Tradesight Market Preview for 4/12/12

Not much looks good here after the market dropped sharply Tuesday on volume, even though the volume disappeared again Wednesday.

One key note is that the Russell 2000 (Small Cap Index) has dropped sharply and broken recent lows. The index usually rides upward through April 15 (Tax Day) for a variety of reasons, so this is not a normal event:

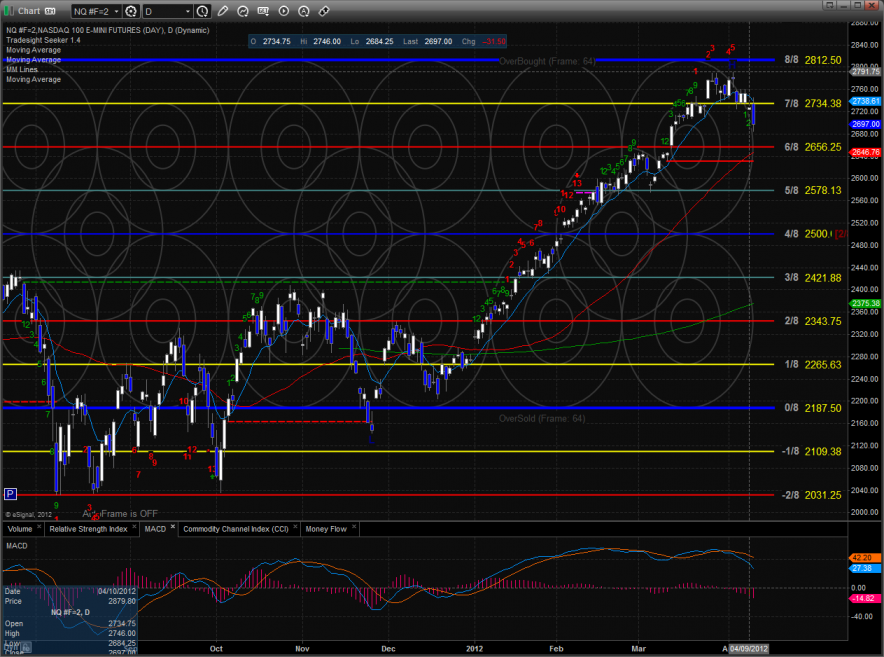

The NDX (NASDAQ 100) has clearly broken a key trendline, and after a pattern like that, it is usually not a short-lived phenomenon:

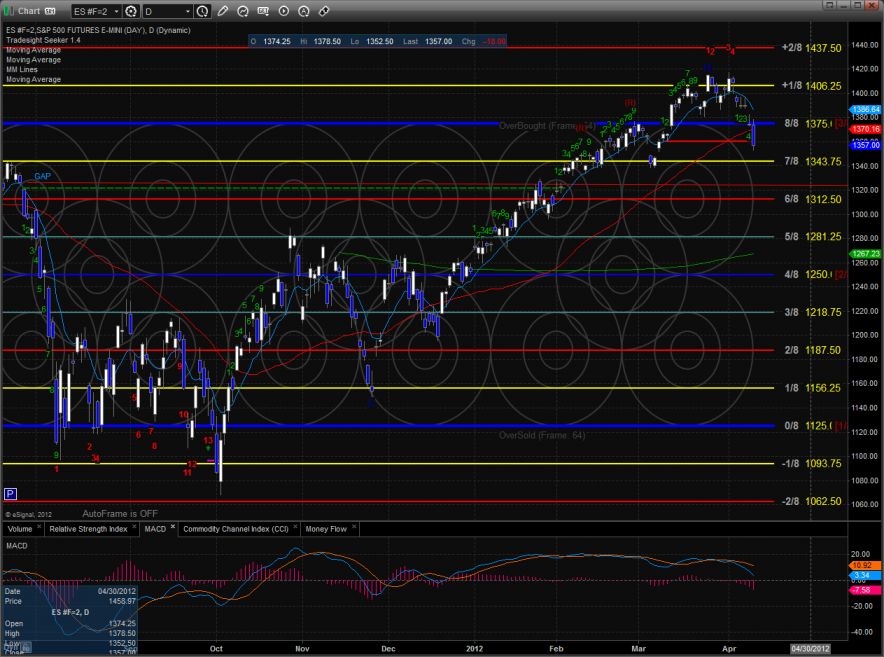

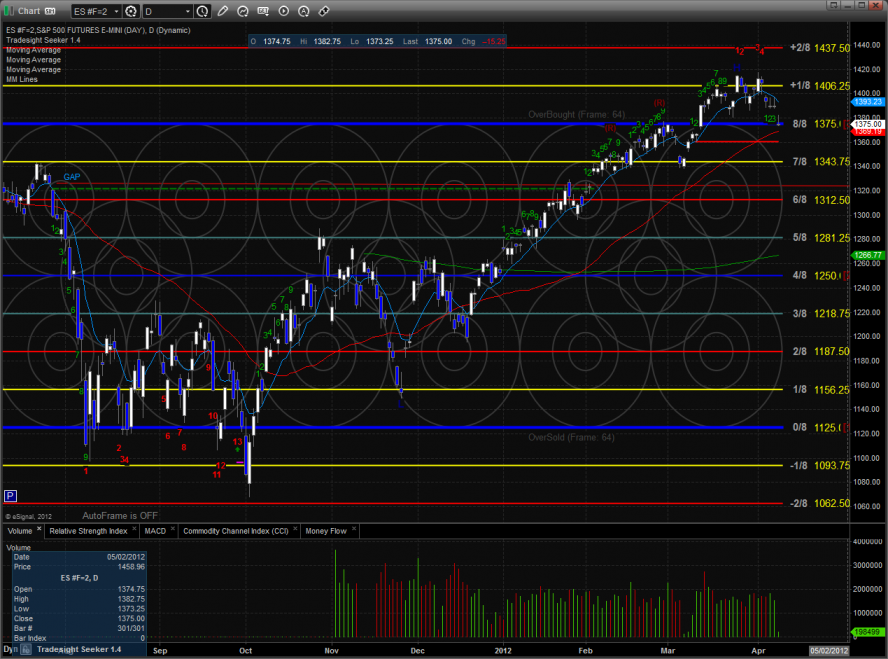

The S&P 500 also broke:

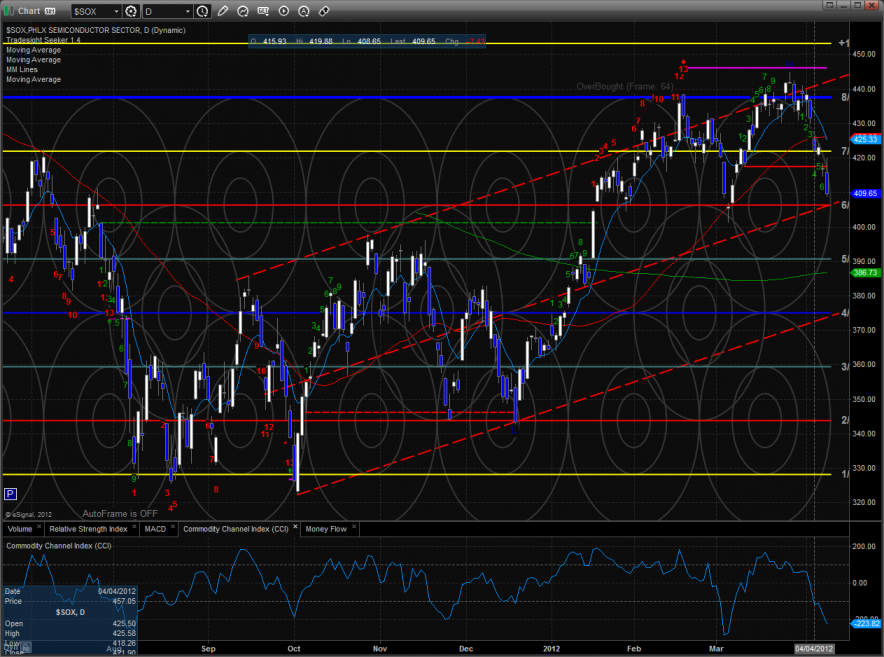

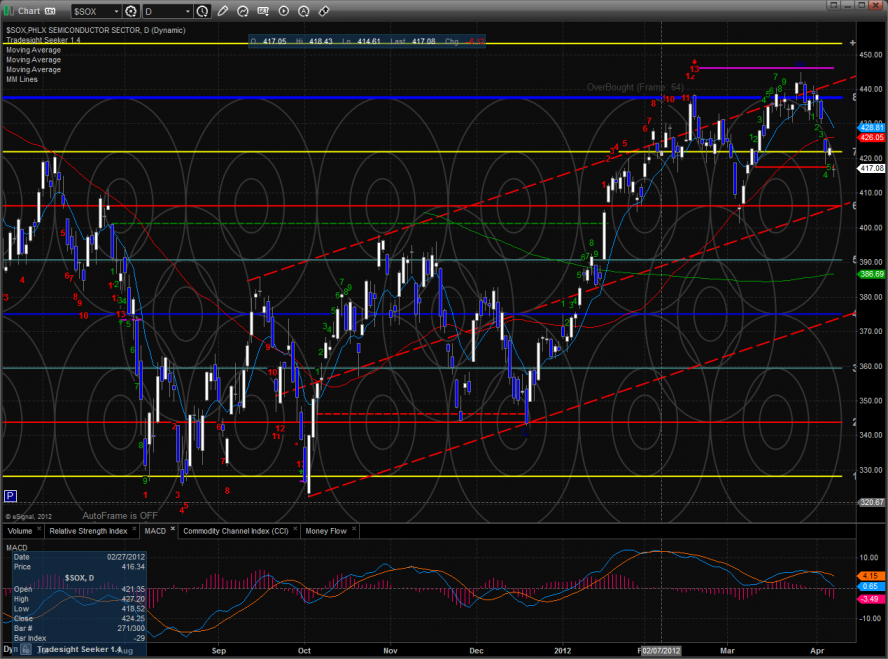

Watch the flatline support on the black line for the SOX (Semiconductors):

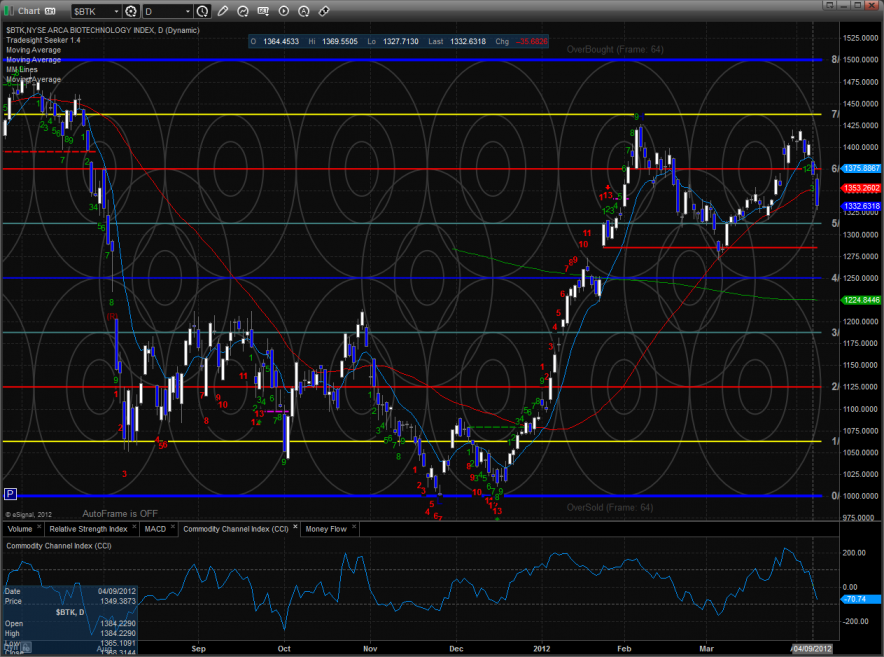

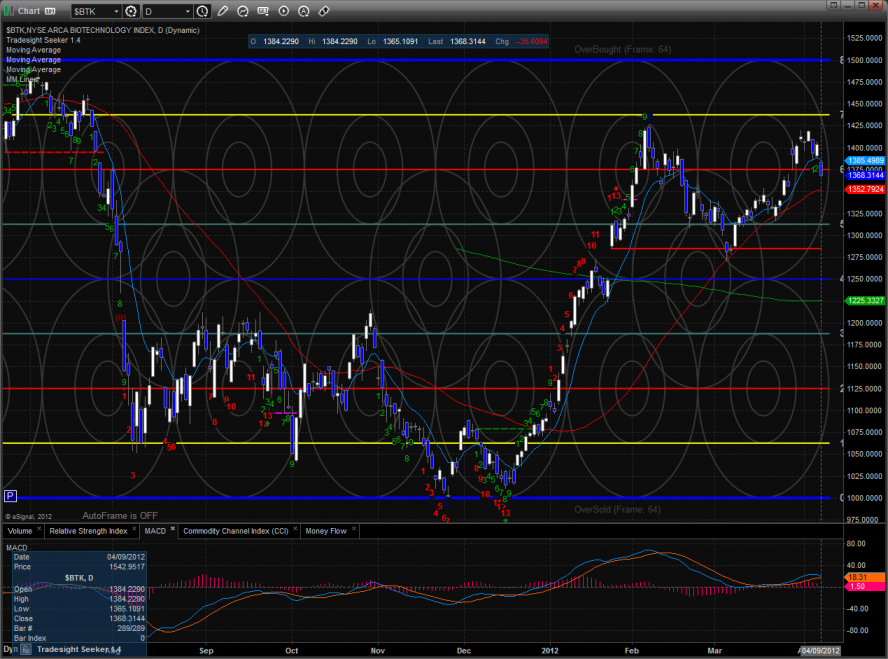

And NBI (Biotechs):

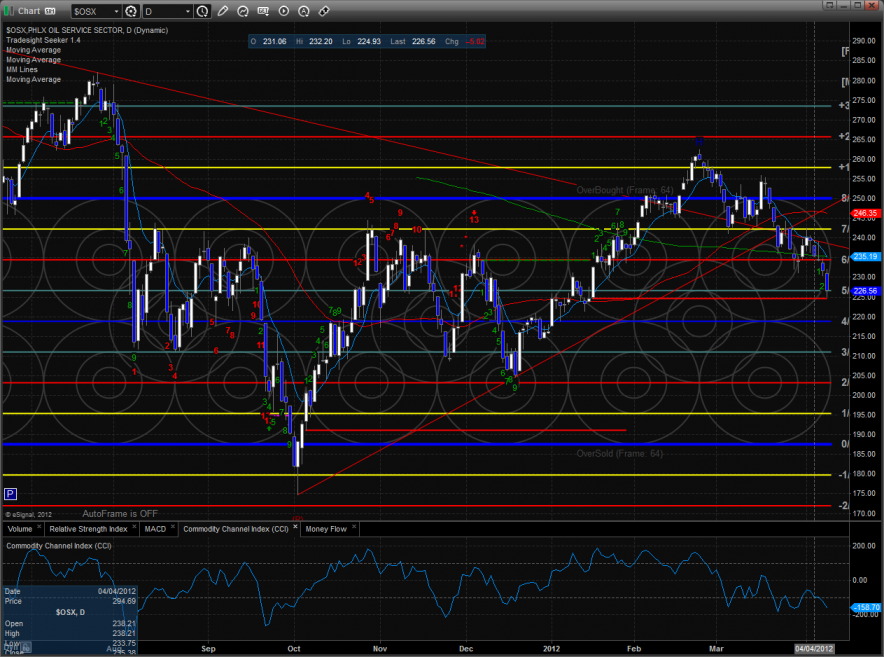

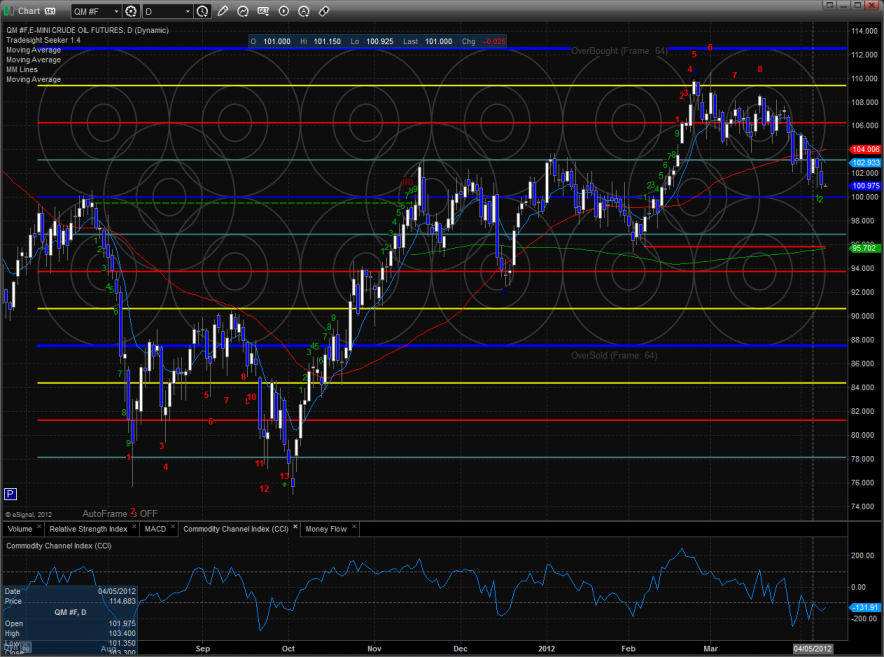

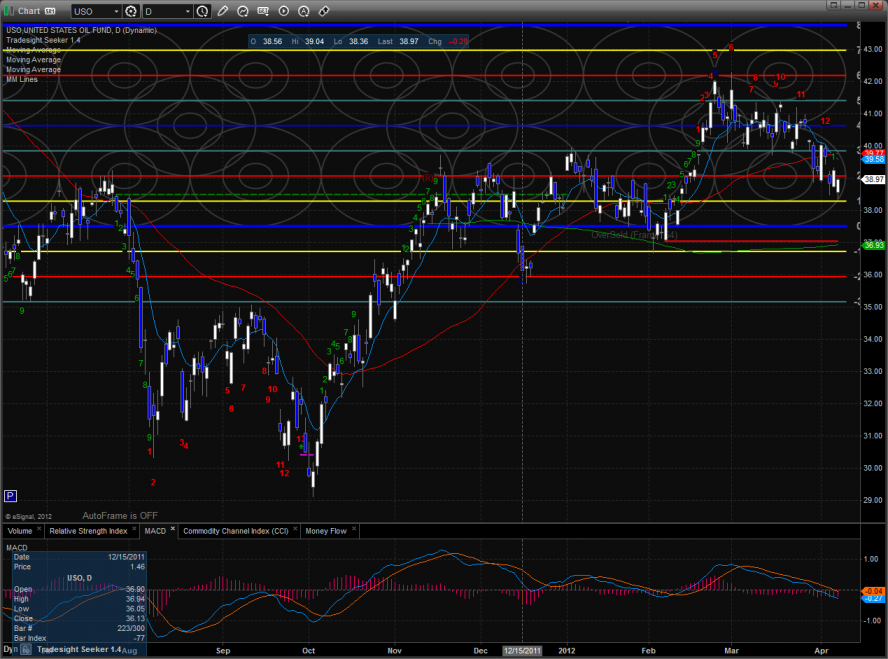

Oil is also pulling in slowly:

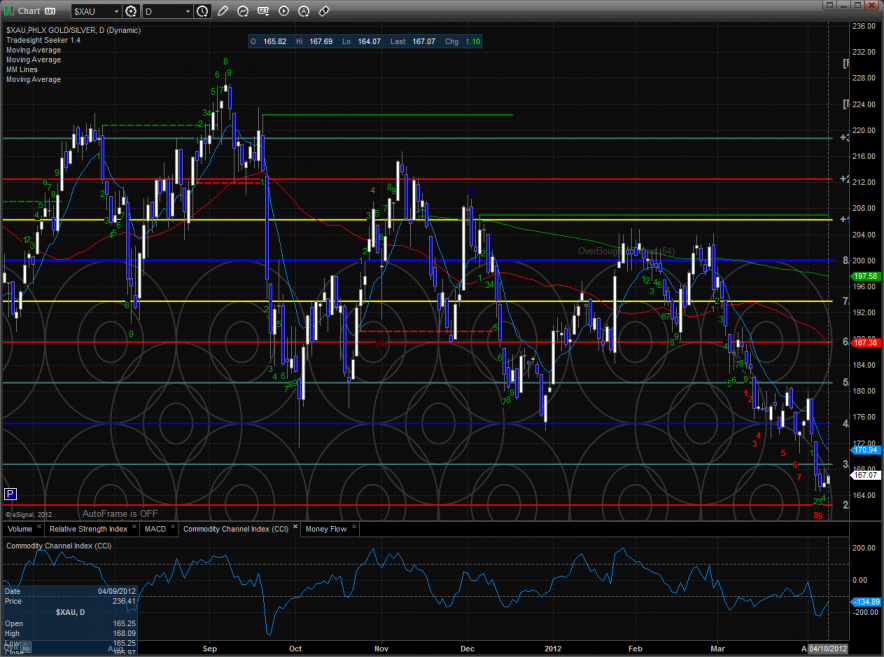

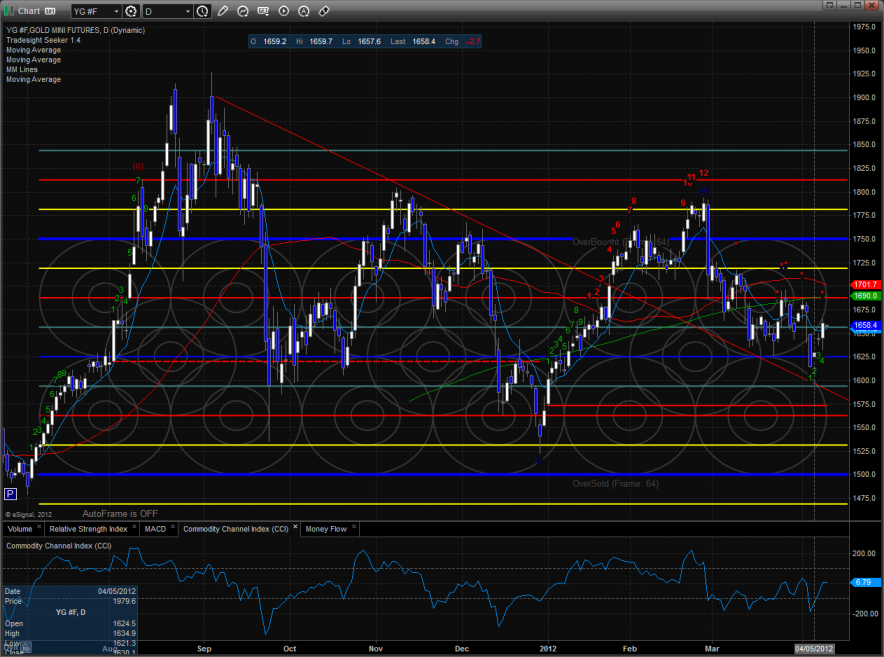

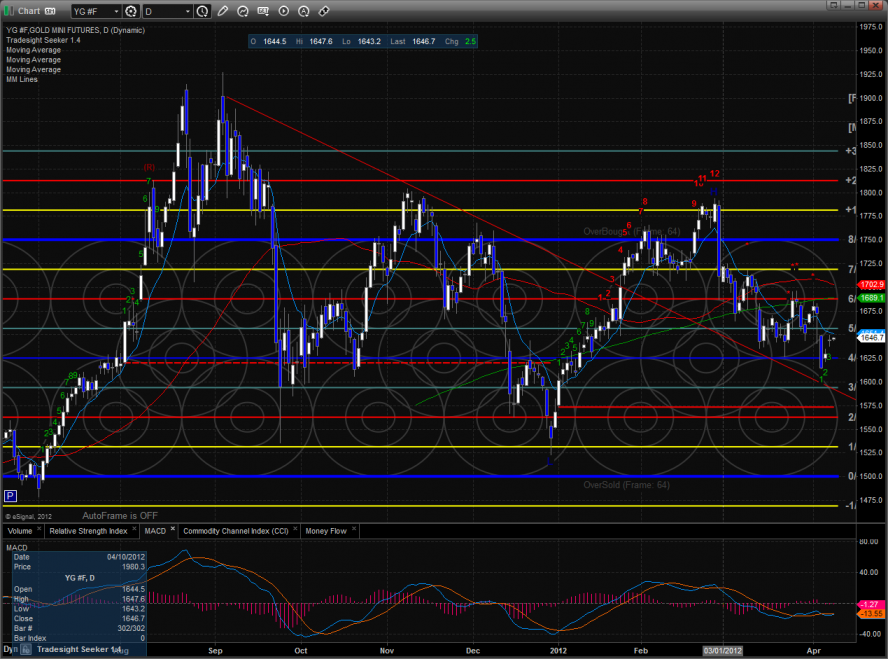

Market action and range were poor on Wednesday, and this carried over as well to metals, such as gold, which barely traded:

The bias has to be to the downside here, and therefore, we have lowered our Tradesight Swing Rating to -3.

Tradesight Market Preview for 4/12/12

Not much looks good here after the market dropped sharply Tuesday on volume, even though the volume disappeared again Wednesday.

One key note is that the Russell 2000 (Small Cap Index) has dropped sharply and broken recent lows. The index usually rides upward through April 15 (Tax Day) for a variety of reasons, so this is not a normal event:

The NDX (NASDAQ 100) has clearly broken a key trendline, and after a pattern like that, it is usually not a short-lived phenomenon:

The S&P 500 also broke:

Watch the flatline support on the black line for the SOX (Semiconductors):

And NBI (Biotechs):

Oil is also pulling in slowly:

Market action and range were poor on Wednesday, and this carried over as well to metals, such as gold, which barely traded:

The bias has to be to the downside here, and therefore, we have lowered our Tradesight Swing Rating to -3.

Stock Picks Recap for 4/11/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

In the Messenger, Rich's VXX triggered long over a 5-minute high (ETF, so no market support needed) after the second bar and worked:

His AAPL triggered short (without market support due to opening five minutes) and worked great:

His FFIV triggered short (without market support) and worked enough for a partial:

His VMW triggered short (without market support) and worked enough for a partial:

That was it. Things were so flat and volume so bad that no further calls were made.

In total, that's 1 trades triggering with market support, and it worked (an ETF).

Stock Picks Recap for 4/11/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing triggered off of the report.

In the Messenger, Rich's VXX triggered long over a 5-minute high (ETF, so no market support needed) after the second bar and worked:

His AAPL triggered short (without market support due to opening five minutes) and worked great:

His FFIV triggered short (without market support) and worked enough for a partial:

His VMW triggered short (without market support) and worked enough for a partial:

That was it. Things were so flat and volume so bad that no further calls were made.

In total, that's 1 trades triggering with market support, and it worked (an ETF).

Forex Calls Recap for 4/11/12

A winner on the EURUSD and that's about it as ranges remained narrow. See EURUSD below.

New calls and Chat tonight but Trade Balance tomorrow morning and CPI Friday morning are two of our big three each month, so half size, which makes sense anyway in this environment.

Here's the US Dollar Index intraday with market directional lines:

EURUSD:

Triggered long at A, hit first target at B, raised stop twice and stopped at C in the morning:

Stock Picks Recap for 4/10/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FNSR triggered short (with market support) and worked great:

ITMN triggered short (with market support) and didn't work:

In the Messenger, Rich's VMW triggered long (without market support due to opening five minutes):

NFLX triggered short (without market support) and didn't work, but then triggered 15 minutes later with support and worked:

Rich's LNKD triggered long (with market support) and worked:

Rich's MON triggered short (with market support) and worked:

IWM triggered short (ETF, so no market support needed) and worked:

Rich's VXX triggered long (ETF, so no market support needed) and worked:

Rich's LVS triggered short (with market support) and worked:

PCLN triggered short (with market support) and worked:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

Tradesight Market Preview for 4/11/12

The ES broke hard, losing 18 on the day with price settling around the active static trend line. Price is now below the 50dma for the first time in 2012. Keep a close eye on the MACD which has now turned negative. A break below the zero line would get momentum rolling down in the intermediate time frame.

The NQ futures were lower by 31 on the day but they continue to maintain their relative strength vs. the ES. The NQ’s have broken decisively below the 10ema but its relative strength is keeping it above the 50dma. It’s really up to AAPL. The relative strength in AAPL has buoyed the overall NDX but the soldiers are falling. Tuesday PCLN posted a range high outside day down but AAPL did not. It’s really turning into an NBA index—nothing but Apple. If AAPL breaks, then the NDX is done.

10-day Trin:

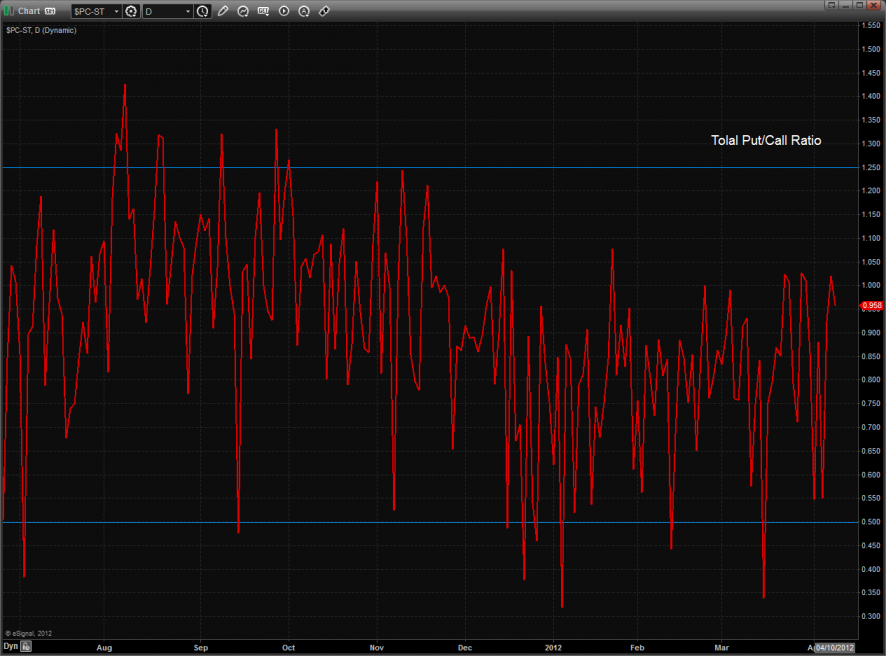

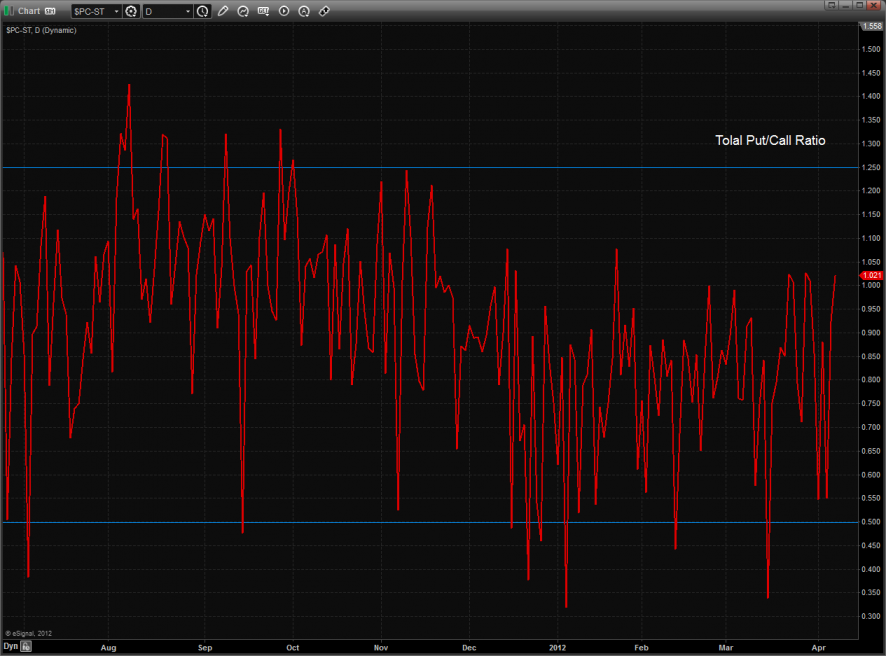

Total put/call ratio:

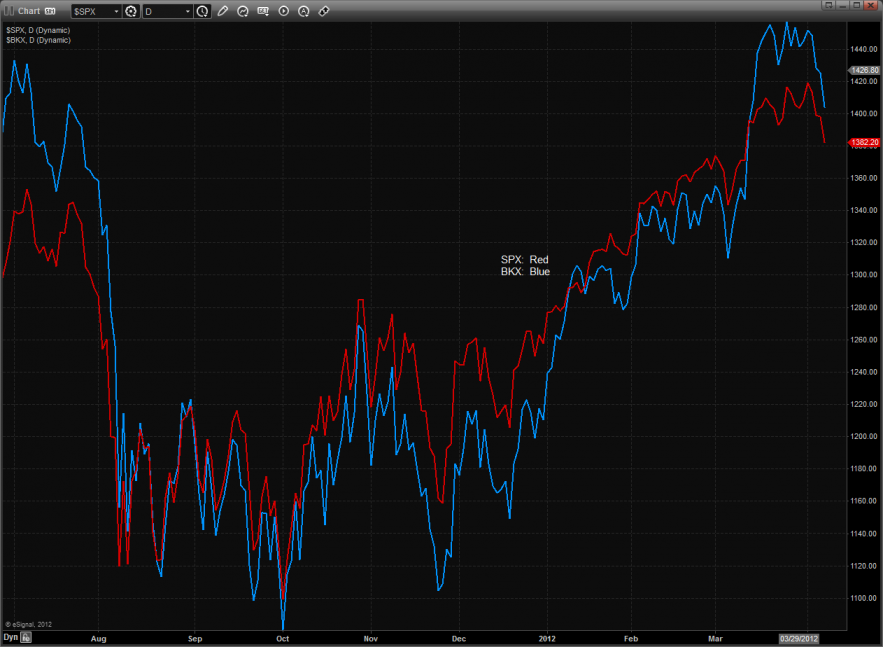

Multi sector daily chart:

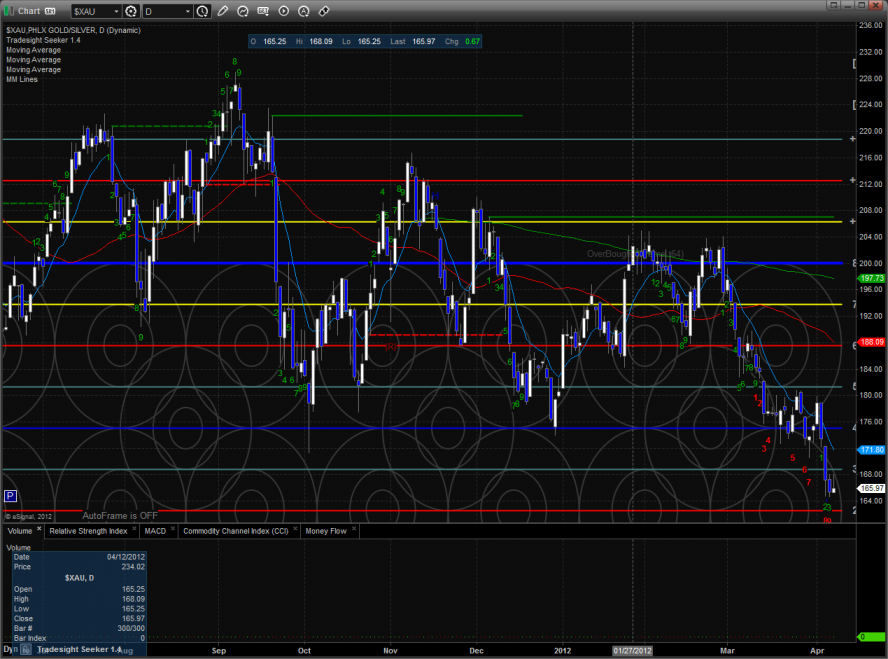

The defensive XAU was the top gun for the second day in a row and was the only major index that was positive on the day.

The SOX broke below the static trend line with next support at the midpoint of the trend channel.

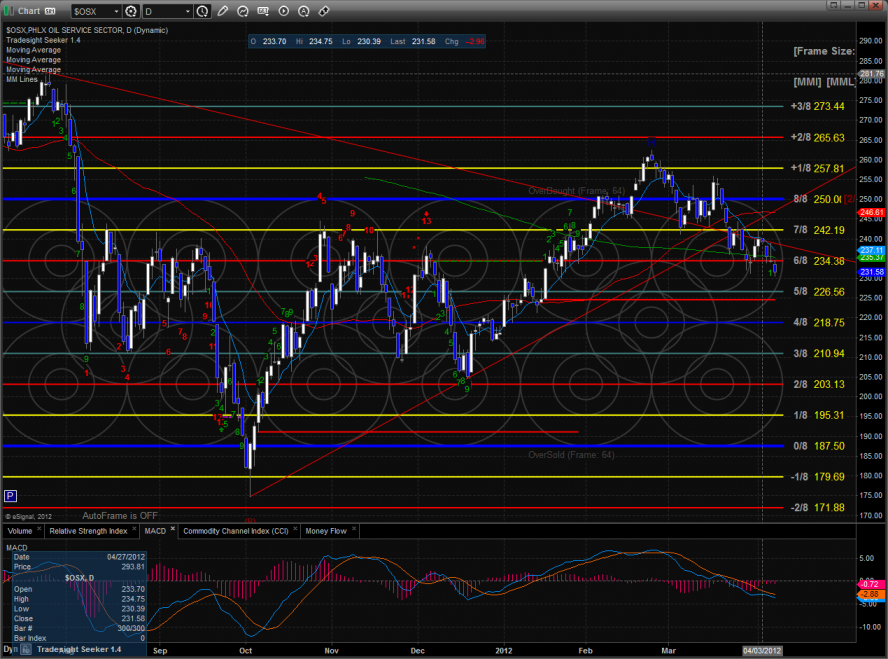

The OSX used the static trend line for support. Price is now below all of the major moving averages.

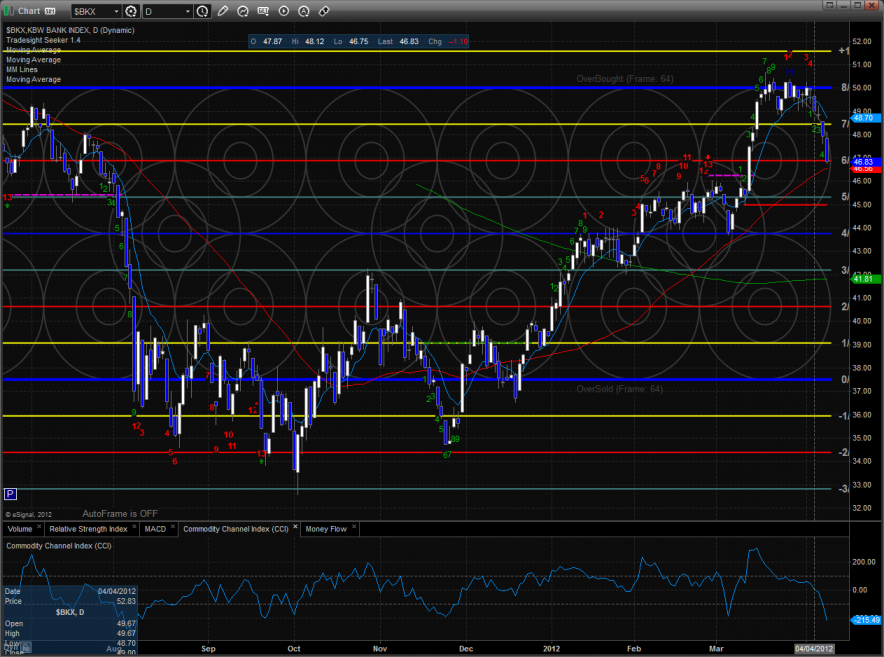

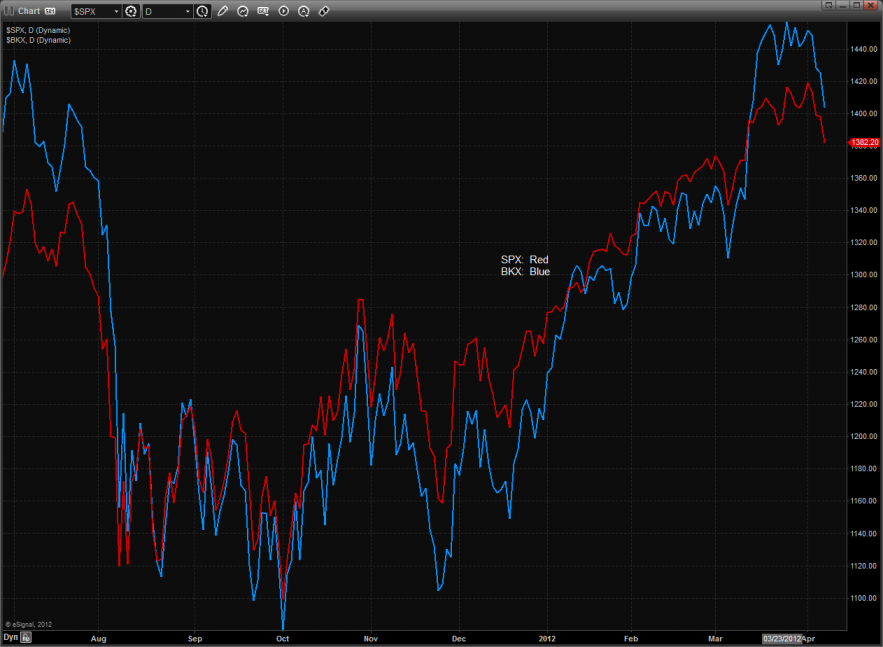

The BKX was weaker than the broad market. Key support is just below where the 50dma converges with the February highs.

The BTK was the last laggard on the day losing more than 2.5%. The double top is in place for lower prices. The next area of support is the static trend line.

Oil:

Gold:

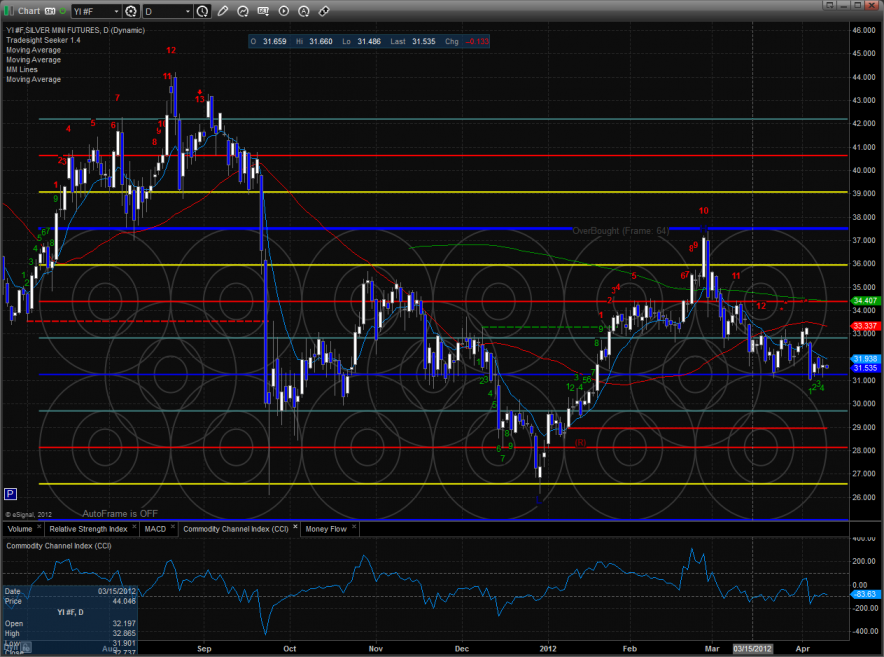

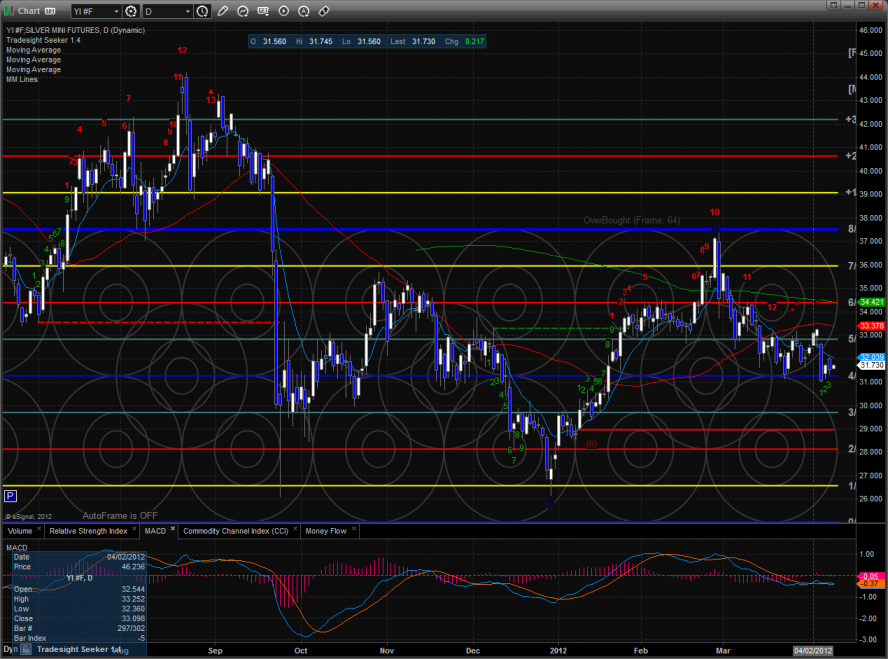

Silver:

Forex Calls Recap for 4/10/12

Another boring session with 70 pips of range on the EURUSD. See EURUSD and GBPUSD sections below for trade recaps.

Here's the US Dollar Index intraday with market directional lines:

New calls and Chat tonight.

EURUSD:

Triggered short at A and stopped at B. Triggered short in the morning at C, should have stopped at least some pieces of your trade under our order staggered methods at D. Triggered short again at E, closed at F as it hadn't hit first target or stop by end of session (again):

GBPUSD:

Triggered long early at A (half size) and stopped. Additional call in the morning never triggered but looked good:

Tradesight Market Preview for 4/10/12

The ES broke down after the awkwardly reported NFP number and settled lower by 15 on the day. This is the low close of the month and is breaking down below the trend defining 10ema. Price gravitated to the 8/8 Murrey math level but most likely will tag the static trend line.

The NQ futures have a similar setup but continue to bullishly hold their relative strength. Seasond traders know that when one stock like AAPL is driving the relative strength, the market is asking too much from one stock. The next level of support will be the static trend line and rising 50dma.

10-day NYSE Trin:

Total put/call ratio is still neutral:

Multi sector daily chart:

SOX/NDX cross remains weak and bearishly made a lower low.

The BKX is giving back a good deal of its relative strength.

The defensive XAU was the strongest sector on the day. The real body of the candle was inside the prior day’s range so a breakout should have extra punch.

The OSX made a new multi month low close and the MACD is gaining downside momentum.

The SOX is using the static trend line for support, if this breaks then the February lows are the next trade to target.

The BKX has decisively broken the 10ema and will find critical support were the February highs converge with the 50dma.

The BTK was the last laggard on the day. If the current lower high becomes qualified by a lower low then a very deep pullback is in the cards.

Oil (USO):

Gold:

Silver:

Stock Picks Recap for 4/9/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GPOR and STLD gappd under the triggers, no plays.

In the Messenger, Rich's MON triggered short (without market support) and didn't work:

NFLX triggered long (with market support) and worked enough for a partial:

Rich's FFIV triggered short (without market support) and worked enough for a partial:

His FIRE triggered short (without market support) and worked enough for a partial:

AMZN triggered long (with market support) and worked:

GPOR triggered long (with market support) and worked enough for a partial:

Rich's GMCR triggered long (with market support) and worked enough for a partial:

Rich's GOOG triggered short (without market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked, plus some that triggered without market support.