Forex Calls Recap for 3/15/12

Took a while to play out, but we have a nice winner going from the session in the GBPUSD finally after a slow week. See that section below for the recap.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, but CPI in the morning, so half size.

GBPUSD:

Triggered long at A, hit first target at B, stop under VAH and holding:

Tradesight.com Market Preview for 3/15/12

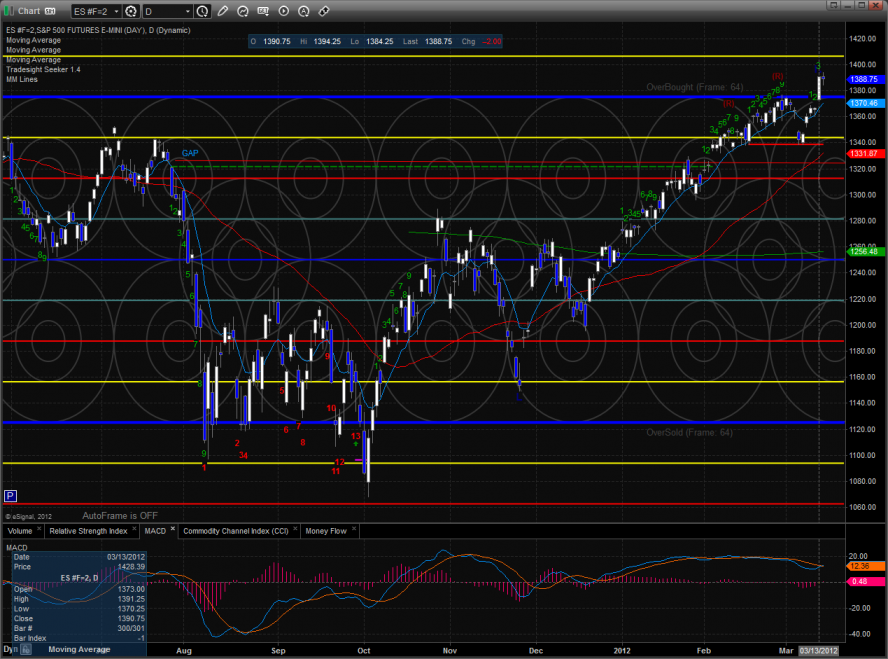

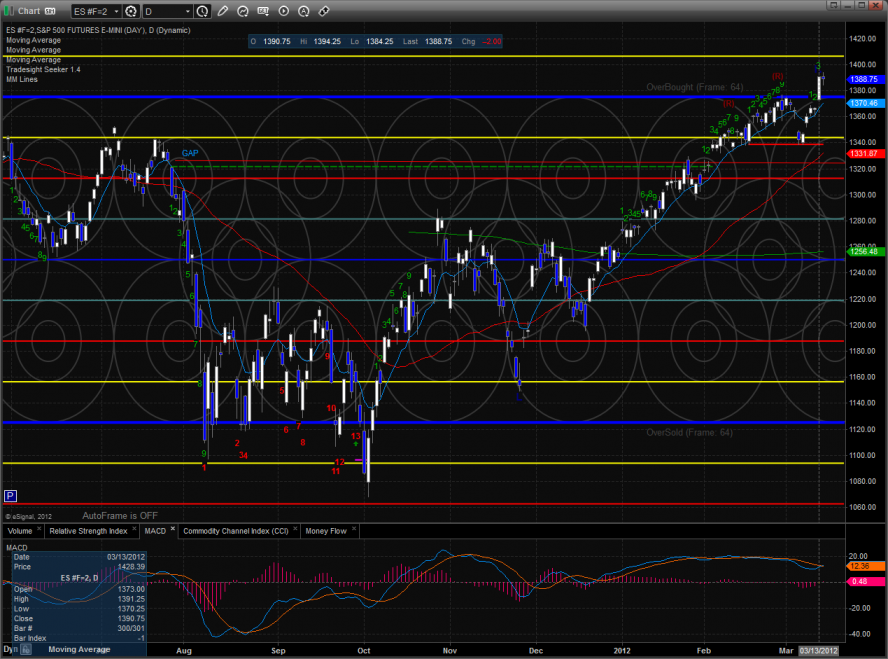

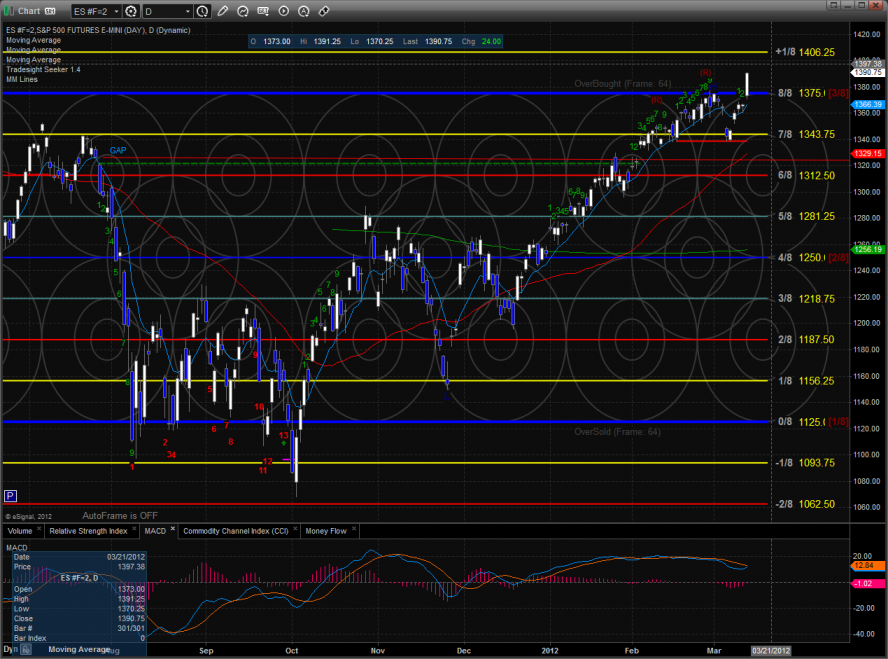

The ES posted a measuring day with a net decline of 2 handles. The market moved sideways in a choppy fashion. A new high was recorded but not a new high close which makes this a distribution dayl.

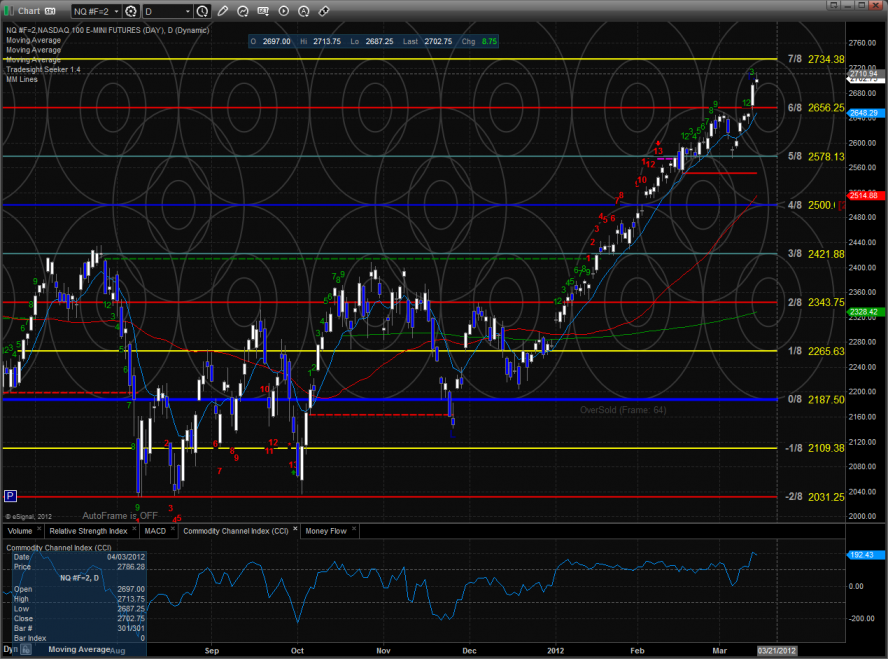

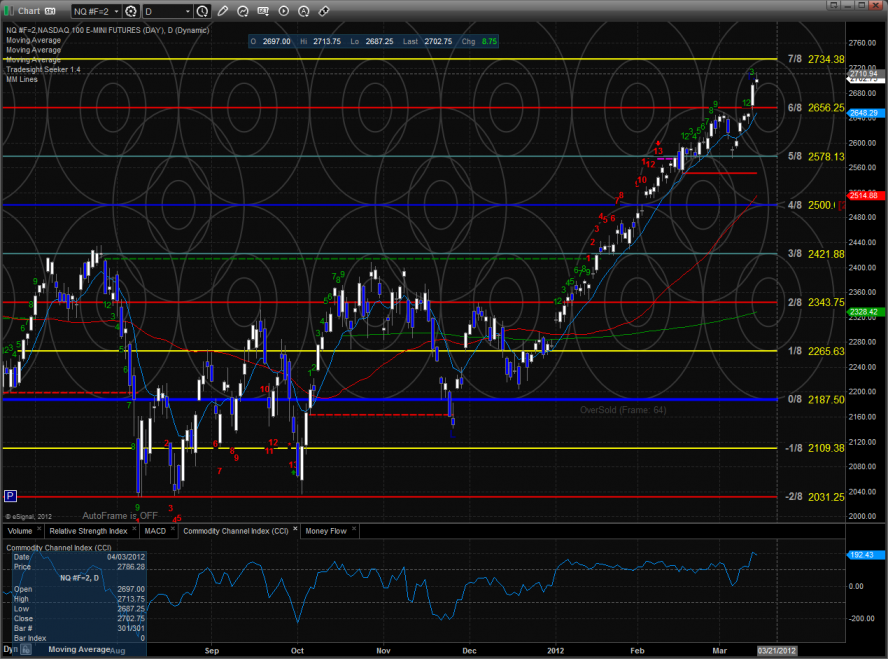

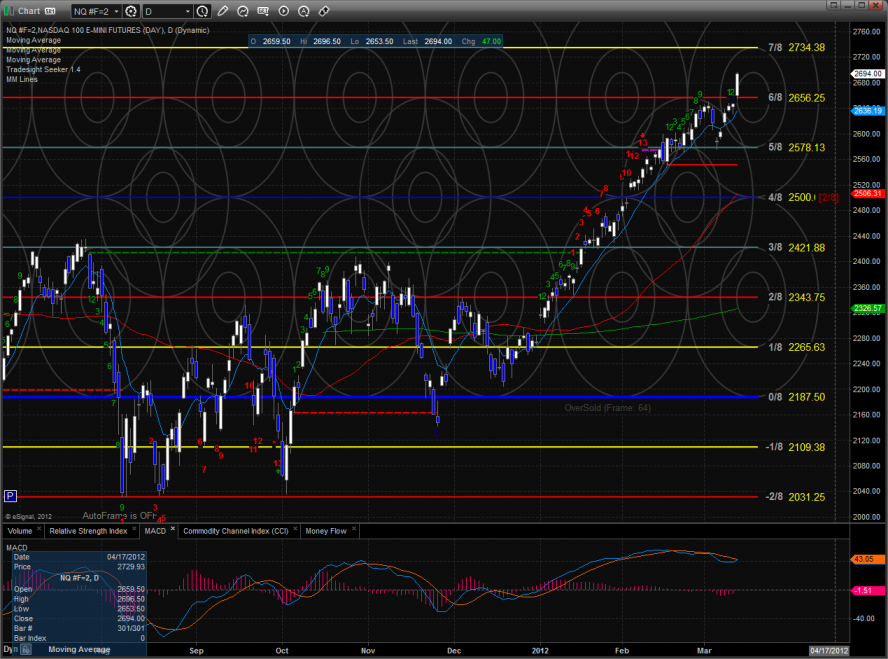

The NQ futures were higher by 9 on the day making a new high close. Note that the MACD is getting extended.

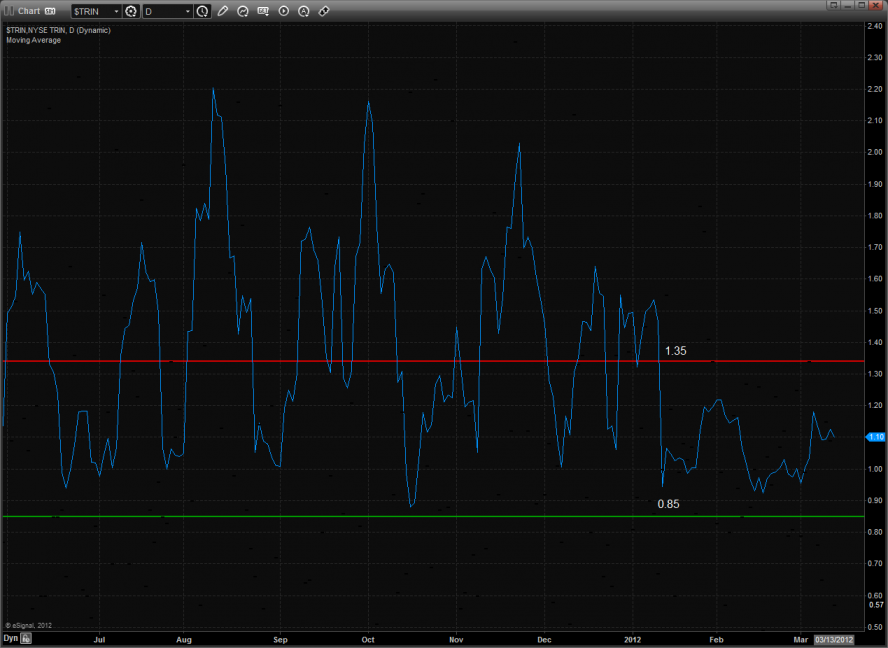

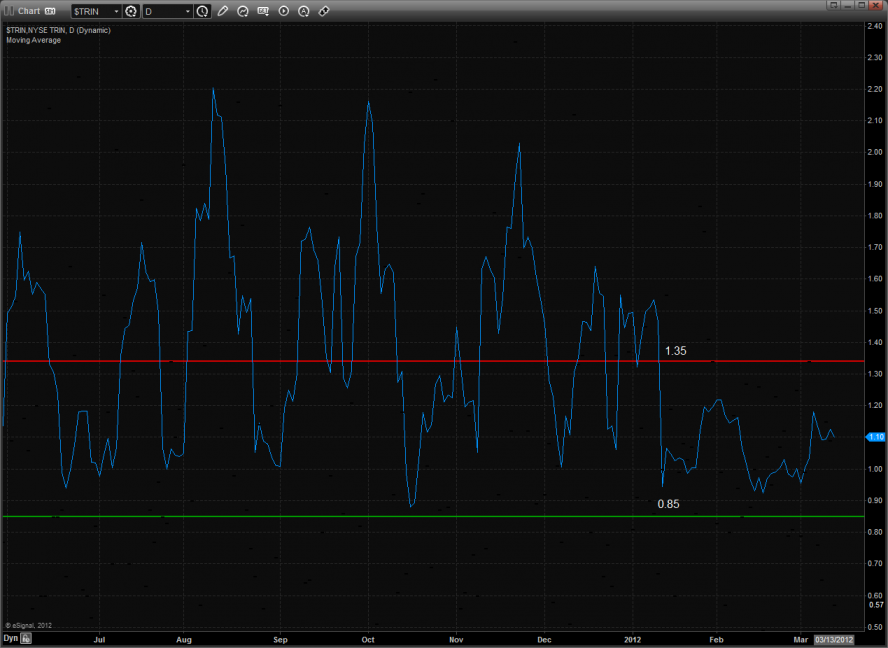

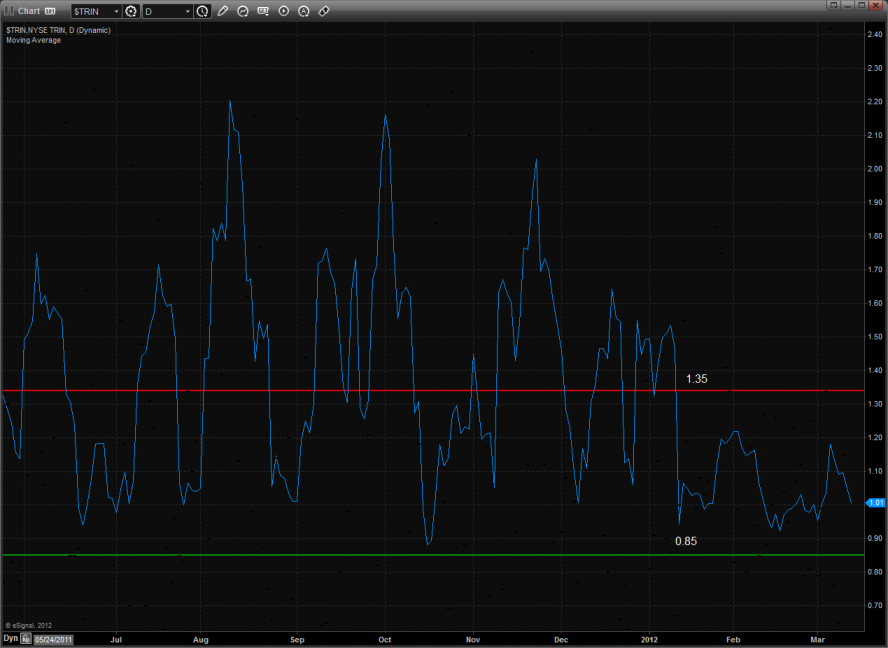

The 10-day Trin is still being very stingy with giving us an overbought or oversold reading.

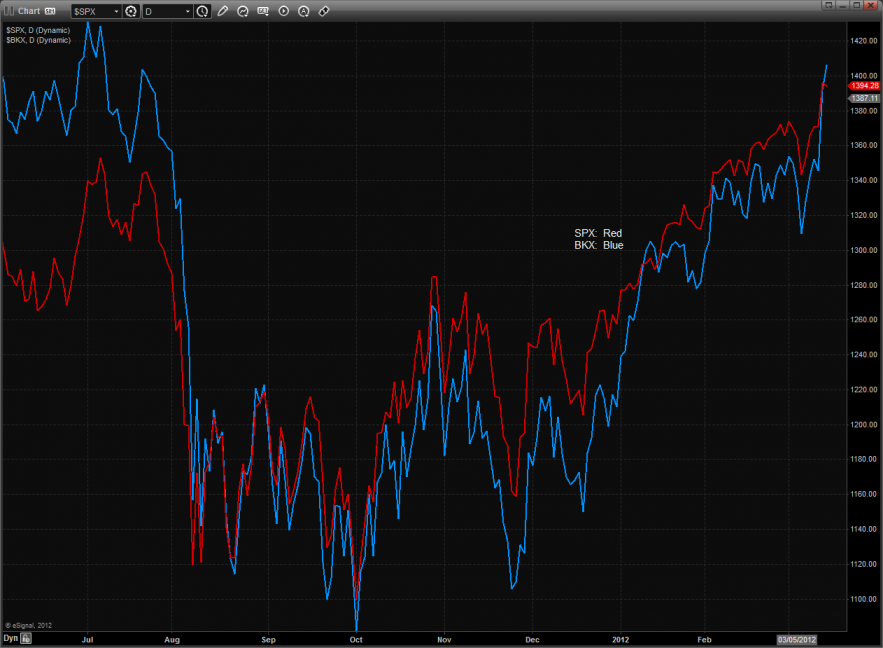

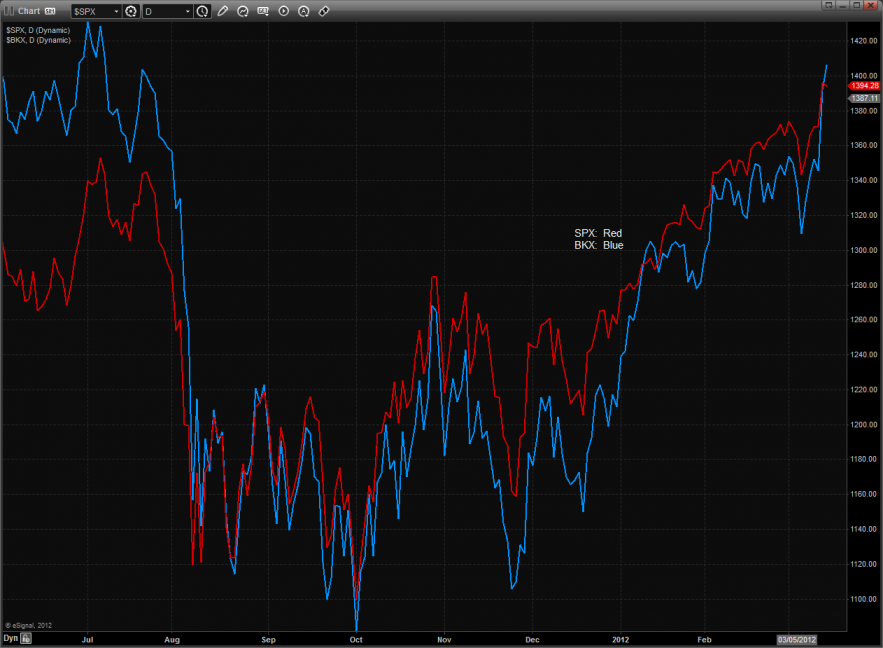

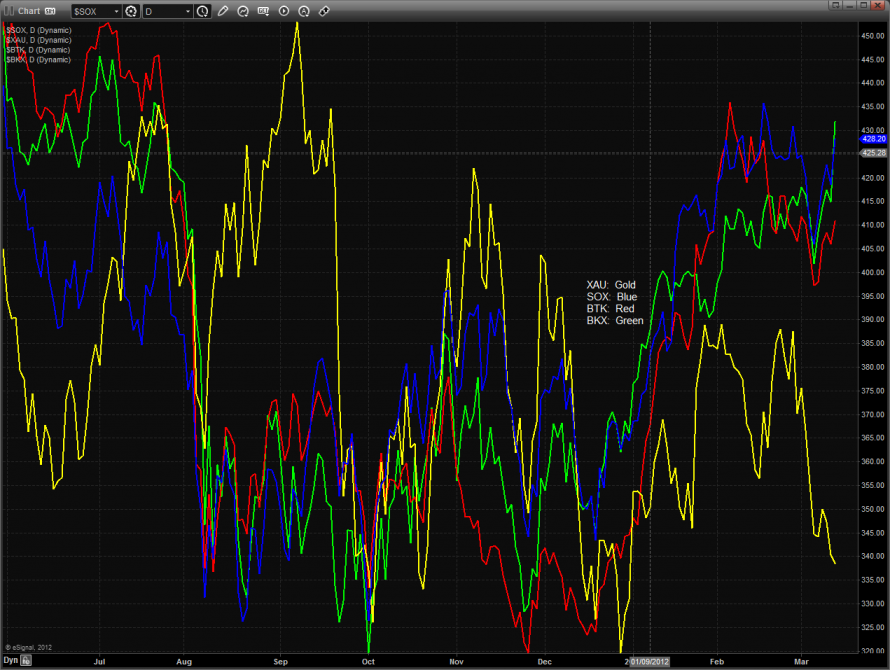

The strength of the banks and the weakness in the mining stocks is eye popping on our comparison chart. Can you say, “Rotation”?

The much welcomed strength in the BKX is good to see on the comparison chart.

The NDX/SPX cross is getting close to a new high. A breakout would be very bullish.

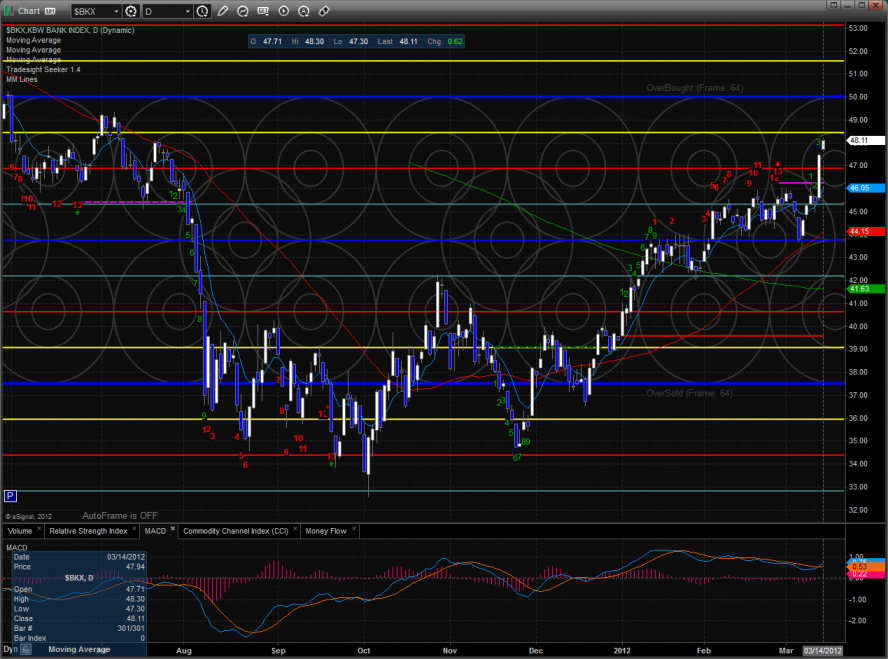

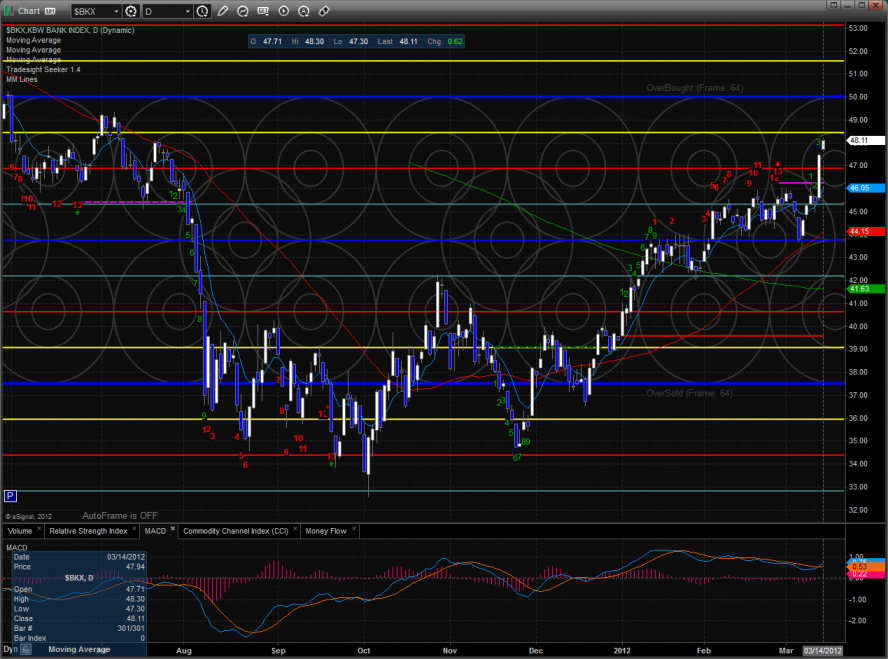

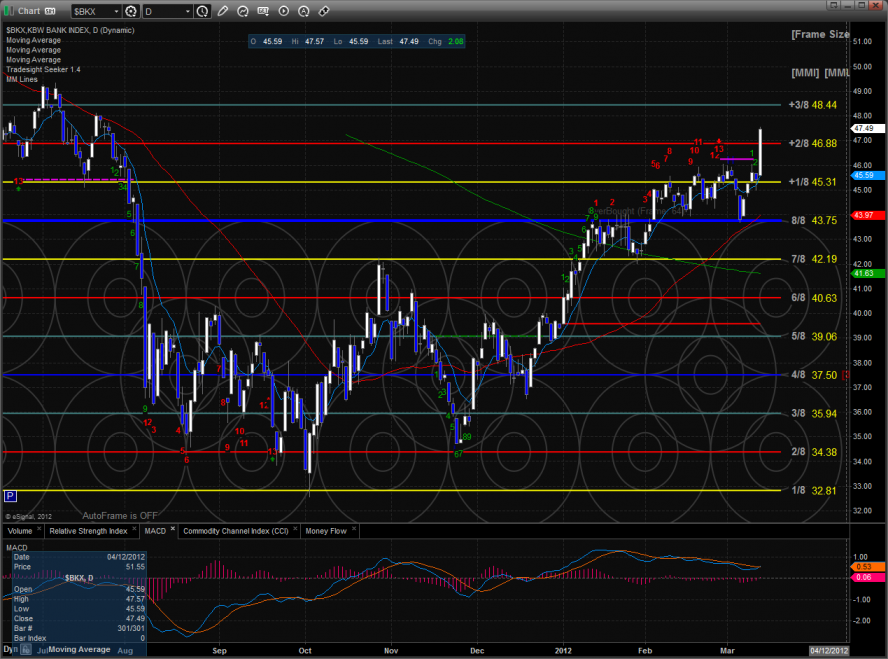

The BKX was the only sector up on the day and with it taking out yesterday’s high will disqualify the Seeker sell signal.

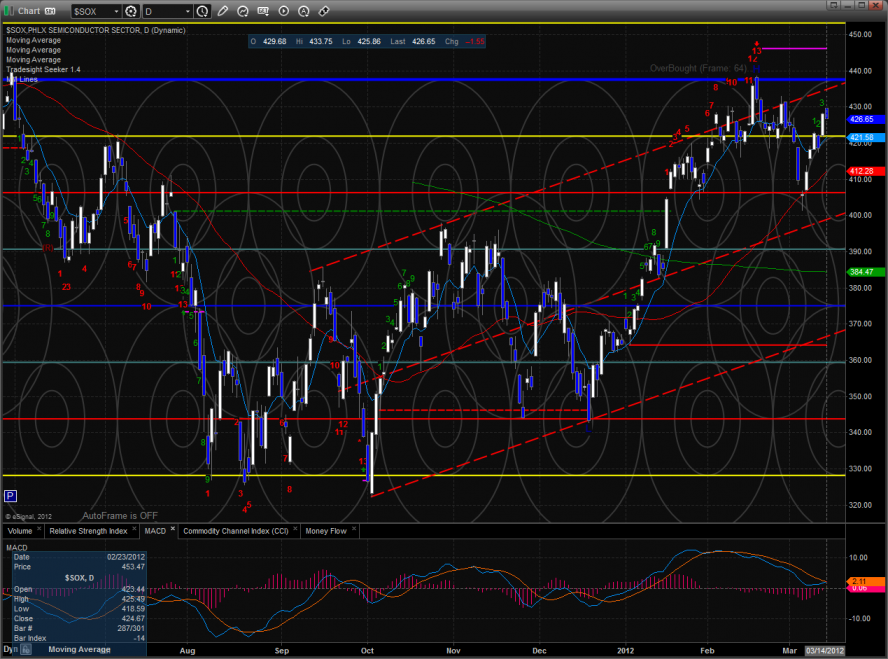

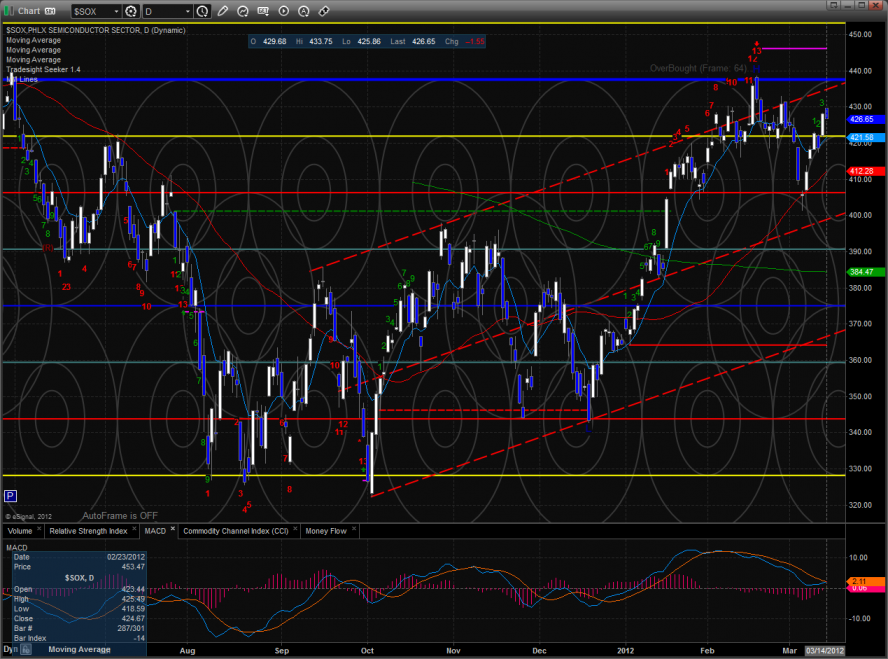

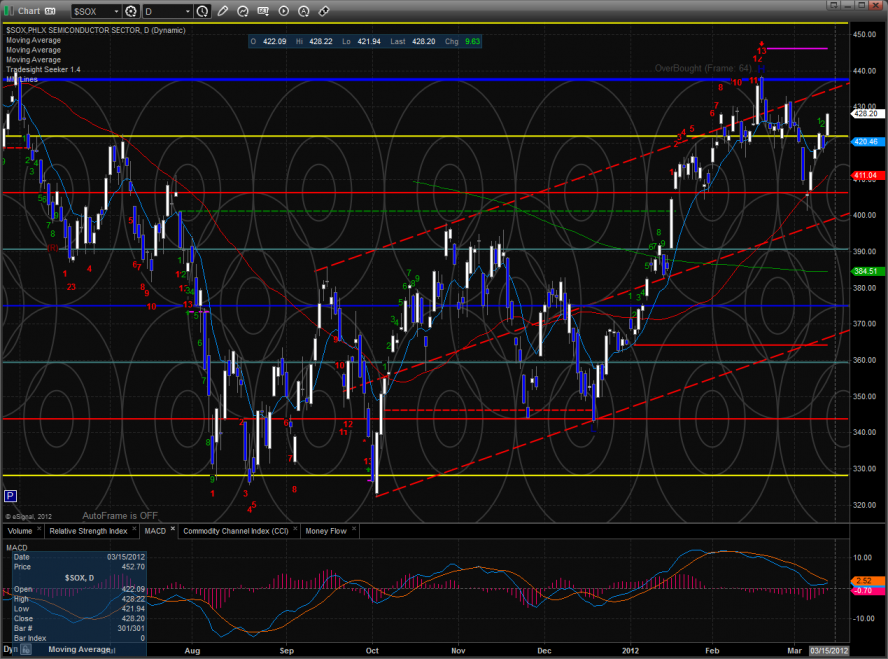

The SOX was the top NSDAQ sector but was lower on the day. The price action in the next couple of days is going to be very key because it will determine if the current up move is a retest of a high or more. The Seeker is still in a sell condition.

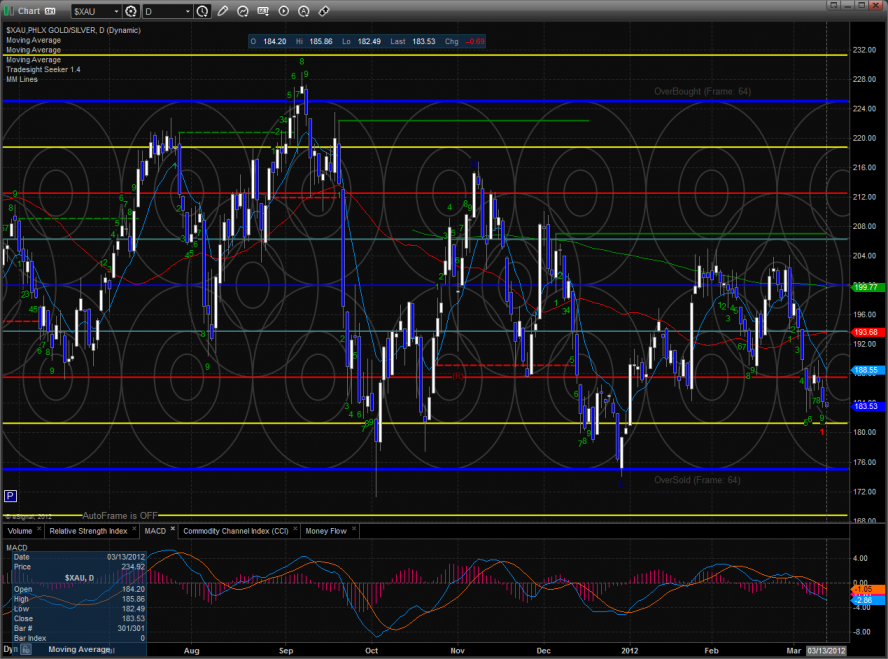

The XAU got thumped and is just above the YTD low. The 9 bar Seeker setup did not support price which implies that a full countdown phase is in the cards. Take it one bar at a time but this could be trouble if the 0/8 level is lost.

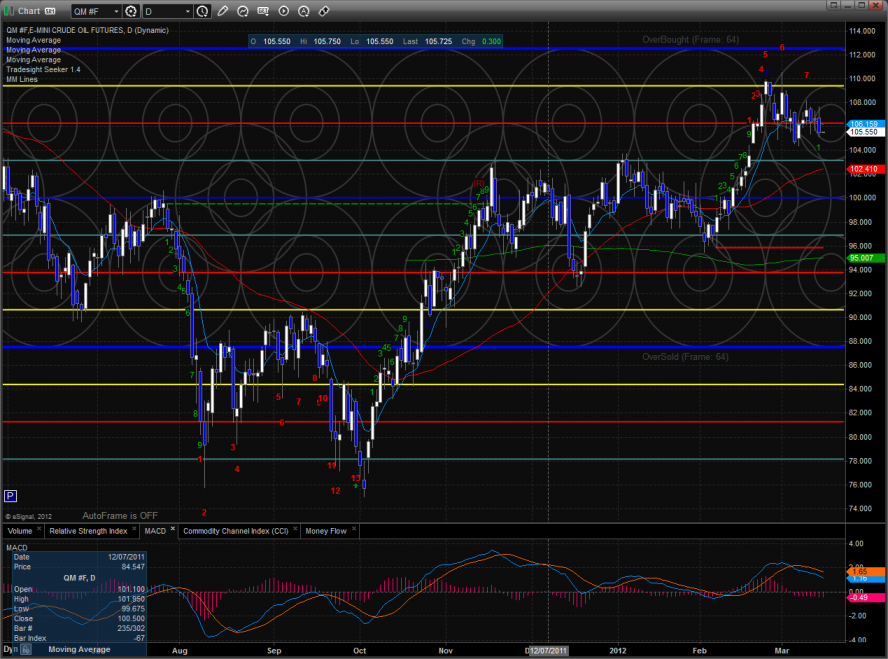

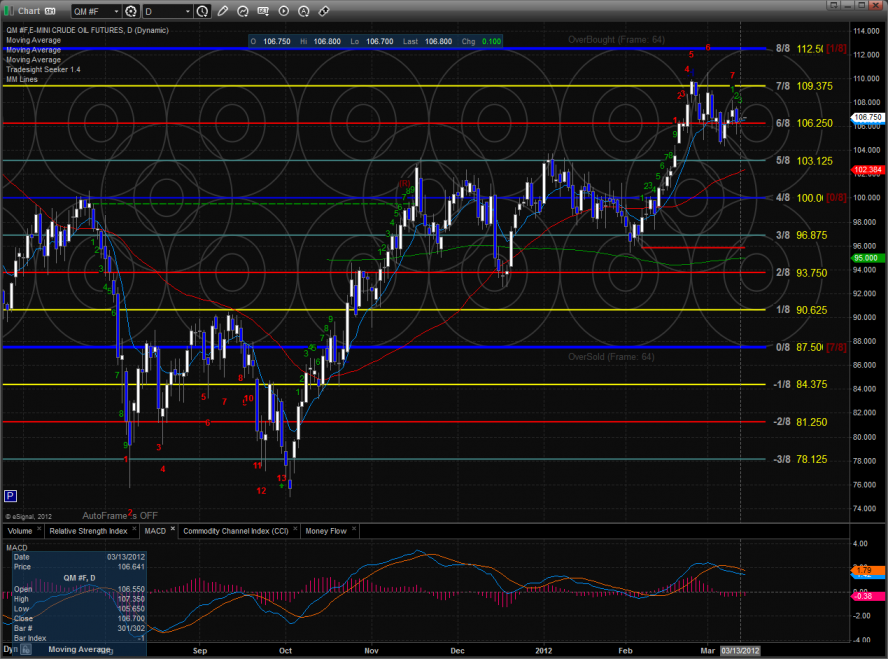

Oil:

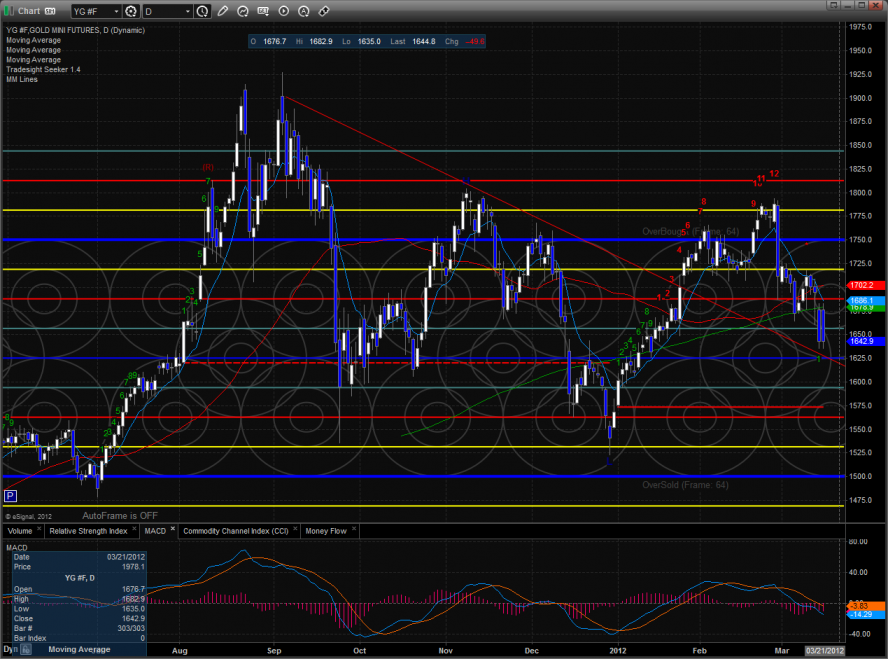

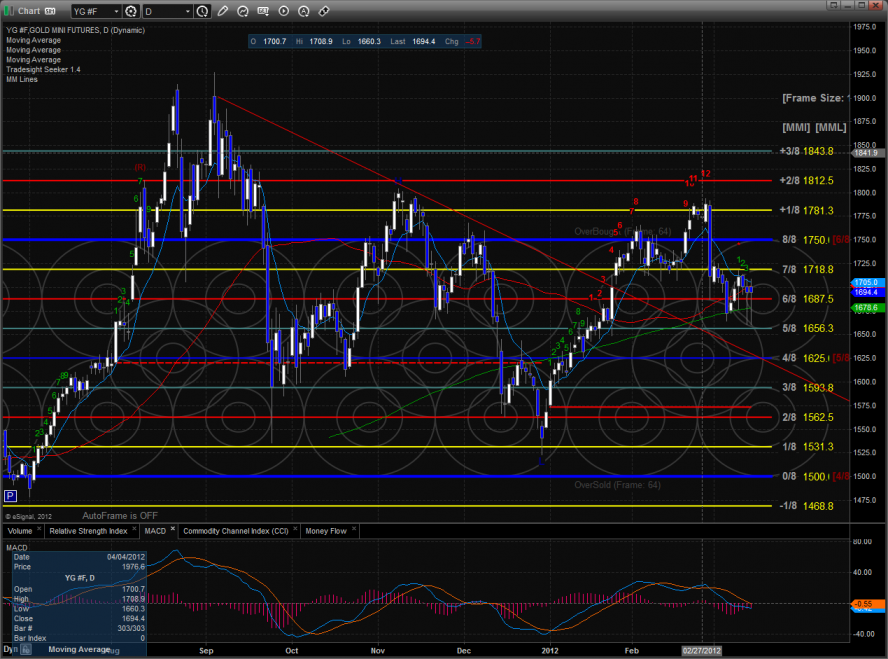

Gold:

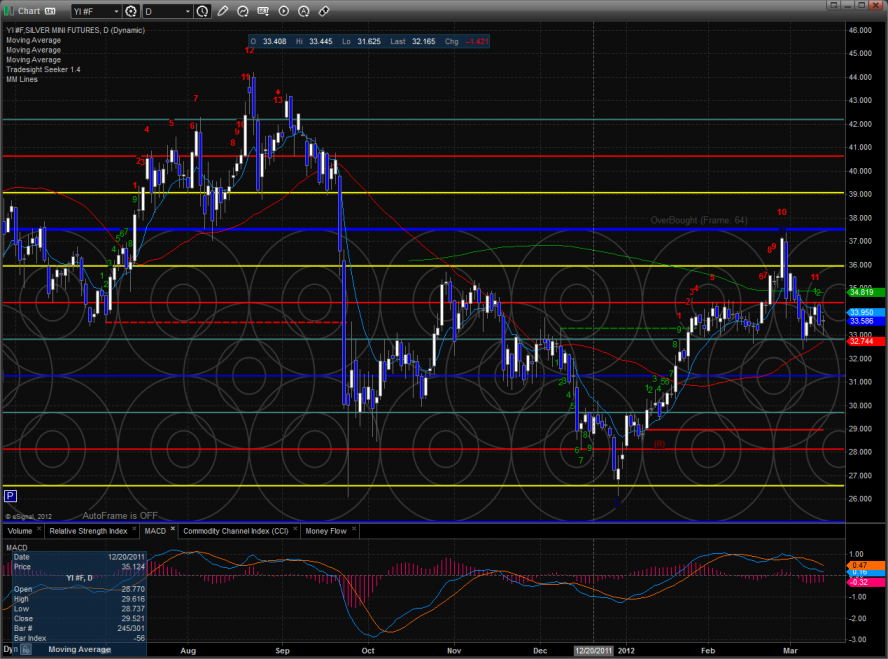

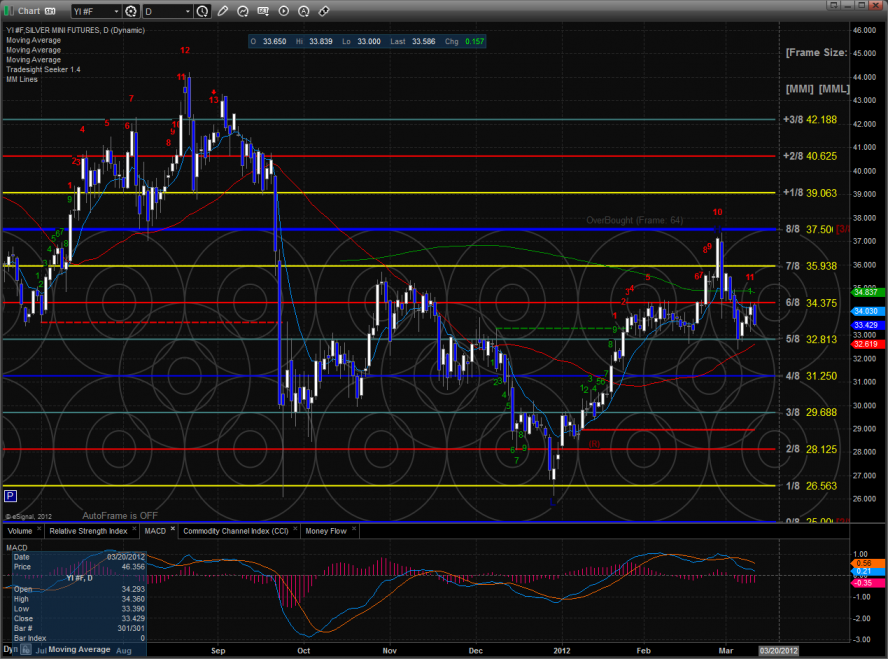

Silver:

Tradesight.com Market Preview for 3/15/12

The ES posted a measuring day with a net decline of 2 handles. The market moved sideways in a choppy fashion. A new high was recorded but not a new high close which makes this a distribution dayl.

The NQ futures were higher by 9 on the day making a new high close. Note that the MACD is getting extended.

The 10-day Trin is still being very stingy with giving us an overbought or oversold reading.

The strength of the banks and the weakness in the mining stocks is eye popping on our comparison chart. Can you say, “Rotation”?

The much welcomed strength in the BKX is good to see on the comparison chart.

The NDX/SPX cross is getting close to a new high. A breakout would be very bullish.

The BKX was the only sector up on the day and with it taking out yesterday’s high will disqualify the Seeker sell signal.

The SOX was the top NSDAQ sector but was lower on the day. The price action in the next couple of days is going to be very key because it will determine if the current up move is a retest of a high or more. The Seeker is still in a sell condition.

The XAU got thumped and is just above the YTD low. The 9 bar Seeker setup did not support price which implies that a full countdown phase is in the cards. Take it one bar at a time but this could be trouble if the 0/8 level is lost.

Oil:

Gold:

Silver:

Stock Picks Recap for 3/14/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, AVGO triggered long (with market support) and worked enough for an easy partial:

QGEN triggered short (with market support) and didn't go a dime either direction, so doesn't count:

In the Messenger, Rich's SINA triggered short (without market support due to opening five minutes) and worked great:

GOOG triggered long (with market support) and worked great:

Rich's LULU triggered short (with market support) and worked great:

AMZN triggered short (with market support) and didn't work:

Rich's AAPL triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Stock Picks Recap for 3/14/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, AVGO triggered long (with market support) and worked enough for an easy partial:

QGEN triggered short (with market support) and didn't go a dime either direction, so doesn't count:

In the Messenger, Rich's SINA triggered short (without market support due to opening five minutes) and worked great:

GOOG triggered long (with market support) and worked great:

Rich's LULU triggered short (with market support) and worked great:

AMZN triggered short (with market support) and didn't work:

Rich's AAPL triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Forex Calls Recap for 3/14/12

Another slow session. See GBPUSD below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A overnight and stopped. Put back in in morning and triggered short at B and stopped again:

Forex Calls Recap for 3/14/12

Another slow session. See GBPUSD below.

New calls and Chat tonight.

Here's the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A overnight and stopped. Put back in in morning and triggered short at B and stopped again:

Today's Use of the Tradesight Upper Pressure Threshold

Almost every trading session begins with some degree of a price gap. Depending on overnight news, the performance of overseas markets, and many other influences, markets tend to gap from session to session. Small price gaps tend to fill very quickly, usually in the first third of a trading day. Larger gaps tend to take longer to fill and gaps that are big enough will have to wait until subsequent trading days to fill.

So when is a gap large enough that it won’t fill in the same trading day? Tradesight is launching an enhancement to our Levels service that will give traders objective levels to determine the probability of a gap fill or gap and go environment. The Levels will be automatically plotted on the futures that we follow. There will be an upper Pressure Threshold and a Lower Pressure Threshold.

When price gaps but is contained between the Upper Pressure Threshold (UPT) and Lower Pressure Threshold (LPT), the expectation is that the gap is not large enough to stay open and will fill during the current trading session. However, when price gaps beyond the Pressure Threshold then the gap is significantly large enough to stay open for the entire session.

On Tuesday 3/13/12, the ES futures gapped above the Upper Pressure Threshold which defined that the gap was large enough not to fill in the current session. Not only did the gap not fill but the objectively plotted level was key support when price broke under the opening range and was threatening to make the gap fill move. The gap fill never happened and traders that were aware of the key level were empowered to stay on the long side of the tape for a spectacular afternoon explosion in price as short scurried to cover.

Below is the 15 minute chart of the ES futures with the Upper Pressure Threshold (UPT) shown as a bold green line:

You can learn more about how to use this key Level and many others in this weekend's all-new Tradesight Futures Levels course.

Tradesight.com Market Preview for 3/14/12

The ES gapped above the Tradesight Pressure Threshold and never looked back. After the FOMC decision and JPM buy back news the market plowed higher leaving the shorts scrambling for cover. The ES was higher by 24 on the day and made a new high close on the move. Note that this is the first meaningful close above the Murrey math 8/8 level.

The NQ futures were higher by 47 on the day making a new high and new high close on the move.

The 10-day Trin is still neutral but the daily Trin closed at 0.38 which favors a gap down tomorrow to relive the overbought pressure.

Multi sector daily chart:

The NDX continues to bullishly keep its relative strength vs. the SPX.

The BKX was decisively higher in the day which will force a frame shift in the Murrey math levels. The next couple of days are critical because if there is a trade that is one tick higher than Tuesday’s close the Seeker sell signal will be disqualified.

The SOX was stronger than the NDX which is a good sign for the bulls. This is a key intermarket nuance that needs to continue to pave the way for higher NDX prices.

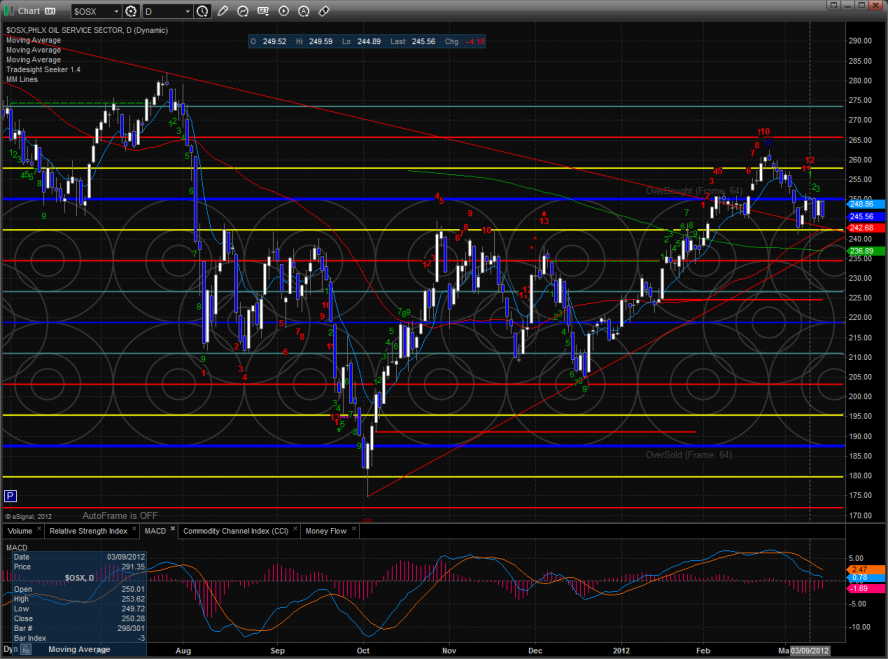

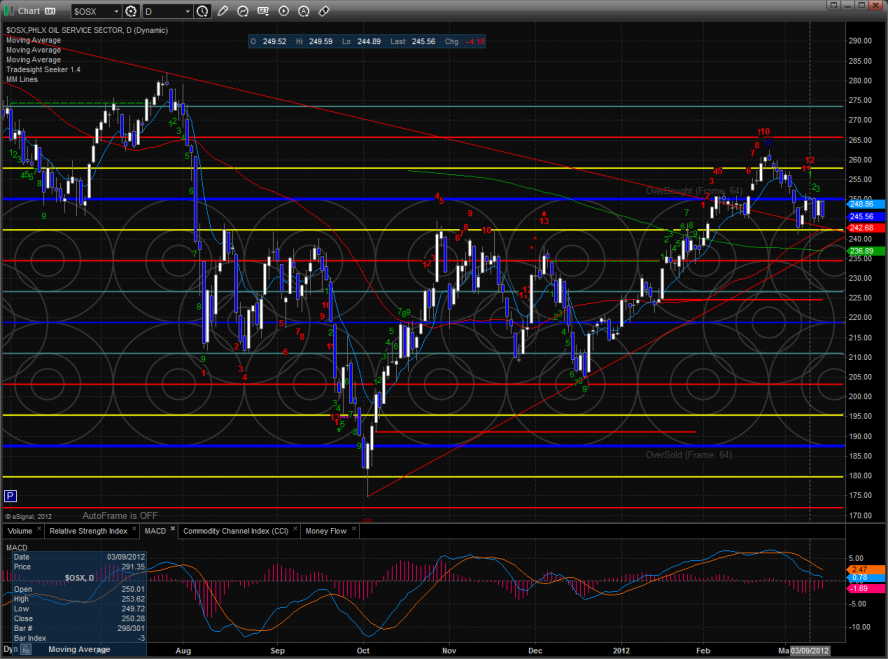

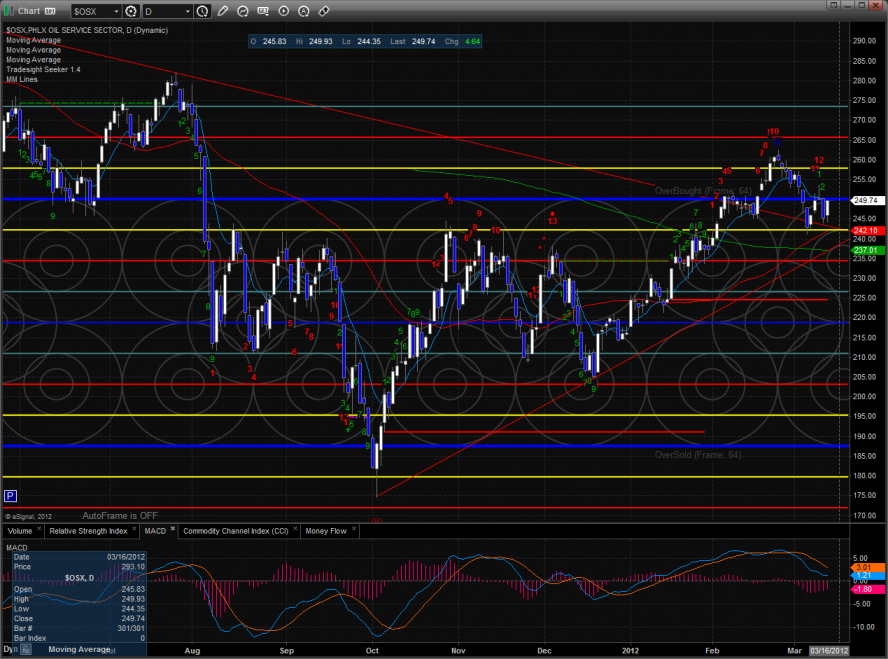

The OSX is still one day away from a Seeker sell signal.

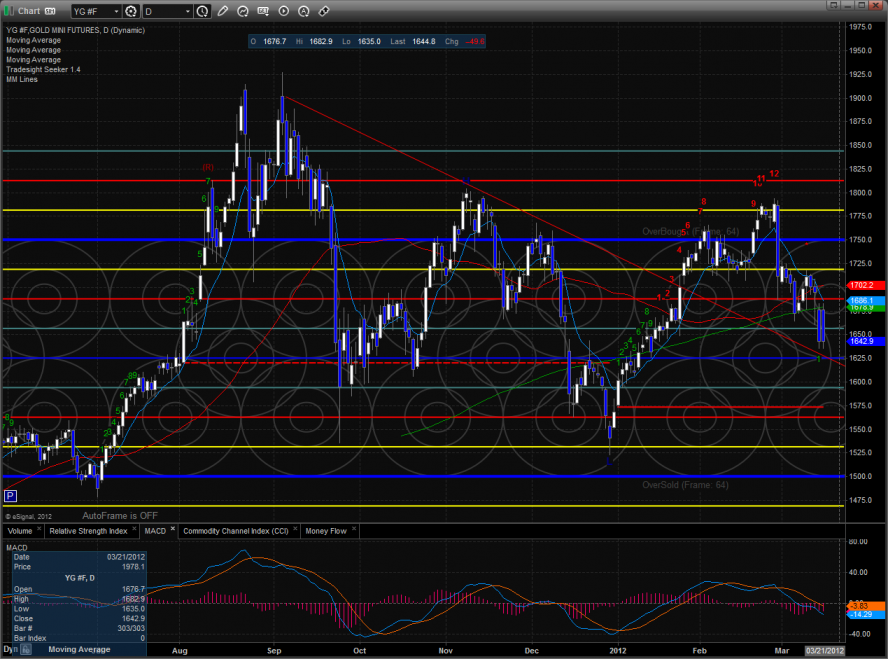

The XAU was the last laggard on the day but did not make a new low since the Seeker just recorded a completed 9 bar buy setup.

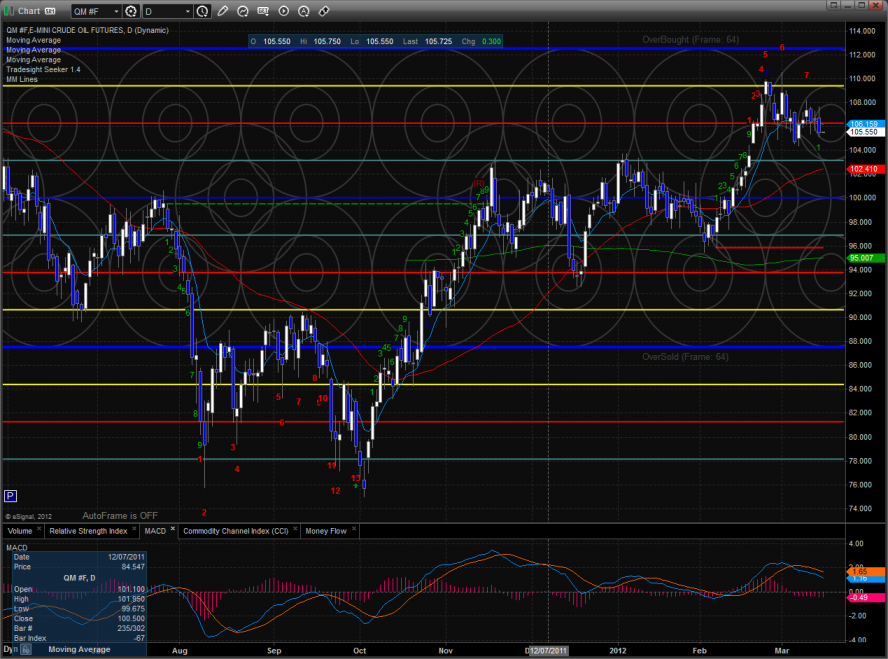

Oil:

Gold:

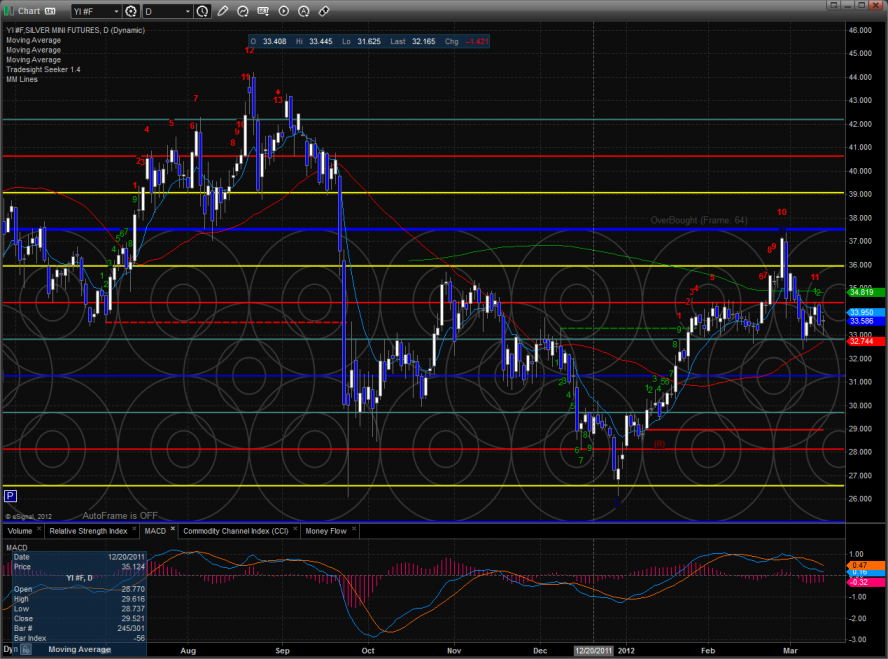

Silver:

Stock Picks Recap for 3/13/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, CTXS triggered long (without market support) and worked great:

VECO triggered long (with market support) and worked enough for a partial:

In the Messenger, Rich's SHLD triggered short (with market support) and didn't work:

His YOKU triggered short (with market support) and didn't work:

AAPL triggered short (with market support) and didn't work:

Rich's AMZN triggered short (with market support) and worked:

His FFIV triggered long (with market support) and worked:

Many more calls were posted to the Messenger, none of them triggered.

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.