Forex Calls Recap for 3/13/12

Ended up with both of our calls working on the EURUSD, which was nice to have them just close at the target ahead of the Fed instead of holding a piece. See that section below.

The US Dollar got a little stronger after the Fed, but not much.

New calls and Chat tonight.

Here's a look at the US Dollar Index intraday with market directional lines:

EURUSD:

Triggered long at A and hit target (no partials, we were just selling the whole thing today) at B. Triggered short at C (didn't break the level by enough an hour earlier to enter) and closed whole thing at target at D:

Tradesight.com Market Preview for 3/13/12

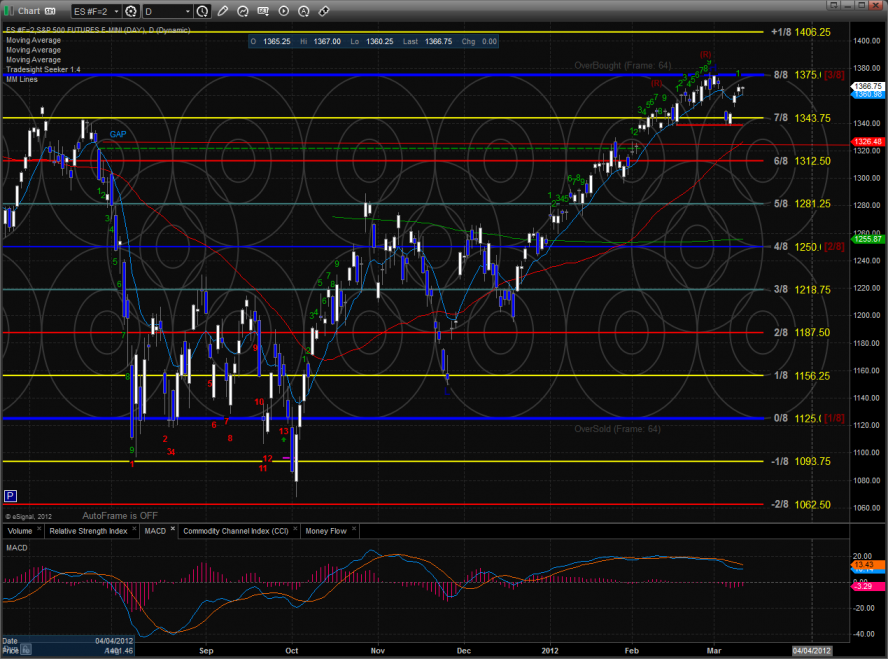

The ES closed the day unchanged which is actually notable for a couple of reasons. Internally there was a classic tug-of-war that wasn’t really visible by just looking at how the major averages closed. The advance/declines were sloppy closing -438 net issues, the economically sensitive OSX and SOX was much weaker than the broad market and then the VIX was bucking the negative internals. The VIX, which trades opposite of the averages, where you typically see higher ES prices and lower VIX values or vise versa, was very weak all day. So the weakness in the VIX usually sets the table for higher ES prices but the A/D numbers were sloppy and the leading OSX and SOX sectors were very weak and in conflict with the lower (read bullish) VIX. Markets that are trending with good internal support tend to keep trending but markets that are have been trending and show conflict rather than harmony are prone to reversals. Is one day of internal conflict a trend killer? Of course not but if the internal conflicts persist or worse if other divergences are seen be ready for a real change in trend.

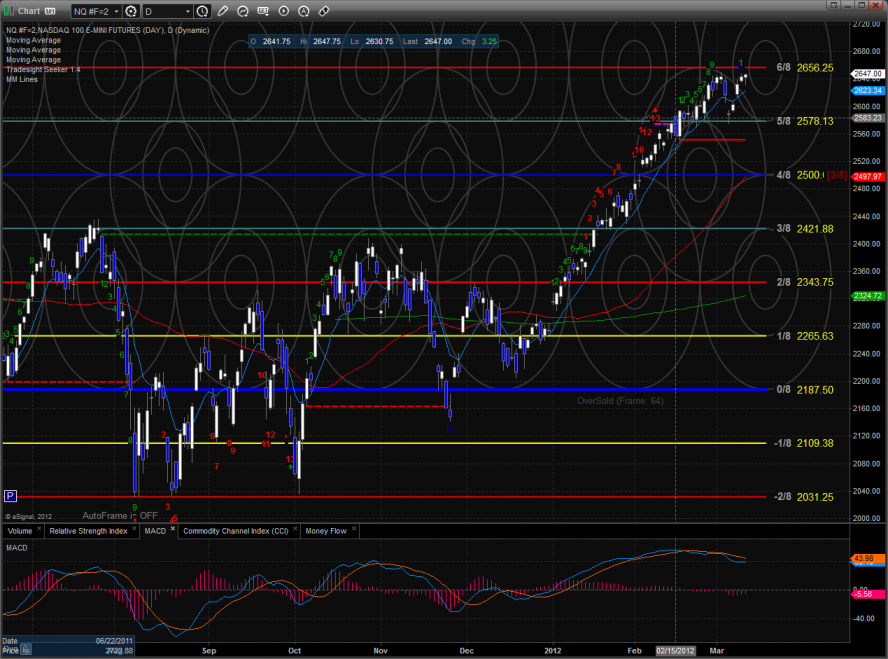

The NQ futures are at a very key area. The settled higher on the day by 3 handles but did not print a new high on the move. Any time price comes back up to retest a prior high it is important because very few high go untested and most trends require a period of pause or retracement. Last week price settled below the 10ema for the first time this year and the drop was recovered and is now right back to the old high which could be good or bad news. If price fails and begins to roll lower than last week’s low is the CIT denominator.

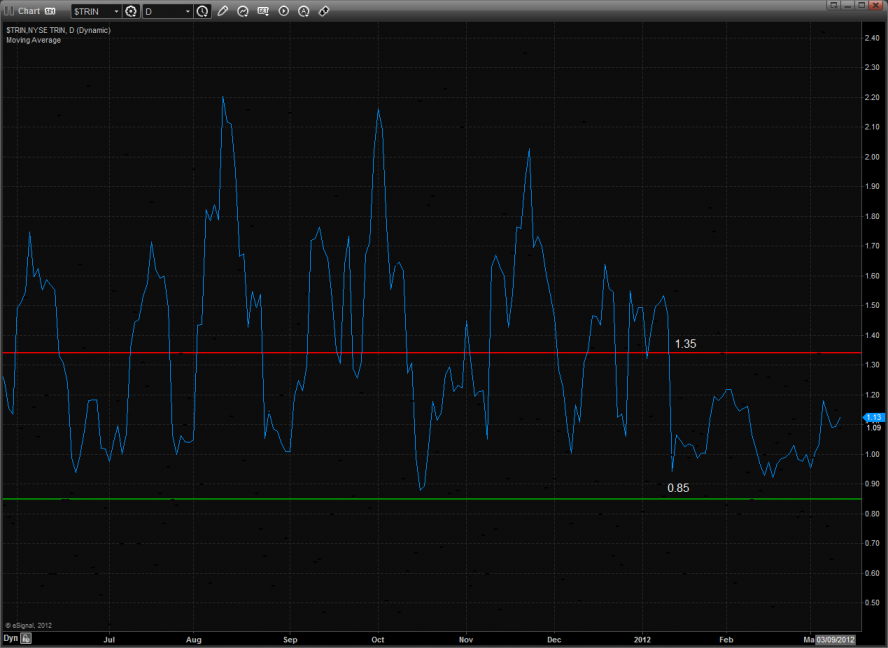

The 10-day Trin is still in the neutral area and has not yet produced an overbought reading.

Multi sector daily chart:

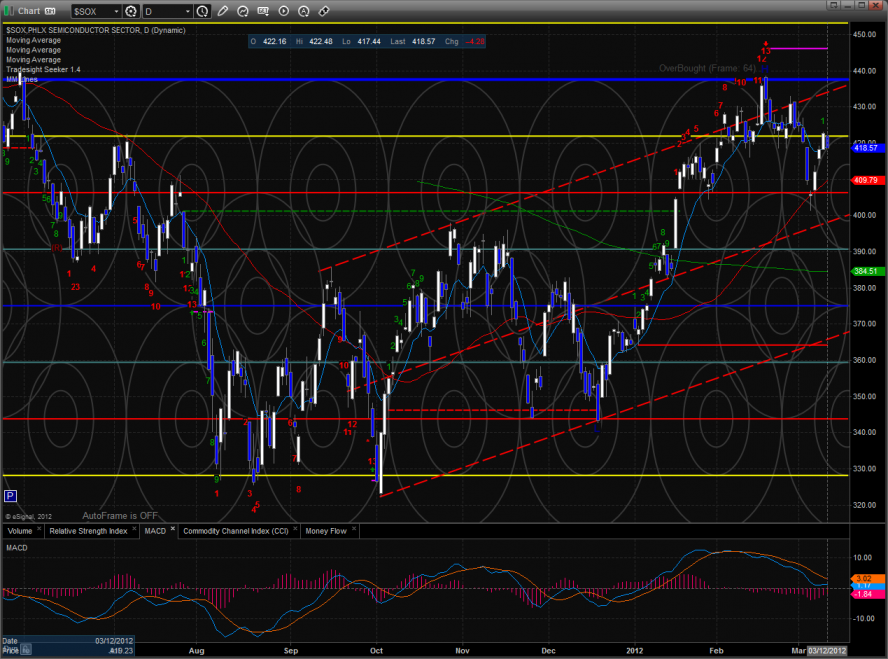

The SOX was weak on the day but didn’t cross the break down level which would be a killer for the overall NQ.

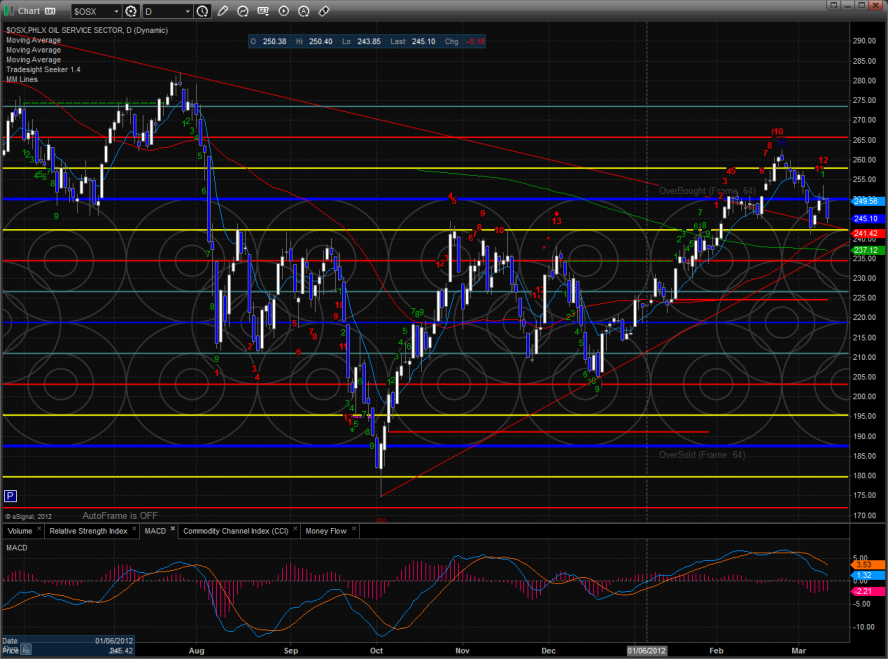

The OSX continues to bearishly lag crude futures.

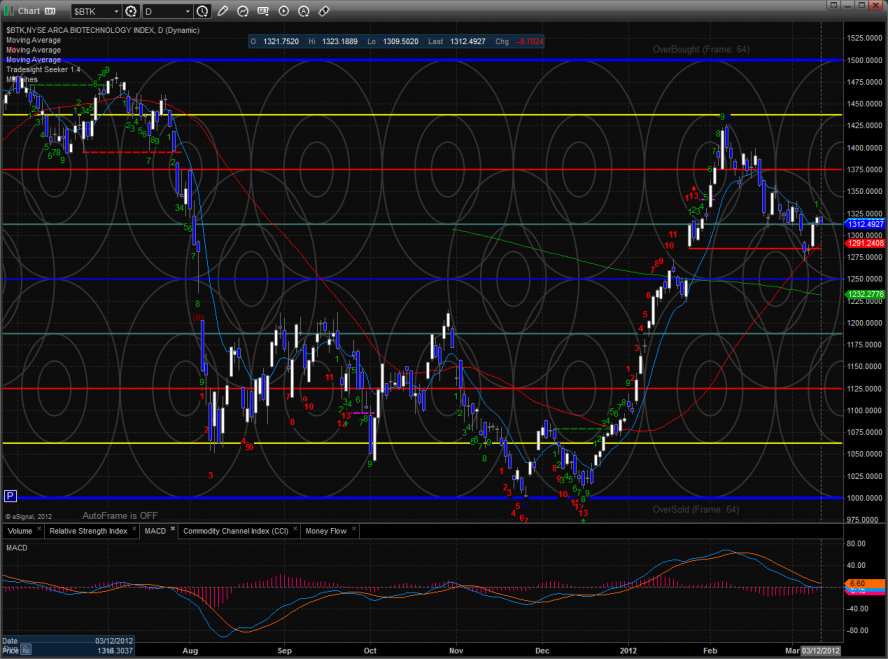

The BTK was the best performing major sector and was lower by 0.6%. Keep a close eye on the MACD which is close to breeching the zero level which will kick in downward momentum.

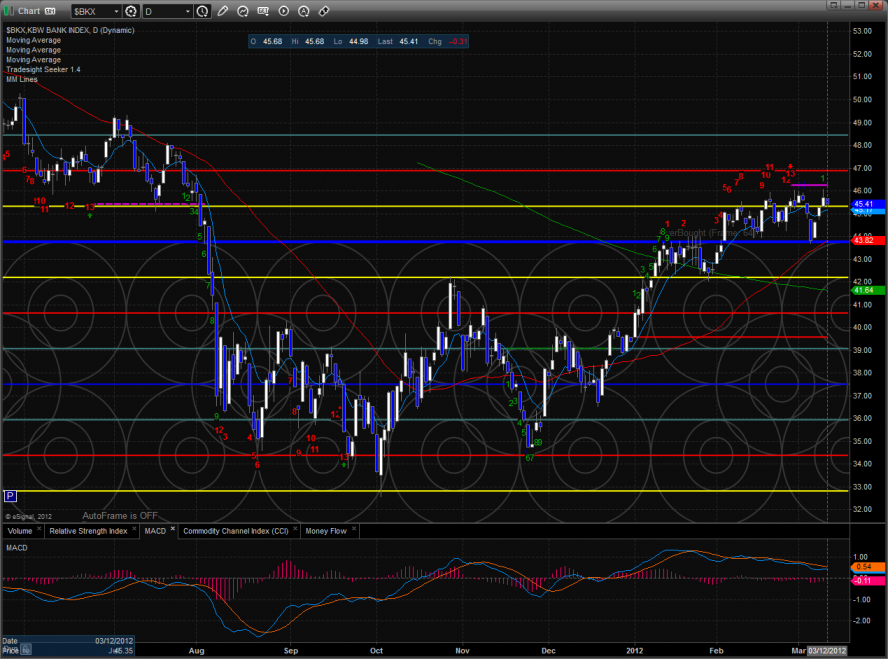

The BKX still has an active Seeker sell signal that hasn’t released its energy yet.

The SOX was contained within the prior day’s range and still has an active sell signal.

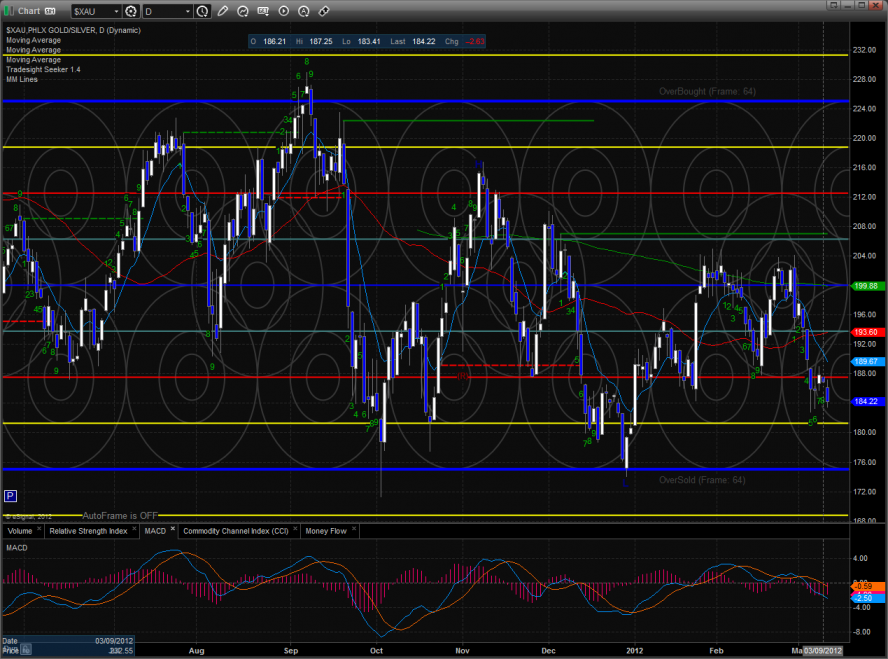

The XAU is now 9 days down which puts it on deck for a bounce.

The OSX was the last laggard on the day down a full 2%. Note that the Seeker is 12 days up and only one strong day away from a sell signal.

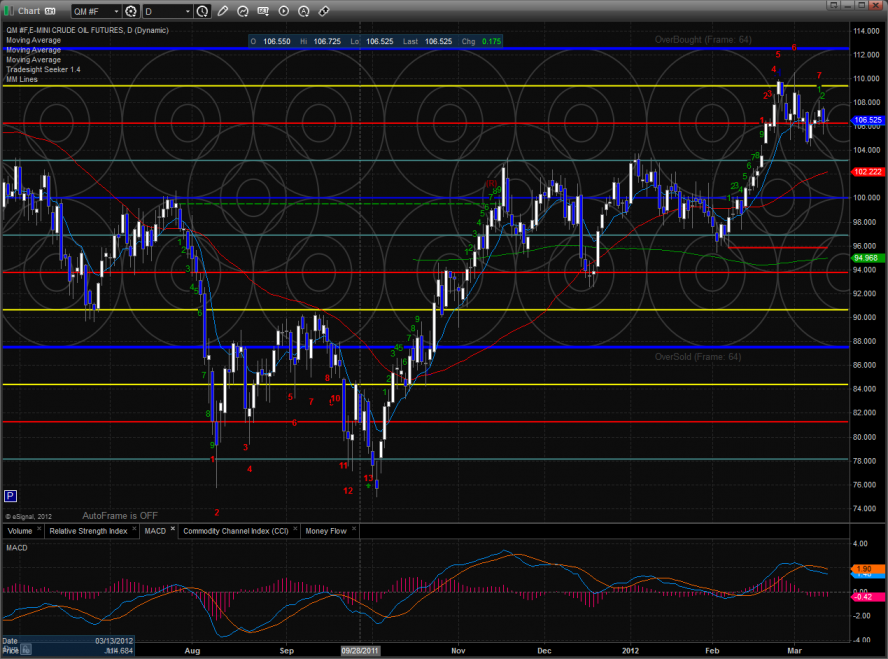

Oil:

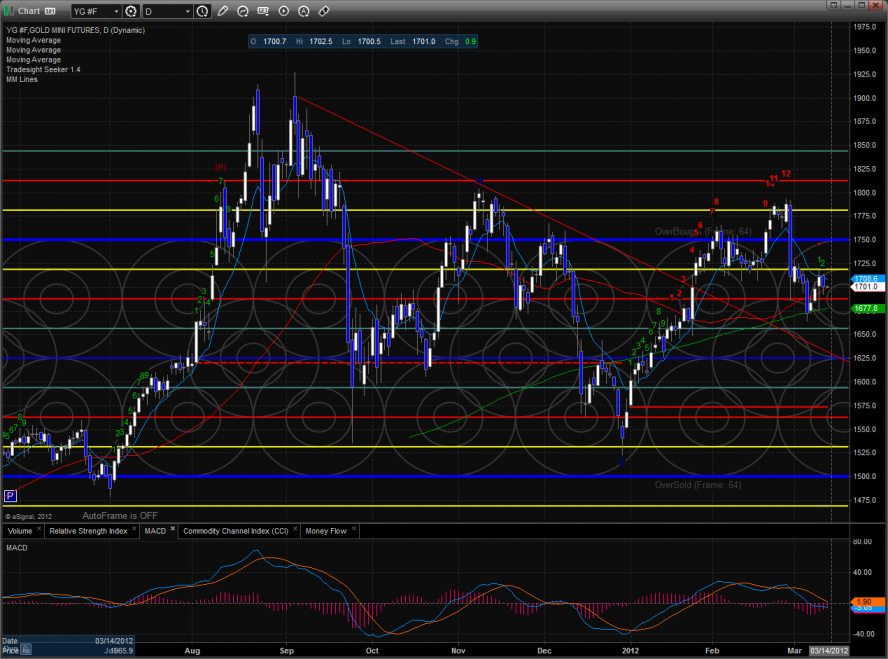

Gold:

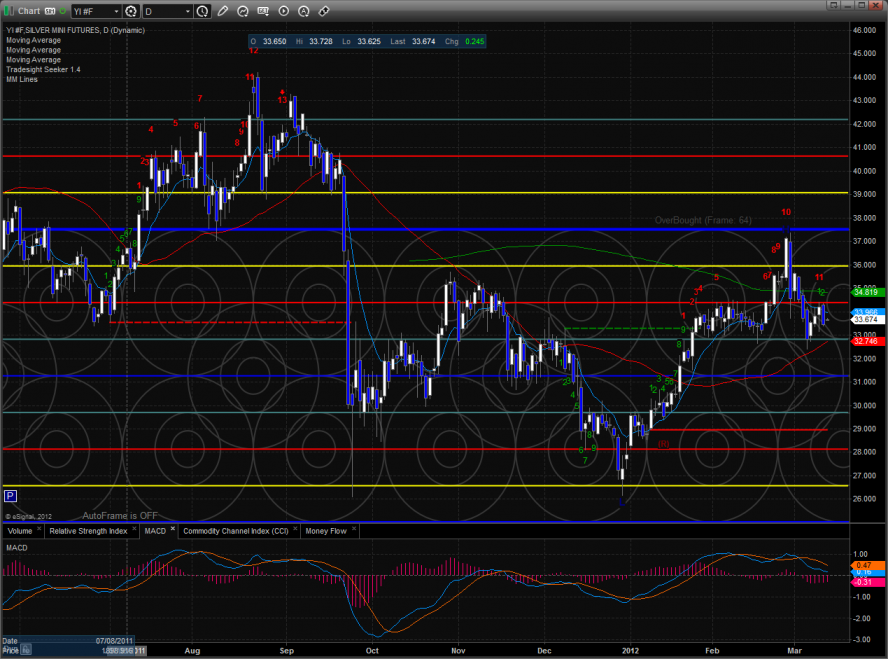

Silver:

Stock Picks Recap for 3/12/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, TSLA triggered long (with market support) and worked:

CTXS triggered long (with market support) and didn't work, worked later:

In the Messenger, Rich's GS triggered short (without market support due to opening five minutes) and worked:

NFLX triggered long (with market support) and didn't work:

Rich's KLAC triggered long (with market support) and didn't work:

His CAT triggered short (with market support) and worked:

His ALXN triggered long (with market support) and worked:

His AAPL triggered long (with market support) and didn't work:

His JVA triggered long (with market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 4 of them worked, 4 did not. Not shocking on a light volume day.

Stock Picks Recap for 3/12/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, TSLA triggered long (with market support) and worked:

CTXS triggered long (with market support) and didn't work, worked later:

In the Messenger, Rich's GS triggered short (without market support due to opening five minutes) and worked:

NFLX triggered long (with market support) and didn't work:

Rich's KLAC triggered long (with market support) and didn't work:

His CAT triggered short (with market support) and worked:

His ALXN triggered long (with market support) and worked:

His AAPL triggered long (with market support) and didn't work:

His JVA triggered long (with market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 4 of them worked, 4 did not. Not shocking on a light volume day.

Forex Calls Recap for 3/12/12

Since not all countries do the time change the same weekend anymore, we have seen an impact on trading the last couple of years when certain countries change their time zone over the weekend but others do not. Since Forex is the offset of two currencies and requires that both sides participates, the technicals of a pair can be thrown off by one country shifting their clocks by an hour when another does not. This then leads to a dull session for a day until the technical realign. We say that in this session, which was probably made worse by the fact that we have a Fed announcement tomorrow. So we ended up with about 60 pips of range in the EURUSD, 20 of that late in the session. See EURUSD section below for the recap.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, but half size ahead of the Fed tomorrow.

EURUSD:

Triggered short at A and stopped at B. Triggered long at C and stopped at D, put them both back in in the morning. Triggered long at E and closed at F for 20 pip gain as it hadn't reached first target and the session was ending (and dull):

Forex Calls Recap for 3/12/12

Since not all countries do the time change the same weekend anymore, we have seen an impact on trading the last couple of years when certain countries change their time zone over the weekend but others do not. Since Forex is the offset of two currencies and requires that both sides participates, the technicals of a pair can be thrown off by one country shifting their clocks by an hour when another does not. This then leads to a dull session for a day until the technical realign. We say that in this session, which was probably made worse by the fact that we have a Fed announcement tomorrow. So we ended up with about 60 pips of range in the EURUSD, 20 of that late in the session. See EURUSD section below for the recap.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, but half size ahead of the Fed tomorrow.

EURUSD:

Triggered short at A and stopped at B. Triggered long at C and stopped at D, put them both back in in the morning. Triggered long at E and closed at F for 20 pip gain as it hadn't reached first target and the session was ending (and dull):

Tradesight Launches New Futures Levels Tool for e-Signal and Tradesight Pressure Threshold Levels

Tradesight is pleased to announce the launch of the latest version of the Tradesight Futures Levels Tool for e-Signal, which includes the introduction of the new Tradesight Pressure Threshold Levels. In addition, the Futures tool and Futures Levels service now covers the ES (S&P e-mini), NQ (NASDAQ e-mini), YM (Dow e-mini), ER/TF (Russell 2000 e-mini), YG (gold e-mini), and QM (crude oil e-mini) contracts. Additional contracts are coming soon.

The tool now includes exciting features such as backtesting, Value Area shading, on/off toggles for each line, and more. In addition, the Pivot series Levels, which we calculate based on contract settlement and not market hours, have been expanded from R2, R1, Pivot, S1, and S2 to now include R3 and R4 and S3 and S4.

The key starred levels have changed from three tri-star levels and two dual-star levels to four tri-star levels.

Therefore, each contract now has a value for each of the following:

Breaks (UBreak and LBreak) - Key Murrey Math levels that bracket the market above and below each day, considered by many to be the most important number to know coming into the session.

Pressure Thresholds (UPT and LPT) - Threshold levels that serve as support and resistance, but are also a proprietary calculation from Tradesight that shows the likelihood of a gap fill.

Value Areas (VAH and VAL) - Market profile values that indicate the high and low of where 70% of the trading action occurred in the prior session based on volume.

Settlement-Based Pivot Series - R4, R3, R2, R1, Pivot, S1, S2, S3, and S4 for each contract. These are traditionally support and resistance points for trade management.

Tri-starred Levels - These four levels are "magnet" points for the market and also serve several purposes during trading when hit.

The tool now allow you to plug in any date and view the key levels for that date for back-testing purposes in e-Signal. Dates after 3/1/2012 show all levels. Dates prior to 3/1/2012 show only the Breaks and Value Areas.

The tool is available later this week on the site and will be used extensively in the new Tradesight Futures Course.

Here are two examples of the tool with the Value Area shaded in, first on the ES:

And then on the NQ:

Tradesight Launches New Futures Levels Tool for e-Signal and Tradesight Pressure Threshold Levels

Tradesight is pleased to announce the launch of the latest version of the Tradesight Futures Levels Tool for e-Signal, which includes the introduction of the new Tradesight Pressure Threshold Levels. In addition, the Futures tool and Futures Levels service now covers the ES (S&P e-mini), NQ (NASDAQ e-mini), YM (Dow e-mini), ER/TF (Russell 2000 e-mini), YG (gold e-mini), and QM (crude oil e-mini) contracts. Additional contracts are coming soon.

The tool now includes exciting features such as backtesting, Value Area shading, on/off toggles for each line, and more. In addition, the Pivot series Levels, which we calculate based on contract settlement and not market hours, have been expanded from R2, R1, Pivot, S1, and S2 to now include R3 and R4 and S3 and S4.

The key starred levels have changed from three tri-star levels and two dual-star levels to four tri-star levels.

Therefore, each contract now has a value for each of the following:

Breaks (UBreak and LBreak) - Key Murrey Math levels that bracket the market above and below each day, considered by many to be the most important number to know coming into the session.

Pressure Thresholds (UPT and LPT) - Threshold levels that serve as support and resistance, but are also a proprietary calculation from Tradesight that shows the likelihood of a gap fill.

Value Areas (VAH and VAL) - Market profile values that indicate the high and low of where 70% of the trading action occurred in the prior session based on volume.

Settlement-Based Pivot Series - R4, R3, R2, R1, Pivot, S1, S2, S3, and S4 for each contract. These are traditionally support and resistance points for trade management.

Tri-starred Levels - These four levels are "magnet" points for the market and also serve several purposes during trading when hit.

The tool now allow you to plug in any date and view the key levels for that date for back-testing purposes in e-Signal. Dates after 3/1/2012 show all levels. Dates prior to 3/1/2012 show only the Breaks and Value Areas.

The tool is available later this week on the site and will be used extensively in the new Tradesight Futures Course.

Here are two examples of the tool with the Value Area shaded in, first on the ES:

And then on the NQ:

Stock Calls Recap for 3/9/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, COST triggered long (without market support due to opening 5 minutes), didn't work, worked later in the day on a retrigger:

CROX triggered short (without market support) and didn't work):

In the Messenger, GOOG triggered long (with market support) and didn't work:

Rich's JPM triggered long (with market support) and worked:

NFLX triggered long (with market support) and worked:

Rich's LULU triggered long (with market support) and didn't do enough either way to count, closed right above the entry:

His CF and ABT triggered at the end of the session.

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Forex Calls Recap for 3/9/12

Closed out the week with another nice winner, see EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we'll look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (nothing new to focus on, but look at how the 13 sell signals on EURUSD and GBPUSD from last week nailed the turning points), and then glance at the US Dollar Index.

New calls and Chat Sunday.

EURUSD:

Triggered short at A, hit first target at B, lowered stop twice and then closed at C for end of week for 120 pip gain:

Subscribers have access to the preview of the week ahead.