Forex Calls Recap for 5/16/12

Two new triggers that didn't work out, and our GBPUSD short continues and currently about 150 pips in the money. See EURUSD and GBPUSD sections below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

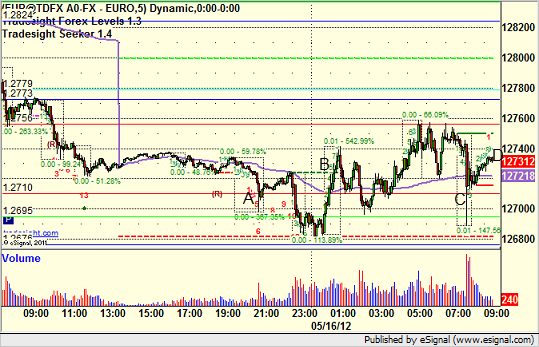

EURUSD:

Triggered short at A, gave you another chance to enter, and stopped at B. Triggered short at C on news out of Greece on a spike, stopped at D:

GBPUSD:

Still short from prior session at 1.6050 with a stop over the S1 here:

Stock Picks Recap for 5/15/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AKRX triggered long (without market support due to opening 5 minutes) and didn't work:

In the Messenger, Rich's DKS triggered long (with market support) and worked:

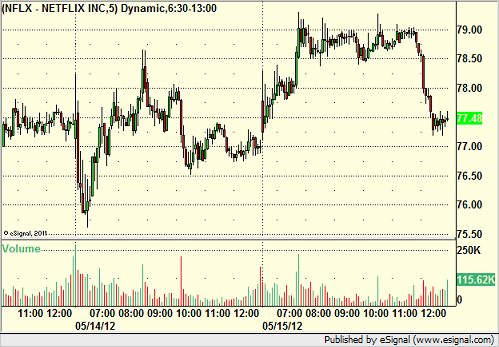

NFLX triggered long (with market support) and worked enough for a partial:

GS triggered long (with market support) and technically worked under our rules, but you had to wait a long time:

Rich's NKE triggered long (with market support) and worked enough for a partial:

His GRPN triggered short (with market support) and worked:

His VRTX triggered short (with market support) and worked:

AAPL triggered short (with market support) and worked:

In total, that's 7 trades triggering with market support, 6 of them worked (we won't count GS since it took so long and market direction switched several times during the trade), 1 did not.

Futures Calls Recap for 5/15/12

Three triggers today, two on the ES and one on the NQ, both early, as action faded quick and the market volume was not impressive. See both of those sections below.

Net ticks: -2.

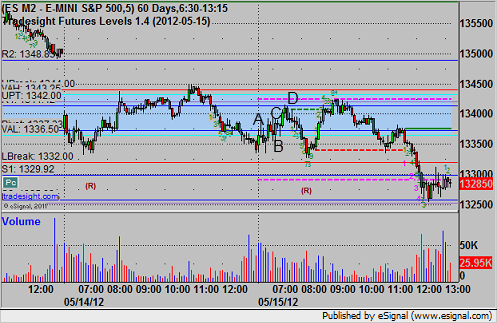

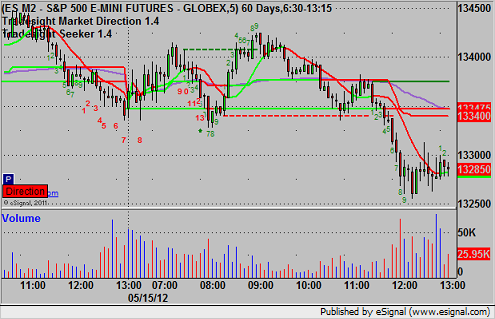

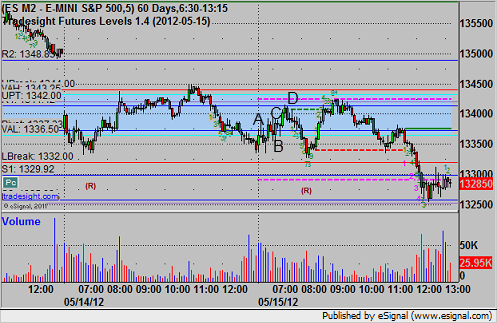

Here's the ES and NQ with our market directional tool, VWAP, and Seeker:

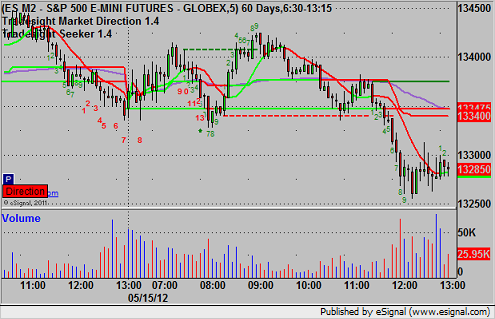

ES:

Triggered long at A and stopped for 7 ticks loss at B. Triggered long at C, hit first target at D for 6 ticks, second half adjusted for 1 tick loss under entry:

NQ:

Triggered long at A and hit first target at B, second half stopped at entry at C:

Remember that even though a "tick" on the NQ is a quarter point for $5 per contract, we still count the half point moves as the smaller increment is too hard to count.

Futures Calls Recap for 5/15/12

Three triggers today, two on the ES and one on the NQ, both early, as action faded quick and the market volume was not impressive. See both of those sections below.

Net ticks: -2.

Here's the ES and NQ with our market directional tool, VWAP, and Seeker:

ES:

Triggered long at A and stopped for 7 ticks loss at B. Triggered long at C, hit first target at D for 6 ticks, second half adjusted for 1 tick loss under entry:

NQ:

Triggered long at A and hit first target at B, second half stopped at entry at C:

Remember that even though a "tick" on the NQ is a quarter point for $5 per contract, we still count the half point moves as the smaller increment is too hard to count.

Forex Calls Recap for 5/15/12

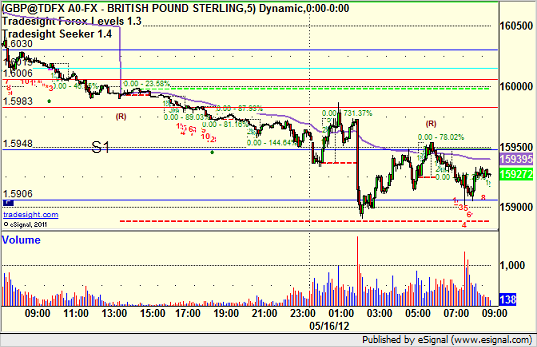

Another winner, this one short the GBPUSD and still holding the second half of the trade. See that section below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

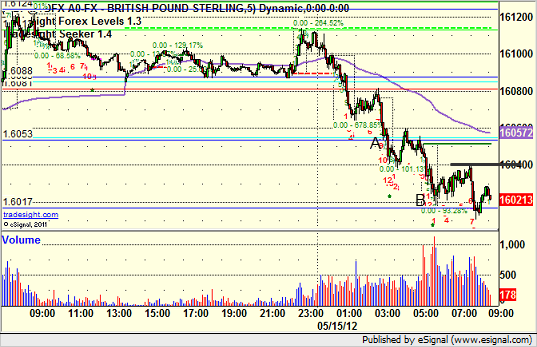

GBPUSD:

Triggered short at A, hit first target at B, stop currently over black line on the second half:

Tradesight Market Preview for 5/16/12

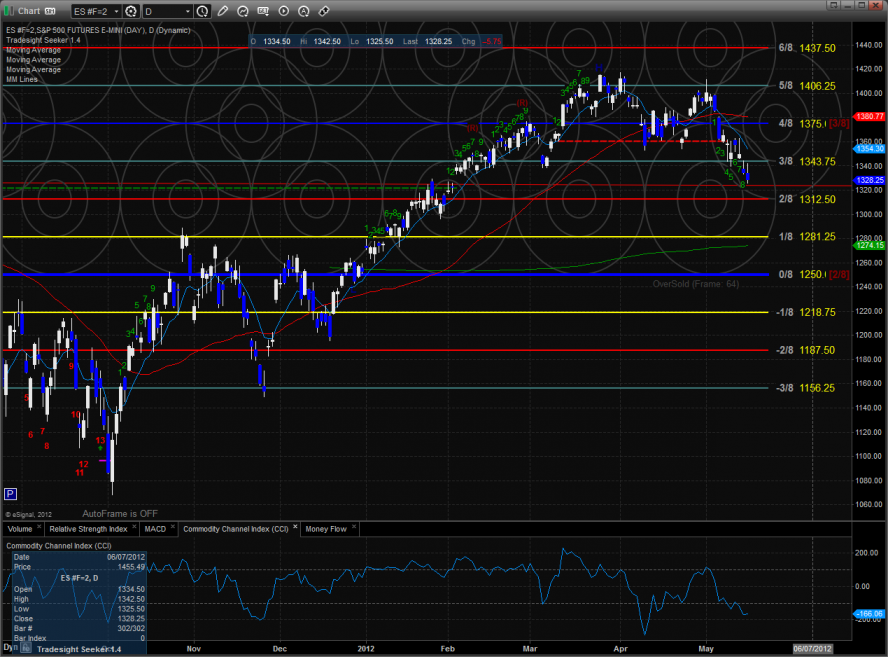

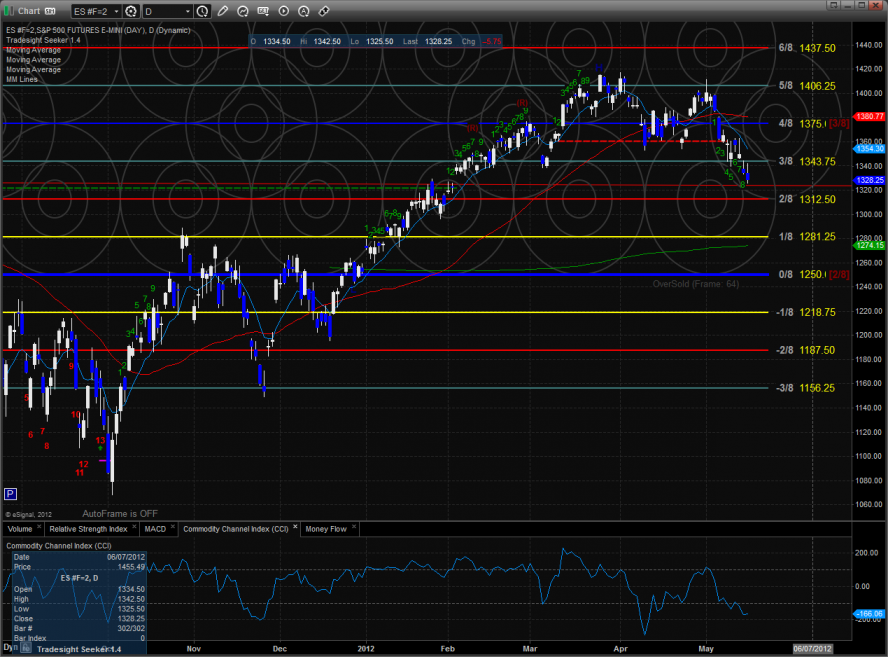

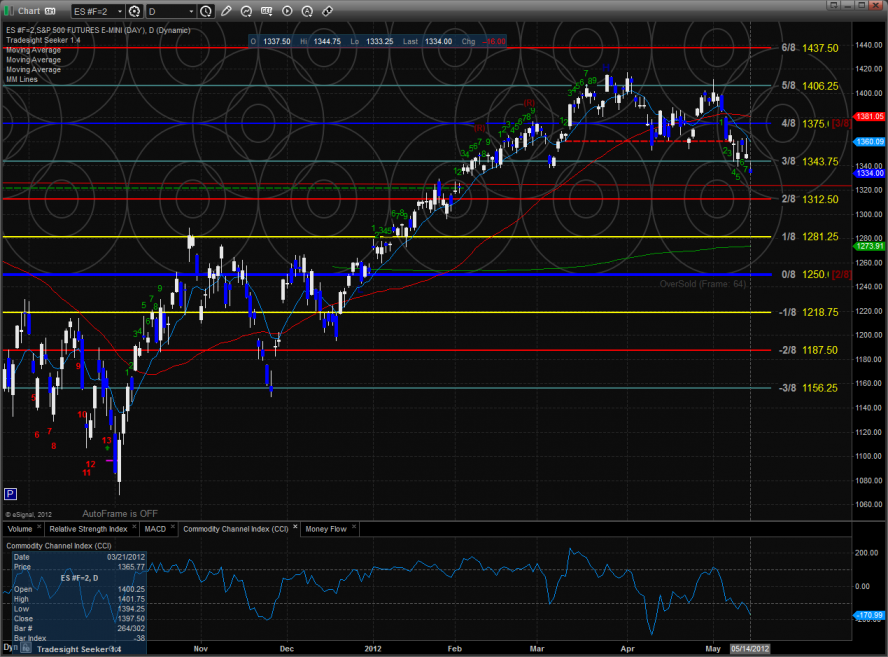

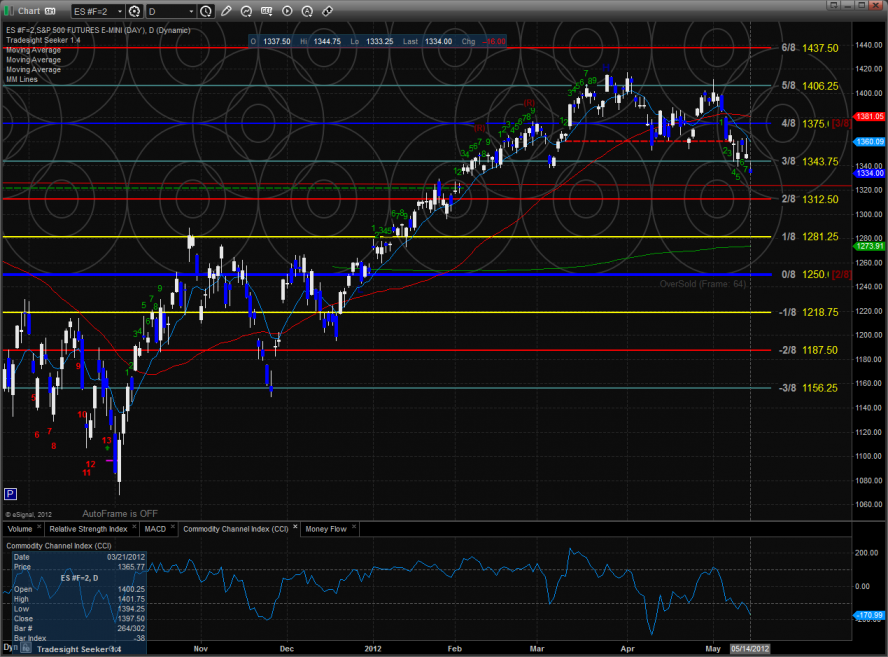

The ES lost 6 handles on the day making a new low on the move and a new low close. Note that the Seeker count is now 9 days down.

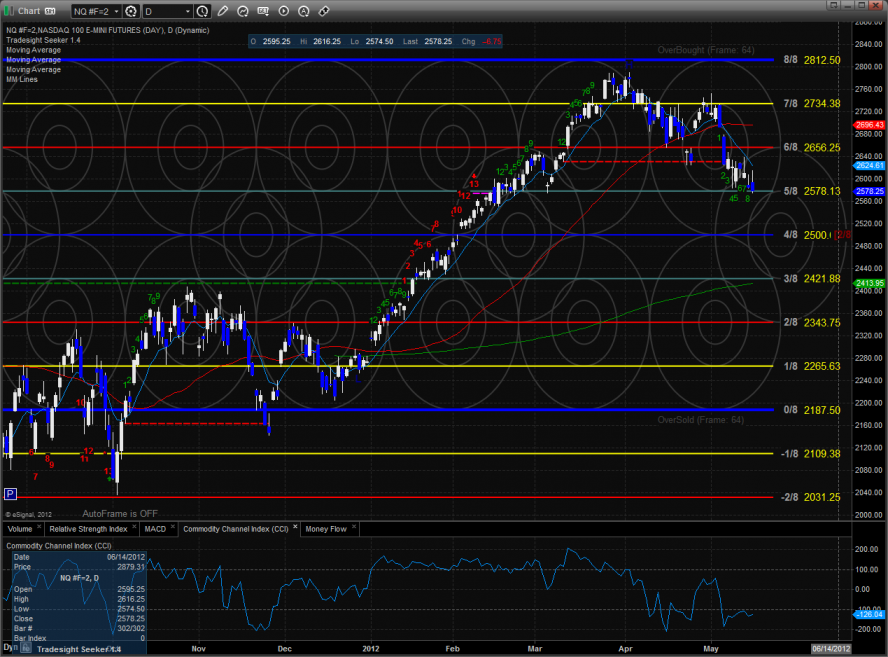

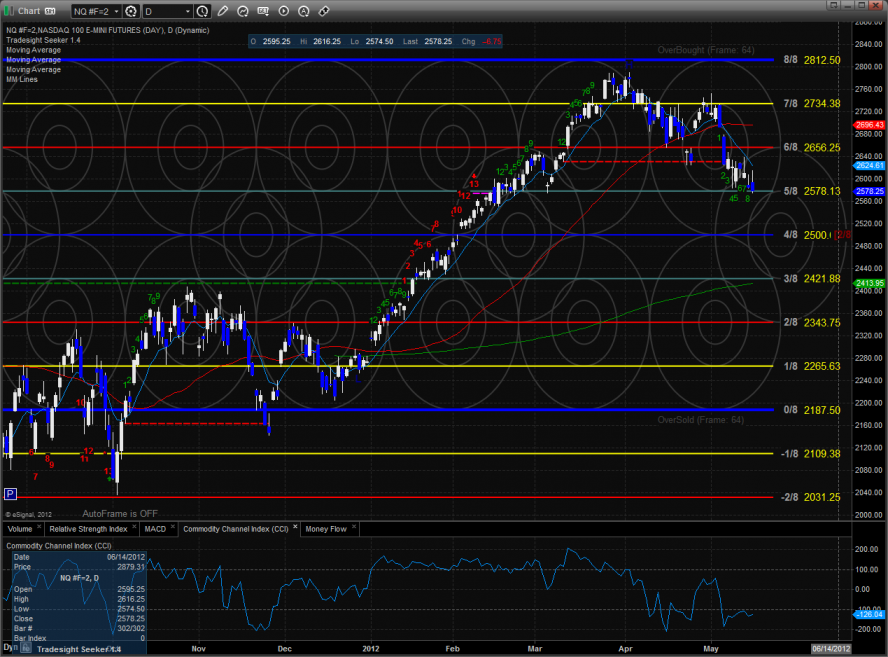

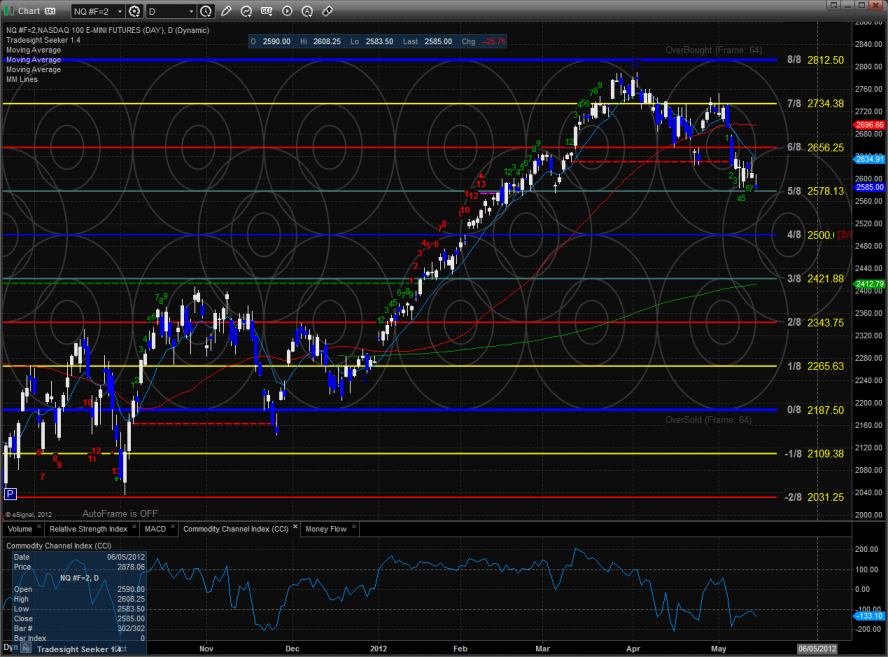

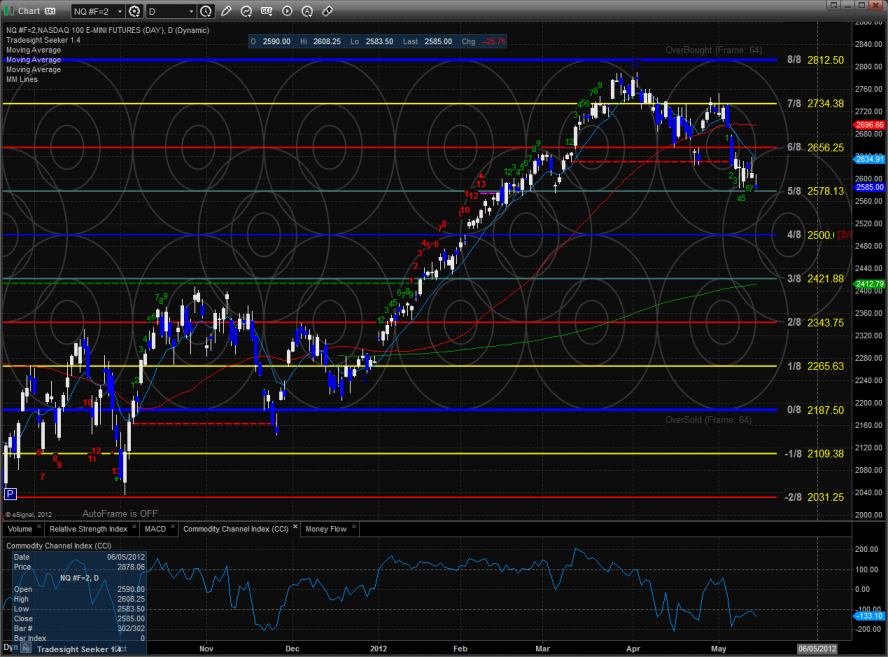

The NQ futures were also down on the day though were relatively strong vs. the broad market. Price did make a new low on the move but the pattern is finally 9 days down.

The 10-day Trin has matched the most oversold reading of the year to date.

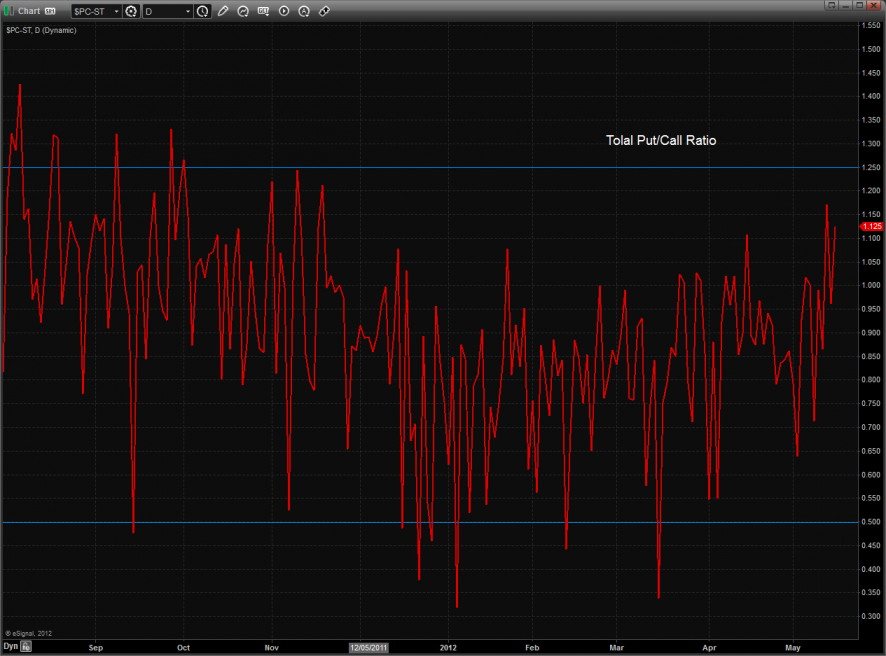

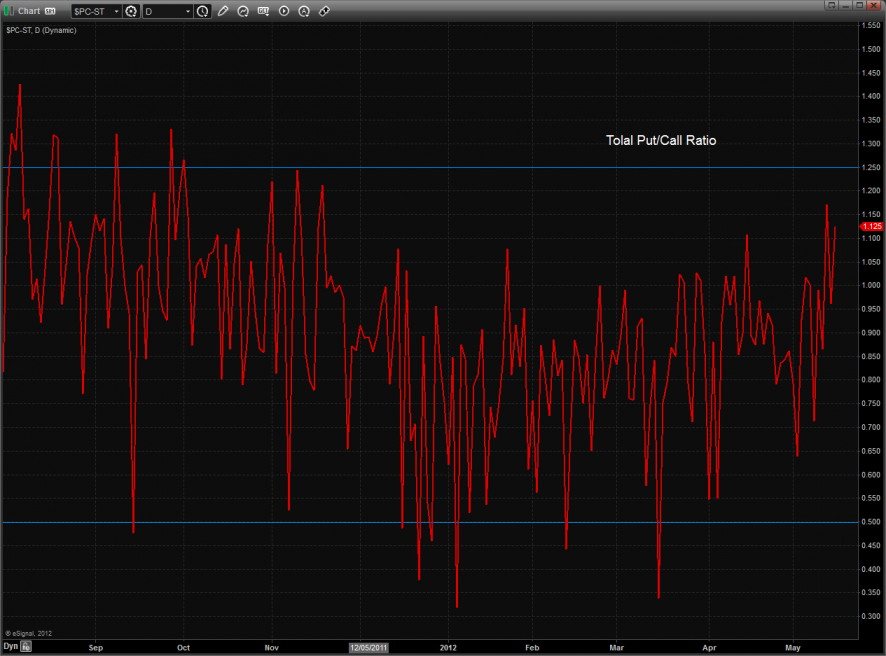

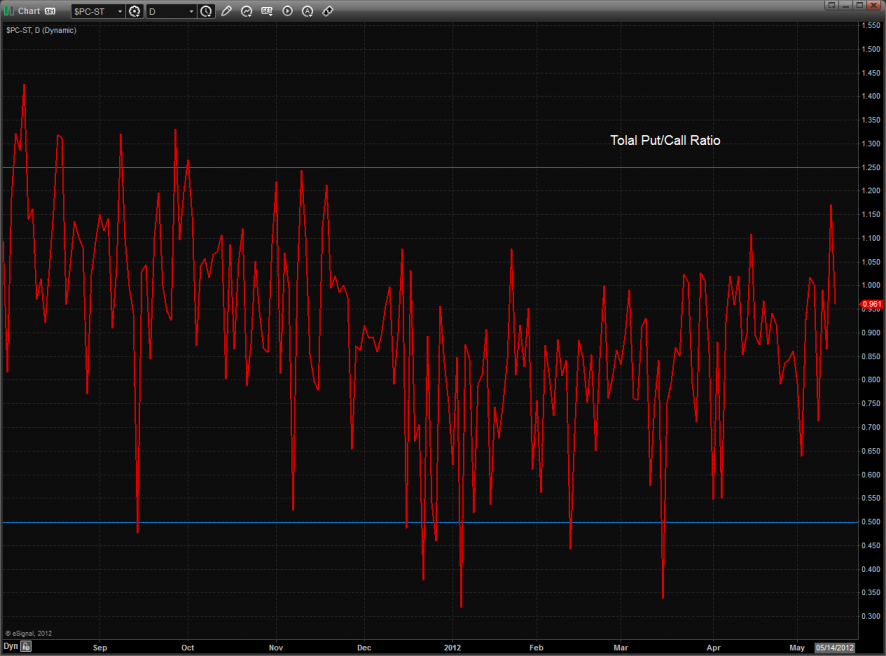

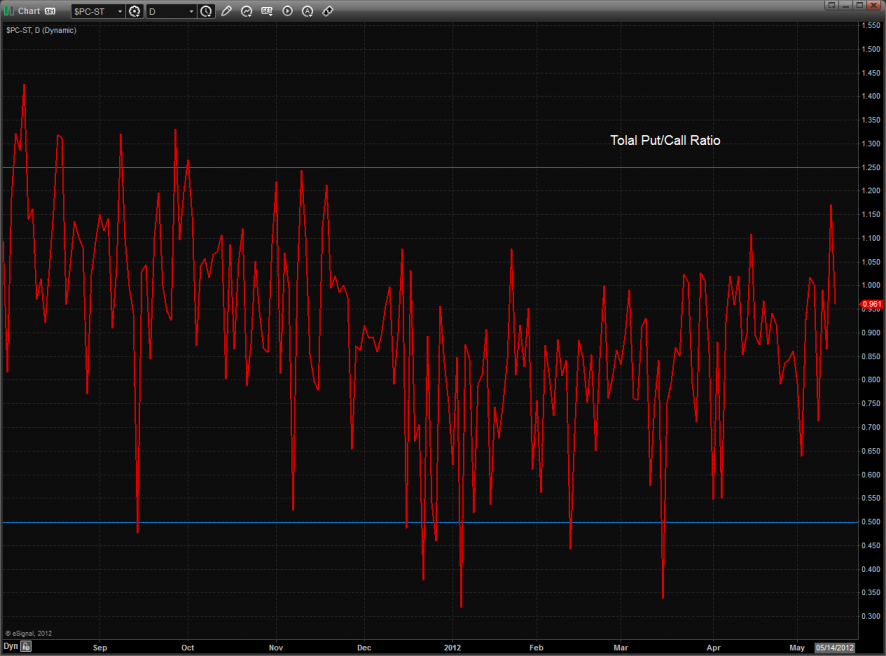

The total put/call ratio has yet to record a climatic close.

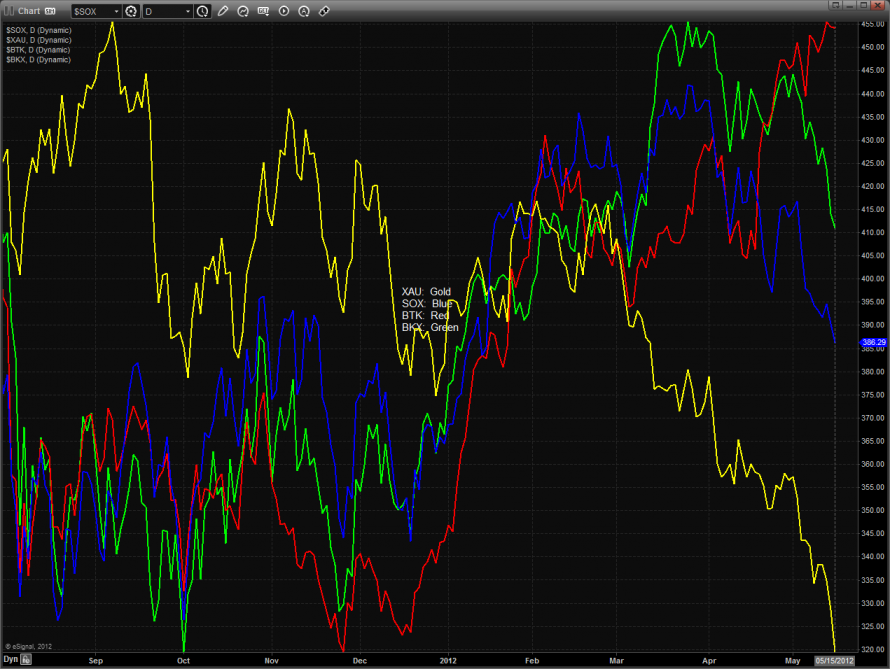

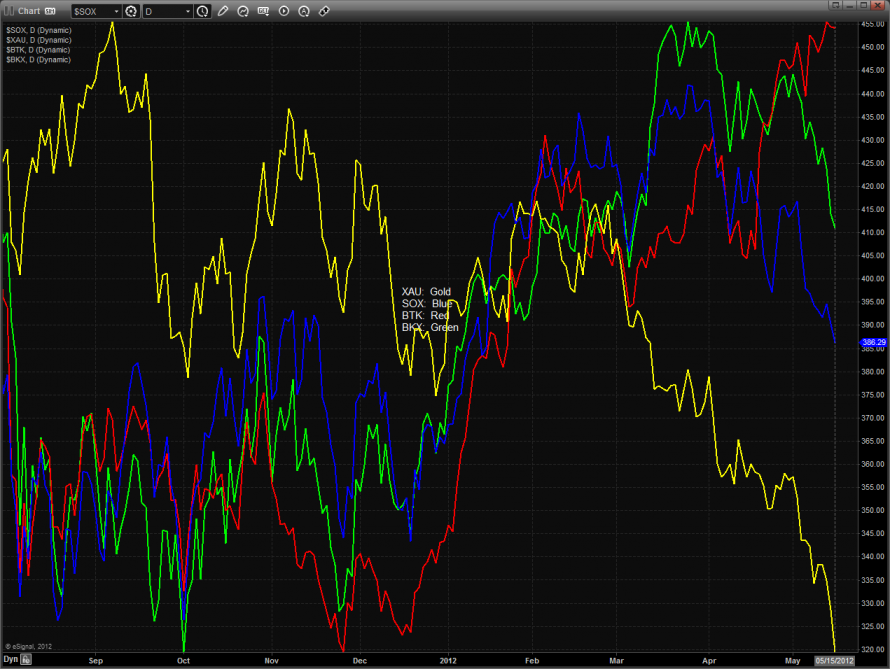

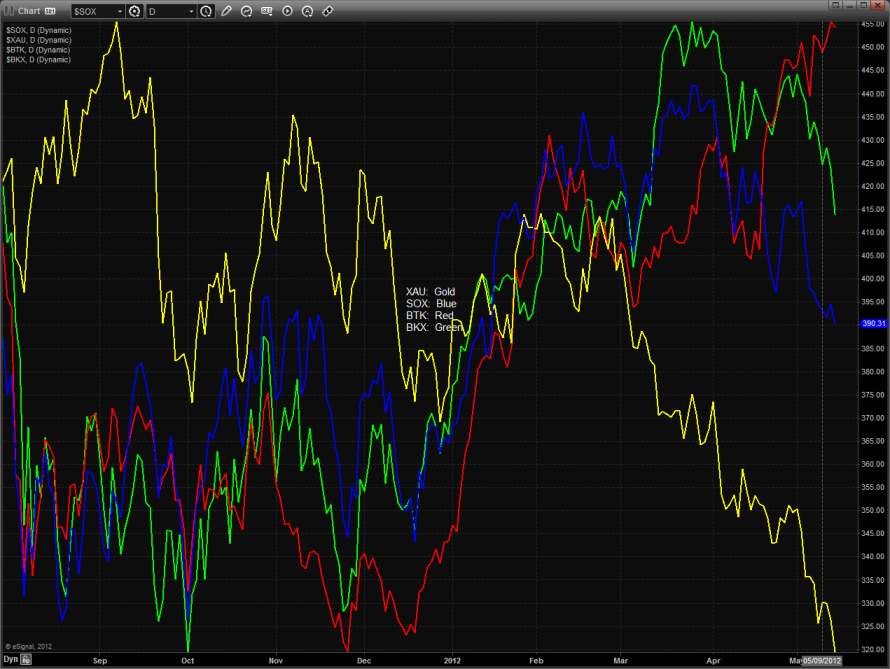

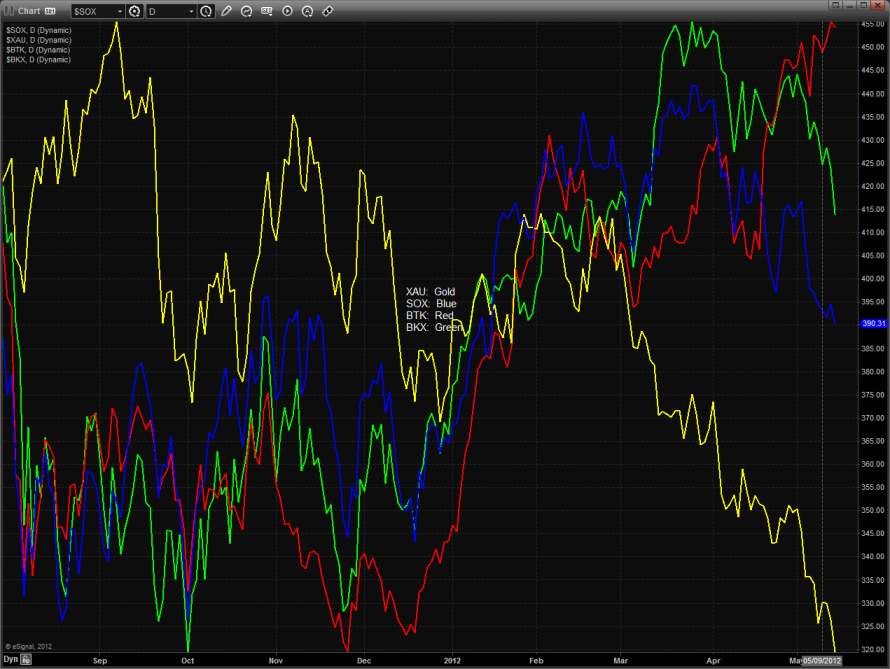

Multi sector daily chart:

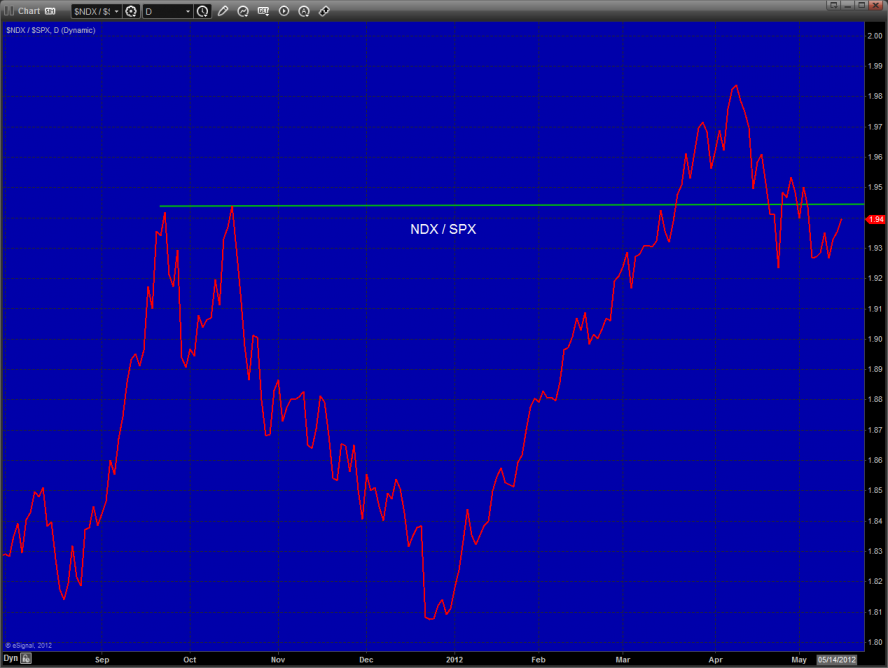

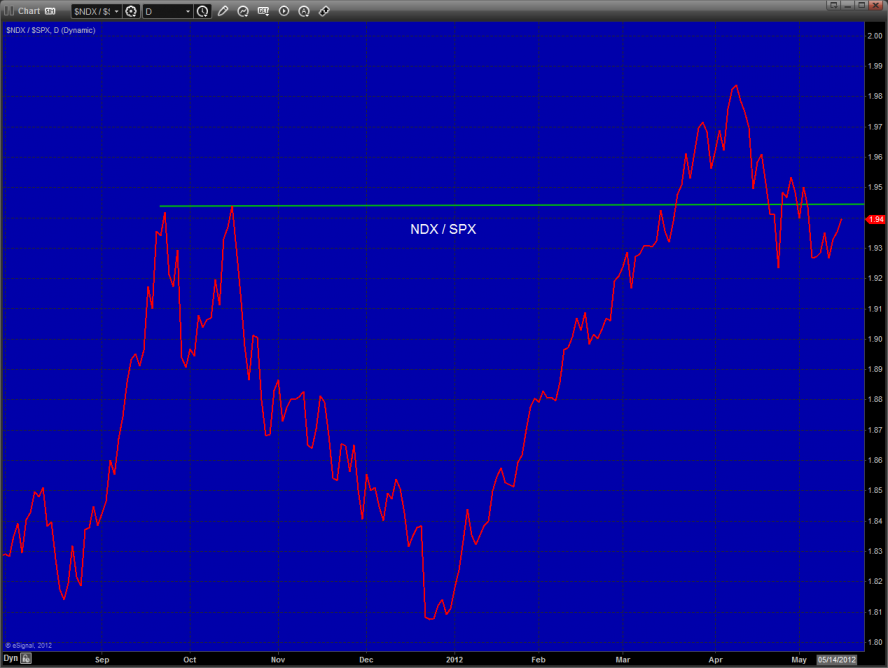

The NDX/SPX cross ratio chart shows that the NDX bullishly still has relative strength vs. the SPX.

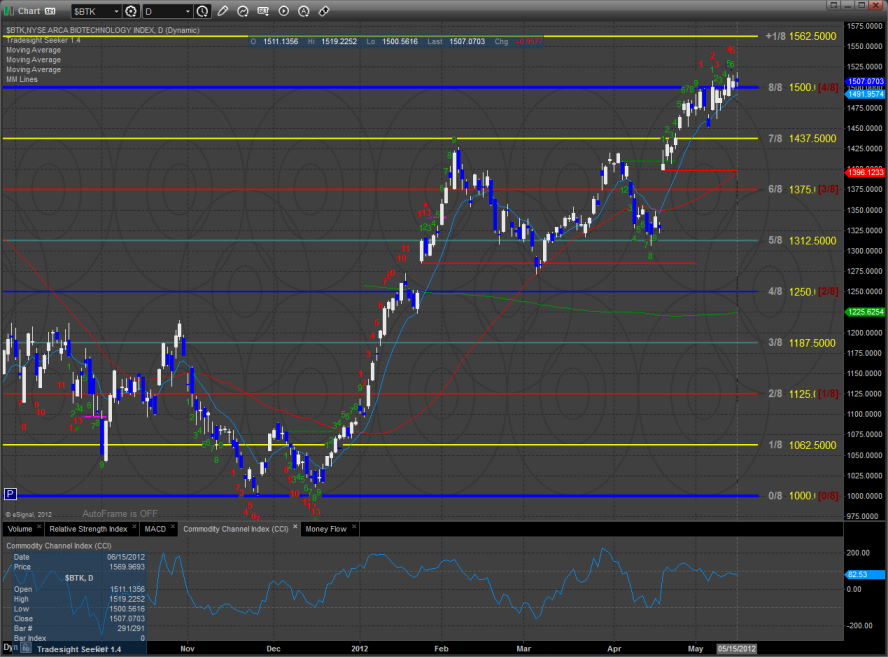

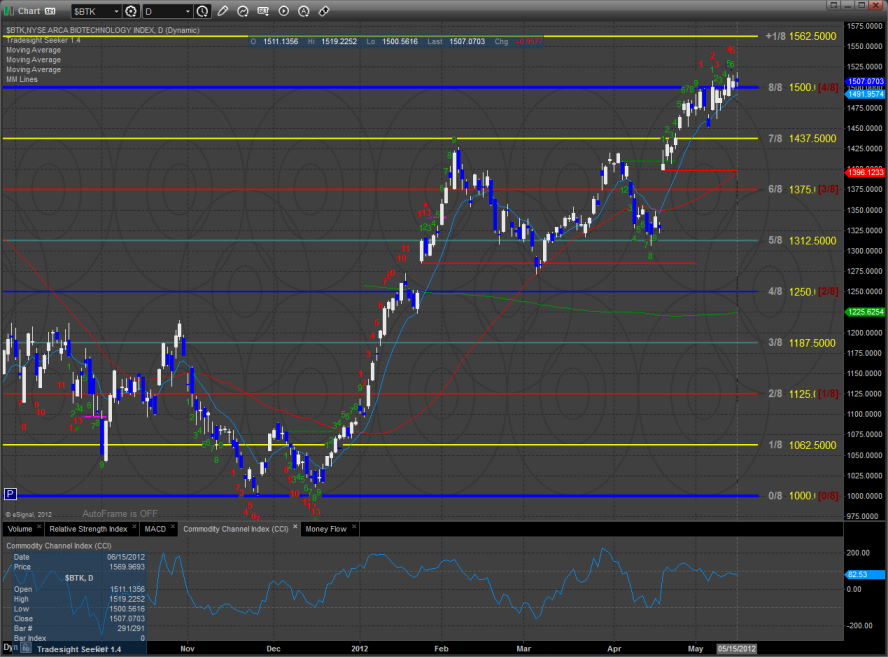

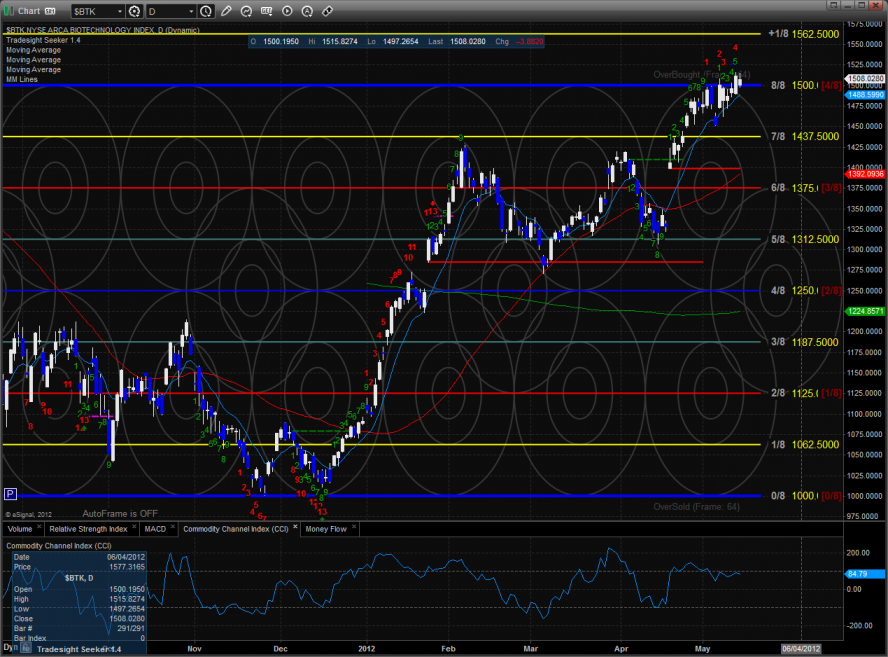

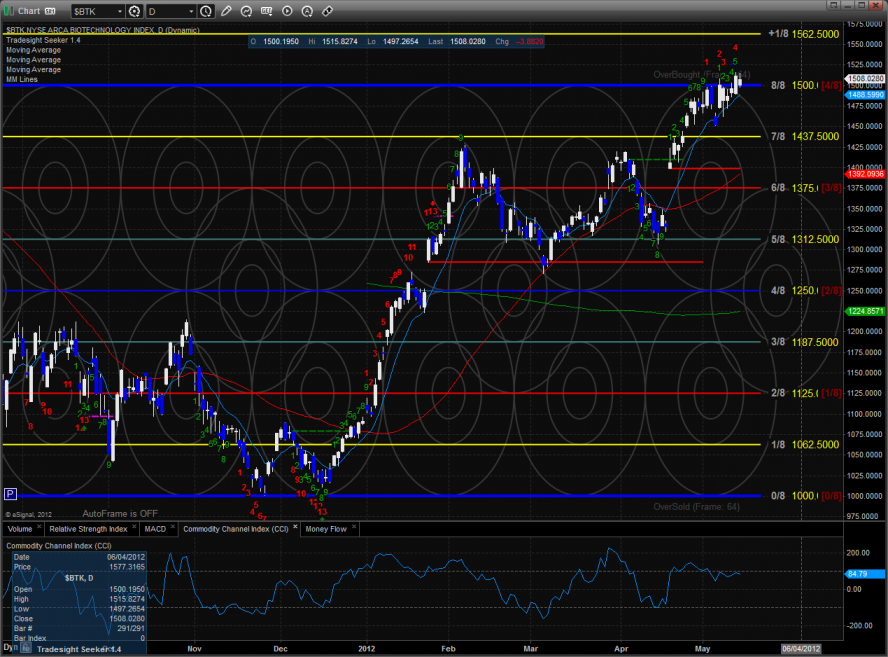

The BTK was the top gun on the day and is still controlled by the 8/8 level.

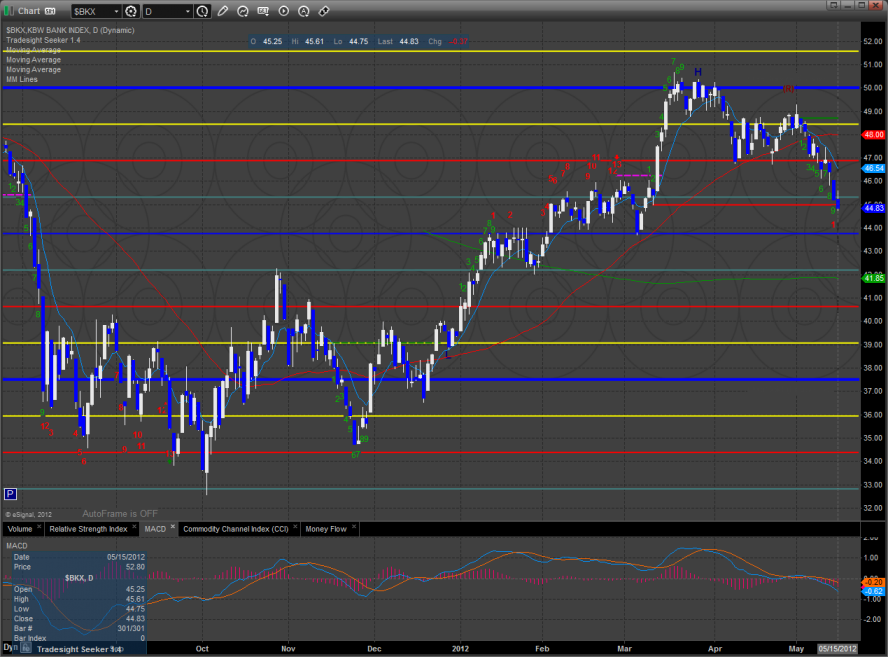

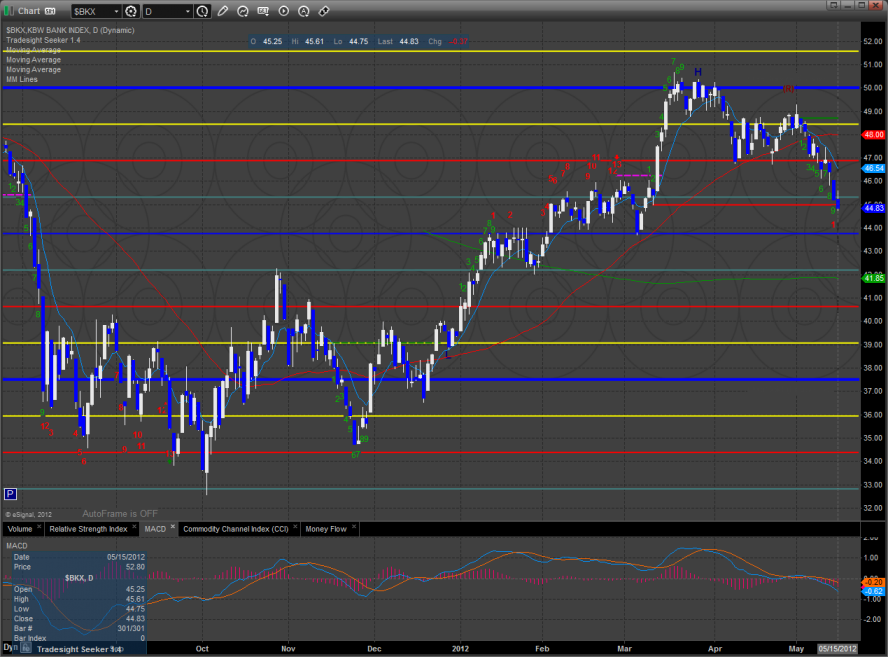

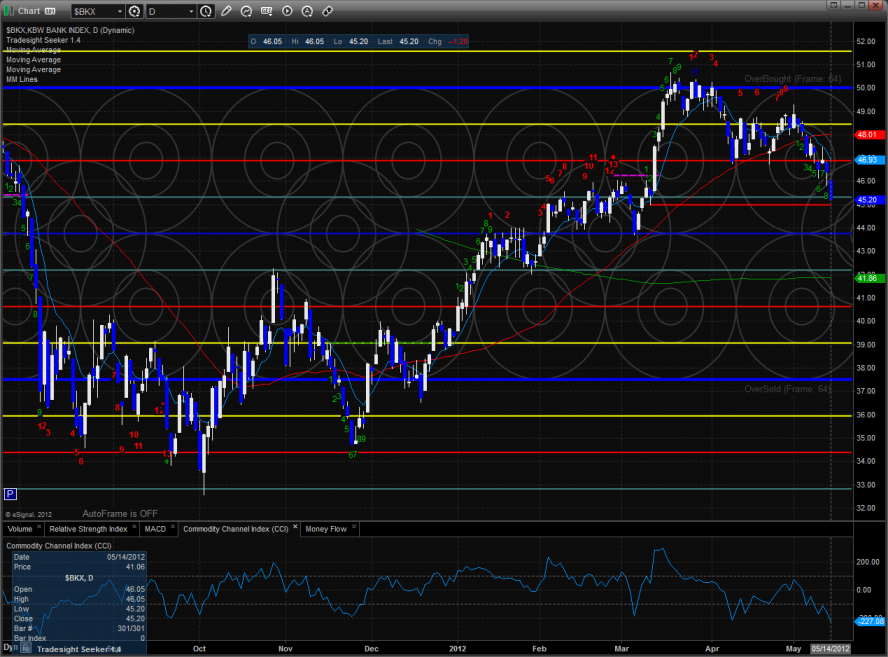

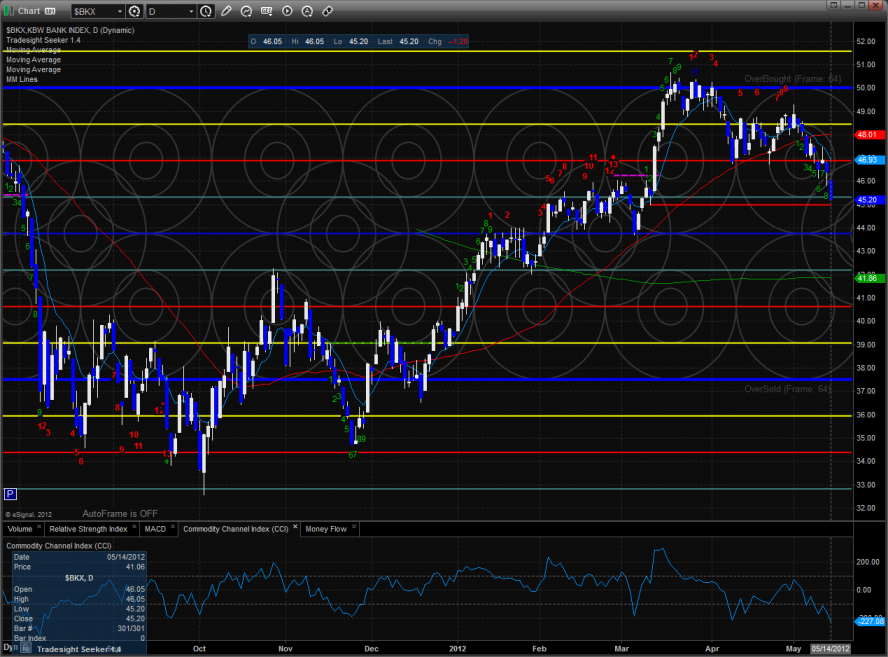

The BKX closed just below critical support which doesn’t quite yet qualify as a break of the static trend line.

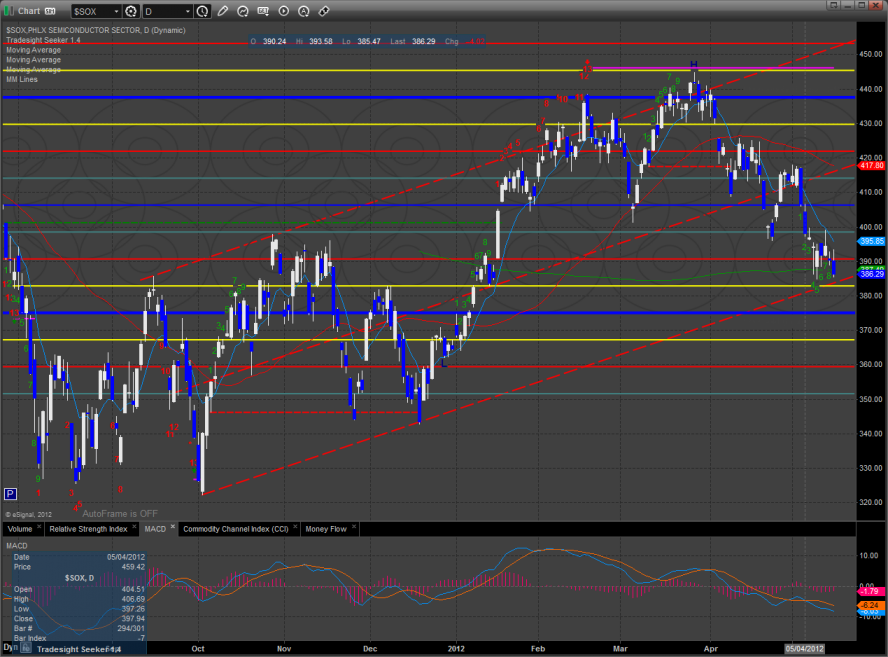

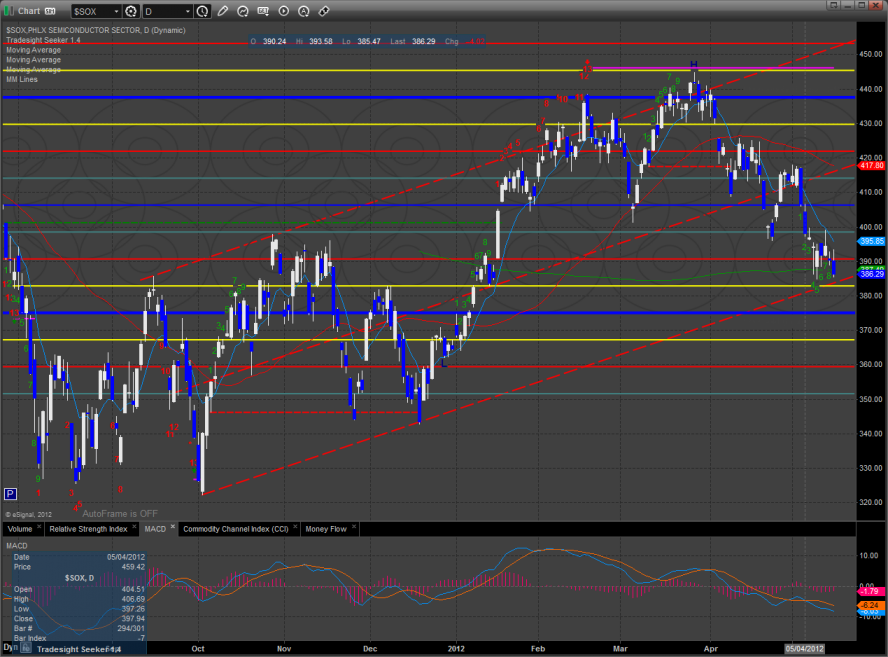

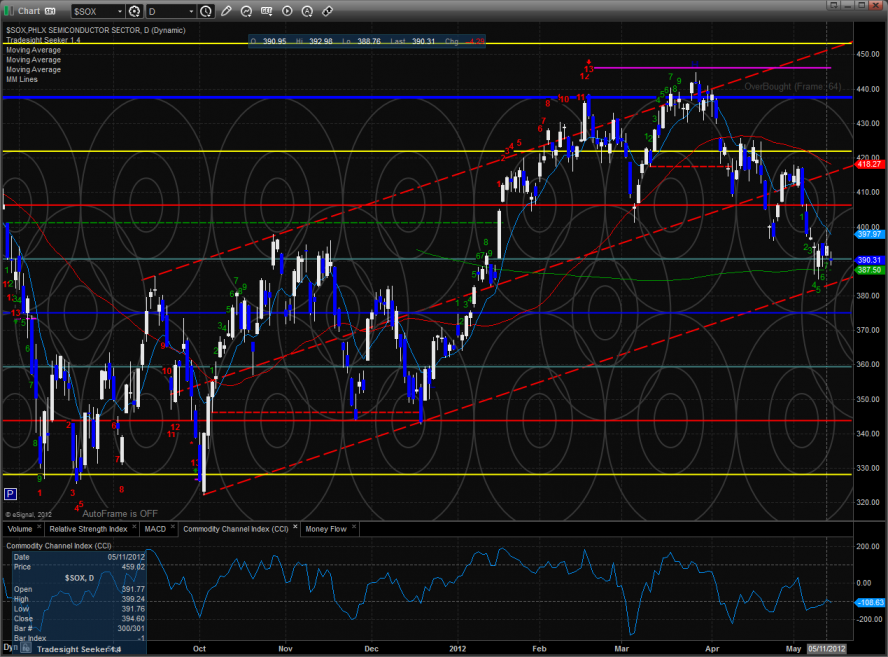

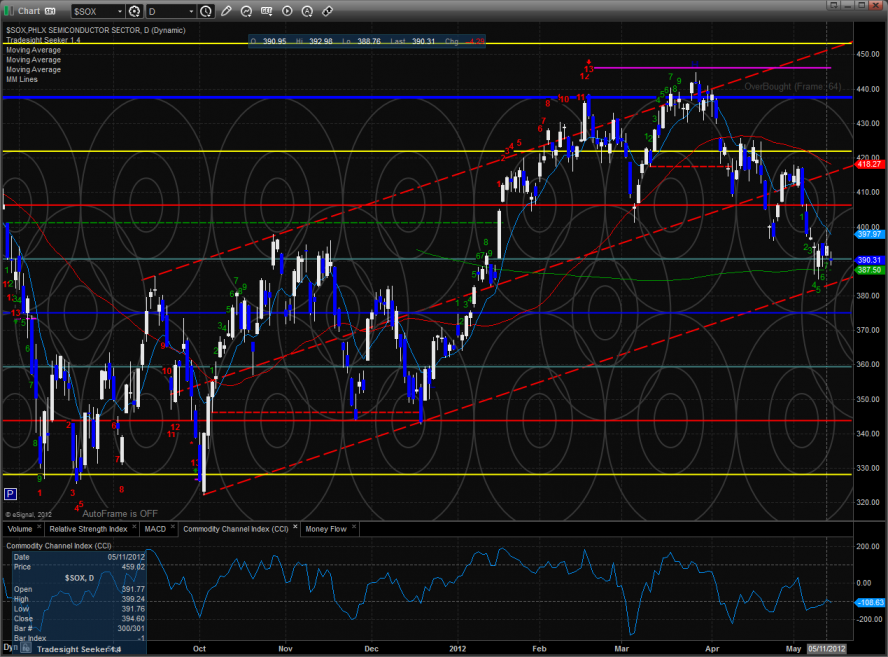

The SOX is 9 days down into a super key area of support.

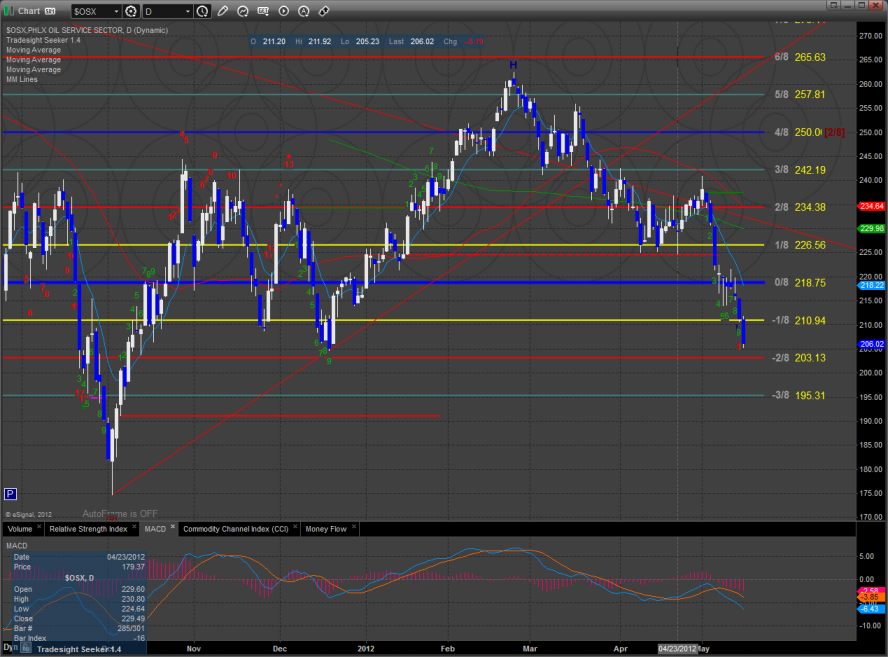

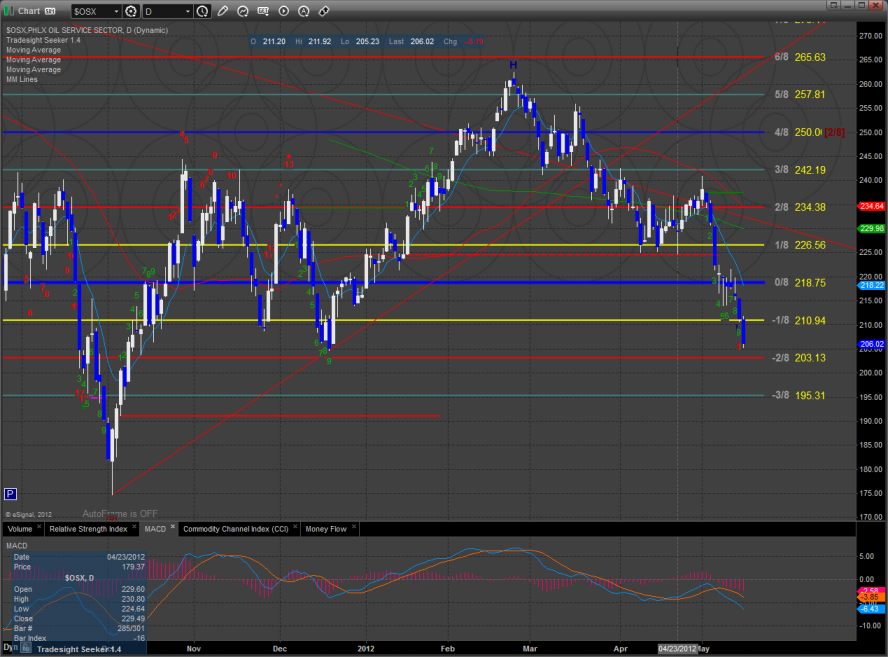

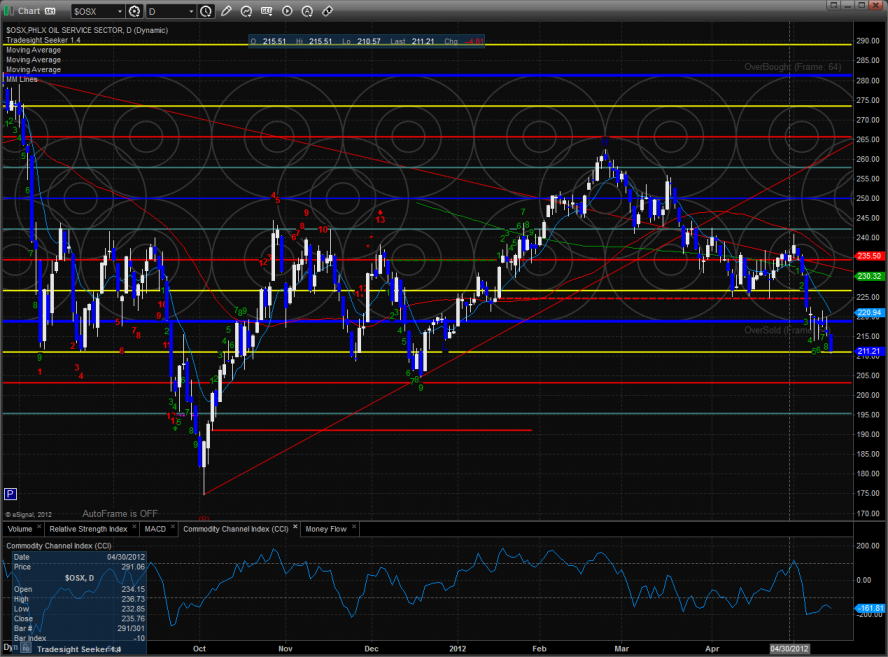

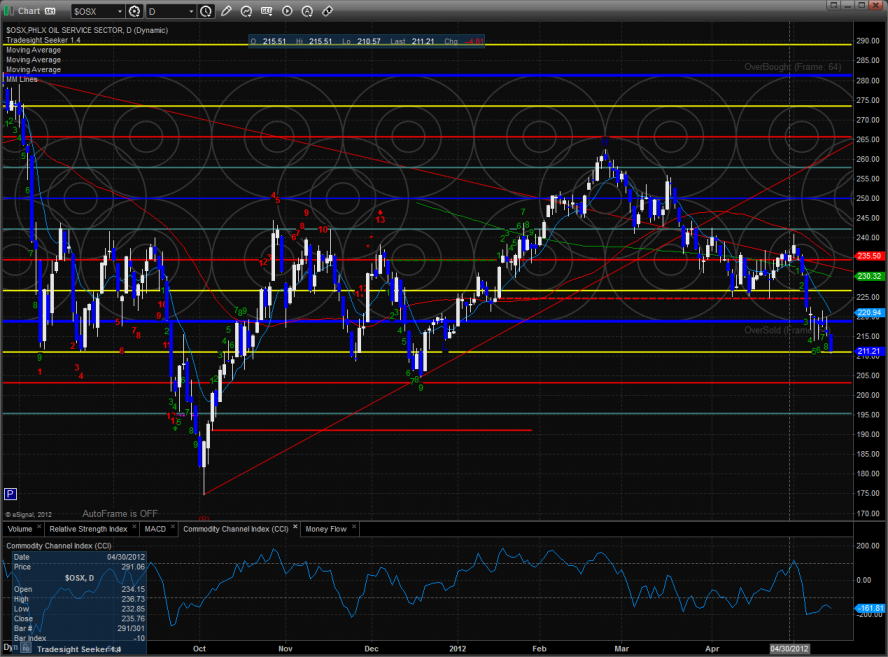

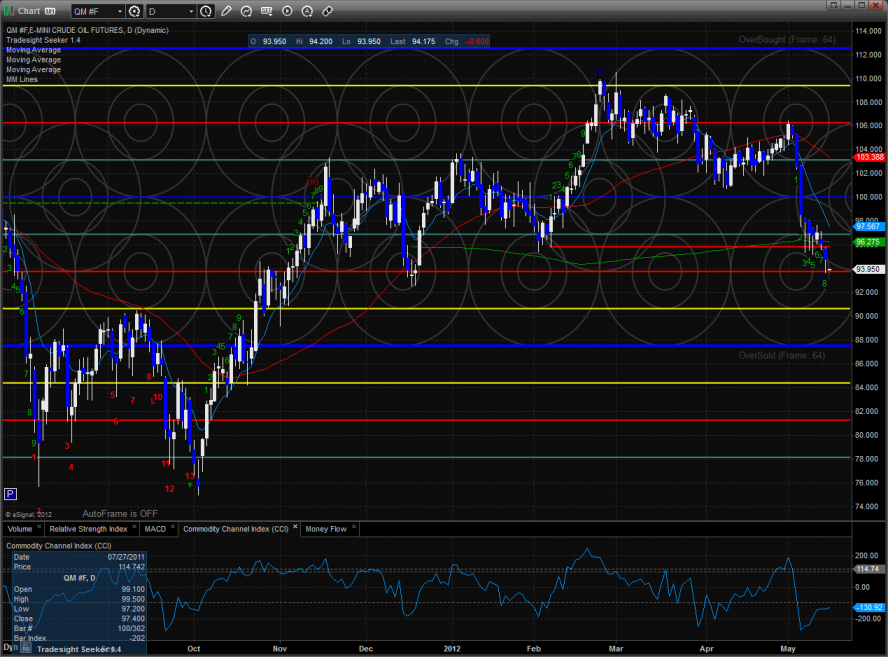

The OSX is moving deeper into oversold territory. Keep a close eye on the -2/8 level which is the last line of defense before a frame shift.

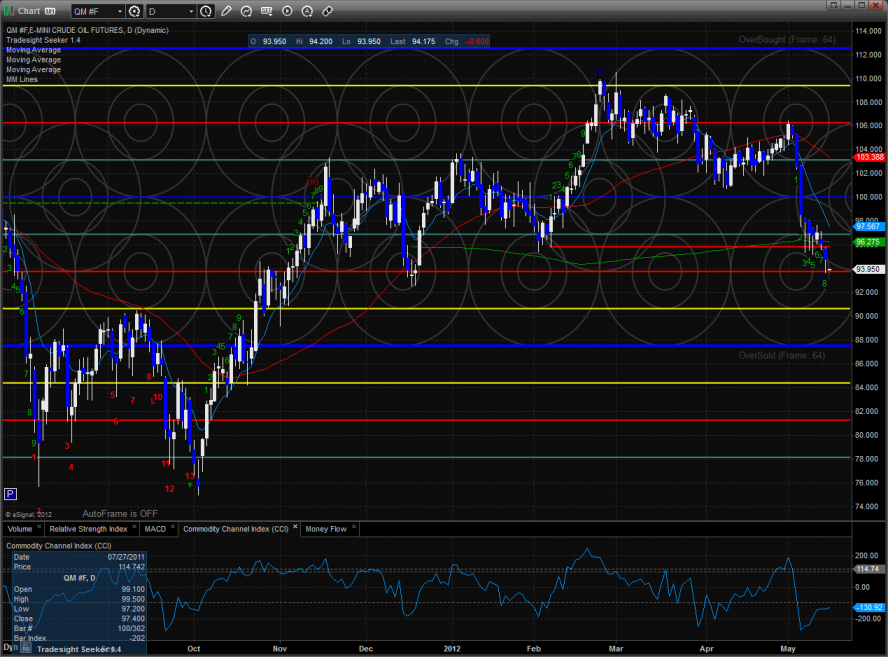

Oil:

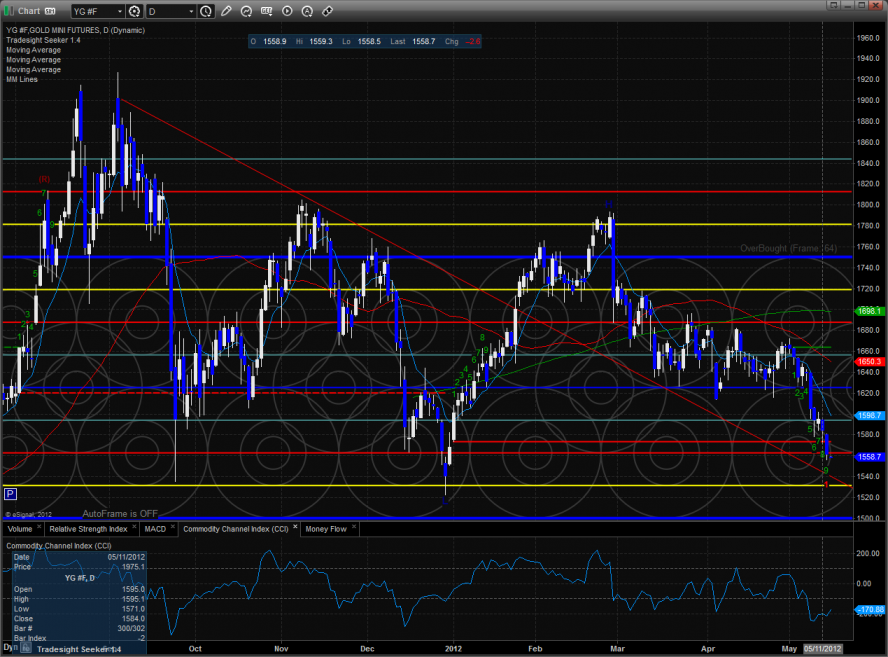

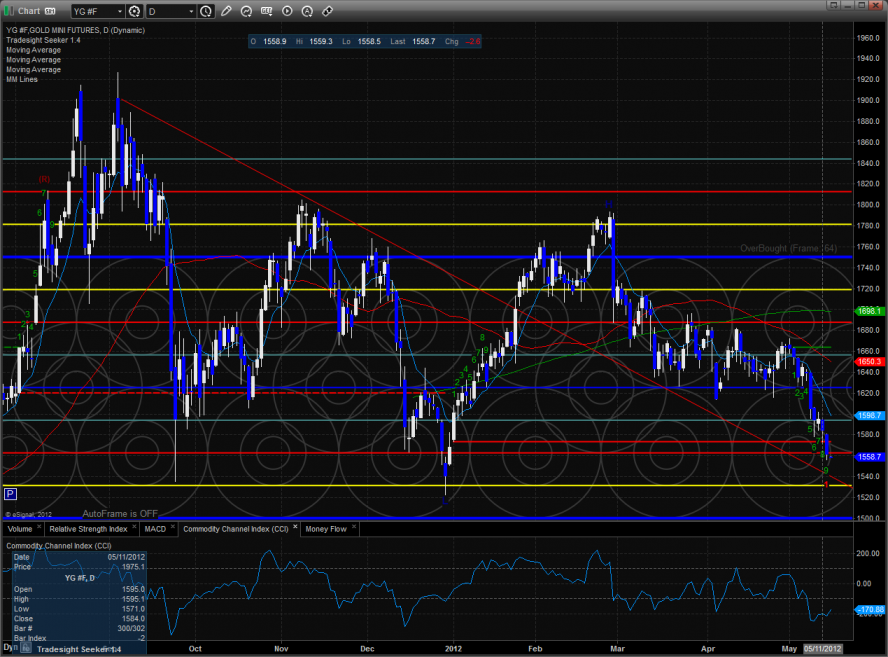

Gold:

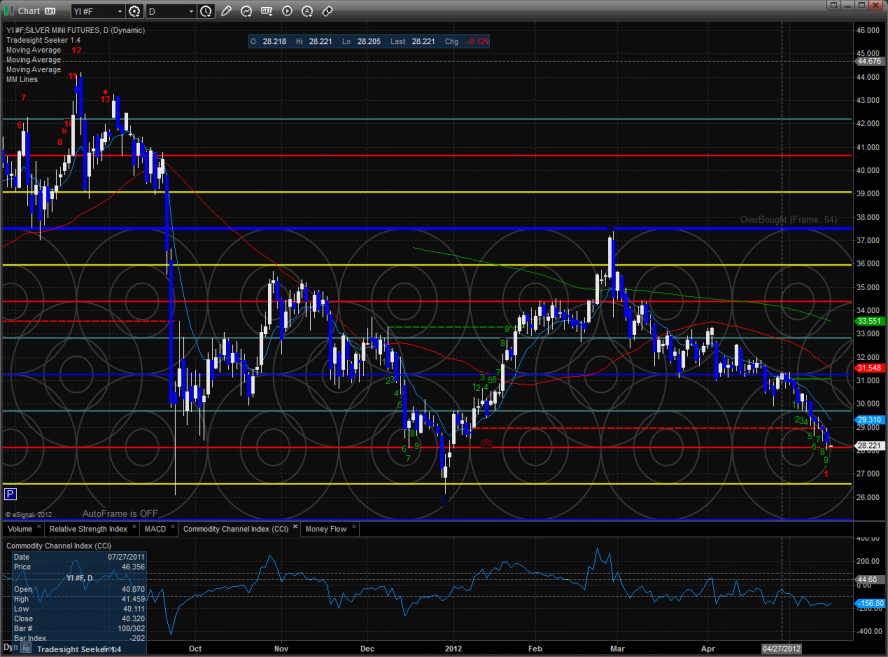

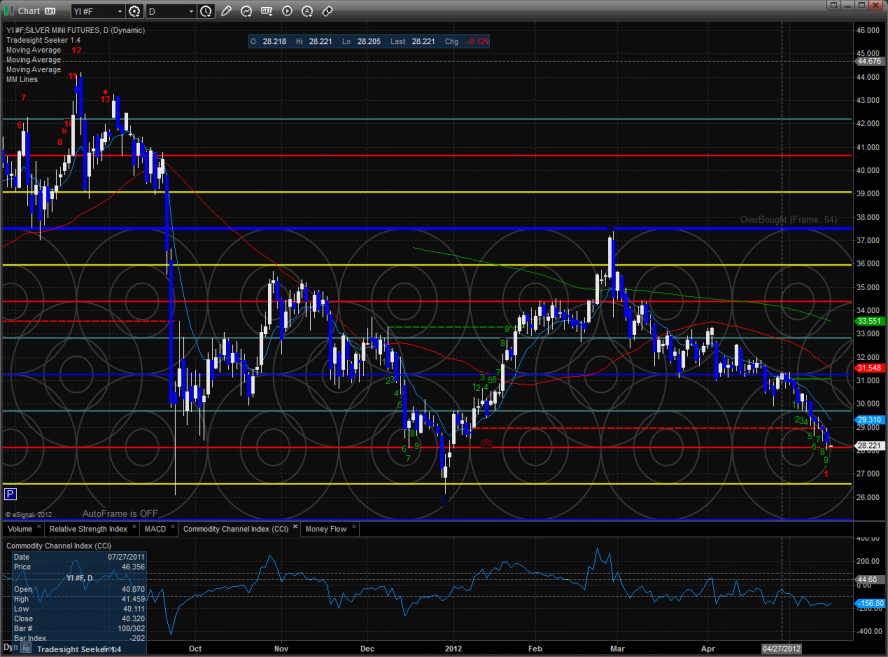

Silver:

Tradesight Market Preview for 5/16/12

The ES lost 6 handles on the day making a new low on the move and a new low close. Note that the Seeker count is now 9 days down.

The NQ futures were also down on the day though were relatively strong vs. the broad market. Price did make a new low on the move but the pattern is finally 9 days down.

The 10-day Trin has matched the most oversold reading of the year to date.

The total put/call ratio has yet to record a climatic close.

Multi sector daily chart:

The NDX/SPX cross ratio chart shows that the NDX bullishly still has relative strength vs. the SPX.

The BTK was the top gun on the day and is still controlled by the 8/8 level.

The BKX closed just below critical support which doesn’t quite yet qualify as a break of the static trend line.

The SOX is 9 days down into a super key area of support.

The OSX is moving deeper into oversold territory. Keep a close eye on the -2/8 level which is the last line of defense before a frame shift.

Oil:

Gold:

Silver:

Tradesight Market Preview for 5/15/12

The ES lost 16 handles on the day making a new low on the move. Price undercut the key 2 bar island made in early March and has qualified the lower high set in late April. The Seeker count is now 8 days down so the broad market could see a bounce later this week.

The NQ futures made a new low close on the move. Price is below all the important major moving averages and is in a short-term down trend. Like the ES, the NQ futures are 8 days down so either a lateral move or bounce is on deck. Note how the early March lows are key support.

The 10-day Trin is still hovering around the oversold threshold.

The total put/call ratio remains neutral.

Multi sector daily chart:

All of the major moving averages were red on the day with the BTK being the strongest. It was in insicde day but net another accumulation session with price closing above the open.

The short term oversold SOX was stronger than the broad market one the day. Keep a close eye on the 200dma and the lower trend channel which together are key support.

The OSX made a new low on the move and is now 9 days down on the Seeker count.

The BKX was hit hard and much weaker than the broad market. The pattern is now 9 days down and just above key support at the static trend line.

The XAU recorded its first close below the Seeker risk level. A new intraday low would nullify the buy signal though it’s unlikely in the next 48 hours because of the new 9 bar setup that just completed.

Oil:

Gold is 9 days down:

Silver is also 9 days down:

Tradesight Market Preview for 5/15/12

The ES lost 16 handles on the day making a new low on the move. Price undercut the key 2 bar island made in early March and has qualified the lower high set in late April. The Seeker count is now 8 days down so the broad market could see a bounce later this week.

The NQ futures made a new low close on the move. Price is below all the important major moving averages and is in a short-term down trend. Like the ES, the NQ futures are 8 days down so either a lateral move or bounce is on deck. Note how the early March lows are key support.

The 10-day Trin is still hovering around the oversold threshold.

The total put/call ratio remains neutral.

Multi sector daily chart:

All of the major moving averages were red on the day with the BTK being the strongest. It was in insicde day but net another accumulation session with price closing above the open.

The short term oversold SOX was stronger than the broad market one the day. Keep a close eye on the 200dma and the lower trend channel which together are key support.

The OSX made a new low on the move and is now 9 days down on the Seeker count.

The BKX was hit hard and much weaker than the broad market. The pattern is now 9 days down and just above key support at the static trend line.

The XAU recorded its first close below the Seeker risk level. A new intraday low would nullify the buy signal though it’s unlikely in the next 48 hours because of the new 9 bar setup that just completed.

Oil:

Gold is 9 days down:

Silver is also 9 days down:

Stock Picks Recap for 5/14/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SPRD triggered long (without market support due to opening 5 minutes) and worked great, finally:

In the Messenger, Rich's NFLX triggered long (with market support) and didn't work:

GOOG triggered long (with market support) and worked great:

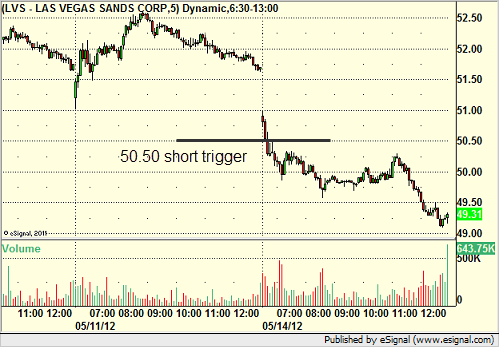

Rich's LVS triggered short (with market support) and worked great:

Rich's AKAM triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.