Forex Calls Recap for 3/28/12

The EURUSD and GBPUSD went opposite directions overnight, missing our triggers, and then the EURUSD finally triggered in the morning. See that section below.

Here's the US Dollar Index intraday with our market directional tools:

New calls and Chat this evening.

EURUSD:

Finally triggered short at A and stopped:

Forex Calls Recap for 3/28/12

The EURUSD and GBPUSD went opposite directions overnight, missing our triggers, and then the EURUSD finally triggered in the morning. See that section below.

Here's the US Dollar Index intraday with our market directional tools:

New calls and Chat this evening.

EURUSD:

Finally triggered short at A and stopped:

Tradesight.com Market Preview for 3/28/12

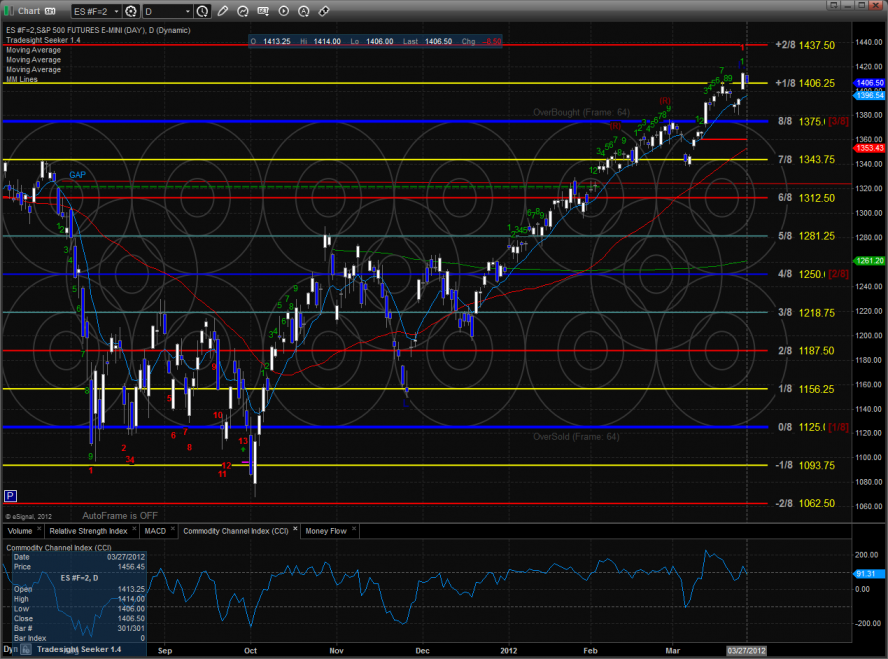

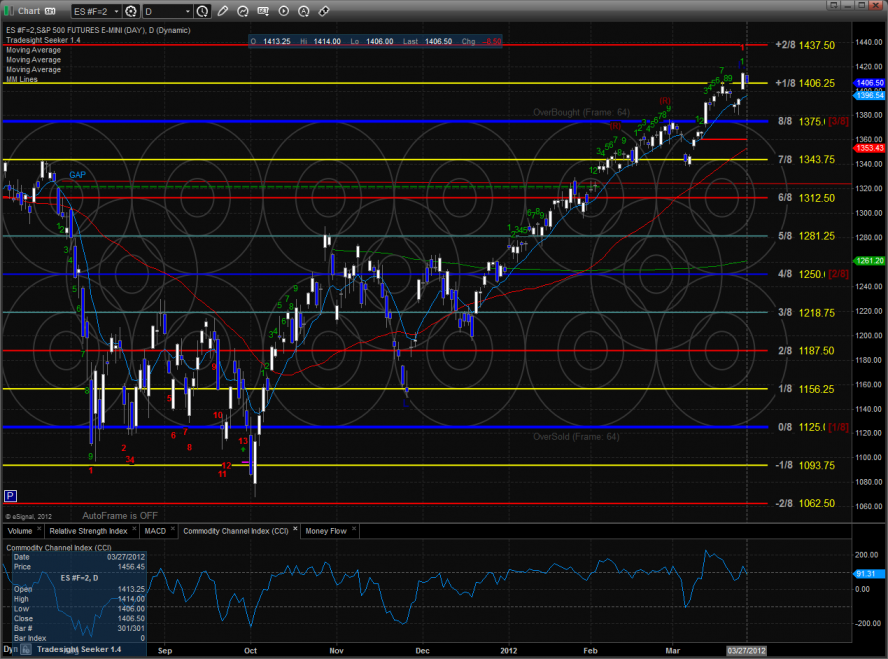

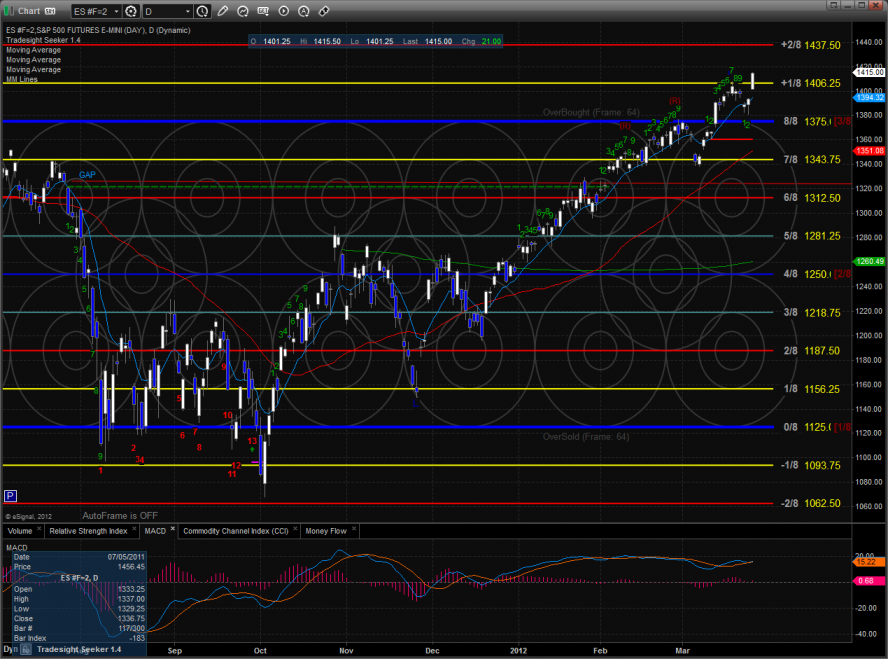

The ES was lower on the day by 8 handles and was totally controlled by yesterday’s range. This leaves an inside day on the chart which works off a tiny bit of the overbought energy in the pattern.

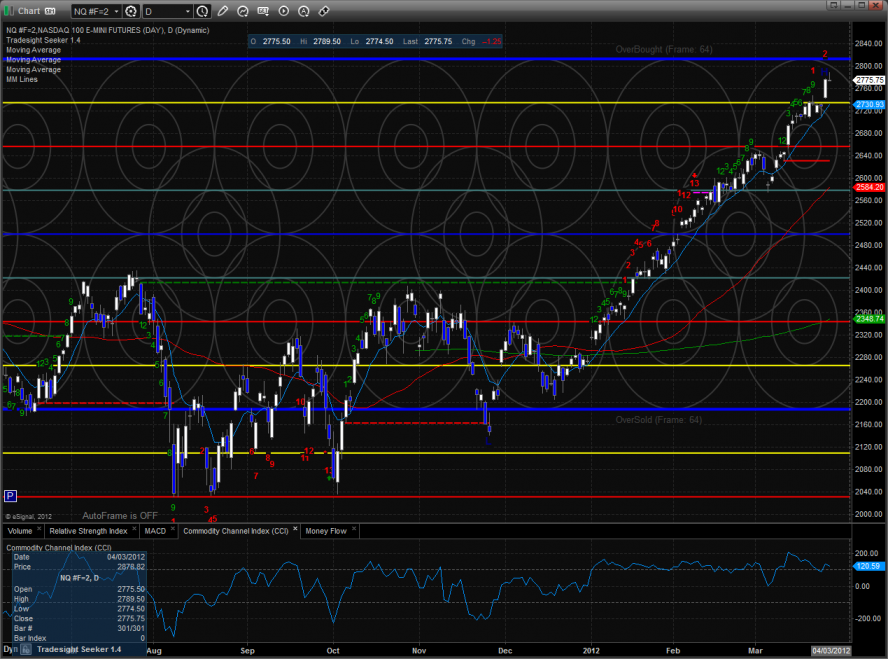

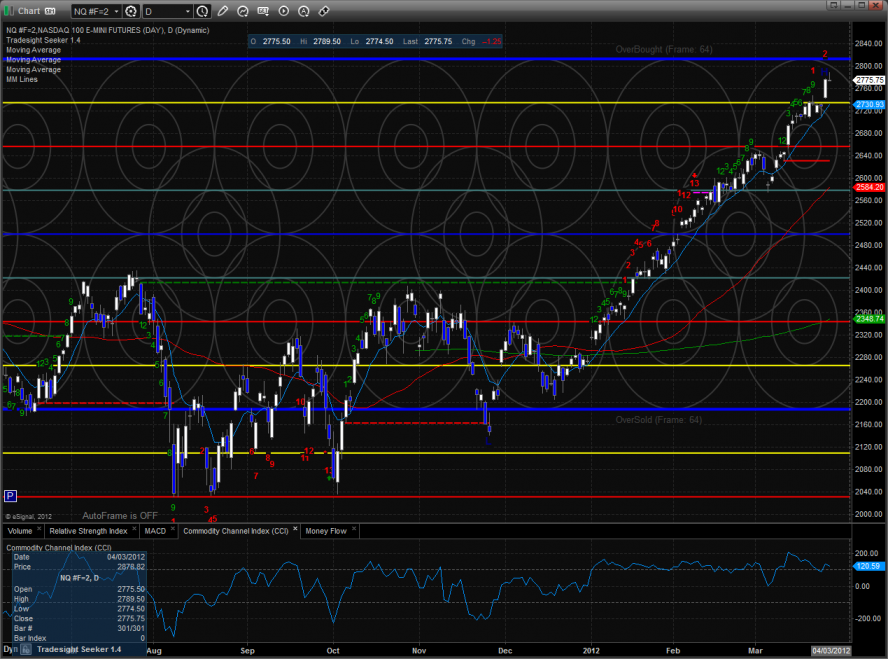

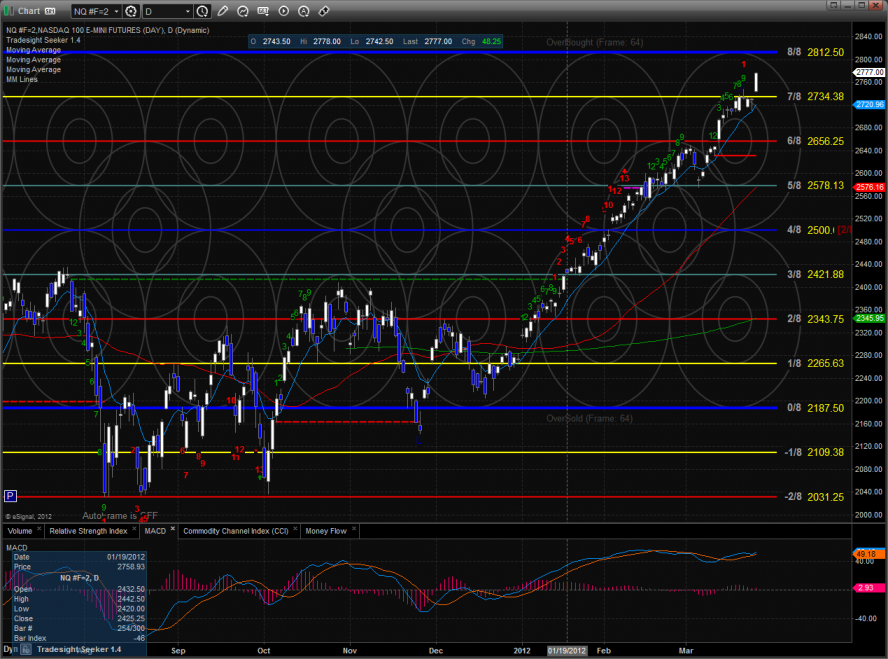

The NQ futures were again relatively strong vs. the SP side. The Naz futures were lower by only 1 point on the day. Price did make a new intraday high on the move so there is no question that this was a range high distribution day. The end of month chicanery is about to start so be prepared for some more volatility.

10-day Trin:

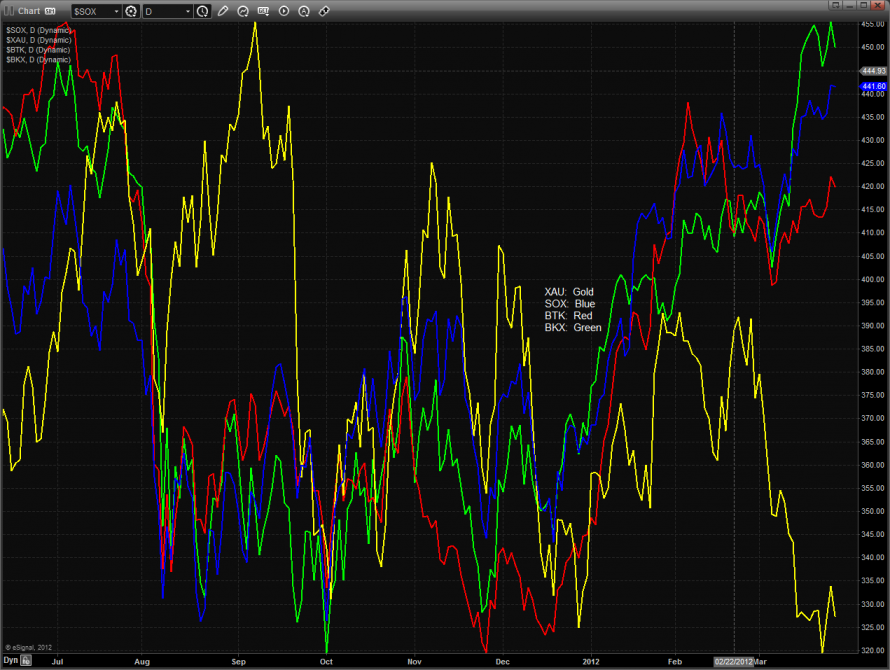

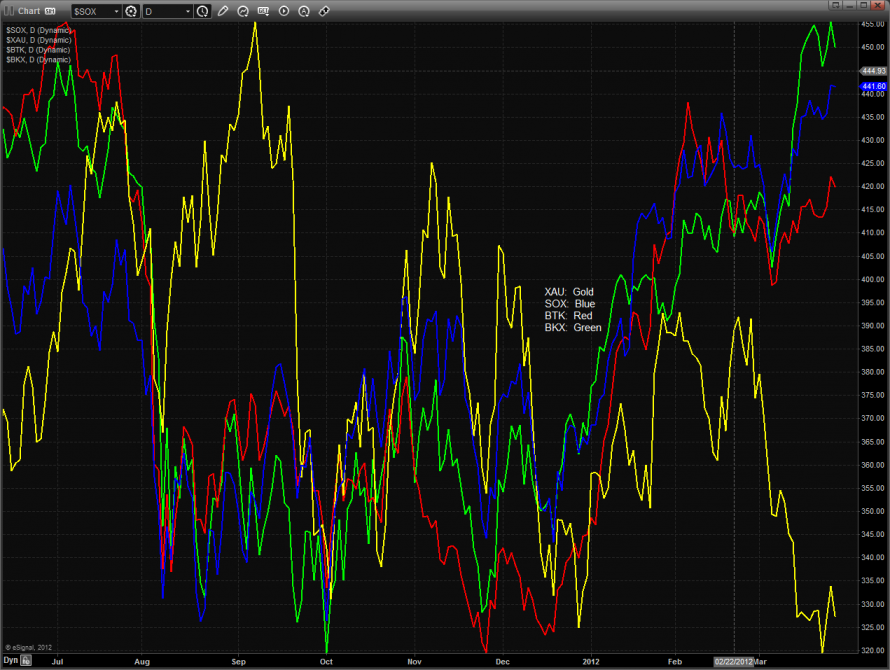

Multi sector daily chart:

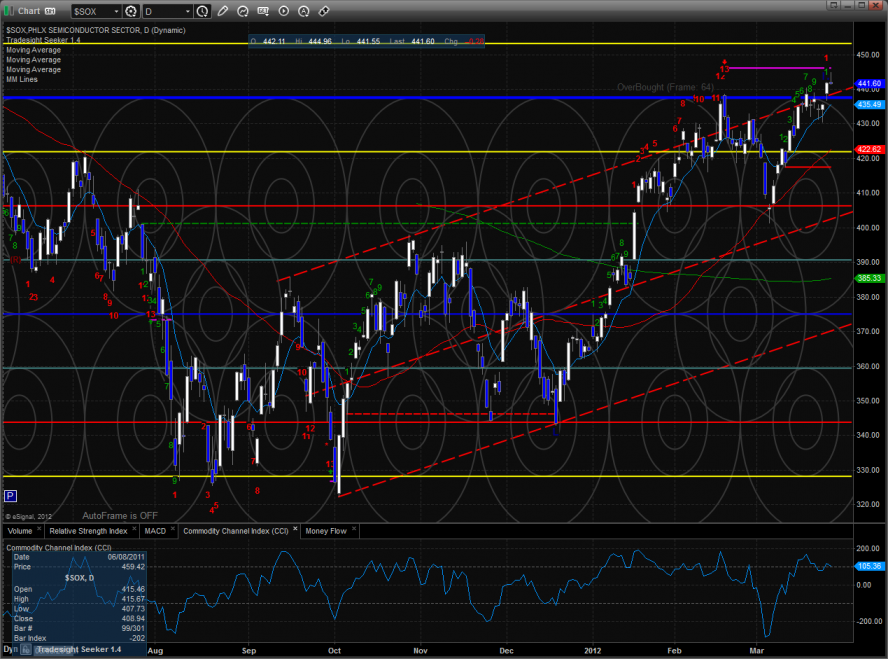

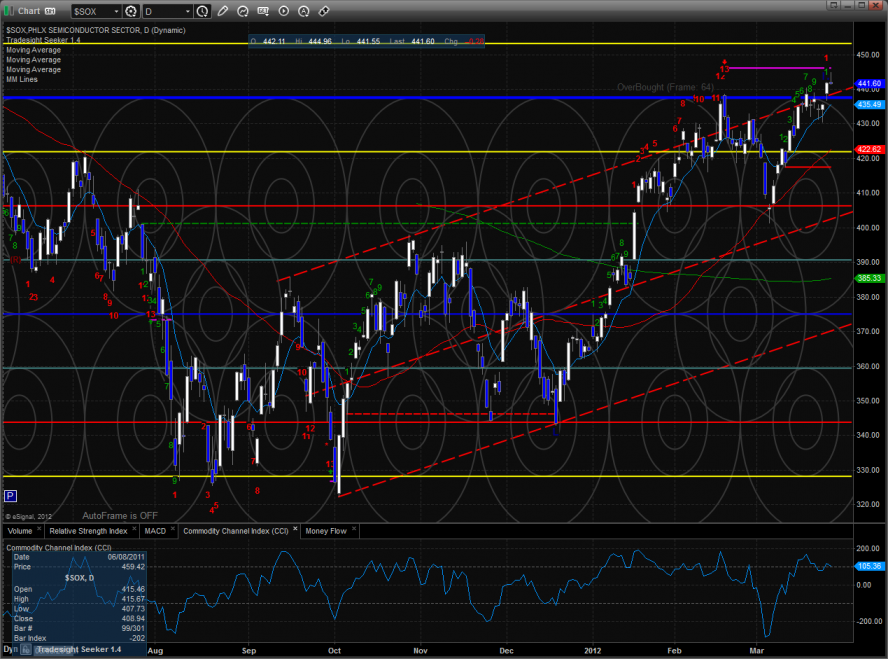

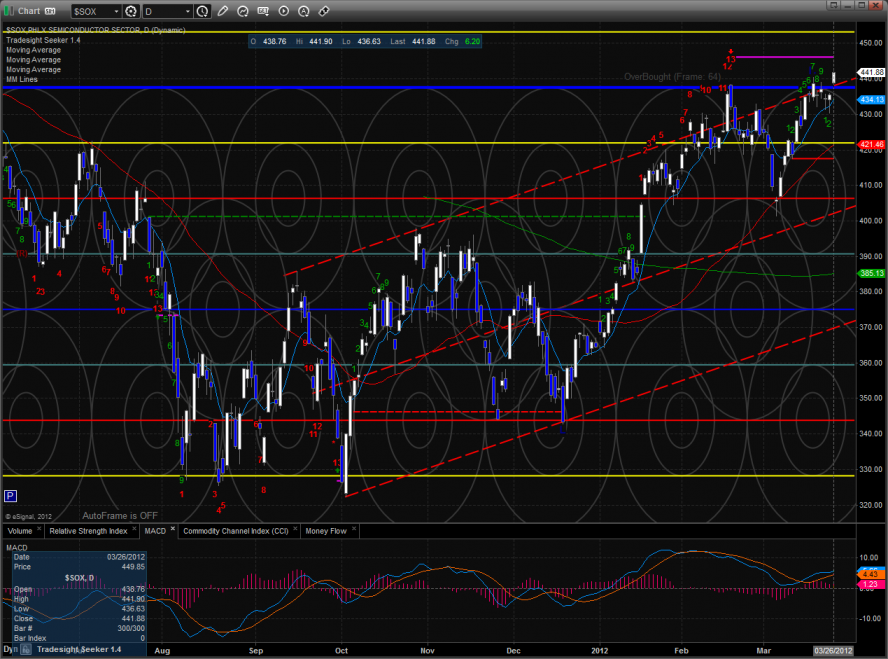

The SOX continues to struggle vs. the overall NDX:

The NDX still has good relative strength vs. the SPX:

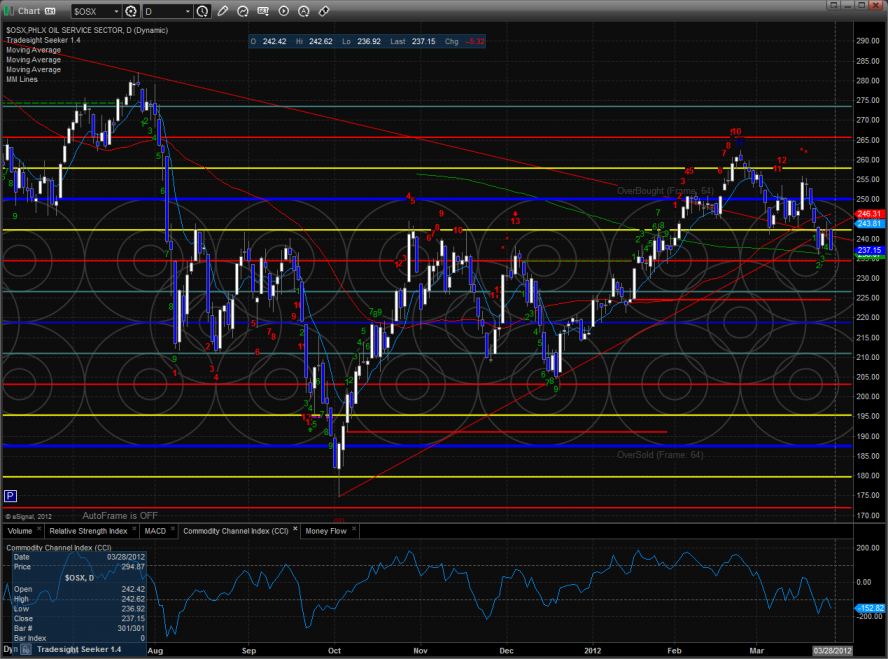

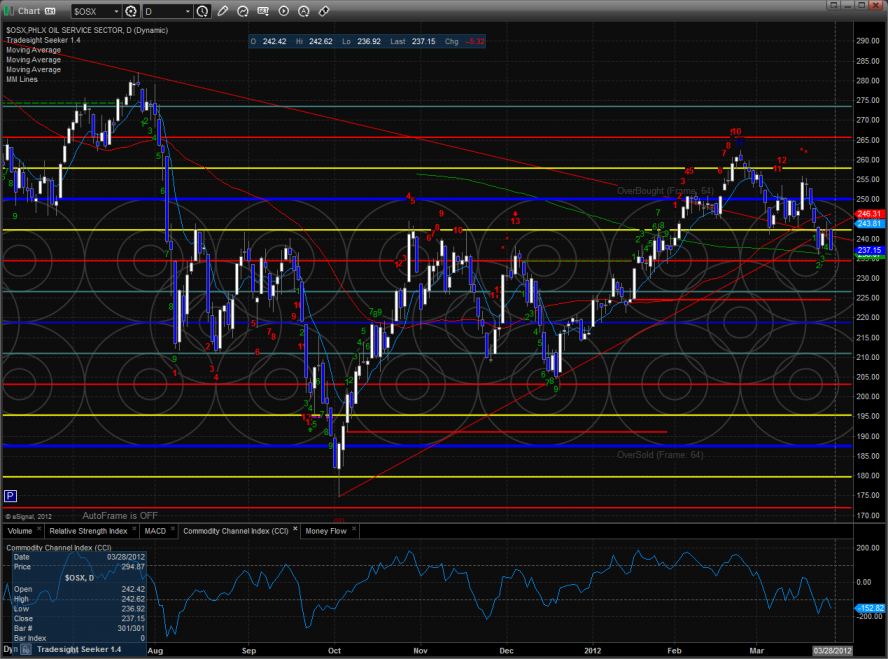

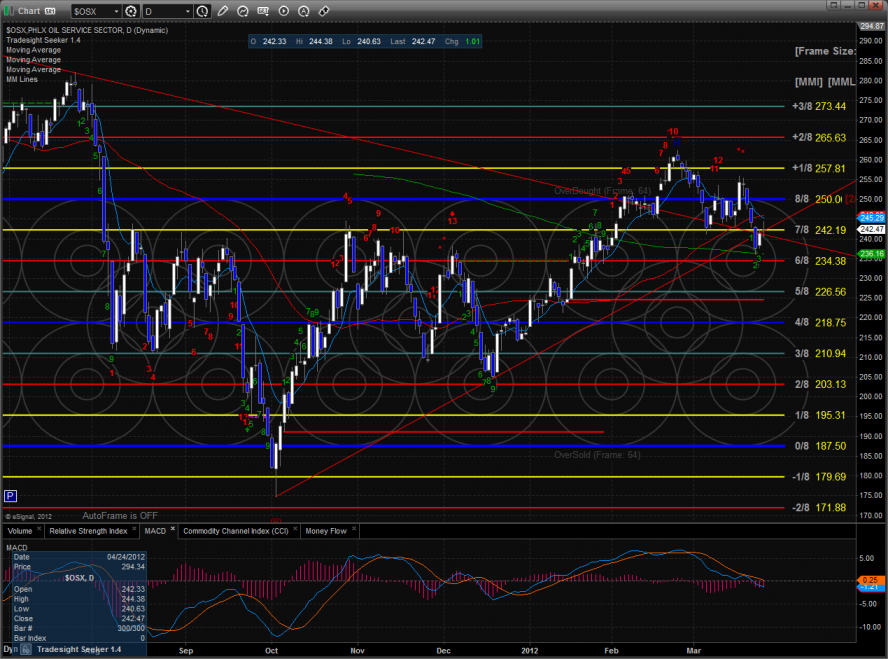

The most notable intermarket divergence continues to be the OSX which bearishly lags crude futures.

The SOX was unchanged on the day almost touching the risk level from the Seeker sell signal.

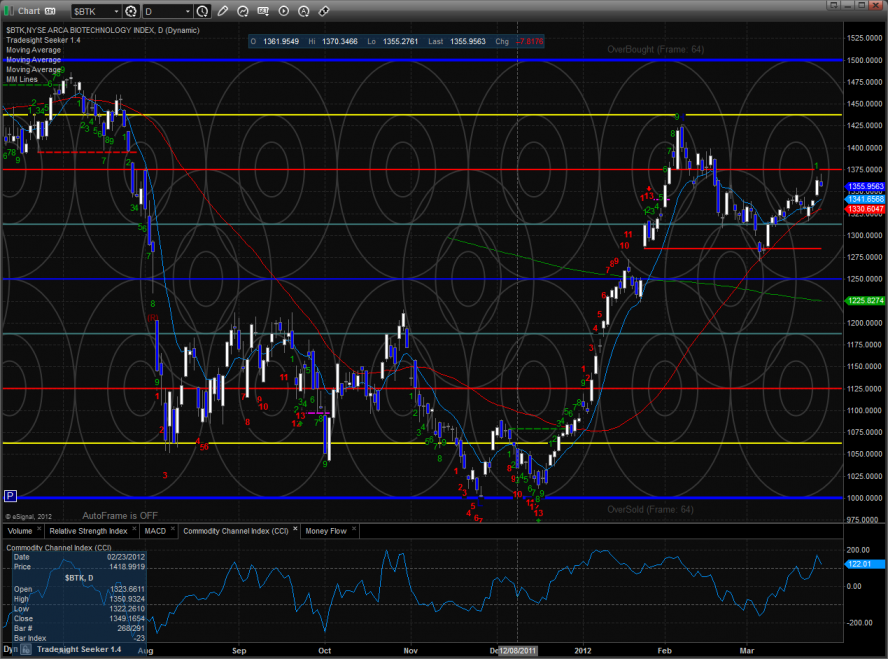

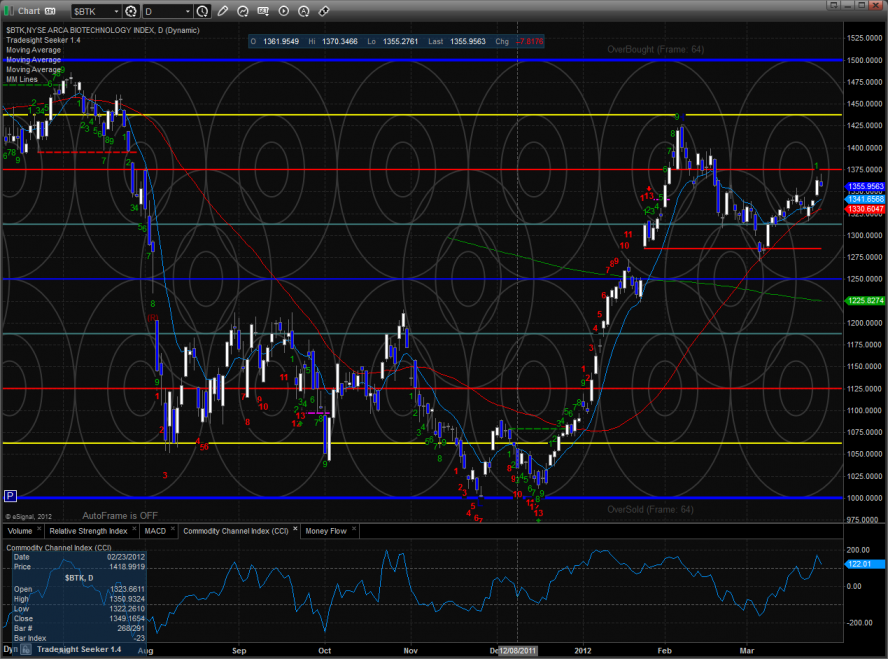

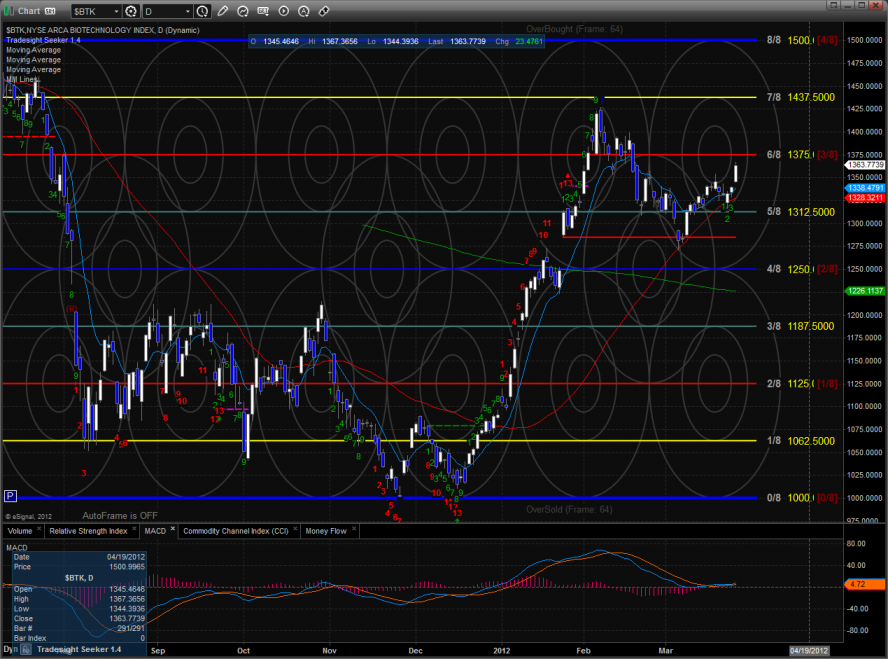

The BTK traded inside yesterday’s range.

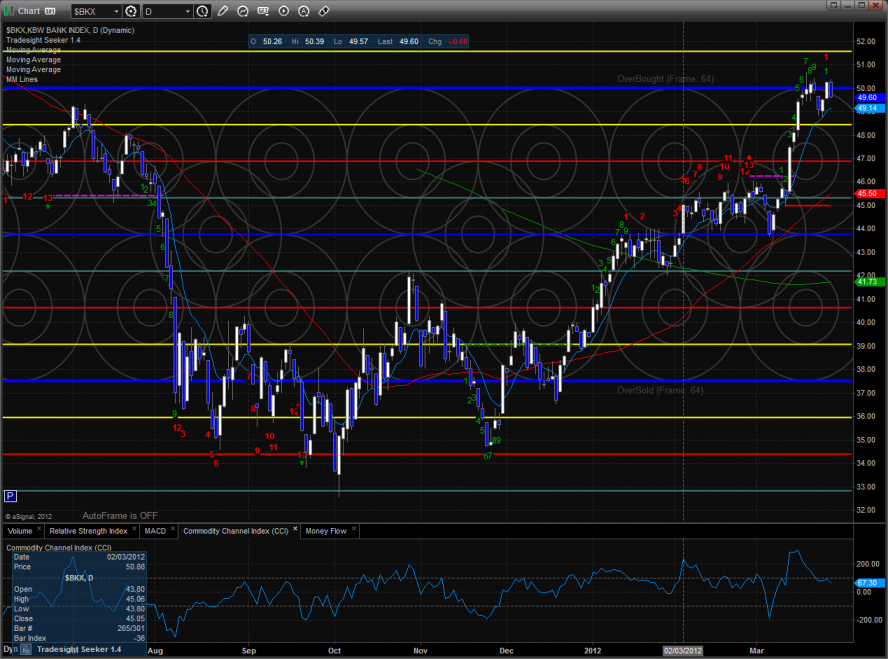

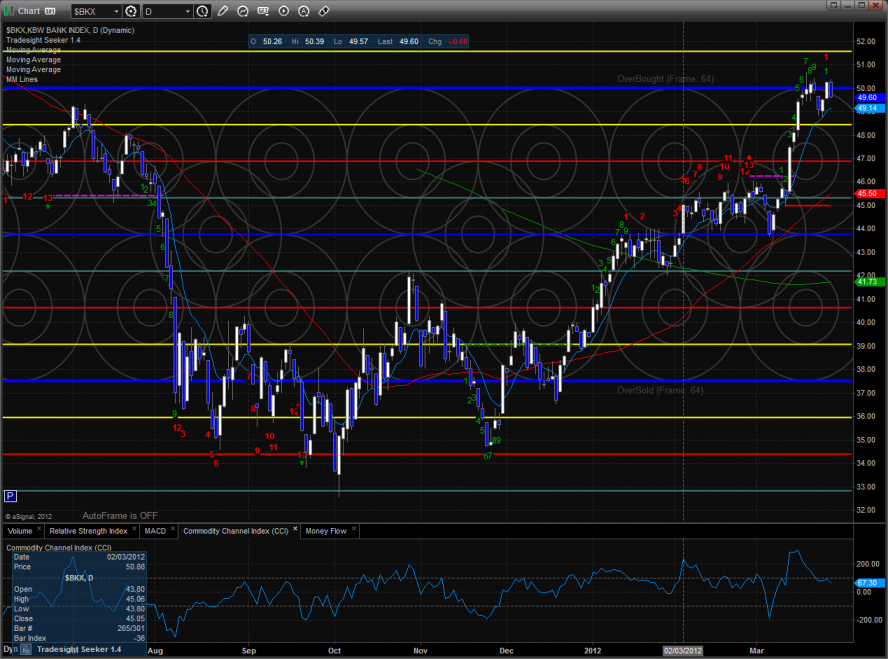

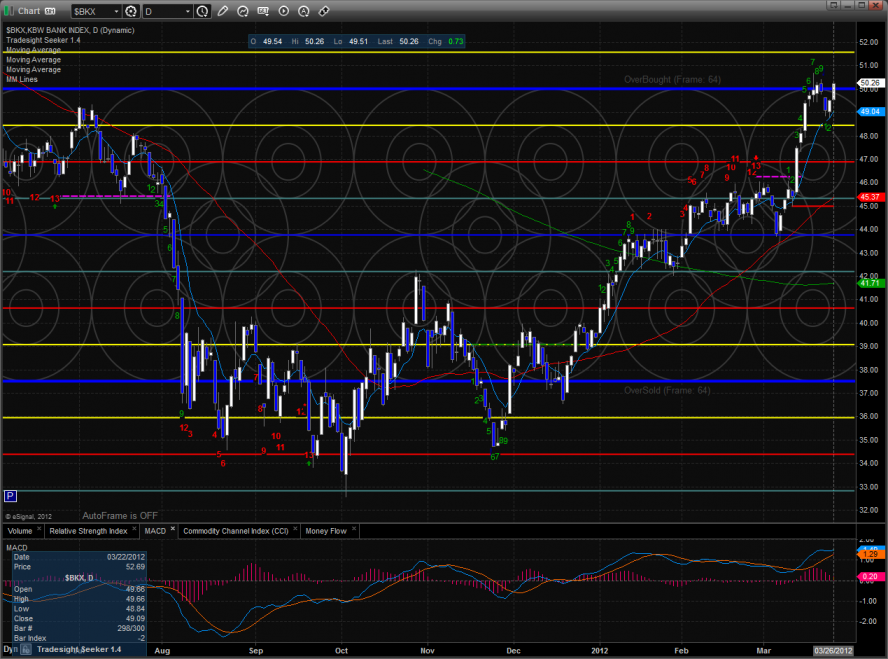

The BKX was lower on the day and weaker than the broad market. Possible signs of fatigue but be sure to allow for end of quarter nonsense in the sectors that have been attracting money.

The OSX was again the last laggard and is just above the very key support area of the 200dma.

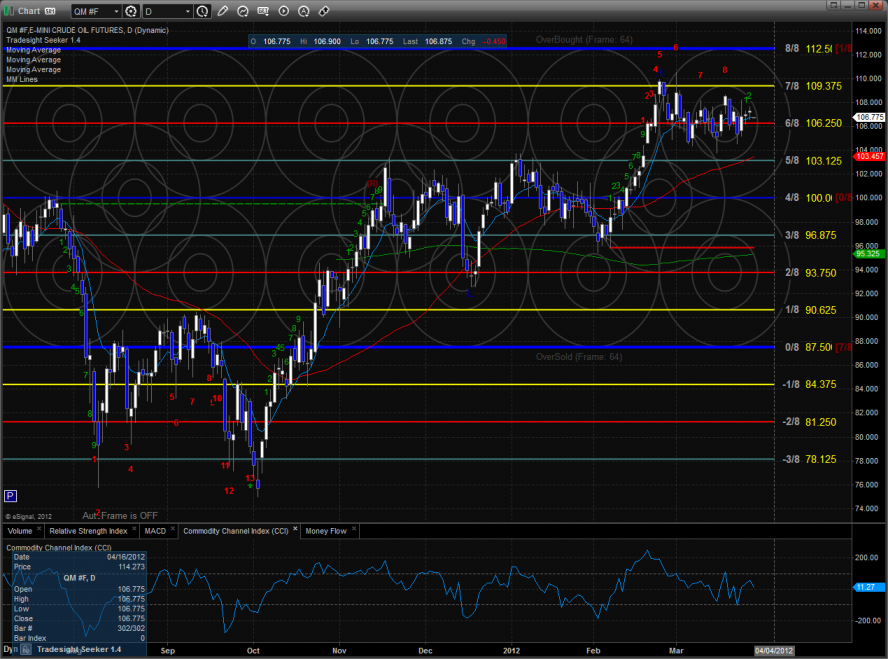

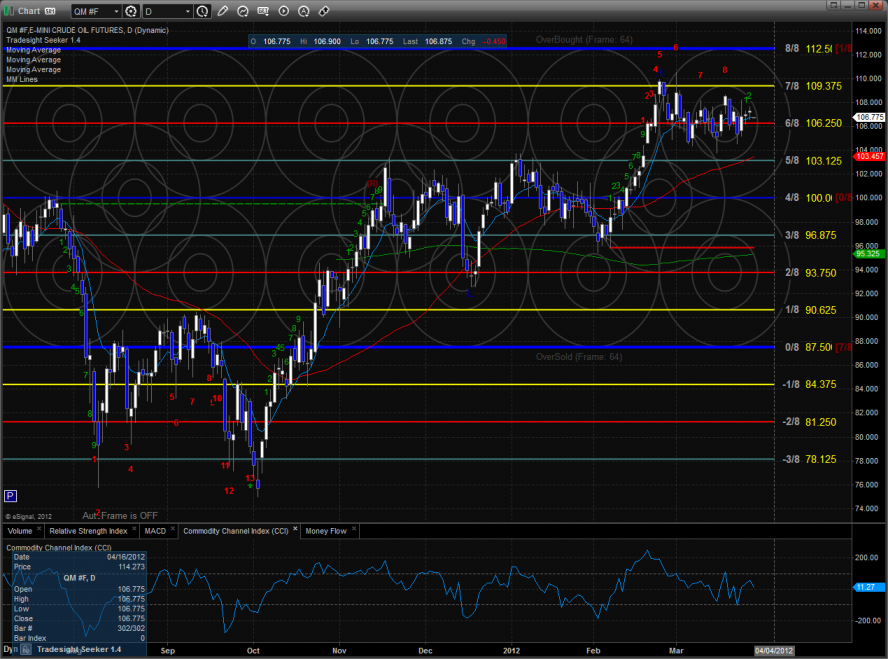

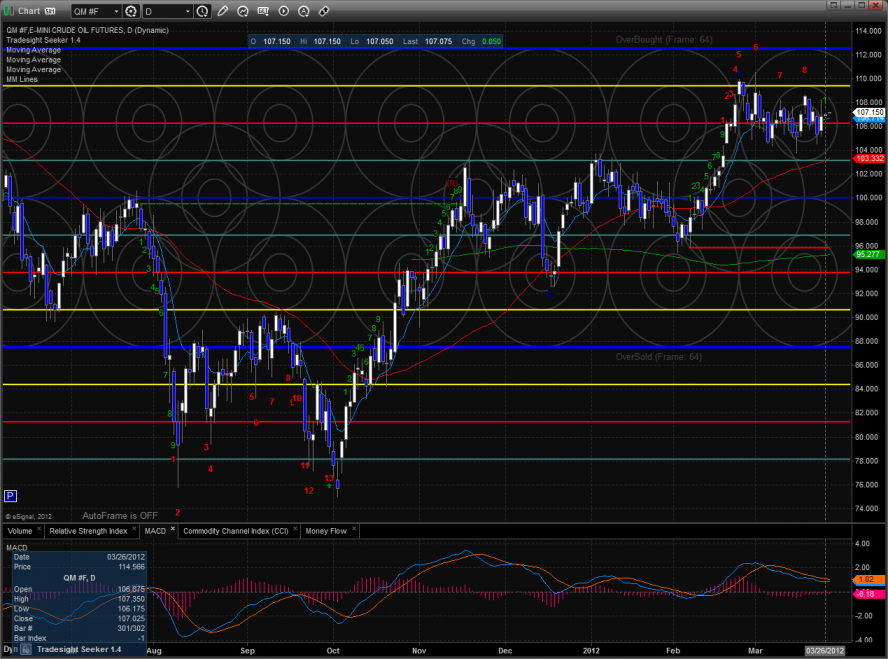

Oil:

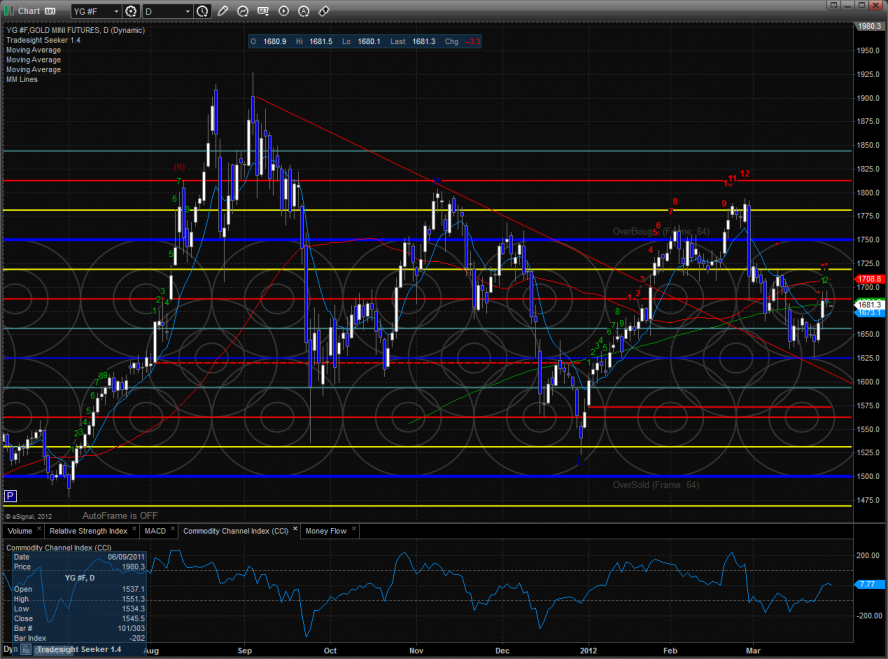

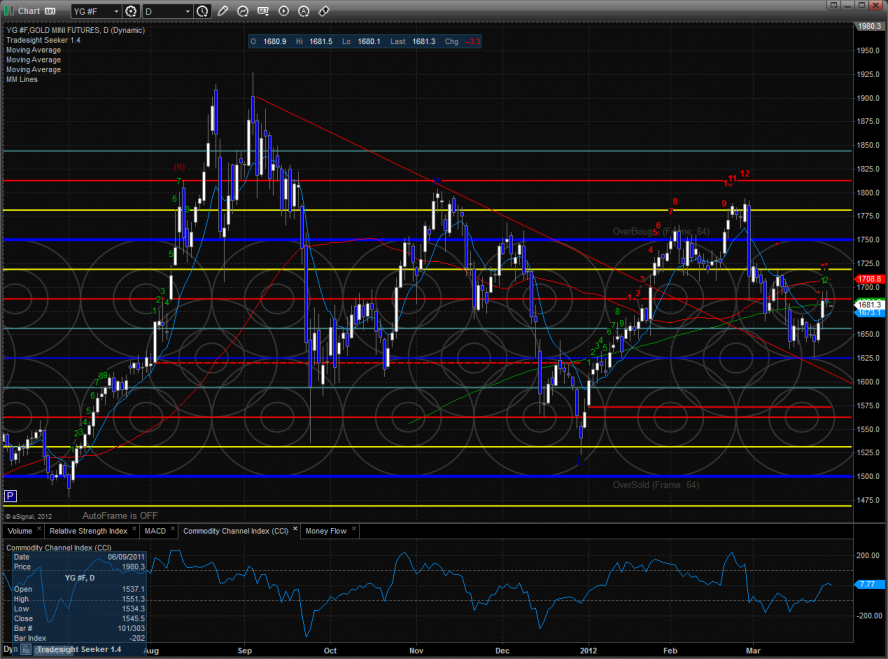

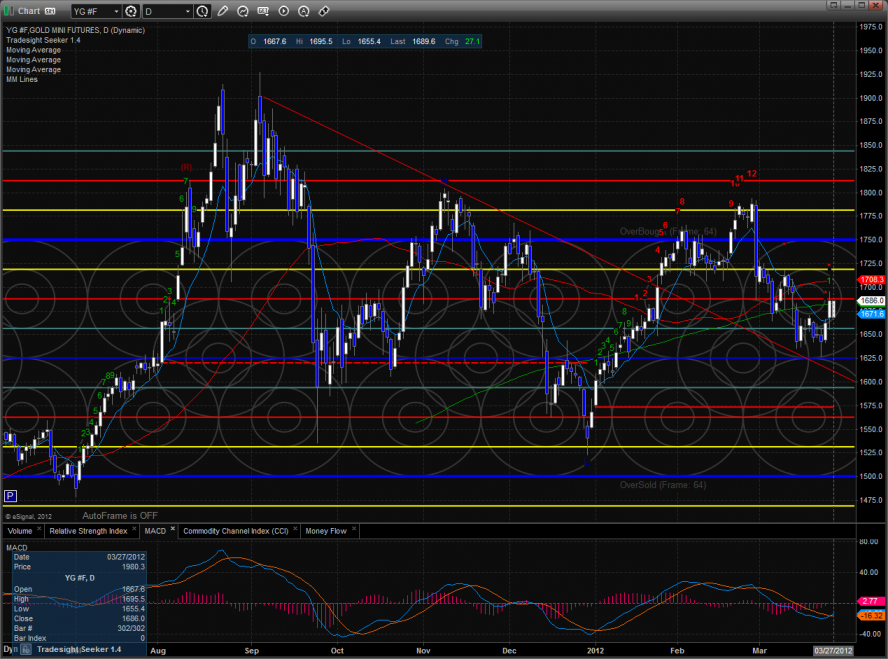

Gold:

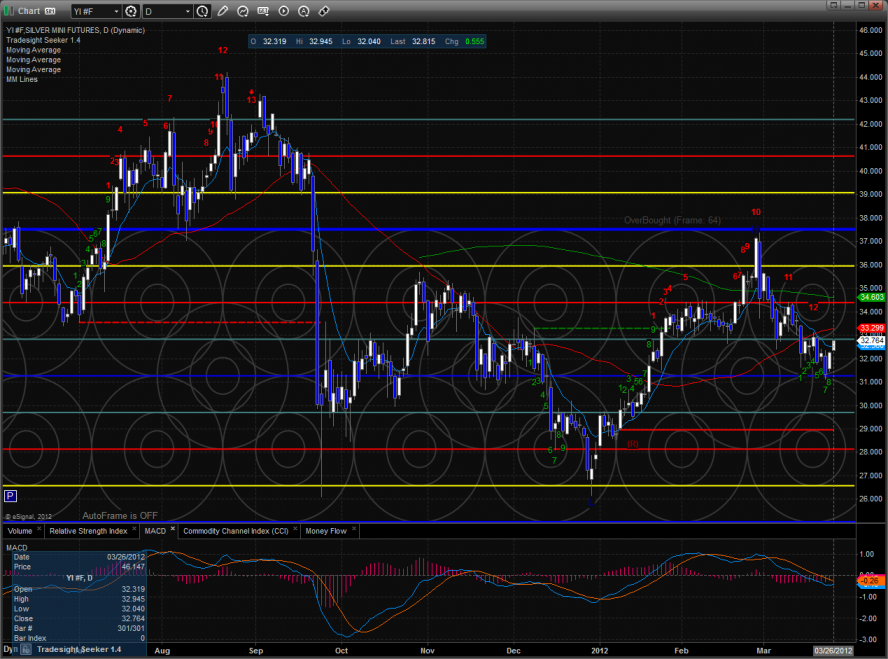

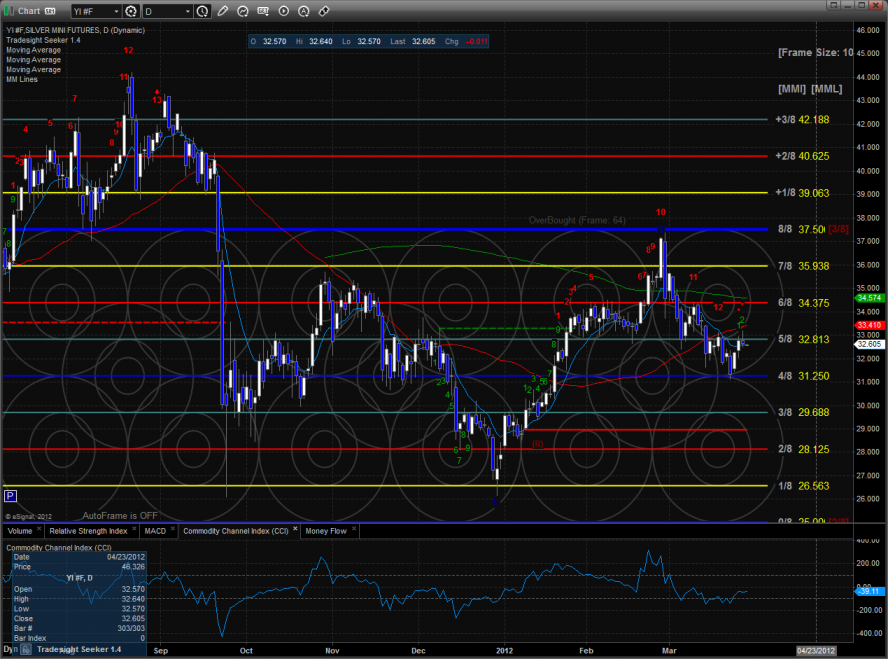

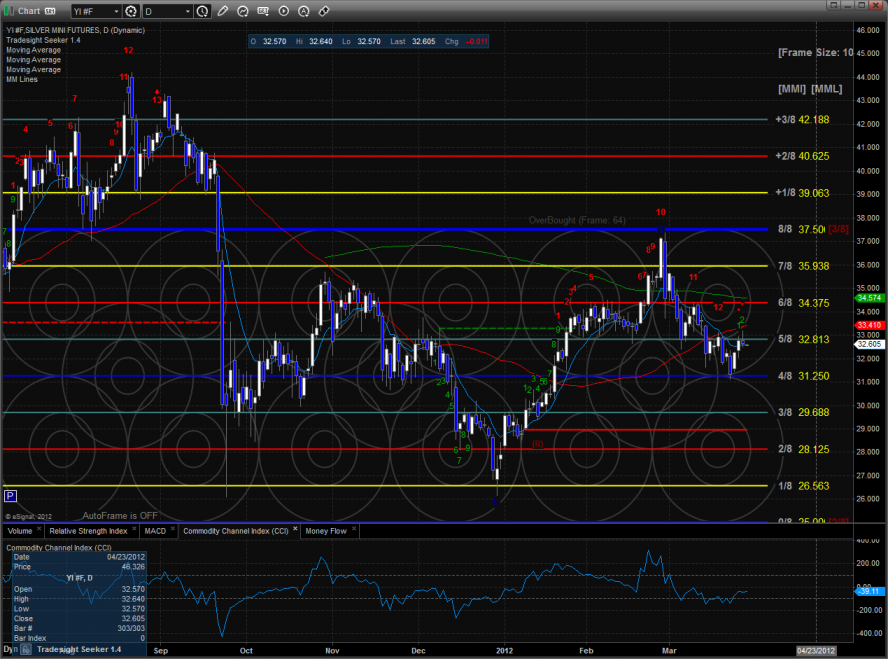

Silver:

Tradesight.com Market Preview for 3/28/12

The ES was lower on the day by 8 handles and was totally controlled by yesterday’s range. This leaves an inside day on the chart which works off a tiny bit of the overbought energy in the pattern.

The NQ futures were again relatively strong vs. the SP side. The Naz futures were lower by only 1 point on the day. Price did make a new intraday high on the move so there is no question that this was a range high distribution day. The end of month chicanery is about to start so be prepared for some more volatility.

10-day Trin:

Multi sector daily chart:

The SOX continues to struggle vs. the overall NDX:

The NDX still has good relative strength vs. the SPX:

The most notable intermarket divergence continues to be the OSX which bearishly lags crude futures.

The SOX was unchanged on the day almost touching the risk level from the Seeker sell signal.

The BTK traded inside yesterday’s range.

The BKX was lower on the day and weaker than the broad market. Possible signs of fatigue but be sure to allow for end of quarter nonsense in the sectors that have been attracting money.

The OSX was again the last laggard and is just above the very key support area of the 200dma.

Oil:

Gold:

Silver:

Stock Picks Recap for 3/27/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, QLIK triggered long (without market support due to opening five minutes) and worked:

MLHR triggered long (with market support) and didn't work:

In the Messenger, NFLX triggered long (with market support) and worked:

Rich's VXX (ETF call so no market support needed) triggered long and worked:

GOOG triggered long (with market support) and worked enough for a quick partial:

Rich's STRA triggered short (with market support) and worked:

His JOY triggered short in the last ten minutes of the day, so we won't count it.

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Forex Calls Recap for 3/27/12

A very dull session and one stop out on the EURUSD. See that section below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with market directional lines:

EURUSD:

Triggered long at A and stopped. Dead night:

Stock Picks Recap for 3/26/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, ENDP triggered long (without market support due to opening five minutes) and worked great:

CTSH triggered long (with market support) and worked:

TIVO triggered long (with market support) and didn't work:

EGLE triggered long (without market support due to opening five minutes, but this is a Small Cap pick and should just be taken) and worked:

In the Messenger, Rich's ALXN triggered long (without market support due to opening five minutes) and worked:

His BIDU triggered long (with market support) and worked:

RIMM triggered short (without market support) and didn't work:

AMZN triggered long (with market support) and worked great:

Rich's VMW triggered long (with market support) and didn't work:

TEVA triggered short (without market support) and didn't work:

Rich's UA triggered long (with market support) and didn't work:

Rich's MA triggered long (with market support) and worked:

Rich's MDVN triggered long (with market support) and worked:

GOOG triggered long (with market support) and worked:

In total, that's 9 trades triggering with market support, 6 of them worked (several extremely well, which was a surprise given market volume), 3 did not.

Stock Picks Recap for 3/26/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, ENDP triggered long (without market support due to opening five minutes) and worked great:

CTSH triggered long (with market support) and worked:

TIVO triggered long (with market support) and didn't work:

EGLE triggered long (without market support due to opening five minutes, but this is a Small Cap pick and should just be taken) and worked:

In the Messenger, Rich's ALXN triggered long (without market support due to opening five minutes) and worked:

His BIDU triggered long (with market support) and worked:

RIMM triggered short (without market support) and didn't work:

AMZN triggered long (with market support) and worked great:

Rich's VMW triggered long (with market support) and didn't work:

TEVA triggered short (without market support) and didn't work:

Rich's UA triggered long (with market support) and didn't work:

Rich's MA triggered long (with market support) and worked:

Rich's MDVN triggered long (with market support) and worked:

GOOG triggered long (with market support) and worked:

In total, that's 9 trades triggering with market support, 6 of them worked (several extremely well, which was a surprise given market volume), 3 did not.

Forex Calls Recap for 3/26/12

Two winners to start the week in the EURUSD, see below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

Triggered short at A, hit first target at B (never went 20 pips plus against the LBreak), second half stopped overnight. Triggered long at D, used R1 as support after that, closed the whole thing for 30 pips gain as it never hit first target or stopped:

Tradesight.com Market Preview for 3/27/12

The ES broke to new highs on the move and has cleared the next level of resistance and is moving deeper into the Murrey math overbought territory.

The NQ futures also hit a new high gaining 48 on the day. Price is beginning to accelerate and get parabolic with a next target of 2812.50.

The 10-day Trin recently hit the overbought threshold but has yet to produce a reversal. The overall design still has overbought energy to be released.

Multi sector daily chart:

The NDX continues to show relative strength vs. SPX:

The BTK was the top gun on the day pivoting off support from the rising 50dma.

The XAU was stronger than the broad market which is a cause for concern to the bulls since a defensive sector is attracting money.

The BKX was up 1.5% which makes a new closing high but not new absolute high on the move.

The SOX made a new high on the move. Keep in mind that the Seeker still has an active sell signal in place and the risk level has yet to be violated.

The OSX was the last laggard on the day and continues to be an underperformer.

Oil:

Gold:

Silver: