Forex Calls Recap for 5/10/12

Closed out the short from the prior day on the EURUSD in the money. Lost on the GBPUSD short and closed out the second one just under the entry. See those sections below.

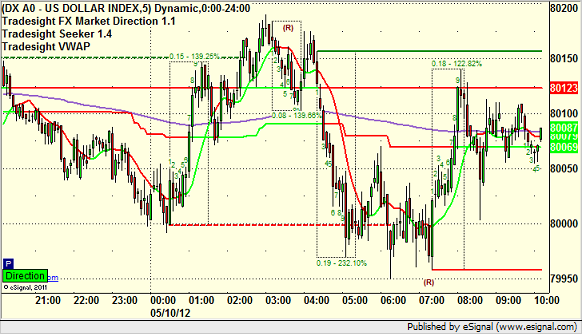

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

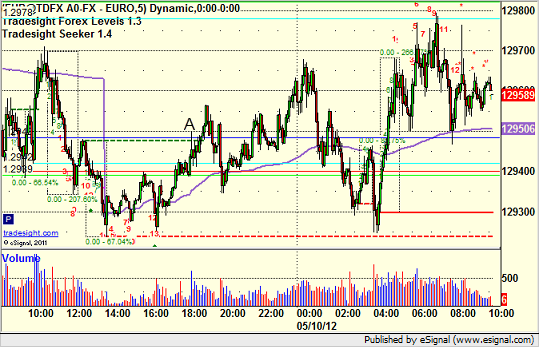

EURUSD:

Second half of the short from the prior session stopped at A over the new Pivot:

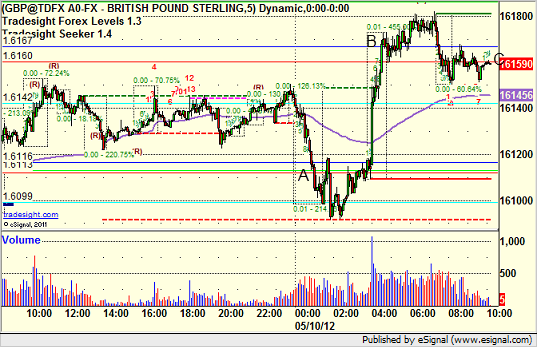

GBPUSD:

Triggered short at A and stopped. Triggered long at B, eventually gave up and closed at C:

Tradesight Market Preview for 5/10/12

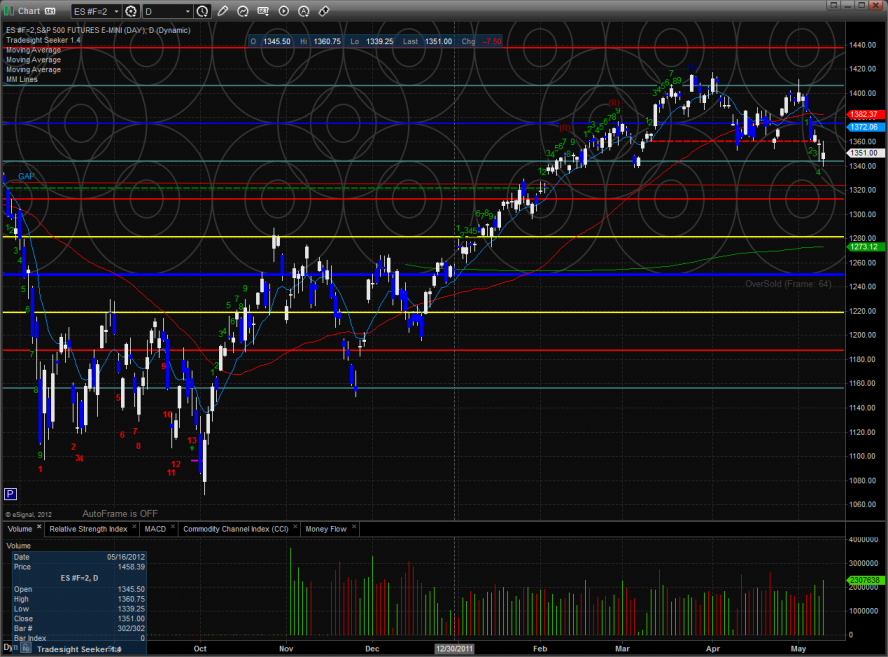

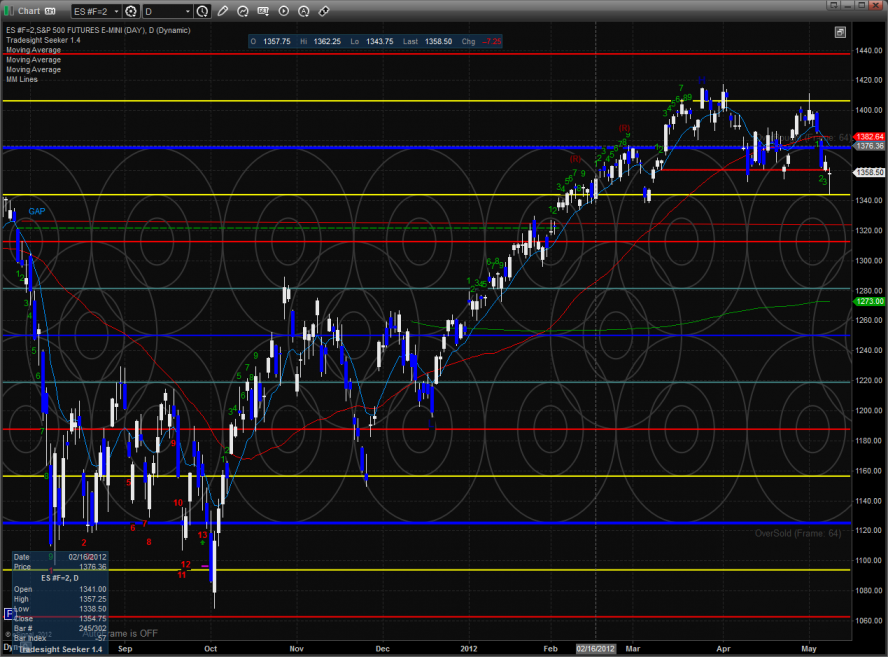

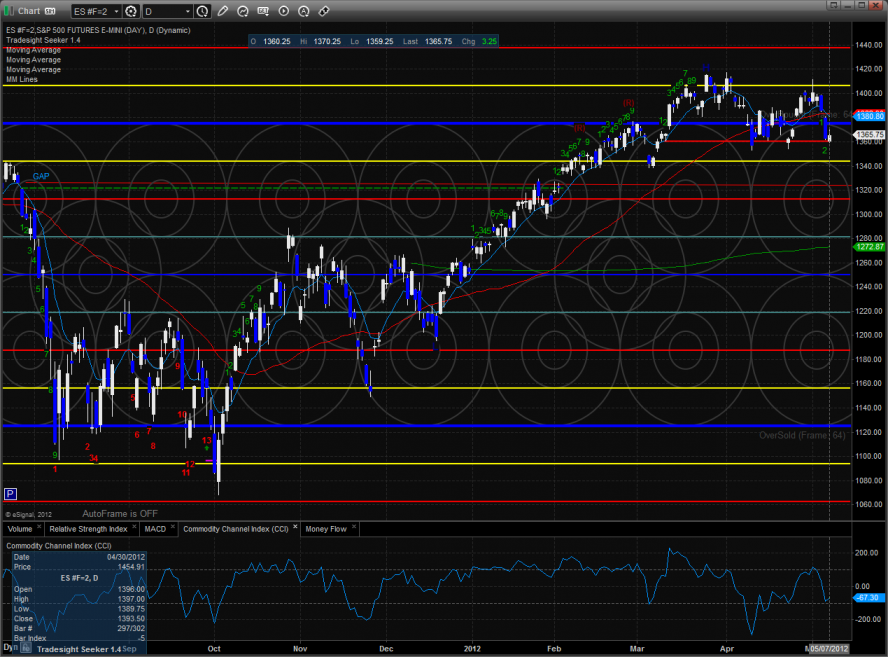

The ES closed right at the key 1352 level which was the intraday low form April. The bullish development was that even though price was lower on the day the close was above the open.

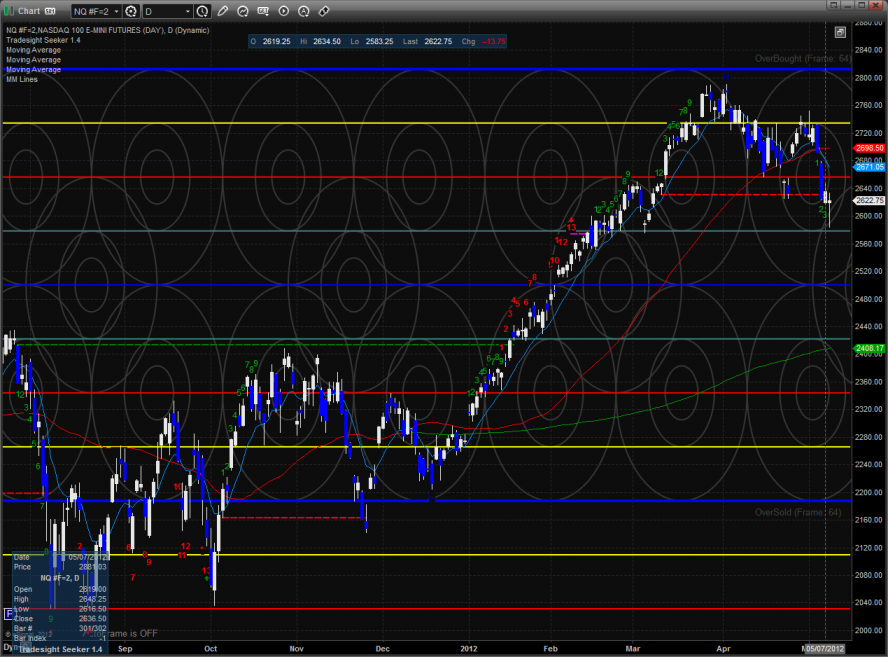

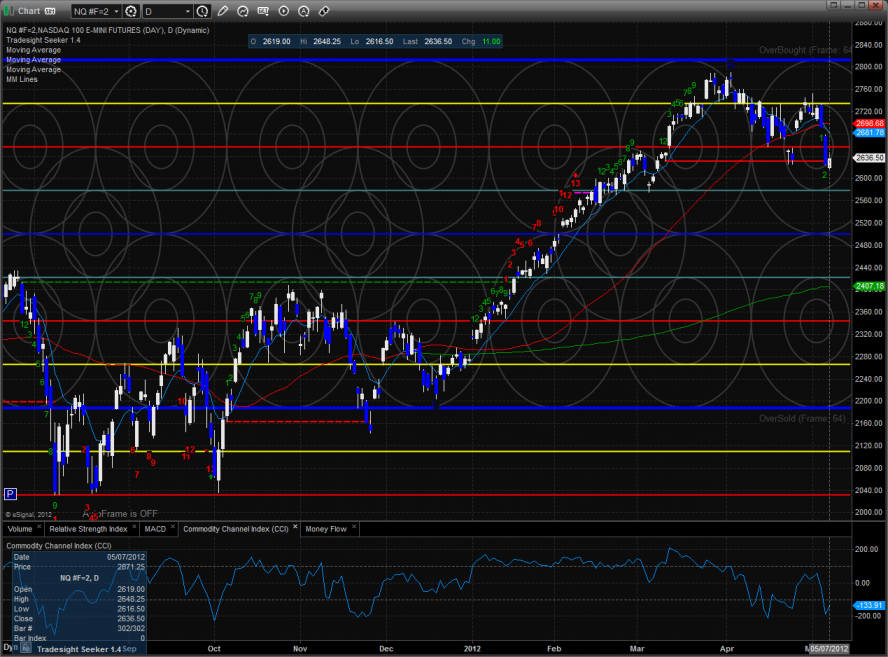

The NQ futures were little changed on the day but closed well above the open. Price was contained within the prior day’s range and the breakout should have some extra punch.

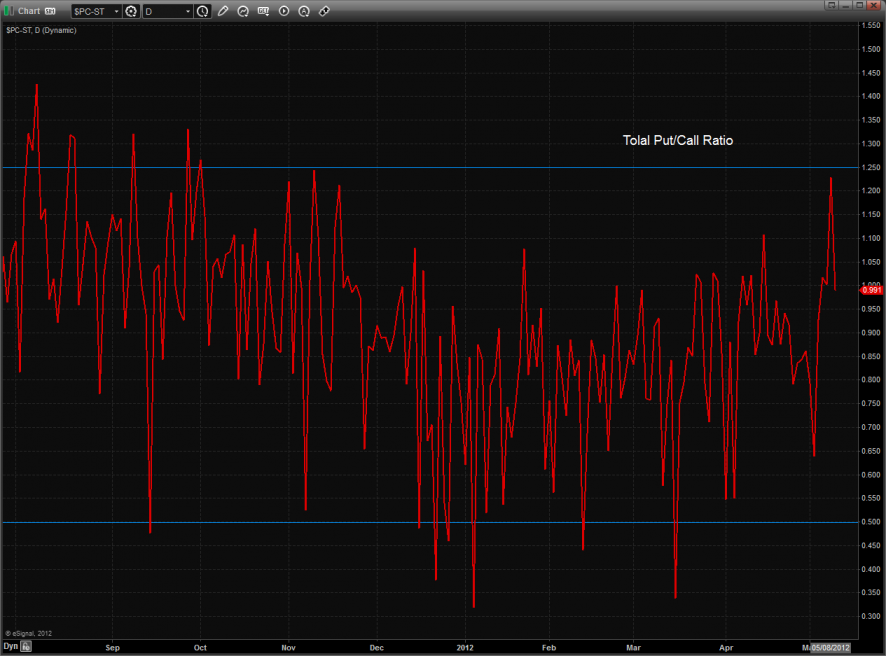

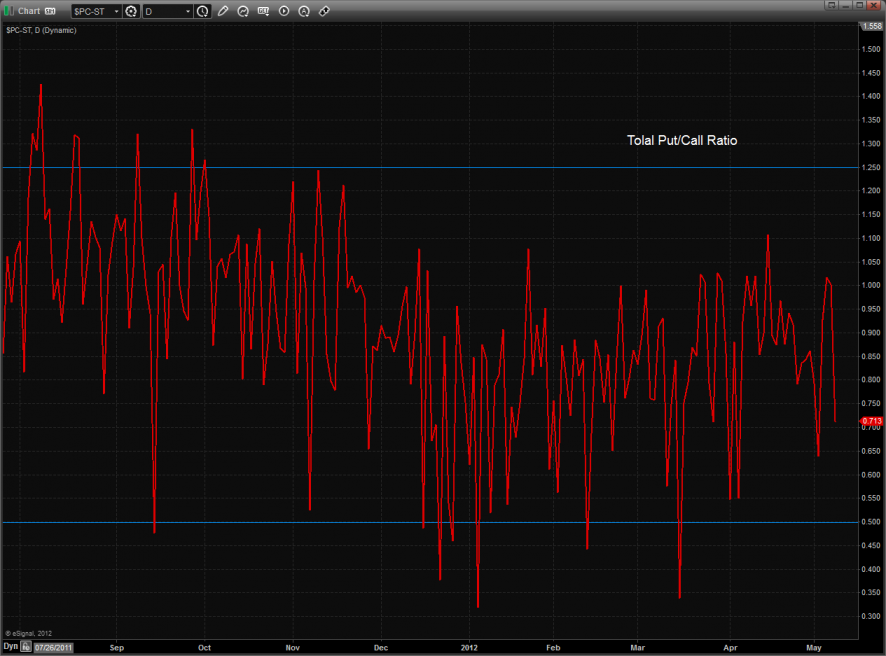

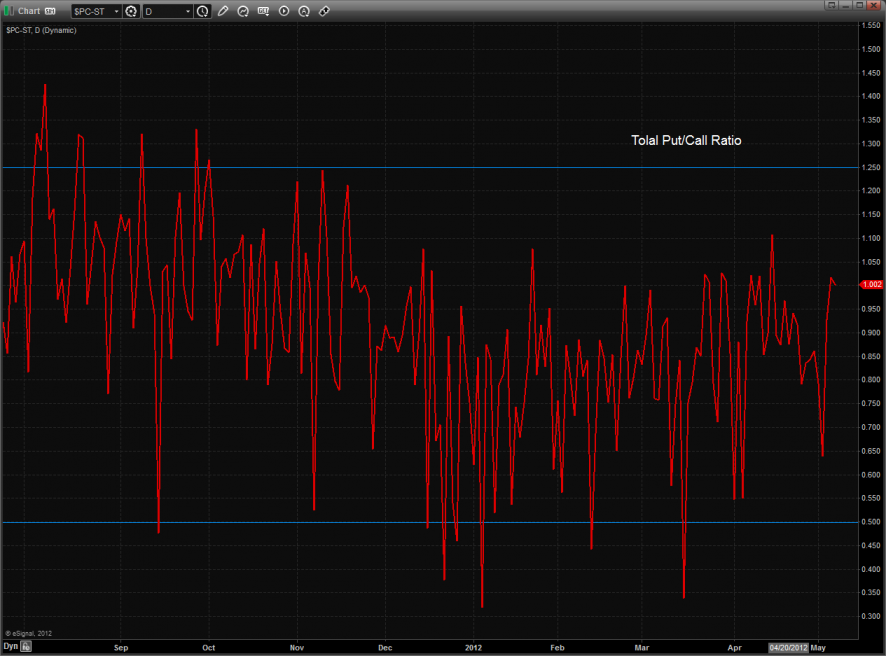

Total put/call ratio:

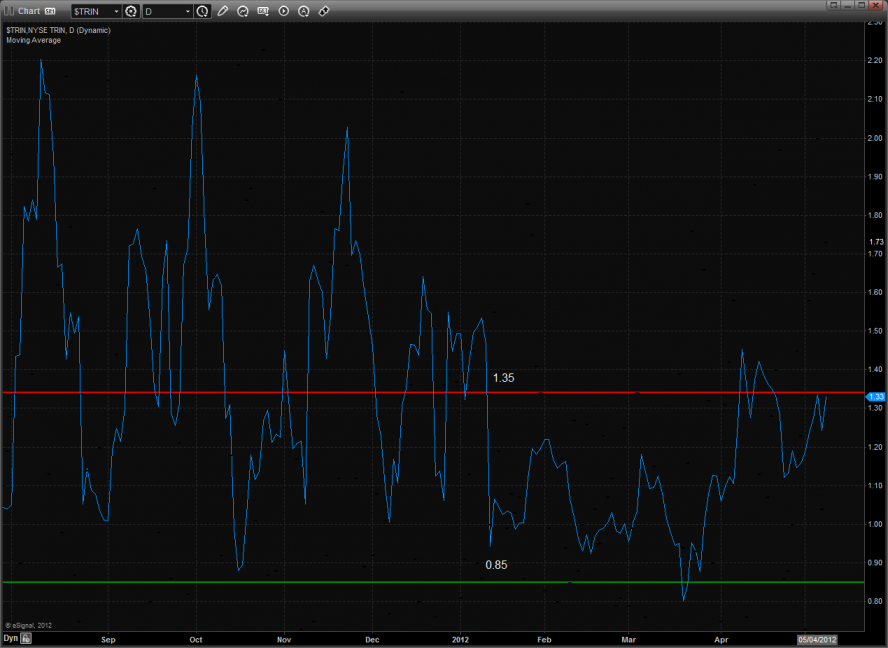

10-day NYSE Trin:

Multi sector daily chart:

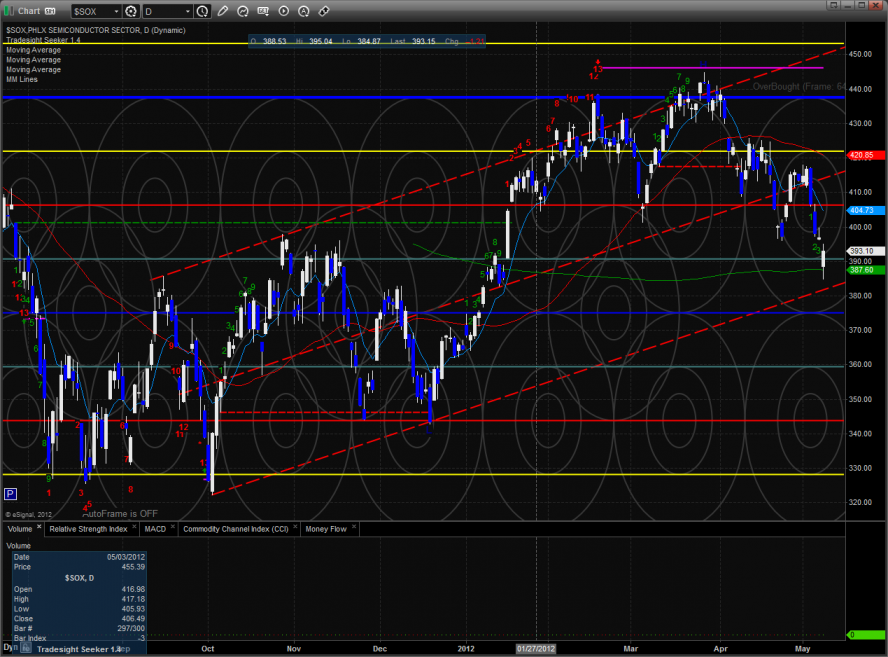

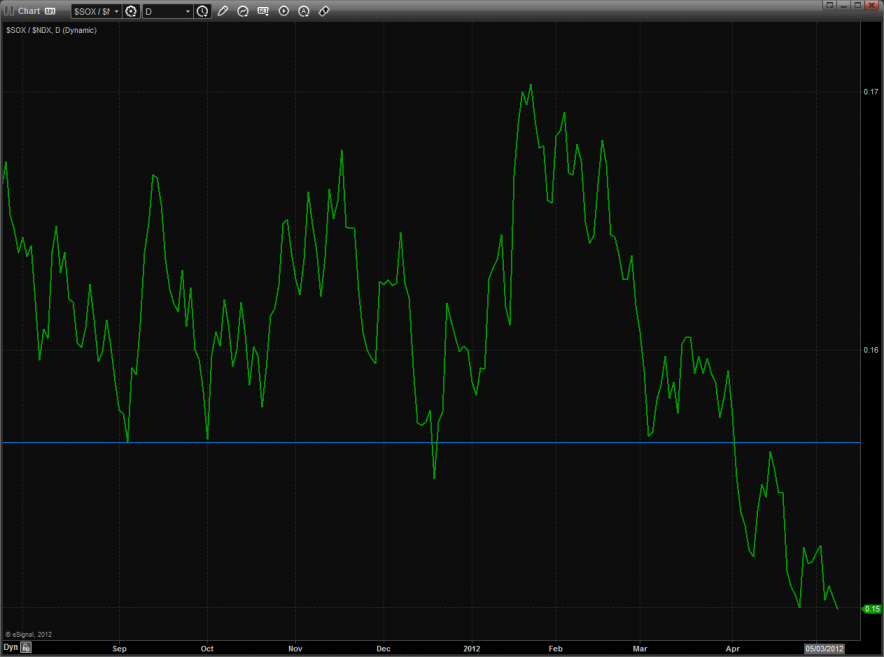

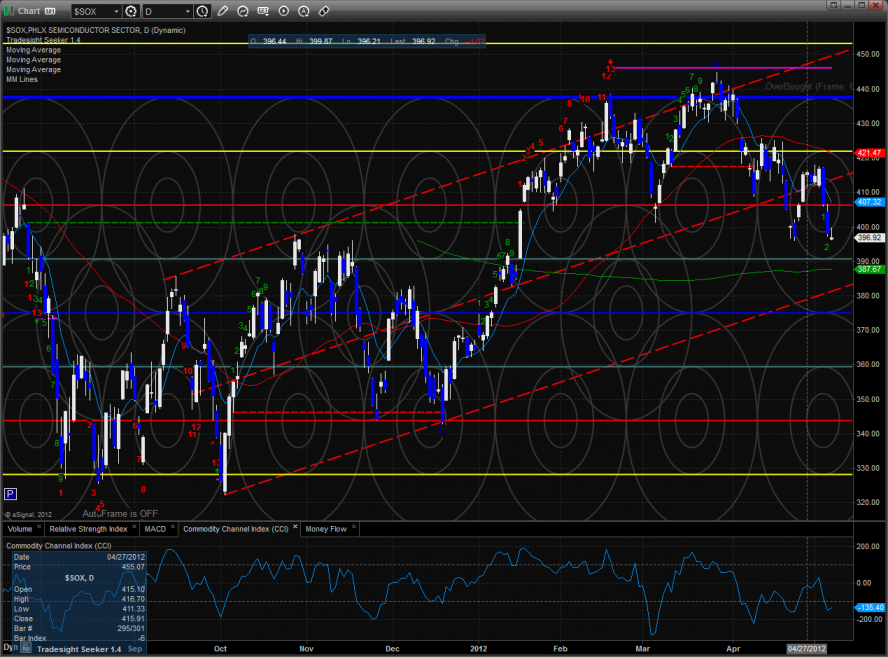

The SOX/NDX cross is hanging on by a thread, see below.

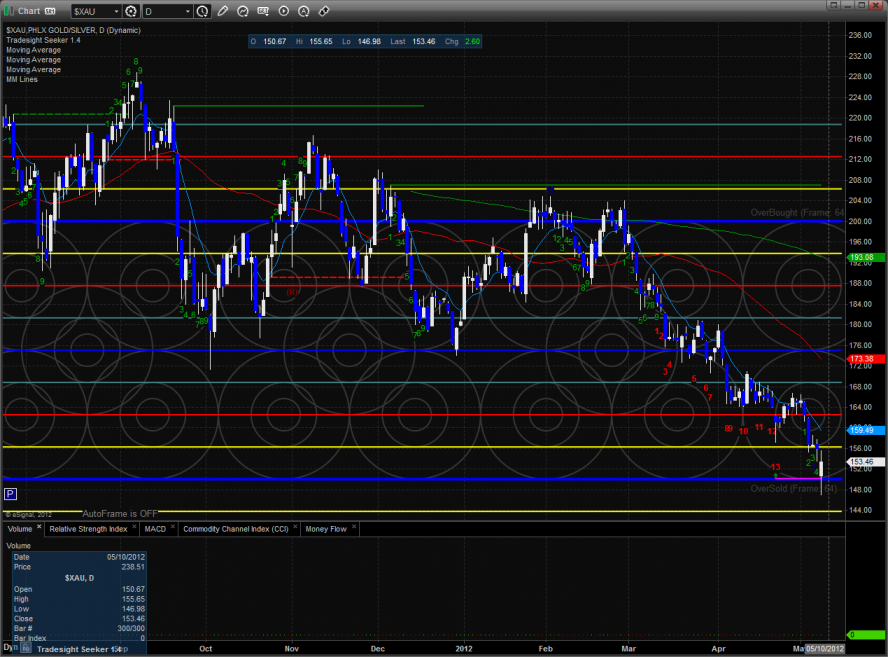

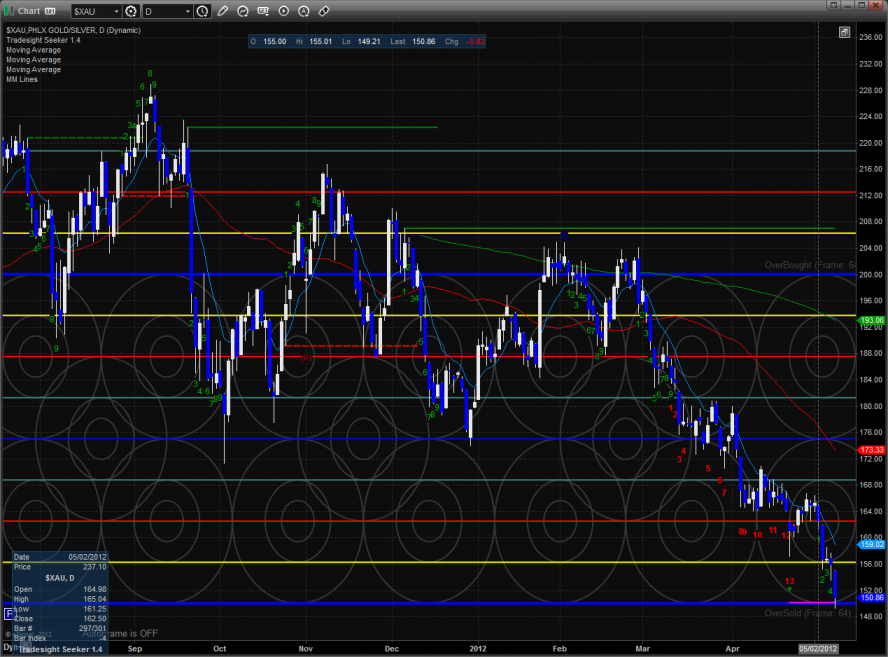

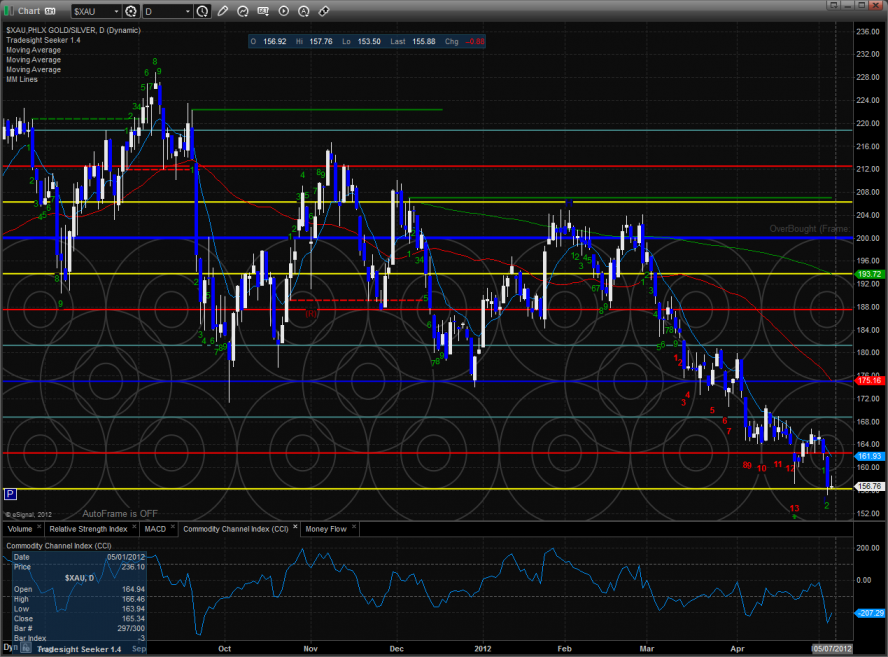

The XAU tested the risk level of the Seeker buy signal and was saved by it. Keep a close eye on this sector the rest of the week and look for reversal setups.

The SOX tested and held above the key 200dma. Keep in mind that this also maintains price above the lower channel boundary.

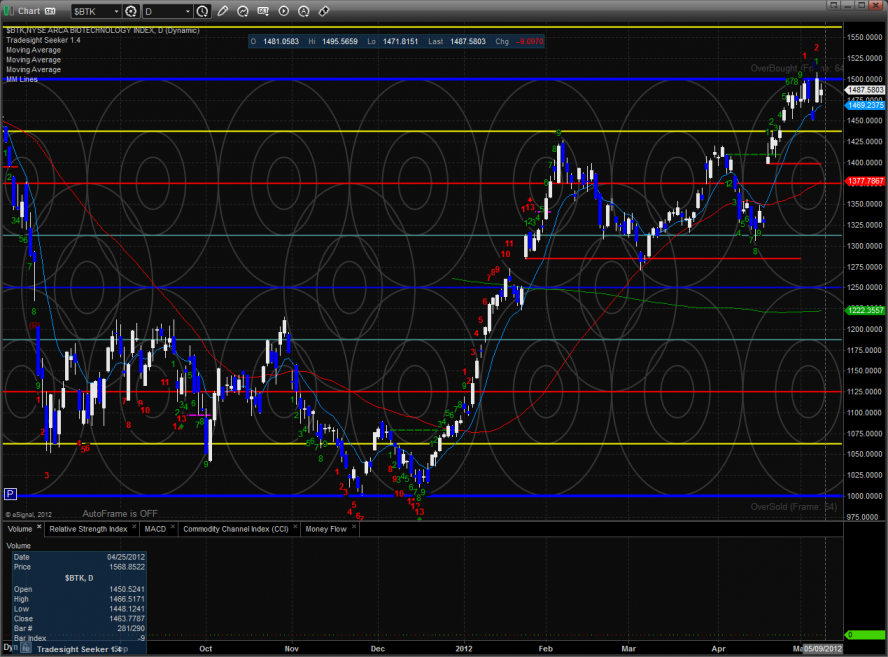

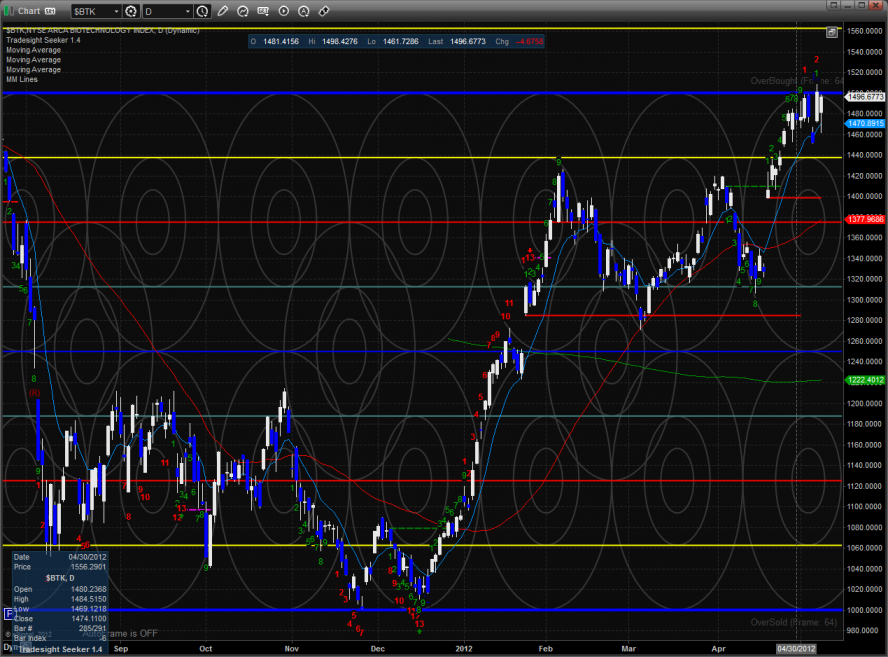

The BTK posted a relatively narrow inside day.

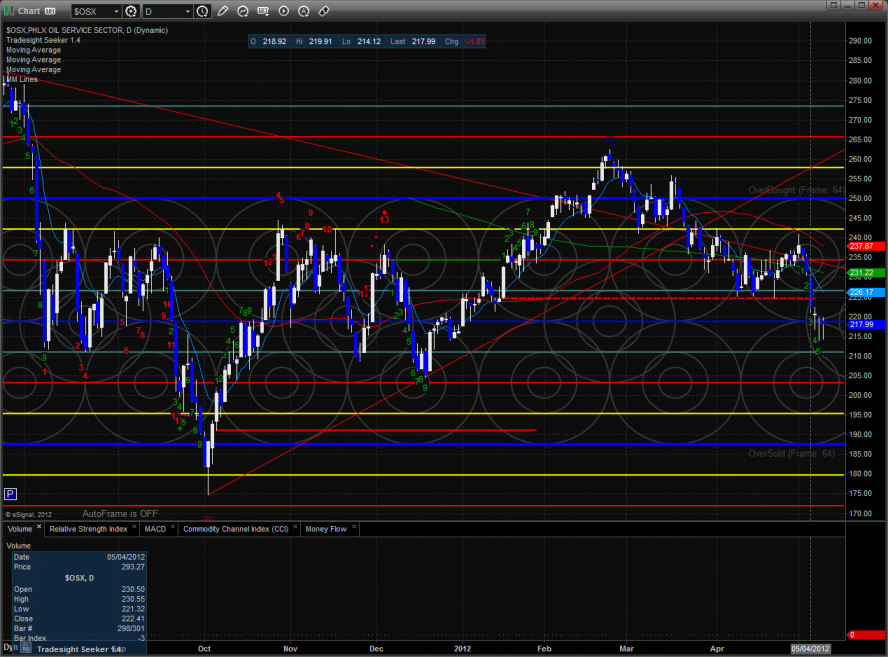

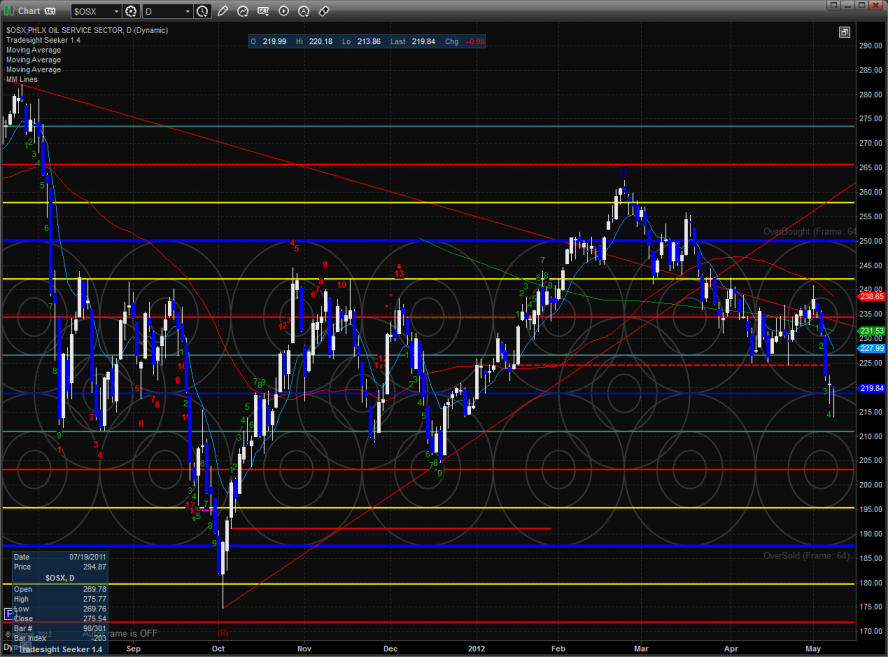

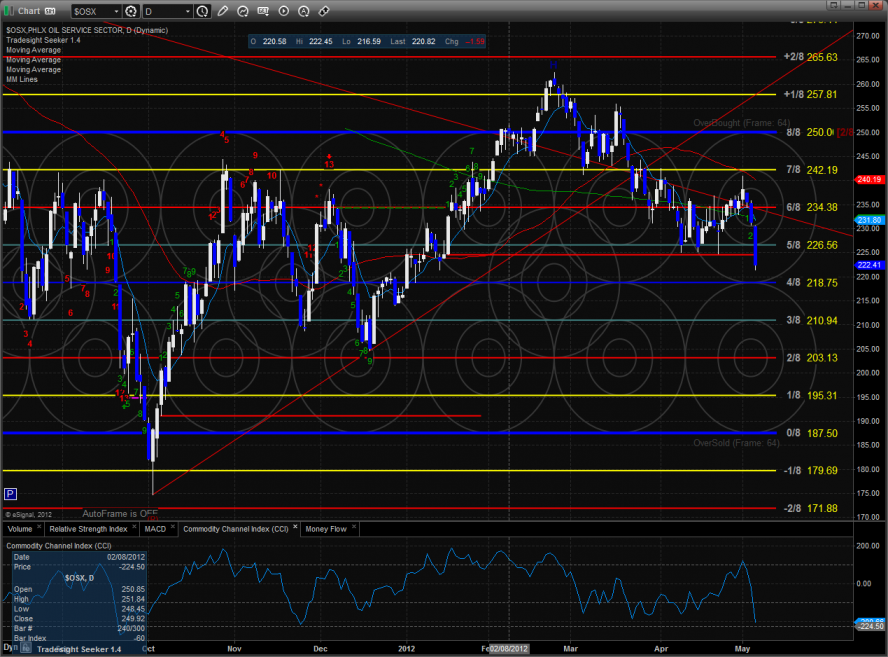

The OSX continues to trace out some bottoming tails on the daily chart and closing at a 3 day high will kick in some short covering.

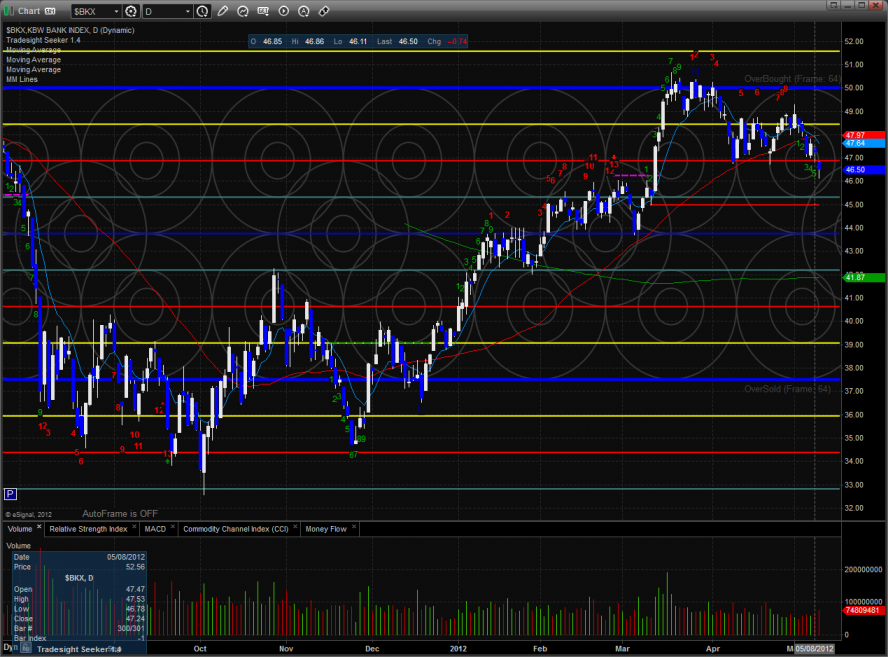

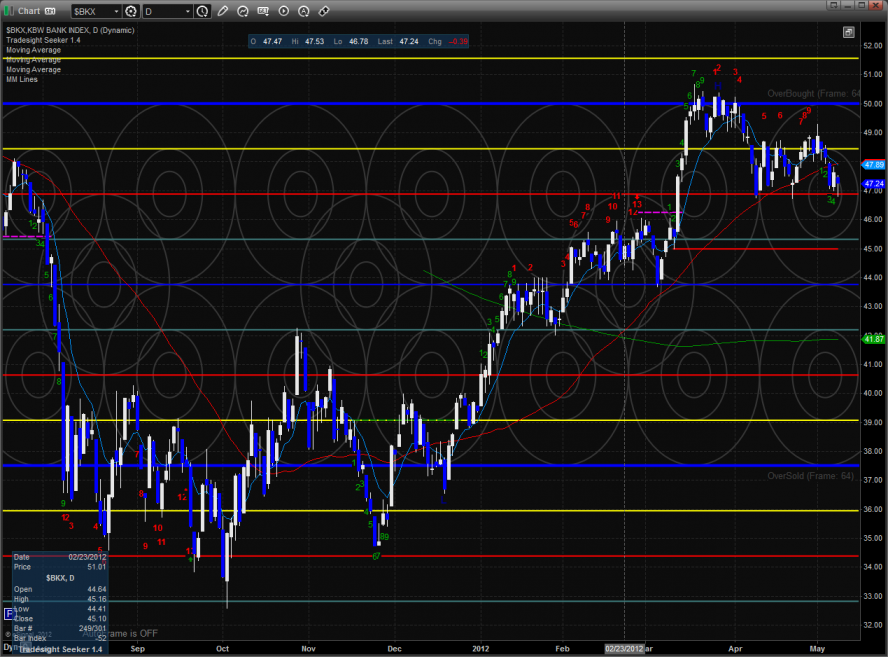

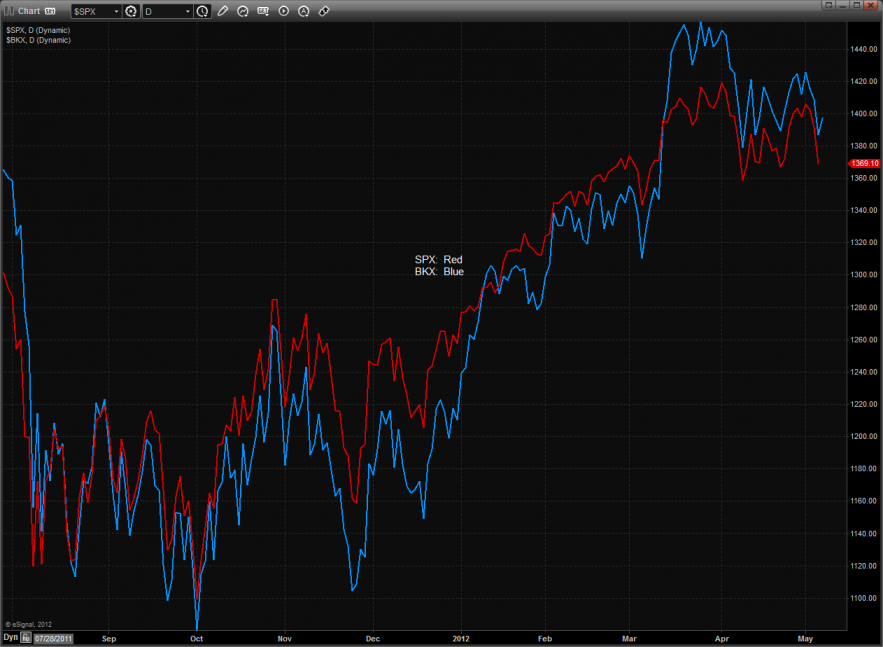

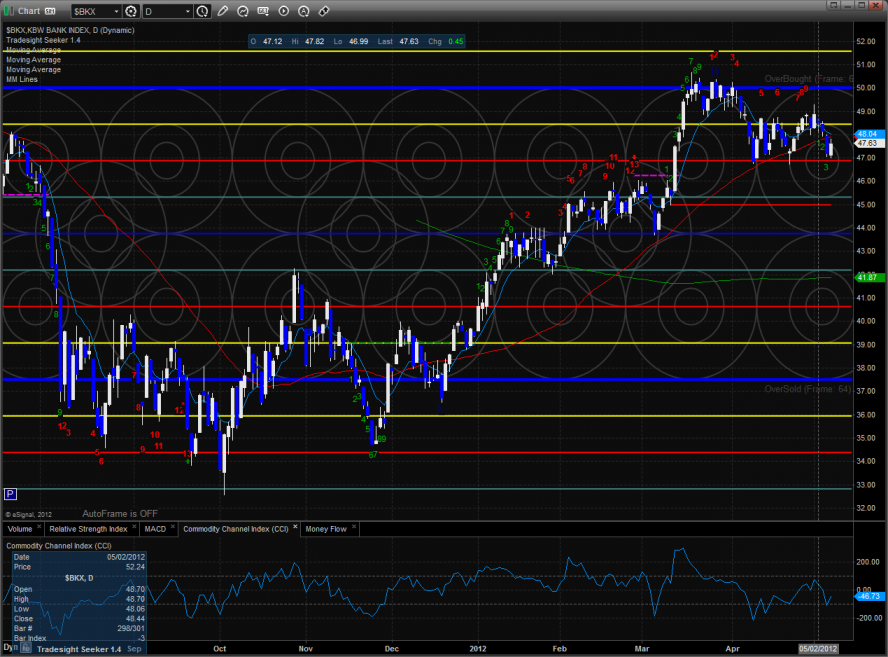

The BKX was the weakest major sector on the day. Price settled below the recent range and continuation will put the static trend line in play.

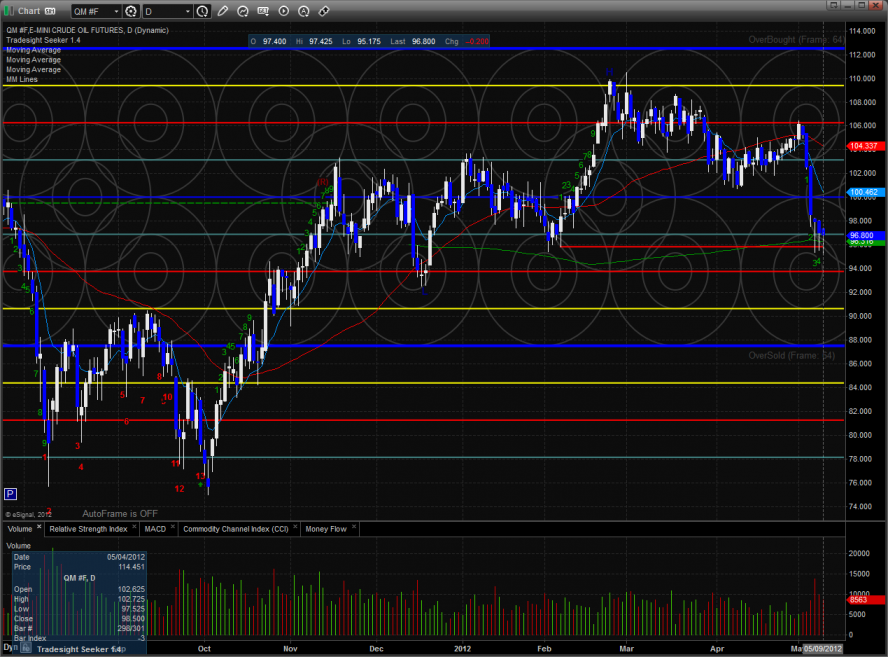

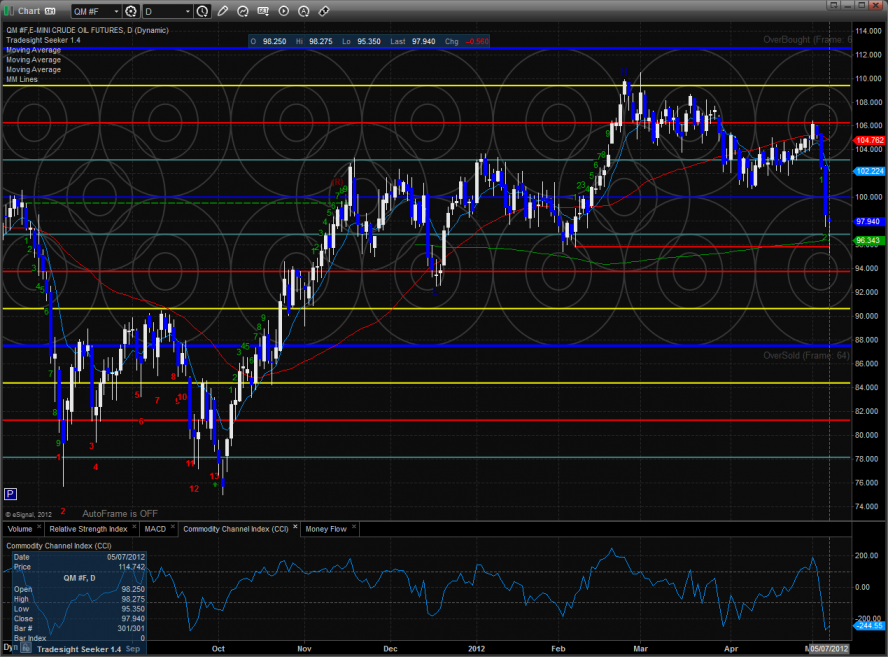

Oil:

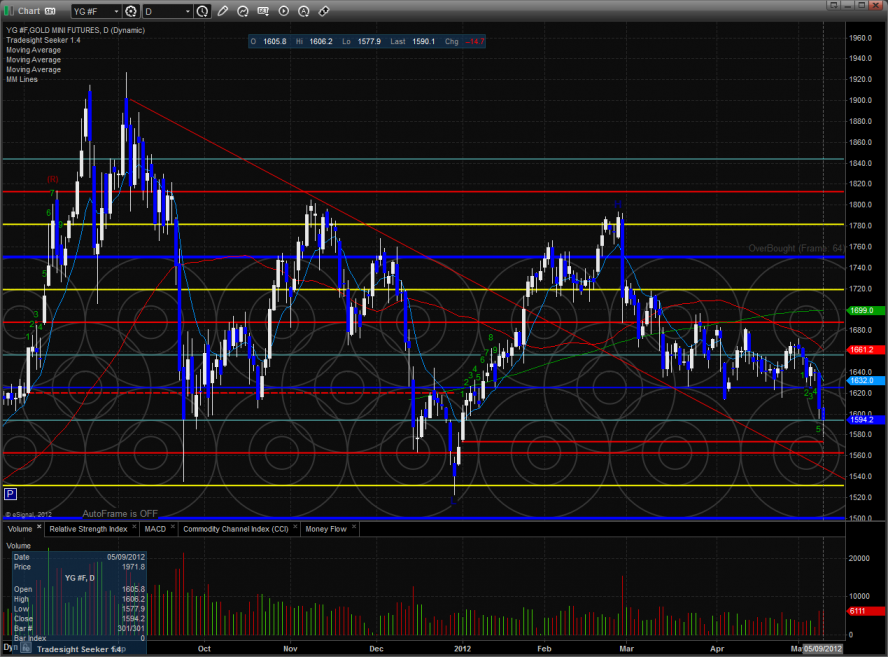

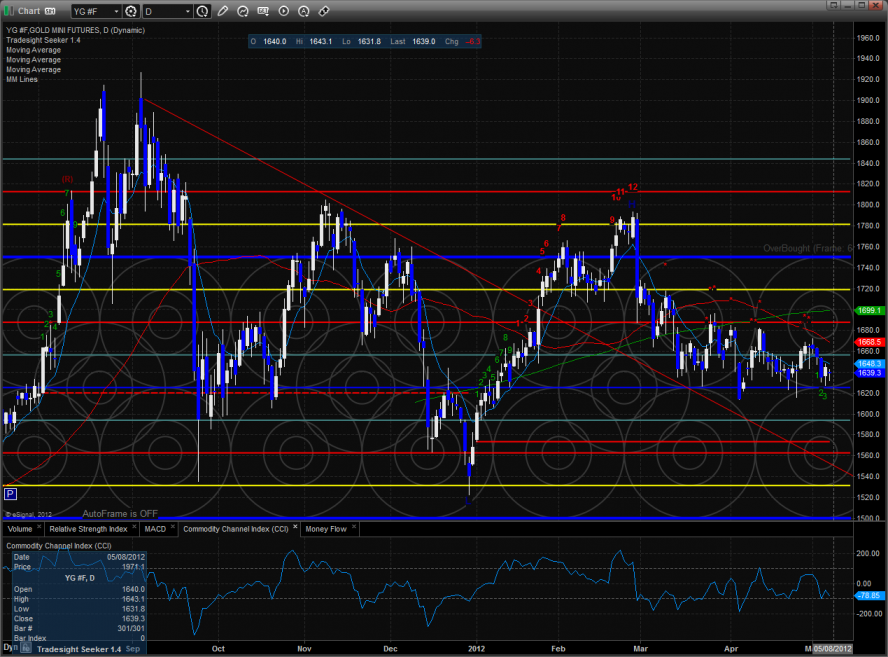

Gold:

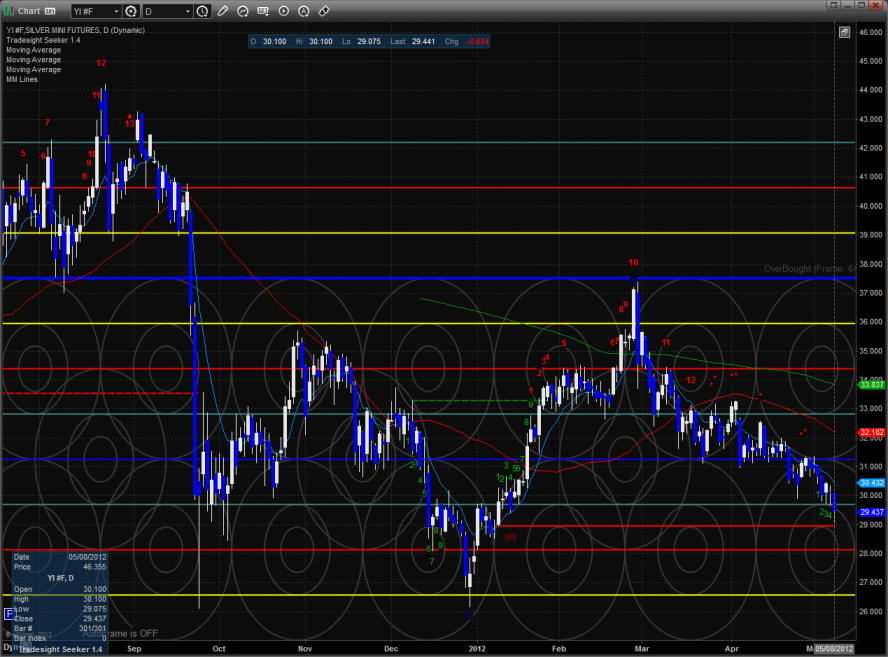

Silver:

Stock Picks Recap for 5/9/12

Triggered short early (half-size) at A and stopped at B. Triggered short again at C, hit first target at D, and holding second half with a stop over S1:

Stock Picks Recap for 5/9/12

Triggered short early (half-size) at A and stopped at B. Triggered short again at C, hit first target at D, and holding second half with a stop over S1:

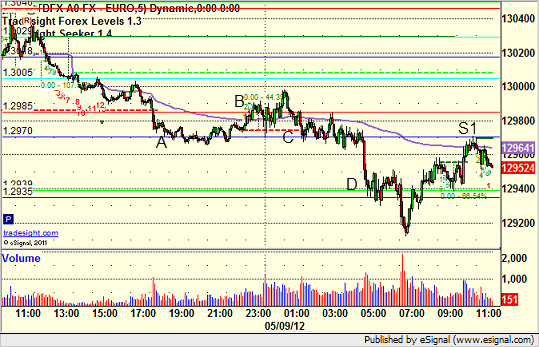

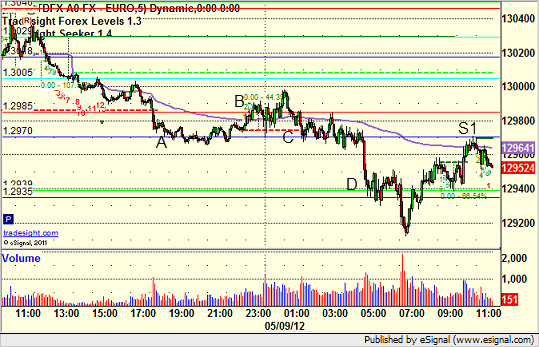

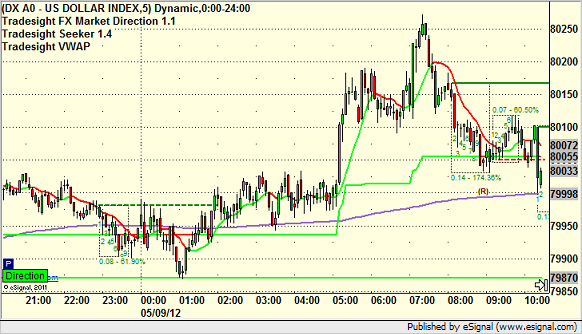

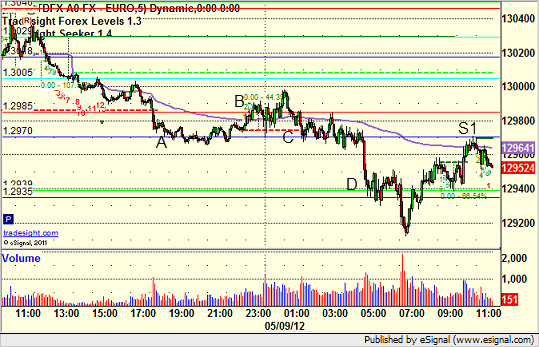

Forex Calls Recap for 5/9/12

Early triggered stopped and then triggered during the European session and worked on the EURUSD. See the recap below. Slow session other than that.

New calls and Chat tonight as we start to get some economic data the next two days.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

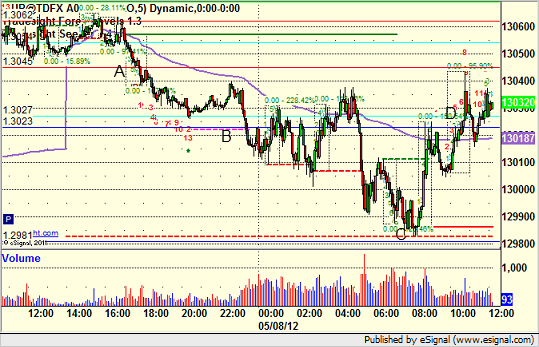

Triggered short early (half-size) at A and stopped at B. Triggered short again at C, hit first target at D, and holding second half with a stop over S1:

Tradesight Market Preview for 5/9/12

The ES lost 7 handles on the day after trading at some key price. On the chart you will see the prior low close at 1357 and the prior intraday low at 1352. Both prices traded but the ES managed to close above both of those levels. Once those levels are penetrated the potential lower high on the chart will be confirmed. Until this confirmation occurs the short term trend is frustratingly lateral. Note that Tuesday’s candle was a camouflage buy signal.

The NQ futures lost 14 on the day and also recorded a camouflage buy signal.

The 10-day Trin is close to but just below the oversold threshold.

The total put/call ratio remains neutral.

The multi sector daily chart shows the XAU continues to bleed.

The SOX/NDX cross matched its low close but did not break futher.

The decline in gold pushed the Dow/gold ratio to a new high in favor of stocks over gold.

The BTK was again the top gun on the day but did not record a new high on the move.

The OSX has posted two days in a row that have put some very interesting bottoming tails on the candles.

The BKX remains boxed up and is using the same key level for support. Don’t forget the bullish triangle that is being traced out.

The XAU was the last laggard on the day. The Seeker buy signal is hanging on by a thread. Price has penetrated the risk level but not yet broken it.

Oil:

Gold:

Silver:

Stock Picks Recap for 5/8/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INTU triggered short (with market support) and worked:

INFY triggered short (with market support) and worked:

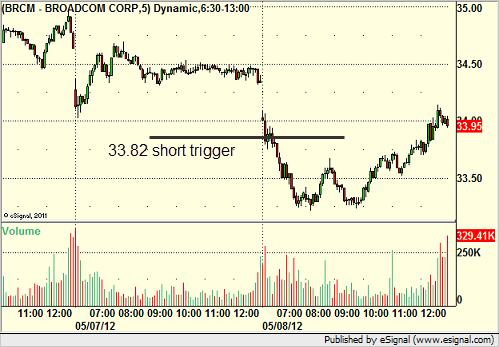

BRCM triggered short (with market support) and worked:

FOSL and ULTA gapped well below their triggers, no plays.

SINA triggered short (with market support) and worked great:

In the Messenger, Rich's WYNN triggered short (with market support) and worked:

His NFLX triggered short (with market support) and worked:

His AMZN triggered short (with market support) and worked:

His CROX triggered short (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and worked:

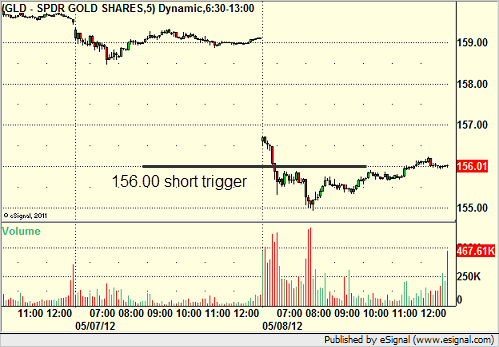

His GLD triggered short (ETF, so no market support needed) and worked:

His AAPL triggered short (with market support) and worked:

In total, that's 11 trades triggering with market support, and ALL 11 of them worked.

Forex Calls Recap for 5/8/12

Our EURUSD long from the prior session stopped in the money, and then we had a new winner short on the EURUSD. See that section below.

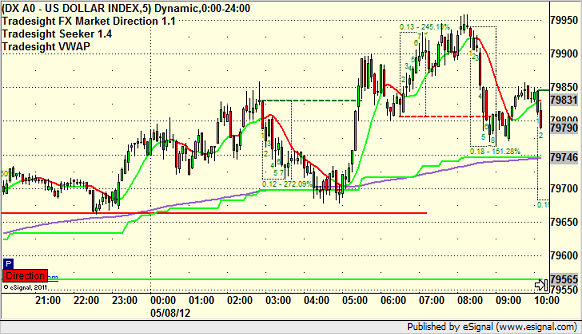

Here's the US Dollar Index intraday with our market directional tools:

New calls and Chat tonight.

EURUSD:

Second half of the long from the prior day stopped at A. New trade triggered short at B, hit first target at C, lowered stop and stopped at D:

Stock Picks Recap for 5/7/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CDNS, SOHU, MOLX, and CTSH gapped under their short triggers, no plays.

Strange day with the gaps and light volume. Very few trades triggered with market support.

CROX triggered short (without market support due to opening five minutes) and worked enough for a partial:

ORCL triggered short (without market support) and didn't work:

In the Messenger, Rich's IBM triggered short (without market support) and didn't work:

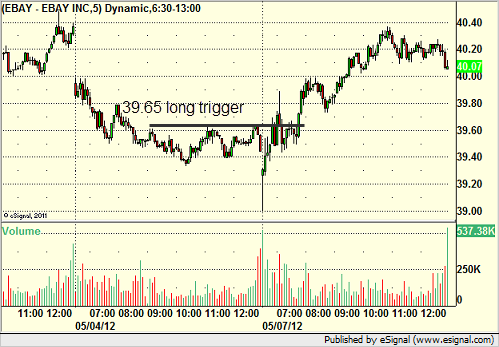

EBAY triggered long (with market support) and didn't work, although it worked later:

FFIV triggered long (with market support) and worked enough for a partial:

Rich's GMCR triggered short (without market support) and worked enough for a partial:

AMGN triggered long (with market support) and didn't work.

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

Tradesight Market Preview for 5/8/12

The ES gapped down opening at the active static trend line then rallied up to close high on the day by 3 handels. Keep in mind that while the bulls saved the one day, price remained in the lower half of Friday’s down candle.

The NQ futures posted a similar session. The big break remains on the chart with a lower high on the chart. Price is bearishly below the 10 and 50 period moving averages.

10-day Trin:

The put/call ratio remains neutral.

Multi sector daily chart:

The SOX/NDX cross is near the prior low showing weakness in the SOX. A break to new lows would be very bearish for the overall NDX.

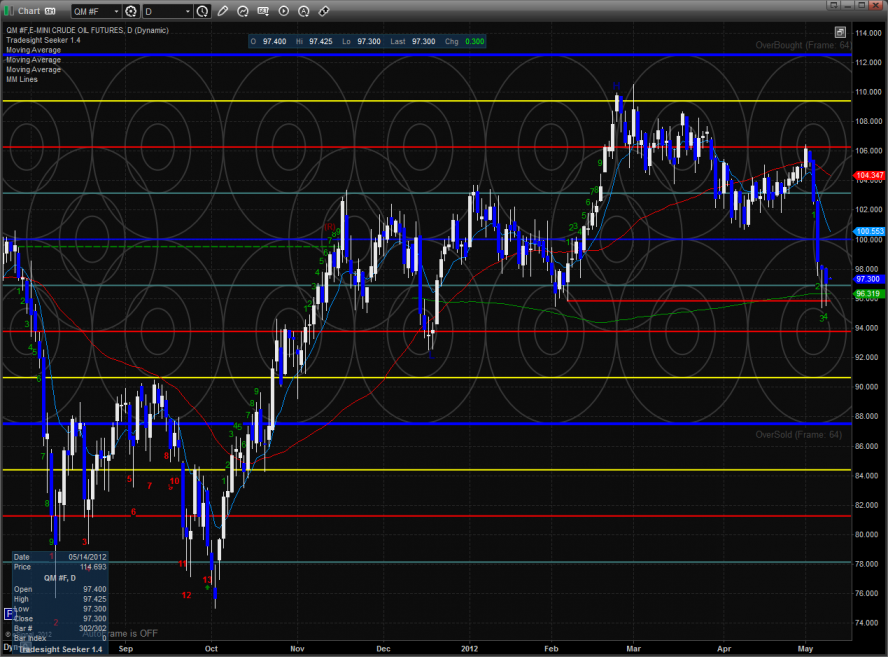

The OSX continues its bearish posture and is weighing down the underlying crude futures. This is a classic bearish condition for oil.

The one small positive is that the BKX is holding onto its relative strength vs. the SPX.

The BKX was relatively strong on the day up almost 1%. The February highs have been providing strong support and the daily chart is forming a bullish declining wedge formation.

The SOX was weak on the day using the prior low for support. This chart still could decline to the lower trend channel.

The XAU matched the old low but didn’t break. Be careful that this isn’t just a measuring day that gives way to further downside continuation.

The OSX was the last laggard on the day and broke key support by closing under the static trend line. The next important level is the 4/8 and then the YTD lows. This is not what the bulls want to see because there is typically a bid under energy stocks when a recovery is underway and has teeth.

Oil:

Gold:

Silver: