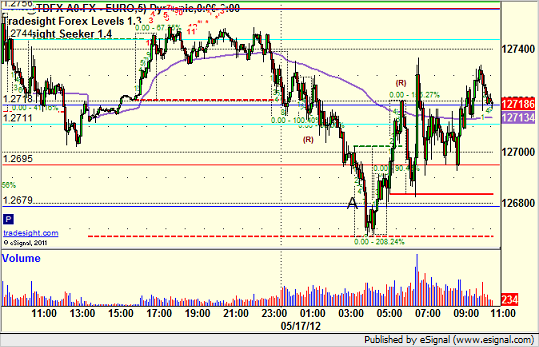

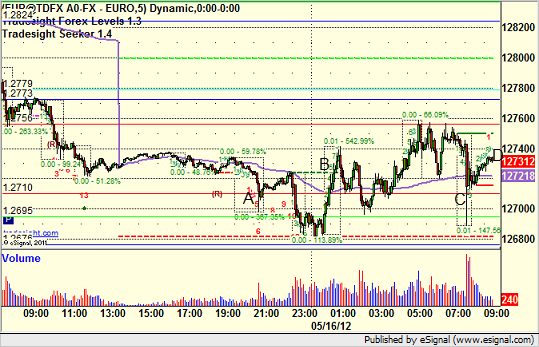

EURUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, should have closed out at D for end of week:

Stock Picks Recap for 5/17/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

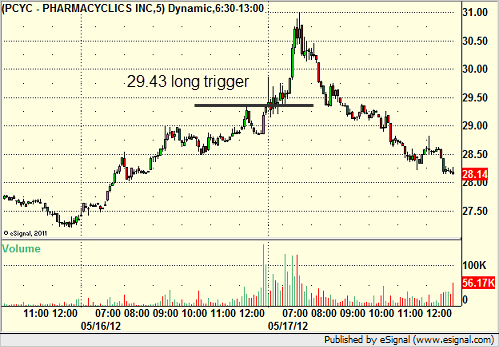

From the report, PCYC triggered long (without market support due to opening 5 minutes) and worked enough for a partial if you were quick, and worked more later, but doesn't count anyway due to opening 5 minute trigger):

IDIX triggered long (with market support) and didn't work:

NVLS triggered short (with market support) and worked:

LULU triggered short (with market support) and worked:

In the Messenger, Rich's SHLD triggered long (without market support due to opening 5 minutes) and didn't work:

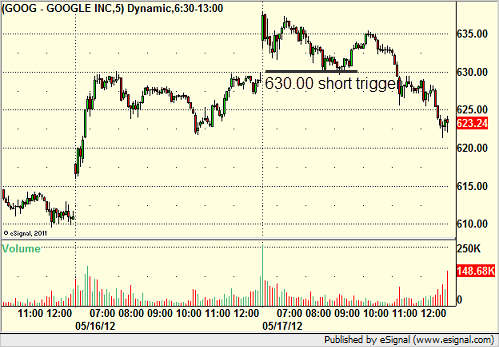

His GOOG triggered short (with market support) and didn't work:

His AMZN triggered short (with market support) and worked:

His DE triggered short (with market support) and worked:

AAPL triggered short (with market support) and worked great:

Rich's LULU triggered short (with market support) and didn't work:

His FAS triggered short (ETF, so no market support needed) and worked:

In total, that's 9 trades triggering with market support, 6 of them worked, 3 did not.

Futures Calls Recap for 5/17/12

A much better session for futures trading, although the morning was where the action was and volume dipped for the afternoon. We had a winner in both the ES and NQ, see those sections below.

Net ticks: +10.5

Let's start by looking at the ES and NQ with our market directional tool, VWAP, and the Tradesight Seeker:

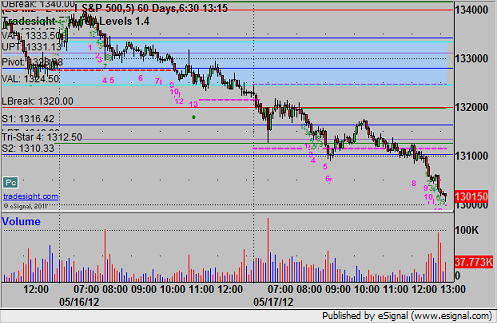

ES:

ES triggered short at A, hit first target in that bar at B, lowered stop over entry and stopped out in the next bar:

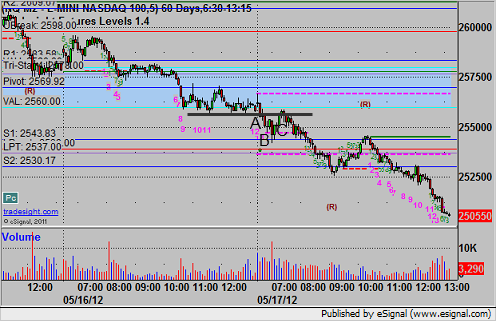

NQ:

We consider a tick on the NQ half a point instead of every quarter point.

Triggered short at A, came within a tick of the first target, then a tick of the stop, and then hit the first target at B, lowered stop twice and stopped out at C:

Forex Calls Recap for 5/17/12

A stop out in a new EURUSD call, but our GBPUSD short from the last two days finally stopped out 250 pips in the money. See both sections below.

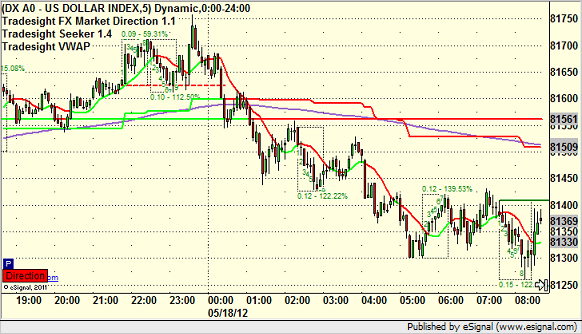

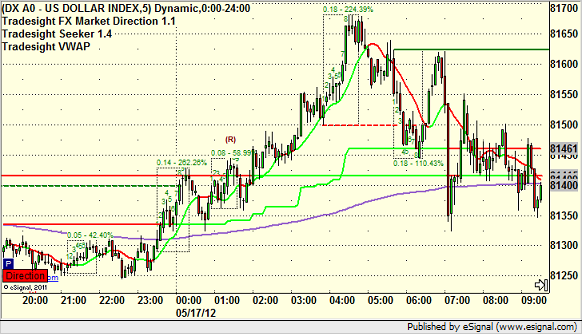

Here's the US Dollar Index intraday with market directional lines:

New calls and Chat tonight, options expiration tomorrow.

EURUSD:

Triggered short at A and stopped:

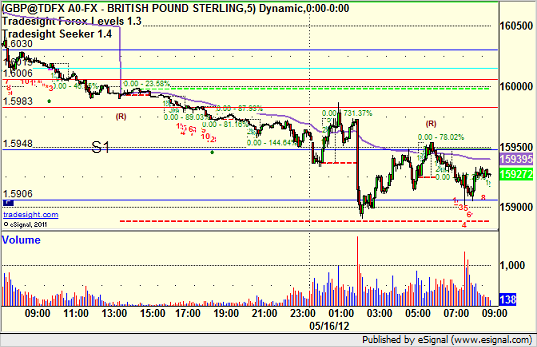

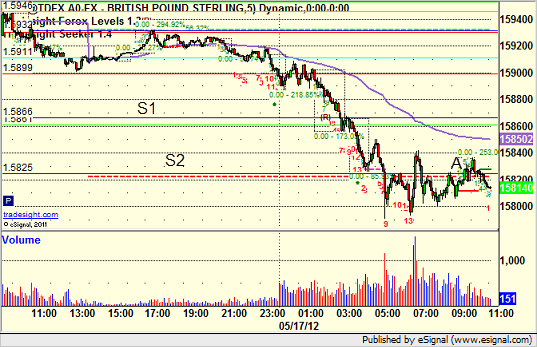

GBPUSD:

Lowered stop two more times on the GBPUSD and finally stopped over S2 at A for a 250 pip gain from the call earlier in the week:

Tradesight Market Preview for 5/17/12

The ES made a new low on the move losing 6 on the day. Next support is the 2/8 Gann level.

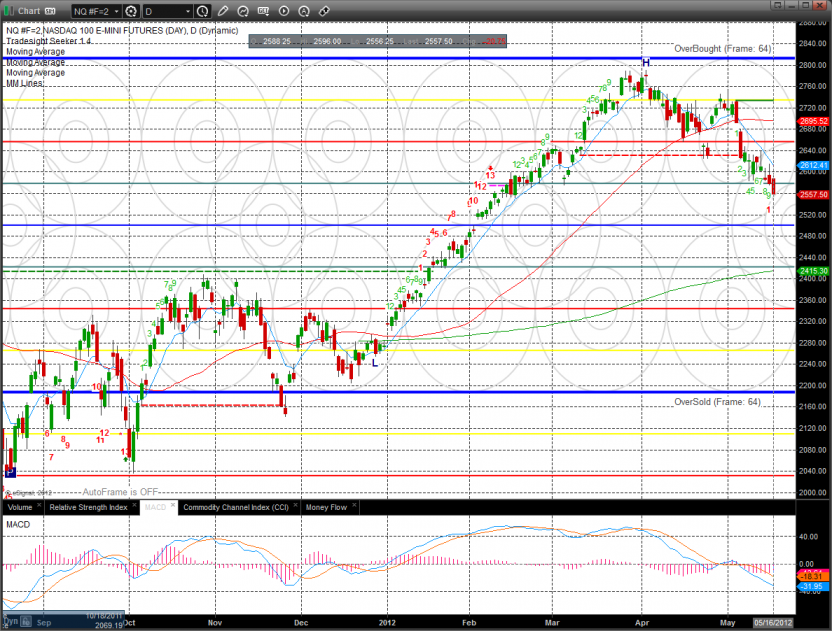

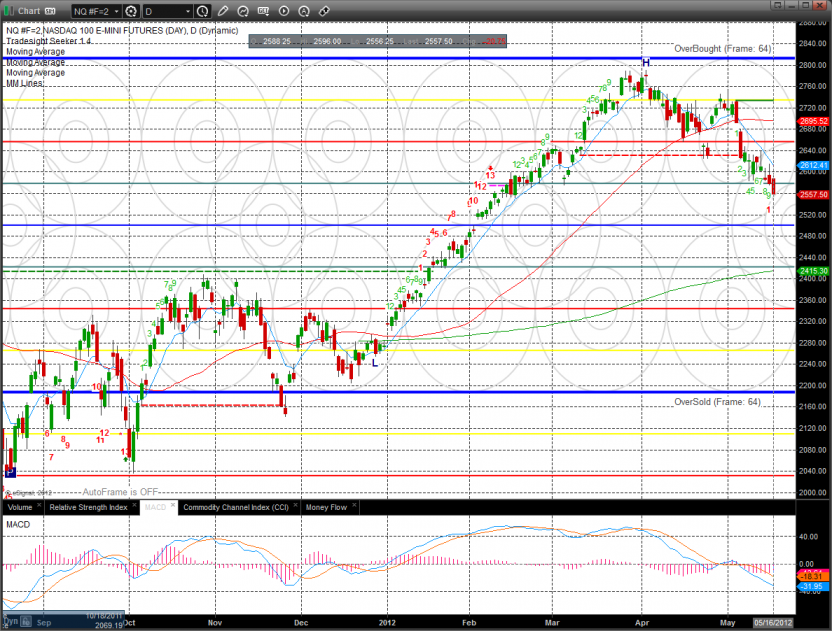

The NQ futures broke to new lows losing 21 on the day. Both the ES and NQ have down side CPS candles from today’s session.

10-day Trin:

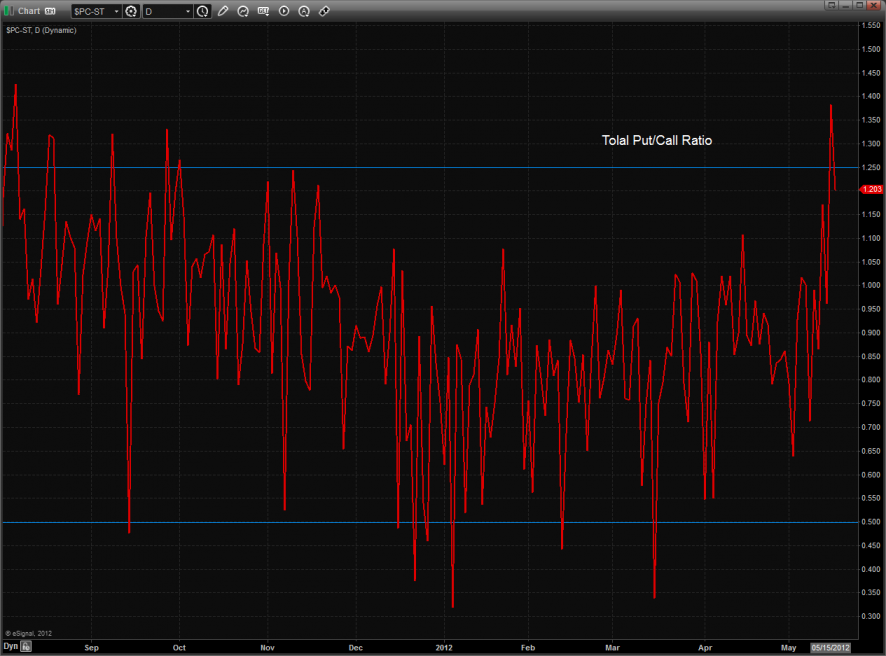

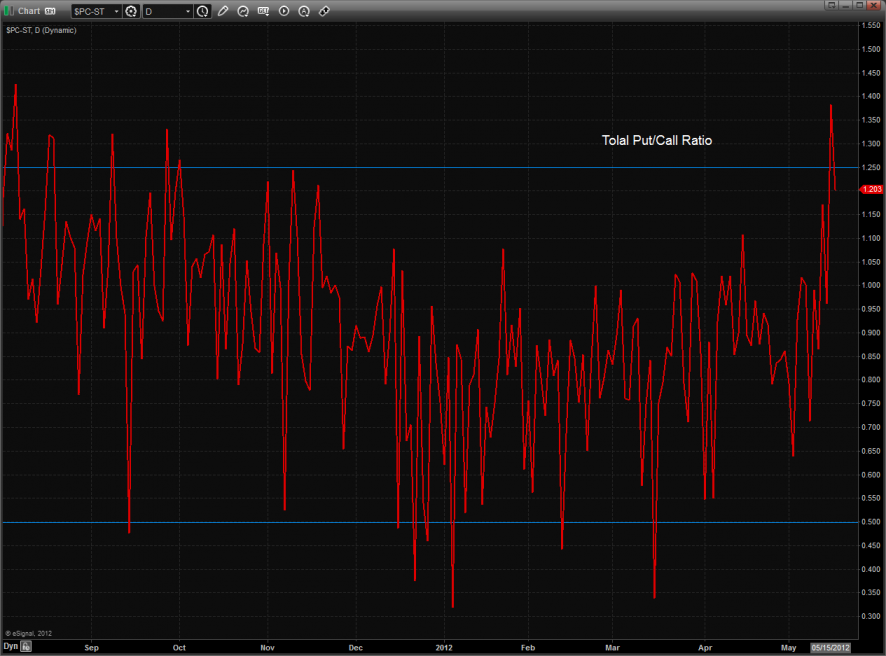

The total put/call ratio now has a climatic spike in place:

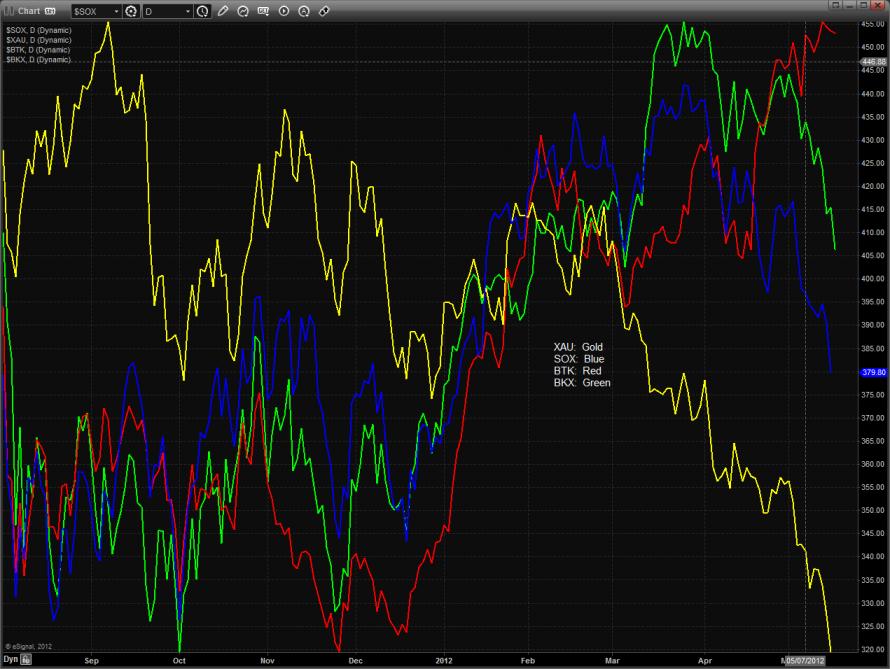

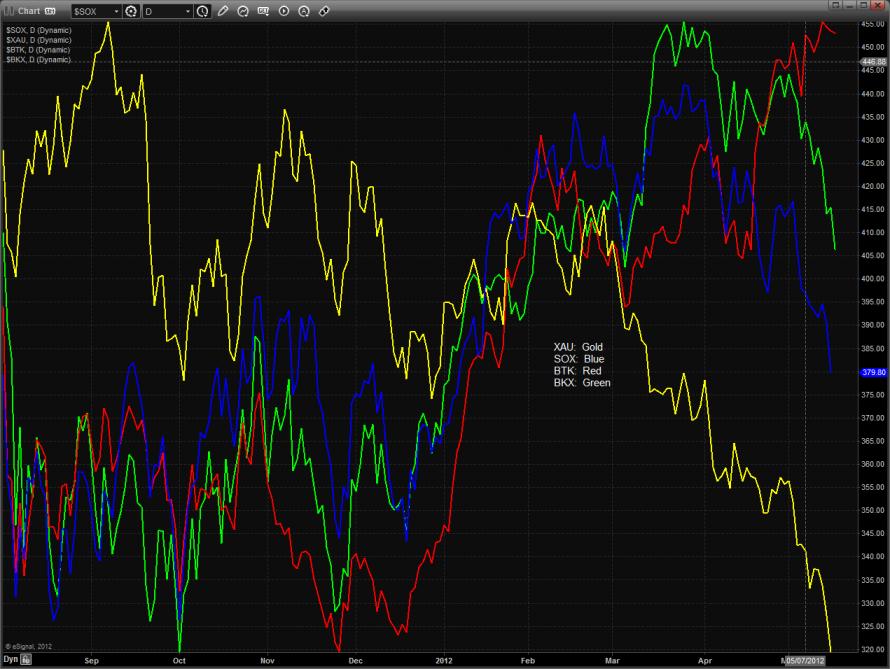

Multi sector daily chart:

The XAU was the top gun on the day and the only major sector up on the day. The eSignal below is wrong as they often are.

The BTK was relatively strong and is still glued to the 8/8 level.

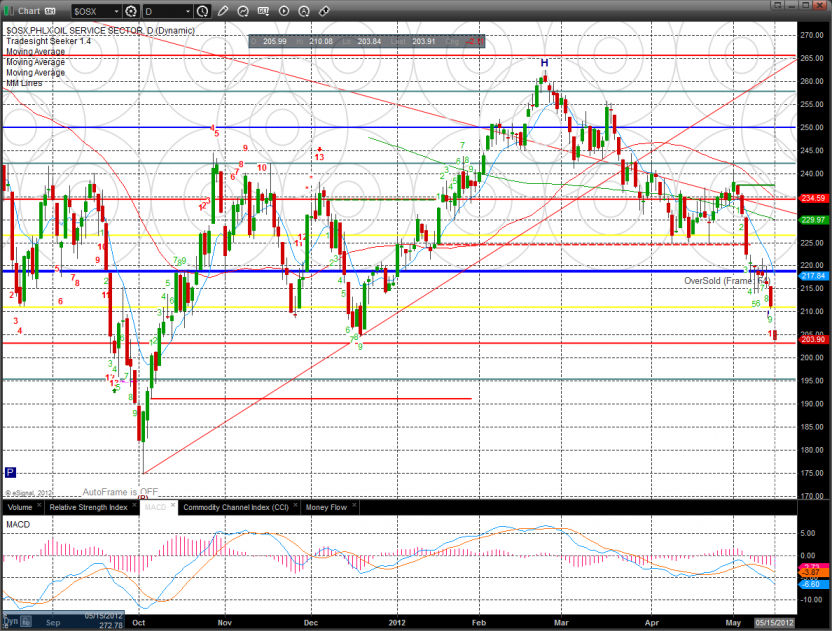

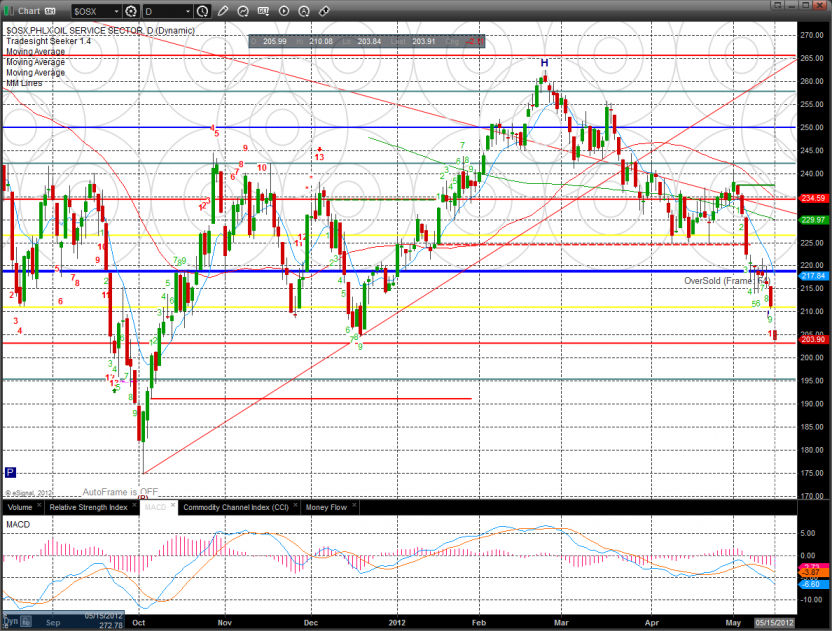

The OSX made a new low and is hovering just above the critical -2/8 level. Keep in mind that a frame shift would be very bearish.

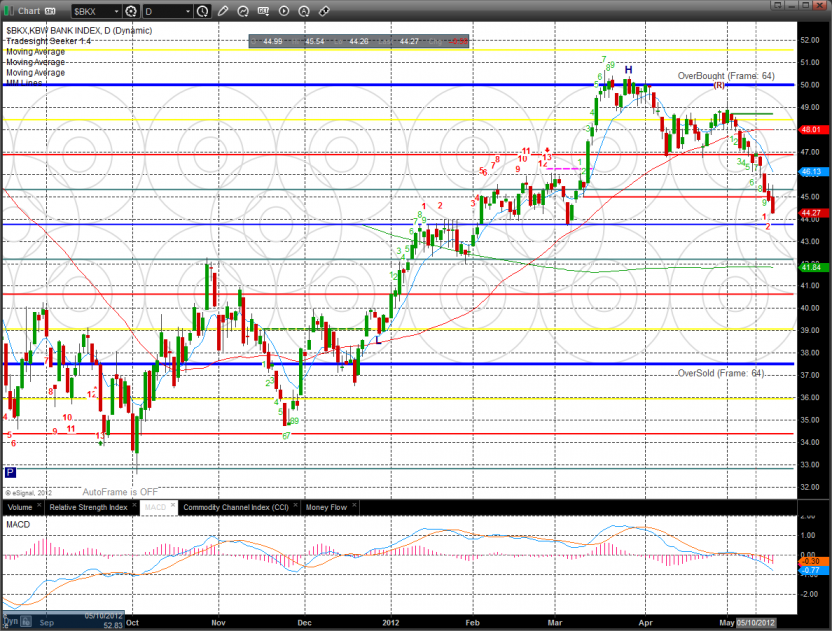

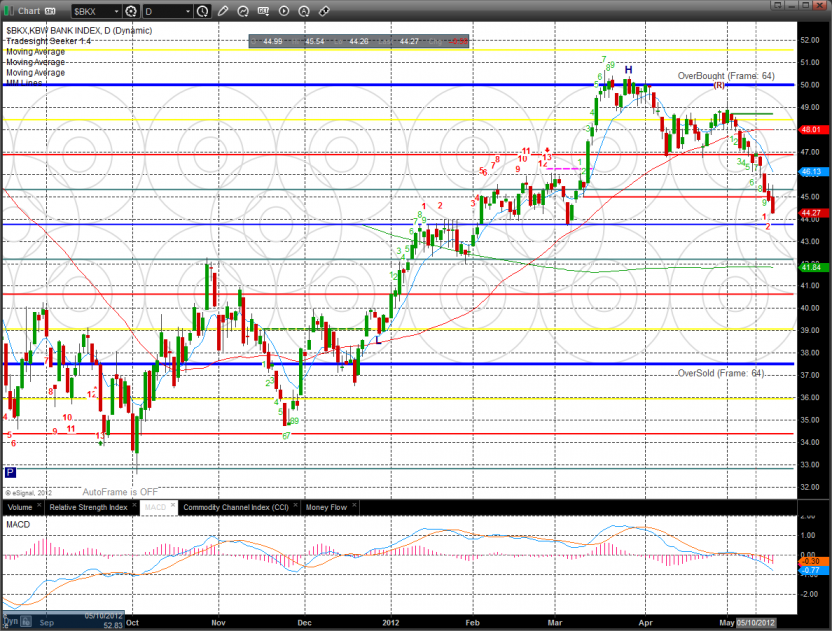

The BKX continues to retreat and should find important support at the 4/8 level just below 44.

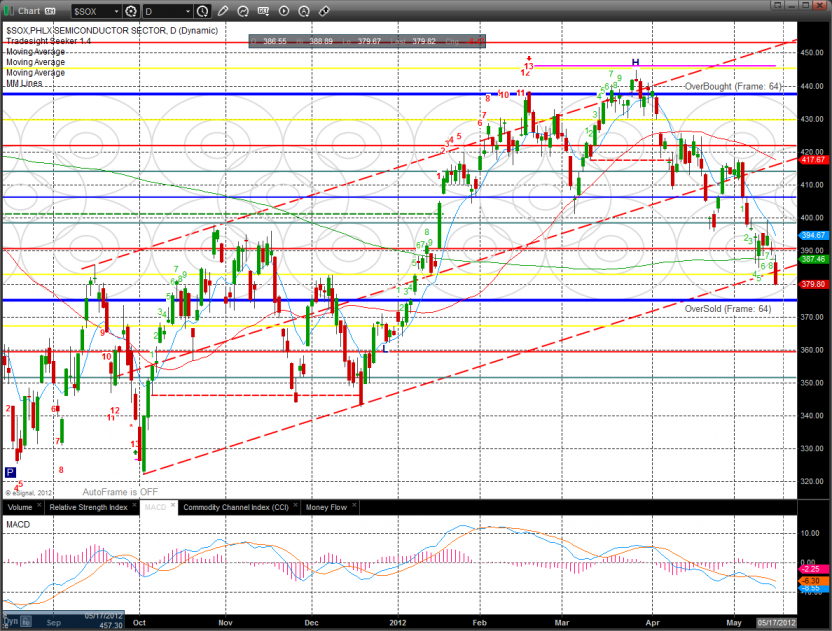

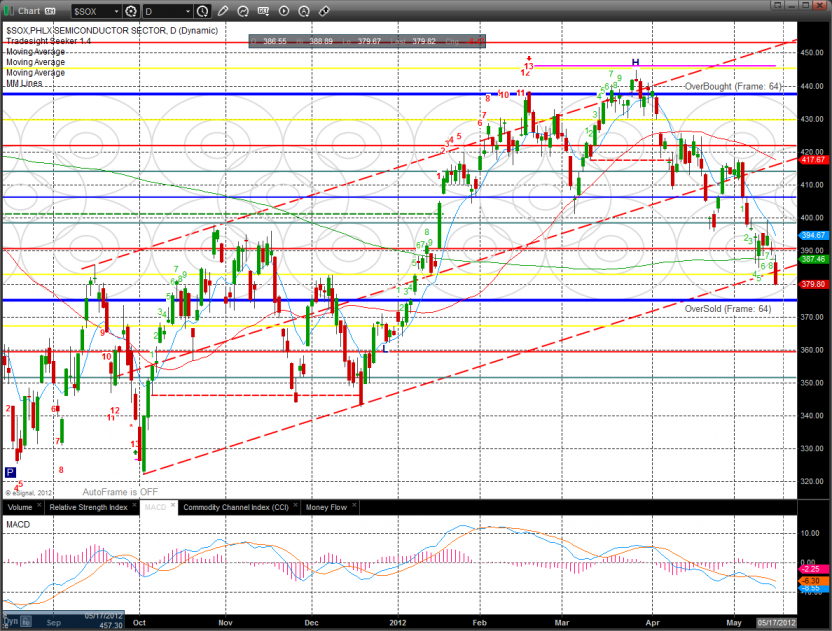

The SOX settled below the 200dma and also the lower channel boundary. The pattern is just now 9 days down so there could be some lateral or retracement activity soon.

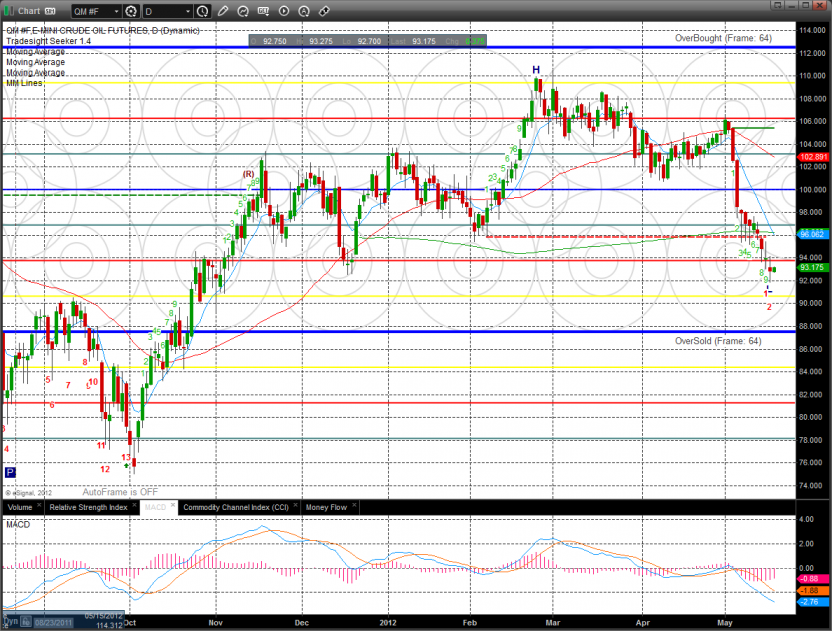

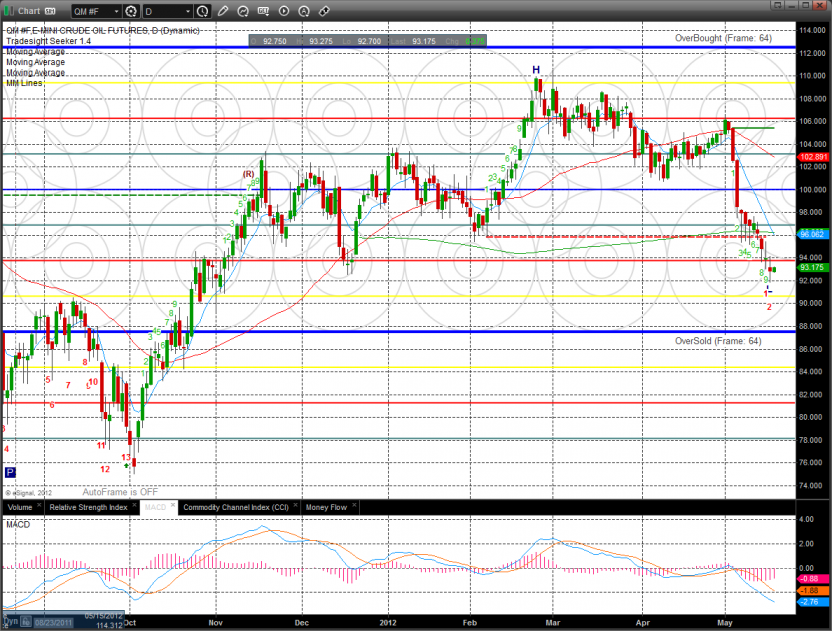

Oil:

Gold:

Silver

Tradesight Market Preview for 5/17/12

The ES made a new low on the move losing 6 on the day. Next support is the 2/8 Gann level.

The NQ futures broke to new lows losing 21 on the day. Both the ES and NQ have down side CPS candles from today’s session.

10-day Trin:

The total put/call ratio now has a climatic spike in place:

Multi sector daily chart:

The XAU was the top gun on the day and the only major sector up on the day. The eSignal below is wrong as they often are.

The BTK was relatively strong and is still glued to the 8/8 level.

The OSX made a new low and is hovering just above the critical -2/8 level. Keep in mind that a frame shift would be very bearish.

The BKX continues to retreat and should find important support at the 4/8 level just below 44.

The SOX settled below the 200dma and also the lower channel boundary. The pattern is just now 9 days down so there could be some lateral or retracement activity soon.

Oil:

Gold:

Silver

Stock Picks Recap for 5/16/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BMRN gapped over, no play.

ISIS triggered long (with market support) and didn't go enough in either direction to count:

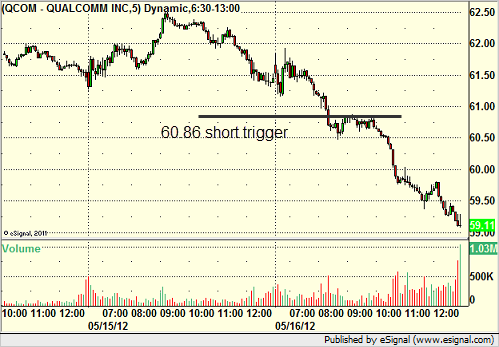

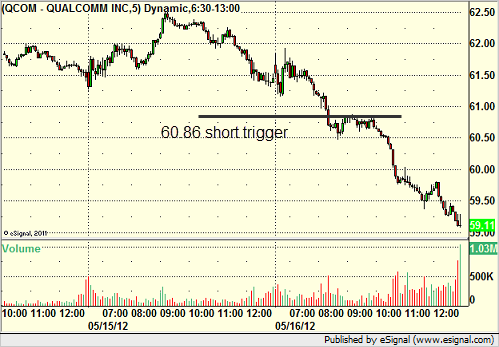

QCOM triggered short (with market support) and worked great:

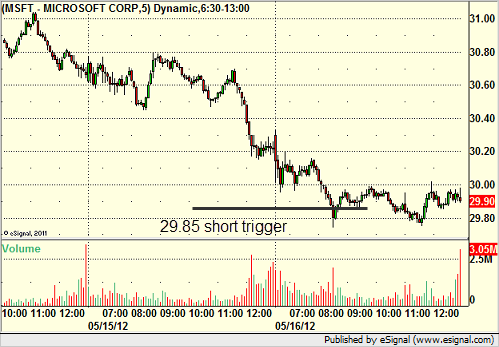

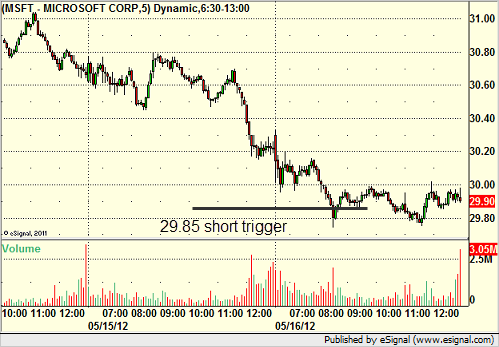

MSFT triggered short (with market support) and didn't work (I don't usually list MSFT anymore because it rarely goes anywhere, and this was no exception):

SBUX triggered short (with market support) and didn't work:

In the Messenger, Mark's ENDP triggered short (without market support due to opening 5 minutes) and worked quickly:

Rich's GS triggered short (with market support) and didn't work initially, worked later:

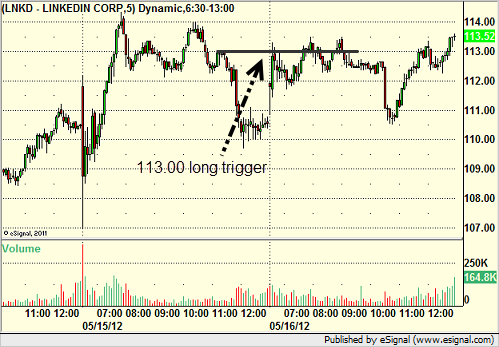

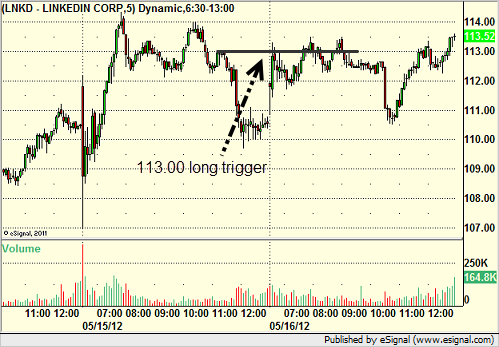

Rich's LNKD triggered long (without market support) and didn't work:

His GOOG triggered long (without market support) and worked great:

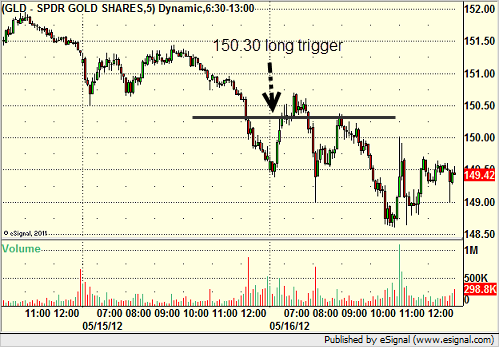

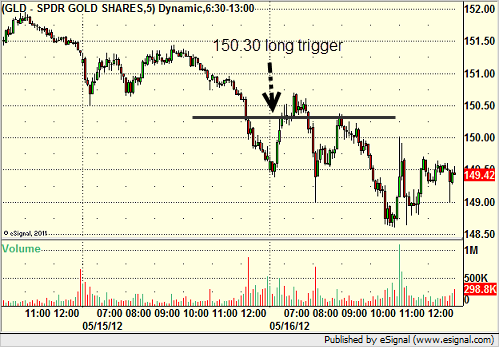

His GLD triggered long (ETF, so no market support needed) and worked enough for a partial:

His WYNN triggered long (with market support) and didn't work:

His DE triggered short (with market support) and worked:

His JCP triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked:

AAPL triggered short (with market support) and worked:

In total, that's 10 trades triggering with market support, 6 of them worked, 4 did not, and several of the winners ran big.

Stock Picks Recap for 5/16/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BMRN gapped over, no play.

ISIS triggered long (with market support) and didn't go enough in either direction to count:

QCOM triggered short (with market support) and worked great:

MSFT triggered short (with market support) and didn't work (I don't usually list MSFT anymore because it rarely goes anywhere, and this was no exception):

SBUX triggered short (with market support) and didn't work:

In the Messenger, Mark's ENDP triggered short (without market support due to opening 5 minutes) and worked quickly:

Rich's GS triggered short (with market support) and didn't work initially, worked later:

Rich's LNKD triggered long (without market support) and didn't work:

His GOOG triggered long (without market support) and worked great:

His GLD triggered long (ETF, so no market support needed) and worked enough for a partial:

His WYNN triggered long (with market support) and didn't work:

His DE triggered short (with market support) and worked:

His JCP triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked:

AAPL triggered short (with market support) and worked:

In total, that's 10 trades triggering with market support, 6 of them worked, 4 did not, and several of the winners ran big.

Futures Calls Recap for 5/16/12

Another really choppy morning on the futures. Everything was in the ES.

Net ticks: -18 1/2.

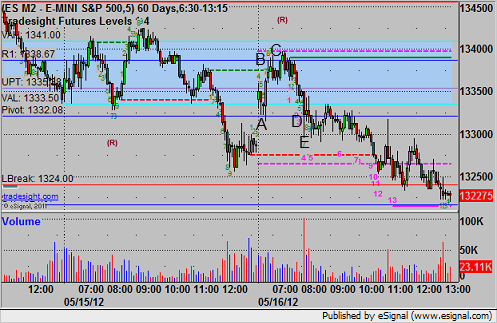

First, here's the ES and NQ with our market directional lines, Seeker, and VWAP:

ES:

Triggered short at A by sweeping the Pivot and immediately stopped for 7 ticks. Triggered long at B by sweeping the R1 and immediately stopped for 7 ticks. Triggered long again about 15 minutes later at C and stopped for 7 ticks. Triggered short at D and hit partial at E and adjusted stop to over the entry and stopped:

Forex Calls Recap for 5/16/12

Two new triggers that didn't work out, and our GBPUSD short continues and currently about 150 pips in the money. See EURUSD and GBPUSD sections below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, gave you another chance to enter, and stopped at B. Triggered short at C on news out of Greece on a spike, stopped at D:

GBPUSD:

Still short from prior session at 1.6050 with a stop over the S1 here: