Forex Calls Recap for 2/29/12

Here's something unusual: neither of our trades triggered. The GBPUSD went up and the EURUSD went down, but our calls were in the opposing directions on each, which was probably a good thing as the overnight session was jumpy but flat, and it seems unlikely that anything would have worked. We finally got a spike when the Fed Chairman started his testimony to Congress. Here's the US Dollar Index intraday with market directional:

New calls and Chat tonight. Lot of data overnight, including unemployment out of Europe, but none of it is our Big Three. No reviews of any of the pairs below since nothing triggered, although there was a nice breakout formation on GBPJPY over R1 that anyone that has taken our courses should have caught.

AGO Seeker Sell Signal Trade

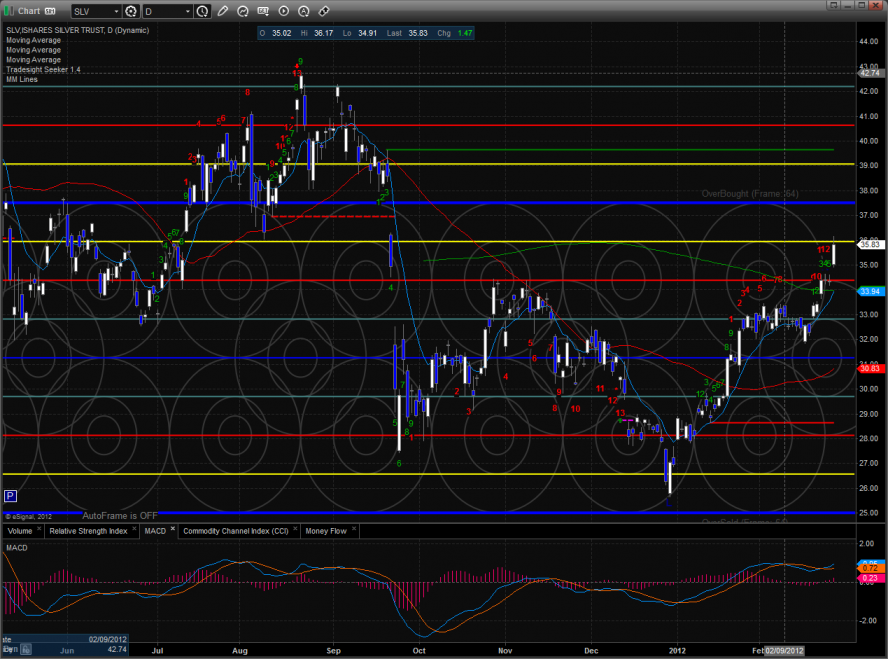

Tuesday our Seeker tool flashed a sell signal for silver. This was the first sell signal since it correctly identified the top in August last year. A short was called and delivered via our messenger to alert traders to short triple leveraged AGQ<70.67 or the 1x SLV<35.47. The trade triggered and over the course of only about 60 minutes the AGQ moved $10 in our favor.

Here is a 15 minute chart of the AGQ with the trade trigger and subsequent price action:

Below is a look at the daily chart showing the Seeker sell signal generated Tuesday for the AGQ. The candle with the red number 13 and red arrow is the sell signal that alerted us that the trend was ready to change from bullish to bearish:

Tradesight.com Market Prevew for 2/29/12

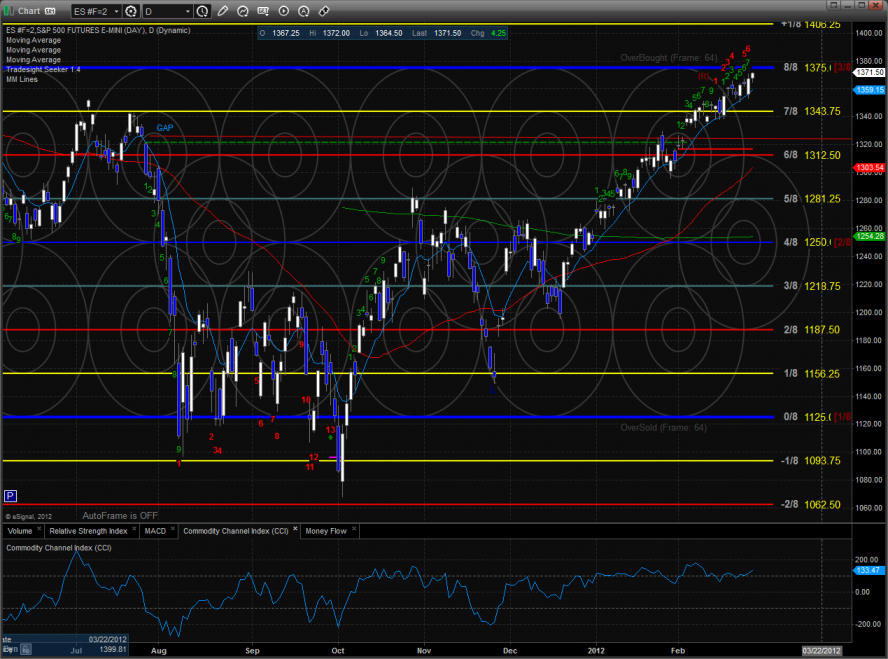

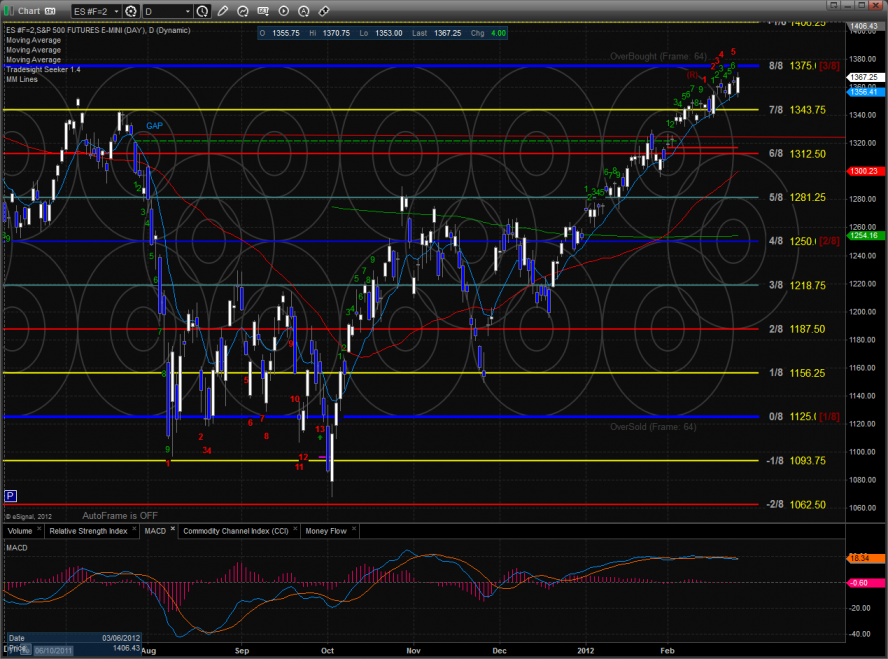

The ES is marching closer and closer to the key 1375 level. Up 4 handles on the day in a very grinding advance the futures are about to interact with the very powerful 8/8 level. Tuesday was a new high on the move.

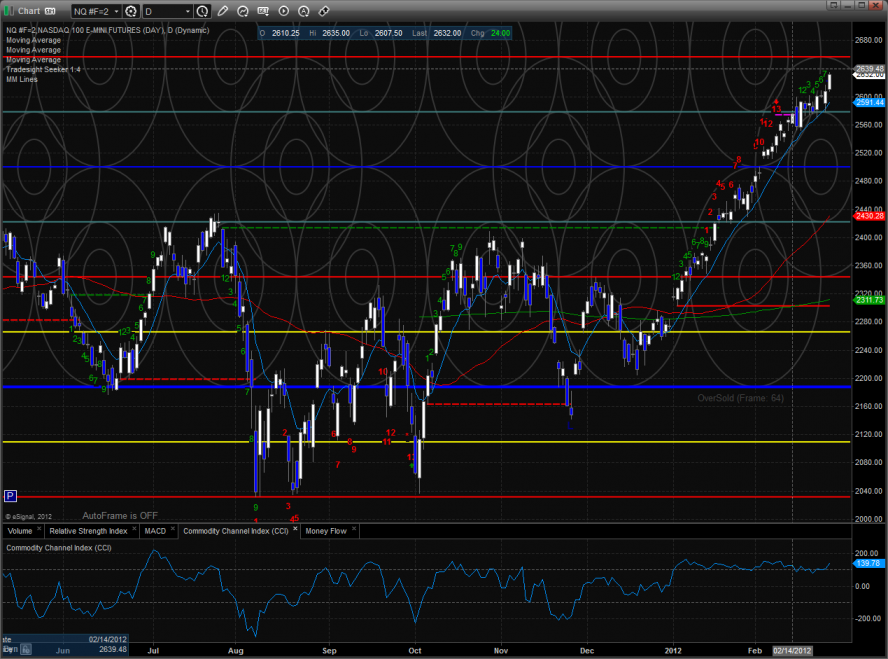

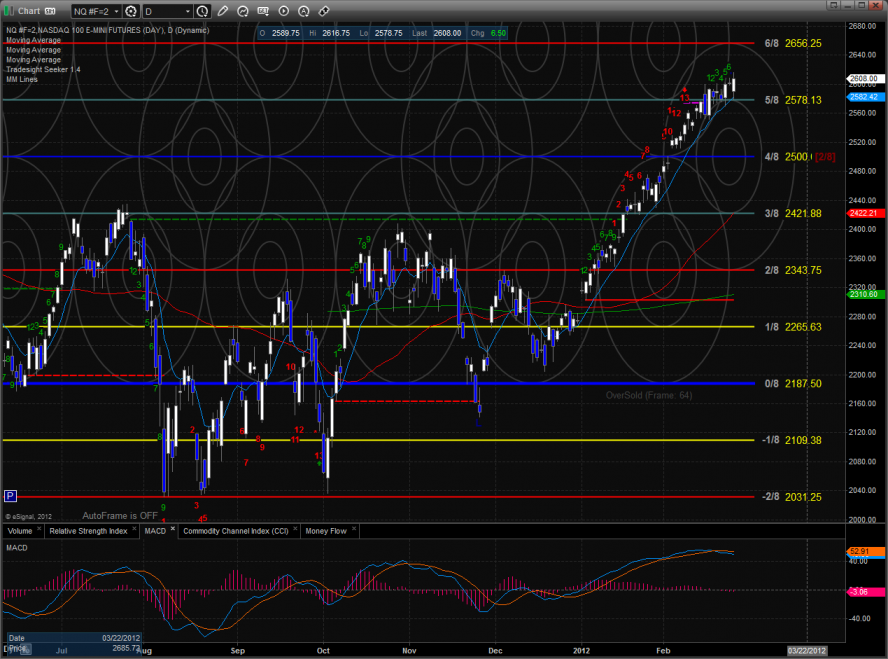

The NQ futures were relatively strong vs. the ES posting triple the percentage advance. This is good relative strength but it is mostly coming from over weighted index gorilla AAPL. If at some point AAPL breaks, the NDX will get the stuffing pulled out of it. Money will flow out of the NQ faster than an Italian captain can abandon ship.

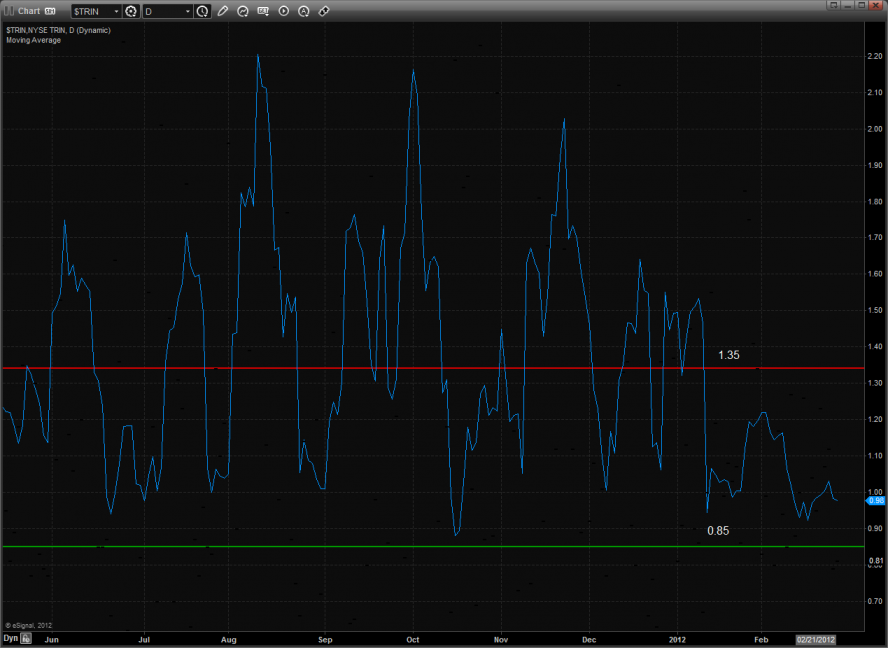

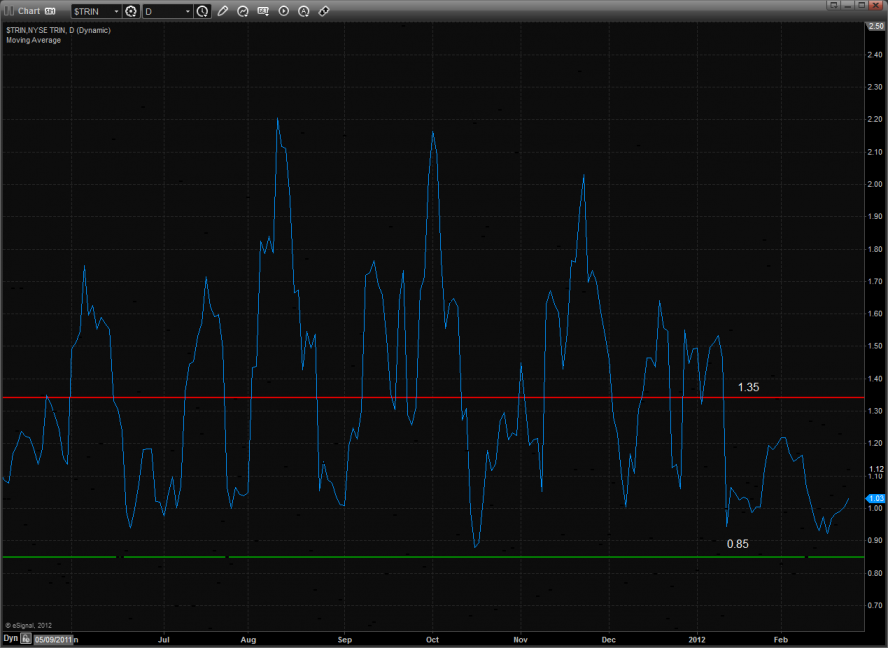

The 10-day NYSE Trin remains neutral:

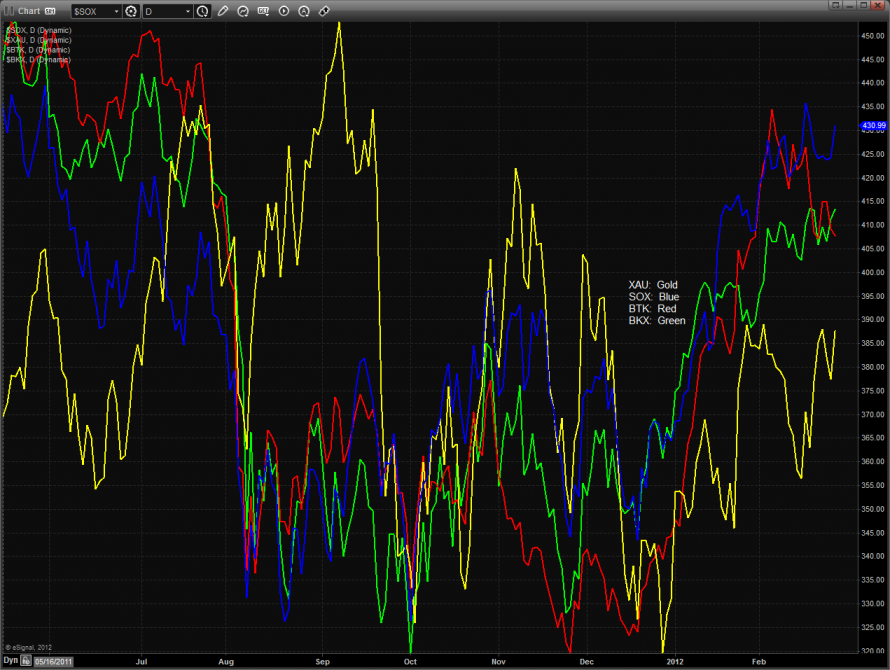

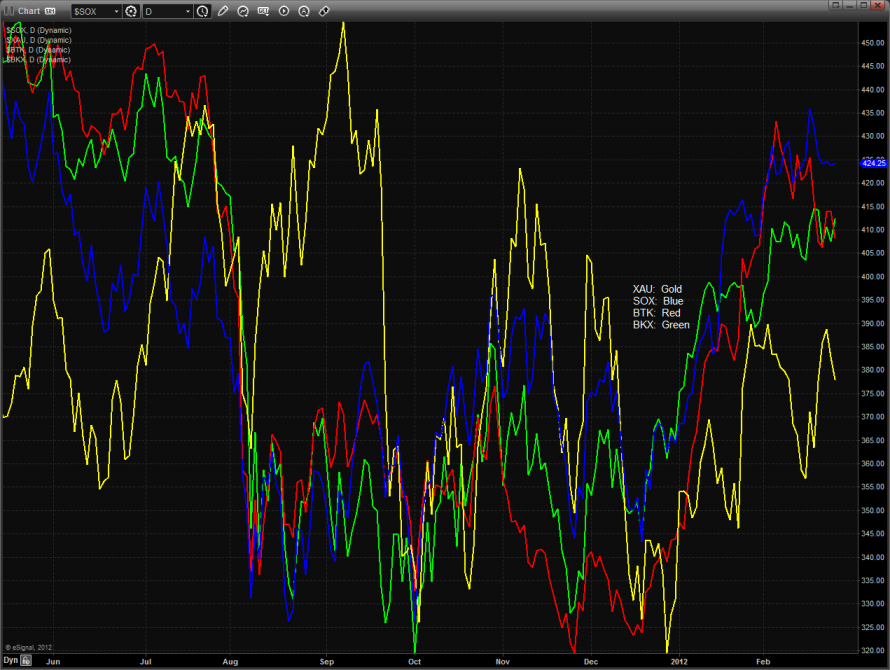

Multi sector daily chart shows that the SOX is trying to make a move--more on this below.

The SPX/NDX cross bullishly made a new high on the move.

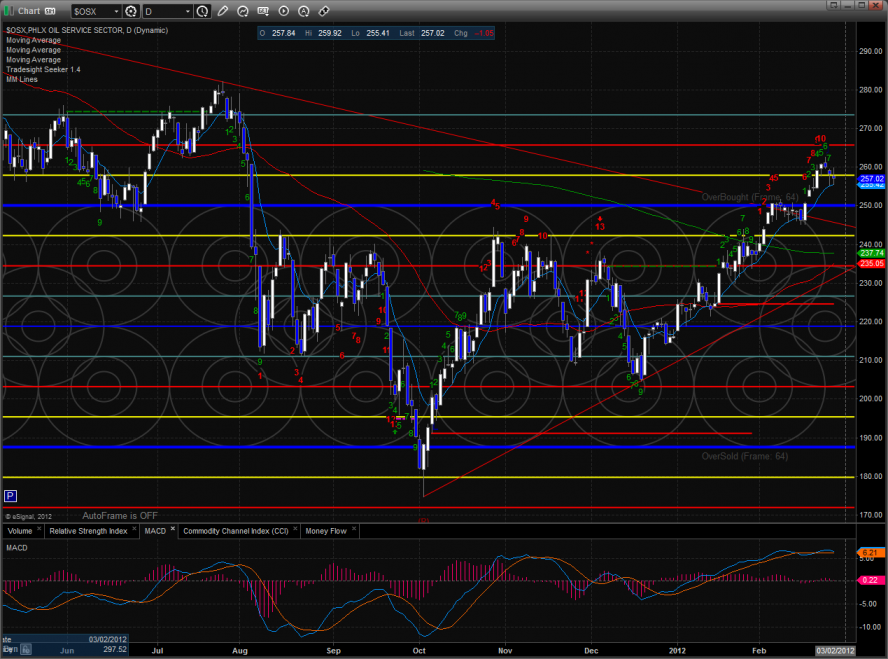

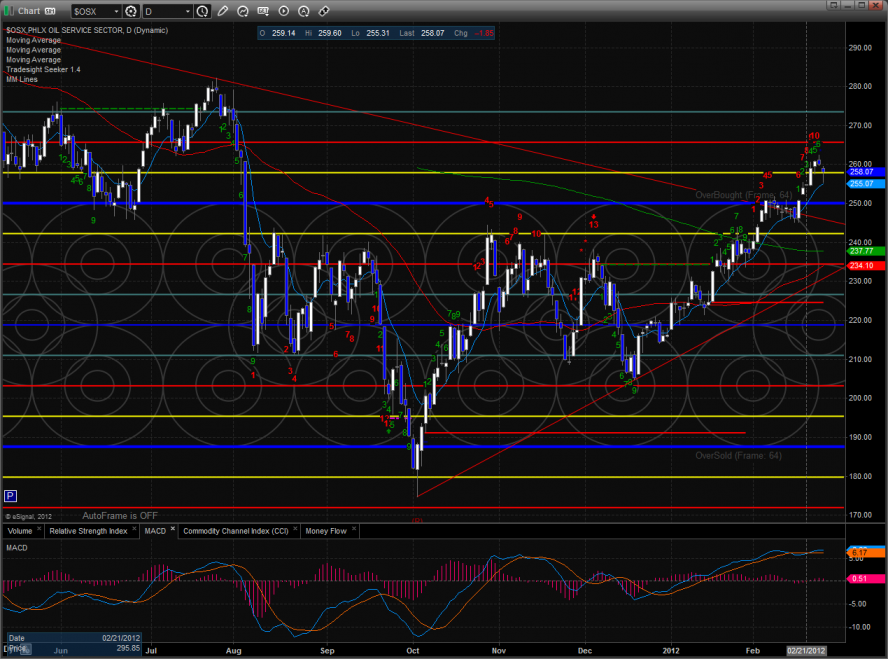

The OSX continues to bearishly lag crude futures. If this persists it will hold crude back and eventually reverse the futures.

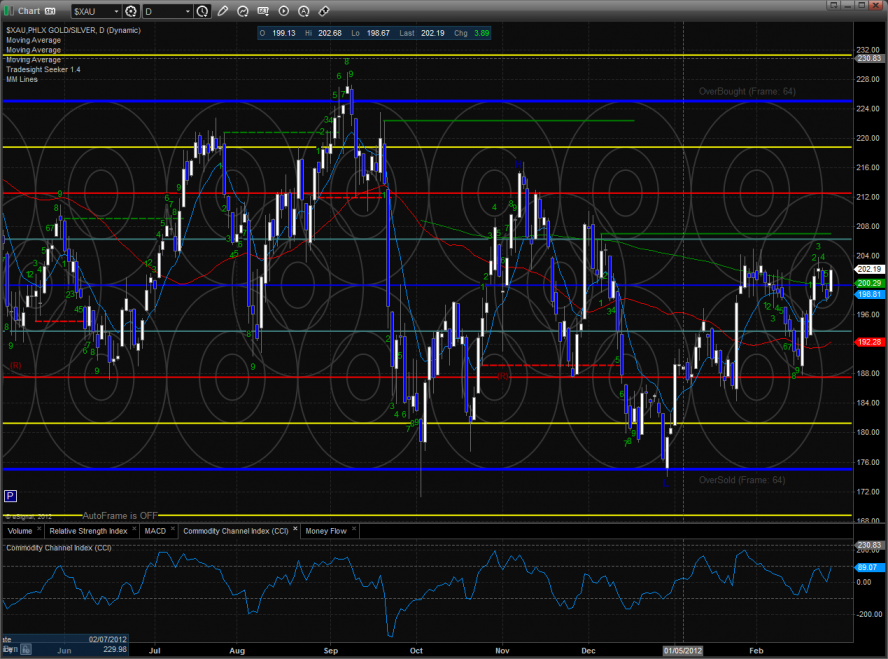

The defensive XAU was the top gun on the day. It remains rangebound but is but now above all of the major moving averages. If the XAU reclaims its relative strength vs. the broad market then the overall equity bull trend is getting close to done.

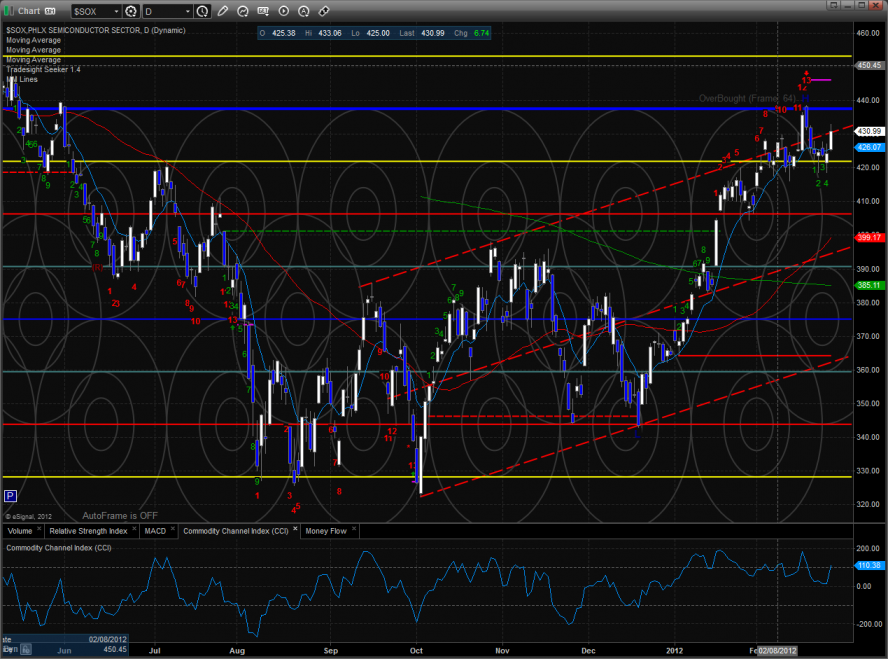

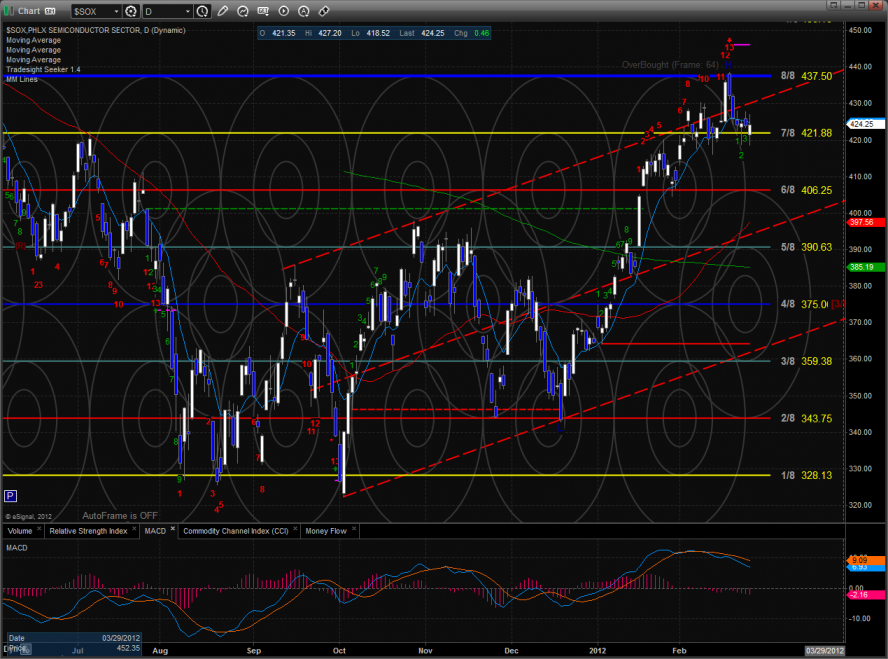

The SOX was higher on the day and outperformed the NDX but it didn’t record a new high.

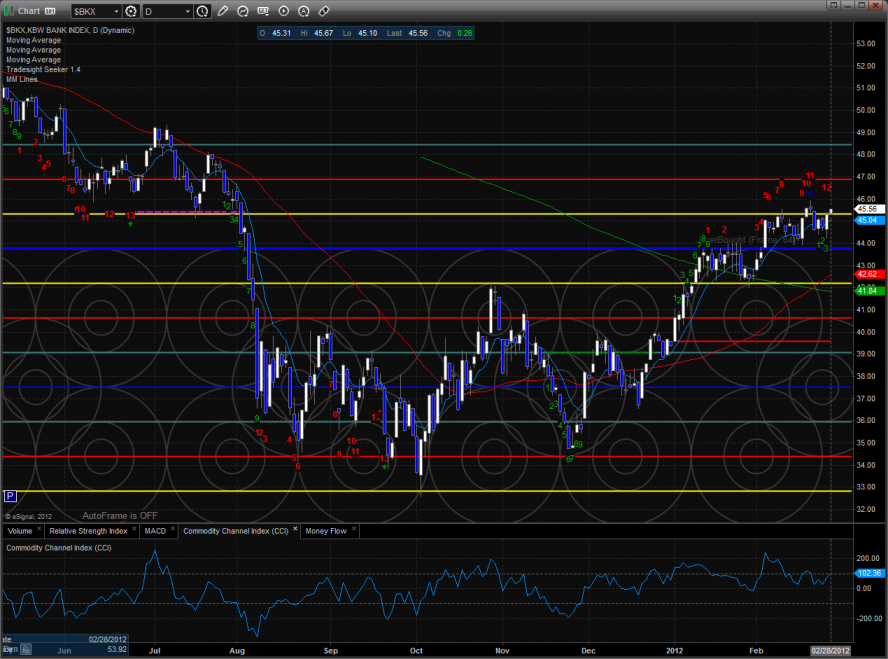

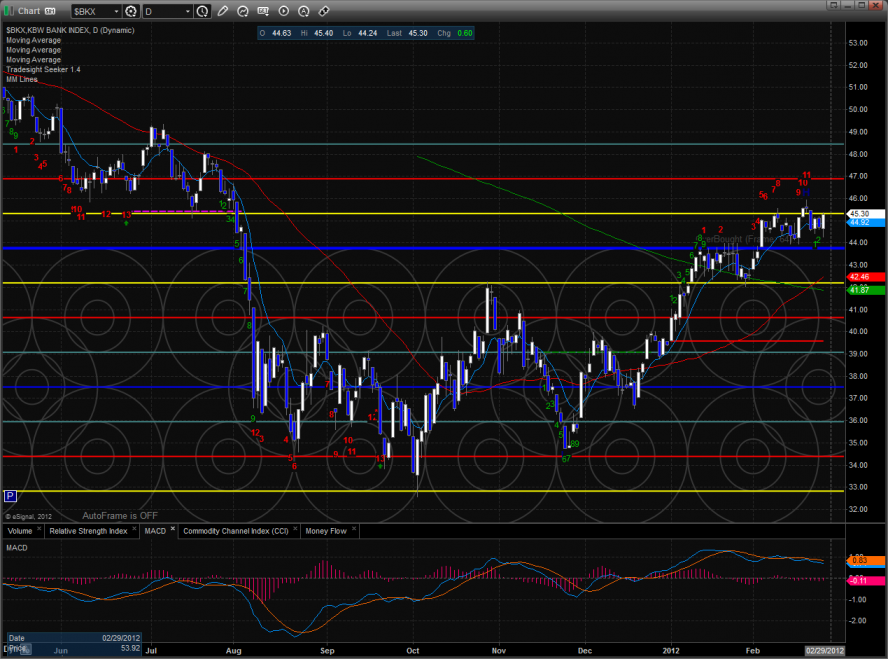

The BKX was higher on the day but in so doing will record a 13 Seeker exhaustion signal.

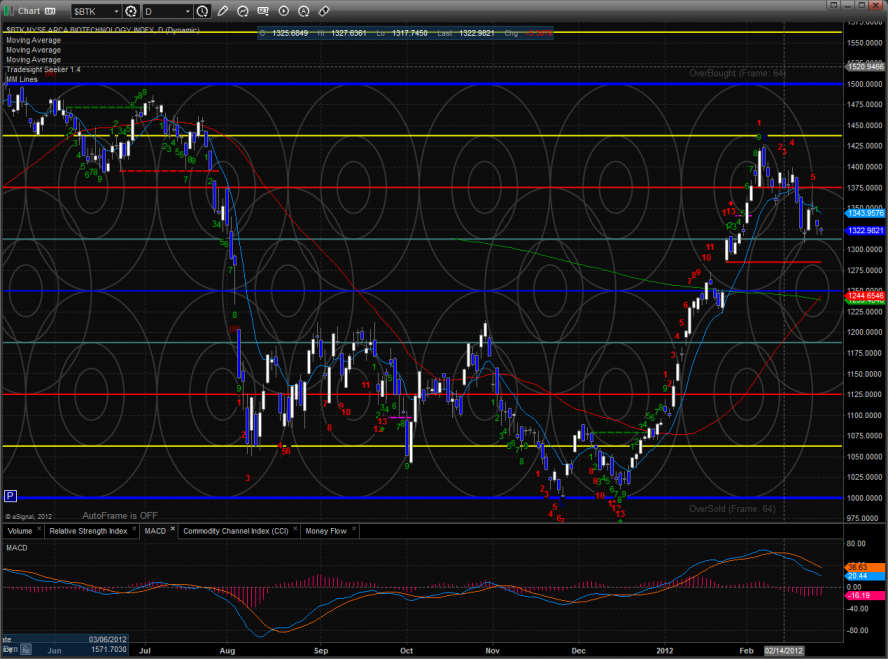

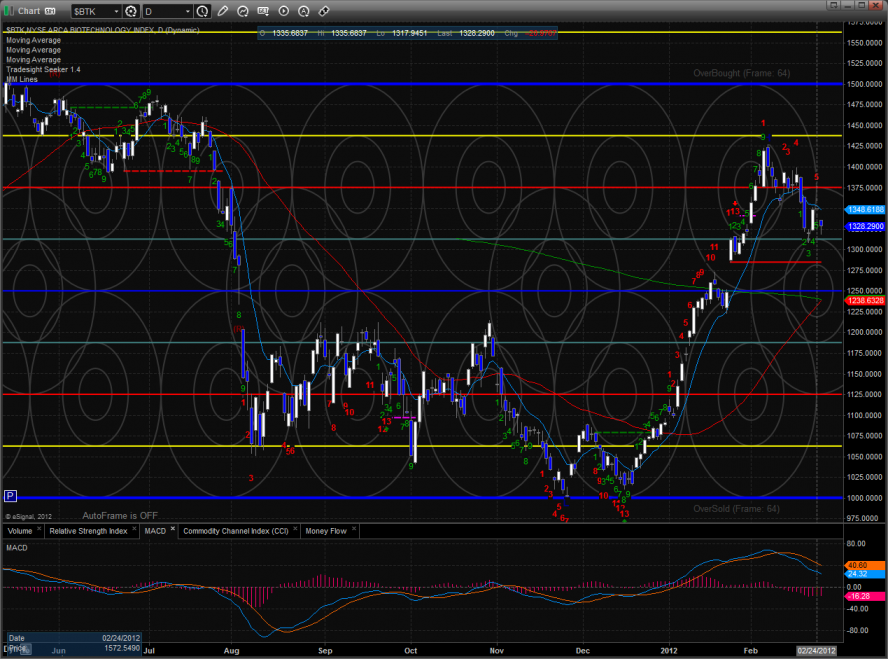

The BTK traded inside yesterday’s range and showed relative weakness. Be sure to have an alarm set for a break under last week’s low. Note how the MACD is rolling over.

The OSX also posted an inside day and underperformed the overall market. Price remains overbought and a close under the 10ma could get momentum rolling to the downside.

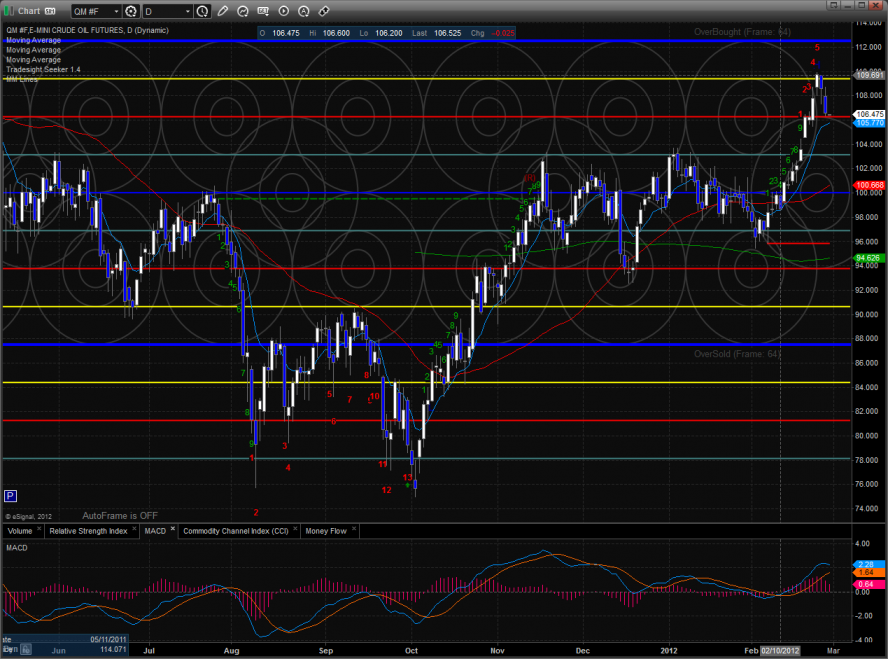

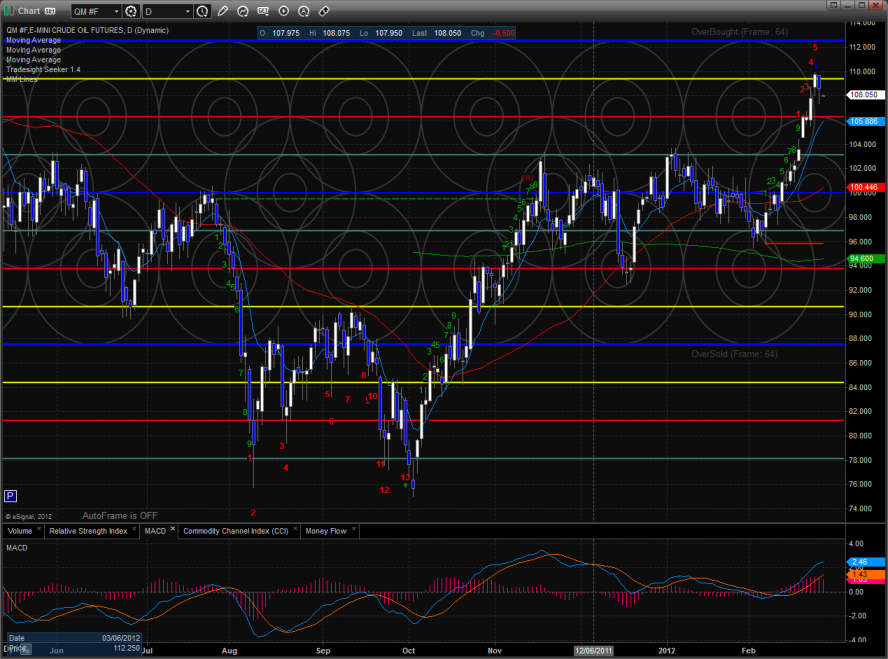

Oil futures are retreating and falling back to the breakout level.

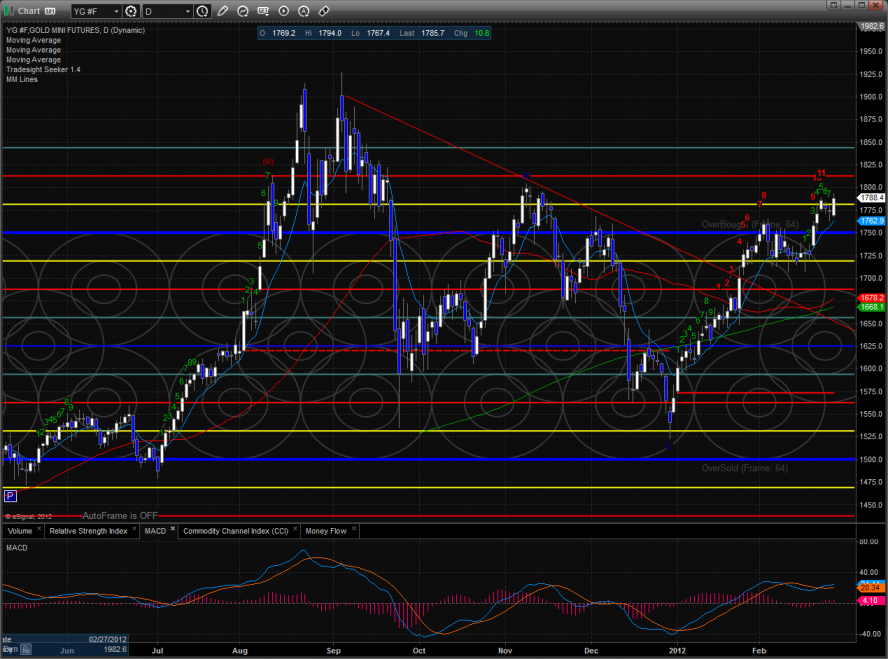

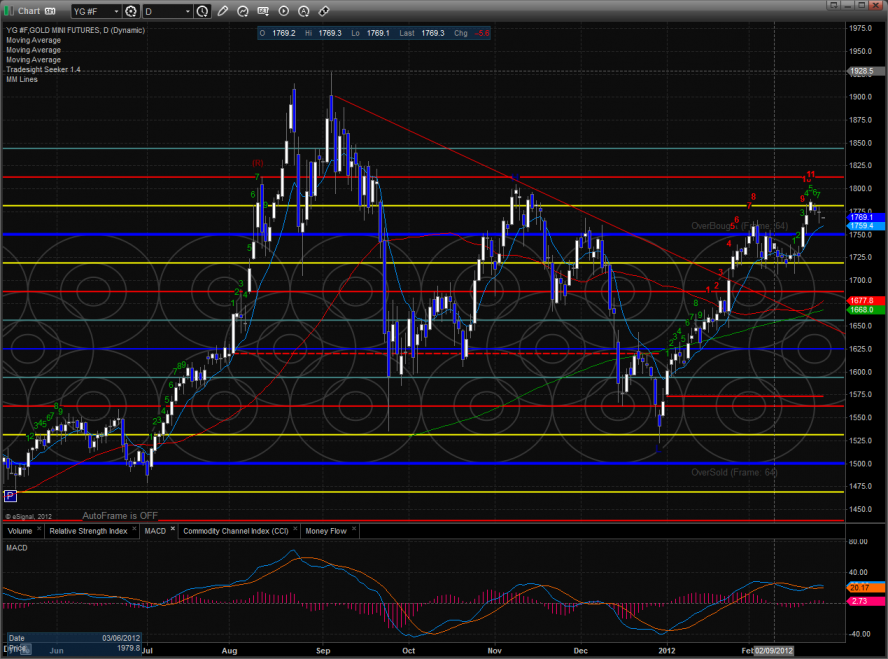

Gold made a new high on the move and is getting very close to the Nov. highs. The Seeker pattern is now 12 days up but is at risk of recycling.

Silver has now recorded 13 days up in the daily Seeker count.

Stock Picks Recap for 2/28/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, NTES triggered long (with market support) and worked great:

SYNA triggered long (without market support due to opening five minutes) and worked:

In the Messenger, NFLX triggered long (with market support) and worked:

CELG triggered short (without market support) and didn't work:

We had 8 other trade calls in the Messenger, long and short, neither triggered.

In total, that's 2 trades triggering with market support, both of them worked.

Stock Picks Recap for 2/28/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, NTES triggered long (with market support) and worked great:

SYNA triggered long (without market support due to opening five minutes) and worked:

In the Messenger, NFLX triggered long (with market support) and worked:

CELG triggered short (without market support) and didn't work:

We had 8 other trade calls in the Messenger, long and short, neither triggered.

In total, that's 2 trades triggering with market support, both of them worked.

Forex Calls Recap for 2/28/12

Two winners (see EURUSD and EURJPY sections below) as the market again went mostly nowhere. Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

Triggered long at A, hit first target at B, raised stop and stopped final piece at C:

EURJPY:

Put in a scalp idea as the UBreak red line had been hit four times over the last two days. Long over A, ran nicely:

Forex Calls Recap for 2/28/12

Two winners (see EURUSD and EURJPY sections below) as the market again went mostly nowhere. Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

Triggered long at A, hit first target at B, raised stop and stopped final piece at C:

EURJPY:

Put in a scalp idea as the UBreak red line had been hit four times over the last two days. Long over A, ran nicely:

Tradesight Market Preview for 2/28/12

The ES gained 4 handles on the day after recouping a gap down that tested the 10ema. The 10eam has been the defining level since the breakaway gap on the first trading day of the year. Keep a close eye on the 8/8 level just overhead.

The NQ futures were higher on the day by 6 making both a new high and new high close on the move. Price is extended and the MACD is starting to top off. Mind the 10ema which has defined the trend.

The 10-day Trin is still in the neutral range:

Multi sector daily chart:

The NDX/SPX cross has not made a new high to confirm the new high in the broad market. If it doesn’t happen in the next 48 hours it will be a notable divergence.

The BKX was the top gun on the day but did not make a new high on the move. Intermediate trends tend to mature when leaders take pause and laggards outperform.

The SOX has a Seeker 13 exhaustion signal in place and hit but retreated from the 8/8 level. Keep a close eye on how the MACD behaves. This move may be mature and ready for a test of the midpoint of the regression channel.

The OSX was weaker than the broad market and is still in the Murrey math overbought territory.

Watch the BTK closely for a break under last week’s low. This was the leading sector and may be ready for a test of the static trend line. The chart pattern has a strong 9-13-9 Seeker setup.

Oil was lower on the day, backing off range high levels.

Gold remains in the overbought area of +1/8:

Forex Calls Recap for 2/27/12

Clean winner (although with no follow through) to start the week. See EURUSD section below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat this evening. No major news this week to slow us down.

EURUSD:

Triggered short at A, hit first target at B, lowered stop over entry and stopped at C:

Forex Calls Recap for 2/27/12

Clean winner (although with no follow through) to start the week. See EURUSD section below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat this evening. No major news this week to slow us down.

EURUSD:

Triggered short at A, hit first target at B, lowered stop over entry and stopped at C: