Getting Back in the Game After Striking Out with a Loss

by Mark Likos

Getting back into the Game after Striking Out with a Loss …

Striking out with a loss is never fun but striking out on your first trade of the day has always been worse for me. Many traders have a hard time getting back into their game after an initial loss. They let their emotions take over and are hesitant or worse yet ‘can’t’ pull the trigger on their next trade. They end the session in the red on a day they should have seen profits.

To help avoid this, focus on only the strongest trade opportunities to start your day. Not all trades are equal; those with strong directional bias as evidenced by the current trend with solid momentum in the direction of your proposed trade will have the high-degree of probable success. Avoid taking setups that trigger against the current directional bias. One way to evaluate this is: IF your normal trade size is 500 shares, would you still feel strongly about taking the trade with 3000 or 5000 shares? If so, you probably have targeted a strong play.) I like to play enough size so I can take a partial profit on the initial run (pay yourself from the first fruits!) then move a stop to breakeven or better, and let the remaining lot play out for the swing or term play IF you are lucky enough to have picked a trade with that kind of a move in it. Remember, it’s nice to hit a homerun every once in a while, but veteran players know the game is won with base hits. The homeruns will come with your frequency at bat, they are rarely planned.

This way, you will have a higher probability of starting the day with a profitable trade that will do wonders in keeping those evil emotions out of your trade decision process.

So what happens when your best analytical efforts don’t work and you open with a loser?

It happens. Astute traders know losing is part of the game. Successful traders also know that all large losers start with small ones and take their stops as they materialize without hesitation.

It happened to me today with in an ES Index Futures trade. I felt the ES was setup well for an upside continuation/breakout IF it could move above near-term resistance. Soon after the open, with solid volume the market moved higher triggering my entry. That was as far as it went. I didn’t panic. I double checked the technical factors that lead me to the trade initially and they were still supporting my ‘technical argument’ for this long-play decision. I hadn’t made any mistakes there. I then checked the market internals I track that help verify the directional bias of the overall market and they were still bullish; I hadn’t missed anything there. There was NO technical indication of a bearish condition. I held tight. The market moved no farther than my entry, triggered (a sweep) and took me out with my 6-tick stop loss. Not good when you feel you’ve analyzed the market direction technically correct and you lose…

I took a small loss (all losses are painful) but a technically managed loss for my first trade of the session. You know what happened. The market changed character, gave me a technically supported short setup just under the opening range low, triggered and then dropped like a rock for more than 20-ticks (5-points).

Trade Summary - After taking that first loss, I continued to monitor market conditions which changed to technically bearish and I found a good trade to short on the low of the morning. Playing the same size as my first play, I entered my short, took my initial partial profit (that wiped out my first trade’s loss), moved my stop to breakeven and trailed my stop just behind the downside run with my remaining position, for a nice second trade ending the morning in the green.

The primary goal, is to avoid an initial strikeout. The best way to do that is to wait for the strongest trade opportunity. If you should lose on your opening trade, continue to look for the strongest trade setups (those that are supported by current directional bias with volume) and stick to your tried and proven approach. Don’t miss out on strong trade conditions because of your emotions, stick to looking for the best plays.

Stock Picks Recap for 3/3/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

Nothing triggered from the report.

In the Messenger, Rich's GS triggered long (without market support) and didn't work:

His PAAS triggered short (with market support) and worked:

His SLW triggered short (with market support) and worked enough for a partial:

AMZN triggered long (with market support) and didn't work:

There were a lot of other calls but nothing triggered on a dull day.

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Stock Picks Recap for 3/3/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

Nothing triggered from the report.

In the Messenger, Rich's GS triggered long (without market support) and didn't work:

His PAAS triggered short (with market support) and worked:

His SLW triggered short (with market support) and worked enough for a partial:

AMZN triggered long (with market support) and didn't work:

There were a lot of other calls but nothing triggered on a dull day.

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Forex Calls Recap for 3/3/12

A nice ending to the week with a solid winner in the EURUSD and no stop outs. See EURUSD section below.

Here's the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week for all of the pairs with the Seeker and Comber separately (lots to discuss there), and then look at the US Dollar Index.

EURUSD:

Triggered short at A, hit first target at B, closed late in the day for end of week and +75 pips:

Here's a sample of our analysis on the daily charts of the pairs, this one for EURUSD:

Note the Comber 13 sell signal three days ago at A, which creates the pink risk line. Also note that this occurred at the green static trendline, which is the high of the last 9 bar downward setup at A. That's pretty much as technical as it gets. The green line is dashed, by the way, because we did get a day where the EURUSD closed a couple of pips over it, which doesn't matter for the sell signal:

Rest of the pairs available for subscribers only.

Stock Picks Recap for 3/2/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, LINE gapped over the trigger, no play.

In the Messenger, Rich's AAPL triggered short (without market support) and worked:

His ABX triggered short (without market support) and didn't work:

His AMTD triggered long (with market support) and didn't go a dime either way all day, not enough to count either way, closed at the entry:

His WYNN triggered long (with market support) and worked great:

His CAT triggered short (with market support) and didn't work:

In total, that's 2 trades triggering with market support, 1 of them worked great, 1 did not.

Forex Calls Recap for 3/2/12

Boring session, one loser in EURUSD, and I didn't put it back in in the morning (not that it triggered anyway).

Here's the US Dollar Index intraday with market directional lines:

EURUSD:

Triggered short at A, stopped at B:

Forex Calls Recap for 3/2/12

Boring session, one loser in EURUSD, and I didn't put it back in in the morning (not that it triggered anyway).

Here's the US Dollar Index intraday with market directional lines:

EURUSD:

Triggered short at A, stopped at B:

Stock Picks Recap for 2/29/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

Nothing triggered off of the report.

In the Messenger, Rich's AAPL triggered short (with markets support) and worked:

SINA triggered short (with market support) and worked:

Rich's YOKU triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 of them worked.

Stock Picks Recap for 2/29/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

Nothing triggered off of the report.

In the Messenger, Rich's AAPL triggered short (with markets support) and worked:

SINA triggered short (with market support) and worked:

Rich's YOKU triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 of them worked.

Tradesight.com Market Preview for 3/1/12

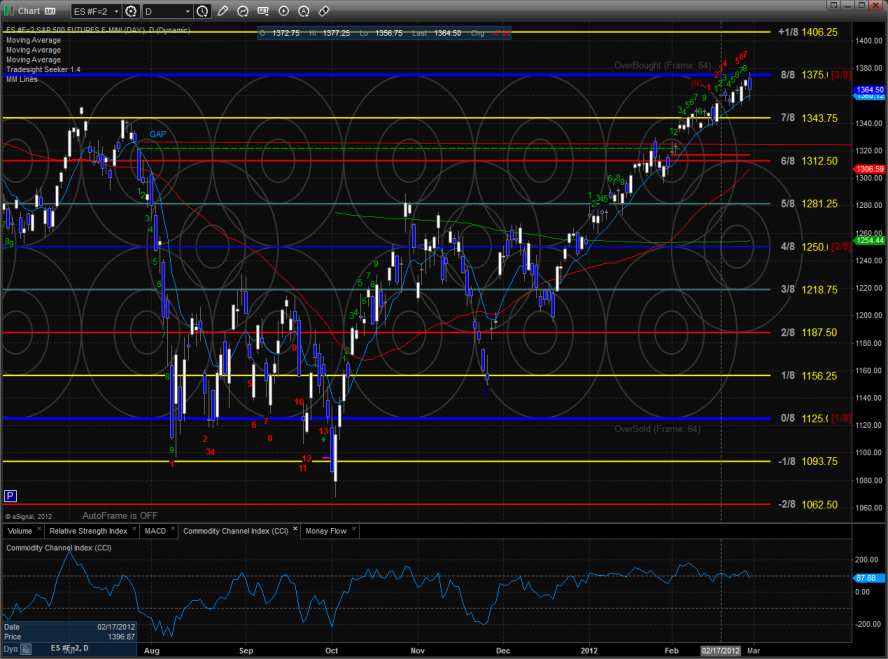

The ES posted a very sloppy outside day down. Though the futures were only down by 7 on the day, the chart pattern has a potential reversal candle in place. The candle was small but the turn came just below the Murrey math 8/8 level of 1375.The next 48 hours of trading will be very important to see if this turn follows through to the downside. The early indication of a change in trend will come on a settlement below the 10ema (blue MA on chart) which hasn’t happened since 2011.

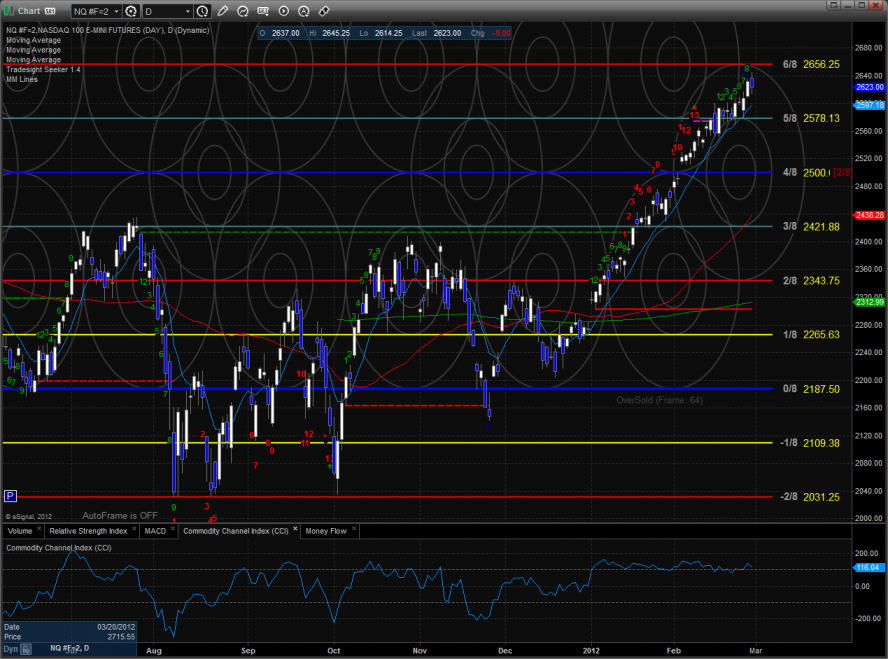

The NQ futures were weak but didn’t breech yesterday’s low. AAPL continues to be driving the bus and if it breaks the Naz futures and other high beta stocks will break.

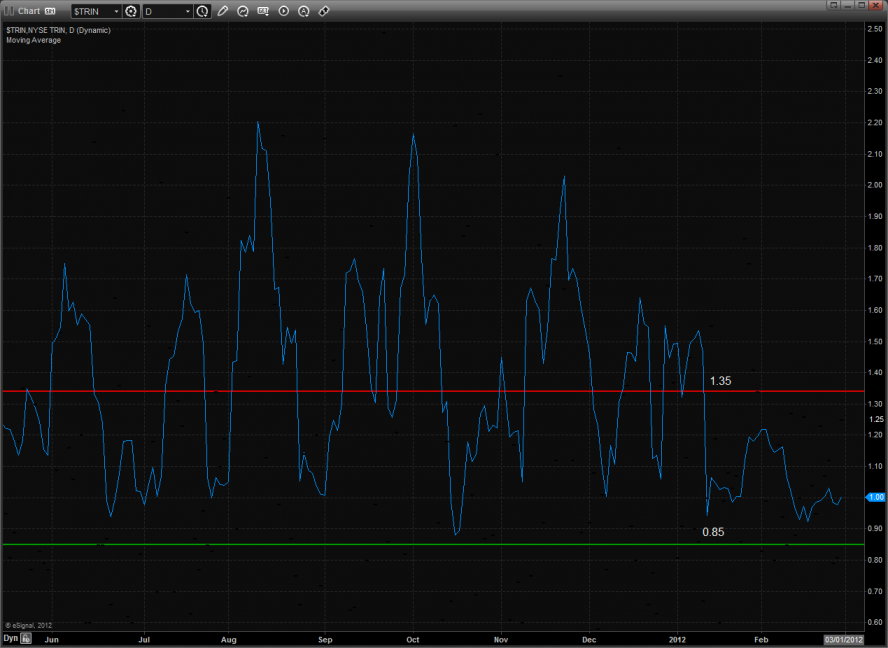

The 10-day Trin still has some room before recording an overbought reading of 0.85 or less.

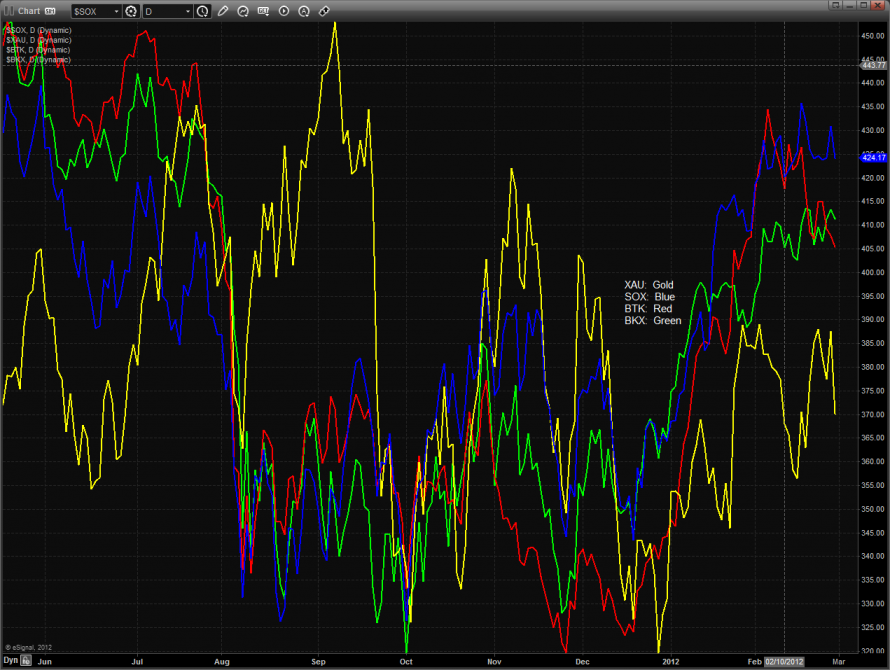

Multi sector daily chart:

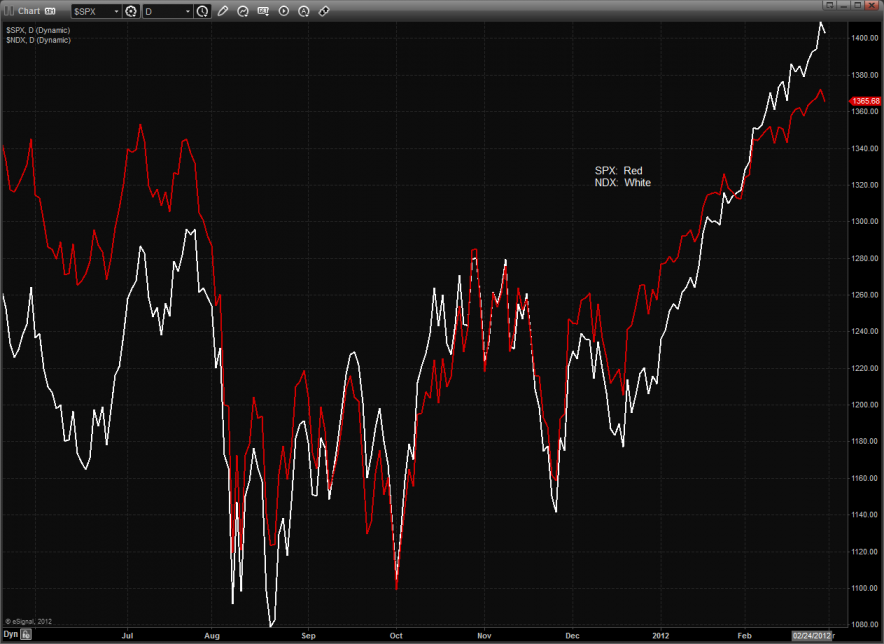

In the multicomparison chart below the important NDX100 continues to have relative strength vs. the SPX.

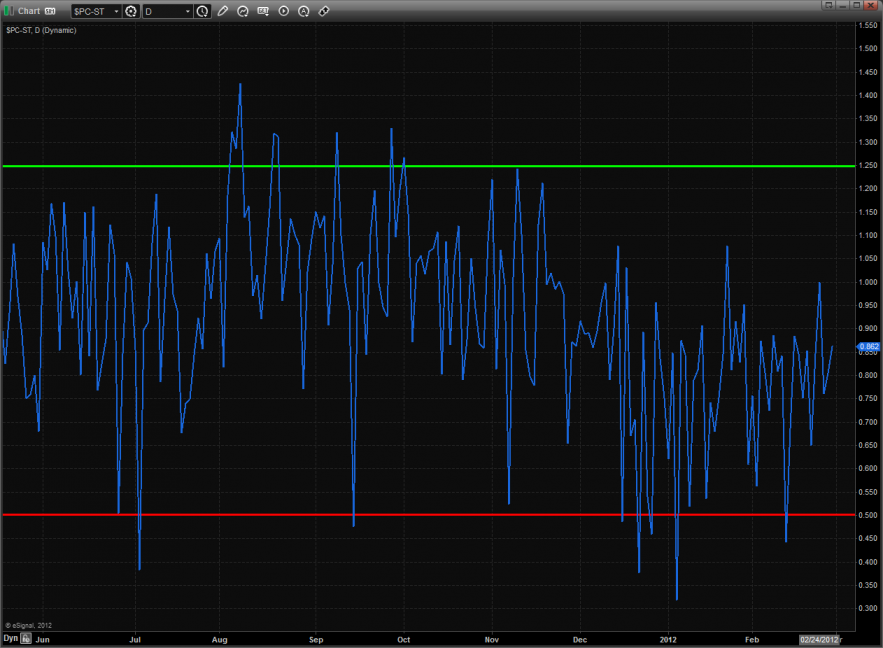

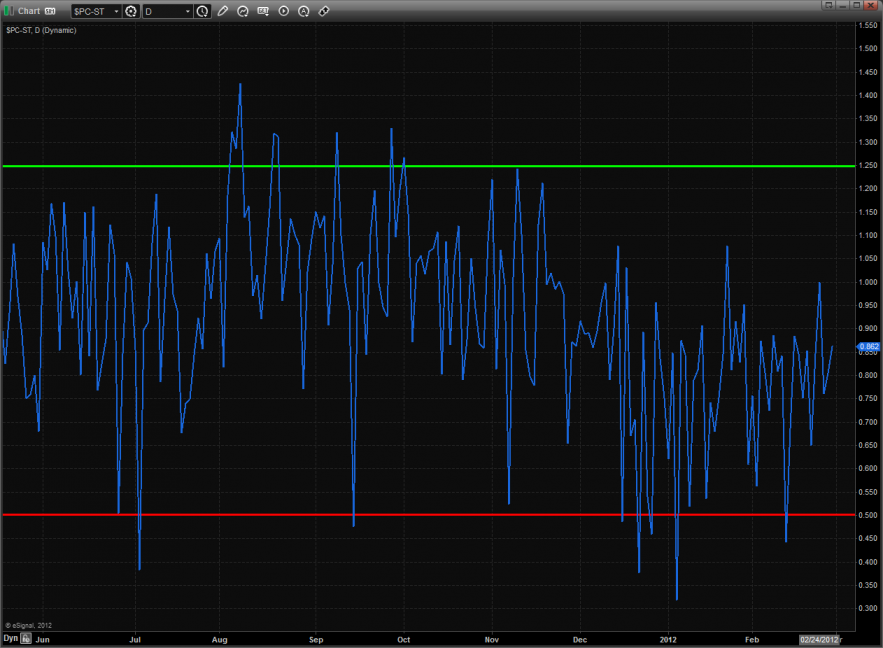

The put/call ratio remains neutral:

The BKX was the best of the major sectors on the day though it was lower on the day. Keep in mind that there is an active Seeker sell signal that hasn’t released its energy yet.

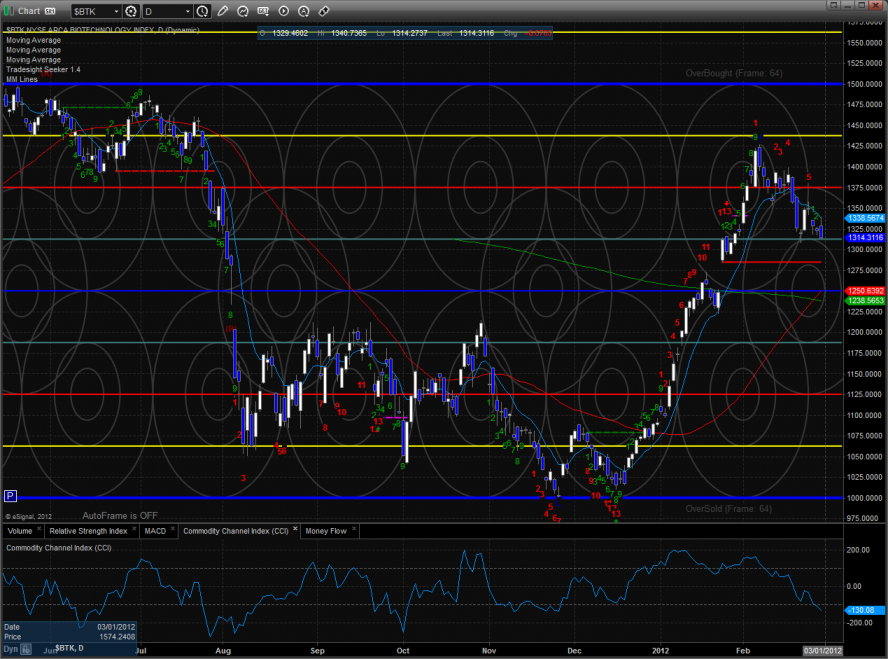

The BTK is hovering just above last week’s low and has relative weakness vs. all the important averages. Continue to monitor this sector for short setups.

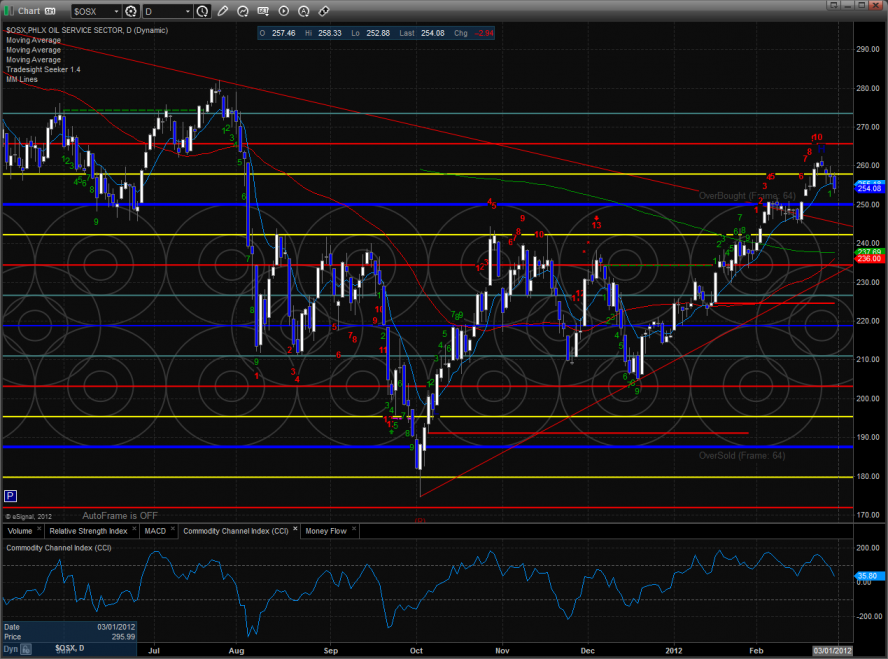

The OSX has bearishly closed below the 10ema. Keep a close eye on a fallback to the triangle breakout.

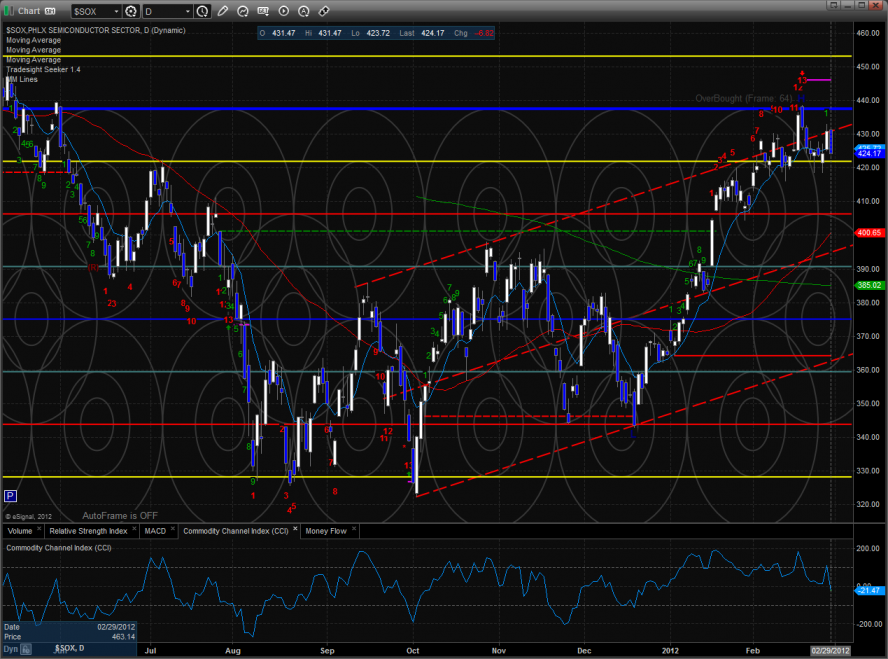

The SOX has an active Seeker sell signal in place is starting to trace out a head and shoulder pattern.

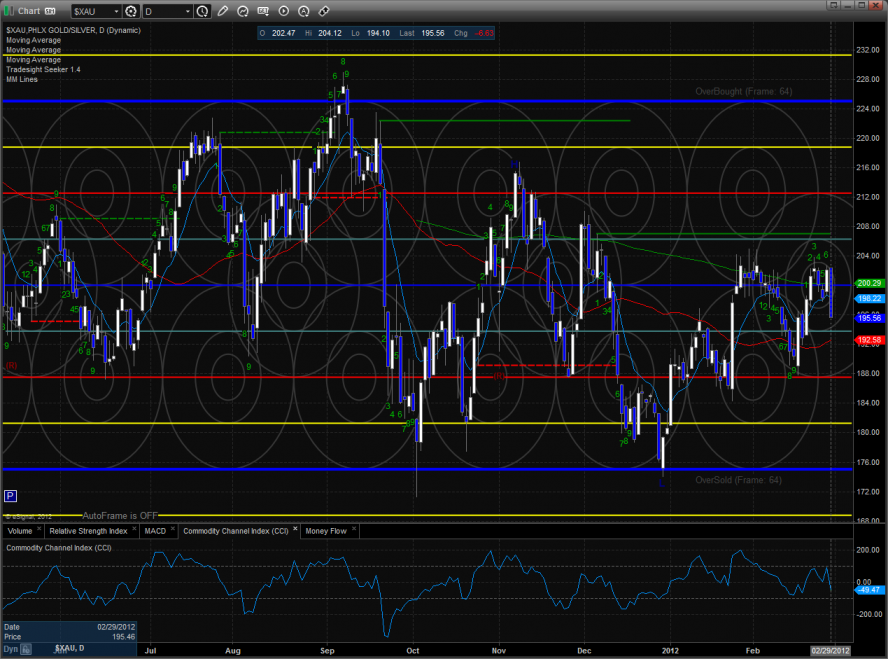

The XAU was by far the weakest sector on the day after the very sharp break in gold. Next important support is the 50dma at about 192.50.

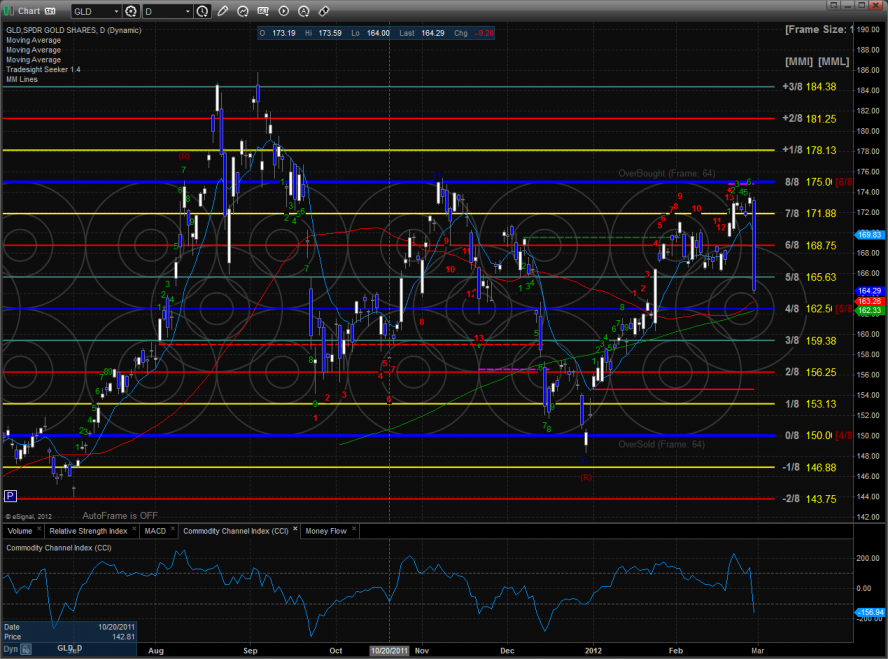

Gold has a huge decline after recording a Seeker sell signal last week. Support will first be found in the area were the 50dma, 200dma and 4/8 Gann level converge.

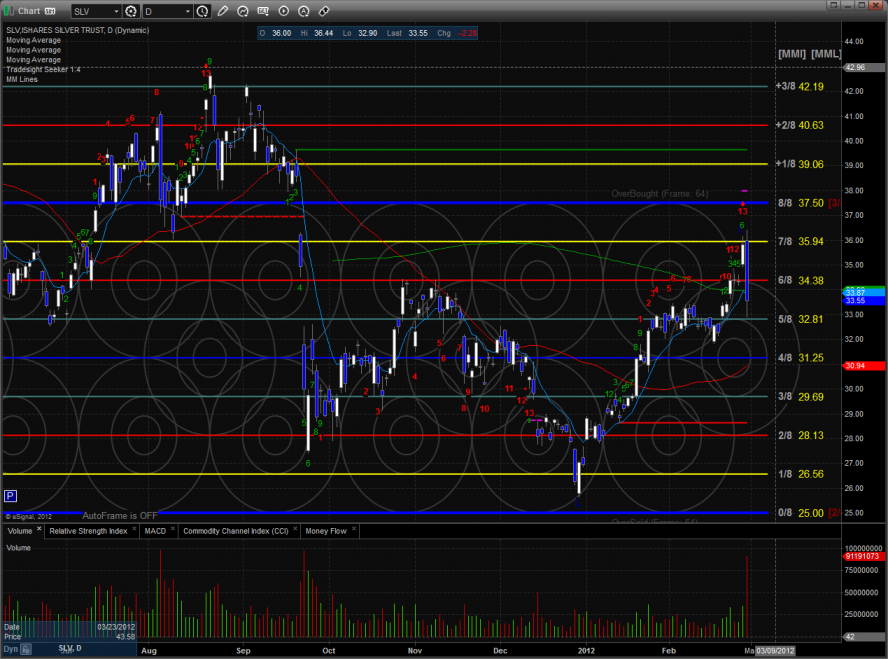

Silver collapsed after only yesterday flashing a Seeker sell signal. Note the volume spike in the SLV etf. Real support lies around 31.25 where the 4/8 level and 50dma sit.

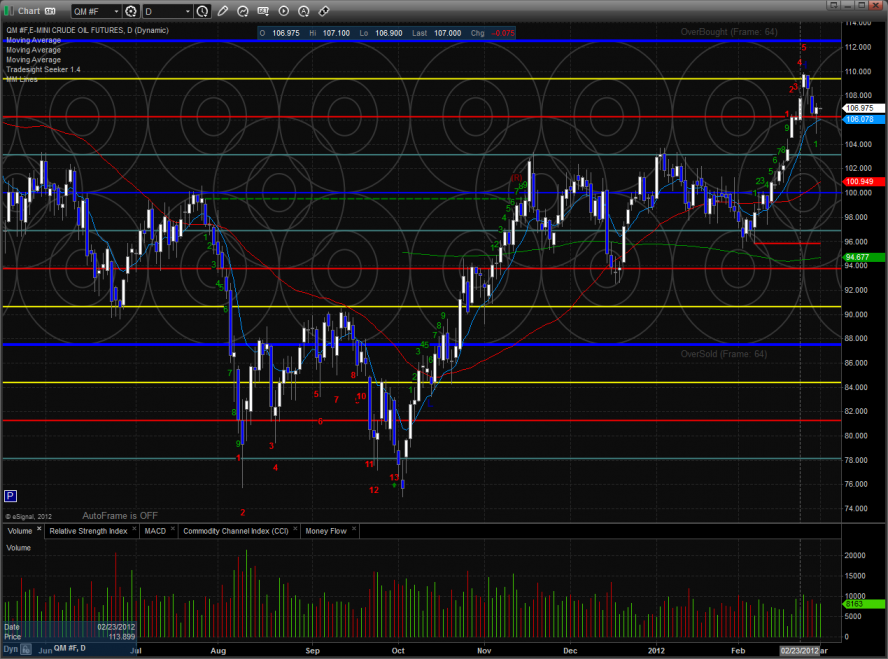

Oil: