Tradesight Market Preview for 5/1/12

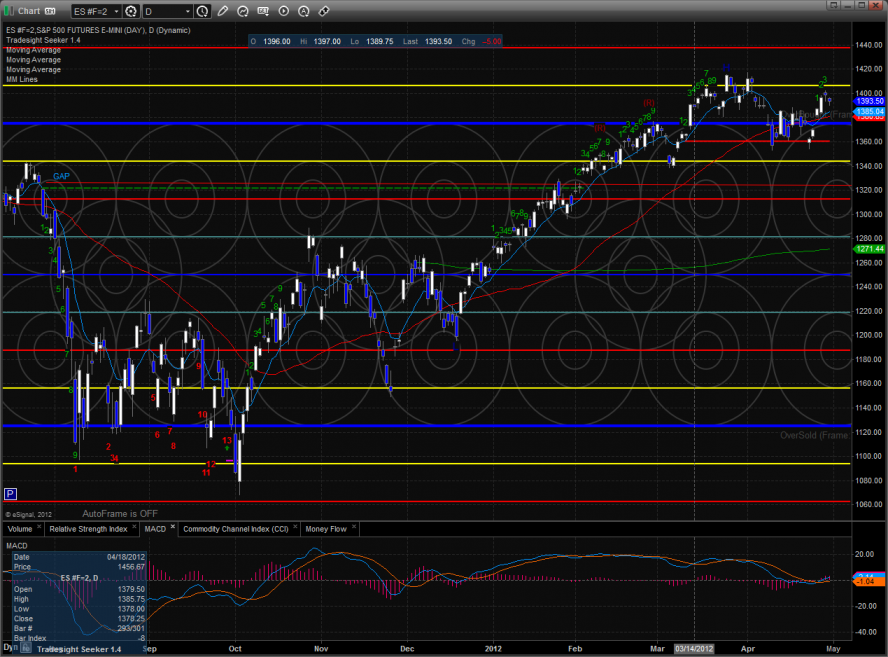

The ES capped off the month by losing 5 handles on the session. This could be a very important couple of candles because this mini-formation will either continue higher and take out the old high or will bearishly turn into a “B” wave retest that fails at the prior high. If the pattern fails to make a higher high and takes out the April lows then the bearish “B” wave scenario will be confirmed.

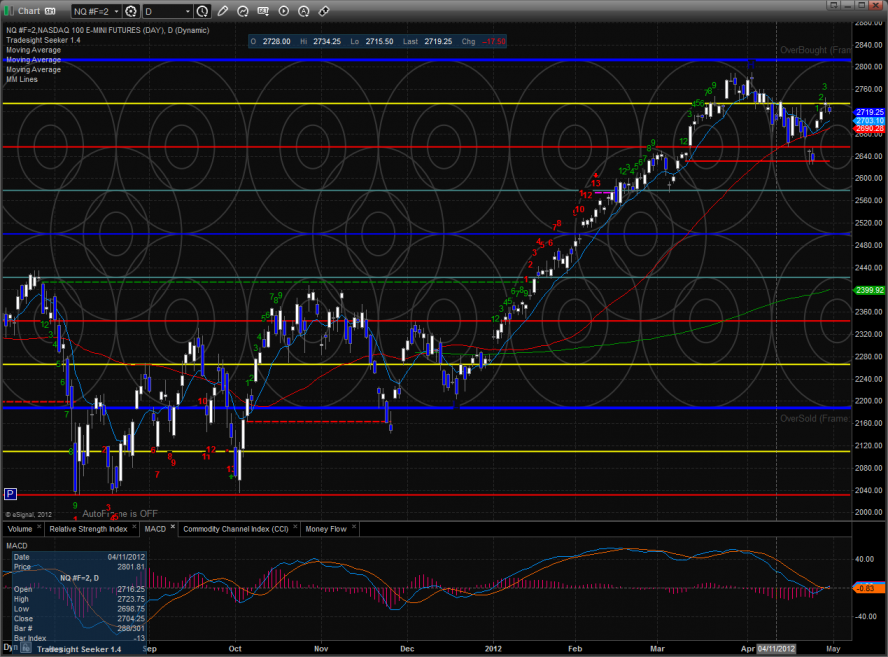

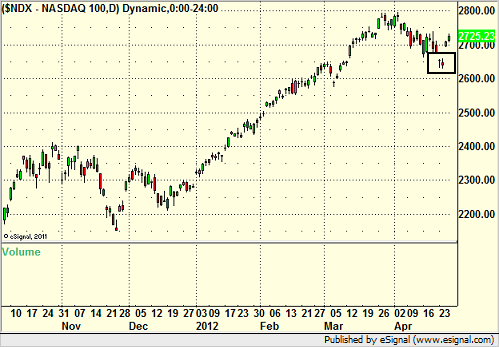

The NQ futures lost 18 on the day and has the same general design as the ES futures only with more relative strength. The same pattern is in play and the next few candles are critical.

The 10-day Trin is in the neutral zone:

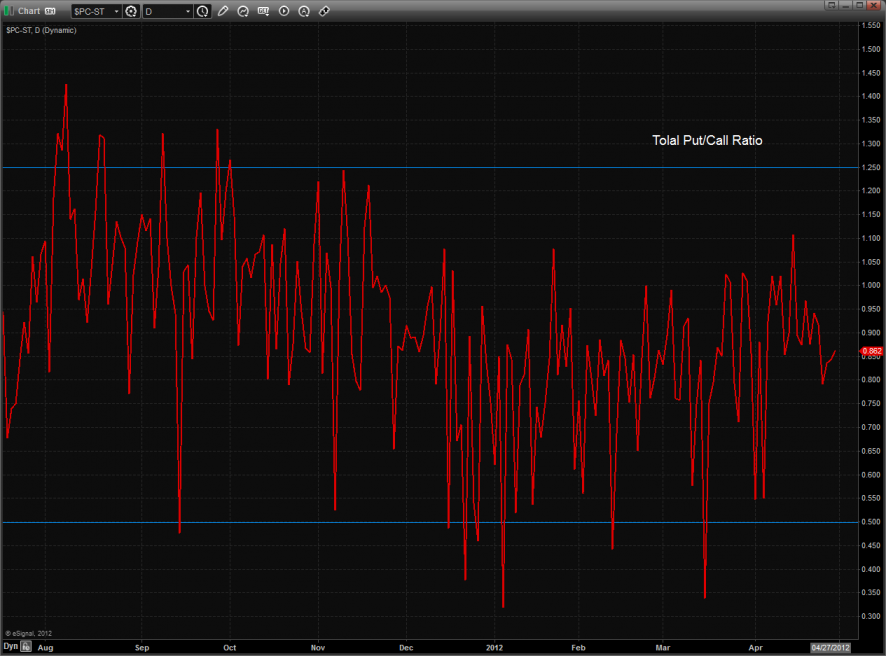

Like the Trin, the total put/call ratio is neutral:

Multi sector daily chart:

The Dow/gold ratio should be monitored here. A breakout over the 6.00 level will put the upper trend channel in play.

The BKX was bearishly decoupled from the broad market today showing relative weakness. Keep a close eye on this relationship. Underperformance of the BKX might be an early indication that “Sell in May” is in play.

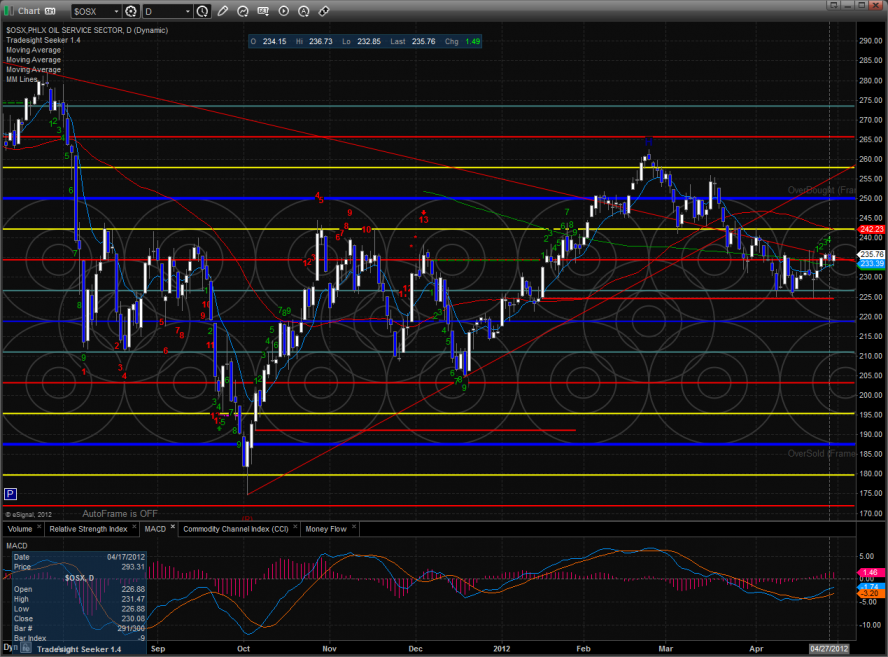

The OSX was the top gun on the day but was inside Friday’s range.

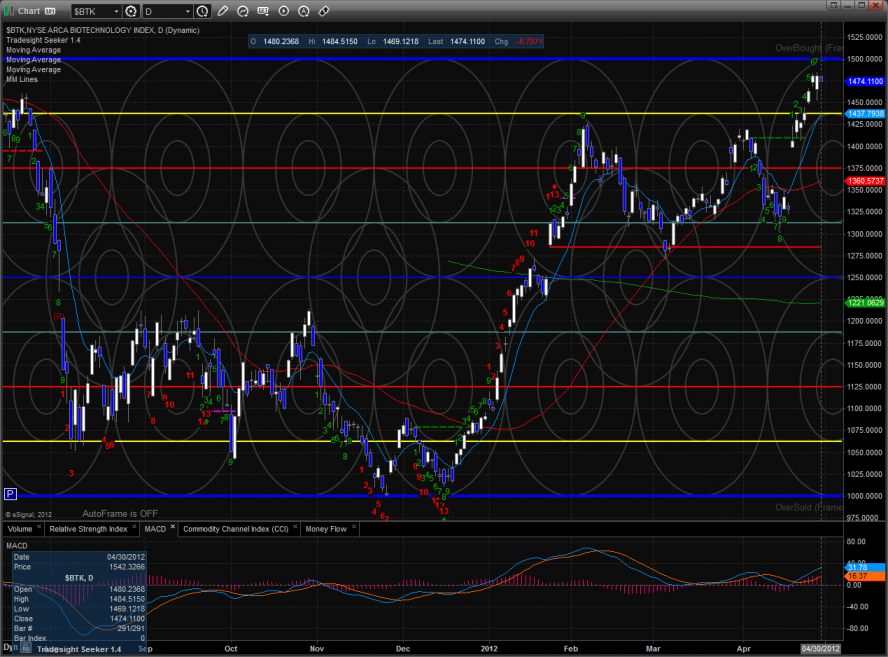

The BTK also traded inside:

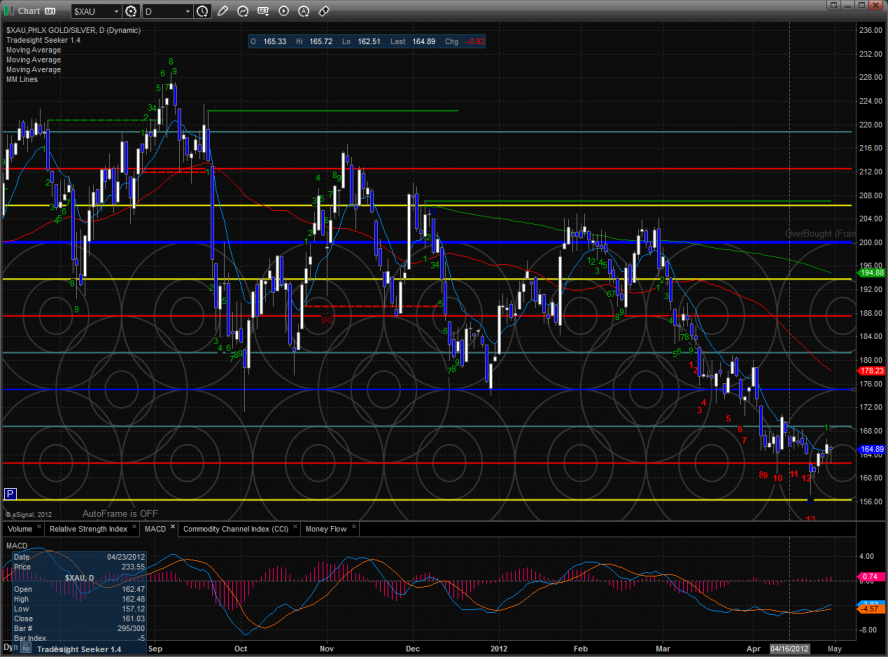

XAU inside day:

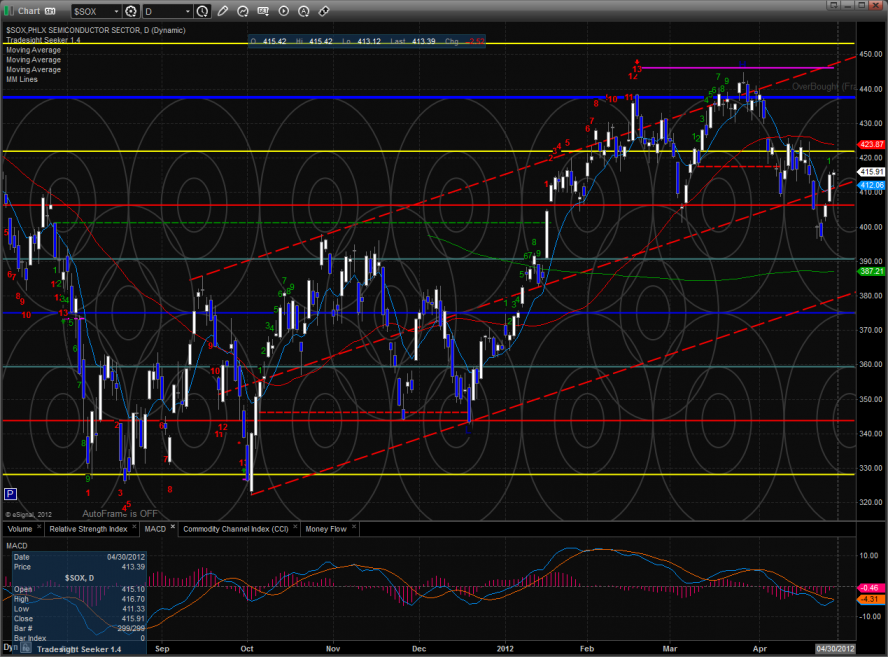

The SOX traded in-line with the NDX:

Stock Picks Recap for 4/30/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

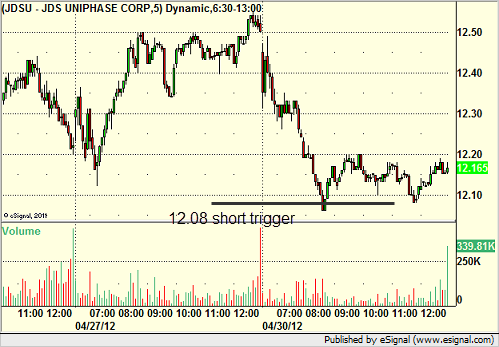

From the report, JDSU triggered short (with market support) and didn't work:

In the Messenger, Rich's AAPL triggered short (with market support) and worked great:

His VXX triggered short (ETF, so no market support needed) and worked, although it took all day, never really went against:

NTAP triggered short (with market support) and worked:

SINA triggered long (with market support) and worked:

Rich's DECK triggered short (with market support) and worked enough for a partial:

His GOOG triggered short (with market support) and worked:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Stock Picks Recap for 4/30/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, JDSU triggered short (with market support) and didn't work:

In the Messenger, Rich's AAPL triggered short (with market support) and worked great:

His VXX triggered short (ETF, so no market support needed) and worked, although it took all day, never really went against:

NTAP triggered short (with market support) and worked:

SINA triggered long (with market support) and worked:

Rich's DECK triggered short (with market support) and worked enough for a partial:

His GOOG triggered short (with market support) and worked:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Forex Calls Recap for 4/30/12

That was a very slow session for Forex. Both the EURUSD and GBPUSD barely traded 40 pips of range during the European session. We eventually had a trigger, but closed it out around the entry. See GBPUSD below. Tonight's calls are the last official calls of April.

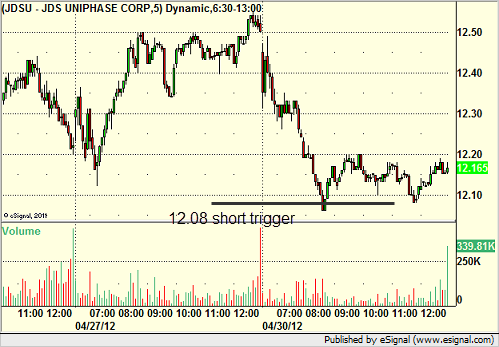

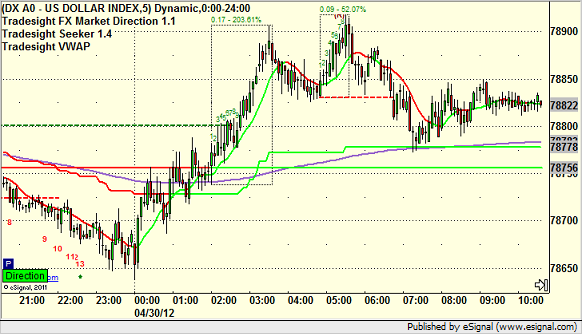

Here's the US Dollar Index intraday with our market directional lines:

New Calls and Chat tonight.

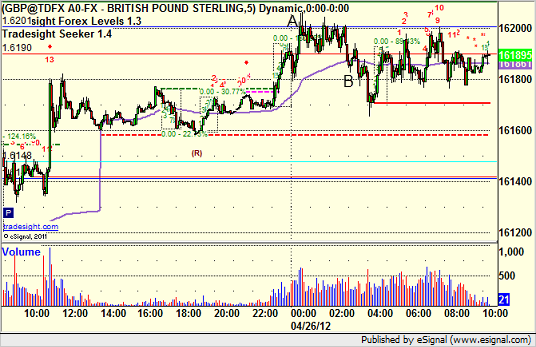

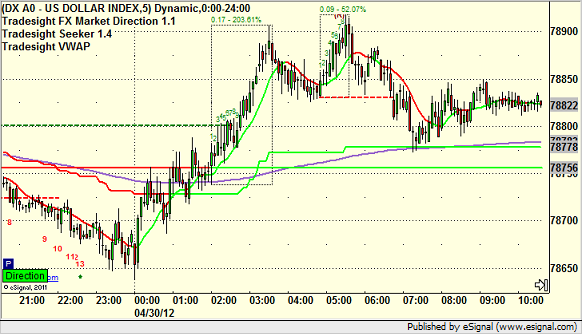

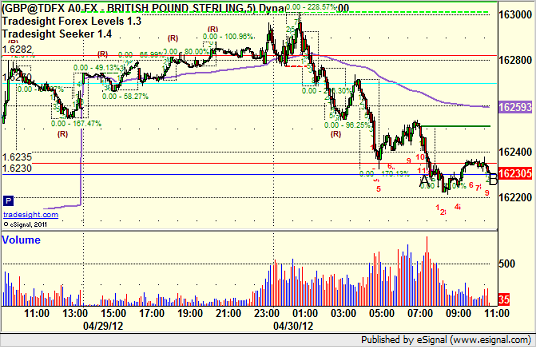

GBPUSD:

Finally triggered short at A, closed at B just over entry for end of session after it went nowhere:

Forex Calls Recap for 4/30/12

That was a very slow session for Forex. Both the EURUSD and GBPUSD barely traded 40 pips of range during the European session. We eventually had a trigger, but closed it out around the entry. See GBPUSD below. Tonight's calls are the last official calls of April.

Here's the US Dollar Index intraday with our market directional lines:

New Calls and Chat tonight.

GBPUSD:

Finally triggered short at A, closed at B just over entry for end of session after it went nowhere:

Stock Picks Recap for 4/27/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

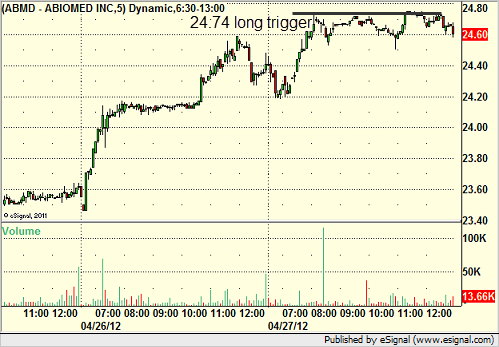

From the report, ABMD triggered long (with market support) and didn't work (only triggered by a penny):

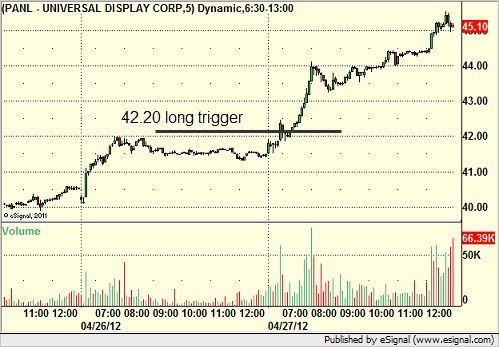

PANL triggered long (without market support) and worked:

VVUS triggered long (without market support) and didn't work, although it went later:

MEOH gapped over, no play.

In the Messenger, Rich's AAPL triggered short (with market support) and worked:

His SBUX triggered short (with market support) and worked:

NFLX triggered short (with market support) and worked:

GS triggered short (with market support) and worked:

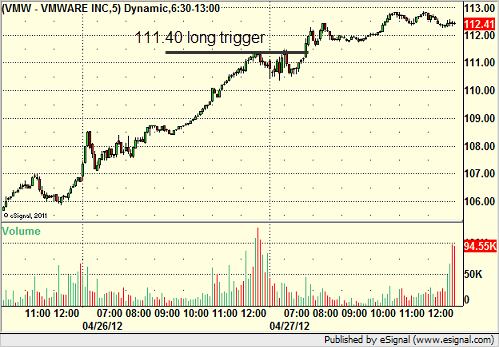

Rich's VMW triggered long (without market support) and didn't work, but went later with market support:

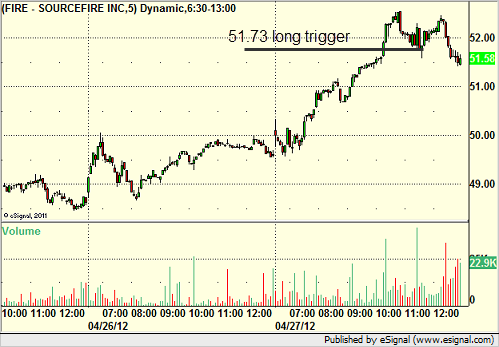

Rich's FIRE triggered long (with market support) and worked:

His CMG triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Forex Calls Recap for 4/27/12

Winner and a tiny loser to close out the week, and we were trading half size for the GDP first look. See EURUSD below for the trade review.

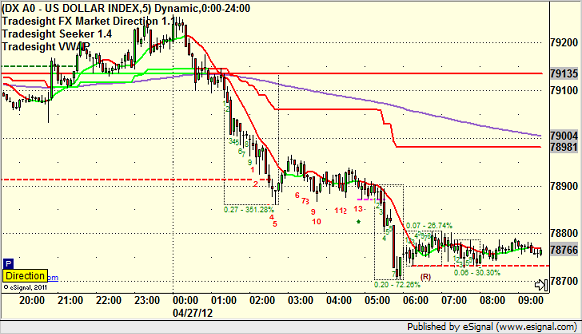

Here's the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we'll look at the action from Thursday night/Friday, then look at the daily charts for each pair with our Seeker and Comber tools separately, and then look at the US Dollar Index (nothing new there).

New calls Sunday afternoon.

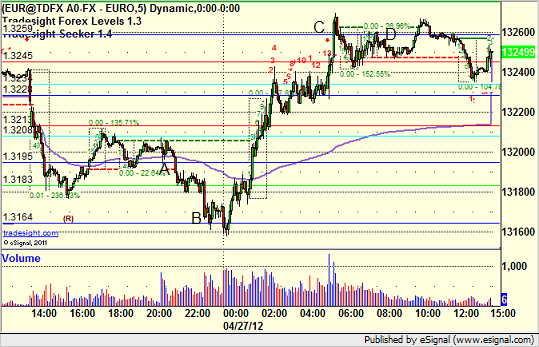

EURUSD:

Triggered short at A, hit first target at B, moved stop over entry and stopped overnight. Triggered long at C, closed at D for end of week and a 5 pip loss:

The NDX Floating Island

A "Floating Island" is a very specific technical setup on any chart. Essentially, the stock or futures contract must be heading in one direction (trending), then gap IN that same direction, trade sideways in a range, and then gap back out of that range in the opposite direction. The concept of a Floating Island is that you get a bunch of players at a range high or low that are now trapped out of the market, having no chance to exit at their desired stop. This then creates a mechanism that pushes the market away from the island.

The NASDAQ 100 (NDX) formed a 2-day Floating Island on Monday and Tuesday, after having a downward trend for weeks before it, then gapping down Monday, trading sideways Tuesday, and gapping back up Wednesday. The confirmation is when you take out Wednesday's high on Thursday, which we did. That is the buy signal and the point where those who had been selling or shorting down on those two days are now starting to panic. It tends to lead, in this case, to more upward movement. Here's a look at the raw chart with the Floating Island in the black box:

The one caveat at the moment is that we have a huge economic number coming out in the morning, which is the Advanced look at Q1 GDP, which the market is focusing on. That could beat or disappoint and cause another gap. A gap down here from news would lessen the impact of the Floating Island, but anything else means we're probably bullish in the short term.

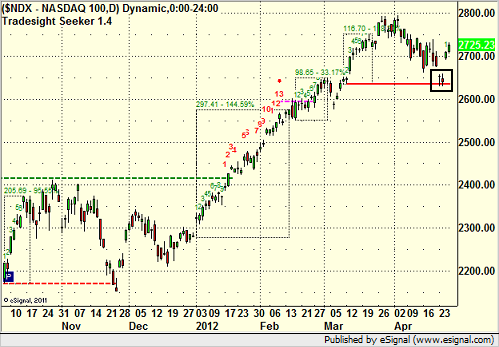

On top of it, this particular floating island formed at a very important technical location on the chart when you have more information. Our Seeker tool, which uses a 9-bar look-back mechanism to spot turning points in the market, had a 9-bar up move back in March that formed a key static trendline, which becomes a "trade to" target, if you will, on a reversal. That is denoted by the red line on this chart:

As you can see, the market rolled, headed down, gapped to the static trendline, which we identified as a target and support area, and formed the sideways action for two days there, then gapped up. We were warning people against selling further at that red line, and now you have a Floating Island set to penalize those that did.

Stock Picks Recap for 4/26/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, DNDN triggered long (with market support) and worked enough for a partial:

NTES triggered long (with market support) and worked, although you had to be fast:

VPRT triggered long (with market support) and worked:

In the Messenger, Rich's AAPL triggered short (without market support due to opening five minutes) and worked huge:

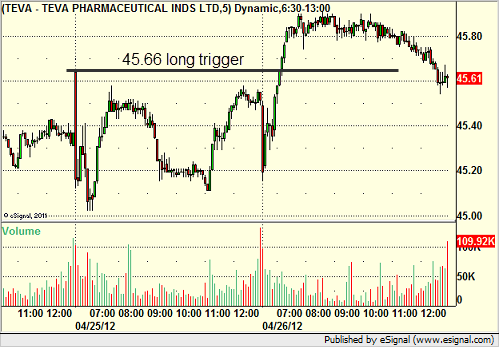

TEVA triggered long (with market support) and worked enough for an easy partial:

Rich's VMW triggered long (with market support) and worked:

BIIB triggered long (with market support) and worked:

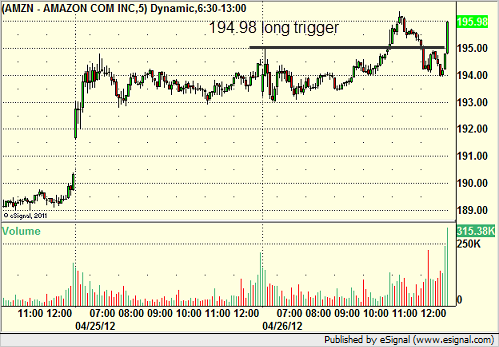

AMZN triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, all 7 of them worked great.

Forex Calls Recap for 4/26/12

Wow, that was flat trading. Market is waiting at least for the first look at GDP for Q1, which comes out Friday morning. See GBPUSD for our trigger for the day.

New calls and Chat this evening, but we will be half size ahead of the GDP.

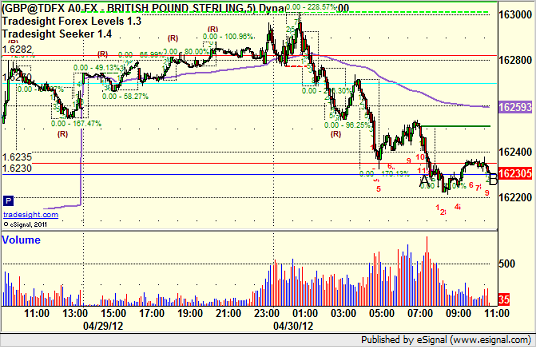

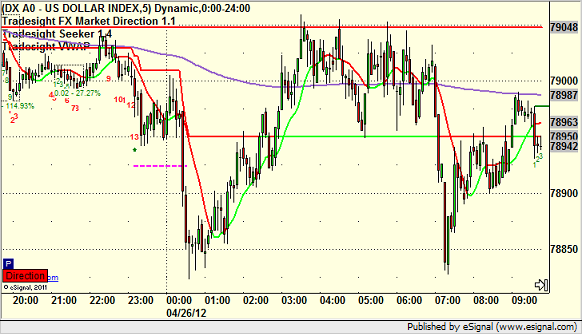

Here's the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped at B. No action at all. Hit the trigger again in the morning exactly but didn't get through: