Forex Calls Recap for 4/2/12

Essentially no triggers overnight as the GBPUSD never went down to the trigger and the EURUSD never broke through the long trigger, although depending on how you staggered your orders, one piece of the EURUSD entry might have triggered, see below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

It's possible that one leg of your long idea triggered at A under our order staggering rules, but it only went one pip beyond the number:

Forex Calls Recap for 4/2/12

Essentially no triggers overnight as the GBPUSD never went down to the trigger and the EURUSD never broke through the long trigger, although depending on how you staggered your orders, one piece of the EURUSD entry might have triggered, see below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

It's possible that one leg of your long idea triggered at A under our order staggering rules, but it only went one pip beyond the number:

Tradesight.com Market Preview for 4/3/12

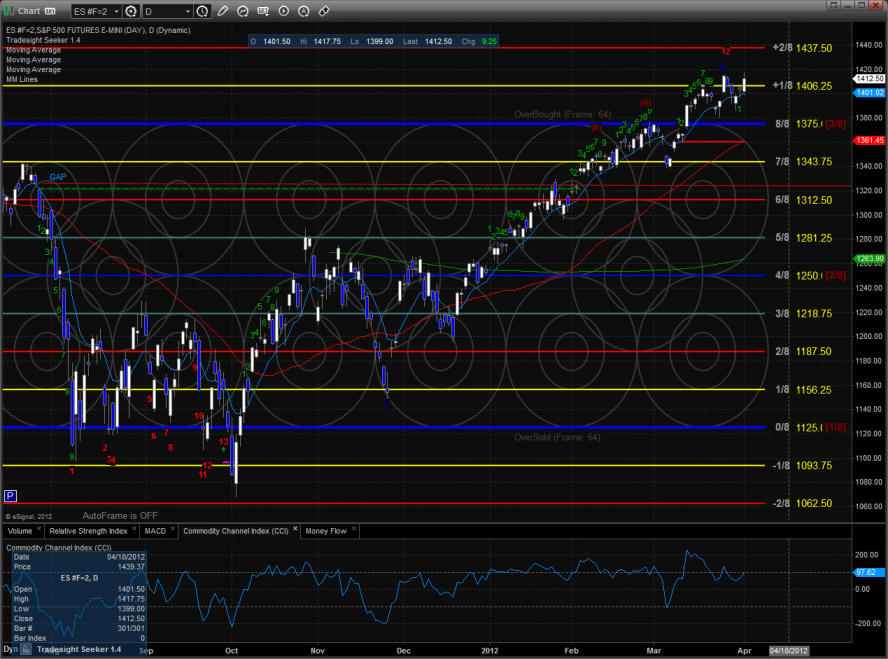

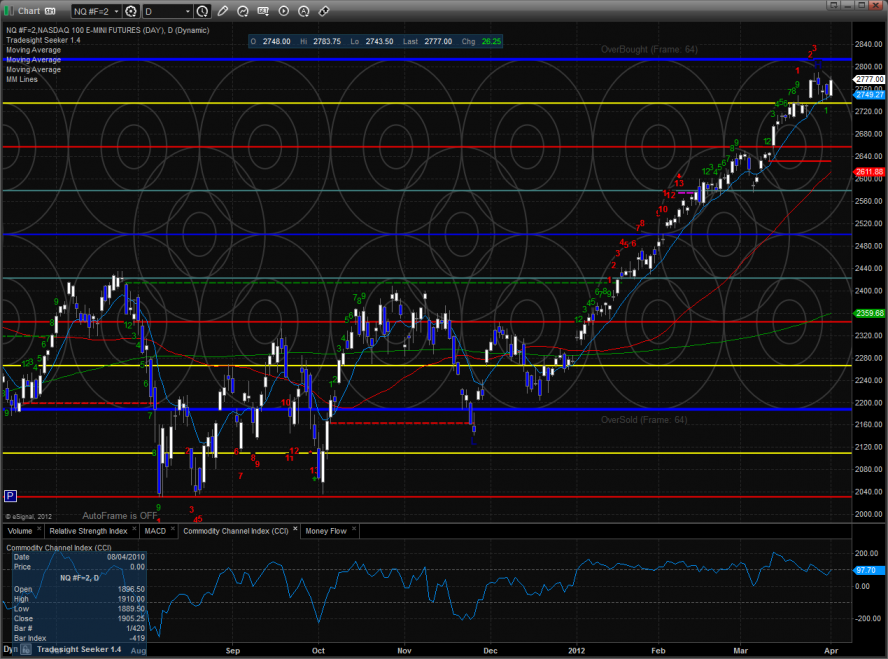

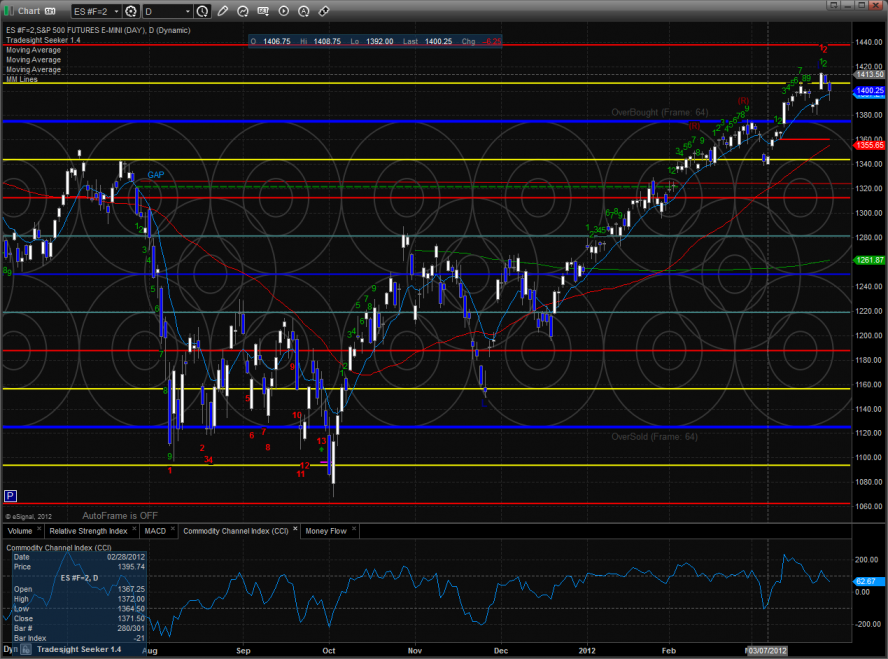

The ES started Q2 with a gain of 9 on the day. This is neither a new high nor a new high close on the move. There is nothing new technically other than settling above the 9/8 level again.

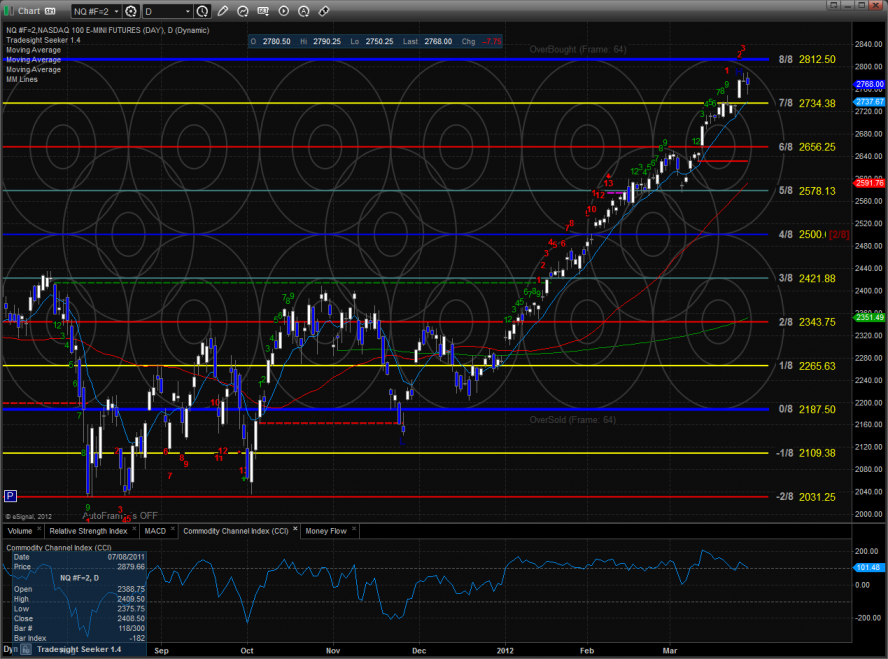

The NQ futures exactly matched the high close of the move by gaining 26 on the day. The 8/8 level just overhead is the Sheriff in town and is still supported by the 10ema.

The 10-day Trin is in the middle of the neutral area.

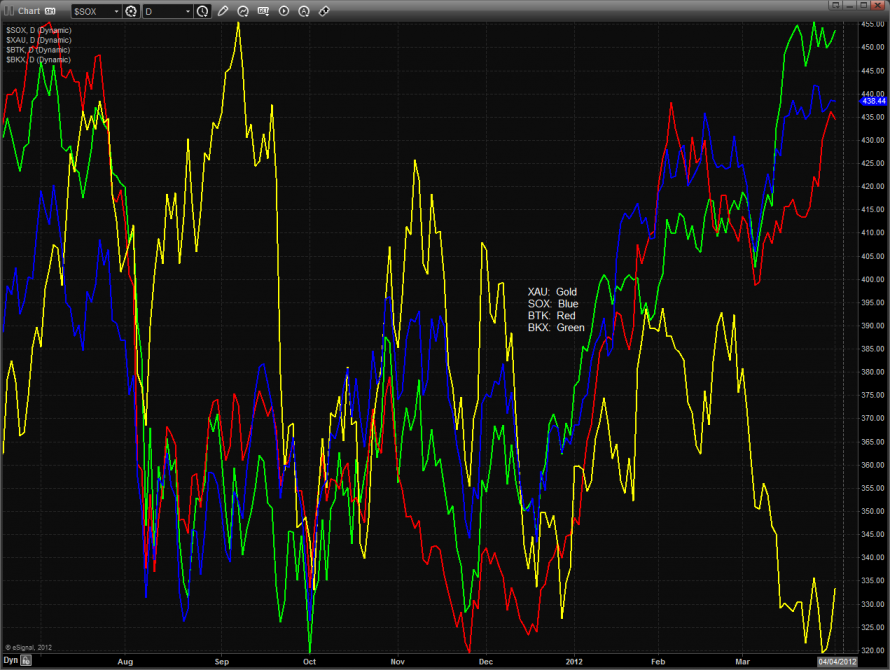

Multi sector daily chart:

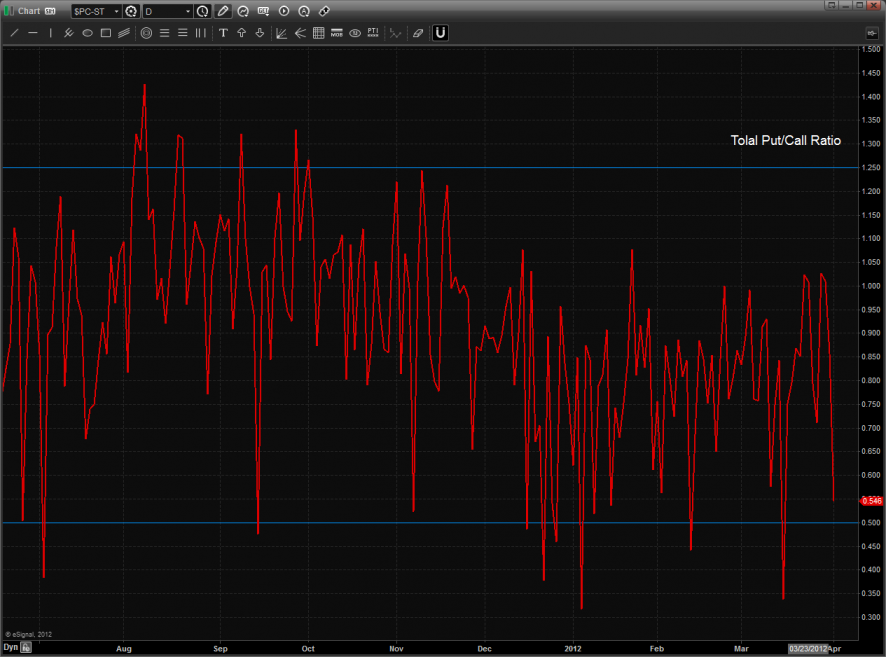

The total put/call ratio recorded moderately bearish reading.

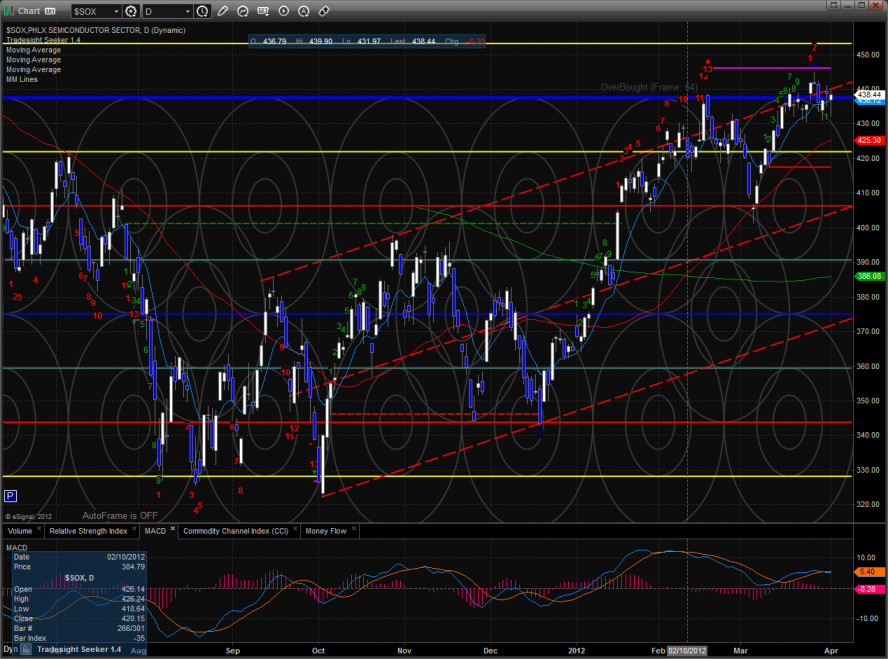

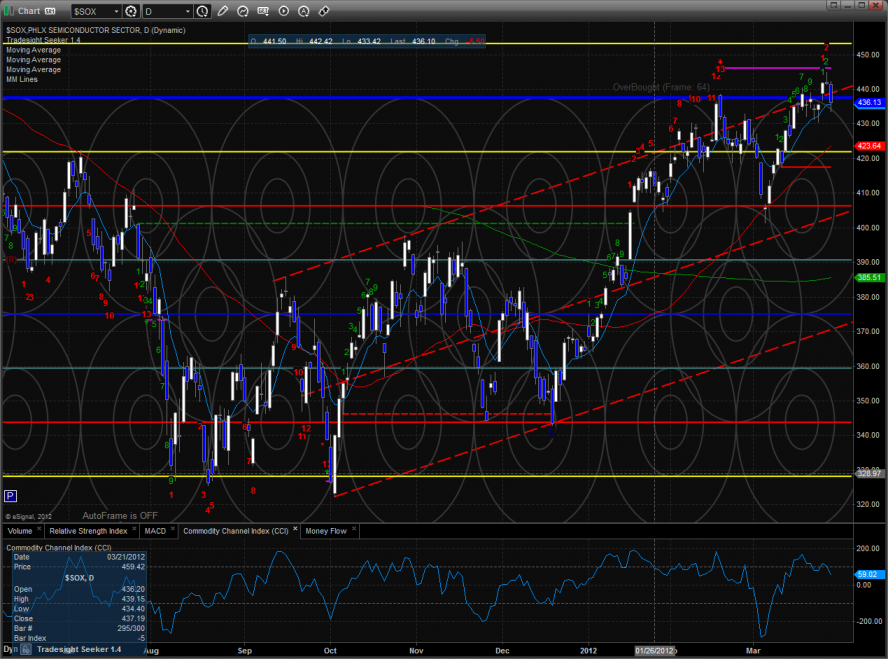

The SOX continues to bearishly lag the NDX.

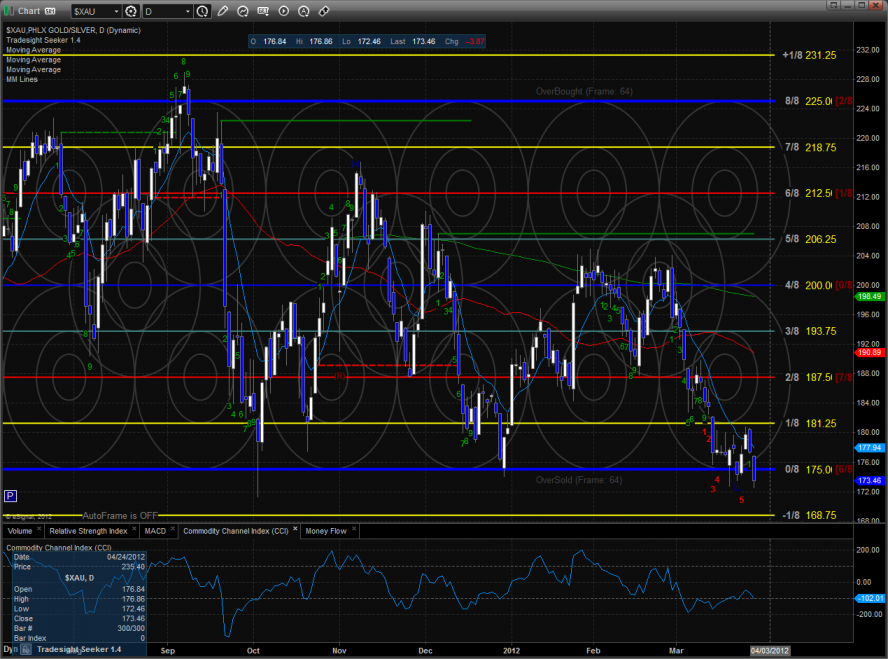

The XAU was the top gun on the day perhaps making a short term bottom. Keep a close eye on how the MACD plays out over the next few days.

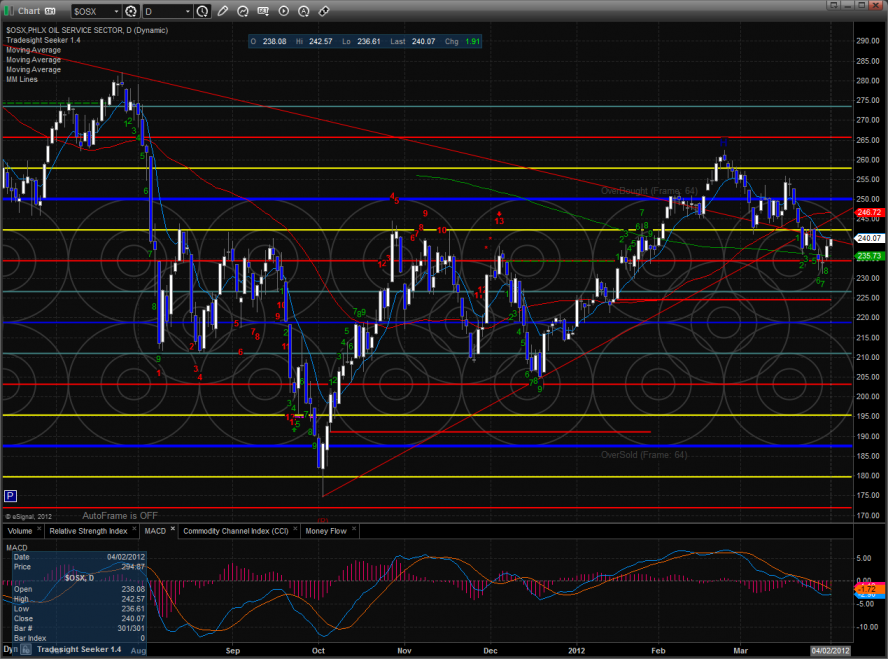

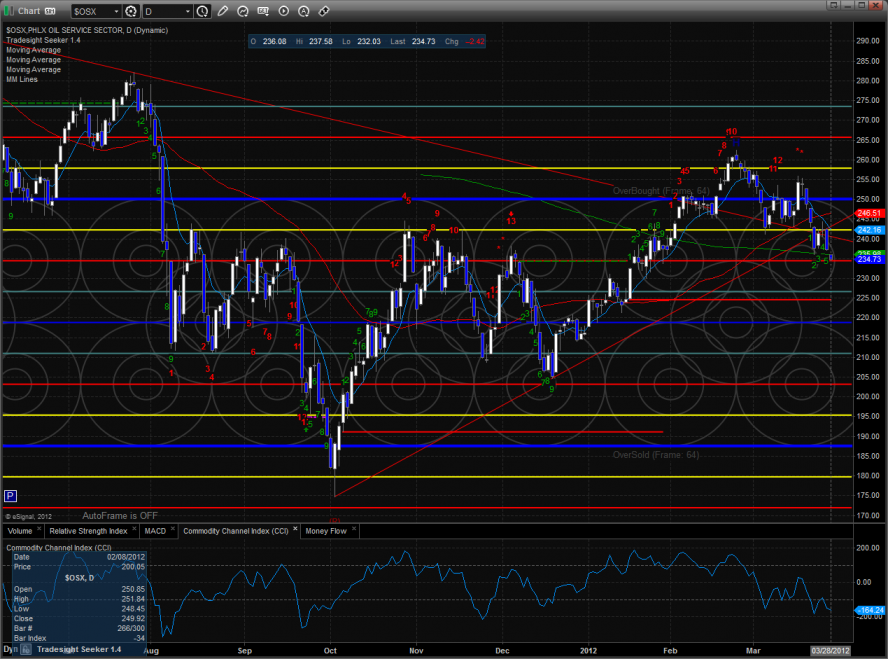

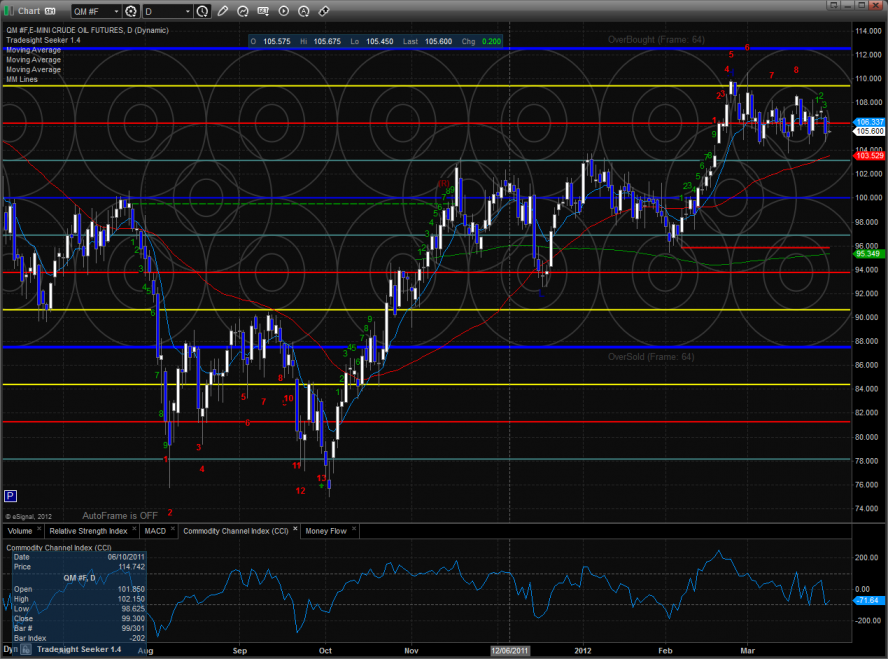

The OSX bounced back to the breakdown area.

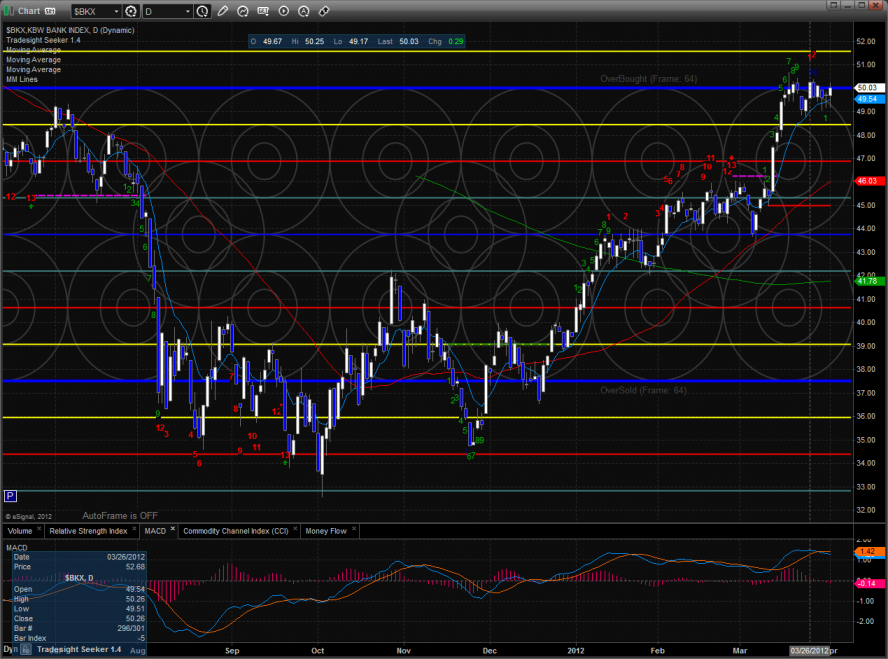

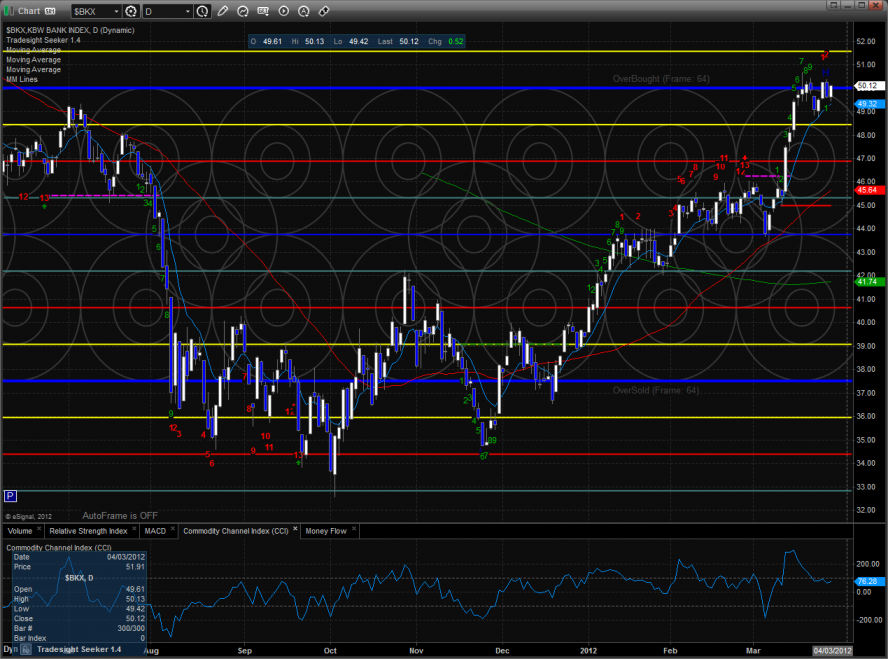

The BKX remains boxed up staging right at the key 8/8 Murrey math level.

The SOX was lower on the day still feeling the weight of the active Seeker signal. This was a gross underperformance vs. the broader NDX.

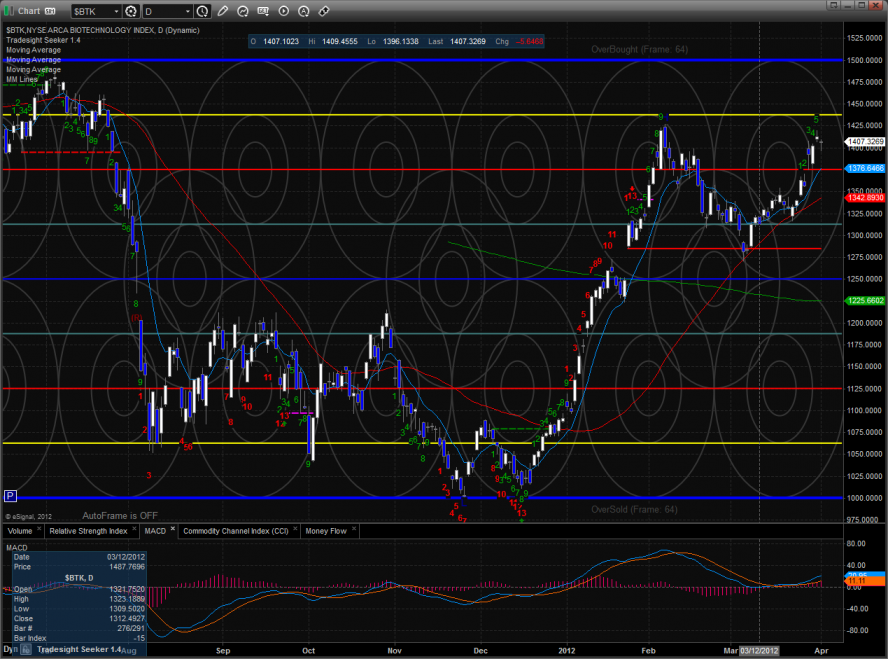

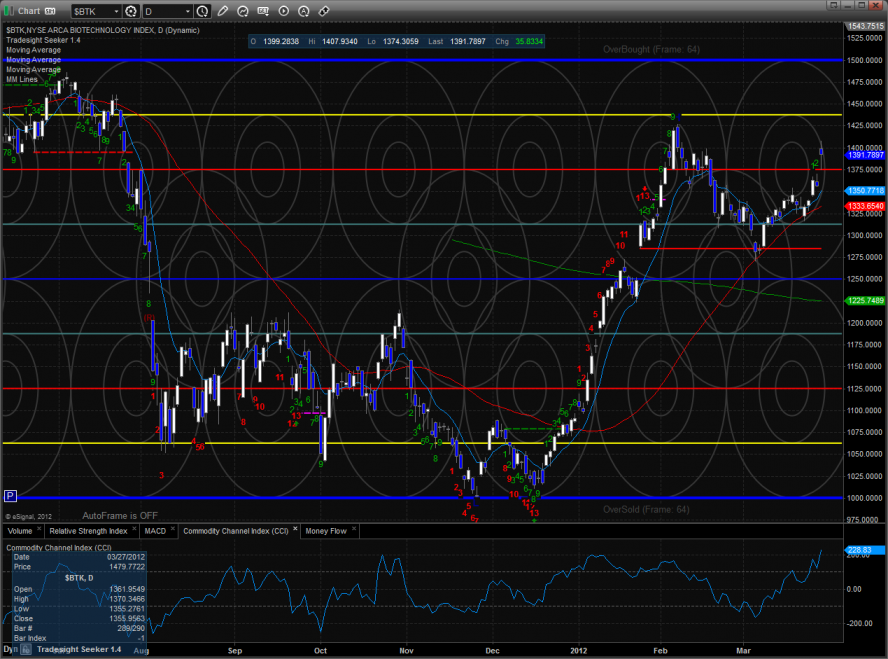

The BTK was notably weak and has an active Seeker sell signal in the 65min chart.

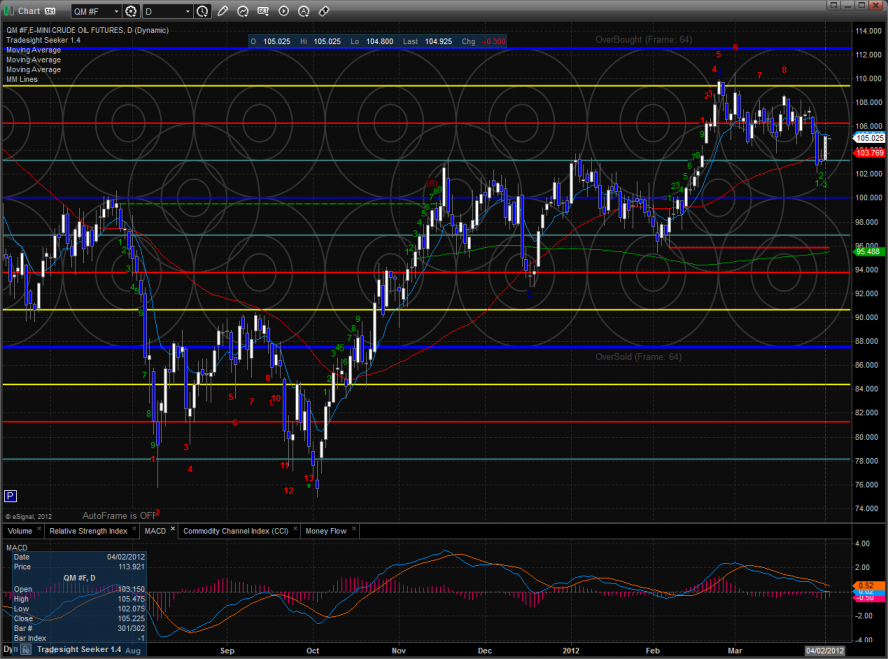

Oil:

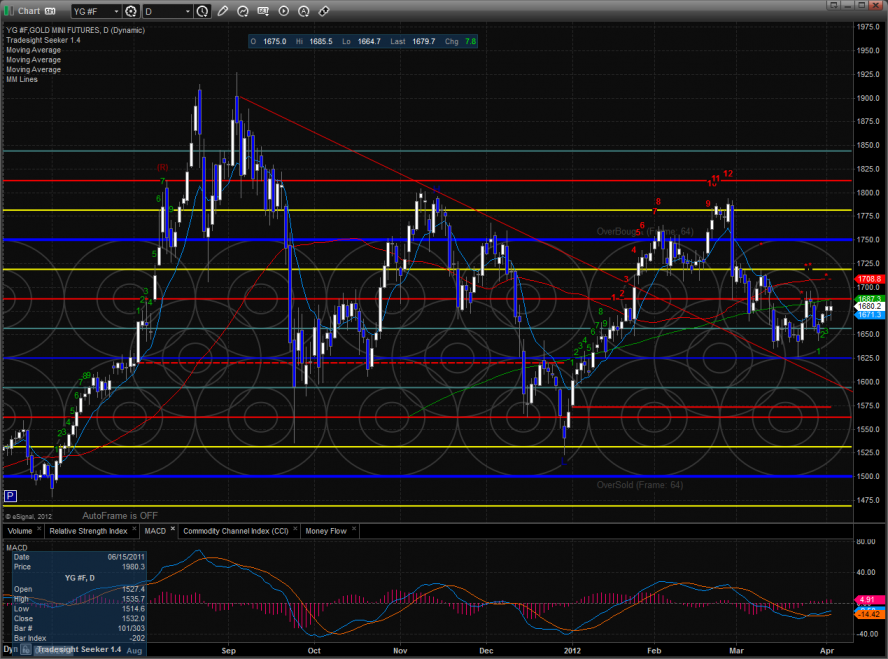

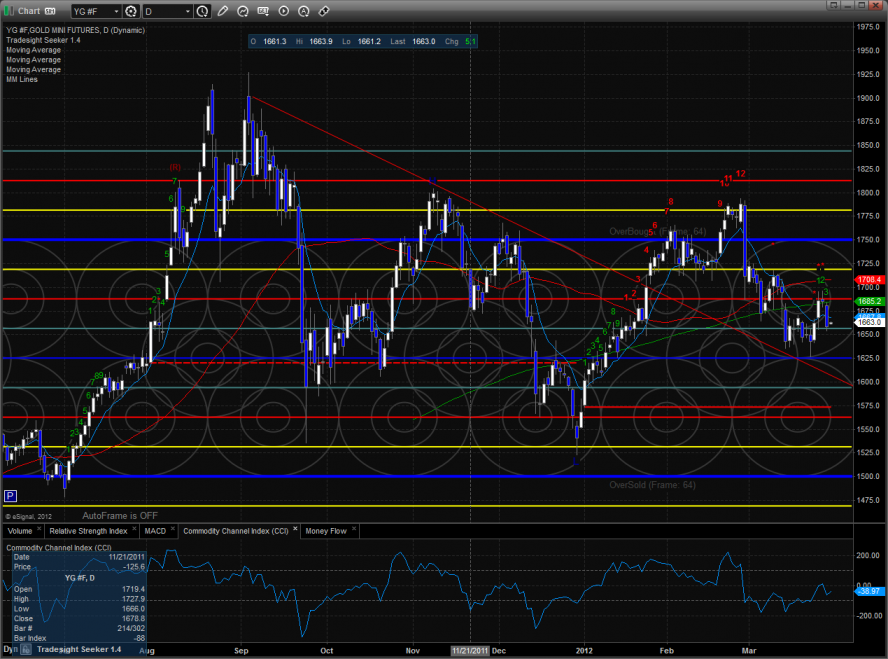

Gold:

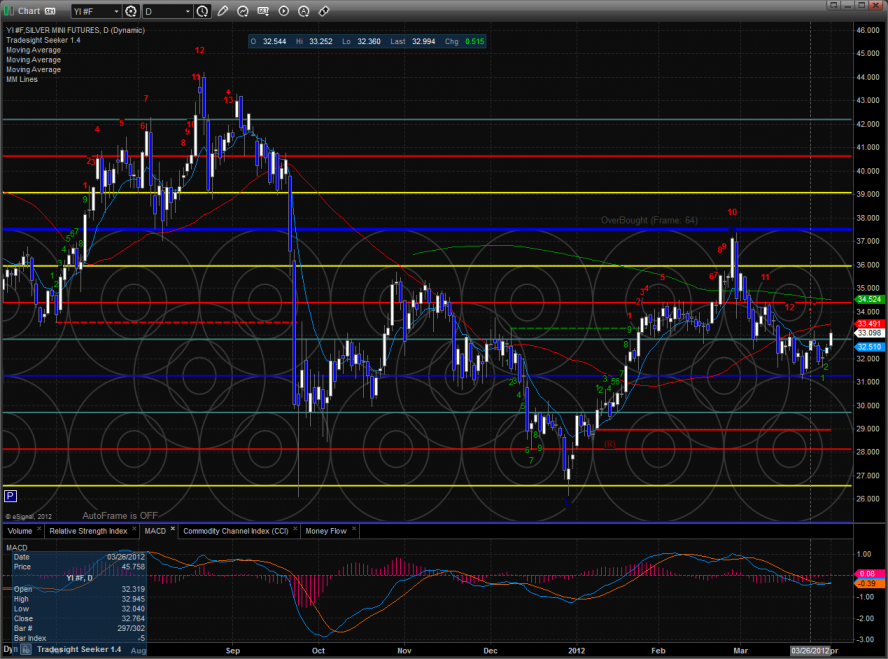

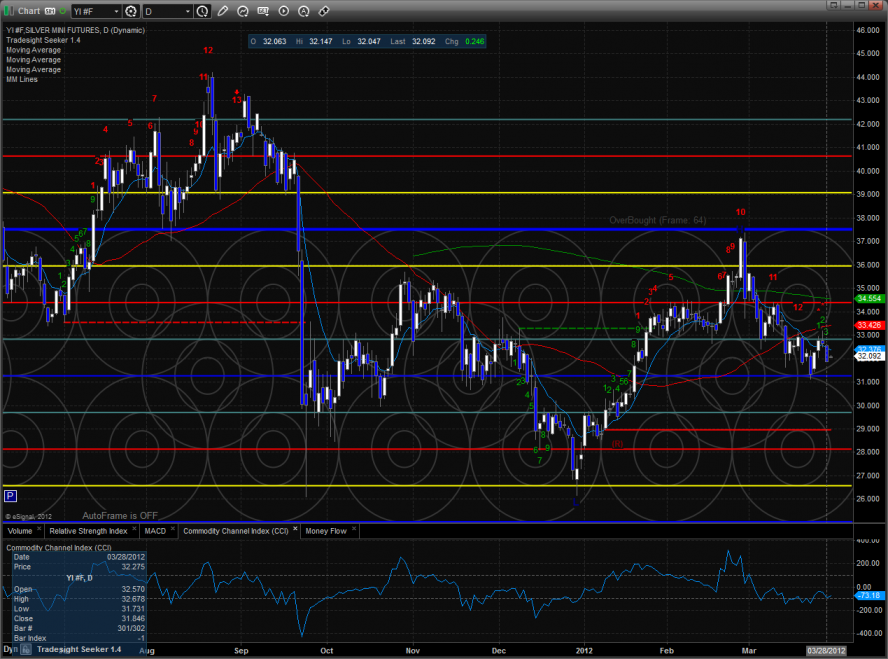

Silver:

Stock Picks Recap for 3/30/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

There were no calls for end of quarter on the report.

In the Messenger, Rich's VXX triggered long (no need for market support on an ETF) and worked:

His CAT triggered short (without market support due to opening five minutes) and worked:

His IBM triggered short (with market support) and worked:

His AAPL triggered short (with market support) and didn't work initially, worked fine after:

AMZN triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Forex Calls Recap for 3/30/12

Totally flat session to end the quarter, which isn't a surprise. See EURUSD below.

Here's the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we'll take a look at the action from Thursday night/Friday, then look at the daily charts with the Seeker and Comber counts separately (nothing new to see, but watch the continuation of last weekend's conversation about USDJPY action), and then look at the US Dollar Index.

EURUSD:

Triggered long at A, finally stopped at B, very flat:

Stock Picks Recap for 3/29/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, CTRP, MDRX, and CAVM gapped under, no plays.

In the Messenger, Rich's AAPL triggered long (without market support due to opening five minutes) and worked:

His AMZN triggered long (without market support) and worked:

His VXX triggered short (market direction irrelevant with an ETF) and worked:

His SHLD triggered short (with market support) and didn't work:

His PNRA triggered long (with market support) and worked:

His NFLX triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Forex Calls Recap for 3/29/12

Not much for results. Basically a loser, a winner, and a flat trade. See EURUSD and GBPUSD sections below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat this evening.

EURUSD:

Triggered short at A, dead flat after, never hit first target or stop, closed at B:

GBPUSD:

Triggered long at A and stopped. Triggered long in the morning at B, closed at C in the money as it hadn't hit first target or stop:

Forex Calls Recap for 3/29/12

Not much for results. Basically a loser, a winner, and a flat trade. See EURUSD and GBPUSD sections below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat this evening.

EURUSD:

Triggered short at A, dead flat after, never hit first target or stop, closed at B:

GBPUSD:

Triggered long at A and stopped. Triggered long in the morning at B, closed at C in the money as it hadn't hit first target or stop:

Tradesight.com Market Preview for 3/29/12

The ES lost 6 handles on the day and filled the open gap in the process which crosses this off the to-do list. Thursday is the day before the end of the month and more importantly the end of the quarter which is the cue for window dressing. Be flexible and respect a return to the dominant upside bias.

The NQ futures were again relatively strong vs. the ES only losing 7 on the day. The 8/8 Murrey math level is just over head and both a draw and strong resistance if reached.

Multi sector daily chart:

The SOX is still relatively weak vs. the NDX and is still a cause for concern for the bulls.

The BTK was the top gun on the day but registered a camouflage sell signal below the high of the move.

The BKX closed right at the 8/8 level showing relative strength but didn’t make a new high on the move. A new high here on Thursday could well be a false move on window dressing so beware.

The OSX bearishly close below the 200dma and a close below Wednesday’s low would qualify the breakdown.

The SOX was much weaker then the broad market and NDX. The Seeker sell signal is still active.

The XAU was the last laggard and closed at a new low. This should not be surprising since it’s the weakest sector of the quarter.

Oil:

Gold:

Silver:

Stock Picks Recap for 3/28/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, HGSI gapped up and opened right at the trigger, which is never really an ideal trigger, worked a little and then came back (gaps tend to fill):

APKT triggered short (with market support) and worked enough for a partial, not much else:

In the Messenger, Rich's BIDU triggered short (with market support) and worked:

His SINA triggered short (with market support) and worked:

His FSLR triggered short (with market support) and worked:

TEVA triggered short (with market support) and worked:

Rich's VMW triggered long in the last few minutes, didn't have enough time to do anything:

His SHLD triggered short (with market support) and worked:

His CAT triggered short (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.