Forex Calls Recap for 4/26/12

Wow, that was flat trading. Market is waiting at least for the first look at GDP for Q1, which comes out Friday morning. See GBPUSD for our trigger for the day.

New calls and Chat this evening, but we will be half size ahead of the GDP.

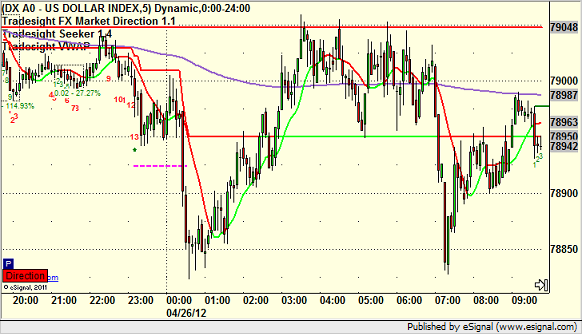

Here's the US Dollar Index intraday with our market directional lines:

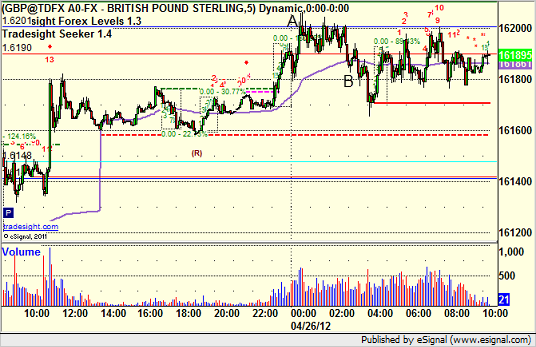

GBPUSD:

Triggered long at A and stopped at B. No action at all. Hit the trigger again in the morning exactly but didn't get through:

Tradesight Market Preview for 4/26/12

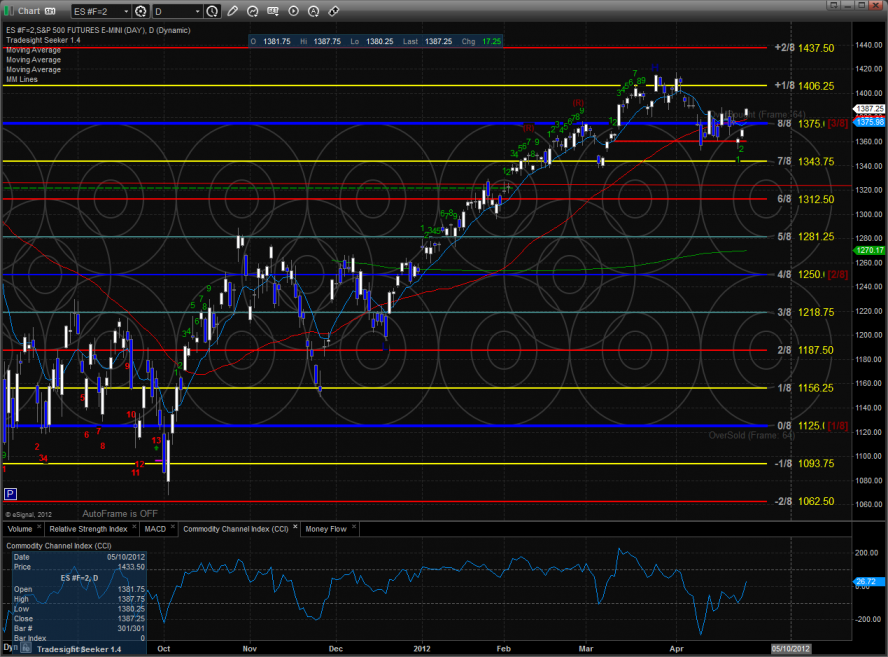

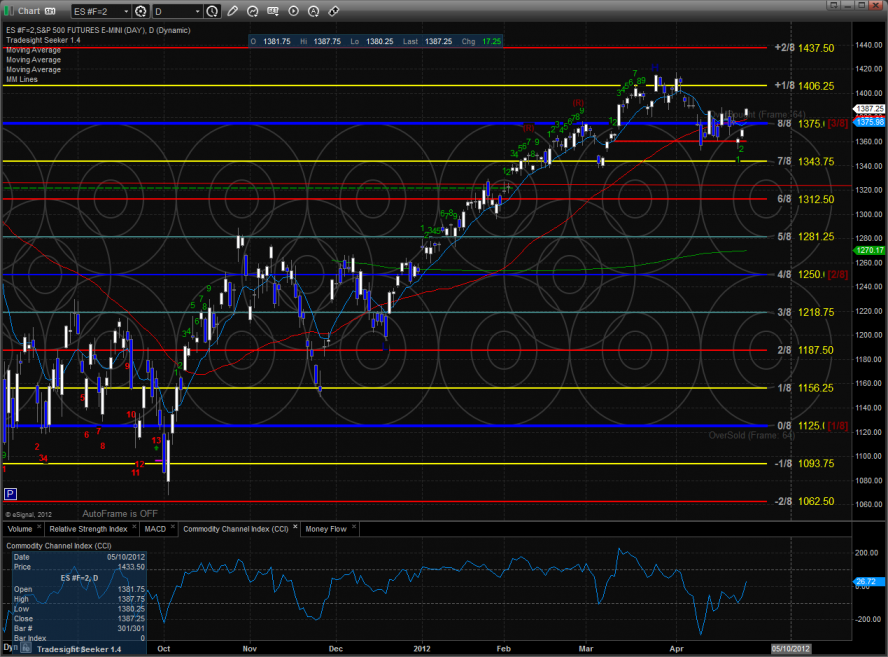

The ES gapped higher and closed at the HOD gaining 17. Price has advanced to the high of the recent range and also the recent breakdown level and gap window.

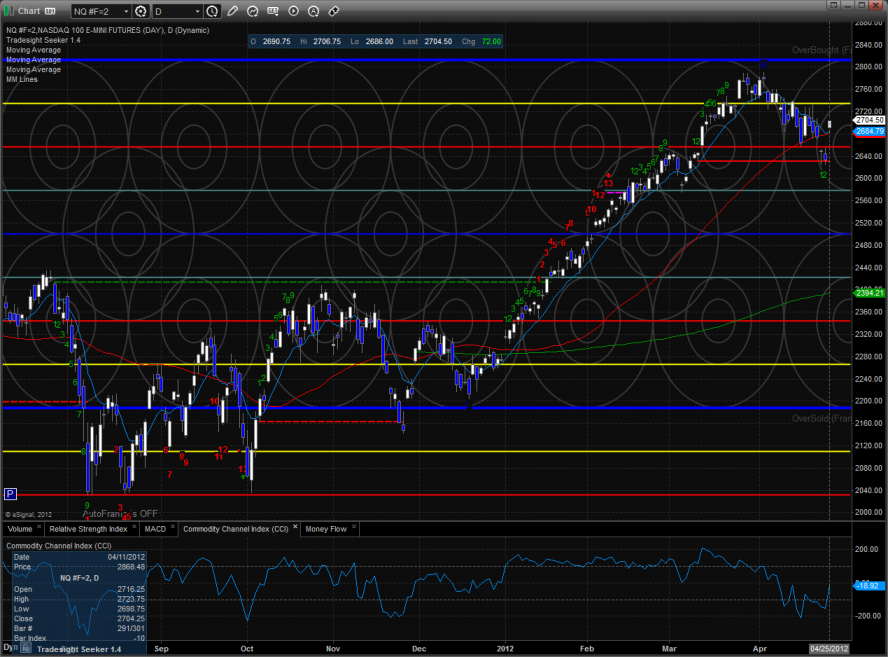

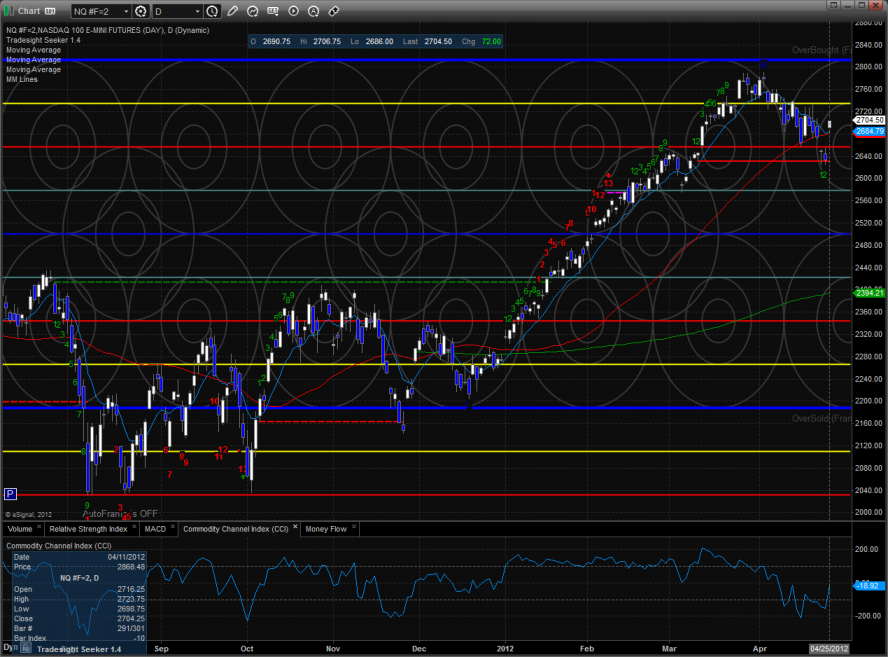

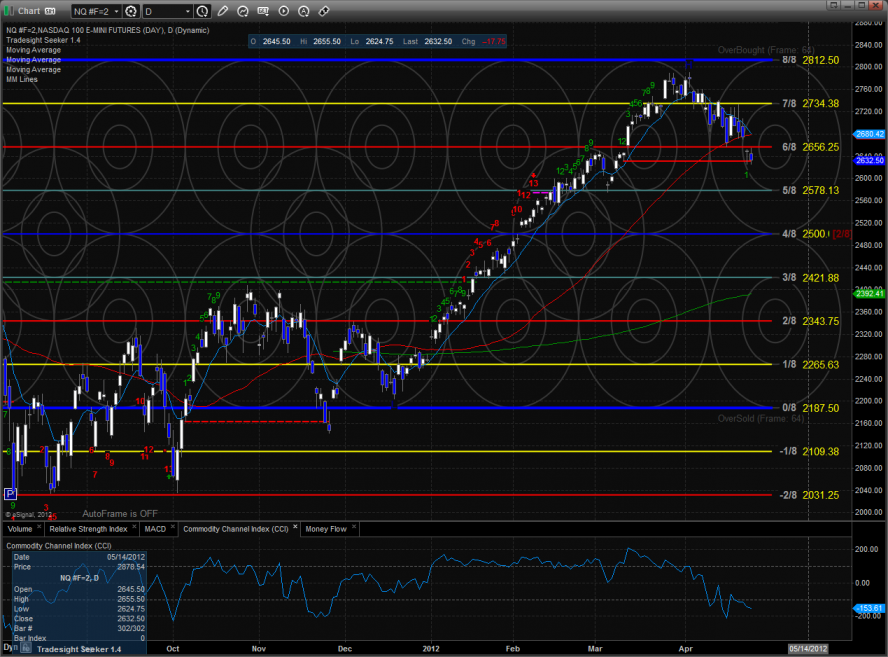

The NQ futures were much stronger than the ES on the day exploding higher by 72 and leaving a small 2 candle island below. Note that price is now back above all the important moving averages.

10-day NYSE Trin:

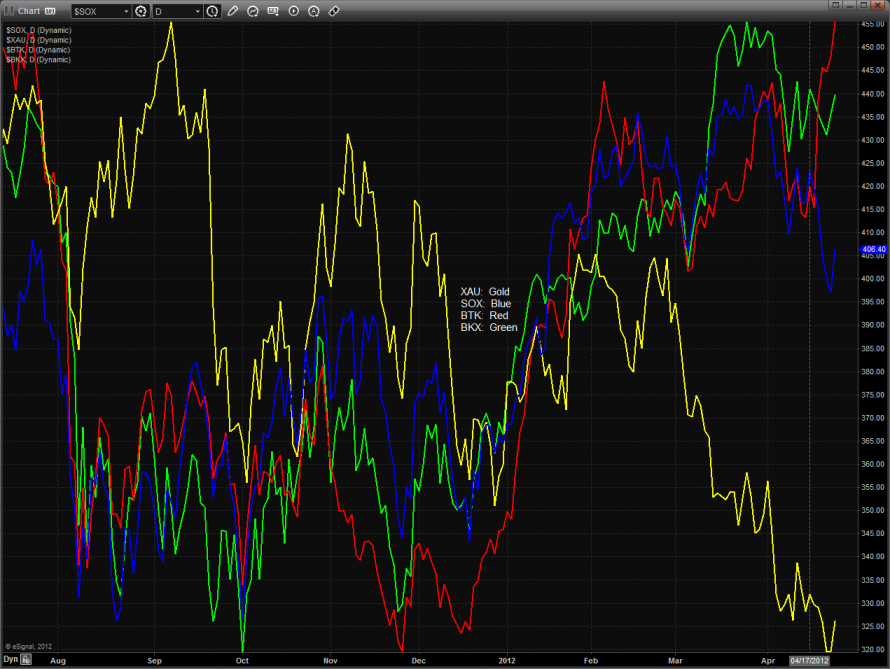

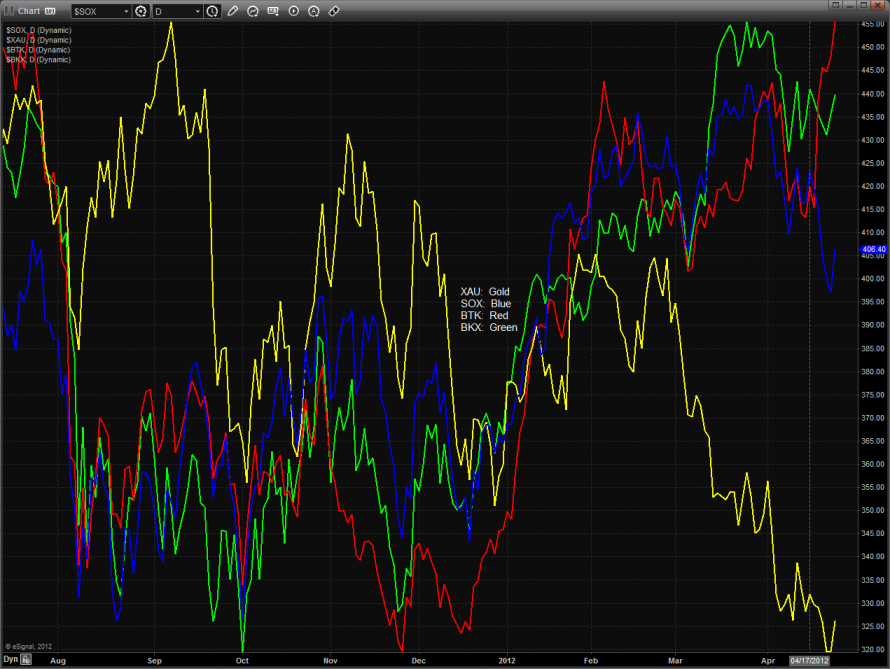

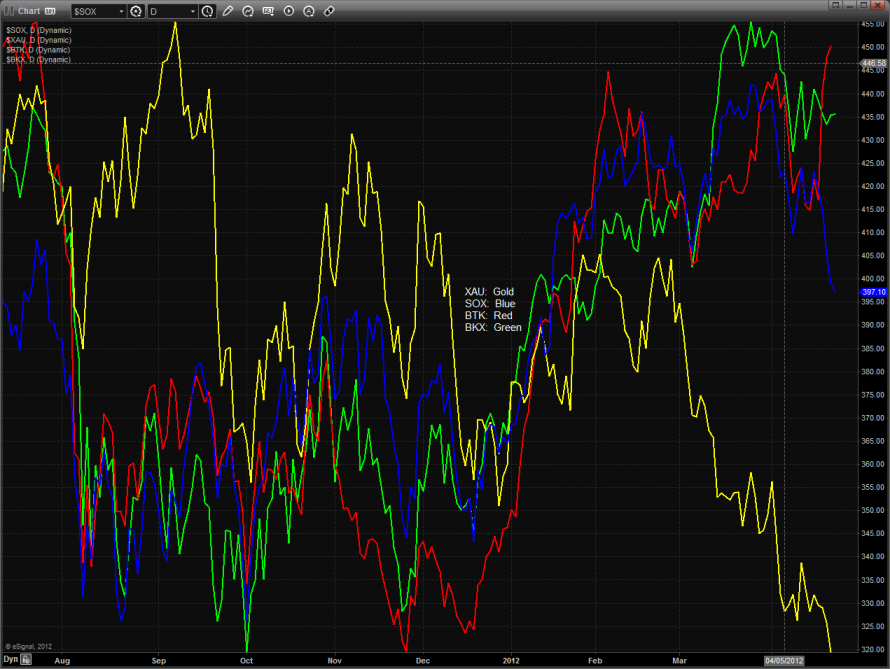

Multi sector daily chart:

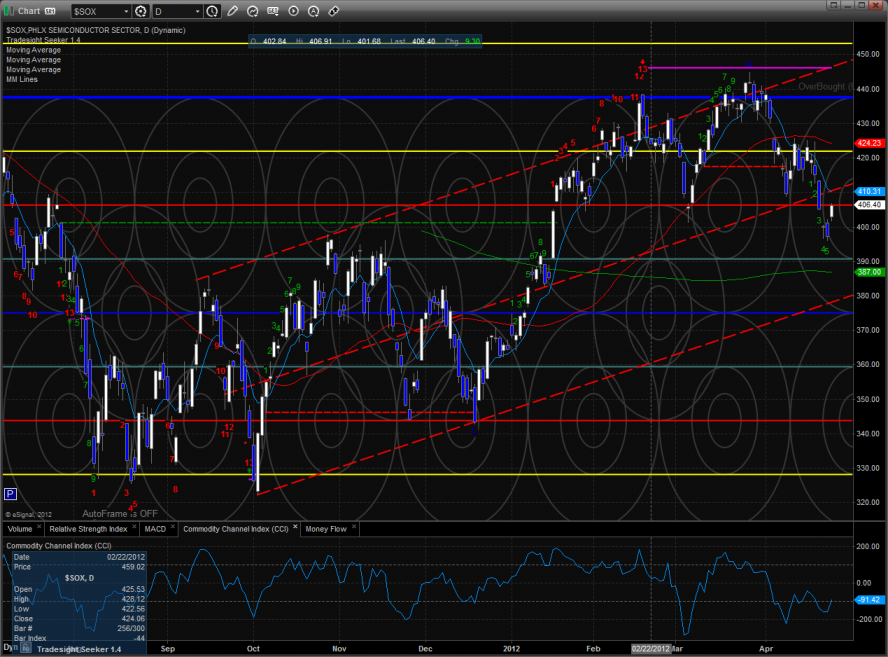

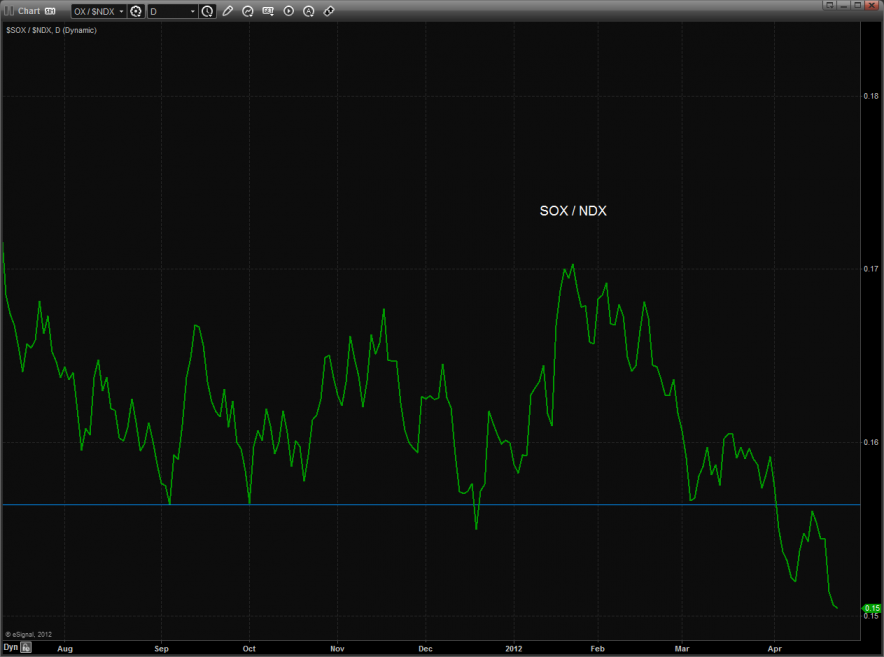

The SOX/NDX cross bearishly made a new low on the move:

The NDX is showing very good relative strength and building on it would be very bullish for the overall market.

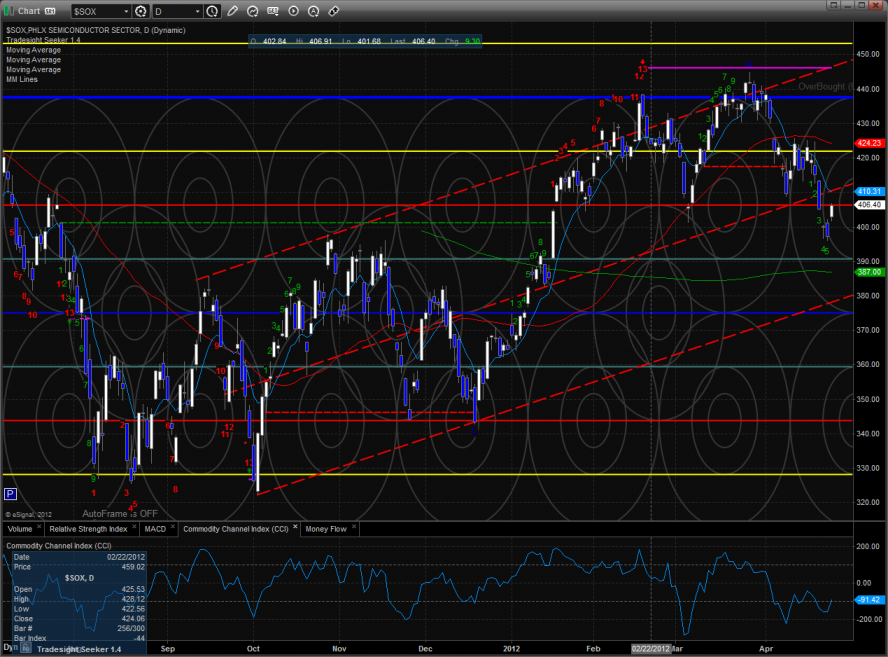

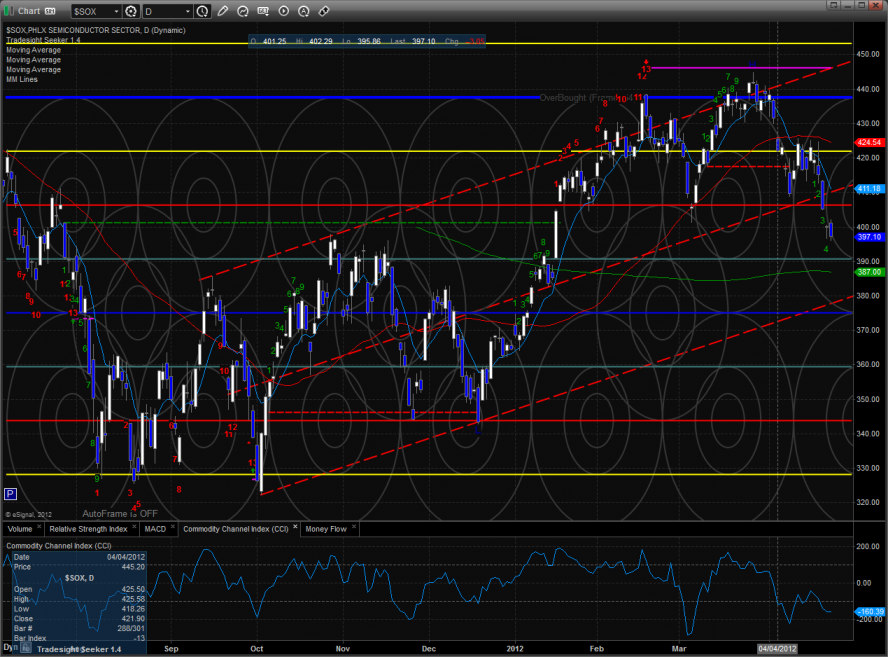

The SOX was strong on the day but underperformed the overall NDX.

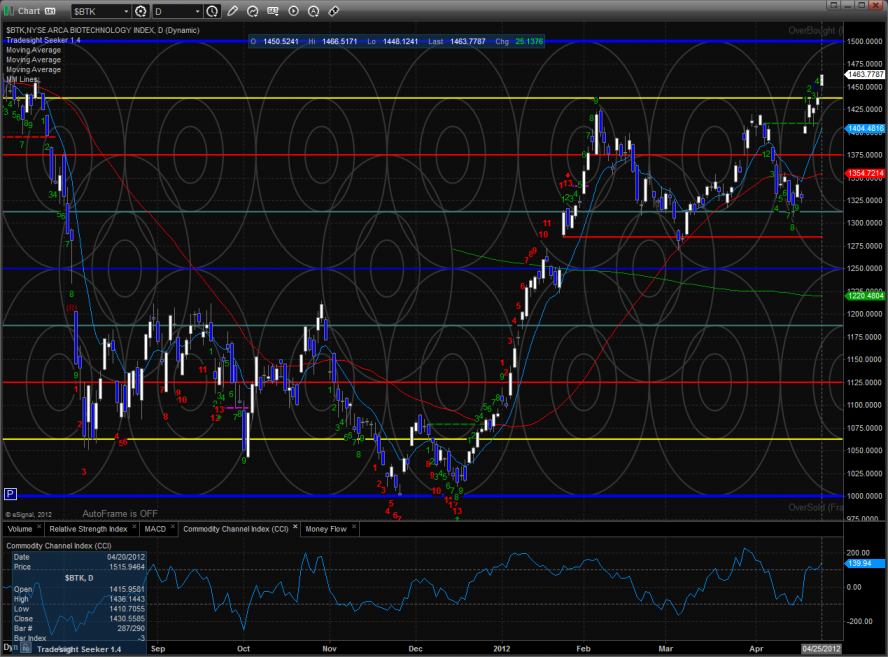

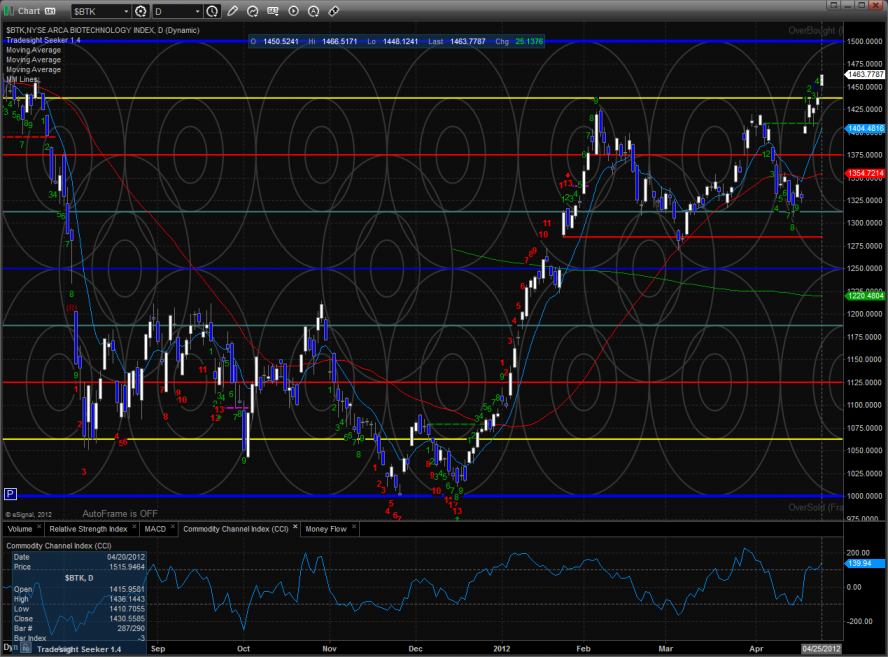

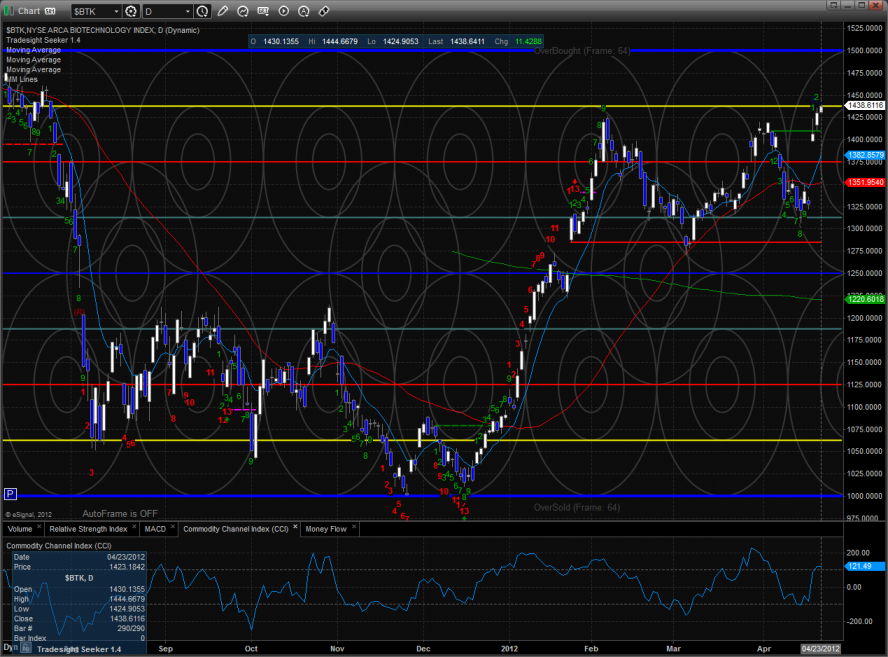

The BTK continues to print new highs and is unencumbered by the Seeker count.

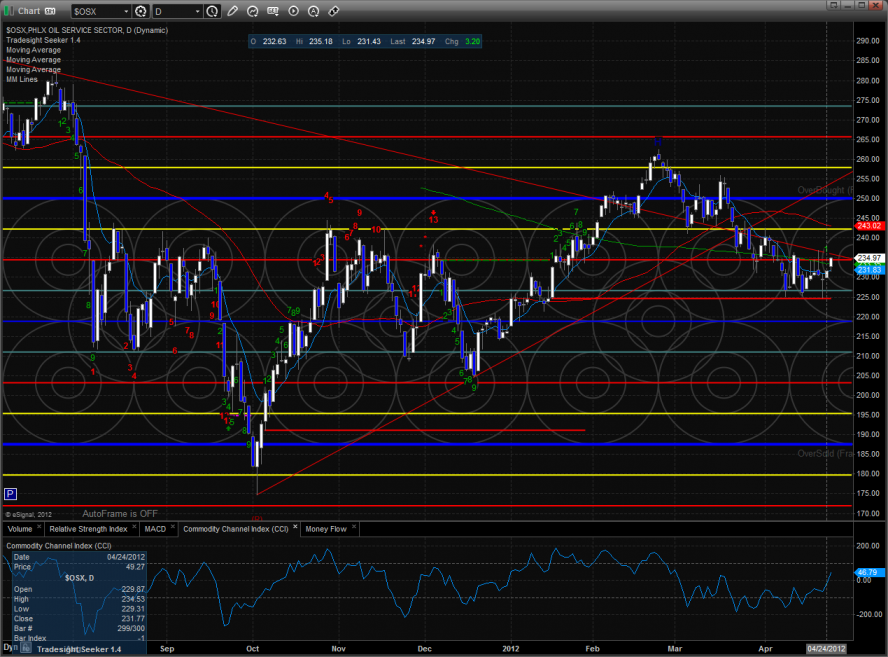

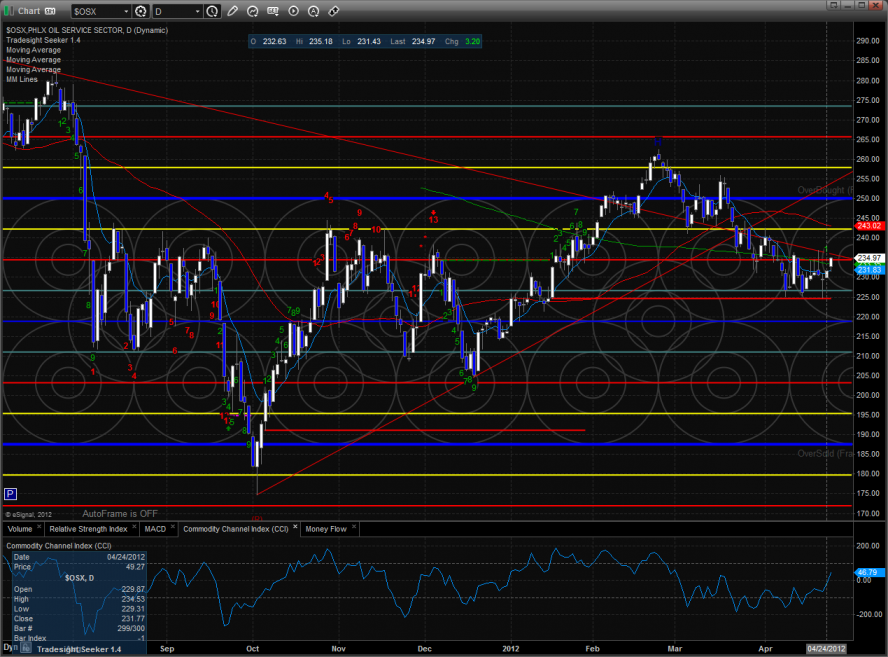

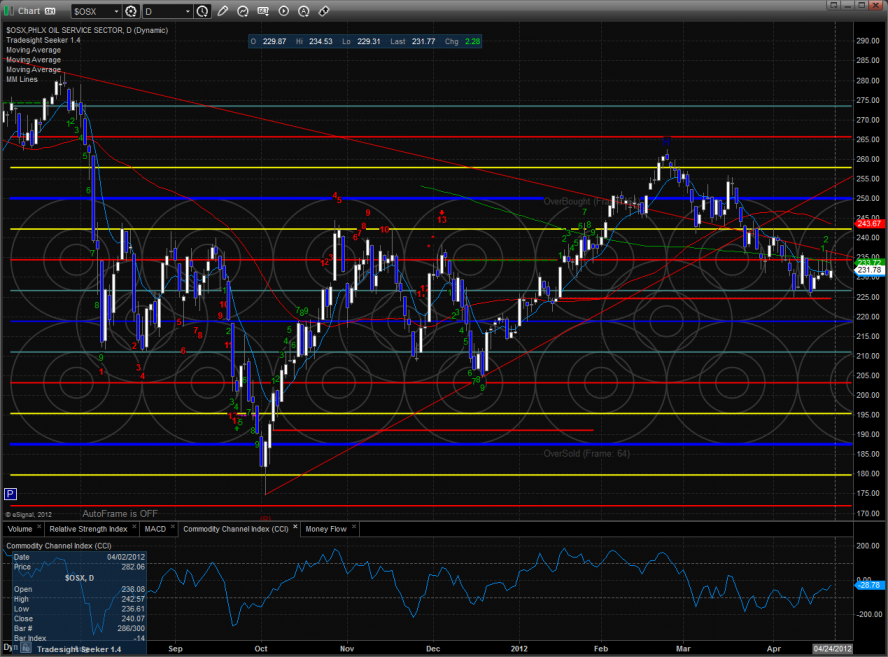

The OSX has rallied to key resistance and a potential short-term breakout level.

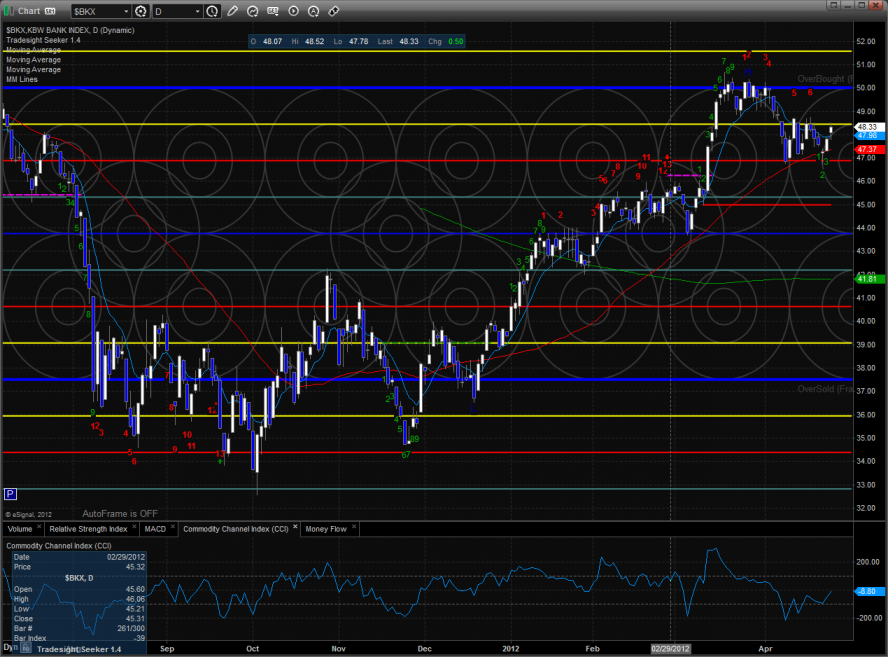

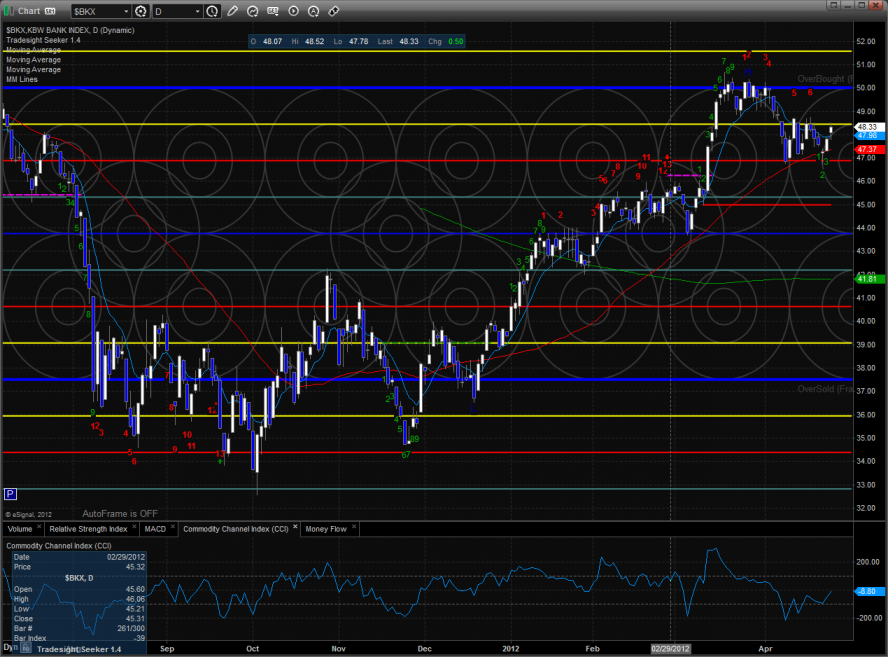

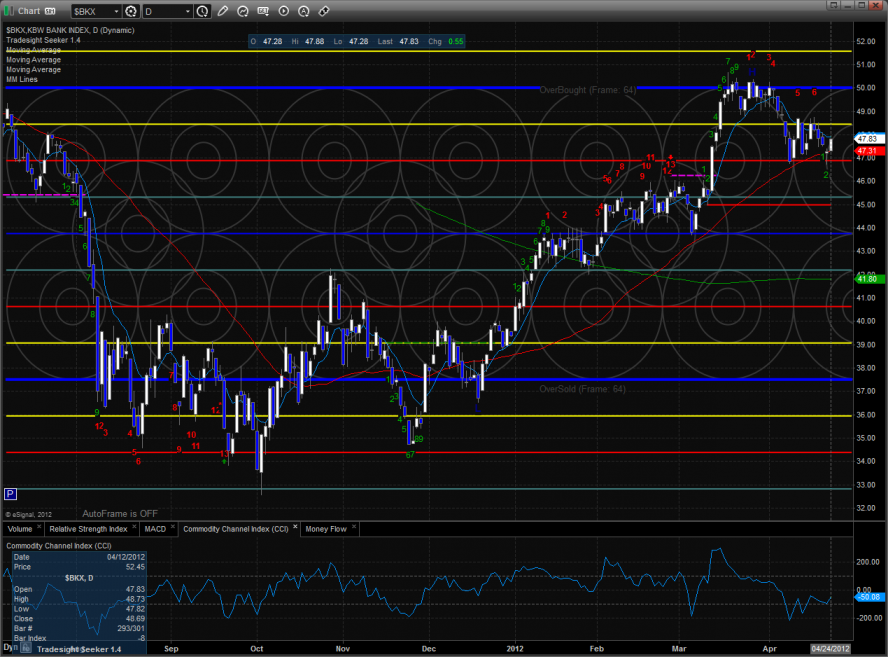

The BKX jumped over the 10ema but was weaker than the broad market. Price is still holding above the 50 and 200 period moving averages.

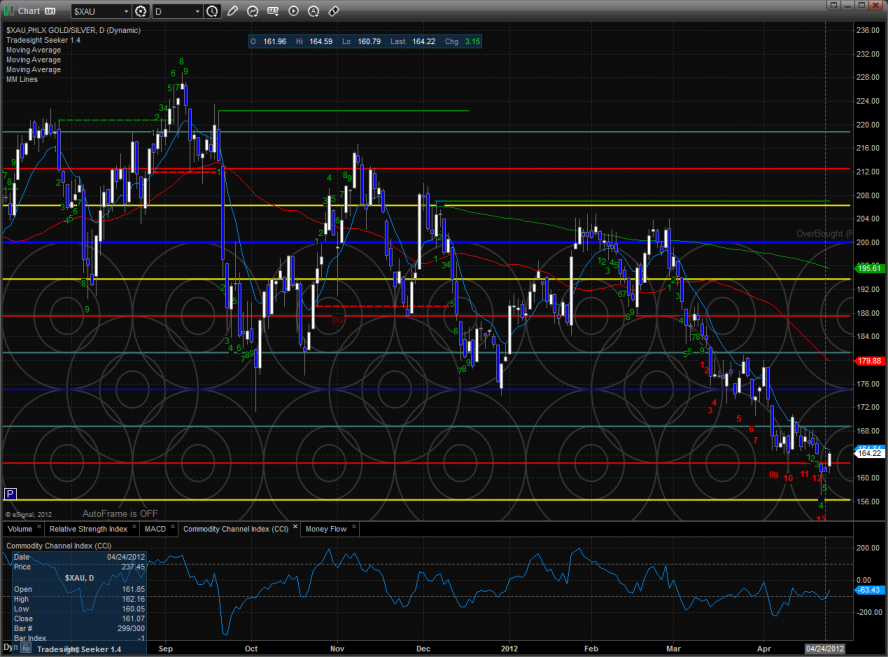

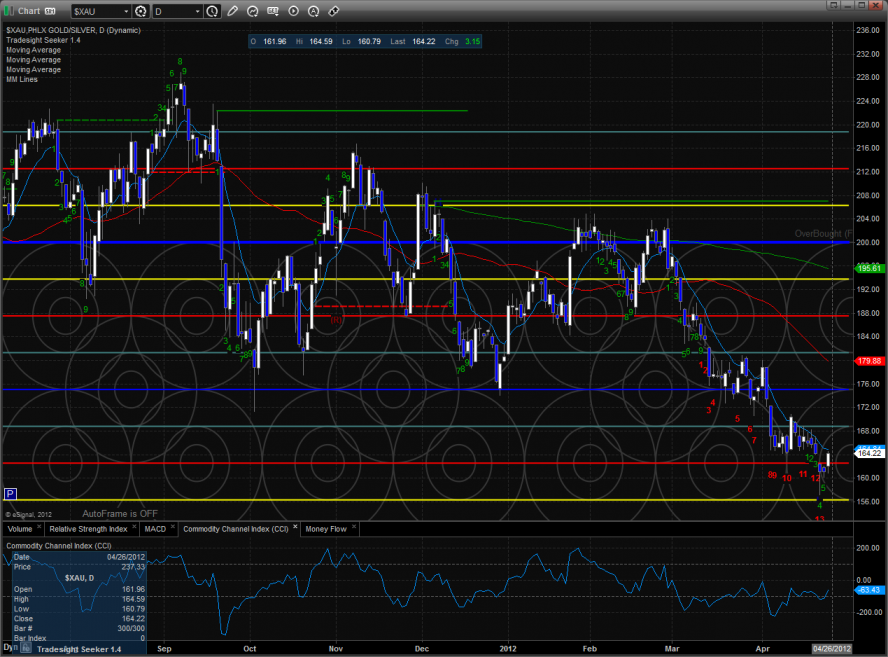

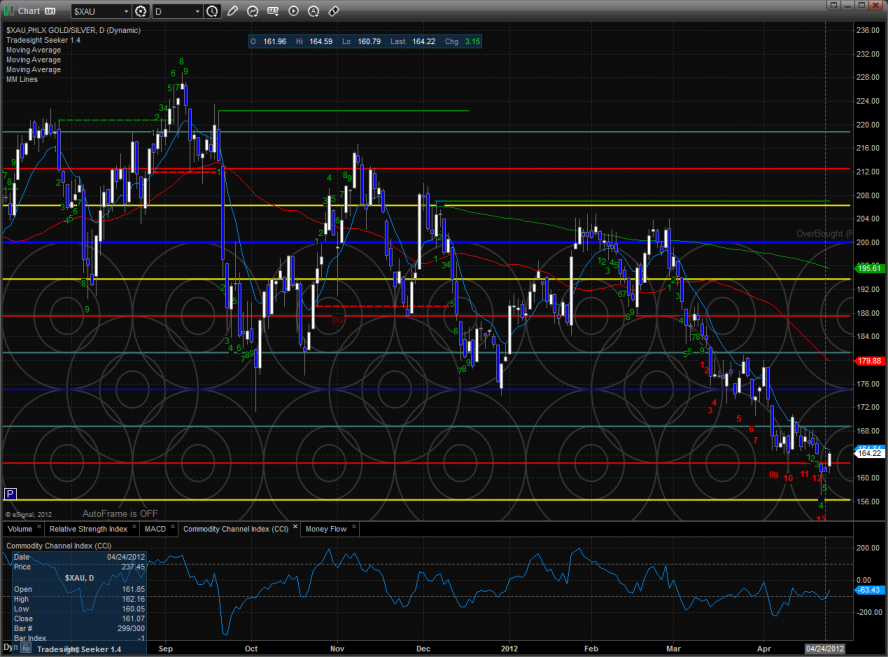

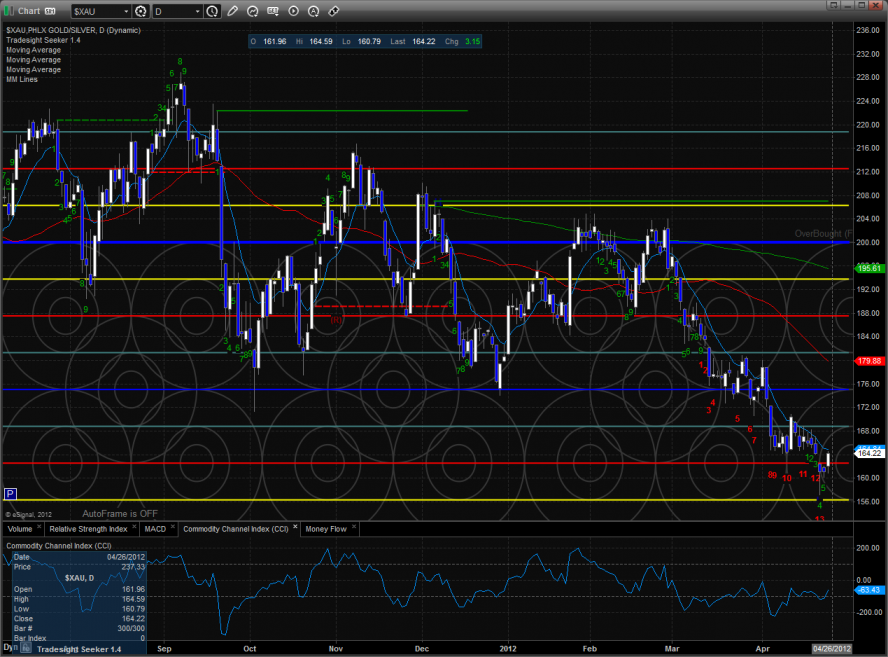

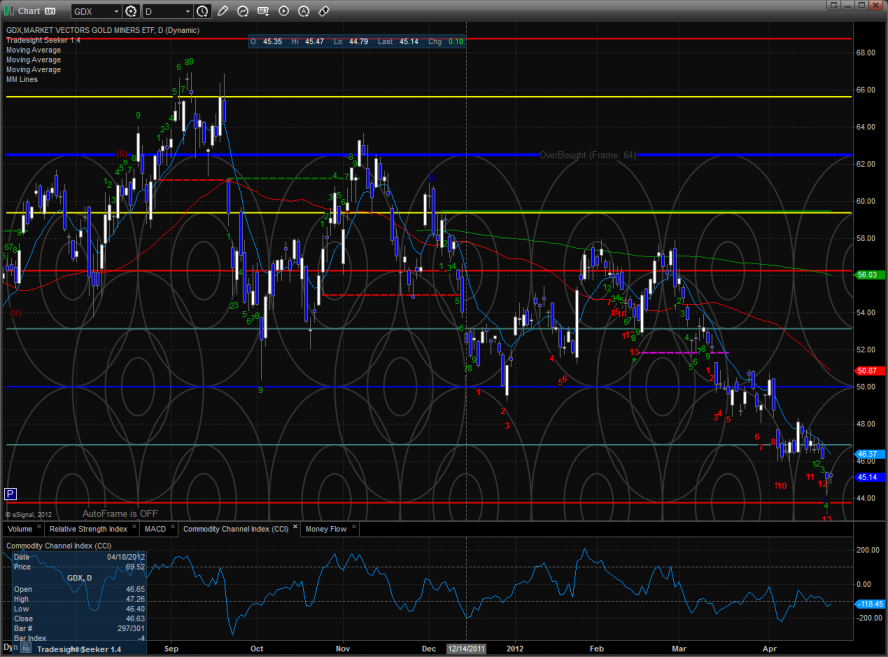

The XAU is trying to make the turn. There is a ton of room for the next upward impulse.

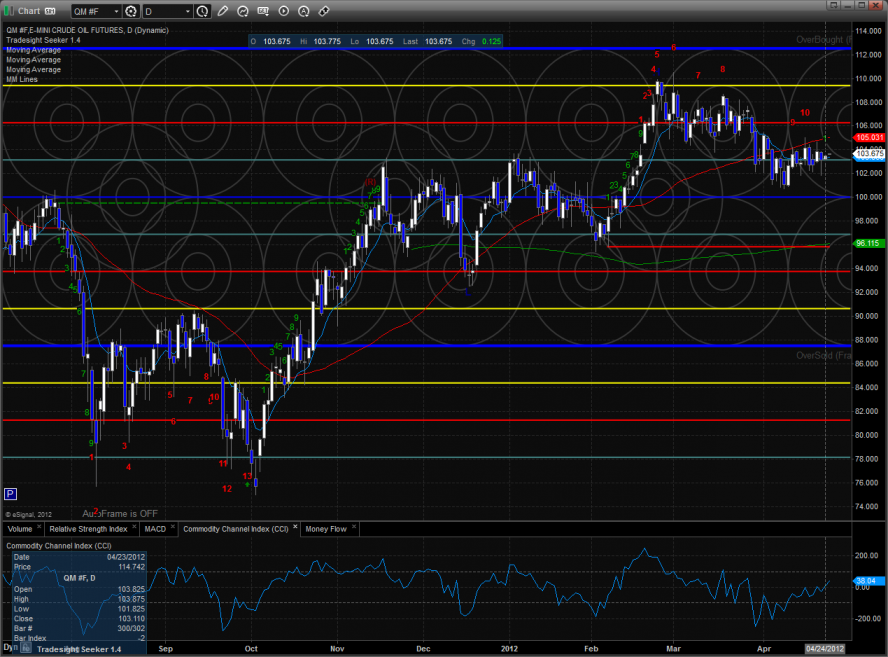

Oil:

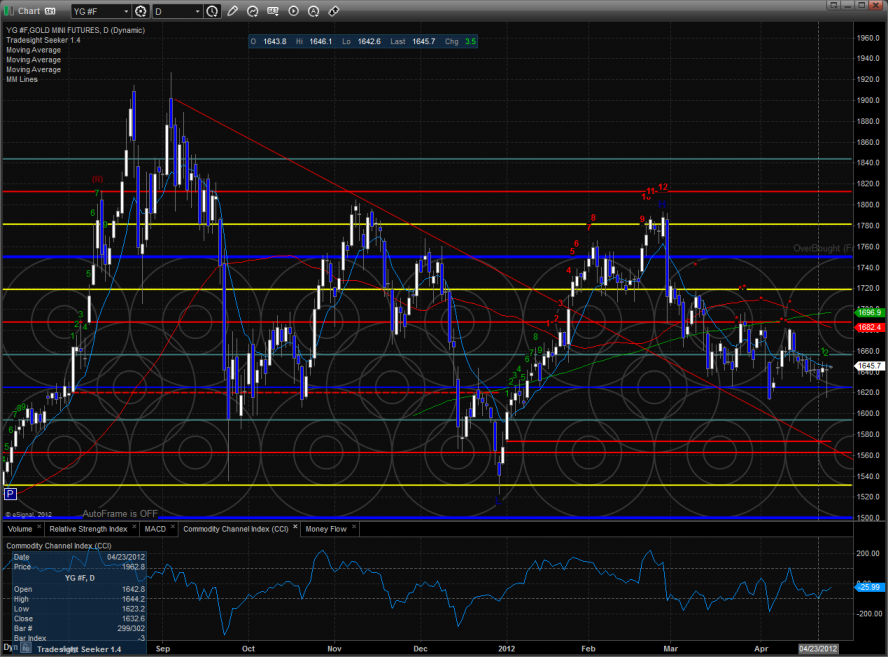

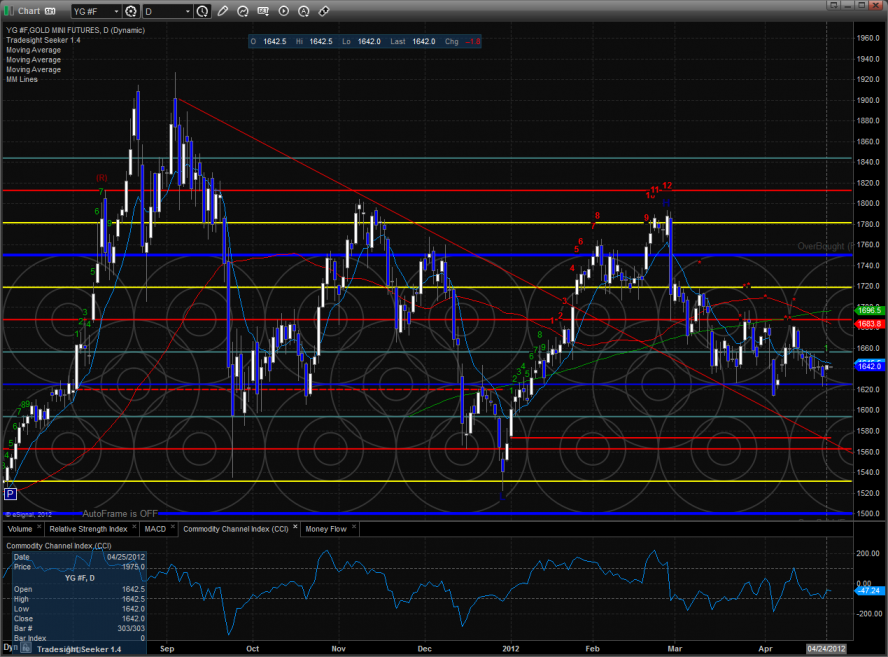

Gold:

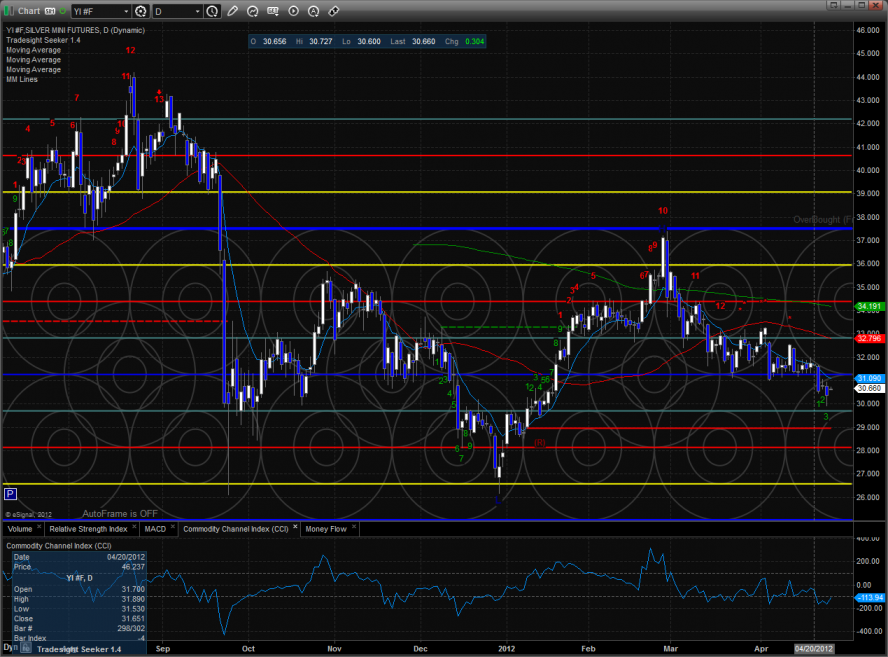

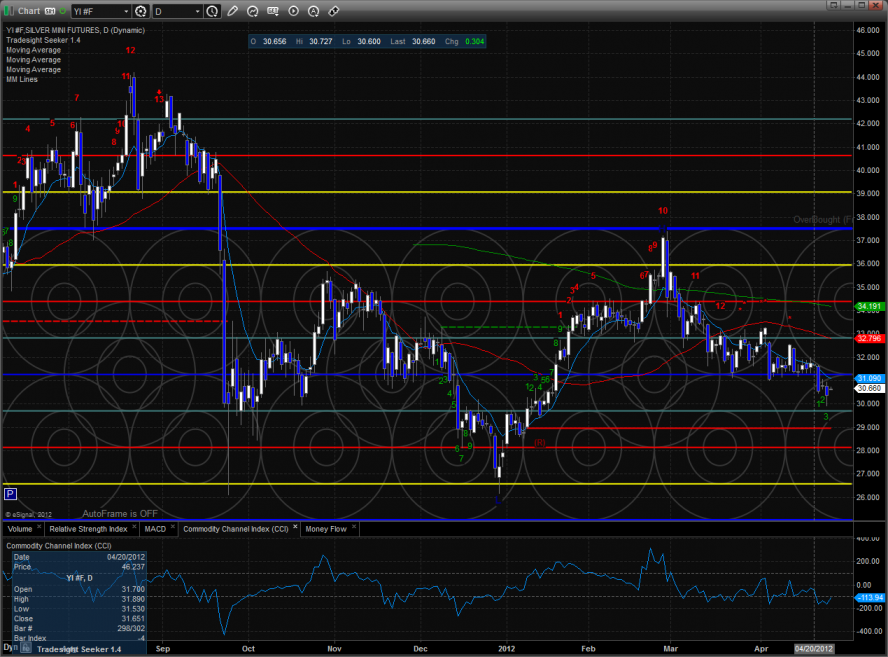

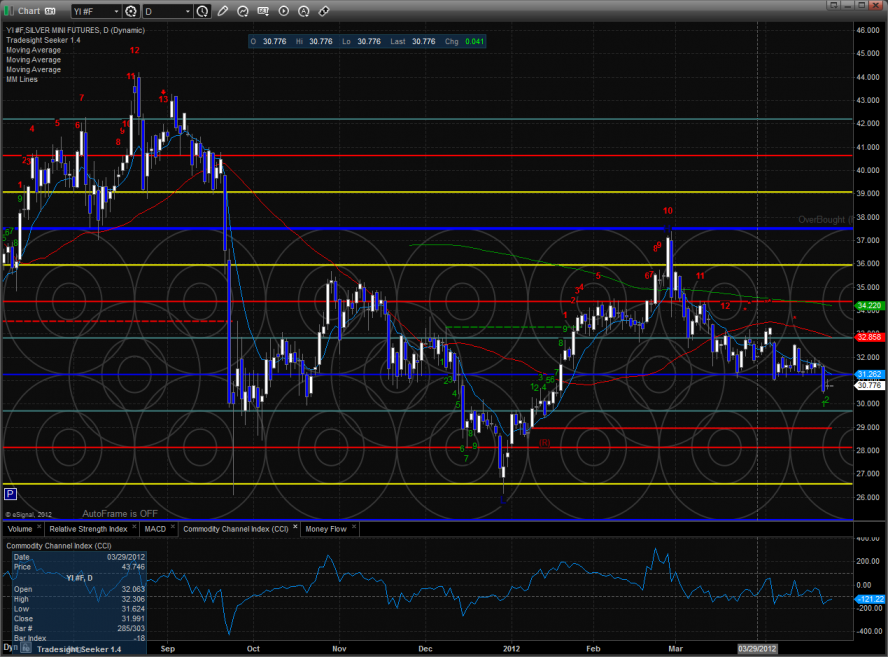

Silver:

Tradesight Market Preview for 4/26/12

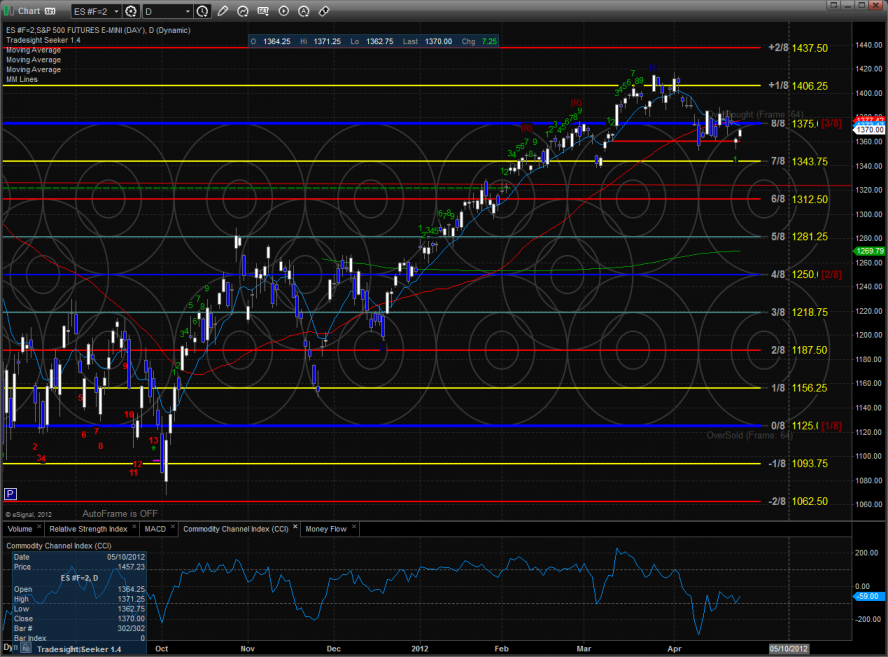

The ES gapped higher and closed at the HOD gaining 17. Price has advanced to the high of the recent range and also the recent breakdown level and gap window.

The NQ futures were much stronger than the ES on the day exploding higher by 72 and leaving a small 2 candle island below. Note that price is now back above all the important moving averages.

10-day NYSE Trin:

Multi sector daily chart:

The SOX/NDX cross bearishly made a new low on the move:

The NDX is showing very good relative strength and building on it would be very bullish for the overall market.

The SOX was strong on the day but underperformed the overall NDX.

The BTK continues to print new highs and is unencumbered by the Seeker count.

The OSX has rallied to key resistance and a potential short-term breakout level.

The BKX jumped over the 10ema but was weaker than the broad market. Price is still holding above the 50 and 200 period moving averages.

The XAU is trying to make the turn. There is a ton of room for the next upward impulse.

Oil:

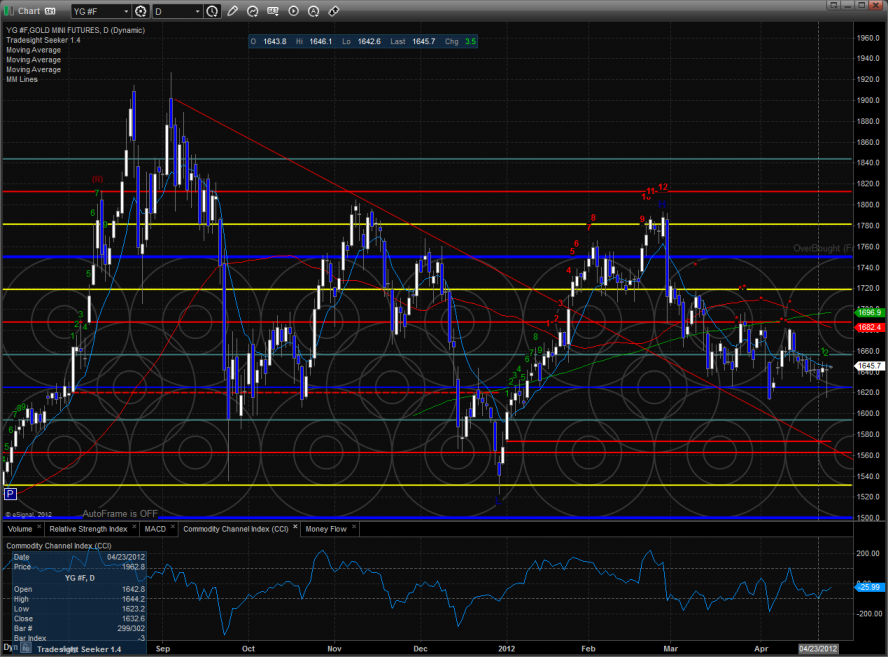

Gold:

Silver:

Stock Picks Recap for 4/25/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ACAS triggered long (with market support), worked a little:

In the Messenger, Rich's CAT triggered short (without market support) and worked great:

His BIDU triggered long (without market support due to opening five minutes) and worked:

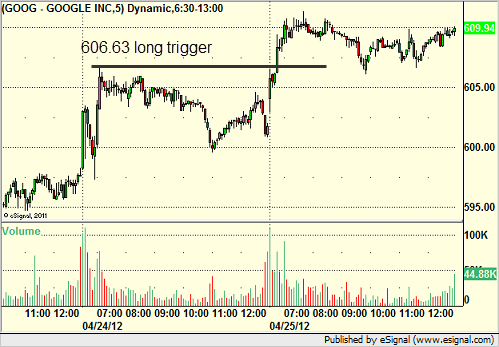

GOOG triggered long (with market support) and worked:

Rich's FFIV triggered short (without market support) and didn't work:

His FAZ (ETF, no market support needed), triggered long and didn't work:

His PCLN triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Forex Calls Recap for 4/25/12

New trade in EURUSD stopped out (half size ahead of Fed), and then we stopped the second half of the prior day's trade in the money. See that section below.

Pretty flat session before and after the Fed.

New calls and Chat tonight.

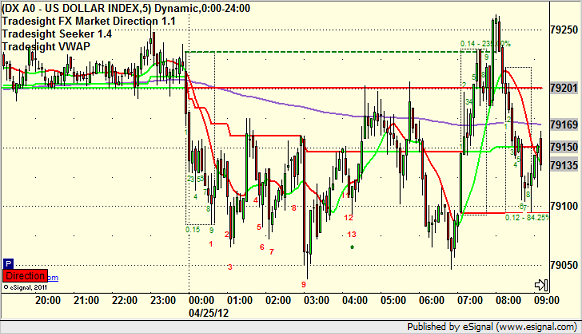

Here's the US Dollar Index intraday with our market directional lines:

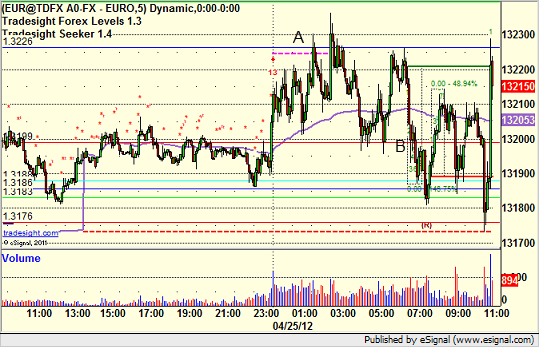

EURUSD:

Triggered long at A (half size for session ahead of Fed) and stopped. Raised stop in the morning on the long from the prior session and stopped in the money at B:

Tradeisght Market Preview for 4/25/12

The ES made good on the camouflage buy signal in place from yesterday’s trade to gain 7 on the day. Earnings releases will likely continue to drive price and keep things gappy.

The NQ futures were lower by 17 on the day which continues with the relative weakness theme. Price settled right at the key static trend line. If this level is lost then the downside momentum will really accelerate and the 4/8 Murrey math level will come into play.

10-day Trin is back to the neutral level at 1.00:

Multi sector daily chart:

The SOX/NDX cross made a new low on the move. The AAPL earnings will likely have a vote as to the near term direction of this ratio.

The BKX was the top major sector on the day. A close above the 10ema would turn the chart back to short term positive.

The OSX is trying to make a turn here. Keep an eye on the old DTL.

The BTK made a new high on the move settling right at the 7/8 level. Note that the Seeker count is only 3 days up.

The XAU still has a fresh 13 buy signal. Monday’s action was inside the prior day’s candle so be sure to set an alarm for a break over Friday’s high and have some long ideas ready to go after the FOMC announcement.

The SOX was the last laggard on the day making a new low close on the move. The next important level of support is the 200dma at 387.

Oil:

Gold:

Silver:

Stock Picks Recap for 4/24/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ONXX triggered long (without market support due to opening five minutes) and didn't work:

PLCE triggered short (with market support) and worked:

SANM gapped under the trigger, no play.

TRIP triggered short (with market support) and worked:

In the Messenger, Rich's NFLX triggered long (with market support) and worked:

AMZN triggered long (with market support) and worked:

Rich's AAPL triggered short (without market support) and didn't work:

His BWLD triggered short (without market support) and worked, but would have been hard to get on the news:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Forex Calls Recap for 4/24/12

A decent winner on the EURUSD, and we're holding the second half still. See that section below.

Here's the US Dollar Index intraday with our market directional lines:

New calls tonight, and Chat, but half size ahead of Fed announcement tomorrow.

EURUSD:

Triggered long at A, hit first target eventually at B without coming close to stopping, and currently have a stop under tri-star green line at C:

Stock Picks Recap for 4/23/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NVDA triggered short (without market support due to opening five minutes) and worked:

CPHD triggered short (without market support due to opening five minutes) and worked:

MCHP triggered short (without market support due to opening five minutes) and worked:

MXIM and PMTC gapped under their triggers, no plays.

In the Messenger, Rich's VXX triggered long (ETF, so no market support needed) and didn't work:

His CAT triggered short (with market support) and didn't work:

His SNDK triggered long (without market support) and worked:

His NKE triggered short (with market support) and worked:

His NFLX triggered short (without market support) and didn't work:

His VMW triggered short (without market support) and didn't work:

NVDA triggered long (with market support) and only went five cents in an hour, so we won't count it:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

Stock Picks Recap for 4/23/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NVDA triggered short (without market support due to opening five minutes) and worked:

CPHD triggered short (without market support due to opening five minutes) and worked:

MCHP triggered short (without market support due to opening five minutes) and worked:

MXIM and PMTC gapped under their triggers, no plays.

In the Messenger, Rich's VXX triggered long (ETF, so no market support needed) and didn't work:

His CAT triggered short (with market support) and didn't work:

His SNDK triggered long (without market support) and worked:

His NKE triggered short (with market support) and worked:

His NFLX triggered short (without market support) and didn't work:

His VMW triggered short (without market support) and didn't work:

NVDA triggered long (with market support) and only went five cents in an hour, so we won't count it:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.