Stock Picks Recap for 10/15/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SNBR triggered long (without market support) due to opening 5 minutes and worked:

From the Messenger/Tradesight_st Twitter Feed, nothing triggered.

In total, that's 0 trades triggering with market support.

Futures Calls Recap for 10/15/20

The markets gapped down and made their way back up on 3.9 billion NASDAQ shares.

Net ticks: +0 ticks.

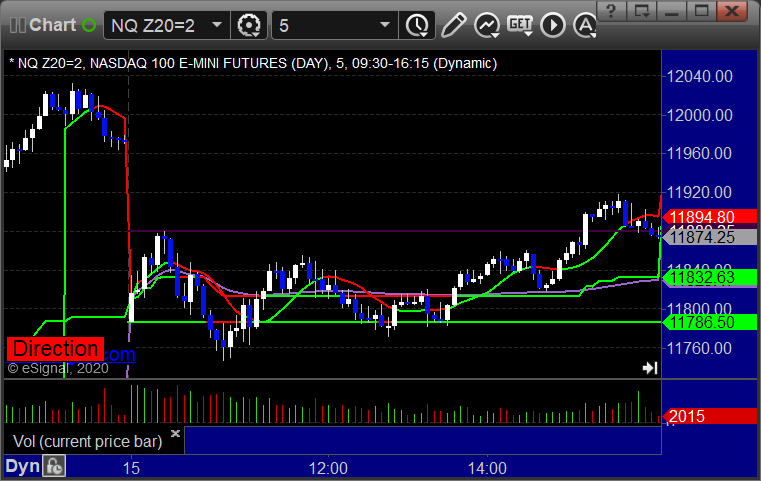

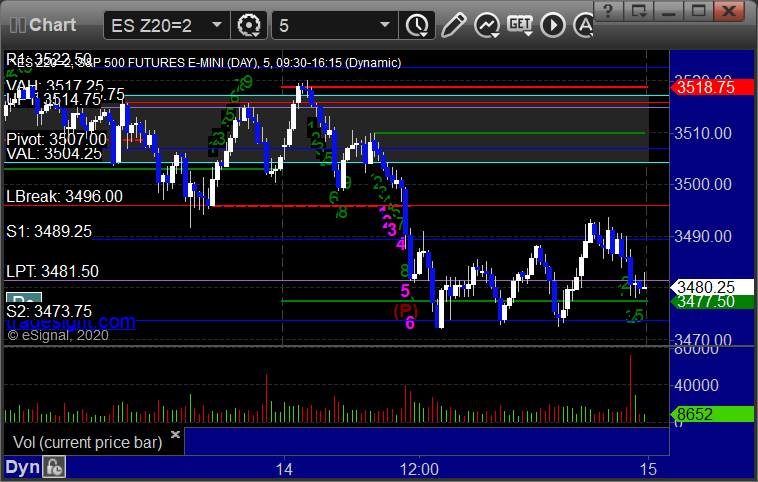

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A but too far out of range to take:

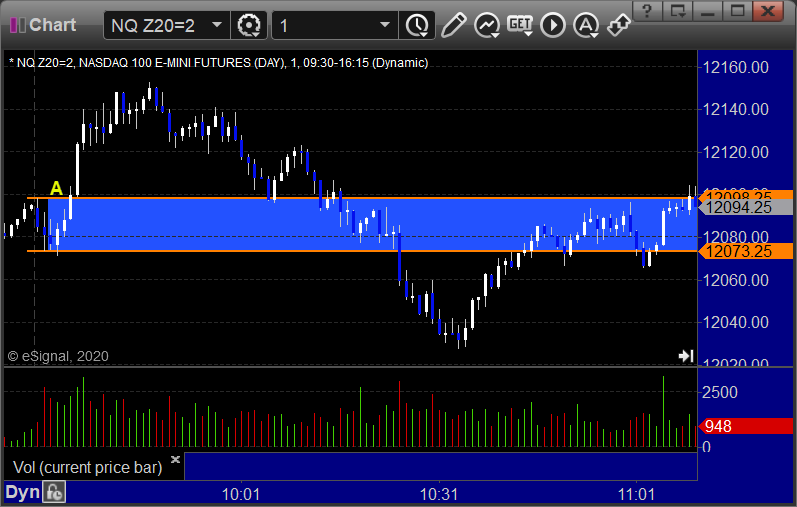

NQ Opening Range Play triggered long at A but too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 10/15/20

A winner for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

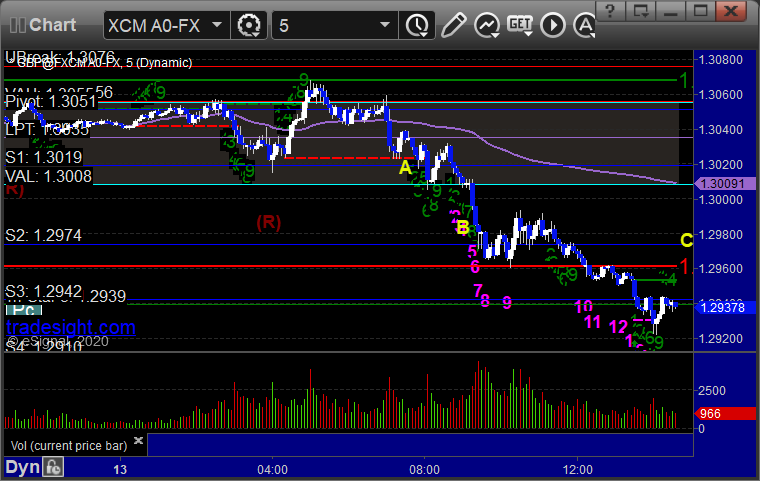

GBPUSD:

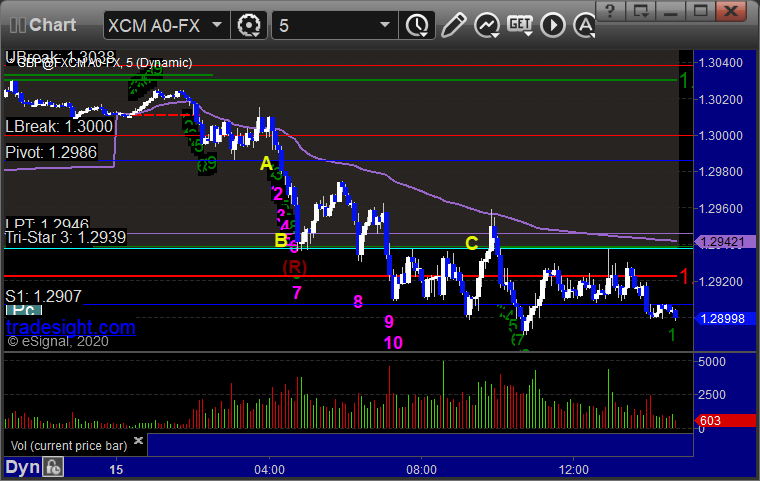

Triggered short at A, hit first target at B, second half stopped in the money at C:

Stock Picks Recap for 10/14/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SNBR triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and worked great:

His GRUB triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 10/14/20

The markets opened close to flat, went higher for 20 minutes and then filled the gap, bounced around, went lower ahead of lunch and that was the low of the day on 3.3 billion NASDAQ shares, which is really weak. If there was an options unraveling move, it was on light volume.

Net ticks: +16.5 ticks.

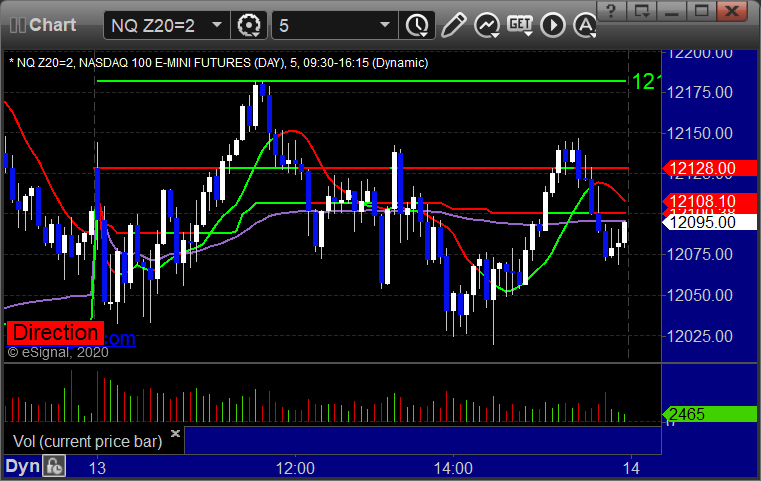

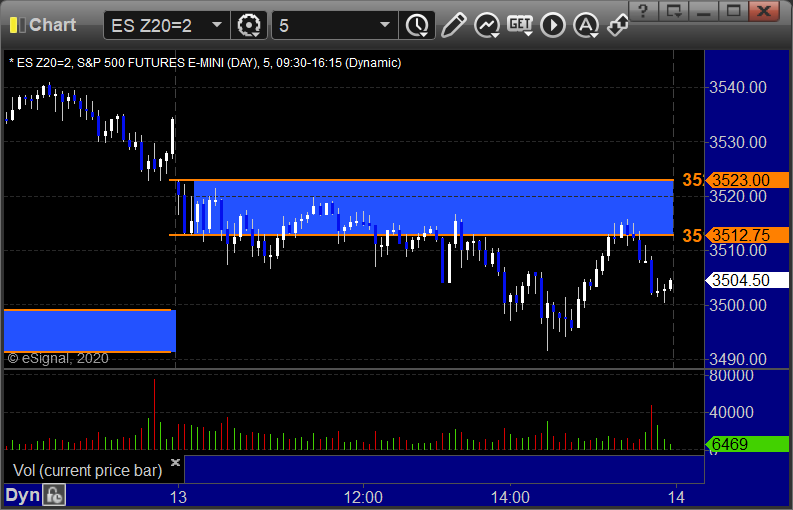

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 10/14/20

A loser and a winner for the session (still going). See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

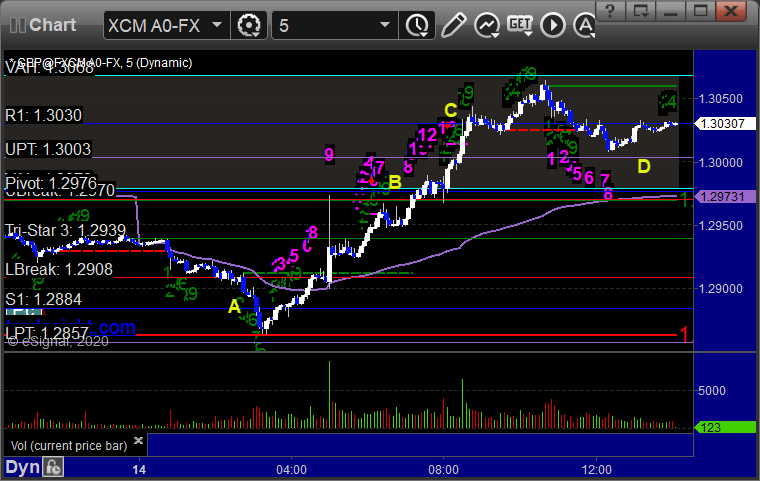

GBPUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, still holding second half with a stop under UPT at D:

Stock Picks Recap for 10/13/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FOLD triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's QCOM triggered short (with market support) and worked:

Rich's ROKU triggered long (with market support) and worked:

Mark's SGEN triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all of them worked.

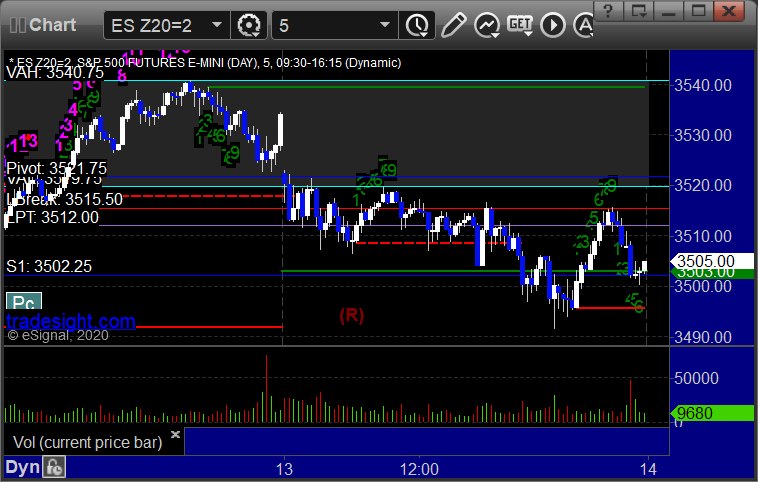

Futures Calls Recap for 10/13/20

The markets gapped mixed, drifted lower early, went flat for over half of the day, then dipped coming out of lunch and popped back up to the midpoint/VWAP area on 3.5 billion NASDAQ shares.

Net ticks: +4 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered short at A but too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 10/13/20

A winner (still going) for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over S2 at C:

Stock Picks Recap for 10/12/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls for the bank Holiday.

From the Messenger/Tradesight_st Twitter Feed, Rich's KLAC triggered short (without market support) and didn't work:

In total, that's 0 trades triggering with market support.