Futures Calls Recap for 5/14/12

Several calls and triggers today, some working and some not, as the market volume dropped off sharply to only 1.5 billion NASDAQ shares by the close. We had a gap down in the market and then pressed lower, came back a bit (exactly hit the 50% retracement of the gap before lunch), and then fizzled in the afternoon as volume never came back. See ES and NQ below for trade summaries.

Net results of the day if you took all five trades (one is questionable in my mind and I didn't take) is a loss of 9 ticks. See details below.

Here's the ES and NQ with our market direction tool, Seeker count, and VWAP:

ES:

Nice setup under early lows triggered at A and stopped at B. Technically triggered again about a minute later, although I don't necessarily agree that you retake something that stops out without letting it consolidate again first. If you did, the second trigger was short at C in the same bar as the original stopped out. That stopped at D. We then had the ES retrace 50% of the gap and stall out right the LBreak, a perfect setup for the afternoon, but volume never came back in and it triggered early at E and stopped at F:

If you took the initial trade, the immediate retrigger, and the later long, there was 21 ticks of net loss.

NQ:

Even though they split the NQ down to 4 ticks per point a couple of years ago, we still count every HALF point as a tick (so two ticks per point, at $10 per contract per tick).

Mark's NQ short triggered at A, hit first target at B, lowered stop right over the entry and stopped out on the second half there for basically a net 3 tick gain (6 to target and flat on second). Then, my long triggered at C, hit first target at D, raised stop twice and stopped in the money at E for a net 9 ticks):

Forex Calls Recap for 5/14/12

Nothing at all through the Asian and European sessions, and then we finally moved in the North American session and triggered a winner in the GBPUSD. See that section below.

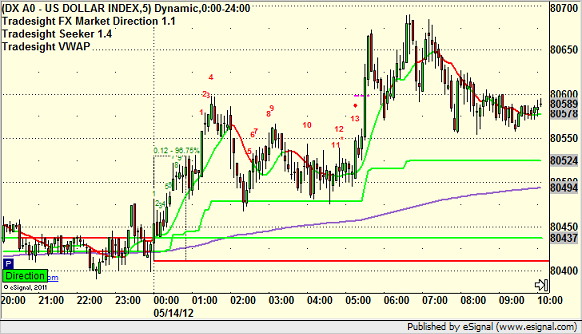

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

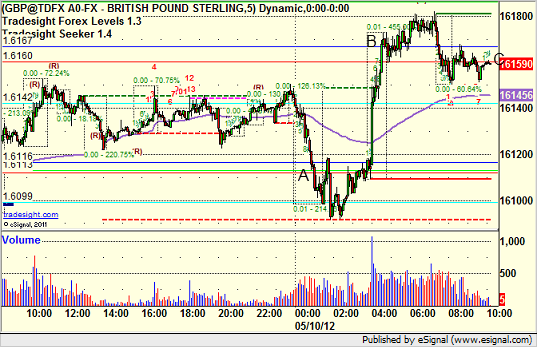

GBPUSD:

Triggered long at A, hit first target at B, still long second half with a stop under Pivot (entry):

My Current Trading Rig

Once a year or so, I update my trading machine, and I typically give a write-up about it for our subscribers. The current state of technology is really great. It's important to have a clean and powerful pipeline from outside your house all the way to your machine and screens to trade effective. One bad component can make it hard to be a successful trader.

Let's start outside the house. If you have the option in your area, use cable modem service and not DSL or satellite. And pay for one of their top two tiers of data speed. Remember, if you are trading and following a lot of charts and information, you don't want a bogged down pipeline. It's true that at the top speeds, you rarely run into a situation where you need most of what you are paying for. But if you have ever had your charts freeze up on news, it might not be your broker or charting company. It could just be Internet speed.

Inside the house, get yourself a good Wireless-N router and make sure that the hard ports pass information at a gigabit level. I currently use the Netgear WNDR4500 N900 Dual Band Gigabit Router, which can be found here if you are looking for cool domain names.

The mistake that people make next is a big one, though. Having a fast cable modem and a great router doesn't mean anything if your computer can't receive that information at top speeds. If you are using a hard port, it needs to accept the data at the gigabit level (this is typically something built into a motherboard and something worth checking when you buy a computer). If you are getting a wireless card, I suggest looking into the higher end chipsets for Wireless N cards, like the Intel Centrino Ultimate-N 6300 AGN. This will guarantee that even over wireless, your machine gets the smoothest reception of data for what you are pumping to it.

For the machine itself, I always prefer to install a fresh Operating System and not upgrade versions of Windows on one machine. Most people that had issues with Windows Vista, for example, had upgraded from XP. This leaves a lot of files and such that cause conflicts and problems. Currently, you want Windows 7 64-bit Ultimate. Windows 8 is on the horizon and I have heard great things, but it will probably be a bit before companies like e-Signal are fully compatible.

I am a big fan of solid state hard drives, at least for a primary drive. I have been using them now for three years. My machine boots in 10-15 seconds, which is important in the rare cases that I feel that I need to reboot in the middle of the day. I put a 120 GB solid state Intel hard drive as my primary drive and run most of my main applications from there. Everything loads instantly. I have a 2 TB secondary drive for everything else, like data, documents, and lesser-used programs.

You can get away with 8 GB of RAM, but I put 16 on my machine. This allows me to run a lot of programs with no slow down at all. Only 64-bit applications really take advantage of the bigger RAM number, but it is quite a useful thing to have in my opinion.

The other change in technology that I love is the video card technology. I currently run 3 separate 27" monitors at high resolutions off of one ATI graphics card with their Eyefinity technology. The exact card is the Radeon HD 7900. Works great. Keyboard and mouse technology has also come a long way in recent years, and I finally felt comfortable cutting the cord and using the wireless versions of these. I tried them previously, and they would disconnect from time to time, which obviously can't happen when you are trading.

I run e-Signal across two monitors. I'm currently in the process of creating my layouts for e-Signal 11.4 while using 10.6 as my primary charting. There are still some issues with 11.4, although there are certainly things about it that make it faster and easier to use and watch more things (i.e. the new pages system of tabs). You can run both 10.6 and 11.4 on your machine at the same time as the Data server serves both from a single login. I then use my third monitor for other things, such as email, the Lab, and instant messaging and more.

Don't screw around when you are getting yourself a trading rig. This is your primary tool for making money. You're fighting for executions against everyone else in the world. One bad link in the technology chain, and you might be disadvantaged. Have a great weekend.

My Current Trading Rig

Once a year or so, I update my trading machine, and I typically give a write-up about it for our subscribers. The current state of technology is really great. It's important to have a clean and powerful pipeline from outside your house all the way to your machine and screens to trade effective. One bad component can make it hard to be a successful trader.

Let's start outside the house. If you have the option in your area, use cable modem service and not DSL or satellite. And pay for one of their top two tiers of data speed. Remember, if you are trading and following a lot of charts and information, you don't want a bogged down pipeline. It's true that at the top speeds, you rarely run into a situation where you need most of what you are paying for. But if you have ever had your charts freeze up on news, it might not be your broker or charting company. It could just be Internet speed.

Inside the house, get yourself a good Wireless-N router and make sure that the hard ports pass information at a gigabit level. I currently use the Netgear WNDR4500 N900 Dual Band Gigabit Router, which can be found here if you are looking for cool domain names.

The mistake that people make next is a big one, though. Having a fast cable modem and a great router doesn't mean anything if your computer can't receive that information at top speeds. If you are using a hard port, it needs to accept the data at the gigabit level (this is typically something built into a motherboard and something worth checking when you buy a computer). If you are getting a wireless card, I suggest looking into the higher end chipsets for Wireless N cards, like the Intel Centrino Ultimate-N 6300 AGN. This will guarantee that even over wireless, your machine gets the smoothest reception of data for what you are pumping to it.

For the machine itself, I always prefer to install a fresh Operating System and not upgrade versions of Windows on one machine. Most people that had issues with Windows Vista, for example, had upgraded from XP. This leaves a lot of files and such that cause conflicts and problems. Currently, you want Windows 7 64-bit Ultimate. Windows 8 is on the horizon and I have heard great things, but it will probably be a bit before companies like e-Signal are fully compatible.

I am a big fan of solid state hard drives, at least for a primary drive. I have been using them now for three years. My machine boots in 10-15 seconds, which is important in the rare cases that I feel that I need to reboot in the middle of the day. I put a 120 GB solid state Intel hard drive as my primary drive and run most of my main applications from there. Everything loads instantly. I have a 2 TB secondary drive for everything else, like data, documents, and lesser-used programs.

You can get away with 8 GB of RAM, but I put 16 on my machine. This allows me to run a lot of programs with no slow down at all. Only 64-bit applications really take advantage of the bigger RAM number, but it is quite a useful thing to have in my opinion.

The other change in technology that I love is the video card technology. I currently run 3 separate 27" monitors at high resolutions off of one ATI graphics card with their Eyefinity technology. The exact card is the Radeon HD 7900. Works great. Keyboard and mouse technology has also come a long way in recent years, and I finally felt comfortable cutting the cord and using the wireless versions of these. I tried them previously, and they would disconnect from time to time, which obviously can't happen when you are trading.

I run e-Signal across two monitors. I'm currently in the process of creating my layouts for e-Signal 11.4 while using 10.6 as my primary charting. There are still some issues with 11.4, although there are certainly things about it that make it faster and easier to use and watch more things (i.e. the new pages system of tabs). You can run both 10.6 and 11.4 on your machine at the same time as the Data server serves both from a single login. I then use my third monitor for other things, such as email, the Lab, and instant messaging and more.

Don't screw around when you are getting yourself a trading rig. This is your primary tool for making money. You're fighting for executions against everyone else in the world. One bad link in the technology chain, and you might be disadvantaged. Have a great weekend.

Futures Calls Recap for 5/11/12

The market gapped down today on the JPM news and headed up immediately. Sensing the reciprocal energy and the fact that the Value Areas and gaps were above, Mark immediately made an NQ call on the long side that worked fine and actually barely stopped out in the money to his adjusted stop before pushing much higher, but still a nice winner. See that section below.

First, here are the ES and NQ with our VWAP (purple line), the market directional tools, and the Seeker on the 5-minute chart:

NQ:

Triggered long at A heading into the Value Area at 2611.00. Sold half at 2614.00 at B and adjusted the stop twice. Sadly, the stop moved to 2616 and stopped by a tick at C before running much further, but still a clean 5 points or 20 ticks on the trade:

Stock Picks Recap for 5/11/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

In the Messenger, Rich's NVDA triggered short (without market support due to opening 5 minutes) and didn't work:

Mark's SWKS triggered long (with market support) and worked:

Rich's RGLD triggered long (with market support) and worked great:

GOOG triggered long (with market support) and didn't work:

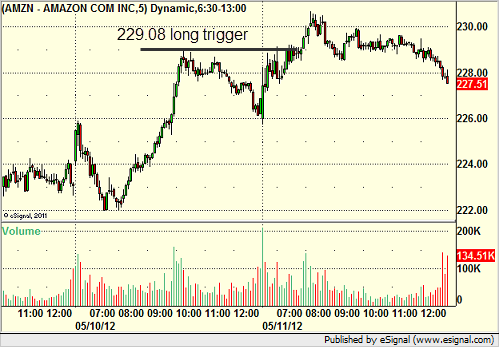

AMZN triggered long (with market support) and didn't work, although it went later:

Rich's GDX triggered long (ETF, so no market support needed) and worked:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Forex Calls Recap for 5/11/12

50 pips of range on the EURUSD. Ouch. See that section below.

We close out another fairly dull week with a couple of winners and a couple of losers for the week. Very unexciting at the moment, as the action continues to be in stocks and futures.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts with the Seeker and Comber separately on them (nothing new to see), and then discuss the US Dollar Index.

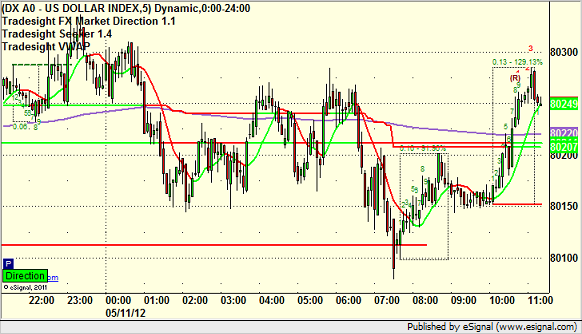

Here's the index intraday with our market directional lines:

EURUSD:

Triggered short at A, gave you another chance to enter at B without stopping, then stopped at C. 50 pips of range, ouch:

Stock Picks Recap for 5/10/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TASR triggered long (with market support) and worked:

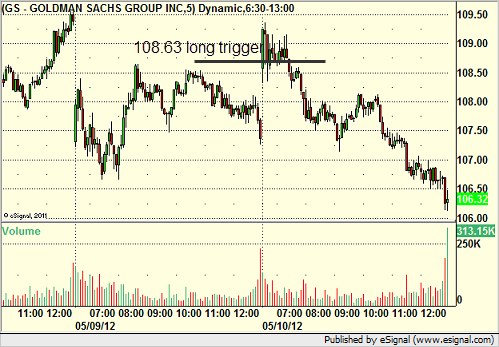

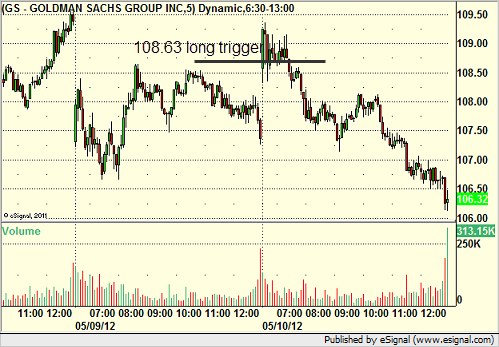

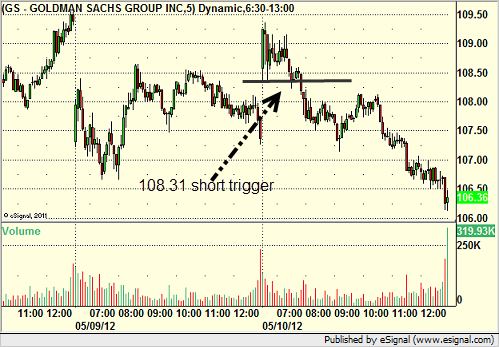

In the Messenger, Rich's GS triggered long out of the gate (without market support due to opening five minutes) and worked enough for a partial if you were quick to grab it:

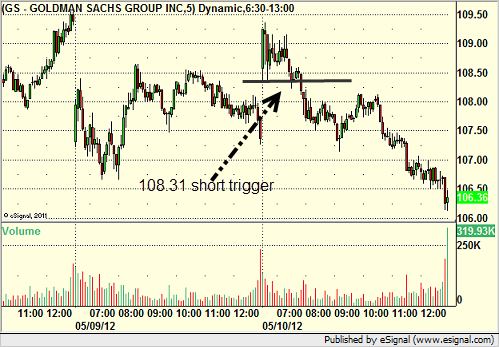

GS triggered short (with market support) and worked:

Rich's AMGN triggered short (with market support) and worked enough for a partial:

Nothing else triggered on a slow day.

In total, that's 3 trades triggering with market support, all three of them worked, but none went far.

Stock Picks Recap for 5/10/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TASR triggered long (with market support) and worked:

In the Messenger, Rich's GS triggered long out of the gate (without market support due to opening five minutes) and worked enough for a partial if you were quick to grab it:

GS triggered short (with market support) and worked:

Rich's AMGN triggered short (with market support) and worked enough for a partial:

Nothing else triggered on a slow day.

In total, that's 3 trades triggering with market support, all three of them worked, but none went far.

Forex Calls Recap for 5/10/12

Closed out the short from the prior day on the EURUSD in the money. Lost on the GBPUSD short and closed out the second one just under the entry. See those sections below.

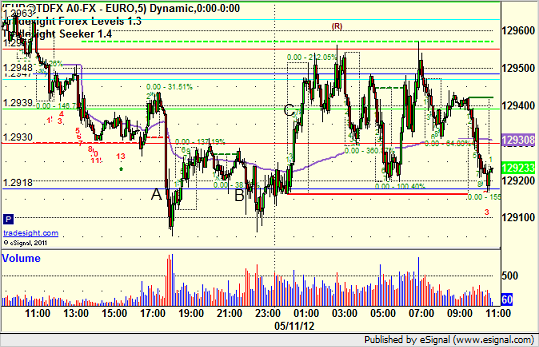

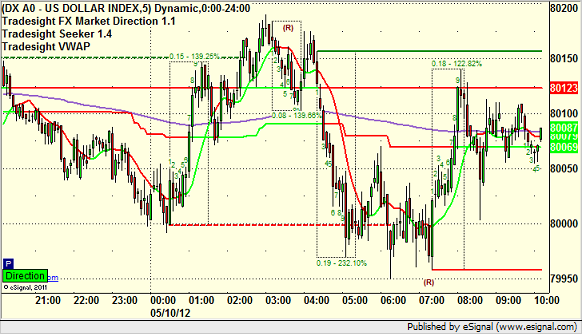

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

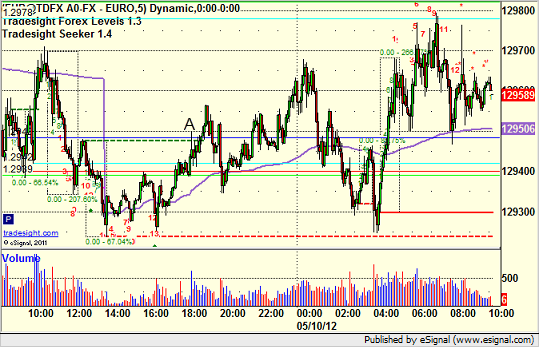

EURUSD:

Second half of the short from the prior session stopped at A over the new Pivot:

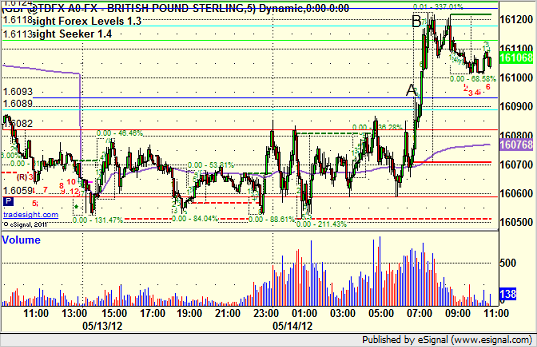

GBPUSD:

Triggered short at A and stopped. Triggered long at B, eventually gave up and closed at C: