Tradesight.com Market Preview for 3/27/12

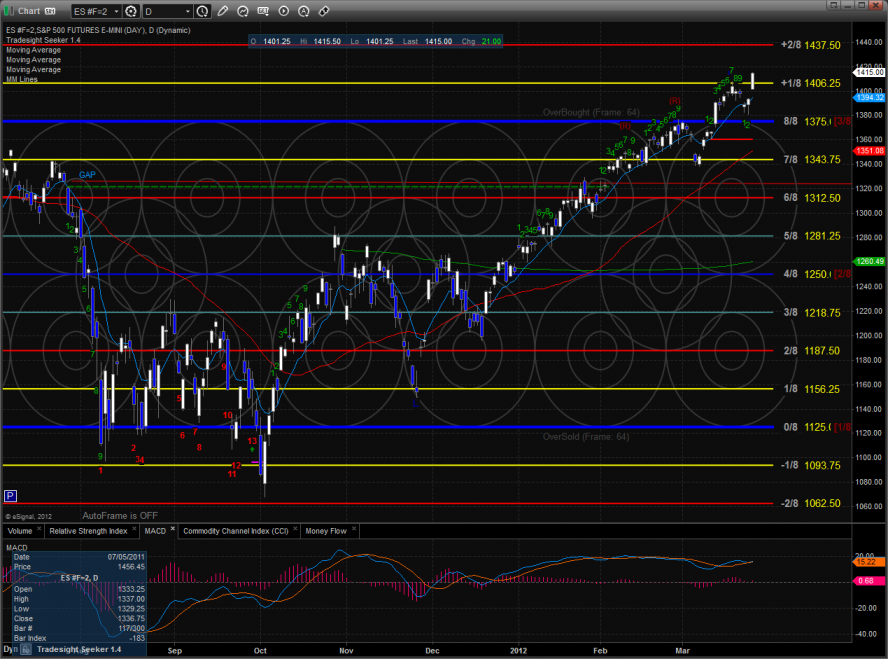

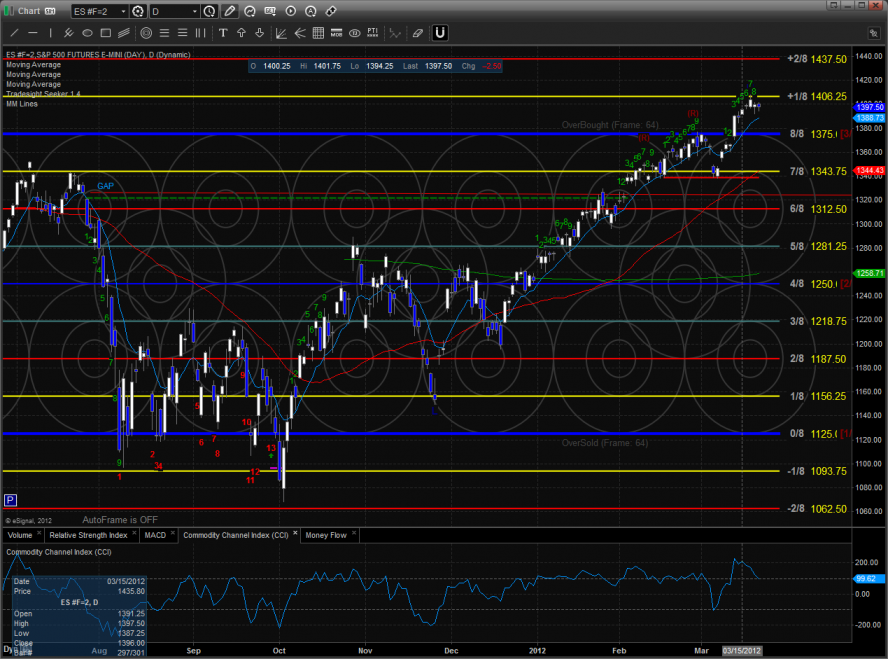

The ES broke to new highs on the move and has cleared the next level of resistance and is moving deeper into the Murrey math overbought territory.

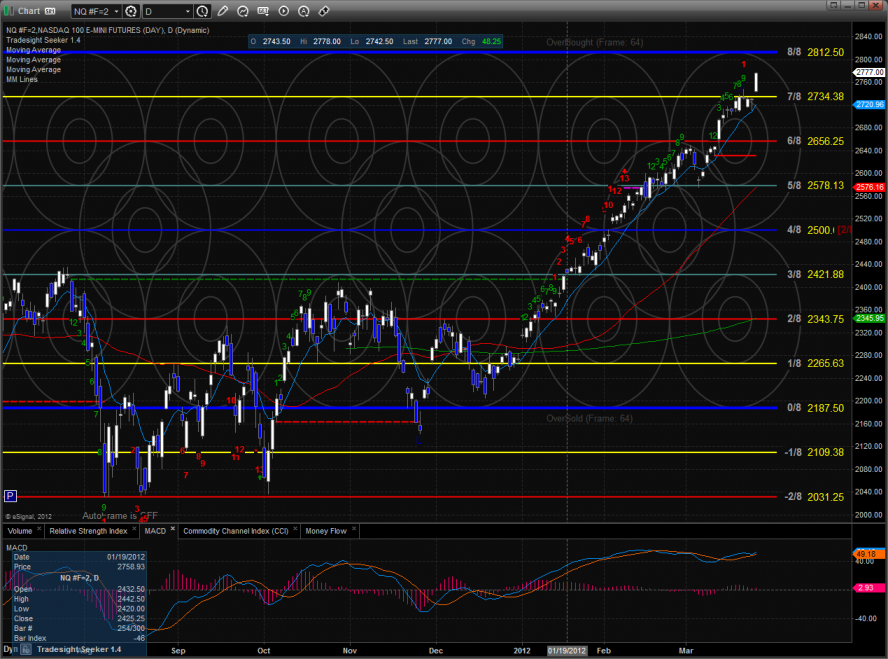

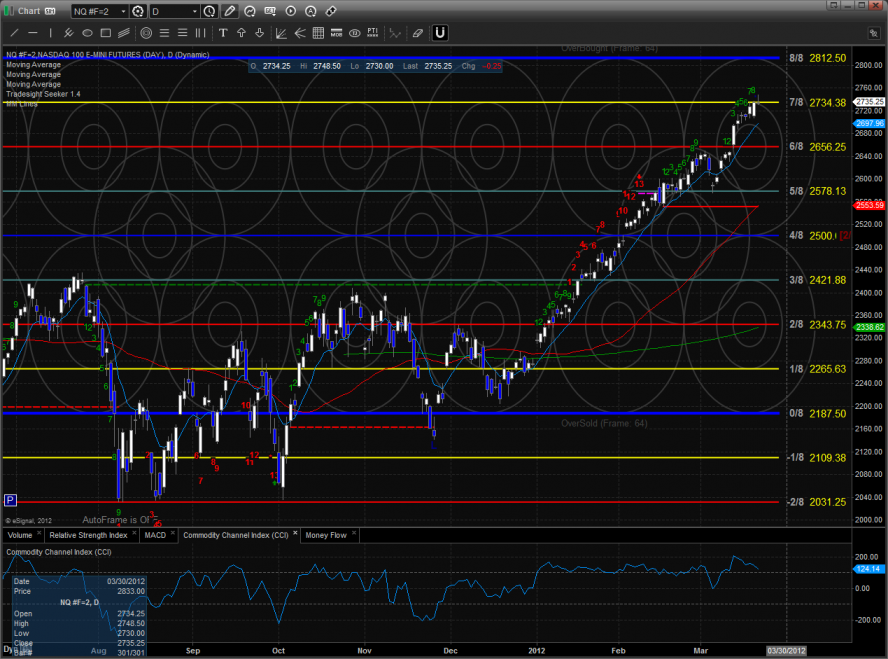

The NQ futures also hit a new high gaining 48 on the day. Price is beginning to accelerate and get parabolic with a next target of 2812.50.

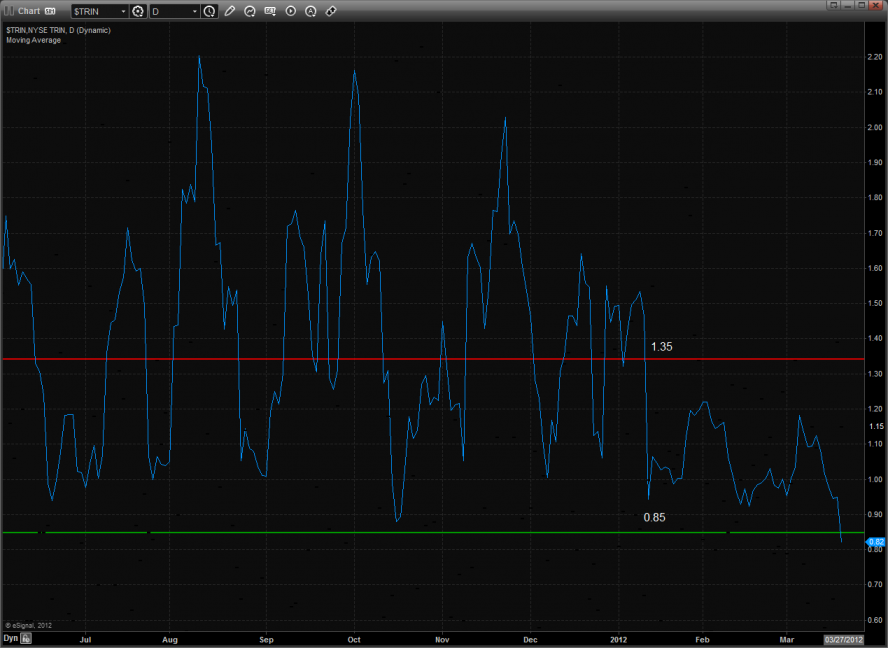

The 10-day Trin recently hit the overbought threshold but has yet to produce a reversal. The overall design still has overbought energy to be released.

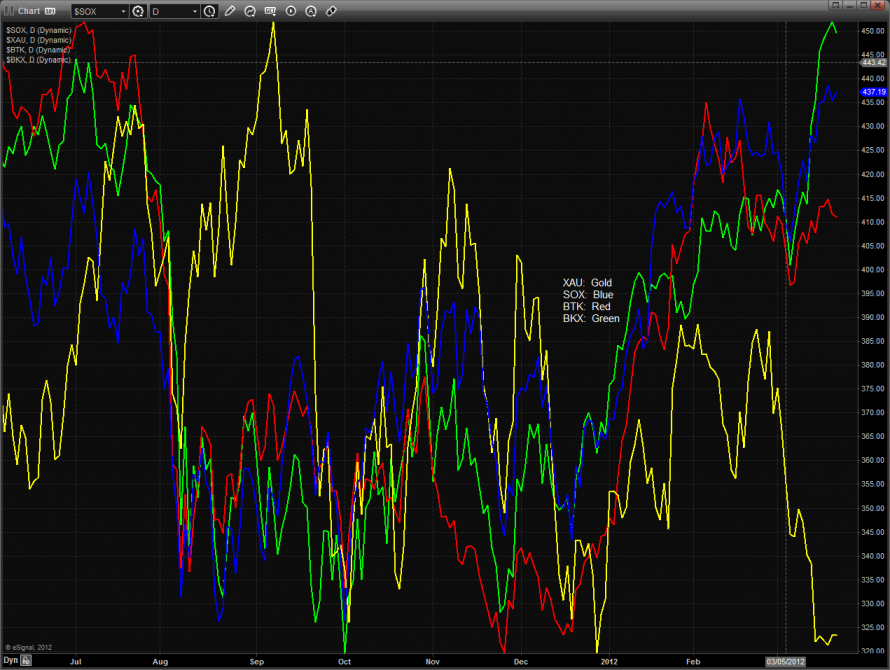

Multi sector daily chart:

The NDX continues to show relative strength vs. SPX:

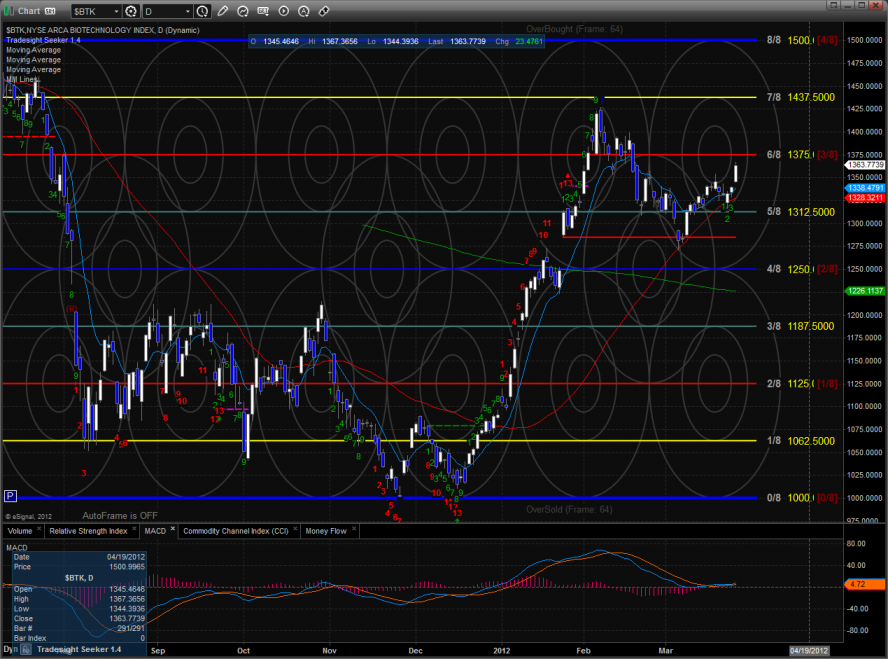

The BTK was the top gun on the day pivoting off support from the rising 50dma.

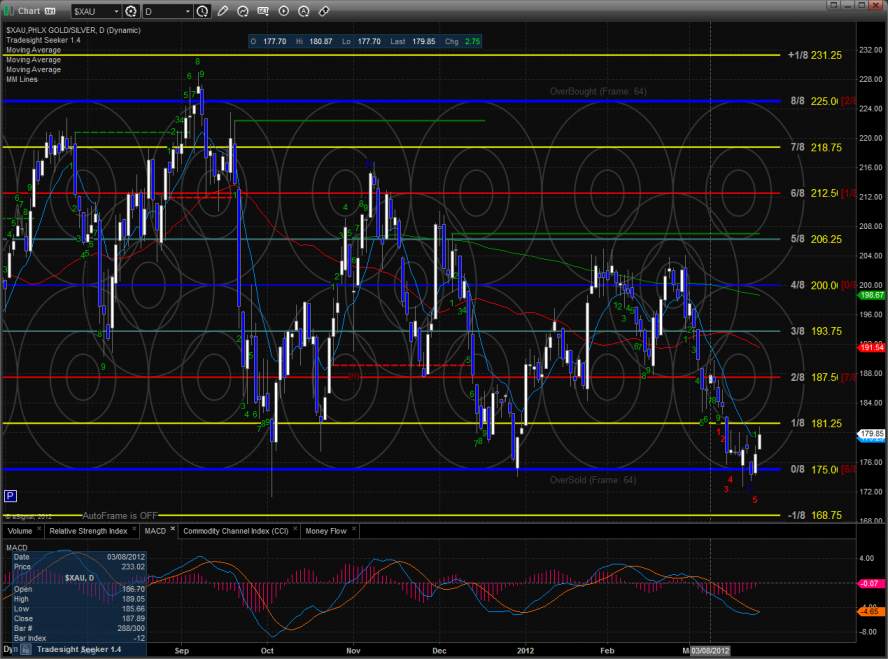

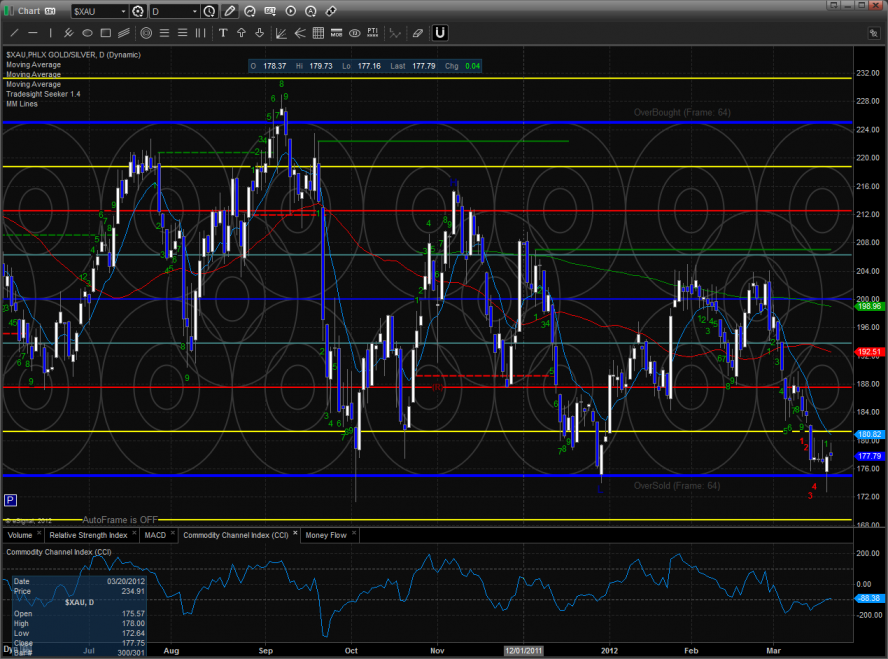

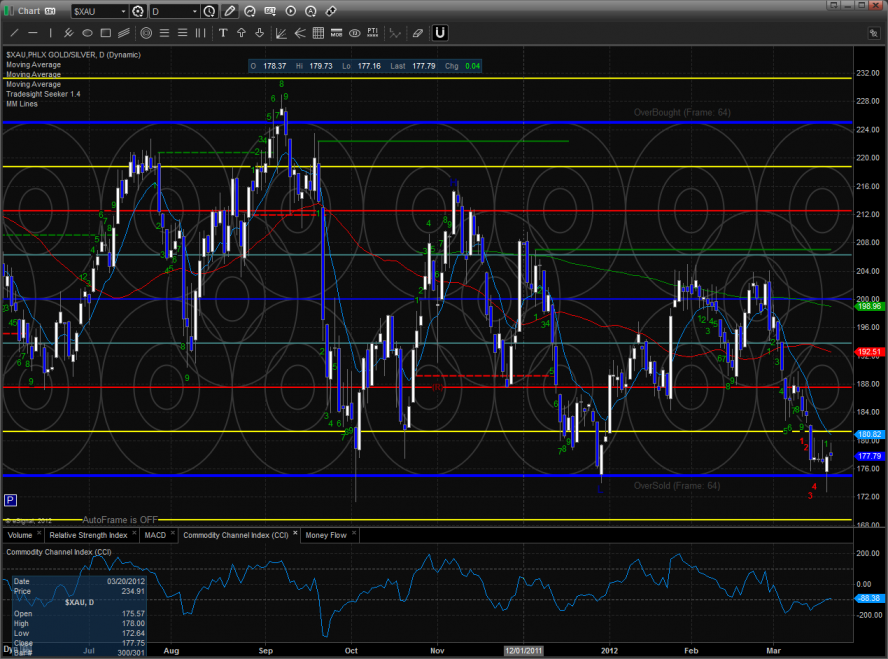

The XAU was stronger than the broad market which is a cause for concern to the bulls since a defensive sector is attracting money.

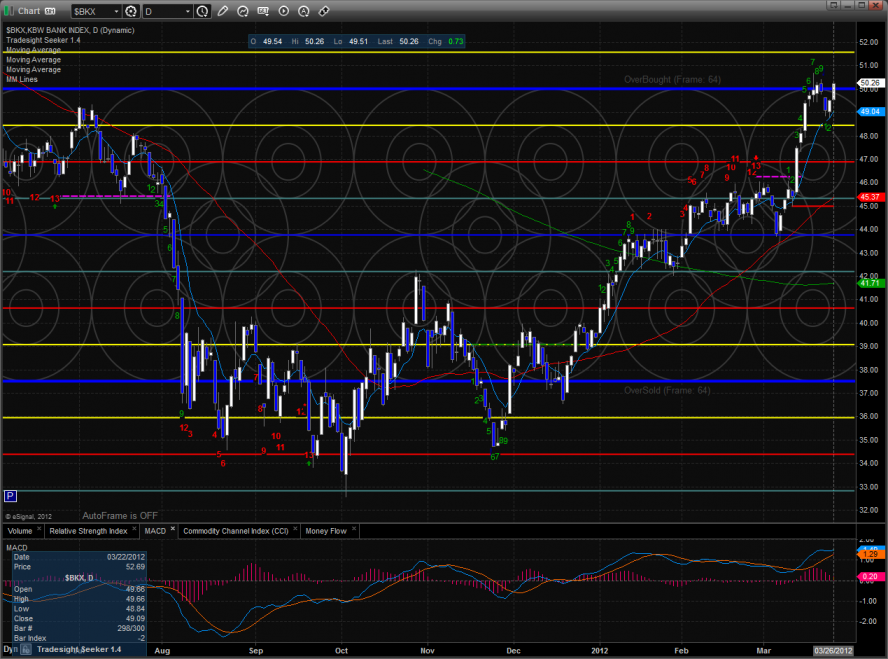

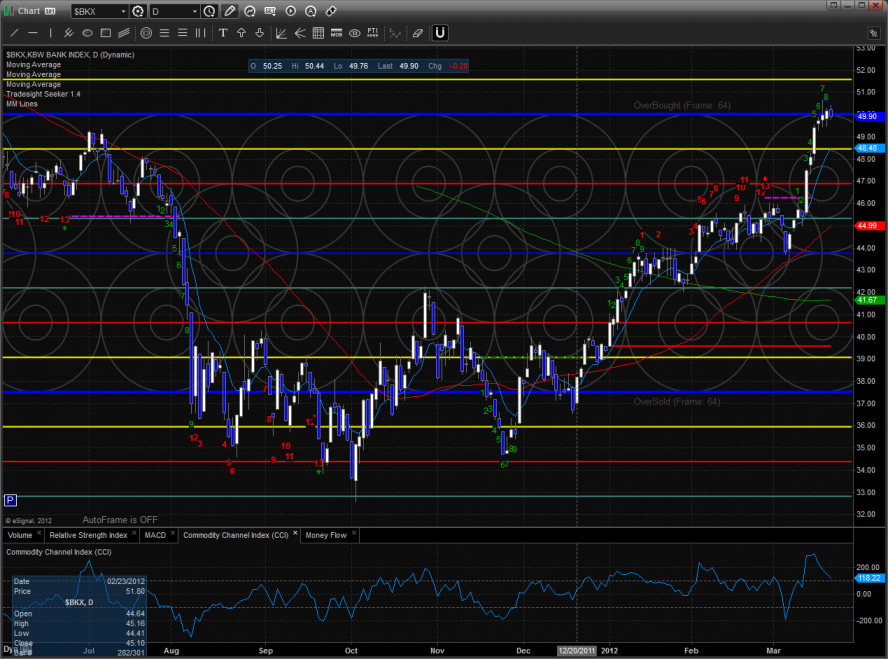

The BKX was up 1.5% which makes a new closing high but not new absolute high on the move.

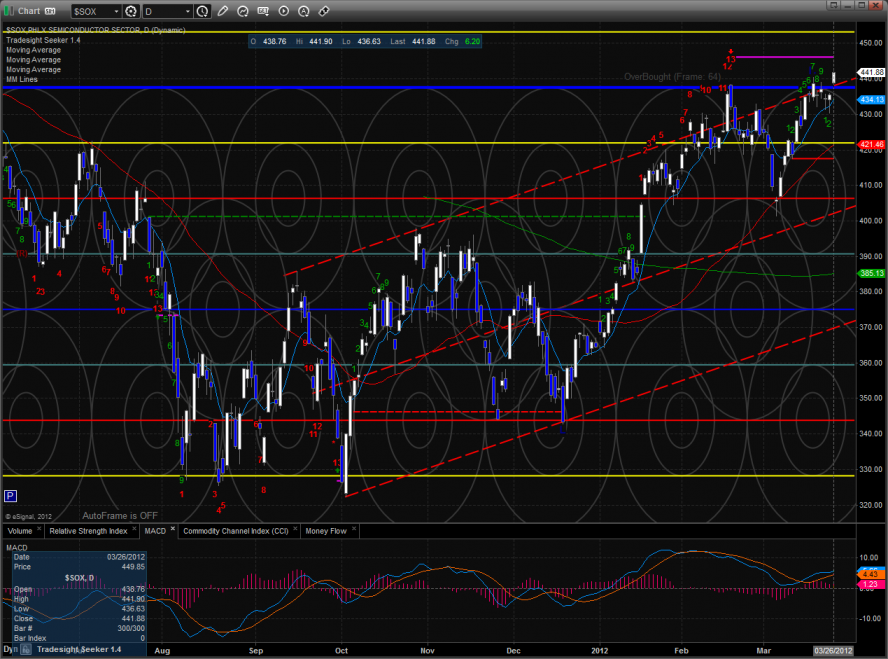

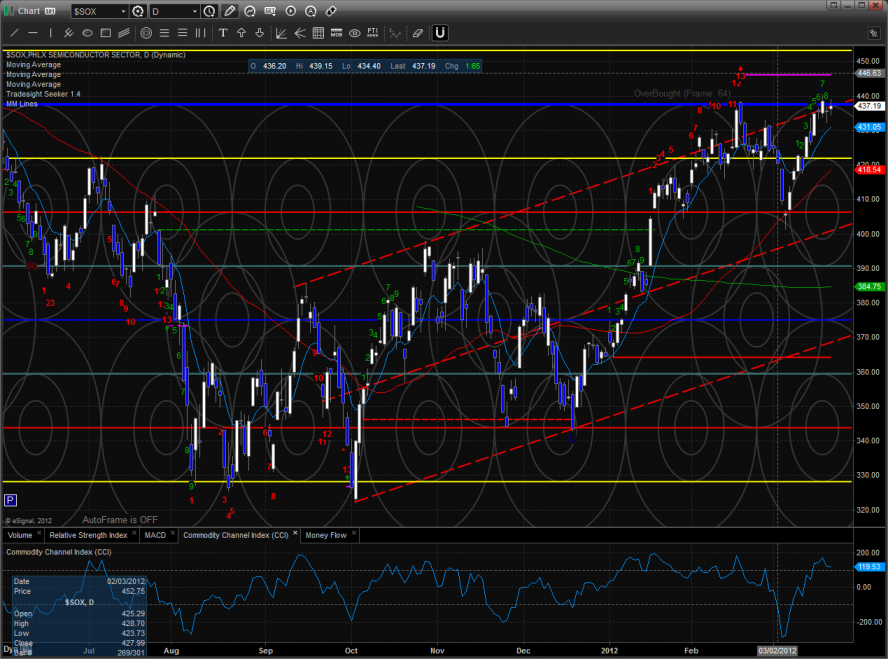

The SOX made a new high on the move. Keep in mind that the Seeker still has an active sell signal in place and the risk level has yet to be violated.

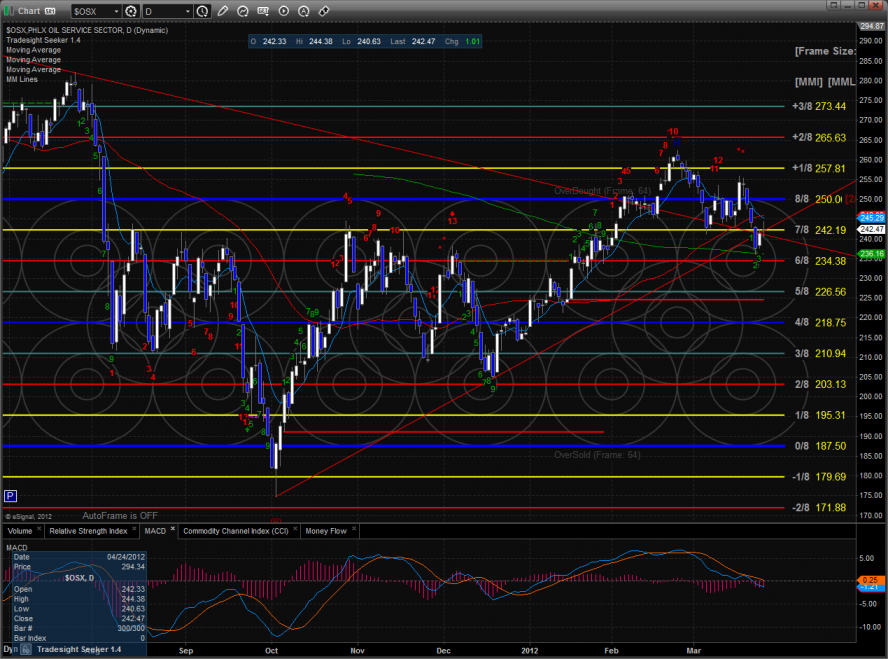

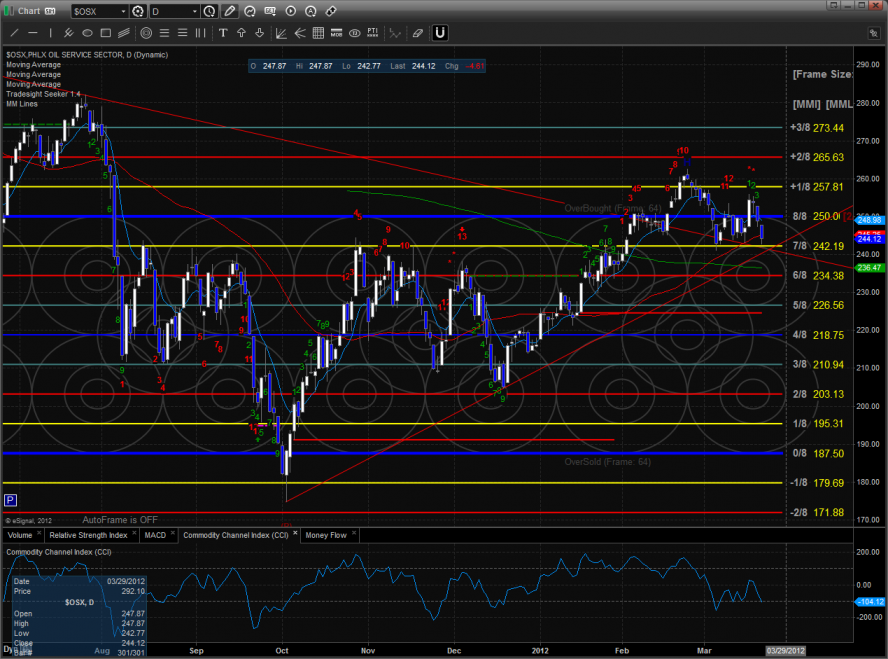

The OSX was the last laggard on the day and continues to be an underperformer.

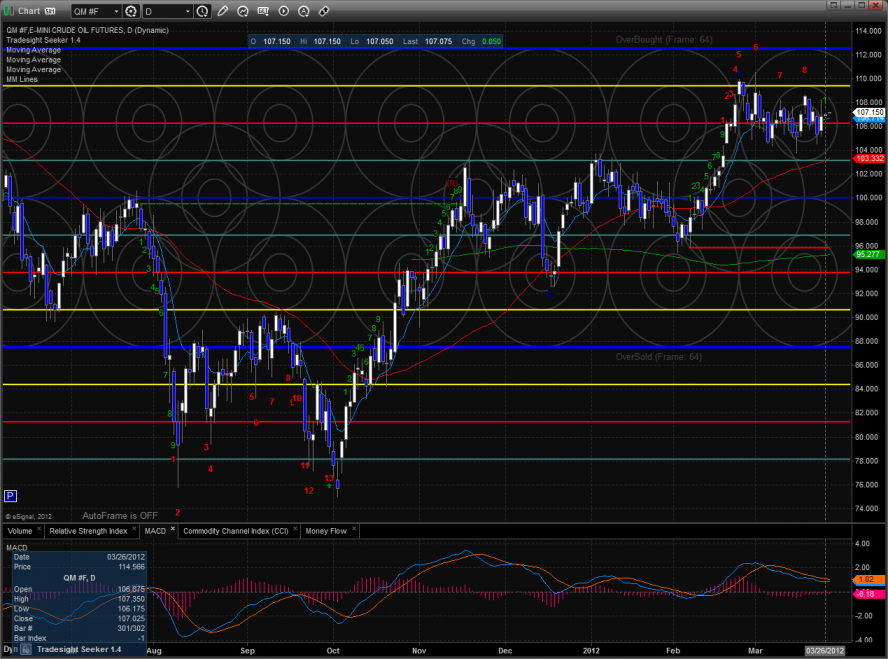

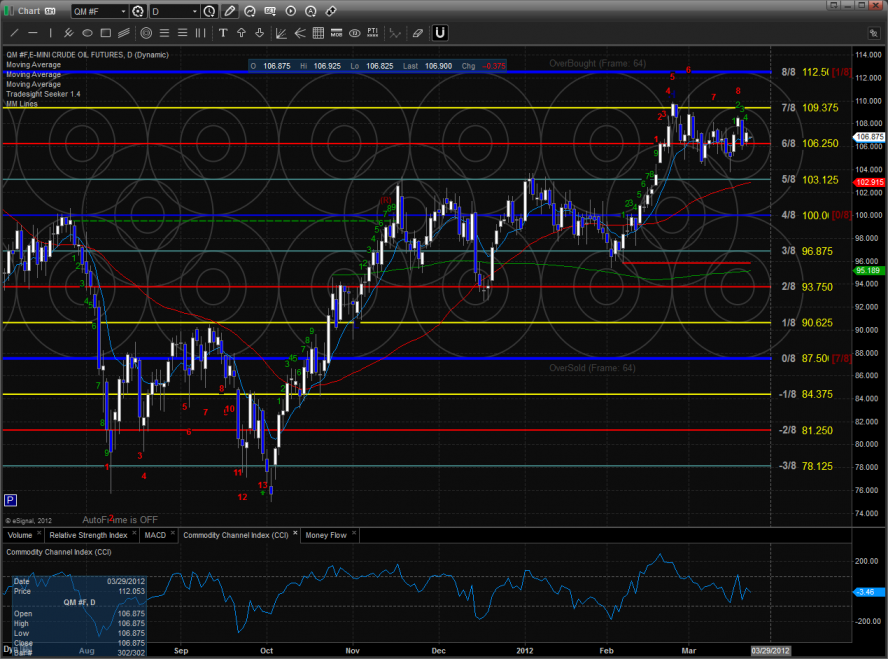

Oil:

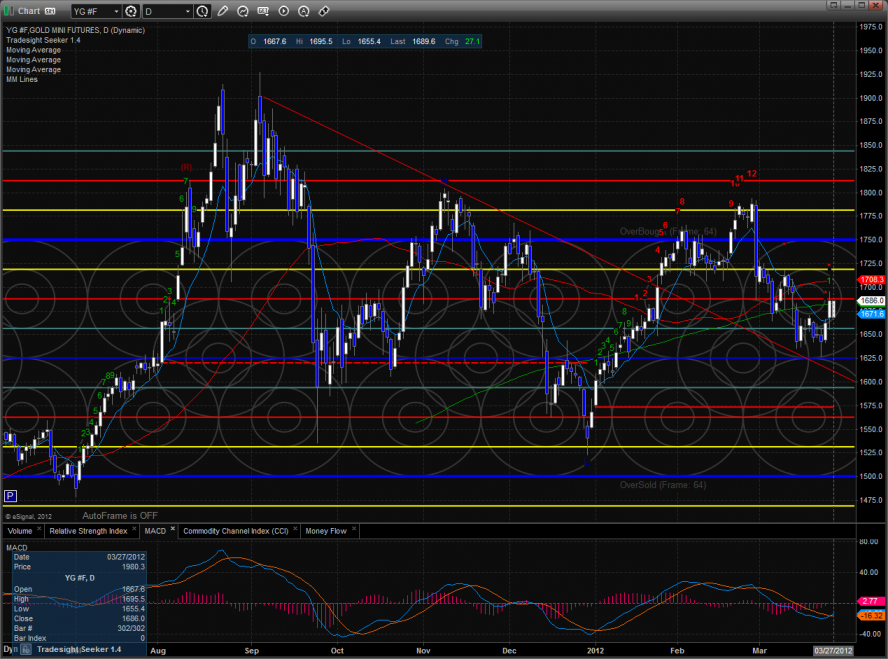

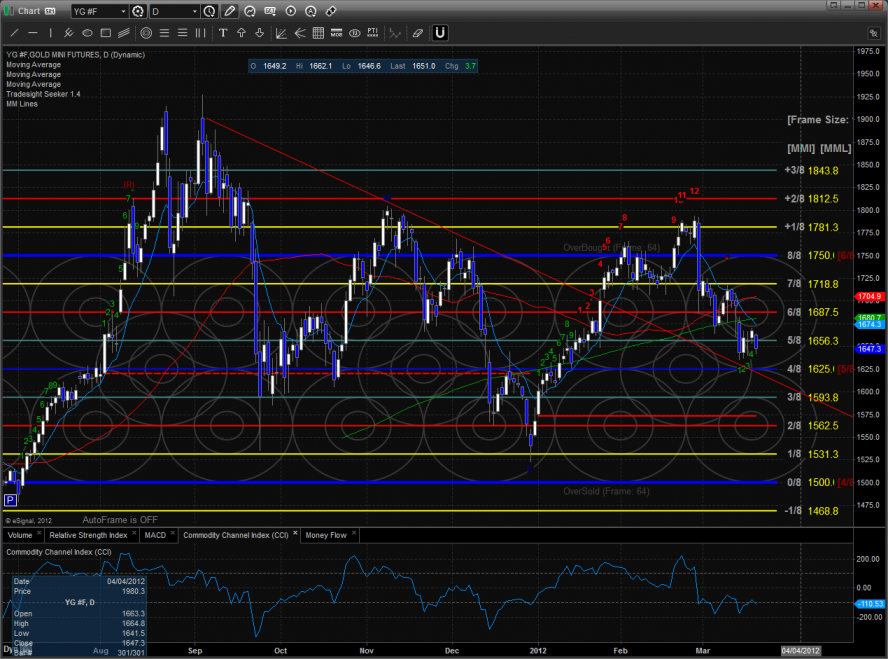

Gold:

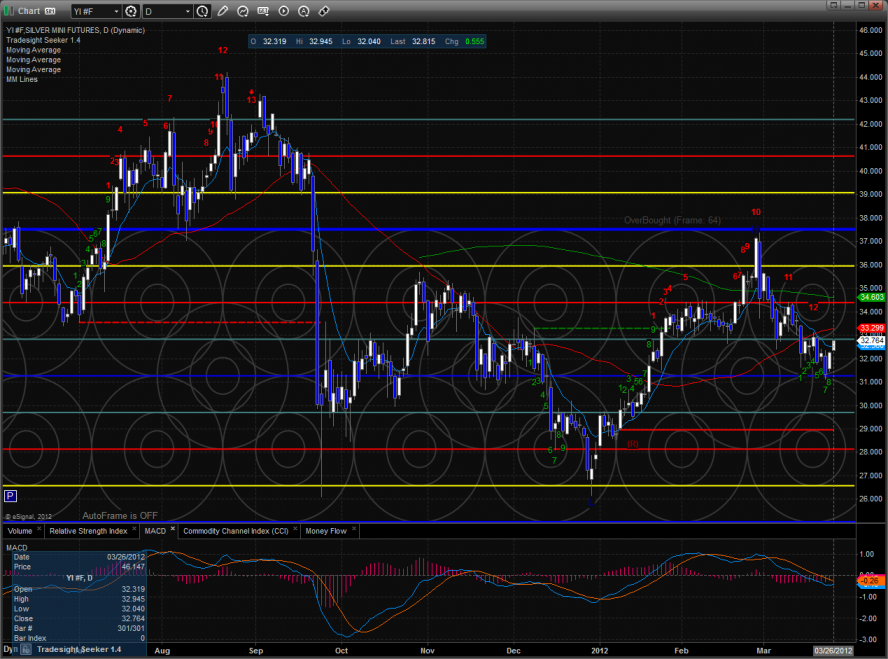

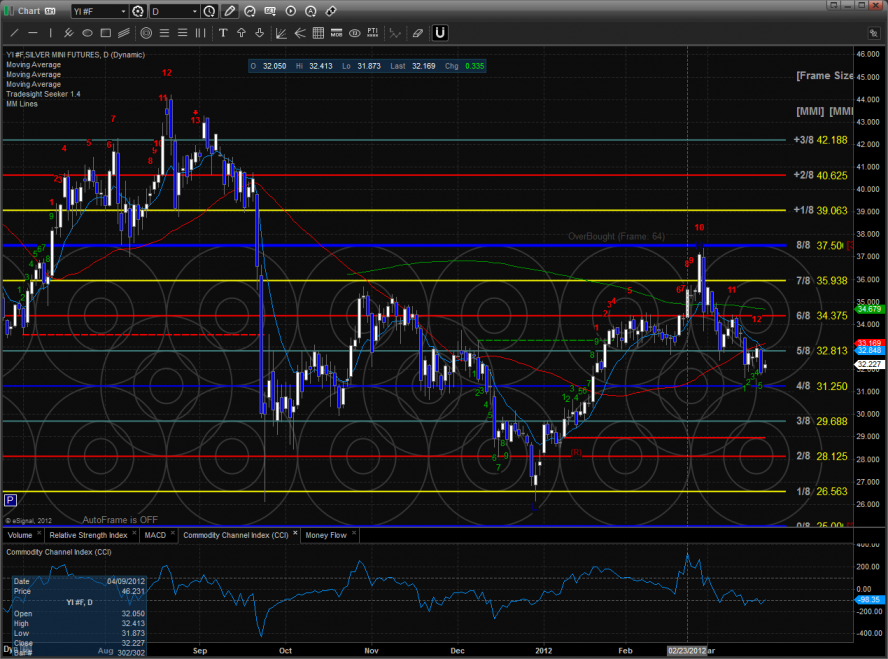

Silver:

An Outlook on the USDJPY: Dual Exhaustion Signals

We had an interesting set of events last week on the USDJPY. Both our Seeker and Comber tools, which use different techniques to give exhaustion signals after large moves, but gave separate 13 bar sell signals on the daily chart of the USDJPY...at the same time! This is extremely rare for this to happen and add to the power of the potential reversal. Let's take a look at the two tools separately and then discuss how the USDJPY has reacted so far.

First, we have our Seeker tool, which gives a reversal sell signal with a red "13" above a bar. It also draws a pink risk line, which is then used as a stop out point for the short if we close above it. If the pair closes above it, the pink line becomes dashed instead of solid to show that it is broken. We commonly see a signal and then the use of the risk level as strong resistance, which is exactly what we see here:

So far, the risk level has not broken, and the USDJPY is starting to roll.

Even though the Comber counts exhaustion differently, in this case, it got the exact same signal, which means the exact same risk level, so even though the numeric count that gets to 13 is different than the Comber, the sell signal and risk level look the same:

When these two signals line up at the same time, or even one or two bars apart, it creates an even more probably reversal point.

At this point, the USDJPY is just starting to rollover and has established the first 2 bars of a green "setup" count to the downside, which we will monitor to see if it can approach the key 9th bar. At the same time, two targets are in motion. One is the 50% retracement of the move, which is the black line at B. The second, which should not be discounted although it looks extreme now, is the red line C, which is the static trendline of the count itself. Let's watch for both in the coming days and weeks.

Stock Picks Recap for 3/23/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

Nothing triggered off of the report.

In the Messenger, Rich's SHLD triggered short (with market support) and worked:

AMZN triggered long (without market support) and worked:

Rich's NKE triggered short (with market support) and worked:

His AFFY triggered long (without market support) and didn't work:

NFLX triggered short (with market support) and worked enough for a partial and then reversed:

In total, that's 3 trades triggering with market support, all 3 of them worked, although 2 better than the other.

Forex Calls Recap for 3/23/12

A winner to close out the week in the EURUSD for a full 45 pips. See that section below.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (a few things to see on EURUSD and USDJPY) and then glance at the US Dollar Index.

Speaking of, here's the Dollar Index intraday Thursday/Friday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, closed final piece at C:

At least that trade washes two stop outs from this slow week. Still no continuation though.

Stock Picks Recap for 3/22/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, nothing triggered.

In the Messenger, Rich's FDX triggered short (without market support) and worked:

His VMW triggered short (without market support) and didn't work:

NTES triggered long (with market support) and worked:

Rich's SHLD triggered short (with market support) and worked:

His NTAP triggered short (with market support) and didn't work:

His AAPL triggered short (with market support) and worked great:

His PXD triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Stock Picks Recap for 3/22/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, nothing triggered.

In the Messenger, Rich's FDX triggered short (without market support) and worked:

His VMW triggered short (without market support) and didn't work:

NTES triggered long (with market support) and worked:

Rich's SHLD triggered short (with market support) and worked:

His NTAP triggered short (with market support) and didn't work:

His AAPL triggered short (with market support) and worked great:

His PXD triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Forex Calls Recap for 3/22/12

Loser and a draw as the market headed one way, went a little bit the other, and ended up back where it started yet again.

See EURUSD and GBPUSD below.

New calls and Chat tonight to wrap up what has been one of the slowest weeks in a while.

Here's the US Dollar Index intraday with market directional lines:

EURUSD:

Triggered long at A and stopped:

GBPUSD:

Triggered short at A, went 40 pips but didn't quite reach first target, lowered stop in the morning over entry, might have stopped you at B or else just sitting there at entry:

GOOG Trade Call Summary

Coming into the week on Sunday, we posted a swing trade idea (meaning a trigger with a stop that is meant to be held over time if needed, not just daytraded). The call was a long on GOOG, and you can read the original posting that we Tweeted and sent out via the Blog. The posting can still be read here as it was posted Sunday night.

When you enter a trade from a daily chart, looking for a multiple day "swing," you can't just use a 5-minute chart to determine how you will manage the trade. You need something wider, such as the 15-minute chart. Let's take a look at how the GOOG trade worked. The exact call was to buy it over $625.91 with a stop loss if it closed under $625 on a closing 15-minute bar basis. The target was the daily chart gap fill at $639.57.

Here's the 15-minute chart, with the trigger line where the trade was entered on Monday:

Now, there are several important points on the chart. First, the trigger was clean and easy, no gaps at the time, just a clean move through the price. Second, the stock clearly never went back under $625 to stop out. Third, if you held it over the next three days (or at least part of Wednesday), it easily hit the target of the gap fill at $639.57 for almost a $14 winner, but then proceeded higher, and the HIGH BAR OF THE MOVE was the 13-bar sell signal using our Comber tool, which should have been a final exit. Note that that bar is the top for the week so far, and as we say at Tradesight, on to the next trade. What happens next doesn't matter to us, but we had a clean trigger, no risk against the price, met our first target and final target both established in advance, and had a tool that gave you the ultimate sell.

Tradesight.com Market Preview for 3/22/12

The ES was slightly lower on the day in distribution fashion. The chart has completed a Seeker 9 bar setup and will likely either take a pause or do something more corrective. Time will tell.

The NQ futures are now 9 bars up and completed the most recent Seeker sell setup. Price bearishly made a new intraday high but closed down on the day.

The 10-day Trin remains overbought and is loaded with reversal potential.

Multi sector daily chart:

The OSX continues to bearishly underperform crude futures.

The SOX was the top sector on the day but is now 9 days up.

The XAU was about flat on the day and looks poised for a bounce. A return to the safety trade would really fuel this.

Be sure to set an alarm for a break under Monday’s low for the BTK. The pattern looks very vulnerable here.

The BKX is now 9 days up and right at key resistance at the Murrey math 8/8 level

The OSX was the last laggard on the day and is very close to a breakdown level. If price settles below 242 the 200dma should quickly come into play.

Oil:

Gold:

Silver:

Stock Picks Recap for 3/21/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, ARMH gapped over, no trigger.

In the Messenger, Rich's JPM triggered short (with market support) and worked enough for a partial and a little more:

His RIG triggered short (with market support) and didn't work:

His DVN triggered short (with market support) and didn't work:

Rich's WPRT triggered short (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.