Forex Calls Recap for 4/18/12

Loser and a winner (still going) on GBPUSD, see that section below.

Ranges were improved, let's hope it continues.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

GBPUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, currently holding second half with a stop under R1, which will be adjusted when we get the new Levels:

Tradesight Market Overview for 4/18/12

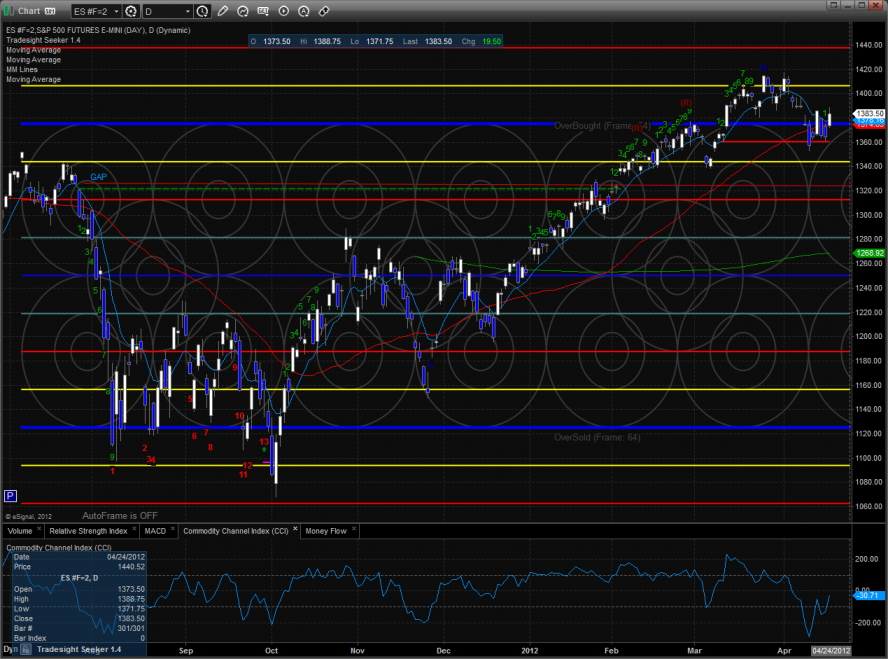

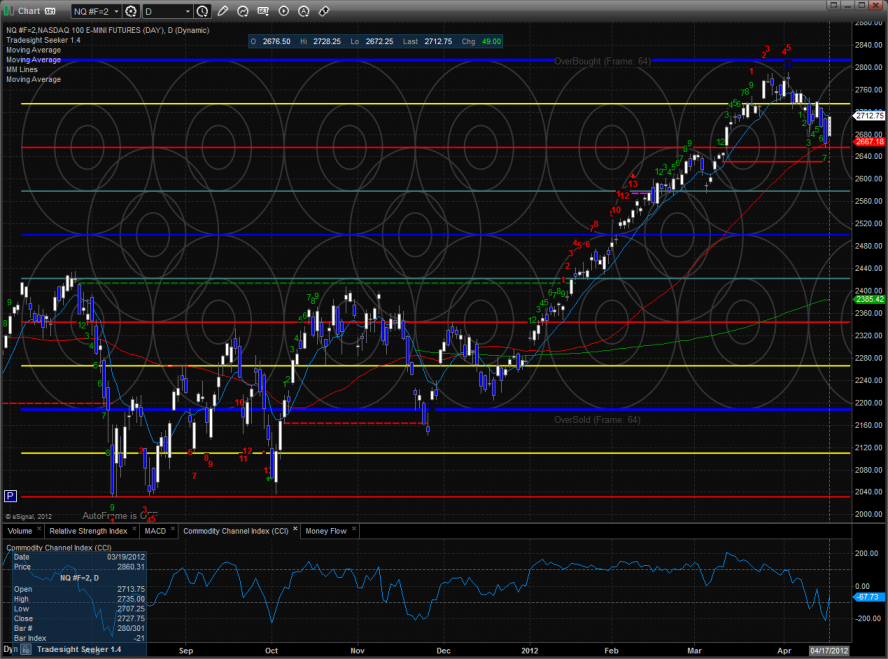

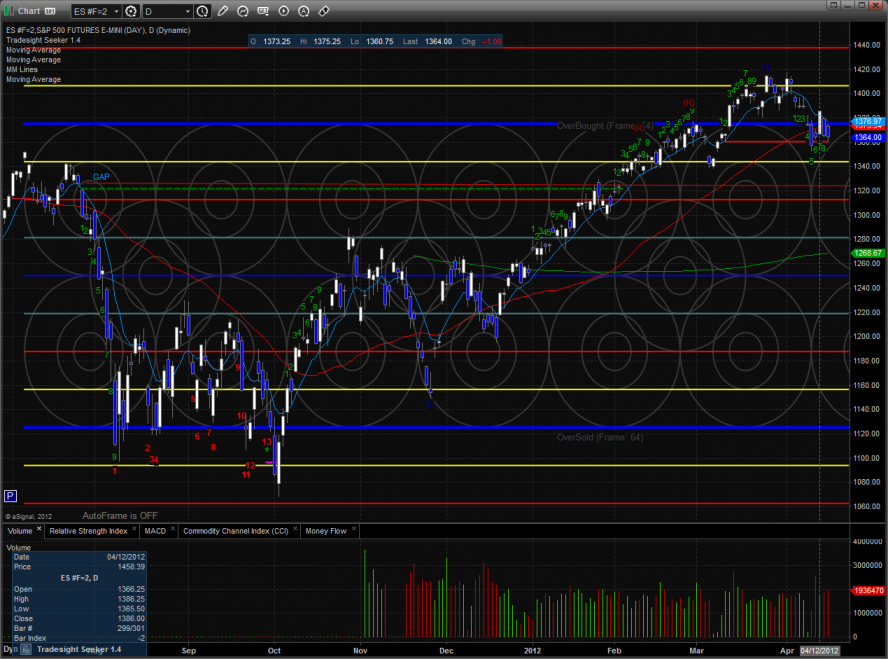

The ES was higher by 19 on the day, possibly beginning the “B” wave bounce. This is a key pivot off 9 bars down on the Seeker but does not necessarily mean that the all clear signal has been sounded.

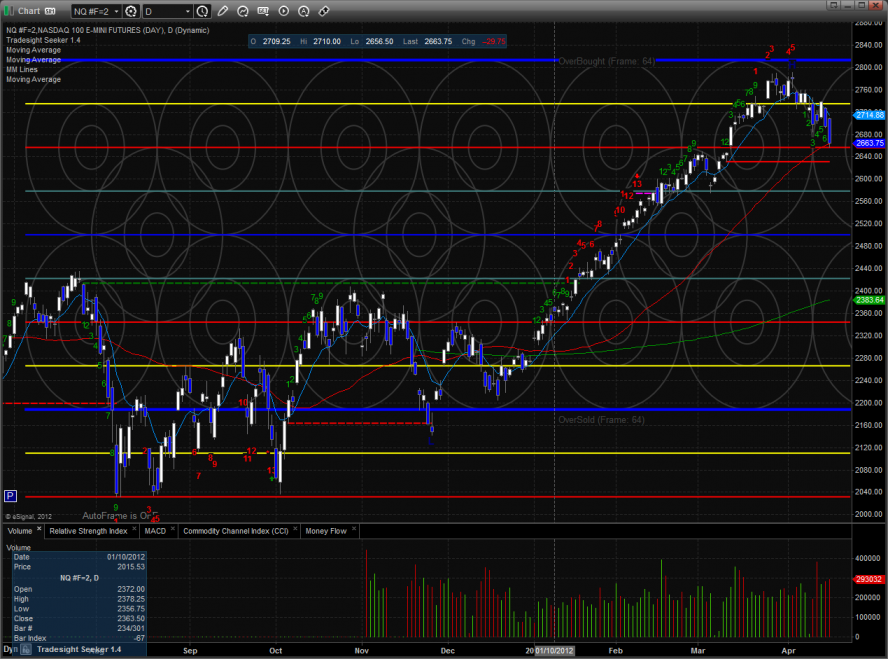

The NQ futures were higher by 49 handles settling just below the 10ema. The 50dma is still providing support.

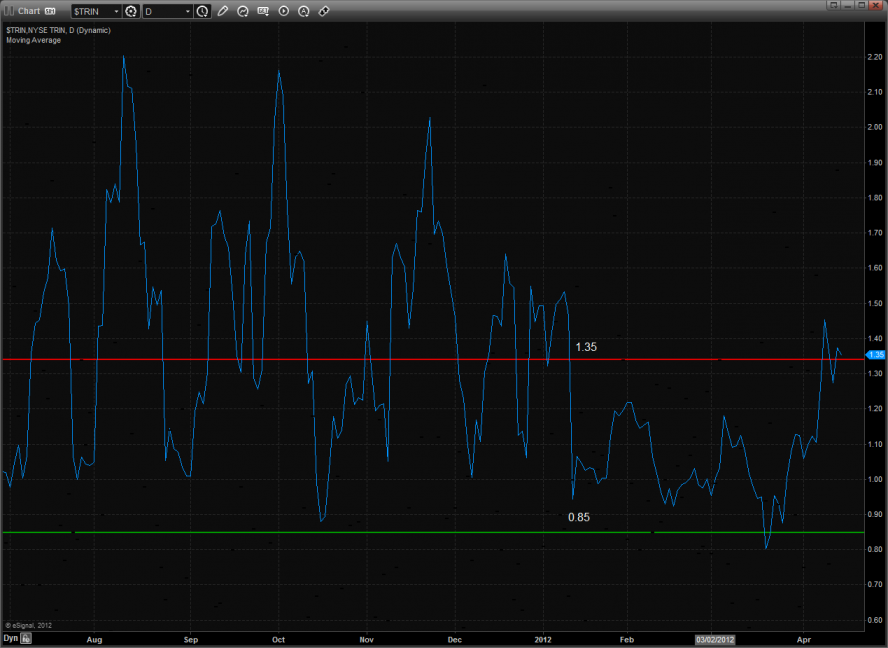

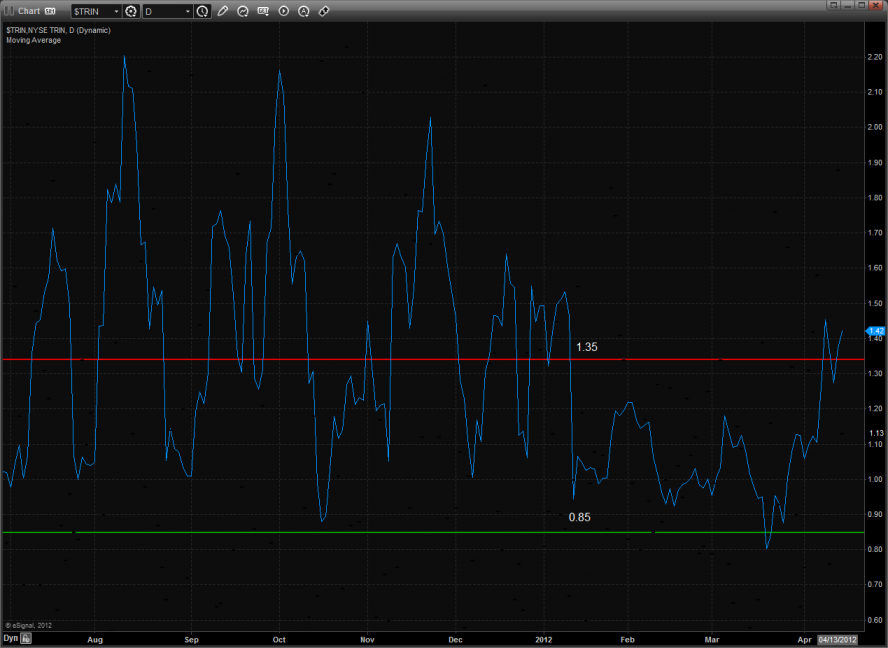

10-day Trin:

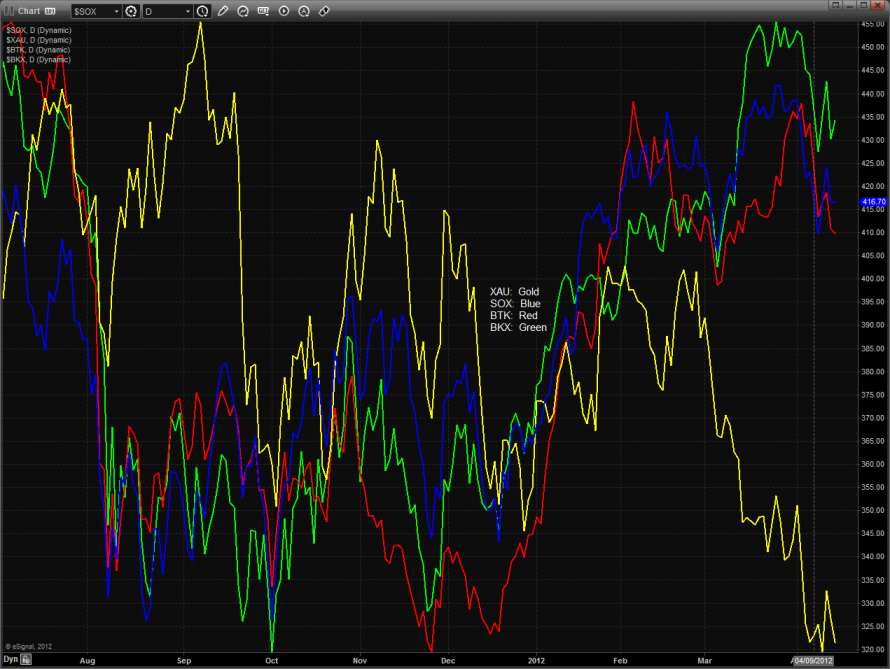

Multi sector daily chart:

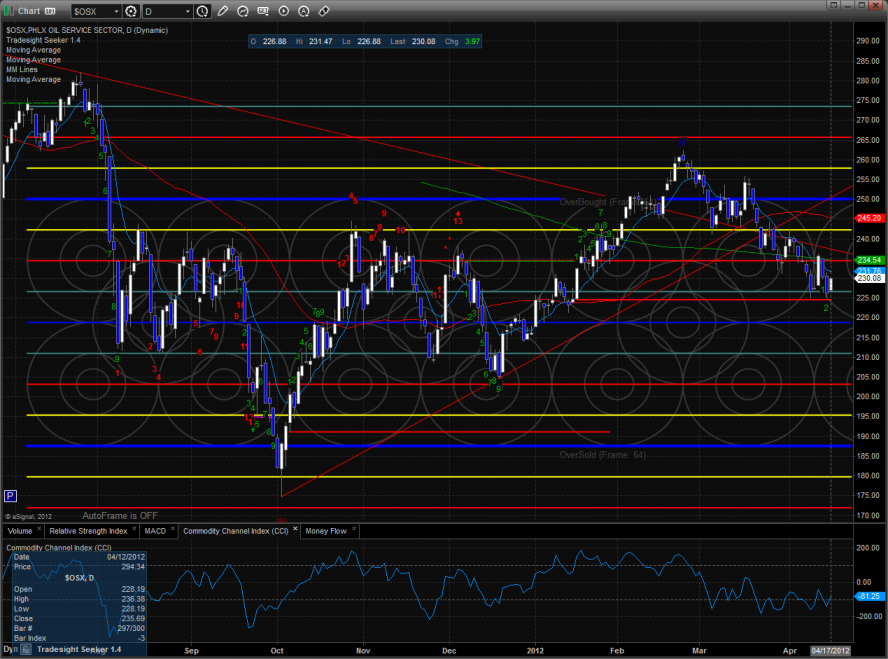

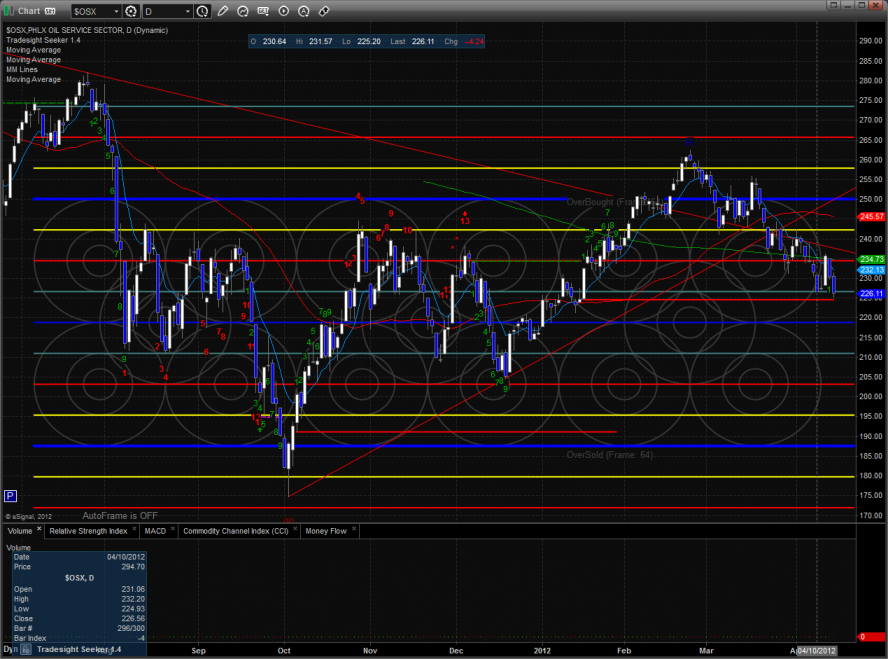

The OSX was top gun using the static trend line for support:

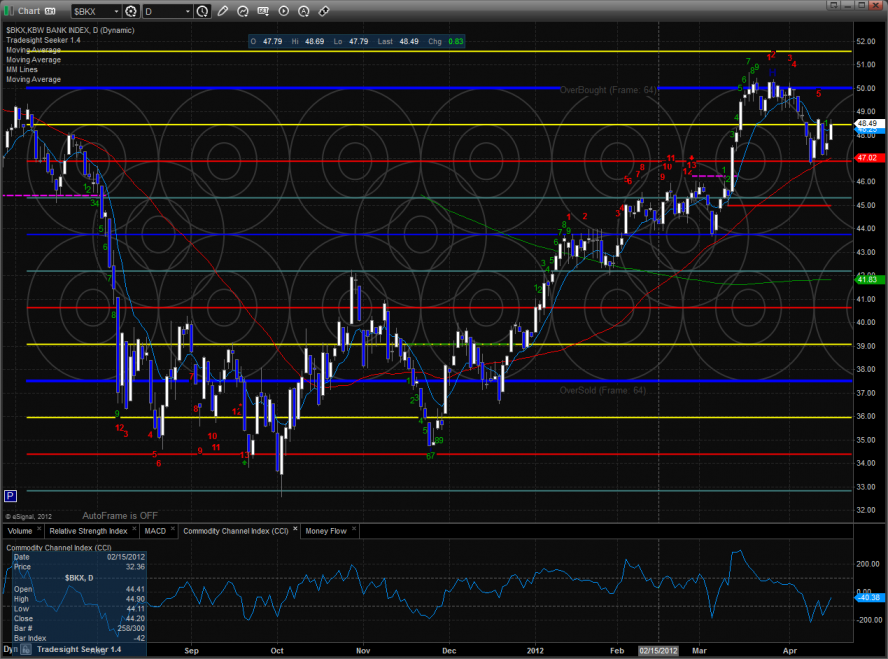

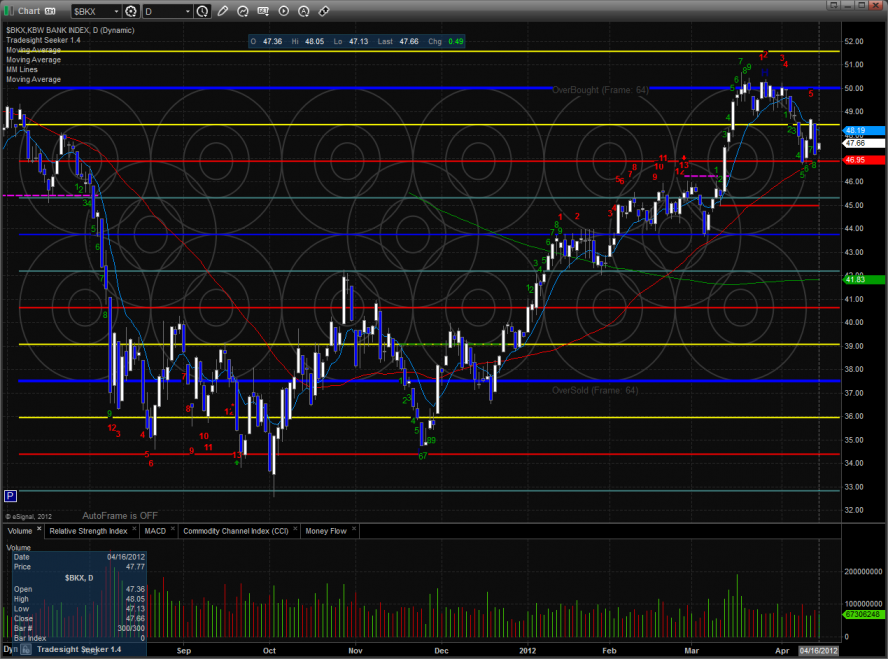

The BKX was stronger than the broad market but remains trapped in the recent range. Note how what were the weakest stocks were the strongest on the day. This is very typical of the first day up in a reflex rally.

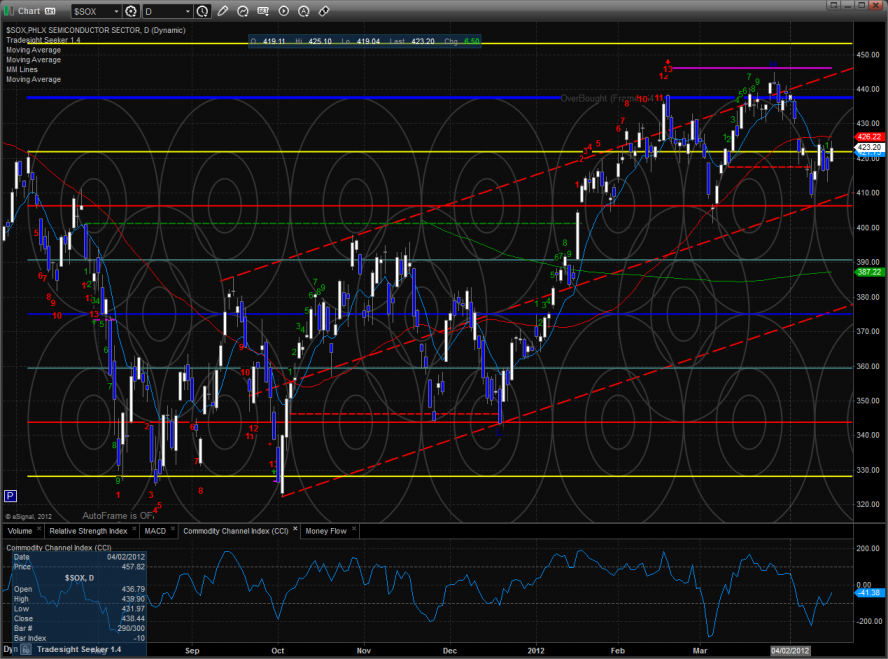

The SOX was nicely higher on the day but for the time remains below the key 50dma. Keep a close eye on the gap window overhead which will be stiff resistance.

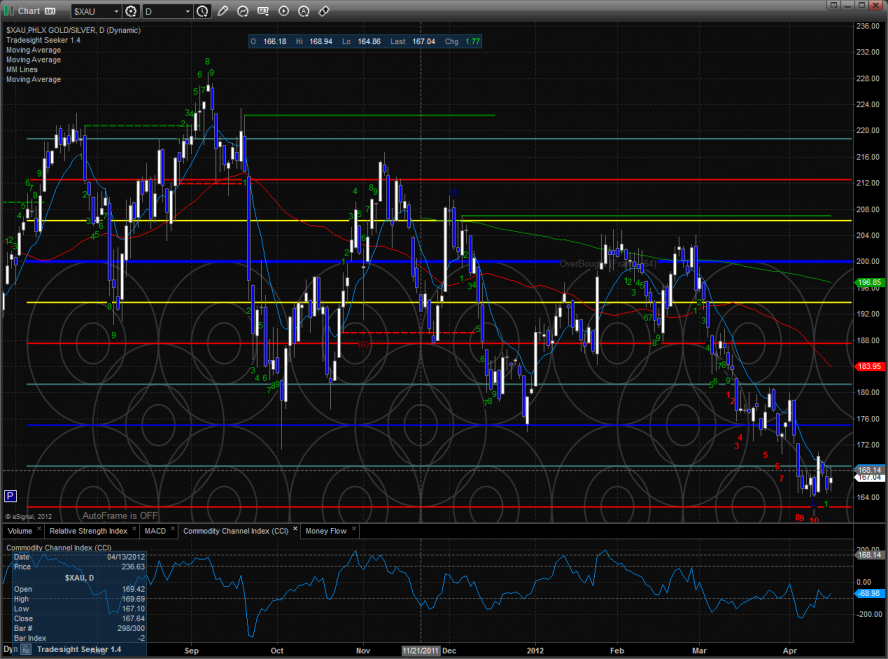

The XAU traded inside yesterday’s candle. The Seeker count is has yet to record the exhaustion signal.

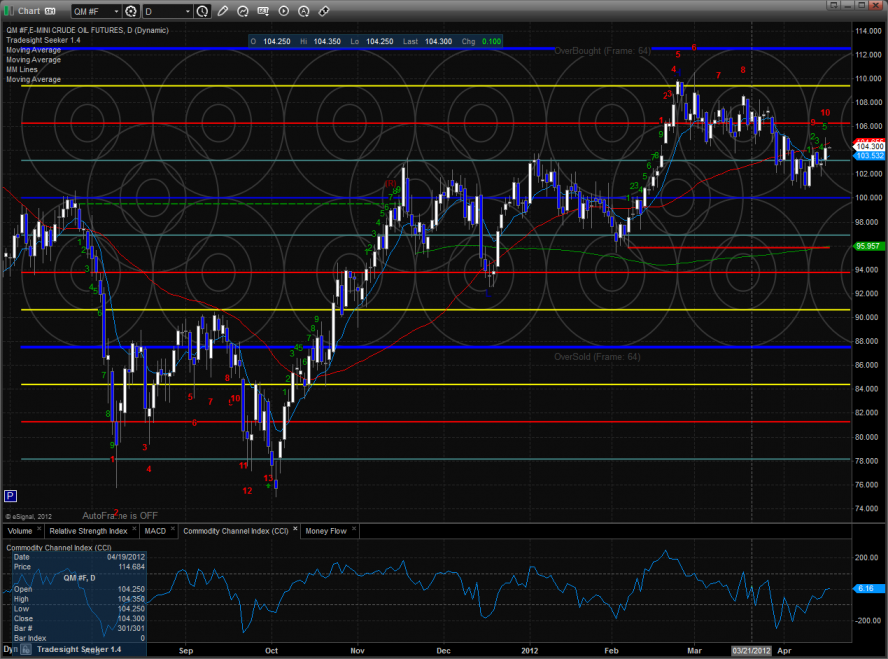

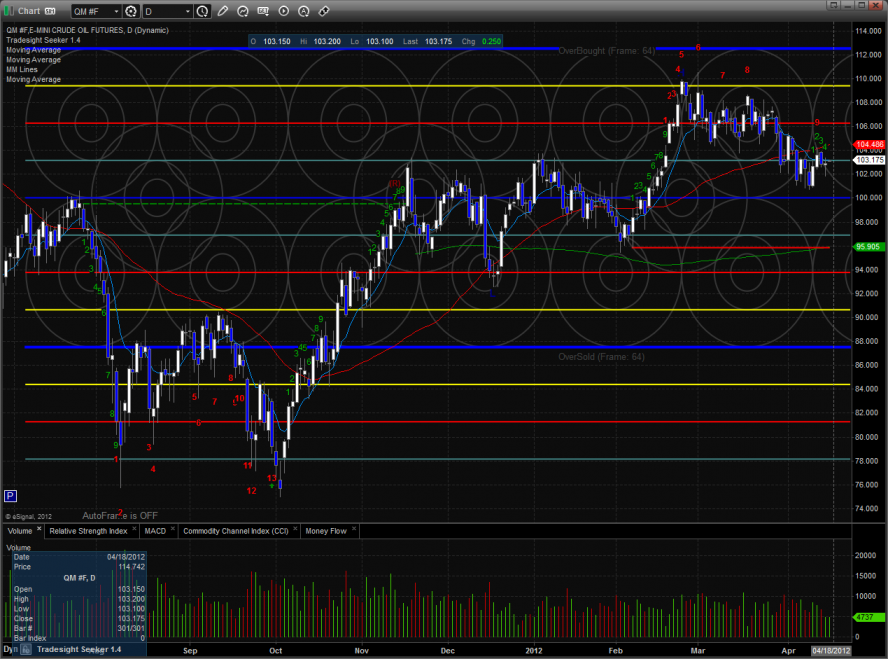

Oil:

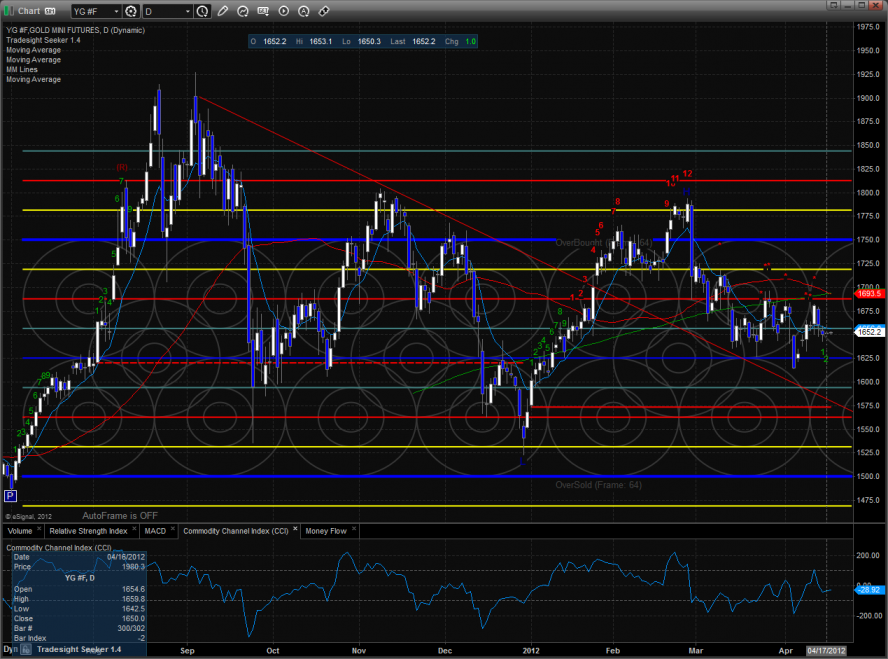

Gold:

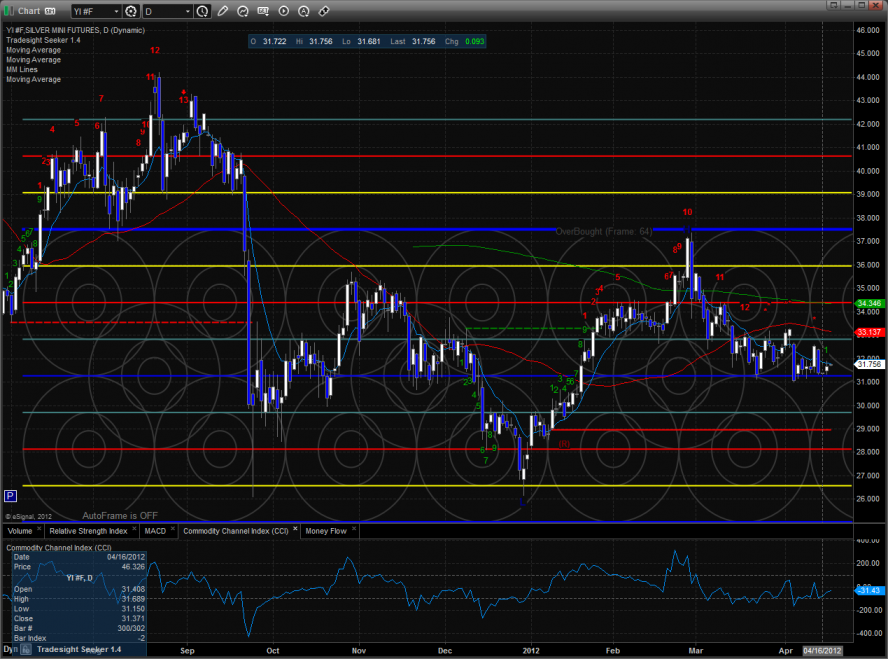

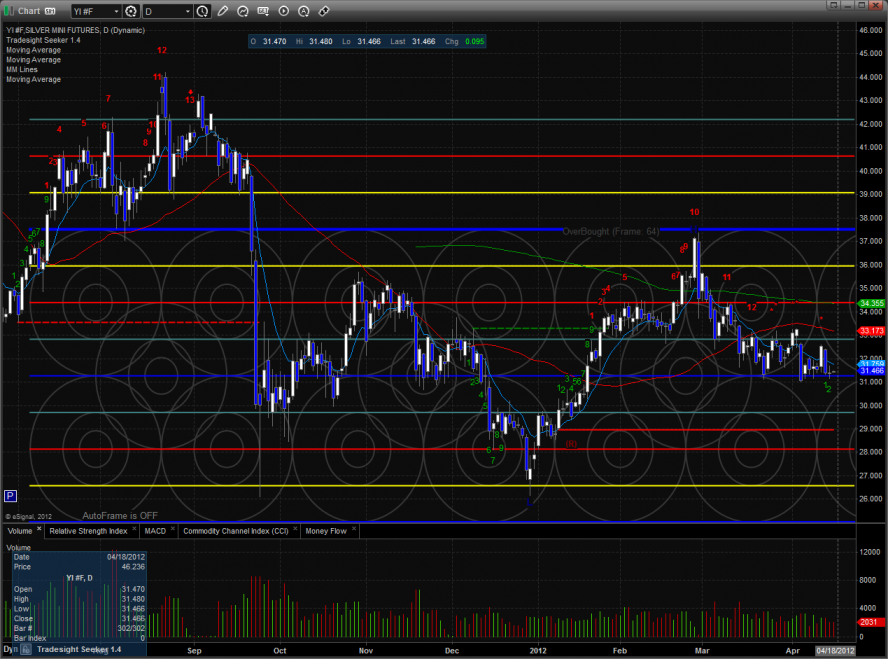

Silver:

Stock Picks Recap for 4/17/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

In the Messenger, Rich's AAPL triggered long (with market support) and worked:

His GOOG triggered long (without market support due to opening five minutes) and worked:

BIDU triggered long (with market support) and didn't work:

Rich's GDX triggered short (ETF, no market support necessary) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Forex Calls Recap for 4/17/12

Closed out a 90 pip winner from the prior session and stopped out of a new trade. See EURUSD section below.

Here's the US Dollar Index intraday with market directional lines:

New calls and Chat this evening.

EURUSD:

We had a short entry under the Pivot, and look how the EURUSD exactly hit and bounced off of it at A without triggering. We then triggered long at B, never went far enough to hit the first target, and I raised the stop on the trade from the prior day in the morning to match the new trade, which all stopped at C for 90 pips gain on the prior day's trade and a usual loss on the new one. If you took the trade again later, it ended up doing nothing:

Stock Picks Recap for 4/16/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ARAY triggered long (without market support due to opening five minutes) and didn't work:

JDAS triggered long (without market support) and didn't do enough either way to count:

In the Messenger, Rich's AAPL triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked:

Rich's PCLN triggered short (with market support) and worked for a couple of points:

His FFIV triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all of them worked.

Forex Calls Recap for 4/16/12

Two winners to start the week (one went early, so half size, the other we still have half on). See EURUSD below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat this evening.

EURUSD:

Triggered short early (half size) at A, hit first target at B, stopped in the money second half at C. C was also a long entry for an additional call, hit first target at D, still holding second half long with stop under LBreak:

Tradesight Market Preview for 4/17/12

The ES was lower by one handle on the day one handle closing at key support just above the static trend line. The pattern is now 9 days down and setup for a bounce. This doesn’t mean that the bounce will happen Tuesday but probability favors that there will be a “B” wave bounce somewhere.

The NQ futures were much weaker than the SP losing 30 on the day. The pattern is much different than the SP because the static trend line has yet to come into play and price is not below the 50dma. The Seeker setup count is only 7 days down.

The 10-day Trin is in oversold territory:

Multi sector daily chart:

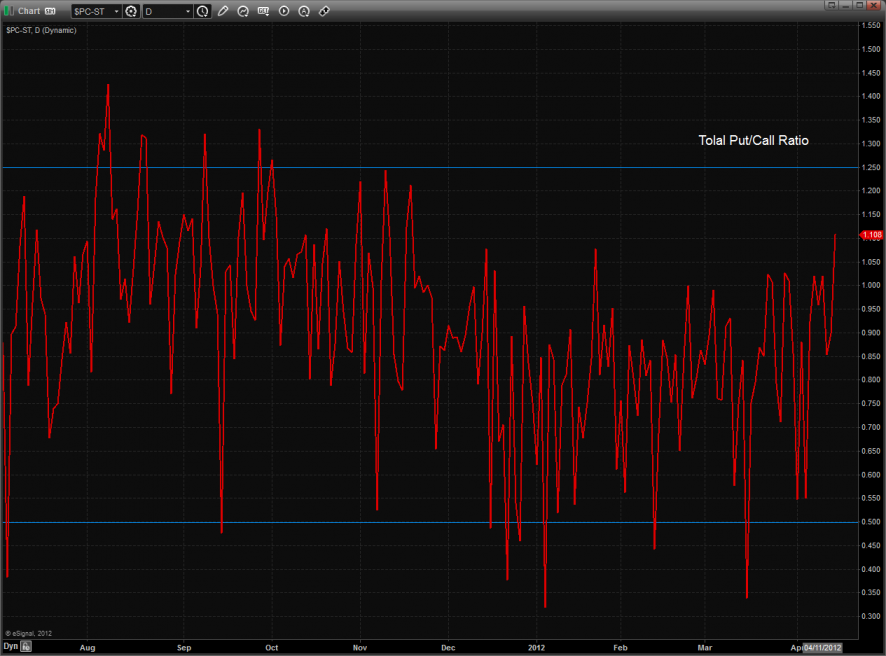

The total put/call ratio has recorded the highest close of the year which means that investors has been accumulating downside protection. This is a contra-indicator.

The SOX/NDX cross has bounced back to the breakdown level which is a sign of relative strength for the SOX. This is potentially bullish if the bounce doesn’t fail at the breakdown.

The BKX was relatively strong vs. the NDX which is bullish for the broad market.

The OSX vs. crude futures made a new low on the move. This is one intermarket pair that throws cold water on the broad market bounce setup.

The BKX was the top gun on the day and is now 9 days down. Note that today’s candle was inside yesterday’s candle.

The SOX was unchanged on the day and was inside yesterday’s range.

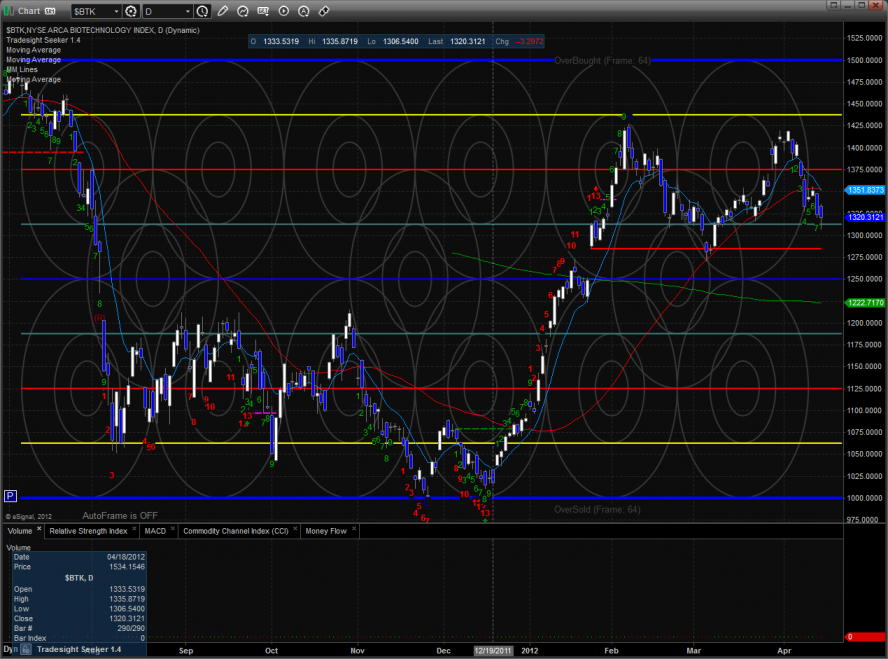

The BTK is 8 days down.

The OSX was the last laggard on the day,

Oil:

Gold:

Silver:

Forex Calls Recap for 4/13/12

We closed the week out with a 90 pip winner on the EURUSD. See that section below. Here's the US Dollar Index intraday with our market directional:

As usual on the Sunday report, we'll take a look at the action from Thursday night/Friday, then look at the daily charts with both the Seeker and Comber separately, and then glance at the US Dollar Index, which is doing nothing.

Even though we don't have any Seeker or Comber signals pending, it is interesting to look at something like the USDJPY now, which gave solid sell signals a couple of weeks ago, and see how it played out.

EURUSD:

Triggered short at A, hit first target at B, closed final piece at C for 90 pips for end of week:

The rest of the report and the analysis for next week is for subscribers only.

Stock Picks Recap for 4/12/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QNST triggered long in the last few minutes of the day, doesn't count either way.

FORM triggered long (with market support) and held in the money all day:

In the Messenger, FSLR triggered short (without market support) and worked:

EBAY triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, both worked.

Forex Calls Recap for 4/12/12

A winner, but not anything special, and then it went further after the normal time for trading and movement is done. Strange environment.

Here's the US Dollar Index intraday with our market directional lines:

Half size again tonight ahead of the CPI in the morning, so nothing special to expect.

EURUSD:

Triggered long at A, did not stop, closed at B when it was stuck to the tri-star level, but eventually made a move to the first target at C after that: