Forex Calls Recap for 4/4/12

Another dead session but a winner for us in GBPUSD, see that section below.

New calls and Chat tonight to wrap the short week.

Here's the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A early (half size) but gave you hours to enter (and get to full size) through B, hit first target at C, stopped slightly in the money on the second half after adjusting stop in the morning:

Forex Calls Recap for 4/4/12

Another dead session but a winner for us in GBPUSD, see that section below.

New calls and Chat tonight to wrap the short week.

Here's the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A early (half size) but gave you hours to enter (and get to full size) through B, hit first target at C, stopped slightly in the money on the second half after adjusting stop in the morning:

A Classic Look at Window Dressing

One of the features of the end of a quarter is known as "window dressing." Funds and institutions are measured by their performance and holdings from quarter to quarter, more than they are from month to month. What this means is that as we approach the last few days of the quarter, the funds have to do final adjusting on their positions so that they show the number of shares that they want. For example, if a stock has performed badly during a quarter, they want to show less on the books. If a stock has performed well, they want to show more.

But the funds have such large positions that they can't just buy and sell enough shares on the last day to get themselves where they want to be. They spend the days and even weeks leading up to the end of the quarter positioning themselves. Once they have done this, there is less buying and selling to be done until the quarter actually ends and statements print. In addition, they want the prices to be stable after they have set their shares.

What we have seen over time is that this leads to a 3-day phenomenon known as "window-dressing." The net of these three days is often nothing at all as the big players have nothing left to do.

Here is a look at the last 3 and a half days of the quarter, ending last Friday, on the S&P 500 index, in 5 minute bars. Note that I've drawn a flat line from the close on Tuesday, and we closed almost exactly at that same price on Friday:

Classic window dressing. Something to be aware of next quarter if you weren't already.

A Classic Look at Window Dressing

One of the features of the end of a quarter is known as "window dressing." Funds and institutions are measured by their performance and holdings from quarter to quarter, more than they are from month to month. What this means is that as we approach the last few days of the quarter, the funds have to do final adjusting on their positions so that they show the number of shares that they want. For example, if a stock has performed badly during a quarter, they want to show less on the books. If a stock has performed well, they want to show more.

But the funds have such large positions that they can't just buy and sell enough shares on the last day to get themselves where they want to be. They spend the days and even weeks leading up to the end of the quarter positioning themselves. Once they have done this, there is less buying and selling to be done until the quarter actually ends and statements print. In addition, they want the prices to be stable after they have set their shares.

What we have seen over time is that this leads to a 3-day phenomenon known as "window-dressing." The net of these three days is often nothing at all as the big players have nothing left to do.

Here is a look at the last 3 and a half days of the quarter, ending last Friday, on the S&P 500 index, in 5 minute bars. Note that I've drawn a flat line from the close on Tuesday, and we closed almost exactly at that same price on Friday:

Classic window dressing. Something to be aware of next quarter if you weren't already.

Tradesight.com Market Preview for 4/4/12

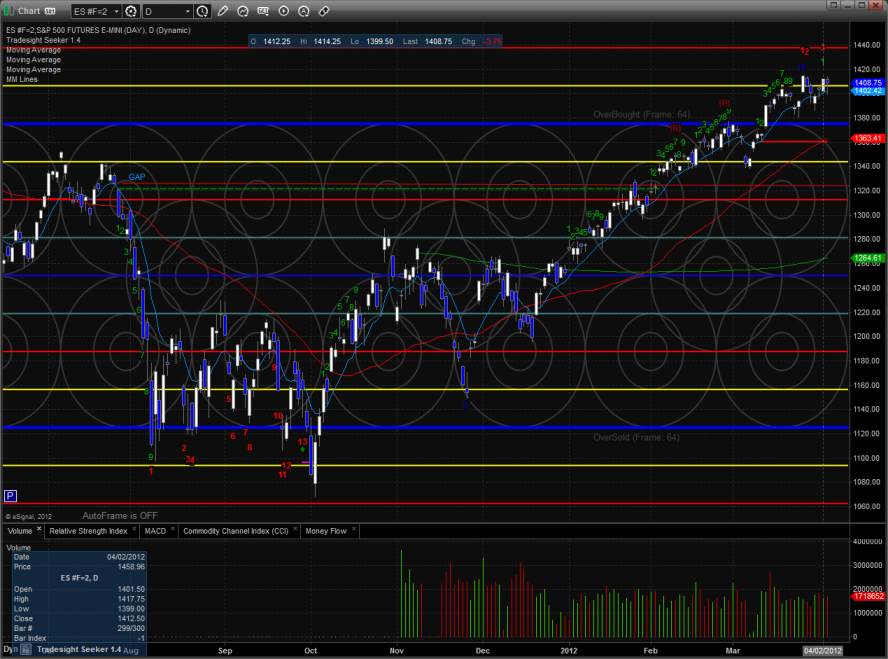

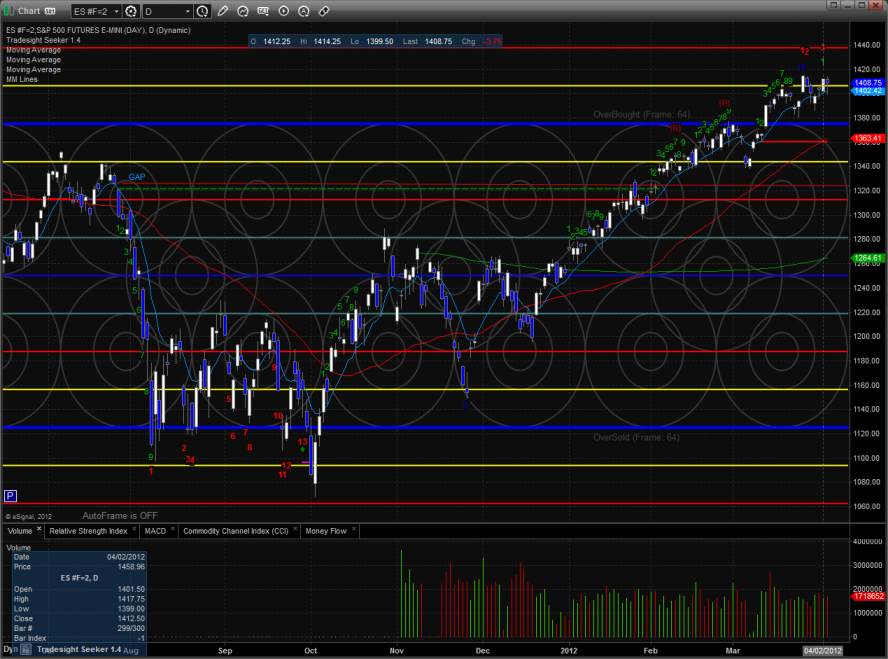

The ES was lower on the day by 3 handles but was contained by the previous day’s range which means there was no new technical development until price breaks the two day range.

The NQ futures were relatively strong all day gaining 2 points lead by the strength in AAPL. However, even though the futures were higher on the day, internally the market was weak with a net 1k issues lower on the day. Poor internals and bad breadth are often signs of an impending change in trend.

Multi sector daily chart:

The SOX/NDX cross is very close to a breakdown. A leg down would have very bearish implications for the overall NDX.

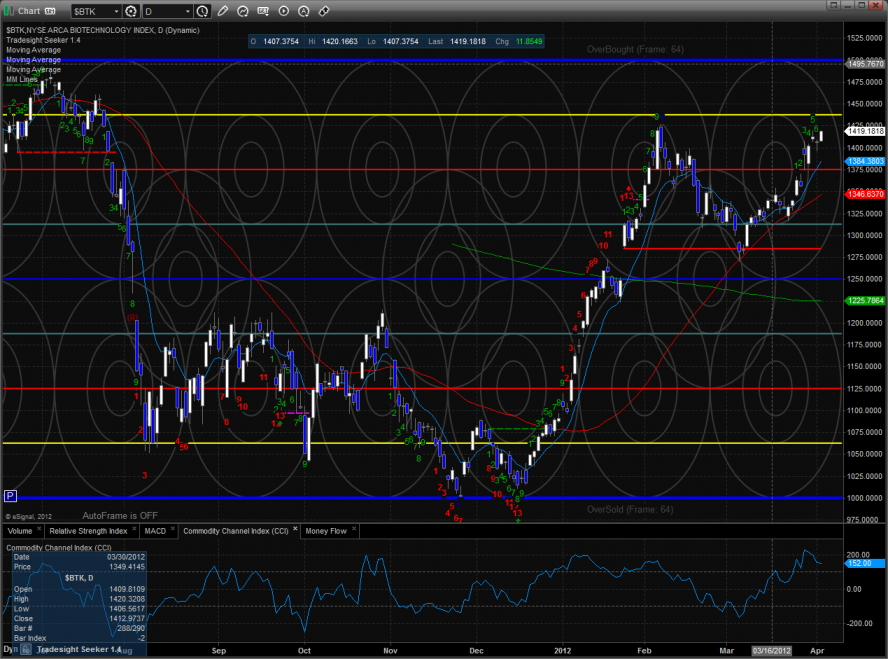

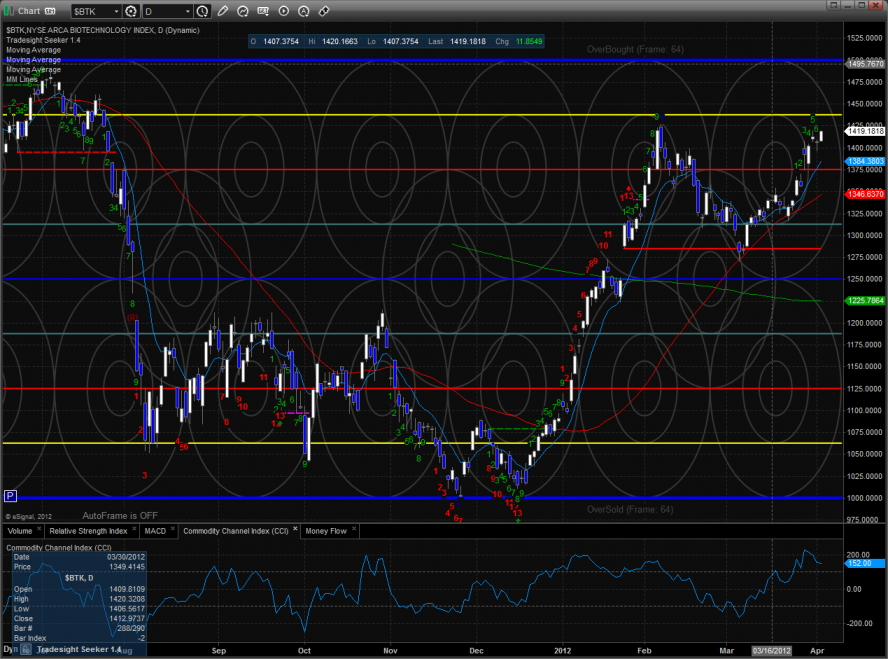

The BTK was the top gun on the day but did not make a new high on the move.

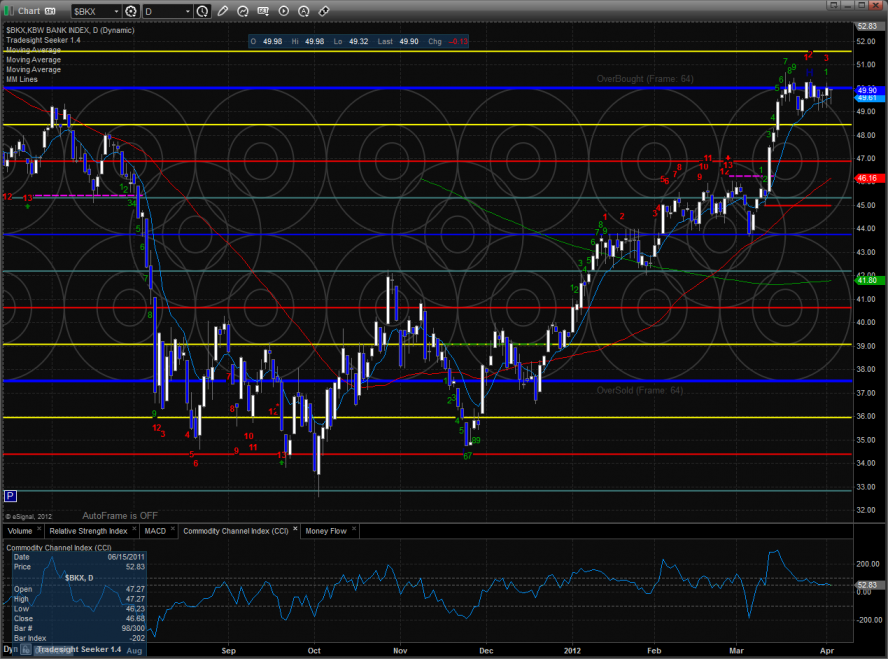

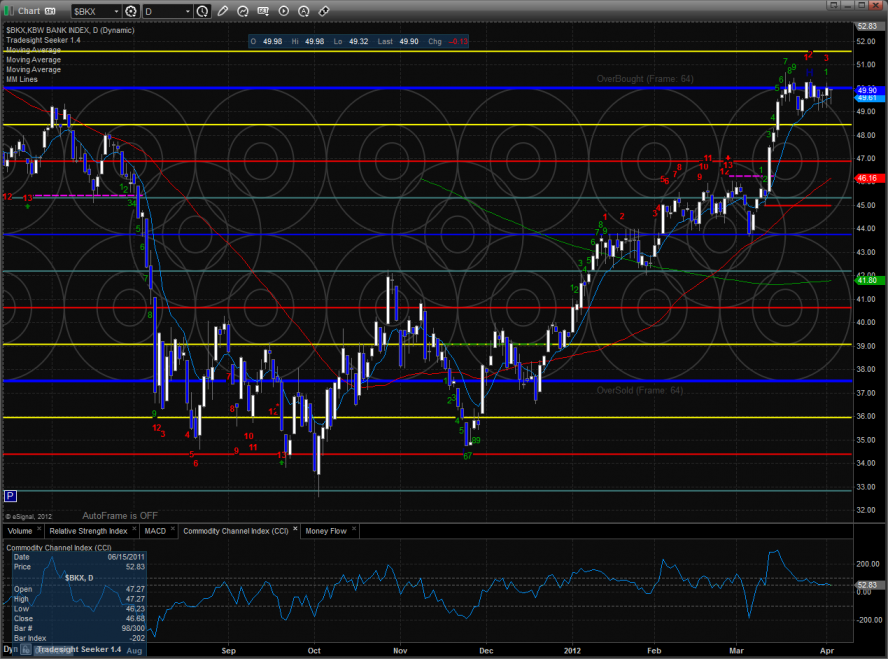

The BKX was little changed and remains boxed up at the 8/8 level.

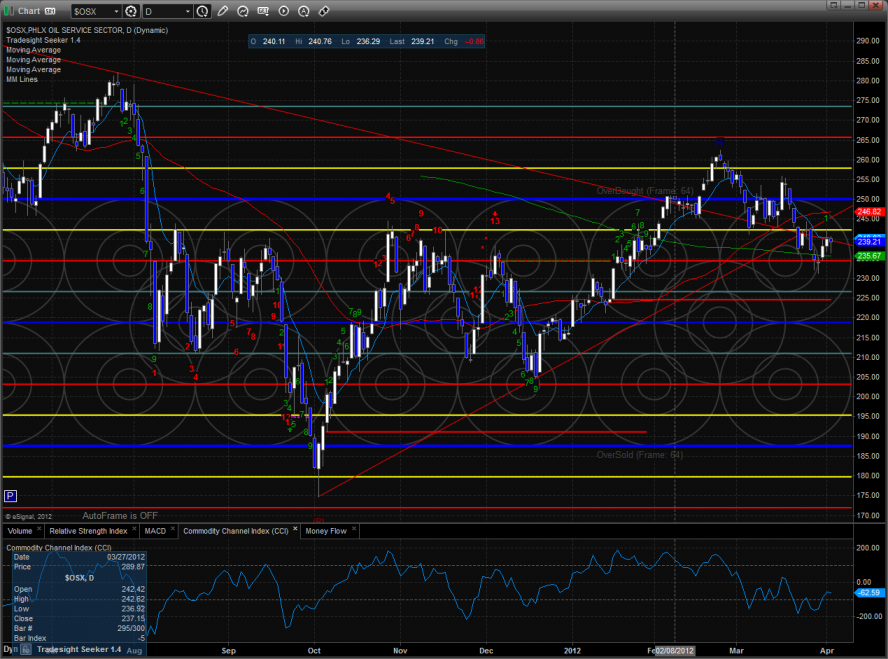

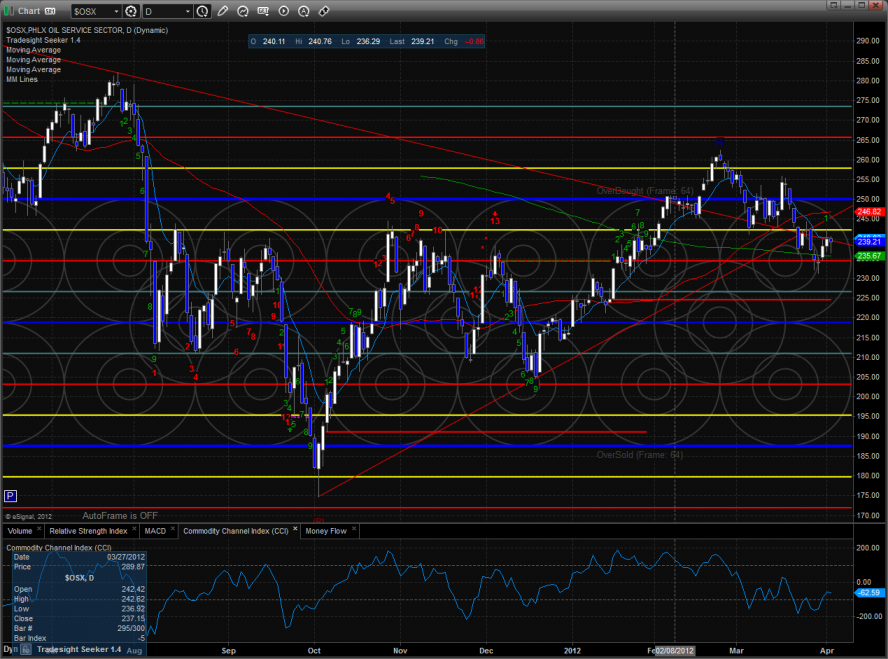

The OSX is trapped between the 50 and 200dmas, when price resolves this area it should move nicely.

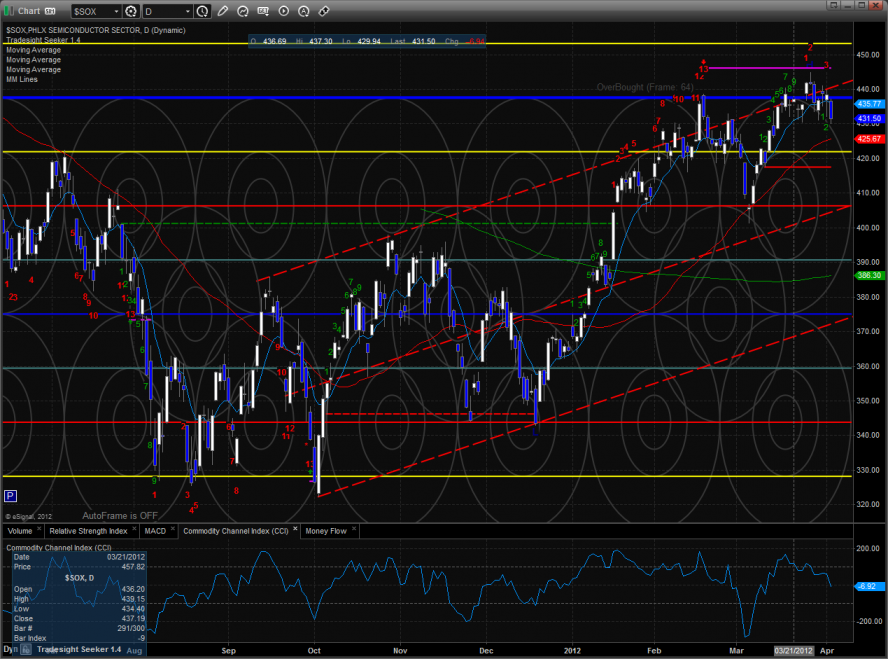

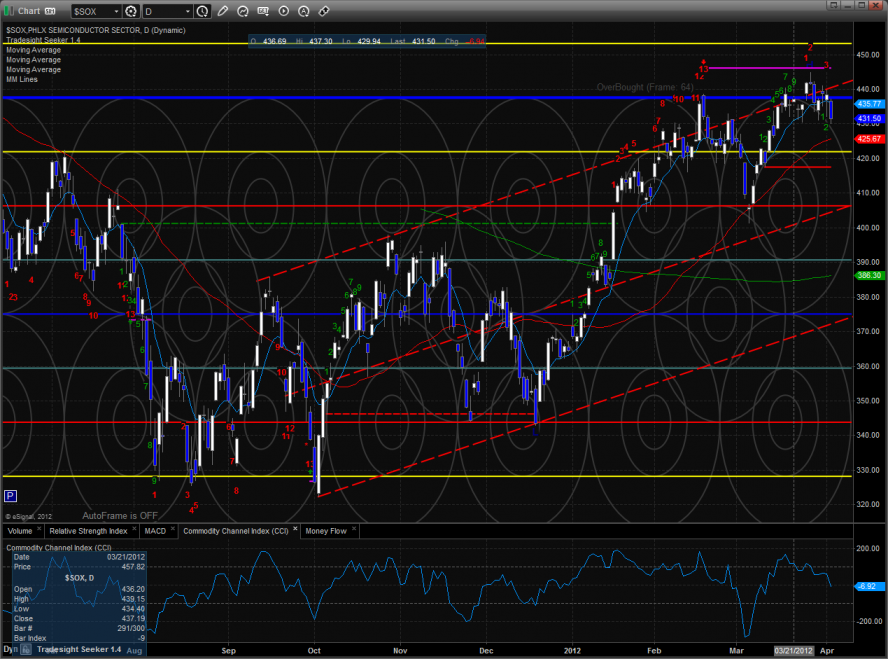

The SOX was the weakest NDX sector on the day and the relative weakness must stop here. The Seeker sell signal is still acive.

The XAU was by far the weakest sector on the day and the bottom fishers were frustrated by the chart making a new low on the move.

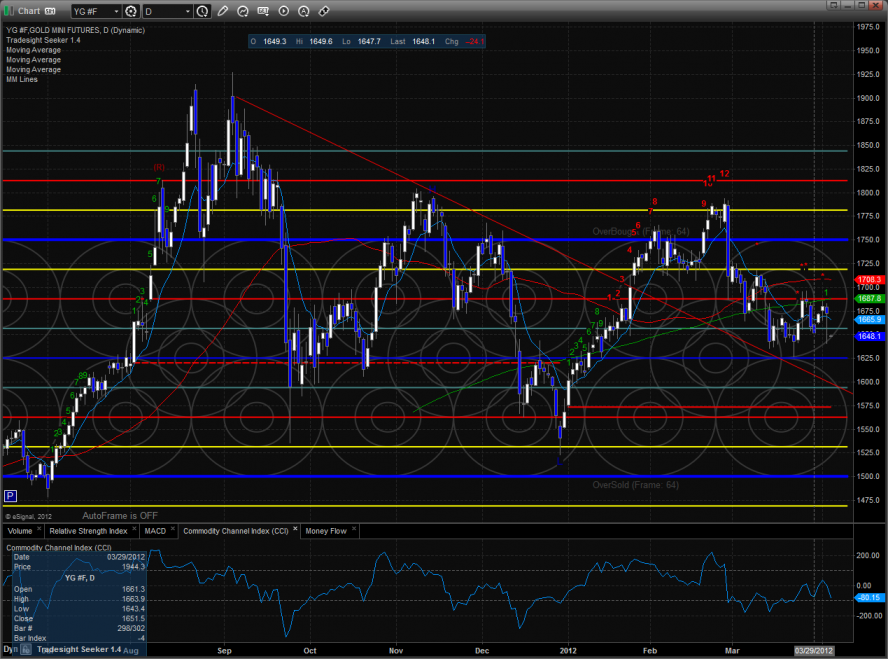

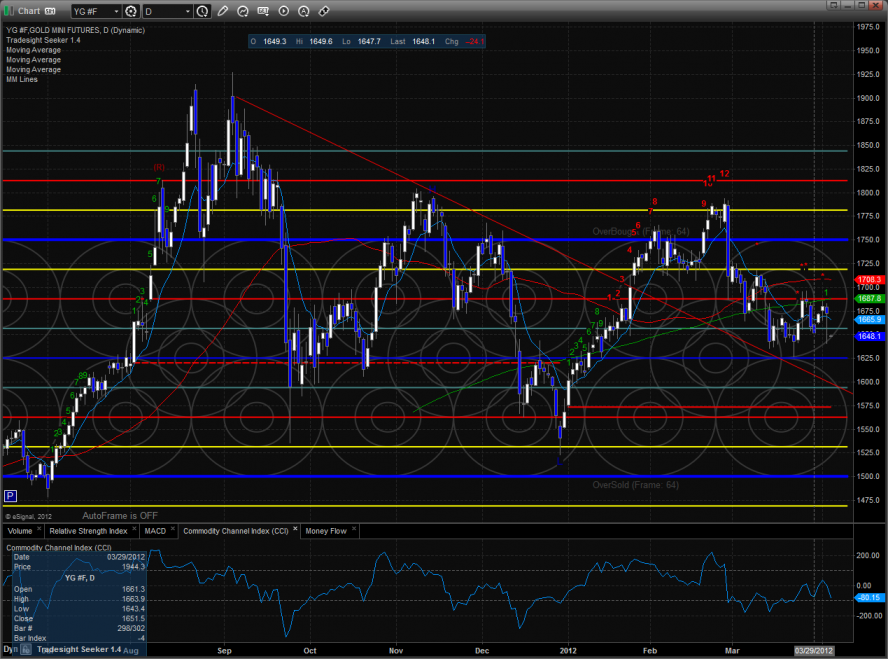

Gold waterfalled lower after the release of the FOMC minutes and didn’t recover.

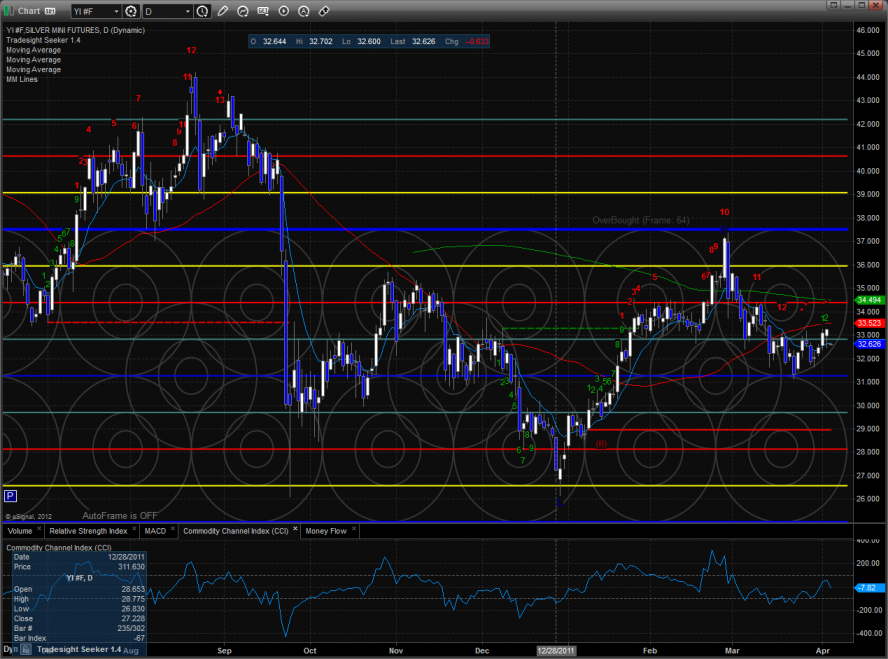

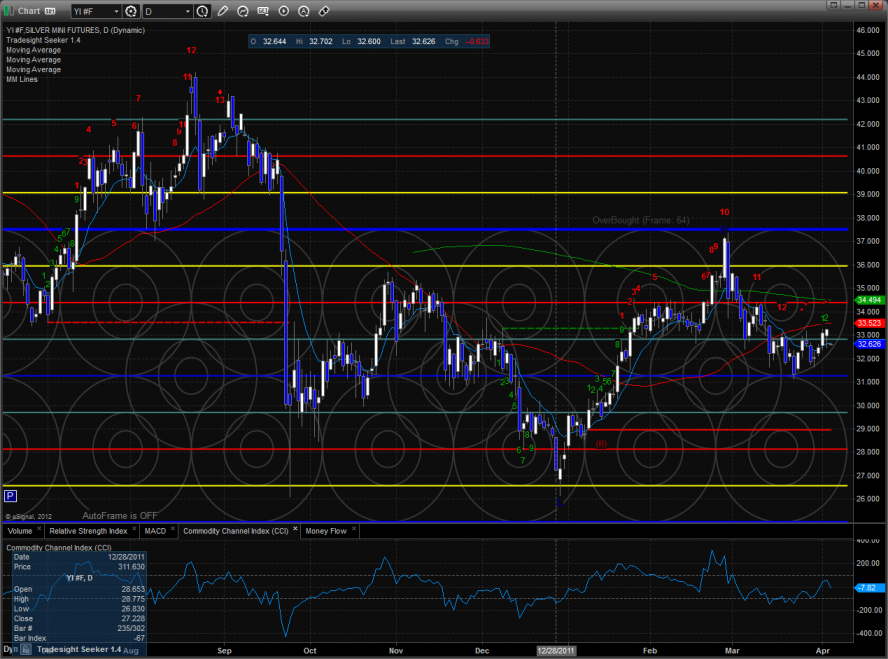

Silver:

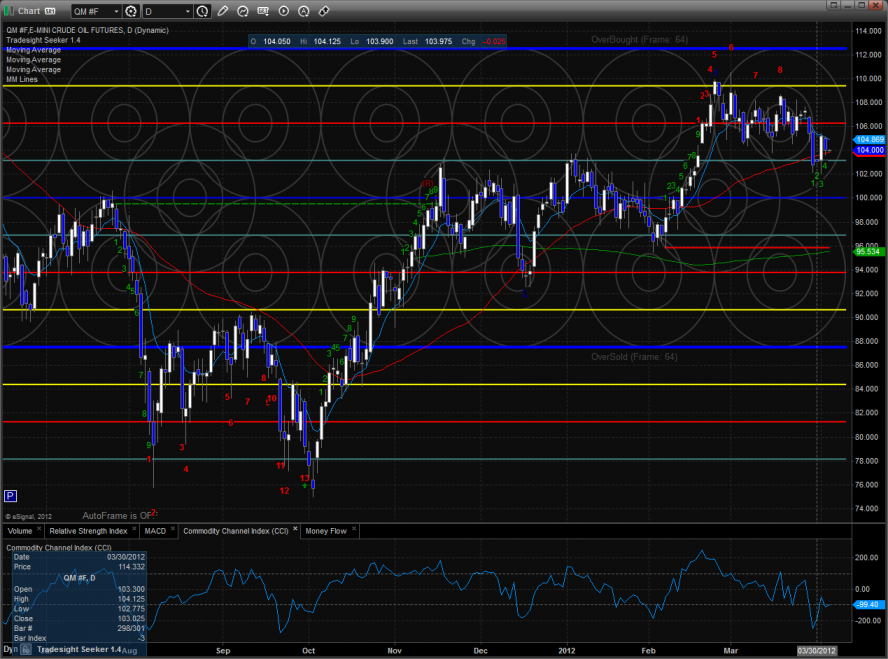

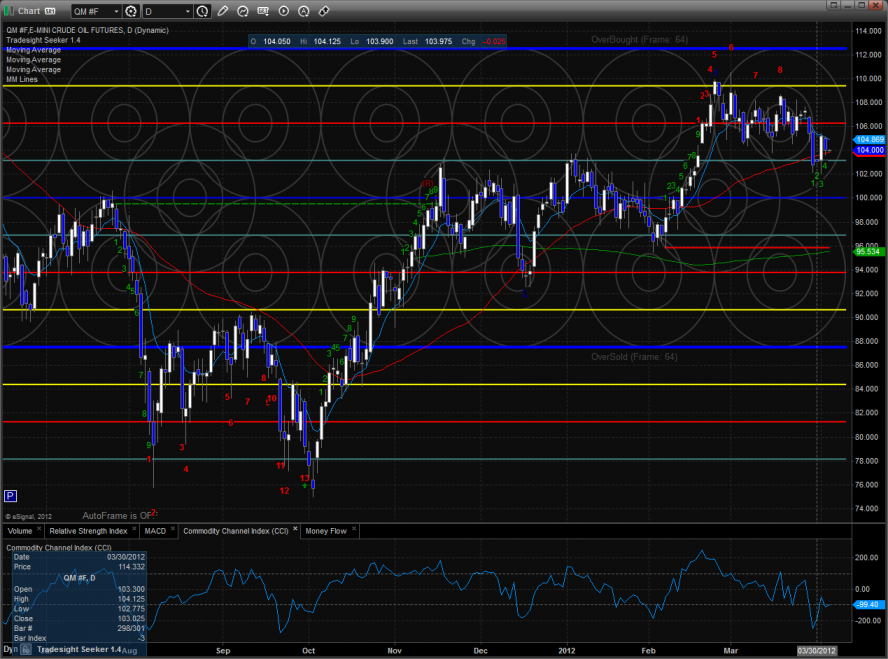

Oil:

Tradesight.com Market Preview for 4/4/12

The ES was lower on the day by 3 handles but was contained by the previous day’s range which means there was no new technical development until price breaks the two day range.

The NQ futures were relatively strong all day gaining 2 points lead by the strength in AAPL. However, even though the futures were higher on the day, internally the market was weak with a net 1k issues lower on the day. Poor internals and bad breadth are often signs of an impending change in trend.

Multi sector daily chart:

The SOX/NDX cross is very close to a breakdown. A leg down would have very bearish implications for the overall NDX.

The BTK was the top gun on the day but did not make a new high on the move.

The BKX was little changed and remains boxed up at the 8/8 level.

The OSX is trapped between the 50 and 200dmas, when price resolves this area it should move nicely.

The SOX was the weakest NDX sector on the day and the relative weakness must stop here. The Seeker sell signal is still acive.

The XAU was by far the weakest sector on the day and the bottom fishers were frustrated by the chart making a new low on the move.

Gold waterfalled lower after the release of the FOMC minutes and didn’t recover.

Silver:

Oil:

Stock Picks Recap for 4/3/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BMRN triggered short (without market support due to opening five minutes) and didn't work:

In the Messenger, Rich's SLV triggered long (ETF) and didn't work:

AMZN triggered long (with market support) and worked great:

Rich's AZO triggered short (with market support) and worked:

His SINA triggered short (with market support) and worked:

His MDVN triggered long (without market support) and worked:

His FCX triggered short (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Stock Picks Recap for 4/3/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BMRN triggered short (without market support due to opening five minutes) and didn't work:

In the Messenger, Rich's SLV triggered long (ETF) and didn't work:

AMZN triggered long (with market support) and worked great:

Rich's AZO triggered short (with market support) and worked:

His SINA triggered short (with market support) and worked:

His MDVN triggered long (without market support) and worked:

His FCX triggered short (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Forex Calls Recap for 4/3/12

Another boring session until way too late to matter. There was news around 2 pm EST, and the pairs spiked hard in favor of the USD.

See EURUSD section below.

Here's the US Dollar Index intraday with market directional lines:

EURUSD:

Triggered long early (half size) at A, eventually stopped at B. Triggered short at C, stopped at D. Then came the big move at an odd time of day on the FOMC notes:

Stock Picks Recap for 4/2/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

PDCO triggered long (without market support due to opening five minutes) and didn't work:

WOOF triggered long (with market support) and didn't do anything either way, so we don't count it:

CINF triggered short (without market support) and didn't work:

In the Messenger, Rich's APKT triggered long (with market support) and didn't work:

NTAP triggered long (with market support) and didn't work:

Rich's VMW triggered long (with market support) and worked huge:

NFLX triggered short (without market support) and worked:

FSLR triggered short (without market support) and didn't work:

AMZN triggered long (with market support) and didn't work:

Rich's CAT triggered short (without market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, 1 of them worked, 3 did not.