Stock Picks Recap for 4/20/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SPRD triggered short (with market support) and worked:

STEC triggered short (with market support) and didn't go ten cents either way, so we don't count it:

Not many extra calls due to the options expiration, which we knew would keep things dull.

In the Messenger, Rich's AAPL triggered short (with market support) and didn't work:

AMZN triggered short (without market support) and worked great:

Rich's AMGN triggered long (with market support) and didn't work, although worked later:

In total, that's 3 trades triggering with market support, 1 worked, 2 didn't.

Stock Picks Recap for 4/20/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SPRD triggered short (with market support) and worked:

STEC triggered short (with market support) and didn't go ten cents either way, so we don't count it:

Not many extra calls due to the options expiration, which we knew would keep things dull.

In the Messenger, Rich's AAPL triggered short (with market support) and didn't work:

AMZN triggered short (without market support) and worked great:

Rich's AMGN triggered long (with market support) and didn't work, although worked later:

In total, that's 3 trades triggering with market support, 1 worked, 2 didn't.

Tradesight Market Preview for 4/24/12

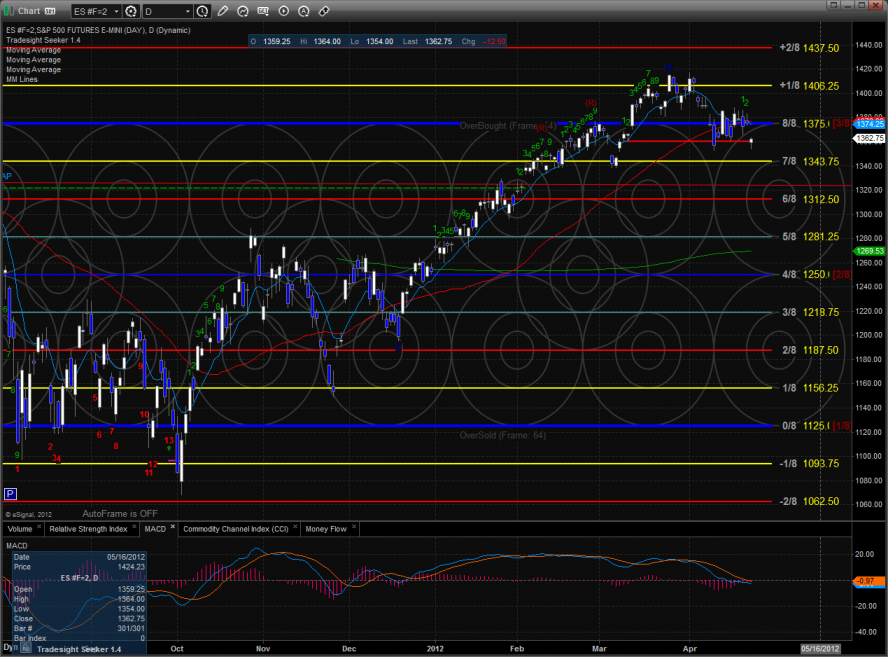

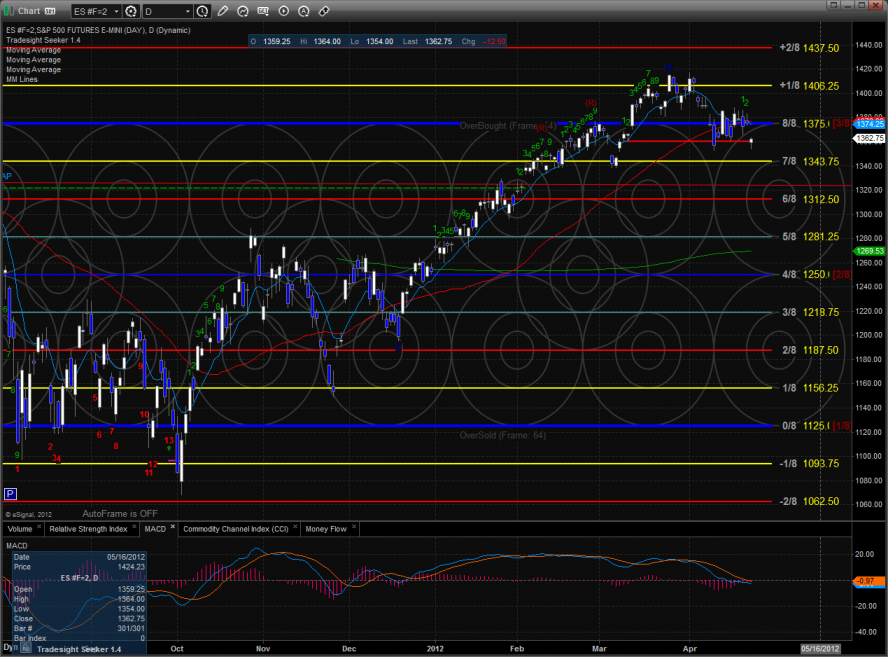

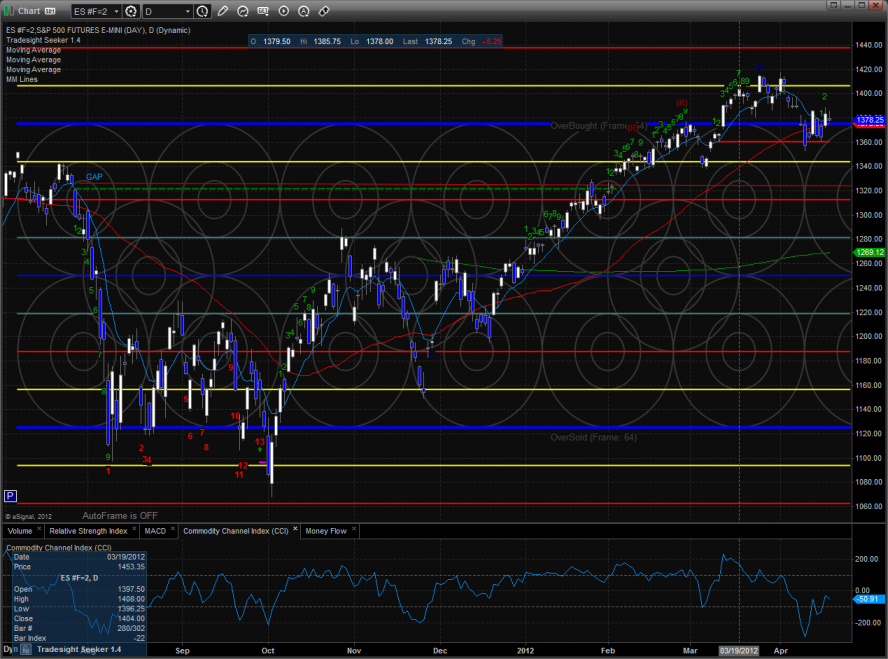

The ES gapped down huge on the day and really did very little with one small exception. The exception was that price closed above the open which makes for a camouflage buy signal. This puts Monday’s gap fill in play. Price was lower 13 on the day using the active static trend line as support. The market did one other important thing by filling the open gap at 1356.75.

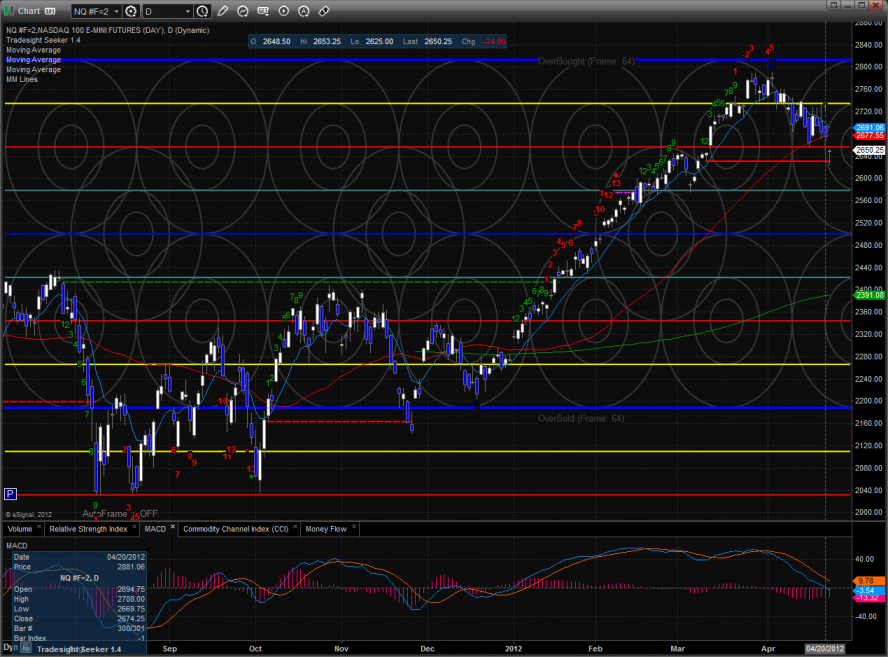

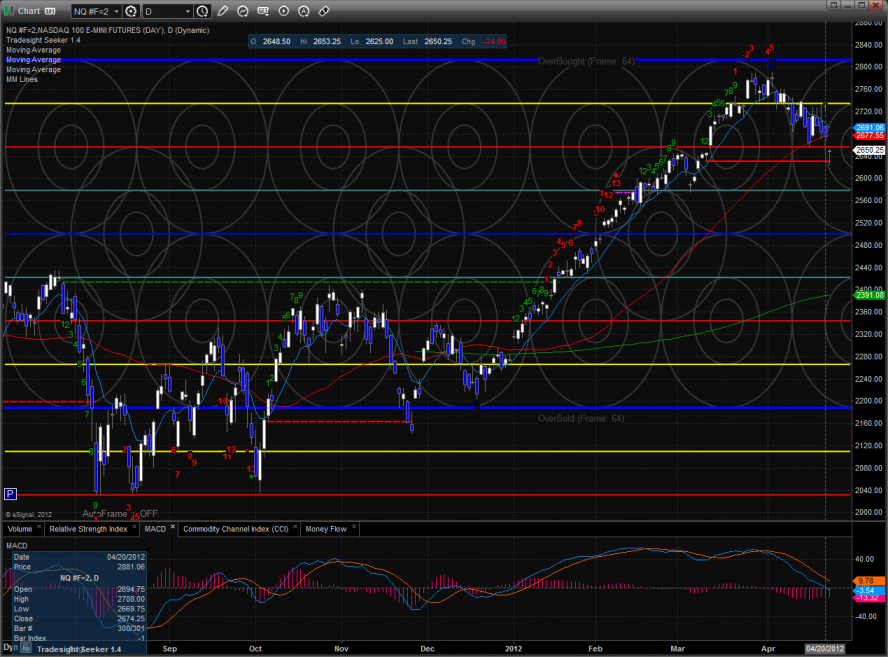

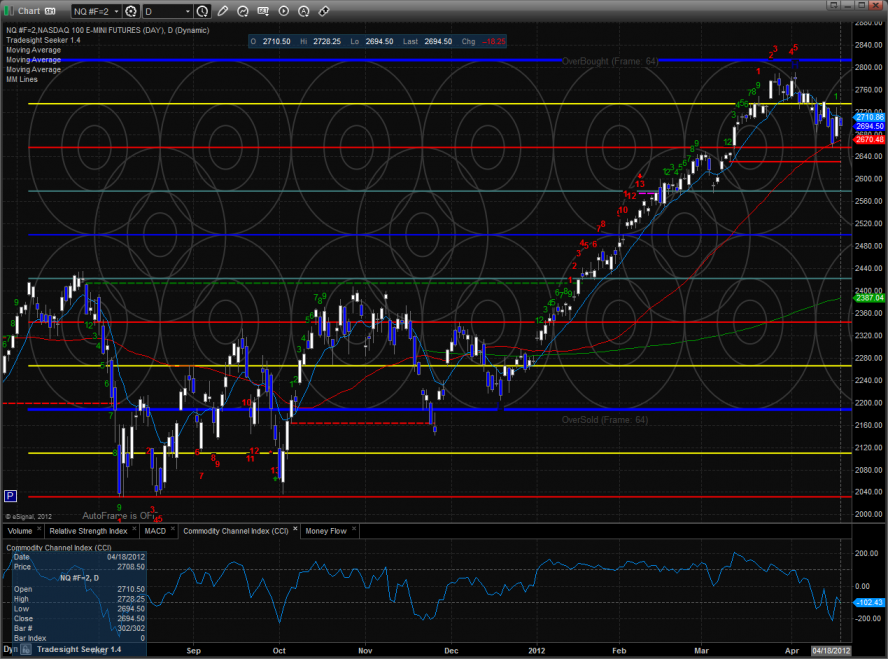

The NQ futures were lower by 24 on the day. Price is pinching between the 10eama and the 50dma. Momentum is picking up as confirmed by the break below the zero line of the MACD. The next area of support is the static trend line.

10-day Trin:

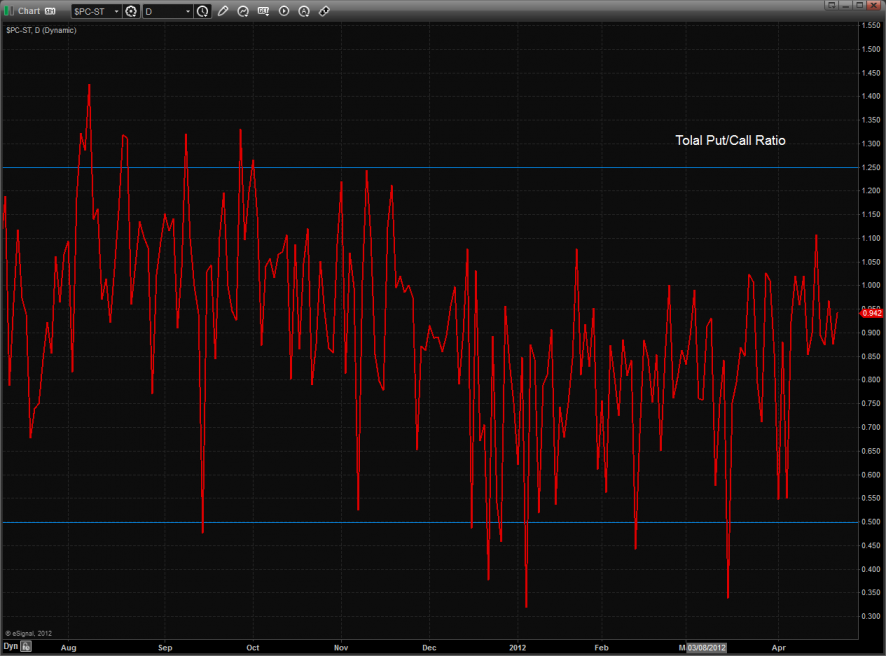

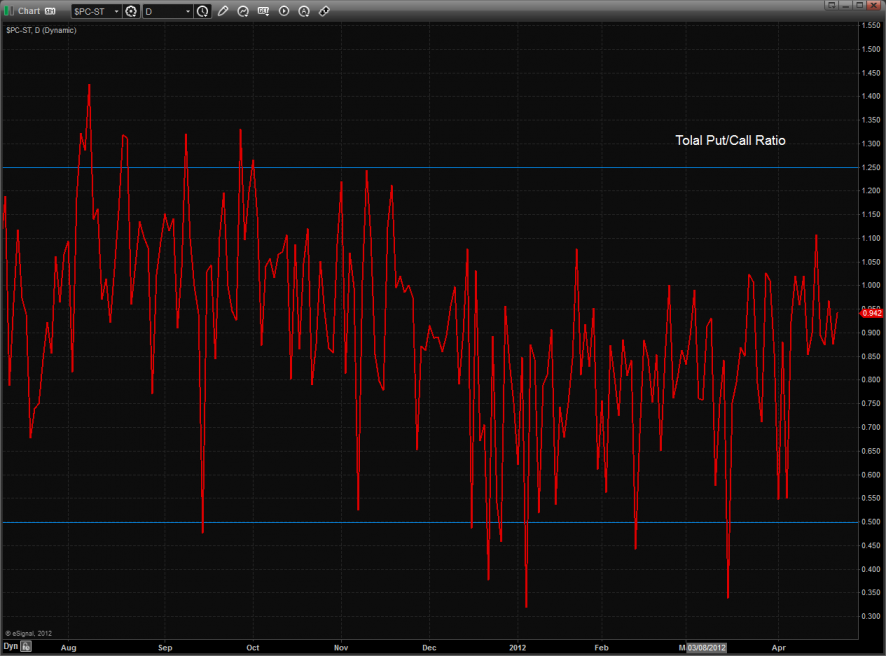

The put/call ratio is neutral:

Multi sector daily chart:

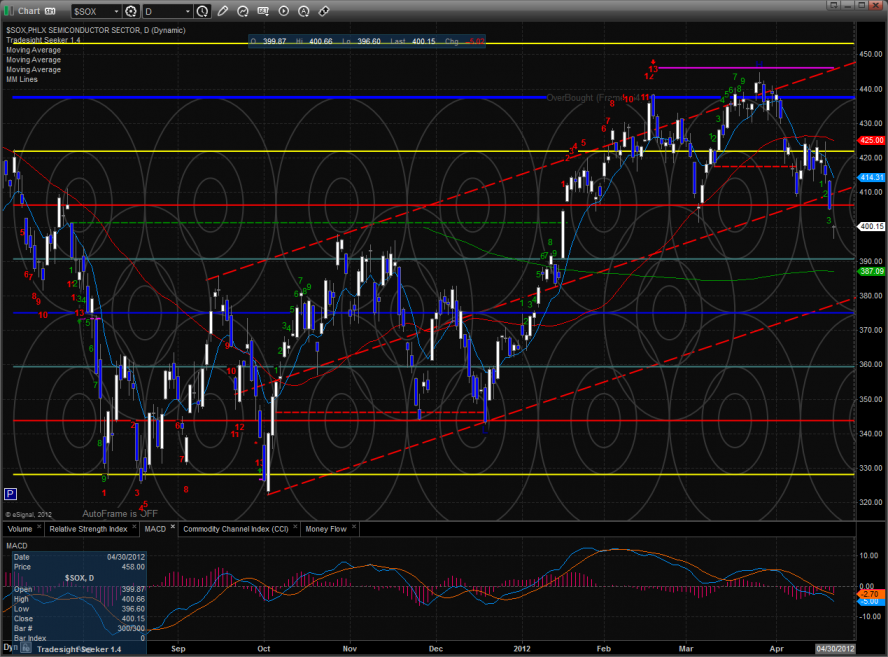

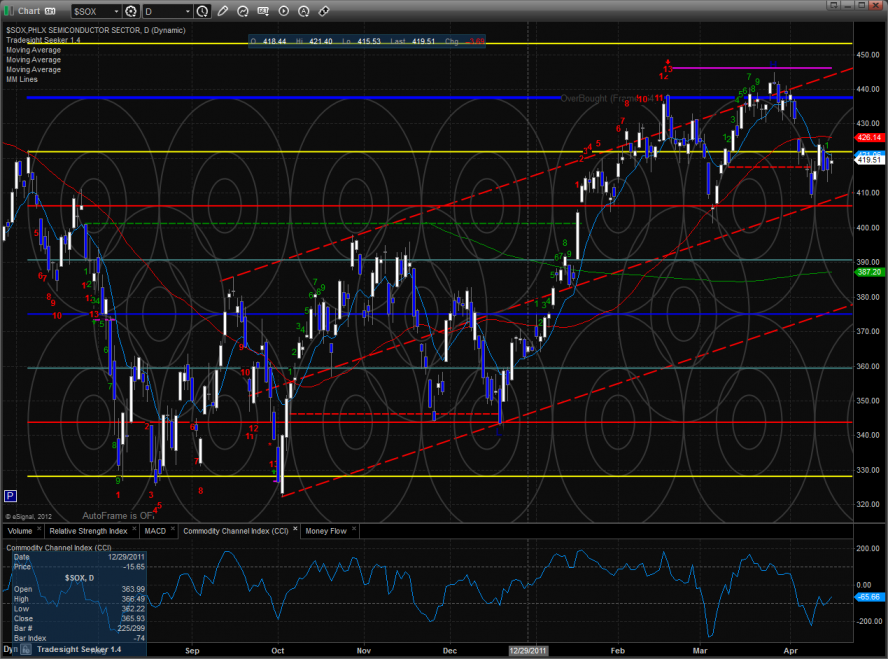

The SOX/NDX cross has bearishly recorded a new low close:

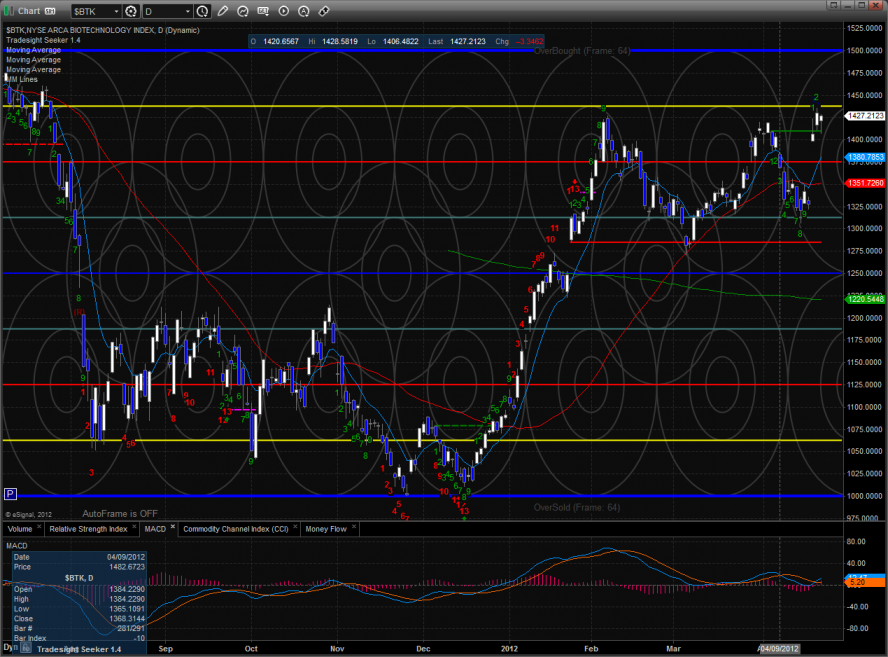

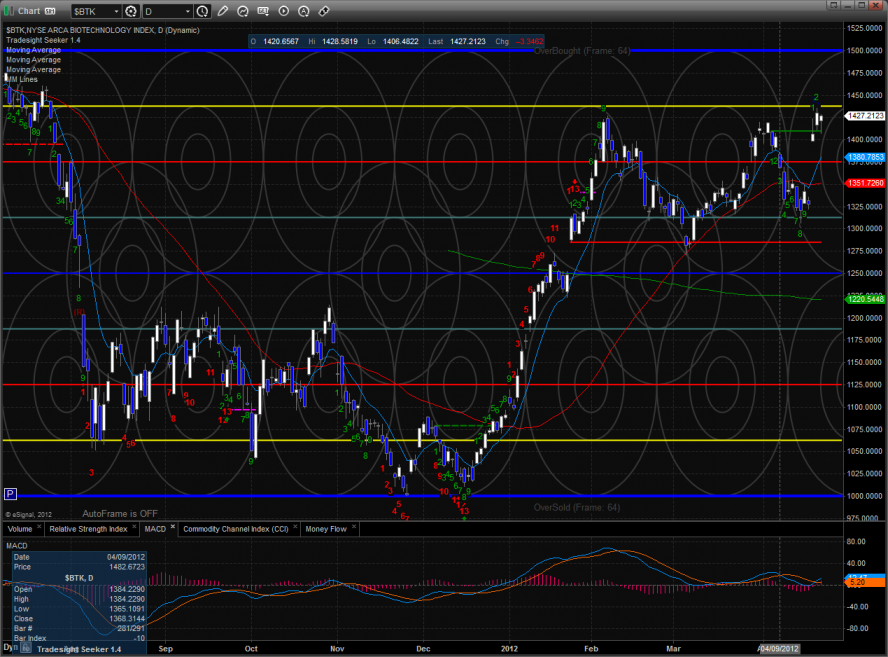

The best sector on the day was the BTK which is still holding above the recent gap.

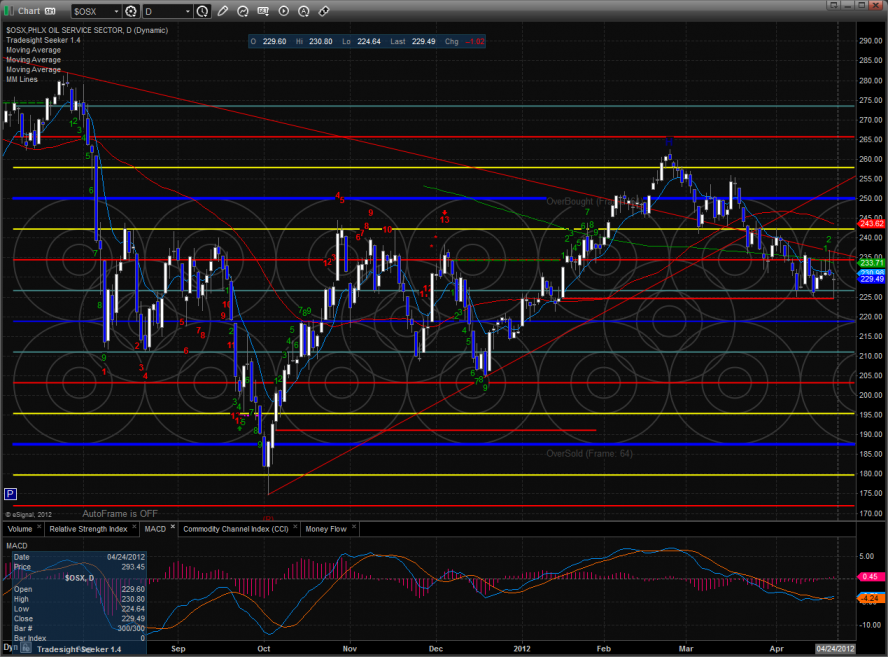

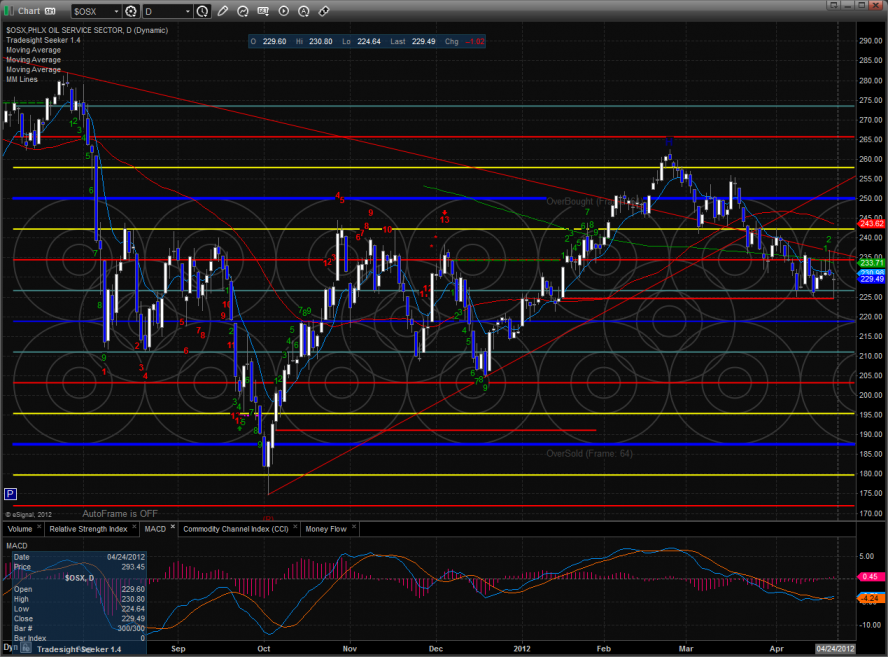

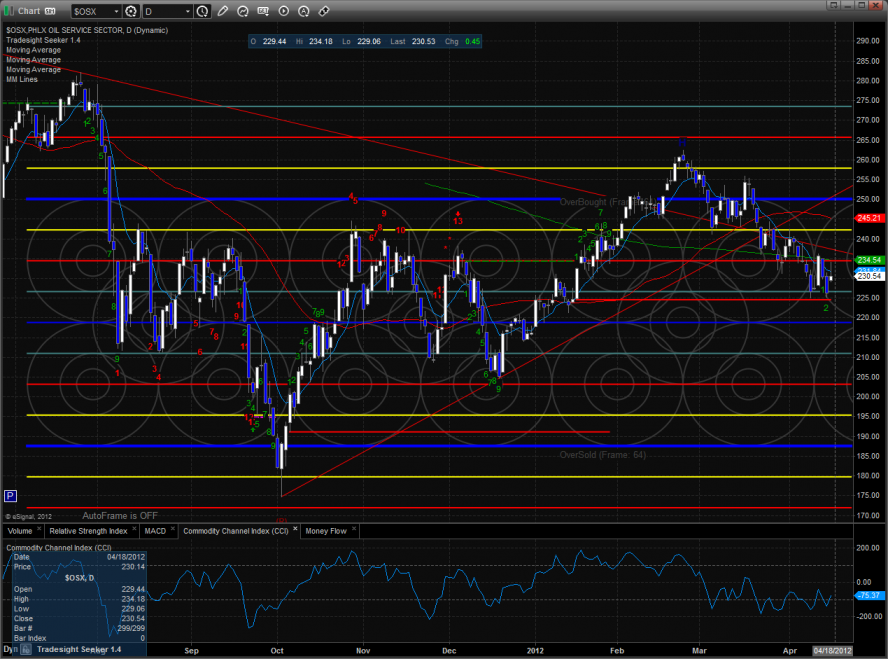

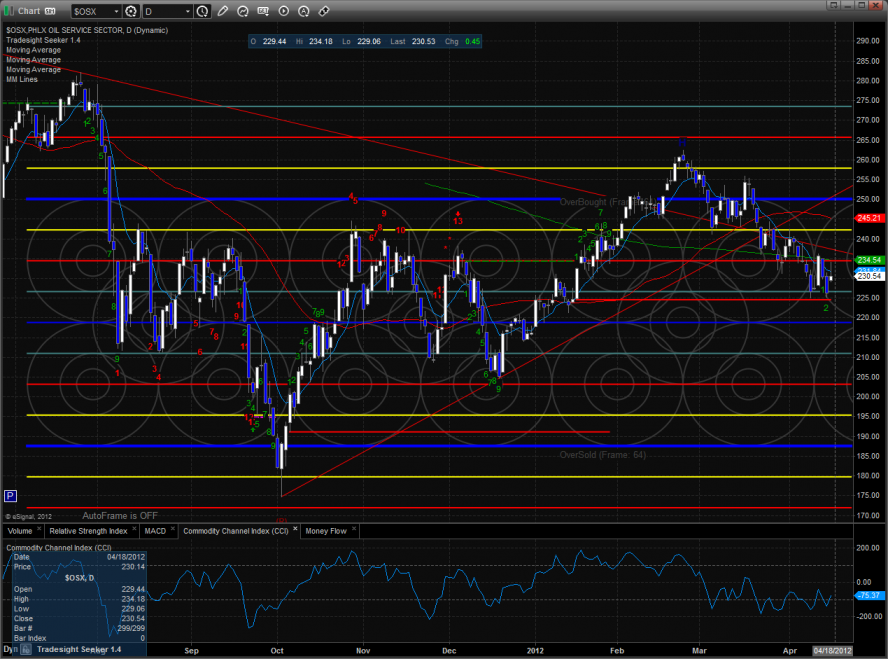

The OSX used the static trend line for support as should be expected. Traders should view the chart as short term neutral with oversold energy for a bounce until there is a close below the STL.

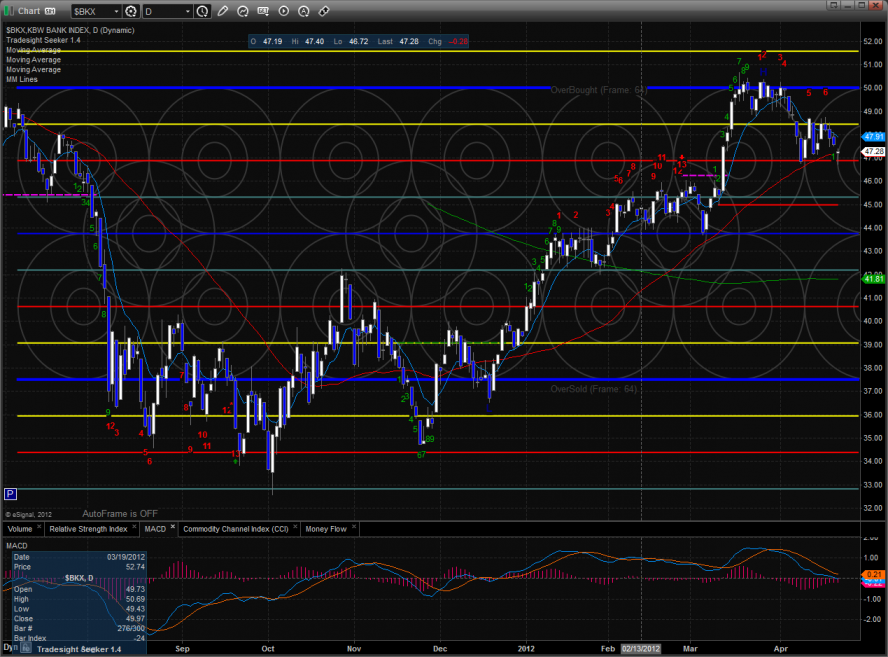

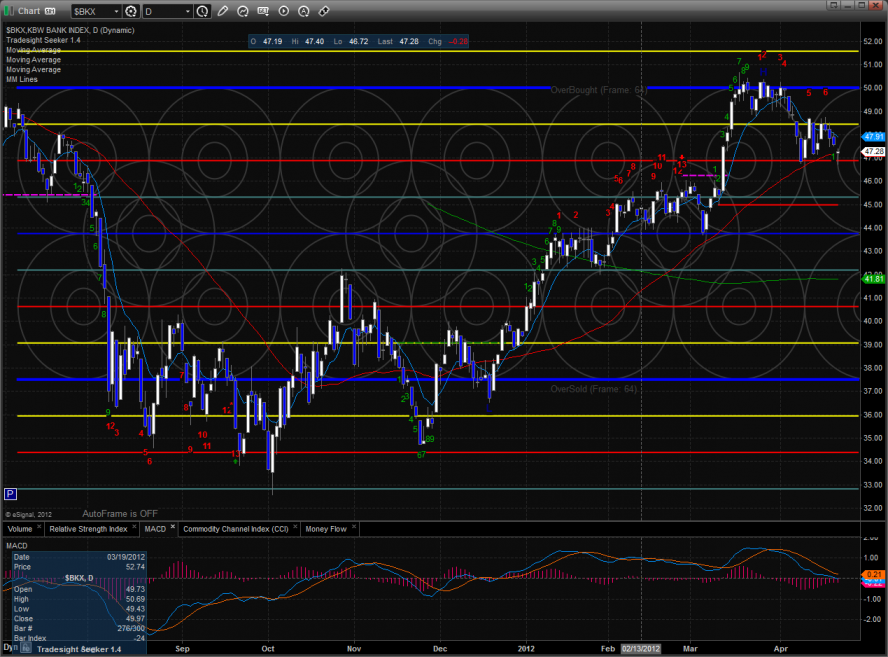

The BKX was slightly stronger than the broad market using the 50dma for support. The MACD is still above the zero line. A break below the zero line will kick in a wave of momentum selling.

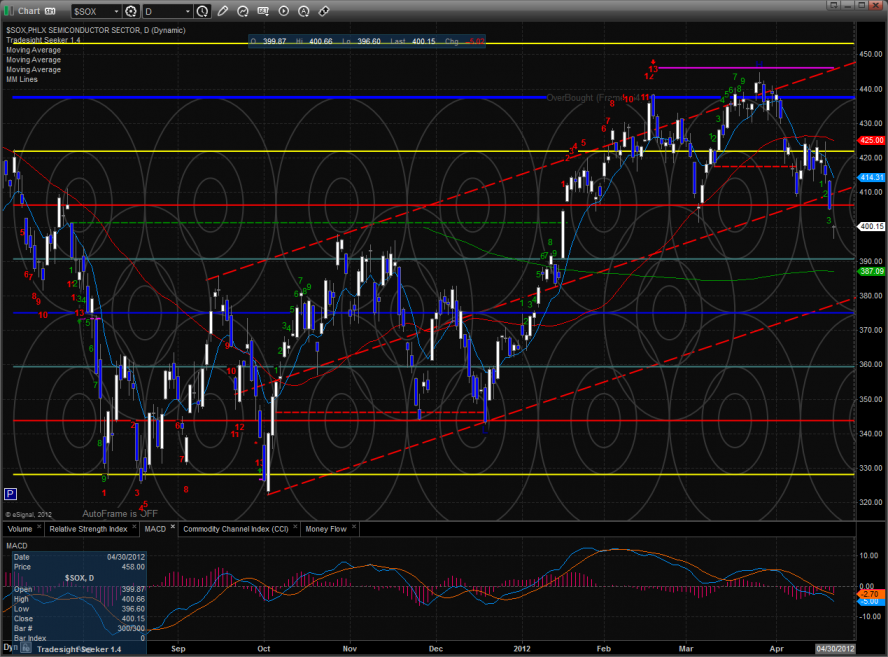

The SOX gapped lower and continues to be a problem the overall NDX. Next real support is at 390.

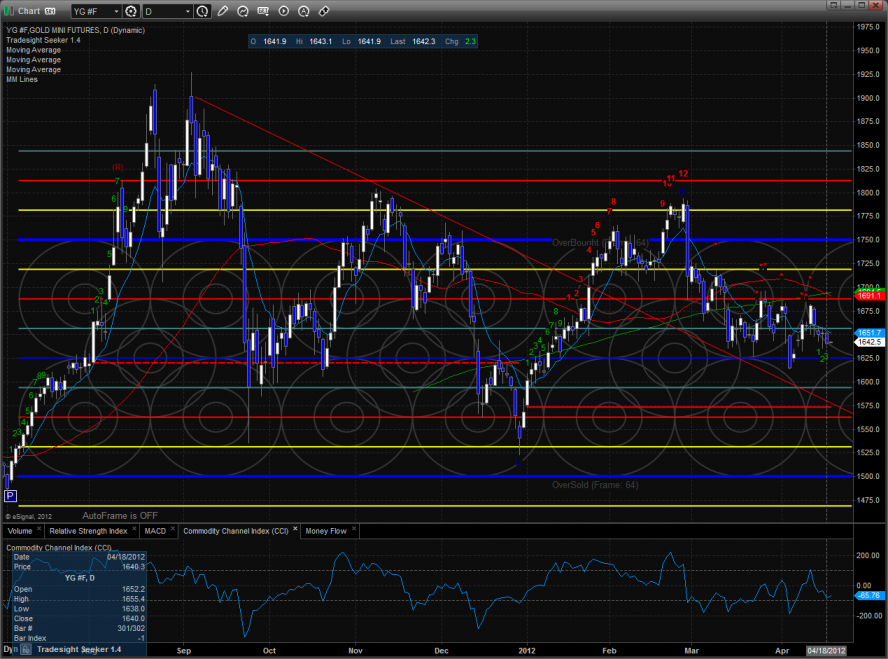

The XAU closed at a new low and is now 13 days down in the daily Seeker count. Be sure to look at this index for reversal opportunities.

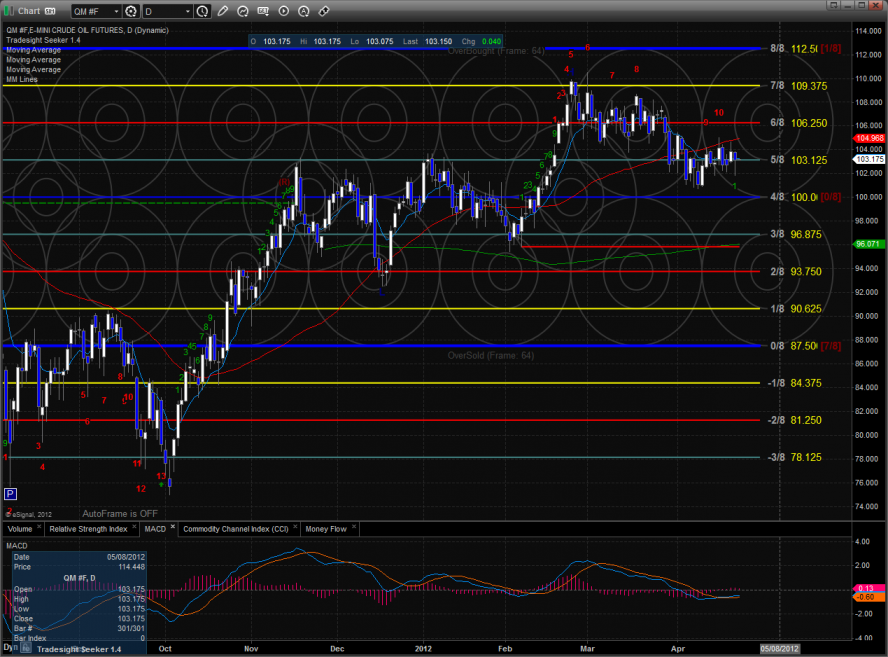

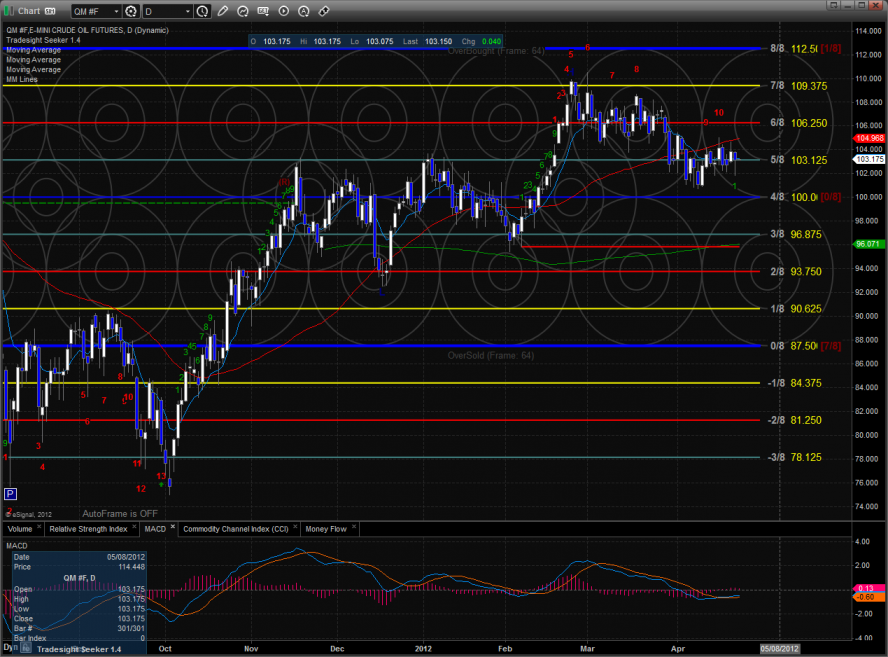

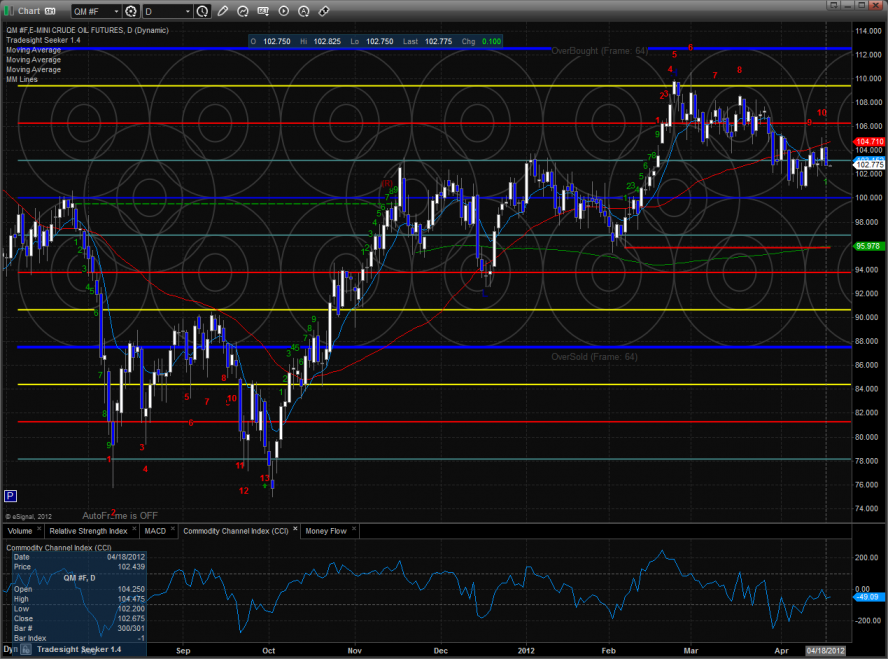

Oil:

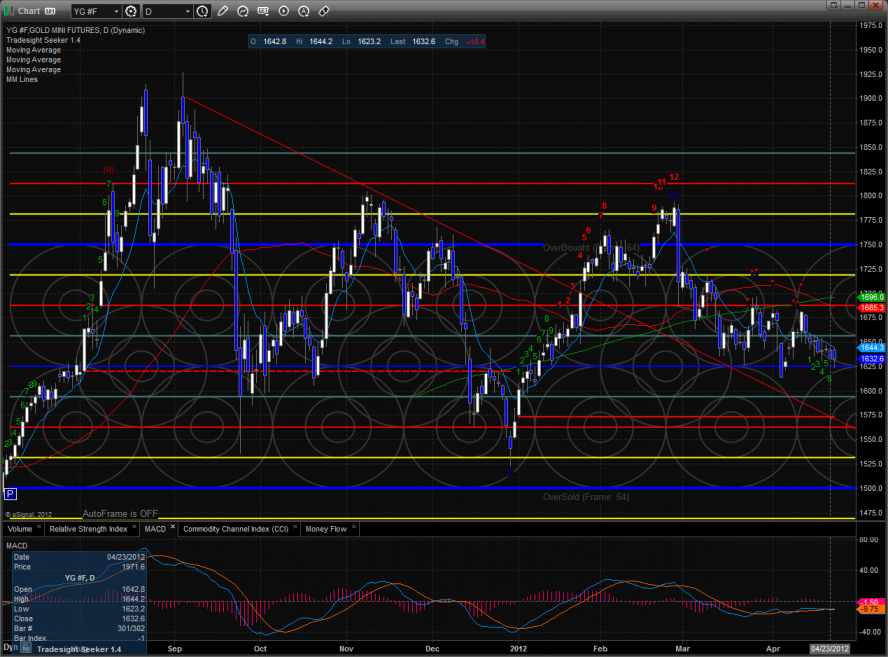

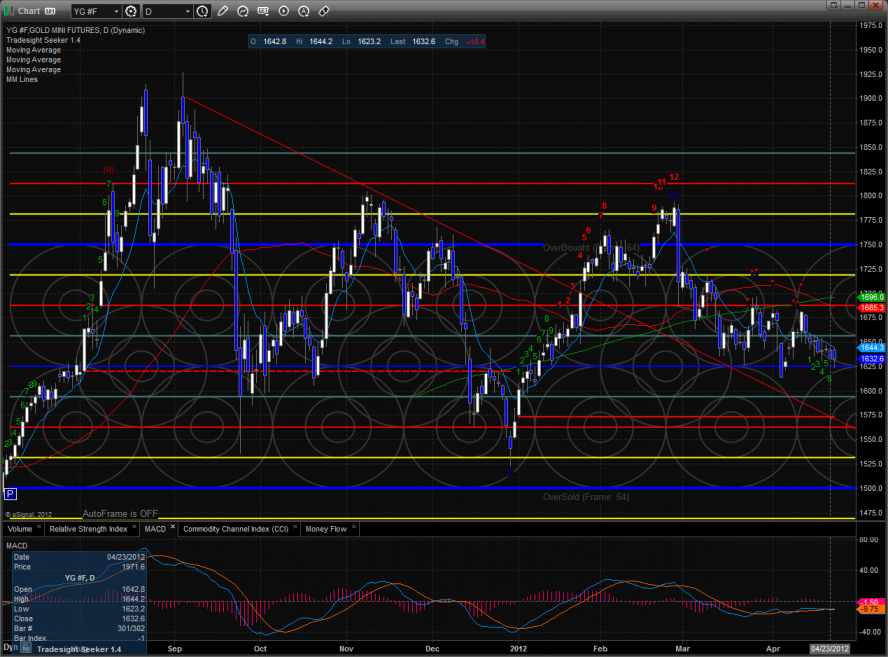

Gold:

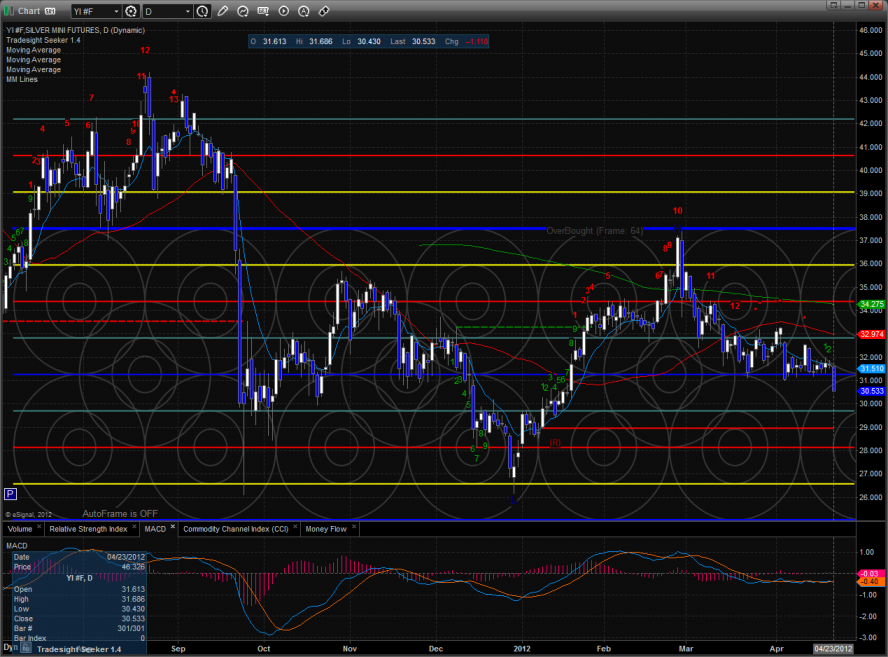

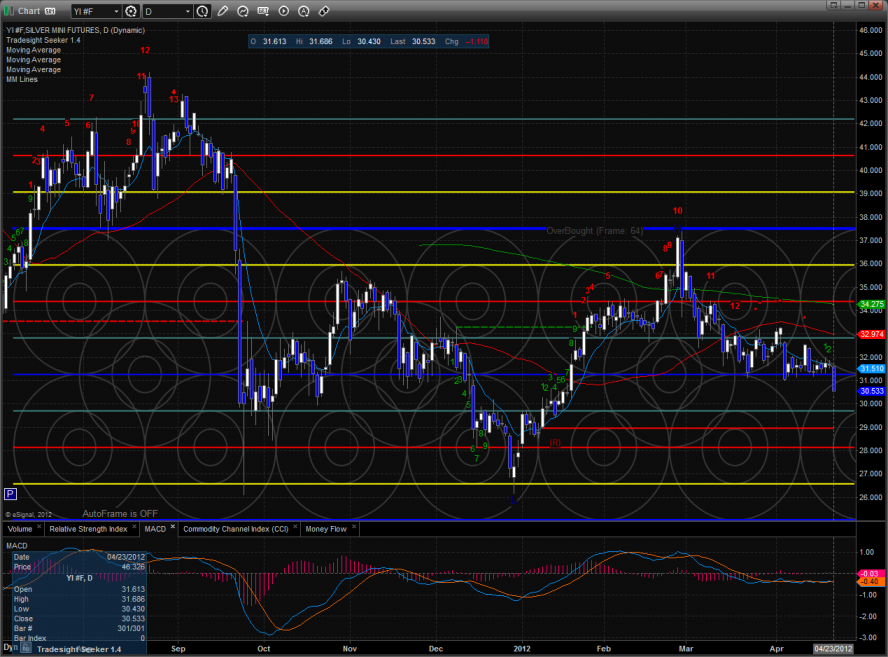

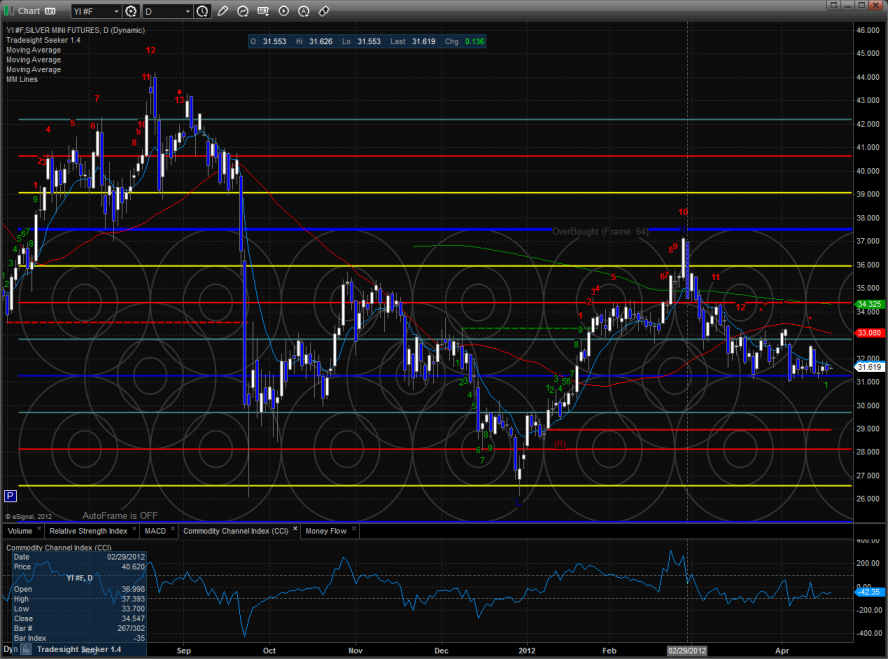

Silver:

Tradesight Market Preview for 4/24/12

The ES gapped down huge on the day and really did very little with one small exception. The exception was that price closed above the open which makes for a camouflage buy signal. This puts Monday’s gap fill in play. Price was lower 13 on the day using the active static trend line as support. The market did one other important thing by filling the open gap at 1356.75.

The NQ futures were lower by 24 on the day. Price is pinching between the 10eama and the 50dma. Momentum is picking up as confirmed by the break below the zero line of the MACD. The next area of support is the static trend line.

10-day Trin:

The put/call ratio is neutral:

Multi sector daily chart:

The SOX/NDX cross has bearishly recorded a new low close:

The best sector on the day was the BTK which is still holding above the recent gap.

The OSX used the static trend line for support as should be expected. Traders should view the chart as short term neutral with oversold energy for a bounce until there is a close below the STL.

The BKX was slightly stronger than the broad market using the 50dma for support. The MACD is still above the zero line. A break below the zero line will kick in a wave of momentum selling.

The SOX gapped lower and continues to be a problem the overall NDX. Next real support is at 390.

The XAU closed at a new low and is now 13 days down in the daily Seeker count. Be sure to look at this index for reversal opportunities.

Oil:

Gold:

Silver:

Forex Calls Recap for 4/23/12

Slow session to start the week with one tight stop out in the GBPUSD. See below.

Here's the US Dollar Index intraday with our market directional lines:

A 2-day Fed meeting begins Tuesday.

GBPUSD:

Triggered short at A, never went enough overnight to matter, and I tightened the stop to 10 pips in the morning and it stopped at B:

Forex Calls Recap for 4/20/12

Closed out two winners to end what was a surprisingly decent week despite continued bad ranges. See EURUSD and GBPUSD below.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber separately (not getting near any 13 signals, but note the GBPUSD daily chart below), then look at the US Dollar Index, which isn't indicating anything new.

Here's the Index intraday with our market directional lines:

New calls and Chat Sunday evening.

EURUSD:

Triggered long at A, hit first target at B, closed final piece at C for end of week:

GBPUSD:

Finally stopped second half of trade from Wednesday under LBreak at A, which was only a 60 pip gain since ranges have been bad:

Stock Picks Recap for 4/19/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CIEN triggered long (with market support) and didn't work:

SIMG triggered long (with market support) and didn't work:

SPRD triggered short (with market support) and didn't work (we cut this off for a few penny loss in the Lab):

VMED triggered short (with market support) and didn't go ten cents in either direction, so doesn't count either way:

In the Messenger, Rich's VXX triggered long (ETF, no support needed) and didn't work:

AMZN triggered long (with market support) and worked:

WYNN triggered long (with market support) and didn't work:

Rich's AAPL triggered short (with market support) and didn't work:

AMZN triggered short (with market support) and didn't work:

NFLX triggered short (with market support) and worked:

In total, that's 9 trades triggering with market support, 2 of them worked, 7 did not. Easily our worst win ratio of the year on a day when the market changed directions six times.

Forex Calls Recap for 4/19/12

Two new trades worked exactly to their first targets. See EURUSD and GBPUSD below, plus we are still long GBPUSD from the prior session.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, but no news on Friday and we have options expiration, which might slow things down.

EURUSD:

Triggered short at A, hit first target at B, lowered stop in the morning and stopped at C just over entry:

GBPUSD:

We came into the session long the second half of the trade from the prior day with a stop under LBreak. New trade triggered long at A, hit first target at B, and stopped the second half at C overnight, but never broke LBreak. We then adjusted the stop on the piece from the prior day under UBreak and continue to hold, which would be stopped under the line at D:

Tradesight Market Preview for 4/19/12

The ES was lower by 5 posting an inside day on the day. This means that there was technically nothing new on the day.

The NQ futures also posted an inside day losing 18 doing so. This was a classic measuring day where the market worked off yesterday’s strong upward impulse.

Multi sector daily chart:

The SOX/NDX cross is still below the key breakdown level which is bearish for the overall NDX.

The OSX was the top gun on the day and closed higher by a small margin on the day. The bad news is that price remains below all of the major moving averages.

The BKX remains trapped within the recent trading range.

The XAU posted an inside day.

The SOX remains below all 3 major moving averages with an active Seeker sell signal in place.

The BTK has yet to release any of the energy from the 9 days down.

Oil:

Gold:

Silver:

Stock Picks Recap for 4/18/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, our top pick ARAY triggered long (with market support) and worked great:

SINA triggered short (without market support) and worked:

In the Messenger, Rich's FSLR triggered short (without market support) and worked:

His GOOG triggered short (without market support) and actually worked for a couple of points quickly before reversing:

COST triggered long (with market support) and worked:

Rich's CF triggered long (with market support) and worked:

His CAT triggered long (with market support) and didn't work:

GOOG triggered long (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.