Tradesight Market Preview for 5/3/12

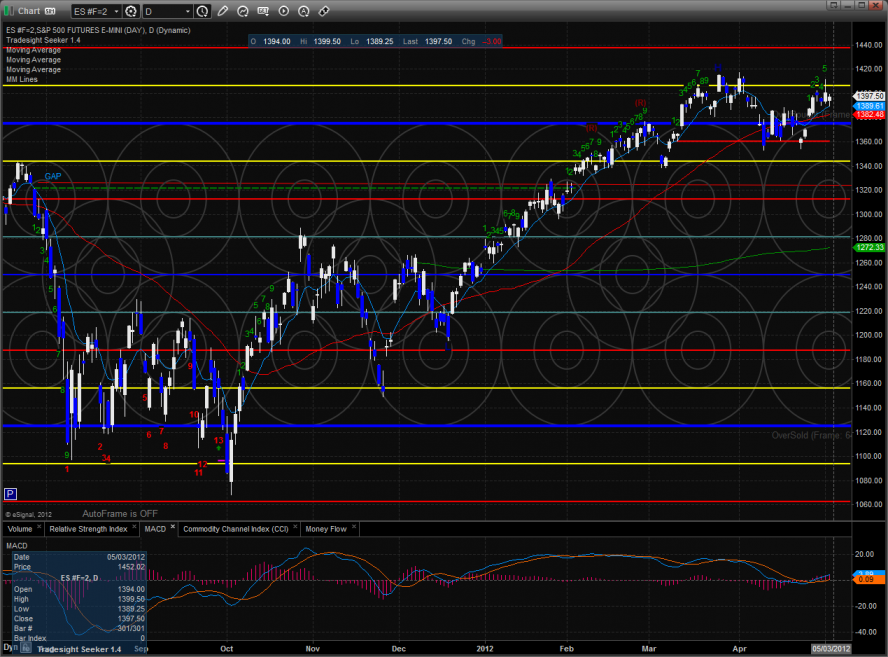

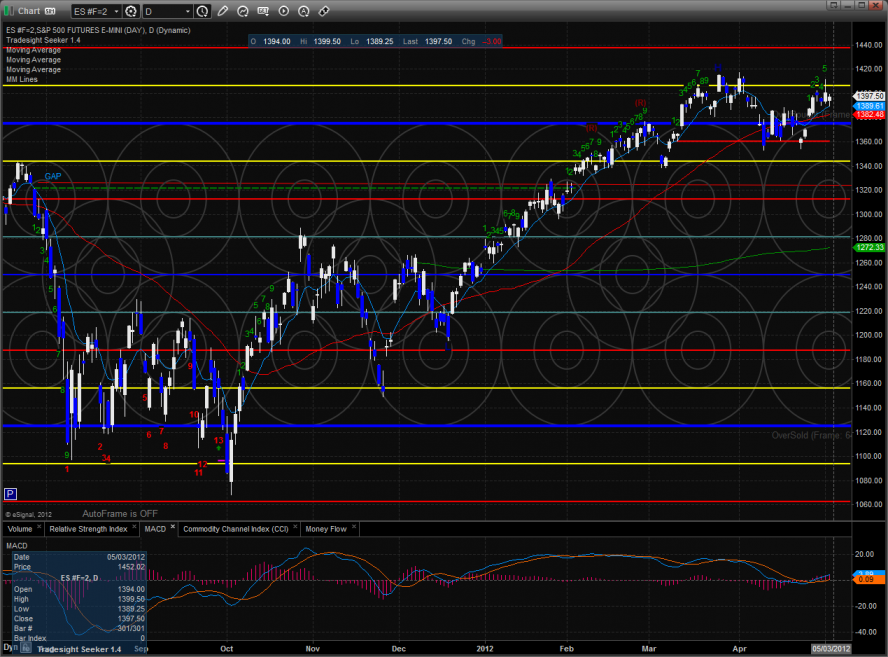

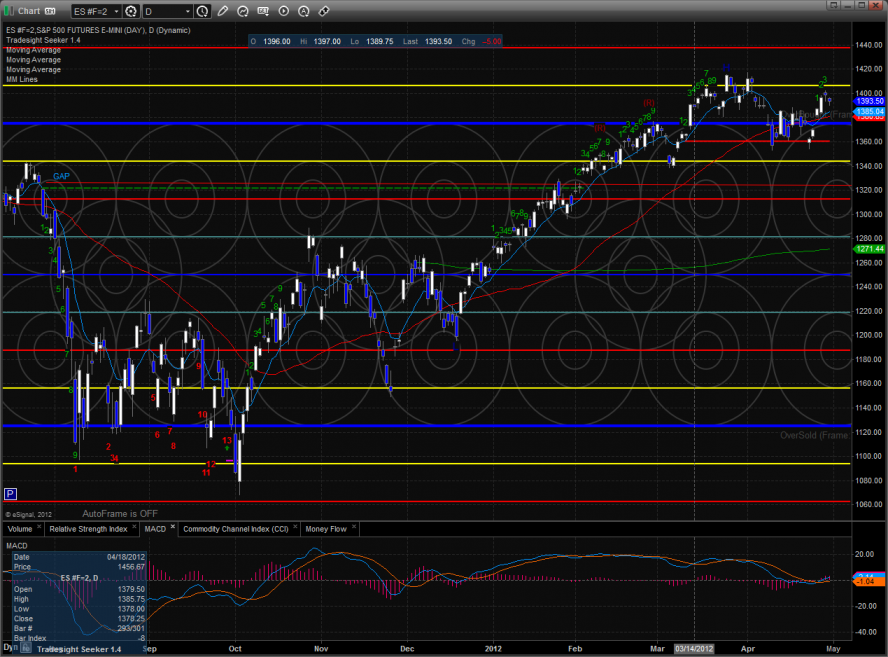

The ES did little on the day shaking off a disappointing ADP number. This left the chart with loss of 3 handles on day but in a subtly positive fashion, the day’s close was above the open.

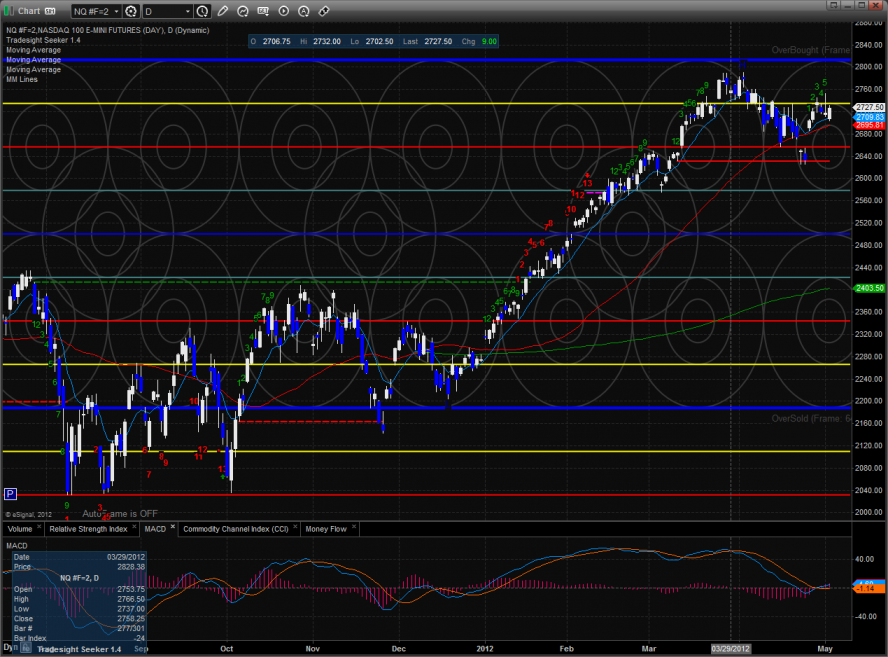

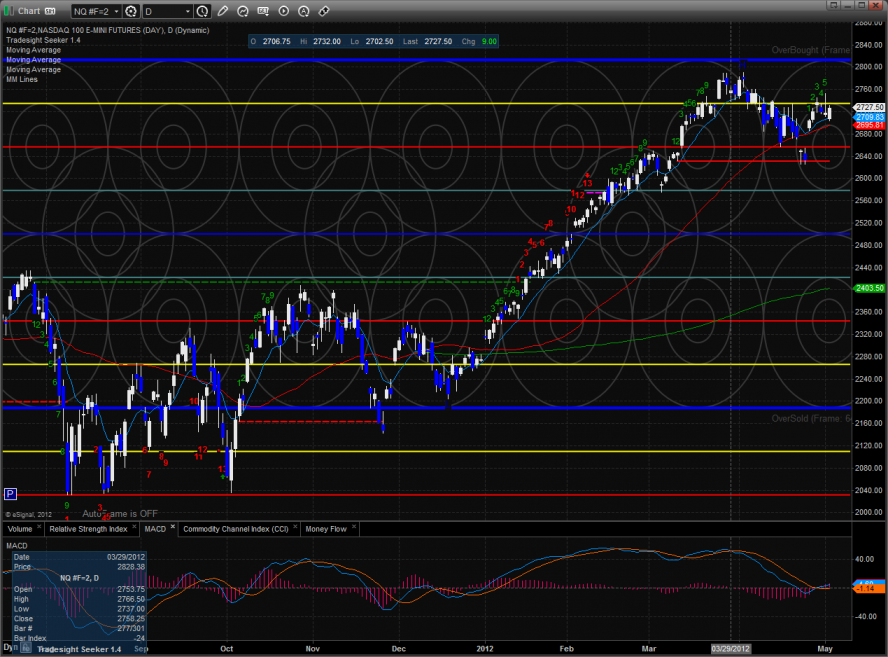

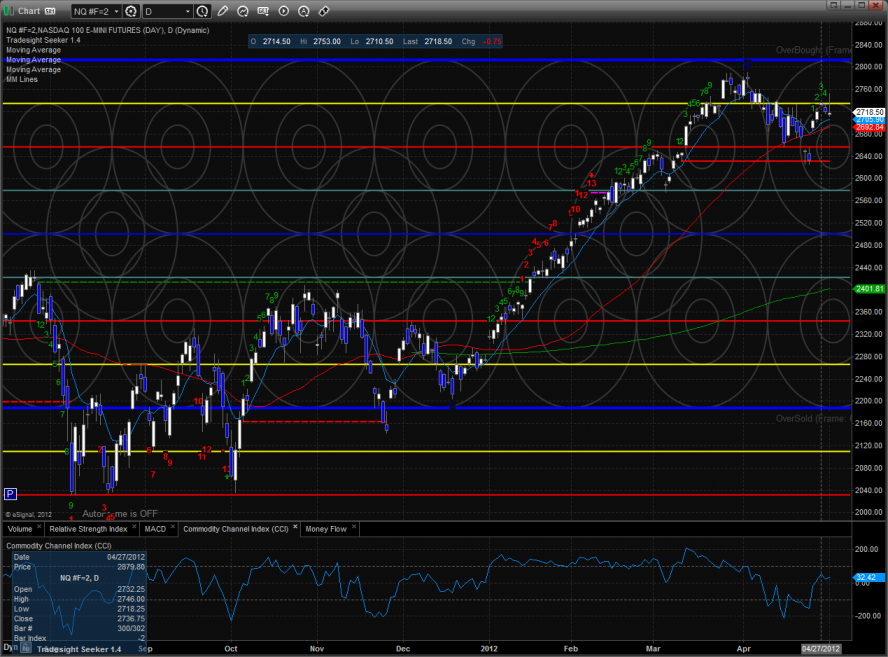

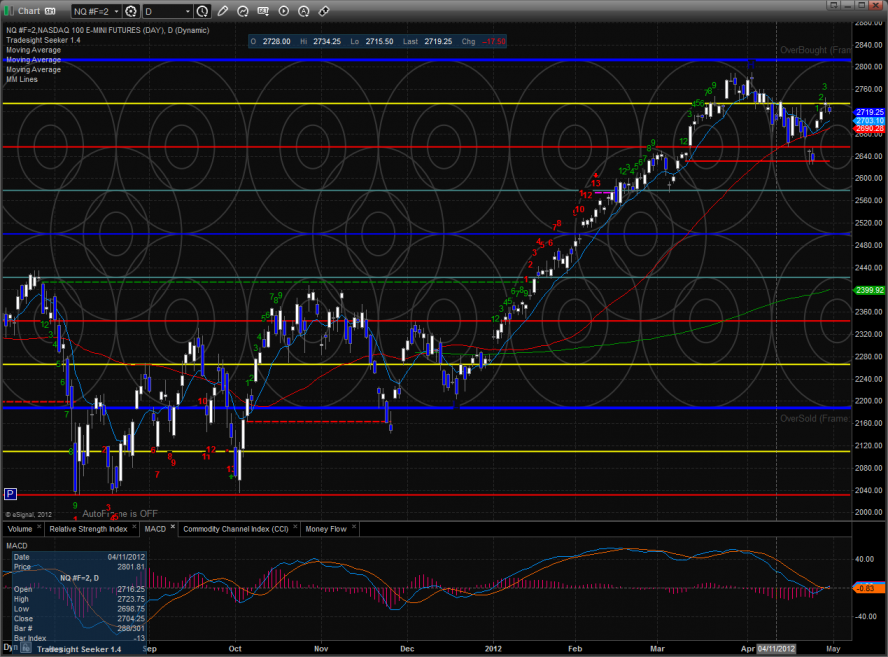

The NQ futures were high by 9 on the day and bullishly remain above all of the major moving averages. Friday’s non-farm payroll number will the week’s arbiter. This leaves Thursday’s trade as kind of a jump ball.

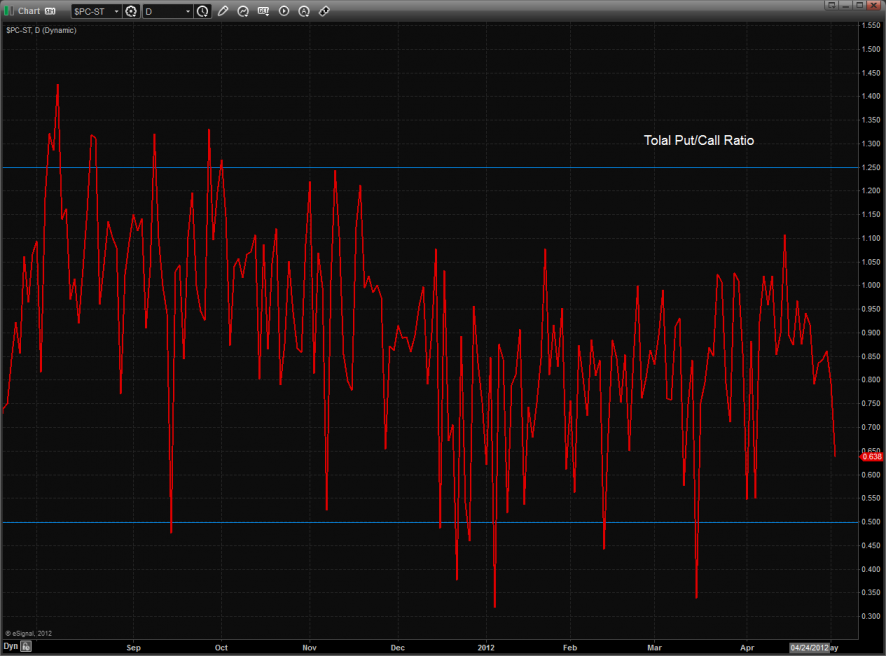

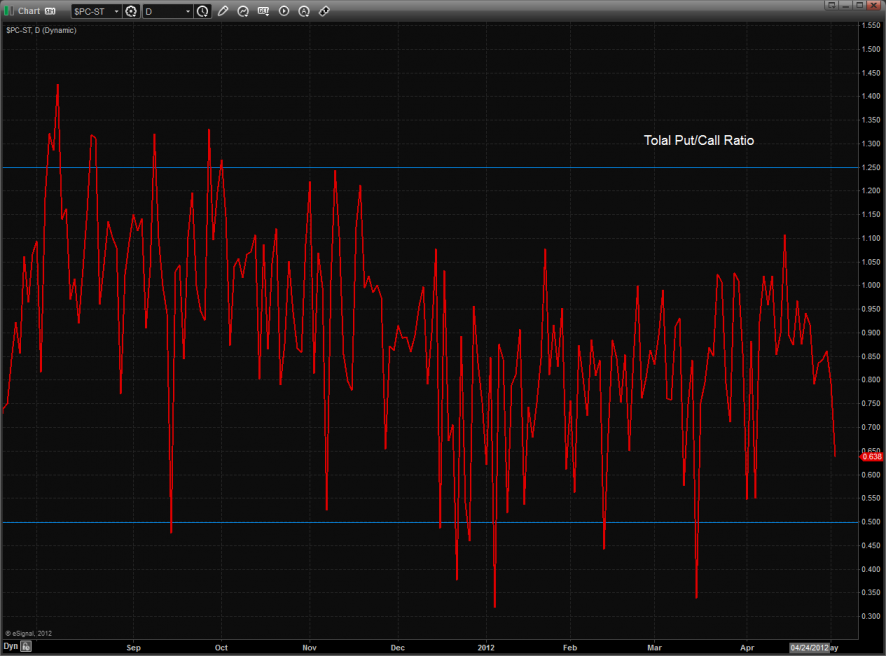

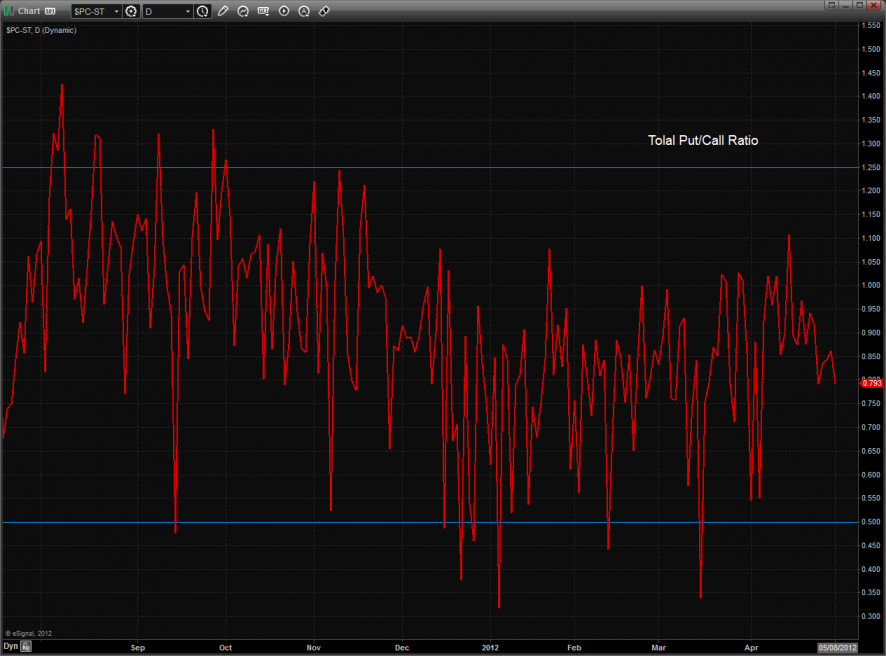

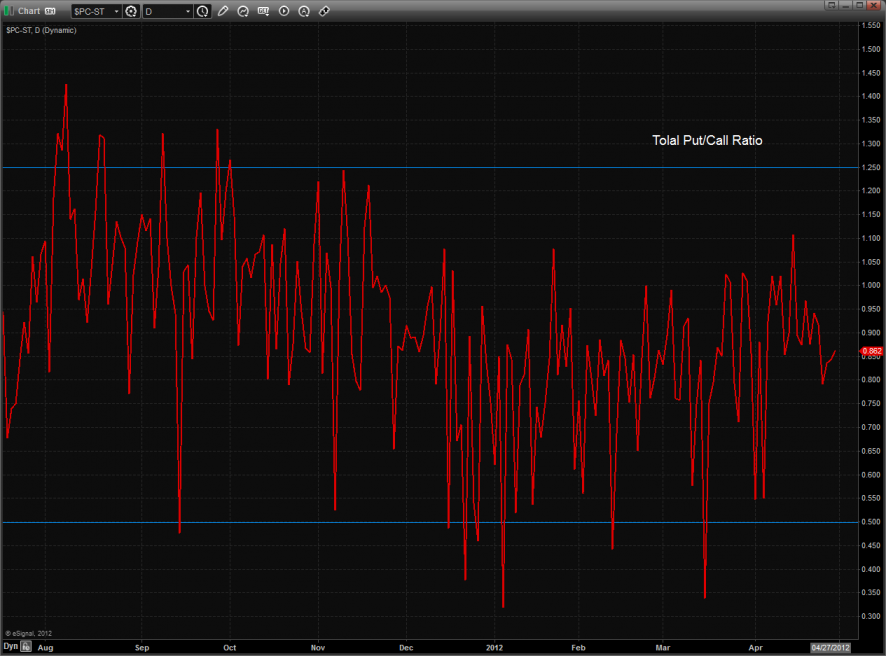

Total put/call ratio is moving lower but not yet climatic:

10-day NYSE Trin:

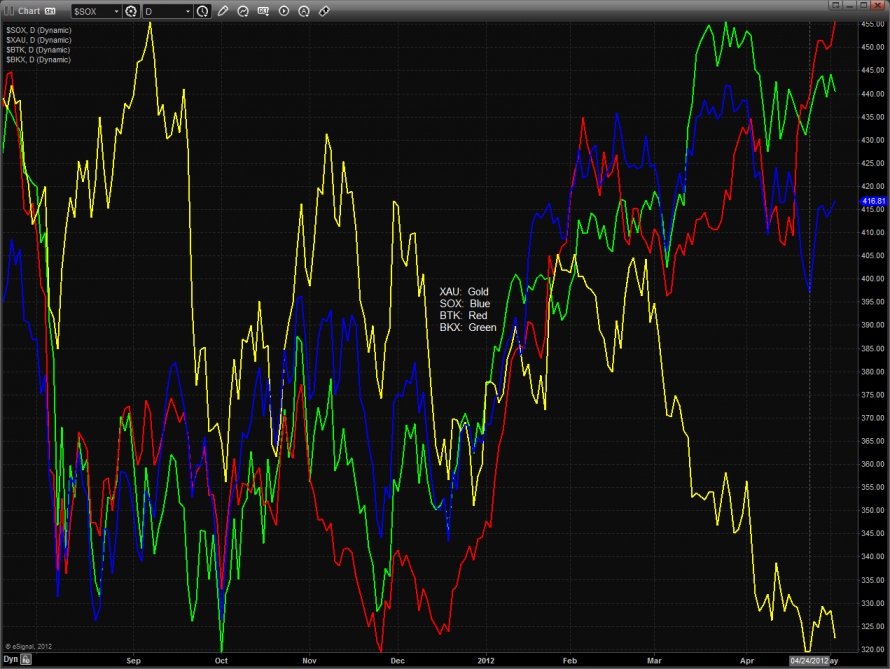

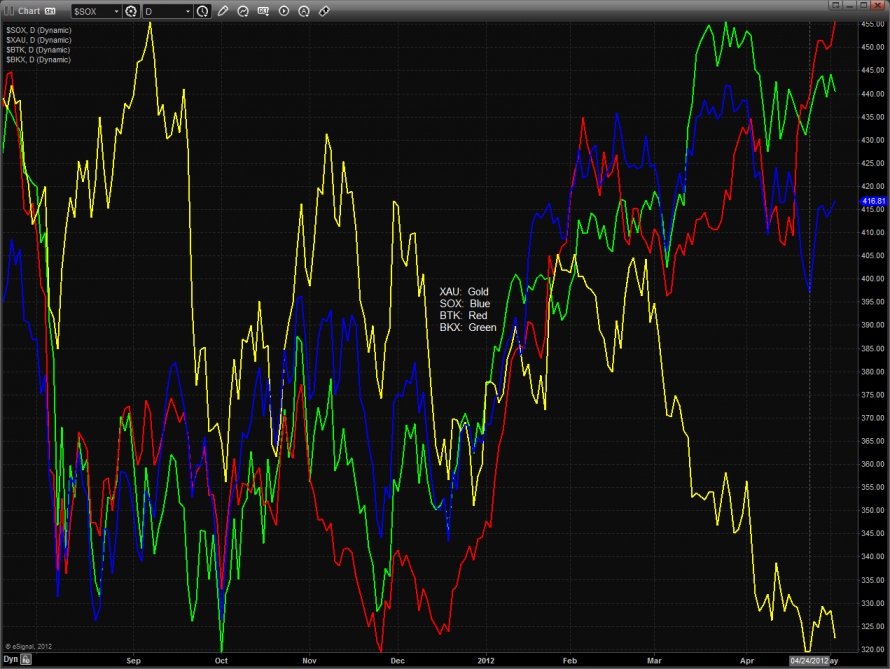

Multi sector daily chart:

The NDX/SPX cross ratio chart is still holding above the key breakout level. This should be revisited early next week after the NFP release.

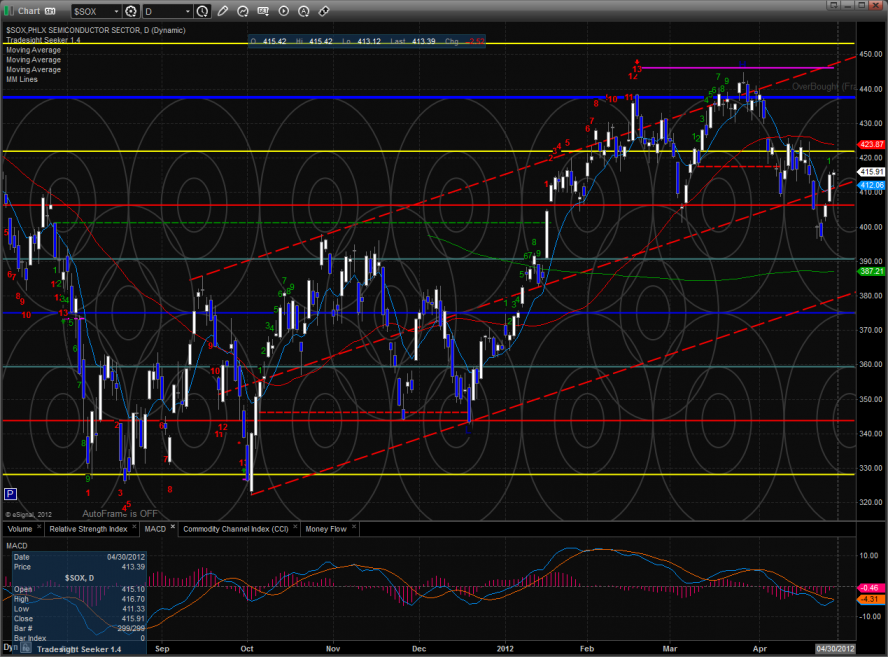

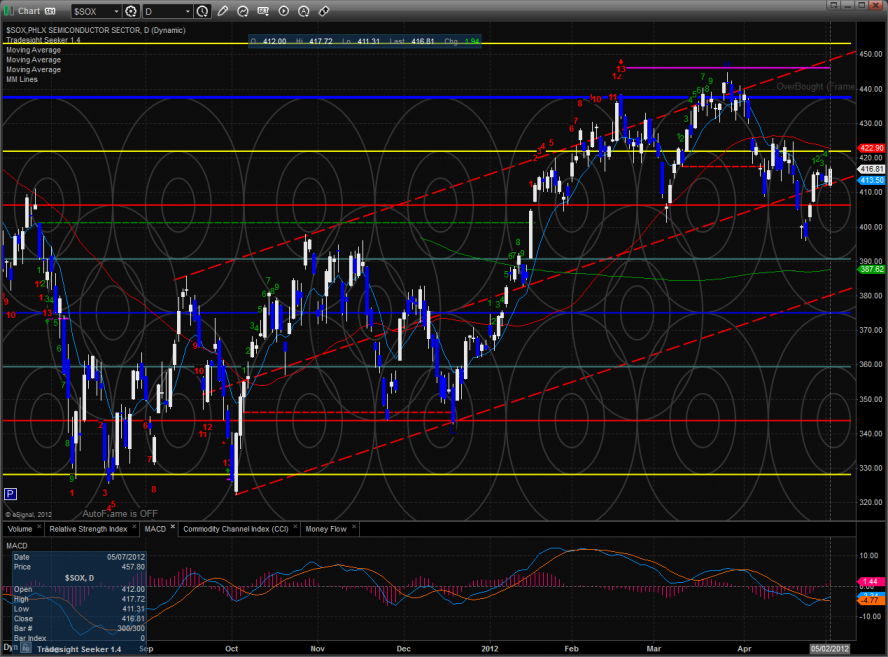

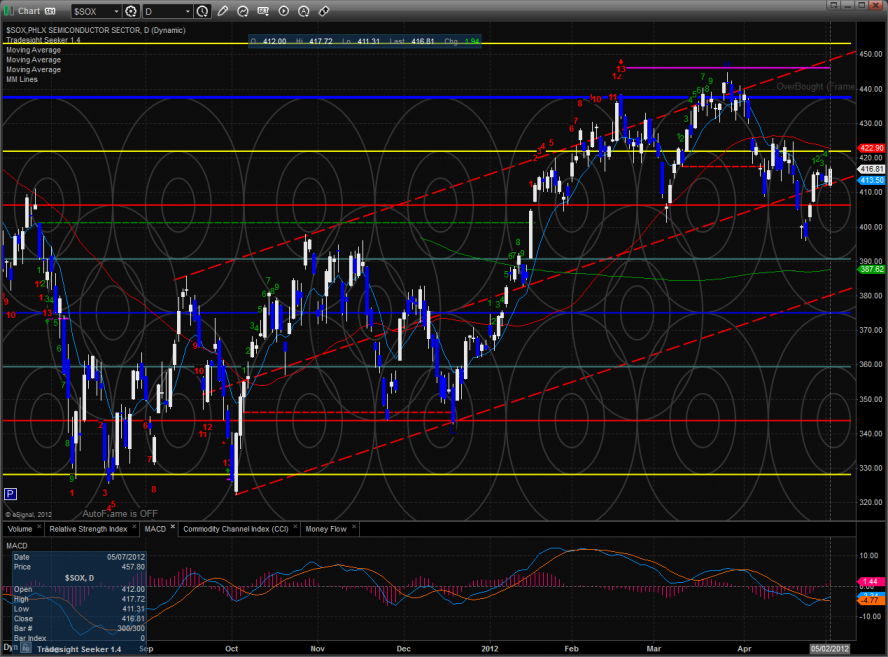

The SOX/NDX cross remains below the breakdown level.

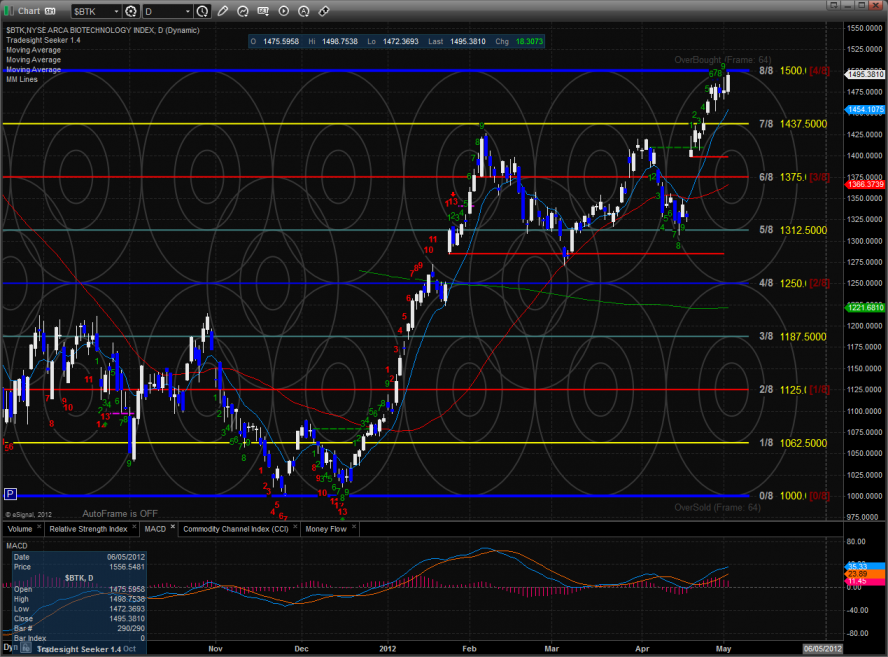

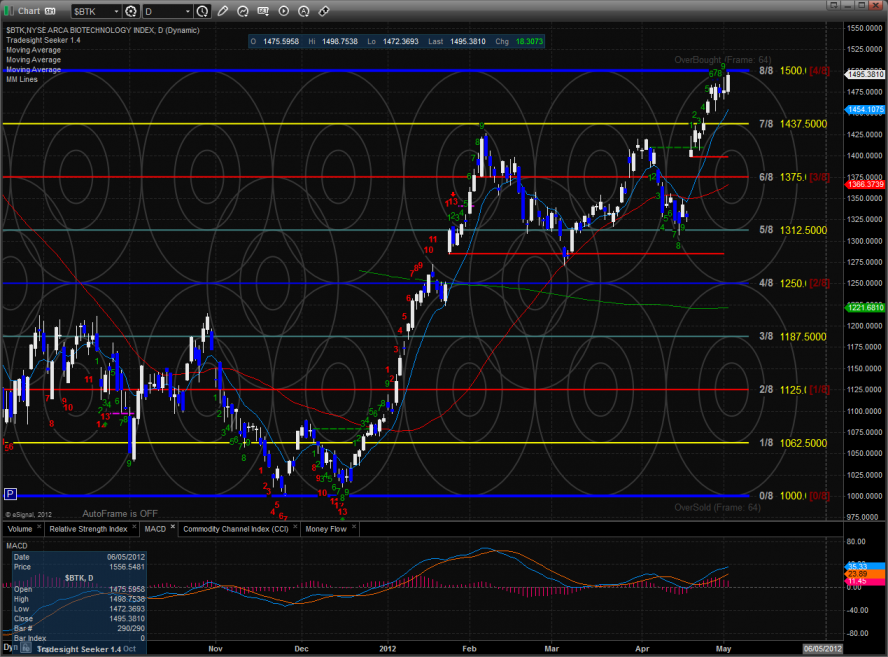

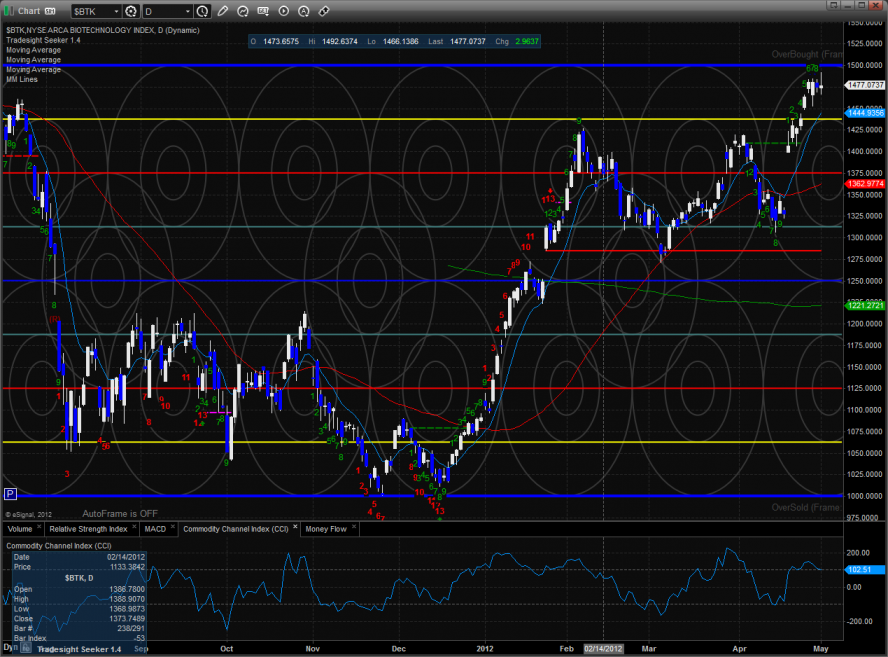

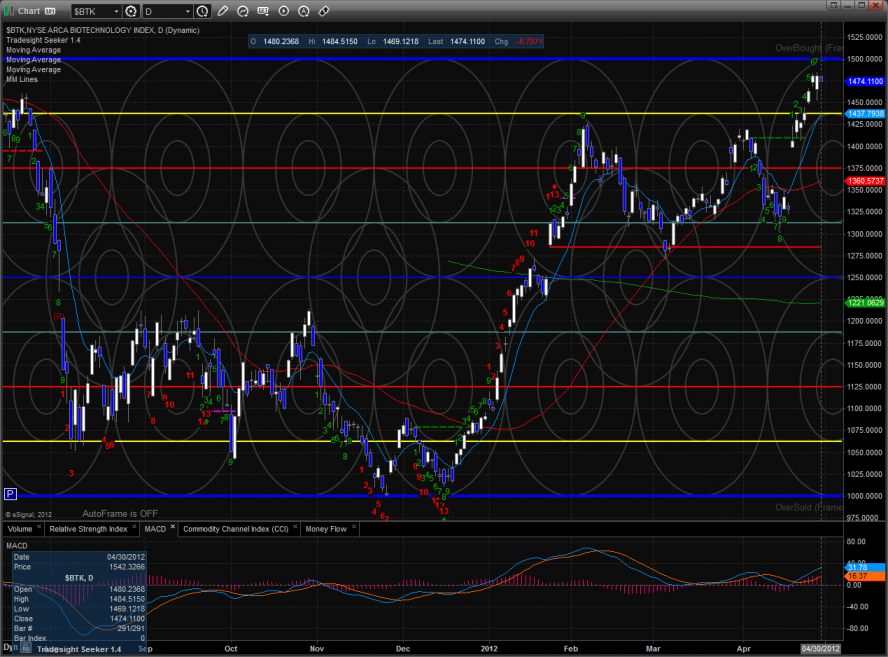

The BTK was the top gun on the day and essentially closed at the 8/8 level which is the first price hurdle after the breakout.

The SOX closed at one week high but still remains below the 50dma.

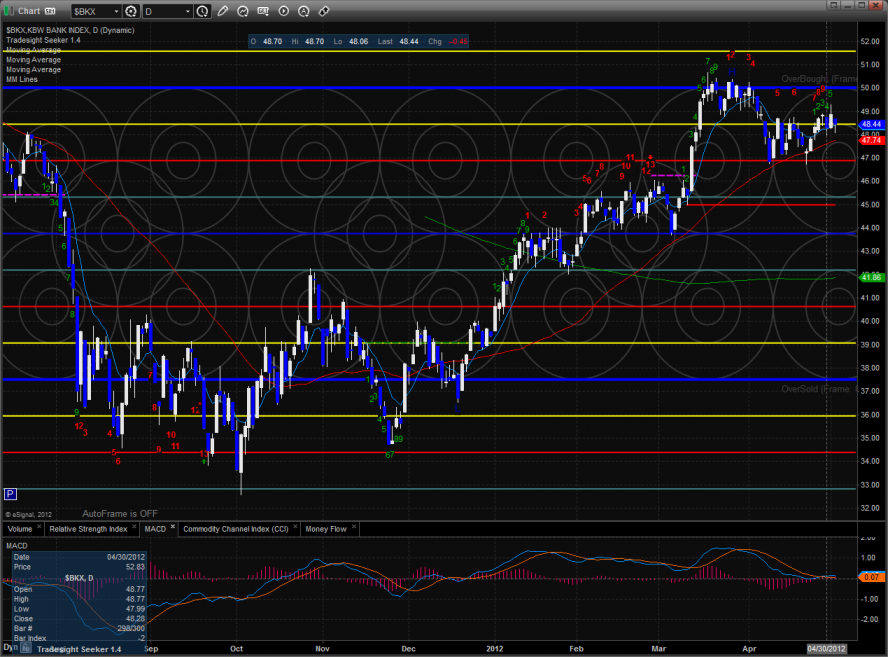

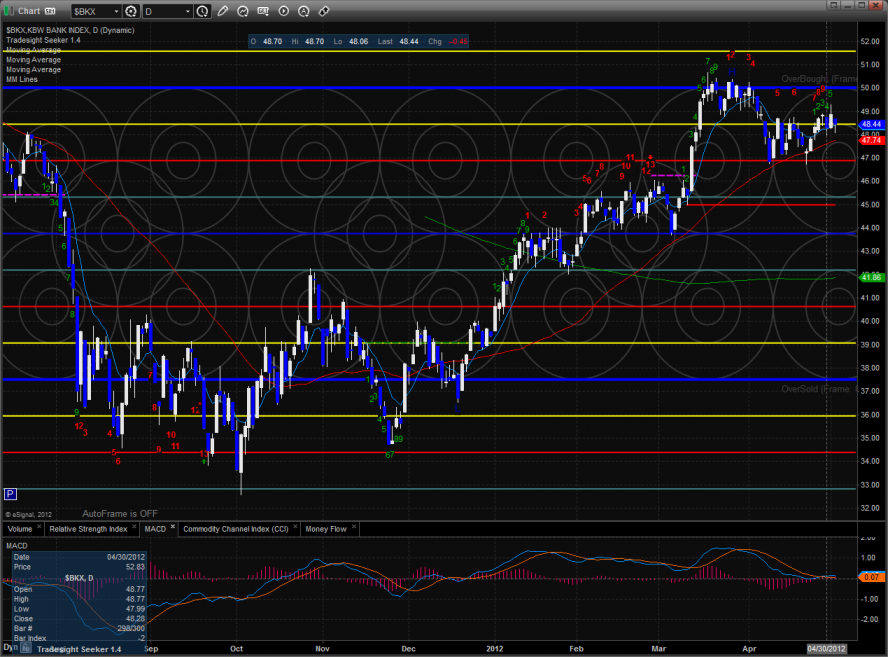

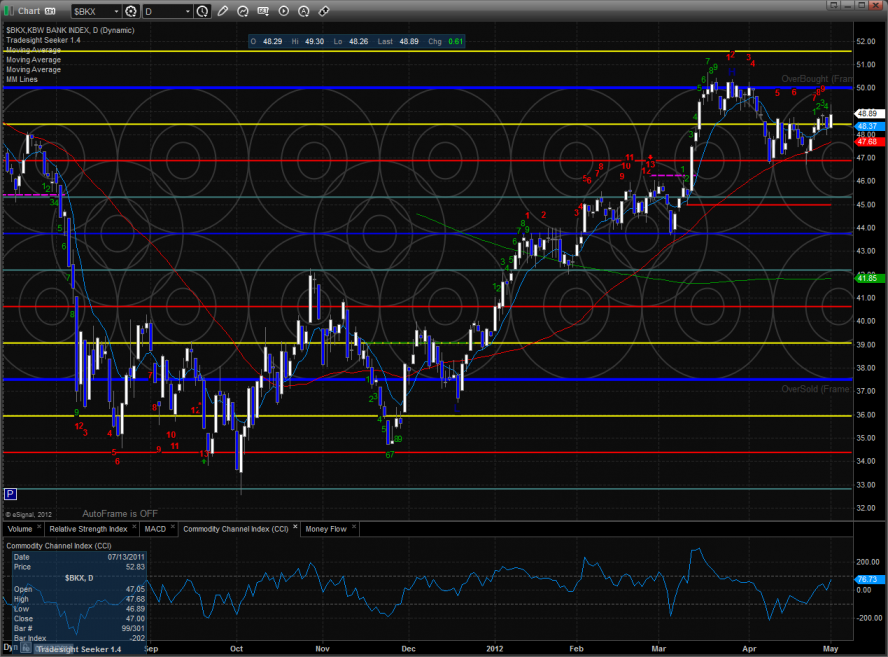

The BKX was lower by a full percent on the day but there were no new technical developments.

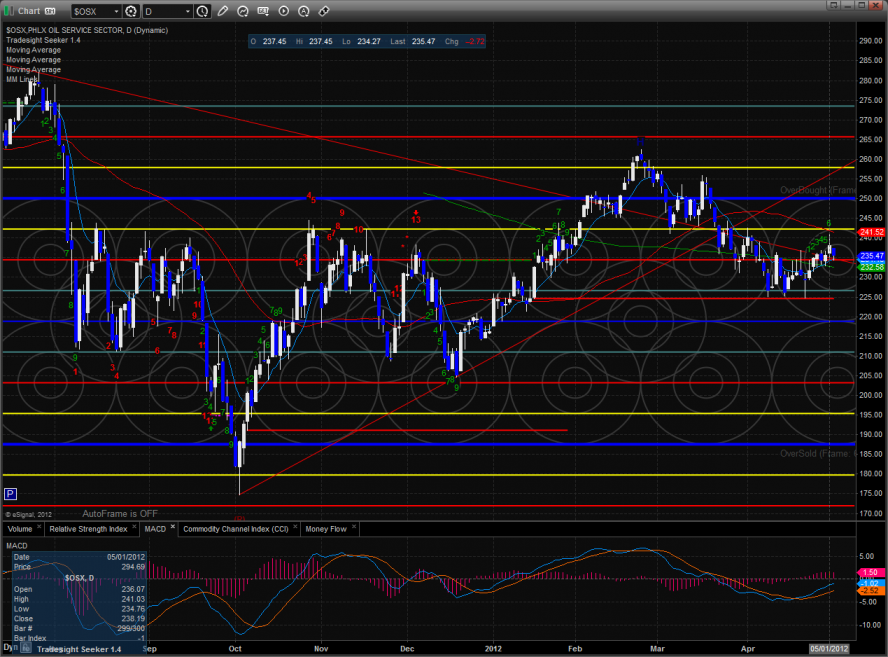

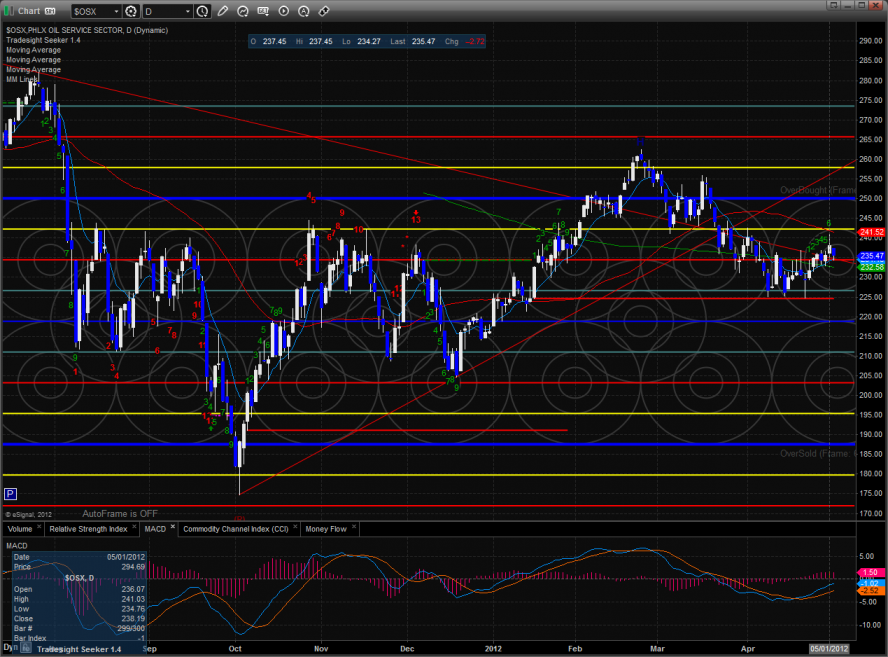

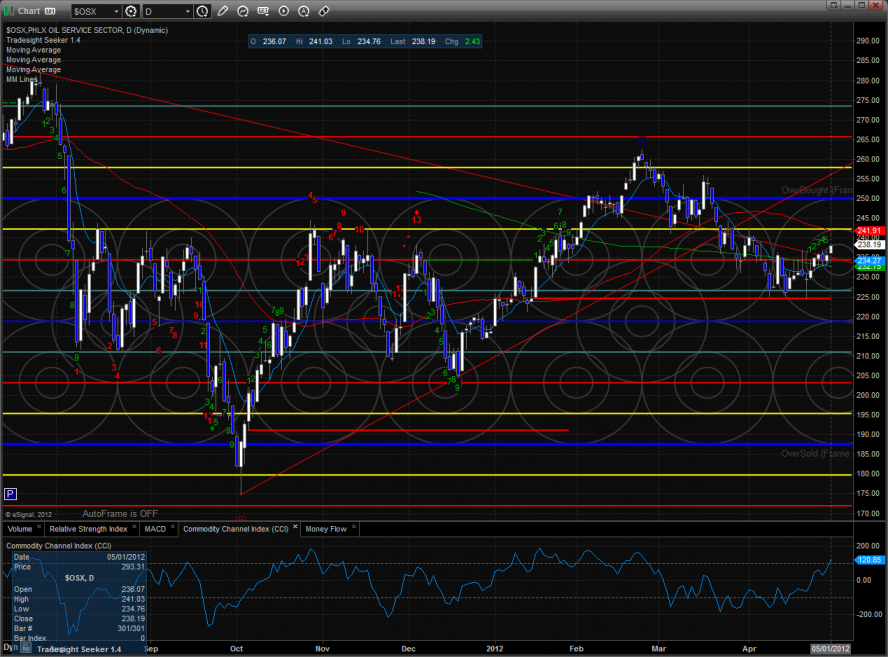

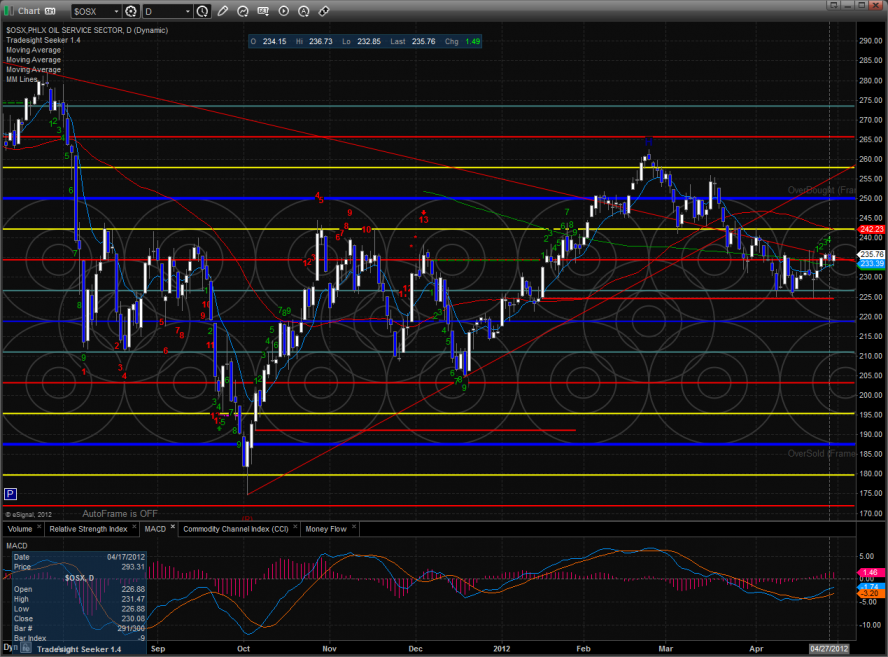

The OSX should be monitored closely here. A breakout of the range that has been defined by the 50 and 200dma’s should be very powerful.

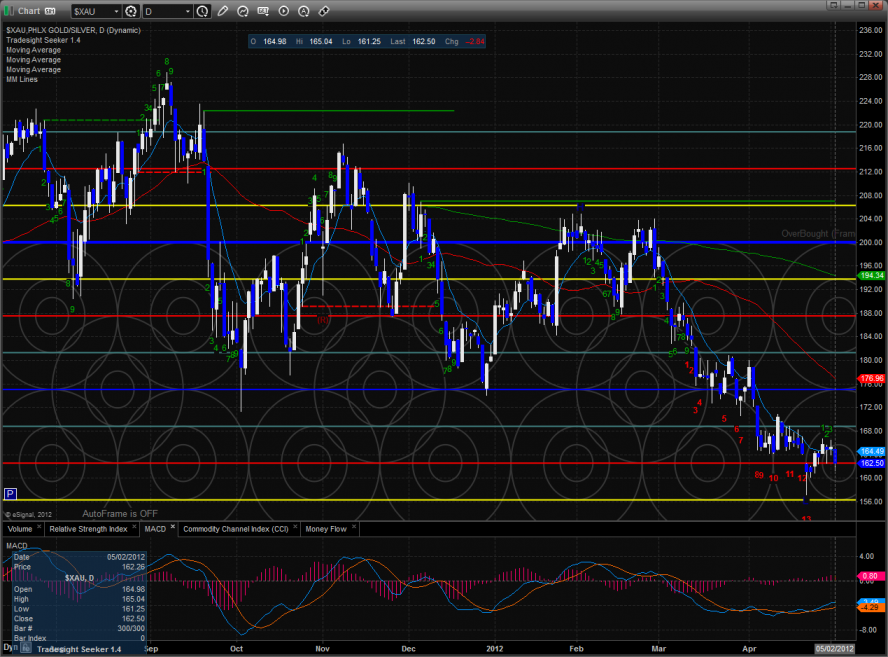

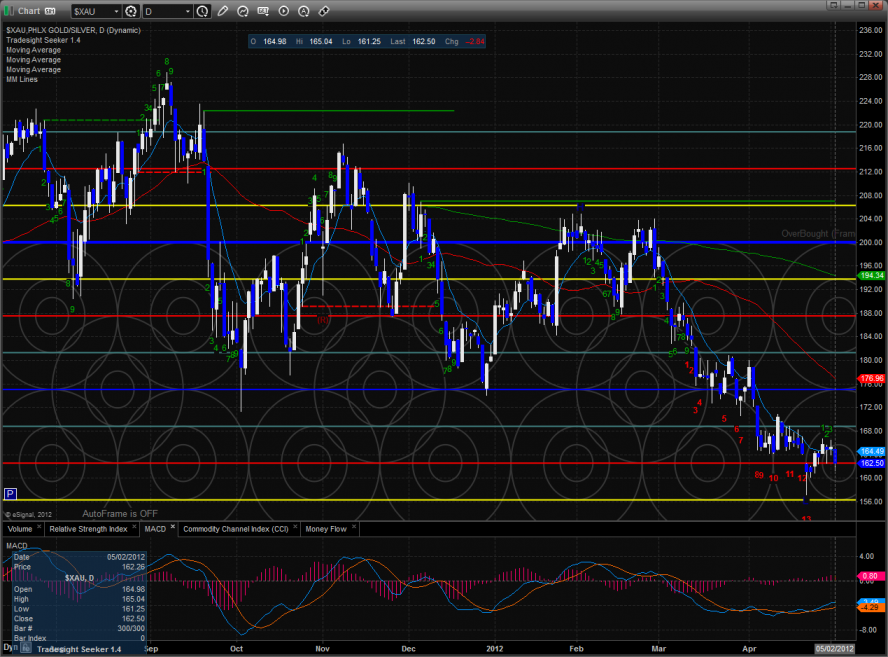

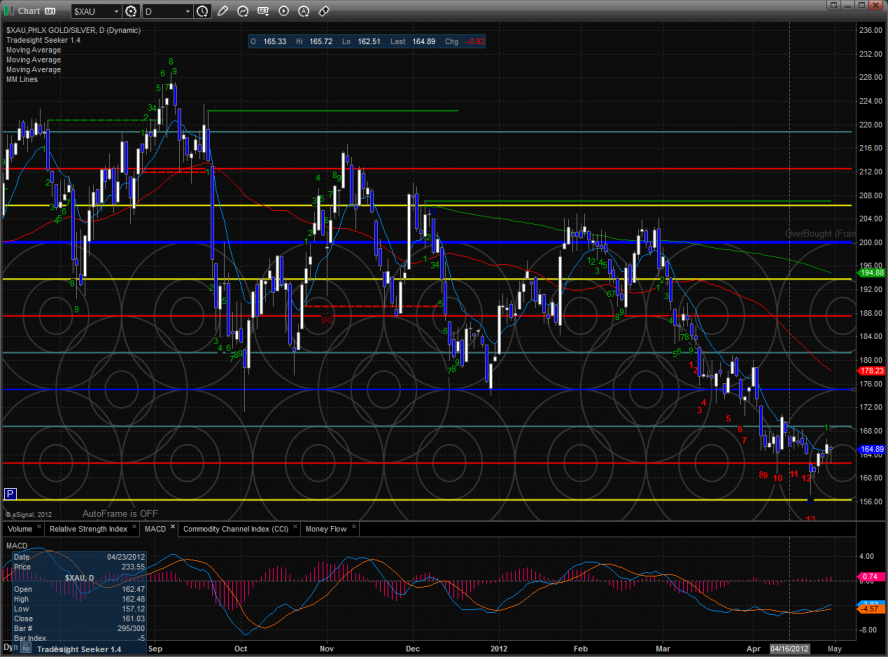

The XAU was the last laggard on the day. Keep in mind that the Seeker exhaustion signal is still in place and has yet to release its energy.

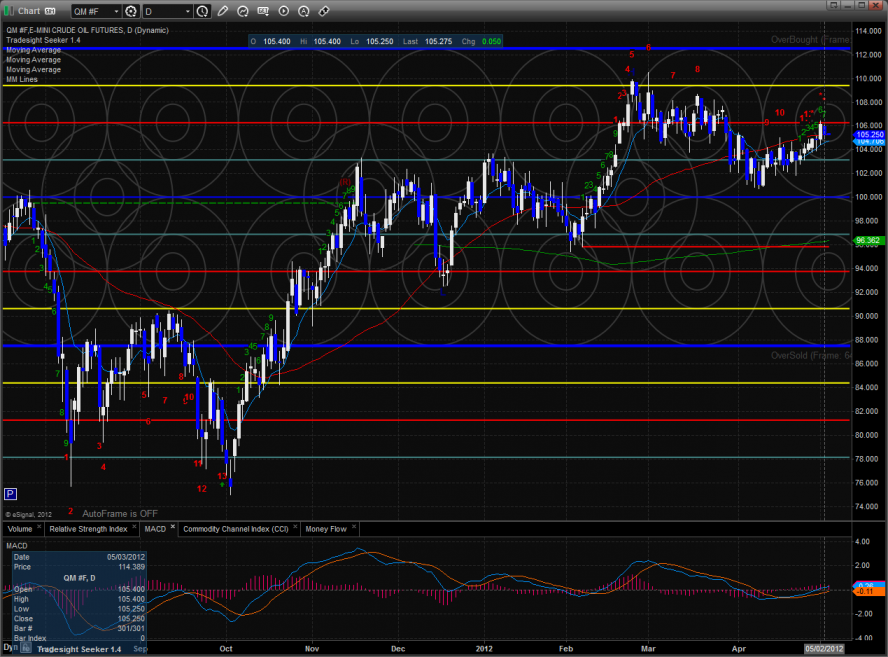

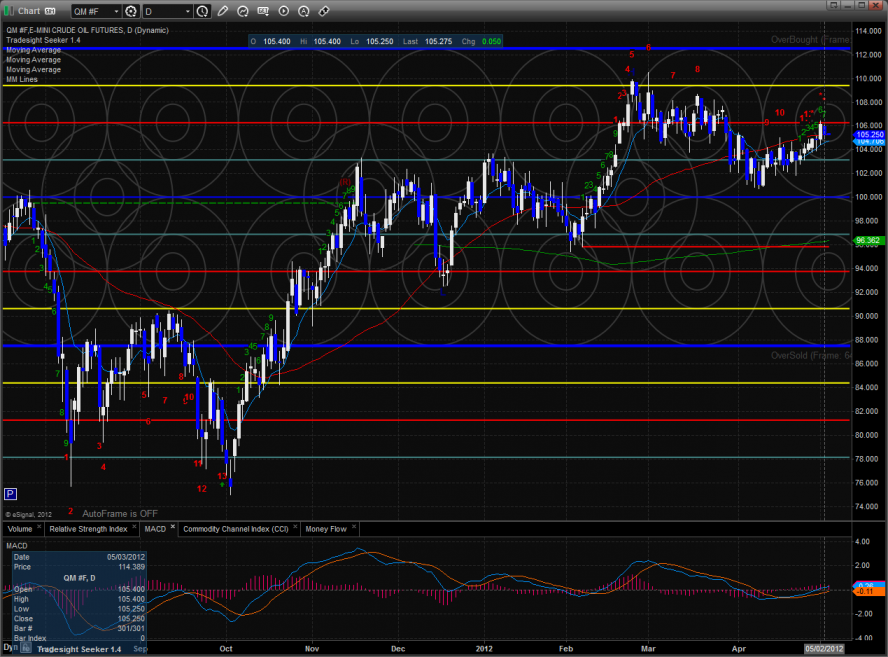

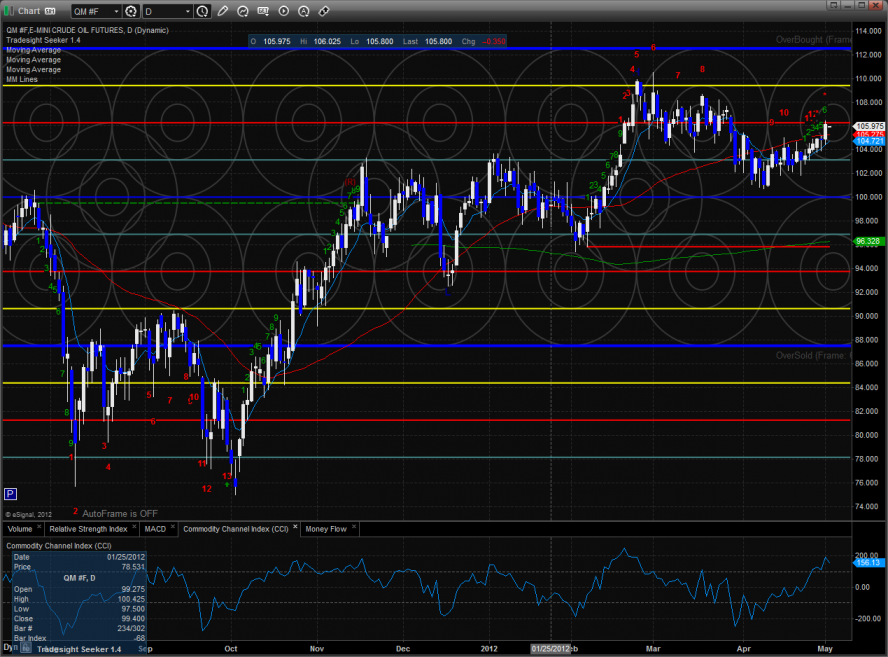

Oil, note there is a Seeker 13 exhaustion on deck:

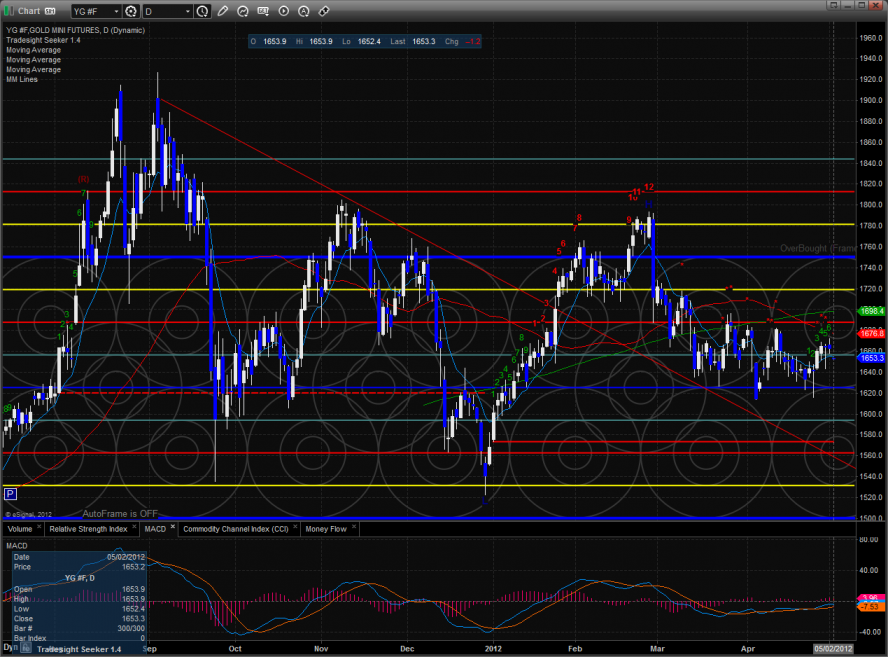

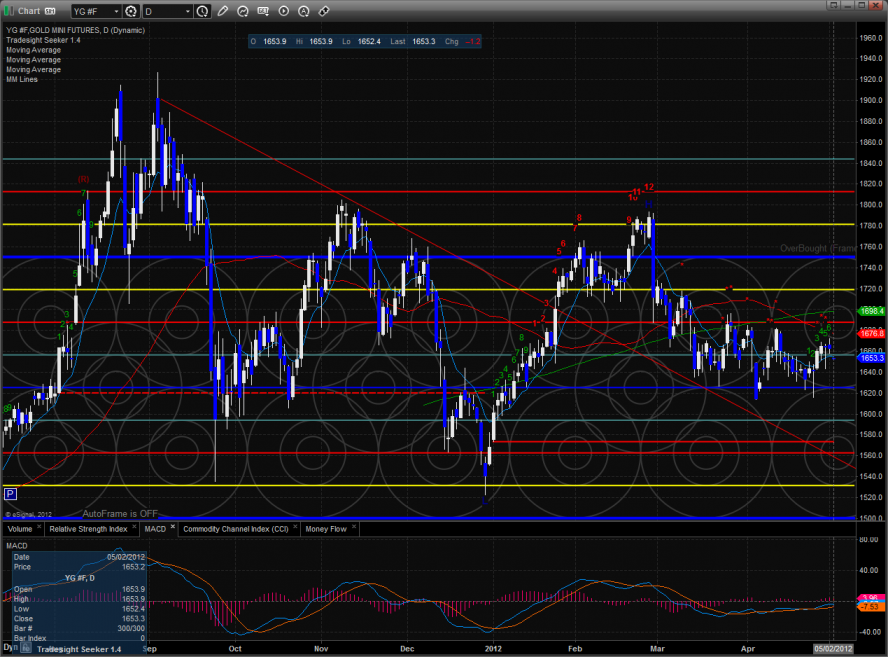

Gold:

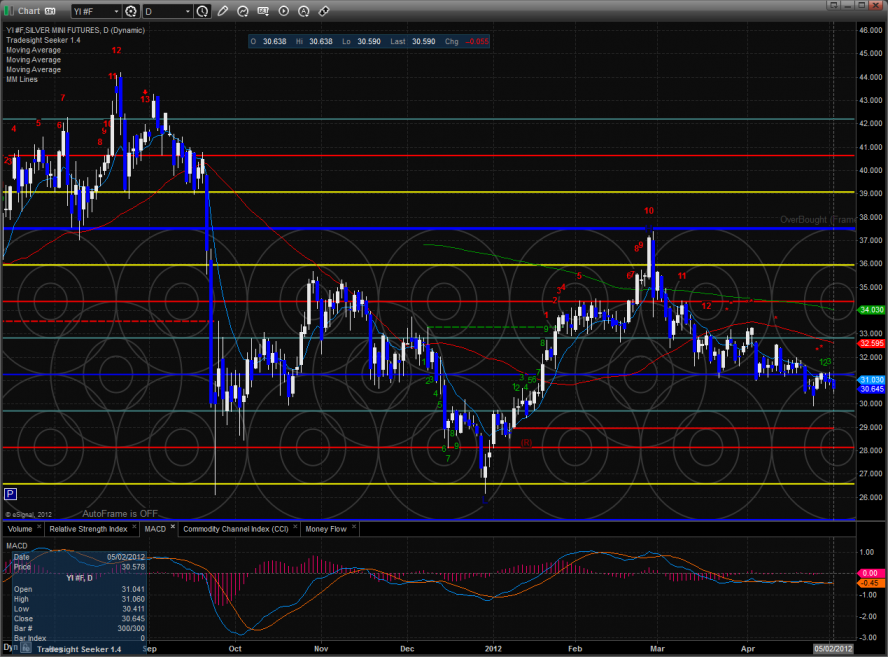

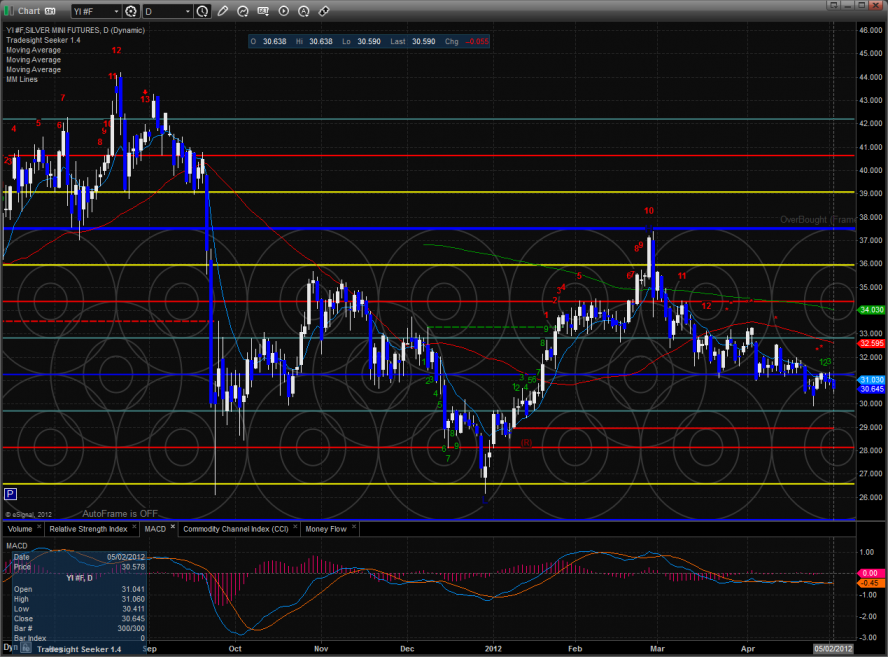

Silver:

Tradesight Market Preview for 5/3/12

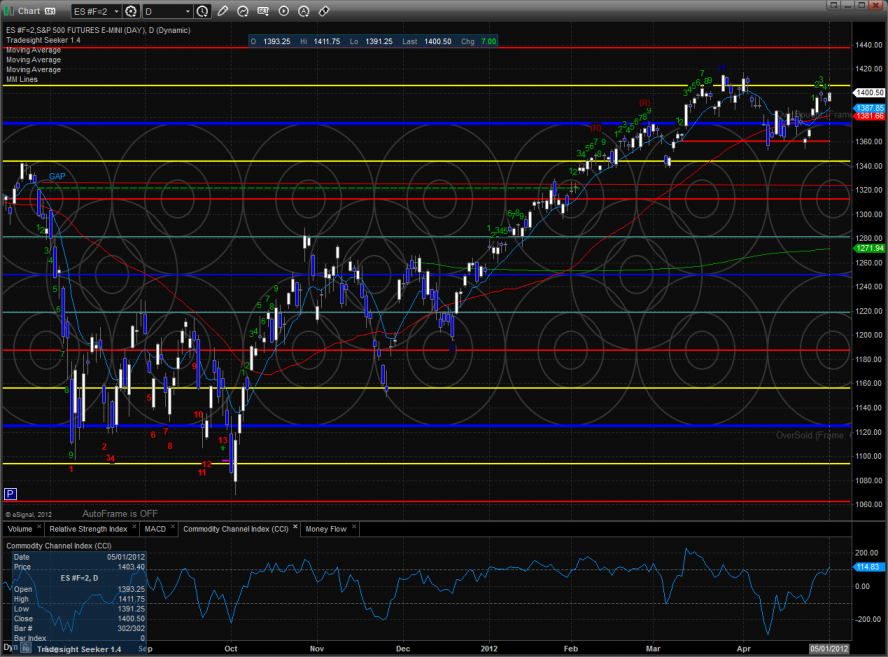

The ES did little on the day shaking off a disappointing ADP number. This left the chart with loss of 3 handles on day but in a subtly positive fashion, the day’s close was above the open.

The NQ futures were high by 9 on the day and bullishly remain above all of the major moving averages. Friday’s non-farm payroll number will the week’s arbiter. This leaves Thursday’s trade as kind of a jump ball.

Total put/call ratio is moving lower but not yet climatic:

10-day NYSE Trin:

Multi sector daily chart:

The NDX/SPX cross ratio chart is still holding above the key breakout level. This should be revisited early next week after the NFP release.

The SOX/NDX cross remains below the breakdown level.

The BTK was the top gun on the day and essentially closed at the 8/8 level which is the first price hurdle after the breakout.

The SOX closed at one week high but still remains below the 50dma.

The BKX was lower by a full percent on the day but there were no new technical developments.

The OSX should be monitored closely here. A breakout of the range that has been defined by the 50 and 200dma’s should be very powerful.

The XAU was the last laggard on the day. Keep in mind that the Seeker exhaustion signal is still in place and has yet to release its energy.

Oil, note there is a Seeker 13 exhaustion on deck:

Gold:

Silver:

Stock Picks Recap for 5/2/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

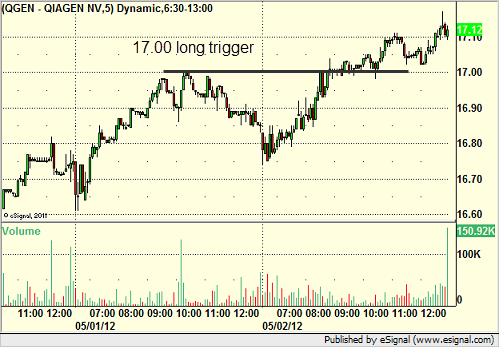

From the report, QGEN triggered long (with market support) and worked:

SGMS triggered short (without market support due to opening five minutes) and worked:

In the Messenger, Rich's RENN triggered long (without market support due to opening five minutes) and worked enough for a partial:

His WYNN triggered short (without market support) and worked:

His PEET triggered short (without market support) and worked:

NFLX triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, both worked.

Forex Calls Recap for 5/2/12

There we go. Some movement and an easy winner in the EURUSD. See that section below.

New calls and Chat tonight as we head into the last couple of days of the week and the NFP data on Friday.

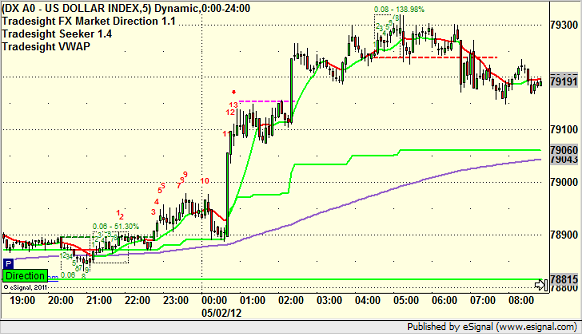

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short early at A, never stopped but gave you all the way to B and the European session to take or go full size, hit first target at C, lowered stop over S2 in the morning and stopped at D:

Tradesight Market Preview for 5/2/12

The ES futures were higher by 7 on the day. Price tested the YTD highs but fell back sharply after setting the high water mark at noon EST.

The NQ futures were much weaker than the broad market. The NQ lost a fraction on the day making a new high over Monday’s range and bearishly closing near the LOD.

10-day Trin:

Total put/call ratio:

Multi sector daily chart:

The BKX was the best performing major sector on the day closing at a multi week high. The index remains above all the major moving averages.

The SOX is still trapped in the same range and below the key 50dma.

The BTK was little changed on the day and is now 9 days up on the seeker.

Oil:

Gold:

Silver:

Stock Picks Recap for 5/1/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

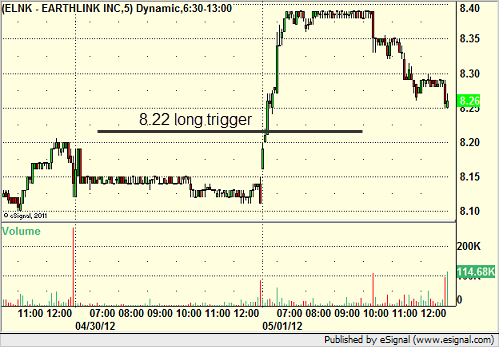

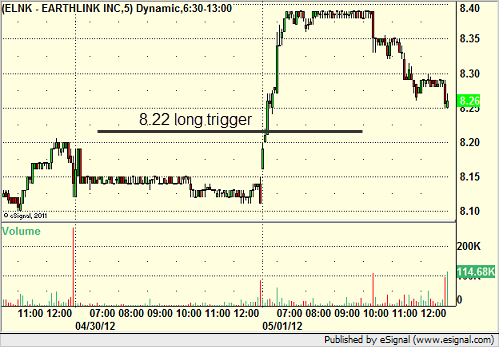

From the report, ELNK triggered long (with market support) and worked:

SIMO triggered short (without market support) and worked:

From the Messenger, Rich's SHLD triggered long (without market support due to opening 5 minutes) and worked:

Rich's CAT triggered short (without market support) and worked:

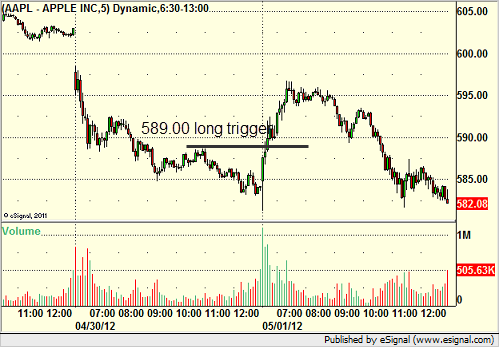

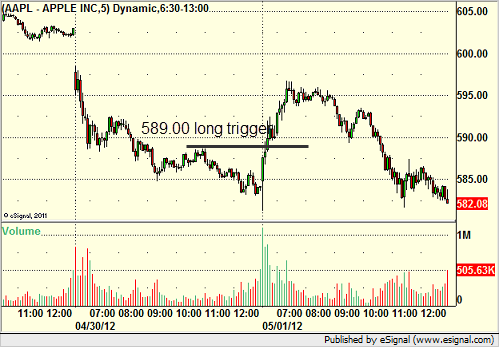

His AAPL triggered long (with market support) and worked:

GS triggered long (with market support) and didn't work:

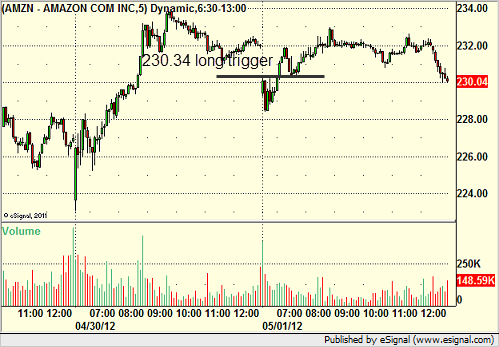

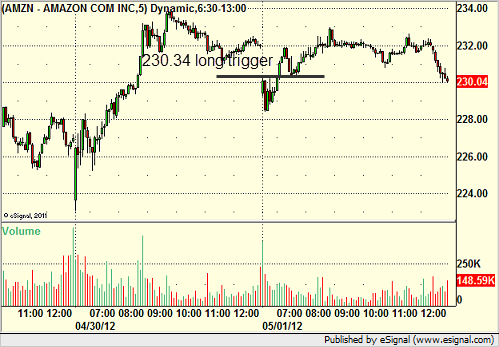

AMZN triggered long (with market support) and worked great:

Rich's MA triggered long (with market support) and worked:

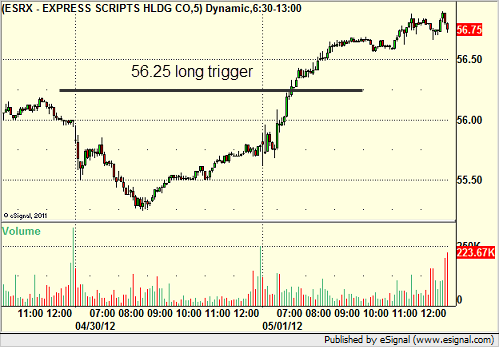

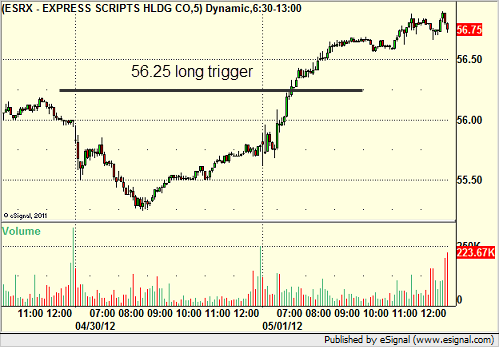

ESRX triggered long (with market support) and worked:

GOOG triggered short (without market support, late in the session) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Stock Picks Recap for 5/1/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ELNK triggered long (with market support) and worked:

SIMO triggered short (without market support) and worked:

From the Messenger, Rich's SHLD triggered long (without market support due to opening 5 minutes) and worked:

Rich's CAT triggered short (without market support) and worked:

His AAPL triggered long (with market support) and worked:

GS triggered long (with market support) and didn't work:

AMZN triggered long (with market support) and worked great:

Rich's MA triggered long (with market support) and worked:

ESRX triggered long (with market support) and worked:

GOOG triggered short (without market support, late in the session) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Forex Calls Recap for 5/1/12

Another dull session until the ISM data here in the US that caused a spike for 30 minutes. Strangely, the EURUSD and GBPUSD went in separate directions, both away from our triggers initially, although the news managed to hit the EURUSD short. See that section below.

New calls and Chat this evening.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short after a big move down on news at A, went exactly 20 pips against at B, closed at C for end of day again since nothing had happened:

Forex Calls Recap for 5/1/12

Another dull session until the ISM data here in the US that caused a spike for 30 minutes. Strangely, the EURUSD and GBPUSD went in separate directions, both away from our triggers initially, although the news managed to hit the EURUSD short. See that section below.

New calls and Chat this evening.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short after a big move down on news at A, went exactly 20 pips against at B, closed at C for end of day again since nothing had happened:

Tradesight Market Preview for 5/1/12

The ES capped off the month by losing 5 handles on the session. This could be a very important couple of candles because this mini-formation will either continue higher and take out the old high or will bearishly turn into a “B” wave retest that fails at the prior high. If the pattern fails to make a higher high and takes out the April lows then the bearish “B” wave scenario will be confirmed.

The NQ futures lost 18 on the day and has the same general design as the ES futures only with more relative strength. The same pattern is in play and the next few candles are critical.

The 10-day Trin is in the neutral zone:

Like the Trin, the total put/call ratio is neutral:

Multi sector daily chart:

The Dow/gold ratio should be monitored here. A breakout over the 6.00 level will put the upper trend channel in play.

The BKX was bearishly decoupled from the broad market today showing relative weakness. Keep a close eye on this relationship. Underperformance of the BKX might be an early indication that “Sell in May” is in play.

The OSX was the top gun on the day but was inside Friday’s range.

The BTK also traded inside:

XAU inside day:

The SOX traded in-line with the NDX: