Forex Calls Recap for 3/21/12

Loser and a winner (still going) for the session in the EURUSD. Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat this evening. Ranges continue to be narrow.

EURUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, stop currently over red LBreak level on second half:

First 10-Day Trin Sell Signal in Months?

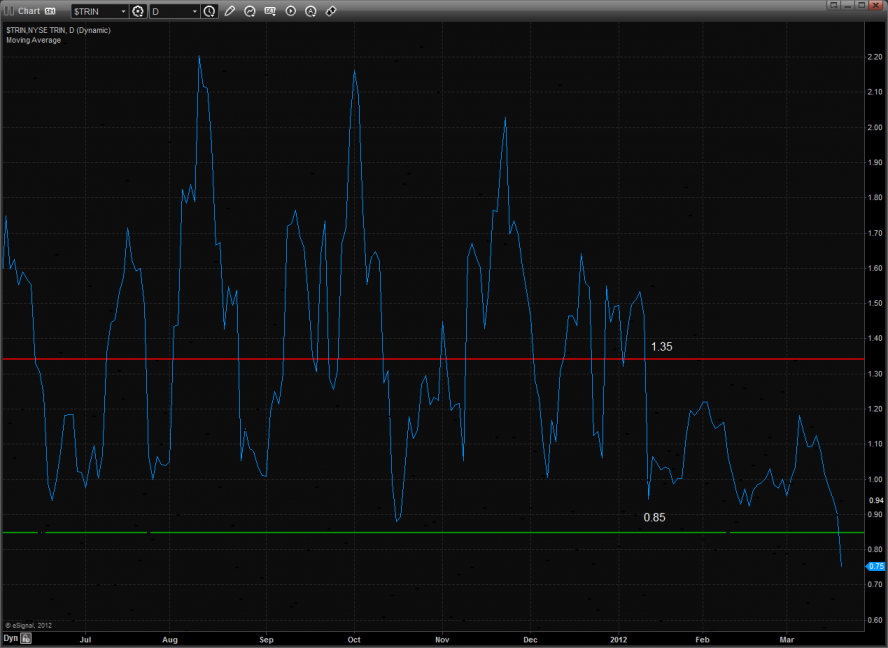

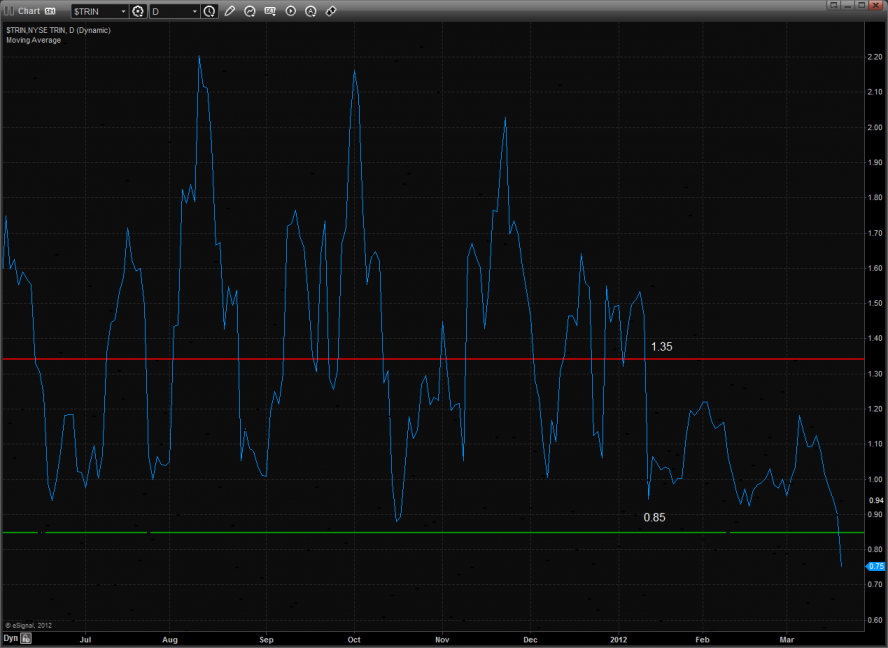

The 10-day Trin has flashed the fist overbought warning signal of the year. When the 10 day simple average of the NYSE Arms index (TRIN) goes below 0.85 the market has become sufficiently overbought for a change in trend. Below is a chart of the SP500 that has a sub chart showing the 10-day Trin. Note in the chart how the high extreme readings of the 10-day average have preceded important upside reversals for the SPX. This indicator works the same way at extreme low readings only in reverse where the extreme low reading precedes a downside reversal in the SPX. For the first time in months the SPX is setup for a reversal:

First 10-Day Trin Sell Signal in Months?

The 10-day Trin has flashed the fist overbought warning signal of the year. When the 10 day simple average of the NYSE Arms index (TRIN) goes below 0.85 the market has become sufficiently overbought for a change in trend. Below is a chart of the SP500 that has a sub chart showing the 10-day Trin. Note in the chart how the high extreme readings of the 10-day average have preceded important upside reversals for the SPX. This indicator works the same way at extreme low readings only in reverse where the extreme low reading precedes a downside reversal in the SPX. For the first time in months the SPX is setup for a reversal:

Tradesight.com Market Preview for 3/21/12

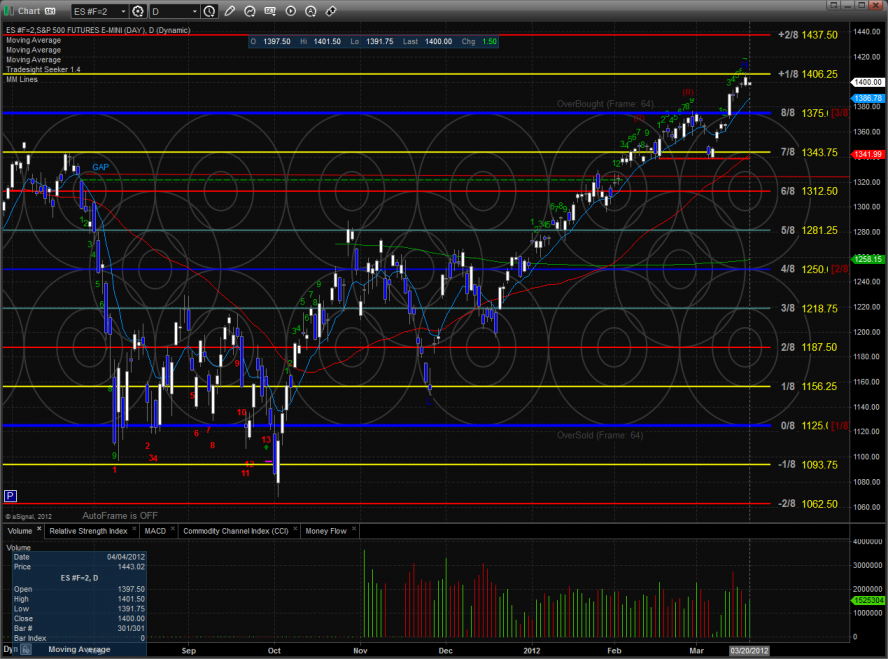

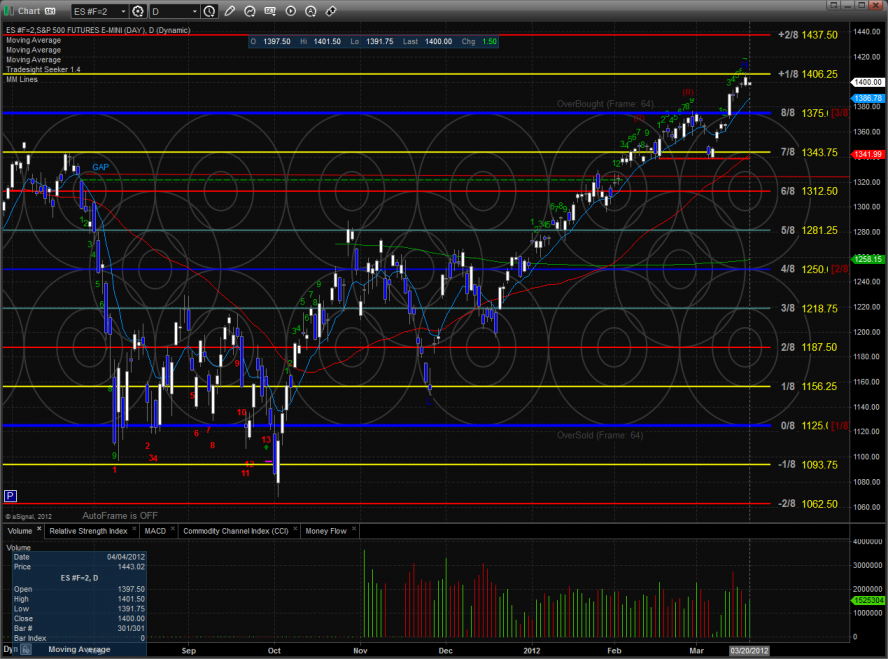

The ES recouped a gap down and filled about two thirds of the gap. The gap is still open and will be important for the bulls to fill sooner rather than later. The overall pattern is now 8 days up and most likely will complete a 9 bar Seeker sell setup tomorrow. Take note that there are 600+ stocks that are 8 days up as well.

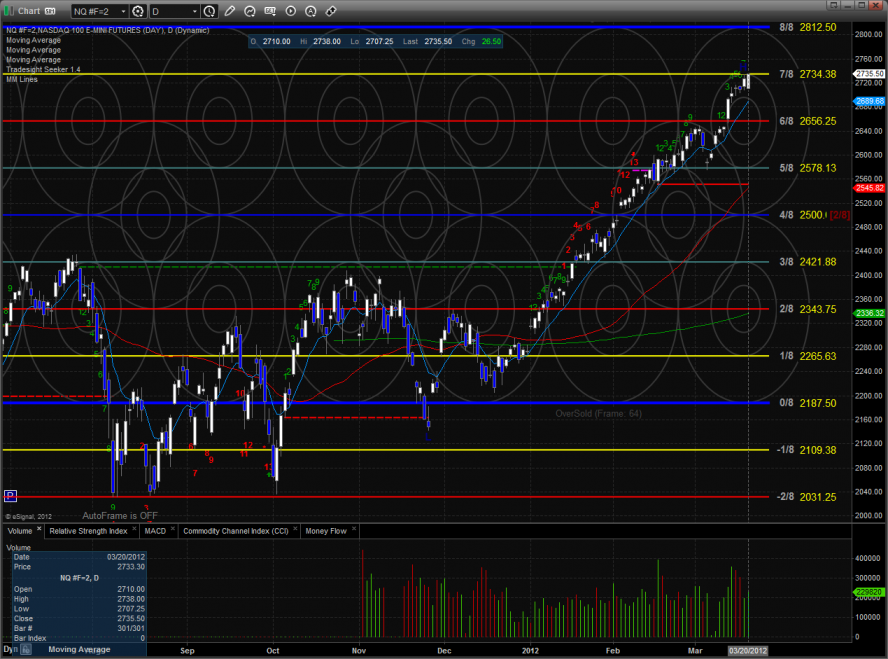

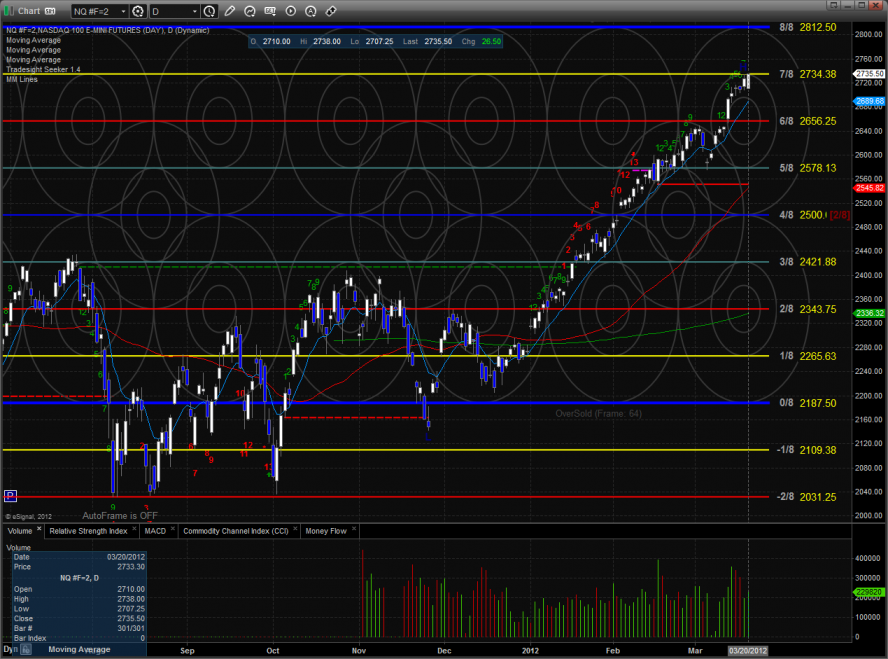

The NQ futures were much stronger than the ES. The NDX100 tracking futures closed up 26 on the day and made a new high on the move. Like the SP side, the NQ futures are 8 days up.

For the first time this year the 10-day Trin has recorded and overbought reading. The is a very notable development and finally loads the pattern with energy for a reversal.

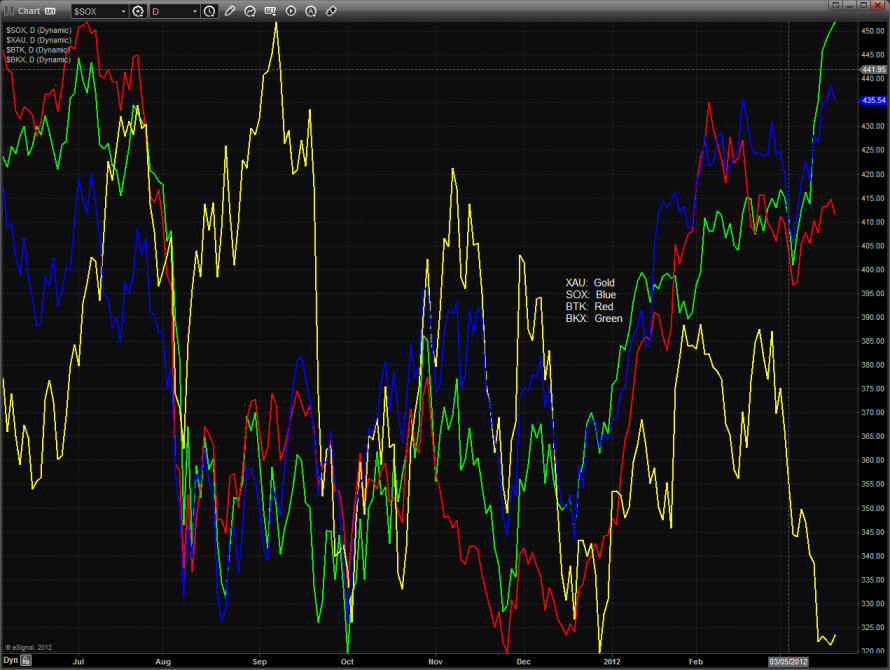

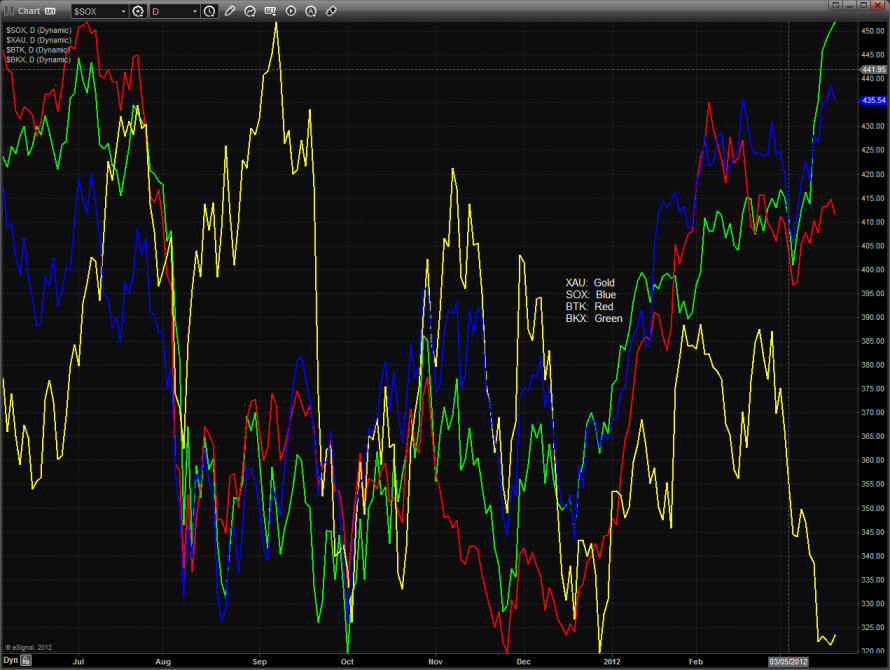

Multi sector daily chart:

The NDX/SPX cross broke out to a new high which is a very positive development for the bulls. Keep in mind that this is in direct conflict with the reversal warning that the 10-day Trin is flashing.

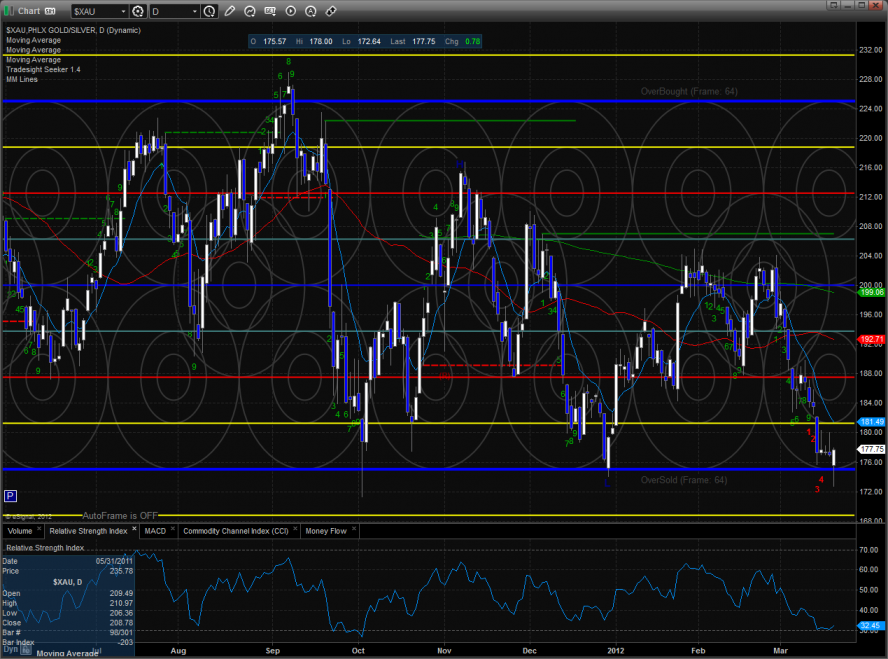

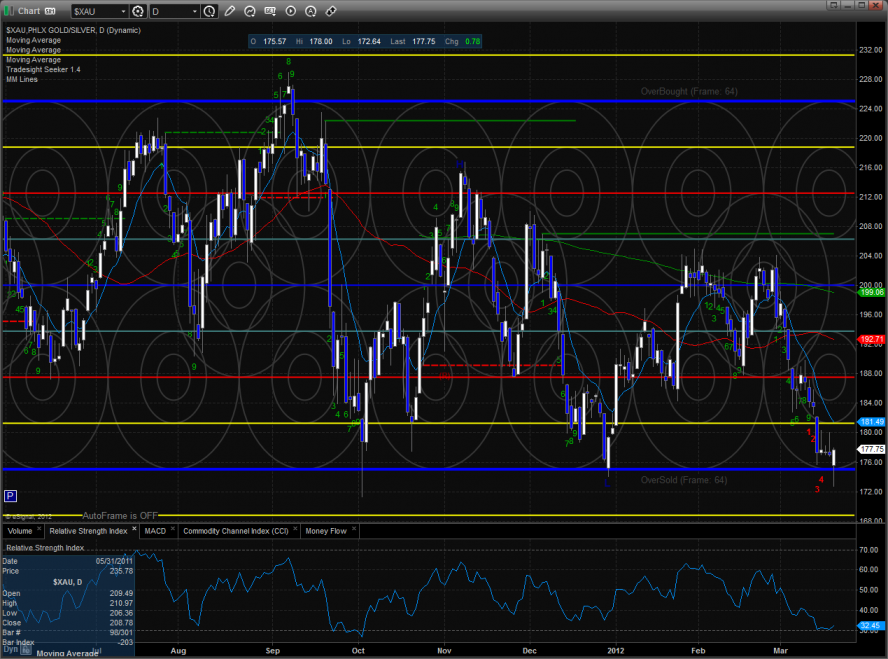

The XAU was one of the strongest sectors on the day and may be looking for a tradable bottom.

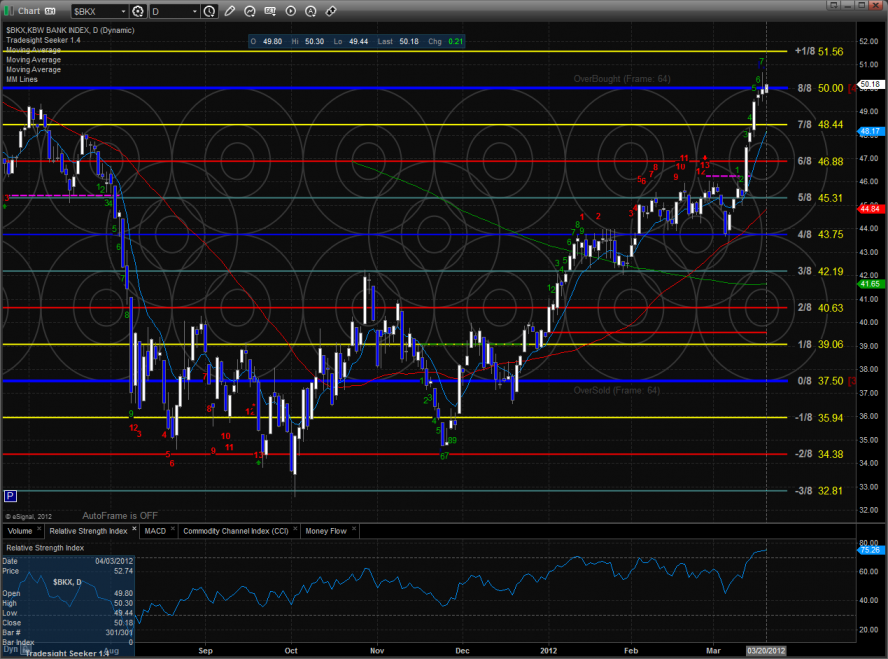

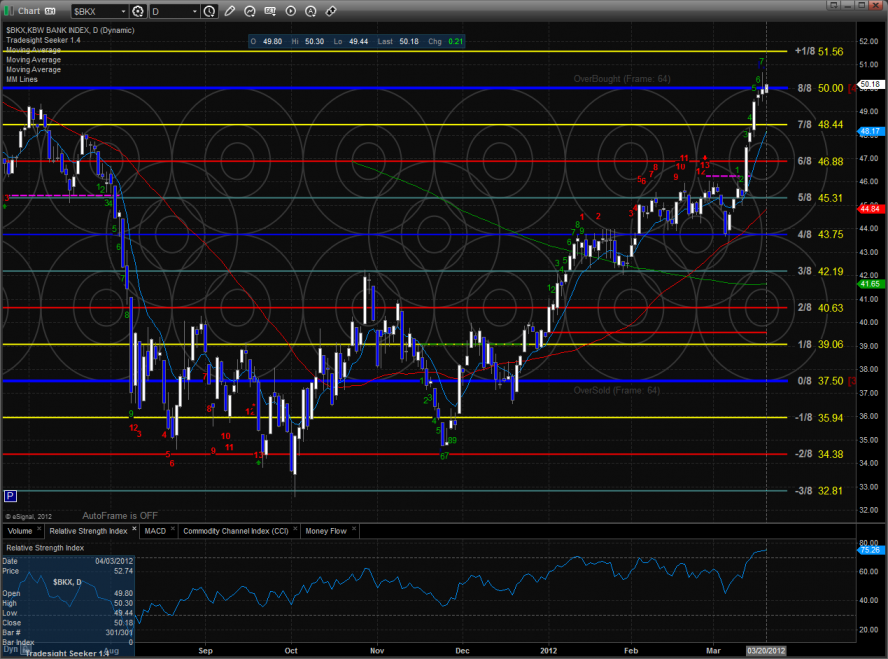

The BKX was higher on the day but traded inside yesterday’s range. The Seeker setup count is now 8 days up.

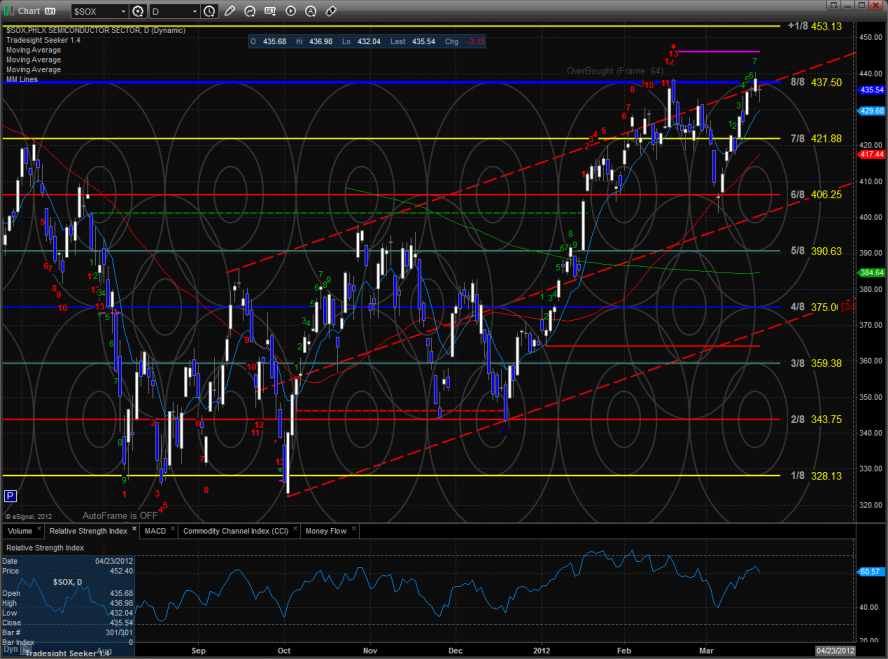

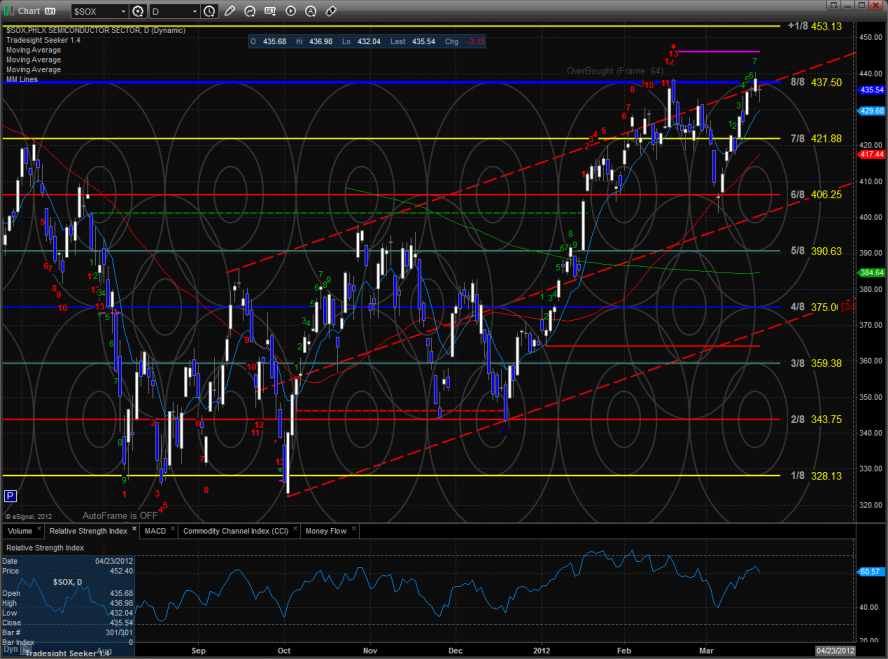

The SOX was notable weak, diverging from the strength in the NDX.

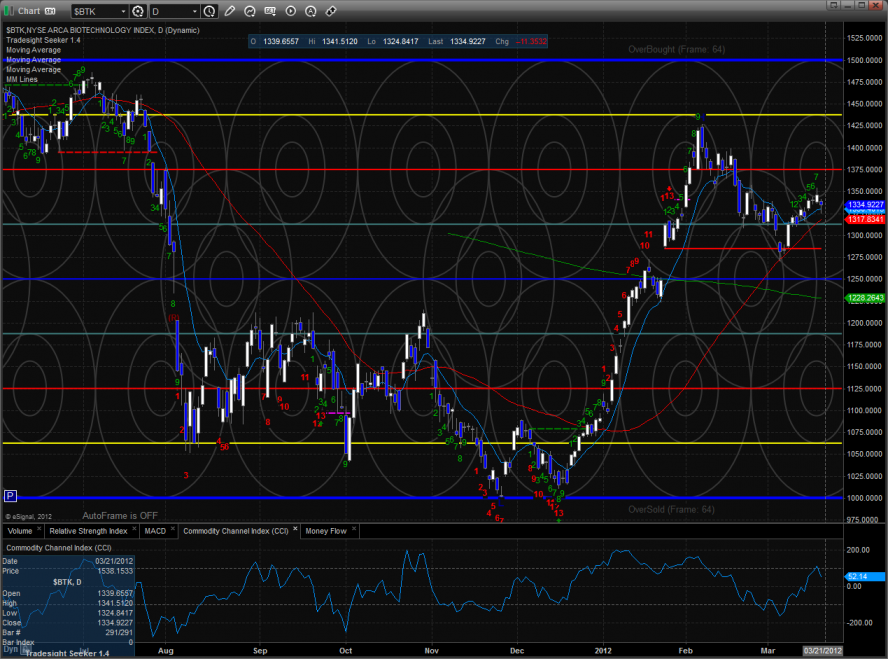

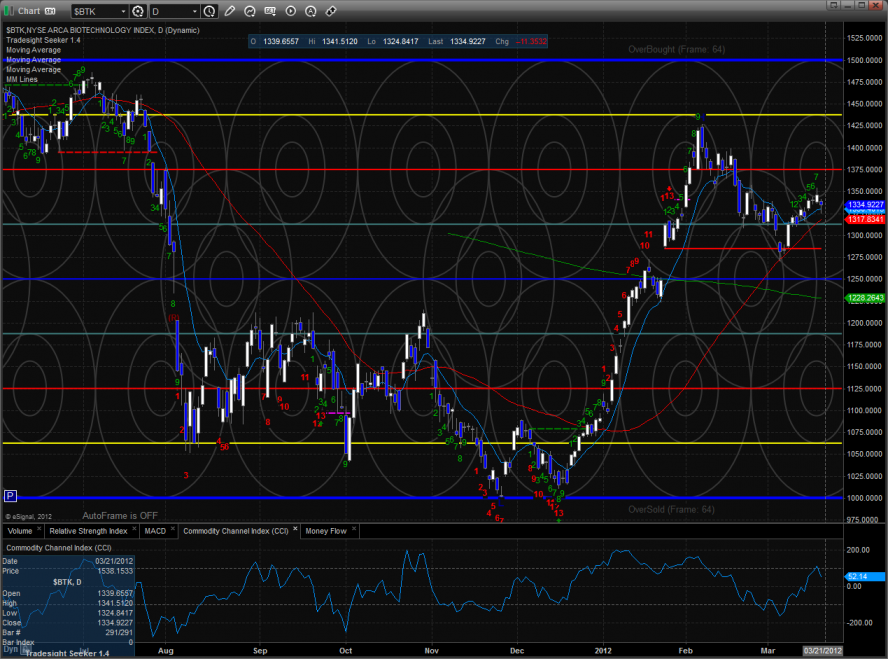

The BTK is still waiting for a resolution to see if this is a bounce wave or if it is ready to move to new highs. The Seeker that has a 9-13-9 in place strongly suggests that price will see the 200dma before new highs.

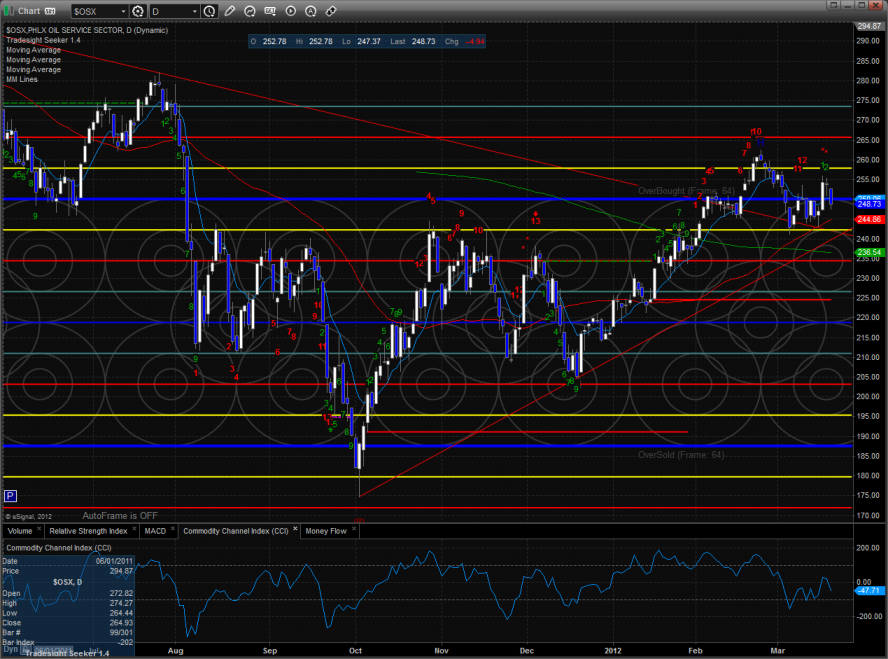

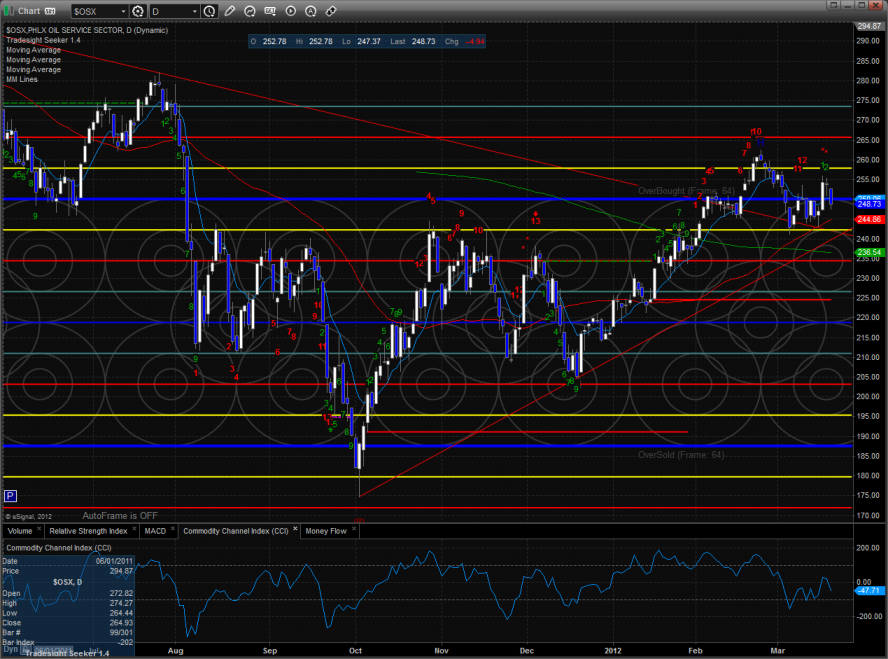

The OSX was the last laggard on the day and continues to struggle. The Seeker is in the qualification stage of the countdown waiting for the ultimate exhaustion signal to print.

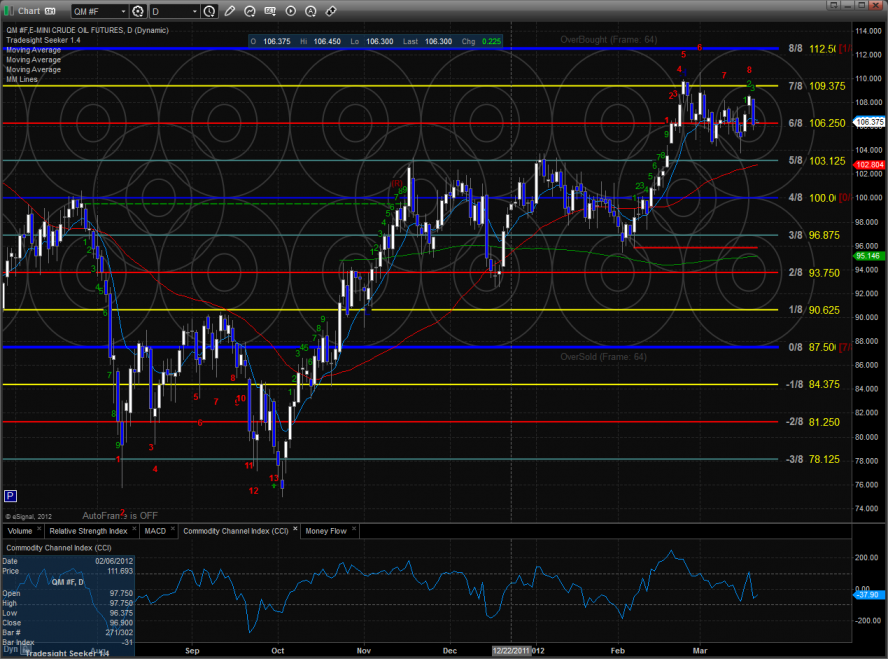

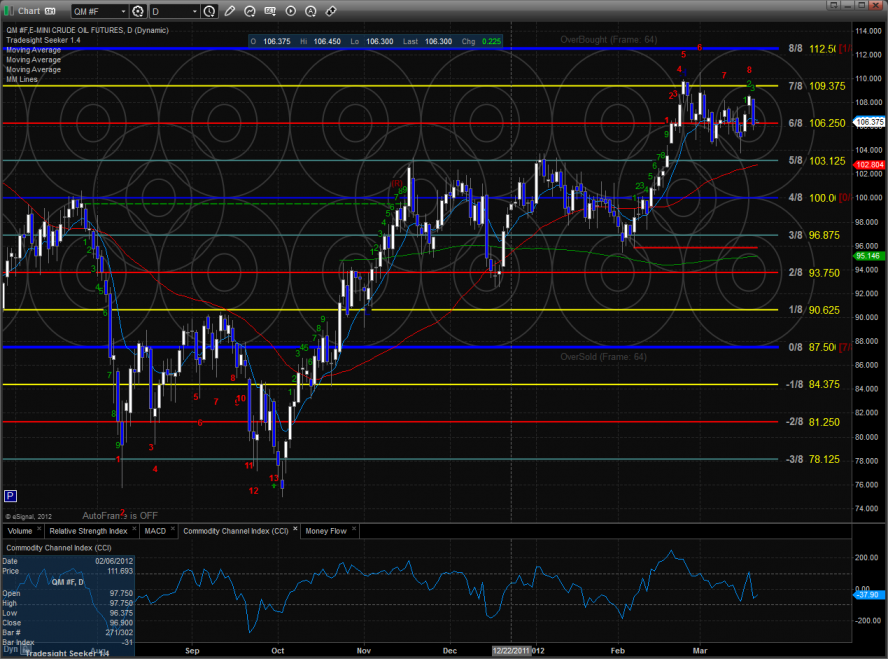

Oil:

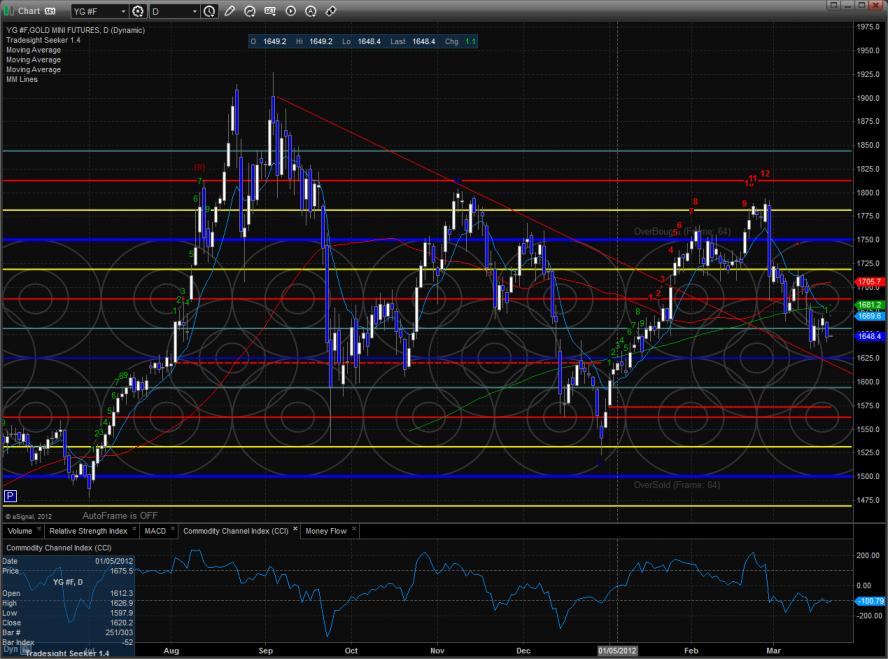

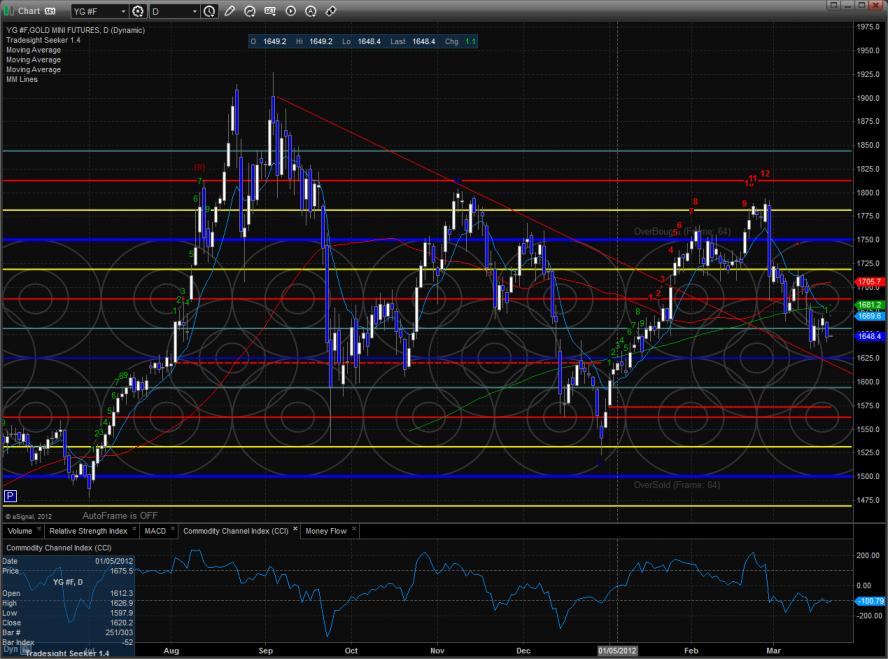

Gold:

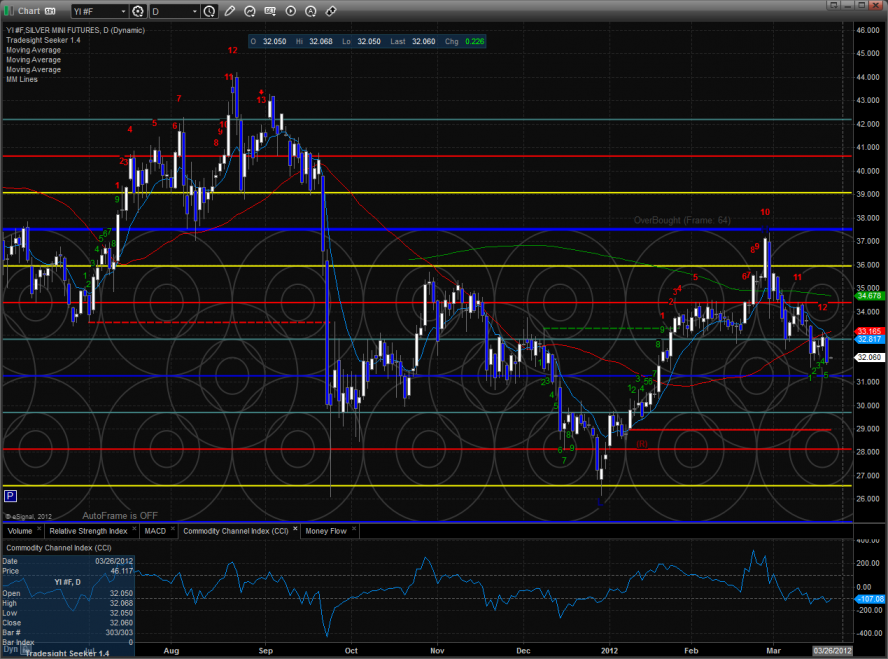

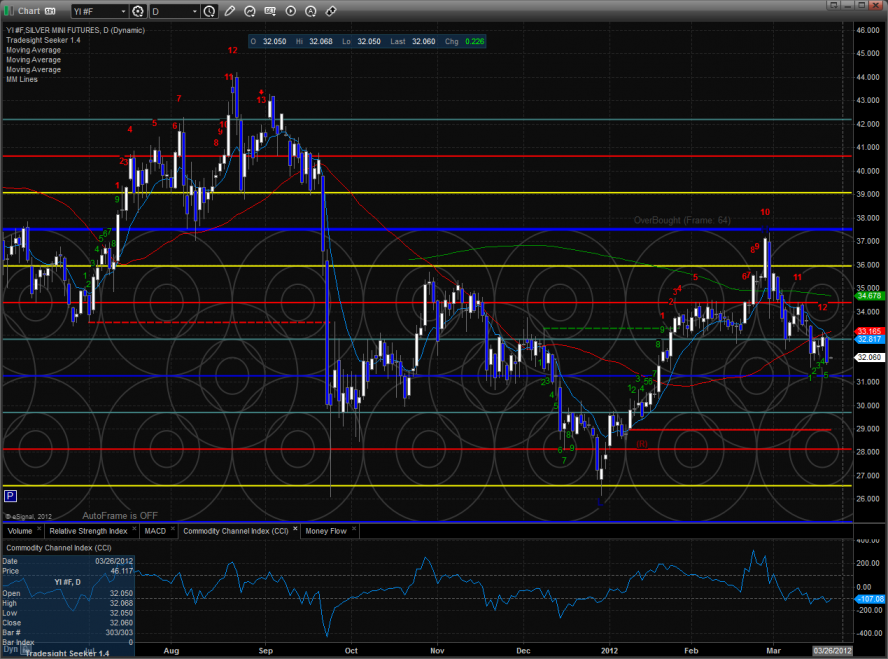

Silver:

Tradesight.com Market Preview for 3/21/12

The ES recouped a gap down and filled about two thirds of the gap. The gap is still open and will be important for the bulls to fill sooner rather than later. The overall pattern is now 8 days up and most likely will complete a 9 bar Seeker sell setup tomorrow. Take note that there are 600+ stocks that are 8 days up as well.

The NQ futures were much stronger than the ES. The NDX100 tracking futures closed up 26 on the day and made a new high on the move. Like the SP side, the NQ futures are 8 days up.

For the first time this year the 10-day Trin has recorded and overbought reading. The is a very notable development and finally loads the pattern with energy for a reversal.

Multi sector daily chart:

The NDX/SPX cross broke out to a new high which is a very positive development for the bulls. Keep in mind that this is in direct conflict with the reversal warning that the 10-day Trin is flashing.

The XAU was one of the strongest sectors on the day and may be looking for a tradable bottom.

The BKX was higher on the day but traded inside yesterday’s range. The Seeker setup count is now 8 days up.

The SOX was notable weak, diverging from the strength in the NDX.

The BTK is still waiting for a resolution to see if this is a bounce wave or if it is ready to move to new highs. The Seeker that has a 9-13-9 in place strongly suggests that price will see the 200dma before new highs.

The OSX was the last laggard on the day and continues to struggle. The Seeker is in the qualification stage of the countdown waiting for the ultimate exhaustion signal to print.

Oil:

Gold:

Silver:

Stock Picks Recap for 3/20/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, MAKO triggered long (with market support) and worked:

REXX triggered long (with market support) and didn't work, although it didn't go much against and came back late in the day:

In the Messenger, Rich's SINA triggered short (with market support) and worked:

GOOG triggered long (without market support) and didn't work, same trigger worked later with market support:

Rich's IBM triggered short (with market support) and worked enough for a partial but that was it:

FSLR triggered short (with market support) and worked:

Rich's AAPL triggered short (without market support) and worked for a couple of points:

COST triggered long (with market support) and worked:

EBAY triggered long (with market support) and didn't work:

Rich's VMW triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

Forex Calls Recap for 3/20/12

Closed out the second half of a nice winner from the prior session in the GBPUSD, but stopped out on a new trade in the EURUSD. See both sections below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, might have stopped a piece of your trade at B depending on how you staggered your stops based on our system (was exactly 21 pips over entry level), did not reach first target but went 40 pips, stopped at C in morning. Meanwhile the second half of the long from the prior session had stopped at D for a 50 pip gain:

Stock Picks Recap for 3/19/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, SGEN triggered long (with market support) and didn't work:

In the Messenger, Rich's BIDU triggered short (without market support due to opening five minutes) and didn't work:

His FFIV triggered long (with market support) and worked enough for an easy partial:

His GS triggered long (with market support) and didn't work on the trigger, worked later:

NFLX triggered long (with market support) and worked:

Rich's IBM triggered short (without market support) and worked a little:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Forex Calls Recap for 3/19/12

Totally flat European session, but our EURUSD trade finally triggered in the US session and worked great on the long side (still holding half). See that section below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, holding second half with a stop under R1:

Forex Calls Recap for 3/19/12

Totally flat European session, but our EURUSD trade finally triggered in the US session and worked great on the long side (still holding half). See that section below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, holding second half with a stop under R1: